Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - C&J Energy Services, Inc. | d310164d8k.htm |

C&J Energy

Services, Inc. Investor Presentation

March 1, 2012

Exhibit 99.1 |

2

Disclaimer

Forward-Looking Statements

Certain

statements

and

information

in

this

presentation

may

constitute

“forward-looking

statements”

within

the

meaning of

Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of

1934, as amended, and the Private

Securities

Litigation

Reform

Act

of

1995.

The

words

“believe,”

“expect,”

“anticipate,”

“plan,”

“intend,”

“foresee,”

“should,”

“would,”

“could”

or other similar expressions are intended to identify forward-looking statements, which are

generally not historical in nature. These forward-looking statements are based

on our current expectations and beliefs concerning future developments and their potential

effect on us. While management believes that these forward-looking statements are reasonable as and when made,

there can be no assurance that future developments affecting us will be those that we anticipate. All

comments concerning our expectations

for

future

revenues

and

operating

results

are

based

on

our

forecasts

for

our

existing

operations

and

do

not

include

the

potential impact of any future acquisitions. Our forward-looking statements involve

significant risks and uncertainties (some of which are beyond our control) and assumptions that

could cause actual results to differ materially from our historical experience and our present

expectations or projections. Known material factors that could cause our actual results to differ from our projected results

are described in our filings with the Securities and Exchange Commission (“SEC”), including

but not limited to our Annual Report on Form 10-K for the period ended December 31,

2011. All readers are cautioned not to place undue reliance on forward-looking statements,

which speak only as of the date hereof. We undertake no obligation to publicly

update or revise any forward-looking statements after the date they are made, whether as a result

of new information, future events or otherwise.

Non-GAAP Financial Measures

We use both GAAP and certain non-GAAP financial measures to assess performance. Generally, a

non-GAAP financial measure is a numerical

measure

of

a

company's

performance,

financial

position

or

cash

flows

that

either

excludes

or

includes

amounts

that

are

not normally excluded or included in the most directly comparable measure calculated and presented in

accordance with GAAP. C&J management believes that these non-GAAP measures provide

useful supplemental information to investors in order that they may evaluate our financial

performance using the same measures as management. These non-GAAP financial measures should not be

considered as a substitute for, or superior to, measures of financial performance prepared in

accordance with GAAP. In evaluating these measures, investors should consider that the

methodology applied in calculating such measures may differ among companies and analysts.

Reconciliation of non-GAAP results to GAAP results for historic periods can be found on slide 35 of this presentation

and in our filings with the SEC, as applicable. |

Company Overview

|

4

Founded by current Chairman and CEO Josh Comstock

Well-positioned to benefit from many of the most important trends in drilling and

completion Focused on complex, technically demanding completions that deliver superior

returns Operates modern, high-pressure rated equipment

Integrated manufacturing capabilities

Recent rapid growth through penetration of prominent E&P customers

Unique

financial

business

model

through

“take-or-pay

plus”

contracts

that

combine

visibility

with spot upside optionality

C&J is a Differentiated Energy Services Company |

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

5

Josh

Comstock

founded C&J

Introduced stand-

alone pressure

pumping services

Ordered first

hydraulic

fracturing fleet

Added 5 coiled tubing units, bringing total to 13

Geographic expansion into East Texas

Launched hydraulic fracturing service

Contracted Fleets 1 and 2

Ordered Fleets 3, 4 and 5

Evolution of C&J

Introduced

coiled tubing

services

Closed Total Acquisition

Coiled tubing count reaches 18 units

Contracted Fleets 3, 4, 5 and 6

Ordered Fleets 7, 8, 9

2012

Ordered 6 additional

coiled tubing units

C&J Timeline

Key Customers |

6

C&J Investment Highlights

Operational

expertise

in

service

-

intensive basins

Visible revenue

growth

Modern, high-

specification

equipment

High-quality

service

Focused on technically-demanding, service-intensive basins

Generate higher revenue per unit of horsepower relative to peers

Exclusive focus on high-pressure rated equipment (all rated up to 15,000 psi)

Modern fracturing fleet, all entered into service in the past four years

Acquisition of Total provides specialized, in-house manufacturing capability

Substantial hydraulic fracturing and completion services experience

Vested executive team with significant ownership

Experienced

management

Scheduled equipment deliveries to support sustained growth

Term contracts provide visibility with flexibility for spot market upside

Customized solutions through extensive front-end technical analysis and planning Design engineers and job supervisors involved throughout project execution |

Industry Trends

|

Ongoing development

of existing and emerging unconventional resource basins Increased horizontal drilling

Greater service intensity

Strong North American supply-demand fundamentals

Increased demand for expertise to execute complex completions

High levels of asset utilization and constrained supply growth

Spread of North American unconventional drilling and completion techniques

Conventional field redevelopment applications

Emerging international opportunities

8

Key Industry Themes Driving C&J Opportunity |

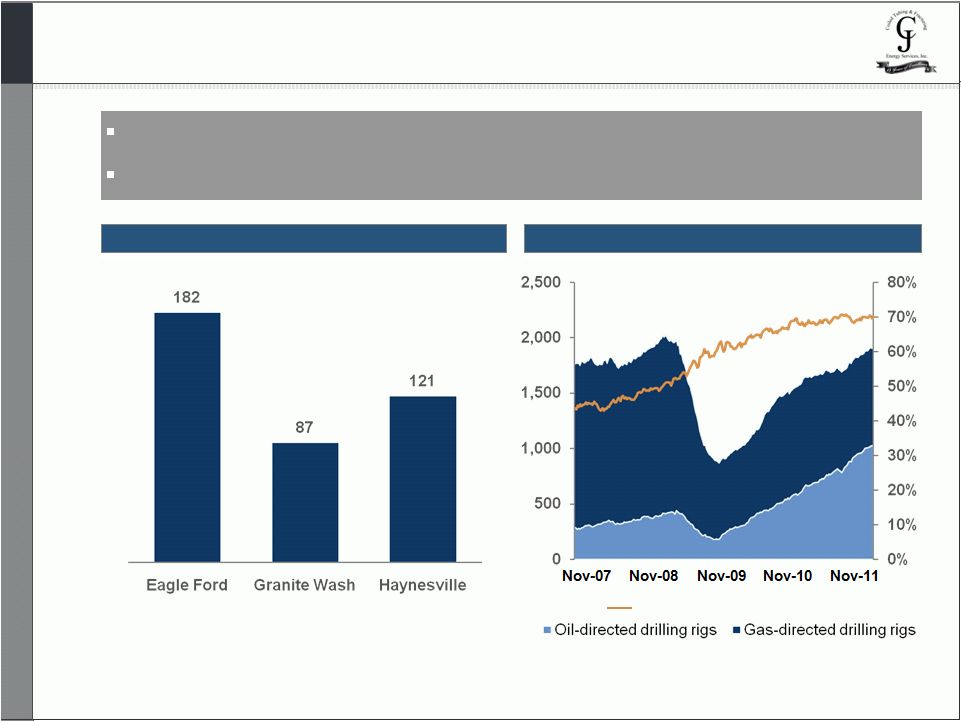

Source: Unconventional

Drilling data as of September 2011 and Baker Hughes Rig Count data as of November 04, 2011.

Strong Drilling Outlook Drives Completion Demand

% Horizontal / Directional

9

Significant increase in rig count and horizontal drilling activity

Increased service intensity of horizontal wells

Rig Count Change Since 6/09 by Shale Play

U.S. Horizontal Rig Count |

10

Source: Goldman Sachs Equity Research, management estimates.

Note: Dark blue bars denote current C&J basin of operation.

Advances in Completion Techniques Driving Demand

Average Fracturing Stages Per Well

Average Horsepower Per Well (000’s of HP)

40

38

30

25

11

Haynesville

Eagle

Ford

Granite

Wash

Other

Unconventional

Median

Conventional

16

16

12

13

3

Haynesville

Eagle

Ford

Granite

Wash

Other

Unconventional

Median

Conventional

Longer laterals

More frac stages

Higher pressure wells |

11

Favorable Supply / Demand Fundamentals

Continued increase in horizontal drilling

Longer laterals

Growing number of fracturing stages per well

Improved drilling efficiencies

High-pressure environments

Customized approach to the completion of

complex, technically demanding wells

Redevelopment of conventional fields

Older equipment not well-suited to meet

demanding completion requirements

Significant increase in attrition and

maintenance downtime

24-hour continuous service

More aggressive sand / proppant use

More demanding operating conditions in

higher pressure formations

Supply chain constraints in obtaining new

equipment

Limited industry experience executing the

most complex completions

Demand-Side Drivers

Supply-Side Drivers |

Business

Overview |

13

Overview of Service Offerings

Hydraulic

Fracturing

Pressure

Pumping

Coiled Tubing

Provide highly customized services for

technically challenging basins

Engineering staff offers extensive

front-end technical evaluation

Demonstrated efficiency gains to client

allows for premium pricing

Ability to handle heavy-duty jobs across

a wide spectrum of environments

Leverage CT business to expand into

additional fracturing opportunities

Provides various functions associated

with well completion and well servicing

Diverse portfolio of value-added

services

Routinely performed in conjunction with

coiled tubing services

Often provides advanced knowledge of

potential coiled tubing work

Focus on most

complex projects in

most challenging

basins

Services |

14

Highly Experienced Management Team

Josh Comstock

Founder,

Chairman and CEO

Randy McMullen

EVP,

CFO and Treasurer

Brett Barrier

COO

John Foret

VP, Coiled Tubing

Billy Driver

VP, Hydraulic

Fracturing

Brandon

Simmons

VP, Coiled Tubing

Pat Winstead

VP, Marketing

Ted Moore

VP, General Counsel

Industry

Experience

20+ years

Industry

Experience

20+ years

Industry

Experience

10+ years

Industry

Experience

20+ years

Industry

Experience

25+ years

Industry

Experience

18+ years

Industry

Experience

25+ years

Industry

Experience

9+ years |

15

Modern, High-Specification Equipment

Currently operates six modern 15,000 psi pressure rated hydraulic fracturing fleets with

aggregate of 210,000 horsepower

–

Specifically designed to handle well completions with long lateral segments and

multiple fracturing stages in high pressure formations

Also owns a fleet of 18 coiled tubing units, 21 double-pump pressure pumps and

9 single-pump pressure pumps

–

Additional 6 coiled tubing units and ancillary equipment to be delivered in

the second half of 2012 for deployment to new

geographic basins –

20 of the 24 coiled tubing units will be 2-inch dimension

Vertical integration through acquisition of Total E&S (“Total”)

Premium Hydraulic Fracturing Fleets

Current Fleets

Year Built

On-Time Delivery

Number of Pressure Pumps

Horsepower Capacity

1

2007

17

34,000

2

2010

12

24,000

3

2010

16

32,000

4

2011

20

40,000

5

2011

16

32,000

6

2011 / 2012

24

48,000

Expected Fleets

Expected Delivery Date

On-Time Delivery

Number of Pressure Pumps

Horsepower Capacity

7

2Q 2012

16

32,000

8

3Q 2012

16

32,000

9

4Q 2012

16

32,000

Total

153

306,000 |

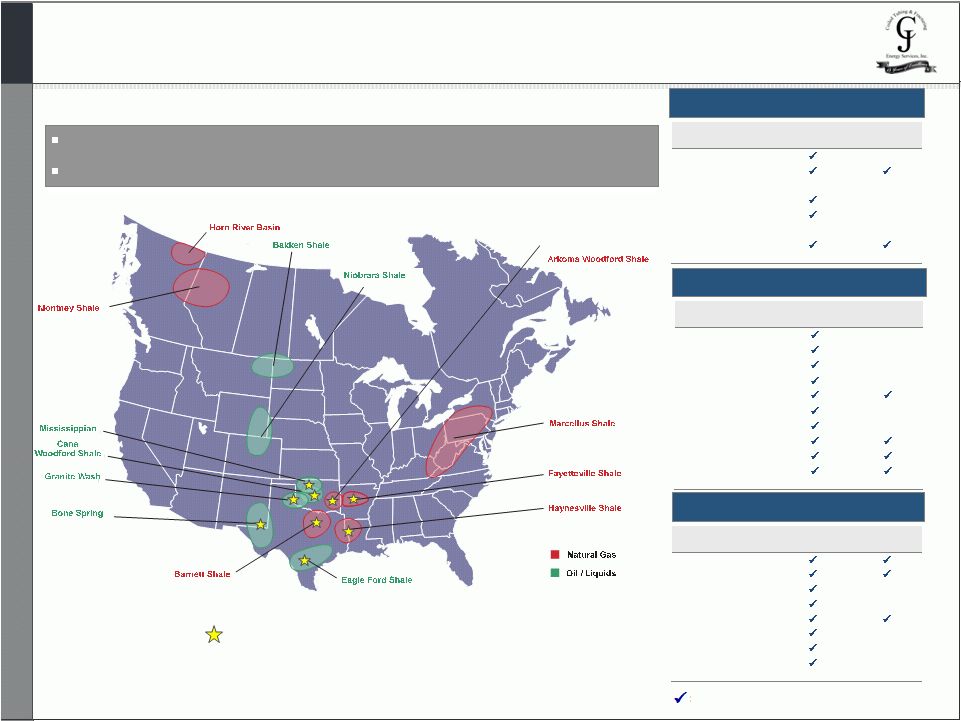

Company

Coiled

Tubing

Hydraulic

Fracturing

Chesapeake

Encana

Samson

Petrohawk

EOG

Shell

Devon

Plains Exploration

EXCO

Penn Virginia

Company

Coiled

Tubing

Hydraulic

Fracturing

Chesapeake

Apache

Forest Oil

Cordillera

Newfield

Unit

Penn Virginia

16

Geographically Focused in Attractive Basins

=

C&J

Customer

Relationship

Granite Wash

Company

Coiled

Tubing

Hydraulic

Fracturing

Chesapeake

EOG

Petrohawk

Newfield

Anadarko

Shell

SM Energy

ConocoPhillips

Eagle Ford Shale

Haynesville Shale

= Basin where C&J is currently active

Existing relationships provide platform for future growth

Prominent shales are in reach of C&J’s existing service centers |

Offer customized

solutions on a job-by-job basis

Engineers and fleet managers

onsite throughout process

Culture of flexibility and

collaboration

Completed thousands of

fracturing stages in Eagle

Ford and Haynesville

Operating team with 20+

years of in-basin experience

Relationships with several

proppant and chemical

suppliers

Technical proficiency and

front-end analysis

The Result is Enhanced Economics for Our Customers

Superior

customer

service

New, highly

capable

equipment

Exceptional

execution

High-quality

service

provider

Minimize cycle time and limit

pump downtime

Design fluids that perform well

in various environments

Focus on maintaining

performance data that is used

to supplement and increase

effectiveness of future

assignments

We Offer an Attractive Value Proposition to Our Customers

All fracturing fleets less than 4

years old; rated for 15,000 psi

Optimized configuration of fleet

according to basin specific

requirements

Custom-designed equipment

maximizes efficiency and

durability

Specific competence in

fracturing fluid design and local

application

17 |

18

Relationships with Industry Leaders

(Through mid-2012)

(Through mid-2012)

(Through early 2013)

(Through mid-2014)

(Through mid-2013)

(Early 2014)

Large operators have embraced C&J’s technical capabilities

Term Frac Contract

Hydraulic

Fracturing

Coiled Tubing

Stand Alone

Pressure Pumping

Customer

Current Service Offerings |

19

Outperformance Through Efficiency

Pre-job best

practices

Pumping

procedures

Motivated

workforce

Rig-up

flexibility

More frequent communication with customers during well design process

Lab fluids testing in advance for optimal well design

Develop best layout for job site to maximize Hydration Unit and Blender performance

Organize crew into focused teams to complete multiple tasks simultaneously

Conduct field fluid tests during rig process to confirm lab results

Real-time monitoring of equipment to spot potential problems early

On-site maintenance of pump units as soon as each one is offline

Proactive replacement of wear items rather than waiting for a failure

Streamline paperwork requirements to allow supervisors to focus on efficiency and

planning

Empowering employees and promoting best practices produces a proud and highly

motivated workforce

Continuity of technical staff to avoid repetition and save customers’ time

Engineers and blender operators on site during rig up to “jump start” technical review |

20

Strategy for Continued Growth

Capitalize on growth in development of shale and other resource plays

Leverage customer relationships to geographically expand

–

Further expansion into new geographic basins

–

Evaluating opportunities to expand operations into new areas throughout the U.S.

Pursue additional term hydraulic fracturing contracts

–

Currently seeking term contracts for Fleets 7, 8 and 9

Maintain flexibility to pursue spot market work

–

Retains upside revenue potential at prevailing market rates |

Financials

|

22

Key Drivers of Financial Performance

Visibility

Growth

Vertical integration

Risk management

Hourly rates under take-or-pay contracts

Spot market optionality

Utilization drives model

Balance sheet strength

Business Model

Financial Model |

23

Significant Historical Growth

34,000

58,000

130,000

178,000

300,000

2009

2010

Apr-11

2011

2012E¹

$19.9

$13.1

$82.3

2008

2009

2010

2011

$62.4

$67.0

$244.2

2008

2009

2010

2011

$67

$93

$331

$374

2008

2009

2010

2011

$285.0

$758.5

Revenue ($mm)

Adjusted EBITDA ($mm)

Growth in HHP (period end)

Avg. Monthly Revenue / HHP

1

Assumes timely delivery of Fleets 6 – 9

|

24

More demanding wells drive higher hourly rates and higher revenues from

chemicals and proppant

More frac stages per well keep fleets onsite longer, allowing more pumping hours

per month

Demonstrated

shorter

time

per

completion

permits

us

to

negotiate

premium

rates

with customers

Less redundant pumping capacity boosts utilization

Average monthly revenue per unit of horsepower:

$331 in 2010

$374 in 2011

ROCE of 42% in 2010 and 57% in 2011

Operational Strategy Drives Strong Financial Performance

Regional focus and operating efficiency generate higher revenues per unit of horsepower |

25

Strong Margin Profile

31%

19%

34%

38%

2008

2009

2010

2011

1

EBITDA margin based on Adjusted EBITDA.

Margins driven by utilization, not price

In 2011 generated $285MM in Adjusted EBITDA

EBITDA Margin¹ |

26

Contract Coverage for Fracturing Fleets

Delivery 2Q 2012

Delivery 2Q 2012

Fracturing Term Contracts Provide Visible Growth

Delivery 4Q 2012

Fleet 1

Fleet 2

Fleet 9

Fleet 6

Fleet 7

Fleet 8

Fleet 5

Fleet 4

Fleet 3

Operating Regions

Haynesville/Eagle

Ford/Granite wash

Eagle Ford

Eagle Ford

Eagle Ford

Eagle Ford

Permian

(Uncontracted)

(Uncontracted)

(Uncontracted)

2011

2012

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Expected Delivery of Future Fleets

Fleet Under Contracts |

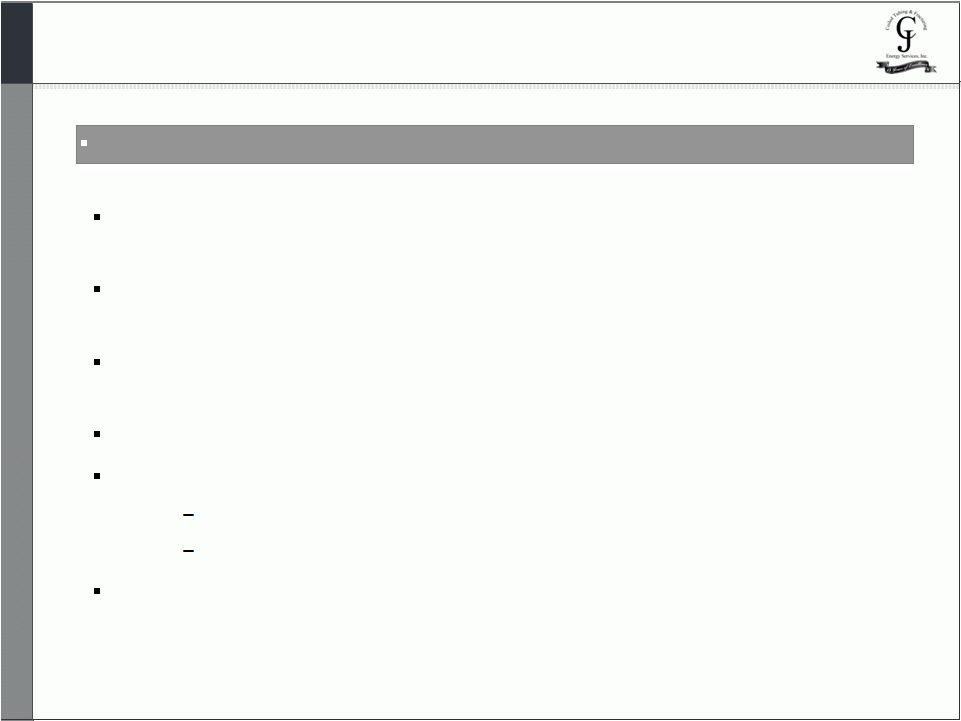

27

Overview of Term Contracts

•

1 –

3 year contract life

•

Revenues under term contracts are derived from:

–

Mandatory monthly payments for minimum hours

–

Pre-agreed amounts for each hour of service in excess of the contracted

minimum

–

Service charge to customers for chemicals and proppant materials

•

Take or pay

•

Optionality to deploy equipment when not utilized

•

Contractual protections for term |

28

Total E&S Acquisition Facilitates Growth Strategy

Total E&S is a manufacturer of hydraulic fracturing equipment, coiled tubing,

pressure

pumping

and

other

equipment

used

in

the

energy

services

industry

and one of C&J’s largest suppliers of machinery and equipment

–

Acquisition closed April 28, 2011

–

Aggregate purchase price of approximately $33.0mm

–

Received

$5.4mm

cash

as

part

of

acquisition,

for

net

transaction

value

of

$27.5mm

–

$25.0mm financed through incremental revolver borrowings

–

Remainder funded through cash on hand

Strategic benefits include

–

Internal control over supply chain

–

Significantly reduces exposure to third-party supply constraints

–

Shorter cycle times for the delivery of new equipment and replacement parts

–

Provides for greater potential control of costs associated with new equipment

–

Acquisition has reduced C&J’s procurement costs from Total

–

Ability to delay, or indefinitely postpone, delivery time of equipment

–

Platform for R & D, continued equipment design improvements |

Strong Balance Sheet and

Liquidity Flexible balance sheet with strong liquidity position

–

$200mm revolving credit facility

29

.

Improved Balance Sheet

($ in thousands)

6/30/2011

12/31/2011

Cash and Cash Equivalents

$

7,634

$

46,780

Long-term Debt

Five-Year $200mm Credit Facility

$

105,000

-

Total Long-Term Debt

$

105,000

-

Shareholders' Equity

$

176,039

$

395,055

Total Capitalization

$

281,039

$

395,055 |

30

C&J Investment Highlights

Visible revenue

growth

Modern, high-

specification

equipment

High-quality

service

Focused on technically-demanding, service-intensive basins

Generate higher revenue per unit of horsepower relative to peers

Exclusive focus on high-pressure rated equipment (all rated up to 15,000 psi)

Modern fracturing fleet, all entered into service in the past four years

Acquisition of Total provides specialized, in-house manufacturing capability

Substantial hydraulic fracturing and completion services experience

Vested executive team with significant ownership

Experienced

management

Scheduled equipment deliveries to support sustained growth

Term contracts provide visibility with flexibility for spot market upside

Operational

expertise in

service-intensive

basins

Customized solutions through extensive front-end technical analysis and

planning

Design engineers and job supervisors involved throughout project execution |

Appendix

|

Detailed

Historical

Financials

–

Income

Statement

32

Year Ended December 31,

($ in thousands except per share amounts)

2007

2008

2009

2010

2011

Statement of Operations Data

Revenue

$28,022

$62,441

$67,030

$244,157

$758,454

Cost of Sales

14,227

42,401

54,242

154,297

443,556

Gross Profit

$13,795

$20,040

$12,788

$89,860

$314,898

Selling, General and Administrative Expenses

7,427

8,950

9,533

17,998

52,737

Loss (Gain) on Sale / Disposal of Assets

129

397

920

1,571

(25)

Operating Income

$6,239

$10,693

$2,335

$70,291

$262,186

Other Income (Expense)

Interest Income

$50

$5

$4

$9

–

Interest Expense

(5,786)

(6,913)

(4,712)

(17,350)

$(4,221)

Lender Fees

(341)

(511)

(391)

(322)

–

Loss on early extinguishment of debt

–

–

–

–

(7,605)

Other Income

–

–

–

163

–

Other Expense

(17)

(68)

(52)

(150)

(40)

Total Other Expenses

$(6,094)

$(7,487)

$(5,151)

$(17,650)

$(11,866)

Income (Loss) Before Income Taxes

$145

$3,206

$(2,816)

$52,641

$250,320

Provision (Benefit) for Income Taxes

868

2,085

(386)

20,369

88,341

Net Income (Loss)

$(723)

$1,121

$(2,430)

$32,272

$161,979

Basic Net Income (Loss) per Share

$(0.02)

$0.02

$(0.05)

$0.70

$3.28

Diluted Net Income (Loss) per Share

(0.02)

0.02

(0.05)

0.67

3.19

(Unaudited) |

Detailed

Historical

Financials

–

Cash

Flow

33

Year Ended December 31,

( $ in thousands except per share amounts)

2007

2008

2009

2010

2011

Statement of Cash Flows Data

Capital Expenditures

$30,152

$21,526

$4,301

$44,473

$140,723

Cash Flow Provided by (Used in)

Operating Activities

$8,377

$8,611

$12,056

$44,723

$171,702

Investing Activities

(30,054)

(20,673)

(4,254)

(43,818)

(165,545)

Financing Activities

21,305

11,921

(6,733)

734

37,806

(Unaudited) |

Detailed

Historical

Financials

–

Balance

Sheet

34

As of December 31,

in thousands)

2007

2008

2009

2010

2011

Balance Sheet Data

Cash and Cash Equivalents

$250

$109

$1,178

$2,817

$46,780

Accounts Receivable, Net

4,409

13,362

12,668

44,354

122,169

Inventories, Net

581

861

2,463

8,182

45,440

Property, Plant and Equipment, Net

57,991

71,441

65,404

88,395

213,697

Total Assets

133,711

155,212

150,231

226,088

537,849

Accounts Payable

1,705

6,519

10,598

13,084

57,564

Long-term Debt and Capital Lease Obligations,

Excluding Current Portion

56,773

25,041

60,668

44,817

Total Stockholders' Equity

$66,797

$68,099

$65,799

$109,446

$395,055

(Unaudited) |

EBITDA

Reconciliation 35

Year Ended December 31,

($ in thousands)

2008

2009

2010

2011

Net Income (Loss)

$1,121

$(2,430)

$32,272

$161,979

Interest Expense, Net

6,909

4,708

17,341

4,221

Provision (Benefit) for Income Taxes

2,085

(386)

20,369

88,341

Depreciation and Amortization

8,836

9,828

10,744

22,919

EBITDA

$18,951

$11,720

$80,726

$277,460

Adjustments to EBITDA

Loss on early extinguishment of debt

7,605

Loss (Gain) on Sale / Disposition of Property,

Plant & Equipment

397

920

1,571

(25)

Adjusted EBITDA

$19,348

$12,640

$82,297

$285,040

Note: EBIT, EBITDA and Adjusted EBITDA are

non-GAAP financial measures, and when analyzing C&J’s operating performance, investors should use EBIT, EBITDA

and Adjusted EBITDA in addition to, and not as an alternative for, operating income and

net (loss) income (each as determined in accordance with GAAP). C&J uses EBIT,

EBITDA and Adjusted EBITDA as supplemental financial measures. EBIT is defined as net income (loss) before interest expense (net) and income taxes.

EBITDA is EBIT adjusted for depreciation and amortization. Adjusted EBITDA is EBITDA further

adjusted for certain other items which are not indicative of future performance or cash flow,

including lender fees, other non-operating expenses and loss on sale/disposal of property, plant and equipment. C&J believes EBIT, EBIDA

and Adjusted EBITDA are useful supplemental indicators of its performance. EBIT, EBITDA and Adjusted

EBITDA, as used and defined by C&J, may not be comparable

to similarly titled measures employed by other companies and are not measures of performance

calculated in accordance with GAAP. |