Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 0-33377

MCG CAPITAL CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 54-1889518 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1100 Wilson Boulevard, Suite 3000, Arlington, VA | 22209 | |

| (Address of principal executive offices) | (Zip Code) | |

(703) 247-7500

(Registrant’s telephone number, including area code)

| Securities registered pursuant to Section 12(b) of the Act: | ||

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, par value $0.01 per share | The NASDAQ Global Select Market | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the Registrant’s voting shares of common stock held by non-affiliates of the Registrant on June 30, 2011, was $426,239,573, based on $6.08 per share, the last reported sale price of the shares of common stock on the NASDAQ Global Select Market. For purposes of this computation, shares held by certain stockholders and by directors and executive officers of the Registrant have been excluded. Such exclusion of shares held by such persons is not intended, nor shall it be deemed, to be an admission that such persons are affiliates of the Registrant. There were 76,997,119 shares of the Registrant’s common stock outstanding as of February 24, 2012.

Documents Incorporated by Reference

Portions of the Registrant’s definitive Proxy Statement relating to its 2012 Annual Meeting of Stockholders, to be filed pursuant to Regulation 14A with the Securities and Exchange Commission, are incorporated by reference into Part III of this Annual Report on Form 10-K as indicated herein.

Table of Contents

Table of Contents

| ITEM 1. | BUSINESS |

General

We are a solutions-focused commercial finance company that provides capital and advisory services to middle-market companies throughout the United States. Our investment objective is to achieve current income and capital gains.

We are an internally managed, non-diversified, closed-end investment company that has elected to be regulated as a business development company, or BDC, under the Investment Company Act of 1940, as amended, or the 1940 Act. As a BDC, we are required to meet various regulatory tests, which include investing at least 70% of our total assets in private or thinly traded public U.S.-based companies and meeting a 200% asset coverage ratio of total net assets to total senior securities.

For federal income tax purposes, we have elected to be treated as a regulated investment company, or RIC, under Subchapter M of the Internal Revenue Code. In order to continue to qualify as a RIC for federal income tax purposes and obtain favorable RIC tax treatment, we must meet certain requirements, including certain minimum distribution requirements.

Corporate Structure

We conduct some of our activities through wholly owned, special-purpose financing subsidiaries. These subsidiaries are bankruptcy remote, special-purpose entities to which we transfer certain loans. Each financing subsidiary, in turn, transfers the loans to a Delaware statutory trust. For accounting purposes, the transfers of the loans to the Delaware statutory trusts are structured as on-balance sheet securitizations. We also use wholly owned subsidiaries, all of which are structured as Delaware corporations and limited liability companies, to hold the assets of one or more of our portfolio companies. Some of these subsidiaries have wholly owned subsidiaries, all of which are Delaware corporations that hold the assets of certain of our portfolio companies.

We also make investments in qualifying small businesses through Solutions Capital I, L.P., or Solutions Capital, our wholly owned subsidiary licensed by the United States Small Business Administration, or the SBA, to operate as a small business investment company, or SBIC, under the Small Business Investment Act of 1958, as amended, or the SBIC Act. As a SBIC, Solutions Capital is subject to a variety of regulations concerning, among other things, the size and nature of the companies in which it may invest and the structure of those investments.

Company Background

We were incorporated in Delaware in 1998. On March 18, 1998, we changed our name from MCG, Inc. to MCG Credit Corporation and, on June 14, 2001, we changed our name from MCG Credit Corporation to MCG Capital Corporation. Our principal executive offices are located at 1100 Wilson Boulevard, Suite 3000, Arlington, VA 22209 and our telephone number is (703) 247-7500.

In this Annual Report on Form 10-K, the terms “Company,” “MCG,” “we,” “us” and “our” refer to MCG Capital Corporation and its wholly owned subsidiaries (including its affiliated securitization trusts) unless the context otherwise requires.

We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and, accordingly, file reports, proxy statements and other information with the Securities Exchange Commission, or the SEC. Such reports, proxy statements and other information can be read and copied at the public reference facilities maintained by the SEC at the Public Reference Room, 100 F Street, N.E., Washington, D.C. 20549. Information regarding the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC maintains a web site (www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

Our Internet address is www.mcgcapital.com. We are not including the information contained on our website as a part of, or incorporating it by reference into, this Annual Report on Form 10-K. We make available free of charge on our website our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

1

Table of Contents

Our logo, trademarks and service marks are the property of MCG. Other trademarks or service marks appearing in this Annual Report on Form 10-K are the property of their respective holders.

Significant Developments in 2011

In 2011, we continued to execute on our previously stated strategic plan to, among other initiatives, convert lower-yielding equity investments and unencumbered cash into yield-oriented new investment opportunities. We successfully monetized equity investments in 15 control and other equity positions generating cash proceeds of $64.3 million. Our liquidity position, together with the generation of distributable net operating income, or DNOI, of $0.53 per share, enabled our board or directors to declare dividend distributions of $0.66 per share in 2011.

Notwithstanding the success of our 2011 monetization efforts and the solid performance of the majority of our investment portfolio, continued valuation adjustments to our largest control investment, Broadview Networks Holdings, Inc., or Broadview, and valuation adjustments to certain other legacy investments resulted in a reported loss of $93.1 million for 2011. These losses, together with our limited access to debt and equity markets, have currently restricted our origination liquidity sources to our existing SBIC facility and unencumbered cash.

On October 31, 2011, Richard W. Neu, Chairman of our board of directors, was elected as chief executive officer, succeeding Steven F. Tunney, Sr. who resigned in order to pursue other interests. Additionally, B. Hagen Saville, previously our Executive Vice President of Business Development and a member of our board of directors, was appointed President and Chief Operating Officer.

Outlook

Under the direction of Messrs. Neu and Saville, MCG took a fresh look at how to prudently and expeditiously return the Company to its roots as a strong middle market debt lender. As part of that undertaking, every aspect of the Company was examined under the assumption that our legacy equity positions wind down over the course of 2012 and with the fundamental goal of simplifying operations.

This transition is consistent with the desire to create a company with less credit and leverage risk yet one that has a sustainable and predictable level of NOI and dividend generation. The transition also addresses the potential impact of an expected reduction, over the next several years, of the size of our investment portfolio as our existing secondary market funding facilities contractually wind down.

We are substantially complete with our process review. Relative to our fourth quarter annualized general and administrative costs, excluding costs related to the resignation of Mr. Tunney, we have identified non-compensation cost reduction opportunities of approximately $4.5 million to $5.5 million per annum which, when fully implemented, we believe will target a non-compensation cost structure of approximately $5.5 million to $6.5 million. We expect these cost reductions to be embedded in our non-compensation general and administrative costs by no later than the end of the first quarter of 2013, which is when the lease on our current headquarters facility expires.

In addition to our process review, and taking into consideration the anticipated wind down of our legacy equity positions and current secondary market funding facilities, we undertook a comprehensive review of our current work force and structure. This review encompassed a benchmark review against internally managed peers together with a skill assessment of our current personnel. It was undertaken with the intended fundamental principle of allowing no degradation to the Company’s existing risk management profile.

As a result of this review, we would anticipate our current work force of 37 employees will transition to a level of 20 to 25 by year end 2012. This reduction in force is intended to generate a targeted future base compensation and benefits level of approximately $4.0 million to $5.0 million beginning in 2013.

As we enter 2013 and begin to realize the expected benefits of the initiatives discussed above, we are forecasting NOI of approximately $0.50 per share to $0.60 per share. In effect, the anticipated cost savings of approximately $8.5 million to $10.5 million, together with the earnings benefits from projected monetizations and proposed conversions of legacy equity investments to debt instruments, are intended to provide a substantial offset to the earnings reduction attributable to the significant deleveraging of our balance sheet.

In arriving at this forecast, a number of assumptions are required which, if incorrect, could materially change the results of our forecast, including potential monetizations and proposed conversions. However, we have assumed no incremental debt or equity issuances as we clearly recognize that the primary path to future debt and equity support from investors, at economic levels, is through the stabilization of our investment portfolio.

2

Table of Contents

With respect to 2012, we are anticipating to incur non-recurring costs of approximately $0.10 per share to $0.15 per share, primarily associated with expected severance costs, the previously announced amendment of our SunTrust Warehouse facility, the early retirement of our private placement notes and other transitional costs. Excluding these costs, we are forecasting NOI of approximately $0.40 per share to $0.50 per share.

Recognizing the one time nature of the 2012 transitory costs, our strong liquidity position, and the importance of dividends to our investor base, we have committed to a dividend declaration level of $0.14 per share for the next two quarters. Accordingly, we will pay a $0.17 per share dividend in May 2012 followed by a $0.14 per share dividend in both July and October 2012. Such payments are expected to include a return of capital.

Lastly, as previously announced on January 17, 2012, we are authorized to repurchase shares of our common stock, up to $35 million, in open market transactions, including through block purchases, depending on prevailing market conditions and other factors. As of March 1, 2012, no shares have been repurchased.

MCG’s Investment Portfolio

Our investment portfolio is composed primarily of middle-market companies in which we have made up to $75 million of debt and equity investments. Typically, these middle-market companies have $20 million to $200 million in annual revenue and $3 million to $25 million in earnings before interest, taxes, depreciation and amortization, or EBITDA. Generally, our portfolio companies use our capital investments to finance acquisitions, recapitalizations and buyouts, as well as for organic growth and working capital. We identify and source new portfolio companies through multiple channels, including private equity sponsors, investment bankers, brokers, fund-less sponsors, institutional syndication partners, owner operators, and other club lenders (“club lenders” are organizations that facilitate peer-to-peer loans). We generally invest in some combination of senior debt, second lien debt, secured and unsecured subordinated debt and equity.

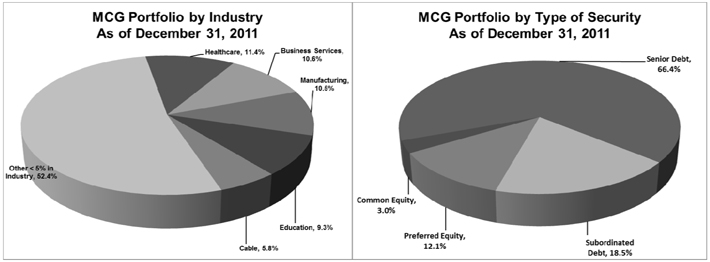

As of December 31, 2011, we had debt and equity investments in 60 portfolio companies with a combined fair value of over $741 million. As shown in the following chart, over 80% of the fair value of our portfolio as of December 31, 2011 was invested in senior and subordinated debt, while the remainder of our portfolio was invested in preferred and common equity securities. Our diversified investment portfolio spans 29 industries. Approximately 53% of our portfolio is composed of investments in industries that comprise less than 5% of the fair value of our portfolio. See Portfolio Composition and Investment Activity in our Management’s Discussion and Analysis of Financial Condition and Results of Operations for additional detail about our investment portfolio, including a detailed listing of the industries represented in our investment portfolio.

Most of the loans in our portfolio were originated directly with our portfolio companies; however, we have also participated in loan syndications or other transactions. Our debt instruments bear contractual interest rates ranging from 2.5% to 17.5%, a portion of which may be deferred. As of December 31, 2011, approximately 88.2% of the fair value of our loan portfolio had variable interest rates, based on a LIBOR benchmark or prime rate, and 11.8% of the fair value of our loan portfolio had fixed interest rates. As of December 31, 2011, approximately 79.2% of the fair value of our loan portfolio had LIBOR floors between 1.0% and 3.0% on a LIBOR-based index or prime floors between 1.75% and 6.0%. At origination, our loans generally have four- to eight-year stated maturities. Borrowers typically pay an origination fee based on a percent of the total commitment and a fee on undrawn commitments.

3

Table of Contents

From time to time, we make equity investments in companies in which we have also made debt investments. Our equity investments include preferred stock, common stock and warrants and, in many cases, include the right to board representation. We may invest across the capital structure of our portfolio companies using a combination of debt and equity investments to meet our portfolio companies’ needs and achieve favorable risk-adjusted returns.

The following table summarizes the fair value and revenue contributions of our ten largest investments. As of December 31, 2011, these ten investments comprised 40.8% of the fair value of our portfolio and contributed 34.7% of our total revenues during 2011.

| (dollars in thousands) |

As of December 31, 2011 | Year ended December 31, 2011 | ||||||||||||||||

| Company |

Industry | Fair Value | % of Portfolio |

Revenues | % of Total Revenues |

|||||||||||||

| Orbitel Holdings, LLC |

Cable | $ | 37,602 | 5.1 | % | $ | 2,870 | 3.4 | % | |||||||||

| GSDM Holdings, Corp. |

Healthcare | 34,653 | 4.7 | 4,062 | 4.7 | |||||||||||||

| RadioPharmacy Investors, LLC |

Healthcare | 34,457 | 4.6 | 5,264 | 6.1 | |||||||||||||

| NDSSI Holdings, LLC |

Electronics | 31,966 | 4.3 | 4,372 | 5.1 | |||||||||||||

| Stratford School Holdings, Inc. |

Education | 30,690 | 4.1 | 1,584 | 1.9 | |||||||||||||

| Capstone Logistics, LLC |

Logistics | 29,816 | 4.0 | 3,270 | 3.8 | |||||||||||||

| Coastal Sunbelt Holding, Inc. |

Food Services | 28,842 | 3.9 | 3,466 | 4.0 | |||||||||||||

| G&L Investment Holdings, LLC |

Insurance | 24,987 | 3.4 | 2,906 | 3.4 | |||||||||||||

| Education Management, Inc. |

Education | 24,963 | 3.4 | 1,492 | 1.8 | |||||||||||||

| Jenzabar, Inc. |

Technology | 24,690 | 3.3 | 413 | 0.5 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total—ten largest investments |

302,666 | 40.8 | 29,699 | 34.7 | ||||||||||||||

| Other portfolio companies |

438,500 | 59.2 | 55,997 | 65.3 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total investment portfolio |

$ | 741,166 | 100.0 | % | $ | 85,696 | 100.0 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

As of December 31, 2011, our control companies comprised 16.1% of the fair value of our portfolio and contributed 14.1% of our total revenues during 2011.

Competition

Our primary competitors in providing financing to middle-market companies include public and private funds, commercial and investment banks, commercial financing companies, and, to the extent they provide an alternative form of financing, private equity funds. Additionally, because competition for investment opportunities generally has increased among alternative investment vehicles, such as hedge funds, those entities have begun to invest in areas they have not traditionally invested, including investments in middle-market companies. Some of our existing and potential competitors are substantially larger and have considerably greater financial, technical and marketing resources than we do. For example, some competitors may have a lower cost of funds and access to funding sources that are not available to us. In addition, some of our competitors may have higher risk tolerances or different risk assessments, which could allow them to consider a wider variety of investments and establish more relationships and build their market shares.

We do not seek to compete primarily based on the interest rates we offer, and we believe that some of our competitors make loans with interest rates that are comparable to, or lower than, the rates we offer. We generally compete by using our knowledge of our portfolio companies’ business needs, derived from the research, analyses, and interaction by our professional staff with our portfolio companies, to offer the appropriate product-mix coupled with a range of corporate finance services and information that enhances our portfolio companies’ business prospects.

Life Cycle of Debt and Equity Originations

The key aspects of our portfolio origination, servicing and monitoring process are set forth below.

INVESTMENT OBJECTIVE AND STRATEGIES

Our investment objective is to achieve current income and capital gains. The primary goal of our investment process is to increase our earnings and net asset value, or NAV, by investing in debt and equity securities of middle-market companies. We earn interest, dividends and fees on our investments, and we may report unrealized appreciation and depreciation as the fair value of our investments increases or decreases. We realize capital gains or losses when the investment is eventually monetized.

4

Table of Contents

When we originate debt and equity investments, we strive to achieve favorable risk-adjusted rates of return in the form of current income and capital gains, while maintaining credit and investment quality in our portfolio. Before making investments, we apply well established credit processes to assess investment risk and we structure and price our investments accordingly. We have developed proprietary analytics, data and knowledge to support our business activities. We designed our investment process to achieve the following strategic objectives:

| • | generate favorable risk-adjusted rates of return by delivering capital and strategic insight to increase our portfolio companies’ enterprise value; |

| • | maintain sound credit and investment discipline and pricing practices, regardless of market conditions, to avoid adverse investment selection; and |

| • | manage risk by utilizing an integrated team approach to business development, underwriting and investment servicing. |

We maintain a flexible approach to funding that permits us to adjust price, maturity and other transaction terms to accommodate the needs of our portfolio companies.

ORGANIZATION OF MCG’S INVESTMENT PROFESSIONALS

Our organization includes experienced professionals with the ability to originate, underwrite, finance, syndicate, monitor and exit investments that generate attractive returns. The following bullets describe the key functional teams that are responsible for our investment processes:

| • | Deal Teams—Our deal teams are responsible for identifying and performing a financial and risk analysis of potential investment opportunities. After an investment is approved and funded, the deal teams have continuing ongoing responsibility for monitoring the performance of their respective investments. Under the general direction of our President and Chief Operating Officer, our deal teams are led by one of our Managing Directors or Deal Sponsors and also include one or more financial analysts and a member of our in-house legal staff. |

| • | Credit Committee—The prospective investment is presented to MCG’s credit committee for review and approval. The credit committee includes our Chief Executive Officer, our President and Chief Operating Officer, and all of our Managing Directors. |

| • | Investment and Valuation Committee of the Board of Directors—The investment and valuation committee is responsible for reviewing all investments over $20.0 million and it has the discretion to review and approve other investments. Subsequent to the review and funding of an investment, the investment and valuation committee makes recommendations that are used by our board of directors for its quarterly determination of the fair value of our investment portfolio. |

The following sections provide additional information on how these teams support the investment process. In addition to the teams described above, we also have an infrastructure of professionals that provide accounting, finance, human resources, investor relations, legal, and other services that support our investment professionals and provide other corporate, compliance and governance functions.

BUSINESS DEVELOPMENT

MCG and its predecessors have been active investors in middle-market companies since 1990. We believe our experience in middle-market investing is a meaningful competitive advantage that we use to operate our business.

Our deal teams identify and source new investments through multiple channels, including private equity sponsors, investment bankers, brokers, fund-less sponsors, institutional syndication partners, other club lenders and owner-operators. The deal teams also market to prospective portfolio companies identified through various data services, customized Internet searches and relationships with investment bankers, accountants, lawyers and other professionals.

Once we identify a prospective portfolio company, we review the company’s financial reports, business plan, corporate activities and other relevant information that we gather from third-party databases, industry reports and publications. We focus on a company’s fundamental performance against industry conditions and operational benchmarks. We work with our current and prospective portfolio companies to understand their business, as well

5

Table of Contents

as the costs and benefits of their corporate development initiatives, opportunities, competition and acceptable risks and returns. This analysis allows us to support our portfolio companies’ corporate development decisions, even in some cases where short-term financial ratios or other metrics may decline temporarily.

RISK ANALYSIS

After we identify a prospective investment, we review the company’s history, organization and product lines. In addition, we analyze the prospective portfolio company’s industry, competition and market share, obsolescence and substitution risk, markets served, legal and regulatory environment and technology. In particular, we analyze:

| • | Industry Risks—maturity, cyclicality and seasonality associated with the industries in which we invest, as well as the proportion of our portfolio that is invested in specific industries and individual portfolio companies; |

| • | Competitive Risks—strengths and weaknesses of prospective portfolio companies relative to their competitors’ pricing, product quality, customer loyalty, substitution and switching costs, brand positioning and capitalization. We also assess the defensibility of a prospect’s market position and its opportunity for increasing market share; |

| • | Management Risks—track records, industry experience, the prospective portfolio companies’ respective business plans and management incentives; |

| • | Regulatory Risks—new and evolving regulations applicable to the BDC industry and industries in which the prospective portfolio companies operate; |

| • | Customer Concentration and Market Risks—sustainability, stability and opportunities for the growth of the prospective portfolio companies’ customer bases, including the number and size of its customers, attrition rates and dependence on one or a limited number of customers; and |

| • | Technology Risks—impact of technological advances in the industries and portfolio companies in which we may invest. |

We also assess other attributes that may have a significant impact on the risk of a potential transaction. Quantitative attributes that we evaluate include industry-specific comparisons, such as cash flow margins, product and cash flow diversification, revenue growth rates, cost structure and other operating benchmarks that are derived from historical and projected financial statements. Qualitative attributes we evaluate may include management skill and depth, industry risk, substitution risk, sensitivity to economic cycles, cyclicality, geographic diversification, facilities infrastructure, administration requirements and product quality and ranking.

To assess the risk of a potential investment and to quantify the underlying value of the prospective portfolio company, we employ a series of valuation techniques. We primarily derive enterprise valuations through analyses of comparative public and private market transactions and other data. We also look to comparable public companies to benchmark the value of the enterprise using public market data. We generally base enterprise value on current and projected market conditions. Using these methods provides us with multiple views of the value of the enterprise and allows us to calculate certain metrics that we use in both risk assessment and product pricing, such as loan-to-value ratios for our debt investments.

UNDERWRITING AND RISK MANAGEMENT

Our underwriting process, which focuses on investment risk analysis, is initiated during the business development process. Our underwriting process includes standard due diligence on a prospective portfolio company’s financial performance, as well as customized analyses of a prospective portfolio company’s operations, systems, accounting policies, human resources and competitive, legal and regulatory environments.

In addition to gaining an in-depth understanding of prospective portfolio companies, our research and due diligence process evaluates industry-wide operational, strategic and valuation issues. We also assess emerging trends and competitive threats to the portfolio company, as well as the industry in which it operates. The knowledge and insight we obtain through our research are valuable to our portfolio companies who may draw on our industry expertise to refine their strategic plans, identify acquisition opportunities and set appropriate financial and operational goals.

As part of our evaluation, the deal team prepares an investment memorandum for presentation to our credit committee. When the dollar amount of the proposed investment exceeds certain pre-defined thresholds, or includes a significant investment in equity, the investment memorandum is also submitted to our investment and valuation committee of our board of directors for review and approval. The investment memorandum generally consists of:

| • | a business description; |

6

Table of Contents

| • | historical financial analyses, projections and scenario modeling; |

| • | a risk evaluation specific to the prospective portfolio company’s business and industry, considering the anticipated use of proceeds of our investment; |

| • | an enterprise valuation to assess the underlying value of the prospective portfolio company, both as an ongoing operation and its value relative to comparable public and private companies; |

| • | a description of the capital structure and the investment risk and return characteristics; and |

| • | reviews by third-party experts. |

INVESTMENT STRUCTURE

We evaluate our portfolio companies’ needs and utilize our product mix to structure investments that meet their capital requirements and business plans and protect our capital, with an expectation toward generating risk-adjusted returns through current income on our loans and equity investments and capital gains on our equity investments. We structure our debt investments to mitigate risk by requiring appropriate financial and collateral coverage thresholds. When structuring our debt investments, we evaluate key components, including payment priority, collateral or asset value, and financial support from guarantors and other credit enhancements. Since our investments typically include loans and our loans are typically cash-flow loans, rather than asset-backed loans, we factor the enterprise value of the prospective portfolio company’s assets into our credit decisions. For the majority of our loans, we receive a security interest in our portfolio companies’ tangible and intangible assets, which entitles us to a preferred position on payments in the event of liquidation. In addition, our loan covenants generally include affirmative covenants that require the portfolio company to provide periodic financial information, notification of material events and compliance with laws, as well as restrictive covenants that prevent the portfolio company from taking a range of significant actions, such as incurring additional indebtedness or making acquisitions without our consent. We also generally include covenants requiring the portfolio company to maintain or achieve specified financial ratios, such as cash flow leverage, interest charge coverage, total charge coverage, and, in certain cases, covenants requiring the portfolio company to maintain certain operational benchmarks.

We generally invest in some combination of the following securities:

| • | Senior Debt—We provide cash flow based senior debt in the form of amortizing term loans, bullet maturity term loans, and revolving credit facilities. Senior debt ranks senior in priority of payment to other debt and equity, and benefits from a first priority collateral interest in the assets of the borrower. As such, most other creditors rank junior to our investments in these securities in the event of insolvency. Due to its lower risk profile and often more restrictive covenants as compared to other debt, senior secured debt generally earns a lower return. |

| • | Second-Lien Debt—We provide second-lien term loans on a sole-source or participant basis where assets or enterprise-value based borrowing capacity is not readily available within typical senior debt leverage constraints. Second-lien debt ranks senior in priority of payment to subordinated debt and equity but subordinated to senior debt. Second-lien debt benefits from a collateral interest in the assets of the borrower subordinated to senior debt in a liquidation. As such, senior creditors rank senior to second-lien creditors in the event of insolvency with respect to pursuing remedies against the collateral of the portfolio company. Due to its higher risk profile and often less restrictive covenants as compared to senior debt, second-lien debt generally earns a higher return than senior debt. |

| • | Secured and Unsecured Subordinated Debt—We invest in secured and unsecured subordinated debt, which may be structured with a combination of current interest, deferred interest or equity-linked components. Subordinated debt ranks subordinate in priority of payment to senior and second lien debt. Our subordinated debt may not have a collateral interest in the borrower or may have a collateral interest subordinated to the senior and second lien debt. As such, senior and second lien creditors rank senior to us in the event of insolvency. Due to its higher risk profile and often less restrictive covenants as compared to other loans, subordinated debt generally earns a higher return than other debt. |

7

Table of Contents

| • | Equity—We may from time-to-time invest in minority equity positions with private equity partners or on our own. In the past we have invested in control equity positions, including $46.3 million (fair value) of control equity positions that remained in our portfolio as of December 31, 2011. In addition, we may receive warrants to purchase preferred or common stock of a portfolio company related to our debt investments in such portfolio company. |

To protect our investments and maximize our returns, we negotiate the structure of each debt and equity security in our investment portfolio. Our contracts with those portfolio companies generally include many terms governing interest rate, repayment terms, prepayment penalties, financial covenants, operating covenants, ownership and corporate governance parameters, dilution parameters, liquidation preferences, voting rights, and put or call rights. In some cases, our loan agreements also allow for increases in the spread to the base index rate, if the portfolio company’s financial or operational performance deteriorates or shows negative variances from its business plan and, in some cases, allow for decreases in the spread if financial or operational performance improves or exceeds the portfolio company’s plan.

We use the following core products to execute our strategy:

| • | Unitranche—We provide unitranche debt that blends characteristics of both senior and subordinated financing, generally in a first-lien position. |

| • | One-Stop Solution—Our “one-stop” solution enables our portfolio companies to satisfy multiple financing needs from a single capital provider with an efficient diligence, structuring, negotiating and closing process. In a typical “one-stop” transaction, we provide a combination of senior and subordinated debt to the portfolio company and, in certain cases, also acquire an equity interest in the portfolio company. The overall transaction size and product mix are based upon our portfolio company’s needs. In some cases our “one-stop” solution results in a product mix that meets our portfolio company’s needs, but which, we believe, does not optimize the use of our capital. In those cases, we may sell portions of some of the securities to achieve a more optimal mix. |

| • | Institutional Subordinated Debt—We provide institutional subordinated debt in the form of junior, yielding capital, as a sole or club investor in the larger end of our target market. Typically, these loans are payable in full at maturity and generally provide attractive yields. Our institutional subordinated debt portfolio companies generally are larger businesses supported by institutional equity capital that reduces the risk profile of these investments. |

| • | Control Investments—Historically, we have made control investments for which we have taken a majority ownership position and, in most cases, control the board of directors of a portfolio company. We did not make any control investments in new portfolio companies during 2011 and we do not expect to make control investments in new portfolio companies for the foreseeable future. |

| • | Other Investments and Services—To help balance our portfolio, we also make other investments, such as investments in broadly syndicated loans. In addition to capital, we also offer managerial assistance to our portfolio companies. Typically, this assistance involves strategic advice, evaluation of business plans, financial modeling assistance and industry research and insights. We believe that providing assistance to our portfolio companies enables us to maximize our value proposition for our portfolio companies, which, in turn, helps maximize our investment returns. |

INVESTMENT APPROVAL PROCESS

The credit process for each investment opportunity begins with our deal sponsors, who are responsible for originating transactions, as well as for investment performance, including credit risk, throughout the life cycle of an investment. Deal sponsors provide an initial credit screen based on our investment policies, described herein, and then bring the best opportunities to our credit committee in a “pipeline meeting.” For pipeline meetings, the deal sponsor prepares a report that summarizes the transaction and includes financial statements, credit ratios and pricing, background information on the principals, equity investors and industry dynamics. The credit committee determines whether the investment should be pursued, giving consideration to the risk return profile, industry concentrations and general economic outlook for the sector in which the business operates. In these meetings the credit committee also offers the deal sponsor insight into key issues that must be resolved before a potential investment is funded.

Objectives are determined and due diligence is conducted. On-site due diligence, including general ledger reviews, proofs of cash, material contract reviews, background checks, reviews of customer and vendor concentrations, and confirmation of historical results are performed by our personnel and, in certain situations, by third-party service providers. We believe in using our own in-house expertise when applying our consistent standards for due diligence.

8

Table of Contents

All of our investments are approved by our credit committee. In addition, investments of over $20 million must also be approved by the investment and valuation committee of our board of directors, of which a super majority of the members are independent directors.

INVESTMENT FUNDING

We fund our investments using cash that we receive in exchange for a combination of debt and equity instruments that we issue from time to time. Throughout 2011, our debt obligations included secured obligations that included provisions that restricted the types of investments that could be used as collateral in the facility. In 2011, our debt obligations also included unsecured obligations that we subsequently repaid in full in January 2012. See the Liquidity and Capital Resources—Borrowings section of our Management’s Discussion and Analysis of Financial Condition and Results of Operations for additional information about these secured and unsecured debt obligations. As a BDC, we are not permitted to incur indebtedness unless immediately after such borrowing we meet a coverage ratio of total assets to total senior securities, which include all of our borrowings (excluding borrowings made by our SBIC) and any preferred stock we may issue in the future, of at least 200%.

INVESTMENT MONITORING AND RESTRUCTURING

We monitor the status and financial performance of each company in our portfolio in order to evaluate overall portfolio quality. We are proactive with companies that are underperforming and, in many instances, have added better covenant protection and rights over time.

When our attempts to collect past due principal and/or interest on a loan are unsuccessful, we will perform an analysis to determine the appropriate course of action. In some cases, we may consider restructuring the investment to better reflect the current financial performance of the portfolio company. Such a restructuring may, among other things, involve deferring principal and interest payments, adjusting interest rates or warrant positions, imposing additional fees, amending financial or operating covenants or converting debt to equity. In connection with a restructuring, we generally receive compensation from the portfolio company for any increased risk. During the process of monitoring a loan in default, we will send a notice of non-compliance outlining the specific defaults that have occurred and preserving our contractual remedies, and initiate a review of the collateral, if any. When a restructuring is not the most appropriate course of action, we generally pursue remedies available to us that minimize potential losses, including initiating foreclosure and/or liquidation proceedings.

When one of our loans becomes more than 90 days past due, or if we otherwise do not expect the portfolio company to be able to service its debt and other obligations, we will, as a general matter, place the loan on non-accrual status and generally will cease recognizing interest income on that loan until all principal and interest has been brought current through payment or due to a restructuring such that the interest income is deemed to be collectible. However, we may make exceptions to this policy if the loan has sufficient collateral value and is in the process of collection. If the fair value of a loan is below cost, we may cease recognizing paid-in-kind interest and/or the accretion of a discount on the debt investment until such time that the fair value equals or exceeds cost.

INVESTMENT POLICIES

Our investment policies provide that we will not:

| • | act as an underwriter of securities of other issuers, except to the extent that we may be deemed an “underwriter” of securities (i) purchased by us that must be registered under the Securities Act of 1933, as amended, before they may be offered or sold to the public, or (ii) in connection with offerings of securities by our portfolio companies; |

| • | sell securities short in an uncovered position; |

| • | write or buy uncovered put or call options, except to the extent of options, warrants or conversion privileges in connection with our loans or other investments, and rights to require the issuers of such investments or their affiliates to repurchase them under certain circumstances; |

| • | engage in the purchase or sale of commodities or commodity contracts, including futures contracts, except for the purpose of hedging in the ordinary course of business or where necessary in working out distressed loan or investment situations; or |

9

Table of Contents

| • | acquire more than 3% of the voting stock of, or invest more than 5% of our total assets in any securities issued by, any other investment company, except if we acquire them as part of a merger, consolidation or acquisition of assets or if they result from a sale of a portfolio company, or otherwise as permitted under the 1940 Act. |

All of the above policies and the investment and lending guidelines set by our board of directors or any committees, including our investment objective to achieve current income and capital gains, are not “fundamental” as defined under the 1940 Act. Therefore, our board may change them without notice to, or approval by, our stockholders. However, any change may require the consent of our lenders.

Other than the restrictions pertaining to the issuance of senior securities under the 1940 Act, the percentage restrictions on investments generally apply on the effective date of the transaction. A subsequent change in a percentage resulting from market fluctuations or any cause other than an action by us will not require us to dispose of portfolio securities or to take other action to satisfy the percentage restriction.

We intend to conduct our business so as to retain our status as a BDC. To retain our status as a BDC, we may not acquire any assets, other than non-investment assets necessary and appropriate to our operations as a BDC, if after giving effect to such acquisition the value of our “qualifying assets” is less than 70% of the value of our total assets.

Investment Adviser

We have no investment adviser and are internally managed by our executive officers under the supervision of the board of directors. Our investment decisions are made by our officers, directors and senior investment professionals who serve on our credit and investment and valuation committees. None of our executive officers or other employees has the unilateral authority to approve any investment.

Regulation

INVESTMENT COMPANY ACT OF 1940

As a BDC, we are regulated under the 1940 Act. The BDC structure provides stockholders the ability to retain the liquidity of a publicly traded stock, while sharing in the possible benefits, if any, of investing in primarily privately owned companies.

In part, the 1940 Act requires us to be organized in the United States for the purpose of investing in, or lending to, primarily private companies and making managerial assistance available to them. As a BDC we may use capital provided by public stockholders and from other sources to invest in long-term, private investments in businesses.

We may not, however, change the nature of our business so as to cease to be, or withdraw our election as, a BDC unless authorized by vote of a majority of our outstanding voting securities. The 1940 Act defines a majority of the outstanding voting securities as the lesser of:

| i) | 67% or more of such company’s shares present at a meeting if more than 50% of the outstanding shares of such company are present or represented by proxy; or |

| ii) | more than 50% of the outstanding shares of such company. |

We currently do not anticipate any substantial change in the nature of our business.

Qualifying Assets

A BDC must have been organized and have its principal place of business in the United States and must be operated for the purpose of making investments in the types of securities described in (1), (2) or (3) below. Thus, under the 1940 Act, we may not acquire any asset other than assets of the type listed in Section 55(a) of the 1940 Act, which are referred to as qualifying assets, unless, at the time the acquisition is made, qualifying assets represent at least 70% of the company’s total assets. The principal categories of qualifying assets relevant to our business are the following:

| 1) | Securities purchased in transactions not involving any public offering from the issuer of such securities, which issuer (subject to certain limited exceptions): |

| a) | is an eligible portfolio company, or from any person who is, or has been during the preceding 13 months, an affiliated person of an eligible portfolio company, or from any other person, subject to such rules as may be prescribed by the SEC. An eligible portfolio company is defined in the 1940 Act as any issuer that: |

| i) | is organized under the laws of, and has its principal place of business in, the United States; |

10

Table of Contents

| ii) | is not an investment company (other than a small business investment company wholly owned by us) or a company that would be an investment company but for certain exclusions under the 1940 Act; and |

| iii) | does not have any class of securities listed on a national securities exchange; |

| b) | is a company that meets the requirements of (a)(i) and (ii) above, but is not an eligible portfolio company because it has issued a class of securities on a national securities exchange, if: |

| i) | at the time of the purchase, we own at least 50% of the (x) greatest number of equity securities of such issuer and securities convertible into or exchangeable for such securities; and (y) the greatest amount of debt securities of such issuer, held by us at any point in time during the period when such issuer was an eligible portfolio company; and |

| ii) | we are one of the 20 largest holders of record of such issuer’s outstanding voting securities; or |

| c) | is a company that meets the requirements of (a)(i) and (ii) above, but is not an eligible portfolio company because it has issued a class of securities on a national securities exchange, if the aggregate market value of such company’s outstanding voting and non-voting common equity is less than $250.0 million. |

| 2) | Securities of any eligible portfolio company that we control. |

| 3) | Securities purchased in a private transaction from a U.S. issuer that is not an investment company or from an affiliated person of the issuer, or in transactions incident thereto, if the issuer is in bankruptcy and subject to reorganization or if the issuer, immediately prior to the purchase of its securities was unable to meet its obligations as they came due without material assistance other than conventional lending or financing arrangements. |

| 4) | Securities of an eligible portfolio company purchased from any person in a private transaction if there is no ready market for such securities and we already own 60% of the outstanding equity of the eligible portfolio company. |

| 5) | Securities received in exchange for or distributed on or with respect to securities described in (1) through (4) above, or pursuant to the exercise of warrants or rights relating to such securities. |

| 6) | Cash, cash items, U.S. Government securities or high-quality debt securities maturing in one year or less from the time of investment. |

Control, as defined by the 1940 Act, is presumed to exist where a BDC beneficially owns more than 25% of the outstanding voting securities of the portfolio company. For the foreseeable future, we do not expect to add new control positions to our portfolio.

Significant Managerial Assistance

In order to count portfolio securities as qualifying assets for the purpose of the 70% test discussed above, we must either control the issuer of the securities or must offer to make available significant managerial assistance; except that, where we purchase such securities in conjunction with one or more other persons acting together, one of the other persons in the group may make available such managerial assistance. Making available significant managerial assistance means, among other things, any arrangement in which we offer to provide and, if accepted, provide significant guidance and counsel concerning the management, operations or business objectives and policies of a portfolio company through monitoring of portfolio company operations, selective participation in board and management meetings, consulting with and advising a portfolio company’s officers or other organizational or financial guidance.

Warrants and Options

Under the 1940 Act, we are subject to restrictions on the amount of warrants, options, restricted stock or rights to purchase shares of capital stock that we may have outstanding at any time. In particular, the amount of capital stock that would result from the conversion or exercise of all outstanding warrants, options or rights to purchase capital stock cannot exceed 25% of our total outstanding shares of capital stock. This amount is reduced to 20%

11

Table of Contents

of our total outstanding shares of capital stock if the amount of warrants, options or rights issued pursuant to an executive compensation plan would exceed 15% of our total outstanding shares of capital stock. We have received exemptive relief from the SEC permitting us to issue restricted stock to our employees and directors subject to the above conditions, among others.

Indebtedness and Senior Securities

We will be permitted, under specified conditions, to issue multiple classes of indebtedness and one class of stock senior to our common stock if our asset coverage, as defined in the 1940 Act, is at least equal to 200% immediately after each such issuance. In addition, we may not be permitted to declare any cash dividend or other distribution on our outstanding common shares, or purchase any such shares, unless, at the time of such declaration or purchase, we have asset coverage of at least 200% after deducting the amount of such dividend, distribution, or purchase price. We may also borrow amounts up to 5% of the value of our total assets for temporary or emergency purposes.

Capital Structure

As a BDC, we generally cannot issue and sell our common stock at a price below the current NAV per share. We may, however, sell our common stock, or warrants, options or rights to acquire our common stock, at a price below the current NAV of our common stock in a rights offering to our stockholders if: 1) our board of directors determines that such sale is in the best interests of the Company and our stockholders; 2) our stockholders approve the sale of our common stock at a price that is less than the current NAV; and 3) the price at which our common stock is to be issued and sold may not be less than a price which, in the determination of our board of directors, closely approximates the market value of such securities (less any sales load).

We may also be prohibited under the 1940 Act from participating in certain transactions with our affiliates without the prior approval of our directors who are not interested persons and, in some cases, prior approval by the SEC.

We do not intend to acquire securities issued by any investment company that exceed the limits imposed by the 1940 Act. Under these limits, we generally cannot acquire more than 3% of the voting stock of any registered investment company (as defined in the 1940 Act), invest more than 5% of the value of our total assets in the securities of one such investment company or invest more than 10% of the value of our total assets in the securities of such investment companies in the aggregate.

1940 Act Code of Ethics

We have adopted and will maintain a code of ethics that establishes procedures for personal investments and restricts certain personal securities transactions. Personnel subject to the code may invest in securities for their personal investment accounts, including securities that may be purchased or held by us, so long as such investments are made in accordance with the code’s requirements. Our Amended and Restated Code of Ethics, or 1940 Act Code of Ethics, will generally not permit investments by our employees in securities that may be purchased or held by us. We may be prohibited under the 1940 Act from conducting certain transactions with our affiliates without the prior approval of our directors who are not interested persons and, in some cases, the prior approval of the SEC.

A copy of our 1940 Act Code of Ethics is available at our website at www.mcgcapital.com. We are not including the information contained on our website as a part of, or incorporating it by reference into, this Form 10-K. In addition, you may read and copy the 1940 Act Code of Ethics at the SEC’s Public Reference Room in Washington, D.C. You may obtain information on the operation of the Public Reference Room by calling the SEC at (202) 551-8090. In addition, the 1940 Act Code of Ethics attached as an exhibit to our registration statement and is available on the EDGAR Database on the SEC’s Internet site at http://www.sec.gov. You may also obtain copies of the 1940 Act Code of Ethics, after paying a duplicating fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Section, 100 F Street, N.E., Washington, D.C. 20549.

PRIVACY PRINCIPLES

We are committed to maintaining the privacy of our stockholders and safeguarding their non-public personal information. The following information is provided to help you understand what personal information we collect, how we protect that information and why, in certain cases, we may share information with select other parties.

Generally, we do not receive any non-public personal information relating to our stockholders, although certain non-public personal information of our stockholders may become available to us. We do not disclose any non-public personal information about our stockholders or former stockholders, except as permitted by law or as is necessary in order to service stockholder accounts (for example, to a transfer agent).

12

Table of Contents

We restrict access to non-public personal information about our stockholders to our employees with a legitimate business need for the information. We maintain physical, electronic and procedural safeguards designed to protect the non-public personal information of our stockholders.

PROXY VOTING POLICIES AND PROCEDURES

We vote proxies relating to our portfolio securities in the best interest of our stockholders. We review on a case-by-case basis each proposal submitted to a stockholder vote to determine its impact on the portfolio securities held by us. Although we generally vote against proposals that may have a negative impact on our portfolio securities, we may vote for such a proposal if there are compelling long-term reasons to do so.

Our proxy voting decisions are discussed with our committee that is responsible for monitoring each of our investments. To ensure that our vote is not the product of a conflict of interest, we require that: (i) anyone involved in the decision-making process disclose to our General Counsel and Chief Compliance Officer any potential conflict that he or she is aware of and any contact that he or she has had with any interested party regarding a proxy vote; and (ii) employees involved in the decision-making process or vote administration are prohibited from revealing how we intend to vote on a proposal in order to reduce any attempted influence from interested parties.

EXEMPTIVE RELIEF

We have received an exemptive order of the SEC to permit us to issue restricted shares of our common stock as part of the compensation packages for certain of our employees and directors. We believe that the particular characteristics of our business, the dependence we have on key personnel to conduct our business effectively and the highly competitive environment in which we operate require the use of equity-based compensation for our personnel in the form of restricted stock. The issuance of restricted shares of our common stock requires the approval of our stockholders. In June 2006, our stockholders approved our Amended and Restated 2006 Employee Restricted Stock Plan and our Amended and Restated 2006 Non-Employee Director Restricted Stock Plan.

In October 2008, we received exemptive relief from the SEC, which effectively allows us to exclude debt issued by Solutions Capital from the calculation of our consolidated BDC asset coverage ratio.

OTHER

We will be examined periodically by the SEC for compliance with the Exchange Act and the 1940 Act.

As with other companies regulated by the 1940 Act, we must adhere to certain substantive regulatory requirements. A majority of our directors must be persons who are not interested persons, as that term is defined in the 1940 Act. We must provide and maintain a bond issued by a reputable fidelity insurance company to protect us against larceny and embezzlement. Furthermore, as a BDC, we cannot protect any director or officer against any liability to our stockholders arising from willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of such person’s office.

We are required to adopt and implement written policies and procedures reasonably designed to prevent violation of the federal securities laws, and to review these policies and procedures annually for their adequacy and the effectiveness of their implementation. Mr. Tod Reichert, our General Counsel and Chief Compliance Officer, is responsible for administering these policies and procedures.

COMPLIANCE WITH THE SARBANES-OXLEY ACT OF 2002 AND THE NASDAQ GLOBAL SELECT MARKET CORPORATE GOVERNANCE REGULATIONS

The Sarbanes-Oxley Act of 2002, or Sarbanes-Oxley Act, imposes a wide variety of regulatory requirements on publicly held companies and their insiders. The Sarbanes-Oxley Act requires us to review our policies and procedures to determine whether we comply with the Sarbanes-Oxley Act and the regulations promulgated thereunder.

The NASDAQ Global Select Market has also adopted various corporate governance requirements as part of its listing standards. We believe we are in compliance with such corporate governance listing standards.

13

Table of Contents

SMALL BUSINESS ADMINISTRATION REGULATIONS

In December 2004, we formed Solutions Capital and Solutions Capital G.P., LLC. In September 2007, Solutions Capital received final approval to be licensed as an SBIC. Solutions Capital has borrowed funds from the SBA against eligible investments and additional deposits to regulatory capital. As of January 2012, we had borrowed $150.0 million of SBA-guaranteed debentures under the SBIC program. SBA-guaranteed debentures are non-recourse, interest-only debentures with interest payable semi-annually and a ten-year maturity. The principal amount of SBA-guaranteed debentures is not required to be paid prior to maturity, but may be prepaid at any time without penalty.

The maximum amount of outstanding leverage available to single-license SBIC companies is $150.0 million. The limit may be increased to $225.0 million with the approval of a second SBIC license and the investment of additional regulatory capital. To access the $150.0 million, we have funded a total of $75.0 million to Solutions Capital.

SBICs are designed to stimulate the flow of private capital to eligible small businesses. Under SBA regulations, Solutions Capital is subject to regulatory requirements including making investments in SBA eligible businesses, investing at least 25% of regulatory capital in eligible “smaller” businesses, placing certain limitations on the financing terms of investments, prohibiting investing in certain industries, required capitalization thresholds, and is subject to periodic audits and examinations among other regulations. If Solutions Capital fails to comply with applicable SBA regulations, the SBA could, depending on the severity of the violation, limit or prohibit its use of debentures, declare outstanding debentures immediately due and payable, and/or limit Solutions Capital from making new investments. In addition, the SBA can revoke or suspend a license for willful or repeated violation of, or willful or repeated failure to observe, any provision of the SBIC Act or any rule or regulation promulgated thereunder. These actions by the SBA would, in turn, negatively affect us because Solutions Capital is our wholly owned subsidiary.

Eligible Small and Smaller Businesses

Under present SBA regulations, eligible small businesses include businesses that have a tangible net worth not exceeding $18 million and have average annual net income not exceeding $6 million for the two most recent fiscal years. In addition, an SBIC must devote 25% of its investment activity to “smaller” concerns as defined by the SBA. A smaller concern is one that has a tangible net worth not exceeding $6 million and has average annual net income not exceeding $2 million for the two most recent fiscal years. SBA regulations also provide alternative size standard criteria to determine eligibility, which depend on the industry in which the business is engaged and are based on such factors as the number of employees or gross sales. According to SBA regulations, SBICs may make long-term loans to small businesses and invest in the equity securities of such businesses. Once an SBIC has invested in a company, it may continue to make follow-on investments in the company, regardless of the size of the business, up and until the time a business offers its securities in a public market. Through Solutions Capital, we plan to continue to provide long-term loans to, and non-control equity investments in, qualifying small businesses.

Financing Limitations

SBA regulations also include restrictions on a “change of control” of an SBIC or transfers that would result in any person or group owning 10% or more of a class of capital stock (or its equivalent in the case of a partnership) of a licensed SBIC and require that SBICs invest idle funds in accordance with SBA regulations. In addition, our SBIC subsidiary may also be limited in its ability to make distributions to us if it does not have sufficient earnings and capital, in accordance with SBA regulations. The SBA places certain limits on the financing terms of investments by SBICs in portfolio companies such as limiting the interest rate on debt securities and loans provided to portfolio companies of the SBIC. The SBA also limits fees, prepayment terms and certain other economic arrangements that are sometimes charged in lending environments.

SBA Leverage or Debentures

SBA-guaranteed debentures are non-recourse to us, have a ten-year maturity and may be prepaid at any time without penalty. The interest rate of SBA-guaranteed debentures is fixed at the time of issuance at a market-based spread over ten-year U.S. Treasury Notes. Leverage through SBA guaranteed debentures is subject to required capitalization thresholds. Current SBA regulations limit the amount that Solutions Capital may borrow to a maximum of $150 million, which is up to twice its regulatory capital.

14

Table of Contents

Our SBIC subsidiary is subject to regulation and oversight by the SBA. Receipt of an SBIC license does not assure that our SBIC subsidiary will receive SBA-guaranteed debenture funding, which is dependent upon our SBIC subsidiary continuing to be in compliance with SBA regulations and policies. Periodically, SBA staff audits Solutions Capital to verify its compliance with SBA regulations.

The SBA, as a creditor, will have a superior claim to our SBIC subsidiary’s assets over our stockholders in the event we liquidate our SBIC subsidiary or the SBA exercises its remedies under the SBA-guaranteed debentures issued by our SBIC subsidiary upon an event of default.

CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS

We elected to be treated as a RIC, under Subchapter M of the Internal Revenue Code, or the Code, with the filing of our federal corporate income tax return for 2002, for which the election was effective as of January 1, 2002. As a RIC, we generally do not have to pay corporate taxes on any income we distribute to our stockholders as dividends, which allows us to reduce or eliminate our corporate-level tax liability. To continue to qualify as a RIC, we must, among other things, meet certain source-of-income and asset diversification requirements (as defined below). In addition, to qualify for RIC tax treatment we must distribute to our stockholders, for each taxable year, at least 90% of our “investment company taxable income,” which is generally our ordinary income plus the excess of our realized net short-term capital gains over our realized net long-term capital losses, which we collectively refer to as the 90% Distribution Requirement.

TAXATION AS A REGULATED INVESTMENT COMPANY

If we:

| • | qualify as a RIC, and |

| • | distribute each year to stockholders at least 90% of our investment company taxable income (which is defined in the Internal Revenue Code generally as ordinary income plus realized net short-term capital gains in excess of realized net long-term capital losses), and 90% of any ordinary pre-RIC built-in gains we recognize between January 1, 2002 and December 31, 2011, less our taxes due on those gains, |

we will be entitled to deduct and, therefore, will not be subject to U.S. federal income tax on, the portion of our income we distribute or are deemed to distribute to stockholders (other than any built-in gain recognized between January 1, 2002 and December 31, 2011). We will be subject to U.S. federal income tax at the regular corporate rate on any income not distributed (or deemed distributed) to our stockholders. We will be subject to a 4% nondeductible U.S. federal excise tax, or 4% excise tax, to the extent we do not make specified levels of distributions (actually or on a deemed basis) in a timely manner. For calendar years ended December 31, 2010 and earlier, we would have been subject to the 4% excise tax to the extent that we did not distribute (on either an actual or deemed basis): 98% of our ordinary income for each calendar year; 98% of our capital gain net income for each calendar year; and any income realized, but not distributed, in prior calendar years. As a RIC, beginning in 2011, we are subject to the 4% excise tax to the extent that we do not distribute (on either an actual or deemed basis): 98% of our ordinary income for each calendar year; 98.2% of our capital gain net income for each calendar year; and any income realized, but not distributed, in prior calendar years.

To qualify as a RIC for federal income tax purposes, we must, among other things:

| • | continue to qualify as a BDC under the 1940 Act at all times during each taxable year; |

| • | derive in each taxable year at least 90% of our gross income from (1) dividends, interest, payments with respect to certain securities, loans, gains from the sale of stock or other securities, or other income derived with respect to our business of investing in such stock or securities and (2) net income derived from an interest in a “qualified publicly traded partnership;” and |

| • | diversify our holdings so that at the end of each quarter of the taxable year: |

| • | at least 50% of the value of our assets consist of cash, cash items, U.S. government securities, securities of other RICs, and other securities, if such other securities of any one issuer do not represent more than 5% of the value of our assets or more than 10% of the outstanding voting securities of the issuer; and |

| • | no more than 25% of the value of our assets is invested in the securities, other than U.S. government securities or securities of other RICs, of (i) one issuer, (ii) two or more issuers that are |

15

Table of Contents

| controlled, as determined under applicable Internal Revenue Code rules, by us and are engaged in the same or similar or related trades or businesses or (iii) one or more “qualified publicly traded partnerships,” known as the Diversification Tests. |

We may be required to recognize taxable income in circumstances in which we do not receive cash. For example, if we hold debt obligations that are treated under applicable tax rules as having original issue discount, we must include in taxable income each year a portion of the original issue discount that accrues over the life of the obligation, regardless of whether cash representing such income is received by us in the same taxable year. We also may have to include in taxable income other amounts that we have not yet received in cash, such as payment-in-kind interest and deferred loan origination fees that are paid after origination of the loan or are paid in non-cash compensation such as warrants or stock. Because any original issue discount or other amounts accrued will be included in our investment company taxable income for the year of accrual, we may be required to make a cash distribution to our stockholders in the amount of that non-cash income in order to satisfy the 90% Distribution Requirement, even though we will not have received any cash representing such income.

If we fail to satisfy the 90% Distribution Requirement or fail to qualify as a RIC in any taxable year, we would be subject to tax in that year on all of our taxable income at regular corporate rates, regardless of whether we make any distributions to our stockholders. Distributions would not be required, and any distributions made in taxable years beginning before January 1, 2013 would be taxable to our stockholders as ordinary dividend income that, subject to certain limitations, may be eligible for the 15% maximum rate to the extent of our current and accumulated earnings and profits. Subject to certain limitations under the Code, corporate distributees would be eligible for the dividends-received deduction. Distributions in excess of our current and accumulated earnings and profits would be treated first as a return of capital to the extent of the stockholder’s tax basis, and any remaining distributions would be treated as a capital gain.

EMPLOYEES

We believe our success will depend greatly on our ability to identify, attract and retain capable employees. As of December 31, 2011, we employed 36 full-time and one part-time individual, including investment, portfolio and operations professionals, in-house counsel and administrative staff. Virtually all of these employees are located in our corporate headquarters in Arlington, Virginia. Our employees are not represented by any collective bargaining unit and we believe our relations with our employees are good.

| ITEM 1A. | RISK FACTORS. |

Investing in our common stock may be speculative and involves a high degree of risk. You should consider carefully the risks described below and all other information contained in this Annual Report on Form 10-K, including our consolidated financial statements and the related notes and the schedules and exhibits to this Annual Report on Form 10-K. The risks set forth below are not the only risks we face. If any of the following risks occur, our business, financial condition and results of operations could be materially adversely affected. In such case, our net asset value and the trading price of our common stock could decline, and you may lose all or part of your investment.

Substantially all of our portfolio investments are not publicly traded and, as a result, there is uncertainty as to the value of our portfolio investments. If our determinations regarding the fair value of our investments were materially higher than the values that we ultimately realize upon the disposition of such investments, our NAV could be affected adversely.

In accordance with the 1940 Act and accounting principles generally accepted in the United States, we carry substantially all of our portfolio investments at fair value as determined in good faith by our board of directors. Typically, there is no public market for the securities of the privately held companies in which we have invested and generally will continue to invest. As a result, we value these securities quarterly at fair value as determined in good faith by our board of directors.

Whenever possible, we value securities at market value; however, only a small percentage of our investment portfolio is traded publicly. We value the investments that are not publicly traded based on various factors during our valuation process and our investment and valuation committee reviews and approves these valuations. The types of factors that may be considered in the determination of the fair value of these investments include public and private mergers and acquisitions transactions, comparisons to publicly traded comparable companies, third-

16

Table of Contents