Attached files

| file | filename |

|---|---|

| 8-K - 8-K - REGIONS FINANCIAL CORP | d307702d8k.htm |

Raymond James 33

rd

Annual

Institutional Investors Conference

March 5, 2012

David Turner

Chief Financial Officer

Exhibit 99.1 |

Why

Regions? •

Strong Southeastern franchise with comprehensive line

of product offerings

•

Leading brand favorability and exceptional service

quality

•

Solid core business performance

•

Aggressively identifying and disposing of problem assets

•

Capital and liquidity remain solid and continue to

improve

2 |

Regional Bank in the Southeast with Comprehensive

and Diversified Line of Product Offerings

3

Associates: 26,813*

Assets: $127B

Loans: $78B

Deposits: $96B

Branches: 1,726

Insurance Offices: 30

ATMs: 2,083

Market Cap: $7.0B**

* Includes Morgan Keegan associates

**As of February 3, 2012

Small and mid-sized C&I lending

Commercial Real Estate

Equipment Finance

Private Banking

Insurance

Wealth Management

Trust Services

Mortgage

Home Equity

Credit Card

Direct Lending

Indirect Auto

Consumer Services

Business Services |

4

($ in billions)

National Average: 3.9%

Regions’

Footprint is Characterized by Either High

Market Shares, High Growth Markets or Both

Source: SNL Financial

Note: Core Markets include AL, FL, LA, MS, AR, TN

Weighted Average Deposit Market Share

in Regions’

Core Markets

Top 10 MSAs

Deposits

Market

Share

Market

Rank

’10-’15 Population

Growth

Birmingham, AL

$11.0

37.6%

1

Nashville, TN

$6.6

17.3%

1

Miami, FL

$4.8

3.1%

7

Tampa, FL

$4.4

8.7%

4

Memphis, TN

$3.8

16.8%

2

Atlanta, GA

$3.4

3.0%

6

St. Louis, MO

$3.0

4.7%

4

Jackson, MS

$2.8

25.5%

2

New Orleans, LA

$2.4

8.3%

4

Mobile, AL

$2.3

38.2%

1

Rank

Name

Market Share

1

Bank of America

11.5%

2

Regions

9.8%

3

Wells Fargo

9.4%

4

SunTrust

6.9%

5

JPMorgan Chase

3.3%

6

BB&T

2.5%

7

Capital One

2.3%

8

First Horizon

2.0%

9

Hancock

1.9%

10

PNC

1.4%

1.0%

8.8%

4.4%

2.0%

10.1

%

4.3%

3.7%

1.4%

9.6%

3.4% |

Competitive Advantage Driven by Customer

Loyalty

5

Regions continues to

perform in the top 10%

in customer loyalty and

top 20% for branch

service quality

(1)

(1)

Based on Gallup survey

(2)

Based on Prime Performance study

(3)

2011 Greenwich Excellence Award

#1 in Customer Service and

“Friendliest”

Bank

(2)

Regions received

Excellence Award

for Small Business

and Middle Market

Banking

(3)

Ranked 2

nd

in Satisfaction for

Mortgage Servicing

J.D. Power

AND ASSOCIATES |

Quality Loans Key to Profitable Growth

6

Portfolio Mix

Consumer Services

›

40% of Total Loan Portfolio

›

Growing consumer loans to achieve a more balanced

portfolio

›

Consumer loan growth will be fueled by new businesses

as well as growth in existing businesses

›

Loan production in mortgage grew 18% over prior

quarter

›

Non-real estate consumer portfolio has increased

45% since 2010

›

$1 billion Regions-branded credit portfolio

›

Indirect auto lending grew 16% year-over-

year

Business Services

›

60% of Total Loan Portfolio

›

Focused on middle market & small business

›

Represents over 80% of Business Services

Revenue

›

Broad based middle-market commercial loan

growth across footprint and industries

›

Driven by specialized industries, including health

care, franchise restaurant, as well as technology

and defense |

Recent

C&I Loan Growth Reflects Slowdown in 2011

7

Loan Growth Quarter to Quarter

*Balances are on ending basis

•

Commercial & Industrial

loans have grown 9% since

end of 2010

•

Commercial & Industrial

commitments increased

14%

•

Line utilization increased

over 200 basis points since

the end of 2010 |

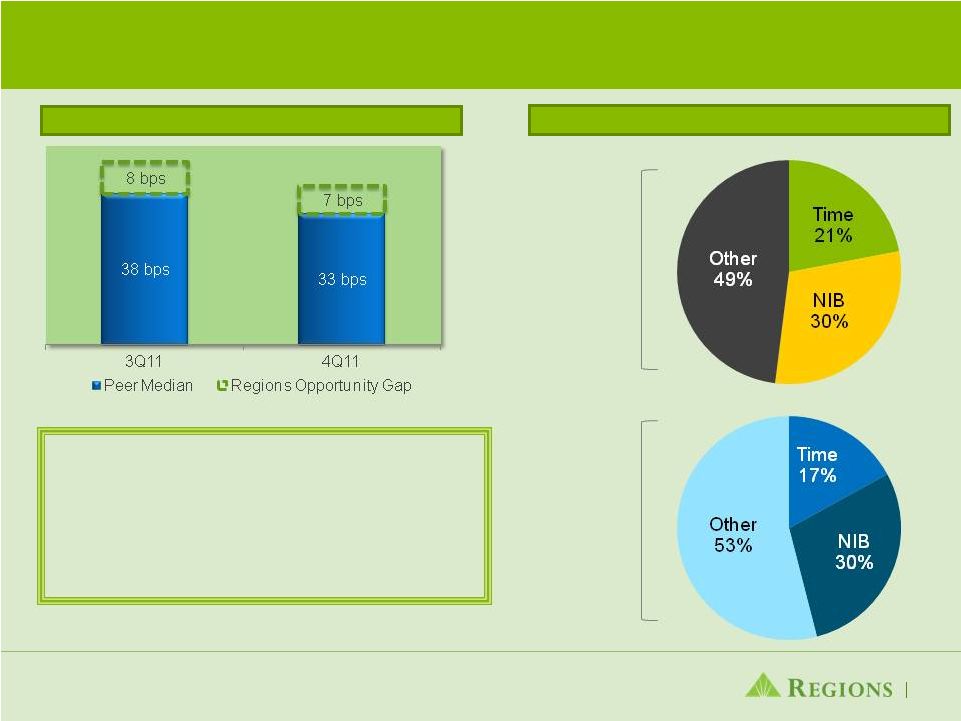

Mix

and Cost of Deposits Provides Further Opportunity to Lower Deposit Costs

8

Deposit Cost Opportunity Gap

Note: Peer banks include BAC, BBT, CMA, FITB, KEY, MTB, PNC, STI, USB,

WFC Deposit Mix Compared to Peers

Regions

Peer

Average

•

Regions has additional room to reduce deposit costs

•

Opportunity to reduce deposit costs, most significantly

through profitably re-pricing maturing CDs

•

$11.7 B of higher cost CDs maturing in 2012 at 1.46%

•

Funding costs declined 31 basis points from 4Q10 |

Funding Mix and Deployment of Cash Reserves

Expected to Result in Improvement to the NIM

9

Impact of Excess Cash Reserves &

Non-Accruals on NIM

1

Regions has closed a portion of its

gap vs. the peers in the last 5 quarters

69 bps

41 bps

Note: Peer banks include BAC, BBT, CMA, FITB, KEY, MTB, PNC, STI, USB,

WFC 1 From Continuing Operations |

Ability to Adapt Our Business Model Helps

Mitigate New Legislation

10

Fee Income by Quarter

Offsetting Durbin

•

Ongoing restructuring

of our accounts from

free to fee-eligible

•

Increased hurdle to

obtain free checking

•

Cross-sell new

revenue initiatives

Total 2011 service charges were relatively stable despite the

negative impact of Regulation E and debit interchange legislation.

|

Expense control continues to be a focus

11

4Q11 vs. 4Q10 % Change

•

Year-over-year

Regions’

expenses

declined 7% while

many peers continued

to grow expenses

•

While many peers

expenses increased

in the fourth quarter,

Regions expenses

were stable,

excluding Visa charge

Source: SNL Financial – from continuing operations excludes goodwill impairment; see appendix for

reconciliation

Note: Peer banks include BAC, BBT, CMA, FITB, KEY, MTB, PNC, STI, USB, WFC

|

Expenses Per FTE Lowest of All Peers

12

NIE Per FTE

Salaries and Benefits Expense Per FTE

Source: SNL Financial – 4Q11 vs 4Q10 – from continuing operations excludes goodwill

impairment; see appendix for reconciliation Note: Peer banks include BAC, BBT, CMA, FITB, KEY, MTB, PNC, STI, USB, WFC

|

Significant Reduction in Highest Risk Portfolio

Segments

13

Total Investor Real Estate

Higher Risk Investor Real Estate Segments

Reduced Investor Real Estate $15.1 B

or

59%

over 5 years

Reduced High Risk Segments $11.8 B

or

87%

over 5 years |

Continued Improvement in Credit Quality Metrics

14

Business Services Criticized Loans *

*Includes classified loans and special mention loans

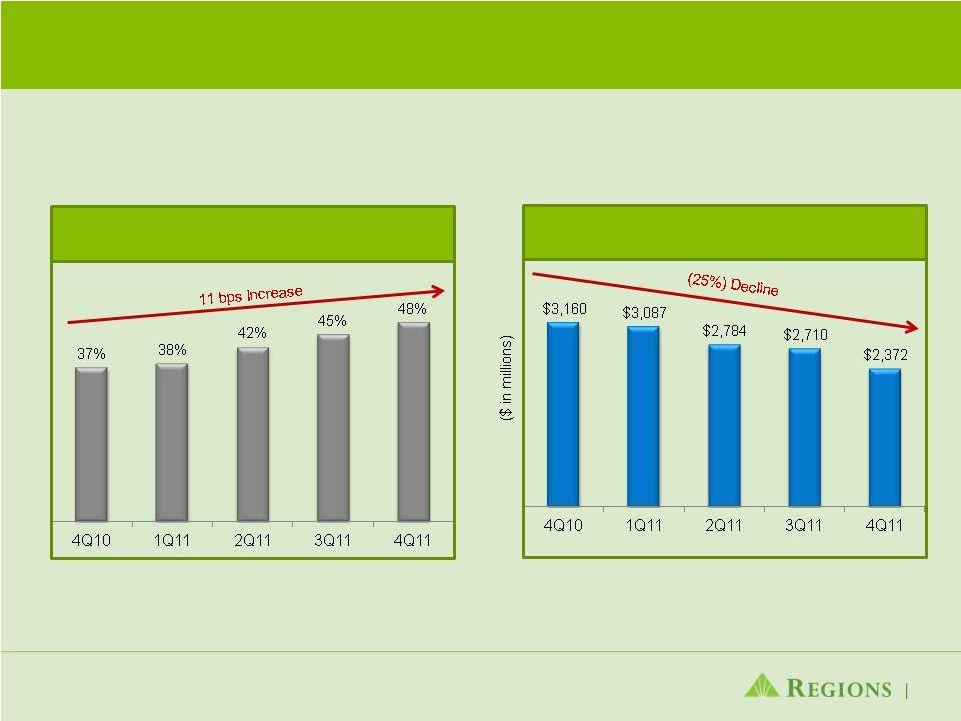

NCO’s Avg Loans

Total NPAs (including HFS)

NPLs Gross Migration |

Loan

Loss Provision Down 57% Since 4Q10; Allowance Ratio 1.2X Higher Than Peer

Average (1) Loan charge-offs related to Sales and Transfer to Held

for Sale Note: Peer banks include BAC, BBT, CMA, FITB, KEY, MTB, PNC, STI,

USB, WFC 15

Loan Loss Provision

Allowance versus Peers

Sales/

HFS

(1) |

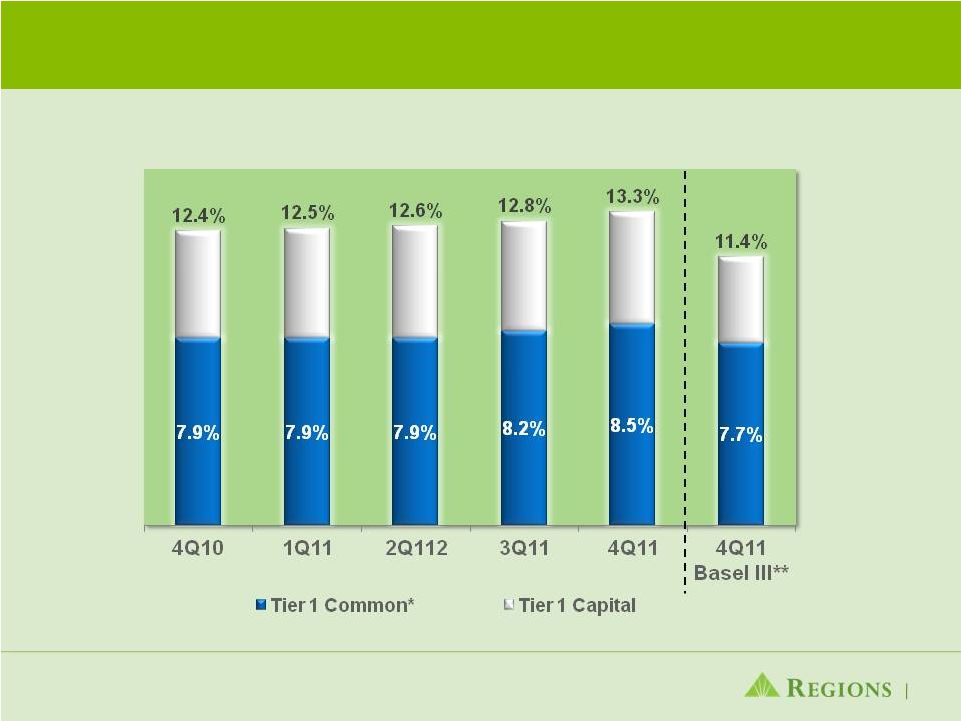

Strong Capital

16

* Non-GAAP – see appendix for reconciliation; 4Q11 Tier 1 Common and Tier 1 Capital ratios

are estimated ** Non-GAAP - Subject to change as interpretation of Basel III rules is ongoing and dependent

on guidance from Basel and regulators; see appendix for reconciliation

|

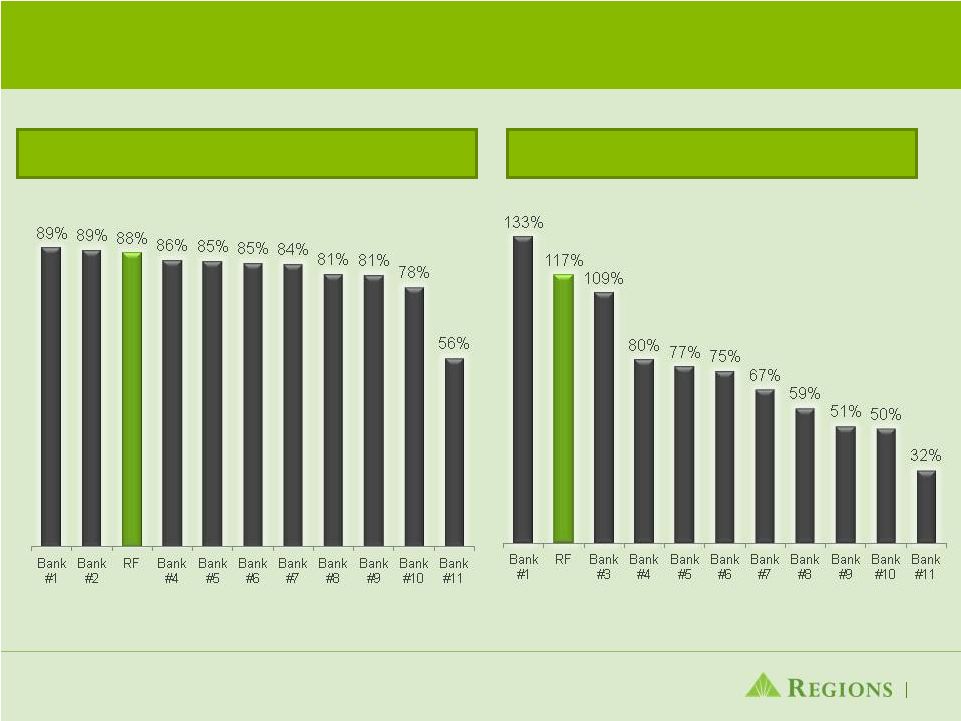

Liquidity Coverage Ratio

17

Core Deposits as a % of Total Funding

Solid Liquidity

Source: SNL Financial

Note: Peer banks include BAC, BBT, CMA, FITB, KEY, MTB, PNC, STI, USB,

WFC Note 2: Liquidity Coverage Ratio as of 3Q11 Data provided by

Barclay’s Capital based on the their models using publicly

available information and dual deposit run-off assumptions |

We

reached three important milestones in 2011 Our core franchise strengthened

and we achieved sustainable profitability from our continuing

operations* All of our credit quality related metrics experienced

marked improvement throughout the year

Completed the strategic review of Morgan Keegan,

resulting in the announced sale to Raymond James

18

* Excluding goodwill impairment and regulatory charge (non-GAAP); see appendix

for reconciliation |

Appendix

19 |

Forward-Looking Statements

This

presentation

may

include

forward-looking

statements

which

reflect

Regions’

current

views

with

respect

to

future

events

and

financial

performance.

The

Private

Securities

Litigation

Reform

Act

of

1995

(“the

Act”)

provides

a “safe harbor”

for forward-looking statements which are identified as such and are accompanied

by the identification of important factors that could cause actual results to differ materially from the forward-looking statements.

For these statements, we, together with our subsidiaries, claim the protection

afforded by the safe harbor in the Act. Forward-looking statements are not based on historical information, but rather are related to future

operations,

strategies,

financial

results

or

other

developments.

Forward-looking

statements

are

based

on

management’s

expectations

as

well

as

certain

assumptions

and

estimates

made

by,

and

information

available

to,

management at the time the statements are made. Those statements are based on

general assumptions and are subject to various risks, uncertainties and other factors that may cause actual results to differ materially from

the

views,

beliefs

and

projections

expressed

in

such

statements.

These

risks,

uncertainties

and

other

factors

include,

but

are

not

limited

to,

those

described

below:

›

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the

“Dodd-Frank Act”)became law on July 21, 2010, and a number of legislative, regulatory and tax proposals remain pending. Additionally, the U.S.

Treasury

and

federal

banking

regulators

continue

to

implement,

but

are

also

beginning

to

wind

down,

a

number

of

programs

to

address

capital

and

liquidity

in

the

banking

system.

Proposed

rules,

including

those

that

are part of the Basel III process, could require banking institutions to increase

levels of capital. All of the foregoing may have significant effects on Regions and the financial services industry, the exact nature of

which cannot be determined at this time.

›

Regions'

ability

to

mitigate

the

impact

of

the

Dodd-Frank

Act

on

debit

interchange

fees

through

revenue

enhancements

and

other

revenue

measures,

which

will

depend

on

various

factors,

including

the

acceptance

by

our customers of modified fee structures for Regions' products and services.

›

The impact of compensation and other restrictions imposed under the Troubled Asset

Relief Program (“TARP”) until Regions repays the outstanding preferred stock and warrant issued under the TARP, including

restrictions on Regions’

ability to attract and retain talented executives and associates.

›

Possible additional loan losses, impairment of goodwill and other intangibles, and

adjustment of valuation allowances on deferred tax assets and the impact on earnings and capital.

›

Possible changes in interest rates may increase funding costs and reduce earning

asset yields, thus reducing margins. Increases in benchmark interest rates would also increase debt service requirements for

customers whose terms include a variable interest rate, which may negatively impact

the ability of borrowers to pay as contractually obligated. ›

Possible changes in general economic and business conditions in the United States in

general and in the communities Regions serves in particular, including any prolonging or worsening of the current unfavorable

economic conditions including unemployment levels.

›

Possible changes in the creditworthiness of customers and the possible impairment of

the collectability of loans. ›

Possible

changes

in

trade,

monetary

and

fiscal

policies,

laws

and

regulations

and

other

activities

of

governments,

agencies,

and

similar

organizations,

may

have

an

adverse

effect

on

business.

›

The current stresses in the financial and real estate markets, including possible

continued deterioration in property values. ›

Regions' ability to manage fluctuations in the value of assets and liabilities and

off-balance sheet exposure so as to maintain sufficient capital and liquidity to support Regions' business.

›

Regions' ability to expand into new markets and to maintain profit margins in the

face of competitive pressures. ›

Regions' ability to develop competitive new products and services in a timely manner

and the acceptance of such products and services by Regions' customers and potential customers.

›

Regions' ability to keep pace with technological changes.

›

Regions' ability to effectively manage credit risk, interest rate risk, market risk,

operational risk, legal risk, liquidity risk, and regulatory and compliance risk.

›

Regions’

ability to ensure adequate capitalization which is impacted by inherent

uncertainties in forecasting credit losses. ›

The cost and other effects of material contingencies, including litigation

contingencies, and any adverse judicial, administrative or arbitral rulings or proceedings.

›

The effects of increased competition from both banks and non-banks.

›

The effects of geopolitical instability and risks such as terrorist attacks.

›

Possible changes in consumer and business spending and saving habits could affect

Regions' ability to increase assets and to attract deposits. ›

The effects of weather and natural disasters such as floods, droughts, wind,

tornados and hurricanes, and the effects of man-made disasters.

›

Possible downgrades in ratings issued by rating agencies.

›

Potential

dilution

of

holders

of

shares

of

Regions’

common

stock

resulting

from

the

U.S.

Treasury’s

investment

in

TARP.

›

Possible

changes

in

the

speed

of

loan

prepayments

by

Regions’

customers

and

loan

origination

or

sales

volumes.

›

Possible acceleration of prepayments on mortgage-backed securities due to low

interest rates and the related acceleration of premium amortization on those securities.

›

The

effects

of

problems

encountered

by

larger

or

similar

financial

institutions

that

adversely

affect

Regions

or

the

banking

industry

generally.

›

Regions’

ability to receive dividends from its subsidiaries.

›

The

effects

of

the

failure

of

any

component

of

Regions’

business

infrastructure

which

is

provided

by

a

third

party.

›

Changes in accounting policies or procedures as may be required by the Financial

Accounting Standards Board or other regulatory agencies. ›

With regard to the sale of Morgan Keegan:

the possibility that regulatory and other approvals and conditions to the

transaction are not received on a timely basis or at all; the possibility that modifications to the terms of the transaction may be required in

order

to

obtain

or

satisfy

such

approvals

or

conditions;

changes

in

the

anticipated

timing

for

closing

the

transaction;

business

disruption

during

the

pendency

of

or

following

the

transaction;

diversion

of

management

time

on

transaction-related

issues;

reputational

risks

and

the

reaction

of

customers

and

counterparties

to

the

transaction

›

The

effects

of

any

damage

to

Regions’

reputation

resulting

from

developments

related

to

any

of

the

items

identified

above.

›

The

foregoing

list

of

factors

is

not

exhaustive.

For

discussion

of

these

and

other

factors

that

may

cause

actual

results

to

differ

from

expectations,

look

under

the

captions

“Forward-Looking

Statements”

and

“Risk

Factors”

in Regions’

Annual Report on Form 10-K for the year ended December 31, 2011.

›

The words "believe," "expect," "anticipate,"

"project," and similar expressions often signify forward-looking statements. You should not place undue reliance on any forward-looking statements, which speak only as of

the date made. We assume no obligation to update or revise any forward-looking

statements that are made from time to time. 20

|

Non-GAAP Reconciliation: Pre-Tax Pre-Provision

Income and Adjusted Expenses

21

1

Adjusted non-interest expense declined 5% for the full year 2011 and 12%

comparing 4Q10 to 4Q11, while increasing 2% on a linked quarter basis in

4Q11 2011

2010

4Q11

3Q11

2Q11

1Q11

4Q10

Pre-Tax Pre-Provision Income (non-GAAP)

Income (loss) from continuing operations available to common shareholders

(GAAP) $ (25)

$ (682)

$ (135)

$ 87

$ 25

$ (2)

$ 14

Preferred dividends and accretion (GAAP)

214

224

54

54

54

52

53

Income tax expense (GAAP)

(28)

(376)

18

17

(34)

(29)

44

Pre-tax income (loss) from continuing operations (GAAP)

161

(834)

(63)

158

45

21

111

Provision for loan losses (GAAP)

1,530

2,863

295

355

398

482

682

Pre-tax pre-provision income from continuing operations

(non-GAAP) $ 1,691

$ 2,029

$ 232

$ 513

$ 443

$ 503

$ 793

Goodwill impairment from continuing operations

253

-

253

-

-

-

-

Regulatory Charge from continuing operations

-

75

-

-

-

-

-

Pre-tax pre-provision income from continuing operations, excluding goodwill

impairment and regulatory charge (non-GAAP)

$ 1,944

$ 2,104

$ 485

$ 513

$ 443

$ 503

$ 793

Non-interest Expense (GAAP)

$ 3,862

$ 3,859

$ 1,124

$ 850

$ 956

$ 932

$ 990

Adjustments:

Goodwill impairment from continuing operations

253

-

253

-

-

-

-

Regulatory Charge from continuing operations

-

75

-

-

-

-

-

Adjusted non-interest expense (non-GAAP)

(1)

$ 3,609

$ 3,784

$ 871

$ 850

$ 956

$ 932

$ 990

As of and for Quarter Ended

Year Ended December 31

The tables below present computations of earnings (loss) and certain other financial measures,

excluding goodwill impairment and regulatory charge and related tax benefit

(non-GAAP). The goodwill impairment charge and the regulatory charge and related tax benefit are included in financial results presented in

accordance with generally accepted accounting principles (GAAP). A table also presents computations of

full year and quarterly pre-tax pre-provision income (non-GAAP). Non-interest

expense (GAAP) is presented excluding certain adjustments to arrive at adjusted non-interest expense (non-GAAP). Regions believes

that the exclusion of the goodwill impairment and the regulatory charge and related tax benefit in

expressing earnings (loss) and certain other financial measures, including "earnings (loss)

per common share, excluding goodwill impairment and regulatory charge and related tax benefit“ provides a meaningful base for

period-to-period comparisons, which management believes will assist investors in analyzing the

operating results of the Company and predicting future performance. These non-GAAP

financial measures are also used by management to assess the performance of Regions' business because management does

not consider the goodwill impairment and regulatory charge and related tax benefit to be relevant to

ongoing operating results. Management and the Board of Directors utilize these

non-GAAP financial measures for the following purposes: preparation of Regions' operating budgets; monthly financial performance

reporting; monthly close-out "flash" reporting of consolidated results (management

only); and presentations to investors of company performance. Management uses these

measures to monitor performance and believes these measures provide meaningful information to investors.

Continuing Operations - Non-interest Expense |

Non-GAAP Reconciliation: Tier 1 Common

22

($ amounts in millions)

12/31/11

9/30/11

6/30/11

3/31/11

12/31/10

TIER 1 COMMON RISK-BASED RATIO CONSOLIDATED

-

Stockholders' equity (GAAP)

16,499

$

17,263

$

16,888

$

16,619

$

16,734

$

Accumulated other comprehensive (income) loss

69

(92)

177

387

260

Non-qualifying goodwill and intangibles

(4,900)

(5,649)

(5,668)

(5,686)

(5,706)

Disallowed deferred tax assets

(432)

(506)

(498)

(463)

(424)

Disallowed servicing assets

(35)

(35)

(35)

(28)

(27)

Qualifying non-controlling interests

92

92

92

92

92

Qualifying trust preferred securities

846

846

846

846

846

Tier 1 capital (regulatory)

12,139

$

11,919

$

11,802

$

11,767

$

11,775

$

Qualifying non-controlling interests

(92)

(92)

(92)

(92)

(92)

Qualifying trust preferred securities

(846)

(846)

(846)

(846)

(846)

Preferred stock

(3,419)

(3,409)

(3,399)

(3,389)

(3,380)

Tier 1 common equity (non-GAAP)

7,782

$

7,572

$

7,465

$

7,440

$

7,457

$

Risk-weighted assets (regulatory)

91,663

92,786

93,865

93,929

94,966

Tier 1 common risk-based ratio (non-GAAP)

8.5%

8.2%

7.9%

7.9%

7.9%

As of and for Quarter Ended

The following table provides a reconciliation of stockholder’s equity to

"Tier 1 common equity" (non-GAAP). Traditionally, the Federal Reserve and

other banking regulatory bodies have assessed a bank's capital adequacy based on

Tier 1 capital, the calculation of which is codified in federal banking

regulations. In connection with the Company's Comprehensive Capital Assessment and Review ("CCAR"), these regulators are

supplementing

their

assessment

of

the

capital

adequacy

of

a

bank

based

on

a

variation

of

Tier

1

capital,

known

as

Tier

1

common

equity.

While

not

codified,

analysts

and

banking

regulators

have

assessed

Regions'

capital

adequacy

using

the

Tier

1

common

equity

measure.

Because

Tier

1

common

equity

is

not

formally

defined

by

GAAP

or

codified

in

the

federal

banking

regulations,

this

measure

is

considered

to

be

a

non-GAAP

financial

measure and other entities may calculate it differently than Regions' disclosed

calculations. Since analysts and banking regulators may assess

Regions' capital adequacy using Tier 1 common equity, we believe that it is

useful to provide investors the ability to assess Regions' capital adequacy

on the same basis.

Tier 1 common equity is often expressed as a percentage of risk-weighted

assets. Under the risk-based capital framework, a company's balance

sheet assets and credit equivalent amounts of off-balance sheet items are

assigned to one of four broad risk categories. The aggregated dollar

amount in each category is then multiplied by the risk-weighted category.

The resulting weighted values from each of the four categories are added

together and this sum is the risk-weighted assets total that, as adjusted,

comprises the denominator of certain risk-based capital ratios. Tier 1 capital

is then divided by this denominator (risk-weighted assets) to determine the

Tier 1 capital ratio. Adjustments are made to Tier 1 capital to arrive at Tier

1 common equity. Tier 1 common equity is also divided by the

risk-weighted assets to determine the Tier 1 common equity ratio. The amounts

disclosed as risk-weighted assets are calculated consistent with banking

regulatory requirements. |

Non-GAAP Reconciliation: Basel III

23

($ amounts in millions)

12/31/11

BASEL III

Stockholders' equity (GAAP)

16,499

$

Non-qualifying goodwill and intangibles

(1)

(5,065)

Adjustments, including other comprehensive income related to cash flow hedges,

disallowed deferred tax assets, threshold deductions and other

adjustments (857)

10,577

$

Qualifying non-controlling interests

4

Basel III Tier 1 Capital (non-GAAP)

10,581

$

Basel III Tier 1 Capital (non-GAAP)

10,581

$

Preferred Stock

(3,419)

Qualifying non-controlling interests

(4)

Basel III Tier 1 Common (non-GAAP)

7,158

$

Basel I risk-weighted assets

91,663

Basel III risk-weighted assets

(2)

93,267

Minimum

Basel III Tier 1 Capital Ratio

11.3%

8.5%

Basel III Tier 1 Common Ratio

7.7%

7.0%

The

following

table

provides

calculations

of

Tier

1

capital

and

Tier

1

common,

based

on

Regions’

current

understanding

of

Basel

III

requirements.

Regions currently calculates its risk-based capital ratios under guidelines

adopted by the Federal Reserve based on the 1988 Capital Accord (“Basel I”)

of the Basel Committee on Banking Supervision (the “Basel

Committee”). In December 2010, the Basel Committee released its final framework for

Basel III, which will strengthen international capital and liquidity

regulation. When implemented by U.S. bank regulatory agencies and fully phased-in,

Basel III will change capital requirements and place greater emphasis on common

equity. Implementation of Basel III will begin on January 1, 2013, and

will be phased in over a multi-year period. The U.S. bank regulatory

agencies have not yet finalized regulations governing the implementation of Basel

III.

Accordingly,

the

calculations

provided

below

are

estimates,

based

on

Regions’

current

understanding

of

the

framework,

including

the

Company’s

reading

of

the

requirements,

and

informal

feedback

received

through

the

regulatory

process.

Regions’

understanding

of

the

framework

is

evolving

and

will likely change as the regulations are finalized. Because the Basel III

implementation regulations are not formally defined by GAAP and have not yet

been

finalized

and

codified,

these

measures

are

considered

to

be

non-GAAP

financial

measures,

and

other

entities

may

calculate

them

differently

from

Regions’

disclosed

calculations.

Since

analysts

and

banking

regulators

may

assess

Regions’

capital

adequacy

using

the

Basel

III

framework,

we

believe

that

it

is

useful

to

provide

investors

the

ability

to

assess

Regions’

capital

adequacy

on

the

same

basis.

1

Under Basel III, regulatory capital must be reduced by purchased credit card relationship intangible

assets. These assets are 2

Regions continues to develop systems and internal controls to precisely calculate risk-weighted

assets as required by Basel III. The amount included above is a reasonable approximation, based

on our understanding of the requirements.

partially allowed in Basel I capital. |

Continued Improvement in Credit Quality Metrics

24

NPL Balances Paying

Current and as Agreed

Total NPLs (excluding HFS) |

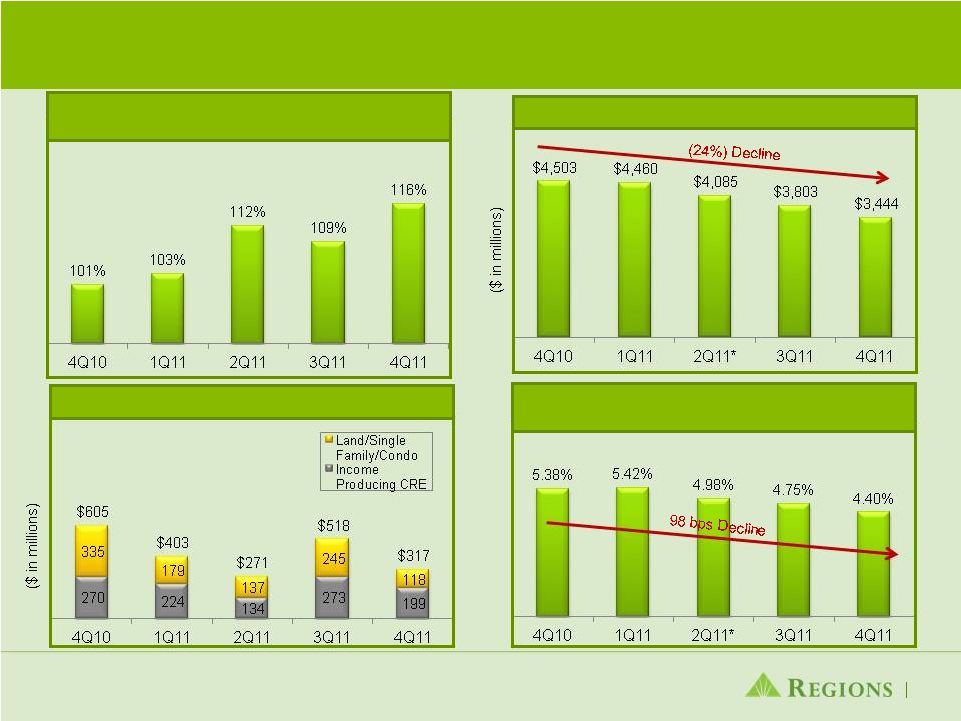

Credit Quality Metrics

25

Allowance for Loan Losses to NPLs

(excl HFS)

Investor Real Estate Gross NPA Migration

NPAs + 90 Day Delinquencies/Loans +

OREO + HFS

NPAs + 90 day Delinquencies

* Previous presentation showed 2Q11 on a pro-forma basis to include completed

bulk sale after quarter-end. Current presentation shows actual 2Q11 and

3Q11 numbers as reported. |

|