Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Magyar Bancorp, Inc. | form8k-119657_mgyr.htm |

Annual Meeting February 22, 2012 M A G Y A R

Forward - Looking Statements 3 2 M A G Y A R This presentation contains statements about future events that constitute forward - looking statements within the meaning of the Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward - looking statements may be identified by reference to a future period or periods, or by the use of forward - looking terminology, such as “may,” “will,” “believe,” “expect,” or similar terms or variations on those terms, or the negative of those terms. Forward - looking statements are subject to numerous risks and uncertainties, including, but not limited to, those risks previously disclosed in the Company’s filings with the SEC, general economic conditions, changes in interest rates, regulatory considerations, competition, technological developments, retention and recruitment of qualified personnel, and market acceptance of the Company’s pricing, products and services, and with respect to the loans extended by the Bank and real estate owned, the following: risks related to the economic environment in the market areas in which the Bank operates, particularly with respect to the real estate market in New Jersey; the risk that the value of the real estate securing these loans may decline in value; and the risk that significant expense may be incurred by the Company in connection with the resolution of these loans. The Company wishes to caution readers not to place undue reliance on any such forward - looking statements, which speak only as of the date made. The Company does not undertake and specifically declines any obligation to publicly release the result of any revisions that may be made to any forward - looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

Company Overview M A L V E R N M A G Y A R

19 Overview of Magyar Bancorp, Inc. 4 ▪ Magyar Bank, a New Jersey chartered savings bank originally founded in 1922, is the wholly owned subsidiary of Magyar Bancorp, Inc. ▪ On January 23, 2006, Magyar Bank completed its reorganization into the mutual holding company form by completing its initial IPO raising $26.2 million. Currently, 44.84% of Magyar Bancorp, Inc. is owned by public shareholders. ▪ Magyar Bancorp, Inc. trades on the NASDAQ National Market under the symbol MGYR. ▪ Magyar Bank conducts its business from its main office in New Brunswick and five additional branch offices located in North Brunswick, South Brunswick, Branchburg, Bridgewater, and North Edison, New Jersey. ▪ As of September 30, 2011, we had $524.0 million in total assets, $381.3 million in net loans, $424.9 million in deposits and $44.5 million in stockholders’ equity. M A G Y A R

6 Magyar Bank Branch Locations 5 M A G Y A R Branchburg Bridgewater New Brunswick - HQ North Brunswick Edison South Brunswick

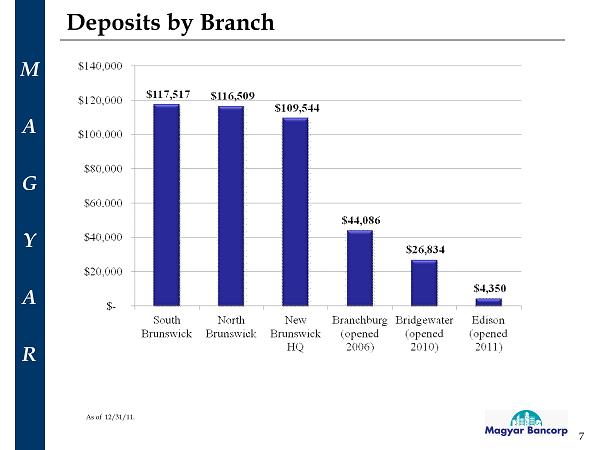

12 Market Demographic Summary 6 Non - Retail Branches not included. Source: SNL Financial ▪ The population change from 2000 - 2010 for Middlesex and Somerset County was 5.92% and 11.96%, respectively, compared to 4.85% for New Jersey and 10.59% for the United States. ▪ Median household income for 2010 for Middlesex and Somerset County was $78,561 and $101,044, respectively, compared to $72,519 for New Jersey and $54,442 for the United States. ▪ We opened our Edison branch in July 2011. As of December 31, 2011, deposits have grown to $4.4 million. M A G Y A R

12 Deposits by Branch 7 As of 12/31/11. M A G Y A R

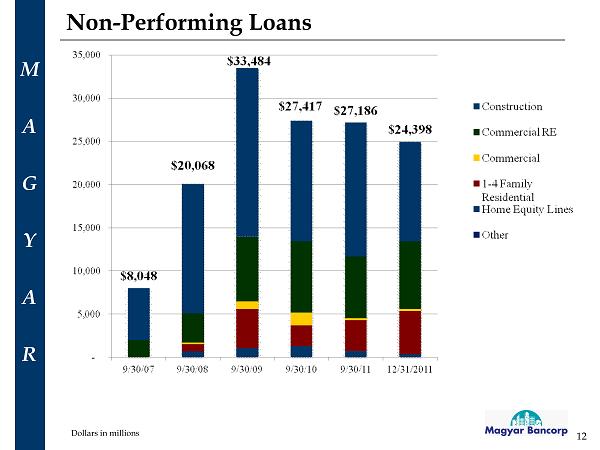

19 2011 Review 8 ▪ Sold $6.3 million in REO property during calendar year 2011 ▪ Non - performing loans declined in 2011, and have declined 27% since 9/30/09 ▪ Construction portfolio declined 40% in FY2011 ▪ In July 2011, a new branch was opened in Edison, NJ ▪ Solid Capital Base with Tangible Common Equity to Tangible Assets of 8.49% as of 9/30/11 ▪ Borrowings from the FHLB decreased $10.9 million, or 23.7%, to $34.9 million at 9/30/11 from $45.8 million at 9/30/10 ▪ Certificates of deposit as a percentage of total deposits declined to 39.9% as of 12/31/11, while checking deposits as a percentage of total deposits increased to 21.2% as of 12/31/11 M A G Y A R

Financial Highlights M A L V E R N M A G Y A R

9 Asset Trends 10 Dollars in millions M A G Y A R $473.2 $514.3 $565.2 $537.9 $524.0 $526.3 $0.0 $100.0 $200.0 $300.0 $400.0 $500.0 $600.0 $700.0 9/30/07 9/30/08 9/30/09 9/30/10 09/30/11 12/31/11

12 Loan Composition 11 M A G Y A R Dollars in millions 40% 38% 39% 41% 41% 41% 21% 23% 24% 28% 31% 33% 25% 23% 21% 14% 9% 7% 7% 9% 8% 8% 9% 10% 3% 4% 5% 6% 6% 6% 4% 4% 3% 3% 3% 3% $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 $350.0 $400.0 $450.0 $500.0 9/30/07 9/30/08 9/30/09 9/30/10 09/30/11 12/31/11 Other HELOC Commercial Business Construction Commercial RE 1 - 4 Family Residential $384.9 $385.6 $410.7 $408.5 $444.8 $390.0 Construction Loans now only 7% of total loans

12 Non - Performing Loans 12 M A G Y A R Dollars in millions

12 Other Real Estate Owned 13 M A G Y A R Dollars in millions

12 Non - Performing Assets 14 M A G Y A R

12 Sale of Real Estate Owned (REO) 15 M A G Y A R ▪ Fiscal Year 2011 - Magyar Bank sold nine REO properties with an aggregate carrying value of $3.2 million for a net loss of $107,000 ($.97 cents on the dollar). ▪ 1 st Quarter of Fiscal Year 2012 – Magyar Bank sold 2 properties with an aggregate carrying value of $3.2 million for a net loss of $32,000 ($.99 cents on the dollar). ▪ Magyar Bank was able to secure the title for eleven other properties totaling $6.6 million. ▪ Potential strategies in addressing REO properties ▪ Hold property until real estate market improves ▪ Selling properties to a developer and completing partially completed homes ▪ Transition from sales to rentals

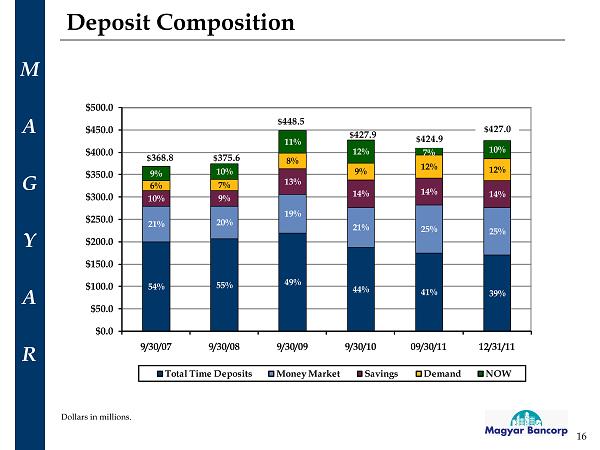

12 Deposit Composition 16 Dollars in millions. M A G Y A R 54% 55% 49% 44% 41% 39% 21% 20% 19% 21% 25% 25% 10% 9% 13% 14% 14% 14% 6% 7% 8% 9% 12% 12% 9% 10% 11% 12% 7% 10% $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 $350.0 $400.0 $450.0 $500.0 9/30/07 9/30/08 9/30/09 9/30/10 09/30/11 12/31/11 Total Time Deposits Money Market Savings Demand NOW $ 424.9 $ 368.8 $ 375.6 $ 427.9 $ 448.5 $ 427.0

$0 $50,000 $100,000 $150,000 $200,000 $250,000 9/30/07 9/30/08 9/30/09 9/30/10 09/30/11 12/31/11 Checking Money Market $188,850 $132,651 $134,637 $178,050 $170,212 $196,640 12 Checking & Money Market Deposit Growth 17 Dollars in thousands. CAGR: Compound Annual Growth Rate M A G Y A R

12 10 - Year Treasury / Fed Funds 18 M A G Y A R 2.53% 3.30% 3.47% 3.18% 1.92% 1.89% 0.25% 0.25% 0.25% 0.25% 0.25% 0.25% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 9/30/10 12/31/10 03/31/11 06/30/11 09/30/11 12/31/11 US Treasury - 10yr Fed Funds

12 Net Interest Margin 19 M A G Y A R 3.21% 3.01% 3.14% 3.21% 3.08% 3.07% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 9/30/10 12/31/10 03/31/11 06/30/11 09/30/11 12/31/11

12 Pre - Tax Quarterly Net Income (Loss) 20 M A G Y A R Dollars in thousands $281 $89 $135 $163 - $601 $75 $159 $38 ($800) ($600) ($400) ($200) $0 $200 $400 3/31/10 6/30/10 9/30/10 12/31/10 3/31/11 6/30/11 9/30/11 12/31/11

10.2% 8.9% 7.1% 8.2% 8.5% 8.4% 0.0% 3.0% 6.0% 9.0% 12.0% 15.0% 09/30/07 09/30/08 09/30/09 09/30/10 09/30/11 12/31/11 $48.2 $45.8 $40.0 $44.2 $44.5 $44.1 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 09/30/07 09/30/08 09/30/09 09/30/10 09/30/11 12/31/11 Stockholder’s Equity 21 Tangible Common Equity / Tangible Assets MGYR Remains Well - Capitalized M A G Y A R Total Equity Dollars in millions

Market Statistics M A G Y A R

0.50 0.60 0.70 0.80 0.90 1.00 1.10 1.20 1.30 1.40 1.50 1.60 2/18/11 3/18/11 4/18/11 5/18/11 6/18/11 7/18/11 8/18/11 9/18/11 10/18/11 11/18/11 12/18/11 1/18/12 MGYR NASDAQ Bank S&P 500 1.4% 21 MGYR LTM Stock Price Performance 23 MGYR Price on 2/17/12 - $4.95 Data as of February 17, 2012. Source: SNL Financial M A G Y A R - 6.0% 16.5%

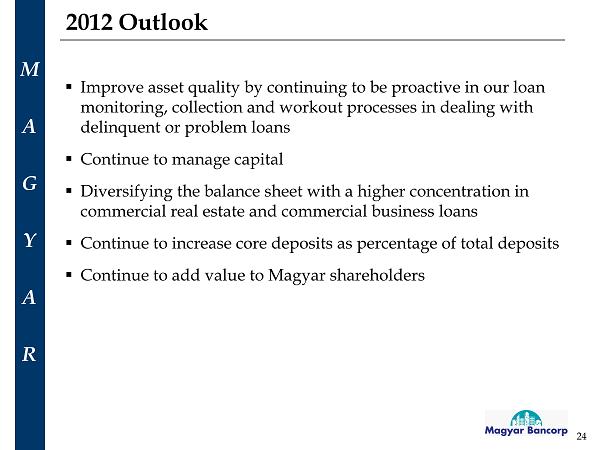

19 2012 Outlook 24 ▪ Improve asset quality by continuing to be proactive in our loan monitoring, collection and workout processes in dealing with delinquent or problem loans ▪ Continue to manage capital ▪ Diversifying the balance sheet with a higher concentration in commercial real estate and commercial business loans ▪ Continue to increase core deposits as percentage of total deposits ▪ Continue to add value to Magyar shareholders M A G Y A R

Questions? M A L V E R N M A G Y A R