Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SunCoke Energy, Inc. | d303387d8k.htm |

J.P. Morgan

Global High Yield & Leveraged Finance Conference

February 28, 2012

Exhibit 99.1 |

1

Safe Harbor Statement

Some

of

the

information

included

in

this

presentation

contains

“forward-looking

statements”

(as

defined

in

Section

27A

of

the

Securities

Act

of

1933,

as

amended

and

Section

21E

of

the

Securities

Exchange

Act

of

1934,

as

amended).

Such

forward-looking

statements

are

based

on

management’s

beliefs

and

assumptions

and

on

information

currently

available.

Forward-looking

statements

include

the

information

concerning

SunCoke’s

possible

or

assumed

future

results

of

operations,

business

strategies,

financing

plans,

competitive

position,

potential

growth

opportunities,

potential

operating

performance

improvements,

effects

resulting

from

our

separation

from

Sunoco,

the

effects

of

competition

and

the

effects

of

future

legislation

or

regulations.

Forward-looking

statements

include

all

statements

that

are

not

historical

facts

and

may

be

identified

by

the

use

of

forward-looking

terminology

such

as

the

words

“believe,”

“expect,”

“plan,”

“intend,”

“anticipate,”

“estimate,”

“predict,”

“potential,”

“continue,”

“may,”

“will,”

“should”

or

the

negative

of

these

terms

or

similar

expressions.

Forward-looking

statements

involve

risks,

uncertainties

and

assumptions.

Actual

results

may

differ

materially

from

those

expressed

in

these

forward-looking

statements.

You

should

not

put

undue

reliance

on

any

forward-looking

statements.

In

accordance

with

the

safe

harbor

provisions

of

the

Private

Securities

Litigation

Reform

Act

of

1995,

SunCoke

has

included

in

its

filings

with

the

Securities

and

Exchange

Commission

cautionary

language

identifying

important

factors

(but

not

necessarily

all

the

important

factors)

that

could

cause

actual

results

to

differ

materially

from

those

expressed

in

any

forward-looking

statement

made

by

SunCoke.

For

more

information

concerning

these

factors,

see

SunCoke's

Securities

and

Exchange

Commission

filings.

All

forward-

looking

statements

included

in

this

presentation

are

expressly

qualified

in

their

entirety

by

such

cautionary

statements.

SunCoke

undertakes

no

obligation

to

update

publicly

any

forward-looking

statement

(or

its

associated

cautionary

language)

whether

as

a

result

of new information or future events or otherwise.

This

presentation

includes

certain

non-GAAP

financial

measures

intended

to

supplement,

not

substitute

for,

comparable

GAAP

measures.

Reconciliations

of

non-GAAP

financial

measures

to

GAAP

financial

measures

are

provided

in

the

Appendix

at

the

end

of

the

presentation.

Investors

are

urged

to

consider

carefully

the

comparable

GAAP

measures

and

the

reconciliations

to

those

measures

provided in the Appendix, or on our website at www.suncoke.com.

J.P. Morgan Global High Yield & Leveraged Finance Conference

|

2

SunCoke Introduction

2011 Adjusted EBITDA

(1)

(excluding Corporate Segment)

(1) For a definition of Adjusted EBITDA, please see the appendix.

J.P. Morgan Global High Yield & Leveraged Finance Conference

Largest independent producer of

metallurgical coke in the Americas

with nearly 50 years experience

~85% of Adjusted EBITDA

(1)

generated

by cokemaking business

–

Secure, long-term take-or-pay

contracts with leading steelmakers

Metallurgical coal mining operations in

Virginia and West Virginia

–

2011 production of approximately

1.4 million tons

–

High quality metallurgical coal

reserves; primarily mid-vol.

2011 Results:

•Revenue of $1.5 billion

•Adjusted EBITDA

(1)

of $140.5 million |

3

5.9 million tons of capacity with

new Middletown, Ohio facility

–

Six cokemaking facilities; five in

U.S. and one in Brazil

–

More than doubled capacity

since 2005

Proven ability to permit, develop,

construct and start up new facilities

and work internationally

Industry leading environmental

signature: U.S. EPA Maximum

Achievable Control Technology

The Leading Independent Cokemaker

SunCoke

Cokemaking Capacity

(Tons in thousands)

J.P. Morgan Global High Yield & Leveraged Finance Conference

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

2004

2005

2006

2007

2008

2009

2010

2011

Jewell Coke

Indiana Harbor

Haverhill I

Vitória

Haverhill II

Granite City

Middletown |

4

$227

$141

2010

2011

2011 Overview

2011 Net Income

(1)

of $60.6 million, EPS of $0.87,

and Adjusted EBITDA

(2)

of $140.5 million

($ in millions)

(1)

Attributable to shareholders

(2)

For a definition of Adjusted EBITDA and reconciliation of Adjusted EBITDA to net

income and operating income, please see the appendix. J.P.

Morgan Global High Yield & Leveraged Finance Conference Adjusted EBITDA

(2) |

5

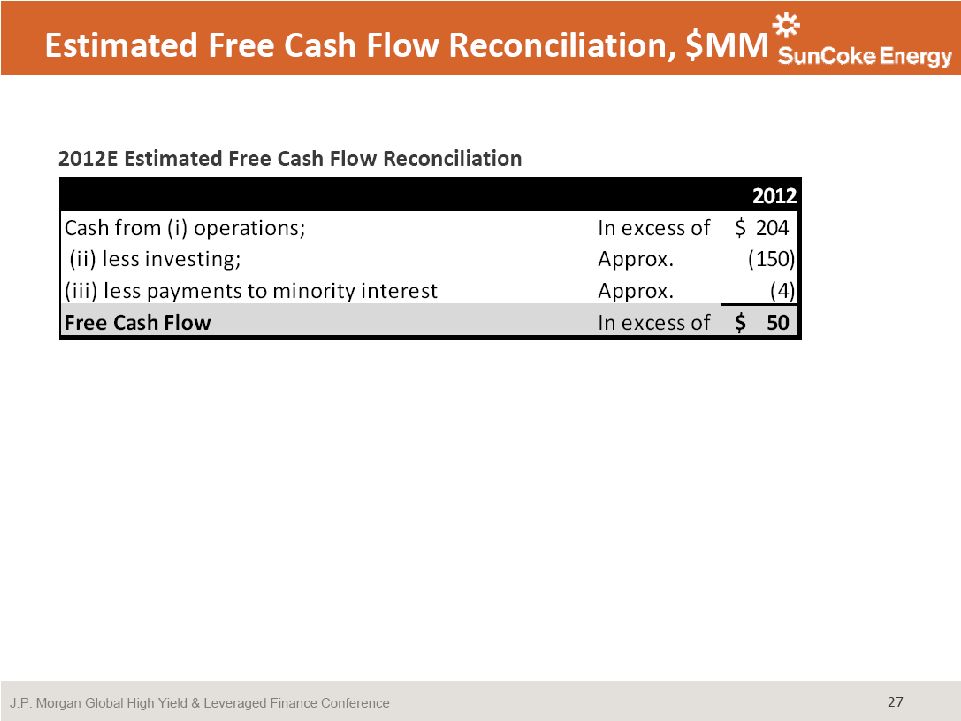

Cash Flow Update

•

Working capital change reflects

higher coal and coke inventory in

2011

•

Expect to decline

in first

half 2012 •

Solid year end liquidity position

with $128 million cash balance

and undrawn revolver

•

Intend to build liquidity near term

to support potential future

growth projects

•

Expect 2012 free cash flow of

$50+ million, weighted to second

half 2012

(1) Free Cash Flow represents cash from operations less cash from investing less

payments to minority interest. For a definition of Free

Cash Flow and a reconciliation of Free Cash Flow, please see the appendix. (2)

For a

definition

of

Adjusted

EBITDA

and

reconciliation

of

Adjusted

EBITDA

to

net

income

and

operating

income,

please

see

the

appendix.

J.P. Morgan Global High Yield & Leveraged Finance Conference

Summary Cash Flow

($ in millions, except where indicated)

Net Income

$59

$146

Loss on firm purchase commitment

18

-

Depreciation, depletion, and amortization

58

48

Deferred income tax expense

24

15

Payments (in excess of) less than expense for retirement plans

6

(6)

Changes in working capital pertaining to operating activities

(61)

91

Other

(3)

2

Net cash provided by operations

$101

$297

Capital Expenditures

Ongoing

($59)

($46)

Expansion

(179)

(170)

Proceeds from sale of assets

-

2

Acquisition of business, net of cash received

(38)

-

Net cash used in investing activities

($276)

($214)

Proceeds from issuance of long-term debt/costs/repayments

$707

$0

Contribution from parent

-

$1

Purchase of noncontrolling interest in Indiana Harbor facility

(34)

-

Distributions to noncontrolling interests in cokemaking operations

(2)

(21)

Increase (decrease) in advances/payable to/from affiliate

(408)

(25)

Repayment of notes payable assumed in acquisition

(2)

-

Net cash provided by (used in) financing activities

$261

($45)

Net increase in cash

$87

$36

Cash balance at beginning of period

$40

$3

Cash balance at end of period

$128

$40

Free Cash Flow

(1)

($177)

$62

For Year

Ended

December 31,

2011

For Year

Ended

December 31,

2010 |

6

SunCoke‘s Value Proposition

Provide an assured supply of coke to steelmakers

Larger, stronger coke for improved blast furnace performance

Demonstrated sustained 30% turndown; higher turndown on temporary basis

High quality coke with cheaper coal blends

–

Burn loss vs. by-product

Capital preservation and lower capacity cost per ton; particularly relative to

greenfield investment

Stringent U.S. regulatory environment

Power prices and reliability versus value of coke oven gas and by-product

"credits"

High Quality &

Reliable Coke

Supply

Turndown

Flexibility

Coal Flexibility

Capital

Efficiency

and Flexibility

Environmental /

Economic

Trade-offs

J.P. Morgan Global High Yield & Leveraged Finance Conference

|

7

SunCoke’s Heat Recovery Oven vs. By-Product Oven

SunCoke’s technology is the industry’s environmental standard and provides

many advantages over the traditional cokemaking process

J.P. Morgan Global High Yield & Leveraged Finance Conference

|

8

SunCoke’s Contract Proposition

Plant Production and Environmental

Compliance

Permits and Approvals

Engineering, Procurement &

Construction

Capital Funding and Ownership

Reliable, High-Quality Coke Supply

Deliver coke to customers through a competitive turnkey solution,

which produces a consistent stream of earnings

Operating Cost Component

(Pass-Through)

Fixed Fee

(Profit and Return on Capital)

Coal Cost Component

(Pass-Through)

Take-Or-Pay

Taxes and Transportation and Future

Environmental Costs (Pass-Through)

Coke fee

Energy fee

SunCoke

Energy

Typical Key Coke Sales

Agreement Provisions

What SunCoke Offers

J.P. Morgan Global High Yield & Leveraged Finance Conference

|

9

Focused Growth Strategy

Expand domestic coal production from current reserves and

improve efficiency of existing mines

We believe

SunCoke Energy

is uniquely

positioned for

continued

investment and

earnings

growth

Continue to grow our cokemaking businesses in the U.S. and

Canada; reserving portion of future capacity for market sales

Grow international footprint in key growth markets with

immediate focus on India

Growth Initiatives

J.P. Morgan Global High Yield & Leveraged Finance Conference

|

SunCoke's U.S.

and Canada Market Position North American Coke Imports

SunCoke believes it has the opportunity to displace higher cost coke imports

(Tons in millions)

Source: CRU, The Annual Outlook for Metallurgical Coke 2011.

(1)

Represents SunCoke’s domestic cokemaking capacity weighted by the number of

months each facility operated during that year.

(1)

5.4

3.6

5.6

1.3

2.5

2.4

2.8

2.3

2.6

2.8

3.6

–

1.0

2.0

3.0

4.0

5.0

6.0

2006

2007

2008

2009

2010

2011

2012E2013E

2014E

2015E2021E

SunCoke domestic coke sales volumes

SunCoke weighted-average domestic cokemaking capacity

10

J.P. Morgan Global High Yield & Leveraged Finance Conference

|

11

SunCoke's U.S. and Canada Market Position

Source: CRU, The Annual Outlook for Metallurgical Coke 2011;

Company estimates. (1) Chinese coke production costs net of by-product

credits; does not include return on capital. J.P. Morgan Global High Yield

& Leveraged Finance Conference SunCoke Domestic Coke pricing is competitive

versus Chinese imports in the event the 40% tariff on exports is reduced or

removed |

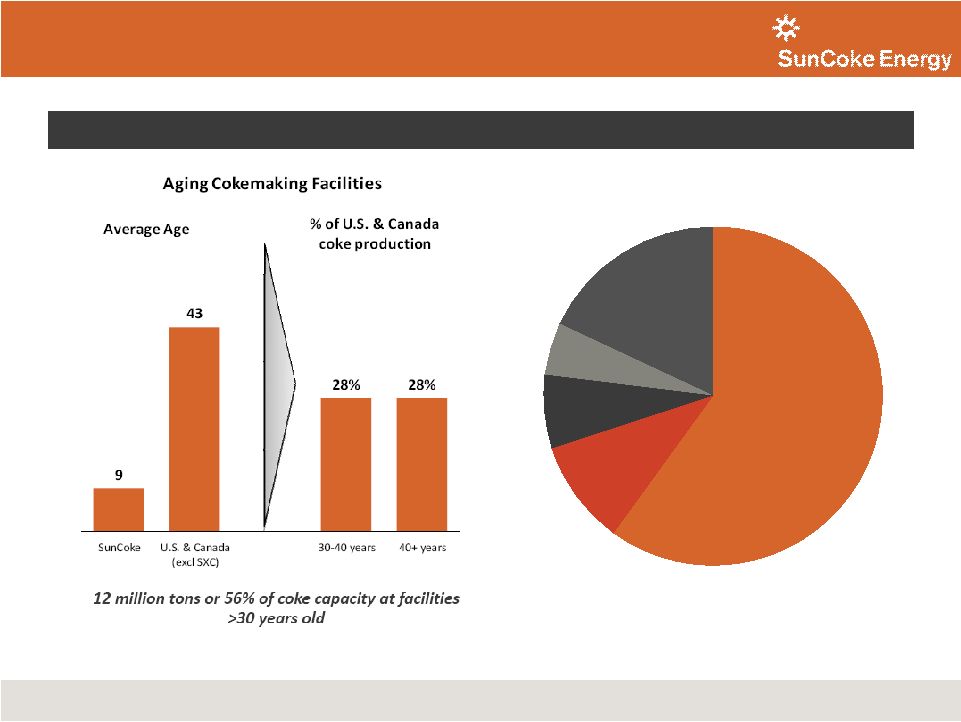

12

U.S. & Canada Coke Supply

SunCoke’s U.S. and Canada Market Position

Source: CRU, The Annual Outlook for Metallurgical Coke 2011.

Replace aging coke batteries operated by integrated steel producers

Source: CRU, The Annual Outlook for Metallurgical Coke 2011.

J.P. Morgan Global High Yield & Leveraged Finance Conference

Integrated

Steel

Producers

60%

SunCoke

18%

DTE

5%

Other Merchant &

Foundry

7%

Imports

10% |

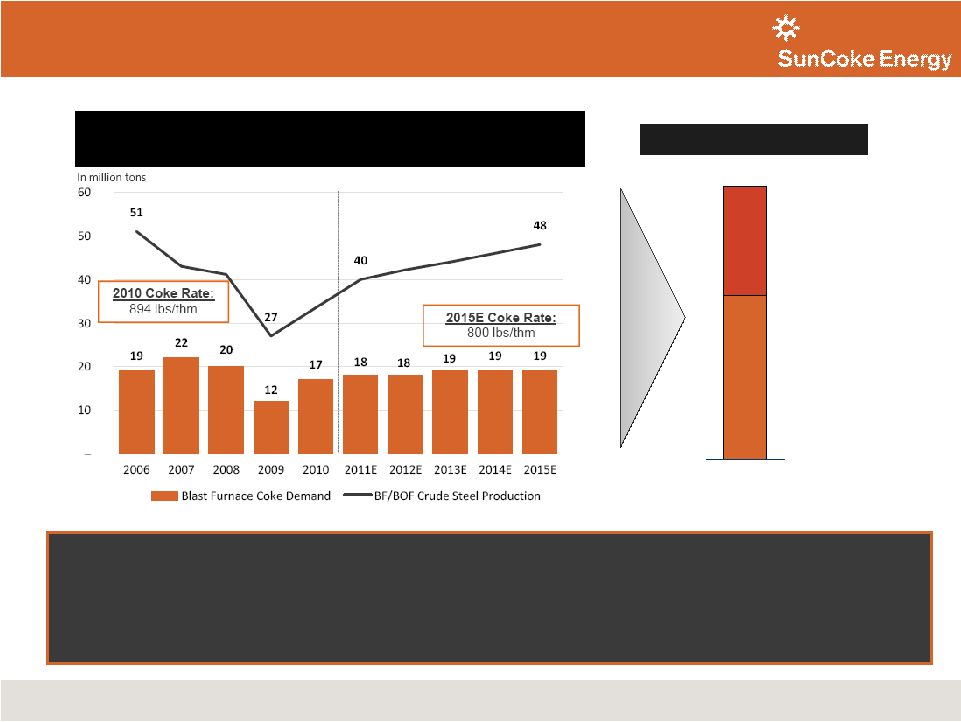

13

SunCoke's U.S. and Canada Market Position

BF/BOF Crude Steel Production

and Blast Furnace Coke Demand

3

2

Aging battery

replacement

Demand growth with

market recovery

Expected demand

opportunity by

2015

5

Market Opportunity

Source: CRU, The Annual Outlook for Metallurgical Coke 2011;

Company estimates. million tons

J.P. Morgan Global High Yield & Leveraged Finance Conference

•

We

believe

SunCoke

is

positioned

to

capture

significant

share

of

market

opportunity

•

Next U.S. coke plant size anticipated to be up to 1.1 million tons

•

Near-term focus remains on obtaining permits; anticipated in second half of 2012

•

Will defer seeking customer commitments until further progress on permits achieved in view of

current economic outlook |

14

India –

Macro Outlook

Population growth

•

1.2 billion people today

•

Projected 1.5 billion by 2030

•

Growth equal to the entire U.S.

population

Urbanization

•

Less than 50% urban population

•

Vehicle production 3.6 MM (’11)

vs. 13 MM in NAFTA

•

Lowest steel intensity of BRICs

Economic prosperity

•

Economy expected to grow

6-8% per year

•

Per capital income could triple

Per Capita Crude Steel Use

(2010)

Kg/y

India

58

Brazil

147

United States

292

China

445

World Avg.

221

Source: World Steel Association, 2011.

Source: Census.gov, United States Census Bureau -

International Data Base, CIA World Factbook.

Significant

Expected

GDP

Growth

Source: CIA World Factbook.

J.P. Morgan Global High Yield & Leveraged Finance Conference

|

15

India Opportunity for SunCoke

J.P. Morgan Global High Yield & Leveraged Finance Conference

|

16

Why is China Important?

Source: CRU, The Annual Outlook for Metallurgical Coke 2011;

Company estimates. Rest of

World

48%

China

45%

U.S. & Canada

2011E World Steel Production

Rest of

World

35%

China

62%

U.S. &

Canada

2011E World Coke Production

7%

3%

J.P. Morgan Global High Yield & Leveraged Finance Conference

•

Chinese steel market represents 45% of

world production

•

Steel market expected to grow

46% over the next 10 years producing

an incremental 300+ million tons (more

than 2x entire U.S. market)

•

Integrated steelmaking comprises

90% of production, driving China to

represent 62% of the world coke

market

•

China’s coke demand expected to grow

approximately 160 million tons in the

next 10 years (equivalent to nearly

7 U.S. markets)

•

Chinese government has targeted

closure of nearly 40 million tons of

older/inefficient coke capacity

Source:

CRU,

The

Annual

Outlook

for

Metallurgical

Coke

2011;

Companyestimates.

Source: CRU, The Annual Outlook for Metallurgical Coke 2011;

Company estimates. |

17

Coal Expansion

0.35 million tons expected

surface mining

1.15 million tons

expected production from Jewell

underground mines

0.30 million tons HKCC acquisition

Projected 2012 Coal Production

Planned Growth

Current Operations

Underground

Mining

Surface

Mining

Selective

Reserve

Additions

Projected 1.80 million tons in 2012

(A

projected

increase

of

approximately

0.4

million

tons

from

2011

)

+

+

=

106 million tons of proven and

probable reserves

Reserve life of 50+ years

Near

term

focus

on

increasing

productivity

at

existing

mines;

will

defer

opening

new

mines

until

2013

Currently limited to highwall

mining at HKCC

Signed agreement to extract

additional surface tons

–

Expect 1.2 million tons over

3 years beginning in 2012

Acquired Harold Keene Coal

Companies (HKCC) in January

2011

Open to opportunistic

additions of coal reserves

J.P. Morgan Global High Yield & Leveraged Finance Conference

|

18

2012 Priorities

J.P. Morgan Global High Yield & Leveraged Finance Conference

•

Execute the ramp up of Middletown; expect to reach full

production levels in Q2 2012

•

Achieve targeted coke production volumes of 4.0

to 4.2 million

tons •

Continue permitting work for potential new U.S. plant in

anticipation of a market recovery

•

Implement India entry strategy

•

Drive improved productivity at existing mines; mining a

projected 1.8 million tons and positioning segment for future

expansion |

19

Coal Expansion

Coal prices offer attractive growth and

return on capital in our coal mining business

SunCoke’s Mid-Vol. Coal

Contract Prices

$130

$165

2010

2011

2012E

$170 - $190

2012

Estimates

MV

(2)

HV

Thermal

Total

Sales Tons

(1)

1,550k

150k

150k

1,850k

% Committed

88%

27%

40%

79%

Price of

Committed

Tons (per ton)

$177

$130

$81

$171

Estimated Price Range of Uncommitted Tons (per ton)

High

$170

$120

$80

Low

$150

$100

$60

(1)

Includes approximately 50k of purchased coal.

(2)

Includes approximately 200k of 2011 carryover tonnage at $165.

J.P. Morgan Global High Yield & Leveraged Finance Conference

($ per ton) |

20

$141

$74 -

$84

$25 -

$40

$10 -

$15

2011

Adj. EBITDA

Coke

Coal Mining

Corporate

and Other

2012E

Adj. EBITDA

$250 -

$280

$250 -

$280

2012 Adjusted EBITDA

(1)

Outlook

Estimated 2012 Adjusted EBITDA

(1)

projected to increase by $109 million to $139 million over 2011;

expect 80% -

85% of 2012 Adjusted EBITDA

(1, 2)

to be generated by cokemaking business

($ in millions)

(1)

For a definition of Adjusted EBITDA, please see the appendix.

(2)

Excluding corporate costs.

•

Middletown

•

Indiana Harbor

improvement

•

Higher prices and

volumes

J.P. Morgan Global High Yield & Leveraged Finance Conference

|

21

2012 Outlook Summary

Metric

Expected 2012 Outlook

Adjusted EBITDA

(1)

$250 million –

$280 million

Capital Expenditures

& Investments

Approximately $150 million

Free Cash Flow

(2)

$50 million +

Cash Tax Rate

10% –

15%

Effective Tax Rate

20% –

24%

Corporate Costs

$30 million -

$35 million

Coke Production

4.0 -

4.2 million tons

Coal Production

Approximately 1.8 million tons

EPS (at 22% tax rate)

$1.30 -

$1.65

(1) For a definition of Adjusted EBITDA, please see the appendix

(2) For a definition of Free Cash Flow, please see the appendix

J.P. Morgan Global High Yield & Leveraged Finance Conference

|

22

Leverage Ratios

J.P. Morgan Global High Yield & Leveraged Finance Conference

$ in millions

2011

Estimated

2012

(1)

Total Debt

$726

$723

Total Debt / Adj. EBITDA

(2)

5.1x

2.7x

Net Debt

(3)

$598

$545

Net Debt / Adj. EBITDA

(2)

4.2x

2.1x

(1) Estimated

2012

ratios

using

mid-point

of

estimated

2012

Adjusted

EBITDA

guidance

range

of

$250

million

to

$280

million.

(2) For

a

definition

of

Adjusted

EBITDA

and

reconciliation

of

Adjusted

EBITDA

to

net

income

and

operating

income,

please

see

the

appendix.

(3) Net

Debt

represents

Total

Debt

less

cash

balances.

Net

Debt

as

of

12/31/2011

was

calculated

using

Total

Debt

of

$726

million

less

12/31/2011

cash balances of $128 million. Estimated 2012 Net Debt was calculated by

subtracting estimated 2012 Total Debt of $723 million less the sum of our

12/31/2011 cash balances plus our projected 2012 free cash flow of $50 million. Net Debt provides a perspective on the company’s

overall debt position.

Key Leverage Ratios |

23

J.P. Morgan Global High Yield & Leveraged Finance Conference

Strategy for Shareholder Value Creation |

|

25

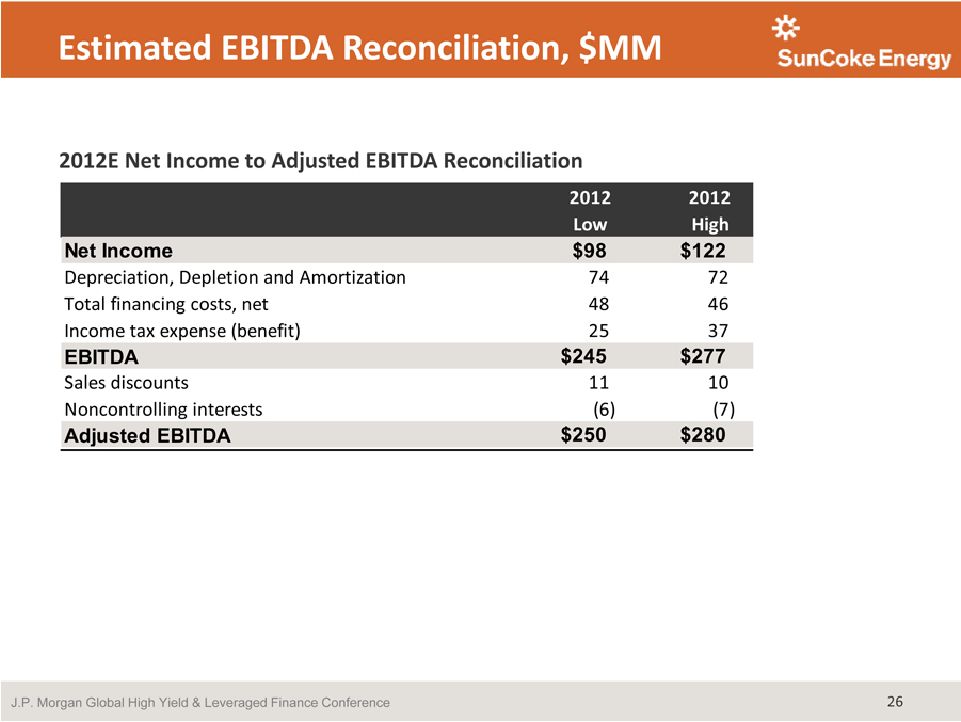

Adjusted

EBITDA

represents

earnings

before

interest,

taxes,

depreciation,

depletion

and

amortization

(“EBITDA”)

adjusted

for

sales discounts and the deduction of income attributable to non-controlling

interests in our Indiana Harbor cokemaking operations. EBITDA

reflects

sales

discounts

included

as

a

reduction

in

sales

and

other

operating

revenue.

The

sales

discounts

represent

the

sharing

with

our

customers

of

a

portion

of

nonconventional

fuels

tax

credits,

which

reduce

our

income

tax

expense.

However,

we

believe that our Adjusted EBITDA would be inappropriately penalized if these

discounts were treated as a reduction of EBITDA since they represent sharing

of a tax benefit which is not included in EBITDA. Accordingly, in computing Adjusted EBITDA, we have

added back these sales discounts. Our Adjusted EBITDA also reflects the deduction

of income attributable to noncontrolling interest in our Indiana Harbor

cokemaking operations. EBITDA and Adjusted EBITDA do not represent and should not be considered

alternatives to net income or operating income under United States generally

accepted accounting principles (GAAP) and may not be comparable to other

similarly titled measures of other businesses. Management believes Adjusted EBITDA is an important

measure of the operating performance of the Company’s assets and is indicative

of the Company’s ability to generate cash from operations.

Free Cash Flow

equals cash from operations less cash used in investing activities less cash

distributions to non-controlling interests.

Management

believes

Free

Cash

Flow

information

enhances

an

investor’s

understanding

of

a

business’

ability

to

generate cash. Free Cash Flow does not represent and should not be considered

an alternative to net income or cash flows from operating activities as

determined under GAAP and may not be comparable to other similarly titled measures of other businesses.

Definitions

J.P. Morgan Global High Yield & Leveraged Finance Conference

|

|

|

|

29

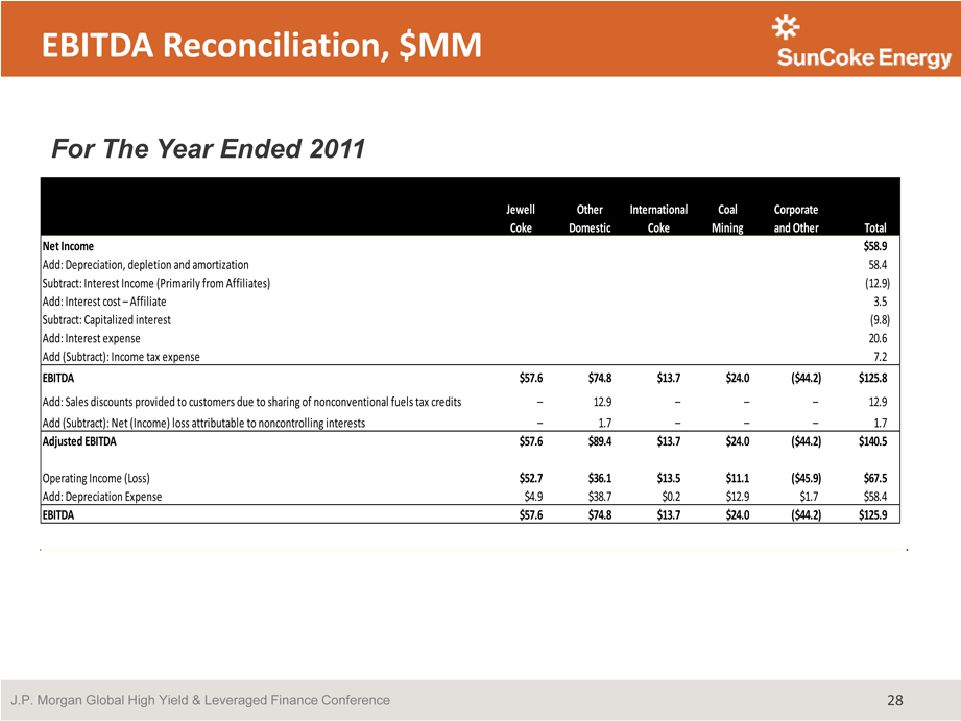

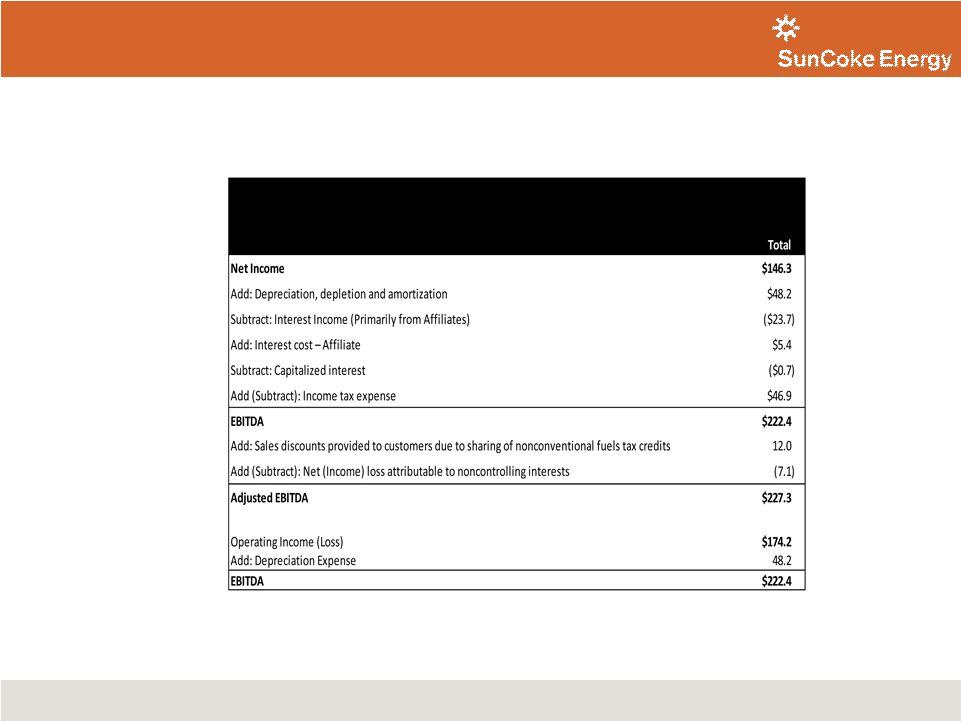

EBITDA Reconciliation, $MM

For The Year Ended 2010

J.P. Morgan Global High Yield & Leveraged Finance Conference

|

|