Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION - HARROW HEALTH, INC. | tdlp_ex311.htm |

| EX-31.2 - CERTIFICATION - HARROW HEALTH, INC. | tdlp_ex322.htm |

| EX-31.1 - CERTIFICATION - HARROW HEALTH, INC. | tdlp_ex321.htm |

| EX-31.2 - CERTIFICATION - HARROW HEALTH, INC. | tdlp_ex312.htm |

| EX-23.1 - CONSENT - HARROW HEALTH, INC. | tdlp_ex231.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES ACT OF 1934

For the fiscal year ended December 31, 2010

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES ACT OF 1934

Commission File Number: 000-52998

TRANSDEL PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

45-0567010

|

|

|

(State or other jurisdiction of

|

(IRS Employer Identification No.)

|

|

|

Incorporation or organization)

|

437 S. Hwy 101, Suite 209

Solana Beach, CA 92075

(Address, including zip code, of principal executive offices)

4275 Executive Square, Suite 485, La Jolla, CA

(Former name or former address if changed since last report.)

(858) 433-2800

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

|

Common Stock, $0.001 par value per share

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No þ

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No þ

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

o |

Accelerated filer

|

o |

|

Non-accelerated filer

|

o |

Smaller reporting company

|

þ |

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

As of June 30, 2010 approximately 15,852,061 shares of common stock were outstanding. The aggregate market value of the common stock held by non-affiliates of the registrant, as of June 30, 2010, the last business day of the second fiscal quarter, was approximately $7,109,497 based on the average high and low price of $1.15 for the registrant’s common stock as quoted on the OTC Markets Pink Sheets on that date. Shares of common stock held by each director, each officer and each person who owns 10% or more of the outstanding common stock have been excluded from this calculation in that such persons may be deemed to be affiliates. The determination of affiliate status is not necessarily conclusive.

As of February 22, 2012, there were 15,900,811 shares of our common stock outstanding.

Documents incorporated by reference: None.

TABLE OF CONTENTS

|

PART I

|

|

||||

|

Item 1.

|

Description of Business

|

1 | |||

|

Item 1A.

|

Risk Factors

|

13 | |||

|

Item 1B.

|

Unresolved Staff Comments

|

23 | |||

|

Item 2.

|

Properties

|

23 | |||

|

Item 3.

|

Legal Proceedings

|

24 | |||

|

Item 4.

|

Mine Safety Disclosures

|

24 | |||

|

PART II

|

|||||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

25 | |||

|

Item 6.

|

Selected Financial Data

|

25 | |||

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

26 | |||

|

Item 7A.

|

Quantitative and Qualitative Disclosure About Market Risk

|

35 | |||

|

Item 8.

|

Financial Statements and Supplementary Data

|

35 | |||

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

35 | |||

|

Item 9A.

|

Controls and Procedures

|

35 | |||

|

Item 9B.

|

Other Information

|

37 | |||

|

PART III

|

|||||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

38 | |||

|

Item 11.

|

Executive Compensation

|

41 | |||

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

47 | |||

|

Item 13.

|

Certain Relationships and Related Transactions and Director Independence

|

49 | |||

|

Item 14.

|

Principal Accountant Fees and Services

|

52 | |||

| PART IV | |||||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

53 | |||

|

SIGNATURES

|

57 | ||||

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain of the statements included in this Form 10-K, are “forward-looking statements.” Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance or achievements, and may contain the words “estimate,” “project,” “intend,” “forecast,” “anticipate,” “plan,” “planning,” “expect,” “believe,” “will,” “shall,” “will likely,” “should,” “could,” “would,” “may” or words or expressions of similar meaning, including when used in the negative. Forward-looking statements, include, but are not limited to: statements regarding our research and development programs; proposed marketing and sales; patents and regulatory approvals; the effect of competition and proprietary rights of third parties; our interpretation of the results of the Phase 3 clinical trial for Ketotransdel®; whether the results from the clinical trial, along with the other clinical trials that may be required by the FDA, will be sufficient to support a 505(b)(2) New Drug Approval (NDA) submission; the potential indications for use for Ketotransdel®; the market opportunity for our products; and our ability to complete additional development activities for products utilizing our proprietary transdermal delivery platform, the need for and availability of additional financing and our access to capital; the trading of our common stock, licensing, distribution, collaboration and marketing arrangements with pharmaceutical companies; and the period of time for which our existing cash will enable us to fund our operations. Information regarding factors that could cause actual results to differ materially from such expectations is disclosed in this Report, including, without limitation, information under the caption “Risk Factors.” You should not place undue reliance on such forward-looking statements , which are based on the information currently available to us and speak only as of the date on which this Annual Report was filed with the Securities and Exchange Commission (“SEC”). We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

PART I

ITEM 1. DESCRIPTION OF BUSINESS

Company Overview

We are a specialty pharmaceutical company developing non-invasive, topically delivered products. Our innovative patented Transdel™ cream formulation technology is designed to facilitate the effective penetration of a variety of products through the tough skin barrier. Ketotransdel®, our lead pain product, utilizes the Transdel™ platform technology to deliver the active drug, ketoprofen, a non-steroidal anti-inflammatory drug (“NSAID”), through the skin directly into the underlying tissues where the drug exerts its well-known anti-inflammatory and analgesic effects. We intend to leverage the Transdel™ platform technology to expand and create a portfolio of topical products for a variety of indications.

Our common stock has been quoted on the OTC Market System since October 1, 2007 and currently trades on the OTC Market Pink Sheets under the symbol TDLP.PK. Prior to October 1, 2007, there was no active market for our common stock. On February 14, 2012, the closing price of our common stock was $0.09 per share. Our executive offices are located at 437 S. Hwy 101, Suite 209, Solana Beach, CA 92075 and our telephone number at such office is (858) 433-2800. Our website address is www.imprimispharma.com.

Corporate History

On September 17, 2007, we entered into an Agreement of Merger and Plan of Reorganization (the “Merger Agreement”) with, Transdel Pharmaceuticals Holdings, Inc., a privately held Nevada corporation (“Transdel Holdings”), and Trans-Pharma Acquisition Corp., our newly formed, wholly-owned Delaware subsidiary (“Acquisition Sub”). Upon closing of the merger transaction contemplated under the Merger Agreement (the “Merger”), Acquisition Sub merged with and into Transdel Holdings, and Transdel Holdings, as the surviving corporation, became our wholly-owned subsidiary. On June 20, 2011, Transdel Holdings was merged with Transdel Pharmaceuticals, Inc., at which time Transdel Holdings ceased as a corporation, and Transdel Pharmaceuticals, Inc. remains as the sole surviving corporation.

On each of September 17, 2007, and October 10, 2007, we completed private placements to selected institutional and individual investors in which we issued shares of our common stock and warrants to purchase shares of our common stock. In connection with the private placements, we raised approximately $3.8 million (net of placement fees and other costs aggregating $342,105 of which $36,229 was paid in fiscal year 2008) from the issuance of 2,071,834 shares of common stock and detachable redeemable five-year warrants to purchase 517,958 shares of our common stock at a cash exercise price of $4.00 per share and a cashless exercise price of $5.00 per share. In addition, we issued redeemable three-year warrants to purchase 33,750 shares of common stock to placement agents in connection with the September 2007 and October 2007 private placements.

Also, on May 12, 2008, we sold 1,818,180 shares of common stock for gross proceeds of approximately $4.0 million (net of legal and accounting costs of $22,470) through a follow-on private placement (the “Follow-on Private Placement”) to accredited investors. In addition, the investors received warrants to purchase 227,272 shares of common stock, exercisable for a period of five years at a cash and cashless exercise price of $4.40 and $5.50 per share, respectively.

Recent Developments

Bankruptcy Petition and Dismissal

On June 26, 2011 we filed a voluntary petition for reorganization relief under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the Southern District of California (the “Bankruptcy Court”), Case No. 11-10497-11 (the “Chapter 11 Case”). In connection with the Chapter 11 Case, we, as seller, and Cardium Healthcare, Inc., a wholly-owned subsidiary of Cardium Therapeutics, Inc., as purchaser (the “Cardium”), entered into an Asset Purchase Agreement dated June 26, 2011 (the “Asset Purchase Agreement”) pursuant to which we agreed to sell substantially all of our assets pursuant to Sections 105, 363 and 365 of the Bankruptcy Code, subject to court approval and the satisfaction of certain conditions set forth in the Asset Purchase Agreement.

1

Consummation of the sale to Cardium was subject to a number of conditions, including, among others, the approval by the Bankruptcy Court of the transactions contemplated by the Asset Purchase Agreement and compliance with certain specified deadlines for actions in connection with the Bankruptcy Case. The Asset Purchase Agreement was terminable by the parties under a number of circumstances, including failure to obtain certain Bankruptcy Court orders by agreed dates.

On July 26, 2011, the Bankruptcy Court denied our motion to sell our assets pursuant to the Asset Purchase Agreement. On October 7, 2011, we terminated the Asset Purchase Agreement pursuant to its terms. On November 21, 2011, in connection with the transactions described below, we requested that the Bankruptcy Court dismiss the Chapter 11 Case and retain jurisdiction to decide matters related to claims brought in the Bankruptcy Case by the Purchaser. On December 9, 2011, the Bankruptcy Court entered an order dismissing the Chapter 11 Case. In connection with the dismissal of the Chapter 11 Case, the Bankruptcy Court, among other things, declined to retain jurisdiction over claim objection proceedings and found moot our objection to certain claims to receive a break-up fee pursuant to the Asset Purchase Agreement of Cardium Therapeutics, Inc. and Cardium Healthcare, Inc., a wholly owned subsidiary of Cardium. The dismissal of the Chapter 11 Case was based upon the provisions of both 11 U.S.C. Sections 305(a) and 1112(b).

Secured Line of Credit – Related Party

On November 21, 2011, we entered into a Secured Line of Credit Letter Agreement (the “Line of Credit Agreement”) with DermaStar International, LLC (“DermaStar”), pursuant to which DermaStar agreed to lend us funds under a line of credit upon certain conditions, including the dismissal of the Chapter 11 Case by the Bankruptcy Court. The Line of Credit Agreement became effective on December 9, 2011, in connection with the dismissal of the Chapter 11 Case by the Bankruptcy Court. On December 9, 2011, as required by the Line of Credit Agreement, we entered into a Security Agreement and an Intellectual Property Security Agreement, pursuant to which we granted to DermaStar a blanket security interest in all of our assets, including our intellectual property. The Line of Credit Agreement provides for advances of up to an aggregate of $750,000 (each an “Advance” and collectively the “Loan”), subject to the satisfaction by us of certain conditions in connection with the initial Advance and each subsequent Advance. Each Advance will be made pursuant to a Promissory Note in favor of DermaStar. On December 12, 2011, we requested and received advances totaling $300,000.

Change in Control – Preferred Stock

In partial consideration for and in connection with the Line of Credit Agreement, on November 21, 2011 we executed a Securities Purchase Agreement (the “Purchase Agreement”) with DermaStar, pursuant to which we agreed to issue ten (10) shares of newly-designated Series A Convertible Preferred Stock (the “Series A Preferred Stock”) to DermaStar for an aggregate purchase price of $100,000. The Purchase Agreement, as amended, became effective on December 9, 2011, in connection with the dismissal of the Chapter 11 Case by the Bankruptcy Court. On December 12, 2011, we and DermaStar consummated the transactions contemplated by the Purchase Agreement. The shares of Series A Preferred Stock issued to DermaStar in the offering are convertible into 59,988,002 shares of our Common Stock; however, until the effective date of the stockholder action by written consent to approve to increase the number of authorized shares of Common Stock through an amendment to the our Amended and Restated Certificate of Incorporation (as described below) , DermaStar has the ability to convert five of its ten shares of Series A Preferred Stock into 29,994,001 shares of Common Stock, representing approximately 65% of the capital stock of the Company on an as-converted basis. Upon issuance of the Series A Preferred Stock, DermaStar, and its members individually, became control persons of the Company, and as such, this and any further transactions between the Company and DermaStar, and/or its members individually, will be disclosed as related party transactions. We appointed DermaStar Managing Members Mark L. Baum and Robert J. Kammer to our Board of Directors in December 2011.

Settlement with the Holders of the Company’s 7.5% Convertible Promissory Note

Effective as of January 25, 2012, we entered into separate waiver and settlement agreements with the two parties holding a $1,000,000 7.5% convertible promissory note (the “Convertible Note”) issued by us on April 5, 2010. DermaStar had previously acquired eighty percent (80%) of the Convertible Note in a private transaction with Alexej Ladonnikov, the original purchaser of the Convertible Note. Mr. Ladonnikov is now the holder of twenty percent (20%) of the Convertible Note.

2

In connection with each of the waiver and settlement agreements, the holders of the Convertible Note each agreed to forever waive their rights to (i) accelerate the entire unpaid principal sum of the Convertible Note and all accrued interest pursuant to Section 1 of the Convertible Note related to the Company’s Bankruptcy petition filed June 26, 2011, (ii) Section 7 of the Senior Convertible Note Purchase Agreement dated April 5, 2010, regarding the designation and creation of the Series A Convertible Preferred Stock and (iii) certain conversion rights pursuant to Section 3 of the Convertible Note related to the change of control that resulted from the sale of the Series A Convertible Preferred Stock. In addition, pursuant to the terms of the waiver and settlement agreement with DermaStar (the “DermaStar Waiver Agreement”), we and DermaStar agreed to the mandatory conversion of the eighty percent (80%) of the principal and accrued and unpaid interest of the Convertible Note held by DermaStar, at such time as we have a sufficient number of authorized common shares to effect such a conversion, into our common stock at a conversion price of $0.01667 (“DermaStar Conversion Price”). Additionally, DermaStar agreed to a mandatory conversion of an additional $56,087 in good and valid current accounts payable of the Company (“AP Conversion”) currently held by DermaStar, at such time as we have a sufficient number of authorized common shares and DermaStar is able to convert the Convertible Note. The AP Conversion will be made at the DermaStar Conversion Price. Directors Mr. Baum and Dr. Kammer are both affiliates of DermaStar. The DermaStar Waiver Agreement was negotiated and approved by the sole disinterested director unaffiliated with DermaStar. Directors Mr. Baum and Dr. Kammer abstained from voting on this matter.

Pursuant to the terms of the waiver and settlement agreement with Mr. Ladonnikov (the “Ladonnikov Waiver Agreement”), we and Mr. Ladonnikov agreed to the mandatory conversion of the twenty percent (20%) of the principal and accrued and unpaid interest of the Convertible Note held by Mr. Ladonnikov, at such time as we have a sufficient number of authorized common shares to effect such a conversion, into our common stock a conversion price of $0.015. Additionally, Mr. Ladonnikov agreed to make a one-time payment of $50,000 to us at such time as the Convertible Note is converted into common stock.

At any time prior to the automatic conversions of the Convertible Note we retain the right to prepay the Convertible Note in full. As of February 15, 2012, the balance of the Convertible Note, including principal and accrued and unpaid interest, equals approximately $1,139,932. At maturity, to the extent the number of authorized shares of common stock is increased, the conversion of the Convertible Note and AP Conversion would result in the issuance of approximately 73,269,391 additional shares of our common stock. A conversion of the Convertible Note would eliminate all amounts due to DermaStar and Alexej Ladonnikov in connection with the Convertible Note. Upon the effective date of the Certificate Amendment described below we will have sufficient authorized shares of common stock to enable the automatic conversion of the Convertible Note.

Amendment to Certificate of Incorporation

On January 25, 2012, the Board approved an amendment to our Amended and Restated Certificate of Incorporation (the “Certificate Amendment” and submitted the Certificate Amendment to our stockholders for approval. The Certificate Amendment: (i) increases the number of authorized shares of our capital stock to Four Hundred Million (400,000,000) and the number of authorized shares of common stock to Three Hundred Ninety-Five Million (395,000,000) (the “Share Increase”); and (ii) changes our name from Transdel Pharmaceuticals, Inc. to Imprimis Pharmaceuticals, Inc. Our stockholders approved the Certificate Amendment in an action by written consent on January 25, 2012. We expect the Certificate Amendment to become effective on February 28, 2012, following our compliance with certain information requirements of the SEC.

In addition, also on January 25, 2012, the Board approved and submitted to our stockholders a proposal to effect a reverse stock split of all of the outstanding shares of common stock (the “Reverse Stock Split”) at an exchange ratio of either one-for-six, one-for-eight, one-for-ten or one-for-20, such exchange ratio to be determined by the Board of Directors in its sole discretion at any time following stockholder approval of the Reverse Stock Split through the date twelve months following the date of such stockholder approval. The Reverse Stock Split would preserve the existing aggregate par value of our common stock. In the event we effect the Reverse Stock Split, no stockholder holding greater than 100 common shares prior to the Reverse Stock Split will hold, after such Reverse Stock Split, less than 100 common shares. Our stockholders approved an Amendment to our Amended and Restated Certificate of Incorporation to effect the Reverse Stock Split (the “Reverse Split Certificate Amendment”) in an action by written consent on January 25, 2012. The stockholder approval will become effective following the Company’s compliance with certain information statement requirements of the SEC, which the Company expects to occur on or about February 28, 2012. At that time, the Board will effect a one-for-eight reverse stock split..

3

Amendments to 2007 Incentive Stock and Awards Plan

The 2007 Incentive Stock and Awards Plan (the “Plan”) was originally approved by the Board and the stockholders of the Company on September 17, 2007 and prior to the approval of the amendments to the Plan discussed below, provided for the granting of stock options and awards to purchase up to a maximum of 3,000,000 shares of common stock (subject to adjustment in the event of certain capital changes). On January 25, 2012, our Board unanimously approved the below amendments to the Plan (collectively, the “Plan Amendments”) and recommended their approval to our stockholders. The Plan currently authorizes the grant of awards to Participants with respect to a maximum of 3,000,000 shares of Common Stock, which will increase to 30,000,000 as of the effective date of the Plan Amendment.

Changes in Management and Board of Directors

As a result of the Chapter 11 Case, our management team has undergone significant changes during the fiscal year ending December 31, 2011. The Board accepted the resignation of John N. Bonfiglio, Ph.D. as Chief Executive Officer and President of the Company and as a director on the Board, effective May 13, 2011. On the same date, the Board appointed John T. Lomoro, to serve as the Company’s Principal Executive Officer. The Board accepted the resignation of John T. Lomoro as Principal Executive Officer, Chief Financial Officer and Treasurer of the Company, effective September 16, 2011. On the same date, the Board appointed Terry Nida, the Company’s Chief Business Officer, to serve as the Company’s Principal Executive Officer and Principal Financial Officer. Effective December 16, 2011, Terry Nida resigned as Principal Executive Officer and Principal Financial Officer of the Company.

Since January 1, 2012, we have assembled a new management team. Effective January 1, 2012, the Board appointed Balbir Brar, D.V.M., Ph.D. as President of the Company. Effective February 1, 2012, the Board appointed Andrew R. Boll as Vice-President of Accounting and Public Reporting and Principal Accounting and Financial Officer of the Company. Effective February 15, 2012, the Board appointed Joachim Schupp, M.D. as Chief Medical Officer of the Company. Mr. Baum, Chairman of our Board of Directors, currently serves as our Principal Executive Officer.

Our Board of Directors has also undergone significant change. Effective December 16, 2011, Mark L. Baum and Dr. Robert J. Kammer joined the Board of Directors. Mr. Baum and Dr. Kammer are the Managing Members of DermaStar and both Dr. Kammer and Mr. Baum hold ownership interests in DermaStar. There are no arrangements or understandings between either Mr. Baum or Dr. Kammer and any other persons pursuant to which either Mr. Baum or Dr. Kammer was elected as a director. Also effective December 16, 2011, Anthony S. Thornley resigned as a director from the Company’s Board of Directors. Effective February 15, 2012, Paul Finnegan, M.D. and Dr. Brar, our President, were appointed as directors of the Company. We currently have five directors: Jeffrey Abrams, M.D., Mr. Baum, Dr. Kammer, Dr.. Finnegan and Dr. Brar. Mr. Baum serves as the Chairman of the Board of Directors.

Ketotransdel®

Ketotransdel®, our lead drug candidate, is comprised of a transdermal formulation of ketoprofen, a non-steroidal anti-inflammatory drug (“NSAID”), and our proprietary Transdel™ drug delivery system and is being developed for the treatment of acute pain. Ketotransdel® penetrates the skin barrier to reach the targeted underlying tissues where it exerts its localized anti-inflammatory and analgesic effect. The topical delivery of the drug minimizes systemic exposure, especially for acute indications, and therefore, have the potential for fewer concerns pertaining to gastrointestinal, hepatic, cardiovascular and other adverse systemic effects, which are associated with orally administered NSAIDs.

We selected ketoprofen as the active ingredient for Ketotransdel® based on its efficacy and safety track record when administered topically.

Clinical Program for Ketotransdel®

In June 2008, we initiated a Phase 3 clinical study designed as a randomized, double-blind, placebo-controlled, multi-center Phase 3 study that enrolled a total of 364 patients with acute soft tissue injuries of the upper or lower extremities in 26 centers in the United States. The primary efficacy endpoint was the difference between Ketotransdel® and placebo in the change from baseline in pain intensity as measured by the 100 mm Visual Analogue Scale (VAS) during daily activities over the past 24 hours on the Day 3 visit.

4

As we reported in October 2009, the top-line results showed that the study demonstrated failed to meet its primary endpoint, although a post-hoc analysis revealed that a modified intent-to-treat analysis showed statistical significance favoring. There were no Ketotransdel® treatment related gastrointestinal, cardiovascular, hepatic or other clinically relevant adverse events (AEs) reported. In particular, there was a low incidence of skin associated AEs, 1.1% with Ketotransdel® and 2.2% with placebo. Furthermore, Ketotransdel® was well absorbed through the skin and in support of the safety and tolerability only minimal blood concentrations of ketoprofen were detected in a subset of patients who underwent blood sampling for pharmacokinetic (PK) analyses following repeated topical applications. These PK results are consistent with our previous clinical study findings and support the strong safety profile.

In January 2010, we reported on further post-hoc analyses of the ITT data from the Ketotransdel® Phase 3 study. For the modified ITT analysis we identified 35 patients who did not meet study entry criteria at the time of randomization. Excluding these patients who did not meet the study entry criteria but was nevertheless randomized into the trial, the modified ITT population demonstrated statistical significance (p<0.038) on the primary efficacy endpoint for Ketotransdel® compared to placebo vehicle). This post-hoc analysis was confirmed by a third-party statistical expert.

The weight of evidence of a treatment effect in this study is further strengthened by a key secondary endpoint (pain intensity recorded 3 times daily on patient diary cards) that supports the primary endpoint. The pain curves over time show consistent separation between treatment groups reaching statistical significance in favor of Ketotransdel®; using both the original and modified ITT population. Furthermore, the proportion of subjects who were satisfied with the treatment and achieved moderate or higher pain relief - as recorded on a 7 point Likert Scale - was statistically significantly greater with Ketotransdel® on Day 3 (p= 0.023).

Based on discussions with the FDA at least two adequate and well-controlled Phase 3 studies are required in order to obtain regulatory approval to market Ketotransdel®.

As part of a routine requirement to provide safety information in the NDA submission we have to perform studies such as to assess the allergenicity potential and absorption of ketoprofen during concurrent exercise and heat exposure with Ketotransdel®. These additional supportive trials will be conducted in healthy subjects. The timing of the second and third Phase 3 trial and the other supportive studies will be dependent on obtaining adequate financing to support the execution of these activities and for other working capital expenditures. Upon receipt of such financing, we anticipate initiating the second Phase 3 trial and supportive studies in 2012 (or 2013). Based on successful outcome of the two additional Phase 3 trials, we anticipate filing the 505(b)(2) application in a timely manner. We expect that Ketotransdel®, if and when approved by the FDA, could become the first topical NSAID cream product available by prescription in the United States for acute, localized pain management.

Cosmetic Product Development Program

We have expanded our product development programs to include cosmetic products, which utilize our patented transdermal delivery system technology, TransdelTM. Our lead product is an anti-cellulite formulation, for which we have initial clinical information supporting the beneficial effects of this key cosmetic product on skin appearance. Our potential pipeline of cosmetic products includes hyperpigmentation and anti-aging formulations.

On August 25, 2008, the Company entered into an agreement with RIL-NA, LLC in order to enter into business relationships with third parties for certain of the Company’s cosmetic product formulations. RIL-NA, LLC was to be paid a commission equal to approximately twenty percent (20%) of the adjusted gross revenues realized from transactions related to this agreement. This agreement is terminable with 60 days written notice by either RIL-NA or the Company. On June 12, 2011, the Company entered into another agreement with RIL-NA, LLC whereby RIL-NA paid approximately $5,000 in related legal filing fees to acquire exclusive marketing rights for the Company’s anti-cellulite product formulation from June 13, 2011 through August 11, 2011. This agreement automatically terminated on August 12, 2011, no revenues or amounts were paid to or on behalf of the Company.

5

On May 20, 2009, we entered into a license agreement with JH Direct, LLC (“JH Direct”) providing JH Direct with the exclusive worldwide rights to our anti-cellulite cosmetic product. Under the terms of the agreement, JH Direct will pay us initial royalty advances if the product is marketed and a continuing licensing royalty on the worldwide sales of the anti-cellulite product. We retained the exclusive rights to seek pharmaceutical/dermatological partners for the anti-cellulite product for an initial period of one year following the launch of the product, thereafter JH Direct will be allowed to expand in this channel. In September 2010, it was announced that JH Direct had completed their initial product testing of our anti-cellulite formulation in 24 subjects, which consisted of observing the before and after results of applying the product over a 16 week period. The excellent results observed during this test have led JH Direct to initiate plans for a final test in approximately 25 subjects to be conducted by a third-party skin research center that will conduct a similar test to the initial test as well as obtain additional measurements over a 12 week period. JH Direct planned a commercial launch of the product for the first quarter of 2011 subject to successful completion of this final test. As of December 31, 2010, we received $80,000 in advance non-refundable royalty payments and $20,000 during April 2011. The Company has exercised its rights under the license agreement and terminated this contract effective January 30, 2012.

In June 2010, we entered into a license agreement with Jan Marini Skin Research, Inc. ("JMSR") providing JMSR with the exclusive U.S. rights to our transdermal delivery technology for use in an anti-cellulite cosmetic product for the dermatological market. Under the terms of the agreement, JMSR will pay us a licensing royalty on the U.S. and worldwide sales of an anti-cellulite product using our delivery technology. JMSR obtained an exclusive right to promote and sell a product in the U.S. dermatological market for approximately one year after which time they have a non-exclusive right. Also, JMSR obtained a non-exclusive right to promote and sell the product in the ex-U.S. dermatological market. The Company does not expect to receive future royalties from this agreement as JMSR has abandoned its efforts to commercialize the product at this time and the Company has exercised its rights under the license agreement and terminated this contract effective January 30, 2012. No revenues or amounts were paid to or on behalf of the Company related to this agreement.

Other Product Development Programs

We believe that the clinical success of Ketotransdel® will facilitate the use of the Transdel™ delivery technology in other products. We have identified co-development opportunities for potential products utilizing the Transdel™ platform technology and we are exploring potential partnerships for these identified products. We are also looking to out-license our Transdel™ drug delivery technology for the development and commercialization of additional innovative drug products. There can be no assurance that any of the activities associated with our product development programs will lead to definitive agreements.

We believe that our current staff is sufficient to carry out our business plan in the coming twelve months, however, if our operations in the future require it, we will consider the employment of additional staff or the use of consultants. For the next twelve months, our current business plan is focused on raising capital in order to complete the development of our lead drug, Ketotransdel® for the indication of acute pain, inflammation and swelling associated with soft tissue injuries and potentially other acute musculoskeletal conditions. In addition, we intend to explore potential co-development opportunities in other therapeutic areas and also with cosmetic products utilizing our Transdel™ platform technology.

Market and Opportunity

The market for NSAIDs and COX-2 inhibitors in the United States may exceed $8 billion. Since the withdrawal of major COX-2 inhibitors in 2005, oral NSAIDs have captured a share of the multibillion retail market for COX-2 inhibitors. Oral NSAIDs remain one of the most prescribed classes of drugs in the pain management market. Over 30 million people worldwide use prescription and over-the-counter NSAIDs daily.

We believe that there is a significant unmet medical need for topical localized pain management products that minimize systemic absorption of NSAIDs such as Ketotransdel® due to the recognition of cardiovascular, gastrointestinal and other risks associated with orally administered NSAIDs.

6

The Transdel™ Technology

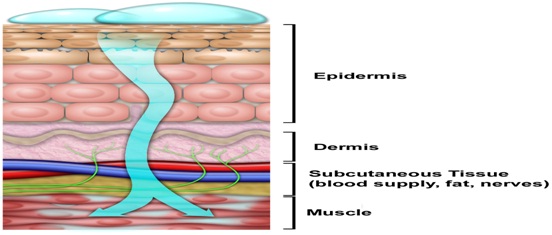

Transdel™ is our proprietary transdermal cream drug delivery platform. It consists of a combination of penetrating enhancers that enables topical delivery of drugs to the underlying target musculoskeletal tissue while avoiding first pass metabolism by the liver and minimizing systemic exposure. The Transdel™ drug delivery system facilitates the effective dissolution and delivery of a drug across the skin barrier to reach targeted underlying tissues as illustrated in the following diagram:

Transdel™ has the following properties that make it a highly versatile vehicle for topical drug administration:

|

●

|

Maximizes solubilization of drugs and components (lipophilic, hydrophilic and amphiphilic);

|

||||

|

●

|

Uses synergistic mechanisms to enhance penetration so that more effective concentrations of the beneficial drug or substances reach the dermal and subcutaneous tissue layers of the skin;

|

||||

|

●

|

Compatible with a broad range of drugs and molecular sizes;

|

||||

| ● | Biocompatible – Components generally regarded as safe (GRAS); | ||||

| ● | Thermodynamically stable, insensitive to moisture and resistant to microbial contamination; |

|

●

|

Clinical data collected to date points to safety and potential efficacy;

|

||||

|

●

|

Expected to result in decreased safety concerns which are typically associated with oral or systemic drugs, (e.g. stomach irritation with oral NSAIDs);

|

||||

|

●

|

Not associated with limitations of transdermal patches; (e.g., non-sticking and peeling of mobile areas; tendency towards local skin irritation);

|

||||

| ● |

Potentially produces patentable new products when combined with established drugs or new drugs.

|

7

Competition

The pharmaceutical industry is highly competitive. There are competitors in the United States that are currently selling FDA- approved products that our products would compete with if and when approved by the FDA. Also, we are aware of companies developing patch products and other pain formulations.

In addition to product safety, development and efficacy, other competitive factors in the pharmaceutical market include product quality and price, reputation, service and access to scientific and technical information. It is possible that developments by our competitors will make our products or technologies uncompetitive or obsolete. In addition, the intensely competitive environment of the pain management products requires an ongoing, extensive search for medical and technological innovations and the ability to market products effectively, including the ability to communicate the effectiveness, safety and value of branded products for their intended uses to healthcare professionals in private practice, group practices and managed care organizations. Because we are smaller than our competitors, we may lack the financial and other resources needed to develop, produce, distribute, market and commercialize any of our drug candidates or compete for market share in the pain management sector.

Third Party Service Agreements

We contract with various third parties to provide certain critical services including conducting and managing clinical and non-clinical studies, manufacturing, certain research and development activities, medical affairs and certain regulatory activities and financial functions. Our failure to maintain our relationships with these third party contractors may have a material adverse effect on our business, financial condition and results of operations.

Governmental Regulation

Our ongoing product development activities are subject to extensive and rigorous regulation at both the federal and state levels. Post development, the manufacture, testing, packaging, labeling, distribution, sales and marketing of our products is also subject to extensive regulation. The Federal Food, Drug and Cosmetic Act of 1983, as amended, and other federal and state statutes and regulations govern or influence the testing, manufacture, safety, packaging, labeling, storage, record keeping, approval, advertising, promotion, sale and distribution of pharmaceutical products. Noncompliance with applicable requirements can result in fines, recall or seizure of products, total or partial suspension of production and/or distribution, refusal of the government to approve New Drug Applications, or NDAs, civil sanctions and criminal prosecution.

FDA approval is typically required before each dosage form or strength of any new drug can be marketed. Applications for FDA approval must contain information relating to efficacy, safety, toxicity, pharmacokinetics, product formulation, raw material suppliers, stability, manufacturing processes, packaging, labeling, and quality control. The FDA also has the authority to revoke previously granted drug approvals. Product development and approval within this regulatory framework requires a number of years and involves the expenditure of substantial resources.

Current FDA standards for approving new pharmaceutical products are more stringent than those that were applied in the past. As a result, labeling revisions, formulation or manufacturing changes and/or product modifications may be necessary. For example, due to an increased understanding of the cardiovascular and gastrointestinal risks associated with NSAIDs, the FDA approved new rules requiring that professional labeling for all prescription and over-the-counter NSAIDs include information on such risks. We cannot determine what effect changes in regulations or legal interpretations, when and if promulgated, may have on our business in the future. Changes could, among other things, require expanded or different labeling, the recall or discontinuance of certain products, additional record keeping and expanded documentation of the properties of certain products and scientific substantiation. Such regulatory changes, or new legislation, could have a material adverse effect on our business, financial condition and results of operations. The evolving and complex nature of regulatory requirements, the broad authority and discretion of the FDA and the generally high level of regulatory oversight results in a continuing possibility that from time to time, we will be adversely affected by regulatory actions despite ongoing efforts and commitment to achieve and maintain full compliance with all regulatory requirements.

8

FDA Approval Process

To obtain approval of a new product from the FDA, we must, among other requirements, submit data supporting safety and efficacy, as well as detailed information on the manufacture and composition of the product and proposed labeling. The testing and collection of data and the preparation of necessary applications are expensive and time-consuming. The FDA may not act quickly or favorably in reviewing these applications, and we may encounter significant difficulties or costs in our efforts to obtain FDA approvals that could delay or preclude us from marketing our products.

The process required by the FDA before a new drug may be marketed in the U.S. generally involves the following: (i) completion of nonclinical laboratory and animal testing in compliance with FDA regulations; (ii) submission of an investigational new drug application, which must become effective before human clinical trials may begin; (iii) performance of adequate and well-controlled human clinical trials to establish the safety and efficacy of the proposed drug for its intended use; and (iv) submission and approval of an NDA by the FDA.

The sponsor typically conducts human clinical trials in three sequential phases, but the phases may overlap

|

|

●

|

Phase 1 clinical studies frequently begin with the initial introduction of the compound into healthy human subjects prior to introduction into patients, involves testing the product for safety, adverse effects, dosage, tolerance, absorption, metabolism, excretion and other elements of clinical pharmacology.

|

|

|

●

|

Phase 2 clinical studies typically involve studies in a small sample of the intended patient population to assess the efficacy of the compound for a specific indication, to determine dose tolerance and the optimal dose range as well as to gather additional information relating to safety and potential adverse effects.

|

||

|

|

●

|

Phase 3 clinical studies are undertaken to further evaluate clinical safety and efficacy in an expanded patient population at typically dispersed study sites, in order to determine the overall risk-benefit ratio of the compound and to provide an adequate basis for product labeling.

|

|

As a product candidate moves through the clinical phases, manufacturing processes are further defined, refined, controlled and validated. The level of control and validation required by the FDA in the conduct of clinical trials increases as clinical studies progress.

Clinical trials must be conducted in accordance with the FDA’s good clinical practices requirements. The FDA may order the temporary or permanent discontinuation of a clinical trial at any time or impose other sanctions if it believes that the clinical trial is not being conducted in accordance with FDA requirements or presents an unacceptable risk to the clinical trial patients. An institutional review board, or IRB, generally must approve the clinical trial design and patient informed consent at each clinical site and may also require the clinical trial at that site to be halted, either temporarily or permanently, for failure to comply with the IRB’s requirements, or may impose other conditions.

The applicant must submit to the FDA the results of the nonclinical studies and clinical trials, together with, among other things, detailed information on the manufacture and composition of the product and proposed labeling, in the form of an NDA, including payment of a user fee, unless waived. The FDA reviews all NDAs submitted before it accepts them for filing and may request additional information rather than accepting an NDA for filing. Once the submission is accepted for filing, the FDA begins an in-depth review of the NDA. Under the Prescription Drug User Fee Act, or PDUFA, the FDA ordinarily has 10 months in which to complete its initial review of the NDA and respond to the applicant. However, the PDUFA goal dates are not legal mandates and the FDA response often occurs several months beyond the original PDUFA goal date. The review process and the target response date under PDUFA may be extended if the FDA requests or the NDA sponsor otherwise provides additional information or clarification regarding information already provided in the NDA submission. Following completion of the FDA’s initial review of the NDA and the clinical and manufacturing procedures and facilities, the FDA will issue a complete response or action letter, which will either include an approval authorizing commercial marketing of the drug for certain indications or contain the conditions that must be met in order to secure final approval of the NDA. If the FDA’s evaluation of the NDA submission and the clinical and manufacturing procedures and facilities is not favorable, the FDA may refuse to approve the NDA.

9

Section 505(b)(2) New Drug Applications

Since the active pharmaceutical ingredient, in Ketotransdel® is ketoprofen (brandname: Orudis, Oruvail), the oral formulation of which has already been approved by the FDA, we are able to file a NDA under section 505(b)(2) of the Hatch-Waxman Act of 1984 for this product as well as other products that we may develop including approved active pharmaceutical ingredients. This is an alternate path to FDA approval for new formulations of previously approved products. Section 505(b)(2) was enacted as part of the Drug Price Competition and Patent Term Restoration Act of 1984, otherwise known as the Hatch-Waxman Act. Section 505(b)(2) permits the submission of an NDA where at least some of the information required for approval comes from studies not conducted by or for the applicant and for which the applicant has not obtained a right of reference. The Hatch-Waxman Act permits the applicant to rely upon certain published nonclinical or clinical studies conducted for an approved product or the FDA’s conclusions from prior review of such studies. The FDA may also require companies to perform additional studies or measurements to support any changes from the approved product. The FDA may then approve the new product for all or some of the label indications for which the referenced product has been approved, as well as for any new indication sought by the Section 505(b)(2) applicant. While references to nonclinical and clinical data not generated by the applicant or for which the applicant does not have a right of reference are allowed, all development, process, stability, qualification and validation data related to the manufacturing and quality of the new product must be included in an NDA submitted under Section 505(b)(2).

Each study is conducted in accordance with certain standards under protocols that detail the objectives of the study, the parameters to be used to monitor safety, and efficacy criteria to be evaluated. Each protocol must be submitted to the FDA. In some cases, the FDA allows a company to rely on data developed in foreign countries or previously published data, which eliminates the need to independently repeat some or all of the studies.

To the extent that the Section 505(b)(2) applicant is relying on the FDA’s conclusions regarding studies conducted for an already approved product, the applicant is required to certify to the FDA concerning any patents listed for the approved product in the FDA’s Orange Book publication. Specifically, the applicant must certify that: (i) the required patent information has not been filed; (ii) the listed patent has expired; (iii) the listed patent has not expired, but will expire on a particular date and approval is sought after patent expiration; or (iv) the listed patent is invalid or will not be infringed by the new product. A certification that the new product will not infringe the already approved product’s listed patents or that such patents are invalid is called a paragraph IV certification. If the applicant does not challenge the listed patents, the Section 505(b)(2) application will not be approved until all the listed patents claiming the referenced product have expired. The Section 505(b)(2) application also will not be approved until any non-patent exclusivity, such as exclusivity for obtaining approval of a new chemical entity, listed in the Orange Book for the referenced product has expired.

As a condition of approval, the FDA or other regulatory authorities may require further studies, including Phase IV post-marketing studies to provide additional data. Other post-marketing studies may be required to gain approval for the use of a product as a treatment for clinical indications other than those for which the product was initially tested. Also, the FDA or other regulatory authorities require post-marketing reporting to monitor the adverse effects of the drug. Results of post-marketing programs may limit or expand the further marketing of the products.

The FDA closely regulates the post-approval marketing and promotion of drugs, including standards and regulations for direct-to-consumer advertising, off-label promotion, industry-sponsored scientific and educational activities and promotional activities involving the Internet. A company can make only those claims relating to safety and efficacy that are approved by the FDA. Failure to comply with these requirements can result in adverse publicity, warning letters, corrective advertising and potential civil and criminal penalties. Physicians may prescribe legally available drugs for uses that are not described in the drug's labeling and that differ from those tested by us and approved by the FDA. Such off-label uses are common across medical specialties. Physicians may believe that such off-label uses are the best treatment for many patients in varied circumstances. The FDA does not regulate the behavior of physicians in their choice of treatments. The FDA does, however, impose stringent restrictions on manufacturers’ communications regarding off-label use.

In 2005, the FDA asked the manufacturer of Celebrex, as well as all manufacturers of prescription and over-the-counter NSAIDs, to revise the labeling for their products. Manufacturers of NSAIDs are being asked to revise their labeling to provide specific information about the potential risk of cardiovascular events and gastrointestinal risks of their individual products. We are continuing to analyze how this pronouncement will affect the labeling of Ketotransdel®.

10

Quality Assurance Requirements

The FDA enforces regulations to ensure that the methods used in, and facilities and controls used for, the manufacture, processing, packing and holding of drugs conform to current good manufacturing practices, or cGMP. The cGMP regulations the FDA enforces are comprehensive and cover all aspects of operations, from receipt of raw materials to finished product distribution, insofar as they bear upon whether drugs meet all the identity, strength, quality, purity and safety characteristics required of them. To assure compliance requires a continuous commitment of time, money and effort in all operational areas.

The FDA conducts pre-approval inspections of facilities engaged in the development, manufacture, processing, packing, testing and holding of the drugs subject to NDAs. If the FDA concludes that the facilities to be used do not meet cGMP, good laboratory practices or good clinical practices requirements, it will not approve the NDA. Corrective actions to remedy the deficiencies must be performed and verified in a subsequent inspection. In addition, manufacturers of both pharmaceutical products and active pharmaceutical ingredients used to formulate the drug also ordinarily undergo a pre-approval inspection, although the inspection can be waived when the manufacturer has had a passing cGMP inspection in the immediate past. Failure of any facility to pass a pre-approval inspection will result in delayed approval and would have a material adverse effect on our business, results of operations and financial condition.

The FDA also conducts periodic inspections of facilities to assess their cGMP status. If the FDA were to find serious cGMP non-compliance during such an inspection, it could take regulatory actions that could adversely affect our business, results of operations and financial condition. The FDA could initiate product seizures, request product recalls and seek to enjoin a product’s manufacture and distribution. In certain circumstances, violations could lead to civil penalties and criminal prosecutions. In addition, if the FDA concludes that a company is not in compliance with cGMP requirements, sanctions may be imposed that include preventing the company from receiving the necessary licenses to export its products and classifying the company as an “unacceptable supplier,” thereby disqualifying the company from selling products to federal agencies. Imported active pharmaceutical ingredients and other components needed to manufacture our products could be rejected by United States Customs.

We believe that we and our suppliers and outside manufacturers are currently in compliance with all FDA requirements.

Other FDA Matters

If there are any modifications to an approved drug, including changes in indication, manufacturing process or labeling or a change in a manufacturing facility, an applicant must notify the FDA, and in many cases, approval for such changes must be submitted to the FDA or other regulatory authority. Additionally, the FDA regulates post-approval promotional labeling and advertising activities to assure that such activities are being conducted in conformity with statutory and regulatory requirements. Failure to adhere to such requirements can result in regulatory actions that could have a material adverse effect on our business, results of operations and financial condition.

Intellectual Property

We obtained a patent from the United States Patent and Trademark Office on our Transdel™ technology in 1998, which affords protection of Transdel™ through 2016 in the United States. This patent specifically lists over 500 different drugs in over 60 therapeutic areas, including both approved and established drugs. The Transdel™ technology may also have an application to deliver drugs not listed in its patent, including novel drugs. Also, it covers composition of matter, methods of use and methods of manufacture. In regard to this U.S. patent, we will be pursuing patent strategies that will potentially allow us to extend the life of the patent beyond 2016. The Company has been granted a patent related to its Transdel™ technology pending in Canada. The Company has filed additional patent applications in various jurisdictions in order to protect the Company’s non-pharmaceutical and cosmetic intellectual property rights. The Company is committed to developing a robust intellectual property strategy in order to pursue its business objectives.

11

Employees

As of February 15, 2012, we employ one part-time individual and two full-time individuals, who are responsible for financial accounting and investor relations, business and corporate development, research and development management, and general administration. We are not party to any collective bargaining agreements with any of our employees. We have never experienced a work stoppage, and we believe our employee relations are good. We hire independent contractor labor and consultants on an as needed basis and have entered into consulting arrangements with certain directors in exchange for stock options and/or cash payments.

SEC Filings; Internet Address

We file our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports with the SEC and make such filings available, free of charge, on www.imprimispharma.com, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The information found on our web-site shall not be deemed incorporated by reference by any general statement incorporating by reference this report into any filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent we specifically incorporate the information found on our web-site by reference, and shall not otherwise be deemed filed under such Acts.

Our filings are also available through the SEC Web-site, www.sec.gov, and at the SEC Public Reference Room at 100 F Street, NE Washington DC 20549. For more information about the SEC Public Reference Room, you can call the SEC at 1-800-SEC-0330.

12

ITEM 1A. RISK FACTORS

Investing in our common stock involves a high degree of risk. Before investing in our common stock you should carefully consider the following risks, together with the financial and other information contained in this Form 10-K. If any of the following risks actually occurs, our business, prospects, financial condition and results of operations could be adversely affected. In that case, the trading price of our common stock would likely decline and you may lose all or a part of your investment.

Risks Relating to Our Business

We will need to raise additional funds to operate our business.

We expect that our operating expenses will increase substantially over the current fiscal annual period as we focus on resuming our operations. We have access to a Line of Credit with DermaStar, pursuant to which we may receive up to a maximum of $750,000. In December 2011 we requested advances totaling $300,000 under the Line of Credit. However, we expect that we will need to raise an additional $6 million in funds in order to operate and execute our business plan during the 2012 fiscal year. Our estimate of total expenditures could increase if we encounter unanticipated difficulties. In addition, our estimates of the amount of cash necessary to fund our business may prove to be wrong, and we could spend our available financial resources much faster than we currently expect. We expect to continue to seek funding in order to pursue our business plan. Other than in connection with the Line of Credit, we do not have any arrangements in place for any future financing. If we cannot raise the money that we need in order to continue to develop our business, we will be forced to delay, scale back or eliminate some or all of our proposed operations, and our business may fail.

The report of our independent registered public accounting firm on our 2010 consolidated financial statements contains a going concern modification, and we will need additional financing to execute our business plan, fund our operations and to continue as a going concern, which additional financing may not be available on a timely basis, or at all.

We have limited remaining funds to support our operations. We have prepared our consolidated financial statements in this Form 10-K on a going-concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. We will not be able to execute our current business plan, fund our business operations or continue as a going concern long enough to achieve profitability unless we are able to secure additional funds. With our current cash and cash equivalents position as of December 31, 2010, we have forecasted and anticipate having adequate resources in order to execute a portion of our operating plan through the third quarter of 2012. This does not include any additional cash resources that would be required to begin additional Phase 3 clinical studies on Ketotransdel®. The Report of Independent Registered Public Accounting Firm on our December 31, 2010 consolidated financial statements includes an explanatory paragraph stating that the recurring losses incurred from operations and a working capital deficiency raise substantial doubt about our ability to continue as a going concern. However, in order to execute the additional Phase 3 and supportive studies to obtain regulatory approval to market Ketotransdel®, we will need to secure additional funds. If adequate financing is not available, we will not be able to meet the FDA’s requirements to obtain regulatory approval to market Ketotransdel®. In addition, if one or more of the risks discussed in these risk factors occur or our expenses exceed our expectations, we may be required to raise further additional funds sooner than anticipated.

We will be required to pursue sources of additional capital to fund our operations through various means, including equity or debt financing, funding from a corporate partnership or licensing arrangement or any similar financing. However, we may be unable to obtain such financings on reasonable terms, or at all. Future financings through equity investments are likely to be dilutive to existing stockholders. Also, the terms of securities we may issue in future capital transactions may be more favorable for our new investors. Newly issued securities may include preferences, superior voting rights and the issuance of warrants or other derivative securities, which may have additional dilutive effects. In addition, if we raise additional funds through collaboration and licensing arrangements, we may be required to relinquish potentially valuable rights to our product candidates or proprietary technologies, or grant licenses on terms that are not favorable to us. Further, we may incur substantial costs in pursuing future capital and/or financing, including investment banking fees, legal fees, accounting fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which will adversely impact our financial results.

The significant downturn in the overall economy and the ongoing disruption in the capital markets has reduced investor confidence and negatively affected investments generally and specifically in the pharmaceutical industry. In addition, the fact that we are not profitable, have previously filed for Chapter 11 bankruptcy and will need significant additional funds to execute the second Phase 3 clinical trial and supportive studies in order to obtain regulatory approval to market Ketotransdel®, and our planned Phase 3b trial and any other clinical trials we would want to commence for other products, could further impact the availability or cost of future financings. As a result, there can be no assurance that additional funds will be available when needed from any source or, if available, will be available on terms that are acceptable to us. If we are unable to raise funds to satisfy our capital needs prior to the end of 2012 we will be required to cease operations.

13

We have incurred losses in the research and development of Ketotransdel® and our Transdel™ technology since inception. We may never generate revenue or become profitable.

Since inception we have recorded operating losses from Inception through December 31, 2010, we have a deficit accumulated during the development stage of approximately $17.5 million, and for the fiscal year ended December 31, 2010, we experienced a net loss of approximately $2.5 million. In addition, we expect to incur increasing operating losses for the foreseeable future as we continue to incur costs for research and development and clinical trials, and in other development activities. Our ability to generate revenue and achieve profitability depends upon our ability, alone or with others, to complete the development of our proposed products, obtain the required regulatory approvals and manufacture, market and sell our proposed products. Development is costly and requires significant investment. In addition, we may choose to in-license rights to particular drugs or active ingredients for use in cosmetic products. The license fees for such drugs or active ingredients may increase our costs.

As we continue to engage in the development of Ketotransdel® and develop other products, including cosmetic products, there can be no assurance that we will ever be able to achieve or sustain market acceptance, profitability or positive cash flow. Our ultimate success will depend on many factors, including whether Ketotransdel® receives FDA approval. We cannot be certain that we will receive FDA approval for Ketotransdel®, or that we will reach the level of sales and revenues necessary to achieve and sustain profitability. Unless we raise additional capital, we will not be able to execute our business plan or fund business operations. Furthermore, we will be forced to reduce our expenses and cash expenditures to a material extent, which would impair or delay our ability to execute our business plan.

We may not be able to correctly estimate our future operating expenses, which could lead to cash shortfalls.

Our operating expenses may fluctuate significantly in the future as a result of a variety of factors, many of which are outside of our control. These factors include:

|

●

|

the time and resources required to develop, conduct clinical trials and obtain regulatory approvals for our drug candidates;

|

|

●

|

the costs to rebuild our management team following our filing for Chapter 11 bankruptcy, including attracting and retaining personnel with the skills required for effective operations; and

|

|

●

|

the costs of preparing, filing, prosecuting, defending and enforcing patent claims and other patent related costs, including litigation costs and the results of such litigation.

|

Timing and results of clinical trials to demonstrate the safety and efficacy of products as well as FDA approval of products are uncertain.

We are subject to extensive government regulations. The process of obtaining FDA approval is costly, time consuming, uncertain and subject to unanticipated delays. Before obtaining regulatory approvals for the sale of any of our products, we must demonstrate through preclinical studies and clinical trials that the product is safe and effective for each intended use. Preclinical and clinical studies may fail to demonstrate the safety and effectiveness of a product. Even promising results from preclinical and early clinical studies do not always accurately predict results in later, large scale trials. A failure to demonstrate safety and efficacy would result in our failure to obtain regulatory approvals. Moreover, if the FDA grants regulatory approval of a product, the approval may be limited to specific indications or limited with respect to its distribution, which could limit revenues.

We cannot assure you that the FDA or other regulatory agencies will approve any products developed by us, on a timely basis, if at all, or, if granted, that such approval will not subject the marketing of our products to certain limits on indicated use. In particular, the outcome of the final analyses of the data from the Phase 3 clinical trial for Ketotransdel® may vary from our initial conclusions or the FDA may not agree with our interpretation of such results or may challenge the adequacy of our clinical trial design or the execution of the clinical trial. The FDA is requiring two adequate and well controlled Phase 3 clinical trials for Ketotransdel® before we can submit a 505(b) (2) New Drug Application. In addition, the results of any future clinical trials may not be favorable and we may never receive regulatory approval for Ketotransdel®. Any limitation on use imposed by the FDA or delay in or failure to obtain FDA approvals of products developed by us would adversely affect the marketing of these products and our ability to generate product revenue, as well as adversely affect the price of our common stock.

14

If we fail to comply with continuing federal, state and foreign regulations, we could lose our approvals to market drugs and our business would be seriously harmed.

Following initial regulatory approval of any drugs we may develop, we will be subject to continuing regulatory review, including review of adverse drug experiences and clinical results that are reported after our drug products become commercially available. This would include results from any post-marketing tests or continued actions required as a condition of approval. The manufacturer and manufacturing facilities we use to make any of our drug candidates will be subject to periodic review and inspection by the FDA. If a previously unknown problem or problems with a product or a manufacturing and laboratory facility used by us is discovered, the FDA or foreign regulatory agency may impose restrictions on that product or on the manufacturing facility, including requiring us to withdraw the product from the market. Any changes to an approved product, including the way it is manufactured or promoted, often requires FDA approval before the product, as modified, can be marketed. In addition, we and our contract manufacturers will be subject to ongoing FDA requirements for submission of safety and other post-market information. If we or our contract manufacturers fail to comply with applicable regulatory requirements, a regulatory agency ay:

|

●

|

issue warning letters;

|

|

●

|

impose civil or criminal penalties;

|

|

●

|

suspend or withdraw our regulatory approval;

|

|

●

|

suspend or terminate any of our ongoing clinical trials;

|

|

●

|

refuse to approve pending applications or supplements to approved applications filed by us;

|

|

●

|

impose restrictions on our operations;

|

|

●

|

close the facilities of our contract manufacturers; or

|

|

●

|

seize or detain products or require a product recall.

|

Additionally, regulatory review covers a company’s activities in the promotion of its drugs, with significant potential penalties and restrictions for promotion of drugs for an unapproved use. Sales and marketing programs are under scrutiny for compliance with various mandated requirements, such as illegal promotions to health care professionals. We are also required to submit information on our open and completed clinical trials to public registries and databases. Failure to comply with these requirements could expose us to negative publicity, fines and penalties that could harm our business.

If we violate regulatory requirements at any stage, whether before or after marketing approval is obtained, we may be fined, be forced to remove a product from the market or experience other adverse consequences, including delay, which would materially harm our financial results. Additionally, we may not be able to obtain the labeling claims necessary or desirable for product promotion.

15

Delays in the conduct or completion of our clinical and non-clinical trials or the analysis of the data from our clinical or non-clinical trials may result in delays in our planned filings for regulatory approvals, and may adversely affect our business.

We cannot predict whether we will encounter problems with any of our completed or planned clinical or non-clinical studies that will cause us or regulatory authorities to delay or suspend planned clinical and non-clinical studies. Any of the following could delay the completion of our planned clinical studies:

|

●

|

failure of the FDA to approve the scope or design of our clinical or non-clinical trials or manufacturing plans;

|

|

●

|

delays in enrolling volunteers in clinical trials;

|

|

●

|

insufficient supply or deficient quality of materials necessary for the performance of clinical or non-clinical trials;

|

|

●

|

negative results of clinical or non-clinical studies; and

|

|

●

|

adverse side effects experienced by study participants in clinical trials relating to a specific product.

|

There may be other circumstances other than the ones described above, over which we may have no control that could materially delay the successful completion of our clinical and non-clinical studies.

None of our pharmaceutical product candidates, other than Ketotransdel®, have commenced clinical trials.

None of our pharmaceutical product candidates, other than Ketotransdel®, have commenced any clinical trials and there are a number of FDA requirements that we must satisfy in order to commence clinical trials. These requirements will require substantial time, effort and financial resources. We cannot assure you that we will ever satisfy these requirements. In addition, prior to commencing any trials of a drug candidate, we must evaluate whether a market exists for the drug candidate. This is costly and time consuming and no assurance can be given that our market studies will be accurate. We may expend significant capital and other resources on a drug candidate and find that no commercial market exists for the drug. Even if we do commence clinical trials of our other drug candidates, such drug candidates may never be approved by the FDA.

Once approved, there is no guarantee that the market will accept our products, and regulatory requirements could limit the commercial usage of our products.

Even if we obtain regulatory approvals, uncertainty exists as to whether the market will accept our products or if the market for our products is as large as we anticipate. A number of factors may limit the market acceptance of our products, including the timing of regulatory approvals and market entry relative to competitive products, the availability of alternative products, the price of our products relative to alternative products, the availability of third party reimbursement and the extent of marketing efforts by third party distributors or agents that we retain. We cannot assure you that our products will receive market acceptance in a commercially viable period of time, if at all. We cannot be certain that any investment made in developing products will be recovered, even if we are successful in commercialization. To the extent that we expend significant resources on research and development efforts and are not able, ultimately, to introduce successful new products as a result of those efforts, our business, financial position and results of operations may be materially adversely affected, and the market value of our common stock could decline.