Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ENDO HEALTH SOLUTIONS INC. | d305051d8k.htm |

grow.

collaborate. innovate. thrive.

ENDO PHARMACEUTICALS

J.P. Morgan Annual Global High Yield & Leveraged Finance

Conference

February 29, 2012

Exhibit 99.1 |

grow.

collaborate. innovate. thrive. ©2012 Endo Pharmaceuticals, Inc.

2

FORWARD LOOKING STATEMENTS

This presentation contains forward-looking statements within the meaning of the Private

Securities Litigation

Reform

Act

of

1995.

Statements

including

words

such

as

“believes,”

“expects,”

“anticipates,”

“intends,”

“estimates,”

“plan,”

“will,”

“may,”

“look forward,”

“intend,”

“guidance,”

“future”

or similar

expressions are forward-looking statements. Because these statements reflect our

current views, expectations and beliefs concerning future events, these

forward-looking statements involve risks and uncertainties. Investors should note

that many factors, as more fully described under the caption “Risk

Factors”

in our Form 10-K, Form 10-Q and Form 8-K filings with the Securities and Exchange

Commission and as otherwise enumerated herein or therein, could affect our future

financial results and could cause our actual results to differ materially from those

expressed in forward-looking statements contained in our Annual Report on Form

10-K. The forward-looking statements in this presentation are qualified by

these risk factors. These are factors that, individually or in the aggregate, could cause our

actual results to differ materially from expected and historical results. We assume no

obligation to publicly update any forward-looking statements, whether as a result

of new information, future developments or otherwise. |

grow.

collaborate. innovate. thrive. ENDO PHARMACEUTICALS

I.

Our Diversified Business

II.

Growth Drivers

III.

Commitment to Innovation

IV.

2012 Financial Guidance

V.

Summary

3 |

4

©2012 Endo Pharmaceuticals, Inc.

FUTURE VALUE CREATION OPPORTUNITIES

grow. collaborate. innovate. thrive. |

grow.

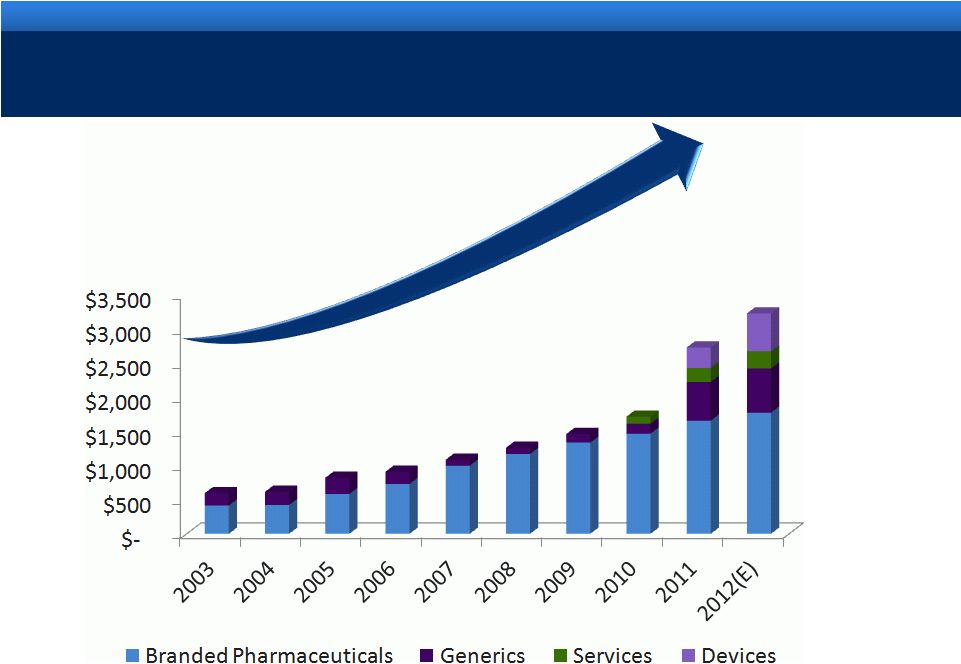

collaborate. innovate. thrive. SOLID TRACK RECORD OF SALES GROWTH

ENDO EXPECTS TO REPORT MORE THAN $3 BILLION IN 2012 SALES

5

Sustaining our Growth

($MM)

grow. collaborate. innovate. thrive.

©2012 Endo Pharmaceuticals, Inc. |

grow.

collaborate. innovate. thrive. STRONG CASH FLOW GENERATION

6

©2012 Endo Pharmaceuticals, Inc. |

grow.

collaborate. innovate. thrive. 7

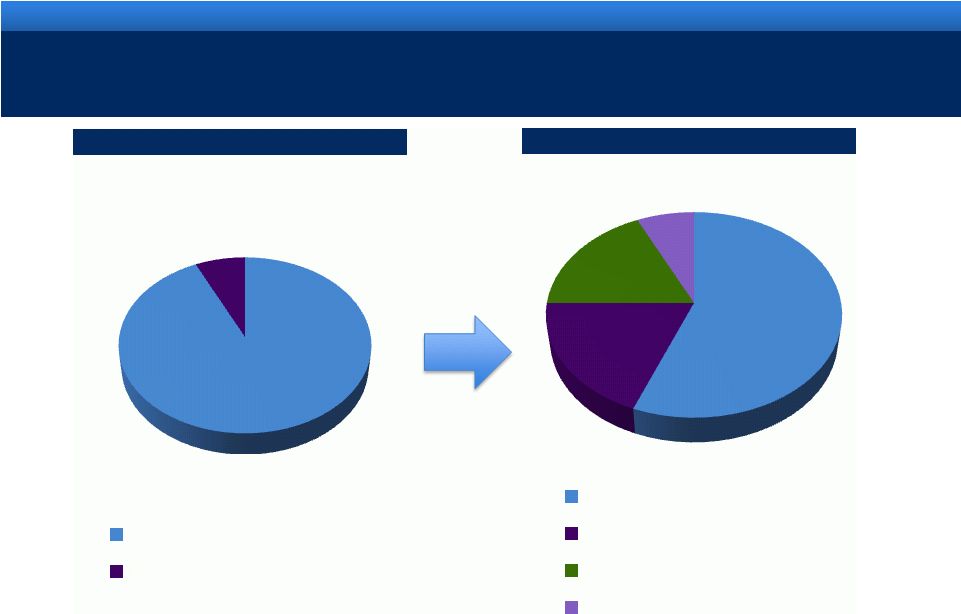

DIVERSIFIED HEALTHCARE SOLUTIONS COMPANY

Endo -

2011

Endo -

2008

*Pro forma -

TTM as of 12/31/2011. Includes full year of AMS.

**The services segment does not include the pro forma impact of pre-acquisition revenues

from the recently acquired electronic medical records

providers,

Intuitive

Medical

Software

(IMS)

and

meridian

EMR,

Inc.

.

©2012 Endo Pharmaceuticals, Inc.

7%

Revenue Mix

Branded Pharmaceuticals

Generics

93%

56%

19%

18%

7%

Revenue Mix*

Branded Pharmaceuticals

Generics

Devices

Services** |

grow.

collaborate. innovate. thrive. ©2011 Endo Pharmaceuticals Inc.

•

Virtual Research

•

Channels within Pelvic Health and Pain

•

Diverse set of Therapeutic Opportunities:

Pain

Prostate Cancer

Bladder Cancer

Hormone Replacement

Sexual function

Incontinence

Malignant Disease

PARTNERSHIPS :

A KEY TO FUTURE VALUE CREATION |

grow.

collaborate. innovate. thrive. COMMITMENT TO INNOVATION

9

Branded Pharmaceuticals

Medical Devices

Generic Pharmaceuticals

Generic Development

Supplements strong

commercial base growth

•

Continually enhancing

existing products

•

Recent advances:

GreenLight™

XPS Laser

Console

MoXy™

Laser Fiber

AdVance™

XP (OUS)

•

Developing treatments in

new areas

Topas™

sling

Cryotherapy

•

Exploring new emerging

technologies

•

Key Therapeutic Areas

•

Pain

•

Oncology

•

Endocrinology

•

Semi-Virtual R&D Model

•

Global Partnerships

•

Discovery

•

Early Development

•

Development Pipeline

©2012 Endo Pharmaceuticals, Inc.

AVEED™

(NDA)

Long Acting Injectable Testosterone

BEMA®

Buprenorphine

(Ph. III)

Urocidin™

(Ph. III)

Pain

Bladder Cancer

(Ph. I)

Androgen Receptor Antagonist

Castration Resistant Prostate Cancer

ANDA

Filings

~50 Current

ANDA Reviews

ANDA

Approvals |

grow.

collaborate. innovate. thrive. 10

NEW PHASE III BEMA Buprenorphine

Complements pain therapeutics portfolio

Draws upon existing expertise in the development and

commercialization of opioids

Key Financial Terms:

$30 million upfront payment to BDSI

$150 million in potential milestone payments

Contingent on IP, Clinical and Regulatory events and

designated sales levels

Tiered royalties on net sales in the U.S.

©2012 Endo Pharmaceuticals, Inc. |

grow.

collaborate. innovate. thrive. ©2012 Endo Pharmaceuticals, Inc.

11

2012 ENDO GUIDANCE

Guidance

Revenue range

$3.15B -

$3.30B

Adjusted diluted EPS range

$5.00 -

$5.20

Reported (GAAP) diluted EPS range

$2.60 -

$2.80 |

grow.

collaborate. innovate. thrive. 2011 KEY ACHIEVEMENTS

New formulation of Opana®

ER approved

Built a diversification-driven business model

Execution of Generics strategy through Qualitest

Expansion of therapeutic device offerings for Urologists with AMS

Create customer-centric opportunities

Endo’s Urology business: Diagnostics, Devices, Services, Pharmaceuticals

and Data

Launched Pilot programs in Urology

AMS Men’s Health and Fortesta®

Gel

Endocare®

cryoablation and AMS GreenLight laser

Continued growth in Branded Pharmaceuticals

12

©2012 Endo Pharmaceuticals, Inc.

TM |

grow.

collaborate. innovate. thrive. ©2012 Endo Pharmaceuticals, Inc.

2012 VALUE CREATION OPPORTUNITIES

Successfully

launch

new

formulation

of

Opana®

ER

Support the future growth of Qualitest

Invest capital to capture growing demand for products

Exceed cost synergies assumed at time of Qualitest acquisition

Invest in AMS to accelerate growth

AMS/Endo pilot program updates in first half 2012

Invest in R&D to accelerate advance of new products to market

Maximize operating cash flow to pay down debt

Expect ~$500M of cumulative debt repayments to be completed by end of

Q1 2012 on our existing Term Loan indebtedness

13 |

grow.

collaborate. innovate. thrive.

ENDO PHARMACEUTICALS |

grow.

collaborate. innovate. thrive. 15

15

RECONCILIATION OF NON-GAAP MEASURES

15

For an explanation of Endo’s reasons for using non-GAAP measures, see Endo’s

Current Report on Form 8-K filed today with the Securities and Exchange Commission

Reconciliation of Projected GAAP Diluted Earnings Per Share to Adjusted Diluted Earnings Per

Share Guidance for the Year Ending December 31, 2012 Lower End of Range

Upper End of Range

Projected GAAP diluted income per common share

$2.60

$2.80

Upfront

and

milestone-related

payments

to

partners

$0.76

$0.76

Amortization

of

commercial

intangible

assets

and

inventory

step-up

$1.89

$1.89

Acquisition and integration costs related to recent acquisitions.

$0.10

$0.10

Interest

expense

adjustment

for

ASC

470-20

and

other

treasury

items

$0.21

$0.21

Tax effect of pre-tax adjustments at the applicable tax rates and

certain other expected cash tax savings as a result of recent

acquisitions

($0.56)

($0.56)

Diluted adjusted income per common share guidance

$5.00

$5.20

The company's guidance is being issued based on certain assumptions including:

•Certain of the above amounts are based on estimates and there

can be no assurance that Endo will achieve these results

•Includes all completed business development transactions as of

February 29, 2012 ©2012 Endo Pharmaceuticals,

Inc. |

grow.

collaborate. innovate. thrive.

ENDO PHARMACEUTICALS

J.P. Morgan Annual Global High Yield & Leveraged Finance

Conference

February 29, 2012 |