Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - SMITH MICRO SOFTWARE, INC. | Financial_Report.xls |

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - SMITH MICRO SOFTWARE, INC. | d282708dex231.htm |

| EX-21.1 - SUBSIDIARIES - SMITH MICRO SOFTWARE, INC. | d282708dex211.htm |

| EX-31.1 - CERTIFICATION OF THE CHIEF EXECUTIVE OFFICER - SMITH MICRO SOFTWARE, INC. | d282708dex311.htm |

| EX-32.1 - CERTIFICATIONS OF THE CHIEF EXECUTIVE OFFICER AND THE CHIEF FINANCIAL OFFICER - SMITH MICRO SOFTWARE, INC. | d282708dex321.htm |

| EX-31.2 - CERTIFICATION OF THE CHIEF FINANCIAL OFFICER - SMITH MICRO SOFTWARE, INC. | d282708dex312.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 0-26536

SMITH MICRO SOFTWARE, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 33-0029027 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |

| 51 Columbia, Aliso Viejo, CA | 92656 | |

| (Address of principal executive offices) | (Zip Code) | |

|

Registrant’s telephone number, including area code: (949) 362-5800 | ||

| Common Stock, $.001 par value (Title of each class) |

The NASDAQ Stock Market LLC (NASDAQ Global Market) | |

| (Name of each exchange on which registered) | ||

Securities registered pursuant to Section 12(b) of the Act: Common Stock, $.001 par value

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YES[ ] NO [ X ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 YES [ ] NO [X ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES [X] NO [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K [X]

Indicate by check mark if whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer [ ] |

Accelerated filer [X] | |||

| Non-accelerated filer [ ] |

(Do not check if a smaller reporting company) | Smaller reporting company [ ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES[ ] NO [ X ]

As of June 30, 2011, the last business day of the registrant’s most recently completed second quarter, the aggregate market value of the common stock of the registrant held by non-affiliates was $135,417,808 based upon the closing sale price of such stock as reported on the Nasdaq Global Market on that date. For purposes of such calculation, only executive officers, board members, and beneficial owners of more than 10% of the registrant’s outstanding common stock are deemed to be affiliates.

As of February 13, 2012, there were 35,591,810 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for the 2012 Annual Meeting of Stockholders to be filed under the Securities Exchange Act of 1934 are incorporated by reference in Part III of this report.

Table of Contents

SMITH MICRO SOFTWARE, INC.

2011 ANNUAL REPORT ON FORM 10-K

2

Table of Contents

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

In this document, the terms “Smith Micro,” “Company,” “we,” “us,” and “our” refer to Smith Micro Software, Inc. and, where appropriate, its subsidiaries.

This report contains forward-looking statements regarding Smith Micro which include, but are not limited to, statements concerning projected revenues, expenses, gross profit and income, the competitive factors affecting our business, market acceptance of products, customer concentration, the success and timing of new product introductions and the protection of our intellectual property. These forward-looking statements are based on our current expectations, estimates and projections about our industry, management’s beliefs, and certain assumptions made by us. Words such as “anticipates,” “expects,” “intends,” “plans,” “predicts,” “potential,” “believes,” “seeks,” “estimates,” “should,” “may,” “will” and variations of these words or similar expressions are intended to identify forward-looking statements. Forward-looking statements also include the assumptions underlying or relating to any of the foregoing statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict. Therefore, our actual results could differ materially and adversely from those expressed or implied in any forward-looking statements as a result of various factors. Such factors include, but are not limited to, the following:

| • | changes in demand for our products from our customers and their end-users; |

| • | our ability to predict consumer needs, introduce new products, gain broad market acceptance for such products and ramp up manufacturing in a timely manner; |

| • | our business and stock price may decline further which could cause an additional impairment of long-lived assets or restructuring charge resulting in a material adverse effect on our financial condition and results of operations; |

| • | the intensity of the competition and our ability to successfully compete; |

| • | the pace at which the market for new products develop; |

| • | the response of competitors, many of whom are bigger and better financed than us; |

| • | our ability to protect our intellectual property and our ability to not infringe on the rights of others; |

| • | our ability to successfully execute our business plan and control costs and expenses; |

| • | the continued economic slowdown and uncertainty and its effects on capital expenditures by our customers and their end users; |

| • | the amount of our legal expenses and our financial exposure to any adverse judgments or settlements associated with the outstanding securities litigation, and any future litigation that may arise, and the adequacy of our insurance policy coverage regarding those expenses and any damages or settlement payments related to such litigation; and |

| • | those additional factors which are listed under the section “1A. Risk Factors” beginning on page 10 of this report. |

The forward-looking statements contained in this report are made on the basis of the views and assumptions of management regarding future events and business performance as of the date this report is filed with the Securities and Exchange Commission (the “SEC”). We do not undertake any obligation to update these statements to reflect events or circumstances occurring after the date this report is filed.

3

Table of Contents

General

Smith Micro Software, Inc. provides software and services that simplify, secure and enhance the mobile experience. The Company’s portfolio of wireless solutions includes a wide range of client and server applications that manage voice, data, video and connectivity over mobile broadband networks. Our primary customers are the world’s leading mobile network operators, mobile device manufacturers and enterprise businesses. In addition to our wireless and mobility software, Smith Micro offers personal productivity and graphics products distributed through a variety of consumer channels worldwide.

The proliferation of mobile broadband technology continues to provide new opportunities for Smith Micro on a global basis. Over the last decade, the Company has developed extensive expertise in embedded software for networked devices (both wireless and wired), and we have leveraged that expertise to solve an unending tide of connectivity and mobile service challenges for our customers. As network operators and businesses struggle to reduce costs and complexity in a market that is characterized by rapid evolution and fragmentation, Smith Micro answers with innovative solutions that increase reliability, security, performance, efficiency, and usability of wireless services over a wide variety of networks and device platforms.

The underlying philosophy driving our products and services is our desire to improve the user experience and optimize resources for our customers. These objectives are delivered through the combination of rigorous market analysis and planning, technology innovation that leverages substantial intellectual property, leadership in industry standards, quality engineering, and extensive commercial deployment experience gained over 30 years. As technology, market dynamics and consumer demands change, Smith Micro has proven its ability to evolve and meet those demands again and again.

During fiscal year 2011, we experienced a significant decrease in our revenues. This was primarily due to the introduction and market acceptance of mobile hotspot devices, Tablets and Smartphones capable of functioning as a WWAN hotspot, resulting in lower demand in our North American marketplace for our core connection management products. While we launched new wireless products that addressed this technology shift, they are new to the market and their rate of adoption and deployment is unknown at this time causing material uncertainty regarding the timing of our future wireless revenues.

As a result of our decreased revenues, slow adoption of our new products, operating losses and depressed stock prices, we recorded a goodwill and other long-lived asset impairment charge of $112.9 million in fiscal year 2011. All goodwill and intangible assets have been written off as of December 31, 2011.

We were incorporated in California in November 1983, and we reincorporated in Delaware in June 1995. Our principal executive offices are located at 51 Columbia, Aliso Viejo, California 92656. Our telephone number is (949) 362-5800. Our website address is www.smithmicro.com. We make our SEC filings available on the Investor Relations page of our website. Information contained on our website is not part of this Annual Report on Form 10-K.

Business Segments

Our operations are organized into two business segments: Wireless and Productivity & Graphics. We do not separately allocate operating expenses, nor do we allocate specific assets to these groups. Therefore, segment information reported includes only revenues and cost of revenues. See Note 7 of Notes to Consolidated Financial Statements for financial information related to our business segments and geographical information.

4

Table of Contents

Wireless

Smith Micro’s primary focus is to develop mobile connectivity and communications management solutions for the wireless industry. Rapid advancements in wireless technology, including higher speed networks, new intelligent connected devices and increasing availability of digital content and mobile applications, are fueling the mobile broadband market. The demand for pervasive connectivity is being driven by an insatiable consumer need to access information and digital entertainment anytime and from anywhere. In addition, there is an evolving variety of media being consumed “on-demand” from Smartphones and Tablets, as well as new devices being used to connect to wireless networks, such as USB modems and mobile hotspots. Wireless data access services for multimedia-enabled devices are being adopted at such a fast pace that global infrastructure for wireless networks cannot support them without significant investments to support higher speeds and greater capacity.

In helping global customers manage this complex wireless ecosystem, we consistently observe four key needs of network operators to:

| • | Simplify mobile connectivity to reduce support costs and increase stickiness of mobile subscribers; |

| • | Optimize network and device resources for maximum performance and efficiency; |

| • | Enable a safe, productive wireless environment that meets enterprise standards for security and control; and |

| • | Engage and maintain relevance to end users in response to business threats from device makers, internet giants like Google and Facebook, and the explosion of over-the-top application and content providers. |

Developing software that enables wireless operators to achieve these goals represents the primary market opportunity for Smith Micro, and we are well-equipped to capitalize on it.

Our flagship broadband connectivity solution, QuickLink® Mobile, has been shipped on more than 100 million devices worldwide. This patented technology allows mobile users to easily connect a PC, laptop or other wireless device to wireless wide area networks (“WWANs”) and wireless local area networks (“WLANs”) or Wi-Fi hotspots. Many of the world’s largest wireless service providers, including AT&T, Bell Canada, Bouygues, Cablevision, Clear, Comcast, Orange, Sprint, T-Mobile USA, Verizon Wireless, Vodafone and others, use QuickLink Mobile to provide a convenient and secure mobile connection for subscribers using wireless services over carrier, public, and private WWAN, WLAN and Wi-Fi networks.

In 2011, Smith Micro announced several new solutions that extend our core connectivity technology to solve new problems and offer more value to mobile operators and consumers. For example, Experience Manager™, QuickLink Hotspot Manager™ and Mobile Network Director™ are all components of our mobile Experience Platform™, designed to enhance the user experience and optimize network resources through an integrated set of client and server applications.

Experience Manager enables end-users to manage their broadband connections and data plans in a consistent way across different devices and networks, while providing convenient access to new mobile services offered by the operator or other content and service providers. For wireless operators, Experience Manager helps to reduce support costs and improve customer satisfaction by simplifying broadband usage for end-users, while leveraging device real estate to promote operator and partner services that increase average revenue per user (“ARPU”). It can be deployed as a host-less client, leveraging our SODA™ (Secure On-Device API) interface technology on mobile connectivity devices such as USB modems and

5

Table of Contents

mobile hotspot “pucks,” or as a rich application running on Windows and Mac computers to further engage end users. QuickLink Hotspot Manager extends Experience Manager to provide greater control over the use and sharing of mobile hotspot devices, including Smartphones used as mobile hotspots and dedicated mobile hotspots.

Mobile Network Director helps mobile operators alleviate data traffic congestion from mobile devices and enables seamless network transitions and data offloading between networks (3G/4G/Wi-Fi). It gives mobile operators greater visibility and more precise control – on a per device basis – over bandwidth usage across their own networks, as well as public, business and home Wi-Fi networks, in order to optimize network resources. Using Mobile Network Director, subscribers are automatically connected to – and transparently moved between – the best networks available, improving connection speed and reliability, and potentially saving billions in capital outlays for operators.

As part of the Experience Platform, Smith Micro continues to provide solutions that enhance mobile communications. These include Push-to-Talk, Visual Voicemail with Voice-to-Text services, Vidio™ for efficient transcoding and adaptive video streaming, and Vidio XTP™ for extending Telepresence capabilities to mobile devices. This portfolio of premium end-user applications includes mobile handset software, as well as hosted software-as-a-service solutions for operators and media content owners. These products work across a broad range of operating systems and platforms, allowing operators to further monetize voice and data services. Smith Micro also provides device management software to leading device manufacturers such as HTC and Nokia, as well as wireless mobility solutions designed to address security and mobility needs of large enterprises.

Productivity & Graphics

The Productivity & Graphics Group focuses on developing a variety of software for the consumer, prosumer, and professional markets. Our solutions span compression, graphics and utilities. This group also republishes and markets third party software titles that complement our existing line of products. All of these products are available through direct sales on the Smith Micro websites (smithmicro.com, mysmithmicro.com and contentparadise.com), on affiliate websites, direct through customer service order desks, on-line resellers and through traditional retail outlets.

The group’s primary product offering is its line of graphic titles, in particular Poser®, Anime Studio® and Manga Studio™. These products are aimed at digital artists of all skill levels helping them to produce professional level animations, comics, and other 2D and 3D art. Poser is the industry leading tool for 3D human figure design and animation. Anime Studio is used by both hobbyists and professional artists working for high-end animation studios like Disney, and Manga Studio is at the top of the market for comic illustration software, used by famous graphic novelists such as Dave Gibbons, the author of the Watchmen. The group is focused on pursuing adjacent markets to these graphic arts, as well as new platforms for the existing titles, such as iOS.

The secondary product line is StuffIt®, driven by its patented and patent-pending image compression, with a focus on our innovative “lossless” JPEG compression technology. StuffIt provides superior lossless compression, encryption and archiving. We have enhanced this industry-leading product’s feature set with new, online file transfer capabilities.

6

Table of Contents

Products and Services

Our primary products consist of the following:

| Product Groups | Products | Description | ||

| Wireless | QuickLink® Mobile | Connection management application to control, customize and automate wireless connections from PCs and Macs to WWAN and WLAN/Wi-Fi networks | ||

| QuickLink® Mobility | A mobile VPN and connection management solution targeted to enterprises with mobile workforces | |||

| Experience Manager™ | A management application for simplifying and enhancing mobile broadband usage for consumers | |||

| QuickLink Hotspot Manager™ | Granular controls for the use and sharing of mobile hotspot features on Smartphones and wireless pucks | |||

| Mobile Network Director™ | Intelligent traffic management for data offload and seamless network transitions between 3G/4G/Wi-Fi | |||

| Device Management Suite | Provides automated mobile device provisioning and configuration | |||

| Push-To-Talk | A data service that uses a mobile Internet connection to send and receive “walkie-talkie” style calls | |||

| Visual Voicemail and Voice –to–Text | Voicemail delivered directly to a mobile phone and stored in a visual inbox, with optional voice to text transcription | |||

| Vidio™ and Vidio XTP™ | Adaptive streaming of video content, as well as extension of Telepresence video streams to personal computers, Tablets and mobile devices | |||

| Productivity & Graphics | StuffIt Deluxe® | Patented, lossless compression solution for documents and media | ||

| Poser® | A solution for creating 3D character art and animations | |||

| Anime Studio™ | An animation tool for professionals and digital artists | |||

| Manga Studio™ | A solution for creating manga and comic art |

Marketing and Sales Strategy

Our primary marketing focus is on enhancing the mobile broadband experience and optimizing network resources through our mobile Experience Platform for wireless operators. Because of our broad product portfolio and deep device integration experience, we are able to leverage innovation across a wide range of platforms and operating systems and quickly bring to market solutions that meet the evolving needs of our target customers. We continue to develop innovative, enabling technology and infrastructure products that facilitate the usage of wireless data and other premium mobile services, thereby providing our customers with additional revenue opportunities and differentiated services that encourage customer loyalty.

Our sales strategy is as follows:

Leverage Carrier and OEM Relationships. We continue to capitalize on our strong relationships with the world’s leading wireless carriers and mobile device manufacturers. Our carrier customers serve as our primary distribution channel, providing access to hundreds of millions of end-users around the world, and also providing market feedback for future product offerings.

Focus on Multiple High-Growth Markets. We continue to focus on wireless connectivity and communications management. Within these markets, we see ongoing enhancement of networks and services by wireless carriers and an increasing availability of rich media and multi-media enabled Smartphones and Tablet computers. This represents a remarkable alignment between our product portfolio and the market opportunity.

Expand our Customer Base. In addition to introducing new products to current customers, we intend to grow our domestic and international business through sales of our portfolio of products to new carrier customers, as well as into new vertical markets such as hospitality, public safety and education.

Selectively Pursue Partnerships and Acquisitions of Complementary Products and Services. In line with the Company’s strategy, we will continue to pursue selected partnerships and acquisition opportunities in an effort to expand our product and technological abilities, enter complementary markets and extend our

7

Table of Contents

geographic reach. In the past, we have used acquisitions to enhance our technology features and customer base, and to extend our product offerings into new markets. We will leverage partnerships with technology providers and systems integrators to further our penetration into new markets and deliver more comprehensive solutions to our customers.

Revenues to three customers (Sprint, Verizon Wireless and AT&T) and their respective affiliates in the Wireless business segment accounted for 24.8%, 18.4% and 11.7%, respectively, of the Company’s total revenues for the fiscal year 2011. In 2010, our three largest customers (Verizon Wireless, Sprint and AT&T) accounted for 40.1%, 13.9% and 12.3%, respectively, of our total revenues. In 2009, our four largest customers (Verizon Wireless, Dell, Sprint and AT&T) accounted for 32.8%, 12.2%, 10.4% and 10.3%, respectively, of our total revenues. Our major customers could reduce their orders of our products in favor of a competitor’s product or for any other reason. The loss of any of our major customers or decisions by a significant customer to substantially reduce purchases could have a material adverse effect on our business.

Sales to Verizon Wireless and their affiliates amounted to 18.4%, 40.1%, and 32.8% of the Company’s revenues for fiscal years 2011, 2010 and 2009, respectively. We have a master software and license distribution agreement with Verizon Wireless whereby Smith Micro grants them non-exclusive licenses to reproduce and have produced, market, and distribute the software, in object form only, to distributors, re-sellers, OEM customers of Verizon Wireless and end users. The license term for end users continues in perpetuity unless otherwise stated in subsequent amendments. The master agreement commenced in December 2000 and has been consistently extended through subsequent amendments. They can cancel the agreement at any time. Products and services sold to Verizon include per unit license fees for connectivity and security and VZAccess manager software, engineering design and development fees, customization and adaptation fees and website hosting. The master agreement and subsequent amendments are detailed in Exhibit 10.4 in this document.

Customer Service and Technical Support

We provide technical support and customer service through our online knowledge base, via email, live chat and by telephone. OEM customers generally provide their own primary customer support functions and rely on us for support to their own technical support personnel.

Product Development

The software industry, particularly the wireless market, is characterized by rapid and frequent changes in technology and user needs. We work closely with industry groups and customers, both current and potential, to help us anticipate changes in technology and determine future customer needs. Software functionality depends upon the capabilities of the hardware. Accordingly, we maintain engineering relationships with various hardware manufacturers and we develop our software in tandem with their product development. Our engineering relationships with manufacturers, as well as with our major customers, are central to our product development efforts. We remain focused on the development and expansion of our technology, particularly in the wireless space. Research and development expenditures amounted to $41.7 million, $42.8 million, and $36.5 million for the years ended December 31, 2011, 2010 and 2009, respectively.

Manufacturing

Although we primarily deliver our software via electronic downloads, we do deliver our software in several other forms. We offer a package or kit that may include CD-ROM(s) and certain other documentation or marketing material. We also permit selected OEM customers to duplicate our products on their own CD-ROM’s, USB devices, or embedded devices, and pay a royalty based on usage. Some OEM business requires that we provide a CD, which includes a soft copy of a user guide. Finally, we grant licenses to

8

Table of Contents

certain OEM customers that enable those customers to preload a copy of our software onto a personal computer. With the enterprise sales program, we offer site licenses under which a corporate user is allowed to distribute copies of the software to users within their corporate sites.

Our product development group produces a product master for each product that is then duplicated and packaged into products by the manufacturing organization. All product components are purchased by our personnel in our Aliso Viejo, California facility. Our manufacturing is subcontracted to outside vendors and includes the replication of CD-ROM’s and the printing of documentation materials. Assembly of the final package is completed by our Aliso Viejo, California facility.

Competition

The markets in which we operate are highly competitive and subject to rapid changes in technology. These conditions create new opportunities for Smith Micro, as well as for our historical connection management competitors, and we expect new competitors to enter the market. We also believe that competition from established and emerging software companies will continue to intensify as the emerging mobile, wireless and Internet markets evolve. We compete with other software vendors for new customer contracts, as well as in our efforts to acquire technology and qualified personnel.

We believe that the principal competitive factors affecting the mobile software market include domain expertise, product features, usability, quality, price, customer service and effective sales and marketing efforts. Although we believe that our products currently compete favorably with respect to these factors, there can be no assurance that we can maintain our competitive position against current and potential competitors. We believe that the market for our software products has been and will continue to be characterized by significant price competition. A material reduction in the price of our products could negatively affect our profitability.

Many existing and potential OEM customers have technological capabilities to develop products that compete directly with our products. These customers may discontinue the purchase of our products. Our future performance is substantially dependent upon the extent to which existing OEM customers elect to purchase communications software from us rather than design and develop their own software. Because our customers are not contractually obligated to purchase any of our products, they may cease to rely, or fail to expand their reliance on us as a source for communications software in the future.

Proprietary Rights and Licenses

Our success and ability to compete is dependent upon our software code base, our programming methodologies and other intellectual properties. To protect our proprietary technology and intellectual property, we rely on a combination of trade secrets, nondisclosure agreements, patents, copyright and trademark law that may afford only limited protection. As of December 31, 2011, we owned 46 issued U.S. patents and have 61 U.S. patent applications that are currently pending. These patents are intended to provide generalized protection of our intellectual property technology base and we will continue to apply for various patents and trademarks in the future as we deem necessary to protect our intellectual property technology base.

We seek to avoid unauthorized use and disclosure of our proprietary intellectual property by requiring employees and consultants with access to our proprietary information to execute confidentiality agreements with us and by restricting access to our source code. The deterrent steps that we have taken to protect our proprietary technology may not be adequate to deter misappropriation of our proprietary information or prevent the successful assertion of any adverse claim against us relating to software or intellectual property utilized by us. In addition, we may not be able to detect unauthorized use of our intellectual property rights or take effective steps to enforce those rights.

9

Table of Contents

In selling our products, we primarily rely on “shrink wrap” licenses that are not signed by licensees and may be unenforceable under the laws of certain jurisdictions. In addition, the laws of some foreign countries do not protect our proprietary rights to as great an extent as do the laws of the United States. Accordingly, the means we use currently to protect and enforce all of our proprietary rights and intellectual property rights may not be adequate. Moreover, our competitors may independently develop competitive technology similar to ours. We also license technology on a non-exclusive basis from several companies for inclusion in our products and anticipate that we will continue to do so in the future. If we are unable to continue to license these technologies or to license other necessary technologies for inclusion in our products, or such third party technologies become subject to claims directed to or against the third party technologies used by us, or if we experience substantial increases in royalty payments under these third party licenses, our business could be materially and adversely affected.

Employees

As of December 31, 2011, we had a total of 410 employees within the following departments: 259 in engineering, 79 in sales and marketing, 36 in management and administration and 36 in operations and customer support. We are not subject to any collective bargaining agreement and we believe that our relationships with our employees are good.

Our future operating results are highly uncertain. Before deciding to invest in our common stock or to maintain or increase your investment, you should carefully consider the risks described below, in addition to the other information contained in this report and in our other filings with the SEC, including our reports on Forms 10-K, 10-Q and 8-K. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business operations. If any of these risks actually occur, that could seriously harm our business, financial condition or results of operations. In that event, the market price for our common stock could decline and you may lose all or part of your investment.

Our revenues currently depend on a small number of products and customers, so our revenue and operating results are vulnerable to shifts in demand and may continue to decline.

A substantial majority of our revenue is derived from sales of our wireless connectivity and security software products. Revenues from sales of our core connection management product have recently declined and may continue to decline in future quarters due to shifts in technology, particularly the inclusion of connectivity in the operating system of new devices and decline in sales of USB hardware by wireless carriers. We have developed new products which address these shifts in technology, but currently have not realized any revenues from these products. There can be no guarantee that our revenues will stabilize or increase in future years.

In addition, our strategy is to continue to introduce and market new products, but these efforts are not likely to reduce the extent to which our revenues are dependent on a small number of products. Rapid shifts in the markets for these products and consumer habits, changes in demand by end-users and changes in underlying technology could cause material and rapid changes in our revenues and profitability. Factors which could affect demand for our products include the rate of adoption of the 4G networking standard by wireless carriers and handset manufacturers, and changes in consumer demand for PC networking due to the adoption of Smartphones and Tablet computing. If our products fail to remain current with and useful to new and emerging markets, our business, financial condition and results of operations would be materially and adversely affected.

10

Table of Contents

We also derive a significant portion of our revenues from a few vertical markets, such as wireless carriers and handset manufacturers. In order to sustain and grow our business, we must continue to sell our software products into these vertical markets. Shifts in the dynamics of these vertical markets, such as new product introductions by our competitors, could materially harm our results of operations, financial condition and prospects. To increase our sales outside our core vertical markets, for example to large enterprises, requires us to devote time and resources to hire and train sales employees familiar with those industries. Even if we are successful in hiring and training sales teams, customers in other vertical markets may not need or sufficiently value our current products or new product introductions.

In addition, because we sell primarily to large carriers and OEMs, there are a limited number of actual and potential customers for our products, resulting in customer concentration for sales of our products and services. For the year ended December 31, 2011, Sprint, Verizon Wireless, and AT&T comprised of 24.8%, 18.4% and 11.7% of our total revenues, respectively. Because of our customer concentration, our largest customers may have significant pricing power over us. Furthermore, a substantial decrease in sales to any of our largest customers could materially affect our revenues and profitability. Additionally, these customers are not the end-users of our products. If any of these customers’ efforts to market their products which incorporate our software are unsuccessful in the marketplace, our revenues and profitability could be adversely affected.

Our quarterly revenues and operating results are difficult to predict and could fall below analyst or investor expectations, which could cause the price of our common stock to fall.

Our quarterly revenues and operating results have fluctuated significantly in the past and may continue to vary from quarter to quarter due to a number of factors, many of which are not within our control. If our operating results do not meet the expectations of securities analysts or investors, our stock price may decline. Fluctuations in our operating results may be due to a number of factors, including the following:

| • | the gain or loss of a key customer; |

| • | the size and timing of orders from and shipments to our major customers; |

| • | the size and timing of any product return requests; |

| • | our ability to maintain or increase gross margins; |

| • | variations in our sales channels or the mix of our product sales; |

| • | our ability to anticipate market needs and to identify, develop, complete, introduce, market and produce new products and technologies in a timely manner to address those needs; |

| • | the availability and pricing of competing products and technologies and the resulting effect on sales and pricing of our products; |

| • | acquisitions; |

| • | the effect of new and emerging technologies; |

| • | the timing of acceptance of new mobile services by users of our customers’ services; |

| • | deferrals of orders by our customers in anticipation of new products, applications, product enhancements or operating systems; and |

| • | general economic and market conditions. |

We have difficulty predicting the volume and timing of orders. In any given quarter, our sales have involved, and we expect will continue to involve, large financial commitments from a relatively small number of customers. As a result, the cancellation or deferral of even a small number of orders would reduce our revenues, which would adversely affect our quarterly financial performance. Also, we have often booked a large amount of our sales in the last month of the quarter and often in the last week of that month. Accordingly, delays in the closing of sales near the end of a quarter could cause quarterly revenues to fall substantially short of anticipated levels. Significant sales may also occur earlier than expected, which could cause operating results for later quarters to compare unfavorably with operating results from earlier quarters.

Future orders may come from new customers, or from existing customers for new products. The sales cycles may be greater than what we have experienced in the past, increasing the difficulty to predict quarterly revenues.

11

Table of Contents

Because we sell primarily to large carriers and OEM customers, we have no direct relationship with most end-users of our products. This indirect relationship delays feedback and blurs signals of change in the quick-to-evolve wireless ecosystem, and is one of the reasons we have difficulty predicting demand.

A large portion of our operating expenses, including rent, depreciation and amortization is fixed and difficult to reduce or change. Accordingly, if our total revenue does not meet our expectations, we may not be able to adjust our expenses quickly enough to compensate for the shortfall in revenue. In that event, our business, financial condition and results of operations would be materially and adversely affected.

Due to all of the foregoing factors, and the other risks discussed in this report, you should not rely on quarter-to-quarter comparisons of our operating results as an indication of future performance.

We may have further impairments of long-lived assets if our business does not improve and our stock price declines which could cause a material adverse effect on our financial condition and results of operations.

The Company assesses potential impairment to its long-lived assets as required by FASB ASC Topic No. 360, Property, Plant, and Equipment, when there is evidence that events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. An impairment loss is recognized when the carrying amount of the long-lived assets exceeds the sum of the undiscounted cash flows expected to result from the use and eventual disposition of the asset. Any required impairment loss is measured as the amount by which the carrying amount of a long-lived asset exceeds its fair value and is recorded as a reduction in the carrying value of the related asset and a charge to operating results. For the year ended December 31, 2011, we recorded a charge for impairment of long-lived assets of $18.7 million ($13.4 million on intangible assets and $5.3 million on fixed assets) due, in part, to continued declines in our revenues and profitability and our continued depressed stock price. In future years, we may be required to take further charges for impairment of fixed assets, which could have a material adverse effect on our financial condition and results of operations.

Competition within our target markets is intense and includes numerous established competitors and new entrants, which could negatively affect our revenues and results of operations.

We operate in markets that are extremely competitive and subject to rapid changes in technology. A number of established software and hardware companies, such as Microsoft Corporation, Google Inc. and Apple Inc. pose a significant competitive threat to us because their handset operating systems and phones may include some capabilities now provided by certain of our OEM and retail software products. If handset manufacturers and carriers are satisfied relying on the capabilities of systems using Windows, Android or iPhone OS, or other hardware or operating systems, sales of our products are likely to decline. In addition, because there are low barriers to entry into the software markets in which we participate and may participate in the future, we expect significant competition to continue from both established and emerging software companies in the future, both domestic and international. In fact, our growth opportunities in new product markets could be limited to the extent established and emerging software companies enter or have entered those markets. Furthermore, our existing and potential OEM customers may acquire or develop products that compete directly with our products.

Many of our other current and prospective competitors have significantly greater financial, marketing, service, support, technical and other resources than we do. As a result, they may be able to adapt more quickly than we can to new or emerging technologies and changes in customer requirements or to devote greater resources to the promotion and sale of their products. Announcements of competing products by competitors could result in the cancellation of orders by customers in anticipation of the introduction of such new products. In addition, some of our competitors are currently making complementary products that are sold separately. Such competitors could decide to enhance their competitive position by bundling their products to attract customers seeking integrated, cost-effective software applications. Some competitors have a retail emphasis and offer OEM products with a reduced set of features. The opportunity

12

Table of Contents

for retail upgrade sales may induce these and other competitors to make OEM products available at their own cost or even at a loss. We also expect competition to increase as a result of software industry consolidations, which may lead to the creation of additional large and well-financed competitors. Increased competition is likely to result in price reductions, fewer customer orders, reduced margins and loss of market share.

Technology and customer needs change rapidly in our market, which could render our products obsolete and negatively affect our business, financial condition and results of operations.

Our success depends on our ability to anticipate and adapt to changes in technology and industry standards. We will also need to continue to develop and introduce new and enhanced products to meet our target markets’ changing demands, keep up with evolving industry standards, including changes in the Microsoft and Google operating systems with which our products are designed to be compatible, and to promote those products successfully. The communications and utilities software markets in which we operate are characterized by rapid technological change, changing customer needs, frequent new product introductions, evolving industry standards and short product life cycles. Any of these factors could render our existing products obsolete and unmarketable. In addition, new products and product enhancements can require long development and testing periods as a result of the complexities inherent in today’s computing environments and the performance demanded by customers and called for by evolving wireless networking technologies. If our target markets do not develop as we anticipate, our products do not gain widespread acceptance in these markets, or we are unable to develop new versions of our software products that can operate on future wireless networks and PC and mobile device operating systems and interoperate with other popular applications, our business, financial condition and results of operations could be materially and adversely affected.

We are entering new, emerging markets in which we have limited experience; if these markets do not develop or we are unable to otherwise succeed in them, our revenues will suffer and the price of our common stock will likely decline.

Our recent and planned product introductions to support new higher speed networking and 4G technologies such as HSPA+, LTE and WiMAX network protocols have allowed us to enter new markets. A viable market for these products may not develop or be sustainable, and we may face intense competition in these markets. In addition, our success in these markets depends on our carrier customers’ ability to successfully introduce new mobile services enabled by our products and our ability to broaden our carrier customer base, which we believe will be difficult and time-consuming. If the expected benefits from entering new markets do not materialize, our revenues will suffer and the price of our common stock would likely decline. In addition, to the extent we enter new markets through acquisitions of companies or technologies, our financial condition could be harmed or our stockholders could suffer dilution without a corresponding benefit to our company if we do not realize expected benefits of entering such new markets.

If the adoption of and investments in new technologies and services grows more slowly than anticipated in our product planning and development, our operating results, financial condition and prospects may be negatively affected.

If the adoption of and investments in new networking and 4G technologies and services does not grow or grows more slowly than anticipated, we will not obtain the anticipated returns from our planning and development investments. For example, our Device Management Suite of products allows our customers to update mobile devices from a home office and incorporates technology that provides a mechanism to allow for efficient firmware updates for mobile devices. In addition, we have introduced new high-speed networking and 4G products, but the pace of the market introduction of such technologies is uncertain. Future sales and any future profits from these and related products are substantially dependent upon the acceptance and use of these new technologies, and on the continued adoption and use of mobile data services by end-users.

13

Table of Contents

Many of our customers and other communications service providers have made and continue to make major investments in next generation networks that are intended to support more complex applications. If communications service providers delay their deployment of networks or fail to deploy such networks successfully, demand for our products could decline, which would adversely affect our revenues. Also, to the extent we devote substantial resources and incur significant expenses to enable our products to be interoperable with new networks that have failed or have been delayed or not deployed, our operating results, financial condition and prospects may be negatively affected.

If we are unable to retain key personnel, the loss of their services could materially and adversely affect our business, financial condition and results of operations.

Our future performance depends in significant part upon the continued service of our senior management and other key technical and consulting personnel. We do not have employment agreements with our key employees that govern the length of their service. The loss of the services of our key employees would materially and adversely affect our business, financial condition and results of operations. Our future success also depends on our ability to continue to attract, retain and motivate qualified personnel, particularly highly skilled engineers involved in the ongoing research and development required to develop and enhance our products. Competition for these employees remains high and employee retention is a common problem in our industry. Our inability to attract and retain the highly trained technical personnel that are essential to our product development, marketing, service and support teams may limit the rate at which we can generate revenue, develop new products or product enhancements and generally would have an adverse effect on our business, financial condition and results of operations.

If we fail to continue to establish and maintain strategic relationships with mobile device manufacturers, market acceptance of our products and our profitability may suffer.

Most of our strategic relationships with mobile device manufacturers are not subject to written contract, but rather are in the form of informal working relationships. We believe these relationships are valuable to our success. In particular, these relationships provide us with insights into product development and emerging technologies, which allows us to keep abreast of, or anticipate, market trends and helps us serve our current and prospective customers. Because these relationships are not typically governed by written agreements, there is no obligation for many of our partners to continue working with us. If we are unable to maintain our existing strategic relationships with mobile device manufacturers or if we fail to enter into additional strategic relationships or the parties with whom we have strategic relationships favor one of our competitors, our ability to provide products that meet our current and prospective customers’ needs could be compromised and our reputation and future revenue prospects could suffer. For example, if our software does not function well with a popular mobile device because we have not maintained a relationship with its manufacturer, carriers seeking to provide that device to their respective customers could choose a competitor’s software over ours or develop their own. Even if we succeed in establishing these relationships, they may not result in additional customers or revenues.

Our growth depends in part on our customers’ ability and willingness to promote services and attract and retain new customers or achieve other goals outside of our control.

We sell our products for use on handheld devices primarily through our carrier customers. Losing the support of these customers may limit our ability to compete in existing and potential markets and could negatively affect our revenues. In addition, the success of these customers and their ability and willingness to market services supported by our products is critical to our future success. Our ability to generate revenues from sales of our software is also constrained by our carrier customers’ ability to attract and retain customers. We have no input into or influence upon their marketing efforts and sales and customer retention activities. If our large carrier customers fail to maintain or grow demand for their services, revenues or revenue growth from our products designed for use on mobile devices will decline and our results of operations will suffer.

14

Table of Contents

Our operating results may be adversely impacted by the continued worldwide economic slowdown and uncertainties in the marketplace.

Since the second half of 2008, economic conditions worldwide and in the United States have experienced a general deterioration, resulting in slower economic activity and a highly uncertain recovery, decreased consumer confidence and retail spending, reduced corporate profits and capital spending, and generally adverse business conditions. These conditions make it difficult for our wireless carrier and OEM customers and their end users to accurately forecast and plan future business activities and capital expenditures, which could cause them to slow spending on our products and services. Furthermore, during challenging economic times our customers may face issues gaining timely access to sufficient credit, which could result in an impairment of their ability to make timely payments to us. We cannot predict the timing, strength or duration of the current economic slowdown or the emerging economic recovery, or to what extent they will continue to affect us. If the economy, consumer spending or the markets in which we operate continue at their present levels or deteriorate, we may need to record charges related to restructuring costs and the impairment of long-lived assets, and our business, financial condition and results of operations will likely be materially and adversely affected.

Acquisitions of companies or technologies may disrupt our business and divert management attention and cause our current operations to suffer.

We have historically made targeted acquisitions of smaller companies with important technology and expect to continue to do so in the future. As part of any acquisition, we will be required to assimilate the operations, products and personnel of the acquired businesses and train, retain and motivate key personnel from the acquired businesses. We may not be able to maintain uniform standards, controls, procedures and policies if we fail in these efforts. Similarly, acquisitions may cause disruptions in our operations and divert management’s attention from our company’s day-to-day operations, which could impair our relationships with our current employees, customers and strategic partners. Acquisitions may also subject us to liabilities and risks that are not known or identifiable at the time of the acquisition.

We may also have to incur debt or issue equity securities in order to finance future acquisitions. Our financial condition could be harmed to the extent we incur substantial debt or use significant amounts of our cash resources in acquisitions. The issuance of equity securities for any acquisition could be substantially dilutive to our existing stockholders. In addition, we expect our profitability could be adversely affected because of acquisition-related accounting costs, write offs, amortization expenses, and charges related to acquired intangible assets. In consummating acquisitions, we are also subject to risks of entering geographic and business markets in which we have had limited or no prior experience. If we are unable to fully integrate acquired businesses, products or technologies within existing operations, we may not receive the intended benefits of acquisitions.

Our operating income or loss may continue to change due to shifts in our sales mix and increased spending on our research and development and infrastructure.

Our operating income or loss can change quarter to quarter and year to year due to a change in our sales mix and the timing of our continued investments in research and development and infrastructure. We continue to invest in research and development which is the lifeline of our technology portfolio. In addition we continue to invest in our infrastructure with a new engineering design and data center in Pittsburgh, Pennsylvania. The timing of these additional expenses can vary significantly quarter to quarter and even from year to year.

Our products may contain undetected software defects, which could negatively affect our revenues.

Our software products are complex and may contain undetected defects. In the past, we have discovered software defects in certain of our products and have experienced delayed or lost revenues during the period it took to correct these problems. Although we and our OEM customers test our products, it is possible that errors may be found or occur in our new or existing products after we have commenced commercial

15

Table of Contents

shipment of those products. Defects, whether actual or perceived, could result in adverse publicity, loss of revenues, product returns, a delay in market acceptance of our products, loss of competitive position or claims against us by customers. Any such problems could be costly to remedy and could cause interruptions, delays, or cessation of our product sales, which could cause us to lose existing or prospective customers and could negatively affect our results of operations. In addition, some of our software contains open source components that are licensed under the GNU General Public License and similar open source licenses. These components may contain undetected defects or incompatibilities, may cause us to lose control over the development of portions of our software code, and may expose us to claims of infringement if these components are, or incorporate, infringing materials, the licenses are not enforceable or are modified to become incompatible with other open source licenses, or exposure to misappropriation claims if these components include unauthorized materials from a third party.

Regulations affecting our customers and us and future regulations, to which they or we may become subject to, may harm our business.

Certain of our customers in the communications industry are subject to regulation by the Federal Communications Commission, which could have an indirect effect on our business. In addition, the United States telecommunications industry has been subject to continuing deregulation since 1984. We cannot predict when, or upon what terms and conditions, further regulation or deregulation might occur or the effect regulation or deregulation may have on demand for our products from customers in the communications industry. Demand for our products may be indirectly affected by regulations imposed upon potential users of those products, which may increase our costs and expenses.

We may be unable to adequately protect our intellectual property and other proprietary rights, which could negatively impact our revenues.

Our success is dependent upon our software code base, our programming methodologies and other intellectual properties and proprietary rights. In order to protect our proprietary technology, we rely on a combination of trade secrets, nondisclosure agreements, patents, and copyright and trademark law. We currently own U.S. trademark registrations for certain of our trademarks and U.S. patents for certain of our technologies. However, these measures afford us only limited protection. Furthermore, we rely primarily on “shrink wrap” licenses that are not signed by the end user and, therefore, may be unenforceable under the laws of certain jurisdictions. Accordingly, it is possible that third parties may copy or otherwise obtain our rights without our authorization. It is also possible that third parties may independently develop technologies similar to ours. It may be difficult for us to detect unauthorized use of our intellectual property and proprietary rights.

We may be subject to claims of intellectual property infringement as the number of trademarks, patents, copyrights and other intellectual property rights asserted by companies in our industry grows and the coverage of these patents and other rights and the functionality of software products increasingly overlap. From time to time, we have received communications from third parties asserting that our trade name or features, content, or trademarks of certain of our products infringe upon intellectual property rights held by such third parties. We have also received correspondence from third parties separately asserting that our products may infringe on certain patents held by each of the parties. Although we are not aware that any of our products infringe on the proprietary rights of others, third parties may claim infringement by us with respect to our current or future products. Additionally, our customer agreements require that we indemnify our customers for infringement claims made by third parties involving our intellectual property embedded in their products. Infringement claims, whether with or without merit, could result in time-consuming and costly litigation, divert the attention of our management, cause product shipment delays or require us to enter into royalty or licensing agreements with third parties. If we are required to enter into royalty or licensing agreements, they may not be on terms that are acceptable to us. Unfavorable royalty or licensing agreements could seriously impair our ability to market our products.

16

Table of Contents

We may raise additional capital through the issuance of additional equity or convertible debt securities or by borrowing money, in order to meet our capital needs. Additional funds may not be available on terms acceptable to us to allow us to meet our capital needs.

We believe that the cash and cash equivalents and short-term investments on hand and the cash we expect to generate from operations will be sufficient to meet our capital needs for at least the next twelve months. However, it is possible that we may need or choose to obtain additional financing to fund our activities in the future. We could raise these funds by selling more stock to the public or to selected investors, or by borrowing money. We may not be able to obtain additional funds on favorable terms, or at all. If adequate funds are not available, we may be required to curtail our operations or other business activities significantly or to obtain funds through arrangements with strategic partners or others that may require us to relinquish rights to certain technologies or potential markets.

We have on file with the SEC a shelf Form S-3 to sell from time to time up to 4,000,000 shares of our common stock in one or more offerings in amounts, at prices and on the terms that we will determine at the time of offering. In addition, we have on file with the SEC a shelf Form S-4 to sell from time to time up to 1,000,000 shares of our common stock in connection with our future acquisitions of other businesses, assets or securities. If we raise additional funds by issuing additional equity or convertible debt securities (whether in a public offering or private placement), the ownership percentages of existing stockholders would be reduced. In addition, the equity or debt securities that we issue may have rights, preferences or privileges senior to those of the holders of our common stock. We currently have no established line of credit or other business borrowing facility in place.

It is possible that our future capital requirements may vary materially from those now planned. The amount of capital that we will need in the future will depend on many factors, including:

| • | the market acceptance of our products; |

| • | the levels of promotion and advertising that will be required to launch our products and achieve and maintain a competitive position in the marketplace; |

| • | our business, product, capital expenditure and research and development plans and product and technology roadmaps; |

| • | the levels of inventory and accounts receivable that we maintain; |

| • | capital improvements to new and existing facilities; |

| • | technological advances; |

| • | our competitors’ response to our products; and |

| • | our relationships with suppliers and customers. |

In addition, we may raise additional capital to accommodate planned growth, hiring, infrastructure and facility needs or to consummate acquisitions of other businesses, products or technologies.

We risk being delisted from NASDAQ if our stock trades below $1.00 per share.

Our stock is currently trading above $1.00 per share. However, if our stock price were to drop below $1.00 per share and remain below $1.00 per share for an extended period of time, we would be in violation of the continued listing requirements of the NASDAQ Global Market (“NASDAQ”) and would risk delisting of our shares from NASDAQ. If our common stock were delisted from NASDAQ, this could have a number of negative consequences, including reduced liquidity of our common stock, the loss of federal preemption of state securities laws, potential loss of confidence by suppliers, customers and employees, loss of additional analyst coverage and institutional investor interest, and more difficulty in raising capital on favorable terms, if at all.

If our market capitalization remains below $50 million for an extended period of time, additional investment analysts who follow our stock may drop their coverage of the Company, which could reduce interest in our stock by institutional investors and reduce liquidity of our shares.

17

Table of Contents

Our business, financial condition and operating results could be adversely affected as a result of legal, business and economic risks specific to international operations.

In recent years, our revenues derived from sales to customers outside the U.S. have not been material. Our revenues derived from such sales can vary from quarter to quarter and from year to year. We also frequently ship products to our domestic customers’ international manufacturing divisions and subcontractors. In the future, we may expand these international business activities. International operations are subject to many inherent risks, including:

| • | general political, social and economic instability; |

| • | trade restrictions; |

| • | the imposition of governmental controls; |

| • | exposure to different legal standards, particularly with respect to intellectual property; |

| • | burdens of complying with a variety of foreign laws; |

| • | import and export license requirements and restrictions of the United States and any other country in which we operate; |

| • | unexpected changes in regulatory requirements; |

| • | foreign technical standards; |

| • | changes in tariffs; |

| • | difficulties in staffing and managing international operations; |

| • | difficulties in securing and servicing international customers; |

| • | difficulties in collecting receivables from foreign entities; |

| • | fluctuations in currency exchange rates and any imposition of currency exchange controls; and |

| • | potentially adverse tax consequences. |

These conditions may increase our cost of doing business. Moreover, as our customers are adversely affected by these conditions, our business with them may be disrupted and our results of operations could be adversely affected.

We have been named as a party to a purported class action and shareholder derivative lawsuit and we may be named in additional litigation, all of which could require significant management time and attention and result in significant legal expenses. An unfavorable outcome in one or more of these lawsuits could have a material adverse effect on our business, financial condition, results of operations and cash flows.

On June 29, 2011, a complaint was filed in the U.S. District Court for the Central District of California against us and certain of our current and past officers and directors on behalf of certain purchasers of our common stock. The complaint has been brought as a purported stockholder class action, and, in general, includes allegations that we and certain of our officers and directors violated federal securities laws by making materially false and misleading statements regarding our business prospects and financial results, thereby artificially inflating the price of our common stock. The plaintiff is seeking unspecified monetary damages and other relief. On August 29, 2011, two prospective lead plaintiffs filed motions for appointment of lead plaintiff and for appointment of lead counsel. On October 17, 2011, the court appointed the two prospective lead plaintiffs as co-lead plaintiffs and their respective counsel as co-lead counsel. On December 15, 2011, the co-lead plaintiffs filed their consolidated amended complaint. On February 14, 2012, we filed our motion to dismiss the consolidated amended complaint. A hearing on the motion to dismiss has been set for May 21, 2012. We intend to vigorously defend against the claims advanced.

On August 11, 2011, a shareholder derivative complaint was filed in the Superior Court of California for the County of Orange against the Company’s directors and certain of its executive officers. Thereafter, two additional similar complaints, also styled as shareholder derivative actions, were filed in state court (collectively, the “State Derivative Actions”). On December 23, 2011, one of the plaintiffs in the State Derivative Actions filed a motion to consolidate the State Derivative Actions and to appoint lead counsel.

18

Table of Contents

A hearing on the pending motion has been set for March 1, 2012. We expect the state court to consolidate the State Derivative Actions and to appoint lead counsel, and we expect plaintiffs to thereafter file an amended shareholder derivative complaint. On September 12, 2011, a shareholder derivative complaint was filed in the U.S. District Court for the Central District of California against certain of the officers and directors named in the State Derivative Actions but also against additional officers of the Company. Thereafter, two additional similar complaints, also styled as shareholder derivative actions, were filed in federal court (collectively, the “Federal Derivative Actions”). On December 6, 2011, the federal court consolidated two of the Federal Derivative Actions and appointed co-lead counsel for plaintiffs, and we expect the federal court to issue an order consolidating all of the Federal Derivative Actions. On January 27, 2012, plaintiffs filed their amended shareholder derivative complaint. Collectively, the State Derivative Actions and the Federal Derivative Actions are referred to as the “Derivative Actions.” The shareholder derivative complaints in the Derivative Actions allege breaches of fiduciary duties by the defendants and other violations of state law. In general, the complaints in the Derivative Actions allege that the Company’s directors and certain of its officers caused or allowed for the dissemination of materially false and misleading statements regarding our business prospects and financial results, thereby artificially inflating the price of our common stock. Plaintiffs in the Derivative Actions seek unspecified monetary damages and other relief, including reforms and improvements to the Company’s corporate governance and internal procedures. We intend to vigorously defend against the claims advanced in the Derivative Actions, and intend to file demurrers and/or motion(s) to dismiss the shareholder derivative complaints in the Derivative Actions.

Regardless of the merits, the expense of defending such litigation may have a substantial impact if our insurance carriers fail to cover the cost of the litigation, and the time required to defend the actions could divert management’s attention from the day-to-day operations of our business, which could adversely affect our business, results of operations and cash flows. In addition, an unfavorable outcome in such litigation could have a material adverse effect on our business, results of operations and cash flows.

Item 1B. UNRESOLVED STAFF COMMENTS

None.

Our corporate headquarters, including our principal administrative, sales and marketing, customer support and research and development facility, is located in Aliso Viejo, California, where we currently lease and occupy approximately 52,700 square feet of space pursuant to leases that expire on May 31, 2016 and January 31, 2022.

We lease approximately 55,600 square feet in Pittsburgh, Pennsylvania under a lease that expires December 31, 2021. We lease approximately 21,000 square feet in Mountain View, California under a lease that expires February 28, 2014. We lease approximately 15,300 square feet in Watsonville, California under a lease that expires September 30, 2018.

Internationally, we lease space in Belgrade, Serbia and Vancouver, Canada. These leases expire in 2012 and 2016.

On June 29, 2011, a complaint was filed in the U.S. District Court for the Central District of California against us and certain of our current and past officers and directors on behalf of certain purchasers of our common stock. The complaint has been brought as a purported stockholder class action, and, in general, includes allegations that we and certain of our officers and directors violated federal securities laws by

19

Table of Contents

making materially false and misleading statements regarding our business prospects and financial results, thereby artificially inflating the price of our common stock. The plaintiff is seeking unspecified monetary damages and other relief. On August 29, 2011, two prospective lead plaintiffs filed motions for appointment of lead plaintiff and for appointment of lead counsel. On October 17, 2011, the court appointed the two prospective lead plaintiffs as co-lead plaintiffs and their respective counsel as co-lead counsel. On December 15, 2011, the co-lead plaintiffs filed their consolidated amended complaint. On February 14, 2012, we filed our motion to dismiss the consolidated amended complaint. A hearing on the motion to dismiss has been set for May 21, 2012. We intend to vigorously defend against the claims advanced.

On August 11, 2011, a shareholder derivative complaint was filed in the Superior Court of California for the County of Orange against the Company’s directors and certain of its executive officers. Thereafter, two additional similar complaints, also styled as shareholder derivative actions, were filed in state court (collectively, the “State Derivative Actions”). On December 23, 2011, one of the plaintiffs in the State Derivative Actions filed a motion to consolidate the State Derivative Actions and to appoint lead counsel. A hearing on the pending motion has been set for March 1, 2012. We expect the state court to consolidate the State Derivative Actions and to appoint lead counsel, and we expect plaintiffs to thereafter file an amended shareholder derivative complaint. On September 12, 2011, a shareholder derivative complaint was filed in the U.S. District Court for the Central District of California against certain of the officers and directors named in the State Derivative Actions but also against additional officers of the Company. Thereafter, two additional similar complaints, also styled as shareholder derivative actions, were filed in federal court (collectively, the “Federal Derivative Actions”). On December 6, 2011, the federal court consolidated two of the Federal Derivative Actions and appointed co-lead counsel for plaintiffs, and we expect the federal court to issue an order consolidating all of the Federal Derivative Actions. On January 27, 2012, plaintiffs filed their amended shareholder derivative complaint. Collectively, the State Derivative Actions and the Federal Derivative Actions are referred to as the “Derivative Actions.” The shareholder derivative complaints in the Derivative Actions allege breaches of fiduciary duties by the defendants and other violations of state law. In general, the complaints in the Derivative Actions allege that the Company’s directors and certain of its officers caused or allowed for the dissemination of materially false and misleading statements regarding our business prospects and financial results, thereby artificially inflating the price of our common stock. Plaintiffs in the Derivative Actions seek unspecified monetary damages and other relief, including reforms and improvements to the Company’s corporate governance and internal procedures. We intend to vigorously defend against the claims advanced in the Derivative Actions, and intend to file demurrers and/or motion(s) to dismiss the shareholder derivative complaints in the Derivative Actions.

Regardless of the merits, the expense of defending such litigation may have a substantial impact if our insurance carriers fail to cover the cost of the litigation, and the time required to defend the actions could divert management’s attention from the day-to-day operations of our business, which could adversely affect our business, results of operations and cash flows. In addition, an unfavorable outcome in such litigation could have a material adverse effect on our business, results of operations and cash flows.

20

Table of Contents

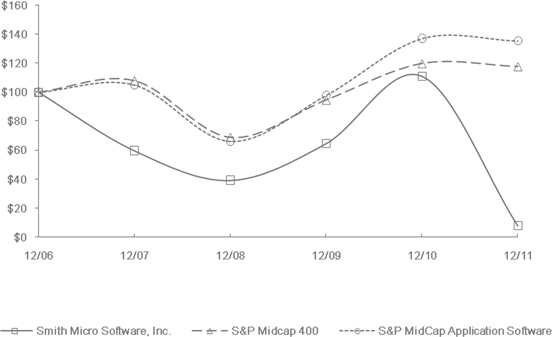

Item 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information