Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CITIZENS REPUBLIC BANCORP, INC. | d309580d8k.htm |

Exhibit 99.1

2011 Letter to Shareholders

Dear Shareholder:

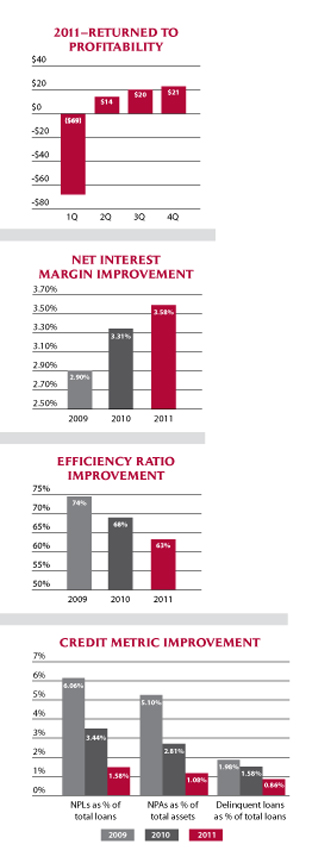

2011 was a pivotal year for Citizens. I am proud to report that after 12 quarters of losses we returned to sustained profitability in the second quarter of 2011. Following the completion of our accelerated asset disposition plan in the first quarter of 2011, we reported consistent pre-tax quarterly profit of $14 million, $20 million and $21 million in the second, third and fourth quarters of the year.

Overall for the year, we reported a net loss attributable to common shareholders (after-tax) of $16 million or $0.41 per share compared to a loss of $315 million or $7.99 per share for 2010, adjusted for our 1-for-10 reverse stock split.

In last year’s letter, I noted the execution of our plan would put us back on the road to profitability and it did just that. We significantly improved the risk profile of the bank by reducing problem assets and improved all of our credit metrics while strengthening capital levels.

Our strategy was successful because of the hard work and dedication of our employees. Our special loans team worked diligently to move over $926 million of problem or potential problem assets off our balance sheet in just six months, ensuring our losses were as minimal as possible. While they were busy doing that, our bankers and support teams were also working hard to do their part by generating revenue and keeping expenses in line.

It was the actions of our entire team, day in and day out, that made our return to profitability possible. For this, I sincerely thank each and every member of our Citizens Bank team.

|

Our consistent focus on pre-tax, pre-provision profit has strengthened our franchise value. Pre-tax, pre-provision profit* was $138.2 million for the year compared to $137.5 million for 2010 and $109.9 million for 2009. Our net interest margin* increased 27 basis points for the year, resulting in a two-year increase of 68 basis points. Our fee income remained strong in the face of mounting regulatory pressure. Our core deposits continued to grow – up 22% since the beginning of 2009 and up 7% during 2011. Higher cost, single service deposits declined by 25% as we had planned.

During 2011, we provided $1.6 billion of credit to commercial clients and $456 million to retail clients for a total of $2.1 billion, a 15% increase over 2010. We are committed to responsible lending in our communities and as we anticipated, the environment has been very competitive for good quality borrowers.

We continue to be disciplined around expense management and carefully consider and scrutinize our expenses. Our efficiency ratio*, a common measure that gauges how much of each dollar of revenue is used to cover expenses, improved to 63% for 2011, from 68% in 2010 and 74% in 2009. This improvement came from reduced credit costs as well as reductions in the number of staff positions. We carefully monitor our performance relative to our peers to ensure we maintain a good balance of service and efficiency.

Importantly, through our work in problem asset resolution, we dramatically improved the risk profile of the bank. Our efforts were designed to strengthen our overall credit profile while reducing the risk of potential future losses, thereby improving the stability of future earnings.

Non-performing assets, non-performing loans and delinquencies are now less than half the level they were at the end of last year. Non-performing loans dropped below $100 million for the first time since early 2007, totaling only $87 million or 1.58% of loans at year end. | |

We believe we have significantly reduced the potential for future problem loans as well. We are seeing a substantial reduction in real estate loans that are currently being downgraded into the classified asset category, a noteworthy slowdown of new non-performing loans, and a considerable reduction in delinquencies, which were $48 million or 0.86% of loans at year end.

As we look forward into 2012, our priorities are clear and through the execution of these priorities, we expect to deliver consistent profitable results.

| • | We will continue to provide client service that ranks us well above industry average. |

| • | We will focus on prudently rebuilding our loan portfolio, without compromising our underwriting standards. The market is competitive but we are still winning new business and retaining our good clients. |

| • | We will continue to focus on generating non-interest revenue by ensuring our fee structure remains competitive and by providing new and enhanced products to our clients. |

| • | We expect net interest margin will be pressured in this consistently low interest rate environment. We will work to mitigate that pressure by remaining disciplined in our relationship pricing and effectively managing our liquidity position. |

| • | We will remain vigilant in managing expense levels. |

| • | Our loan loss reserve models will continue to reflect the substantial improvement in our credit metrics, indicating lower required reserve levels. Throughout this recent economic cycle we have conservatively maintained higher levels of reserves and expect them to trend down to more normalized levels. |

Additionally, we have a number of other key priorities including exiting our written agreement with our regulators. We have been in full compliance with the requirements of the agreement and are hopeful that our continued good results and consistent performance will allow our regulators to terminate the agreement in the near future.

Also important is the recapture of our deferred tax asset, which was valued at $311 million at year end. Eliminating our current valuation allowance would have the effect of increasing our tangible common equity by over 76% as of December 31, 2011. With continued profitability, we are confident that we will be able to reverse the valuation allowance in 2012.

Working with our regulators, we expect to pay the accrued dividends on our trust preferred and TARP obligations. We also continue to explore options to repay TARP in the most shareholder friendly way possible, though no firm timetable has been established to do so.

I am very pleased with the execution of our plans during 2011 that allowed Citizens to emerge from one of the worst credit cycles in banking history as a company in a position of strength. Remaining focused on enhancing that strength will continue to boost long-term shareholder value.

Thank you for your continued support.

Cathleen H. Nash

President and Chief Executive Officer

February 2012

*See accompanying Form 10-K – Item 7 for a reconciliation of pre-tax pre-provision profit, net interest margin and efficiency ratio.

Discussions and statements in this letter that are not statements of historical fact, including without limitation, statements that include terms such as “will,” “may,” “should,” “believe,” “expect,” “anticipate,” “estimate,” “project,” “intend,” and “plan,” and statements regarding Citizens’ future financial and operating results, plans, objectives, expectations and intentions, are forward-looking statements that involve risks and uncertainties, many of which are beyond Citizens’ control or are subject to change. No forward-looking statement is a guarantee of future performance and actual results could differ materially. Factors that could cause or contribute to such differences include, without limitation, risks and uncertainties detailed from time to time in Citizens’ filings with the SEC, available at www.sec.gov., including those listed in its most recent annual report on Form 10-K. Other factors not currently anticipated may also materially and adversely affect Citizens’ results of operations, cash flows, financial position and prospects. While Citizens believes that its forward-looking statements are reasonable, you should not place undue reliance on any forward-looking statement. In addition, these statements speak only as of the date made. Citizens does not undertake, and expressly disclaims any obligation to update or alter any statements except as may be required by applicable law.