Attached files

| file | filename |

|---|---|

| EX-99.1 - COMPLAINT, WYNN RESORTS, LTD. V. KAZUO OKADA ET AL. - WYNN RESORTS LTD | d304177dex991.htm |

| 8-K - FORM 8-K - WYNN RESORTS LTD | d304177d8k.htm |

Exhibit 99.2

REPORT

Attorney – Client / Work Product / Privileged and Confidential

| I. | Introduction |

Wynn Resorts, Limited (“Wynn Resorts”), a publicly traded company incorporated in the State of Nevada, on behalf of its Compliance Committee, retained Freeh Sporkin & Sullivan, LLP (“FSS”) on November 2, 2011 to conduct an independent investigation. That independent investigation has been conducted under the sole direction of the Compliance Committee. The purpose of the investigation was to determine whether there is evidence that Mr. Kazuo Okada, a member of the Wynn Resorts Board of Directors, may have: (i) breached his fiduciary duties to Wynn Resorts; (ii) engaged in conduct that potentially could jeopardize the gaming licenses of Wynn Resorts; and/or, (iii) violated the Wynn Resorts compliance policy. Specifically, FSS has been asked to examine Mr. Okada’s efforts in connection with the creation of a gaming establishment in the Republic of the Philippines.

This is the Report to the Compliance Committee Chairman on the results of FSS’ investigation. As set forth with greater detail in the attached appendix, FSS has performed its investigation by interviewing dozens of individuals and by reviewing thousands of documents, electronic emails, corporate and public records.

| II. | Summary |

The investigation has produced substantial evidence that:

| 1. | Despite being advised by the Wynn Resorts Board of Directors and Wynn Resorts attorneys on the strict US anti-bribery laws which govern Wynn Resorts and its board, Mr. Okada strongly believes and asserts that when doing business in Asia, he should be able to provide gifts and things of value to foreign government officials, whether directly or by the use of third party intermediaries or consultants. |

| 2. | Mr. Okada, his associates and companies have arranged and designed his corporate gaming business and operations in the Philippines in a manner which appears to contravene Philippine Constitutional provisions and statutes that require 60% ownership by Philippine nationals, as well as a Philippine criminal statute. |

| 3. | Mr. Okada, his associates and companies appear to have engaged in a longstanding practice of making payments and gifts to his two (2) chief gaming regulators at the Philippines Amusement and Gaming Corporation (“PAGCOR”), who directly oversee and regulate Mr. Okada’s Provisional Licensing Agreement to operate in that country. Since 2008, Mr. Okada and his associates have made multiple payments to and on behalf of these chief regulators, former PAGCOR Chairman Efraim Genuino and Chairman Cristino Naguiat (his current chief regulator), their families and PAGCOR associates, in an amount exceeding US 110,000. At times, Mr. Okada, his |

1

REPORT

Attorney – Client / Work Product / Privileged and Confidential

| associates and companies have consciously taken active measures to conceal both the nature and amount of these payments, which appear to be prima facie violations of the United States Foreign Corrupt Practices Act (“FCPA”). In one such instance in September 2010, Mr. Okada, his associates and companies, paid the expenses for a luxury stay at Wynn Macau by Chairman Naguiat, Chairman Naguiat’s wife, their three children and nanny, along with other senior PAGCOR officials, one of whom also brought his family. Mr. Okada and his staff intentionally attempted to disguise this particular visit by Chairman Naguiat by keeping his identity “Incognito” and attempting to get Wynn Resorts to pay for the excessive costs of the chief regulator’s stay, fearing an investigation. Wynn Resorts rejected the request by Mr. Okada and his associates to disguise and to conceal the actual expenditures made on behalf of Chairman Naguiat. |

| 4. | Additionally, Mr. Okada, his associates and companies appear to have engaged in a pattern of such prima facie violations of the FCPA. For example, in 2010 it also is possible that Mr. Okada, his associates and companies made similar payments to a Korean government official who oversees Mr. Okada’s initial gaming investment in that country. Additional investigation is needed to develop and confirm these possible FCPA violations. |

| 5. | The prima facie FCPA violations by Mr. Okada, his associates and companies constitute a substantial, ongoing risk to Wynn Resorts and to its Board of Directors, creating regulatory risk, conflicts of interest and potential violations of his fiduciary duty to Wynn Resorts. Finally, Mr. Okada’s documented refusal to receive Wynn Resorts requisite FCPA training provided to other Directors, as well as his failure to sign an acknowledgment of understanding of Wynn Resorts Code of Conduct, increase this risk going forward. |

| 6. | Mr. Okada insisted in his interview that all of his gaming efforts in the Philippines prior to the change of the presidential administration in the summer of 2010 were undertaken on behalf of and for the benefit of Steve Wynn and Wynn Resorts. This assertion is contradicted by press releases dating back to 2007 on his website, which announce an independent effort by Universal; his real estate investments; and the ownership of his corporations in the Philippines. |

| 7. | (7) Mr. Okada has stated that Universal paid expenses related to then-PAGCOR Chairman Genuino’s trip to Beijing during the 2008 Olympics. |

2

REPORT

Attorney – Client / Work Product / Privileged and Confidential

| III. | Kazuo Okada’s Relevant Corporate Affiliations |

A. Wynn Resorts

After an initial public offering which closed in October 2002, Aruze USA, Inc., controlled by Mr. Okada, became a 24.5% shareholder of Wynn Resorts. Mr. Okada’s current ownership of Wynn Resorts through his control of Aruze USA, Inc. is 19.66%.

Mr. Okada became a member of the Wynn Resorts Board of Directors on October 21, 2002, and remains on the Board of Directors as of the date of this Report. In the past, Mr. Okada has used the title of Vice Chairman of Wynn Resorts. In October 2011, the Wynn Resorts Board of Directors eliminated the position of Vice Chairman.

As a Director of Wynn Resorts, Mr. Okada is entitled to receive the courtesy of what is called a “City Ledger Account.” Such accounts were originally instituted as a result of Sarbanes Oxley’s prohibition of extensions of credit, in the form of a personal loan from an issuer to an officer or director. The accounts were funded by deposits from the director or his company. Such an account exists for billing conveniences related to charges incurred at various Wynn Resorts locales. Mr. Okada has availed himself of this courtesy and established such a City Ledger Account.1 Within Wynn Resorts, this Okada City Ledger Account is referred to either as the “Universal City Ledger Account” or as the “Aruze City Ledger Account.” Accordingly, the phrases Universal City Ledger Account and Aruze City Ledger Account will be referred to interchangeably within this report despite the fact that Aruze Corp.’s name was changed to Universal Entertainment Corporation in November of 2009.

Mr. Okada has been found to be suitable by the Nevada Gaming Commission.2

B. Universal Entertainment Corporation of Japan

Mr. Okada currently serves as Director and Chairman of the Board of Universal Entertainment Corporation (“Universal Entertainment”), registered in Tokyo, Japan. Universal Entertainment Corporation is the current trade name of a company which was incorporated in 1969 as Universal Lease Co. Ltd. and which became Aruze Corp. in 1998. Aruze changed its

1 The initial wire to establish the Aruze Corp. City Ledger Account was dated February 15, 2008.

2 Mr. Okada was originally found to be suitable as a shareholder of Aruze Corp. as part of An Order of Registration issued jointly by the State Gaming Control Board and the Nevada Gaming Commission on June 4, 2004. On June 5, 2005, in a similar order, the Nevada Commission and the State Gaming Control Board found Aruze Corp. to be (1) suitable as a controlling shareholder of Wynn Resorts, Limited, (2) suitable as the sole shareholder of Aruze USA, Inc., (3) that Aruze USA, Inc. is registered as an intermediary company and is found suitable as a shareholder of Wynn Resorts, Limited, and (4) that Mr. Okada is suitable as a shareholder and controlling shareholder of Aruze Corp. [See Appendix]

3

REPORT

Attorney – Client / Work Product / Privileged and Confidential

name to Universal Entertainment Corporation in November 2009. Universal is listed on the JASDAQ stock exchange and is engaged in the manufacture and sale of pachinko and gaming machines and related business activities. As of September 2011, Okada Holdings Godokaisha was Universal Entertainment’s major shareholder, with 67.90% of the issued shares.

The Nevada Gaming Commission has approved Universal Entertainment’s suitability as the 100% shareholder for a subsidiary, Aruze USA, Inc.

C. Aruze USA, Inc.

Aruze USA, Inc. (“Aruze USA”) is a wholly owned subsidiary of Universal Entertainment. Aruze USA is a US company and was incorporated in the State of Nevada on June 9, 1999. Mr. Okada is a Director of Aruze USA and serves as its President, Secretary, and Treasurer.

Aruze USA has been found suitable by the Nevada Gaming Commission as a major shareholder of Wynn Resorts.

D. Aruze Gaming America, Inc.

Aruze Gaming America, Inc. is a private company that is 100% personally owned by Mr. Okada. He currently serves as a Director, Secretary, and Treasurer of the company. Aruze Gaming America, Inc. is a US company and was incorporated on February 7, 1983. The company changed its name from Universal Distributing of Nevada, Inc. to Aruze Gaming America, Inc. on January 6, 2006. Aruze Gaming America, Inc. shares a common business address with Aruze USA, Inc. in Las Vegas, Nevada.

E. Business Interests in the Republic of the Philippines

Since 2008, Mr. Okada has been involved with a variety of corporate entities and with various business associates in the creation of a gaming establishment in an area of the Philippines known as Entertainment City Manila.3 In furtherance of this endeavor, Mr. Okada and his associates have procured land and a provisional gaming license in the Philippines. A more detailed review of Mr. Okada’s corporate entities and business associates in the Philippines is set forth in Section V(2)(A) below.

F. Business Interests in the Republic of Korea

Mr. Okada has recently pursued development of a casino resort complex in the Incheon Free Economic Zone in the Republic of Korea. A more detailed review of Mr. Okada’s activities in Korea is set forth in Section V(4) below.

3 On the Universal Entertainment website (viewed January 30, 2012) this project is referenced as “Manila Bay Resorts.” [See Appendix]

4

REPORT

Attorney – Client / Work Product / Privileged and Confidential

| IV. | Relevant Legal and Policy Standards |

A. FCPA

The United States Foreign Corrupt Practices Act (“FCPA”) contains two primary categories of violations: (i) a books and records provision, and (ii) a bribery provision. Based upon available information, it seems clear that Aruze USA fits the definition of domestic concern4 and United States person5 provided in the FCPA, and that the FCPA applies both to Aruze USA and to Mr. Okada personally, in his capacity as an officer and director of Aruze USA.

Under the definitions of domestic concern and United States person, the statute applies to a corporation, partnership, unincorporated organization and other enumerated entities that have their principal place of business in the United States or which are organized under the laws of a State of the United States. It also applies to officers and directors of such concerns.6

In 1998, the FCPA was amended and added an alternative basis to interstate commerce for jurisdiction. As the United States District Court for the Southern District of New York wrote: “…. The amendments expanded FCPA coverage to ‘any person’ — not just ‘issuers’ or ‘domestic concerns’…. [A]ny United States person or entity violating the Act outside of the United States is subject to prosecution, regardless of whether any means of interstate commerce were used. Citing 15 USC 78dd-1, 78dd-2…. (Emphasis added.)7

Under this definition, Aruze USA is a covered party under the FCPA.

The FCPA provides that “[i]t shall be unlawful for any domestic concern, other than an issuer which is subject to section 78dd–1 of this title, or for any officer, director, employee, or agent of such domestic concern or any stockholder thereof acting on behalf of such domestic concern, to make use of the mails or any means or instrumentality of interstate commerce corruptly in furtherance of an offer, payment, promise to pay, or authorization of the payment of any money, or offer, gift, promise to give, or authorization of the giving of anything of value to—

| (1) | any foreign official for purposes of— |

(A)

| 4 15 | U.S.C. 78 dd – 2(a),(h). |

| 5 15 | U.S.C. 78 dd – 2(i). |

| 6 15 | U.S.C. 78 dd – 2(g). |

| 7 In | re Grand Jury Subpoena, 218 F. Supp. 2d 544, 550 (S.D.N.Y 2002). |

5

REPORT

Attorney – Client / Work Product / Privileged and Confidential

(i) influencing any act or decision of such foreign official in his official capacity,

(ii) inducing such foreign official to do or omit to do any act in violation of the lawful duty of such official, or

(iii) securing any improper advantage; or

(B) inducing such foreign official to use his influence with a foreign government or instrumentality thereof to affect or influence any act or decision of such government or instrumentality, in order to assist such domestic concern in obtaining or retaining business for or with, or directing business to, any person;…”8

The head of PAGCOR fits within the definition of foreign official as used in the FCPA.

According to PAGCOR’s website, it “is a 100 percent government-owned and controlled corporation that runs under the direct supervision of the Office of the President of the Republic of the Philippines.”9 In addition to prescribing mandates to generate revenue for certain government programs and promote tourism in the Philippines, PAGCOR’s charter states that the entity will “…[r]egulate, authorize and license games of chance, games of cards and games of numbers, particularly casino gaming, in the Philippines….”10 (Emphasis added.)

As set forth above, there is still the interstate commerce basis for jurisdiction, but there is also an alternative. The alternative would require the same elements for an offense, but a showing of interstate commerce would not be required. If the interstate commerce basis for jurisdiction were used, the analysis set forth below would be of significance.

With regard to means or instrumentality of interstate commerce, some of the facts referred to in this report pertain to Mr. Okada utilizing the Universal City Ledger Account to confer financial benefits upon Philippine gambling regulators who could affect the business interests of Aruze USA, Inc. in the Philippines. Some of those benefits were conferred at Wynn Macau. The following facts concerning the Universal City Ledger Account, which bear upon use of means or instrumentalities of interstate commerce, were established during the investigation:

| n | The account is maintained at the corporate offices of Wynn Resorts, Limited in Las Vegas, Nevada where periodic deposits are made from Universal into the Wynn Resorts, Limited operating account at Bank of America in Las Vegas, Nevada to ensure that the amount on deposit remains at or about US 100,000. Bank documents reflect that the deposits are received from a Universal Entertainment account located in Japan.11 |

8 15 U.S.C. Section 78dd – 2(a).

9 http://www.pagcor.ph/pagcor-faqs-profile.php, viewed January 18, 2012. [See Appendix]

10 Ibid., viewed January 18, 2012. [See Appendix]

11 See, e.g. wire transfer documents from Sumitomo Mitsumi Bank to Bank of America. [See Appendix]

6

REPORT

Attorney – Client / Work Product / Privileged and Confidential

| n | When charges are incurred at Wynn Macau, Wynn Macau tracks all charges for the Universal City Ledger Account on its books, and then the accounting department transfers the charges to accounting at Wynn Resorts, Limited in Las Vegas via a journal entry. Wynn Macau sends a pdf file to a staff accountant at Wynn Resorts, Limited in Las Vegas with all the backup documentation. Invoices issued by Wynn Resorts, Limited are periodically sent to a Universal Entertainment email address.12 |

B. Nevada Gaming Regulations and Wynn Resorts Policies

The question of whether or not a gaming licensee or licensee applicant is deemed “suitable” in Nevada is answered by reviewing the Nevada Revised Statutes (“NRS”) in conjunction with the regulations promulgated by the Nevada Gaming Commission (“NGC”), which is empowered by the NRS.13

1. Legislative Authority

The standard for determining suitability is found in Section 463.170 of the NRS. Paragraph (2) of the NRS 463.170, entitled Qualifications for license, finding of suitability or approval; regulations, provides that the person seeking a license or a suitability determination is subject to the following considerations: “[a]n application to receive a license or be found suitable must not be granted unless the Commission is satisfied that the applicant is: (a) A person of good character, honesty and integrity; (b) A person whose prior activities, criminal record, if any, reputation, habits and associations do not pose a threat to the public interest of this State or to the effective regulation and control of gaming….” In addition, paragraph (3) provides in pertinent part “[a] license to operate a gaming establishment or an inter-casino linked system must not be granted unless the applicant has satisfied the Commission that: (a) [t]he applicant has adequate business probity, competence and experience, in gaming or generally….”

The Nevada Gaming Commission Regulations (“Nevada Gaming Regulations”) are also relevant to the conditions placed upon suitability. According to Section 3.080 of the Nevada Gaming Regulations, entitled Unsuitable affiliates, “[t]he commission may deny, revoke, suspend, limit, condition or restrict any registration or finding of suitability or application therefor upon the same grounds as it may take such action with respect to licenses, licensees and licensing; without exclusion of any other grounds.” Paragraph (1) of Section 3.090, entitled

12 In a Wynn Resorts Memorandum to File from the Corporate Accounting department, dated January 10, 2012, the “invoice[s] and all support documentation are emailed to kimiko.okamura@hq.universal-777.com, takashi.usami@hq.universal-777.com and iwayama.hidetsugu@hq.universal-777.com on the 5th of each month for the prior month [sic] activity.” [See Appendix]

13 For further advice regarding suitability, please consult directly with David Arrajj, Esq. and/or see Memo dated December 9, 2011 from Kate Lowenhar-Fisher, Esq. and Jamie L. Thalgott, Esq. to David Arrajj, Esq. re Associations and the Suitability Analysis. [See Appendix]

7

REPORT

Attorney – Client / Work Product / Privileged and Confidential

Standards for commission action, provides in pertinent part that “[n]o license, registration, finding of suitability, or approval shall be granted unless and until the applicant has satisfied the commission that the applicant: (a) Is a person of good character, honesty, and integrity; (b) Is a person whose background, reputation and associations will not result in adverse publicity for the State of Nevada and its gaming industry; and (c) Has adequate business competence and experience for the role or position for which application is made.”

2. Underlying Corporate Documents of Wynn Resorts

The Second Amended and Restated Articles of Incorporation of Wynn Resorts, Limited (filed September 16, 2002) also provide for standards that seek to define an “Unsuitable Person.” As set forth on page 8 of the Articles of Incorporation, the phrase Unsuitable Person “shall mean a Person who . . . in the sole discretion of the board of directors of the Corporation, is deemed likely to jeopardize the Corporation’s or any Affiliated Company’s application for, receipt of approval for, right to the use of, or entitlement to, any Gaming License.” (Emphasis added.)

Finally, the Amended and Restated Gaming and Compliance Program of Wynn Resorts, Limited (adopted as of July 29, 2010) defines an Unsuitable person as a “[p]erson (i) who has been denied licensing or other related approvals by a Gaming Authority on the grounds of unsuitability or who has been determined to be unsuitable to be associated with a gaming enterprise by a Gaming Authority; or (ii) that the Company determines is unqualified as a business associate of the Company or its Affiliates based on, without limitation, that Person’s antecedents, associations, financial practices, financial condition or business probity.”

In the event of a finding of unsuitability, there are provisions within the aforementioned corporate documents that provide for a resolution post determination. Specifically, on page 6 of the Second Amended and Restated Articles of Incorporation of Wynn Resorts, Limited, the Articles state in pertinent part, “[t]he Securities Owned or Controlled by an Unsuitable Person or an Affiliate of an Unsuitable Person shall be subject to redemption by the Corporation, out of funds legally available therefor, by action of the board of directors, to the extent required by the Gaming Authority making the determination of unsuitability or to the extent deemed necessary or advisable by the board of directors. If a Gaming Authority requires the Corporation, or the board of directors deems it necessary or advisable, to redeem any such Securities, the Corporation shall give a Redemption Notice to the Unsuitable Person or its Affiliate and shall purchase on the Redemption Date the number of shares of the Securities specified in the Redemption Notice for the Price set forth in the Redemption Notice….” The Articles provide further guidance as to the terms of the redemption.

In addition, according to Section 3.6 of the Fourth Amended and Restated Bylaws, effective as of November 13, 2006, the removal of a director is premised upon “. . . the

8

REPORT

Attorney – Client / Work Product / Privileged and Confidential

affirmative vote of the holders of not less than two-thirds (2/3) of the voting power of the issued and outstanding stock of the Corporation entitled to vote generally in the election of directors (voting as a single class)….” Resignation is also listed as an option “upon giving written notice, unless the notice specifies a later time for effectiveness of such resignation, to the chairman of the board, if any, the president or secretary, or in the absence of all of them, any other officer.”

C. Wynn Resorts Code of Business Ethics

Wynn Resorts first adopted a Code of Business Conduct and Ethics on May 4, 2004. The document defines itself as “a statement of policies for the individual and business conduct of the Company’s employees and Directors….”14 There are two sections of the Code that are relevant to this investigation: (i) conflict of interest and (ii) interaction with government officials. The sections are included below for reference purposes.

1. Conflict of Interest:

“A Conflict of interest occurs when your private interests interfere, or even appear to interfere, with the interests of the Company. A conflict situation can arise when you take actions or have interests that make it difficult for you to perform your Company work objectively and effectively. Your obligation to conduct the Company’s business in an honest and ethical manner includes the ethical handling of actual, apparent and potential conflicts of interest between personal and business relationships. This includes full disclosure of any actual, apparent or potential conflicts of interest as set forth below.

Special rules apply to executive officers and Directors who engage in conduct that creates an actual, apparent or potential conflict of interest. Before engaging in any such conduct, executive officers and Directors must make full disclosure of all facts and circumstances to the Corporate Secretary, who shall inform and seek the prior approval of the Audit Committee of the Board of Directors.”

2. Interacting with Government:

Prohibition on Gifts to Government Officials and Employees

“Different governments have different laws restricting gifts, including meals, entertainment, transportation and lodging, that may be provided to government officials and government employees. You are prohibited from providing gifts, meals or anything of value to government officials or employees or members of their families in connection with Company business without prior written approval from the Compliance Officer.”

14 Wynn Resorts Code of Business Conduct and Ethics dated May 4, 2004, page 7. [See Appendix]

9

REPORT

Attorney – Client / Work Product / Privileged and Confidential

Bribery of Government Officials

“The Company’s Policy Regarding Payments to Foreign Officials, the U.S. Foreign Corrupt Practices Act (the “FCPA”), and the laws of many other countries prohibit the Company and its officers, employees and agents from giving or offering to give money or anything of value to a foreign official, a foreign political party, a party official or a candidate for political office in order to influence official acts or decisions of that person or entity, to obtain or retain business, or to secure any improper advantage. Please refer to the Company’s Policy Regarding Payments to Foreign Officials for more details regarding prohibited payments to foreign government officials.”

Discipline for Violations:

“The Company intends to use every reasonable effort to prevent the occurrence of conduct not in compliance with its Code and to halt any such conduct that may occur as soon as reasonably possible after its discovery. Subject to applicable laws and agreements, Company personnel who violate this Code and other Company policies and procedures may be subject to disciplinary action, up to and including discharge.” (Emphasis added.)

The Code has since been revised twice, once in 2009 and then again on November 1, 2011. Although the above sections have been expanded in these later editions, for the purpose of this investigation and the dates in question the substance has remained basically the same and the FCPA has continued to be a point of emphasis.

| V. | Report of Investigation |

1. Mr. Okada’s Attitude Toward Wynn Resorts Compliance Requirements

Mr. Okada’s prima facie violations of FCPA, involving both his government regulators in the Philippines and possibly in Korea, do not appear to be accidental or based upon a misunderstanding of anti-bribery laws. Conversely, despite being advised by fellow Wynn Resorts Board members and Wynn Resorts counsel that payments and gifts to foreign government officials are strictly prohibited, Mr. Okada has insisted that there is nothing wrong with this practice in Asian countries. Mr. Okada has stated his personal rejection of Wynn Resorts anti-bribery rules and regulations, as well as legal prohibitions against making such payments to government officials, to fellow Wynn Resorts Board members.

In a February 24, 2011 Wynn Resorts Board of Directors (“Board”) meeting at which Mr. Okada was present, after a lengthy discussion by the Board of the FCPA,15 including specifically the Universal project in the Philippines and potential Wynn Resorts’ involvement, “[t]he

15 In an email from Kim Sinatra to Michiaki Tanaka, dated February 26, 2011, Ms. Sinatra referenced a meeting with Mr. Okada in which she furnished FCPA policy and training materials and reiterated the importance of strict compliance with the FCPA. [See Appendix]

10

REPORT

Attorney – Client / Work Product / Privileged and Confidential

independent members of the board unanimously advised management that any involvement [by Wynn Resorts] in the Philippines under the current circumstances was inadvisable.”16 During this discussion, Mr. Okada challenged the other board members over statements regarding the impermissibility under the FCPA of giving gifts abroad in return for favorable treatment, and made statements about hiring “third party consultants” to give gifts to officials.17

One board member recalled Mr. Okada stating that, in Asia, one must follow the local culture, and that is why one should hire “consultants” to give the gifts.18 This board member understood Mr. Okada to mean that such use of consultants would help avoid prosecution under the FCPA. Another board member who was present recalled Mr. Okada stating that conducting business in the Philippines was all a matter of “hiring the right people” to pay other people.19 Yet another board member recalled Mr. Okada being “adamant” during the FCPA discussion that it is not corrupt to give “gifts.”20 A board member who participated in the meeting by phone recalled Mr. Okada claiming that, in the Philippines, “business is done in a different manner, and sometimes you have an ‘intermediary’ that will do whatever he has to do,” or words to that effect.21 A different board member recalled being “shocked” by the contradiction between two of Mr. Okada’s statements during this discussion.22 Early in the discussion, Mr. Okada explained that there were no longer corruption issues in the Philippines with the new administration. However, Mr. Okada subsequently stated, in effect, that while he himself would not pay bribes, he would “hire someone else” to bribe the necessary person.

Pursuant to a chain of emails reviewed by FSS, commencing with an email on August 4, 2011 from Roxane Peper, Director of Intellectual Property and Corporate Records, to each of the board members (or their representatives), and ending with an email from Ms. Peper to Kevin Tourek, Senior Vice President and Corporate Counsel, on October 26, 2011, the following is clear:23

| n | All board members were notified of upcoming FCPA training/board meeting set for October 31 – November 1, 2011 and asked to confirm attendance by August 31, 2011. |

| n | Mr. Okada, through two of his representatives, was emailed at least three (3) separate times before Shinobu Noda, his assistant, sent an email on September 15, 2011 confirming that Mr. Okada would attend. |

16 Minutes of Wynn Resorts Board of Directors meeting, February 24, 2011, p.3. [See Appendix]

17 Interview of Steve Wynn, November 7, 2011.

18 Interview of Robert J. Miller, December 16, 2011.

19 Interview of Alvin V. Shoemaker, December 20, 2011.

20 Interview of Marc D. Schorr, December 20, 2011.

21 Interview of Allan Zeman, December 21, 2011.

22 Interview of D. Boone Wayson, December 20, 2011.

23 See emails from Roxane Peper to Kevin Tourek on October 26, 2011. [See Appendix]

11

REPORT

Attorney – Client / Work Product / Privileged and Confidential

Subsequent to the confirmation, Ms. Peper received an email from Ms. Noda on October 25, 2011. Ms. Noda stated that the email contained a message to Kim Sinatra, Senior Vice President and General Counsel of Wynn Resorts, from Mr. Okada.24 This part of the message was entirely in Japanese and had to be translated. Mr. Okada asked for the FCPA training materials to be provided in Japanese. He also stated that he would be arriving on “Monday [October 31]”, which was the day the FCPA training was to commence. He asked if the training could be held after the board meeting or rescheduled. Kim Sinatra sent a response to Ms. Noda via email on October 25, 2011 thanking Mr. Okada for the note and stating further that the FCPA training materials had been translated and would be provided to him via email and that Wynn Resorts had made further arrangements to have the FCPA live training translated to Japanese via simultaneous translation.25 She also stated that the date of the training could not be rescheduled because it had been planned around his previous confirmation and that outside counsel was coming to Las Vegas to provide the training.

Mr. Okada failed to attend the training on October 31, 2011. He was the only member of the board not in attendance (all others attended in person or via telephone dial-in as evidenced via a sign-in sheet).26

| 2. | Gaming Establishment in the Philippines |

Evidence obtained in the course of the investigation establishes that Mr. Okada, his associates and companies, may have arranged and manipulated the ownership and management of legal entities in the Philippines under his control, in a manner that may have enabled the evasion of Philippine constitutional and statutory requirements. It is also noted that Mr. Okada’s two principal Philippine corporations, Eagle I Landholdings, Inc. and Eagle II Holdco, Inc., which may have been purposefully created to circumvent Philippine constitutional restrictions on foreign ownership of land, appear to be closely intertwined with Rodolfo Soriano, Paolo Bombase and Manuel M. Camacho, who have numerous common ties to former PAGCOR Chairman Efraim Genuino. For example, with regard to Eagle II Holdco, Inc., as late as 2010, Platinum Gaming and Entertainment (“Platinum”) had acquired 60% of its shares. According to a dated filing by Platinum on file with the Philippine SEC, Rodolfo Soriano controlled 20% of Platinum at the time of its incorporation. Mr. Soriano, referred to by attorney Camacho as a “bag man” for then-Chairman Genuino, is a former PAGCOR consultant and respondent in PAGCOR corruption referrals (see page 15 infra). Similarly, Paolo Bombase, an officer, director and nominal shareholder of Eagle I Landholding, Inc. and Eagle II Holdco., Inc. has a 1.25% share of Ophiuchus Real Properties Corp. This Ophiuchus entity is 15% owned by a Philippine company named SEAA Corp. In turn, SEAA is the family-controlled company of former PAGCOR Chairman Efraim Genuino. At this time, the significance of this interlocking shareholder link

24 See email from Shinobu Noda to Roxane Peper dated October 25, 2011. [See Appendix]

25 See email from Kim Sinatra to Shinobu Noda dated October 25, 2011. [See Appendix]

26 See FCPA Training Sign-In sheet dated October 31, 2011. [See Appendix]

12

REPORT

Attorney – Client / Work Product / Privileged and Confidential

between Mr. Okada, his former Philippine gaming regulator, and the regulator’s associates is not known.

A. Corporate Links between Mr. Okada’s Business Interests and Those of Philippine Government Officials

Close associates and consultants of the former Genuino PAGCOR administration eventually attained positions as corporate officers, directors and/or nominal shareholders in legal entities controlled by Mr. Okada, and, in some cases, served as links between the business interests of Mr. Okada and those of former PAGCOR chairman Efraim Genuino and members of Genuino’s immediate family.

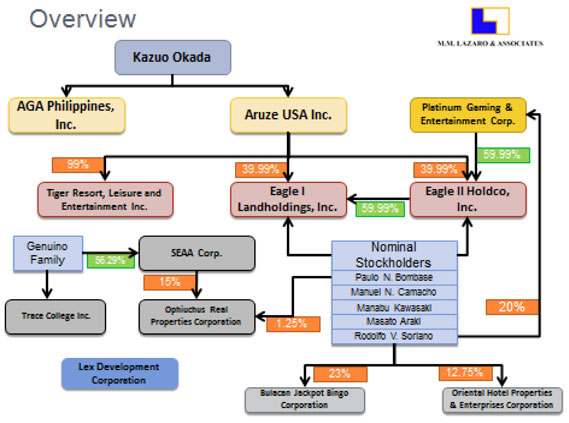

In order to better understand the interrelationships among corporate entities in the Philippines controlled by Mr. Okada and those controlled by PAGCOR officials and their associates, FSS requested the Philippines law firm of M. M. Lazaro & Associates (“Lazaro”) to produce a study of this issue.27 Drawing upon official records obtained from the Philippines Securities and Exchange Commission, Lazaro produced an analysis of the relationships created by the ownership and control structures of these entities.28 The chart below, extracted from that analysis, illustrates these relationships in schematic form.

27 Manuel Lazaro was formerly a government corporate counsel with the rank and privileges of a Philippine presiding justice, court of appeals, who FSS retained to assist in the investigation and to advise on certain aspects of Philippine law. [See Appendix]

28 The complete Lazaro PPT is attached to this report. [See Appendix]

13

REPORT

Attorney – Client / Work Product / Privileged and Confidential

Tiger Resorts, Leisure and Entertainment, Inc. (“Tiger”) was incorporated in the Philippines on June 13, 2008.29 Its primary purpose was stated as:

To acquire, own, maintain, operate and/or manage hotels (city and resort), inns, apartments, private clubs, pension houses, convention halls, lodging houses, restaurants, cocktail bars, and any and all services and facilities related or incident thereto.30

Tiger is predominantly owned by Aruze USA, Inc.31 In August 2008, PAGCOR granted Tiger a Provisional Licensing Agreement to operate a gaming establishment in the Entertainment City Manila Zone. An official of the current PAGCOR administration told FSS in December 2011 that PAGCOR was currently reexamining this license.32

29 Articles of Incorporation of Tiger. [See Appendix]

30 Ibid. [See Appendix]

31 GIS of Tiger, 2010. [See Appendix]

32 Combined interview of Jay Daniel R. Santiago and Thadeo Francis P. Hernando, on December 12, 2011. It should be noted that after the interview with Santiago and Hernando, FSS along with its Philippine counsel, for purposes of this investigation, formally requested a copy of the Provisional Licensing Agreement from PAGCOR, as well as other related documents. On the same date that the formal request was made, PAGCOR refused to supply a

14

REPORT

Attorney – Client / Work Product / Privileged and Confidential

Eagle I Landholdings, Inc. (“Eagle I”) was incorporated in the Philippines on May 16, 2008 with 5 partners of the Philippines law firm Sycip Salazar Gatmaitan (“Sycip”) as the shareholders, directors and officers.33 By certification on September 5, 2008, the original shareholders were all replaced by, among others, Eagle II Holdco, Inc. (“Eagle II”), with approximately 60% ownership. Eagle II maintained this percentage of ownership of Eagle I through the filing of the latest available General Information Statement (“GIS”) for the year 2010.34 Eagle I’s 2009 GIS, filed September 17, 2009, indicates that Paolo Bombase, Manuel N. Camacho and Rodolfo V. Soriano (whose associations with PAGCOR and Mr. Genuino are explained below) all had become officers/directors and nominal stockholders of Eagle I; they retained this status through the filing of the latest GIS for Eagle I.35 Aruze USA, Inc. first appears as the owner of approximately 40% of Eagle I as of the 2010 GIS, owning the share previously owned by Molly Investments Cooperative UA (“Molly”).36

Eagle II’s filings with the Philippines Securities and Exchange Commission indicate a history similar to that of Eagle I. Incorporated on May 19, 2008 by the same 5 Sycip partners,37 Eagle II reflected the acquisition of approximately 60% of its shares by Platinum Gaming & Entertainment Corp. (“Platinum”) on its GIS filed September 17, 2009, with Platinum owning the same percentage as of the 2010 GIS.38 The same filings reflect the appearance--in 2009 and continuing through the 2010 filing--of Messrs. Camacho, Soriano and Bombase as officers/directors and nominal shareholders. In 2010 Aruze USA, Inc. appears with the 40% shareholding that was attributed to Molly in 2009.39

Platinum was incorporated in the Philippines on November 21, 2001, with a Certificate of Filing of Amended Articles of Incorporation (“AOI”) issued by the Philippines Securities and Exchange Commission on June 10, 2002.40 Platinum has no GIS on file with the Philippines Securities and Exchange Commission, and the only corporate document filed besides the Articles of Incorporation is the 2004 Financial Statement. The latest information on file lists Mr.

copy of Tiger’s Provisional Licensing Agreement, saying that they were bound by a non-disclosure clause. That refusal was signed by Francis P. Hernando, who is identified below as a PAGCOR employee, who stayed in Wynn Macau in June 2011 and had US 709.72 of expenses paid for by the Aruze City Ledger account. See Letter of Request and Letter of Refusal. [See Appendix]

33 Articles of Incorporation of Eagle I. [See Appendix]

34 GIS of Eagle I for years 2009 and 2010. [See Appendix] A GIS is required to be filed on an annual basis according to Section 141 of the Corporation Code of the Philippines. [See Appendix]

35 Ibid. [See Appendix]

36 Ibid. [See Appendix]; FSS has determined Molly to be a wholly owned subsidiary of Aruze Corp. See http://www.universal-777.com/en/ir/ir_lib/material/annual_20081119.pdf, page 32.

37 Articles of Incorporation of Eagle II. [See Appendix]

38 GIS of Eagle II, years 2009-2010. [See Appendix]

39 GIS of Eagle II, 2010. [See Appendix]

40 Articles of Incorporation of Platinum, as amended June 10, 2002. [See Appendix]

15

REPORT

Attorney – Client / Work Product / Privileged and Confidential

Soriano, a former PAGCOR consultant, as a director/officer and a 20% shareholder in Platinum.41

Messrs. Camacho, Bombase and Soriano are all directly associated with former PAGCOR Chairman Genuino in significant ways. Mr. Camacho is an attorney and a principal of the Manila law firm Camacho & Associates. He was for a time in a law partnership with Mr. Genuino’s son, Erwin Genuino.42 Mr. Camacho traveled to Japan with Mr. Soriano at then PAGCOR Chairman Genuino’s behest, to meet with Mr. Okada and other representatives of Aruze. This meeting resulted in Mr. Camacho’s firm replacing Sycip in representing Aruze with respect to the development of the project in Entertainment City Manila.43

Sometime subsequent to this meeting, Aruze wired retainer funds to the bank account of Mr. Camacho’s firm, an account controlled jointly by Mr. Camacho and Erwin Genuino. Later, Mr. Camacho discovered that all or most of these funds had been withdrawn by Erwin Genuino. When he questioned this withdrawal, he was eventually told by Mr. Soriano and/or then PAGCOR Chairman Genuino that the funds had been withdrawn to be used as a “cash payoff” to the mayor of the municipality in which the Entertainment City Manila project is located, in order to facilitate approval of the use of some plots of land to build roads needed for Mr. Okada’s casino project. Mr. Camacho claims to have had a falling out with Erwin Genuino and Mr. Soriano, and to be involved currently in a lawsuit against Erwin Genuino over the dissolution of their law partnership.44 Erwin Genuino is named as a respondent, along with former PAGCOR Chairman Genuino, in two sworn corruption referrals (“PAGCOR Referrals”) filed with the Republic of the Philippines Department of Justice (“DOJ”) in the summer of 2011 by the current PAGCOR Administration.45

Mr. Bombase, also an attorney, is an officer/director and shareholder of Ophiuchus Real Properties Corporation (“Ophiuchus”), incorporated in April 2011.46 According to its 2011 GIS, Ophiuchus was 15% owned by SEAA Corporation (“SEAA”).47 SEAA, which was registered with the Philippine SEC on December 3, 1997, is, according to its 2011 GIS, 100% owned by members of former PAGCOR Chairman Genuino’s immediate family.48 The Articles of

41 M. M. Lazaro & Associates, “Aruze Corporations in the Philippines and ‘Related’ Corporations”, p. 18. [See Appendix]

42 Interview of M. Camacho, December 13, 2011.

43 In his discussion with FSS, Mr. Camacho referred to the firm only as “Aruze,” not further defined.

44 Although Mr. Camacho, who is in his seventies, failed to recall some details of his dealings with Mr. Genuino and Mr. Soriano, FSS credits the general account given by him during the December 13, 2011 interview.

45 See PAGCOR Referrals. [See Appendix]

46 Articles of Incorporation of Ophiuchus. [See Appendix]

47 GIS of Ophiuchus, 2011. [See Appendix]

48 GIS of SEAA, 2011. [See Appendix]

16

REPORT

Attorney – Client / Work Product / Privileged and Confidential

Incorporation of Ophiuchus also list Emilio Marcelo as an officer/director and shareholder.49 Mr. Marcelo is named as a respondent in the PAGCOR Referrals.50

Mr. Soriano is a former PAGCOR consultant, named by Mr. Camacho as a close business associate and “bag man” for Mr. Genuino.51 Mr. Soriano is also named as a respondent in the PAGCOR Referrals.52 As of the latest information filed with the Philippines Securities and Exchange Commission in 2002, Mr. Soriano was a 20% shareholder and an officer/director of Platinum,53 identified above as a 60% shareholder in Eagle II. If Mr. Soriano still held the same stake in Platinum when it acquired its share of Eagle II in 2009, then he became an effective owner of 12% of Eagle II and approximately 7% in Eagle I.

B. Apparent Evasion of Republic of Philippines Legal Requirements

As described in the preceding section, Mr. Okada caused various legal entities to be incorporated in the Philippines, in order to develop his casino resort project there, over time replacing the original incorporating Filipino shareholders with combinations of foreign shareholders affiliated with or controlled by him and associates of then-PAGCOR Chairman Genuino. As discussed below, there are constitutional and statutory requirements in the Republic of the Philippines requiring that purchasers of land be Philippines citizens or Filipino-owned legal entities, and that legal entities conducting business in the Philippines, with certain exceptions, be at least 60% Filipino owned.

In 2008, Eagle I purchased various tracts of land near Manila Bay totaling approximately 30 hectares at a total price of PHP 13,527,637,941.00 (approximately US 314,953,000.00) for the development of the project in Entertainment City Manila.54

At FSS’ request, Lazaro prepared an analysis and opinion on the validity of Eagle I’s ownership of these properties, in light of the aforementioned provisions of the Philippines Constitution and applicable statutes.55 The analysis included a detailed review of the ownership and capitalization of Eagle I and associated entities described in the preceding section. The following is a summary of pertinent findings of the Lazaro analysis.

49 Articles of Incorporation of Ophiuchus. [See Appendix]

50 See PAGCOR Referrals. [See Appendix]

51 Interview of M. Camacho, Dec 13, 2011.

52 See PAGCOR Referrals. [See Appendix]

53 Articles of Incorporation of Platinum, as amended June 10, 2002. The 2001 Articles of Incorporation list four (4) additional 20% shareholders, identified as Filipino nationals. Because Platinum has not filed a GIS since 2002, the current ownership and control of Platinum is unknown. [See Appendix]

54 Numbered Transfer Certificates of Title (“TCT”) for Eagle I purchase of land tracts in Parañaque City, Philippines, dated August 19, 2008. [See Appendix]

55 M. M. Lazaro & Associates. Memo re “Validity of Eagle I’s Ownership of Real Estate Properties” (“Ownership Memo”), Jan 2012. [See Appendix]

17

REPORT

Attorney – Client / Work Product / Privileged and Confidential

A review of the 2009 Financial Statement of Eagle I disclosed that the funds used to purchase the land tracts appear to have been advanced by Molly.56

Platinum, the 59.99% owner of Eagle II, has filed no records with the Philippines Securities and Exchange Commission indicating that its paid-in capital ever increased beyond the original PHP 62,500, despite its amended Articles of Incorporation indicating that its authorized capital stock was increased from the initial PHP 1,000,000.00 to PHP 24,000,000.00.57 Nor is it known today what person(s) or entities have controlled Platinum since incorporation in 2001.

The 1987 Constitution of the Philippines requires that only Philippines citizens or corporations with at least 60% of their capital stock owned by Filipinos are qualified to acquire land in the Philippines.58 The Philippines Foreign Investment Act further requires that for a corporation to be considered a Philippines national, at least 60% of its capital stock outstanding and entitled to vote must be owned and held by citizens of the Philippines.59

Whenever facts or circumstances create doubt as to whether the ownership of 60% of a corporation is truly Filipino, Philippines Securities and Exchange Commission case law has held that a stringent examination of the true ownership of the voting stock of the subject corporation and of the true ownership of the voting stock of all successive layers of corporate ownership should be conducted. The application of this stringent standard is known as the “Grandfather Rule.”60

Serious doubts are therefore raised about the actual Filipino equity of Eagle I, because of the appearance that Eagle I and Eagle II were created purposely to “...circumvent the constitutional restriction on foreign ownership of land.”61 Lazaro bases this assertion on its conclusion that “…Platinum appears to be merely a shell corporation used to satisfy the Filipino equity requirement.”62 Application of the Grandfather Rule would therefore be appropriate.

Applying the Grandfather Rule, Lazaro calculates the true percentage of Filipino versus foreign equity in Eagle I as illustrated in the following table:63

56 Ibid, p. 2. [See Appendix]

57 Ibid, pp. 5-6. [See Appendix]

58 Ibid, p. 8. [See Appendix]

59 Ibid, pp. 9-10. [See Appendix]

60 Ibid, pp. 11-14. [See Appendix]

61 Ibid, p. 14. [See Appendix]

62 Ibid, pp. 14-15. [See Appendix]

63 Ibid, p. 15. [See Appendix]

18

REPORT

Attorney – Client / Work Product / Privileged and Confidential

| Total | Total | |||||||

| Shareholder | Direct | Indirect | Filipino investment in Eagle I |

Foreign investment in Eagle I | ||||

| 24% | ||||||||

| Aruze USA | 40% of Eagle I |

(40% of 60% total holdings of Eagle II in Eagle I) |

64% | |||||

| 36% | ||||||||

| Platinum* | (60% of 60% total holdings of Eagle II in Eagle I) |

36% | ||||||

*As noted above, Platinum has failed to file its annually required GIS with the Philippine SEC since its inception in 2001. The calculations in the above table prepared by Lazaro assume the “best case” scenario (for Platinum), i.e., that it is a truly 100% Filipino-owned corporation. If Platinum’s actual Filipino ownership is less than 100%, then the percentage of Filipino investment in Eagle I would be correspondingly even less than calculated in the table.

Lazaro concludes that “...the foregoing shareholder structure appears to have been formulated by the parties as a legal scheme to justify the qualification of Eagle I to own real estate properties. The scheme employed...gives Aruze USA, Inc....a convenient vehicle to justify its ownership...in circumvention of the constitutional restriction on the foreign ownership of land.”64 Lazaro goes on to conclude that the apparent shareholder structuring scheme outlined above may also constitute a violation of Commonwealth Act No. 108, commonly known in the Philippines as the “Anti-Dummy Law.”65 If convicted of a violation of this law, stockholders of Platinum and of Aruze USA, Inc. who profited from the scheme would face a sentence of imprisonment of not less than five years nor more than fifteen years.66

From the foregoing discussion, there is substantial evidence and credible legal opinion indicating that the ownership structure of Eagle I and Eagle II may subject Mr. Okada, along with his associates and companies, to civil as well as criminal sanctions under Philippine law.

64 Ibid, p. 16. [See Appendix]

65 Ibid, pp. 16-17. [See Appendix]

66 Ibid, p. 17. [See Appendix]

19

REPORT

Attorney – Client / Work Product / Privileged and Confidential

| 3. | Apparent FCPA Violations Regarding Philippine PAGCOR Officials at Wynn Resort Properties |

FSS has reviewed records of the Aruze City Ledger Account, through which Mr. Okada and Universal charge expenses for lodging, entertainment and other incidentals incurred at Wynn Resorts facilities against funds deposited into the account by Universal, and available underlying documentation furnished by Wynn Resorts management. The table below highlights thirty-six (36) separate instances, from May, 2008, through June 2011 (more than a three (3) year period), when Mr. Okada, his associates and companies made payments exceeding US 110,000, which directly benefitted senior PAGCOR officials, including two chairmen and their family members.

| Name |

Relationship to PAGCOR/Phil. Gov’t. |

Location(s) and Date(s) of Stay(s) |

Total Charged to Aruze City Ledger Account (in US) | |||

| Efraim C. Genuino | Former PAGCOR Chairman (February 2001 to June 30, 2010) | WM June 6-9 2010 | 1,870.64 | |||

| Cristino L. Naguiat Jr. |

PAGCOR Chairman (July 2, 2010 to Present) |

WM Sep 22-26 2010 | See Suzzanne Bangsil67 | |||

| WLV Nov 15-20 2010 | 5,380.86 | |||||

| WM June 6-10 2011 | 3,909.80 | |||||

| Dinner (Naguiat Party) | Chairman (PAGCOR) | WM Sep 24 2010 (Hosted by and charged to Kazuo Okada) |

1,673.07 | |||

| Maria Teresa Socorro Naguiat |

Wife of PAGCOR Chairman Cristino L. Naguiat Jr. |

WM June 6-10 2011 | 1,039.31 | |||

|

Suzzanne Bangsil68 |

Wife of Rogelio Bangsil, PAGCOR | WM Sep 22-26 2010 | 50,523.22 | |||

| Jose Miguel | Husband of former | WLV Nov 12-17 | 4,642.40 |

67 Chairman Naguiat did not identify himself and Mr. Okada’s representatives insisted that his stay there be “Incognito.” Accordingly, the bulk of the charges for the trip are reflected on the City Ledger Account as attributable to “Suzzanne Bangsil,” the wife of Rogelio Bangsil, a senior PAGCOR official and Chairman Naguiat’s employee. However, interviews, photo identifications and documentary evidence clearly establish that Chairman Naguiat was the “Incognito” guest and the direct beneficiary of these payments.

68 Investigation has in fact determined that Chairman Naguiat was registered as an “Incognito” VIP guest under Suzzanne Bangsil’s reservation. Therefore, this US 50,523.22 was paid for Chairman Naguiat’s benefit.

20

REPORT

Attorney – Client / Work Product / Privileged and Confidential

| “Mike” Arroyo | Philippines President Gloria M. Arroyo (Jan 20 2001 – June 20 2010) |

2009 | ||||

| Imelda Dimaporo | PAGCOR Board Member | WM June 8-10 2010 | 891.44 | |||

| Philip Lo | PAGCOR Board Member | WLV April 29 2009 – May 3 2009 |

1,755.25 | |||

| Manuel Roxas | PAGCOR Board Member | WLV April 200969 | 253.75 | |||

| WLV April 29 2009 – May 3 2009 |

1,686.95 | |||||

| Susan Vargas | PAGCOR Board Member | WM June 8-10 2010 | 480.17 | |||

| Jose Tanjuatco | PAGCOR Board Member (July 19 2010 to Present) | WLV Nov 15-18 2010 | 2,148.57 | |||

| Rogelio J. B. Bangsil |

Officer in Charge of PAGCOR Gaming Department |

WM Sep 24-26 2010 | 1,149.04 | |||

| WM June 6-12 2011 | 2,955.23 | |||||

| Rodolfo Soriano | PAGCOR Consultant | WM June 3-7 2008 | 1,186.08 | |||

| WLV Nov 12-17 2009 | 4,228.00 | |||||

| WM June 7-10 2010 | 1,104.06 | |||||

| WM Aug 18 2010 | 368.06 | |||||

| Olivia Soriano | Relative of Rodolfo Soriano | WLV May 2008 | 975.55 | |||

| Anthony F. “Ton” Genuino70 |

Son of Efraim C. Genuino; Mayor of Los Baños (2010 to Present) |

WLV Sep. 2008 | 2,386.26 | |||

| WLV Oct 2008 | 2,326.49 | |||||

| Rafael Francisco | PAGCOR COO and President | WLV Nov 12-17 2009 | 4,360.16 | |||

| WM June 7-11 2010 | 935.21 |

69 When the “Dates of Stay” in this table were not readily available, the month and year that the charges were entered in the City Ledger Account are used.

70 See PAGCOR Referrals (Anthony Genuino is named as a respondent). [See Appendix]

21

REPORT

Attorney – Client / Work Product / Privileged and Confidential

| Emelio Marcello | PAGCOR Consultant | WLV Nov 12-17 2009 | 1,181.60 | |||

| WM June 7-9 2010 | 471.51 | |||||

| Carlos Bautista | PAGCOR VP Legal | WM June 6-10 2010 | 1,049.69 | |||

| Mario Cornista | PAGCOR Consultant | WM June 7-9 2010 | 600.02 | |||

| Rene Figueroa | PAGCOR Executive VP | WM June 7-10 2010 | 646.76 | |||

| Ernesto Francisco |

PAGCOR Executive Committee and Casino General Manager |

WM June 7-10 2010 | 797.17 | |||

| Edward King | PAGCOR VP Corporate Communications |

WM June 7-10 2010 | 767.71 | |||

| Transportation | PAGCOR Delegation | WM Aug 2010 | 462.42 | |||

| Jeffrey Opinion | Member of Naguiat Party | WM Sep 24-26 2010 | 906.61 | |||

| Ed de Guzman |

PAGCOR Executive Committee, AVP Slots |

WM Jun 6-12 2011 | 3,421.79 | |||

| Gabriel Guzman | Probable relative of Ed de Guzman (had adjoining room) |

WM Jun 6-12 2011 | 1,391.71 | |||

| (Thadeo) Francis P. Hernando71 |

PAGCOR VP, Licensed Casino Development Dept. |

WM Jun 8-10 2011 | 709.72 | |||

| TOTAL | 110,636.36 |

The total in the above table represents charges from the Aruze City Ledger Account that are readily identifiable as incurred directly by officials and consultants of PAGCOR,72 their family members and close associates, including Jose Miguel Arroyo, the then-First Gentleman of the Republic of the Philippines, husband of Philippine President Gloria Arroyo. Through a review of the Aruze City Ledger Account for statement periods March 2008 through November 2011, FSS has calculated that total charges to the account for that period, attributable to

71 This is the same PAGCOR official who denied the FSS request for documents in December 2011, including a copy of the Provisional License Agreement. See footnote 31.

72 In order to establish the PAGCOR affiliation of some of the individuals listed in this chart, various sources were consulted, including the PAGCOR website, internet news articles and the PAGCOR Referrals.

22

REPORT

Attorney – Client / Work Product / Privileged and Confidential

PAGCOR officials, employees, consultants, their associates and family members, exceed USD 110,000.73

FSS investigators interviewed members of the Wynn Macau management team, who furnished the following relevant information regarding a visit to that property in September 2010 by then and current PAGCOR Chairman and CEO Cristino L. Naguiat, Jr., his wife, three children, nanny and other PAGCOR officials, whose four-day stay at Wynn Macau was paid for via the Aruze City Ledger Account:

| n | September 20, 2010: Yoshiyuki Shoji of Universal, in an e-mail to Angela Lai of Wynn Macau, requests reservations for “Rogelio Bangsil (Guest Representative) & Others.” Mr. Shoji requests Encore Suite or “more gorgeous room, such as Villa,” and “the best butler” for unnamed person in group, who is “VIP for Universal.” Mr. Shoji states that guests other than Bangsil should not be registered, that all charges should be posted to Universal’s City Ledger,74 and that “Mr. Okada would like them to experience the best accommodations and services at Wynn Macau.”75 The communication makes no reference to PAGCOR or the government affiliation of the guests. |

| n | September 20, 2010: In an e-mail to Wynn Macau President Ian Coughlan and others, Ms. Lai informs Mr. Coughlan of the reservation and that checks of websites indicate that Mr. Bangsil is in charge of PAGCOR’s gaming department.76 |

| n | September 20, 2010: In an e-mail to Mr. Shoji, Ms. Lai advises that Wynn Macau is checking on availability of the requested upgrade and that Macau law requires that all room occupants be registered, and requests that all guest names be furnished in advance of or at the time of registration.77 |

| n | September 22, 2010: In an e-mail to Wynn Macau President Ian Coughlan, Wynn Macau Senior Vice-President – Legal Jay M. Schall advises Mr. Coughlan of |

73 See City Ledger Account. [See Appendix]

74 When Mr. Shoji set up the City Ledger Account for Mr. Okada in 2008, he asked whether the customer name and amount paid would be made public. He was advised that such information would not become public. Email response from Kim Sinatra to Shoji, dated February 8, 2008. [See Appendix]

75 E-mail from Y. Shoji to A. Lai, September 20, 2010 [See Appendix]; interview of A. Lai, January 4, 2012.

76 E-mail from A. Lai to I. Coughlan, September 20, 2011 [See Appendix]; interview of A. Lai, January 4, 2012; interview of I. Coughlan, December 29, 2011. It should be noted that according to an article in Manilatimes.net, published February 2, 2012, Rogelio Bangsil has recently been transferred to the PAGCOR international marketing department after a probe that found the government losing PHP 160 million in government run casinos to a Mr. Liu. [See Appendix]

77 E-mail from A. Lai to Y. Shoji, September 20, 2010 [See Appendix]; interview of A. Lai, January 4, 2012.

23

REPORT

Attorney – Client / Work Product / Privileged and Confidential

PAGCOR’s 100% government ownership and of Mr. Bangsil’s position there. He writes “Bangsil, the guest of Mr. Okada, is a top five (if not 3) officer.”78

| n | September 22, 2010 (14:00): Wynn Macau sends 1 Rolls Royce and 1 Elgrand to the airport, along with Masato Araki, Special Assistant to Mr. Okada; and Kenichiro Watanabe, another Universal associate, to meet arriving party, who arrived on Philippine Airline Flight 352 from Manila. They return with Chairman Cristino L. Naguiat, Rogelio Bangsil and Jeffrey Opinion at 14:45.79 Only Mr. Bangsil furnishes his name upon registration. Ms. Lai and Wynn Macau VIP Services Manager Beatrice Yeung thereafter checks PAGCOR website and identifies Chairman Naguiat’s name from his picture there.80 Ms. Yeung’s log and ongoing entries refer to “[I]ncognito (Mr. Naguiat, Cristino L.).”81 |

| n | Chairman Naguiat occupies Villa 81, the most expensive accommodation at Wynn Resorts Macau (about 7,000 square feet in size, which then cost about US 6,000 per day and is mostly reserved for “high rollers”). |

| n | September 22, 2010: the Wynn Encore log book reflects “Incognito (Mr. Naguiat) stayed in Villa 81 Master Bedroom l.”82 |

| n | September 23, 2010 (10:00): Mr. Araki advises Ms. Yeung that Chairman Naguiat plans to have lunch with Miss Pansy Ho at MGM.83 |

| n | September 23, 2010 (14:04): Jay Schall sends an email to Wynn Macau corporate security to check Worldcheck, as a rush job, for Cristino L. Naguiat Jr., Chairman and Chief Executive Officer of PAGCOR.84 |

78 E-mail from J. Schall to I. Coughlan, September 22, 2010 [See Appendix]; interview of J. Schall, January 3, 2012; interview of I. Coughlan, December 29, 2011.

79 Wynn Macau Manager – Encore Logbook, September 22, 2010. [See Appendix]

80 Interviews of Beatrice Yeung, January 4, 2012 and February 1, 2012; interviews of Angela Lai January 4, 2012 and February 2, 2012.

81 Wynn Macau Manager – Encore Logbook, September 22, 2010. [See Appendix]

82 Ibid. [See Appendix] During subsequent visits, Chairman Naguiat was identified as “Naguiat,” though he was identified during his initial visit as “incognito.” The negative inference to be drawn is an attempt to hide the payment of extremely costly expenses by a corporation connected with a regulated entity. The fact that he had only recently become chairman may have been a factor in his desire to keep his identity secret.

83 Miss Ho is the daughter of Hong-Kong and Macau-based businessman Stanley Ho. Though Nevada gaming regulators found Miss Ho to be a suitable business partner for MGM Mirage, see

http://www.lvrj.com/business/45462797.html, New Jersey regulators recommended that she be found unsuitable as MGM Mirage’s joint venture partner in Macau. See http://www.newjerseynewsroom.com/state/mgm-mirage-chooses-pansy-ho-over-atlantic-city. [See Appendix]

84 Email from Jay Schall to Peter Barnes of Wynn Macau Corporate Security, dated September 23, 2010. [See Appendix]

24

REPORT

Attorney – Client / Work Product / Privileged and Confidential

| n | September 23, 2010: In an e-mail to Ms. Lai, with a copy to Mr. Okada, Mr. Shoji requests that a credit of US 5,000 be extended to each person now staying at the Villa for shopping and gaming, up to a total of US 50,000. According to Mr. Shoji’s email, the funds are to be advanced by Wynn Macau and charged to the Universal City Ledger account.85 |

| n | September 24, 2010 (13:45): MOP 80,00086 (approximately US 10,000) is advanced from the Wynn Macau main cage to a Wynn Macau VIP Services employee (no longer employed at Wynn Macau), who in turn hands the money to Masato Araki, special assistant to president of Aruze USA, based upon instructions in the above referenced e-mail to Ms. Lai. The handover of funds is witnessed by Wynn Encore manager Alex Kong. The funds are charged to the Universal City Ledger Account. 87 MOP 15,000 of this sum is used to pay for a Chanel bag that Chairman Naguiat requested be purchased for his wife.88 |

| n | September 24, 2010 (Approximately 14:00): Mrs. Naguiat, her three children, Mrs. Bangsil and her daughter arrive at Wynn Macau. |

| n | September 24, 2010 (15:45): Wynn Macau employees meet Mr. Okada and his assistant, Jun Yoshie, at the airport, transport them to Wynn Macau and escort Mr. Okada to room 5688.89 |

| n | September 24, 2010 (late afternoon): Mr. Coughlan receives a phone message from Mr. Yoshie that Mr. Okada would like to speak to him. Mr. Coughlan proceeds to an area near the Wynn Encore reception desk, where he meets Mr. Yoshie and Mr. Okada. They step into the Cristal Bar to talk, whereupon Mr. Okada, with Mr. Yoshie interpreting into English, tells Mr. Coughlan that the guests [referring to |

85 E-mail from Y. Shoji to A. Lai, September 23, 2010 [See Appendix]; e-mail from B. Yeung to I. Coughlan, September 27, 2010 [See Appendix]; interview of B. Yeung, January 4, 2012; Wynn Macau Manager – Encore Logbook, September 24, 2010.

86 MOP 80,000 was worth approximately US 9,816 at that time.

87 Wynn Macau Manager – Encore Logbook, September 24, 2010 [See Appendix]; Wynn Macau “Miscellaneous Disbursement” record #013014, dated September 24, 2010 [See Appendix]; e-mail from B. Yeung to I. Coughlan, September 27, 2010 [See Appendix]; interview of B. Yeung, January 4, 2012; interview of Alex Kong, February 1, 2012.

88 Wynn Macau Manager – Encore Logbook, September 24, 2010. [See Appendix]. The Chanel bag was purchased by a Wynn Macau employee as per instructions by Mr. Araki, who works for Mr. Okada. The Wynn Macau employee gave the bag, store receipt and change to Mr. Araki to deliver to Mrs. Naguiat. Later, Mr. Araki stated that Mrs. Naguiat did not like the bag so he would give it to his own wife.

89 Wynn Macau Manager – Encore Logbook, September 24, 2010 [See Appendix]; interview of B. Yeung, January 4, 2012.

25

REPORT

Attorney – Client / Work Product / Privileged and Confidential

Chairman Naguiat’s party] are very important to Universal, and that Mr. Okada wants Mr. Couglan to insure that they are well cared for during their stay.90

| n | September 24, 2010 (17:00): Mr. Okada meets Chairman Naguiat (and approximately thirteen (13)) others in his party) for dinner at Okada Restaurant.91 Mr. Okada hosts the dinner and the bill for $1,673.07 is charged to his room. |

| n | September 25, 2010 (05:45): Wynn Macau employees meet Mr. Okada outside his room and escort him to a limousine, which transports him to the Macau Ferry Terminal for 07:00 scheduled ferry departure to Hong Kong International Airport.92 |

| n | September 25, 2010: Beatrice Yeung describes in her log book “Movements – Incognito (Mr. Naguiat, Cristino L) / Mr. Bangsil, Rogelio / Mr. Opinion, Jeffrey (Mr. Okada’s guests, Villa 81).”93 |

| n | September 25, 2010: Mr. Araki requests a second advance of MOP 80,000 for guests in Villa 81. Ms. Yeung accompanies Mr. Araki to the Main Cage and obtains the advance for him.94 [This makes a total of MOP 160,000 advanced for the use of Chairman Naguiat and his party and charged to the Universal City Ledger Account per Mr. Okada’s orders, as relayed in Mr. Shoji’s e-mail.] |

| n | September 26, 2010 (11:10): Mr. Araki departs the Wynn Macau Encore main entrance. He hands Ms. Yeung MOP 4100, returning what he says is the remainder of the two cash advances for Chairman Naguiat’s party.95 |

| n | September 26, 2010 (13:15): Chairman Naguiat’s party departs via Wynn Macau limousine to pick up Mrs. Naguiat from shopping and proceeds to the airport.96 |

90 Interviews of Ian Coughlan, January 5, 2012 and February 2, 2012.

91 Interview of B. Yeung, January 4, 2012; Wynn Macau Manager – Encore Logbook, September 24, 2010. [See Appendix]

92 Interview of B. Yeung, January 4, 2012; Wynn Macau Manager – Encore Logbook, September 25, 2010. [See Appendix]

93 Wynn Macau Manager – Encore Logbook, September 25, 2010. [See Appendix]

94 Interview of B. Yeung, January 4, 2012; Wynn Macau Manager – Encore Logbook, September 25, 2010 [See Appendix]; Wynn Macau “Miscellaneous Disbursement” record #013066, dated September 25, 2010. [See Appendix]

95 E-mail from B. Yeung to I. Coughlan, September 27, 2010 [See Appendix]; Wynn Macau Manager – Encore Logbook, September 26, 2010 [See Appendix]; handwritten and signed note dated “9/26/10” with notation “MOP 4.100”. [See Appendix]. The returned funds were equal to approximately US 503.07 returned out of a total of approximately US 19,632 provided.

96 Interview of B. Yeung, January 4, 2012; Wynn Macau Manager – Encore Logbook, September 26, 2010. [See Appendix]

26

REPORT

Attorney – Client / Work Product / Privileged and Confidential

| n | November 10, 2010: Mr. Shoji advises Mr. Coughlan in an e-mail of receipt of Wynn Macau’s invoice for the late September 2010 visit, in which the Villa [for Chairman Naguiat] was charged at the amount of MOP 48,000. Mr. Shoji states that “I understand that Mr. Okada explained to you in Macau that they were our business guests and we made reservations for them and all charges are billed to our company. While some of charges [sic] will be reimbursed by them, room charges were planned to be borne by us as ordinary business expenses. Since the amount charged is too much and beyond the ordinary room charge, our company will be put in a very difficult position to give reasonable explanations if we are inquired by someone. I would appreciate if you would reconsider this matter and charge us the original rate (free upgrade to Villa) since the party directly dealing with [sic] on this matter is our company rather than the each [sic] individual guest.”(Emphasis added.)97 |

| n | On or about December 10, 2010: After e-mails and phone messages following Mr. Shoji’s September 20, 2010 e-mail, Mr. Coughlan has a phone conversation with Mr. Shoji, in which he advises Mr. Shoji that, after internal Wynn Macau discussions, the final decision was that Wynn Macau would not provide the requested free upgrade for the Villa occupied during the September 2010 visit.98 |

The foregoing recitation of facts surrounding the September 2010 visit of Chairman Naguiat and his party to Wynn Macau demonstrates several significant elements of that visit:

| n | Mr. Okada considered these guests to be very important to his company. |

| n | An effort was made from the outset to conceal Chairman Naguiat’s identity and official status, to the point of not even wanting to advise Wynn Macau management and staff. |

| n | With Mr. Okada’s knowledge, Chairman Naguiat and his family were provided with approximately US 20,000 cash to use for gaming and also shopping |

| n | Mr. Okada’s representative sought to have Wynn Resorts fund a portion of the expenses incurred by Chairman Naguiat and his party, i.e., the free upgrade to a Villa. |

97 E-mail from Y. Shoji to I. Coughlan, November 10, 2010 [See Appendix]; interviews of I. Coughlan, December 29, 2011 and January 5, 2012.

98 Interviews of I. Coughlan, December 29, 2011 and January 5, 2012; e-mail string between I. Coughlan and Y. Shoji and others, September 20 to December 9, 2010, subject: “Invoice and Statement for September Stay.” [See Appendix]

27

REPORT

Attorney – Client / Work Product / Privileged and Confidential

| n | Mr. Okada’s representative expressed apprehension about Universal being able to justify the level of expenditures in the event of future inquiries. |

There is evidence that Mr. Okada personally directed the payments and gifts provided to Chairman Naguiat and his family during their luxury stay at Wynn Macau’s most expensive accommodation in September 2010. On October 5, 2010, Mr. Araki sent an email to Wynn Macau in order to arrange for a “second group of PAGCOR” checking into Wynn Macau on October 8, 2010. Clearly referring back to Chairman Naguiat’s stay less than two weeks earlier, Mr. Araki writes: “Our Chairman Okada once again instructed us to take care of the group, but not like last time meaning that we will not take care of their room charges and others.” (Emphasis added). Mr. Araki, who worked for Mr. Okada and personally supervised Chairman Naguiat’s luxury stay at Wynn Macau, appears to confirm Mr. Okada’s personal knowledge and control of the payments for Chairman Naguiat.99

It is significant to note that the leadership of PAGCOR, which is appointed by the President of the Republic of the Philippines, changed effective June 30, 2010, when Benigno S. Aquino III assumed office as President of the Republic of the Philippines, succeeding Gloria M. Arroyo. Former PAGCOR Chairman Efraim C. Genuino, an Arroyo appointee, left office effective June 30, 2010, and Cristino L. Naguiat, Jr., President Aquino’s appointee, assumed the position of Chairman and CEO of PAGCOR on July 2, 2010.

A review of the Aruze City Ledger Account records reveals that, after June 30, 2010, there are no charges attributed to Mr. Genuino or any of his family members who collectively had three (3) separate stays at Wynn resorts (Macau or Las Vegas) while Mr. Genuino was PAGCOR Chairman.100 Conversely, the Aruze City Ledger Account reflects charges for Chairman Naguiat, his family, and key PAGCOR staff from Chairman Naguiat’s “new” administration only after Naguiat became PAGCOR Chairman. This sequence is evidence that the hosting of these persons at Wynn Resorts, and payments made for them through the Aruze City Ledger Account, are solely related to PAGCOR, the Philippines government agency in charge of licensing and regulating Mr. Okada’s business interests.

It is also clear that, having already received approval from PAGCOR in 2008 for a Provisional Licensing Agreement to develop a gaming business in the Philippines, Mr. Okada had a strong and continuing motive through 2010 and beyond to maintain favorable relations with the Chairmen and senior officials of PAGCOR. As previously noted, PAGCOR’s primary governmental mission is regulating gaming businesses in the Philippines. Mr. Okada’s project in Entertainment City Manila was prominently featured in PAGCOR’s annual reports for

99 Email from Matt Araki to Beatrice Yeung dated October 5, 2010. [See Appendix]

100 The sole exception identified, Rodolfo Soriano, Jr., is listed on the Aruze City Ledger Account as having a single room charge on August 18, 2010. [See Appendix]

28

REPORT

Attorney – Client / Work Product / Privileged and Confidential

2008,101 2009102 and 2010.103 The 2010 Annual report features photos and messages from Chairman Naguiat, and several other members of the new PAGCOR leadership. The 2010 Annual report makes it clear that two of the proponents, Bloomsbury and the SM Consortium, are constructing their resorts and are expected to complete their first phase within 2014. The other two proponents (one of which is Tiger, the provisional licensee for Mr. Okada’s casino project) are in the initial design stages and are expected to break ground in 2012.

The continuing coverage of Mr. Okada’s Manila Bay Resorts project in PAGCOR’s annual reports indicates that PAGCOR’s interest in and oversight of this project did not stop with the granting of the Provisional Licensing Agreement in 2008. Indeed, the very nature of the Provisional Licensing Agreement requires continued oversight by PAGCOR officials. As Lazaro advised, the Provisional Licensing Agreement was issued in relation to the “Bagong Nayong Philipino Manila Bay Tourism City” project, which is also referred to as “PAGCOR City.” PAGCOR City is envisioned to be a Las Vegas-style gaming and entertainment complex. The project was designed to attract proponents with established experience in the hotel and gaming business. PAGCOR released the “Terms of Reference,” which detailed a list of requirements to which project proponents must conform in order to qualify for a PAGCOR license to operate within PAGCOR City.

The “Terms of Reference” section provides, in pertinent part, a mandatory Minimum Investment of US 1 Billion, consisting of both equity and debt, and the submission of an associated Project Implementation Plan within 120 days from signing of the Provisional License and approval by PAGCOR (Paragraph 4, Section II, Terms of Reference). Furthermore, within 30 days of signing of the Provisional License, proponents are required to submit a Performance Assurance Bond in the amount of PHP 100 Million to guarantee the completion of the project (Paragraph 8, Section II, Terms of Reference). Within 15 days of signing of the Provisional License, proponents are also required to open an Escrow Account (with an initial deposit of at least US 100 Million) through which funds for the project will pass. This Escrow Account must maintain a balance of at least US 50 Million. (Paragraph 9, Section II, Terms of Reference).

Specifically, paragraph 13 of the Terms of Reference states the following in relation to achieving a regular, non-provisional, Casino Gaming license:

101 PAGCOR 2008 Annual Report, pp. 12-18, viewed January 25, 2012 at http://www.pagcor.ph/annual- reports/annual-2008/pagcor-annual-report-2008.html. [See Appendix]