Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NABORS INDUSTRIES LTD | d305436d8k.htm |

| EX-99.1 - PRESS RELEASE - NABORS INDUSTRIES LTD | d305436dex991.htm |

February 22, 2012

Presenter:

Anthony G. Petrello

Deputy Chairman, President & Chief Executive Officer

4Q 2011 Earnings Presentation

Exhibit 99.2 |

Slide #2

Forward-Looking Statements

We often discuss expectations regarding our markets, demand for our products and services, and our

future performance in our annual and quarterly reports, press releases, and other written and

oral statements. Such statements, including statements in this document incorporated by

reference that relate to matters that are not historical facts are “forward-looking

statements” within the meaning of the safe harbor provisions of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These

“forward-looking statements” are based on our analysis of currently available

competitive, financial and economic data and our operating plans. They are inherently uncertain

and investors must recognize that events and actual results could turn out to be significantly

different from our expectations.

You should consider the following key factors when evaluating these forward-looking statements:

•

fluctuations in worldwide prices and demand for natural gas and oil;

•

fluctuations in levels of natural gas and crude oil exploration and development

activities;

•

fluctuations in the demand for our services;

•

the existence of competitors, technological changes and developments in the oilfield

services industry;

•

the existence of operating risks inherent in the oilfield services industry;

•

the existence of regulatory and legislative uncertainties;

•

the possibility of changes in tax laws;

•

the possibility of political instability, war or acts of terrorism in any of the

countries in which we do business; and

•

general economic conditions including the capital and credit markets. Our businesses

depend, to a large degree, on the level of spending by oil and gas companies for exploration,

development and production activities. Therefore, a sustained increase or decrease in the price of

natural gas or oil, which could have a material impact on exploration and production

activities, could also materially affect our financial position, results of operations and cash

flows. The

above description of risks and uncertainties is by no means all inclusive, but is designed to highlight what we

believe are important factors to consider.

|

Refining Our Business

>

Enhance balance sheet flexibility

>

Review each Business Unit for:

–

Strategic fit

–

Execution effectiveness

–

Capital efficiency

>

Realign with Customers

–

Drilling & Rig Services

–

Completion & Production Services

Slide #3 |

Re-Establish Balance Sheet Flexibility

Increased Focus on Balance Sheet Management and Net Debt Reduction

Slide #4

Balance Sheet Data as of December 31, 2011

($ Millions)

Cash & Securities

540

Accounts Receivable

1,577

Working Capital

1,286

Property, Plant and Equipment, Net

8,630

Total Assets

12,912

Total Debt

4,624

Shareholders’

Equity

5,588

Net Debt to Total Capitalization

42%

Net Debt to TTM EBITDA @ 12/31/2011

2.21x

Diluted Average Shares Outstanding

292,484

Fitch, Moody’s and S&P

BBB+, Baa2, BBB |

Re-Establish Balance Sheet Flexibility

Slide #5

Liquidity

>

Current liquidity approximately $1.0 billion

>

Expect

2012

OCF

to

fund

all

capital

expenditures,

redeem

current

debt and provide significant free cash flow

Total debt

>

Weighted average coupon is 5.8%

>

Interest coverage ratio approximately 8 to 1

Term debt

>

92%

has

maturity

of

2018

or

later

>

No

financial

covenants

Revolving debt

>

Lines

total

$1.4

billion

>

Rate

equals

Libor

plus

150

bps

(currently

1.75%)

>

Net

debt/cap

covenant

less

than

60%

Nonetheless flexibility less than historical levels |

Business Line & Asset Class Evaluation

Criteria

>

Leadership position

>

Attractive investment returns

>

Capable of growth or otherwise strategic

Slide #6 |

Our

Business Lines: An Overview Operating Segments by Line of Business

Drilling and Rig Services

–

US Lower 48

–

GOM Offshore

–

Canada

–

Ryan

–

Alaska

–

Peak

–

International

–

Canrig

Completion and Production Services

–

US Workover and Well Servicing

–

US Fluids Management and Logistics

–

Canada Workover and Well Servicing

–

US and Canada Pressure Pumping

Other –

Oil and Gas

Slide #7 |

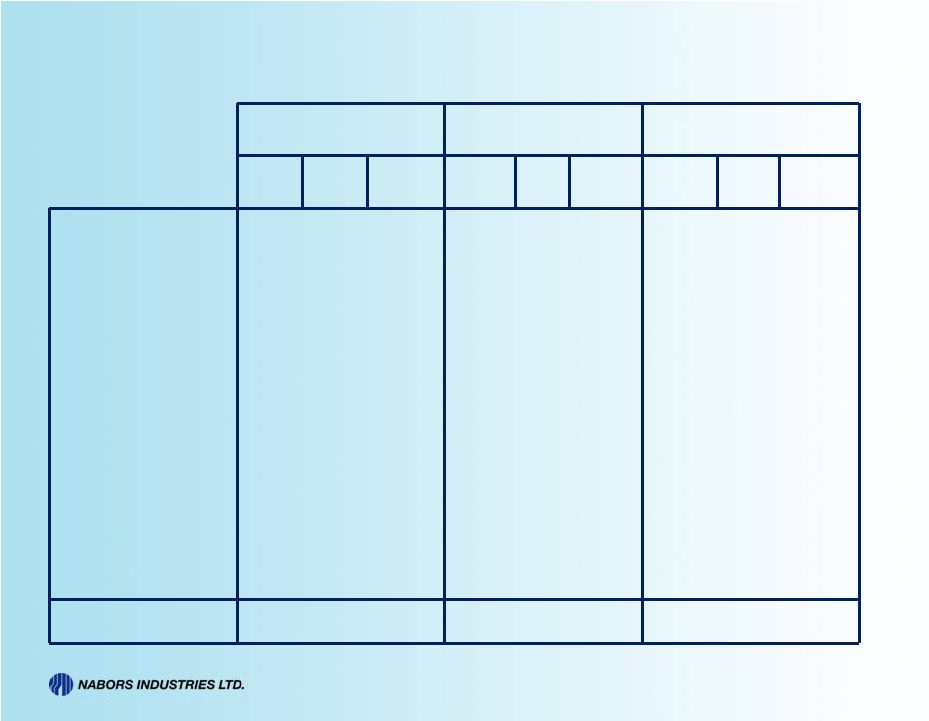

Assets

Strategically Positioned in Major US Unconventional Plays

Slide #8

Shale Plays & Basin

Working

Drilling Rigs

Frac

Crews

CTU

Well Svc

Rigs

Fluid Svc

Trucks

Frac

Tanks

Marcellus

14

4

3

27

155

720

Haynesville

32

1

-

9

43

186

Bakken/Rockies

76

11

3

84

26

323

Eagle Ford

43

4

4

33

126

588

Permian

26

3

-

92

274

1017

Barnett

3

1

-

30

95

185

Granite Wash

11

1

-

46

125

608

Other

42

-

2

227

77

100

Total

247

25

12

548

921

3727

Note: Includes 2012 scheduled new equipment deployments

|

Nabors

Global AC Rig Fleet New build rigs for US lower 48 land are only part of the

Nabors story Slide #9

12/31/11

To Be

Delivered

Total

Alaska Drilling

3

0

3

US Lower 48 Land Drilling

119

25

144

Canada Drilling

24

(1)

2

26

International Drilling

34

2

36

US Offshore Drilling

4

2

6

Total NBR

184

31

215

(1)

Includes 10 AC Hybrid Coiled Tubing rigs |

Our

Business Lines: An Overview Accelerating Operating Cash Flow

4Q Consolidated Run Rate exceeds Prior High and Increasing

Slide #10

GAAP

FY 2008

FY 2011

4Q11 Annualized

US Lower 48

$839

$703

$826

US Well Servicing

214

153

180

US Offshore

102

38

53

Alaska

74

63

49

Canada

128

171

214

International

580

397

382

Pressure Pumping

0

331

410

Oil & Gas

3

60

14

Other

95

90

97

Sub total

$2,035

$2,006

$2,225

Corporate & Eliminations

163

155

175

Total

$1,872

$1,851

$2,050 |

Slide #11

Margins and Activities

(1)

Margin = gross margin per rig per day for the period. Gross margin is

computed by subtracting direct costs from operating revenues for the

period. 4Q11

3Q11

4Q10

Margin

(1)

Rig Yrs

Margin

(1)

Rig Yrs

Margin

(1)

Rig Yrs

US Lower 48

$10,922

216.7

$10,176

201.8

$9,472

184.3

US Offshore

17,250

10.0

15,318

10.8

9,542

6.5

Alaska

29,489

5.0

26,111

4.7

43,745

6.0

Canada

12,061

45.2

10,320

41.8

9,233

39.3

International

11,065

113.2

11,992

105.3

16,392

102.1

Well Servicing

Rev/Hr

Rig Hrs

Rev/Hr

Rig Hrs

Rev/Hr

Rig Hrs

US Lower 48

$511

202,816

$497

205,610

$457

169,318

Canada

$808

52,712

$787

49,788

$719

49,740 |

Slide #12

Quarterly Adjusted Income (Loss)

Derived from Operating Activities

($000’s)

4Q11

3Q11

4Q10

US Lower 48

$130,114

$104,877

$85,308

Nabors Well Services

24,237

22,839

12,132

US Offshore

3,422

2,457

(5,142)

Alaska

5,343

3,021

11,252

Canada

36,553

21,604

16,572

International

23,450

29,015

71,814

Pressure Pumping

76,470

65,052

54,664 |

Drilling Rigs & Services

Slide #13 |

U.S.

Lower 48 Land Drilling Term Contracts in Force at 12/31/11

Slide #14

(1)

Represents the quarter end number of contracts in force with no incremental

contract awards in the future. Quarter end number of rigs

subject to term contracts

(1)

4Q11

1Q12

2Q12

3Q12

4Q12

3Q 2011

144

124

104

86

69

4Q 2011

186

158

131

101

75

2011 Contract Signatures

1Q11

2Q11

3Q11

4Q11

Replaced

Incremental

13

45

5

19

-

13

18

23

Total Signed

13

58

23

42 |

Slide #15

Lower 48 Summary by Basin

Basin

Oil/Gas

Working Rigs

Approx.

Market Share

Marcellus

Gas

13

6%

Haynesville

Gas

26

13%

Bakken/Rockies

Oil/Gas

71

20%

Eagle Ford

Oil

41

15%

Permian

Oil

28

8%

Barnett

Gas

3

Granite Wash

Oil/Gas

18

5%

Other

Oil/Gas

21

N/A

Total

221 |

Drilling Rigs & Services

US

Lower

48

Land

Drilling

-

Premium

Fleet

Makeup

Slide #16

NDUSA Rig Fleet

# of Rigs

Util.

AC

Rigs

@

12/31/11

119

100%

SCR Upgraded

65

85%

SCR

44

50%

Mechanical

41

68%

Current Total

269

83%

AC Rigs still to be deployed

25

100%

Total

294

84%

Expected % AC and AC Equivalent

71% |

Slide #17

Canada Summary by Basin

Basin

Oil/Gas

Working

Rigs

Term Contracts

Approx.

Market Share

Horn River

Gas

6

4.0

24.0%

Montney

Oil/Gas

8

0.0

19.0%

Duvernay

Oil

13

2.0

11.0%

Oil Sands

Oil

7

2.0

6.0%

Cardium

Oil

11

0.0

13.0%

Saskatchewan

Oil

2

0.0

2.0%

Total

47 |

Completion & Production

Services

Slide #18 |

Pressure Pumping Assets by Basin

Slide #19

4Q 2011

1Q 2012

EOY 2012

Pressure

Pumping

Coil

Tubing

Cementing

Pressure

Pumping

Coil

Tubing

Cementing

Pressure

Pumping

Coil

Tubing

Cementing

Marcellus

3

-

30

4

2

30

4

3

31

Haynesville

1

-

3

1

-

3

1

-

3

Bakken/Rockies

9

-

6

10

2

6

11

3

10

Eagle Ford

4

3

3

4

3

3

4

4

8

Permian

3

-

1

3

-

1

3

-

4

Barnett

1

-

-

1

-

-

1

-

-

Granite Wash

1

-

5

1

-

5

1

-

6

Other Lower 48

-

2

16

-

2

16

-

2

16

Canada

-

-

-

-

-

-

2

-

-

Total

22

5

64

24

9

64

27

12

78 |

Slide #20

Pressure Pumping Summary by Basin

Basin

Oil/Gas

# of Crews

LTSA

Spot

Approx.

Market

Position

Marcellus

Gas

4.0

2.0

2.0

T-4

th

Haynesville

Gas

1.0

0.0

1.0

T-4

th

Bakken/Rockies

Oil/Gas

11.0

8.0

3.0

2

nd

Eagle Ford

Oil/Gas

4.0

2.0

2.0

T-6

th

Permian

Oil

3.0

1.0

2.0

T-6

th

Barnett

Gas

1.0

1.0

0.0

T-5

th

Granite Wash

Oil

1.0

0.0

1.0

T-11

th

Total

25.0

14.0

11.0 |

Well

Servicing Product Lines Slide #21 |

Summary by Basin

Slide #22

Basin

Well Svc Rigs

Fluid Svc Trucks

Frac Tanks

Bakken / Rockies

84

26

323

Granite Wash / Mississippian

46

125

608

Permian Basin

92

274

1017

Marcellus / Utica

27

155

720

Eagle Ford

33

126

588

Barnett / Haynesville

39

138

371

San Joachim / Long Beach

227

77

100

Total

548

921

3727 |

Canrig: A Technology Success Story

>

Innovation

–

200th

ROCKIT

TM

system

installed

in

2011

–

REVIT

TM

Stick-Slip

system

commercialized

in

2011

–

over

45

installations

to

date

–

Over 35% of services and rentals revenue in 2011 came from new products,

technologies and services introduced the past three years

–

Successfully

prototyped

with

a

Major

in

2011,

remote

integration

within

automatic driller

–

Received Innovation Award at 2011 OTC for Casing Running Tool

>

Investment

–

Acquired

GE

distributorship

agreement

for

AC

drive

systems

–

exclusive

in

North

America

–

Acquired license for world-class Managed Pressure Drilling technology

>

Patent Portfolio

–

Filed

or

acquired

over

100

patents

(including

foreign

patents

of

same

IP)

–

Beginning to develop patent families, while still investing in new patents

–

Successful monetization of IP portfolio

Slide #23 |