Attached files

| file | filename |

|---|---|

| EX-99.1 - REPORT OF INDEPENDENT PETROLEUM ENGINEERS - Luca Technologies Inc | d196595dex991.htm |

| EX-23.2 - CONSENT OF ERNST & YOUNG LLP - Luca Technologies Inc | d196595dex232.htm |

| EX-23.3 - CONSENT OF RYDER SCOTT COMPANY, L.P. - Luca Technologies Inc | d196595dex233.htm |

Table of Contents

As filed with the Securities and Exchange Commission on February 24, 2012

Registration Statement No. 333-175211

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 5 to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

LUCA TECHNOLOGIES INC.

(Exact name of registrant as specified in its charter)

| Delaware | 1311 | 38-3778663 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

500 Corporate Circle, Suite C

Golden, Colorado 80401

(303) 534-4344

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Robert L. Cavnar

Chief Executive Officer

Luca Technologies Inc.

500 Corporate Circle, Suite C

Golden, Colorado 80401

Telephone: (303) 534-4344

Facsimile: (303) 534-1446

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Robert G. Reedy | Joseph A. Hall | |

| E. James Cowen | Davis Polk & Wardwell LLP | |

| Porter Hedges LLP | 450 Lexington Avenue | |

| 1000 Main Street, 36th Floor | New York, New York 10017 | |

| Houston, Texas 77002 | Telephone: (212) 450-4000 | |

| Telephone: (713) 226-6674 | Facsimile: (212) 701-5565 | |

| Facsimile: (713) 226-6274 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of the registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee | ||

| Common Stock, $0.001 par value per share |

$125,000,000 | $14,513(2) | ||

|

| ||||

| (1) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933. Includes the offering price of additional shares that the underwriters have the option to purchase. |

| (2) | Previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information contained in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED FEBRUARY 24, 2012

P R E L I M I N A R Y P R O S P E C T U S

Shares

Luca Technologies Inc.

Common Stock

$ per share

This is the initial public offering of our common stock. We are selling shares of our common stock. We currently expect the initial public offering price to be between $ and $ per share of common stock.

We have granted the underwriters an option to purchase up to additional shares of common stock.

We have applied to have the common stock listed on The Nasdaq Global Market under the symbol “LUCA.”

Investing in our common stock involves risks. See “Risk factors” beginning on page 12.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public Offering Price |

$ | $ | ||||||

| Underwriting Discount |

$ | $ | ||||||

| Proceeds to Luca (before expenses) |

$ | $ | ||||||

The underwriters expect to deliver the shares to purchasers on or about , 2012 through the book-entry facilities of The Depository Trust Company.

Joint Book-Running Managers

| Citigroup |

Piper Jaffray |

Raymond James |

Co-Managers

| Baird |

ThinkEquity LLC |

, 2012

Table of Contents

Table of Contents

We have not authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where such offers and sales are permitted. The information in this prospectus or any free writing prospectus is accurate only as of its date, regardless of its time of delivery or of any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

| II-2 | ||||

| 1 | ||||

| 12 | ||||

| 34 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| 40 | ||||

| 42 | ||||

| Management’s discussion and analysis of financial condition and results of operations |

44 | |||

| 61 |

| 90 | ||||

| 113 | ||||

| 115 | ||||

| 118 | ||||

| 123 | ||||

| Certain United States federal income and estate tax consequences to non-US holders |

125 | |||

| 129 | ||||

| 136 | ||||

| 136 | ||||

| 137 | ||||

| F-1 |

II-1

Table of Contents

Conventions that apply to this prospectus

Unless the context otherwise requires, in this prospectus:

| Ø | “the company,” “we,” “us” and “our” refer to Luca Technologies Inc. and its subsidiaries taken as a whole; |

| Ø | “Bcf” means billion cubic feet of natural gas; |

| Ø | “BLM” means the US Bureau of Land Management; |

| Ø | “Btu” means British Thermal Unit. One British Thermal Unit is the quantity of heat required to raise the temperature of one pound of water by one degree Fahrenheit; |

| Ø | “completion” means the installation of permanent equipment for the production of oil or natural gas, or in the case of a dry hole, the reporting of abandonment to the appropriate agency; |

| Ø | “deterministic estimate” means the method of estimating reserves or resources when a single value for each parameter (from the geoscience, engineering or economic data) in the reserves calculation is used in the reserves estimation procedure; |

| Ø | “developed acreage” means the number of acres that are allocated or assignable to productive wells or wells capable of production; |

| Ø | “developmental well” means a well drilled within the proved area of an oil or a natural gas reservoir to the depth of a stratigraphic horizon known to be productive; |

| Ø | “EIA” means the US Energy Information Administration; |

| Ø | “EPA” means the US Environmental Protection Agency; |

| Ø | “exploratory well” means a well drilled to find a new field or to find a new reservoir in a field previously found to be productive of oil or natural gas in another reservoir; |

| Ø | “field” means an area consisting of a single reservoir or multiple reservoirs all grouped on or related to the same individual geological structural feature; |

| Ø | “gross acres” or “gross wells” means the total acres or wells, as the case may be, in which a working interest is owned; |

| Ø | “IEA” means the International Energy Agency; |

| Ø | “Mcf” means thousand cubic feet of natural gas; |

| Ø | “MMBtu” means million Btu; |

| Ø | “MMcf” means million cubic feet of natural gas; |

| Ø | “net acres” or “net wells” means the sum of the fractional interest owned in gross acres or wells, as the case may be; |

| Ø | “PRB” means the Powder River Basin; |

| Ø | “probabilistic estimate” means the method of estimation of reserves or resources when the full range of values that could reasonably occur for each unknown parameter (from the geoscience and engineering data) is used to generate a full range of possible outcomes and their associated probabilities of occurrence; |

| Ø | “productive well” means a well that is found to be capable of producing hydrocarbons in sufficient quantities such that proceeds from the sale of such production exceed production expenses and taxes; |

II-2

Table of Contents

| Ø | “proved reserves” means those quantities of oil and natural gas, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible—from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations—prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation; |

| Ø | “reasonable certainty” means, when deterministic methods are used, a high degree of confidence that the quantities will be recovered and also means, when probabilistic methods are used, that there should be at least a 90% probability that the quantities actually recovered will equal or exceed the estimate. A high degree of confidence exists if the quantity is much more likely to be achieved than not, and, as changes due to increased availability of geoscience (geological, geophysical, and geochemical), engineering, and economic data are made to estimated ultimate recovery with time, reasonably certain estimated ultimate recovery is much more likely to increase or remain constant than to decrease; |

| Ø | “reliable technology” means a grouping of one or more technologies (including computational methods) that has been field tested and has been demonstrated to provide reasonably certain results with consistency and repeatability in the formation being evaluated or in an analogous formation; |

| Ø | “reserves” means estimated remaining quantities of oil and natural gas and related substances anticipated to be economically producible, as of a given date, by application of development projects to known accumulations; |

| Ø | “reservoir” means a porous and permeable underground formation containing a natural accumulation of producible oil and/or natural gas that is confined by impermeable rock or water barriers and is individual and separate from other reservoirs; |

| Ø | “Tcf” means trillion cubic feet of natural gas; |

| Ø | “WDEQ” means the Wyoming Department of Environmental Quality; |

| Ø | “WOGCC” means the Wyoming Oil and Gas Conservation Commission; and |

| Ø | “working interest” means an interest in an oil or natural gas lease that gives the owner of the interest the right to drill for and produce oil or natural gas on the leased acreage and requires the owner to pay a share of the costs of drilling and production operations. |

Throughout this prospectus, unless specifically stated otherwise or the context otherwise requires:

(i) when we refer to our Restoration Process, our technology and our treatments, or “to restore” and “to treat,” we are referring to our proprietary bioconversion technology that accelerates and enhances the naturally occurring methanogenic process of native anaerobic microbial communities by circulating a mixture of water and nutrients, which we refer to as our nutrient formulations, into reservoirs using existing oil and natural gas wells;

(ii) when we refer to our ownership or operation of wells and properties, as well as our acquisition or disposition of wells and properties, we are referring to the ownership, operation, acquisition or disposition of an interest in the leasehold estate relating to such properties and a working interest in such wells; and

(iii) when we refer to our units or unit arrangements, we are referring to the fact that we may be required to combine our natural gas leases together into “units” under applicable rules and regulations, allowing us to implement our technology and ensure that owners of the various interests equitably share in costs and production.

II-3

Table of Contents

Certain industry and market data presented in this prospectus has been derived from data included in various industry publications, surveys and forecasts, including those generated by the EIA, the IEA and the WOGCC. We have assumed the correctness and truthfulness of such data, including projections and estimates, when we use them in this prospectus. You should read our cautionary statement in the section entitled “Special note regarding forward-looking statements.”

II-4

Table of Contents

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider in making your investment decision. You should read this summary together with the more detailed information, including our consolidated financial statements and the accompanying notes, appearing elsewhere in this prospectus. You should carefully consider, among other things, the matters discussed in “Risk factors,” before making an investment decision.

BUSINESS OVERVIEW

Our company

We use biotechnology to create and sustainably produce natural gas. Our proprietary technology stimulates native microorganisms that reside in subsurface hydrocarbon deposits, such as coal, oil, and organic-rich shales, to accelerate the bioconversion of such resources into methane, the principal component of natural gas, which we produce and sell using existing infrastructure. We believe that our business represents a transformative and disruptive innovation in natural gas creation and production, integrating sophisticated biotechnology with the traditional natural gas business. We have performed extensive lab and field testing over the past eight years, including the deployment of over 500 field level applications of our technology, which we believe have:

| Ø | proved the efficacy of our technology to economically and sustainably create new methane gas from wells treated with our technology; |

| Ø | demonstrated that additional value can be created from using existing natural gas wells and pipeline infrastructure, potentially extending the economic lives of thousands of wells; |

| Ø | confirmed that water should be conserved and re-used whenever feasible, as it is integral to the biogenic creation of new methane gas; and |

| Ø | demonstrated through extensive testing that the technology is safe to the public and the environment. |

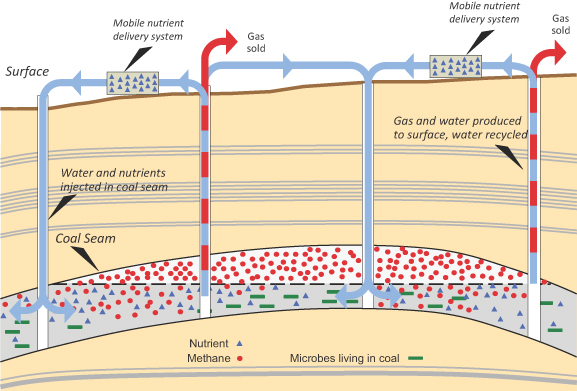

Our Restoration Process, a proprietary bioconversion technology, accelerates and enhances the naturally occurring methanogenic process of native anaerobic microbial communities by circulating a mixture of water and nutrients into reservoirs using existing oil and natural gas wells. Anaerobic microbes have lived in subsurface coal, oil and shale deposits for millions of years, feeding on organic matter to create natural gas. This complex microbial gas creation process is susceptible to interruption by various biological and other conditions, including traditional coalbed methane development, whereby drilling and extraction dewaters the coal formations, inhibiting microbial activity and disrupting natural gas creation. Our initial focus is to use our Restoration Process to convert coal into methane by restoring subsurface habitats to enhance the creation and production of natural gas.

Our technology allows us to economically and sustainably create natural gas from existing wells treated with our technology, thereby utilizing and extending the life of existing natural gas infrastructure, and minimizing our need for new drilling. We produce this newly created natural gas from existing wells and deliver it to the natural gas market via existing pipelines. We are currently dependent on existing wells and associated infrastructure due to the fact that the amount of incremental gas produced from the application of our Restoration Process, combined with current natural gas prices, does not presently justify the drilling of new wells by us. Unlike the traditional exploration and production industry’s extraction methods in which production peaks and then steeply declines as stored hydrocarbons are depleted, we believe, based on lab and field results, that our Restoration Process economically and sustainably creates low-cost energy for many years from wells treated with our technology. We believe

1

Table of Contents

our technology competes favorably with the traditional “hunter/gatherer” style of natural gas development (find, drill, produce, then abandon) by allowing a “farming” style of natural gas creation (restore, feed, grow, then harvest), which continually produces a new crop of natural gas.

Our goal is to be the global market leader in biogenic methane gas creation and production. We anticipate growing our business primarily through acquiring natural gas properties, applying our Restoration Process to create new sustainable sources of natural gas, and producing and selling this natural gas to existing markets. In the future, we may expand our efforts to include oil and organic-rich shales.

Our technology

Our Restoration Process creates methane gas, the simplest hydrocarbon molecule. According to the EIA, methane is the cleanest burning form of natural gas. Most natural gas, including methane, is created by either thermogenic or biogenic geologic processes. Thermogenic generation involves the conversion of deep organic sediment material by extreme pressure and heat into coal, oil or natural gas. In contrast, in biogenic generation, anaerobic microorganisms that have lived in subsurface coal deposits and other hydrocarbon deposits for millions of years, convert carbon and hydrogen-rich organic matter to natural gas as part of naturally occurring processes.

Our Restoration Process is designed to sustain the life processes of naturally occurring microbial communities. We do not introduce foreign microbes, nor do we rely upon genetically-engineered microorganisms. Microbes are already present in coalbed water and are responsible for biogenic methane gas creation. The steps in our Restoration Process include (i) the identification and assessment of underground environments where the native conditions are suitable for microbial life activation and where the biogenic process has been active in the past, (ii) the performance of lab and field studies to assess microbial activation and to identify optimal proprietary nutrient formulations, and (iii) the circulation of such nutrient formulations to target microbes in the underground reservoir to support the creation of new methane.

Our Restoration Process can be applied in two ways.

| Ø | Our initial field delivery process was based on a “push-pull” method, which is more akin to a batch process. Under the push-pull method, water is withdrawn from the coal seam from surrounding wells. That water is then supplemented with a proprietary nutrient formulation and emplaced, or pushed, into the coal seam by gravity feed down the wellbore being treated. After a predetermined time period, the restored well is returned to production and water is withdrawn, or pulled, from the restoration well, tested, and recirculated into another well or disposed of in another manner, typically by discharging into a surface reservoir. |

| Ø | We are transitioning to a multi-well continuous flow method, referred to as “gas farming.” In gas farming, wells are restored in a manner similar to the push-pull method described above, but instead of restoring a well once, producing the well and waiting several years to treat it a second time, additional nutrient formulations are added within months of the original restoration. Water is temporarily withdrawn from the coal seam in surrounding wells and circulated back into the coal seam via the restoration wells through existing infrastructure, creating a linked system of wells. In this manner, nutrient formulations are continuously introduced into a coal seam via selected wells through gravity feed. In addition to sustainably creating natural gas over a longer period of time, this continuous flow gas farming process has the added benefit of allowing more effective water management, an advantage in areas where water discharge is restricted. |

2

Table of Contents

Based on historical results, average incremental daily natural gas production from the push-pull method starts approximately six months following a treatment, grows to a plateau rate of approximately 25 to 30 Mcf of natural gas per day, and remains at this level for several years. We anticipate that a slow decline in production will follow. However, our most comprehensive demonstration project, involving more than 260 Powder River Basin wells (110 of which were treated using our Restoration Process), is now more than five years old, and plateau rates of production appear to be stable with minimal decline. The remaining approximately 150 PRB wells from this demonstration project were not treated with our Restoration Process, but, as part of the project, are monitored for increased gas production resulting from nearby treated wells. We believe that gas farming will lead to similar, if not greater, rates of natural gas production as nutrients are constantly fed to the microbes over time, leading to sustainable levels of natural gas production.

Our area of operation

Our primary geographic area of activity, and currently the only area in which we own and operate wells, is the Powder River Basin, or the PRB. The greater PRB traverses approximately 90 miles from east to west and 200 miles from north to south, encompassing portions of northeastern Wyoming and southeastern Montana. The PRB, with continuous wide-spread thick coal seams, an extensive natural gas production infrastructure, water chemistry well suited to microbial methane bioconversion, and exceptional permeability for the efficient delivery of nutrients and production of natural gas among wells, has been our primary focus for the past eight years and will play a critical role in our future growth. According to the EIA, the PRB accounts for approximately 42% of the coal production in the United States and is the single largest source of coal mined in the United States.

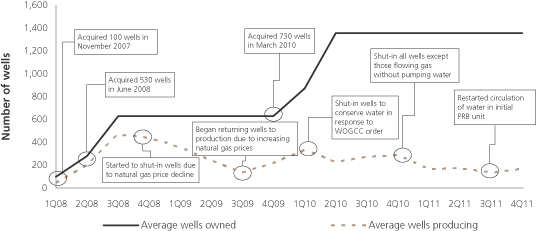

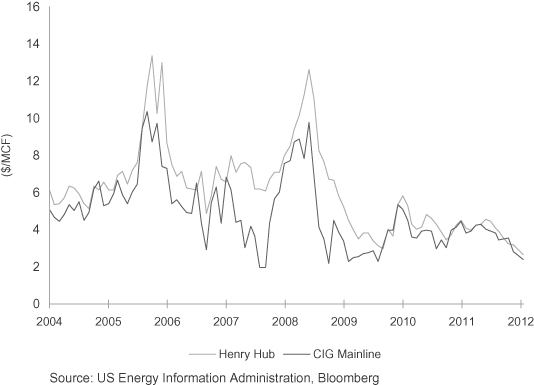

According to the WOGCC, to date over 31,000 wells have been drilled to develop coalbed methane in the PRB in Wyoming. At present, many coalbed methane operations in the basin are economically challenged and, according to the WOGCC, less than 14,000 of such wells were producing in November 2011 as a result of mature, low rate production and current natural gas prices. We believe this situation will present us with a number of opportunities to acquire properties at attractive prices. We presently own and operate over 1,350 wells in the PRB, many of which are currently shut-in, and have over 89,000 gross (75,000 net) acres held by production and approximately 110 miles of associated natural gas gathering pipelines and equipment. Our total estimated proved reserves at December 31, 2011 were 5.0 Bcf of natural gas and include anticipated production from approximately 240 wells in the PRB that have demonstrated a positive response from our Restoration Process. Our intent is to expand our present holdings in the PRB through acquisitions of wells, thereby expanding our control of the basin’s significant bioresource.

From 2006 through March 2010, we performed our Restoration Process on over 400 wells in the PRB, consisting in part of 110 of the more than 260 PRB wells that were involved in our most comprehensive demonstration project described above, under a pilot program regulated by the WOGCC. As we moved towards commercialization, new legislation was required to permit the expanded deployment of our nutrient formulations. Pending the completion of this legislative process, we elected to shut-in a majority of our wells in 2010 to conserve water. The legislation was passed in February 2011 and new rules implementing this legislation were expected to be finalized by the fall of 2011. In September 2011, the WOGCC determined that our Restoration Process could be implemented under existing WOGCC rules and Wyoming statutes without the need for additional rulemaking. We are currently pursuing all of the necessary state and federal permits and approvals required to implement our technology, and anticipate resuming our Restoration Process on a portion of our wells in the first half of 2012.

3

Table of Contents

Our competitive strengths

| Ø | Disruptive and proven technology: We believe that our Restoration Process is a transformative and disruptive innovation that allows for the real-time creation of biogenic methane gas in economic quantities from coal, oil and organic-rich shales using existing infrastructure. Unlike many other new energy technologies, successful commercialization of our Restoration Process does not depend on the availability of government subsidies or incentives. Our path to commercialization focuses on receiving the required regulatory approvals, increasing natural gas production from our existing wells, and acquiring additional wells to achieve commercial scale. |

| Ø | Sustainable production process: When our Restoration Process is applied through existing wells to subsurface environments with native conditions suitable for microbial life, we believe our technology has the potential to create a sustainable source of economic natural gas production that will extend the life of the wells for many years. Production declines from traditional natural gas exploration and production, or E&P, require significant capital investment through additional drilling and completion to maintain natural gas production rates. In contrast, we believe our technology effectively creates a “gas farm,” producing a more stable and sustainable supply of natural gas for an extended period of time. |

| Ø | Capital light investment profile and superior full-cycle economics vs. traditional E&P: Traditional E&P, particularly in shales, requires significant upfront capital investment for land acquisition, well drilling and completion, and production and transportation infrastructure. In contrast, we have a capital-light deployment strategy, whereby minimal new wells and no new meaningful infrastructure investments are required to implement our Restoration Process, significantly reducing our upfront capital expenditures. As a result of this strategy, we are dependent on existing wells and associated infrastructure. The amount of incremental gas produced from the application of our Restoration Process, combined with current natural gas prices, also does not currently justify the drilling of new wells by us. As we create natural gas in real-time, we expect increases to our proved reserves and thus use the term “finding and creation” costs to describe the economics of our full cycle acquisition and natural gas creation process over a 10 to 20 year period. We expect our finding and creation costs over time to be significantly lower than the finding and development costs of traditional E&P companies, due to the lack of significant development costs associated with our Restoration Process. |

| Ø | First mover advantage: We began developing our Restoration Process in 2003, with an initial focus on lab research and development activities to prove the concept of accelerated biogenic gas creation. Beginning in 2006, we transitioned from the lab to the field, and have applied our Restoration Process to over 500 wells, including over 400 in the PRB and over 100 in other natural gas producing basins throughout the United States. In addition, we have anaerobically collected and tested samples from over 1,400 oil and natural gas wells from reservoirs in more than 20 producing regions in three countries. These samples have resulted in thousands of DNA samples of microbes and the DNA sequencing of approximately 2,100 samples from the field and approximately 1,000 samples from laboratory tests to date. We believe that the substantial body of proprietary data, including our intellectual property, and experience obtained from this effort, combined with the advancement of our technology as compared with other biogenic gas creation companies, represents a significant first-mover advantage that will allow us to accelerate decisions relating to well acquisition and treatment. |

| Ø | Cleaner alternative to traditional E&P: With increasing societal pressures for domestically produced and environmentally friendly energy solutions, natural gas production represents a cleaner way to advance energy independence, as it produces lower CO2 emissions than any other hydrocarbon. Hydraulic fracturing, which is being increasingly utilized by traditional E&P companies in horizontal wells, is also under scrutiny and regulatory review in the United States due to its potential impact on aquifers, and, as a result, its use could be diminished, which could lead to lower natural gas production by such companies. By producing natural gas in a sustainable way using existing |

4

Table of Contents

| infrastructure, our technology alleviates many of the issues surrounding hydraulic fracturing, minimizes the necessity for new drilling by us, and has minimal impact on natural resources, including ground water. |

| Ø | Abundant resource: Coal represents the most abundant energy resource and the largest concentration of hydrocarbons in the world on which to apply our technology. According to the EIA, recoverable worldwide coal reserves are reported to be in excess of 900 billion short tons, with unrecoverable coal resources estimated to be many times larger. Our current focus is on the creation and production of coalbed methane gas in a limited number of basins throughout the United States where we expect the implementation of our technology to be economically viable. We have determined through field sampling and testing that certain coalbeds, including the PRB, are particularly well suited for the implementation of our technology, which allows us to access the energy in coal and deliver that energy as natural gas, avoiding the physical mining, transporting and combustion of coal. |

| Ø | Experienced management team: Our management team offers a unique combination of scientific, operational and managerial expertise in biotechnology and traditional E&P. Our senior management team has over 280 years of combined experience and an average of 28 years of experience in the energy industry. Our management team’s technical expertise includes microbiology, chemistry and biochemistry, engineering, geosciences, and traditional E&P. Our management team also played key roles in the commercialization of dozens of successful large-scale industrial biotechnology and traditional E&P projects. |

Our commercialization strategy

| Ø | Grow by acquisition and consolidation of natural gas properties: In order to achieve commercialization of our technology, we plan to continue to acquire natural gas properties (wells and pipeline infrastructure) and corresponding oil and natural gas rights in close proximity to our existing operations in the PRB, as well as in additional locations in the United States and abroad. Given the geologic permeability of many coal seams, controlling a large, contiguous area of producing wells is key to capturing the newly generated natural gas. Our acquisition strategy will include acquiring low cost late-in-life uneconomic wells producing minimal natural gas, as well as mid-life economic wells producing natural gas quantities that are already cash flow positive. |

| Ø | Increase natural gas production with an initial focus on the Powder River Basin: Approximately 275 of our wells in the PRB have been restored and are ready for commercial production of biogenic gas in real-time. We are currently working closely with various Wyoming state and federal agencies to obtain the required regulatory approvals necessary for the expanded deployment of our nutrient formulations. We intend to apply our Restoration Process to a portion of our wells and incrementally bring additional PRB wells on line beginning in the first half of 2012. We expect it will likely take until early 2013 to complete the restoration of a majority of our current wells. As we acquire additional wells, we plan to deploy our Restoration Process to such wells, which we expect will lead to increased gas production in 2013 and beyond. |

| Ø | Develop strategic partnerships: While our technology is proven and available today, its commercialization could be further accelerated and expanded through strategic partnerships with larger companies. A key technical and strategic priority in the near future is to establish research and development collaborations with international resource companies, such as our collaboration with Shell described under “—Recent developments.” We are currently exploring additional collaboration opportunities with a number of major oil and natural gas companies and coal companies. |

| Ø | Advance technology to achieve further yield improvements: We use the term Technology To The Field to describe our efforts to achieve further yield improvements from our Restoration Process, leading to greater natural gas production and improved profitability. The unique microbial and geophysical conditions in the coal seams of each natural gas well require customized restoration treatments and water movement technology for effective microbial activation and commercial natural gas creation. |

5

Table of Contents

| Ø | Broaden our technology applications to other areas and fossil fuels: Our technology and processes are applicable to many other natural gas-producing basins, both in the United States and abroad. In addition to our core assets in the PRB, there are a number of other basins that we have either tested or in which we have pilot projects, such as the Black Warrior Basin in Alabama, the San Juan Basin in New Mexico and the Uinta Basin in Utah, as well as other areas in Oklahoma, Kansas and Illinois. We are also interested in areas in Australia, China, India, South Africa, Indonesia, Canada and Europe. While our current focus is on coalbed methane, heavy oils, mature shallow domestic oil fields, and domestic fractured shale fields offer additional significant hydrocarbon reserves on which to apply our Restoration Process in the future. |

Our intellectual property

Our success depends in large part on our proprietary technology for which we seek protection under patent, copyright, trademark and trade secret laws. As of the date of this prospectus, we have 20 issued US and foreign patents, three foreign patent applications that are currently allowed and awaiting issuance, and 36 pending US and foreign patent applications. These patents and patent applications are directed to our technology and the specific methods that support our business. We continue to file new patent applications, for which terms extend up to 20 years from the earliest priority filing date in the United States.

Industry overview

Natural gas created from our Restoration Process has a distinct advantage over many renewable energy sources, including biofuels, in that it can be sold directly into existing markets using existing infrastructure. Biogenic, domestically-produced natural gas is an accessible and more environmentally friendly energy alternative, which is expected to play an increasing role in advancing both environmental and energy policy goals in the United States. There has been growing concern over CO2 and other emissions that are especially prevalent from burning coal and fuel oil. According to the EIA, methane is the cleanest burning fossil fuel, with approximately 117 lbs. of CO2 produced per 1 million Btu equivalent of natural gas, compared to 160 lbs. of CO2 for fuel oil and 200 lbs. for coal.

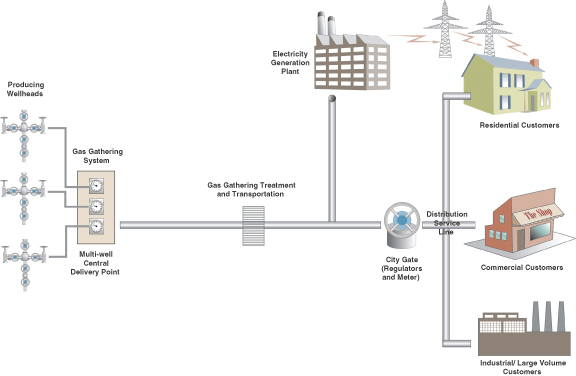

Typically, natural gas producers sell their natural gas to a variety of purchasers under various length contracts ranging from one day to multi-year at market based prices. Purchasers include pipelines, processors, other producers, banks, marketing and trading companies and other midstream service providers. Primary users of natural gas globally are power companies, which use it for the production of electricity, and utility companies, which distribute it for residential and industrial use. In 2009, 21% of natural gas used in the United States was consumed by residential homes, 27% by industry, 30% for electrical power, and 14% by businesses, with the remainder used in the operation of natural gas production and transportation infrastructure. With over 90% of the natural gas used in the United States coming from North America, natural gas plays an important role in advancing US energy security.

Our technology offers the potential to expand domestic energy production, while minimizing the need to expand the footprint of the oil and natural gas industry’s producing areas. According to the EIA, demand for natural gas in the United States and globally is projected to grow at annual growth rates of 0.5% and 1.9% through 2035, respectively. The IEA has identified several factors that could accelerate growth in demand for natural gas in the coming years, including potentially faster acceptance of compressed natural gas, or CNG, vehicles, recent policy changes in China promoting the production, import and use of natural gas, and a more restricted outlook for nuclear power in the wake of the Fukushima nuclear power plant disaster in Japan.

6

Table of Contents

The EPA regards natural gas as the cleanest burning transportation fossil fuel commercially available today. The IEA estimated that in 2010 there were 100,000 natural gas vehicles operating on American roads, and more than 11 million natural gas vehicles worldwide. The current US administration has endorsed incentives for trucks powered by natural gas. Additionally, the EPA has issued stricter requirements on emissions from US power plants. When implemented, such requirements could push power companies to replace coal-fired plants with gas-burning ones, which would further increase domestic natural gas consumption.

Recent developments

On December 16, 2011, we entered into a Development and Commercialization Agreement with Shell International Exploration and Production Inc., or Shell, whereby we and Shell will work together to advance our understanding of the mechanisms of microbial coal conversion to methane and to develop optimal strategies to propagate nutrient-bearing water within coal formations. The current agreement governs the first phase of what is proposed to be a multi-year program, under which Shell will provide both personnel and financial support. During this first phase, each of us will retain all commercial rights to our respective current intellectual property, but will grant the other royalty free licenses for any intellectual property developed independently during the collaboration for use in microbial conversion of coal to methane. In addition, we will own all intellectual property that is jointly developed during the collaboration, but we will grant Shell a royalty free license for such intellectual property for use in microbial conversion of coal to methane.

Summary risk factors

Our business is subject to numerous risks and uncertainties that you should understand before making an investment decision. These risks are discussed more fully in the section entitled “Risk factors” beginning on page 12 of this prospectus. These include:

| Ø | we are in an early stage of our commercialization and our limited operating history and lack of meaningful revenue generally preclude us from using historical results to forecast operating results; |

| Ø | although we have demonstrated our ability to increase natural gas production in a limited number of wells, the future success of our business depends on our ability to achieve similar results, on a commercially viable basis, by deploying our technology in multiple hydrocarbon basins to restore and sustain production of commercial quantities of natural gas from existing wells in a timely and economic manner; |

| Ø | we may not be able to make effective adjustments for other locales to achieve results consistent with those we have thus far achieved in coal deposits in the PRB; |

| Ø | if the WOGCC or WDEQ imposes terms and conditions that delay or that make the use of our technology more costly than we currently anticipate or that expose us to liabilities to regulatory authorities or third parties in a manner that we do not currently anticipate, or if we do not receive the required regulatory approvals from the WOGCC and the WDEQ, our ability to resume operations and successfully develop our business would be adversely affected; |

| Ø | we may be unable to secure the passage of legislation and regulations favorable to our business model in other states or jurisdictions where we expect to deploy our technology; |

| Ø | we are currently dependent on existing wells and associated infrastructure to conduct our business and operations; |

| Ø | we must acquire a significant number of wells in order for our technology to be commercially viable; |

| Ø | the law is unsettled as to whether an oil and natural gas lessee has the right to accelerate the natural production of biogenic coalbed methane without authority from the owner of the coal estate; |

7

Table of Contents

| Ø | we may not be able to restore wells in the PRB using our technology if we are unable to obtain approval of permits from the BLM; |

| Ø | if our leases expire and we are unable to renew the leases, we will lose our right to implement our technology in the related properties; |

| Ø | we could be required to incur substantial expenditures to address concerns of the BLM regarding the impact of our technology on the federal coal estate, including drilling of core holes, to examine the changes in the Btu content of the coal resulting from the implementation of our technology; |

| Ø | if we violate or fail to comply with applicable environmental laws and regulations or with approvals and permits required by such laws and regulations, including with respect to water disposal costs, we could be fined or otherwise sanctioned by regulators; |

| Ø | because the costs of developing our technology at a commercial scale are highly uncertain, we cannot reasonably estimate the amounts necessary to successfully commercialize our technology or be certain that additional capital will be available on acceptable terms when needed; |

| Ø | lower prices for natural gas may reduce the amount of gas that we can produce economically or may require us to write down the carrying value of our assets; |

| Ø | while all current coal mining activities appear to be far removed from our properties and we believe the coal in and around our properties is too deep to economically mine under current conditions, we cannot assure you that coal mining will not occur on our properties and limit our operations; |

| Ø | our actual production, revenues and expenditures related to our reserves are likely to differ from our estimates of proved reserves; |

| Ø | we will likely be impacted more acutely by factors affecting our industry in the PRB than we would if our business was more diversified, increasing our risk profile; |

| Ø | third parties may infringe or misappropriate our patents or other intellectual property rights and litigation may be necessary to enforce our intellectual property rights, protect our trade secrets or determine the validity and scope of the proprietary rights of others; and |

| Ø | our pending and future patent applications may not issue as patents or, if issued, may not issue in a form that will provide us with any meaningful protection or any competitive advantage. |

Corporate information

We were formed as Clearflame Resources LLC, a Delaware limited liability company, in April 2003 and changed our name to Luca Technologies LLC in July 2004. We converted into a Delaware corporation on April 20, 2007. Our principal executive offices are located at 500 Corporate Circle, Suite C, Golden, Colorado 80401, and our telephone number is (303) 534-4344. Our website address is www.lucatechnologies.com. Information contained on our website is not incorporated by reference into this prospectus, and you should not consider information contained on our website to be part of this prospectus.

Our logos and “LUCA TECHNOLOGIES®” and other trademarks or service marks of Luca Technologies Inc. appearing in this prospectus are the property of Luca Technologies Inc. This prospectus contains additional trade names, trademarks and service marks of other companies. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply relationships with, or endorsement or sponsorship of us by, these other companies.

8

Table of Contents

The offering

| Common stock offered by Luca |

shares (or shares if the underwriters exercise their option to purchase additional shares in full) |

| Common stock to be outstanding after this offering |

shares (or shares if the underwriters exercise their option to purchase additional shares in full) |

| Proposed Nasdaq Global Market symbol |

“LUCA” |

| Use of proceeds |

We currently intend to use all or a portion of the net proceeds of this offering, together with existing cash and cash equivalents, to acquire natural gas properties (wells and infrastructure) in the PRB and additional areas in the United States and abroad, apply our Restoration Process to such properties, and continue research and development efforts to achieve further yield and rate improvements from our technology. We may also use a portion of the net proceeds of this offering to fund working capital and other general corporate purposes, including paying off our secured debt obligations and the costs associated with being a public company. Please see “Use of proceeds.” |

| Risk factors |

See “Risk factors” starting on page 12 of this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

The number of shares of common stock to be outstanding after this offering is based on shares outstanding as of , 2012 and excludes:

| Ø | shares of common stock issuable upon the exercise of options outstanding as of , 2012 at a weighted average exercise price of $ per share; and |

| Ø | shares of common stock reserved for issuance under our Fourth Amended and Restated 2007 Equity Incentive Plan, or the 2007 Plan. |

Except as otherwise indicated, all information in this prospectus assumes:

| Ø | the conversion of all of our outstanding shares of preferred stock into shares of common stock in connection with the consummation of this offering; |

| Ø | the conversion of all of our outstanding preferred stock warrants into shares of common stock in connection with the consummation of this offering; |

| Ø | the conversion of all of our outstanding common stock warrants into shares of common stock in connection with the consummation of this offering; and |

| Ø | no exercise of the underwriters’ option to purchase additional shares. |

In order to, among other things, effect the conversion of our preferred stock, preferred stock warrants and common stock warrants, we are amending and restating our certificate of incorporation. Concurrently with the amending and restating of our certificate of incorporation, the number of shares of our authorized common stock will be increased to shares, and each share of common stock then outstanding, including the shares of our preferred stock, preferred stock warrants and common stock warrants that will have been converted, on a one-for-one basis, into shares of common stock, will be split into shares of common stock by way of a stock split. Unless we specifically state otherwise, the share information in this prospectus reflects the increase in the authorized number of shares of our common stock and the stock split.

9

Table of Contents

Summary historical consolidated financial data

The following summary historical consolidated financial data should be read together with our consolidated financial statements and the accompanying notes appearing elsewhere in this prospectus and “Management’s discussion and analysis of financial condition and results of operations.” The summary historical consolidated financial data in this section is not intended to replace our historical consolidated financial statements and the accompanying notes. Our historical results are not necessarily indicative of our future results.

We derived the consolidated statements of operations data for 2009, 2010 and 2011 and the consolidated balance sheet data as of December 31, 2010 and 2011 from our audited consolidated financial statements appearing elsewhere in this prospectus. The data should be read in conjunction with the consolidated financial statements, accompanying notes, and other financial information included herein.

| Consolidated statement of operations data: |

Years ended December 31, | |||||||||||

| 2009 | 2010 | 2011 | ||||||||||

| (in thousands, except share and per share data) |

||||||||||||

| Operating revenue |

$ | 3,823 | $ | 2,419 | $ | 1,058 | ||||||

|

|

|

|

|

|

|

|||||||

| Operating expenses |

||||||||||||

| Research and development expense |

$ | 6,832 | $ | 7,757 | $ | 5,664 | ||||||

| Lease operating expense |

3,054 | 4,159 | 3,232 | |||||||||

| Gathering and transportation expense |

915 | 1,437 | 855 | |||||||||

| Production taxes |

131 | 207 | 109 | |||||||||

| General and administrative expense |

4,374 | 5,824 | 7,278 | |||||||||

| Depreciation, depletion and amortization |

3,856 | 2,607 | 2,229 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total operating expenses |

$ | 19,162 | $ | 21,991 | $ | 19,367 | ||||||

|

|

|

|

|

|

|

|||||||

| Operating loss |

$ | (15,339 | ) | $ | (19,572 | ) | $ | (18,309 | ) | |||

| Other income (expense) |

(63 | ) | (103 | ) | 289 | |||||||

|

|

|

|

|

|

|

|||||||

| Net loss |

$ | (15,402 | ) | $ | (19,675 | ) | $ | (18,020 | ) | |||

|

|

|

|

|

|

|

|||||||

| Net loss per share of common stock, basic and diluted |

$ | (2.35 | ) | $ | (2.14 | ) | ||||||

| Weighted average number of shares of common stock used in computing net loss per share of common stock, basic and diluted |

8,383,980 | 8,436,789 | ||||||||||

| Pro forma net loss per share of common stock, basic and diluted(1) |

$ | (0.92 | ) | |||||||||

| Weighted average number of common shares used in computing pro forma net loss per share of common stock, basic and diluted(1) |

19,557,356 | |||||||||||

| (1) | Pro forma basic and diluted net loss per share of common stock and weighted average number of shares of common stock used in computing pro forma basic and diluted net loss per share of common stock for the periods presented give effect to the conversion of all of our outstanding convertible preferred stock into common stock on a one-for-one conversion ratio. |

10

Table of Contents

| Consolidated balance sheet data: (at period end) |

December 31, 2010 |

December 31, 2011 |

||||||

| (in thousands) | ||||||||

| Cash, cash equivalents and investments |

$ | 36,934 | $ | 17,713 | ||||

| Property and equipment, net |

18,938 | 19,755 | ||||||

| Total assets |

60,886 | 44,337 | ||||||

| Current liabilities |

3,539 | 2,716 | ||||||

| Long-term debt |

310 | — | ||||||

| Convertible preferred stock |

98,468 | 98,468 | ||||||

| Total stockholders’ deficit |

(47,429 | ) | (63,434 | ) | ||||

11

Table of Contents

An investment in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below and the other information included in this prospectus, including our consolidated financial statements and accompanying notes, before deciding to invest in our common stock. If any of the following risks or uncertainties actually occur, our business, financial condition and operating results would likely suffer. In that event, the market price of our common stock could decline and you could lose all or part of your investment in our common stock.

RISKS RELATED TO OUR BUSINESS

Our business is difficult to evaluate due to our limited operating history.

We are in an early stage of our commercialization and our limited operating history and lack of meaningful revenue generally preclude us from using historical results to forecast operating results. Our limited operating history also limits our ability to predict the length of time for which our technology can generate new natural gas from existing wells and whether our technology will be able to restore production from hydrocarbon formations in areas where we are not currently operating. Our proposed business strategies described in this prospectus incorporate our management’s current best analysis of potential markets, opportunities and difficulties that face us. We cannot assure you that our underlying assumptions accurately reflect current trends in our industry or that our technology will be successful. Our business strategies may change substantially from time to time or may be abandoned as our management reassesses our opportunities and reallocates our resources. If we are unable to develop or implement these strategies or if our technology is not economically viable, we may never achieve profitability. Even if we do achieve profitability, we cannot predict the level of such profitability and it may not be sustainable.

We have incurred substantial losses to date, anticipate continuing to incur losses in the future and may never achieve or sustain profitability.

We have incurred substantial net losses since our inception, including net losses of approximately $5.3 million, $9.8 million, $15.4 million, $19.7 million and $18.0 million for the years ended December 31, 2007, 2008, 2009, 2010 and 2011, respectively, and we expect these losses to continue. As of December 31, 2011, we had an accumulated deficit of approximately $81.9 million. We expect to incur additional costs and expenses related to the continued development and expansion of our business, including our research and development operations, the continued restoration and operation of our wells, and acquisitions of additional wells. As a result, even if our revenues increase substantially, we expect that our expenses will exceed revenues for the next several years.

Our ability to become and remain profitable will depend on, among other things, our ability to:

| Ø | acquire wells at suitable prices and in a timely manner; |

| Ø | obtain adequate financing on terms consistent with our expectations; |

| Ø | obtain required regulatory approval for the injection of our nutrient formulations and the circulation of water into the wells; |

| Ø | attract, hire and retain qualified and experienced management, technical and field personnel; |

| Ø | operate our natural gas properties and infrastructure at costs consistent with our expectations; |

| Ø | bioconvert existing hydrocarbon deposits into natural gas in sufficient quantities; |

12

Table of Contents

Risk factors

| Ø | distribute such natural gas at prices which are acceptable to us; and |

| Ø | protect our intellectual property. |

The challenges associated with each of these may be extraordinary, and we may not be able to resolve any difficulties that arise in a timely or cost-effective manner, or at all. As a result of the numerous uncertainties associated with our operations, we are unable to predict the extent of any future losses or when we will become profitable, if ever. Even if we do achieve profitability, we may be unable to sustain or increase our profitability in the future.

Our technology is unproven at commercial scale.

Although we have demonstrated the ability to increase natural gas production in a limited number of wells in the PRB in Wyoming, the Black Warrior Basin in Alabama and the Uinta Basin in Utah, the future success of our business depends on our ability to achieve similar results, on a commercially viable basis, by deploying our technology in multiple hydrocarbon basins to restore and sustain production of commercial quantities of natural gas from existing wells in a timely and economic manner. We do not know whether these wells can be restored to commercial levels of production as a result of our technology or whether we can sustain such level of production once restored. If our technology fails to create and produce natural gas economically on a commercial scale or in commercial volumes, the commercialization of our technology could be delayed and the associated costs could increase or commercialization may not be possible at all, and as a result, our business, financial condition and results of operations would be materially adversely affected.

Our technology may not achieve overall results consistent with those achieved in coal seams in the PRB.

The largest scale creation of natural gas resulting from the utilization of our technology to date was achieved in coal seams in the PRB. Geological conditions differ from basin to basin, and we expect that differing conditions will require us to adjust the composition of our nutrient formulations to the geological conditions of the particular basin. We may not be able to make effective adjustments for other locales to achieve results consistent with those we have thus far achieved in coal seams in the PRB. Even if we are successful in developing an economical process for converting existing coal seams in other basins into commercial quantities of natural gas, we may not be able to adapt such process to other hydrocarbon deposits, including oil and organic rich shales. Any inability to effectively adjust our nutrient formulations to accommodate other basins or other hydrocarbon deposits will limit the commercial reach of our technology, which could materially adversely affect our business, financial condition and results of operations.

Our ability to successfully resume operations and develop our business may be adversely affected by legislative and regulatory requirements.

Our business is initially focused in the State of Wyoming, where we are generally subject to laws and regulations of state authorities, such as the Wyoming state legislature, the WOGCC and the WDEQ relating to the creation, development, production, distribution and marketing of natural gas, as well as environmental, health and safety matters relating to natural gas development. From 2006 through March 2010, we performed our Restoration Process on over 400 wells in the PRB under a pilot program regulated by the WOGCC. As we moved towards commercializing our technology, new legislation was required to permit us to expand deployment of our nutrient formulations. Pending the completion of this legislative process, we elected to shut-in a majority of our wells in 2010 to conserve water, rather than producing natural gas from our previously treated wells in a manner that disposed of water on the surface. This legislation was passed in February 2011, and in September 2011, the WOGCC determined

13

Table of Contents

Risk factors

that our Restoration Process could be implemented under existing WOGCC rules and Wyoming statutes without the need for additional rulemaking. Pursuant to this legislation, the WOGCC and WDEQ must issue permits and approve applications for a process with which they have limited history and familiarity. If the WOGCC or WDEQ imposes terms and conditions that delay or that make the use of our technology more costly than we currently anticipate, our ability to successfully develop our business would be adversely affected. Regulations that are adopted in the future may also impose requirements on the use of our technology that could increase the cost or delay development of our business in Wyoming.

As we attempt to expand our operations into other states and, potentially, foreign jurisdictions, we anticipate that we will continue to confront existing legislative and regulatory regimes that are not easily adaptable to our technology. This will likely require us to continue to work with legislators and regulators in order to educate them about our technology and encourage the passage of legislation and regulation needed to facilitate our doing business in states and other jurisdictions outside Wyoming. We may experience delays similar to those, or more onerous than those, we have confronted in Wyoming, and we cannot predict the degree to which we will be successful in overcoming these delays. A failure to secure the passage of legislation and regulation favorable to our business model in any state or other jurisdiction in which we expect to deploy our technology could have a material adverse effect on our business, financial condition and results of operations.

We may be unable to successfully identify, execute or integrate future acquisitions of natural gas properties.

Our initial strategy is to focus on the acquisition of coalbed methane gas wells in basins throughout the United States where we expect the implementation of our technology to restore and sustain natural gas production on a commercial scale. We must acquire a significant number of wells in order for our technology to be commercially viable, as we do not expect to generate significant revenues from any one well. Accordingly, we must identify large numbers of properties that have coal deposits in sufficient quantities, along with biogenic and operational characteristics that are suitable for the application of our technology. There are a limited number of coal formations that we believe are favorable for coalbed methane development and the application of our technology.

Our need to acquire a large number of natural gas properties exposes us to a number of risks. The valuation of properties involves the application of a number of valuation metrics, and we and the owners of these properties may differ regarding the application of these metrics. For instance, when natural gas prices declined precipitously in 2008 and 2009, we found that it was very difficult to come to terms with natural gas interest owners due to different expectations regarding future natural gas prices or the owners’ unwillingness to sell their wells at prices that were substantially below those that were available before natural gas prices fell. In volatile economic times when commodity prices and interest rates, among other factors, can change significantly in short periods of time, there is a greater challenge in coming to terms on these types of properties. In addition, we may overpay for properties based on mistaken assumptions about future economics, which would adversely affect the future return from our operations. If our technology becomes widely recognized as an effective means of enhancing the productivity of natural gas wells, property owners may increase the value they ascribe to their properties in light of this potential to produce more natural gas than would have been anticipated absent the use of our technology. Some natural gas property owners may also be reluctant or unwilling to sell due to concerns about their potential exposure for plugging and abandonment of wells or other environmental liabilities if we do not meet our obligations.

Further, although we regularly engage in discussions with, and submit proposals to, acquisition candidates, suitable acquisitions may not be available in the future on reasonable terms. Even if we do

14

Table of Contents

Risk factors

identify an appropriate acquisition, we may be unable to finance the acquisition. Negotiations of potential acquisitions may require a disproportionate amount of management’s attention and our resources. Even if we complete additional acquisitions, continued acquisition financing may not be available or available on reasonable terms and any acquired properties may not generate sufficient revenues. Our inability to successfully identify, execute or effectively integrate future acquisitions may negatively affect our business, financial condition and results of operations.

Our property acquisitions will require regulatory approvals that could result in delays and increased costs to us.

We will be required to obtain regulatory approval and permits for new properties that we acquire in Wyoming, and subsequently to combine such properties into approved units prior to initiating our Restoration Process. This permitting process could lead to lengthy delays between the time of our acquisition of new properties and our commercial production of natural gas from them. We anticipate that the approvals and permits issued by the WOGCC, WDEQ, the BLM and other regulators will require monitoring of the wells and reservoirs, and the requirements for such monitoring could be very costly or overly burdensome. Accordingly, this may reduce revenue from the natural gas produced from our wells. It is possible that we may make an acquisition and find that the regulatory requirements are too costly to allow us to economically produce natural gas from the acquired wells. Whether permitting is economically feasible may not be evident until after we have made the acquisitions.

As our operations expand outside of Wyoming, we may also face similar or more stringent regulation by other state or foreign authorities, which may limit, delay or impede such expansion. We cannot predict how agencies or courts will interpret existing laws and regulations relating to our business and our technology, particularly given the unique aspects of both, nor can we predict the effect of the adoption and interpretation of any new laws and regulations on our business, financial condition and results of operations, which effect may be materially adverse.

Wells, once acquired, may not be appropriate for our purposes or may have liabilities associated with them that may negatively affect our business, financial condition and results of operations.

Although we plan to invest in properties that we believe will result in projects that will add value over time, we cannot guarantee that all of our acquired wells will result in commercially viable projects. The potential of a given property to continue to produce natural gas and to be adaptable to our technology cannot be determined with a high level of precision in advance. We will continue to perform due diligence reviews of the properties we seek to acquire in a manner that we believe is both consistent with practices in the traditional E&P industry and necessary to determine the biogenic characteristics of such properties and the viability of the wells for the application of our technology. However, these reviews are inherently incomplete and cannot assure us of the quality of the wells or of the success of our technology in enhancing production at the wells. It is generally not feasible for us to perform testing of every individual property or an in-depth review of its related records as part of each acquisition. Even if we are able to complete an in-depth review and sampling of these properties, such a review may not necessarily reveal existing or potential problems or permit us to become sufficiently familiar with the properties to fully assess their potential for successful application of our technology. Even when problems are identified, it may be necessary for us to assume certain environmental and other risks and liabilities to complete the acquisition of such properties. The discovery of any material liabilities associated with our well acquisitions could harm our results of operations and financial condition. Therefore, we cannot assure you that we will recover all or any portion of our investment in well acquisitions.

15

Table of Contents

Risk factors

We may need to resolve conflicts over ownership of the coal estate to employ our technology.

We have acquired natural gas leases in Wyoming from the owners of the natural gas estate and have proceeded with operations under such leases, based on what we believe to be settled law that, with respect to such leases, coalbed methane is part of the natural gas estate. On certain properties, including some of our leased properties in Wyoming, the coal estate and the natural gas estate have different owners. The largest owner of the coal estate in much of the western United States and the PRB is the US federal government. Of the coal in our area of operations in the PRB, the federal government owns approximately 92%, the State of Wyoming owns approximately 6% and private entities own approximately 2%. In approximately 33% of our wells, the federal government owns both the coal and natural gas estates, while in the other 67%, the federal government owns the coal and either the State of Wyoming or a private entity owns the oil and gas estate. The law is not settled as to whether an oil and gas lessee has the right to accelerate the natural production of biogenic coalbed methane without authority from the coal estate. Our technology may be viewed as an acceleration of the naturally occurring process of the conversion of coal to gas and thus could be viewed to burden, damage or, in the absence of federal authorization, trespass on the coal estate. In instances where the federal government is the coal estate owner but not the oil and natural gas estate owner, the BLM or the Office of the Solicitor will likely request us to consider (i) the requirement of additional legal authorization for the impacts to federal coal, (ii) the payment of an impact fee and (iii) an agreement on how to resolve any conflicts that develop with coal mines.

For areas of federally owned coal, we are actively working with the BLM to obtain approval of land use permits that will allow us to implement our technology in these areas. A prolonged permitting process or overly burdensome permit conditions could delay or prevent implementation of our technology in these areas. Continued development in unresolved split estate ownership locations could subject us to claims for trespass from the coal estate owner. We generally also have obligations to the owner of the natural gas estate to timely develop those interests. Failure to develop these interests in a timely fashion, while resolving the coal estate issue, could jeopardize the leases and cause us to forfeit certain leases that were not timely developed.

The BLM cannot assure us that any agreed resolution of the treatment of the coal estate with respect to our existing acreage in the PRB will be applicable in other areas of the country or other locations within the same basin. In all areas, including Wyoming, the BLM intends to evaluate this issue on a unit-by-unit basis. Therefore, we cannot assure you that we will be able to successfully resolve this issue in every location where the federal government owns the coal estate but not the natural gas estate, even if we are able to successfully implement a permitting process for our existing wells. If we are unable to resolve this issue with regard to new wells obtained in future acquisitions, we would not be able to produce natural gas from those newly acquired wells, which could have a material adverse effect on our business, financial condition and results of operations.

Evaluation of the environmental impact of our technology in connection with the issuance of any federal permits may lead to significant delays in our ability to commercialize our process.

The National Environmental Policy Act, or NEPA, requires federal agencies to integrate environmental considerations into their decision-making processes by evaluating the environmental impact of their proposed actions, including the issuance of any permits by the BLM that will be required to utilize our technology in the PRB, and assessing alternatives to those actions. In the course of a NEPA evaluation, if an action involved is determined to be major, an environmental assessment will be prepared to assess the potential direct, indirect and cumulative impacts of a proposed federal action. If impacts are considered

16

Table of Contents

Risk factors

significant, the BLM will prepare a more detailed Environmental Impact Statement, or EIS, that is made available for public review and comment. The EPA, other governmental agencies, and any interested members of the public may review and comment on the scoping of the EIS, and the adequacy of any findings set forth in the draft and final EIS. The NEPA process and potential ensuing litigation can cause significant delays in the issuance of required permits. The NEPA process may also result in an agency decision to deny the proposed permit or, more likely, to impose conditional approval to mitigate its potential environmental impact, which could negatively impact the economic feasibility of a proposed project. We may not be able to restore wells in the PRB using our technology until we are able to obtain a land use permit from the BLM. Any significant delays in the issuance of required permits as a result of NEPA will likely prevent us from employing our technology on a commercial basis, which may have a material adverse effect on our business, financial condition and results of operations.

Certain of our leasehold assets are subject to lease conditions that require us to reestablish production within the next several years.

The majority of our leasehold acreage consists of leases that are past their primary term and have been held by natural gas production operations. Many of our wells are currently shut-in, and thus are not currently producing, and the associated leases have limitations on the length of time they will remain valid while waiting for operations to resume. Our restoration and production plans for these leases are subject to our ability to receive approvals and permits from the WDEQ, the WOGCC and the BLM. For instance, if we are restricted by the regulatory scheme in Wyoming from forming units and reestablishing production in these areas, the leases will expire. If our leases expire and we are unable to renew the leases, we will lose our right to implement our technology in the related properties. Additional factors, including costs to implement our technology, production results, availability and cost of capital, production costs, and gathering system and pipeline transportation constraints, could impact our ability to implement our technology and hold these leases.

We may have to incur additional unexpected regulatory costs before we can utilize our technology.