Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| (Mark | One) |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-34736

SEMGROUP CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 20-3533152 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

Two Warren Place

6120 S. Yale Avenue, Suite 700

Tulsa, OK 74136-4216

(918) 524-8100

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Class A Common Stock, par value $0.01 per share Common Share Purchase Rights Warrants to Purchase Common Stock |

New York Stock Exchange New York Stock Exchange New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer | x | Accelerated Filer | ¨ | |||||

| Non-Accelerated Filer | ¨ | (Do not check if a smaller reporting company) | Smaller Reporting Company | ¨ | ||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the registrant’s Class A and Class B common stock held by non-affiliates at June 30, 2011, was $1,059,026,939, based on the closing price of the Class A common stock on the New York Stock Exchange on June 30, 2011.

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes x No ¨

At January 31, 2012, there were 41,798,893 shares of Class A Common Stock and 162,361 shares of Class B Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement to be filed pursuant to Regulation 14A of the Securities Exchange Act of 1934, in connection with the registrant’s Annual Stockholders’ Meeting to be held on May 23, 2012, are incorporated by reference into Part III of this Form 10-K.

Table of Contents

SEMGROUP CORPORATION AND SUBSIDIARIES

FORM 10-K—2011 ANNUAL REPORT

Table of Contents

Table of Contents

Cautionary Note Regarding Forward-Looking Statements

Certain matters contained in this Form 10-K include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We make these forward-looking statements in reliance on the safe harbor protections provided under the Private Securities Litigation Reform Act of 1995.

All statements, other than statements of historical fact, included in this Form 10-K regarding the prospects of our industry, our anticipated financial performance, the anticipated performance of NGL Energy Partners LP, management’s plans and objectives for future operations, business prospects, outcome of regulatory proceedings, market conditions, and other matters, may constitute forward-looking statements. In addition, forward-looking statements generally can be identified by the use of forward-looking words such as “may,” “will,” “expect,” “intend,” “estimate,” “foresee,” “project,” “anticipate,” “believe,” “plans,” “forecasts,” “continue” or “could” or the negative of these terms or variations of them or similar terms. Although we believe that the expectations reflected in these forward-looking statements are reasonable, we cannot assure you that these expectations will prove to be correct. These forward-looking statements are subject to certain known and unknown risks, and uncertainties, as well as assumptions that could cause actual results to differ materially from those reflected in these forward-looking statements. Factors that might cause actual results to differ include, but are not limited to, those discussed in Item 1A of this Form 10-K, entitled “Risk Factors,” risk factors discussed in other reports that we file with the Securities and Exchange Commission (“SEC”), and the following:

| • | Our ability to generate sufficient cash flow from operations to enable us to pay our debt obligations or to fund our other liquidity needs; |

| • | Our ability to comply with the covenants contained in, and maintain certain financial ratios required by, our credit facilities; |

| • | Our ability to obtain additional capital on terms that are favorable to us; |

| • | The ability of our subsidiary, Rose Rock Midstream, L.P., to make minimum quarterly distributions to its unitholders, including us; |

| • | The operations of NGL Energy Partners LP, which we do not control; |

| • | The possibility that our hedging activities may result in losses or may have a negative impact on our financial results; |

| • | Any sustained reduction in demand for the petroleum products we gather, transport, process, and store; |

| • | Our ability to obtain new sources of supply of petroleum products; |

| • | Our failure to comply with new or existing environmental laws or regulations or cross border laws or regulations; |

| • | The possibility that the construction or acquisition of new assets may not result in the corresponding anticipated revenue increases; |

| • | The effects of having recently filed for and emerged from bankruptcy protection; |

| • | Any future impairment to goodwill resulting from the loss of customers or business; |

| • | Changes in currency exchange rates; and |

| • | The risks and uncertainties of doing business outside of the U.S., including political and economic instability and changes in local governmental laws, regulations and policies. |

New factors that could cause actual results to differ materially from those described in forward-looking statements emerge from time to time, and it is not possible for us to predict all such factors, or the extent to which any such factor or combination of factors may cause actual results to differ from those contained in any forward-looking statement.

Table of Contents

Readers are cautioned not to place undue reliance on any forward-looking statements contained in this Form 10-K, which reflect management’s opinions only as of the date hereof. Except as required by law, we undertake no obligation to revise or publicly release the results of any revision to any forward-looking statements.

As used in this Form 10-K, and unless the context indicates otherwise, the terms the “Company,” “SemGroup,” “we,” “us,” “our,” “ours,” and similar terms refer to SemGroup® Corporation, its consolidated subsidiaries, and its predecessors. We sometimes refer to crude oil, natural gas, natural gas liquids (natural gas liquids, or “NGLs,” include ethane, propane, normal butane, iso-butane, and natural gasoline), refined petroleum products, and liquid asphalt cement, collectively, as “petroleum products” or “products.”

Table of Contents

PART I

Items 1 and 2. Business and Properties

Overview

Our business is to provide gathering, transportation, storage, distribution, marketing, and other midstream services primarily to independent producers, refiners of petroleum products, and other market participants located in the Midwest and Rocky Mountain regions of the United States of America (the “U.S.”), Canada and the West Coast of the United Kingdom (the “U.K.”). We, or our significant equity method investees, have an asset base consisting of pipelines, gathering systems, storage facilities, terminals, processing plants, and other distribution assets located between North American production and supply areas, including the Gulf Coast, Midwest, Rocky Mountain and Western Canadian regions. We also maintain and operate storage, terminal and marine facilities at Milford Haven in the U.K. that enable customers to supply petroleum products to markets in the Atlantic Basin. We also operate a network of liquid asphalt cement terminals throughout Mexico. Our operations are conducted directly and indirectly through our primary operating segments.

Company Information

Our website is located at www.semgroupcorp.com. Our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as well as proxy statements and other information we file with, or furnish to, the SEC are available free of charge on our website. We make these documents available as soon as reasonably practicable after we electronically file them with, or furnish them to, the SEC. The information contained on our website, or available by hyperlink from our website, is not incorporated into this Form 10-K or other documents we file with, or furnish to, the SEC. We intend to use our website as a means of disclosing material non-public information and for complying with our disclosure obligations under Regulation FD. Such disclosures will be included on our website in the “Investor Relations” sections. Accordingly, investors should monitor such portions of our website, in addition to following our press releases, SEC filings and public conference calls and webcasts.

Our History

SemGroup Corporation is a Delaware corporation. We were founded in February 2000 and are based in Tulsa, Oklahoma. During the period from February 2000 through July 2008, our asset and revenue base grew through a series of strategic acquisitions and capital expansion projects. During this time period, we made 64 acquisitions at an aggregate purchase price of approximately $1.1 billion, excluding amounts paid for working capital, and spent approximately $732 million on capital expansion projects.

Historically, we conducted significant physical and financial marketing and trading activities to take advantage of price differences related to time, location and quality of various energy commodity products and to utilize our transportation and storage assets. We also provided midstream energy related services such as gathering, storage, transportation, processing and distribution of petroleum products, both to third party customers and to ourselves.

As a result of trading losses incurred and other negative economic conditions, we faced a liquidity crisis and on July 22, 2008, we filed voluntary petitions for reorganization under Chapter 11 of the U.S. Bankruptcy Code, as well as applications for creditor protection under the Companies’ Creditors Arrangement Act in Canada (collectively, the “Bankruptcy”). During the Bankruptcy, we continued to operate our midstream energy-related businesses, exited certain non-core businesses and activities, disposed of certain assets and continued certain energy infrastructure construction projects. Certain of our business units also continued marketing activities to fulfill contractual obligations and to utilize their asset bases.

During the Bankruptcy, we took steps to restructure our business portfolio and to rebalance to a business heavily weighted toward fee-based asset activities and away from trading activities. As part of these steps, and

1

Table of Contents

subject to the terms of our debtor in possession credit facility, we attempted to sell certain assets. Due to the economic environment and a lack of available financing, bids for various assets came in below valuation expectations. In some cases, assets were not sold for strategic reasons. However, the assets of two business units, SemFuel and SemMaterials, were sold in a series of transactions during the divestiture process. For additional information relating to our recent divestitures, refer to Notes 6 and 7 of our consolidated financial statements beginning on page F-1 of this Form 10-K. Additionally, we ceased the operations of two other businesses, SemCanada Energy and SemEuro Supply. Also during the Bankruptcy, certain creditors foreclosed on our ownership interests in SemGroup Energy Partners G.P., L.L.C., the general partner of Blueknight Energy Partners, L.P., formerly known as SemGroup Energy Partners, L.P. (“Blueknight”), and also on our subordinated units in Blueknight. As a result, we no longer had, and we no longer have, any direct or indirect ownership interest in Blueknight.

On November 30, 2009, we emerged from the Bankruptcy as a newly reorganized company. We continue to provide midstream energy services in North America and the U.K. from an asset base consisting of pipelines, gathering systems, storage facilities, terminals, processing plants and other distribution assets. Midstream services are provided to independent producers, refiners of petroleum products and other market participants. We also selectively engage in marketing activities geared toward serving our customers and maximizing the value of our asset base.

As part of the reorganization, and in conjunction with approval from our creditors and the U.S. Bankruptcy Court, we appointed a new Board of Directors and senior management team. Norman Szydlowski was hired as Chief Executive Officer and brings considerable industry experience, management and leadership skills. Additionally, Robert Fitzgerald was hired as Senior Vice President and Chief Financial Officer and Candice Cheeseman was hired as General Counsel.

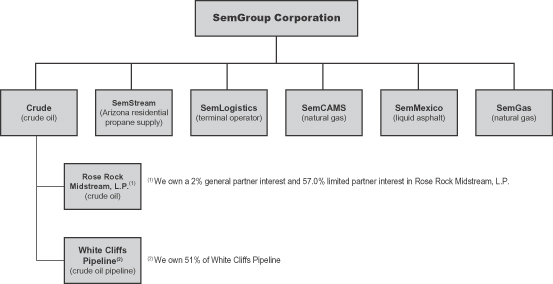

We conduct our operations through six primary business segments: Crude, SemStream®, SemLogistics, SemCAMS, SemMexico and SemGas®. The following diagram is a simplified organizational chart of our business segments:

We previously had a seventh business segment, SemCanada Crude, which aggregated and blended crude oil in Western Canada. Due to adverse market conditions impacting this segment, we sold the property, plant and equipment of SemCanada Crude in late 2010 and began winding down its operations.

2

Table of Contents

On November 1, 2011, we contributed the primary operating assets of our SemStream segment to NGL Energy Partners LP in exchange for cash and equity interests. We retained our ownership interest in SemStream’s Arizona residential business. (See Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations for additional information.)

Rose Rock Midstream, L.P. (“Rose Rock”) was formed in August 2011. On November 29, 2011, SemGroup Corporation contributed a wholly-owned subsidiary, SemCrude, L.P., to Rose Rock, in return for limited partner interests, general partner interests, and certain incentive distribution rights in Rose Rock. On December 14, 2011, Rose Rock completed an initial public offering (“IPO”) in which it sold 7,000,000 common units representing limited partner interests. Based on our control of, and ownership interest in, Rose Rock, we continue to consolidate Rose Rock and account for other partnership interest in Rose Rock as non-controlling interest.

We previously referred to the crude business segment as SemCrude, but following the contribution of SemCrude, L.P. to Rose Rock, we decided to change the name of the segment to “Crude”. The Crude business segment holds a 51% ownership interest in White Cliffs Pipeline L.L.C. and a 2% general partner interest and a 57.0% limited partner interest in Rose Rock.

Industry Overview

We move petroleum products throughout the U.S., Canada, Mexico and the U.K. We provide gathering, transportation, storage, distribution, marketing and other midstream services to producers and refiners of petroleum products. The market we serve, which begins at the point of purchase at the source of production and extends to the point of distribution to the end-user customer, is commonly referred to as the “midstream” market.

Regional Production of Petroleum Products in the U.S.

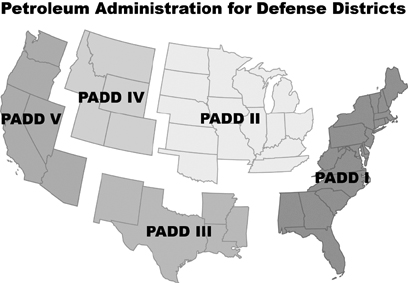

The U.S. Department of Energy divides the continental U.S. into five geographic regions called Petroleum Administration for Defense Districts, or “PADDs”. PADD 2 is the Midwest region of the U.S. PADD 2 is the second largest PADD in terms of refinery production, surpassed only by PADD 3. As a result of the flow of petroleum products across and throughout the Midwest region, we believe PADD 2 is an important crude oil production, logistics and refining center.

According to Energy Information Administration (“EIA”) data, as of November 2011, approximately 21%, or 3.7 million barrels per day (“Bpd”), of total U.S. daily refining capacity was in PADD 2. Also, according to November 2011 EIA reports, PADD 2 produces approximately 14%, or 0.8 million Bpd, of total U.S. daily crude oil production and imports approximately 13.6%, or 1.7 million Bpd, of total U.S. daily imports.

3

Table of Contents

PADD 2 refiners source crude oil from the Gulf Coast, Rocky Mountain, Canada’s Western Canadian Sedimentary Basin, which includes Alberta and parts of Saskatchewan to the East and British Columbia to the West, and major commodity hubs in the U.S. The production of petroleum products by PADD 2 refiners and processors historically has been less than the demand for petroleum products within that region, with the shortfall being supplied via common carrier pipelines primarily from the Gulf Coast, Canada and, to a lesser extent, the Rocky Mountain and East Coast regions. Additional petroleum product supply is available via barge transport up the Mississippi River with significant deliveries into local markets along the Ohio River.

Increased Importance of Independents and Specialization

In the 1990s, the major oil companies began focusing primarily on large-scale oil and gas projects. Until recently, this resulted in the major oil companies focusing more on foreign and deep-water exploration and production activities. As a result, they sold many of their North American integrated oil and gas assets, including producing properties, proprietary transportation systems, storage and distribution networks and refineries to independent operators. Whereas the major oil companies typically owned and operated proprietary networks that handled every aspect of the production, refining, storage, transportation and marketing of petroleum products, independent operators have generally focused on a single activity. As a result, the North American market is increasingly characterized by independent oil and gas producers and refiners that are generally without their own gathering, transportation, storage and distribution infrastructure. We focus on providing these services, using our asset base and distribution, processing and marketing expertise to provide independent operators with a stable source of supply and market access for their petroleum products.

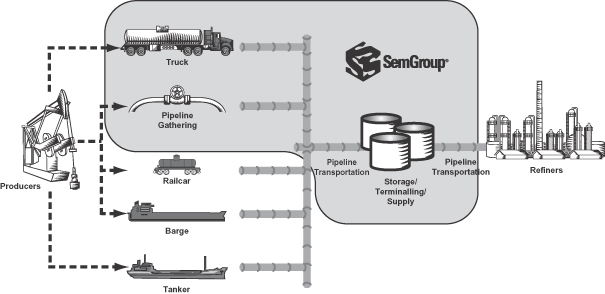

Crude Oil Industry Overview

Refined petroleum products, such as jet fuel, gasoline and distillate fuel oil, are all sources of energy derived from crude oil. According to 2010 data compiled by the EIA, petroleum currently accounts for about 44% of the nation’s total annual energy consumption. Growth in petroleum consumption is expected to keep pace with growth in overall energy consumption over the next 20 to 25 years. The EIA expects U.S. annual petroleum consumption to grow 13.5% from 17.1 million barrels per day in 2009 to 19.4 million barrels per day in 2035. The diagram below depicts the segments of the crude oil value chain and our participation in the crude oil industry.

4

Table of Contents

Our crude oil business operates primarily in Colorado, Kansas, North Dakota, Oklahoma and Texas where there are extensive crude oil production operations. Our assets extend from gathering systems in and around producing fields to transportation pipelines carrying crude oil to logistics hubs, such as the Cushing Interchange, where we have terminalling and storage facilities that aid our customers in managing the delivery of crude oil.

Gathering and Transportation

Pipeline transportation is generally the lowest cost method for shipping crude oil and transports about two-thirds of the petroleum shipped in the U.S. Crude oil pipelines transport oil from the wellhead to logistics hubs and/or refineries. Crude oil gathering assets generally consist of a network of smaller diameter pipelines that are connected directly to the well site or central receipt points delivering into larger diameter trunk lines. Logistic hubs like the Cushing Interchange provide storage and connections to other pipeline systems and modes of transportation, such as tankers, railroads and trucks. Trucking complements pipeline gathering systems by gathering crude oil from operators at remote wellhead locations not served by pipeline gathering systems. Trucking is generally limited to low volume, short haul movements because trucking costs escalate sharply with distance, making trucking the most expensive mode of crude oil transportation.

Storage Terminals and Supply

Storage terminals complement the crude oil pipeline gathering and transportation systems and address a fundamental imbalance in the energy industry wherein crude oil is often produced in different locations and at different times than it is ultimately consumed. Within the U.S., there are also geographical imbalances, as a substantial majority of the petroleum refining that occurs in the U.S. east of the Rocky Mountains is concentrated in the Gulf Coast region, particularly Louisiana and Texas which, according to the EIA, accounts for approximately 48% of all refining capacity in the United States. Over time, the crude oil storage business has evolved from its beginnings as a component of integrated production processes into a mature, stand-alone operation.

Terminals are facilities in which crude oil is transferred to or from a storage facility or transportation system, such as a gathering pipeline, to another transportation system, such as trucks or another pipeline. Terminals play a key role in moving crude oil to end-users, such as refineries, by providing the following services:

| • | inventory management; |

| • | distribution; and |

| • | upgrading to achieve marketable grades or qualities of crude oil. |

Overview of Cushing Interchange

The Cushing Interchange is one of the largest crude oil marketing hubs in the U.S. and is the designated point of delivery specified in all NYMEX crude oil futures contracts. As the NYMEX delivery point and a cash market hub, the Cushing Interchange serves as a significant source of refinery feedstock for Midwest refiners and plays an integral role in establishing and maintaining markets for many varieties of foreign and domestic crude oil.

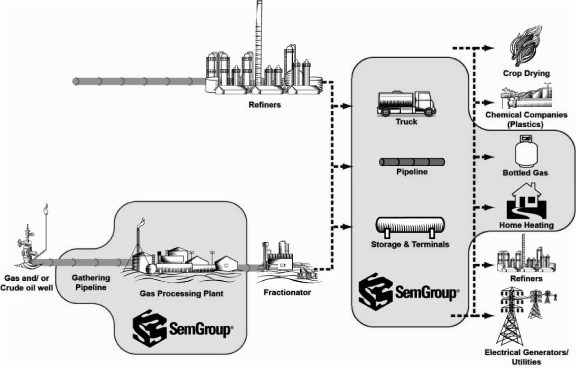

Natural Gas Industry Overview

In 2010, according to EIA data, natural gas was the second largest source of primary energy, accounting for 30% of total U.S. energy use in 2010. While the primary use for natural gas in the U.S. is for residential heating, it also has a number of commercial, industrial and electric generation uses across several different customer bases. The EIA forecasts that natural gas consumption will increase from 23.3 quadrillion BTU in 2009 to 27.24 quadrillion BTU in 2035.

5

Table of Contents

Since mid-2008, North American natural gas prices have declined significantly as a result of drilling technology improvements and the recent development of shale. Demand for natural gas and NGLs has historically been higher during the winter and lower during the summer, as gas is used primarily for heating and the need for it increases in cold months.

Natural gas passes through many stages before reaching end-users. First, exploration and production companies locate and produce natural gas. Second, gathering companies collect the natural gas, sometimes sending it to processing plants where liquids and other elements are removed. Third, transmission companies transport the gas through pipelines to storage units or areas of high demand. Finally, distributors deliver the gas to customers. The midstream natural gas industry is the link between upstream exploration and production activities and downstream end-use markets. The diagram below depicts the segments of the natural gas value chain and our participation in the natural gas industry.

We operate in the pipeline gathering and processing segments of the natural gas midstream industry in the U.S. and Canada. The operating fundamentals of Canadian natural gas processing operations differ somewhat from those in the U.S. The most significant difference is that, unlike U.S. natural gas processing facilities where the purchaser often purchases and owns the natural gas that it gathers and processes, in Canadian natural gas processing operations, the processor typically does not take title to the natural gas it gathers and processes. The processor, instead, receives fee income from transporting and processing natural gas owned by others.

As natural gas is processed to remove unwanted elements that interfere with pipeline transportation, higher value hydrocarbon liquids such as NGLs and condensate are separated from the raw natural gas stream. NGLs are obtained during the production and processing of natural gas or are a by-product from the crude oil distillation process within refineries. Supplies of NGLs are determined by the level of natural gas production, the amount of liquids in the gas, refining capacity utilization and by imports of NGLs. Condensate is a mixture of petroleum products consisting primarily of pentanes and heavier liquids extracted from natural gas. It is used to make gasoline, jet fuel and as a diluent used to dilute crude bitumen so that it can be transported by pipeline. We are engaged in residential propane supply operations in Page and Payson in Arizona.

6

Table of Contents

Gas Gathering

The natural gas gathering process begins with the drilling of wells into gas bearing rock formations. Once a well has been completed, the well is connected to a gathering system. Gathering systems typically consist of a network of small diameter pipelines and, if necessary, compression systems that collect natural gas from points near producing wells and transport it to larger pipelines for further transmission.

Gas Dehydration

Wellhead gas is generally fully saturated with water vapor. This water vapor must be removed from the gas stream to prevent formation of hydrates and condensation of free water in downstream facilities, to prevent corrosion and to meet downstream pipeline quality specifications. Dehydration is generally performed at central points along an upstream gathering system utilizing either a glycol absorption process or a solid desiccant adsorption process.

Gas Treating

In addition to water vapor, wellhead gas contains impurities such as carbon dioxide, nitrogen, hydrogen sulfide, helium, oxygen and other inert components. These impurities must be removed from the gas stream to protect downstream equipment, prevent corrosion and meet downstream pipeline quality specifications. They are removed through a variety of processes utilizing chemical reaction, absorption, adsorption or permeation.

Gas Processing

Natural gas delivered to the burner tip is almost pure methane. However, natural gas is produced from the reservoir containing impurities and heavier hydrocarbons entrained in the gas stream. The heavier hydrocarbons of NGLs must be removed from the wellhead gas stream before the gas is transported to market. These heavier hydrocarbons are removed by “processing” the gas at plants, either through temperature and pressure manipulation or absorption. The extracted heavier hydrocarbons have a high value and are sold separately to petrochemical manufacturers or wholesale marketers.

NGL Terminalling, Storage and Supply

The production of NGLs by gas processing plants and refineries is fairly constant throughout the year, whereas demand is seasonal. NGL terminalling and storage serves to balance this constant production or supply with the seasonal demand. Supply and marketing agreements are entered into with gas processors and refiners to market production on the supply side. This supply is then marketed to petrochemical plants and retail customers, as well as other consumers of NGLs.

Overview of North American NGL Hubs

There are four major North American NGL trading centers located at Edmonton, Alberta; Sarnia, Ontario; Conway, Kansas; and Mont Belvieu, Texas. These locations have substantial underground storage and are connected to NGL supply, transmission and distribution systems. Edmonton and Conway serve the U.S. midwest market while Sarnia and Mont Belvieu serve the U.S. northeast market. Mont Belvieu is the price reference point for North American NGL markets as it is the largest consuming region. Its strategic location on the Gulf Coast allows access to supplies from Europe, Africa and the Middle East. Mont Belvieu also has significant storage and pipelines to transport liquids to market and is close to large crude oil refineries. Petrochemical demand is approximately 42% of NGL demand and is the main factor affecting Mont Belvieu NGL prices. The two largest contributors to overall demand are weather, since propane is used in home heating and crop drying, and the petrochemical industry’s requirement for ethane. In general, NGLs are priced higher than natural gas to cover the cost for extraction.

7

Table of Contents

Mexican Asphalt Industry

Mexico is the 14th largest country in the world based on land area and the 11th largest country in terms of population. Although its land area is only one-fifth the size of the U.S., Mexico has a population of roughly one-third that of the U.S. Mexico has a large and diverse road network in place. Mexico’s land transportation network is one of the most extensive in Latin America with over 220,000 miles of paved roads. Roads are a critically important component of Mexico’s transportation infrastructure, with 99% of its passengers and 59% of its cargo being transported over road surfaces. The use of rail and water transportation in Mexico, in most cases, is either not practical or not available. As a result, roads are a high priority item of the country. The total current demand for road asphalt products in Mexico is roughly 2.1 million metric tons per year, requiring approximately 1.8 million metric tons of asphalt, either as a raw material or for end-use.

Mexico’s national highway infrastructure is comprised of three main components: the federal network (which includes both toll and toll-free roads) accounting for approximately 13% of all roads, the regional network accounting for approximately 21%, and the rural network consisting of approximately 66%. The federal road system is the responsibility of the Secretary of Communications and Transportation (SCT), while the regional network of roads is the responsibility of state governments. Rural and state roads and low-volume roads are also improved by the states. These networks help establish the annual demand for asphalt. Asphalt demand can increase, or decline, at a pace comparable to the level of on-going highway expansion and/or maintenance projects. Such projects rely on the availability of government concessions, continued public-private partnership undertakings and locally funded ventures.

European Petroleum Products Storage Industry

Storage for refined products and crude oil is critical to the European economy. Fluctuations in demand for crude oil and transportation fuels, combined with changing flows of petroleum product production and refining capacity, means storage is necessary to balance demand. Additionally, supply and demand disruptions due to weather, industry upsets, political tensions and terrorism have forced industry participants to understand the significance that access to storage, and the availability of storage, will have over the future years.

The independent storage industry has experienced fluctuating demand for its services over recent years from major oil companies, oil traders and strategic storage agencies (government entities that store fuel to protect against significant fluctuations in supply or demand as mandated by the European Union and the International Energy Agency). The construction of new tank storage facilities has historically been restricted, resulting in a supply shortage. However, high crude oil prices and backwardated market conditions (i.e., prices for future deliveries are lower than current prices) have had a negative effect on storage economics. As a result, demand for such storage facilities is currently weak.

Our Business

We provide gathering, transportation, storage, distribution, marketing and other midstream services primarily to independent producers, refiners of petroleum products and other market participants located in the Midwest and Rocky Mountain regions of the U.S., Canada and the West Coast of the U.K. We, or our significant equity method investees, have an asset base consisting of pipelines, gathering systems, storage facilities, terminals, processing plants and other distribution assets located between North American production and supply areas, including the Gulf Coast, Midwest, Rocky Mountain and Western Canadian regions. We also maintain and operate storage, terminal and marine facilities at Milford Haven in the U.K. that enable customers to supply petroleum products to markets in the Atlantic Basin. We also operate a network of liquid asphalt terminals throughout Mexico.

We gather, purchase, transport, store, distribute and market petroleum products to markets primarily in the Midwest, ensuring that our customers have consistent access to petroleum products supply and markets. Our strategically located pipelines, terminals and storage tanks, with access to North American transportation pipeline interconnects, are well positioned to benefit from the continuing need to transport and gather petroleum products from areas of supply to areas of demand.

8

Table of Contents

Our Property, Plant and Equipment

Assets include:

| • | a 51% ownership interest in White Cliffs Pipeline, which owns a 527-mile pipeline that transports crude oil from Platteville, Colorado to Cushing, Oklahoma (Crude operates White Cliffs); |

| • | a 2% general partner interest and a 57.0% limited partner interest in Rose Rock, which owns an approximately 640-mile crude oil pipeline network in Kansas and Oklahoma and a crude oil storage facility in Cushing, Oklahoma with a capacity of over 5.0 million barrels; |

| • | 8.93 million common units of NGL Energy Partners LP (32.2% of the common units outstanding at December 31, 2011) and a 7.5% interest in NGL Energy Holdings LLC, the general partner of NGL Energy Partners LP; |

| • | more than 1,700 miles of natural gas and NGL transportation, gathering and distribution pipelines in Arizona, Kansas, Oklahoma and Texas and Alberta, Canada; |

| • | 8.7 million barrels of owned multi-product storage capacity located in the United Kingdom; |

| • | 14 asphalt terminals in Mexico; |

| • | majority interest in four natural gas processing plants located in Alberta, Canada, with a combined operating capacity of 654 MMcf/d; and |

| • | three natural gas processing plants located in Oklahoma and Texas, with a combined operating capacity of 78 MMcf/d. |

We believe that the variety of our petroleum product assets creates opportunities for us and our customers year round.

Business Strategy

Our principal business strategy is to utilize our assets and operational expertise to:

| • | move petroleum products throughout the U.S., Canada, Mexico and the U.K.; |

| • | provide consistently reliable high-quality midstream services under predominantly fee and margin based contractual arrangements; |

| • | mitigate commodity price risk exposure; |

| • | aggressively manage operating costs to maintain and improve operating margins; |

| • | expand business by improving, enhancing and expanding services at existing facilities and gaining new customers; |

| • | pursue complementary “bolt-on” growth opportunities having acceptable risks and returns; and |

| • | generate consistent operating margins, earnings and cash flows. |

Our Business Segments

We conduct our business through six business segments:

| • | Crude; |

| • | SemStream; |

| • | SemLogistics; |

| • | SemCAMS; |

9

Table of Contents

| • | SemMexico; and |

| • | SemGas |

For information relating to revenue and total assets for each segment, refer to Note 10 of our consolidated financial statements beginning on page F-1 of this Form 10-K.

The following sections present an overview of our business segments, including information regarding the principal business and services rendered, assets and operations and markets and competitive strengths. Our results of operations and financial condition are subject to a variety of risks. For information regarding our key risk factors, see “Item 1A. Risk Factors.”

Crude

Crude’s business operations are conducted through its 51% ownership interest in White Cliffs Pipeline, L.L.C. (which Crude operates) and a 2% general partner interest and 57.0% limited partner interest in Rose Rock. These operations include crude oil transportation, storage, terminalling, gathering and marketing in Colorado, Kansas, Montana, North Dakota, Oklahoma and Texas for third party customers as well as for itself. The Crude business unit consists of three primary operations: (i) Kansas and Oklahoma pipeline system (Rose Rock); (ii) Cushing storage (Rose Rock); and (iii) the White Cliffs Pipeline. A majority of Crude’s revenue is generated from fee-based contractual arrangements that, in some instances, are fixed and not dependent on usage. For purposes of this discussion of Crude’s operations, all Rose Rock and White Cliffs Pipeline operations will be referred to as “Crude”.

Assets and Operations

Cushing Storage. Crude owns and operates over 5.0 million barrels of crude oil storage in Cushing, Oklahoma, with an additional 1.95 million barrels of crude oil storage under construction. Crude directly utilizes, and provides to customers, fee-based storage and terminal services from owned assets in Cushing. Currently, most of our owned operating storage capacity at Cushing is leased to third-party customers. Crude also owns and operates a delivery/receipt pipeline to connect its storage operations to Enterprise Products Partners, LP’s facility in Cushing, which is the hub where all NYMEX barrels are delivered. We have additional acreage and infrastructure in place to significantly expand storage capacity at Cushing.

Kansas and Oklahoma Pipeline. Crude owns and operates an approximately 640-mile crude oil gathering and transportation pipeline system and related pipeline storage tanks in Kansas and northern Oklahoma. The pipeline system connects to several third party trunk pipelines in Kansas, several refineries, and storage terminals located at Cushing, Oklahoma. The Kansas and Oklahoma pipeline system can currently transport approximately 40,000 barrels of crude oil per day.

White Cliffs Pipeline. Crude owns and operates a modern, ten-lane crude oil truck unloading facility in Platteville, Colorado, which connects to the origination point of the White Cliffs Pipeline, which was first placed into service in 2009. Substantially all of the crude oil production from the DJ Basin and nearby Niobrara Shale must initially be transported by truck due to a shortage of gathering capacity, and the White Cliffs Pipeline is the only direct pipeline out of the DJ Basin to the Cushing market and to Mid-Continent refineries. Throughput at the facility averaged 32,400 barrels per day and 25,800 barrels per day for the years ended December 31, 2011 and 2010, respectively. The facility includes 220,000 barrels of crude oil storage capacity.

Crude also owns 51% of, and operates, a 527-mile common carrier, crude oil pipeline system that originates in Colorado and terminates in Cushing, Oklahoma (the “White Cliffs Pipeline”). The White Cliffs Pipeline provides the Denver-Julesburg Basin (“DJ Basin”) producers in Colorado direct access to the Cushing market and to refiners in the Midwest area. The White Cliffs Pipeline also includes a 100,000 barrel crude oil storage tank and a truck unloading facility owned and operated by Crude and located and connected at the White Cliffs Pipeline’s origination point at Platteville, Colorado. The White Cliffs Pipeline’s capacity is 70,000 barrels of

10

Table of Contents

crude oil per day. The White Cliffs Pipeline became fully operational on June 1, 2009. Crude currently owns 51% of the White Cliffs Pipeline. The other 49% is owned as follows: 34% by Plains Pipeline, L.P. (“Plains”), 10% by Anadarko Wattenberg Company, LLC (“AWC”) and 5% by Samedan Pipe Line Corporation (“Noble Energy”). AWC and Noble Energy have each entered into throughput agreements with us for the shipment of their product on the White Cliffs Pipeline. (See Note 5 of our consolidated financial statements beginning on page F-1 of this Form 10-K for additional information.)

In addition to these operations, Crude conducts a crude oil aggregation, marketing and blending business in the Bakken shale play area in North Dakota, utilizing two truck unloading facilities. Crude oil is purchased, transported via owned trucks, shipped on an Enbridge Pipeline (utilizing a historical pipeline allocation) or via rail and marketed. (This part of the Crude business was previously conducted by SemCanada Crude, but prior to the sale of the SemCanada Crude assets, as previously noted, this activity was transferred to Crude.) There are currently more rigs working in this shale play than any other in the U.S. As more volume moves southeast from the Bakken to Cushing, our assets are very well positioned to benefit in an upsurge in activity.

Revenue and Marketing

A majority of Crude’s revenue is derived from fee-based contractual arrangements with third party customers. The White Cliffs Pipeline has two throughput contracts that require each shipper to pay a minimum fixed monthly payment for the capacity allocated to it on the pipeline, regardless of the capacity actually utilized. The agreements run through May 2014, although they could end sooner if the contracted volumes are shipped before that date. In addition, other parties may ship on White Cliffs Pipeline at FERC based rates. The Kansas and Oklahoma pipeline system provides transportation and storage services to customers on fee-based arrangements, typically based on usage with varying term lengths. Cushing storage capacity is provided to customers under fixed fee contractual arrangements, typically based on the amount of storage capacity reserved for each customer.

In addition to third party customer revenue, Crude generates revenue from limited marketing activities. Crude’s U.S. marketing includes purchasing crude oil for its own account from producers and aggregators and selling crude oil to traders and/or refiners.

We mitigate the commodity price exposure of our crude oil marketing operations by limiting our net open positions through (i) the concurrent purchase and sale of like quantities of crude oil to create “back-to-back” transactions intended to lock in positive margins based on the timing, location or quality of the crude oil purchased and delivered, or (ii) derivative contracts. All of our marketing activities are subject to our comprehensive risk management policy which establishes limits in order to manage risk and mitigate financial exposure. Our marketing activities account for a portion of the revenue we generate on our Kansas and Oklahoma pipeline system and through our Bakken Shale operations.

Market and Competitive Strengths

Crude’s pipelines are located in areas where they have the ability to move crude oil to Cushing. The Cushing Interchange is one of the largest crude oil marketing hubs in the U.S. and the designated point of delivery specified in all NYMEX crude oil futures contracts. As the NYMEX delivery point and a cash market hub, the Cushing Interchange serves as a significant source of refinery feedstock for PADD 2 refiners and plays an integral role in establishing and maintaining markets for many varieties of foreign and domestic crude oil. The White Cliffs Pipeline is the only direct route out of the DJ Basin in Colorado to Cushing. The Kansas/Oklahoma pipeline system allows Kansas producers and purchasers access to local refineries and Cushing.

SemStream

SemStream is engaged in the residential propane supply business through its wholly-owned subsidiary, SemStream Arizona Propane, L.L.C. (“SemStream Arizona”), with operations in Page and Payson, Arizona and holds our interests in NGL Energy Partners LP.

11

Table of Contents

Assets and Operations

| • | A regulated underground utility business and a non-regulated propane bulk business with over 200 miles of associated NGL pipeline and aggregate total of approximately 12,000 customers; and |

| • | SemStream holds SemGroup’s ownership interests in NGL Energy Partners LP (“NGL Energy”), a master limited partnership, publicly traded on the New York Stock Exchange (“NYSE”) as “NGL”. NGL Energy is a diversified partnership engaged in retail propane operations from coast to coast as well as midstream propane terminal operations. |

SemStream Arizona is engaged in retail sales and downstream distribution of propane. It includes a regulated underground utility business and a non-regulated propane bulk business, serving approximately 12,000 residential customers in Arizona. The regulated business serves approximately 10,000 customers through two regulated utilities operating underground vapor systems in and around Payson and Page, Arizona. The non-regulated operations include the retail distribution of bulk propane to approximately 2,000 customers in these same Arizona communities and in certain Utah/Arizona border communities. SemStream Arizona’s assets include over 200 miles of underground pipelines, propane storage and other equipment.

Revenue and Marketing

Through our regulated utility in Arizona, we market propane directly to approximately 10,000 residential customers connected through a low pressure pipeline delivery system. Non-regulated operations in Arizona provide retail distribution to an additional 2,000 customers.

SemLogistics

SemLogistics owns the largest independent petroleum products storage facility in the U.K. The main activities of SemLogistics are the receipt, storage and redelivery of clean petroleum products and crude oil at the Milford Haven site.

Assets and Operations

SemLogistics operates a tank storage business and offers build-bulk (importing small cargos, building volume and exporting larger cargos) and break-bulk (importing larger cargos and exporting smaller cargos) operations to its customers that transport products from the Middle East to Europe, the east coast of the U.S. and the west coast of Africa. The terminal is strategically located to access the U.K. market and to service numerous global markets.

SemLogistics’ storage facility includes approximately 8.7 million barrels of above ground storage tanks and has received approval from Pembrokeshire County Council to build nine new tanks with a total storage capacity of 1.5 million barrels. The construction of new tankage is dependent on, and will commence when, the supply and demand for additional product storage is prudent. The terminal has two deep water jetties, one of which can accommodate vessels of up to 165,000 dead weight tons. It also has access to Mainline Pipeline Limited (pipeline from Milford Haven to Manchester and Nottingham), which is owned by four major oil companies.

Over 40% of SemLogistics’ storage capacity is multi-product, providing customers with tank storage for clean petroleum products, including gasoline, gasoline blendstocks, jet fuel, gas oil and diesel. The remaining tankage is either dedicated to crude oil or dual-purpose tankage for at least two clean petroleum products (gasoline/jet fuel or gasoline/gas oil or jet fuel/gas oil). SemLogistics also provides related services, e.g., tank-to-tank transfers, mixing of gasoline blendstocks, and kerosene marking.

12

Table of Contents

Revenue and Marketing

SemLogistics generates revenue from fixed-fee storage tank leasing and related services by making available to third parties all of the terminal’s available tank capacity for the storage of crude oil and refined products. Customers fall into three broad categories: trading, structural marketing storage and compulsory strategic storage.

Markets and Competitive Strength

SemLogistics’ ability to handle multiple products provides flexibility to change its operations in response to market conditions. Demand for independent storage terminals can be impacted by a wide range of influences such as the forward price curve, expanding oil production, security of supply concerns, European compulsory stock holding requirements, and mismatches in regional production and consumption of oil and refined petroleum products.

SemLogistics’ terminal size (approximately 23% of the total independent storage in the U.K.) and its vessel handling capabilities make it unique compared with other terminals. In addition to being the only independent U.K. facility that serves the bulk trans-shipment sector, it is also the only facility capable of handling crude oil, with the only other comparable facility in the British Isles being a terminal in Ireland. However, the owner of this other facility, a major oil company, uses its terminal exclusively for proprietary storage and storage of Irish strategic stocks.

SemCAMS

We own and operate four natural gas processing and gathering facilities in Alberta, Canada. The principal process performed at the processing plants is to “sweeten” sour natural gas by removing sulfur. Approximately two-thirds of the total natural gas throughput at our processing plants is sour gas. All of SemCAMS’ assets are located in West-Central Alberta, in the heart of the Western Canadian Sedimentary Basin, which accounts for approximately 80% of Canada’s sour natural gas production.

Assets and Operations

SemCAMS owns and operates varying working interests in (i) two sour natural gas processing plants known as the Kaybob South No. 3 plant (the “K3 Plant”), and the Kaybob Amalgamated plant (the “KA Plant”); (ii) two sweet gas plants known as the West Fox Creek plant and the West Whitecourt plant (the “WW Plant”), and (iii) a network of more than 600 miles of natural gas gathering and transportation pipelines. The sour gas plants are dually connected to two major long-haul natural gas pipelines that serve Canada and the U.S. The plants also have the ability to load product for transportation by truck and railcar.

Revenue and Marketing

SemCAMS generates revenue from the processing plants through volumetric fees for services under contractual arrangements with working interest owners and third party customers. SemCAMS does not have direct exposure to commodity prices. In addition, SemCAMS generates fee-based revenue from volume throughput on its pipelines. SemCAMS’ customers include producers of varying sizes.

SemCAMS also derives revenue as the operator of pipeline gathering systems that gather gas from multiple wells located in the same production unit and as the operator of pipeline transportation systems that deliver the gathered gas to each plant.

To support operations at our plants, several producers have committed to process all of their current and future natural gas production from lands owned by them, or their subsequent assignees, within a “dedicated area” comprised of approximately 180 townships located in and around our plants. The “dedicated area” covers approximately 27% of the volumes in the area surrounding our plants. This dedication continues until field depletion.

13

Table of Contents

Market and Competitive Strengths

SemCAMS’ natural gas gathering and processing operations are located in an area that generates more than 95% of Canada’s total natural gas production and approximately 80% of Canada’s total sour gas production. Natural gas is used for a variety of purposes in Canada including heating, electricity production and other industrial processes.

SemMexico

SemMexico provides a variety of liquid asphalt cement products and product application services to the Mexican market. SemMexico purchases, produces, stores and distributes asphalt products throughout Mexico. SemMexico’s primary supplier of asphalt is Pemex, Mexico’s state-owned petroleum company. SemMexico is the largest asphalt distributer in Mexico and, in addition to direct asphalt cement sales, further processes asphalt materials in combination with other raw materials to produce value-added products. These products, such as polymer modified asphalts and asphalt emulsions, are then sold to road contractors and government agencies.

Assets and Operations

SemMexico currently operates an in-country network of 12 asphalt cement terminals and modification facilities, two emulsion distribution terminals and one portable rail unloading facility to import asphalt from the U.S. SemMexico’s national technical center and headquarters are located in the city of Puebla, Mexico.

Revenue and Marketing

SemMexico generates revenues through the sale of asphalt product to customers. In general, SemMexico’s sales and purchases of asphalt cement are matched; SemMexico procures product on an as-needed basis, thereby limiting exposure to price movements of inventory. SemMexico’s focus is to maintain its reputation as a quality supplier of asphalt products by consistently producing high quality products and introducing technologically advanced products and solutions to Mexico’s asphalt market, while simultaneously increasing production capacity and product distribution availability.

Market and Competitive Strengths

SemMexico is a leader in asphalt pavement technologies and capabilities. It is the only liquid asphalt cement company with a national footprint in Mexico. These factors have resulted in a long-term supply relationship with Pemex and continuous business transactions with its customers. SemMexico is exposed to market risk, such as the sustainability of road construction and maintenance funds from the Mexican government. However, we believe that SemMexico’s significant market position, reputation, technology and long-term relationships with suppliers and customers are strategic strengths that will benefit SemMexico if funding or demand should increase.

SemGas

SemGas provides natural gas gathering and processing services. It has gathering and processing plants and assets in Kansas, Oklahoma and Texas. SemGas aggregates gas supplies from the wellhead and provides various services to producers that condition the wellhead gas production for downstream markets.

Assets and Operations

SemGas currently owns and operates over 800 miles of gathering pipelines in Kansas, Oklahoma and Texas. SemGas has one processing plant located in Sherman, Texas, with a processing capacity of 23 million cubic feet per day and over 400 miles of low pressure gathering lines. SemGas also has two plants in Northern Oklahoma (Nash and Hopeton) located roughly 20 miles apart, with a combined processing capacity of approximately 55 million cubic feet per day. This area, also called the Mississippi Zone, has emerged into a key oil resource

14

Table of Contents

play with associated gas. There are approximately 690,000 acres dedicated to SemGas, from several area producers, with about 60,000 acres in the core of the emerging Mississippian play.

Additionally, SemGas owns a Eufaula gathering system which gathers, dehydrates and compresses gas in eastern Oklahoma, and a gathering system in Kansas.

Revenue and Marketing

SemGas generates revenue from a portfolio of contracts. Initial contract terms can range from two years to the life of the reserves and, upon expiration, continue to renew on a month-to-month or year-to-year evergreen basis. The majority of the contracts provide upside potential by providing SemGas participation in commodity price and processing margin upswings through percent-of-proceeds and percent-of-index contracts. On these contracts, SemGas is generally responsible for marketing the gas and NGLs for both its and the producers’ share of the products. Percent-of-proceeds contracts are based on SemGas paying the producers a percentage of the sale proceeds from the products and percent-of-index contracts are based on SemGas paying the producers a percentage of the sale proceeds based on an index price. SemGas also has fee-based contracts for processing and gathering services. SemGas’ customers include producers, operators, marketers and traders.

Market and Competitive Strengths

SemGas’ gathering and processing volumes can be impacted by market demand for the products it handles, as well as the price for crude oil because the Mississippi Zone is primarily a crude oil play with associated natural gas and natural gas liquids. Gathering and processing activities are also reliant on continued drilling and production activity by producers in our areas of operation. While price increases in natural gas might lead to increased drilling and supply, price increases can also adversely affect demand.

We face competition in acquiring new natural gas supplies. The natural gas gathering and processing industry is generally characterized by regional competition, based on the proximity of gathering systems and processing plants to natural gas producing wells. SemGas’ gathering and processing assets tend to have relatively long-term contracts and, in some instances, are the only assets that can provide the offered services to the customers.

SemGas generally sells all natural gas and NGLs it obtains under its percentage-of-proceeds and percentage-of-index contracts immediately in the spot market and, therefore, has little commodity price risk with respect to inventory or other physical commodity positions. SemGas’ percentage-of-proceeds and percentage-of-index processing contracts intrinsically have commodity price risk since SemGas’ fees, with respect to these contracts, vary with the level of natural gas and commodity prices. SemGas may elect to use financial derivatives to hedge this risk. SemGas is limited in the amount, and in the time period, for which it may hedge its commodity price risk associated with its contracts pursuant to our Comprehensive Risk Management Policy. More generally, all of our marketing and hedging activities are subject to our Comprehensive Risk Management Policy which establishes a set of limits, both at the SemGas and the SemGroup Corporation levels, to manage risk and mitigate financial exposure.

Risk Governance and Comprehensive Risk Management Policy

We expect to generate the majority of our earnings from owning and operating strategic assets while endeavoring to prudently manage all risks, including commodity price risk, associated with the ownership and operations of our assets. We have a Comprehensive Risk Management Policy that reflects an enterprise-wide approach to risk management and considers both financial and non-financial risks.

Our Board of Directors is responsible for the oversight of our enterprise-wide risk and has approved our Comprehensive Risk Management Policy. The Comprehensive Risk Management Policy is designed to ensure we:

| • | identify and communicate our risk appetite and risk tolerances; |

15

Table of Contents

| • | establish an organizational structure that prudently separates responsibilities for executing, valuing and reporting our business activities; |

| • | value (where appropriate), report and manage all material business risks in a timely and accurate manner; |

| • | effectively delegate authority for committing our resources; |

| • | foster the efficient use of capital and collateral; and |

| • | minimize the risk of a material adverse event. |

The Audit Committee of our Board of Directors has oversight responsibilities for the implementation of, and compliance with, our Comprehensive Risk Management Policy.

Our Executive Management Committee, comprised of corporate officers, oversees the financial and non-financial risks associated with all activities governed by our Comprehensive Risk Management Policy including:

| • | asset operations; |

| • | marketing and trading; |

| • | investments, divestitures, and other capital expenditures and dispositions; |

| • | credit risk management; and |

| • | other strategic activities. |

We also have a Risk Management Group that is assigned responsibility for independently monitoring compliance with, reporting on, and enforcing the provisions of our Comprehensive Risk Management Policy.

Our Comprehensive Risk Management Policy provides a set of limits or thresholds for activities related to owned assets, physical commodities, and derivatives and capital transactions involving market and credit risk. Our limits monitor these risks for each individual segment and on a consolidated basis. Our Comprehensive Risk Management Policy also specifies the types of transactions that may be executed by incumbents of named positions without specific approval of our Board of Directors or our Executive Management Committee. It also restricts proprietary trading activities within limits significantly more restrictive than the corporate market risk management limits.

Competition

We face intense competition in the operations of each of our segments. Our competitors include other midstream companies, major integrated oil companies and their marketing affiliates, crude oil pipeline companies and independent gatherers, brokers and marketers of petroleum products of widely varying sizes, financial resources and experience. Some of these competitors have capital resources many times greater than ours and control greater supplies of crude oil and petroleum products. Competition for customers of petroleum products is based primarily on price, access to supply, access to logistics assets, distribution capabilities, the ability to meet regulatory requirements, and maintenance of quality of service and customer relationships.

Operational Hazards and Insurance

Pipelines, terminals, storage tanks, processing plants or other facilities may experience damage as a result of an accident, natural disaster or deliberate act. These hazards can also cause personal injury and loss of life, severe damage to, and destruction of, property and equipment, pollution or environmental damage and suspension of operations. Through the services of a major national insurance broker, we have maintained insurance of various

16

Table of Contents

types and varying levels of coverage similar to that maintained by other companies in the industry and which we consider adequate, under the circumstances, to cover our operations and properties, including coverage for natural catastrophes, pollution related events and acts of terrorism and sabotage. The limit of operational insurance maintained covering loss of, or damage to, property and products is $300 million per loss and includes business interruption loss. For claims arising under general liability, automobile liability and excess liability, the limits maintained total $250 million per occurrence/claim. Primary and excess liability insurance limits maintained for pollution liability claims vary by location for claims arising from gradual pollution with limits ranging from $20 million to $40 million in the aggregate. The combined primary and excess liability insurance limits for claims arising from sudden and accidental pollution total $270 million per claim and $290 million in the aggregate. This insurance does not cover every potential risk associated with the operating pipelines, terminals and other facilities. We have a favorable claims history enabling us to self-insure the “working layer” of loss activity utilizing deductibles and self-insured retentions commensurate with our financial abilities and in line with industry standards, in order to create a more efficient and cost effective program and a consistent risk profile. The working layer consists of high frequency/low severity losses that are best retained and managed in-house. Sizeable or difficult self-insured claims or losses may be handled by professional adjusting firms hired by us. We will continue to monitor the appropriateness of our deductibles and retentions as they relate to the overall cost and scope of our risk and insurance program.

With a few limited exceptions, our customers have not agreed to indemnify us for losses arising from a release of crude oil, and we may instead be required to indemnify our customers in the event of a release or other incident.

Regulation

General

Our operations are subject to extensive regulation. The following discussion of certain laws and regulations affecting our operations should not be relied on as an exhaustive review of all regulatory considerations affecting us, due to the myriad of complex federal, state, provincial, foreign and local regulations that may affect our business.

Regulation of U.S. Pipeline and Storage Operations

Interstate Storage and Transportation

White Cliffs Pipeline is subject to regulation by the Federal Energy Regulatory Commission (“FERC”) because the rates charged to shippers on the pipeline system are required to be filed with, and accepted by, FERC. Under the Interstate Commerce Act (the “ICA”), FERC has authority to regulate companies that provide interstate petroleum based products pipeline transportation services, including pipeline operational transportation related storage services. FERC’s authority to regulate those interstate services includes the rates charged for services, terms and conditions of service, maintenance of accounts and records and various related ancillary matters. Regulated companies may not charge rates that have been determined not to be “just and reasonable” by FERC. The rates, terms and conditions for our service are found in FERC-approved tariffs. Pursuant to FERC’s jurisdiction over rates, existing rates may be challenged by complaint and proposed rate increases and proposed changes in terms and conditions of service may be challenged by protest. In addition, FERC prohibits petroleum and NGL based products transportation from unduly preferring, or unreasonably discriminating against, any person with respect to pipeline rates or terms and conditions of service.

Gathering and Intrastate Pipeline Regulation

The ICA, the Natural Gas Act (the “NGA”) and the Natural Gas Policy Act of 1978 do not apply to intrastate petroleum and natural gas based products facilities and activities, i.e., those that are not used or usable in the conduct of interstate commerce. FERC has ruled that intrastate petroleum and natural gas gathering

17

Table of Contents

systems are exempt from regulation by the Commission. We own a number of natural gas pipelines that we believe operate wholly intrastate and are, therefore, exempt from FERC regulation. We also own a number of intrastate crude oil gathering systems that are subject to state and local, but not federal regulation. These gathering systems are currently operated as proprietary systems and may be subject to regulation by FERC in the future.

In the states in which we operate, regulation of intrastate natural gas and crude oil gathering facilities and intrastate crude oil pipeline service generally includes various safety, environmental and, in some circumstances, nondiscriminatory take requirements and complaint-based rate regulation. For example, our natural gas gathering facilities are, in some cases, subject to state ratable take and common purchaser statutes. Ratable take statutes generally require gatherers to take, without undue discrimination, natural gas production that may be tendered to the gatherer for handling. Common purchaser statutes generally require gatherers to purchase without undue discrimination as to source of supply or producer. These statutes are designed to prohibit discrimination in favor of one producer over another producer or one source of supply over another source of supply. These statutes have the effect of restricting our right, as an owner of gathering facilities, to decide with whom we contract to purchase or transport natural gas.

Department of Transportation

All crude oil and liquefied petroleum gases interstate pipelines, and certain intrastate crude oil and liquefied petroleum gases pipelines and storage facilities, are subject to regulation by the Department of Transportation (the “DOT”) with respect to the design, construction, operation and maintenance of the pipeline systems and storage facilities. The DOT routinely conducts audits of the regulated assets and we must make certain records and reports available to the DOT for review as required by the Secretary of Transportation. In some states, the DOT has given a state agency authority to assume all or part of the regulatory and enforcement responsibility over the intrastate assets.

Regulation of NGL Terminals, Distribution and Utility Operations

SemStream’s Arizona non-regulated and regulated propane distribution operations are subject to the code set forth in the National Fire Protection Association Standard #58 (“NFPA 58”), Standard for the Storage and Handling of Liquefied Petroleum Gases. Arizona state agencies routinely conduct physical audits to ensure compliance with such regulations.

SemStream Arizona’s utility operations are subject to regulation by the Arizona Corporation Commission (“ACC”). The ACC regulates the sale price of propane gas to customers connected to our underground propane gas systems in Payson and Page, Arizona. The ACC also conducts annual inspections of the Payson and Page utility underground pipeline systems under authority delegated to it from the DOT.

Trucking Regulation

Through our interest ownership in Rose Rock, we operate a fleet of trucks to transport crude oil. We are licensed to perform both intrastate and interstate motor carrier services and are subject to certain safety regulations issued by the DOT. DOT regulations cover, among other things, driver operations, maintaining log books, truck manifest preparations, the placement of safety placards on the trucks and trailer vehicles, drug and alcohol testing, safety of operation and equipment and many other aspects of truck operations. We are also subject to Occupational Safety and Health Administration (“OSHA”) regulations with respect to our trucking operations.

Cross-Border Regulation

We are subject to regulatory matters specific to border crossing, which include export licenses, tariffs, customs and tax issues and toxic substance certifications. Regulations include the Short Supply Controls of the

18

Table of Contents

Export Administration Act, the North American Free Trade Agreement, National Energy Board Reporting and Certification and the Toxic Substances Control Act. Violations of license, tariff and tax reporting requirements under these regulations could result in the imposition of significant administrative, civil and criminal penalties. Furthermore, the failure to materially comply with applicable tax requirements could lead to the imposition of additional taxes, interest and penalties.

Regulation of Canadian Gathering, Processing, Transportation and Marketing Businesses

National Energy Board (“NEB”)

Our Canadian assets are not currently regulated by the NEB. The importation and exportation of natural gas and crude oil to and from Canada, however, are regulated by the NEB. The Government of Alberta tracks volumes exported from Alberta and, although it has not previously done so, reserves the right to limit the volume of natural gas that may be removed from Alberta in the event of domestic supply constraint.

Energy Resources Conservation Board (“ERCB”)

The ERCB’s purpose is to ensure that the discovery, development and delivery of Alberta’s resources take place in an orderly and efficient manner and in the public interest.

Among other matters, the ERCB has the authority to regulate the exploration, production, gathering, processing, transmission and distribution of natural gas within the province. With respect to natural gas gathering and processing activities, the ERCB’s primary role is to serve as a licensing authority for the construction and operation of the facilities used in those activities.

While the ERCB has jurisdiction to regulate the rates and fees charged for services provided by these types of facilities using a public complaint process, this authority is discretionary and historically has not commonly been exercised. Generally, the complaint-based method of regulation has meant that parties have had the opportunity to use alternative means to resolve disputes without resorting to the ERCB.

Sulphur Recovery Standards

In 2001, the ERCB set more stringent sulphur recovery standards for older sour gas processing plants, as set out in ID 2001-3. This interim directive directed older, “grandfathered” plants to either gradually increase their sulphur recovery to current standards or accept a reduction in their licensed capacity.

The K3 Plant and the KA Plant are capable of meeting “de-grandfathered” recovery requirements. The K3 Plant was “de-grandfathered” in 2006 after installation of a new Super Claus Sulphur recovery process. The KA Plant can be “de-grandfathered” via simple administrative application.

Other Provincial Regulatory Agencies

The Alberta Boilers Safety Association (“ABSA”) is the regulatory agency in Alberta of pressure systems with a mandate to ensure that pressure equipment is constructed and operated in a manner that protects public safety. SemCAMS maintains an approved program to meet all requirements.

Regulation of U.K. Operations

In the U.K., the Department of Energy and Climate Change’s Energy Resources Development Unit is responsible for the regulation of a number of relevant areas, including licensing, fiscal policy, national oil stocks policy (including their compulsory oil stocking obligations as a member of the European Union and International Energy Agency), policy on oil disposal, offshore environmental policy, oil sharing arrangements and

19

Table of Contents

decommissioning. Other regulatory bodies include the Health and Safety Executive, which regulates health and safety in the upstream and downstream oil industry (among others) and the Hazardous Installations Directorate, which is responsible for inspection and enforcement of health and safety regulation with respect to the downstream oil industry (among others). There is no regulator dedicated specifically to the oil industry. The activities of SemLogistics may also be regulated as a result of the European Union’s participation in the International Carriage of Dangerous Goods by Road and Rail agreements, as well as the International Maritime Dangerous Goods Code, which governs the safe transport of dangerous goods (including oil) by sea and, in due course, by the Marine Management Organization when it comes into being pursuant to the Marine and Coastal Access Bill.

The Department for Environment Food and Rural Affairs is responsible for setting legislation, policy, regulations and guidance for a number of environmental issues. There are also several European and international laws and policies that apply. SemLogistics’ activities are regulated by the Environment Agency Wales (“EAW”). EAW also oversees spills and their cleanup, as well as new construction of tanks, bunds (spill prevention berms in the U.S.) and other improvements, and whose regulations require us to maintain a Pollution Prevention and Control permit.