Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Millennial Media Inc. | a2206760zex-23_1.htm |

As filed with the Securities and Exchange Commission on February 24, 2012

Registration No. 333-178909

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2 to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

MILLENNIAL MEDIA, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 7311 | 20-5087192 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

2400 Boston Street, Suite 201

Baltimore, MD 21224

(410) 522-8705

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

Paul J. Palmieri

President and Chief Executive Officer

Millennial Media, Inc.

2400 Boston Street, Suite 201

Baltimore, MD 21224

(410) 522-8705

(Name, address, including zip code, and telephone number, including

area code, of agent for service)

Copies to:

| Brent B. Siler, Esq. Ryan E. Naftulin, Esq. Brian F. Leaf, Esq. Cooley LLP One Freedom Square, Reston Town Center 11951 Freedom Drive Reston, VA 20190-5656 Tel: (703) 456-8000 Fax: (703) 456-8100 |

Ho Shin, Esq. General Counsel and Chief Privacy Officer Millennial Media, Inc. 2400 Boston Street, Suite 201 Baltimore, MD 21224 Tel: (410) 522-8705 |

Robert D. Sanchez, Esq. Mark R. Fitzgerald, Esq. Michael C. Labriola, Esq. Wilson Sonsini Goodrich & Rosati, Professional Corporation 1700 K Street, NW, Fifth Floor Washington, D.C. 20006 Tel: (202) 973-8800 Fax: (202) 973-8899 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 under the Securities Exchange Act of 1934. (Check one):

| Large Accelerated Filer o | Accelerated Filer o | Non-accelerated Filer ý | Smaller Reporting Company o |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

PROSPECTUS (Subject to Completion)

Issued February 24, 2012

The information in this prospectus is not complete and may be changed. We and the selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we and the selling stockholders are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Shares

COMMON STOCK

Millennial Media, Inc. is offering shares of its common stock and the selling stockholders identified in this prospectus are offering an additional shares. We will not receive any of the proceeds from the sale of the shares being sold by the selling stockholders. This is our initial public offering and no public market currently exists for our common stock. We anticipate that the initial public offering price of our common stock will be between $ and $ per share.

We have applied to list our common stock on the under the symbol " ."

Investing in our common stock involves risks. See "Risk Factors" beginning on page 11.

PRICE $ A SHARE

| |

Price to Public |

Underwriting Discounts and Commissions |

Proceeds to Millennial Media |

Proceeds to Selling Stockholders |

||||

|---|---|---|---|---|---|---|---|---|

Per Share |

$ | $ | $ | $ | ||||

Total |

$ | $ | $ | $ |

We and the selling stockholders have granted the underwriters the right to purchase up to an additional shares of common stock.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares to purchasers on , 2012.

MORGAN STANLEY |

GOLDMAN, SACHS & CO. |

BARCLAYS CAPITAL |

||

ALLEN & COMPANY LLC STIFEL NICOLAUS WEISEL |

||||

, 2012

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus and any related free writing prospectus we may authorize to be delivered to you. We have not, the selling stockholders have not and the underwriters have not, authorized any person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. Neither this prospectus nor any related free writing prospectus is an offer to sell, nor are they seeking an offer to buy, these securities in any state where the offer or solicitation is not permitted. The information contained in this prospectus is complete and accurate as of the date on the front cover of this prospectus, but information may have changed since that date.

Until , 2012 (25 days after the commencement of this offering), all dealers that buy, sell or trade shares of our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

For investors outside the United States: We have not, the selling stockholders have not and the underwriters have not done anything that would permit this offering, or possession or distribution of this prospectus, in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside of the United States.

Conventions Used in this Prospectus

Mobile connected devices—We refer to mobile devices, such as traditional mobile phones, smartphones and tablets, that are able to connect to the internet through a cellular, wireless or other network as mobile connected devices.

Apps—Software applications specifically designed to operate on mobile connected devices are commonly called apps. Mobile connected devices can access information and content either through apps downloaded onto the device or from web-based mobile sites accessed using a web browser installed on the device. For convenience, unless the context otherwise requires, we refer to these apps and web-based mobile sites together as apps.

Developers—For convenience, we refer to the developers of apps and the publishers of web-based mobile sites together as developers.

Unique users—When we discuss the number of unique users our platform reaches, we measure this as the total number of unique users whose devices made ad requests to our platform within the last 30 days. This represents the number of users to whom we had an opportunity to deliver ads during that period, not the number of users who actually received ads.

Ad impressions—When we discuss the number of ad impressions we processed during a particular period, we measure this as the number of ad requests that were received by our platform from individual mobile devices, not the number of ads actually delivered or viewed by users.

Number of apps—When we discuss the number of apps enabled by the developers of those apps to receive ads delivered through our platform, we count an app developed for multiple operating systems as multiple apps.

New and existing clients—When we discuss existing clients, we are referring to advertiser clients who had, as of the beginning of the period being discussed, previously advertised on our platform at any time. An existing client would include a new brand or subsidiary of a parent company that had previously advertised with us. When we discuss new clients, we are referring to advertiser clients who had, as of the beginning of the period being discussed, not previously advertised on our platform.

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our consolidated financial statements and the related notes thereto and the information set forth under the sections "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations," in each case included in this prospectus. Unless the context otherwise requires, we use the terms "Millennial Media," "company," "we," "us" and "our" in this prospectus to refer to Millennial Media, Inc. and, where appropriate, our consolidated subsidiaries.

MILLENNIAL MEDIA, INC.

Our Mission

Our mission is to power the mobile app economy through innovative mobile advertising technology and solutions.

Our Company

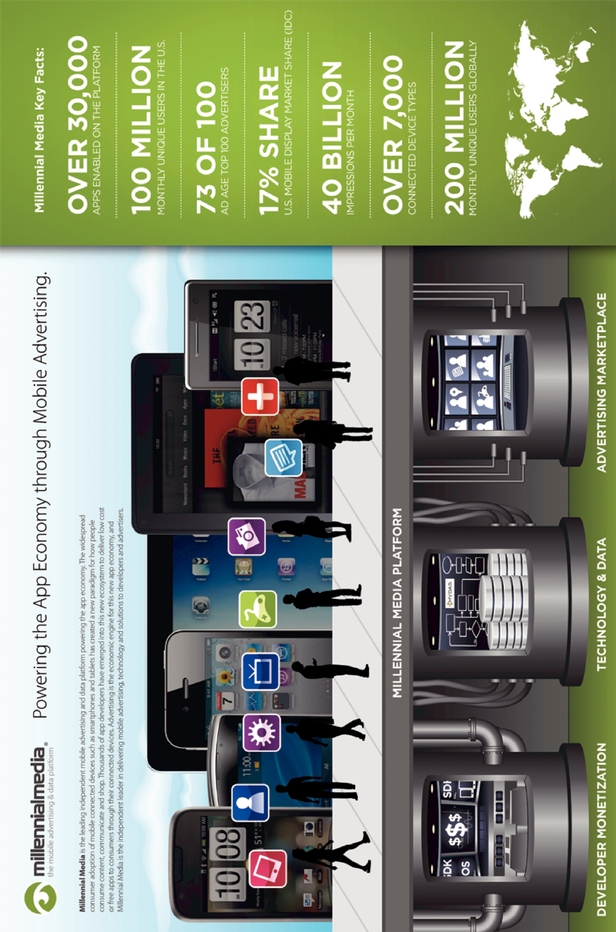

We are the leading independent mobile advertising platform company. Our technology, tools and services help developers maximize their advertising revenue, acquire users for their apps and gain insight about their users. To advertisers, we offer significant audience reach, sophisticated targeting capabilities and the opportunity to deliver interactive and engaging ad experiences to consumers on their mobile connected devices. Our proprietary technology and data platform, known as MYDAS®, determines in real-time which ad to deliver, as well as to whom and when, with the goal of optimizing the effectiveness of advertising campaigns regardless of device type or operating system. In December 2011, our platform reached approximately 200 million unique users worldwide, including approximately 100 million unique users in the United States alone. More than 30,000 apps are enabled by their developers to receive ads delivered through our platform, and we can deliver ads on over 7,000 different mobile device types and models. Our platform is compatible with all major mobile operating systems, including Apple iOS, Android, Windows Phone, Blackberry and Symbian. In December 2011, we processed 40 billion ad impressions. According to a December 2011 report by International Data Corporation, a market research firm, or IDC, we are the second largest mobile display advertising platform in the United States with a 16.7% market share. We are the only one of the three principal mobile advertising platform companies that is not affiliated with a particular mobile operating system or set of devices.

As smartphones, tablets and other mobile connected devices become increasingly powerful and affordable, and mobile internet access becomes more widespread and faster, users are consuming more content on their mobile devices. Apps in particular are becoming a popular way for consumers to engage with and consume personalized digital content on their mobile connected devices. Gartner Inc., an industry research firm, or Gartner, forecasts that the total number of downloads from mobile application stores worldwide will increase from 17.7 billion in 2011 to 108.8 billion in 2015, representing a compound annual growth rate of 57%. As the number of apps has proliferated, however, it has become increasingly difficult for developers to differentiate their apps from those of competitors in overcrowded app stores. As a result, large and small developers are competing for advertising budgets and visibility among users in order to realize their business objectives.

With growth in this mobile app-based economy, mobile advertising creates new opportunities for advertisers to reach and engage audiences of potential consumers. Mobile devices are inherently personal in nature, facilitate anytime-anywhere access to their users, allow for engaging app-enabled experiences and offer location-targeting capabilities. We believe that the combination of these features creates a powerful opportunity for delivering highly targeted, interactive advertising through mobile connected devices. However, a number of factors, including device and operating system diversity, as well as technological challenges, make it difficult and complex to deliver mobile advertising effectively.

1

We help developers and advertisers remove complexity from mobile advertising. By working with us, developers gain access to our tools and services that allow their apps to display banner ads, interactive rich media ads and video ads from our platform. In return, developers supply us with space on their apps to deliver ads for our advertiser clients and also provide us with access to anonymous data associated with their apps and users. We analyze this data to build sophisticated user profiles and audience groups that, in combination with the real-time decisioning, optimization and targeting capabilities of our technology platform, enable us to deliver highly targeted advertising campaigns for our advertiser clients. Advertisers pay us to deliver their ads to mobile connected device users, and we pay developers a fee for the use of their ad space. As we deliver more ads, we are able to collect additional anonymous data about users, audiences and the effectiveness of particular ad campaigns, which in turn enhances our targeting capabilities and allows us to deliver better performance for advertisers and better opportunities for developers to increase their revenue streams. Our use of data for interest-based targeting, including location data, is based on consumer consent, and we offer consumers the ability to opt out of such targeting.

We have built relationships with developers and advertisers of all sizes. Our developer base includes large mobile web publishers, such as CBS Interactive and The New York Times, and large app developers, such as Zynga, Rovio and Pandora, as well as other developers, such as UberMedia and Gogii. Our advertiser clients include leading advertising agencies and brands, including 23 of the top 25 national advertisers as ranked by Advertising Age magazine, or Ad Age, based upon U.S. ad spending in 2010, as well as smaller advertisers and often the developers themselves.

We have achieved significant growth as our platform has scaled and as we have expanded our product and service offerings. From 2009 to 2010, our revenue increased from $16.2 million to $47.8 million, or 195%, our gross margin improved from 29% to 34%, our net loss improved from $7.6 million to $7.1 million and our adjusted EBITDA improved from a loss of $7.0 million to a loss of $6.4 million. From 2010 to 2011, our revenue increased from $47.8 million to $103.7 million, or 117%, our gross margin improved from 34% to 39%, our net loss improved from $7.1 million to $287,000 and our adjusted EBITDA improved from a loss of $6.4 million to earnings of $1.8 million. Adjusted EBITDA is a financial measure that is not calculated in accordance with U.S. generally accepted accounting principles, or GAAP. For an explanation of the elements of adjusted EBITDA and a full reconciliation of adjusted EBITDA to net loss, the most directly comparable GAAP measure, see "—Adjusted EBITDA."

During the year ended December 31, 2011, approximately 10% of our revenue was derived from outside of the United States, up from 3% during the year ended December 31, 2010. We commenced our international operations in the United Kingdom during the first half of 2010 and launched operations in Singapore during the fourth quarter of 2011.

Industry Background

The convergence of several key trends is driving the growth of the mobile app economy and fundamentally changing the way that users consume content on their mobile connected devices. We believe these trends will continue to create a significant opportunity for mobile advertising. These trends include:

- •

- Adoption of faster and more functional mobile connected

devices. Driven by intuitive user interfaces, increased functionality, faster processing speeds, better graphics processors and advanced

display technologies with touch capabilities, it has become possible to deliver innovative, interactive and engaging consumer media experiences on a wide variety of mobile connected devices.

- •

- Widespread access to faster wireless networks facilitates consumer consumption of content. With the growth of mobile connected devices, consumers increasingly expect to have a high-quality online experience everywhere. Expansion of worldwide 3G network penetration, the rise of next-generation networks, such as 4G, and the prevalence of Wi-Fi access are facilitating the consumption of content on mobile connected devices. The combination of increased network access

2

- •

- Mobile usage has disrupted how content is

consumed. Consumers are increasingly using their mobile devices instead of personal computers or other traditional media to access

content. Mobile devices have become an increasingly important part of daily life, with users relying on mobile connectivity to read newspapers, magazines and blogs, watch movies, play games, check

sports scores, shop, monitor weather forecasts, conduct banking transactions, find maps and directions and listen to online radio stations. According to eMarketer, Inc., a market research firm,

the amount of time spent by consumers with their mobile devices is rising at a faster rate than is time spent viewing other kinds of media.

- •

- Growth of the mobile app

economy. Developers have created apps as an easy, intuitive and interactive way to instantly deliver content on mobile devices. Emerging

technologies, such as improvements in computer programming languages for structuring and presenting web-based content, have allowed app developers to harness the increasing processing

power and functionality of mobile devices and faster networks to deliver more engaging media to users. Gartner forecasts that the total number of free and charged-for downloads from mobile

application stores worldwide will increase from 17.7 billion in 2011 to over 108 billion in 2015.

- •

- Advertising industry is being disrupted by mobile advertising. Traditional advertising media, such as billboards, newspapers, magazines, radio and television, often suffer from a number of inherent limitations, including limited ability to target specific audiences, limited ability to measure audience reach and, in some cases, limited geographic range. As consumers spend more time online with personal computers, or PCs, digital advertising has proven to be more effective because it allows for user interaction, provides better measurement and achieves expanded audience reach. However, even PC-based digital advertising suffers from a number of significant limitations with respect to personalization, accessibility and location-based targeting, all of which can be provided through mobile advertising.

and faster network technologies is enabling the development of rich media content, presenting new opportunities in the mobile ecosystem.

Benefits of Mobile Advertising

Mobile advertising provides significant benefits both to developers and to advertisers. For developers, mobile advertising allows them to make money, acquire users and gain insight into app usage. For advertisers, the combination of the inherently personal nature of mobile devices, their enhanced functionality and the proliferation of app-enabled experiences creates a powerful opportunity for highly targeted and effective advertising. We believe mobile advertising enjoys a number of benefits over traditional advertising and PC-based online digital advertising, including:

- •

- anytime, anywhere access to users;

- •

- personalization of the advertising experience;

- •

- location-based targeting;

- •

- more complete user engagement;

- •

- enhanced audience targeting based on location, behavioral and demographic data; and

- •

- superior monetization opportunities for developers.

Market Opportunity

Given the benefits of mobile advertising as compared to traditional offline advertising and PC-based online advertising, we expect that marketers will continue to shift their advertising budgets to mobile. Gartner estimates that worldwide mobile advertising revenue, excluding advertising delivered in connection with search requests and maps, will grow from $1.8 billion in 2011 to approximately

3

$13.5 billion in 2015, reflecting a compounded annual growth rate of 65%. We believe that we are well-positioned to capture a significant portion of this growing mobile advertising market.

Complexities of Mobile Advertising

Despite the growing market opportunity for mobile advertising, companies in our industry must address several complexities and challenges in order to effectively deliver mobile advertising solutions, including:

- •

- fragmentation of the mobile ecosystem caused by a wide diversity of device types, numerous operating systems and varied

delivery and user engagement mechanisms;

- •

- limitations in using traditional identification techniques typically used in PC-based web advertising, such as

"cookies";

- •

- difficulty in predicting user behavior, including when and where a user will be consuming content on a mobile device;

- •

- varying connection quality that a mobile device may have at any given time; and

- •

- difficulties measuring performance of ads and user interactions with them on mobile connected devices.

Needs of Mobile App Developers and Advertisers

Developers require a flexible, easy-to-use solution that enables the delivery of engaging advertising to the users of their apps, regardless of the mobile operating system or device being used. Developers of all sizes want to minimize the complexities of monetizing their apps so that they can focus their resources instead on app development.

Advertisers, to achieve their business objectives in the mobile app context, require scale, reach and the ability to target and engage specific audiences. Advertisers need solutions that help optimize their investment by delivering effective campaigns across multiple devices and operating systems, maximizing the number of potential consumers the campaigns reach and then measuring the effectiveness of those campaigns.

Our Competitive Strengths

We believe the following strengths differentiate us from our competitors:

- •

- Differentiated technology

platform. Our MYDAS technology platform is specifically architected to deliver mobile advertising at scale, rather than applying

traditional online advertising technology or focusing on particular mobile operating systems. We designed our technology platform for the mobile environment, where the delivery and targeting of ads

must allow for a much larger number of variables than in traditional online advertising. Our platform is capable of accounting for, and efficiently analyzing, variables such as wireless connection

strength, device operating system and audience profile in real-time in order to decide which ad to send in response to a specific ad request from an app.

- •

- Large and growing data asset. We collect and analyze data from the billions of ads delivered on our platform each month to create anonymous profiles of unique users. This includes information such as data about the user's location or the user's interaction and response levels for ads shown on the device. This data helps us draw inferences about a user's demographic profile and better understand the user's behavior and preferences. To date, we have created more than 150 million proprietary anonymous unique user profiles. As we deliver more ads, our technology platform is able to dynamically recognize and link new information to these profiles, allowing us to continuously refine and gain additional insight into users' preferences and behavior, which helps us better deliver relevant ads to consumers.

4

- •

- Sophisticated audience targeting

capabilities. By leveraging the extensive data we collect to create audience profiles based on context and behavior, our platform can

match advertising campaigns with target audiences automatically in real-time. Our platform also allows us to target these audiences within a specific geographic area to achieve the goals

of an advertising campaign. We believe that our targeting capabilities enable us to maximize the campaign objectives of advertisers and the monetization objectives of developers.

- •

- Trusted partner for

developers. We help developers focus on their core business of developing apps. Our extensive experience and data asset give us valuable

industry insights and knowledge of successful developer business practices, which we share across our developer community. We believe that this partnership approach with developers helps to solidify

our developer relationships and the strategic role we play in their businesses, providing us with increased access to advertising opportunities.

- •

- Trusted partner for brand

advertisers. We have built relationships with leading advertising agencies and brands, including 23 of the top 25 Ad Age advertisers. We offer advertisers access

to our mobile advertising specialists, who supervise and support advertising campaigns through all

stages of planning and execution. As an independent advertising platform not focused on any particular device or operating system, we believe that we are able to effectively educate our advertiser

clients on the latest mobile trends and help them plan and deliver engaging and effective advertising campaigns that deliver sustainable and measurable results.

- •

- Mobile advertising industry pioneer and thought

leader. We believe that we have become the authoritative source for research and insight on the mobile advertising market. Using the

data collected on our platform, we publish our monthly Scorecard for Mobile Advertising Reach and Targeting, or S.M.A.R.T. report, which provides a

comprehensive view of trends in mobile advertising, and our Mobile Mix report, which highlights monthly trends for connected devices, device

manufacturers and mobile operating systems.

- •

- Significant scale and

reach. According to IDC, we are the second largest mobile display advertising platform in the United States, with a 16.7% market share.

We are the only one of the three principal mobile advertising platform companies that is not affiliated with a particular mobile operating system or set of devices. In December 2011, our platform

reached approximately 100 million unique mobile users in the United States and approximately 200 million users worldwide. Our technology and tools have been integrated into many of the

most popular apps available through major distribution channels, such as the Android Market and the Apple App Store.

- •

- Powerful network effects that connect our developers and advertisers. We believe that developers and advertisers both benefit from the use of our advertising platform. As the targeting capability of our advertising campaigns increases, we believe advertisers will be willing to pay more for our services, which in turn will attract developers to our platform since we can help them more effectively generate revenue through the advertising space within their apps.

Our Growth Strategy

We seek to become the strategic independent platform partner of choice for developers and advertisers wanting to capitalize on the large and growing mobile advertising opportunity. The key elements of our strategy are to:

- •

- innovate through continued investments in technology and data;

- •

- deepen our relationship with developers;

- •

- increase our share of advertising budgets from existing advertisers;

- •

- acquire new developers and advertisers;

5

- •

- increase our global market penetration;

- •

- expand our network of third-party providers of tools and services;

- •

- pursue strategic acquisitions; and

- •

- provide further insight into the mobile app economy.

Risks Related to our Business

Our business is subject to a number of risks of which you should be aware before making an investment decision. These risks are discussed more fully in the "Risk Factors" section of this prospectus immediately following this prospectus summary. These risks include, among others:

- •

- We have incurred significant net losses since inception and we expect our operating expenses to increase significantly in

the foreseeable future;

- •

- We may not be able to compete successfully, particularly against larger competitors, such as Google or Apple, that may

have greater resources or control their own mobile connected devices, mobile operating systems or content distribution channels;

- •

- Our business depends on our ability to collect and analyze data about mobile device user behavior, and we may become

subject to liabilities or reputational harm as a result of governmental regulation or industry standards relating to consumer privacy and data protection;

- •

- We may not be able to enhance our mobile advertising platform to keep pace with technological and market developments;

- •

- We depend on developers for mobile advertising space to deliver our advertiser clients' advertising campaigns;

- •

- Our international operations subject us to increased challenges and risks;

- •

- Our failure to protect our intellectual property rights could diminish the value of our services and weaken our

competitive position; and

- •

- We may need additional capital in the future to meet our financial obligations and to pursue our business objectives, and this additional capital may not be available on favorable terms, or at all.

Corporate Information

We were incorporated under the laws of the State of Delaware on May 30, 2006. Our principal executive office is located at 2400 Boston Street, Suite 201, Baltimore, Maryland. Our telephone number is (410) 522-8705. Our website address is www.millennialmedia.com. Information contained in, or accessible through, our website does not constitute a part of, and is not incorporated into, this prospectus.

"Millennial Media," the Millennial Media logo, "MYDAS," "S.M.A.R.T.," "Mobile Mix," "mmDev," "mmStudio," "mMedia," "mmPlan" and other trademarks or service marks of Millennial Media, Inc. appearing in this prospectus are the property of Millennial Media, Inc. This prospectus contains additional trade names, trademarks and service marks of others, which are the property of their respective owners.

6

Common stock offered by Millennial Media |

shares | |

Common stock offered by the selling stockholders |

shares |

|

Total common stock offered |

shares |

|

Total common stock to be outstanding after this offering |

shares |

|

Use of proceeds |

The principal purposes of this offering are to create a public market for our common stock and to facilitate our future access to the public equity markets, as well as to obtain additional capital. We intend to use the net proceeds from this offering for working capital and general corporate purposes, including further expansion of our international operations and product development. In addition, we may use a portion of the proceeds from this offering for acquisitions of complementary businesses, technologies or other assets, although we do not currently have any plans for any acquisitions. We will not receive any of the proceeds from the sale of shares to be offered by the selling stockholders. See "Use of Proceeds" on page 33. |

|

Risk factors |

See the section titled "Risk Factors" beginning on page 11 and the other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

|

Proposed symbol |

|

The number of shares of our common stock that will be outstanding after this offering is based on 65,690,038 shares of common stock outstanding as of December 31, 2011, and excludes:

- •

- 7,650,498 shares of our common stock issuable upon the exercise of stock options outstanding under our 2006 equity

incentive plan as of December 31, 2011, at a weighted average exercise price of $1.11 per share;

- •

- 50,750 shares of our common stock issuable upon the exercise of an outstanding warrant to purchase common stock as

of December 31, 2011, at an exercise price of $1.18 per share; and

- •

- shares of our common stock to be reserved for future issuance under our equity incentive plans following this offering.

Except as otherwise indicated herein, all information in this prospectus, including the number of shares that will be outstanding after this offering, assumes or gives effect to:

- •

- a -for- reverse stock split of our common stock expected

to be

completed prior to the completion of this offering;

- •

- the conversion of all outstanding shares of our convertible preferred stock into an aggregate of 47,679,003 shares of our

common stock, which will occur automatically upon the closing of this offering; and

- •

- no exercise of the underwriters' over-allotment option.

7

SUMMARY CONSOLIDATED FINANCIAL DATA

In the following tables, we provide our summary consolidated financial data. We have derived the summary consolidated statement of operations data for the years ended December 31, 2009, 2010 and 2011 and balance sheet data as of December 31, 2011 from our audited consolidated financial statements appearing elsewhere in this prospectus.

When you read this summary consolidated financial data, it is important that you read it together with the historical financial statements and related notes to those statements, as well as "Management's Discussion and Analysis of Financial Condition and Results of Operations," which are included in this prospectus.

| |

Year Ended December 31, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2009 | 2010 | 2011 | |||||||

| |

(in thousands, except share and per share data) |

|||||||||

Consolidated Statement of Operations Data: |

||||||||||

Revenue |

$ | 16,220 | $ | 47,828 | $ | 103,678 | ||||

Cost of revenue |

11,596 | 31,602 | 63,595 | |||||||

Gross profit |

4,624 | 16,226 | 40,083 | |||||||

Operating expenses: |

||||||||||

Sales and marketing |

4,609 | 8,508 | 14,255 | |||||||

Technology and development |

1,095 | 2,175 | 5,181 | |||||||

General and administrative |

6,326 | 12,535 | 21,321 | |||||||

Total operating expenses |

12,030 | 23,218 | 40,757 | |||||||

Loss from operations |

(7,406 | ) | (6,992 | ) | (674 | ) | ||||

Total other income (expense) |

(144 | ) | (107 | ) | (99 | ) | ||||

Loss before income taxes |

(7,550 | ) | (7,099 | ) | (773 | ) | ||||

Income tax (expense) benefit |

— | (22 | ) | 486 | ||||||

Net loss |

(7,550 | ) | (7,121 | ) | (287 | ) | ||||

Accretion of dividends on redeemable convertible preferred stock |

(1,793 | ) | (2,933 | ) | (5,022 | ) | ||||

Net loss attributable to common stockholders |

$ | (9,343 | ) | $ | (10,054 | ) | $ | (5,309 | ) | |

Net loss attributable to common stockholders per share—basic and diluted |

$ | (0.56 | ) | $ | (0.56 | ) | $ | (0.32 | ) | |

Pro forma net loss per share—basic and diluted(1) |

$ | (0.00 | ) | |||||||

Weighted average shares of common stock outstanding used in computing net loss attributable to common stockholders per share—basic and diluted |

16,783,411 | 17,965,893 | 16,362,810 | |||||||

Weighted average shares of common stock outstanding used in computing pro forma net loss per share—basic and diluted |

64,041,813 | |||||||||

Other Financial Data: |

||||||||||

Adjusted EBITDA(2) |

$ | (7,048 | ) | $ | (6,436 | ) | $ | 1,839 | ||

- (1)

- Pro

forma basic and diluted net loss per share have been calculated assuming (i) the conversion of all outstanding shares of redeemable convertible

preferred stock into an aggregate of 47,679,003 shares of common stock as of the beginning of the applicable year or at the time of issuance, if later, and (ii) the reclassification of the

outstanding preferred stock warrant to additional paid-in capital as of the beginning of the applicable year. The numerator of pro forma net loss per share of common stock is derived by

adding $78,000 for the year ended December 31, 2011 related to the change in fair value of the preferred stock warrant liability and by adding $5.0 million for the year ended

December 31, 2011 related to accretion of dividends on redeemable convertible preferred stock, respectively.

- (2)

- We define adjusted EBITDA as net loss plus: income tax (expense) benefit, interest income (expense), net, depreciation and amortization, and stock-based compensation. Please see "—Adjusted EBITDA" for more information and for a reconciliation of adjusted EBITDA to net loss, the most directly comparable financial measure calculated and presented in accordance with GAAP.

8

The following table presents our summary balance sheet data as of December 31, 2011:

- •

- on an actual basis;

- •

- on a pro forma basis to give effect to:

- •

- the conversion of all then outstanding shares of our redeemable convertible preferred stock into an aggregate of

47,679,003 shares of our common stock, which will occur automatically upon the closing of this offering; and

- •

- the reclassification of the preferred stock warrant liability to additional paid-in-capital upon

the automatic conversion of the redeemable convertible preferred stock issuable upon exercise of such warrant into common stock; and

- •

- on a pro forma as adjusted basis to give further effect to our sale of shares of common stock in this offering at an assumed initial public offering price of $ per share, which is the midpoint of the range set forth on the cover page of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

| |

As of December 31, 2011 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Actual | Pro forma | Pro forma as adjusted |

|||||||

| |

(in thousands) |

|||||||||

Consolidated Balance Sheet Data: |

||||||||||

Cash and cash equivalents |

$ | 16,707 | $ | 16,707 | $ | |||||

Accounts receivable, net of allowances |

34,986 | 34,986 | ||||||||

Total assets |

61,885 | 61,885 | ||||||||

Series B warrant outstanding |

183 | — | ||||||||

Total liabilities |

29,638 | 29,455 | ||||||||

Total redeemable convertible preferred stock |

76,668 | — | ||||||||

Additional paid-in capital |

— | 76,803 | ||||||||

Total stockholders' (deficit) equity |

(44,421 | ) | 32,430 | |||||||

The pro forma as adjusted information presented in the summary balance sheet data is illustrative only and will change based on the actual initial public offering price and other terms of this offering determined at pricing. Each $1.00 increase or decrease in the assumed initial public offering price of $ per share, which is the midpoint of the range set forth on the cover page of this prospectus, would increase or decrease each of cash and cash equivalents, working capital, total assets and total stockholders' equity on a pro forma as adjusted basis by approximately $ , assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same.

9

To provide investors with additional information regarding our financial results, we have used within this prospectus adjusted EBITDA, a non-GAAP financial measure. We have provided below a reconciliation of adjusted EBITDA to net loss, the most directly comparable GAAP financial measure.

We have included adjusted EBITDA in this prospectus because it is a key measure used by our management and board of directors to understand and evaluate our core operating performance and trends, to prepare and approve our annual budget and to develop short- and long-term operational plans. In particular, we believe that the exclusion of the expenses eliminated in calculating adjusted EBITDA can provide a useful measure for period-to-period comparisons of our core business. Additionally, adjusted EBITDA is a key financial measure used by the compensation committee of our board of directors in connection with the determination of compensation for our executive officers. Accordingly, we believe that adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors.

Our use of adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our financial results as reported under GAAP. Some of these limitations are:

- •

- although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may

have to be replaced in the future, and adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements;

- •

- adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs;

- •

- adjusted EBITDA does not reflect the potentially dilutive impact of equity-based compensation;

- •

- adjusted EBITDA does not reflect tax payments that may represent a reduction in cash available to us; and

- •

- other companies, including companies in our industry, may calculate adjusted EBITDA or similarly titled measures differently, which reduces its usefulness as a comparative measure.

Because of these and other limitations, you should consider adjusted EBITDA alongside other GAAP-based financial performance measures, including various cash flow metrics, net income (loss) and our other GAAP financial results. The following table presents a reconciliation of adjusted EBITDA to net loss for each of the periods indicated:

| |

Year Ended December 31, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2009 | 2010 | 2011 | |||||||

| |

(in thousands) |

|||||||||

Net loss |

$ | (7,550 | ) | $ | (7,121 | ) | $ | (287 | ) | |

Adjustments: |

||||||||||

Interest (income) expense, net |

144 | 28 | 21 | |||||||

Income tax expense (benefit) |

— | 22 | (486 | ) | ||||||

Depreciation and amortization expense |

146 | 223 | 759 | |||||||

Stock-based compensation expense |

212 | 412 | 1,832 | |||||||

Total net adjustments |

502 | 685 | 2,126 | |||||||

Adjusted EBITDA |

$ | (7,048 | ) | $ | (6,436 | ) | $ | 1,839 | ||

10

Investing in our common stock involves a high degree of risk. Before you invest in our common stock, you should carefully consider the following risks, as well as general economic and business risks, and all of the other information contained in this prospectus. Any of the following risks could have a material adverse effect on our business, operating results and financial condition and cause the trading price of our common stock to decline, which would cause you to lose all or part of your investment. When determining whether to invest, you should also refer to the other information contained in this prospectus, including our consolidated financial statements and the related notes thereto.

Risks Related to Our Business and Our Industry

We have incurred significant net losses since inception, and we expect our operating expenses to increase significantly in the foreseeable future. Accordingly, we may never achieve profitability.

We incurred net losses of $287,000 and $7.1 million in 2011 and 2010, respectively, and we had an accumulated deficit of $44.4 million as of December 31, 2011. We do not know when or if we will ever achieve profitability. Although our revenue has increased substantially in recent periods, it is likely that we will not be able to maintain this rate of revenue growth. Historically, our operating expenses have increased in proportion to our revenue. We anticipate that our operating expenses will continue to increase in the foreseeable future to the extent that our revenue grows and as we increase headcount, particularly our sales and technology-related headcount, incur general and administrative expenses associated with being a public company and expand our facilities. Although we expect to achieve operating efficiencies and greater leverage of resources as we grow, if we are unable to do so, we may be unable to achieve profitability. If we are not able to achieve and maintain profitability, the value of our company and our common stock could decline significantly.

We operate in an intensely competitive industry, and we may not be able to compete successfully.

The mobile advertising market is highly competitive, with numerous companies providing mobile advertising services. We compete primarily with Google Inc. and Apple Inc., both of which are significantly larger than us and have more capital to invest in their mobile advertising businesses. They, or other companies that offer competing mobile advertising solutions, may establish or strengthen cooperative relationships with their mobile operator partners, brand advertisers, app developers or other parties, thereby limiting our ability to promote our services and generate revenue. Competitors could also seek to gain market share from us by reducing the prices they charge to advertisers or by introducing new technology tools for developers. Moreover, increased competition for mobile advertising space from developers could result in an increase in the portion of advertiser revenue that we must pay to developers to acquire that advertising space.

Our business will suffer to the extent that our developer clients and advertiser clients purchase and sell mobile advertising directly from each other or through other companies that are able to become intermediaries between developers and advertisers. For example, we are aware of companies that have substantial existing platforms for developers but that currently do not heavily use those platforms for mobile advertising campaigns. These companies could compete with us to the extent they expand into mobile advertising. Other companies, such as large app developers with a substantial mobile advertising business, may decide to directly monetize some or all of their advertising space without utilizing our services. Other companies that offer analytics, mediation, exchange or other third-party services may also become intermediaries between mobile advertisers and developers and thereby compete with us. Any of these developments would make it more difficult for us to sell our services and could result in increased pricing pressure, reduced profit margins, increased sales and marketing expenses or the loss of market share.

11

The mobile advertising market may deteriorate or develop more slowly than expected, which could harm our business.

Advertising on mobile connected devices is an emerging phenomenon. Advertisers have historically spent a smaller portion of their advertising budgets on mobile media as compared to traditional advertising methods, such as television, newspapers, radio and billboards, or online advertising over the internet, such as placing banner ads on websites. Future demand and market acceptance for mobile advertising is uncertain. Many advertisers still have limited experience with mobile advertising and may continue to devote larger portions of their advertising budgets to more traditional offline or online personal computer-based advertising, instead of shifting additional advertising resources to mobile advertising. In addition, our current and potential advertiser clients may ultimately find mobile advertising to be less effective than traditional advertising media or marketing methods or other technologies for promoting their products and services, and they may even reduce their spending on mobile advertising from current levels as a result. If the market for mobile advertising deteriorates, or develops more slowly than we expect, we may not be able to increase our revenue.

Our business is dependent on the continued growth in usage of smartphones, tablets and other mobile connected devices.

Our business depends on the continued proliferation of mobile connected devices, such as smartphones and tablets, that can connect to the internet over a cellular, wireless or other network, as well as the increased consumption of content through those devices. Consumer usage of these mobile connected devices may be inhibited for a number of reasons, such as:

- •

- inadequate network infrastructure to support advanced features beyond just mobile web access;

- •

- users' concerns about the security of these devices;

- •

- inconsistent quality of cellular or wireless connection;

- •

- unavailability of cost-effective, high-speed internet service; and

- •

- changes in network carrier pricing plans that charge device users based on the amount of data consumed.

For any of these reasons, users of mobile connected devices may limit the amount of time they spend on these devices and the number of apps they download on these devices. If user adoption of mobile connected devices and consumer consumption of content on those devices do not continue to grow, our total addressable market size may be significantly limited, which could compromise our ability to increase our revenue and to become profitable.

If mobile connected devices, their operating systems or content distribution channels, including those controlled by our primary competitors, develop in ways that prevent our advertising from being delivered to their users, our ability to grow our business will be impaired.

Our business model depends upon the continued compatibility of our mobile advertising platform with most mobile connected devices, as well as the major operating systems that run on them and the thousands of apps that are downloaded onto them. The design of mobile devices and operating systems is controlled by third parties with whom we do not have any formal relationships. These parties frequently introduce new devices, and from time to time they may introduce new operating systems or modify existing ones. Network carriers, such as Verizon, AT&T or T-Mobile, may also impact the ability to download apps or access specified content on mobile devices.

In some cases, the parties that control the development of mobile connected devices and operating systems include companies that we regard as our most significant competitors. For example, Apple controls two of the most popular mobile devices, the iPhone and the iPad, as well as the iOS operating system that

12

runs on them. Apple also controls the App Store for downloading apps that run on Apple's mobile devices. Similarly, Google controls the Android operating system and, if its proposed acquisition of Motorola Mobility is completed, it will also control a significant number of additional mobile devices. If our mobile advertising platform were unable to work on these devices or operating systems, either because of technological constraints or because a maker of these devices or developer of these operating systems wished to impair our ability to provide ads on them or our ability to fulfill advertising space, or inventory, from developers whose apps are distributed through their controlled channels, our ability to generate revenue could be significantly harmed.

We do not control the mobile networks over which we provide our advertising services.

Our mobile advertising platform is dependent on the reliability of network operators and carriers who maintain sophisticated and complex mobile networks, as well as our ability to deliver ads on those networks at prices that enable us to realize a profit. Mobile networks have been subject to rapid growth and technological change, particularly in recent years. We do not control these networks.

Mobile networks could fail for a variety of reasons, including new technology incompatibility, the degradation of network performance under the strain of too many mobile consumers using the network, a general failure from natural disaster or a political or regulatory shut-down. Individuals and groups who develop and deploy viruses, worms and other malicious software programs could also attack mobile networks and the devices that run on those networks. Any actual or perceived security threat to mobile devices or any mobile network could lead existing and potential device users to reduce or refrain from mobile usage or reduce or refrain from responding to the services offered by our advertising clients. If the network of a mobile operator should fail for any reason, we would not be able to effectively provide our services to our clients through that mobile network. This in turn could hurt our reputation and cause us to lose significant revenue.

Mobile carriers may also increase restrictions on the amounts or types of data that can be transmitted over their networks. We currently generate different amounts of revenue from our advertiser clients based on the kinds of ads we deliver, such as display ads, rich media ads or video ads. In some cases, we are paid by advertisers on a cost-per-thousand, or CPM, basis depending on the number of ads shown. In other cases, we are paid on a cost-per-click, or CPC, or cost-per-action, or CPA, basis depending on the actions taken by the mobile device user. Different types of ads consume differing amounts of bandwidth and network capacity. If a network carrier were to restrict the amounts of data that can be delivered on that carrier's network, or otherwise control the kinds of content that may be downloaded to a device that operates on the network, it could negatively affect our pricing practices and inhibit our ability to deliver targeted advertising to that carrier's users, both of which could impair our ability to generate revenue.

Mobile connected device users may choose not to allow advertising on their devices.

The success of our business model depends on our ability to deliver targeted, highly relevant ads to consumers on their mobile connected devices. Targeted advertising is done primarily through analysis of data, much of which is collected on the basis of user-provided permissions. This data might include a device's location or data collected when device users view an ad or video or when they click on or otherwise engage with an ad. Users may elect not to allow data sharing for targeted advertising for a number of reasons, such as privacy concerns, or pricing mechanisms that may charge the user based upon the amount or types of data consumed on the device. Users may also elect to opt out of receiving targeted advertising from our platform. In addition, the designers of mobile device operating systems are increasingly promoting features that allow device users to disable some of the functionality, which may impair or disable the delivery of ads on their devices, and device manufacturers may include these features as part of their standard device specifications. Although we are not aware of any such products that are widely used in the market today, as has occurred in the online advertising industry, companies may develop products that enable users to prevent ads from appearing on their mobile device screens. If any of these

13

developments were to occur, our ability to deliver effective advertising campaigns on behalf of our advertiser clients would suffer, which could hurt our ability to generate revenue and become profitable.

Our limited operating history makes it difficult to evaluate our business and prospects and may increase your investment risk.

We commenced operations in 2006 and, as a result, we have only a limited operating history upon which you can evaluate our business and prospects. Although we have experienced significant revenue growth in recent periods, it is likely that we will not be able to sustain this growth. As part of the nascent mobile advertising industry, we will encounter risks and difficulties frequently encountered by early-stage companies in rapidly evolving industries, including the need to:

- •

- maintain our reputation and build trust with our advertiser and developer clients;

- •

- offer competitive pricing to both advertisers and developers;

- •

- maintain and expand our network of advertising space through which we deliver mobile advertising campaigns;

- •

- deliver advertising results that are superior to those that advertisers or developers could achieve directly or through

the use of competing providers or technologies;

- •

- continue to develop and upgrade the technologies that enable us to provide mobile advertising services;

- •

- respond to evolving government regulations relating to the internet, telecommunications, privacy, direct marketing and

advertising aspects of our business;

- •

- identify, attract, retain and motivate qualified personnel; and

- •

- manage our expanding operations.

If we do not successfully address these risks, our revenue could decline and our ability to pursue our growth strategy and attain profitability could be compromised.

We may not be able to enhance our mobile advertising platform to keep pace with technological and market developments.

The market for mobile advertising services is characterized by rapid technological change, evolving industry standards and frequent new service introductions. To keep pace with technological developments, satisfy increasing advertiser and developer requirements, maintain the attractiveness and competitiveness of our mobile advertising solutions and ensure compatibility with evolving industry standards and protocols, we will need to regularly enhance our current services and to develop and introduce new services on a timely basis.

For example, advances in technology that allow developers to generate revenue from their apps without our assistance could harm our relationships with developers and diminish our available advertising inventory within their apps. Similarly, technological developments that allow third parties to better mediate the delivery of ads between advertisers and developers by introducing an intermediate layer between us and our developer clients could impair our relationships with those developers. Our inability, for technological, business or other reasons, to enhance, develop, introduce and deliver compelling mobile advertising services in response to changing market conditions and technologies or evolving expectations of advertisers or mobile device users could hurt our ability to grow our business and could result in our mobile advertising platform becoming obsolete.

14

We depend on developers for mobile advertising space to deliver our advertiser clients' advertising campaigns, and any decline in the supply of advertising inventory from these developers could hurt our business.

We depend on developers to provide us with space within their apps on which we deliver ads. The developers that sell their advertising inventory to us are not required to provide any minimum amounts of advertising space to us, nor are they contractually bound to provide us with a consistent supply of advertising inventory. The tools that we provide to developers allow them to make decisions as to how to allocate advertising inventory among us and other advertising providers, some of which may be our competitors. A third party acting as a mediator on behalf of developers, or any competing mediation tools embedded within a developer's apps, could result in pressure on us to increase the prices we pay to developers for that inventory or otherwise block our access to developer inventory, without which we would be unable to deliver ads on behalf of our advertiser clients.

We generate a significant portion of our revenue from the advertising inventory provided by a limited number of developers. In most instances, developers can change the amount of inventory they make available to us at any time. Developers may also change the price at which they offer inventory to us, or they may elect to make advertising space available to our competitors who offer ads to them on more favorable economic terms. In addition, developers may place significant restrictions on our use of their advertising inventory. These restrictions may prohibit ads from specific advertisers or specific industries, or they could restrict the use of specified creative content or format. Developers may also use a fee-based or subscription-based business model to generate revenue from their content, in lieu of or to reduce their reliance on ads.

If developers decide not to make advertising inventory available to us for any of these reasons, decide to increase the price of inventory, or place significant restrictions on our use of their advertising space, we may not be able to replace this with inventory from other developers that satisfy our requirements in a timely and cost-effective manner. If this happens, our revenue could decline or our cost of acquiring inventory could increase.

Our business depends on our ability to collect and use data to deliver ads, and any limitation on the collection and use of this data could significantly diminish the value of our services and cause us to lose clients and revenue.

When we deliver an ad to a mobile device, we are often able to collect anonymous information about the placement of the ad and the interaction of the mobile device user with the ad, such as whether the user visited a landing page or watched a video. We may also be able to collect information about the user's mobile location. As we collect and aggregate this data provided by billions of ad impressions, we analyze it in order to optimize the placement and scheduling of ads across the advertising inventory provided to us by developers. For example, we may use the collected information to limit the number of times a specific ad is presented to the same mobile device, to provide an ad to only certain types of mobile devices, or to provide a report to an advertiser client on the number of its ads that were clicked. We also compile the data derived from our platform to publish monthly reports of key mobile industry trends in the form of our S.M.A.R.T. and Mobile Mix reports, which we provide to advertisers and developers to enable them to improve their business decisions about mobile advertising or monetization strategies and to promote their use of our services.

Although the data we collect is not personally identifiable, our clients might decide not to allow us to collect some or all of this data or might limit our use of this data. For example, app developers may not agree to provide us with the data generated by interactions with the content on their apps, or device users may not consent to having information about their device usage provided to the developer. Any limitation on our ability to collect data about user behavior and interaction with mobile device content could make it more difficult for us to deliver effective mobile advertising programs that meet the demands of our advertiser clients.

15

Although our contracts with advertisers generally permit us to aggregate data from advertising campaigns, these clients might nonetheless request that we discontinue using data obtained from their campaigns that have already been aggregated with other clients' campaign data. It would be difficult, if not impossible, to comply with these requests, and these kinds of requests could also cause us to spend significant amounts of resources. Interruptions, failures or defects in our data collection, mining, analysis and storage systems, as well as privacy concerns and regulatory restrictions regarding the collection of data, could also limit our ability to aggregate and analyze mobile device user data from our clients' advertising campaigns. If that happens, we may not be able to optimize the placement of advertising for the benefit of our advertiser clients, which could make our services less valuable, and, as a result, we may lose clients and our revenue may decline.

Our business depends in part on our ability to collect and use location-based information about mobile connected device users.

Our business model depends in part upon our ability to collect data about the location of mobile connected device users when they are interacting with their devices, and then to use that information to provide effective targeted advertising on behalf of our advertising clients. Our ability to either collect or use location-based data could be restricted by a number of factors, including new laws or regulations, technology or consumer choice. Limitations on our ability to either collect or use location data could impact the effectiveness of our platform and our ability to target ads.

Our business practices with respect to data could give rise to liabilities or reputational harm as a result of governmental regulation, legal requirements or industry standards relating to consumer privacy and data protection.

In the course of providing our services, we transmit and store information related to mobile devices and the ads we place, including a device's geographic location for the purpose of delivering targeted location-based ads to the user of the device, with that user's consent. Federal, state and international laws and regulations govern the collection, use, retention, sharing and security of data that we collect across our mobile advertising platform. We strive to comply with all applicable laws, regulations, policies and legal obligations relating to privacy and data protection. However, it is possible that these requirements may be interpreted and applied in a manner that is inconsistent from one jurisdiction to another and may conflict with other rules or our practices. Any failure, or perceived failure, by us to comply with U.S. federal, state, or international laws, including laws and regulations regulating privacy or consumer protection, could result in proceedings or actions against us by governmental entities or others. We are aware of several ongoing lawsuits filed against companies in our industry alleging various violations of privacy-related laws. These proceedings could hurt our reputation, force us to spend significant amounts in defense of these proceedings, distract our management, increase our costs of doing business, adversely affect the demand for our services and ultimately result in the imposition of monetary liability. We may also be contractually liable to indemnify and hold harmless our clients from the costs or consequences of inadvertent or unauthorized disclosure of data that we store or handle as part of providing our services.

The regulatory framework for privacy issues worldwide is evolving, and various government and consumer agencies and public advocacy groups have called for new regulation and changes in industry practices, including some directed at the mobile industry in particular. It is possible that new laws and regulations will be adopted in the United States and internationally, or existing laws and regulations may be interpreted in new ways, that would affect our business, particularly with regard to location-based services, collection or use of data to target ads and communication with consumers via mobile devices.

The U.S. government, including the Federal Trade Commission and the Department of Commerce, has announced that it is reviewing the need for greater regulation of the collection of consumer information, including regulation aimed at restricting some targeted advertising practices. The Federal Trade Commission has also proposed revisions to the Children's Online Privacy Protection Act, or COPPA,

16

that could, if adopted, create greater compliance burdens on us. COPPA imposes a number of obligations, such as obtaining parental permission, on website operators to the extent they collect certain information from children who are under 13 years old. The proposed changes would broaden the applicability of COPPA, including the types of information that would be subject to these regulations, and could apply to information that we or our clients collect through mobile devices or apps that is not currently subject to COPPA.

As we expand our operations globally, compliance with regulations that differ from country to country may also impose substantial burdens on our business. In particular, the European Union has traditionally taken a broader view as to what is considered personal information and has imposed greater obligations under data privacy regulations. In addition, individual EU member countries have had discretion with respect to their interpretation and implementation of the regulations, which has resulted in variation of privacy standards from country to country. In January 2012, the European Commission announced significant proposed reforms to its existing data protection legal framework, including changes in obligations of data controllers and processors, the rights of data subjects and data security and breach notification requirements. The EU proposals, if implemented, may result in a greater compliance burden if we deliver ads to mobile device users in Europe. Complying with any new regulatory requirements could force us to incur substantial costs or require us to change our business practices in a manner that could compromise our ability to effectively pursue our growth strategy.

In addition to compliance with government regulations, we voluntarily participate in several trade associations and industry self-regulatory groups that promulgate best practices or codes of conduct addressing the provision of location-based services, delivery of promotional content to mobile devices, and tracking of device users or devices for the purpose of delivering targeted advertising. We could be adversely affected by changes to these guidelines and codes in ways that are inconsistent with our practices or in conflict with the laws and regulations of U.S. or international regulatory authorities. If we are perceived as not operating in accordance with industry best practices or any such guidelines or codes with regard to privacy, our reputation may suffer and we could lose relationships with advertiser or developer partners.

Our quarterly operating results have fluctuated in the past and may do so in the future, which could cause our stock price to decline.

Our operating results have historically fluctuated and our future operating results may vary significantly from quarter to quarter due to a variety of factors, many of which are beyond our control. You should not rely on period-to-period comparisons of our operating results as an indication of our future performance. Factors that may affect our quarterly operating results include the following:

- •

- seasonal patterns in mobile advertisers' spending, which tend to be cyclical;

- •

- the addition of new advertiser or developer clients or the loss of existing advertisers or developers;

- •

- changes in demand for our mobile advertising services;

- •

- changes in the amount, price and quality of available advertising inventory from developers;

- •

- the timing and amount of sales and marketing expenses incurred to attract new advertisers and developers;

- •

- changes in the economic prospects of advertisers or the economy generally, which could alter current or prospective

advertisers' spending priorities, or could increase the time it takes us to close sales with advertisers;

- •

- changes in our pricing policies, the pricing policies of our competitors or the pricing of mobile advertising generally;

17

- •

- changes in governmental regulation of the internet, wireless networks, mobile advertising or the collection of mobile

device user data;

- •

- costs necessary to improve and maintain our technology platform;

- •

- timing differences at the end of each quarter between our payments to developers for advertising space and our collection

of advertising revenue related to that space; and

- •

- costs related to acquisitions of other businesses.

Our operating results may fall below the expectations of market analysts and investors in some future periods. If this happens, even just temporarily, the market price of our common stock may fall.

Seasonal fluctuations in mobile advertising activity could adversely affect our cash flows.

Our cash flows from operations could vary from quarter to quarter due to the seasonal nature of our advertisers' spending. For example, many advertisers devote the largest portion of their budgets to the fourth quarter of the calendar year, to coincide with increased holiday purchasing. To date, these seasonal effects have been masked by our rapid revenue growth. However, if and to the extent that seasonal fluctuations become more pronounced, our operating cash flows could fluctuate materially from period to period as a result.

We do not have long-term agreements with our advertiser clients, and we may be unable to retain key clients, attract new clients or replace departing clients with clients that can provide comparable revenue to us.

Our success requires us to maintain and expand our current advertiser client relationships and to develop new relationships. Our contracts with our advertiser clients generally do not include long-term obligations requiring them to purchase our services and are cancelable upon short or no notice and without penalty. As a result, we may have limited visibility as to our future advertising revenue streams. We cannot assure you that our advertiser clients will continue to use our services or that we will be able to replace, in a timely or effective manner, departing clients with new clients that generate comparable revenue. If a major advertising client representing a significant portion of our business decides to materially reduce its use of our platform or to cease using our platform altogether, it is possible that we would not have a sufficient supply of ads to fill our developer clients' advertising inventory, in which case our revenue could be significantly reduced. Any non-renewal, renegotiation, cancellation or deferral of large advertising contracts, or a number of contracts that in the aggregate account for a significant amount of revenue, could cause an immediate and significant decline in our revenue and harm our business.

Our sales efforts with both advertisers and developers require significant time and expense.

Attracting new advertiser and developer clients requires substantial time and expense, and we may not be successful in establishing new relationships or in maintaining or advancing our current relationships. For example, it may be difficult to identify, engage and market to potential advertiser clients who do not currently spend on mobile advertising or are unfamiliar with our current services or platform. Furthermore, many of our clients' purchasing and design decisions typically require input from multiple internal constituencies. As a result, we must identify those involved in the purchasing decision and devote a sufficient amount of time to presenting our services to each of those individuals.

The novelty of our services and our business model often requires us to spend substantial time and effort educating potential advertiser and developer clients about our offerings, including providing demonstrations and comparisons against other available services. This process can be costly and time-consuming. If we are not successful in streamlining our sales processes with advertisers and developers, our ability to grow our business may be adversely affected.

18