Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WESTAR ENERGY INC /KS | d307786d8k.htm |

UBS Electric Power Conference

February 29, 2012

Dallas, TX

2012 UBS Electric Power Conference

Exhibit 99.1 |

2

Forward Looking Disclosures

2012 UBS Electric Power Conference

Forward-looking statements: Certain matters discussed in this presentation are

“forward- looking statements.” The Private Securities Litigation Reform Act of

1995 has established that these statements qualify for safe harbors from liability.

Forward-looking statements may include words like “believe,”

“anticipate,” “target,” “expect,” “pro forma,” “estimate,”

“intend,” “guidance” or words of similar meaning. Forward-looking statements

describe future plans, objectives, expectations or goals. Although we believe expectations are

based on reasonable assumptions, all forward-looking statements involve risk and

uncertainty. The factors that could cause actual results to differ materially from these

forward-looking statements include those discussed herein as well as (1) those discussed in

the company’s Annual Report on Form 10-K for the year ended Dec. 31, 2011 (a) under

the heading, “Forward-Looking Statements,” (b) in ITEM 1. Business, (c) in ITEM

1A. Risk Factors, (d) in ITEM 7. Management’s Discussion and Analysis of Financial

Condition and Results of Operations, and (e) in ITEM 8. Financial Statements and Supplementary

Data: Notes 13 and 15; and (2) other factors discussed in the company’s filings with the

Securities and Exchange Commission. Any forward-looking statement speaks only as of the

date such statement was made, and the company does not undertake any obligation to update any

forward-looking statement to reflect events or circumstances after the date on which such

statement was made.

|

3

•

Rate request settlement filed ($50 million rate increase)

•

Priced $250 million First Mortgage Bond

•

2011 results $1.95 per share; ongoing earnings $1.81 per share

•

Dividend increased to $0.33 per share, 3% increase

•

2012 EPS guidance range $1.85 -

$2.00 per share

•

2012 –

2014 CapEx plan

•

Environmental rules

Recent Events

2012 UBS Electric Power Conference |

4

•

Provisions of Settlement filed in February include:

–

Annual retail revenue increase $50 million, effective May

–

$11 million annual increase in tree trimming expense

–

$33 million annual increase in pension expenses

–

$40 million annual lower depreciation expense

–

Use 10% ROE for regulatory accounting purposes

•

Hearings complete

•

Next step --

filing briefs

•

Order due in proceeding by April 23

2011 General Rate Request

2012 UBS Electric Power Conference |

5

•

Priced $250 million FMB

•

Coupon 4.125%

•

30 year maturity, due March 2042

•

Use of Proceeds

–

provide long-term funding of investment in infrastructure

•

Planned closing March 1, 2012

First Mortgage Bond Offer

2012 UBS Electric Power Conference |

6

•

EPS from continuing operations of $1.81 vs. $1.81 for 2010

•

Retail MWh sales increased 1%

–

Warmer than normal weather, modestly above 2010

–

Continued

signs

of

industrial

growth

–

2%

over

2010

•

Implemented all planned price adjustments (annualized amts):

–

Transmission adjustments -

$17 million

–

Environmental adjustment -

$10 million

–

Energy efficiency adjustment -

$5 million

•

No COLI proceeds in 2011

•

($0.10) per share impact from additional shares to fund

infrastructure investment

2011 Ongoing EPS Results Unchanged From 2010

2012 UBS Electric Power Conference |

7

•

KCC approval of Stipulation & Agreement (S&A) in rate review

–

Annual retail revenue increase $50 million, effective May

•

Planned price adjustments via tracking mechanisms

•

Expect weather-adjusted retail sales to grow

1%

•

Combined O&M and SG&A (excl. SPP costs) increase

7%

–

Excludes $34 million increase SPP transmission expenses

–

Includes S&A expense increases of $7 million for tree trimming and

$33 million for pension expenses

–

2011 adjusted for legal settlement of arbitration

•

Depreciation

$10 million lower including effects of S&A

•

AFUDC increase

$7 million

•

COLI proceeds of

$14 million; (will book

$9 million in Q1)

•

Effective tax rate of 29-31%

•

Debt used for 2012 external funding needs

2012 Earnings Guidance of $1.85 -

$2.00

2012 UBS Electric Power Conference |

8

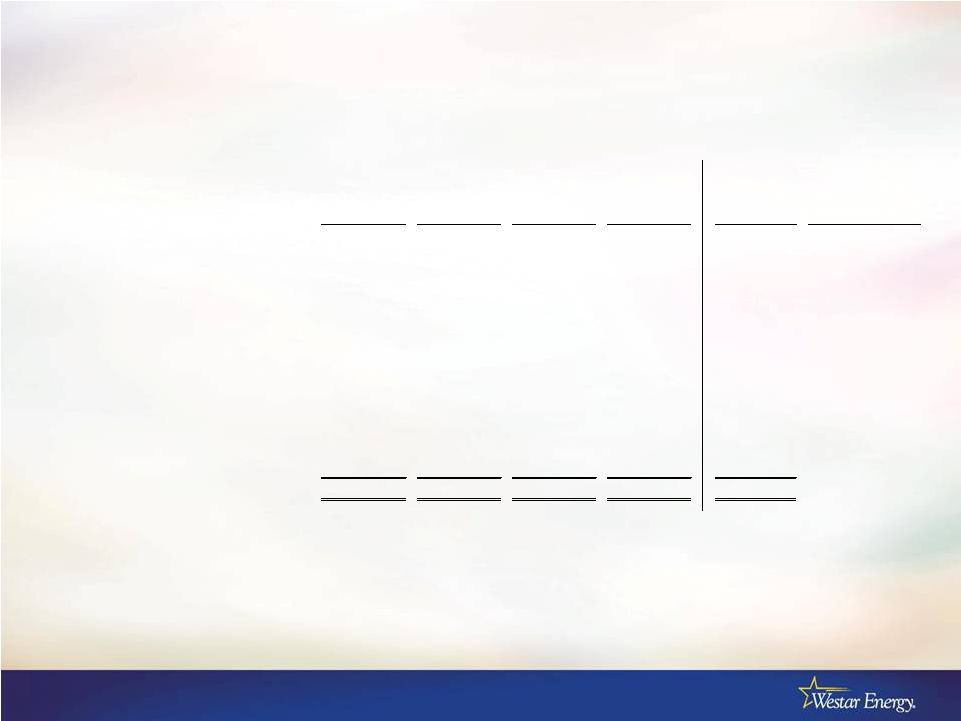

Capital Expenditure Forecast 2012 -

2014

Actual

Forecast

Forecast

Forecast

Forecast

Method of

Cost

2011

2012

2013

2014

2012 - 2014

Recovery

Generation replacements and other

132.8

$

159.8

$

172.3

$

164.6

$

496.7

$

GRC

Westar environmental

153.4

219.3

121.8

107.4

448.5

ECRR

La Cygne environmental

66.5

215.8

205.9

122.3

544.0

GRC

Nuclear Fuel

18.5

21.9

44.2

20.6

86.7

RECA

Transmission

188.8

136.5

200.7

197.4

534.6

FERC / TDC

Distribution

New customers, replacements & other

95.9

92.8

106.7

88.1

287.6

GRC

Smart grid (a)

17.9

3.7

3.7

GRC

Other

23.6

21.5

23.6

12.1

57.2

GRC

Total

697.4

$

871.3

$

875.2

$

712.5

$

2,459.0

$

(a) net of DOE matching grant

Prairie Wind Transmission joint venture

2.0

$

1.8

$

27.4

$

3.4

$

32.6

$

Not included in the table are Westar's planned investment in Prairie Wind

Transmission joint venture 2012 UBS Electric Power Conference

|

9

•

Mercury and Air Toxics Standards (MATS)

–

Final rule issued February 2012

–

Not viewed as problematic

•

Reasonable time for compliance

•

Compliance viewed as additive to current environmental plans

•

Projected investment up to $40 million

•

Cross-States Air Pollution Rule (CSAPR)

–

Rule currently stayed

–

Arguments before DC Circuit Court in April

–

Optimistic no major issues with compliance or reliability

•

Time for implementation in our favor

•

Helpful technical adjustments by EPA

Environmental Rules

2012 UBS Electric Power Conference |

10

2012 UBS Electric Power Conference

2012 Plans

|

11

Annualized Rate & Revenue Changes

Actual and Estimated

2011

2012

(Estimated)

2013

(Estimated)

Base rates

$50 million

May

Transmission rates (a)

$17

million

Jan 1

$25

million

Jan 1

$17 million

Jan 1

ECRR

$10

million

June 1

$15

million

June 1

$27

million

June 1

Energy Efficiency

$5 million

November

$1 million

November

$1 million

November

2012 UBS Electric Power Conference

Complete

In process

(a)

Incremental transmission revenue is from FERC transmission formula rate and the

retail Transmission Delivery Charge, net of the projected 2012 increase in

SPP transmission costs. |

12

Major Construction Projects Underway

•

Air Quality Improvements

–

Lawrence Energy Center

•

Fabric filters, rebuild scrubbers, precipitator, low NOx system

–

Jeffrey Energy Center

•

SCR on 1 unit

–

La Cygne Energy Center

•

Scrubbers, fabric filters, common chimney, SCR and low NOx system

•

Transmission

–

Wichita to Oklahoma 345 kV

–

Prairie Wind Transmission line (

110 mile double circuit 345 kV)

•

SmartStar Lawrence

–

$40 million project reduced by 50% DOE match

•

Advanced outage management

•

Automated metering infrastructure

2012 UBS Electric Power Conference |

13

Capital Expenditure Forecast 2012 -

2014

Actual

Forecast

Forecast

Forecast

Forecast

Method of

Cost

2011

2012

2013

2014

2012 - 2014

Recovery

Generation replacements and other

132.8

$

159.8

$

172.3

$

164.6

$

496.7

$

GRC

Westar environmental

153.4

219.3

121.8

107.4

448.5

ECRR

La Cygne environmental

66.5

215.8

205.9

122.3

544.0

GRC

Nuclear Fuel

18.5

21.9

44.2

20.6

86.7

RECA

Transmission

188.8

136.5

200.7

197.4

534.6

FERC / TDC

Distribution

New customers, replacements & other

95.9

92.8

106.7

88.1

287.6

GRC

Smart grid (a)

17.9

3.7

3.7

GRC

Other

23.6

21.5

23.6

12.1

57.2

GRC

Total

697.4

$

871.3

$

875.2

$

712.5

$

2,459.0

$

(a) net of DOE matching grant

Prairie Wind Transmission joint venture

2.0

$

1.8

$

27.4

$

3.4

$

32.6

$

Not included in the table are Westar's planned investment in Prairie Wind

Transmission joint venture 2012 UBS Electric Power Conference

|

14

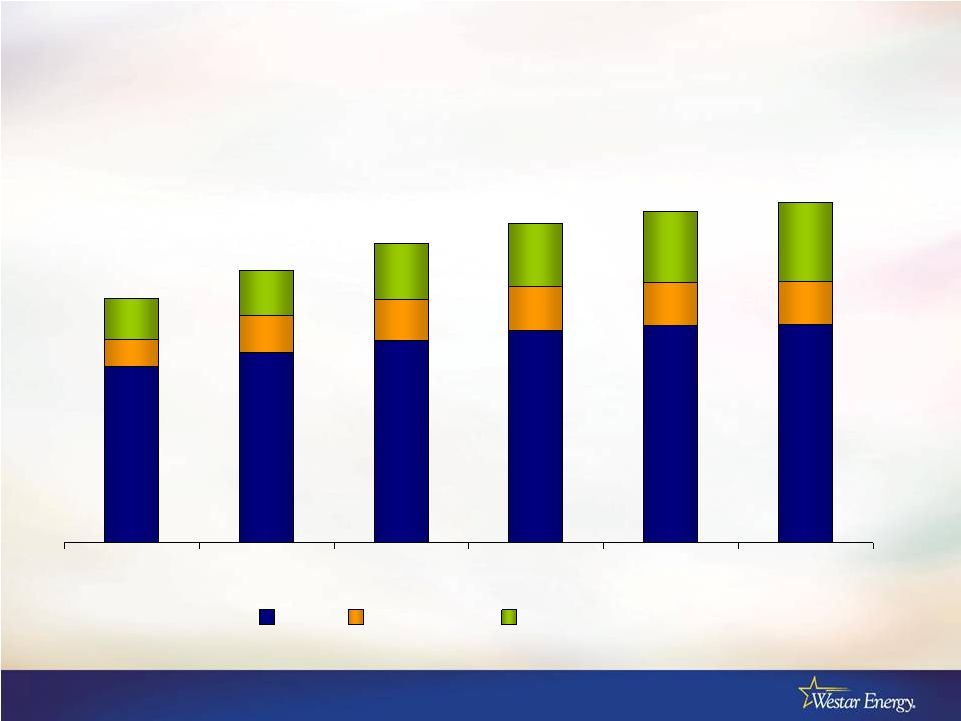

Capital Expenditure Forecast 2012 -

2014

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

$1,000

2011

2012

2013

2014

$697

$871

$875

$713

Air Quality

Other

Transmission

43%

37%

41%

49%

La Cygne

2012 UBS Electric Power Conference |

15

Projected Rate Base 2010 –

2015 (in billions)

2011

2012

2013

2014

2015

2016

Base

Air Quality

Transmission

$6.9

$6.7

$6.5

$6.0

$5.4

$4.8

$3.4

$3.8

$4.1

$4.3

$4.4

$4.4

2012 UBS Electric Power Conference

$0.8

$0.9

$1.1

$1.3

$1.4

$1.6

$0.6

$0.7

$0.8

$0.9

$0.9

$0.9 |

16

Environmental

2012 UBS Electric Power Conference |

17

Cross-State Air

Pollution Rule

Mercury and Air

Toxics Standards

Water 316(b)

Coal

Combustion

Waste

Status

Stayed by DC

Circuit Court

Published

February 2012

Proposed

Proposed

Effective

Pending Court

Decision

April 2012

(3 to 5 years to

comply)

July 2012

Mid 2013

Emissions / Areas

Covered

NOx

SO

2

Mercury

Acid gases

Water intake

Coal waste

Generation

Sources Affected

Coal

Gas

Coal

Coal

Nuclear

Coal

Issue(s)

Cost

Reliability

Allowances

Timeline

Cost

Timeline

Cost

Cost

Designation as

hazardous or non-

hazardous

Environmental Regulation Summary

2012 UBS Electric Power Conference |

18

•

Rule issued February 2012

•

Westar does not view as problematic

–

No surprises in final rule

–

Allow three years for compliance

•

Opportunity for one additional year

–

View as additive to current environmental plans

•

Incorporated anticipated rules in current compliance plans for Regional

Haze and JEC Consent Decree

–

Largest fleet impact on smallest coal-fired units

–

MATS compliance investment estimated up to $40 million

Mercury and Air Toxics Standards (MATS)

2012 UBS Electric Power Conference |

19

Dramatic Improvement in Air Quality

2012 UBS Electric Power Conference

Actual

Projected

Actual

Projected

Nitrogen Oxide

57%

(tons per year)

Sulfur Dioxide

83%

(tons per year)

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

0

20,000

40,000

60,000

80,000

100,000

120,000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017 |

20

Westar Coal Fleet Emission Control Equipment

Unit

Scrubber

Precipitator

Fabric Filter

Low NOx

SCR

ACI

DSI

Jeffrey 1

Yes

Yes

No plans

Yes

Planned

Planned

No plans

Jeffrey 2

Yes

Yes

No plans

Yes

Uncertain

Planned

No plans

Jeffrey 3

Yes

Yes

No plans

Yes

No plans

Planned

No plans

La Cygne 1

Yes

(b)

Planned

No

Yes

Planned

No plans

La Cygne 2

Planned

Yes

Planned

Planned

Planned

Planned

No plans

Lawrence 3

No plans

Yes (c)

No plans

Planned

No plans

Planned

Planned

Lawrence 4

Yes (a)

(b)

Planned

Planned

No plans

Planned

No plans

Lawrence 5

Yes (a)

(b)

Planned

Yes

No plans

Planned

No plans

Tecumseh 7

No plans

Yes

No plans

Yes

No plans

Planned

Planned

Tecumseh 8

No plans

Yes (c)

No plans

Planned

No plans

Planned

Planned

(a) Equipment rebuild underway

(b) PM removal integrated into scrubbers

(c) Equipment upgrade planned

83% of MWs Currently Scrubbed

2012 UBS Electric Power Conference |

21

Air Quality Control

Targeted Emission / Benefit

Low NOx Burner Systems

NOx

Selective Non-Catalytic Reduction

NOx

Selective Catalytic Reduction

NOx

Scrubber

SO

2

Acid gases

Small amount of mercury

Baghouse

Particulate matter

Small amount of mercury

Metals

Electrostatic Precipitator

Particulate matter

Metals

Activated Carbon Injection (ACI)

Mercury

Dry Sorbent Injection (DSI)

SO

2

Acid gases

Air Quality Controls

2012 UBS Electric Power Conference |

22

Transmission

2012 UBS Electric Power Conference |

23

Major Transmission Investments Underway

2012 UBS Electric Power Conference

•

Rose Hill –

Oklahoma

Under construction

•

Target completion Apr 2012

•

Investment

n

$80 million

•

Favorable to budget

•

Prairie Wind Transmission

•

50/50 JV with ETA

•

Siting approved June 2011

•

Acquiring ROW and clearing

•

Begin construction mid 2012

•

Approximately 110 miles

•

Estimated completion 2014

•

Project cost

$225 million

n |

24

Prairie Wind Transmission Regulation

•

Received FERC incentives

–

Recovery of pre-commercial development costs

–

CWIP recovery in rate base

–

Allowed ROE of 12.8%

•

KCC

–

Siting approved June 2011

•

Southwest Power Pool

–

Regional cost allocation approved by FERC

–

“Notice to Construct”

accepted

–

JV became a member of the SPP

–

PWT’s formula rate in effect

2012 UBS Electric Power Conference |

25

Potential for High Voltage Transmission Growth

A.

JEC to Iatan

Energy Center

B.

Wolf Creek to

Swissvale

C.

Concordia to Salina

D.

Salina to Hays

E.

JEC to Swissvale

F.

Hutchinson to

Spearville

G.

Wichita to Rose Hill

H.

JEC to Concordia

F

G

A

B

C

E

D

H

2012 UBS Electric Power Conference |

26

Profile

2012 UBS Electric Power Conference |

27

Strategic Approach

•

Embrace uncertainty

–

Acknowledge inability to predict the future

•

Value flexibility

–

Operational

–

Financial

–

Regulatory

•

Leverage actions and strategies around intrinsic advantages

•

Seek collaborative and constructive approaches to regulation

•

Value proposition

–

Protect against downside while growing investor returns

2012 UBS Electric Power Conference

Pure-play, vertically

integrated, rate-regulated

•

7,100 MW of generation

•

6,200 miles transmission

•

688,000 customers |

28

Regulatory Approach

•

A sound regulatory and energy policy platform

–

KCC and FERC

•

Ultimately results in lower rates for customers

2012 UBS Electric Power Conference |

29

Favorable Supply Portfolio

$52.65

$19.30

$7.15

Uranium

Coal

Gas

Ave. Fuel Cost

$20.60/MWh

Fuel Mix

Coal

49%

Gas

39%

Wind

4%

Uranium

8%

MW Capacity

5.0¢

6.0¢

7.0¢

8.0¢

9.0¢

10.0¢

Westar Energy

Kansas City Power

and Light (KS)

Empire District

Electric (KS)

National

Average

8.0¢

8.8¢

9.8¢

Low Rates

Source: Edison Electric Institute 07/01/2011

Coal

77%

Gas

8%

Wind

3%

Uranium

12%

Cost of Fuel

2012 UBS Electric Power Conference |

30

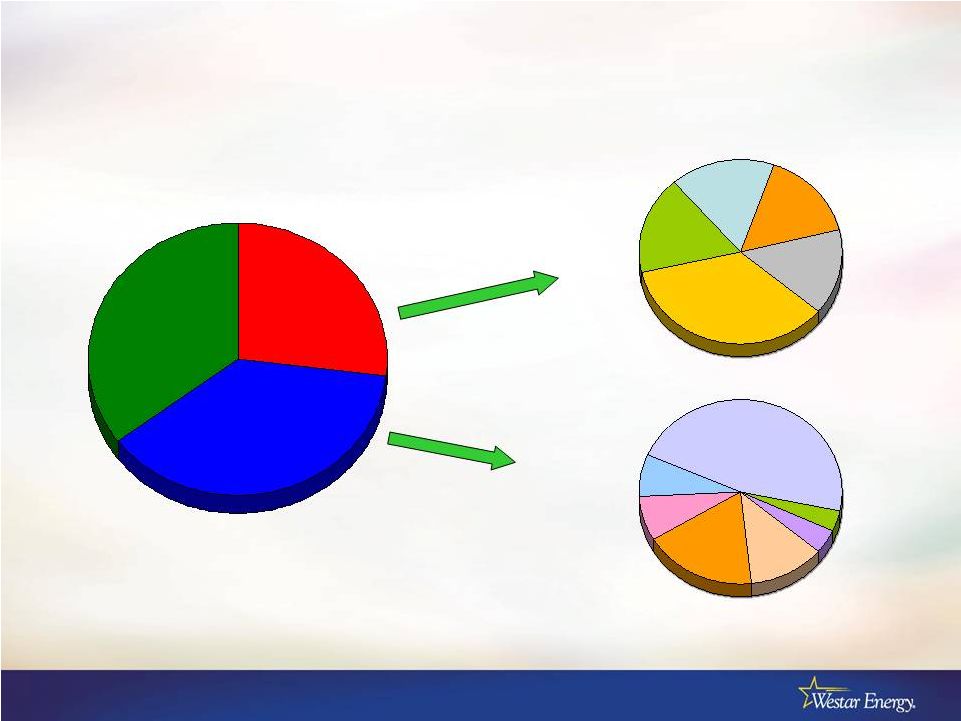

Diverse Energy Sales (MWh)

Chemical & oil

Food

processing

Aerospace

Consumer

manufacturing

Other

Commercial

37%

Residential

35%

Industrial

28%

40%

17%

15%

16%

12%

12%

18%

8%

7%

3%

4%

48%

Other

General

merchandise

Grocery/

Convenience

Real estate

Health care

Government

Education

2012 UBS Electric Power Conference |

31

Strong Service Territory

•

Economy significantly stronger

than for the nation

–

No real estate crash

–

Unemployment remains 2+ pts

favorable to nation

•

Economic development gains

fueling industrial resurgence

–

Sales up 2% 12me Dec ‘11

–

EcoDevo successes:

•

Mars Chocolate opening M&M

and Snickers factory in Topeka

•

South central Kansas becoming a

wind manufacturing corridor

–

Pulling from aerospace base

2012 UBS Electric Power Conference |

32

Liquidity and Capitalization

Target n 50/50

capital structure Debt

47%

Equity

52%

Preferred

<1%

Dec. 31, 2011

(a)

(millions)

Long-term, net

$2,491

Preferred

21

Common

2,769

Total Capitalization $5,281

(a) Capitalization excludes short-term debt

and adjustments for VIEs

2012 UBS Electric Power Conference

•

Solid investment grade credit

•

Total credit facility capacity $1 Billion

•

Active in Commercial Paper market

•

No bonds mature before 2014

Secured

Unsecured

Outlook

Moody's

A3

Baa2

Stable

Fitch Ratings

A-

BBB+

Stable

Standard & Poor's

BBB+

BBB

Stable |

33

$0.92

$1.00

$1.08

$1.16

$1.20

$1.24

$1.28

$1.32

$0.75

$0.85

$0.95

$1.05

$1.15

$1.25

$1.35

2005

2006

2007

2008

2009

2010

2011

2012

Dividend

•

Quarterly dividend increased 3% effective April 1

•

Long-standing dividend payout target of 60%-75% of earnings

–

2012 guidance implies payout in middle of range

Indicated

annual rate

2012 UBS Electric Power Conference |

34

Westar’s Value Proposition

•

Solid, transparent business strategy

•

Strong, experienced utility management team

•

Thoughtful, disciplined approach to operations, capital planning

and financing

•

Constructive regulatory and policy environment

–

Results in lower, more gradual price changes for customers

–

Preserves reliable infrastructure as base for economic growth

–

Provides investors clarity

•

Focus on containing risks and maintaining returns

•

Diverse customer base and stable service territory

2012 UBS Electric Power Conference |

35

Rates and Regulation

2012 UBS Electric Power Conference |

36

•

Kansas Corporation Commission

–

Three-member board appointed by governor

•

Serve staggered four year terms

•

Current KCC commissioners

–

Mark Sievers (R), chairman

•

Term expires March 2015

–

Thomas Wright (D)

•

Term expires March 2014

–

Ward Loyd (R)

•

Term expires March 2012

Kansas Regulators

2012 UBS Electric Power Conference |

37

Regulatory Approach

•

A sound regulatory and energy policy platform

–

KCC and FERC

•

Ultimately results in lower rates for customers

2012 UBS Electric Power Conference |

38

Methods of Cost Recovery

Revenue Requirement

Method of Recovery

Comment

1.

Fuel, purchased power and

environmental consumables

Quarterly adjustment based on

forecasted cost, with annual true-up

Adjusts prices for actual costs,

protecting both customers and

investors from mispricing

2.

Environmental capital, excluding

La Cygne environmental project

Environmental Cost Recovery Rider

adjusts annually

Allows annual price adjustment to

reflect capital costs for investments

in emission controls

3.

Transmission rate recovery

FERC formula rate adjusts annually;

companion retail tariff to reflect

current revenue requirement

Timely recovery of transmission

system operating and capital costs

4.

General capital investments

Traditional rate case, but with

predetermination and CWIP

Typical rate case reflects current

level of operating expenses and

most recent plant investment

5.

Property taxes

Annual adjustment to reflect current

property taxes

Allows timely recovery of actual

property tax costs in current rates

6.

Extraordinary storm damages

Traditionally deferred accounting

treatment as rate base

Smoothes period expenses for

extraordinary storm restoration costs

7.

Pension expenses

Deferred as a regulatory asset for

subsequent recovery

Smoothes period expenses in

excess of amount in base rates

8.

Energy efficiency programs

Deferred as a regulatory asset for

subsequent recovery

Smoothes period expenses for

energy efficiency programs

2012 UBS Electric Power Conference |

39

Retail Energy Cost Adjustment (RECA)

•

Provides timely price adjustments for fuel and purchased power

costs

•

Retail rates based on forecast of fuel and purchased power costs

and retail sales

–

Set quarterly

–

Difference between forecast and actual is deferred

•

Quarterly approach produces more stable prices

•

Annual settlement of deferred balance

•

RECA also used to rebate wholesale margins as a credit to retail

cost of service

–

Energy Marketing (i.e., non-asset) margins continue to be excluded

from rate setting

2012 UBS Electric Power Conference |

40

Pension Tracker

•

Defer as regulatory asset shortfall between funding of GAAP

pension/OPEB expense and pension/OPEB currently authorized

in rates

•

Maintain minimum funding level equal to GAAP pension/OPEB

expense

•

Recover deferred expenses through multi-year amortization as

part of next rate case

2012 UBS Electric Power Conference |

41

Environmental Cost Recovery Rider Mechanics

•

ECRR adjusts retail rates annually to reflect capital investments in

emission controls

–

Investments as of December 31 recovered in rates subsequent June

–

Eliminates need to file a rate case to capture rate base additions

•

Return of

and on

capital that is in service December 31

•

Return on

capital not yet placed in service December 31 (i.e., CWIP)

•

ECRR reduces regulatory lag

–

Regulatory lag limited to months, rather than longer lag typically

associated with traditional rate case filings

2012 UBS Electric Power Conference |

42

Illustrative ECRR Mechanics

(1)

Illustration reflects only the projects publicly announced and assumes one-half of annual

investment in service at year end (2)

Illustration uses

n

11.9% pretax return and 4% depreciation recovery

(3)

Annual ECRR Tariff is effective June 1; assume Jan-May at prior year revenue requirement and

Jun-Dec at new revenue requirement Clean Air Investment (1)

2008

2009

2010

2011

2012

2013

2014

Year 1 Investment

238.4

$

Year 2 Investment

85.2

$

Year 3 Investment

107.7

$

Year 4 Investment

153.4

$

Year 5 Investment

219.3

$

Year 6 Investment

121.7

$

Year 7 Investment

107.4

$

Environmental Investment

238.4

$

85.2

$

107.7

$

153.4

$

219.3

$

121.7

$

107.4

$

Accumulated Depreciation Clean Air Investment

Depreciation on Year 1 Investment

4.8

$

9.5

$

9.5

$

9.5

$

9.5

$

9.5

$

9.5

$

Depreciation on Year 2 Investment

1.7

3.4

3.4

3.4

3.4

3.4

Depreciation on Year 3 Investment

2.2

4.3

4.3

4.3

4.3

Depreciation on Year 4 Investment

3.1

6.1

6.1

6.1

Depreciation on Year 5 Investment

4.4

8.8

8.8

Depreciation on Year 6 Investment

2.4

4.9

Depreciation on Year 7 Investment

2.1

Annual Depreciation

4.8

$

11.2

$

15.1

$

20.3

$

27.8

$

34.6

$

39.2

$

Total Accum Depreciation for Environmental Investment

4.8

$

16.0

$

31.1

$

51.4

$

79.2

$

113.8

$

153.0

$

Environmental Investment, net of Accum. Depreciation

233.6

$

69.2

$

76.6

$

102.0

$

140.1

$

7.9

$

(45.6)

$

Return on prior YE investment balance (2)

27.7

$

8.2

$

9.1

$

12.1

$

16.6

$

0.9

$

4.8

11.2

15.1

20.3

27.8

34.6

Annual ECRR Revenue Requirement

32.5

$

19.4

$

24.2

$

32.4

$

44.4

$

35.5

$

Estimated calendar year revenue recognition (3)

18.9

$

24.9

$

22.2

$

29.0

$

39.4

$

39.2

$

Cumulative ECRR revenue recognition

18.9

$

43.8

$

66.0

$

95.0

$

134.4

$

173.6

$

2012 UBS Electric Power Conference

Return of prior YE investments completed |

43

Transmission Cost Recovery

•

FERC formula transmission rate

–

Changes in cost of service reflected in annual update of FERC tariff

•

Update posted each October using projected test year

–

Capital expenditures

–

O&M

–

Tariff based on year-end consolidated capital structure

•

FERC transmission changes effective January 1

•

Allowed ROE 11.3%

•

Annual true-up compares projected revenue requirement to actual, with

difference incorporated into next update

–

Incentives on recently completed central Kansas line

•

12.3% ROE

•

Accelerated book depreciation of 15 vs. 45 years

•

Transmission Delivery Charge (TDC)

–

Retail rates adjusted to match changes to FERC tariff

2012 UBS Electric Power Conference |

44

Transmission Formula Rate Mechanics

•

Fixed formula with changing inputs

–

Updated annually using Form 1 data

–

Established protocols for updates

•

Uses projected test year

–

Rate base (based on 13 month average)

–

O&M, depreciation and taxes

–

Cost of debt

•

Annual true-up

incorporated in subsequent year’s formula inputs

Establish

Proj. 2012

Rev. Req.

Establish

Proj. 2013

Rev. Req.

Start of 2013

Rate Year

Start of 2012

Rate Year

FERC

Form 1

Released

True-up between ’11

Proj. Rev. Req. and

Actual Rev. Req.

Transmission Formula Rate Time Line

2012 UBS Electric Power Conference |

45

Energy Efficiency Initiatives

•

SmartStar Lawrence smart grid project

–

Installing

48,000 “smart”

meters

–

Advanced outage management system

–

Total project cost of

$40 million

•

Reduced by 50% DOE match

–

Expect to implement over 2 -

3 years

•

Deferred accounting for the cost of energy efficiency initiatives,

such as

–

Smart thermostats

–

Customer educational programs

–

Demand response programs

2012 UBS Electric Power Conference |

46

Kansas’

Renewable Requirements

•

Renewable Portfolio Standard established

–

Installed capability standard in lieu of energy standard

•

10%

of

peak

load

by

2011,

15%

by

2016

and

20%

after

2020

–

If generated in Kansas, treated at 110% of requirement

–

Relief from standard possible if costs would increase prices >1%

•

Potential to offset with RECs for initial period

•

Limited net metering

–

Limited to 1% of peak demand

–

Customer’s net metered sales can’t produce net negative sales

•

Environmental predictability

–

Legislation precludes state air emission levels from being more

stringent than federal standards

2012 UBS Electric Power Conference |

47

•

Statute requires

200 MW additional renewables by 2011

–

KCC approved use of RECs to satisfy 2011 requirement until projects

placed in-service in late 2012

•

KCC approved request for

370 MW through PPAs

–

Agreements for 2 projects

•

Post Rock Wind Farm -

201 MW

•

Ironwood Wind Farm –

168 MW

–

Expect both projects to be in-service by end 2012

–

Recover through the fuel adjustment clause

•

20 year agreements priced < $35/MWh

Addition of Renewables in 2012

2012 UBS Electric Power Conference |

Westar Renewables Compliance

Favorable pricing allowed

for head start on 2016

statute requirements

KCC allowed the 2011 statute

requirement to be satisfied

with Renewable Energy Credits

2012 UBS Electric Power Conference

48 |

49

Statutes for Predetermination and CWIP

•

Predetermination

–

Utilities can obtain order establishing ratemaking principles that will

apply over the life of the asset

•

Construction Work in Progress (CWIP)

–

Utilities can include CWIP in rate cases

2012 UBS Electric Power Conference |

50

Capital Structure for Ratemaking (Per Recent Orders)

Capitalization

Ratio

Cost of

Capital

Weighted Cost

of Capital

Pre-tax Weighted

Cost of Capital

Long-term debt

48.66%

6.55%

3.19%

3.19%

Preferred

0.51

4.55

.02

.04

Common

50.83

10.40

5.29

8.77

100.00%

8.50%

12.00%

Capitalization

Ratio

Cost of

Capital

Weighted Cost

of Capital

Pre-tax Weighted

Cost of Capital

Long-term debt

50.89%

6.30%

3.21%

3.21%

Preferred

0.44

4.52

.02

.03

Common

48.67

11.30

5.50

9.10

100.00%

8.73%

12.34%

KCC

FERC Transmission

(1) Incentive ROE of 12.3% for applicable rate base

(1)

2012 UBS Electric Power Conference |

51

Capital Structure for Ratemaking (Proposed)

Capitalization

Ratio

Cost of

Capital

Weighted Cost

of Capital

Pre-tax Weighted

Cost of Capital

Long-term debt

46.97%

6.65%

3.12%

3.12%

Preferred

0.40

4.55

.02

.03

Common

52.63

10.00

5.26

8.71

100.00%

8.40%

11.86%

KCC

(proposed in Settlement Agreement)

2012 UBS Electric Power Conference |

52

•

Obtain permission from KCC to file ARC

–

Request made in a general rate case (GRC)

–

Identify scope of proposed ARC

•

Must file within 12 months of final GRC order

•

Applicant must adopt from previous rate order:

–

All regulatory procedures

–

All regulatory principles

–

Established rate of return

Abbreviated (Limited Scope) Rate Case (ARC)

2012 UBS Electric Power Conference |

53

Background

2012 UBS Electric Power Conference |

54

Westar Energy Legal Structure

Kansas Gas and

Electric Company

Consolidated capital

structure is used for

ratemaking

(Rate regulated utility)

(Rate regulated utility)

Westar Energy, Inc.

Parent

Subsidiary

Combined company

does business under

the name “Westar

Energy”

2012 UBS Electric Power Conference |

55

Westar’s Generating Resources

2012 UBS Electric Power Conference

Indicates proposed facility |

56

Westar’s Plants

Westar's

MW

Operator

Years Installed

Pulverized coal

Jeffrey Energy Center

2,005

Westar

1978, 1980, 1983

Lawrence Energy Center

531

Westar

1954, 1960, 1971

Tecumseh Energy Center

205

Westar

1957, 1962

LaCygne Station

711

KCPL

1973, 1977

Nuclear

Wolf Creek

547

WCNOC (1)

1985

Gas steam turbine

Gordon Evans Energy Center

527

Westar

1961, 1967

Hutchinson Energy Center

167

Westar

1965

Murray Gill Energy Center

293

Westar

1952, 1954, 1956, 1959

Neosho Energy Center

62

Westar

1954

Gas combustion turbine

Abilene Energy Center

68

Westar

1973

Gordon Evans Energy Center

294

Westar

2000, 2001

Hutchinson Energy Center

229

Westar

1974, 1975

Spring Creek Energy Center

279

Westar

2001

Emporia Energy Center

660

Westar

2008, 2009

Gas combined cycle

State Line

201

EDE Co.

2001

Wind

Meridian Way

96

Horizon (2)

2008

Central Plains

99

Westar

2009

Flat Ridge

100

Westar (3)

2009

Available generation

At Dec. 31, 2011

7,074

(1)

Wolf Creek Nuclear Operating Company is a company formed specifically to operate

Wolf Creek for its owners. WCNOC is governed by a board of directors

consisting of the CEO of WCNOC and senior executives of the plant

owners. (2)

100% of generation purchased under Power Purchase Agreement (PPA)

(3)

50% owned and 50% of generation purchased under PPA from BP Alternative

Energy Westar Energy

2011 Results

NERC

5-Year Average

Plant Performance

72.1%

85.8%

71.2%

89.3%

87.0%

90.1%

70.4%

73.7%

0%

20%

40%

60%

80%

100%

Coal Capacity

Factor

Wolf Creek

Capacity Factor

Coal Availability

Factor

Wolf Creek

Availability

Factor

2012 UBS Electric Power Conference |

57

Low-Cost Coal Fleet

•

Very low fuel cost

–

PRB coal

–

Excellent rail arrangements

–

Proximity to mines

•

Low embedded capital cost

•

No high-heat rate obsolete

plants

LAC 2 subject to lease agreement

2012 UBS Electric Power Conference

$0

$150

$300

$450

$600

JEC

3

JEC

2

JEC

1

LEC

5

LAC

1

LAC

2

TEC

8

LEC

4

TEC

7

LEC

3

Low Embedded Cost

5,000

7,000

9,000

11,000

13,000

Heat Rate |

58

Westar Energy Coal Fleet

Unit

Capacity

(MW)

WR Share

(MW)

Age

Heat Rate

(Btu/kWh)

Net Book

Value

(Millions)

$/KW

Jeffrey 3

730

672

28

11,265

314

$

467

$

Jeffrey 2

725

667

31

11,256

248

$

372

$

Jeffrey 1

724

666

33

11,204

207

$

311

$

Lawrence 5

371

371

40

10,713

65

$

175

$

La Cygne 1

736

368

38

10,497

147

$

399

$

La Cygne 2

(a)

686

343

34

10,500

25

$

73

$

Tecumseh 8

132

132

49

11,189

19

$

144

$

Lawrence 4

109

109

51

11,605

46

$

422

$

Tecumseh 7

73

73

54

11,749

27

$

370

$

Lawrence 3

51

51

57

11,707

27

$

529

$

3,452

(a) Subject to lease agreement

2012 UBS Electric Power Conference |

59

Westar-operated plant fuel supply (80%)

•

JEC supply under contract through 2020 (10+ million tons/year)

–

70% has no market openers

–

30% reopened on price every 5 years

•

Next re-pricing will occur in 2013

–

All volumes have cost escalators

–

Rail contract through 2013

•

LEC/TEC supply under contract until 2012 (3.5 million tons/year)

–

100% at fixed price or capped through 2012

–

Rail contract through 2013

Co-owned plant fuel supply managed by GXP (20%)

•

LAC supply (3 million tons/year)

Coal Supply

2012 UBS Electric Power Conference |