Attached files

| file | filename |

|---|---|

| 8-K - FSP GALLERIA NORTH - FSP GALLERIA NORTH CORP | eps4559.htm |

Exhibit 10.1

galleria north tower i

OFFICE LEASE AGREEMENT

Between

FSP GALLERIA NORTH LIMITED PARTNERSHIP,

a Texas limited partnership

as

Landlord

and

DEALERTRACK, INC.,

a Delaware corporation

as

Tenant

Premises:

Galleria North Tower I

Suites 220, 300, and 400

13737 Noel Road

Dallas, Texas 75240

BASIC LEASE INFORMATION

| Effective Date: | February 16, 2012 |

| Tenant: | DealerTrack, Inc., |

| a Delaware corporation | |

| Tenant's Address: | 1111 Marcus Ave. – Suite M04 |

| Lake Success, NY 11042 | |

| Ana Herrera | |

| Contact: | |

| Telephone: | 516-734-3604 |

| Landlord: | FSP Galleria North Limited Partnership, |

| a Texas limited partnership | |

| Landlord's Address: | Franklin Street Properties |

| 401 Edgewater Place | |

| Suite 200 | |

| Wakefield, Massachusetts 01880-6210 | |

| Contact: | John Donahue |

| 781-557-1300 | |

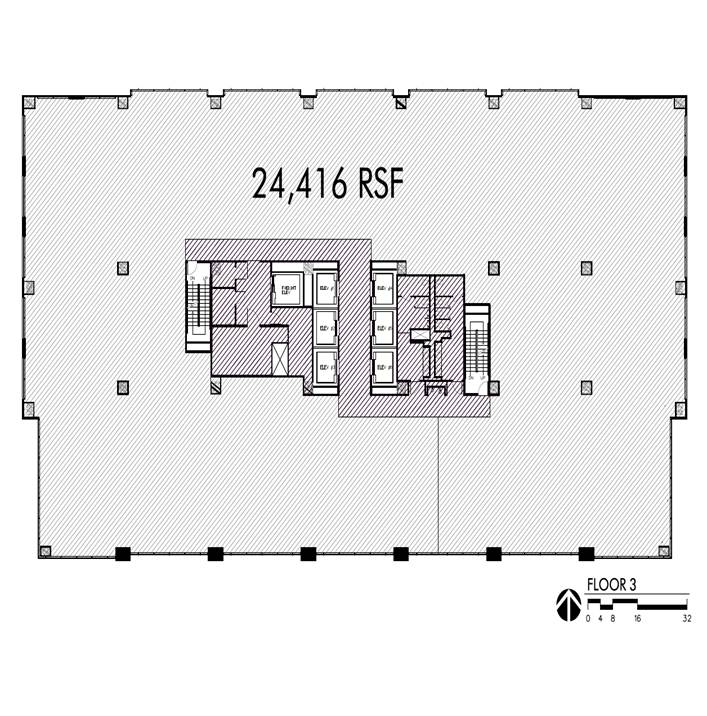

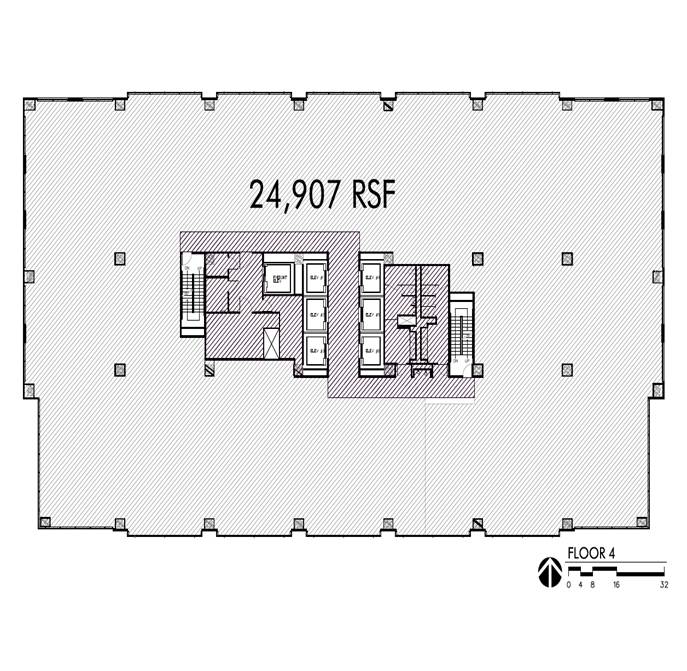

| Premises: | Suite 220 composed of 9,829 square feet of Rentable Area and Suites 300, and 400, composed of all of the Rentable Area on the third and fourth floors of the office building (the "Building") located at 13737 Noel Road, City of Dallas, Dallas County, Texas ("Land"). The Premises are outlined on the plan attached to the Lease as Exhibit B. |

| Term: | 130 months, commencing on the earlier of (i) August 1, 2012, as such date may be extended for Landlord Delays (as defined on Exhibit D hereto), or (ii) Substantial Completion (as defined on Exhibit D hereto), and ending at 5:00 p.m. on the last day of the 130th calendar month following the Commencement Date, subject to adjustment, extension and earlier termination as provided in the Lease. |

| Renewal Option(s): | Two renewal periods of 5 years each |

Base Rental:

| Lease Months | Annual Base Rental Rate Per RSF |

Annual Base Rental |

Monthly Installment |

Electricity |

| 1 thru 7 | -0- | -0- | “free rent” period | + Electricity |

| 8 thru 35 | $19.50 | $1,153.464.00 | $96,122.00 | + Electricity |

| 36 thru 63 | $20.70 | $1,224,446.40 | $102,037.20 | + Electricity |

| 64 thru 91 | $21.90 | $1,295,428.80 | $107,952.40 | + Electricity |

| 92 thru 94 | -0- | -0- | “free rent” period | + Electricity |

| 95 thru 118 | $23.10 | $1,366,411.20 | $113,867.60 | + Electricity |

| 119 thru 130 | $24.30 | $1,437,393.60 | $119,782.80 | + Electricity |

| Security Deposit: | None |

| Rent: | Base Rental, Tenant’s Share of Basic Operating Costs and Tenant’s Share of Taxes and all other sums that Tenant may owe to Landlord under the Lease. |

| Improvement Allowance: | $25.00 per square foot of Rentable Area. |

| Permitted Use: | General office purposes consistent with comparable first class office buildings in the Market Area. |

| Tenant's Share of Basic Operating Costs: | 15.586% |

| Base Year for Taxes: | 2012 |

| Base Year for Operating Costs: | 2012 |

| Initial Liability Insurance Amount: | $5,000,000.00 |

| Brokers: | Corporate Realty Consultants, for Tenant and Cassidy Turley Commercial Real Estate Services, for Landlord |

| Right of First Refusal | Covers space on 5th floor described on Exhibit “H” |

| Expansion Option | Covers space on 5th floor as described on Exhibit “I” |

| Early Termination Right | One time right at end of 91st Lease Month upon notice and payment of $861,308.00 termination fee no later than end of 79th Lease Month |

The foregoing Basic Lease Information is incorporated into and made a part of the Lease identified above. If any conflict exists between any Basic Lease Information and the Lease, then the Lease shall control.

OFFICE LEASE AGREEMENT

THIS OFFICE LEASE AGREEMENT ("Lease") is executed effective as of February 16, 2012 (the "Effective Date"), between FSP GALLERIA NORTH LIMITED PARTNERSHIP, a Texas limited partnership ("Landlord"), and DEALERTRACK, INC., a Delaware corporation ("Tenant").

W I T N E S S E T H:

1. Definitions. Capitalized terms used in this Lease and not defined elsewhere have the meanings given them below:

“After Hours HVAC Rate” means $50.00 per hour per floor, subject to change as provided herein.

“Alterations” shall have the meaning given such term in Section 15(a) hereto.

“Base Amount for Basic Operating Costs” means the Basic Operating Costs for the Base Year for Operating Costs.

"Base Amount for Taxes" means actual Taxes for the Base Year for Taxes.

"Base Rental" means the “Base Rental” set forth in the Basic Lease Terms.

“Base Year for Operating Costs” means calendar year 2012

“Base Year for Taxes” means calendar year 2012.

"Basic Operating Costs" shall have the meaning given to such term in Section 6(c) hereto.

"Broker" shall mean the broker(s) identified in the Basic Lease Information.

"Building" means the office building located upon the Property. The address of the Building is 13737 Noel Road, Dallas, Texas 75240.

"Building Standard" means the level of service or type of equipment standard in the Building or the type, brand and/or quality of materials Landlord designates from time to time to be the minimum type, brand or quality to be used in the Building or the exclusive type, grade or quality of material to be used in the Building.

"Business Day" means any day other than a Saturday, Sunday or other day on which commercial banks are authorized to close under the Laws of the State, or are in fact closed in, the State.

“Claims” means any and all liabilities, obligations, damages, claims, suits, losses, causes of action, lien, judgments and expenses (including court costs, attorneys fees and costs of investigation) of any kind, nature or description.

"Commencement Date" means the earlier of (i) Substantial Completion or (ii) August 1, 2012.

| OFFICE LEASE AGREEMENT/[DealerTrack, Inc.] – Page 1 |

"Common Areas" means all areas, spaces, facilities and equipment (whether or not located within the Building) made available by Landlord for the common and joint use of Landlord, Tenant and others designated by Landlord using or occupying space in the Building, including, but not limited to, tunnels, loading docks, walkways, sidewalks and driveways necessary for access to the Building, Parking Areas, Building lobbies (including the lobby area on the ground floor and lobbies on floors with one tenant), fitness center, conference center, atriums, landscaped areas, public corridors, public rest rooms, Building stairs, elevators open to the public, service elevators (provided that such service elevators shall be available only for tenants of the Building and others designated by Landlord), drinking fountains, equipment rooms, risers and any such other areas and facilities, if any, as are designated by Landlord from time to time as Common Areas, including, but not limited to, any such areas so designated by Landlord on a single-tenant floor of the Building.

"Complex" means the Property, the Building and the Parking Areas.

"Default Rate" means a simple rate of interest equal to the lesser of (1) the rate of fifteen percent (15%) per annum, or (2) the maximum rate of interest then permissible for a commercial loan to Tenant in the State.

“Disability Laws” shall have the meaning given such term in Section 15(a) hereto.

“Dispute” shall have the meaning given such term in Section 6(f) hereto.

“Event of Default” shall have the meaning given such term in Section 27(a) hereto.

“Force Majeure” means acts of God; strikes; lockouts; labor troubles; inability to procure materials; acts of war; terrorist actions; inclement weather; governmental laws or regulations; casualty; orders or directives of any legislative, administrative, or judicial body or any governmental department; inability to obtain any licenses, permissions or authorities (despite commercially reasonable pursuit of such licenses, permissions or authorities); and other similar or dissimilar causes beyond Landlord’s reasonable control.

“Hazardous Materials” means any of the following, in any amount: (a) any petroleum or petroleum product, asbestos in any form, urea formaldehyde and polychlorinated biphenyls; (b) any radioactive substance; (c) any toxic, infectious, reactive, corrosive, ignitable or flammable chemical or chemical compound; and (d) any chemicals, materials or substances, whether solid, liquid or gas, defined as or included in the definitions of hazardous substances, hazardous wastes, hazardous materials, extremely hazardous wastes, restricted hazardous wastes, toxic substances, toxic pollutants, solid waste, or words of similar import in any federal, state or local Law now existing or existing on or after the Effective Date as the same may be interpreted by government offices and agencies.

“Hazardous Materials Laws” means any federal, state or local statutes, laws, ordinances or regulations now existing or existing after the Effective Date that control, classify, regulate, list or define Hazardous Materials.

"Landlord Related Party" means any officer, director, partner, employee, member, agent or contractor of Landlord.

“Landlord’s Mortgagee” shall have the meaning given such term in Section 33(a) hereto.

“Landlord’s Notice Address” shall mean the address of Landlord set forth on the signature page of this Lease.

“Landlord’s Relocation Notice” shall have the meaning given such term in Section 30 hereto.

“Laws” means any law, regulation, rule, order, statute or ordinance of any governmental entity in effect on or after the Effective Date and applicable to the Complex or the use or occupancy of the Complex, including, without limitation, Hazardous Materials Laws, Rules and Regulations and Permitted Encumbrances.

"Lease Term" means the period commencing on the Commencement Date and terminating on the last day of the calendar month that is 130 months after the Commencement Date.

| OFFICE LEASE AGREEMENT/[DealerTrack, Inc.] – Page 2 |

"Lease Year" means a period of twelve (12) consecutive calendar months with respect to each subsequent Lease Year. The first Lease Year shall begin on the 1st day of the month following the Commencement Date unless the Commencement Date occurs on the 1st day of a month, in which event the first Lease Year shall begin on the Commencement Date.

"Market Area" means Dallas North Tollway submarket area.

“Miscellaneous Power” shall have the meaning given such term in Section 9(a)(6) hereto.

“Mortgage” shall have the meaning given such term in Section 33(a) hereto.

“Non-Structural Alterations” shall have the meaning given such term in Section 15(a) hereto.

"Normal Business Holidays" means New Years Day, Memorial Day, July 4th (Independence Day), Labor Day, Thanksgiving and Christmas Day and any other day which shall be recognized by office tenants generally (excluding federal or state banking institutions) as a national holiday on which employees are not required to work.

"Normal Business Hours" for the Building means 7:00 a.m. to 6:00 p.m. on Monday through Friday, and 8:00 a.m. to 1:00 p.m. on Saturday, exclusive of Normal Business Holidays.

“OFAC” shall have the meaning given such term in Section 60 hereto.

"Parking Areas" means those areas located (i) upon the Property designated by Landlord, from time to time, to be parking areas, including the Underground Parking, and (ii) available for parking by the owner and tenants of the Building in the Parking Garage.

"Parking Garage" means the multi-level parking garage attached to the Property, the ownership and use of which is shared with the Related Projects as more particularly set forth in the REA.

“Permitted Encumbrances” means all easements, declarations, encumbrances, covenants, conditions, reservations, restrictions, including specifically the REA and other matters now or after the Effective Date affecting title to the Complex.

“Permitted Transfer” shall have the meaning given such term in Section 18(a) of this Lease.

"Premises" means the suite of offices, known as Suite No. 220 on the 2nd Floor of the Building, Suite No. 300 located on the 3rd Floor of the Building, and Suite No. 400 located on the 4th Floor of the Building and outlined on the floor plan attached to this Lease as Exhibit "B" and incorporated herein by reference, and consists of 59,152 square feet of Rentable Area.

“Primary Lease” shall have the meaning given such term in Section 33(a) of this Lease.

"Property" means the land described in Exhibit "A" attached hereto and incorporated herein by reference.

“Provider” shall have the meaning given to such term in Section 11(a) of this Lease.

“REA” means a certain Amended and Restated Construction, Operation and Reciprocal Easement Agreement for Galleria North dated September 27, 2004 that encumbers the Property and the Related Projects.

“Related Projects” means the real property and improvements situated on the Tower II Tract (as defined in the REA) and the Hotel/Condo Tract (as defined in the REA).

"Rent" means, collectively, the Base Rental, the Tenant’s Electricity costs (as provided in Section 6(a)), the Tenant’s Share of Basic Operating Costs and Tenant’s Share of Taxes (as provided in Section 6), the amounts, if any, to be paid by Tenant pursuant to the Tenant Improvements Agreement, and all other sums of money becoming due and payable to Landlord under this Lease.

| OFFICE LEASE AGREEMENT/[DealerTrack, Inc.] – Page 3 |

"Rentable Area" means rentable area calculated in accordance with BOMA ANSI Z65.1-1996 modified to take into account certain amenities offered to all tenants of the Building. All references to "RSF" mean the square feet of Rentable Area.

"Rentable Area of the Building" means (and is hereby deemed to be) 379,518 square feet of Rentable Area.

"Rentable Area of the Premises" means (and is hereby deemed to be) 59,152 square feet of Rentable Area.

"Rules and Regulations" means the rules and regulations for the Complex set forth on Exhibit "C" attached of this Lease and incorporated herein by reference, and the rules and regulations for the Parking Areas set forth in Section 5 of Exhibit "E", and any rules and regulations that be adopted or altered by Landlord in accordance with Section 26 of Exhibit "C".

"Service Areas" means those areas, spaces, facilities and equipment serving the Building (whether or not located within the Building), but to which Tenant and other occupants of the Building will not have access, including, but not limited to, service elevators, mechanical, telephone, electrical, janitorial and similar rooms and air and water refrigeration equipment.

“State” means the State of Texas.

“Substantial Completion” shall have the meaning given such term on Exhibit “D” attached to this Lease.

“Substitute Tenant” shall have the meaning given such term in Section 27(f) of this Lease.

"Taxes" means all taxes, assessments and governmental charges, whether federal, state, county or municipal, and whether they be by taxing districts or authorities presently taxing the Complex or by others, subsequently created or otherwise and any other taxes, association dues and assessments attributable to the Complex or its operation, including the so called “Margin Tax” assessed against Landlord based on revenues from the operation of the Complex and the costs of Landlord’s ad valorem tax consultant, excluding, however, federal and state income taxes, franchise taxes, inheritance, estate, gift, corporation, net profits or any similar tax for which Landlord becomes liable and/or which may be imposed upon or assessed against Landlord.

“Taxing Authority” means any authority having the direct or indirect power to tax, including but not limited to, (a) any city, county, state or federal entity, (b) any school, agricultural, lighting, drainage or other improvement or special assessment district, (c) any governmental agency, or (d) any private entity having the authority to assess the Property under the REA.

"Tenant Improvements" means those improvements to the Premises which are to be constructed in the Premises in accordance with the Tenant Improvements Agreement.

"Tenant Improvements Agreement" means an agreement between Tenant and Landlord for construction of the Tenant Improvements attached as Exhibit “D” of the Lease.

“Tenant’s Notice Address” shall mean the address of Tenant set forth on the signature page of this Lease.

"Tenant Related Party" means any affiliate, officer, director, partner, employee, agent or contractor of Tenant.

"Tenant's Share" means the proportion which the Rentable Area of the Premises bears to the Rentable Area of the Building. The initial Tenant’s Share shall be 15.586%.

"Tenant's Share of Basic Operating Costs" means the Tenant's Share of the amount, if any, by which the Basic Operating Costs during any 12-month period ending on the anniversary date of the Base Year exceed the Base Amount for Basic Operating Costs.

| OFFICE LEASE AGREEMENT/[DealerTrack, Inc.] – Page 4 |

"Tenant's Share of Taxes" means the Tenant's Share of the amount, if any, by which the Taxes during any 12-month period ending on the anniversary date of the Base Year exceed the Base Amount for Taxes.

“Transfer” shall have the meaning given such term in Section 18(a) hereto.

“Underground Parking Area” means the parking areas underneath the Building.

2. Lease Grant. Upon the terms of this Lease, Landlord leases to Tenant, and Tenant leases from Landlord, the Premises and the non-exclusive right to use the Common Areas, subject to all of the terms and conditions of this Lease (including the Rules and Regulations).

3. Lease Term; Acceptance of Premises.

(a) This Lease shall continue in force during a period beginning on the Effective Date of this Lease (though the Lease Term shall not commence and no Rent shall accrue until the Commencement Date) and ending on the expiration of the Lease Term, unless this Lease is terminated early (pursuant to a right to so terminate specifically set forth in this Lease) or extended to a later date pursuant to any other term or provision hereof.

(b) Landlord is delivering possession of the Premises to Tenant on or about the date of Substantial Completion of Tenant Improvements. Tenant acknowledges that it has inspected the Premises prior to the date of this Lease and is familiar with the condition of the Premises.

(c) On or about the date on which Landlord delivers to Tenant a certificate of occupancy for the Premises or May 1, 2012, as extended for Landlord Delays (as defined in Exhibit “D” attached hereto), whichever occurs first, Landlord and Tenant shall execute an Commencement Date Memorandum in the form attached hereto as Exhibit “J” confirming the Commencement Date and the acceptance by Tenant of the Leased Premises.

(d) Landlord represents and warrants that to its knowledge such measurements of the square footage of Rentable Area are accurate in all material respects and have been made in accordance with BOMA ANSI Z65.1-1996 as modified to take into account certain amenities offered to all tenants of the Building.

4. Use. The Premises shall be used solely for general office purposes and for no other purpose. Tenant shall (i) lock the doors to the Premises and take other reasonable steps to secure the Premises and the personal property of all Tenant Related Parties and any of Tenant’s transferees, contractors or licensees in the Common Areas and the Complex, from unlawful intrusion, theft, fire and other hazards; (ii) keep and maintain in good working order all security and safety devices installed in the Premises by or for the benefit of Tenant (such as locks, smoke detectors and burglar alarms); and (iii) cooperate with Landlord and other tenants in the Building on Building safety matters. Tenant acknowledges that Landlord is not a guarantor of the security or safety of Tenant, its employees and invitees or their property; and that such security and safety matters are the responsibility of Tenant and the local law enforcement authorities.

5. Payment of Rent.

(a) Except as otherwise expressly provided in this Lease, the Rent shall be due and payable to Landlord in advance in monthly installments on the first (1st) day of each calendar month during the Lease Term, at Landlord's address as provided on the signature page of this Lease or to such other person or at such other address as Landlord may from time to time designate in writing. Landlord may, at its option, bill Tenant for Rent, but no delay or failure by Landlord in providing such a bill shall relieve Tenant from the obligation to pay the Base Rental on the first (1st) day of each month as provided herein. All payments shall be in the form of a check unless otherwise agreed by Landlord, provided that payment by check shall not be deemed made if the check is not duly honored with good funds. The Rent shall be paid without notice, demand, abatement, deduction or offset, except as otherwise expressly provided in this Lease. If the Lease Term commences on other than the first (1st) day of a calendar month, then the Base Rental for such partial month shall be prorated and paid at the rental rate applicable during the first full month of the Lease Term. The Base Rental for the first full month of the Lease Term for which a payment of rent is due and, if the first full month of the Lease Term falls on a date that is after the end of the Base Year, an estimated monthly amount of Tenant’s Share of Basic Operating Costs and Tenant’s Share of Taxes described in Section 6(a) herein, is being deposited with Landlord by Tenant contemporaneously with the delivery by Tenant to Landlord of an executed copy of this Lease and shall be applied to the payment of Base Rental and Tenant’s Share, as the case may be, by Landlord for the appropriate periods without any further notice by Tenant.. If the Lease Term commences or ends at any time other than the first day of a calendar year, the Tenant’s Share of Basic Operating Costs and Tenant’s Share of Taxes shall be prorated for such year according to the number of days of the Lease Term in such year.

| OFFICE LEASE AGREEMENT/[DealerTrack, Inc.] – Page 5 |

6. Electricity; Basic Operating Costs; Taxes.

(a) Tenant shall pay to Landlord, without any offset or deduction, Tenant's Share of the total electricity costs charged to Landlord by the entity supplying electricity to the Complex (but not including any of the tenant space in the Building), including taxes for the cost of electricity ("Electricity Costs for the Complex”) incurred in the use, occupancy and operation of the Complex and all related improvements and appurtenances, including, but not limited to, electricity use for heating and air conditioning and perimeter lighting for the Complex, net of all electricity that is separately submetered by Landlord then paid by tenants in the Building or that is separately tracked and calculated by Landlord's engineer and paid by tenants in the Building. Landlord will bill Tenant for Tenant's electricity charges under this Section 6(a) monthly. Landlord will bill Tenant for Tenant's electricity charges for the last full or partial month of the Lease Term as soon as practicable after the termination or expiration of this Lease. Tenant will pay its electricity charges with its next following payment of Rent after receipt of each bill. Tenant's obligation to pay the final bill and any other unpaid bills survives the termination or expiration of this Lease. Notwithstanding anything set forth herein to the contrary, Landlord, at its sole option, may elect to bill Tenant for Tenant's electricity charges under this Section 6(a) in the same manner as Landlord bills Tenant for Tenant's Share of Basic Operating Cost pursuant to and in accordance with the terms and provisions of Section 6(b) below. If Landlord reasonably determines that Tenant will require, or is consuming, special lighting or Miscellaneous Power (as defined in Section 9(a)(6) below) in excess of Building Electric Standard (as defined Section 9(e)(9)), Tenant will be required to reimburse Landlord for the cost of any additional equipment, such as transformers, risers and supplemental air conditioning equipment, that Landlord's engineer reasonably deems necessary to accommodate such above standard consumption (without implying any obligation on the part of Landlord to accommodate such use). If Landlord makes any such determination, it will advise Tenant and agree to meet with Tenant and its engineer to consider alternative solutions proposed by Tenant and its engineer for minimizing any additional costs to Tenant but Landlord shall decide in its good faith business judgment on the appropriate course of action to take to address the excess consumption. Landlord also may install separate meters to all or a portion of the Premises, at the cost of Tenant, and require all charges for the utilities separately metered to the Premises to be billed to and paid directly by Tenant. If the Premises is separately metered, Landlord will make a corresponding adjustment to Tenant's Share of Electricity Costs for the Complex (so that Tenant's Share of Electricity Costs for the Complex will include only Tenant's Share of the cost of electrical current for the Complex). If the Premises are not separately metered, Landlord will allocate a portion of the Electricity Costs of the Complex to the Premises based upon Premises share of the actual occupancy of the Building and not based upon Tenant’s Share. In the event the Building is not at least ninety-five percent (95%) occupied during any year of the Lease Term (including the calendar year in which the Lease Term commences), the Electricity Costs of the Complex shall be "grossed up" to the amount which Landlord projects would have been incurred had the Building been ninety-five percent (95%) occupied during such year, such amount to be annualized for any partial year.

. Prior to the commencement of each calendar year during the Lease Term beginning with calendar year following the Base Year for Operating Costs, Landlord may, at its option, provide Tenant with a then current estimate of Basic Operating Costs for the upcoming calendar year, and thereafter Tenant shall pay, as additional rental, in monthly installments, the estimated Tenant's Share of Basic Operating Costs for the calendar year in question. In addition, if Landlord determines that any component of the Basic Operating Costs has changed or is going to change prior to the end of a calendar year, Landlord shall have the right to revise its estimate of Basic Operating Costs to take into account such change and Tenant shall pay such adjusted amount thereafter; provided, however, Landlord agrees it will not revise the original estimate of Basic Operating Costs more than two times in any calendar year. The failure of Landlord to estimate Basic Operating Costs and bill Tenant on an annual basis shall in no event relieve Tenant of its obligation to pay Tenant's Share of Basic Operating Costs. In the event the Building is not at least ninety-five percent (95%) occupied during any year of the Lease Term (including the calendar year in which the Lease Term commences), the Basic Operating Costs shall be "grossed up" by increasing the variable components of janitorial services, management fees and utilities costs included within Basic Operating Costs to the amount which Landlord projects would have been incurred had the Building been ninety-five percent (95%) occupied during such year, such amount to be annualized for any partial year.

| OFFICE LEASE AGREEMENT/[DealerTrack, Inc.] – Page 6 |

(c) Tenant shall pay to Landlord Tenant's Share of Taxes. Prior to the commencement of each calendar year during the Lease Term beginning with calendar year following the Base Year for Taxes, Landlord may, at its option, provide Tenant with a then current estimate of Taxes for the upcoming calendar year, and thereafter Tenant shall pay, as additional rental, in monthly installments, the estimated Tenant's Share of Taxes for the calendar year in question. The failure of Landlord to estimate Taxes and bill Tenant on an annual basis shall in no event relieve Tenant of its obligation to pay Tenant's Share of Taxes. Landlord agrees that property taxes shall be based on annual assessments and shall not be "grossed up. All Taxes (if the amount of Taxes payable for any calendar year, including the amount of Taxes included in the Base Amount, is changed by final determination of legal proceedings, settlement, or otherwise, such changed amount shall be the Taxes for such year).

(d) On or before April 1 of each calendar year during Tenant's occupancy (including the calendar year following the year in which the Lease Term is terminated), or as soon thereafter as possible, Landlord shall furnish to Tenant a statement of Tenant's Share of Basic Operating Costs and Tenant’s Share of Taxes (the "Statement") for the prior year. In the event of an underpayment by Tenant because of any difference between the amount, if any, collected by Landlord from Tenant for the estimated Tenant’s Share of Basic Operating Costs and Tenant’s Share of Taxes and the actual amount of Tenant’s Share of Basic Operating Costs and Tenant’s Share of Taxes, such underpayment shall be paid to Landlord within thirty (30) days after receipt by Tenant of an invoice therefore. In the event of an overpayment by Tenant because of any difference between the amount, if any, collected by Landlord from Tenant for the estimated Tenant’s Share of Basic Operating Costs and Tenant’s Share of Taxes and the actual amount of Tenant's Share of actual Basic Operating Costs and Tenant’s Share of Taxes, and provided no Event of Default has occurred and is continuing and there are no amounts owing and unpaid by Tenant to Landlord, Landlord shall credit such overpayment against the amount of the estimated Tenant’s Share of Basic Operating Costs and Tenant’s Share of Taxes for the upcoming calendar year. Any overpayment by Tenant during the last year of the then existing Term shall be refunded by Landlord to Tenant within thirty (30) days following the expiration of such Term. The obligation to refund underpayments and overpayments shall survive the expiration of this Lease.

(e) "Basic Operating Costs" means all direct and, to the extent provided in Section 6(e)(1), indirect costs and expenses incurred in each calendar year of operating, maintaining, repairing, managing and, to the extent specifically provided below, owning the Complex, including, without limitation, the following:

(1) Wages, salaries, benefits and other compensation of all employees engaged in the direct operation and maintenance of the Complex, employer's social security taxes, unemployment taxes or insurance and any other taxes which may be levied on such wages, salaries and other compensation, and the cost of medical, disability and life insurance and pension or retirement benefits for such employees; provided, however, with respect to employees engaged in the operation and maintenance of other buildings owned by Landlord (or an affiliate of Landlord), other than the Complex, such items shall be fairly apportioned among all such buildings;

(2) Cost of leasing or purchasing all supplies, tools, equipment and materials used in the operation, maintenance, repair and management of the Complex;

(3) Except to the extent the same are paid directly or separately by Tenant (in which case the equivalent costs attributable to any other tenant shall be excluded so that, for example, if Tenant pays separately for electricity used in the Premises, the Basic Operating Costs shall not include the cost of electricity furnished to all other tenants) to the applicable provider or to Landlord, the cost of all utilities for the Complex (both interior and exterior), including, without limitation, the cost of water and power, electrical utilities, sewage, heating, lighting, air conditioning and ventilation for the Complex;

| OFFICE LEASE AGREEMENT/[DealerTrack, Inc.] – Page 7 |

(4) Cost of all maintenance and service agreements for the Complex and surrounding grounds, including, but not limited to, janitorial service, pest control, security service and access control equipment, equipment leasing, energy management system leasing, snow removal, landscape maintenance, alarm service, window cleaning, metal finishing, trash collection and removal and elevator maintenance, re-painting, re-striping, seal-coating, cleaning, sweeping, patching and repairing parking areas and other paved surfaces serving the Building, but excluding any capital expenditures with regard to the foregoing;

(5) Cost of all insurance relating to the Complex, including, but not limited to, fire and extended coverage insurance, earthquake and flood insurance, environmental insurance, rental interruption insurance and liability insurance applicable to the Complex and Landlord's personal property used in connection therewith, plus the cost of all deductible payments made by Landlord in connection therewith (but only to the extent not already deducted as a Basic Operating Cost);

(6) Cost of repairs and general maintenance for the Complex (excluding such repairs and general maintenance paid by insurance proceeds or by Tenant or other third parties); Costs of performing responsibilities allocable to Landlord’s Premises and costs of contributions allocable to the common elements and operation of the Project, including costs, expenses and charges incurred by Landlord in connection with public sidewalks, walkways, rights of way or other public facilities, or any easements or other appurtenances to the Property;

(7) Legal expenses incurred with respect to the Complex which relate directly to the operation of the Complex and which benefit all of the tenants of the Complex generally, such as legal proceedings to abate offensive activities or uses or reduce property taxes (as set forth in Section 16(e) hereof), but excluding legal expenses related to the collection of Rent or to the sale, leasing or financing of the Complex;

(8) Fees for management services, whether provided by an independent management company, by Landlord or by any affiliate of Landlord, but only to the extent that the costs of such services do not exceed the lesser of five percent (5%) of gross rents for the calendar year or competitive costs for comparable services in comparable buildings of the class, type, size, age and location of the Building in the Market Area;

(9) Expenses incurred in order to comply with any federal, state or municipal law, code or ordinance, or regulation which was not promulgated, or which was promulgated but not in effect or applicable to the Complex, as of the Effective Date of this Lease;

(10) Amortization of the cost of installation of capital investment items which (A) Landlord reasonably believes will either (i) reduce (or avoid increases in) Basic Operating Costs, or (ii) promote safety, (B) may be required in order to comply with any federal, state or municipal law, code or ordinance, or regulation which was not promulgated, or which was promulgated but was not in effect or applicable to the Complex, as of the Effective Date of this Lease, or (C) may be required to cause the Building or the Complex to continue to comply with or be certified under its current Gold level green/LEED program(s) undertaken or maintained by Landlord. All costs of such capital investment items shall be amortized together with an amount equal to interest at ten percent (10%) per annum, with (i) the amortization period being not less than five years or extending beyond the remaining useful life of the Building, (ii) the aggregate amount of all capital investment items referred to in this clause (10) being limited to $20,000.00 per calendar year, and (iii) the aggregate amount of amortization of such capital investment items referred to in this clause (10) being limited to $10,000.00 per calendar year (it being agreed that Tenant is only obligated to pay any of such amount to the extent it is included in Tenant’s Share of Basic Operating Costs );

(11) such other costs, expenses and charges as may ordinarily be incurred in connection with managing, maintaining, repairing and operating an office building project similar to the Complex;

(12) The share of Parking Deck Expenses (as defined in the REA), Loading Dock Expenses (as defined in the REA), Tower II Skybridge Expenses (as defined in the REA)and Access Tract Expenses (as defined in the REA) that are allocable to the Property under the REA; and

| OFFICE LEASE AGREEMENT/[DealerTrack, Inc.] – Page 8 |

(13) all reasonable costs of maintaining the LEED Gold Certification of the Building or Complex under any so-called green/LEED program(s) undertaken or maintained by Landlord, including, without limitation all costs related to the management and reporting in connection thereto, but in no event greater than the costs to maintain the existing LEED Gold Certification. Tenant has no obligation to pay any cost or expense in connection with or relating to an upgrade or certification to a higher LEED Certification or standard.

(e) Notwithstanding anything to the contrary in this Lease, Basic Operating Costs shall not include any expenses or costs for the following items:

(1) Except as provided in Section 6(c)(12), costs that under generally accepted accounting principles are required to be classified as capital expenditures, and related amortization thereof;

(2) Except as provided in Section 6(c)(12), depreciation or amortization of the Building or its contents or components;

(3) Expenses for the preparation of space (including tenant finish out costs) or other similar type work which Landlord performs for any tenant or prospective tenant of the Building;

(4) Expenses incurred in leasing or obtaining new tenants or retaining existing tenants, including, but not limited to, marketing costs and leasing commissions;

(5) Except as provided in Section 6(c)(9), legal expenses;

(6) Taxes;

(7) Expenses reimbursed from the proceeds of insurance;

(8) Expenses incurred by Landlord for removal and remediation of any Hazardous Materials on the Property in connection with Landlord’s failure to comply with Hazardous Materials Laws;

(9) Interest, late charges and penalties attributable to Landlord’s failure to timely pay Taxes or items that constitute Basic Operating Costs;

(10) Reserves set aside or held by a Mortgagee until such time as such reserves are applied to pay items of Basic Operating Costs;

(11) Promotional, advertising and brokerage expenses incurred in connection with the leasing of vacant space in the Building; and

(12) Interest, amortization legal expenses or other costs associated with any mortgage, loan or refinancing of the Complex.

(f) If there exists any dispute as to the calculation of Tenant’s Share of Basic Operating Costs (a "Dispute"), the events, errors, acts or omissions giving rise to the Dispute shall not constitute a breach or default by Landlord nor shall Landlord be liable to Tenant, except as specifically provided below. If there is a Dispute, Tenant shall so notify Landlord in writing within thirty (30) days after receipt of the Statement. Such notice shall specify the items in Dispute. Notwithstanding the existence of a Dispute, Tenant shall timely pay the amount in dispute as and when required under this Lease, provided Landlord first provides Tenant with information establishing the basis for the legitimacy of charges that are in dispute. Upon receipt of such payment which payment shall be without prejudice to Tenant's position. Landlord shall supply such supplementary information regarding the items in Dispute as may be reasonably requested by Tenant in an effort to resolve such Dispute. If Landlord and Tenant are unable to resolve such Dispute, such Dispute shall be referred to a mutually satisfactory third party certified public accountant for final resolution, subject to the audit rights of Tenant contained in Section 6(g). The cost of such certified public accountant shall be paid by the party found to be least accurate (in terms of dollars in dispute). If a Dispute is resolved in favor of Tenant, Landlord shall, within thirty (30) days thereafter, refund any overpayment to Tenant, together with interest from the time of such overpayment at ten percent (10%) per annum. The determination of such certified public accountant shall be final and binding, subject to the audit rights of Tenant contained in Section 6(g), and final settlement shall be made within thirty (30) days after receipt of such accountant's decision. If Tenant fails to dispute the calculation of Tenant’s Share of Basic Operating Costs in accordance with the procedures and within the time periods specified in this Section 6(g), or request an audit of the Basic Operating Costs in accordance with the procedures and within the time periods specified in Section 6(f), the Statement shall be considered final and binding for the calendar year in question.

| OFFICE LEASE AGREEMENT/[DealerTrack, Inc.] – Page 9 |

(g) Tenant, at Tenant's expense, shall have the right, no more frequently than once per calendar year, following thirty (30) days' prior written notice (such written notice to be given within sixty [60] days following Tenant's receipt of Landlord's Statement delivered in accordance with Section 6(b)) to Landlord, to audit Landlord's books and records relating to Basic Operating Costs for the immediately preceding calendar year only; provided that such audit must be concluded within ninety (90) days after Tenant's receipt of Landlord's Statement for the year to which such audit relates; and provided further that the conduct of such audit must not unreasonably interfere with the conduct of Landlord's business. Without limitation upon the foregoing, Tenant's right to audit Landlord's books and records shall be subject to the following conditions:

(1) Such audit shall be conducted during Normal Business Hours and at the location where Landlord maintains its books and records;

(2) Tenant shall deliver to Landlord a copy of the results of such audit within five (5) days after its receipt by Tenant;

(3) No audit shall be permitted if an Event of Default by Tenant has occurred and is continuing under this Lease, including any failure by Tenant to pay an amount in Dispute;

(4) Tenant shall reimburse Landlord within ten (10) days following written demand for the cost of all copies requested by Tenant's auditor;

(5) Such audit must be conducted by an independent accounting or auditing firm reasonably acceptable to Landlord that is not being compensated by Tenant on a contingency fee basis and which has agreed with Landlord in writing to keep the results of such audit confidential by executing and delivering to Landlord a confidentiality agreement in the form of Exhibit "F" attached to this Lease, such confidentiality agreement to also be signed and delivered to Landlord by Tenant;

(6) No subtenant shall have the right to audit;

(7) If, for any calendar year, an assignee of Tenant (as permitted by this Lease) has audited or given notice of an audit, Tenant will be prohibited from auditing such calendar year, unless in the case of an audit having been noticed but not yet performed by such assignee, the assignee withdraws its audit notice, and, similarly, if Tenant has audited such calendar year or given such notice, the foregoing restrictions of this Section 6(g)(8) will apply to the assignee's right to audit; and

(8) Any assignee's audit right will be limited to the period after the effective date of the assignment.

Unless Landlord in good faith disputes the results of such audit, an appropriate adjustment shall be made between Landlord and Tenant to reflect any overpayment or underpayment of Tenant’s Share of Basic Operating Costs within thirty (30) days after delivery of such audit to Landlord. In the event of an overpayment by Tenant, within thirty (30) days following the delivery of such audit, Landlord shall, if no Event of Default exists hereunder, make a cash payment to Tenant in the amount of such overpayment, or, if an Event of Default exists hereunder, credit such overpayment against delinquent Rent and make a cash payment to Tenant for the balance. In the event Landlord in good faith disputes the results of any such audit, the parties shall in good faith attempt to resolve any disputed items. If Landlord and Tenant are able to resolve such dispute, final settlement shall be made within thirty (30) days after resolution of the dispute. If the parties are unable to resolve any such dispute, any sum on which there is no longer dispute shall be paid and any remaining disputed items shall be referred to a mutually satisfactory third party certified public accountant for final resolution. The cost of such certified public accountant shall be paid by the party found to be least accurate (in terms of dollars in dispute). The determination of such certified public accountant shall be final and binding and final settlement shall be made within thirty (30) days after receipt of such accountant's decision. Promptly upon the undisputed determination of the results of such audit or the resolution of a disputed audit, the parties shall execute a memorandum indicating acknowledgment of such determination or resolution, as the case may be.

| OFFICE LEASE AGREEMENT/[DealerTrack, Inc.] – Page 10 |

(h) Landlord and Tenant are knowledgeable and experienced in commercial transactions and agree that the provisions of this Lease for determining charges, amounts and rent payable by Tenant (including without limitation, payments for Tenant’s Share of Electricity Costs for the Complex, Tenant’s Share of Basic Operating Costs and Tenant’s Share of Taxes) are commercially reasonable and valid even though such methods may not state a precise mathematical formula for determining such charges. ACCORDINGLY, TENANT VOLUNTARILY AND KNOWINGLY WAIVES ALL RIGHTS AND BENEFITS OF TENANT UNDER SECTION 93.012 OF THE TEXAS PROPERTY CODE, AS AMENDED FROM TIME TO TIME.

7. Late Payments; Dishonored Checks.

(a) In the event any installment of Rent is not received within five (5) days after the date due (without in any way implying Landlord's consent to such late payment), Tenant, to the extent permitted by law, agrees to pay, in addition to said installment of Rent, a late payment charge equal to five percent (5%) of the installment of Rent due, it being understood that said late payment charge shall be for the purpose of reimbursing Landlord for the additional costs and expenses which Landlord presently expects to incur in connection with the handling and processing of late payments. Notwithstanding the foregoing, the late payment charge shall increase to ten percent (10%) of the installment of Rent due if Tenant becomes responsible for a late payment charge more than twice during any consecutive twelve (12) month period. Such charge shall revert to five percent (5%) after Tenant has paid Rent for twelve (12) consecutive months without incurring a late charge. In the event of any such late payment(s) by Tenant, the additional costs and expenses so resulting to Landlord will be difficult to ascertain precisely and the foregoing charge constitutes a reasonable and good faith estimate by the parties of the extent of such additional costs and expenses. Acceptance of such late charge by Landlord shall in no event constitute a waiver of Tenant's default with respect to such overdue amount, nor prevent Landlord from exercising any other rights or remedies granted hereunder unless such default is otherwise cured within the time period provided in this Lease.

(b) In addition to the late payment charge contained in Section 7(a), all Rent, if not paid within thirty (30) days of the date due, shall, at the option of Landlord, and to the extent permitted by law, bear interest at the Default Rate beginning on the date that is thirty (30) days after the date such Rent is due until the date such Rent is paid in full.

(c) If any check is tendered by Tenant and not duly honored with good funds, Tenant shall, in addition to any other remedies available to Landlord under this Lease, pay Landlord a "NSF" fee of $25.00 plus the amount of any NSF fee that the Landlord’s bank imposes upon the Landlord.

8. Security Deposit. [Intentionally deleted]

9. Services to be Furnished by Landlord.

(a) Landlord agrees to furnish Tenant the following services:

(1) Facilities for hot and cold water at those points of supply provided for general use of other tenants in the Building and as necessary to service any kitchen facilities within the Premises approved by Landlord and provided solely for the use of Tenant and its employees, and central heat and air conditioning in season (the cost of such service to be paid by Tenant and other tenants of the Complex in accordance with Section 6(c)(3), and the cost of such service during other than Normal Business Hours to be paid as set forth in Section 9(a)(8)), during Normal Business Hours.

| OFFICE LEASE AGREEMENT/[DealerTrack, Inc.] – Page 11 |

(2) Routine maintenance for all Common Areas and Service Areas of the Building in the manner and to the extent deemed by Landlord to be standard.

(3) Janitorial service, five (5) days per week, exclusive of Normal Business Holidays, at a level consistent with the Janitorial specifications set forth in Exhibit “L” attached hereto.

(4) All Building Standard fluorescent and incandescent bulb and ballast replacement in the Premises, the Common Areas and the Service Areas.

(5) Limited access to the Building (or to the floor on which the Premises are located) during other than Normal Business Hours through the use of master entry cards and/or keys. Landlord shall have no liability to Tenant, its employees, agents, contractors, invitees, or licensees for losses due to theft or burglary (other than theft or burglary committed by employees or contractors of Landlord), or for damages done by unauthorized persons in the Premises or on the Complex. Tenant shall cooperate fully in Landlord's efforts to control access in the Building and shall follow all regulations promulgated by Landlord with respect thereto which are adopted in accordance with Exhibit "C".

(6) Electricity, air conditioning, and proper facilities to furnish (A) Building Standard lighting, and (B) sufficient electrical power and air conditioning for normal office machines (including computer servers and server rooms, PCs and other, desk-top computer facilities, copiers, fax machines, and other server-related equipment) and other machines of similar electrical consumption ("Miscellaneous Power"). Landlord will cause the temperature in the Premises to be maintained between 66° and 74° at all times during Normal Business Hours. In the event Landlord determines that Tenant will require, or is consuming, special lighting in excess of Building Electric Standard (as defined below) or Miscellaneous Power in excess of the Building Electric Standard, Tenant shall reimburse Landlord for the cost of any additional equipment, which Landlord's engineer reasonably deems necessary to accommodate such above-standard consumption (without implying any obligation on the part of Landlord to accommodate such use), and Landlord may install separate meters to all or a portion of the Premises at the cost of Tenant. In the event separate utility meters are provided to the Premises, Landlord may elect to have all charges for the utilities separately metered to the Premises billed directly to Tenant and Landlord shall make a corresponding adjustment to Tenant’s Share of Basic Operating Costs and Tenant’s Share of Taxes.

(7) Passenger elevator service in common with other tenants of the Building for ingress to and egress from the floor(s) upon which the Premises are situated, twenty-four (24) hours a day, seven (7) days a week, and non-exclusive freight elevator service to the Premises during Normal Business Hours and at other times upon reasonable prior notice to Landlord or the Building manager. Any passenger or freight elevator use shall be subject to the Rules and Regulations for the Building and shall be subject to temporary cessation for ordinary repair and maintenance and during times when life safety systems override normal Building operating systems.

(8) Heating and air conditioning during other than Normal Business Hours shall be furnished only upon the prior request of Tenant made in accordance with such procedures as are, from time to time, prescribed by the Building manager, and Tenant shall bear the cost of such heating and air conditioning service at the After Hours HVAC Rate; provided, however, there shall be a one (1) hour minimum charge when such service is requested and the After-Hours HVAC Rate may be adjusted, from time to time, to reflect increases in the costs incurred by Landlord in providing such service. In the event any other tenant within the same HVAC zone as the Premises also requests after-hours heating or air conditioning during the same period as Tenant, Landlord shall equitably allocate the cost thereof among all tenants within the same HVAC zone requesting such service.

(9) The “Building Electric Standard” is defined to mean the current capacity for 120/208 low voltage and 6 watts per usable square foot of connected load for 277/480 high voltage for Tenant’s use in, and that exists on each floor of, the Premises, which is provided by an electrical distribution system in compliance with local codes and the National Electrical Codes and by low and high voltage electrical gear and equipment located on each floor of the Premises that is available for Tenant’s use.

| OFFICE LEASE AGREEMENT/[DealerTrack, Inc.] – Page 12 |

(b) In the event Landlord agrees to provide any additional services at the specific request of Tenant, without implying any obligation on the part of Landlord to do so, the provision of such services shall, unless otherwise specifically agreed in writing, be subject to the availability of Building personnel, and, if the provision of any such service requires Landlord to incur any out-of-pocket cost, Tenant shall reimburse Landlord for the cost of providing such service (plus an administrative charge equal to ten percent [10%] of such cost, plus applicable sales tax) within ten (10) days following receipt of an invoice from Landlord.

The failure by Landlord to furnish services required to be furnished by Landlord hereunder, or any cessation thereof, for reasons that are beyond the reasonable control of Landlord, shall not render Landlord liable in any respect for damages (including, without limitation, business interruption damages) to persons or property, nor be construed as an eviction of Tenant, nor work an abatement of Rent, nor relieve Tenant from fulfillment of any covenant or agreement set forth in this Lease. Should any of such services be interrupted, Landlord shall use commercially reasonable diligence to restore the same promptly, but Tenant shall have no claim for rebate of Rent, damages or eviction on account thereof. Notwithstanding the foregoing, subject to Section 24 (Casualty Damage) and Section 25 (Condemnation), if there is an interruption in electrical power which is (a) specific to the Building (as opposed to an interruption or curtailment in electrical power which extends beyond the Building to include other properties), (b) causes the Premises to be untenantable, and (c) is not caused by an event of Force Majeure or any act of negligence or willful misconduct of Landlord or its property manager, then Tenant will be entitled to deliver Landlord a notice stating that if the untenantability caused by the interruption is not cured within five (5) Business Days, Tenant will be entitled to an abatement of Basic Rent and Operating Expenses (in proportion to the portion of the Premises rendered untenantable) until such electric power is restored.

10. Graphics; Signage. Landlord shall, at Tenant’s sole cost, provide and install one (1) Building Standard identification sign on the front door of entrance to the Premises and add Tenant's name and suite number to the Building directory in the lobby (the "Base Building Signage"). Tenant may also install signage in the elevator lobby of any floor of the Building in which Tenant has leased all of the Rentable Area and is in occupancy of such floor. Such elevator lobby signage and any other signage requested by Tenant in addition to the Base Building Signage shall be subject to the prior approval of Landlord and shall be provided, constructed and installed by Landlord; provided, however, Tenant shall reimburse Landlord for Landlord's cost of providing such service, plus an administrative charge equal to ten percent (10%) of Landlord's cost. All such additional signage shall be in the standard graphics for the Building and no others shall be used or permitted without Landlord's prior written consent. In addition to the foregoing, Landlord will provide Tenant with one line of signage on the Building monument sign which will comply with the Building’s sign criteria for the monument sign.

11. Telecommunications.

(a) In the event that Tenant wishes to utilize the services of a telephone or telecommunications provider whose equipment is not servicing the Building as of the date of Tenant's execution of this Lease ("Provider"), such Provider shall be required to obtain the prior written consent of Landlord, which consent shall not be unreasonably withheld, conditioned, or delayed, before installing its lines or equipment within the Complex. In no event shall the Provider be permitted to provide service to any occupant of the Complex other than Tenant, without the prior written consent of Landlord, which consent shall not be unreasonably withheld, conditioned, or delayed.

(b) The installation of lines or equipment by the Provider shall be subject to the satisfaction of the following conditions:

(1) Tenant shall be responsible for and shall pay all costs incurred in connection with the installation of telephone cables and related wiring in the Premises, including, without limitation, any hook-up, access and maintenance fees related to the installation of such wires and cables in the Premises and the commencement of service therein, and the maintenance thereafter of such wire and cables; and there shall be included in Tenant’s Share of Basic Operating Costs all installation, hook-up or maintenance costs incurred by Landlord in connection with telephone cables and related wiring in the Building which are not allocable to any individual users of such service but are allocable to the Building generally. Notwithstanding the foregoing, Landlord acknowledges that Tenant shall have the right to elect to apply any unused portion of the Improvement Allowance to pay any of the foregoing costs that are incurred in connection with Tenant’s initial move-in and occupancy of the Premises.

| OFFICE LEASE AGREEMENT/[DealerTrack, Inc.] – Page 13 |

(2) Prior to commencement of any work in or about the Building by Provider, Provider shall supply Landlord with such written indemnities, insurance verifications, financial statements, and such other items as Landlord reasonably deems to be necessary to protect its financial interests and the interests of the Building relating to the proposed activities of the Provider.

(3) Prior to the commencement of any work in or about the Building by the Provider (i.e., a provider who is not currently providing telephone or communications services to the Building), (i) if the Provider requested by Tenant is a Provider other than AT&T, Time Warner or Verizon, Landlord and Tenant shall enter into Landlord’s standard Riser and Telecommunication License Agreement or another form previously approved by Landlord in connection with any the commencement of telephone or communications services to the Building by any existing Provider to the Building, and (ii) the Provider shall agree to abide by the Rules and Regulations, the terms in the Riser and Telecommunications License Agreement applicable to the work and such other requirements as are reasonably determined by Landlord to be necessary to protect the interests of the Building, the tenants in the Building, and the Landlord, including, without limitation, providing security in such form and amount as determined by Landlord.

(4) Landlord reasonably determines that there is sufficient space in the Building for the placement of all of the Provider's equipment and materials.

(5) The Provider is licensed.

(6) The Provider agrees to compensate Landlord for space used in the Building for the storage and maintenance of the Provider's equipment that is dedicated to and used exclusively by Tenant and for all costs that may be incurred by Landlord in arranging for access by the Provider's personnel, security for Provider's equipment, and any other such costs as Landlord may reasonably expect to incur.

(c) If Tenant fails to maintain all telephone cables and related wiring in the Premises and such failure affects or interferes with the operation or maintenance of any other telephone cables or related wiring in the Building, Landlord or any vendor hired by Landlord may enter into and upon the Premises forthwith and perform such repairs, restorations or alterations as Landlord deems necessary in order to eliminate any such interference (and Landlord may recover from Tenant all of Landlord's costs in connection therewith). Upon the expiration or earlier termination of this Lease, Tenant agrees to remove all telephone cables and related wiring installed by Tenant for and during Tenant's occupancy which serve only the Premises (as opposed to tenants in the Building generally), which Landlord shall request Tenant to remove. Tenant agrees that neither Landlord nor any of its agents or employees shall be liable to Tenant, or any of Tenant's employees, agents, customers or invitees or anyone claiming through, by or under Tenant, for any damages, injuries, losses, expenses, claims or causes of action because of any interruption, diminution, delay or discontinuance at any time for any reason in the furnishing of any telephone service to the Premises and the Building

(d) Tenant acknowledges and agrees that all telephone and telecommunications services desired by Tenant shall be ordered and utilized at the sole risk and expense of Tenant.

(e) Tenant agrees that, to the extent service by Provider is interrupted, curtailed, or discontinued, Landlord shall have no obligation or liability with respect thereto and it shall be the sole obligation of Tenant at its expense to obtain substitute service unless such interruption, curtailment or discontinuance is caused by some negligent act or omission of Landlord.

(f) The provisions of this Section 11 may be enforced solely by the Tenant and Landlord, and are not for the benefit of any other party. No Provider shall be deemed a third party beneficiary of this Lease.

| OFFICE LEASE AGREEMENT/[DealerTrack, Inc.] – Page 14 |

12. Repair and Maintenance by Landlord. Except as provided in Section 14, Landlord shall be responsible for the maintenance and repair of exterior and load-bearing walls, floors (but not floor coverings), mechanical, electrical, plumbing and HVAC systems and equipment which are Building Standard, the roof of the Building, the Common Areas, the Service Areas and the Parking Areas. In no event shall Landlord be responsible for the maintenance or repair of improvements made by or at the request of Tenant which are not Building Standard. Tenant will cooperate with Landlord to facilitate the performance of Landlord’s obligations under this Section 12, including any entry by Landlord into all or any portion of the Premises and the temporary relocation of items of Tenant’s personal property, all as Landlord may determine is reasonably necessary to properly perform such obligations. All requests for repairs must be submitted to Landlord in writing, except in the case of an emergency. If Tenant believes any maintenance or repair Landlord is obligated under this Section 12 to perform is needed at the Property, Tenant will promptly provide written notice to Landlord specifying in detail the nature and extent of any condition requiring maintenance or repair. Landlord will not be deemed to have failed to perform its obligations under this Section 12 with respect to any maintenance or repair unless Tenant has provided such written notice and Landlord has had a commercially reasonable time within which to respond to such notice and effect the needed maintenance or repair. Repairs and maintenance by Landlord pursuant to this Section 12 are included in Basic Operating Costs, except to the extent excluded by Section 6. Landlord shall not be liable to Tenant for any expense, injury, loss or damage resulting from work done in the Building or upon the Property, or the use of, any adjacent or nearby building, land, street, or alley, and Tenant shall look to the liability insurance maintained by Tenant pursuant to Section 21(a) with respect to any claims and damages resulting therefrom unless such expense, injury, loss or damage is primarily attributable to Landlord’s negligence, failure to timely perform its obligations under this Section 12 or Landlord’s misconduct.

13. Maintenance by Tenant. Except for Landlord’s obligations described in Section 12 above and any janitorial services provided by Landlord under Section 9 above, Tenant, at Tenant’s sole cost and expense, will keep and maintain the Premises in good, clean, sanitary, neat and fully operative condition and repair, reasonable wear and tear excepted, which obligations of Tenant will include, without limitation, the maintenance, repair and replacement of all: (a) interior surfaces of exterior walls and demising walls; (b) interior walls, moldings, partitions and ceilings; (c) carpeting; (d) non-structural interior components; (e) interior windows, plate glass and doors; (f) kitchen or break-room fixtures, appliances and equipment; and (g) Tenant’s personal property situated in the Premises. Tenant will also pay or reimburse Landlord for (or, at Landlord’s option, perform) the repair or replacement of any waste or excessive or unreasonable wear and tear to the Premises or the Complex caused or permitted by Tenant. Any repairs or replacements performed by Tenant pursuant to this Section must be at least equal in quality and workmanship to the original work, be in accordance with all Laws and comply with Landlord’s sustainability practices, including any third-party rating systems concerning environmental compliance of the Building or Complex, as the same may change from time to time. At the expiration or early termination of this Lease, Tenant shall deliver up the Premises to Landlord in as good condition as at the Commencement Date, ordinary wear and tear and damage by fire or casualty loss (unless caused by Tenant) excepted. Tenant’s obligations under this Section 13 does not include the cost of repairs or damage to items (a) through (g) above that is attributable to Landlord’s failure to perform its maintenance and repair obligations under Section 12 above.

14. Repairs by Tenant. Tenant shall, at Tenant's cost, repair or replace any damage to the Premises (including doors and door frames, interior windows and any kitchen equipment, such as dishwashers, sinks, refrigerators, trash compactors and plumbing and other mechanical systems related thereto) that is not caused by Landlord or that is not within the responsibility of Landlord under the Tenant Improvements Agreement, if any, and any damage to the Complex, or any part thereof, caused by Tenant or any employee, officer, contractor, agent, subtenant, guest, licensee or invitee of Tenant (except that with respect to any such damage outside of the Premises or below floor coverings, above ceilings or behind walls or columns, such damage shall be repaired by Landlord, and Tenant shall reimburse Landlord for the cost of such repairs or replacements, plus an administrative charge equal to five percent (5%) of the cost of such repairs or replacements. If Tenant fails to make such repairs or replacements within thirty (30) days after receipt of written notice from Landlord, Landlord may, at Landlord's option, make such repairs or replacements, and Tenant shall reimburse Landlord for the cost of such repairs or replacements, plus an administrative charge equal to five percent (5%) of the cost of such repairs or replacements. Reimbursement for all repairs performed by Landlord pursuant to this Section 14 shall be payable as additional Rent by Tenant to Landlord within ten (10) days following Tenant's receipt of an invoice from Landlord. Notwithstanding anything contained herein to the contrary, if any such damage is covered by Landlord's insurance, in whole or in part, Tenant's liability under this Section 14 shall be limited to the deductible payable by Landlord and any portion of the cost of repairing such damage not covered by Landlord's insurance. Landlord agrees to limit the deductible applicable to casualty insurance policies maintained hereunder to an amount that is consistent with the amount of deductible maintained by other Class A office buildings in the Market Area. In connection with repairs or replacements made by Tenant, Tenant shall provide Landlord with a copy of the contractor agreement regarding such repairs, copies of certificates of insurance evidencing contractor coverage satisfactory to Landlord, copies of "as-built" plans and specifications and other information or documentation reasonably required by Landlord, including evidence of the lien-free completion of such repairs or replacements.

| OFFICE LEASE AGREEMENT/[DealerTrack, Inc.] – Page 15 |

15. Alterations, Additions, Improvements.

(a) Tenant will make no material alteration, change, improvement, replacement or addition to the Premises (collectively, "Alterations"), without the prior written consent of Landlord, which consent shall not be unreasonably withheld, conditioned, or delayed. Tenant shall have the right to make minor Alterations to interior of the Premises which will not affect, in any way, the mechanical, electrical, plumbing, HVAC, structural and/or fire and life safety components of the Building and cost less than $20,000.00 and does not require a permit ("Non-Structural Alterations") without Landlord’s consent. Landlord may, at its option, require Tenant to submit plans and specifications to Landlord for approval prior to commencing any Alterations. All Alterations (other than Non-Structural Alterations) shall be performed by a contractor on Landlord's approved list (a copy of which may be obtained from the Building manager). All Alterations shall be done in a good and workmanlike manner, in compliance with all applicable laws, including, but not limited to, Title III of The Americans With Disabilities Act of 1990 or any applicable local or state Law regarding handicapped access (collectively, the "Disability Laws") and in accordance with Landlord’s sustainability practices under Landlord’s current Gold Level green/LEED program(s) undertaken or maintained by Landlord. Landlord may, in the exercise of reasonable judgment, request that Tenant provide Landlord with appropriate evidence of Tenant's ability to complete and pay for the completion of the Tenant Alterations such as a performance bond or letter of credit. Upon completion of the Tenant Alterations, Tenant shall deliver to Landlord an as-built mylar or digitized (if available) set of plans and specifications for the Tenant Alterations. Tenant shall require that any contractors used by Tenant carry a comprehensive liability (including builder's risk) insurance policy in such amounts as Landlord may reasonably require and provide proof of such insurance to Landlord prior to the commencement of any Alterations and Tenant shall require that any contractors used by Tenant comply with such rules and regulations imposed by Landlord from time to time, including such rules and regulations related to so-called green/LEED program(s) undertaken or maintained by Landlord. TENANT SHALL INDEMNIFY AND HOLD LANDLORD AND LANDLORD RELATED PARTIES HARMLESS FROM, AND REIMBURSE LANDLORD FOR AND WITH RESPECT TO, ANY AND ALL COSTS AND EXPENSES (INCLUDING REASONABLE ATTORNEYS' FEES), DEMANDS, CLAIMS, CAUSES OF ACTION AND LIENS ARISING FROM AND IN CONNECTION WITH ANY ALTERATIONS PERFORMED BY TENANT. All persons performing work in the Building at the request of Tenant shall register with the Building manager prior to initiating any work. Upon completion of any Alterations, Tenant shall provide Landlord with a copy of its building permit, final inspection tag and, if plans and specifications were required by Landlord, final "as built" plans and specifications, together with evidence of the lien-free completion of such Alterations. Except for the Tenant Improvements (which shall be governed by the Tenant Improvements Agreement [if any]), all Alterations now or hereafter placed or constructed on the Premises at the request of Tenant shall be at Tenant's cost. If Tenant performs such Alterations, the cost of such Alterations (plus a construction supervision fee equal to one percent [1%] of hard costs) shall be payable as additional Rent by Tenant to Landlord within ten (10) days following Tenant's receipt of an invoice from Landlord. If Landlord performs such Alterations, Landlord’s construction supervision fee will be three percent (3%) of hard costs.

(b) Upon the expiration or early termination of this Lease, Tenant may remove its trade fixtures, office supplies and movable office furniture and equipment not attached to the Building provided (1) such removal is made prior to the termination or expiration of the Lease Term; (2) no Event of Default has occurred and is continuing; and (3) Tenant promptly repairs all damage caused by such removal. All other property at the Premises, any Alterations to the Premises, and any other articles attached or affixed to the floor, wall, or ceiling of the Premises shall, immediately upon installation, be deemed the property of Landlord and shall be surrendered with the Premises at the termination or expiration of this Lease, without payment or compensation therefor. If, however, Landlord so requests in writing, Tenant will, at Tenant's sole cost and expense, prior to the termination or expiration of the Lease Term, remove any and all trade fixtures, office supplies and office furniture and equipment placed or installed by Tenant in the Premises, and any non-Building Standard Alterations (other than the Tenant Improvements) installed by Tenant or installed by Landlord at Tenant's request in the Premises and which Landlord designated as being subject to removal at the time of approval, and will repair any damage caused by such removal. In addition, Tenant shall, at Tenant's expense, remove all of Tenant's telecommunications equipment and racks, including removal from the Premises or from risers or other Common Areas of all cabling installed by Tenant or for the exclusive use of Tenant, and Tenant shall promptly repair, at Tenant’s expense, any damage caused by such removal.

| OFFICE LEASE AGREEMENT/[DealerTrack, Inc.] – Page 16 |

16. Laws and Regulations; Green/LEED Programs; Disability Laws; Building Rules and Regulations.

(a) Landlord represents and warrants to Tenant that to the knowledge of Landlord, the Common Areas comply with all Disability Laws as of the date of this Lease and the Complex (other than space leased to tenants) and other federal, state, and municipal laws applicable to the Building and Premises. Tenant, at Tenant's sole cost and expense, shall comply with all current and future federal, state, municipal Laws applicable to the use of the Premises, the employees, agents, visitors and invitees of Tenant, and the business conducted in the Premises by Tenant, including, without limitation, all Hazardous Materials Laws; will not engage in any activity which would cause Landlord's fire and extended coverage insurance to be canceled or the rate increased (or, at Landlord's option, Landlord may allow Tenant to engage in such activity provided Tenant pays for any such increase in the insurance rate); which might, in the reasonable judgment of Landlord, tend to injure or depreciate the value of the Building. Without limiting the foregoing, Tenant shall not place or permit to remain within the Premises any "hazardous materials" or “hazardous substances” as such terms are now or hereafter defined under applicable Hazardous Materials Laws, except cleaning supplies, copier toner or other similar type products commonly found in commercial office space, provided such items are properly labeled, stored and disposed of in accordance with all applicable governmental requirements. Notwithstanding the foregoing, nothing in this Section 16(a) shall be construed as requiring Tenant to be responsible for any legal requirements applicable to the structural portions of the Premises, any restrooms within the Building (other than restrooms constructed by or at the special request of Tenant) or the Building Standard mechanical, electrical, plumbing or HVAC systems, unless the failure to comply with any such legal requirements is caused by Tenant or anyone acting for Tenant.