Attached files

| file | filename |

|---|---|

| 10-K - FORM 10-K - WOLVERINE WORLD WIDE INC /DE/ | d268216d10k.htm |

| EX-23 - EXHIBIT 23 - WOLVERINE WORLD WIDE INC /DE/ | d268216dex23.htm |

| EX-24 - EXHIBIT 24 - WOLVERINE WORLD WIDE INC /DE/ | d268216dex24.htm |

| EX-21 - EXHIBIT 21 - WOLVERINE WORLD WIDE INC /DE/ | d268216dex21.htm |

| EX-32 - EXHIBIT 32 - WOLVERINE WORLD WIDE INC /DE/ | d268216dex32.htm |

| EX-31.1 - EXHIBIT 31.1 - WOLVERINE WORLD WIDE INC /DE/ | d268216dex311.htm |

| EX-10.13 - EXHIBIT 10.13 - WOLVERINE WORLD WIDE INC /DE/ | d268216dex1013.htm |

| EX-10.35 - EXHIBIT 10.35 - WOLVERINE WORLD WIDE INC /DE/ | d268216dex1035.htm |

| EX-10.17 - EXHIBIT 10.17 - WOLVERINE WORLD WIDE INC /DE/ | d268216dex1017.htm |

| EX-10.14 - EXHIBIT 10.14 - WOLVERINE WORLD WIDE INC /DE/ | d268216dex1014.htm |

| EX-31.2 - EXHIBIT 31.2 - WOLVERINE WORLD WIDE INC /DE/ | d268216dex312.htm |

Exhibit 10.32

FORM OF PERFORMANCE SHARE AWARD AGREEMENT

| Performance Share Agreement # |

PERFORMANCE SHARE AWARD AGREEMENT

This Performance Share Award Agreement (“Agreement”) is made as of the award date set forth above, between WOLVERINE WORLD WIDE, INC., a Delaware corporation (“Wolverine” or the “Company”), and the employee named above (“Employee”).

Wolverine World Wide, Inc. has an Amended and Restated Executive Long-Term Incentive Plan (3-Year Bonus Plan) that the Compensation Committee of Wolverine’s Board of Directors (the “Committee”) administers. The Committee makes long term incentive awards to encourage longer range strategic planning, cooperation among all the units of the Company, and executive officers and key management individuals to enter and continue in the employ of the Company. Wolverine has a Stock Incentive Plan of 2010 (the “Plan”) that also is administered by the Committee, under which the Committee may award restricted stock as all or part of a long term incentive award. Both the 3-Year Bonus Plan and the Plan have been approved by the Company’s shareholders.

The Committee has determined that Employee is eligible to participate in the Plan for a long term incentive award, the Employee’s participation level, and the criteria for the award. The Committee has awarded to Employee shares of Wolverine’s common stock subject to terms, conditions and restrictions contained in this Agreement and in the Plan (the “Performance Share Award”). Employee acknowledges receipt of a copy of the Plan and accepts this Performance Share Award subject to all of those terms, conditions and restrictions.

1. Award. Wolverine hereby awards to Employee a number of shares of Wolverine’s common stock, $1 par value, as set forth in the grant (the “Performance Restricted Stock”). The Performance Restricted Stock is subject to the restrictions imposed under this Agreement and the Plan (“Stock Restrictions”). The periods during which Performance Restricted Stock is subject to the Stock Restrictions shall be known as “Restricted Periods.” Unless otherwise determined by the Committee, Employee’s “Incentive Award” will be the number of shares of Performance Restricted Stock on which the Stock Restrictions shall lapse.

2. Transferability. Until the Stock Restrictions lapse as set forth in section 3 below, the Plan provides that Performance Restricted Stock is generally not transferable by Employee except by will or according to the laws of descent and distribution. The Plan further provides that all rights with respect to the Performance Restricted Stock are exercisable during Employee’s lifetime only by Employee, Employee’s guardian, or legal representative. Wolverine shall place an appropriate legend upon any certificate representing shares of Performance Restricted Stock and may also issue appropriate stop transfer instructions to its transfer agent with respect to such shares.

3. Lapsing of Restrictions. Except as otherwise provided in this Agreement or by action of the Committee, the Stock Restrictions imposed on the Performance Restricted Stock shall lapse as set forth in Attachment 1.

4. Registration and Listing; Securities Laws.

(a) The Performance Share Award is conditioned upon (i) the effective registration or exemption of the Plan and the Performance Restricted Stock granted there under the Securities Act of 1933 and applicable state or foreign securities laws, and (ii) the effective listing of the common stock on the New York Stock Exchange.

(b) Employee hereby represents and warrants that Employee is receiving the Performance Restricted Stock for Employee’s own account and investment and without any intent to resell or distribute the Performance Restricted Stock. Employee shall not resell or distribute the Performance Restricted Stock after any Restricted Period except in compliance with such conditions as Wolverine may reasonably specify to ensure compliance with federal and state securities laws.

5. Termination of Employment Status.

(a) Except as set forth in subsection (b), Employee:

(i) must be an employee of the Company or one of its Subsidiaries at the time the Committee certifies the achievement of the Performance Period performance criteria for the Stock Restrictions to lapse on any portion of the Performance Share Award (the performance criteria being Cumulative BVA and Cumulative EPS, as defined in Schedule 1); and

(ii) shall forfeit the entire Performance Share Award if, before such certification, Employee’s employment with Wolverine and its Subsidiaries terminates (the “Employment Termination”) or the Committee terminates Employee’s Performance Share Award for the Performance Period (“Award Termination”).

(b) If the Employment Termination is:

(i) due to Employee’s:

(1) disability (as defined in Wolverine’s long-term disability plan);

(2) death;

(3) voluntary termination after Employee has attained 50 years of age and seven years of service as an employee of Wolverine or its Subsidiaries, or 62 years of age, or such other age or years of service as may be determined by the Committee in its sole discretion; or

(ii) due to such other circumstances as the Committee in its discretion allows;

then the number of shares of Performance Restricted Stock on which the Stock Restrictions lapse at the end of the Performance Period shall be calculated as set forth in subsection (c) or in such other manner as the Committee directs. If there is an Award Termination, the Committee may in its discretion allow the Stock Restrictions to lapse on some or all of the Performance Restricted Stock, calculated as set forth in subsection (c) or in such other manner as the Committee directs.

(c) As soon as reasonably practicable following the end of the Performance Period, the Committee shall calculate, as set forth in Schedule 1, the number of shares on which the Stock Restrictions would have lapsed if Employee’s employment or Performance Share Award had not been terminated prior to the certification. That number of shares shall then be multiplied by a fraction, the

2

numerator of which shall be the number of full months during the Performance Period prior to the Employment Termination or Award Termination (as applicable) and the denominator of which shall be the total number of months in the Performance Period. The result of the calculation in the preceding sentence shall be the Employee’s “Prorated Incentive Award” for the Performance Period, which will be the number of shares of Performance Restricted Stock on which the Stock Restrictions shall lapse. The remainder of the Performance Share Award shall be forfeited.

6. Employment by Wolverine. The award of Performance Restricted Stock under this Agreement shall not impose upon Wolverine or any of its Subsidiaries any obligation to retain Employee in its employ for any given period or upon any specific terms of employment. Wolverine or any of its Subsidiaries may at any time dismiss Employee from employment, free from any liability or claim under the Plan or this Agreement, unless otherwise expressly provided in any written agreement with Employee.

7. Stockholder Rights. During the Restricted Period, Employee shall have all voting and liquidation rights with respect to the Performance Restricted Stock held of record by Employee as if Employee held unrestricted common stock; provided, however, that the portion of any Performance Share Award on which the Stock Restrictions have not lapsed shall be subject to any restrictions on transferability or risks of forfeiture imposed pursuant to this Agreement or the Plan. Any cash and stock dividends with respect to any Performance Restricted Stock will be withheld by the Company for the Award Recipient’s account and will be paid upon the lapsing of the Stock Restrictions imposed on the Performance Restricted Stock in respect of which the dividends were paid, and any dividends deferred in respect of any Performance Restricted Stock will be forfeited upon the forfeiture of such Performance Restricted Stock. Any noncash dividends or distributions paid with respect to shares of Performance Restricted Stock on which the Stock Restrictions have not lapsed shall be subject to the same restrictions as those relating to the Performance Restricted Stock awarded under this Agreement. After the restrictions applicable to the Performance Restricted Stock lapse, Employee shall have all stockholder rights, including the right to transfer the shares, subject to such conditions as Wolverine may reasonably specify to ensure compliance with federal and state securities laws.

8. Withholding. Wolverine and any of its Subsidiaries shall be entitled to (a) withhold and deduct from Employee’s future wages (or from other amounts that may be due and owing to Employee from Wolverine or a Subsidiary), or make other arrangements for the collection of, all legally required amounts necessary to satisfy any and all federal, state, and local withholding and employment-related tax requirements attributable to the Performance Restricted Stock award under this Agreement, including, without limitation, the award or lapsing of Stock Restrictions on the Performance Restricted Stock; or (b) require Employee promptly to remit the amount of such withholding to Wolverine or a subsidiary before taking any action with respect to the Performance Restricted Stock. Unless the Committee provides otherwise, withholding may be satisfied by withholding common stock to be received or by delivery to Wolverine or a subsidiary of previously owned common stock of Wolverine.

9. Effective Date. This award of Performance Restricted Stock shall be effective as of the date first set forth above.

10. Amendment. This Agreement shall not be modified except in a writing executed by the parties hereto.

11. Agreement Controls. The Plan is incorporated in this Agreement by reference. Capitalized terms not defined in this Agreement shall have those meanings provided in the Plan. In the event of any conflict between the terms of this Agreement and the terms of the Plan, the provisions of the Agreement shall control.

3

ATTACHMENT 1 TO PERFORMANCE SHARE AWARD AGREEMENT

The “Incentive Award” for the Employee will be the number of shares of Performance Restricted Stock on which the Stock Restrictions shall lapse, calculated as:

[(Overall Award Percentage x Incentive Award Percentage x Applicable Earnings)/Market Price]

rounded up to the nearest whole number, where:

Overall Award Percentage will be the sum of (i) the BVA Award Percentage multiplied by the BVA Factor, and (ii) the EPS Award Percentage multiplied by the EPS Factor, but in no event shall the Overall Award Percentage exceed the Award Cap for the Employee. If the Overall Award Percentage calculated for the Employee is greater than the Award Cap, the Overall Award Percentage shall be reduced to the Award Cap to calculate the Incentive Award.

| 1. | BVA Award Percentage will be calculated as follows: |

If the Cumulative BVA is < Threshold BVA, BVA Award Percentage = 0%

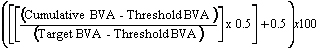

If the Cumulative BVA is ³ Threshold BVA and < Target BVA, BVA Award Percentage =

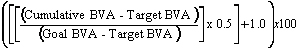

If the Cumulative BVA is ³ Target BVA and < Goal BVA, BVA Award Percentage =

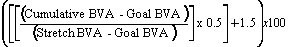

If the Cumulative BVA is ³ Goal BVA and < Stretch BVA, BVA Award Percentage =

If the Cumulative BVA is ³ Stretch BVA, BVA Award Percentage = Award Cap

| 2. | EPS Award Percentage will be calculated as follows: |

If the Cumulative EPS is < Threshold EPS, EPS Award Percentage = 0%

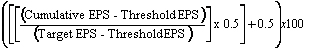

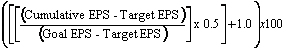

If the Cumulative EPS is ³ Threshold EPS and < Target EPS, EPS Award Percentage =

If the Cumulative EPS is ³ Target EPS and < Goal EPS, EPS Award Percentage =

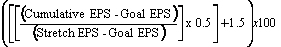

4

If the Cumulative EPS is ³ Goal EPS and < Stretch EPS, EPS Award Percentage =

If the Cumulative EPS is ³ Stretch EPS, EPS Award Percentage = Award Cap

and the other defined terms shall have the following meanings:

| Applicable Earnings |

The Earnings amount used to calculate the Performance Share Award for the Award Recipient. | |

| Award Cap |

The maximum percentage of the Incentive Award that the Award Recipient may receive for the Performance Period upon achievement of “stretch” goal, used to calculate the Performance Share Award for the Award Recipient. | |

| Award Recipient |

An employee of the Company to whom the Compensation Committee of the Board of Directors or the Board of Directors grants a Performance Share Award, for such portion of the Performance Period as the Committee determines. | |

| BVA |

An economic value added measurement that equals the operating income for a Fiscal Year reduced by (i) a provision for income taxes equal to the operating income multiplied by the Company’s total effective tax rate for the same Fiscal Year; and (ii) a capital charge equal to a 14-point average of “net operating assets” at the beginning and end of a Fiscal Year (with “net operating assets” defined as the net of trade receivables (net of reserves), inventory (net of reserves), other current assets, property, plant and equipment, trade payables and accrued liabilities) multiplied by 10%. | |

| Cumulative BVA |

The sum of the BVA for each of the Fiscal Years in the Performance Period. | |

| Cumulative EPS |

The sum of the EPS for each of the Fiscal Years in the Performance Period. | |

| Earnings |

An Award Recipient’s base salary at the time of Performance Share Award. | |

| EPS |

The total after-tax profits for a Fiscal Year divided by the fully-diluted weighted average shares outstanding during the Fiscal Year. | |

| Fiscal Year |

The fiscal year of the Company for financial reporting purposes as the Company may adopt from time to time. | |

| Incentive Award Percentage |

The Incentive Award Percentage used to calculate the Performance Share Award for the Award Recipient. | |

| Market Price |

The closing market price of shares of Common Stock reported on the New York Stock Exchange (or any successor exchange that is the primary stock exchange for trading of Common Stock) on the date the award is granted by the Compensation Committee. | |

5

| Stock Restrictions | Restrictions on the common stock covered by the Performance Share Award, as set forth in the Plan and the Performance Share Award Agreement. | |

| Performance Period | The three year period beginning on the first day of the Company’s 2012 Fiscal Year and ending on the last day of the Company’s 2014 Fiscal Year. | |

| BVA Factor | As set by the Compensation Committee. | |

| Threshold BVA | As set by the Compensation Committee. | |

| Target BVA | As set by the Compensation Committee. | |

| Goal BVA | As set by the Compensation Committee. | |

| Stretch BVA | As set by the Compensation Committee. | |

| EPS Factor | As set by the Compensation Committee. | |

| Threshold EPS | As set by the Compensation Committee. | |

| Target EPS | As set by the Compensation Committee. | |

| Goal EPS | As set by the Compensation Committee. | |

| Stretch EPS | As set by the Compensation Committee. | |

6