Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TrueBlue, Inc. | a2012q1ir8-k.htm |

This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “may,” “will,” “should,” “expects,” “intends,” “projects,” “plans,” “believes,” “estimates,” “targets,” “anticipates,” and similar expressions are used to identify these forward-looking statements. Examples of forward-looking statements include statements relating to our future financial condition and operating results, as well as any other statement that does not directly relate to any historical or current fact. Forward-looking statements are based on our current expectations and assumptions, which may not prove to be accurate. These statements are not guarantees and are subject to risks, uncertainties, and changes in circumstances that are difficult to predict. Many factors could cause actual results to differ materially and adversely from these forward-looking statements. Examples of such factors can be found in our reports filed with the SEC, including the information under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended Dec. 30, 2011. Any forward-looking statement speaks only as of the date on which it is made, and we assume no obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law. Cautionary Note About Forward-Looking Statements:

TrueBlue Investment Highlights 3 Successful vertical industry approach Compelling growth potential for staffing industry Unique industry-related growth drivers for TrueBlue Multiple strategies to drive growth and efficiency Strong operating leverage Solid balance sheet

Every day, we use our specialized approach to the market to find new opportunities to better serve customers and workers at all skill levels. A Leading Provider of Blue-Collar Staffing 4

General labor, on demand Specialized skills for manufacturing & logistics Skilled trades for energy, industrial, & construction projects Aviation mechanics & technicians Truck drivers Blue-Collar Specialties 5

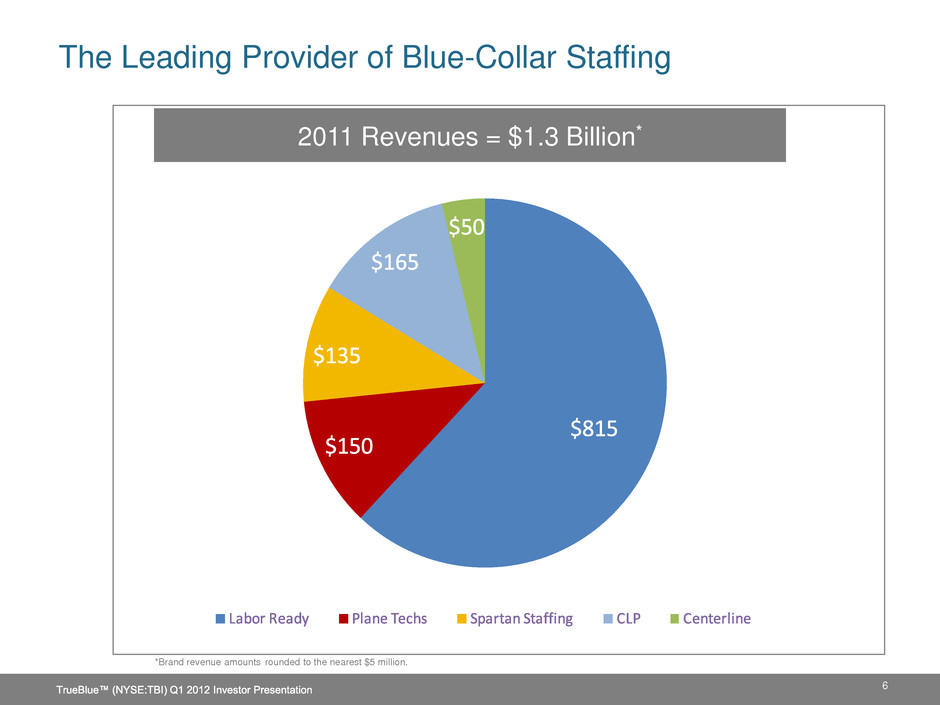

The Leading Provider of Blue-Collar Staffing 2011 Revenues = $1.3 Billion* *Brand revenue amounts rounded to the nearest $5 million. 6

7 Sales by Industry 2011 2006 Construction 25% 37% Manufacturing 20% 17% Transportation 12% 9% Wholesale Trade 9% 10% Retail 7% 8% Services & Other 15% 19% Aviation 12% 0%

“Best practices by DHS/ICE Partner” “Forbes Most Trustworthy Companies” “VIP program to promote employee fairness and safety” “Platinum 400” “Award of Excellence” “Hot Growth Company” “National Universal Agreement to Mediate” 8 TrueBlue Recognized as a Credible Industry Leader

Other Finance Healthcare Office IT 9 Staffing Industry: A $90 Billion Industry Staffing Industry Analysts 2011 forecast, rounded $25 Billion Industrial/ Blue-Collar $65 Billion

Attractive Drivers for Staffing Industry Economic volatility & uncertainty Greater need for flexibility & agility Increased government regulation Unique Industry Drivers Construction rebound Growing need & shortage of truck drivers Manufacturing growth expected to continue Staffing Industry and TrueBlue-Specific Growth Drivers 10 Aging workforce

$25B 2014 Market Forecast $30B Source: Staffing Industry Analysts, Moody’s economic forecasts, TrueBlue estimates 2011 Market Blue-Collar Staffing – Strong Future Growth 11

1.0% 1.5% 2.0% 2.5% '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 Staffing Industry Still Beneath Peak of Last Cycle Temporary Penetration Rates Source: Bureau of Labor Statistics. Temporary penetration rate defined as temporary help employment as a percentage of total U.S. non-farm employment. Seasonally adjusted. Yellow shaded areas represent official U.S. recessionary periods. 12

Construction Poised to Rebound Construction Employment As a percentage of total non-farm employment 13 5.1% Historical Average (1950 – 2010) “Construction is projected to be the fastest growing goods-producing industry over the next decade, representing 1.8 million new jobs by 2020.” Bureau of Labor Statistics, 2020 Employment Projections A construction rebound should provide additional revenue growth and higher gross margin for TrueBlue.* Chart Source: Bureau of Labor Statistics. Seasonally adjusted. * Based on company’s historical experience

Bureau of Labor Statistics, 2020 Employment Projections Rosalyn Wilson, Council of Supply Chain Management Professionals Transportation Employment Poised for Growth U.S. Transportation Employment 000s Source: Bureau of Labor Statistics. Seasonally adjusted. 14 2,500 3,000 3,500 4,000 '9 1 '9 2 '9 3 '9 4 '9 5 '9 6 '9 7 '9 8 '9 9 '0 0 '0 1 '0 2 '0 3 '0 4 '0 5 '0 6 '0 7 '0 8 '0 9 '1 0 '1 1 20-yr. average

Boston Consulting Group, May 5, 2011 New Boom Ahead for U.S. Manufacturing Purchasing Managers Index PMI Source: Federal Reserve Bank of St. Louis. A PMI reading above 50 percent indicates that the manufacturing economy is general ly expanding; below 50 percent that it is generally declining. 15 30 35 40 45 50 55 60 65 '00 '05 '10

$1.35B Revenue Labor Ready (89%) CLP (11%) $5 Billion Market 2006 $1.3B Revenue Labor Ready (62%) CLP (13%) Spartan (10%) PlaneTechs (11%) Centerline (4%) 2011 $15 Billion Market 16 More Opportunities to Serve the Market Percentages in parentheses represent the mix of total company revenue by brand

$4.5 Billion (20%) $7.5 Billion (2%) $1 Billion (17%) $1 Billion (15%) $1 Billion (5%) Market Share Opportunities 1 Staffing Industry Analysts 2011 forecast, 2 Market share (%) based on TrueBlue estimates Market Size1 & (Market Share)2 17

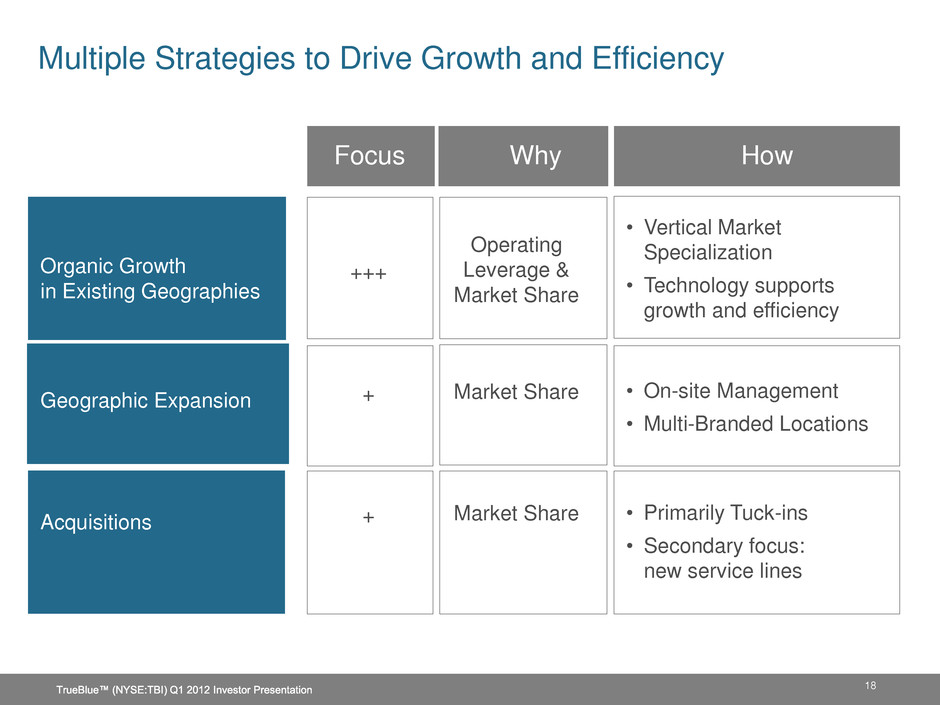

18 Multiple Strategies to Drive Growth and Efficiency Focus How Why Organic Growth in Existing Geographies Geographic Expansion Acquisitions +++ + + Operating Leverage & Market Share Market Share Market Share • Vertical Market Specialization • Technology supports growth and efficiency • On-site Management • Multi-Branded Locations • Primarily Tuck-ins • Secondary focus: new service lines

19 Strategy: Vertical Market Specialization Dedicated sales leaders with expertise in the specific industries we serve Specialized national sales and service teams deliver tailored solutions to our national customers Local sales and service staff use industry best practices to serve local customers better Strong focus on customer relationships and loyalty on both the local and national level TrueBlue™ (NYSE:TBI) Q1 2012 Investor Presentation

20 Strategy: Technology Mobile Technology Point of Sale System Customer and Employee Relationship Management Faster fill rates Recruiting and fulfillment across more geographies Increased process efficiency Higher worker quality More effective use of customer and worker information Improved efficiency of branch procedures Quick employee proficiency Better equipped sales force Decreased employee turnover Stronger customer and prospect information Initiative Expected Benefits

Incremental Revenue $100 Gross Profit Generated $25- 26 Operating Expense Associated with Incremental Revenue $(9) – (10) People Investments $(2) – (3) Incremental EBITDA $12 - 15 21 Strong Operating Leverage from Organic Revenue Organic growth from existing geographies = 12% - 15% incremental EBITDA margins* * Reflects an approximation of the incremental EBITDA that management believes can be achieved, in general, with favorable revenue growth and current gross margin, revenue mix and geographic footprint. See disclosure and reconciliation of EBITDA in Appendix.

Geographic Expansion Opportunities Existing markets KEY 22

Successful Acquisition Record Acquisition Results How We Vet Acquisitions Does it fit our strategy? Does it exceed our return on investment requirements? Does it fit our culture and operational structure? Does it bring unnecessary financial or legal risks? 23

25 Financial Summary 2011 2010 Growth % Revenue $ 1,316 $ 1,149 14% Gross profit $ 347 $ 303 14% % of Revenue 26.4% 26.4% SG&A expense $ 283 $ 259 9% % of Revenue 21.5% 22.5% Depreciation/amortization $ 16 $ 16 0% % of Revenue 1.2% 1.4% Income from operations $ 48 $ 28 69% % of Revenue 3.6% 2.5% Net income $ 31 $ 20 55% % of Revenue 2.3% 1.7% Earnings per share $ 0.73 $ 0.46 60% Dollar amounts in millions, except EPS. Some amounts may not sum due to rounding. TrueBlue™ (NYSE:TBI) Q1 2012 Investor Presentation

26 Solid Balance Sheet In millions Q-4 2011 Q-4 2010 Cash & investments $109 $163 Accounts receivable $154 $109 Current ratio 2.5 3.4 Restricted cash & investments $130 $120 Workers’ comp reserve $192 $187 Debt $0 $0 Shareholders’ equity $294 $313

Recent Revenue Trends 27 * Q4 ’10 was a 14 -week quarter vs. 13 weeks for Q4 ‘11. 22% normal- ized growth*

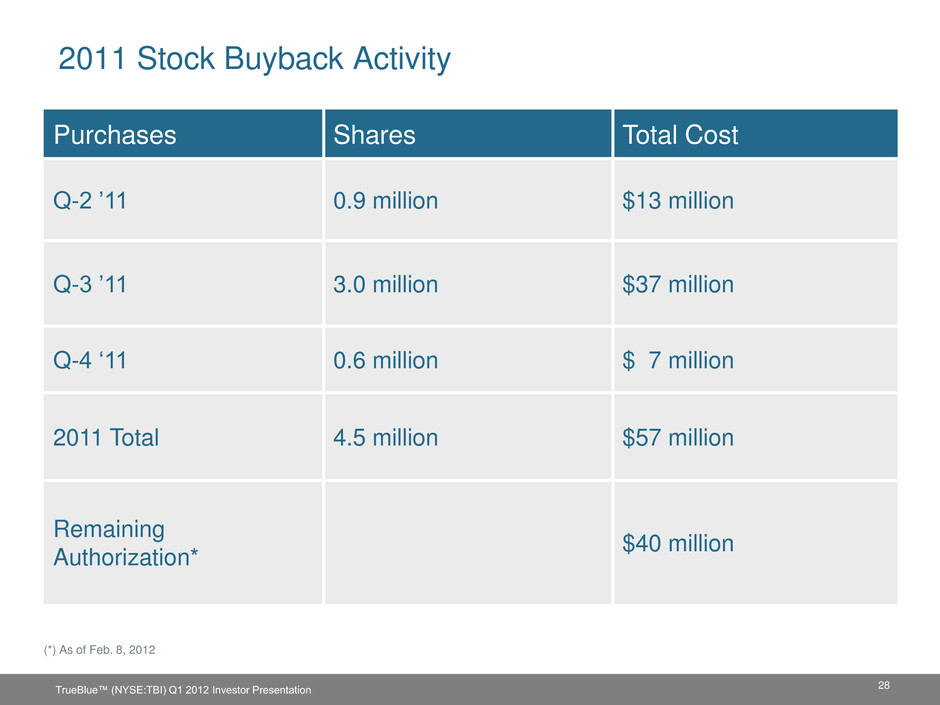

2011 Stock Buyback Activity Purchases Shares Total Cost Q-2 ’11 0.9 million $13 million Q-3 ’11 3.0 million $37 million Q-4 ‘11 0.6 million $ 7 million 2011 Total 4.5 million $57 million Remaining Authorization* $40 million (*) As of Feb. 8, 2012 28 TrueBlue™ (NYSE:TBI) Q1 2012 Investor Presentation

29 Financial Summary Q-4 2011 Q-4 2010 Growth % Revenue $ 350 $ 312 12% Gross profit $ 92 $ 82 12% % of Revenue 26.2% 26.3% SG&A expense $ 77 $ 72 7% % of Revenue 21.9% 23.0% Depreciation/amortization $ 4 $ 5 -4% % of Revenue 1.3% 1.5% Income from operations $ 11 $ 6 93% % of Revenue 3.1% 1.8% Net income $ 8 $ 4 91% % of Revenue 2.2% 1.3% Earnings per share $ 0.19 $ 0.09 110% Dollar amounts in millions, except EPS. Some amounts may not sum due to rounding. TrueBlue™ (NYSE:TBI) Q1 2012 Investor Presentation

30 Gross Margin Change 22% 24% 26% 28% Q4 2010 Actual 2010 HIRE Act Credits / 2011 Sales Mix Pricing Q4 2011 Actual 26.3% 26.2% +0.3%-0.4% TrueBlue™ (NYSE:TBI) Q1 2012 Investor Presentation

SG&A Expense Change $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 Q4 2010 Actual Extra Week in 2010 Variable People Investments Other Q4 2011 Actual +$4M $72M +$2M +$2M $77M ($3M) TrueBlue™ (NYSE:TBI) Q1 2012 Investor Presentation 31

33 Reconciliation of EBITDA to Net Income *EBITDA is non-GAAP financial measure which excludes interest, taxes, depreciation and amortization from net income. EBITDA is a key measure used by management in evaluating performance. EBITDA should not be considered a measure of financial performance in isolation or as an alternative to net income (loss) in the Statement of Operations in accordance with GAAP, and, as presented, may not be comparable to similarly titled measures of other companies. Some amounts may not sum due to rounding. $ $ $ $ $ $ $ $ $ $ $ $ $ $