Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CENTERPOINT ENERGY INC | d309519d8k.htm |

| EX-99.1 - PRESS RELEASE ISSUED FEBRUARY 29, 2012 - CENTERPOINT ENERGY INC | d309519dex991.htm |

The

Benefits of a Balanced Electric & Natural Gas Portfolio NYSE: CNP

www.CenterPointEnergy.com

Full Year 2011 Earnings

Supplemental Materials

February 29, 2012

Exhibit 99.2 |

February 29, 2012

2

Full Year 2011 Earnings

Cautionary Statement Regarding

Forward-Looking Information

This presentation contains statements concerning our expectations, beliefs, plans,

objectives, goals, strategies, future events or performance and underlying

assumptions and other statements that are not historical facts. These

statements are “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of

1995.

Actual

results

may

differ

materially

from

those

expressed

or

implied

by

these

statements.

You

can

generally

identify

our

forward-looking

statements

by

the

words

“anticipate,”

“believe,”

“continue,”

“could,”

“estimate,”

“expect,”

“forecast,”

“goal,”

“intend,”

“may,”

“objective,”

“plan,”

“potential,”

“predict,”

“projection,”

“should,”

“will,”

or

other

similar words.

We have based our forward-looking statements on our management's beliefs and

assumptions based on information currently available to our management at

the time the statements are made. We caution you that assumptions,

beliefs, expectations, intentions, and projections about future events may and often do vary materially

from actual results. Therefore, we cannot assure you that actual results will

not differ materially from those expressed or implied by our

forward-looking statements. Some of the factors that could cause actual

results to differ from those expressed or implied by our forward- looking

statements include the timing and impact of future regulatory, legislative and IRS decisions, financial market

conditions, future market conditions, and other factors described in CenterPoint

Energy, Inc.’s Form 10-K for the period ended December 31, 2011,

under “Risk Factors” and “Management’s Discussion and

Analysis of Financial Condition and Results of Operations -

Certain Factors Affecting Future Earnings”, and in other filings with the SEC

by CenterPoint Energy.

You should not place undue reliance on forward-looking statements. Each

forward-looking statement speaks only as of the date of this

presentation, and we undertake no obligation to publicly update or revise any forward-

looking statements except as required by law. |

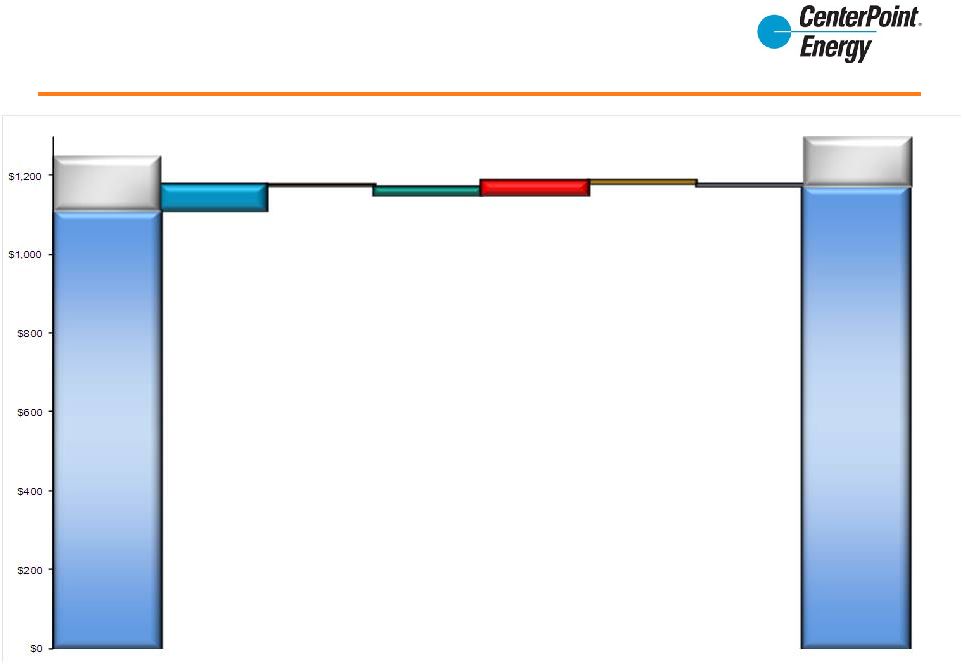

Full Year 2011 Operating

Income Drivers 12 months ended December 31, 2011

Interstate

Pipelines

$(22)

Field Services

$38

Other

$(8)

Competitive

Natural Gas

Sales & Service

$(10)

+

Customer

growth

+

Lower bad

debt expense

+

Rate

increases

¯

Higher benefit

costs

¯

Lower

miscellaneous

revenues

¯

Other,

primarily

higher

expenses

+

New firm

transportation

contracts and

higher

ancillary

services

¯

Restructured

contracts with

natural gas

distribution

affiliates

¯

Lower off-

system

revenues due

to declining

basis

¯

Expiring

Carthage to

Perryville

pipeline

backhaul

contract

Natural Gas

Distribution

$(5)

Electric TDU

$69

+

Higher

throughput in

Haynesville

and

Fayetteville

shales

¯

2010 gain on

sale of non-

strategic

assets

¯

Lower

commodity

prices

¯

Higher O&M,

depreciation,

and other

taxes due to

Magnolia and

Olympia

expansion

+

Increased

usage,

primarily

weather

+

Customer

growth

+

Lower D&A

+

Higher net

TCOS

¯

Rate case

impact

¯

Other,

primarily

higher O&M

+

Higher mark-to-

market in 2011

versus 2010

¯

Lower

optimization

opportunities

around pipeline

and storage

assets

¯

Release of

transportation

capacity

¯

Higher

inventory write-

down in in 2011

versus 2010

$1,109

$1,171

(in millions)

2010

2011

Total Operating Income

$1,249

Total Operating Income

$1,298

Securitization

Bonds

$140

Securitization

Bonds

$127

February 29, 2012

3

Full Year 2011 Earnings |

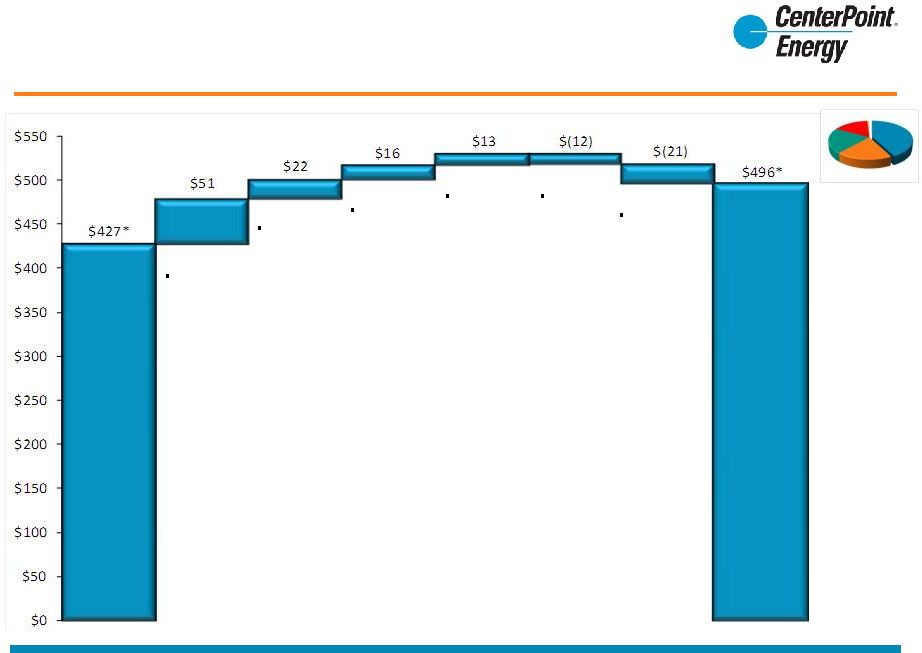

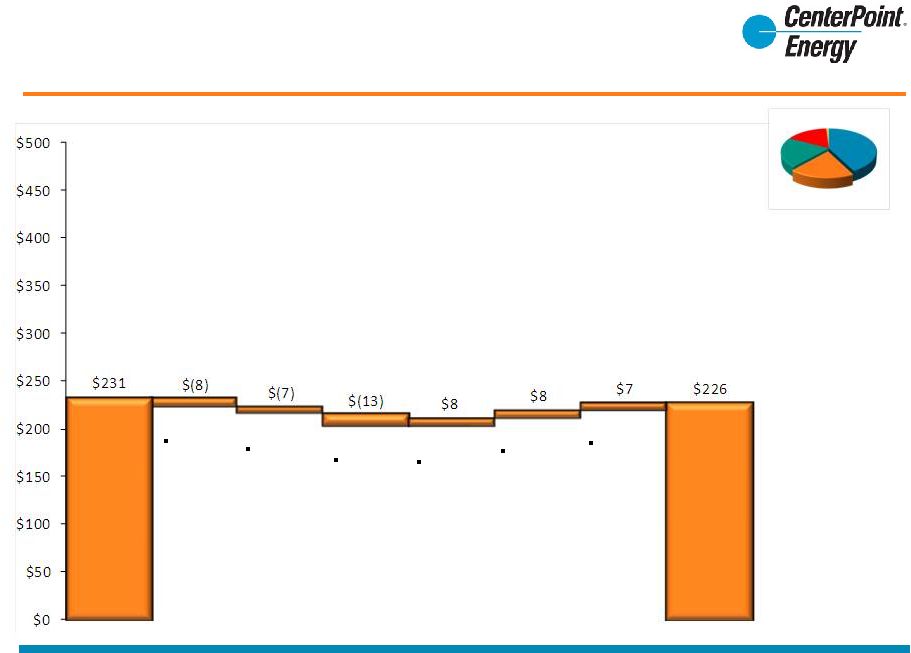

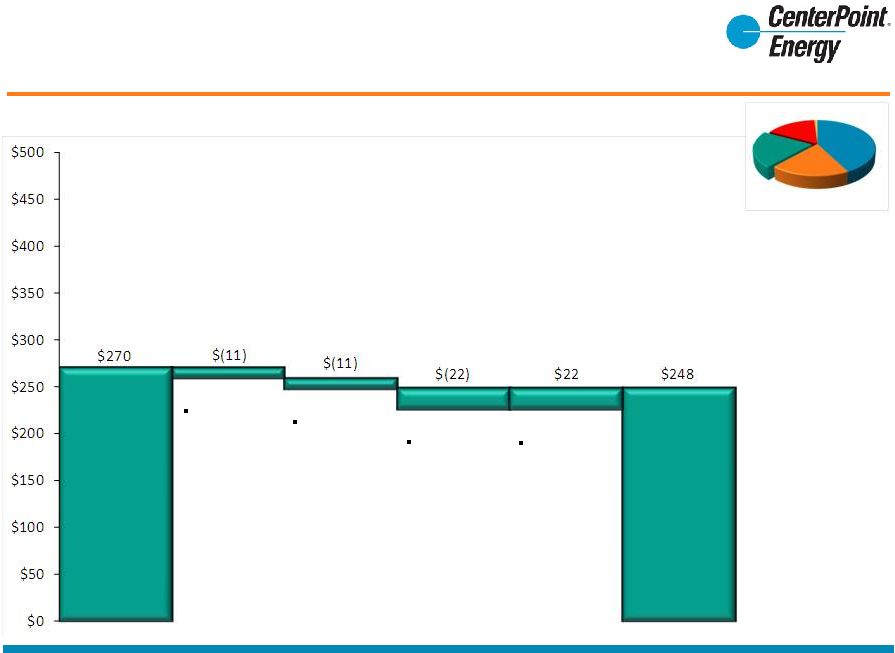

Electric Transmission & Distribution

2011 Operating Income Drivers

Increased

usage,

primarily

weather

Customer

growth

Other,

primarily

higher O&M

and lower

misc.

revenues

Lower

depreciation

expense

* Excludes operating income from transition and system restoration

bonds of $140 million and $127 million for 2010 and 2011, respectively

(in millions)

42%

Percentage of adjusted

operating income which

excludes $127 million of

securitization bonds

2010

2011

Higher net

TCOS

Rate case

impact

February 29, 2012

4

Full Year 2011 Earnings |

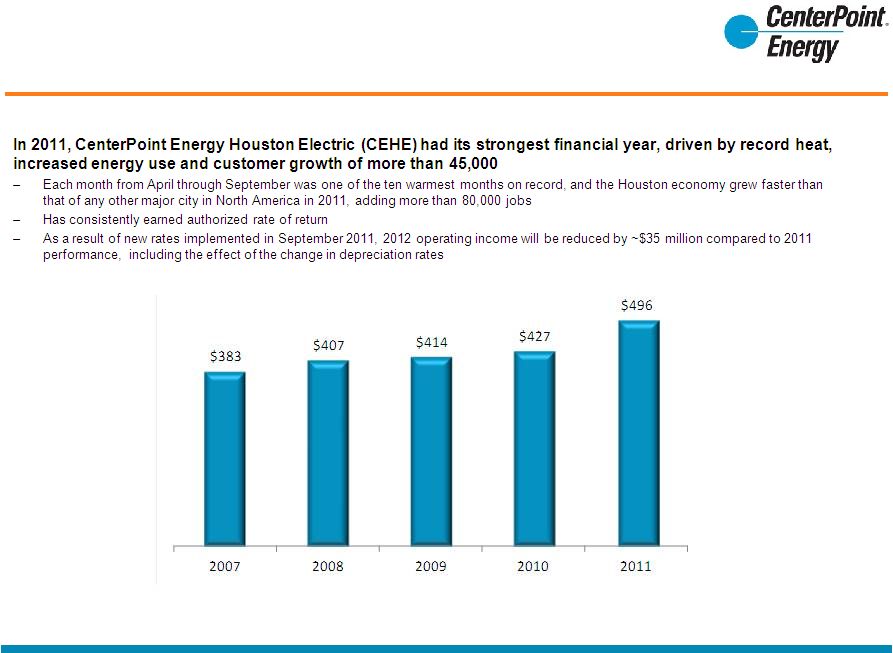

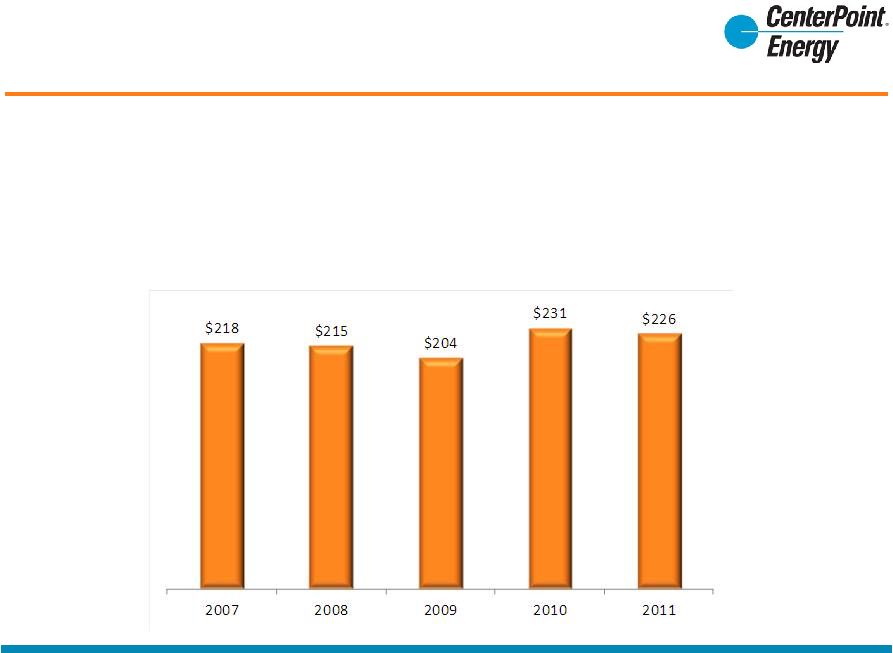

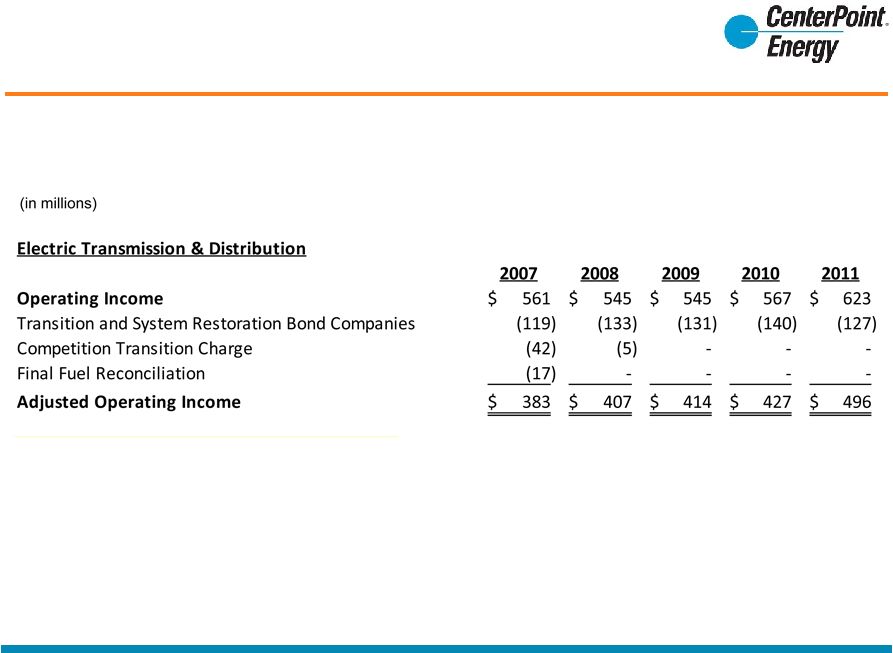

Electric Transmission & Distribution

Operating Income

Note:

Results

exclude

operating

income

from

the

Transition

and

System

Restoration

Bond

Companies,

the

Competition

Transition

Charge

and

the

Final

Fuel

Reconciliation

(see

reconciliation

on

page

28).

(in millions)

February 29, 2012

5

Full Year 2011 Earnings |

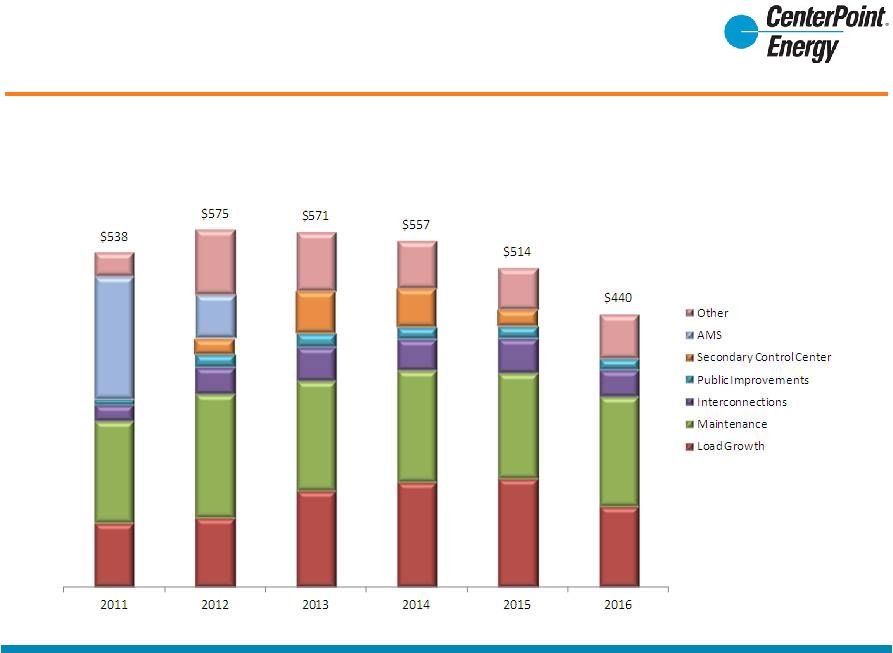

Electric Transmission & Distribution

Capital Expenditures

(in millions)

February 29, 2012

6

Full Year 2011 Earnings |

February 29, 2012

7

Full Year 2011 Earnings

Electric Transmission & Distribution

Innovative Rate Mechanisms

Recovery mechanisms reduce rate case frequency and allow more timely recovery of and

on investments Interim Transmission Cost of Service (TCOS) Adjustment

Transmission Cost Recovery Factor (TCRF)

Distribution Cost Recovery Factor (DCRF)

Other Mechanisms

–

ERCOT transmission service providers (TSPs) charge distribution service providers

(DSPs) the cost of transmission investment –

Allows CEHE to make a filing up to two times per year to update its TCOS to recover

a return of and on transmission related plant investments –

CEHE is allowed to request rate increases twice a year to recover increased

transmission costs from other TSPs –

Additionally, CEHE is allowed to defer, until its next TCRF update, any increase in

expense from other TSPs –

In September 2011, the PUC approved a periodic rate adjustment mechanism that

mitigates regulatory lag for distribution capital investment –

Allows CEHE to file to update its rates each year effective September 1 to recover

a return of and on new distribution related plant investment (net of changes

in distribution related accumulated deferred federal income tax) –

No DCRF adjustment if the annual earnings monitoring report shows a utility is

earning more than its authorized rate of return on a weather normalized

basis –

Deferral

of

Pension

Costs

–

allows

a

utility

to

defer

the

excess

pension

and

other

postemployment

benefits

costs

over

the

amount

that

was

approved in the utility’s last general rate proceeding

–

Deferral

of

Bad

Debt

–

authorizes

utility

to

defer

bad

debts

resulting

from

defaults

by

REPs

for

recovery

in

a

future

rate

case

–

Energy

Efficiency

Cost

Recovery

Factor

(EECRF)

–

recovery

of

certain

energy

efficiency

program

costs

–

Advanced

Metering

System

(AMS)

Surcharge

–

continues

until

December

2014

for

residential

customers

and

until

April

2017

for

commercial

and industrial customers |

Natural Gas Distribution

2011 Operating Income Drivers

Higher

benefit

costs

(in millions)

19%

2010

2011

Lower

misc.

revenues

Other,

primarily

higher

expenses

Customer

growth

Lower bad

debt

expense

Rate

increases

Percentage of adjusted

operating income which

excludes $127 million of

securitization bonds

February 29, 2012

8

Full Year 2011 Earnings |

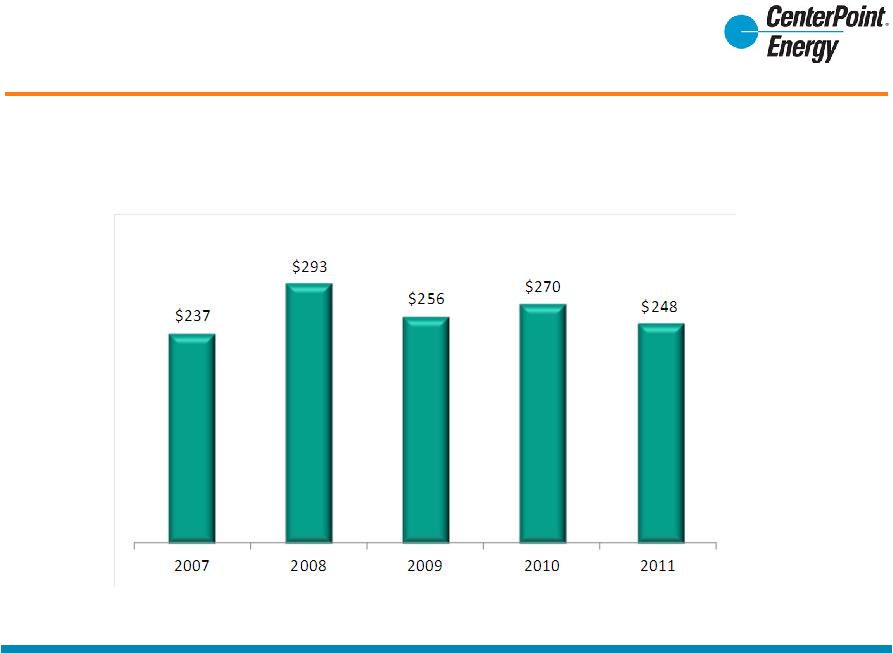

Earned at or near authorized return on equity over last two years

Natural Gas Distribution

Operating Income

(in millions)

February 29, 2012

9

Full Year 2011 Earnings |

Natural Gas Distribution

Capital Expenditures

Increased capital investments primarily for infrastructure, safety and technology

will drive 6 percent growth in rate base

(in millions)

February 29, 2012

10

Full Year 2011 Earnings |

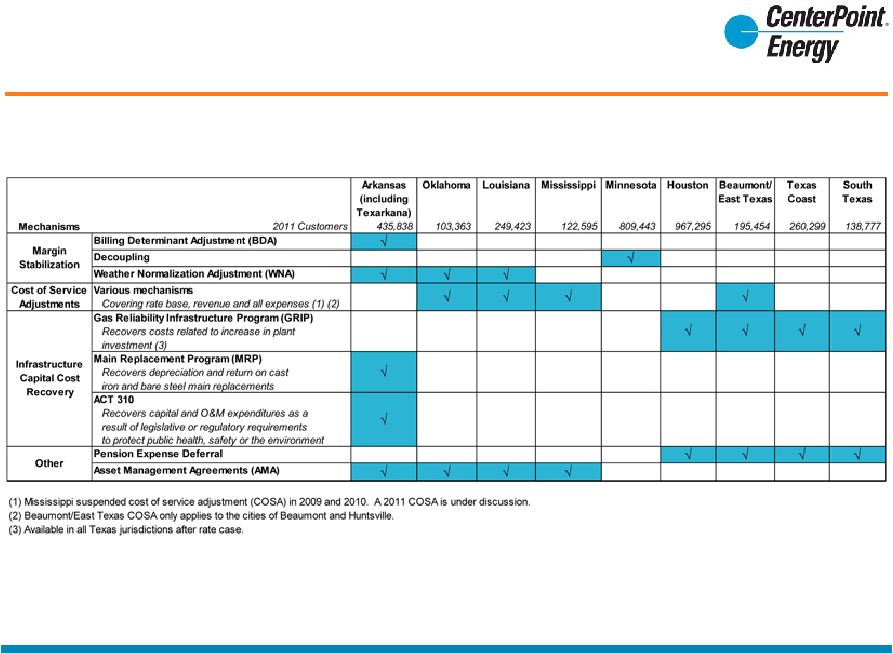

Natural Gas Distribution

Innovative Rate Mechanisms

Rate mechanisms reduce rate case frequency and decouple revenues

from consumption

February 29, 2012

11

Full Year 2011 Earnings |

Interstate Pipelines

2011 Operating Income Drivers

Restructured

contracts with

natural gas

distribution

affiliates

(in millions)

21%

2010

2011

Lower off-

system

revenues due

to declining

basis

Expiring

Carthage to

Perryville

pipeline

backhaul

contract

New firm

transportation

contracts and

higher

ancillary

revenues

Percentage of adjusted

operating income which

excludes $127 million of

securitization bonds

February 29, 2012

12

Full Year 2011 Earnings |

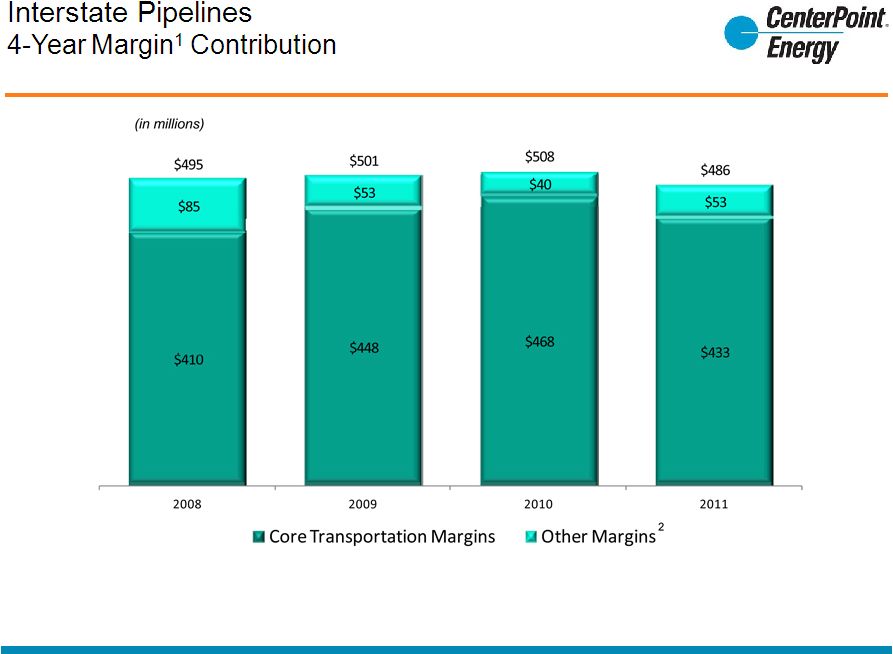

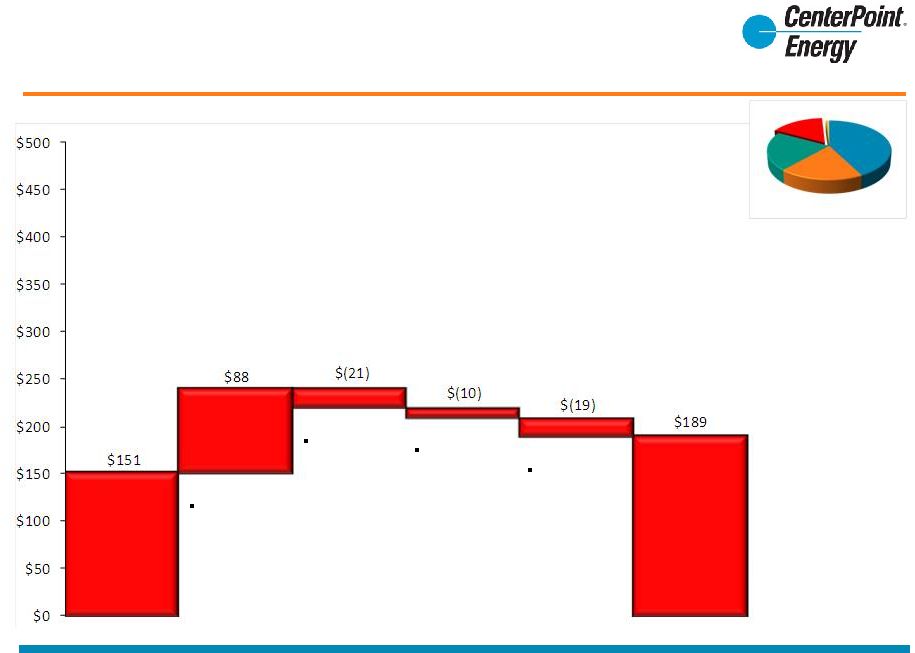

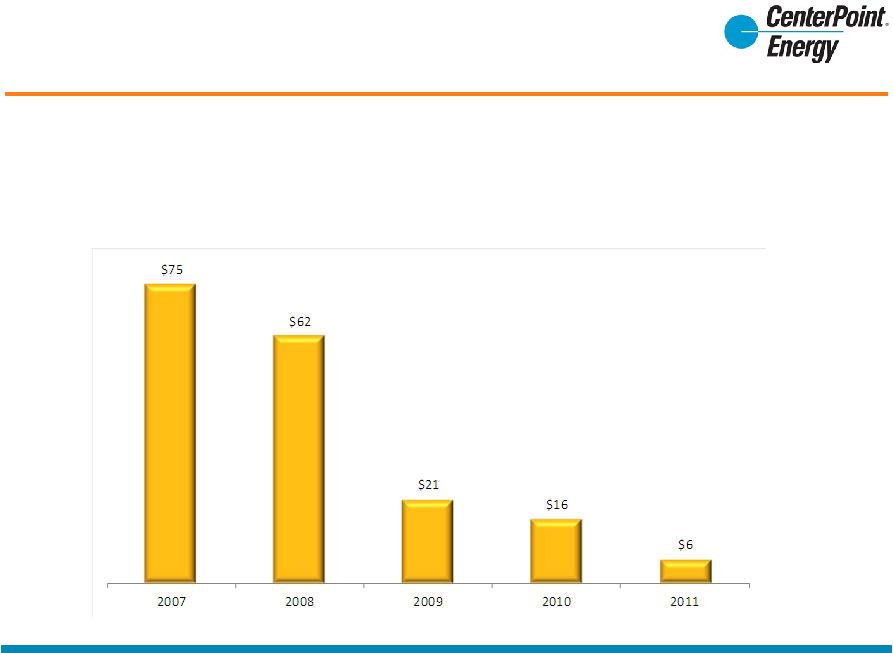

Interstate Pipelines

Operating Income

Operating income has benefited from core transportation contracts

Ancillary services are variable based on market conditions

More competition for new and existing customers expected in the future

(in millions)

Note: Interstate Pipelines also earned $6 million, $36 million, $7 million, $19

million and $21 million of equity income from its 50% interest in Southeast

Supply Header, LLC for 2007, 2008, 2009, 2010 and 2011, respectively.

February 29, 2012

13

Full Year 2011 Earnings |

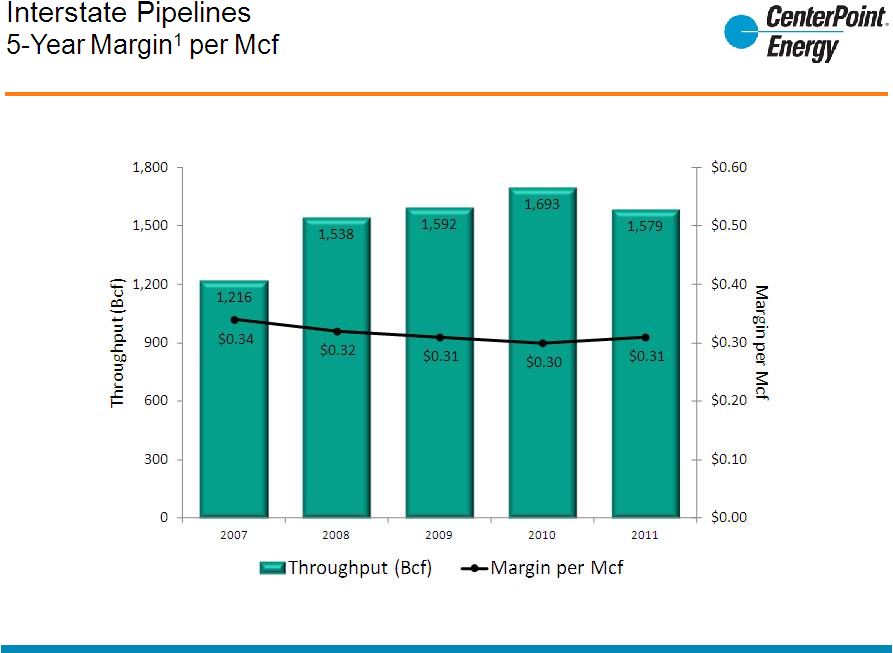

(1)

Margin equals revenues minus natural gas expense

(2)

Natural gas and ancillary services (balancing, system management, liquids)

2

February 29, 2012

14

Full Year 2011 Earnings |

(1)

Margin equals revenues minus natural gas expense

February 29, 2012

15

Full Year 2011 Earnings |

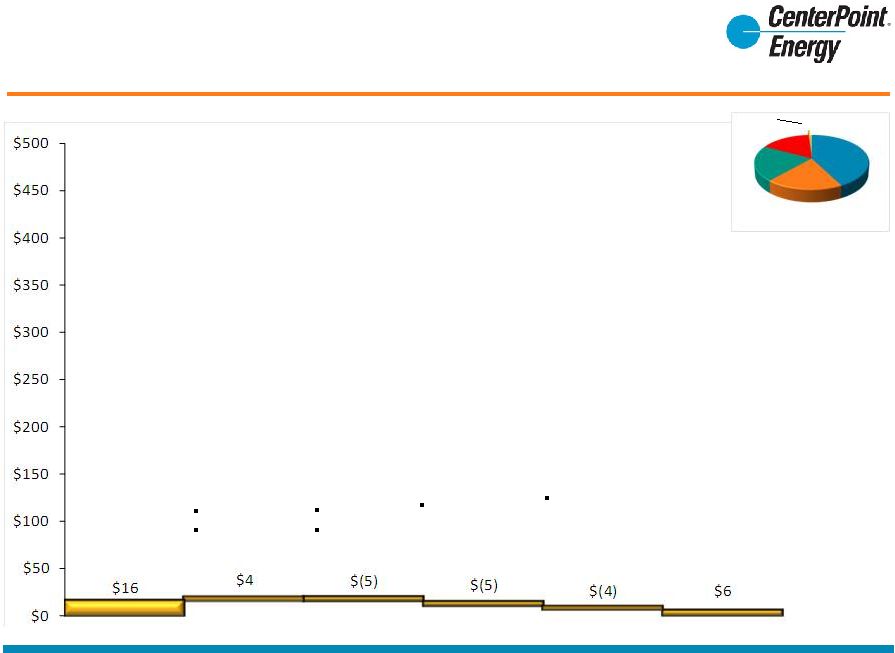

Interstate Pipelines

Capital Expenditures

Planned capital expenditures support maintenance, pipeline upgrades, and pipeline

safety and environmental compliance

(in millions)

February 29, 2012

16

Full Year 2011 Earnings |

Field Services

2011 Operating Income Drivers

Higher

throughput in

Haynesville and

Fayetteville

shales

(in millions)

16%

2010

2011

2010 gain on

sale of non-

strategic

assets

Lower

commodity

prices

Higher O&M,

depreciation,

and other

taxes due to

Magnolia and

Olympia

expansion

Percentage of adjusted

operating income which

excludes $127 million of

securitization bonds

February 29, 2012

17

Full Year 2011 Earnings |

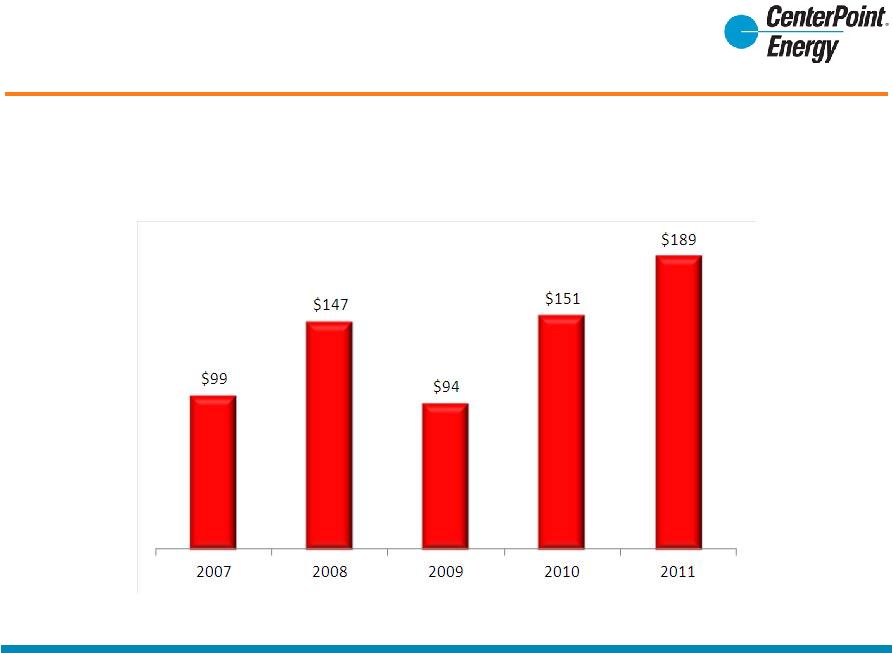

Field Services

Operating Income

Operating income has benefited from significant new investments in mid-continent

shale plays –

Contracted growth supported by fee-based contracts with volume commitments

and/or guaranteed returns on capital deployed (in millions)

Note: Field Services also earned $10 million, $15 million, $8 million, $10 million

and $9 million of equity earnings from its 50% interest in Waskom, a joint

processing plant, for 2007, 2008, 2009, 2010 and 2011, respectively.

February 29, 2012

18

Full Year 2011 Earnings |

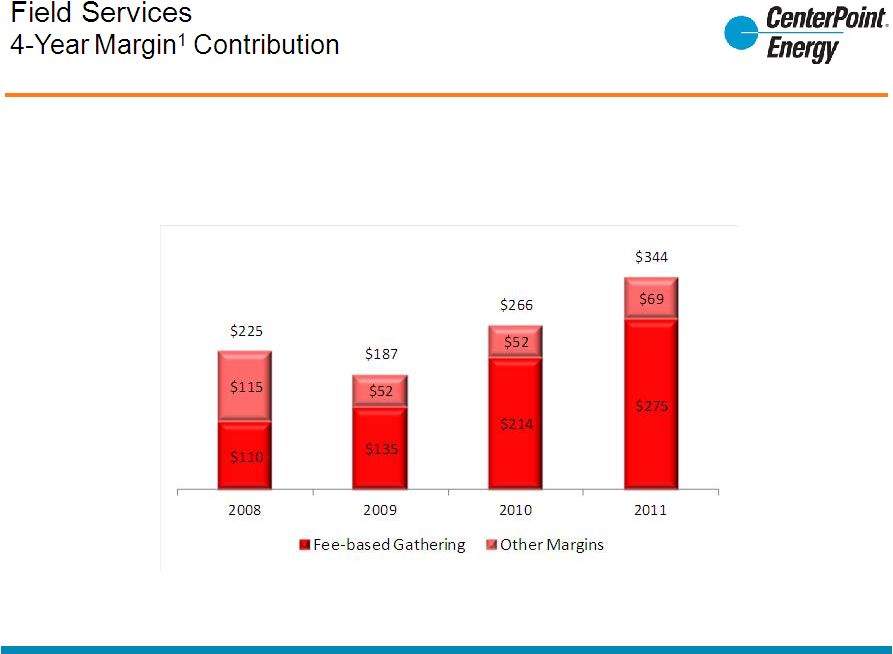

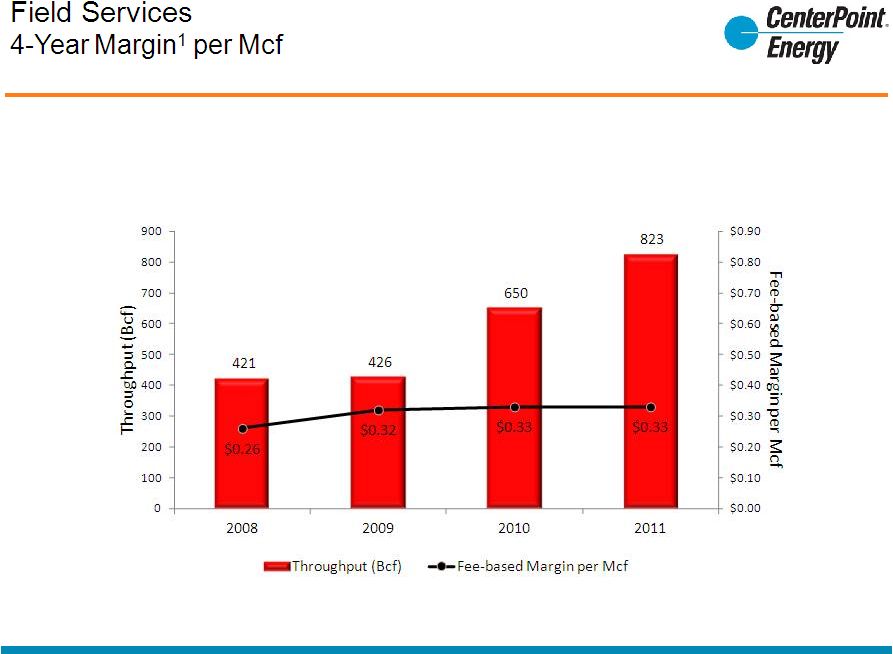

(1)

Margin equals revenues minus natural gas expense

(2)

Natural gas and liquids

2

(in millions)

February 29, 2012

19

Full Year 2011 Earnings |

(1)

Margin equals revenues minus natural gas expense

February 29, 2012

20

Full Year 2011 Earnings |

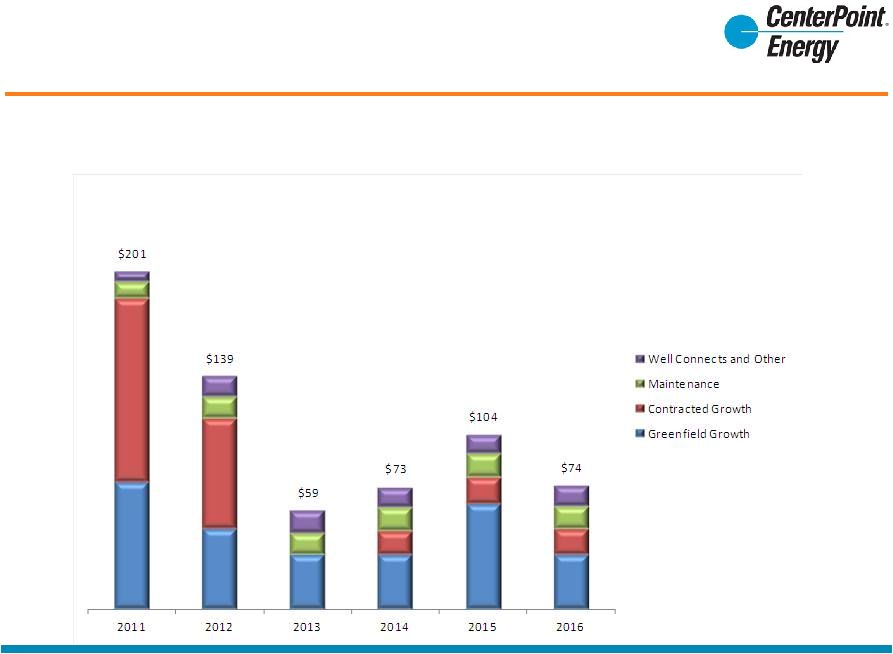

Field Services

Capital Expenditures

Developing shale plays drove significant capital prior to 2012

Beyond 2012, expect to deploy moderate level of capital under existing contractual

arrangements with customers Capital for significant new opportunities not

included (in millions)

February 29, 2012

21

Full Year 2011 Earnings |

Competitive Natural Gas Sales & Services

2011 Operating Income Drivers

Lower optimization

opportunities

around pipeline

and storage assets

(in millions)

1%

2010

2011

Mark-to-market:

2011: $8 gain

2010: $4 gain

Inventory write-

down:

2011: $11

2010: $6

Release of

transportation

capacity

Percentage of adjusted

operating income which

excludes $127 million of

securitization bonds

February 29, 2012

22

Full Year 2011 Earnings |

Competitive Natural Gas Sales & Services

Operating Income

Operating income has been negatively impacted by the significant

reductions in basis and seasonal spreads

Pipeline and storage capacity has been reduced to closely match customers

requirements (in millions)

February 29, 2012

23

Full Year 2011 Earnings |

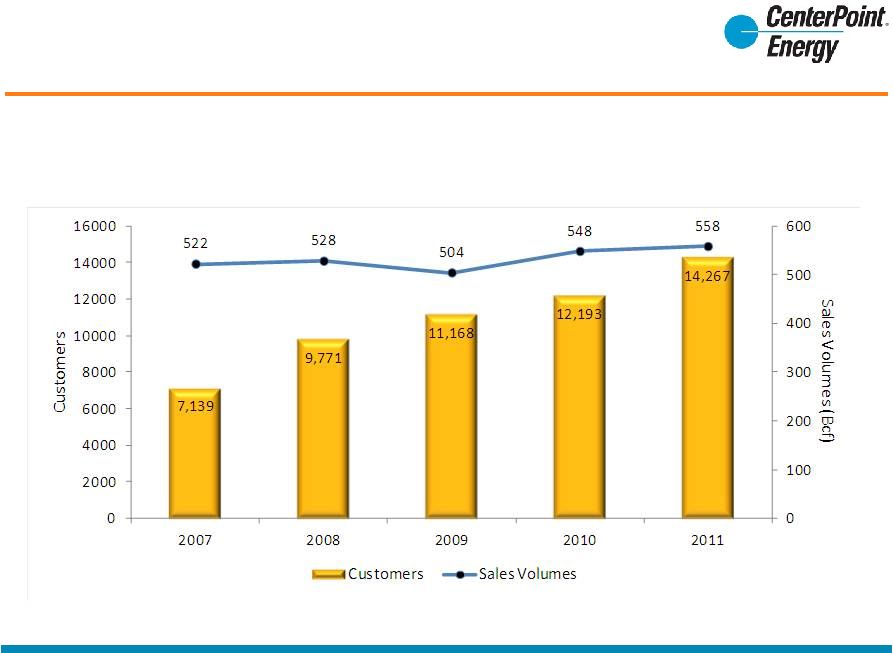

Competitive Natural Gas Sales & Services

Customers and Sales Volumes

February 29, 2012

24

Full Year 2011 Earnings |

February 29, 2012

25

Full Year 2011 Earnings

25

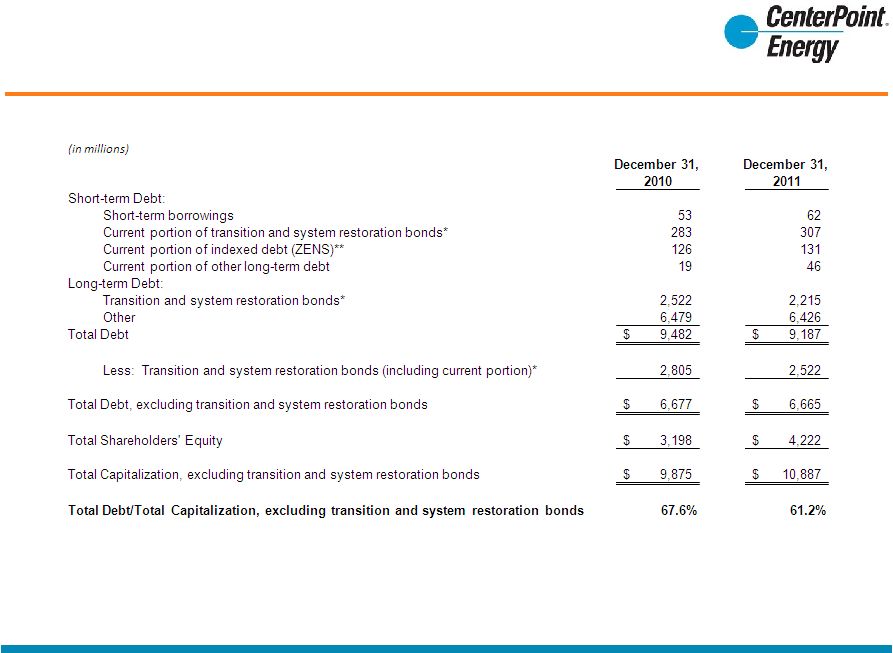

Debt and Capitalization Ratio

Excluding transition and system restoration bonds

* The transition and system restoration bonds are non-recourse to

CenterPoint Energy and CenterPoint Energy Houston Electric and are serviced

through collections of separate charges which are held in trust. **

The

debt

component

reflected

on

the

financial

statements

was

$131

as

of

December

31,

2011

and

$126

million

as

of

December

31,

2010.

The principal amount on which 2% interest is paid was $840 million as of December

31, 2011 and December 31, 2010. The contingent principal amount

was $797 as of December 31, 2011 and $805 million as of December 31, 2010. |

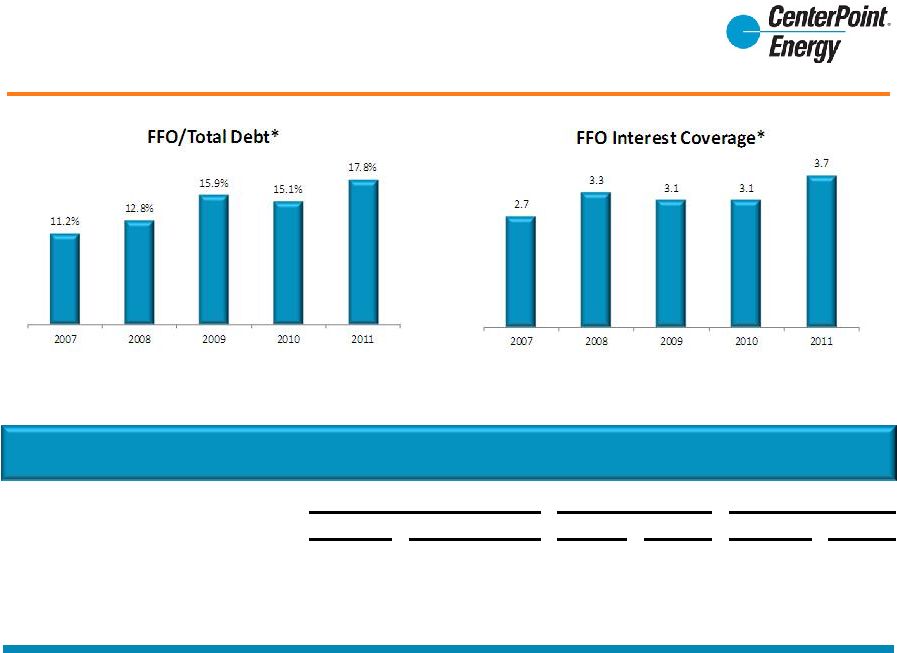

Credit Metrics and Ratings

* Calculated per CNP’s interpretation of S&P methodology; actual calculations

may include other adjustments not anticipated Credit Ratings

Rating

Outlook

Rating

Outlook

Rating

Outlook

CenterPoint Energy (Senior Unsecured)

Baa3

Stable

BBB

Stable

BBB-

Positive

CEHE (Senior Secured)

(1)

A3

Stable

A-

Stable

A-

Positive

CERC (Senior Unsecured)

Baa2

Stable

BBB+

Stable

BBB

Stable

(1) General mortgage bonds and first mortgage bonds.

Moody’s

Fitch

S&P

February 29, 2012

26

Full Year 2011 Earnings |

February 29, 2012

27

Full Year 2011 Earnings

Liquidity

Available Liquidity ($MM)

Amount Utilized

Amount Unutilized

Bank Facilities

Type of Facility

Size of Facility

at February 13, 2012

at February 13, 2012

CenterPoint Energy

Revolver

1,200

$

13

$

(1)

1,187

$

CEHE

Revolver

300

4

(1)

296

CERC

Revolver

950

-

950

Total Credit Facilities

2,450

$

17

$

2,433

$

(1) Represents outstanding letters of credit.

Temporary Investments

Investments in Money Market Funds

(as of February 13, 2012)

1,486

Available Liquidity

3,919

$

|

Reconciliation of CEHE Operating Income to

Adjusted Operating Income

February 29, 2012

28

Full Year 2011 Earnings |