Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CVR ENERGY INC | d307227d8k.htm |

4

th

Quarter and Full Year 2011

Earnings Report

Exhibit 99.1

February 28, 2012 |

2

Forward-Looking Statements

This presentation should be reviewed in conjunction with CVR Energy, Inc.’s Fourth Quarter

earnings conference call held on February 28, 2012. The following information contains

forward- looking statements based on management’s current expectations and beliefs, as

well as a number of assumptions concerning future events. These statements are subject to

risks, uncertainties, assumptions and other important factors. You are cautioned not to put

undue reliance on such forward-looking statements (including forecasts and projections

regarding our future performance) because actual results may vary materially from those expressed

or implied as a result of various factors, including, but not limited to (i) those set forth under

“Risk Factors” in CVR Energy, Inc.’s Annual Report on Form 10-K, Quarterly

Reports on Form 10-Q and any other filings CVR Energy, Inc. makes with the Securities and

Exchange Commission, and (ii) those set forth under “Risk Factors” in the CVR Partners,

LP annual report on form 10-K, quarterly report on form 10-Q and any other filings

CVR Partners, LP makes with the Securities and Exchange Commission. CVR Energy, Inc. assumes no

obligation to, and expressly disclaims any obligation to, update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise. |

3

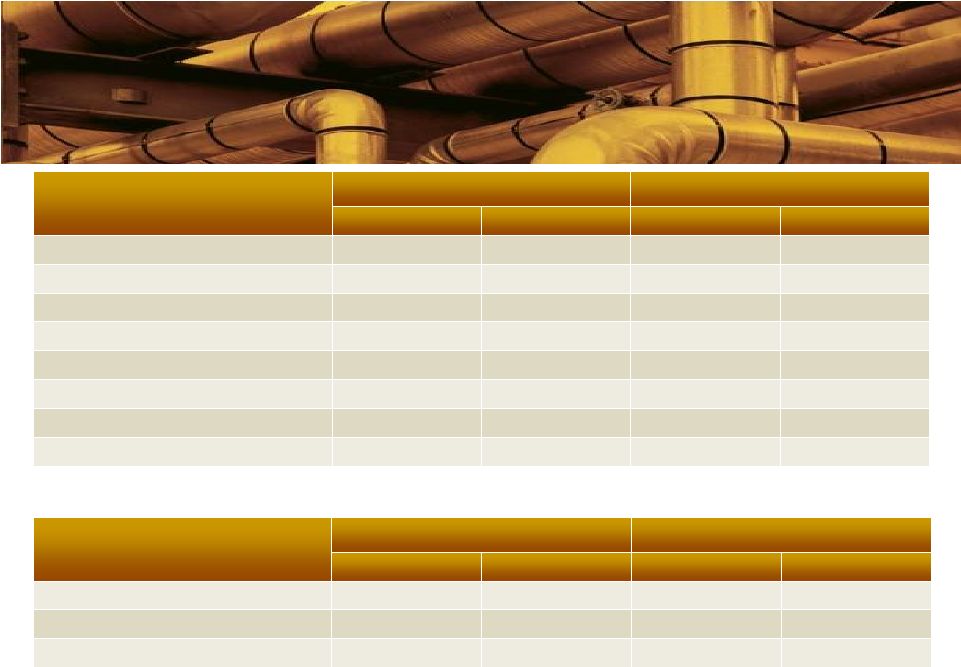

Fourth Quarter

Full Year

(In millions, except for EPS/Distributions)

Q4 2011

Q4 2010

Percent

2011

2010

Percent

Adjusted EBITDA

(1)

$ 80.5

$ 55.8

+ 44%

$ 692.0

$ 192.0

+ 260%

Adjusted Fully Diluted

EPS

(2)

$ 0.34

$ 0.16

+ 113%

$ 3.94

$ 0.47

+ 738%

CVR Partners Adjusted

EBITDA

(3)

$ 48.4

$ 7.5

+ 545%

$ 162.6

$ 52.6

+ 209%

CVR Partners Distributions

$ 0.588

N/A

N/A

$ 1.567

N/A

N/A

Note:

Adjusted EBITDA for the fourth quarter and full year 2011 excludes turnaround

expense of $54m and $66m, respectively (1)

Non-GAAP reconciliation on slide 27

(2)

Non-GAAP reconciliation on slide 28

(3)

Non-GAAP reconciliation on slide 30

Consolidated Results |

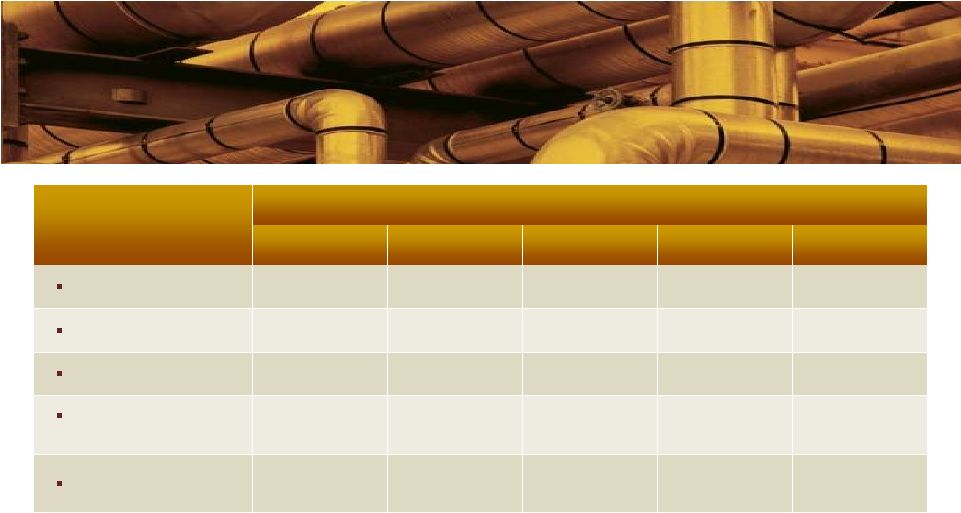

•

Strong earnings and cash flow from both segments

•

Completion of first phase turnaround in Coffeyville

($54m spent in Q4)

•

Completed acquisition of Gary Williams, 70,000 bpd, 9.3

Nelson complexity

•

Set a record for gathered barrels of 37,500+ bpd in one

month in 2011, now gathering 40,000+ bpd

•

Improved Balance Sheet

–

Consolidated cash ending balance of $388m after close of

Wynnewood transaction

–

$237m of cash at CVR Partners

•

UAN quarterly distribution of $0.588 paid on 2/14/2012

•

Corporate rating upgrade to Ba3 from B1

4

Fourth Quarter Highlights |

Market Outlook

•

Brent –

WTI and Canadian crude differentials

recently widened significantly

•

Crack spreads remain well above historic levels

•

Inventory in group expected to normalize by

end of first quarter

•

Fertilizer pricing strong versus historical norms

5

•

Coffeyville Post Turnaround

•

Coffeyville set to run nameplate capacity

until next turnaround

•

Turnaround-related excess inventory to be

monetized by end of second quarter

Operational Highlights

•

Wynnewood Operational Improvements

•

Following temporary downtime in January,

crude throughputs currently at 70k bpd

•

Realizing unit yield improvements in excess

of plan

•

Replacing WTS crude with lower cost

Canadian light sours

Current Outlook |

6

(1) As of 2/22/2012

2010

2011

Q4 2011

Current

Average Differential

$ 0.77

$ 15.89

$ 15.07

$ 16.62

($5)

$0

$5

$10

$15

$20

$25

$30

$35

$40

Feb-10

May-10

Aug-10

Nov-10

Feb-11

May-11

Aug-11

Nov-11

Feb-12

NYMEX 2-1-1 Crack

Brent-WTI Differential

NYMEX 2-1-

1 Crack & Brent

-

WTI Differential

(1)

Market Environment -

Petroleum |

7

Crack Spread vs. Historical Norm

$0

$5

$10

$15

$20

$25

$30

$35

$0

$20

$40

$60

$80

$100

$120

NYMEX CL, $/Bbl

NYMEX 2-1-1 Crack vs NYMEX Crude Oil

Yearly Averages 1997 to 2011

Yrly Avgs

Yrly Avgs Trendline

2012 Daily

Note:

The

trendline

does

not

include

2011 |

8

(1) As of 2/17/2012

2.9

4.5

3.9

2.9

2.0

1.0

1.0

1.0

$23.87

$25.85

$23.19

$20.45

$24.13

$24.56

$23.41

$21.86

$0

$5

$10

$15

$20

$25

$30

0.0

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

5.0

Q1 '12

Q2 '12

Q3 '12

Q4 '12

Q1 '13

Q2 '13

Q3 '13

Q4 '13

Base Level 11/28/2011

As of 12/31/2011

As of 1/31/2012

As of 2/17/2012

Hedged Crack Spread

0.5

Volume Hedged

(1)

Crack Spread Hedging |

9

UAN, Ammonia & Urea Prices

Market

Environment

-

Fertilizer

Source:

Green

Markets |

Financial

Financial |

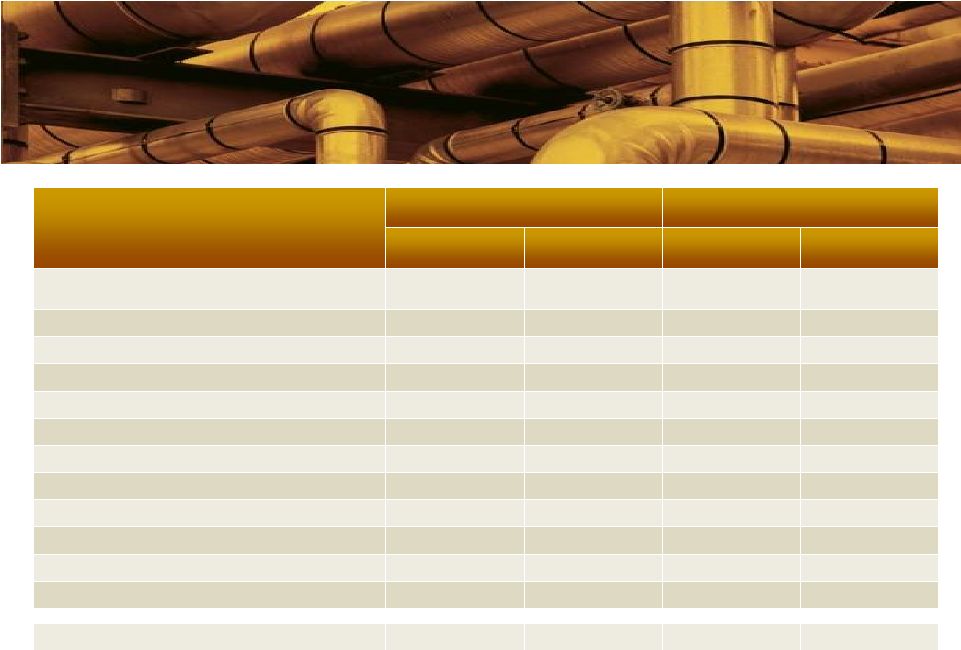

Fourth Quarter

Full Year

(In millions, except for EPS/EPU)

Q4 2011

Q4 2010

2011

2010

Net earnings attributable to

CVR stockholders

$ 65.9

$

2.3 $ 345.8

$ 14.3

Earnings per diluted share

$ 0.76

$ 0.03

$ 3.94

$ 0.16

EBITDA

$ 140.0

$ 47.0

$ 696.2

$ 165.1

Adjusted

EBITDA

(1)

$ 80.5

$ 55.8

$ 692.0

$ 192.0

Adjusted

Fully

diluted

EPS

(2)

$ 0.34

$ 0.16

$ 3.94

$ 0.47

CVR Partners Distributions

$ 0.588

N/A

$ 1.567

N/A

11

Note:

Adjusted EBITDA for the fourth quarter and full year 2011 excludes turnaround

expense of $54m and $66m, respectively (1)

Non-GAAP reconciliation on slide 27

(2)

Non-GAAP reconciliation on slide 28

Financial Results |

(In millions except for

barrels sold data)

Q4 2011

Q3 2011

Q4 2010

Net Sales

$ 979.5

$ 1,284.4

$ 1,109.6

Operating Income

$ (3.3)

$ 179.8

$ 60.4

Adjusted EBITDA

$ 47.6

$ 232.0

$ 51.1

Segment SG&A

$ 11.1

$ 8.6

$ 16.1

Crude Oil Throughput

(barrels per day)

93,705

112,885

116,361

Barrels Sold

(barrels per day)

89,953

114,061

135,478

Refining margin

(per crude oil throughput

barrel)

(1)

$ 11.05

$ 27.55

$ 9.54

Direct Operating Expenses

(per Barrel of Crude

Throughput)

$ 12.03

$ 5.25

$ 3.57

Dir. Op. Ex. (per Barrel of

Crude Throughput) Less:

Turnaround Cost

$ 5.74

$ 4.48

$ 3.51

12

Note:

Adjusted EBITDA for the fourth quarter 2011 excludes turnaround expense of $54m,

and fourth quarter 2011 financial data includes 16 days of Wynnewood operations

(1) Adjusted for FIFO impact

$(3.3)

$34.3

$65.4

$27.5

$8.4

($20)

$0

$20

$40

$60

$80

$100

$120

Q4 2010

Oper.

Inc.

Refining

Margin

Other

(D&A,

FIFO,

SG&A)

Volume

Direct

Oper.

Cost

Q4 2011

Oper.

Inc.

Operating Earnings Bridge

$60.4

Petroleum Segment –

Fourth Quarter |

(In millions except for

barrels sold data)

FY 2011

FY 2010

Net Sales

$ 4,751.8

$ 3,903.8

Operating Income

$ 465.7

$ 104.6

Adjusted EBITDA

$ 580.9

$

154.7 Segment SG&A

$

42.0 Crude Oil

Throughput (barrels per day)

103,702

113,365

Barrels Sold

(barrels per day)

106,397

127,142

Refining margin

(per

crude

oil

throughput

barrel)

(1)

$ 21.12

$

8.07 Direct Operating Expenses (per

Barrel of Crude Throughput)

$

6.54

$

3.70 Dir. Op. Ex. (per Barrel of Crude

Throughput) Less: Turnaround

Cost

$

4.79 13

Note:

Adjusted EBITDA for the full year 2011 excludes turnaround expense of $66m, and

2011 financial data includes 16 days of Wynnewood operations

(1) Adjusted for FIFO impact

$465.7

$54.5

$94.6

$520.0

$104.6

$0

$100

$200

$300

$400

$500

$600

$700

2010

Refining

Margin

Volume

Direct

Oper.

Cost

Other

(D&A,

FIFO,

SG&A)

2011

Operating Earnings Bridge

$9.8

Petroleum Segment –

Full Year

$

41.7

$

3.67 |

(in millions except for tons

sold data)

Q4 2011

Q3 2011

Q4 2010

Net Sales

$ 87.6

$ 77.2

$ 39.4

Operating Income

$ 42.6

$ 37.5

$ (9.7)

Adjusted EBITDA

$ 48.4

$ 43.3

$ 7.5

Segment SG&A

$ 4.6

$ 4.5

$ 11.9

Ammonia Sales (000 tons)

29.3

22.6

49.4

UAN Sales (000 tons)

184.6

179.2

73.8

Ammonia ASP (per ton)

$ 606

$ 568

$ 491

UAN ASP (per ton)

$ 334

$ 294

$

171 Pet Coke Cost (per ton)

$ 42

$ 43

$

8 On-stream Factors

(1)

:

Gasification

Ammonia

UAN

14

(1)

Adjusted for Linde outage

97.6%

97.1%

94.1%

97.0%

98.6%

99.2%

96.5%

95.3%

99.4%

Nitrogen Fertilizer Segment –

Fourth

Quarter

$42.6

$18.4

$(7.7)

$29.8

$4.9

$7.0

$(9.7)

($20)

($10)

$0

$10

$20

$30

$40

$50

Q4 2010

Oper.

Inc.

Aver.

Selling

Price

COGS

Volume

/ Mix

Direct

Oper.

Cost

Other

(D&A,

SG&A)

Q4 2011

Oper.

Inc.

Operating Earnings Bridge |

(in millions except for tons sold

data)

FY 2011

FY 2010

Net Sales

$ 302.9

$ 180.5

Operating Income

$ 136.2

$ 20.4

Adjusted EBITDA

$ 162.6

$ 52.6

Segment SG&A

$ 22.2

$ 20.6

Ammonia Sales (000 tons)

112.8

164.7

UAN Sales (000 tons)

709.3

580.7

Ammonia ASP (per ton)

$ 579

$ 361

UAN ASP (per ton)

$ 284

$

179 Pet Coke Cost (per ton)

$

33

$

17 On-stream Factors

(1)

:

Gasification

99.2%

97.6%

Ammonia

98.0%

96.8%

UAN

95.7%

96.1%

15

(1)

Adjusted for Linde outage

$136.2

$99.2

$(8.2)

$23.2

$0.2

$(1.4)

$20.4

$0

$20

$40

$60

$80

$100

$120

$140

$160

2010

Oper.

Inc.

Aver.

Selling

Price

COGS

Volume

/ Mix

Direct

Oper.

Cost

Other

(D&A,

SG&A)

2011

Oper.

Inc.

Operating Earnings Bridge

Nitrogen Fertilizer Segment –

Full Year |

Capital Summary

Refinery

turnaround

years

16

$0

$100

$200

$300

2010

2011

2012

Nitrogen

Petroleum

Capital Spend Summary

($ in millions)

2010

2011

Estimated 2012

Petroleum

Discretionary

$ 1.6

$ 18.1

$ 24.7

Non-Discretionary

(1)

18.2

50.5

139.9

Other

2.5

1.8

1.7

Total Petroleum

$ 22.3

$ 70.4

$ 166.3

Nitrogen (CVR Partners)

Discretionary

(2)

$ 1.2

$ 12.9

$ 100.1

Non-Discretionary

8.9

6.2

9.7

Other

-

1.7

2.2

Total Nitrogen (CVR Partners)

$ 10.1

$ 20.8

$ 112.0

Total Spending

$ 32.4

$ 91.2

$ 278.3

Note:

The

company

expenses

its

turnarounds,

turnaround

expense

for

2011

is

$66m

and

forecasted

to

be

$32m

in

2012

for

Coffeyville

and

$85m

for

Wynnewood

(1)

Increase of approximately $30m in 2011 vs. 2010 due to sustaining maintenance

capital needs associated with turnaround (2)

Increase in 2011 and 2012 due to work performed on the UAN expansion project.

Project expected to complete by Q1 2013 |

D&A

17

NI

Cash

$200

$379

$90

$630

$586

$49

$99

$176

$388

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

2010 Cash, NI &

D&A

IPO & Net Debt

Issuance

Gary Williams

Acquisition

AP, AR, SBC,

Prepaids &

Other

Cap Ex & Debt

Payments

Inventory

2011 Cash

Cash Flow Waterfall –

2010 to 2011 |

Financial Metrics

2007

2008

2009

2010

2011

Debt to Capital

54%

46%

43%

41%

40%

Debt to Adj.

EBITDA

2.8

2.2

2.4

2.5

1.3

18

Consolidated Net Debt

($ in millions)

Debt Metrics |

Appendix |

To

supplement the actual results in accordance with U.S. generally accepted accounting

principles (GAAP), for the applicable periods, the Company also uses certain

non-GAAP financial measures as discussed below, which are adjusted

for GAAP-based results. The use of non-GAAP adjustments are not in

accordance with or an alternative for GAAP. The adjustments

are

provided

to

enhance

the

overall

understanding

of

the

Company’s

financial

performance for the applicable periods and are also indicators that management

utilizes for planning and forecasting future periods. The non-GAAP

measures utilized by the Company are not necessarily comparable to similarly

titled measures of other companies. The Company believes that

the presentation of non-GAAP financial measures provides useful

information to investors regarding the Company’s financial condition and results of

operations

because

these

measures,

when

used

in

conjunction

with

related

GAAP

financial

measures (i) together provide a more comprehensive view of the Company’s core

operations and ability to generate cash flow, (ii) provide investors with

the financial analytical framework upon which management bases financial and

operational planning decisions, and (iii) presents measurements that

investors and rating agencies have indicated to management are useful to

them in assessing the Company and its results of operations. 20

Non-GAAP Financial Measures |

EBITDA:

EBITDA

represents

net

income

before

the

effect

of

interest

expense,

interest

income,

income

tax

expense

(benefit)

and

depreciation

and

amortization.

EBITDA

is

not

a

calculation

based

upon

GAAP;

however,

the

amounts

included

in

EBITDA

are

derived

from

amounts

included

in

the

consolidated

statement of operations of the Company. Adjusted EBITDA by operating segment

results from operating income by segment adjusted for items that the company

believes are needed in order to evaluate results in a more comparative

analysis from period to period. Additional adjustments to EBITDA include major

scheduled turnaround expense, the impact of the Company’s use of accounting

for its inventory under first-in, first-out (FIFO), net realized

gains/losses on derivative activities, share-based compensation expense,

loss on extinguishment of debt, and other income (expense). Adjusted EBITDA is not a

recognized term under GAAP and should not be substituted for operating income or

net income as a measure of performance but should be utilized as a

supplemental measure of financial performance in evaluating our

business. First-in,

first-out

(FIFO):

The

Company’s

basis

for

determining

inventory

value

on

a

GAAP

basis.

Changes in crude oil prices can cause fluctuations in the inventory valuation of

our crude oil, work in process and finished goods, thereby resulting in

favorable FIFO impacts when crude oil prices increase and unfavorable FIFO

impacts when crude oil prices decrease. The FIFO impact is calculated based

upon inventory values at the beginning of the accounting period and at the end of

the accounting period. 21

Non-GAAP Financial Measures |

Refining margin :

Refining margin per crude oil throughput barrel is a measurement calculated as the

difference

between

net

sales

and

cost

of

product

sold

(exclusive

of

depreciation

and

amortization).

Refining margin is a non-GAAP measure that we believe is important to investors

in evaluating our refinery’s performance as a general indication of the

amount above our cost of product sold that we are able to sell refined

products. Each of the components used in this calculation (net sales and cost of

product

sold

(exclusive

of

depreciation

and

amortization))

are

taken

directly

from

our

Condensed

Statement

of

Operations.

Our

calculation

of

refining

margin

may

differ

from

similar

calculations

of

other

companies in our industry, thereby limiting its usefulness as a comparative

measure. In order to derive the refining margin per crude oil throughput

barrel, we utilize the total dollar figures for refining margin as derived

above and divide by the applicable number of crude oil throughput barrels for the period. We

believe that refining margin and refining margin per crude oil throughput barrel is

important to enable investors to better understand and evaluate our ongoing

operating results and allow for greater transparency

in

the

review

of

our

overall

financial,

operational

and

economic

performance.

22

Non-GAAP Financial Measures |

Refining

margin

per

crude

oil

throughput

barrel

adjusted

for

FIFO

:

Refining

margin

per

crude

oil

throughput barrel adjusted for FIFO impact is a measurement calculated as the

difference between net sales and cost of product sold (exclusive of

depreciation and amortization) adjusted for FIFO impacts. Under our FIFO

accounting method, changes in crude oil prices can cause fluctuations in the inventory

valuation of our crude oil, work in process and finished goods, thereby resulting

in favorable FIFO impacts when

crude

oil

prices

increase

and

unfavorable

FIFO

impacts

when

crude

oil

prices

decrease.

Refining

margin adjusted for FIFO impact is a non-GAAP measure that we believe is

important to investors in evaluating our refinery’s performance as a

general indication of the amount above our cost of product sold

(taking

into

account

the

impact

of

our

utilization

of

FIFO)

that

we

are

able

to

sell

refined

products.

Our

calculation of refining margin adjusted for FIFO impact may differ from

calculations of other companies in our industry, thereby limiting its

usefulness as a comparative measure 23

Non-GAAP Financial Measures |

Nitrogen Fertilizer Segment

($ per ton)

Fourth Quarter

Full Year

Q4 2011

Q4 2010

2011

2010

UAN / Ton (Sales)

$ 334

$ 171

$ 284

$ 179

Ammonia / Ton (Sales)

606

491

579

361

Pet Coke / Ton (Cost of Sales)

$ 42

$ 8

$ 33

$

17 Petroleum Segment

($ per crude oil throughput barrel)

Fourth Quarter

Full Year

Q4 2011

Q4 2010

2011

2010

NYMEX 2-1-1

$ 23.49

$ 11.01

$ 26.33

$ 10.07

Purchased crude discount

1.92

4.12

3.95

3.31

Group 3 basis

0.05

(0.65)

0.44

(0.06)

Liquid Volume yield loss

(5.34)

(4.65)

(5.50)

(4.07)

Yield

structure

difference

(1)

(7.05)

(1.90)

(4.22)

(2.23)

Other

cost

of

product

sold

(2)

(1.62)

(0.27)

(1.25)

(0.35)

Other

(0.40)

1.88

1.37

1.40

Refining margin (adj. for FIFO impact)

$ 11.05

$ 9.54

$ 21.12

$ 8.07

2011 financials do not include 16 days of Wynnewood operations

(1)

Impact of our refinery producing other products in addition to gasoline and

distillate. (2)

Includes cost such as RINS, sulfur credits, ethanol, transportation,

hydrogen. 24

Note:

CVI Performance |

Financials

($ in millions)

Full Year

2007

2008

2009

2010

2011

Cash

$ 30.5

$ 8.9

$ 36.9

$ 200.0

$ 388.3

Long Term Debt

500.8

495.9

491.3

476.9

853.9

Net Debt

470.3

486.9

454.4

276.9

475.5

CVR Stockholder’s

Equity

432.7

579.5

653.8

689.6

1,151.6

Adjusted EBITDA

(1)(2)

$ 139.0

$ 218.1

$ 206.8

$ 192.0

$ 692.0

Note:

2011 includes debt related to acquisition of Gary Williams but only 16 days of

EBITDA contribution (1)

Adjusted for FIFO, turnaround expense, SBC, financing costs and gains/losses on

derivatives, asset dispositions, loss on extinguishment of debt, Gary Williams

(2)

Non-GAAP reconciliation on slide 26

25

Capital Structure

acquisition and integration costs, and bridge loan expenses

|

Financials

($ in millions)

Full Year

2007

2008

2009

2010

2011

Consolidated net income (loss) attributable to CVR Energy

$ (67.6)

$ 163.9

$ 69.4

$ 14.3

$ 345.8

Interest expense, net of interest income

60.0

37.6

42.5

48.1

55.3

Depreciation and amortization

68.4

82.2

84.9

86.8

90.3

Income tax expense (benefit)

(88.5)

63.9

29.2

13.8

209.5

EBITDA adjustments included in NCI

-

-

-

-

(5.3)

FIFO impact (favorable) unfavorable

(69.9)

102.5

(67.9)

(31.7)

(25.6)

Goodwill impairment

-

42.8

-

-

-

Unrealized (gain)/loss on all derivatives

113.5

(247.9)

37.8

(0.6)

(85.3)

Share-based compensation

44.1

(42.5)

8.8

37.2

27.2

Loss on disposal of fixed asset

1.3

2.3

-

2.7

2.5

Loss on extinguishment of debt

1.3

10.0

2.1

16.6

2.1

Major scheduled turnaround

76.4

3.3

-

4.8

66.4

Expenses related to Gary Williams acquisition

-

-

-

-

9.1

Adjusted EBITDA

$ 139.0

$ 218.1

$ 206.8

$ 192.0

$ 692.0

26

Consolidated

Non-GAAP Financial Measures |

Financials

($ in millions)

Fourth Quarter

Full Year

12/31/2011

12/31/2010

12/31/2011

12/31/2010

Consolidated net income (loss) attributable to

CVR Energy

$

65.9

$

2.3

$

345.8

$

14.3

Interest expense, net of interest income

14.7

13.1

55.3

48.1

Depreciation and amortization

24.2

22.0

90.3

86.8

Income tax expense (benefit)

37.1

9.0

209.5

13.8

EBITDA adjustments included in NCI

(1.9)

-

(5.3)

-

FIFO impact (favorable) unfavorable

(31.7)

Unrealized (gain)/loss on all derivatives

(92.1)

2.9

(85.3)

(0.6)

Share-based compensation

3.5

28.9

27.2

37.2

Loss on disposal of fixed asset

1.0

1.4

2.5

2.7

Loss on extinguishment of debt

-

1.6

2.1

16.6

Major scheduled turnaround

54.1

4.2

66.4

4.8

Expenses related to Gary Williams acquisition

9.1

-

9.1

-

Adjusted EBITDA

$

80.5

$

55.8

$

692.0

$

192.0

27

Consolidated

Non-GAAP Financial Measures

(29.6)

(35.1)

(25.6) |

Financials

(1)

($ in millions)

Fourth Quarter

Full Year

12/31/2011

12/31/2010

12/31/2011

12/31/2010

Consolidated net income (loss) attributable to

CVR Energy

65.9

2.3

345.8

14.3

FIFO impact (favorable) unfavorable

(21.3)

(17.8)

(15.5)

(19.1)

Share-based compensation

2.1

23.4

18.6

30.1

Loss on extinguishment of debt

-

1.0

1.3

10.0

Loss on disposition of assets

0.6

0.8

1.5

1.6

Major scheduled turnaround

32.8

2.5

40.2

2.9

Unrealized (gain)/loss on derivatives

(55.8)

1.8

(51.7)

1.3

Expenses associated with the acquisition of

Gary-Williams

5.2

-

5.5

-

Adjusted Net Income

29.5

14.0

345.7

41.1

Adjusted Net Income per diluted share

0.34

0.16

3.94

0.47

28

(1)

All adjustments net of tax

Consolidated

Non-GAAP Financial Measures

$

$

$

$

$

$

$

$

$

$

$

$ |

Financials

($ in millions)

Quarter

Year Ended

12/31/2011

09/30/2011

12/31/2010

12/31/2011

12/31/2010

Operating income

$ (3.3)

$ 183.5

$ 60.4

$ 465.7

$ 104.6

FIFO impact (favorable), unfavorable

(35.1)

4.1

(29.6)

(25.6)

(31.7)

Share-based compensation

0.7

0.5

9.1

8.7

11.5

Loss on disposal of fixed assets

1.0

1.5

-

2.5

1.3

Major scheduled turnaround expense

54.1

1.1

0.7

66.4

1.2

Realized gain (loss) on derivatives, net

11.1

0.5

(6.4)

(7.2)

0.7

Depreciation and amortization

19.0

17.0

16.9

69.9

66.4

Other income (expense)

0.1

0.2

-

0.5

0.7

Adjusted EBITDA

$ 47.6

$ 208.4

$ 51.1

$ 580.9

$ 154.7

29

Petroleum

Non-GAAP Financial Measures |

Financials

($ in millions)

Quarter

Full Year

12/31/2011

9/30/2011

12/31/2010

12/31/2011

12/31/2010

Operating income

$ 42.6

$ 37.5

$ (9.7)

$ 136.2

$ 20.4

Depreciation and amortization

4.9

4.7

4.6

18.9

18.5

Other income (expense)

-

0.2

-

0.2

(0.2)

Share-based compensation

0.9

0.9

7.7

7.3

9.0

Loss on disposition of assets

-

-

1.4

-

1.4

Major scheduled turnaround expense

-

-

3.5

-

3.5

Adjusted EBITDA

$ 48.4

$ 43.3

$ 7.5

$ 162.6

$ 52.6

30

Fertilizer

Non-GAAP Financial Measures |