Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Apollo Commercial Real Estate Finance, Inc. | d309395d8k.htm |

| EX-99.1 - EARNINGS RELEASE - Apollo Commercial Real Estate Finance, Inc. | d309395dex991.htm |

Commercial Real Estate Finance, Inc. (“ARI”)

Quarterly Supplemental Presentation –

December 2011

a

0602201

Information is as of December 31, 2011 except as otherwise noted.

It should not be assumed that investments made in the future will

be profitable or will equal the performance of investments in this document.

Exhibit 99.2 |

Legal Disclaimer

We make forward-looking statements in this presentation and other

filings we make with the SEC within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended, and such statements are intended to be

covered by the safe harbor provided by the same. Forward-looking

statements are subject to substantial risks and uncertainties, many of which

are difficult to predict and are generally beyond our control. These

forward-looking statements include information about possible or assumed

future results of our business, financial condition, liquidity, results

of operations, plans and objectives. When we use the words “believe,”

“expect,”

“anticipate,”

“estimate,”

“plan,”

“continue,”

“intend,”

“should,”

“may”

or similar expressions, we intend to identify forward-looking

statements. Statements regarding the following subjects, among

others, may be forward-looking: our business and investment strategy; our

operating

results;

our

ability

to

obtain

and

maintain

financing

arrangements;

the

return

on

equity,

the

yield

on

investments

and

risks

associated

with investing in real estate assets, including changes in business

conditions and the general economy. The forward-looking

statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all

information currently available to us. Forward-looking statements

are not predictions of future events. These beliefs, assumptions and

expectations can change as a result of many possible events or factors,

not all of which are known to us. Some of these factors are described

under

“Risk

Factors,”

and

“Management’s

Discussion

and

Analysis

of

Financial

Condition

and

Results

of

Operations”

as

included

in

ARI’s

Annual Report on Form 10-K for the fiscal year ended December 31,

2010, and in ARI’s Quarterly Reports on Form 10-Q for the quarters ended

March 31, 2011, June 30, 2011 and September 30, 2011. If a change

occurs, our business, financial condition, liquidity and results of operations

may vary materially from those expressed in our forward-looking

statements. Any forward-looking statement speaks only as of the date on which it

is made. New risks and uncertainties arise over time, and it is not

possible for us to predict those events or how they may affect us. Except as

required by law, we are not obligated to, and do not intend to, update

or revise any forward-looking statements, whether as a result of new

information, future events or otherwise.

This presentation may contain statistics and other data that in some

cases has been obtained from or compiled from information made available

by third-party service providers.

1

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

|

Investment

Statement 2011

2010

% Change

2011

2010

% Change

14,564

$

10,733

$

35.7%

52,918

$

32,485

$

62.9%

(3,618)

$

(3,421)

$

5.8%

(14,454)

$

(10,714)

$

34.9%

Net interest income (in thousands)

10,946

$

7,312

$

49.7%

38,464

$

21,771

$

76.7%

0.39

$

0.27

$

44.4%

1.47

$

1.09

$

34.9%

20,561,032

17,670,468

16.4%

18,840,954

12,679,277

48.6%

Balance sheet

860,247

$

806,870

$

6.6%

336,978

$

297,838

$

13.1%

2.2 years

2.5 years

1.64x

1.88x

251,327

$

297,334

$

290,700

$

242,728

$

3.5x

3.0x

Three Months Ended December 31,

Year Ended December 31,

Interest income (in thousands)

Interest expense (in thousands)

Operating earnings per share

Basic and diluted weighted average common shares

outstanding

Investments at amortized cost (in thousands)

Net equity (in thousands)

Investments - Weighted average Duration

Debt to equity

Fixed rate debt (in thousands)

(1)

Debt service coverage

(2)

Floating rate debt (in thousands)

ARI –

Financial Summary

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

2

(1)

Fixed rate debt refers to the TALF borrowings which were refinanced with

the Wells repurchase facility during January 2012. (2)

The debt service coverage is interest expense as a percentage of

EBITDA. |

ARI Overview

Return on Equity Based on Operating Income

(1)

Net Interest Income ($000s)

Dividend per Share

Operating Earnings per Share

(1)

Return on equity is calculated as annualized operating income for the

quarter as a percentage of average equity. COMMERCIAL REAL ESTATE

FINANCE, INC. (“ARI”) 3

$491

$3,903

$5,056

$5,500

$7,313

$7,599

$9,684

$10,236

$10,946

$0

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

Q3

2009

Q4

2009

Q1

2010

Q2

2010

Q3

2010

Q4

2010

Q1

2011

Q2

2011

Q3

2011

Q4

2011

3.4%

4.3%

6.7%

6.5%

6.3%

6.8%

9.6%

9.3%

9.8%

-6%

-4%

-2%

0%

2%

4%

6%

8%

10%

12%

Q3

2009

Q4

2009

Q1

2010

Q2

2010

Q3

2010

Q4

2010

Q1

2011

Q2

2011

Q3

2011

Q4

2011

-$0.01

-

$0.16

$0.20

$0.31

$0.32

$0.27

$0.29

$0.40

$0.38

$0.39

-$0.20

-$0.10

$0.00

$0.10

$0.20

$0.30

$0.40

$0.50

Q3

2009

Q4

2009

Q1

2010

Q2

2010

Q3

2010

Q4

2010

Q1

2011

Q2

2011

Q3

2011

Q4

2011

$0.35

$0.35

$0.40

$0.40

$0.40

$0.40

$0.40

$0.40

$0.00

$0.05

$0.10

$0.15

$0.20

$0.25

$0.30

$0.35

$0.40

$0.45

Q3

2009

Q4

2009

Q1

2010

Q2

2010

Q3

2010

Q4

2010

Q1

2011

Q2

2011

Q3

2011

Q4

2011

- |

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

4

ARI –

Q4 Financial Highlights

Financial Results & Earnings Per Share

Operating Earnings for the quarter ended December 31, 2011 of $8.3

million, or $0.39 per diluted common share

(1)

–

An

increase

of

44%

per

share

as

compared

with

Operating

Earnings

for

the

same

period

in

2010

–

Net interest income of $10.9 million for Q4 2011

–

Total expenses of $2.9 million, comprised of management fees of $1.3

million and G&A of $1.6

million

(2)

GAAP net income for the quarter ended December 31, 2011 of $8.7

million, or $0.41 per diluted common share

Dividend

Declared dividend of $0.40 per share of common stock for the quarter

ended December 31, 2011

–

Seven consecutive quarters of $0.40 per share dividend

10.6% annualized dividend yield based on closing price on February 27,

2012 (1)

Operating Earnings is a non-GAAP financial measure that is used to

approximate cash available for distribution and is defined by the Company as net income, computed in accordance with GAAP, adjusted for (i) non-

cash equity compensation expense and (ii) any unrealized gains or losses

or other non-cash items included in net income. Please see slide 15 for a reconciliation of operating earnings and operating earnings per diluted

common share to GAAP net income and GAAP net income per diluted common

share. (2)

Total expenses includes $634,000 of non-cash stock based

compensation for Q4 2011. |

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

5

ARI –

Q4 Financial Highlights

Investment Portfolio

Total investments of $860 million at December 31, 2011

Weighted average

underwritten

IRR

of

approximately

14.2%

(1)

Book Value

GAAP book value of $16.39 per share as of December 31, 2011

–

ARI

closed

at

$15.14

on

February

27,

2012

or

at

a

7.6%

discount

to

book

value

(2)

Fair

value

of

$16.80

per

share

outstanding

as

of

December

31,

2011

(3)

Subsequent Events

TALF refinancing

–

January

2012

–

Refinanced

TALF

debt

with

Wells

Facility

Increased advance rate generated approximately $14 million of

additional investable capital Lowered

current

cost

of

funds

from

2.8%

to

1.9%

and

extended

the

maturity

to

August

2013

New Investment

–

January 2012 –

Closed a $15 million mezzanine loan on a 165-room hotel in New

York, NY with an underwritten IRR of approximately 14.0%

(1)

(1)

The internal rates of return (“IRR”) for the investments shown

in the above table reflect the returns underwritten by the Manager, calculated on a weighted average basis assuming no dispositions, early prepayments or defa

but assumes extensions as well as the fully hedged cost of borrowings

under the Company’s master repurchase agreement with Wells Fargo Bank (“Wells Facility”). The Company has also assumed that financing will

available through the maturity of the asset and reflect a cost of funds

based on forward LIBOR curve. There can be no assurance that the actual IRRs will equal the underwritten IRRs shown in the table. See “Risk Factors”

the Company’s Annual Report on Form 10-K for the year ended

December 31, 2010 for a discussion of some of the factors that could adversely impact the returns received by the Company from the investments over time.

(2)

Based on GAAP Book Value of $16.39 per share as of December 31,

2011. (3)

The Company carries loans at amortized cost and its CMBS securities are

marked to market. Management has estimated that the fair value of the Company’s financial assets at December 31, 2011 was approximately $8.0

million greater than the carrying value of the Company’s investment

portfolio as of the same date. This represents a premium of $0.41 per share over the Company's GAAP book value as of December 31, 2011.

|

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

6

Stable, In-Place Investments Offer Attractive Yields

Asset Type

($000s)

Amortized

Cost

Equity

at Cost

Remaining

Weighted

Average

Life

Weighted

Average

IRR

(1)(3)

First

Mortgage

Loans

(1)

$109,006

($ 68,720)

$ 40,286

2.6 years

17.7%

Mezzanine Loans

149,086

—

149,086

6.2 years

14.2%

Repurchase Agreements

47,439

—

47,439

0.8 years

13.7%

AAA

CMBS–(Financed

with

TALF

Borrowings)

(2)

301,980

(251,327)

50,653

1.4 years

13.5%

AAA

CMBS–(Financed

with

Wells

Repurchase

Facility)

(2)

252,736

(221,980)

30,756

0.9 years

11.6%

Investments at December 31, 2011

$ 860,247

($542,027)

$318,220

2.2 years

14.2%

As of December 31, 2011.

(1)

Borrowings under the Company’s master repurchase facility with

JPMorgan bear interest at LIBOR plus 300 basis points, or 3.3% at December 31, 2011. The IRR calculation further assumes that the JPM

repurchase facility will remain available over the life of these

investments. (2)

TALF borrowings are non-recourse and were refinanced with the Wells

Facility during January 2012. The Company has agreed to provide a limited guarantee of up to 15% of the outstanding obligations of its

indirect wholly-owned subsidiary under the Wells Facility, or a

maximum of $37,500. (3)

The IRR for the investments shown in the above table reflect the returns

underwritten by the Manager, calculated on a weighted average basis assuming no dispositions, early prepayments or defaults but

assumes extensions as well as the fully hedged cost of borrowings under

the Wells Facility. The Company has also assumed that financing will be available through the maturity of the asset and reflect a cost of

funds based on forward Libor curve. There can be no assurance that the

actual IRRs will equal the underwritten IRRs shown in the table. See “Risk Factors” in the Company’s Annual Report on Form 10-K for

the year ended December 31, 2010 for a discussion of some of the factors

that could adversely impact the returns received by the Company from the investments shown in the table over time.

Borrowings |

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

7

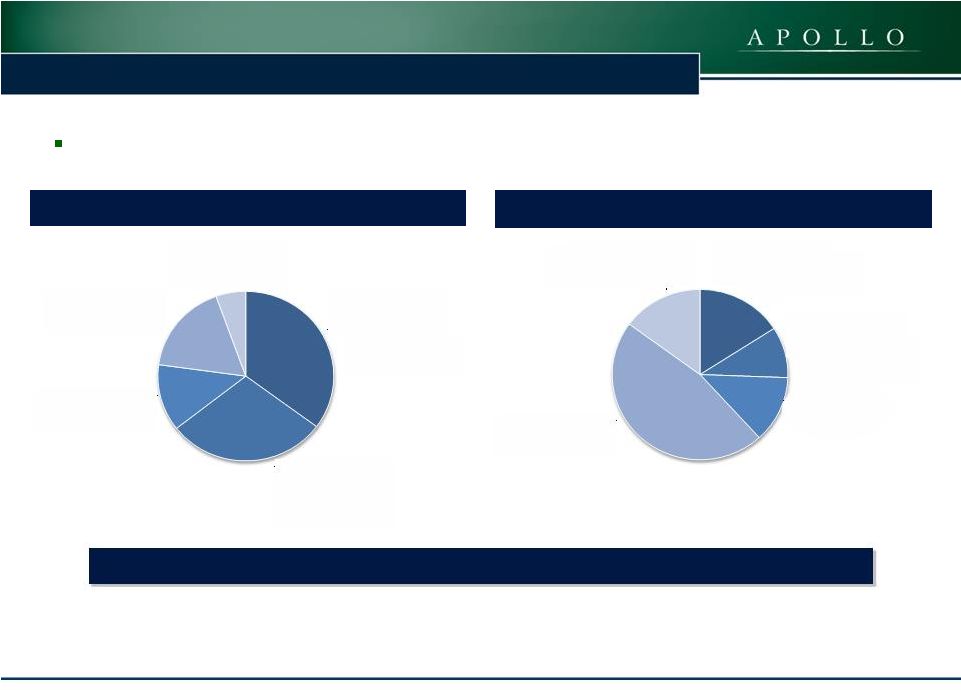

ARI Overview

Diversified Investment Portfolio with Amortized Cost Basis of $860

million Net Equity at Amortized Cost Basis ($000s)

Gross Assets at Amortized Cost Basis ($000s)

AAA CMBS (Financed

with TALF Borrowings)

$301,980

35%

AAA CMBS (Financed

with Wells Repurchase

Facility)

$252,736

29%

First Mortgages Loans

$109,006

13%

Mezzanine Loans

$149,086

17%

Repurchase Agreements

$47,439

6%

AAA CMBS

(Financed with TALF

Borrowings)

$50,653

16%

AAA CMBS

(Financed with Wells

Repurchase Facility)

$30,756

10%

First Mortgages Loans

$40,286

12%

Mezzanine Loans

$149,086

47%

Repurchase

Agreements

$47,439

15%

As of December 31, 2011.

(1) The IRR for the investments shown in the above table

reflect the returns underwritten by the Manager, calculated on a weighted average basis assuming no dispositions, early prepayments or defaults but assumes

extensions as well as the

fully hedged cost of borrowings under the Wells Facility. The Company has also assumed that financing will be available through the maturity of the asset and reflect a cost of funds based on

forward Libor curve. There

can be no assurance that the actual IRRs will equal the underwritten IRRs shown in the table. See “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended

December 31, 2010 for a discussion

of some of the factors that could adversely impact the returns received by the Company from the investments shown in the table over time.

Weighted Average IRR of Approximately 14.2%

(1) |

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

8

ARI Diversification

Net Equity Investments of $318 million as of December 31, 2011

Geographic Diversification by Net Equity

Property Type by Net Equity

(1)

See Form 10-Q and Form 10-K for property type and geographic

location underlying CMBS portfolio. (2)

Other category includes the repurchase agreement and the subordinate

financing on a ski resort. (3)

Other category includes the repurchase agreement as well as investments

in asset portfolios that are geographically diversified. (1)

(2)

(1)

(3)

North East

20%

South East

8%

Mid West

3%

West

13%

Other

31%

CMBS

25%

Hotel

17%

Office

6%

Retail

24%

Other

28%

CMBS

25% |

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

9

Senior Loan Portfolio

Description ($000’s)

Date of

Investment

Maturity

Date

Original

Face

Amount

Current

Face

Amount

Coupon

Amortization

Schedule

Property

Size

Current

Loan

Amount

Appraised

LTV

(1)

Hotel

New York, NY

Jan-10

Feb-15

$32,000

$31,798

8.25%

30 year

151

rooms

$210/

key

40%

Office Condo (Headquarters)

New York, NY

Feb-10

Feb-15

28,000

27,644

8.00

30 year

73,419

sq. ft.

$377/

sq. ft.

54%

Hotel

Silver Spring, MD

Mar-10

Apr-15

26,000

25,564

9.00

25 year

263

rooms

$97/

key

58%

Hotel

New York, NY

Aug-10

Aug-12

24,000

24,000

8.00

Interest

only

155

rooms

$155/

key

40%

Total

.

.

$110,000

$109,006

8.31%

Description ($000’s)

Date of

Investment

Maturity

Date

Original

Face

Amount

Current

Face

Amount

Coupon

Amortization

Schedule

Property

Size

Current

Loan

Amount

Appraised

LTV

(1)

Repurchase Agreement

(2)

Sept-10

Sept-12

$47,439

$47,439

13.00%

Interest only

N/A

N/A

N/A

Total

$47,439

$ 47,439

13.00%

(1)

Appraised loan-to-value (“LTV”) represents the LTV as

of the date of investment for all loans except the $32,000 New York, NY hotel loan. The LTV for the $32,000 New York, N.Y. hotel loan is as of March 2011.

(2)

Interest rate includes 10% current payment with a 3% accrual.

|

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

10

Subordinate Loan Portfolio

Description ($000’s)

Date of

Investment

Maturity

Date

Original

Face

Amount

Current

Face

Amount

Coupon

Amortization

Schedule

Current

Loan

Amount

Appraised

LTV

(1)

Senior

Mezz

–

Retail

Various

Dec-09

Dec-19

$30,000

$30,000

12.24%

Interest

only

(2)

$86/

sq. ft.

69%

Junior

Mezz

–

Retail

Various

Dec-09

Dec-19

20,000

20,000

14.00

Interest

only

(2)

$91/

sq. ft.

74%

Office

Michigan

May-10

Jun-20

9,000

8,950

13.00

25 year

$82/

sq. ft.

70%

Ski Resort

California

Apr-11

May-17

40,000

40,000

13.25

Interest

only

(2)

$356/

key

64%

Hotel Portfolio

New York

(3)

Aug-11

July-13

25,000

25,000

11.49

Interest

only

(4)

$339/

key

60%

Retail Center

Virginia

(5)

Oct-11

Oct-14

25,000

25,136

14.00

Interest

only

(5)

$281/

sq. ft.

60%

Total

.

.

$149,000

$149,086

13.00%

(1) Appraised LTV represents the LTV as of the date of investment.

(2) Prepayments are prohibited prior to the third year of the loan and

any prepayments thereafter are subject to prepayment penalties ranging from 5% to 0%.

(3) Includes a LIBOR floor of 1% and three one-year extension

options subject to certain conditions. (4) Prepayments are prohibited prior to February 2013 and any

prepayments thereafter are subject to spread maintenance premiums.

(5) Interest rate of 14.0% includes a 10.0% current payment with a 4.0%

accrual. There are two one-year extension options subject to certain conditions.

|

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

11

CMBS Portfolio

Face

Amortized

Cost

Remaining Weighted

Average Life with

Extensions (months)

Estimated

Fair Value

Debt

Net

Equity

TOTAL CMBS

$546,807

$554,716

14

$553,995

$473,307

$ 80,688

(1)

TALF borrowings were refinanced with an increase in the Wells repurchase

facility during January 2012. AAA CMBS–(Financed with TALF

Borrowings) (1)

CUSIP

Description

07388YAB8

BSCMS 07-PW16 A2

07401DAB7

BSCMS 2007-PW18 A2

12513YAC4

CD 2007-CD4 A2B

46629MAB1

JPMCC 2006-LDP8 A2

46631BAB1

JPMCC 07-LD11 A2

46632HAB7

JPMCC 2007-LD12 A2

50180CAB6

LBUBS 06-C7 A2

52109PAB1

LBUBS 07-C6 A2

61754KAC9

MSC 07-IQ14 A2

92978NAB0

WBCMT 07-C33 A2

92978YAB6

WBCMT 07-C32 A2

AAA CMBS–(Financed with Wells Repurchase Facility)

CUSIP

Description

07401DAB7

BSCMS 2007-PW18 A2

36246LAB7

GSMS 2007-GG10 A2

46630JAK5

JPMCC 2007-LDPX A2S

46630VAB8

JPMCC 2007-CB19 A2

46631QAB8

JPMCC 2007-CB20 A2

61751NAD4

MSC 2007-HQ11 A31

92978TAB7

WBCMT 2007-C31 A2 |

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

12

Financials |

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

13

(in thousands—except share and per share data)

December 31, 2011

December 31, 2010

Assets:

Cash and cash equivalents

21,568

$

37,894

$

Securities available-for-sale,

at estimated fair value 302,543

363,660

Securities, at estimated fair

value 251,452

279,124

Commercial mortgage loans, held for

investment 109,006

109,695

Subordinate loans, held for

investment 149,086

58,985

Repurchase agreements, held

for investment 47,439

-

Principal and interest receivable

8,075

5,553

Deferred

financing costs, net 2,044

2,818

Derivative instruments, net

-

387

Other assets

17

31

Total Assets

891,230

$

858,147

$

Liabilities and Stockholders' Equity

Liabilities:

TALF borrowings

251,327

$

297,334

$

Borrowings under repurchase agreements

290,700

242,728

Derivative instruments, net

478

-

Accounts payable and accrued expenses

1,746

2,375

Payable

to related party 1,298

683

Dividends payable

8,703

7,189

Deferred

underwriting fee ($8,000 of which was payable to the Manager) -

10,000

Total Liabilities

554,252

560,309

Commitments and Contingencies (see

Note 13) Stockholders' Equity:

Common stock, $0.01 par value, 450,000,000 shares authorized, 20,561,032 and 17,551,828 shares

issued and outstanding in 2011 and 2010, respectively

206

175

Additional paid-in-capital

336,209

291,304

Accumulated other comprehensive

income 563

6,359

Total

Stockholders' Equity 336,978

297,838

Total Liabilities and Stockholders'

Equity 891,230

$

858,147

$

Consolidated Balance

Sheets |

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

14

2011

2010

2011

2010

Net interest income:

Interest income from securities

5,904

$

6,468

$

25,323

$

18,112

$

Interest income from commercial mortgage loans

2,267

2,313

9,153

7,035

Interest income from subordinate loans

4,817

1,952

13,678

7,338

Interest income from repurchase agreements

1,576

-

4,764

-

Interest expense

(3,618)

(3,421)

(14,454)

(10,714)

Net interest income

10,946

7,312

38,464

21,771

Operating expenses:

General and administrative expenses (includes $634 and $1,788 of non-cash

stock based compensation in 2011 and $354 and $1,452 in 2010, respectively)

(1,563)

(1,400)

(5,652)

(5,556)

Management fees to related party

(1,297)

(1,118)

(4,728)

(3,339)

Total operating expenses

(2,860)

(2,518)

(10,380)

(8,895)

Interest income from cash balances

1

7

13

16

Realized loss

on sale of security -

-

-

(33)

Unrealized gain (loss) on

securities 600

$

(1,480)

$

482

$

(1,766)

$

Loss on derivative instruments (includes $426 and $(865) of

unrealized gain (loss) for the three and twelve months 2011 and $(387) and $(1,077) for

the three and nine months 2010, respectively)

(18)

$

645

$

(2,696)

$

(94)

$

Net income

8,669

$

3,966

$

25,882

$

10,999

$

Basic and diluted net income per share of common stock

0.41

$

0.22

$

1.35

$

0.87

$

Basic and diluted weighted average common shares

outstanding 20,561,032

17,670,468

18,840,954

12,679,277

Dividend declared per share of common stock

0.40

$

0.40

$

1.60

$

1.50

$

Year ended December 31,

Three months ended December 31,

Consolidated Statement of Operations |

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

15

Reconciliation of Operating Earnings to Net Income

Three

Months Ended

December 31, 2011

Earnings Per Share

(Diluted)

Three

Months Ended

December 31, 2010

Earnings Per Share

(Diluted)

Operating Earnings:

Net income

$8,669

$0.41

$3,966

$0.22

Adjustments:

Unrealized (gain) loss on securities

(600)

(0.03)

1,480

0.09

Unrealized (gain) on derivative instruments

(426)

(0.02)

(1,077)

(0.06)

Non-cash stock-based compensation expense

634

0.03

354

0.02

Total adjustments:

(392)

(0.02)

757

0.05

Operating Earnings

$8,277

$0.39

$4,723

$0.27

Basic and diluted weighted average common shares outstanding

20,561,032

17,670,468 |