Attached files

| file | filename |

|---|---|

| 8-K - A 2011 10K MEMBER LETTER 8K - Federal Home Loan Bank of Chicago | a201110kmemberletter8k.htm |

Exhibit 99.1

February 22, 2012

To Our Members:

During 2011, the Federal Home Loan Bank of Chicago reached several goals critical to the long-term success of building a new version of the business model conceived by Congress in 1932.

• | We were profitable, growing retained earnings to a historic high; |

• | We resumed dividend payments to our members; |

• | We redeemed $527 million in stock of former members; |

• | We received approval to convert our capital on January 1 of this year to a Gramm Leach Bliley Act structure; and |

• | We also received approval for the excess stock repurchase plan, which outlines quarterly assessments of our capacity to repurchase members' excess stock they no longer wish to hold. Last week, we repurchased $500 million of members' excess capital stock in our first such repurchase. |

Member Value Proposition - Your Strategic Partner

With these milestones behind us, we have turned our attention to leveraging our financial markets expertise to partner with our members. The economy is showing signs of improvement and both loan demand and credit demand are gradually increasing. We believe we are in a position to serve as an effective strategic partner for our members. We are working to identify opportunities, develop strategies, and structure creative financial solutions designed to benefit members in concrete ways and contribute to the growth of our advances portfolio and other member-related business. We are repositioning our products - advances, letters of credit, the Mortgage Partnership Finance® Program, and community investment products and services - to help you enhance your business and provide value in the communities you serve.

Outreach and Alliances

We continue to strengthen our alliances with trade associations, housing finance associates, and economic and development organizations while enhancing our educational offerings for members. We are visiting with members one-on-one and in groups to emphasize that we can create member-focused initiatives and strategies to meet members' needs - as articulated by our members, not the Bank. Soon we will publish a calendar of training opportunities, as well as an invitation to our first annual member management conference to be held this summer in Chicago.

Please refer to the attached unaudited and preliminary Condensed Statements of Income and Statements of Condition. Also, please review the discussion of the market value of the Bank's equity, level of retained earnings, and the spread of return on average regulatory capital to three-month Libor that follows the Condensed Statement of Income. (See “Remediation Dashboard,” page 5.) We expect to file our 2011 Form 10-K Annual Report with the Securities and Exchange Commission next month. You will be able to access it through our website, www.fhlbc.com, or the SEC's reporting website, www.sec.gov/edgar.

1

2011 Financial Highlights

• | We recorded net income of $224 million for 2011, down 39% from income of $366 million in 2010, due primarily to lower net interest income resulting from a lower level of prepayment fees, which were unusually high in 2010. Prepayment fees, net of fair value hedge adjustments, were $23 million in 2011, down from $169 million in 2010. Gains from derivatives and hedging activities increased to $70 million in 2011 from $52 million in 2010. However, the $50 million charge to provide additional funds to promote affordable housing and economic development |

in our district was the primary reason non-interest expense increased $53 million (40%) to

$184 million in 2011. We expect to announce plans for this initiative in late 2012.

• | Other-than-temporary impairment (OTTI) charges on our private-label mortgage-backed securities (MBS) portfolio continue to negatively impact earnings; OTTI charges were |

$68 million in 2011, down from $163 million in 2010.

• | Non-interest expenses, excluding the one-time charge of $50 million to fund the affordable housing and economic development program, increased $3 million (2%) to $134 million. Non-interest expenses include operating expenses which were lower in 2011, as well as expenses associated with regulatory oversight, which were higher in 2011. Our ongoing efforts to streamline our operations to reduce our future base level of operating expenses contribute to the Bank's overall financial success. |

• | Advances outstanding at year-end 2011 were $15.3 billion, 19% lower than the previous year-end level of $18.9 billion. While many members remain liquid, we are showing members how advances can benefit their long-term earnings and interest rate risk management goals, even in this extraordinary low-rate environment. |

• | Mortgage Partnership Finance (MPF®) loans held in portfolio declined $4.2 billion (23%) to $14.1 billion. These reductions are a direct result of our 2008 decision not to add MPF loans to our balance sheet. We increased our allowance for loan loss from $33 million to $45 million consistent with the increase in our nonperforming and impaired MPF loan amounts. MPF loans continue to have lower delinquency rates than the national average for conventional conforming mortgage loans. MPF Xtra® loan volume was $1.8 billion for our participating financial institutions and $2.8 billion for the program overall. |

• | Total investment securities decreased less than 1% to $38.7 billion, reflecting the completion of our investment purchases to build an “income bridge” through balance sheet restructuring over the past three years. |

• | Total assets fell $12.8 billion (15%) to $71.3 billion. We anticipate that the overall size of the Bank will continue to fall with MPF loans continuing to pay down and investment securities maturing as we seek to operate at the scale dictated by the level of our members' borrowing levels. |

• | As a result of our net income, our retained earnings grew $222 million to $1.3 billion. Our strong earnings over the past two years have built our retained earnings, providing better protection for member capital and facilitating $1 billion in stock repurchases and redemptions, beginning with the redemption of former members' stock in 2011. |

2

• | We awarded $24 million in grants through our competitive Affordable Housing Program (AHP) and $10 million in assistance through our Downpayment Plus® (DPP®) Program. For 2012, we have allocated $20 million for AHP and $10 million for DPP. We will be working with both the Illinois Housing Development Authority and the Wisconsin Housing Economic and Development Authority to link our programs to leverage their impact. Helping our members reach their social goals and fulfill their Community Reinvestment Act requirements through our products and programs are important components of the member value proposition. |

In summary, the Bank is financially strong and positioned to add value to our members. We are excited about the future. We look forward to an even stronger cooperative of active members taking full advantage of the resources at our disposal as we partner more closely with you.

Best regards,

Matt Feldman

President and CEO

This letter contains forward-looking statements which are based upon our current expectations and speak only as of the date hereof. These statements may use forward-looking terms, such as “anticipates,” “believes,” “expects,” “could,” “plans,” “estimates,” “may,” “should,” “will,” or their negatives or other variations on these terms. We caution that, by their nature, forward-looking statements involve risk or uncertainty, that actual results could differ materially from those expressed or implied in these forward-looking statements, and that actual events could affect the extent to which a particular objective, projection, estimate, or prediction is realized. These forward-looking statements involve risks and uncertainties including, but not limited to, instability in the credit and debt markets, economic conditions (including effects on, among other things, mortgage-backed securities), changes in mortgage interest rates and prepayment speeds on mortgage assets, our ability to successfully transition to a new business model and to pay future dividends and the risk factors set forth in our periodic filings with the Securities and Exchange Commission, which are available on our website at www.fhlbc.com. We assume no obligation to update any forward-looking statements made in this letter. The financial results discussed in this letter are preliminary and unaudited. “Mortgage Partnership Finance,” “MPF,” “MPF Xtra,” and “Downpayment Plus” are registered trademarks of the Federal Home Loan Bank of Chicago.

3

Condensed Statements of Income | ||||||||||||||||||

(Dollars in millions) | ||||||||||||||||||

(Preliminary and Unaudited) | ||||||||||||||||||

For the Years ended December 31, | ||||||||||||||||||

2011 | 2010 | Change | 2009 | Change | ||||||||||||||

Interest income | $ | 2,244 | $ | 2,774 | (19 | )% | $ | 2,956 | (6 | )% | ||||||||

Interest expense | 1,707 | 1,997 | (15 | )% | 2,376 | (16 | )% | |||||||||||

Provision for credit losses | 19 | 21 | (10 | )% | 10 | 110 | % | |||||||||||

Net interest income | 518 | 756 | (31 | )% | 570 | 33 | % | |||||||||||

Other-than-temporary impairment (credit loss) | (68 | ) | (163 | ) | 58 | % | (437 | ) | 63 | % | ||||||||

Other non-interest gain (loss) | 5 | 36 | (86 | )% | (70 | ) | 151 | % | ||||||||||

Non-interest expense | 184 | 131 | 40 | % | 128 | 2 | % | |||||||||||

Assessments | 47 | 132 | (64 | )% | — | — | % | |||||||||||

Net income | $ | 224 | $ | 366 | (39 | )% | $ | (65 | ) | 663 | % | |||||||

Net yield on interest-earning assets | 0.69 | % | 0.89 | % | (0.20 | )% | 0.65 | % | 0.24 | % | ||||||||

Condensed Statements of Condition | |||||||||||

(Dollars in millions) | |||||||||||

(Preliminary and Unaudited) | |||||||||||

December 31, 2011 | December 31, 2010 | Change | |||||||||

Cash and due from banks | $ | 1,002 | $ | 282 | 255 | % | |||||

Federal Funds sold and securities purchased under agreement to resell | 1,775 | 7,243 | (75 | )% | |||||||

Investment securities | 38,728 | 38,996 | (1 | )% | |||||||

Advances | 15,291 | 18,901 | (19 | )% | |||||||

MPF Loans held in portfolio, net | 14,118 | 18,294 | (23 | )% | |||||||

Other | 341 | 400 | (15 | )% | |||||||

Total assets | $ | 71,255 | $ | 84,116 | (15 | )% | |||||

Consolidated obligation discount notes | $ | 25,404 | $ | 18,421 | 38 | % | |||||

Consolidated obligation bonds | 39,880 | 57,849 | (31 | )% | |||||||

Subordinated notes | 1,000 | 1,000 | — | % | |||||||

Other | 1,679 | 3,897 | (57 | )% | |||||||

Total liabilities | 67,963 | 81,167 | (16 | )% | |||||||

Capital stock | 2,402 | 2,333 | 3 | % | |||||||

Retained earnings | 1,321 | 1,099 | 20 | % | |||||||

Accumulated other comprehensive income (loss) | (431 | ) | (483 | ) | 11 | % | |||||

Total capital | 3,292 | 2,949 | 12 | % | |||||||

Total liabilities and capital | $ | 71,255 | $ | 84,116 | (15 | )% | |||||

Regulatory capital to assets ratio (minimum required 4.76%) | 6.35 | % | 5.90 | % | 0.45 | % | |||||

4

Remediation Dashboard

In order to provide our members with greater clarity as we work to transition the Bank, we regularly monitor our ratio of Market Value to Book Value of Equity, the level of our Retained Earnings, and our Spread of the Return of Average Regulatory Capital to Three-Month Libor. Together, these metrics provide a view of our progress in restructuring our business model and our balance sheet to fortify the financial strength of the Bank.

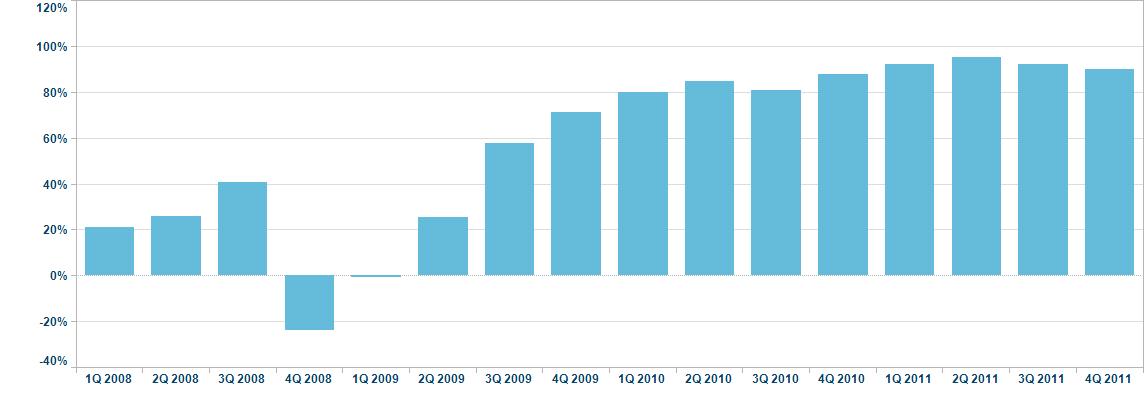

Ratio of Market Value to Book Value of Equity

The market value of the Bank continues to be positively impacted by our previous restructuring of the balance sheet and the increase in value of investment securities. The ratio of market value to book value improved to 90% at December 31, 2011, from 88% at December 31, 2010.

5

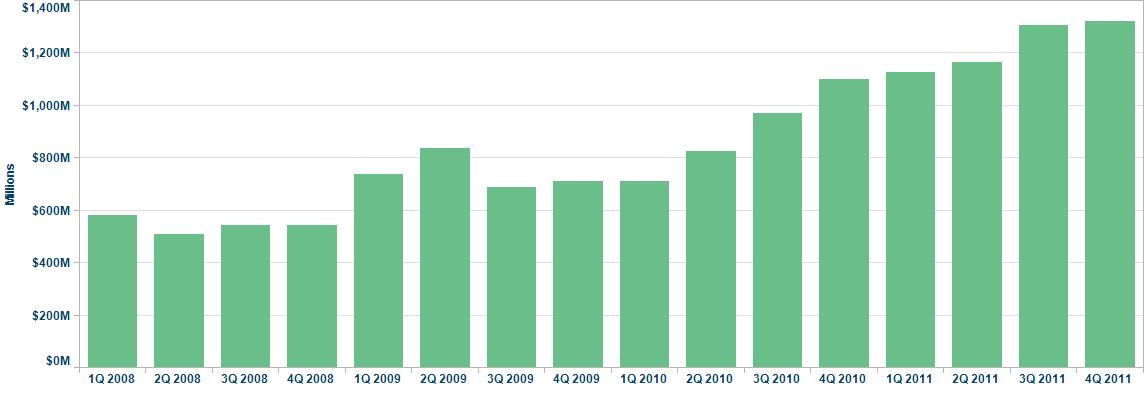

Retained Earnings

The growth of retained earnings is a key element in the Bank's plan to improve its financial strength and stability. Total retained earnings at December 31, 2011, were $1.3 billion compared to $1.1 billion at December 31, 2010.

Spread of Return on Average Regulatory Capital to Three-Month Libor

Over time, we have seen substantial variability in the spread of our return on average regulatory capital (which excludes subordinated notes) relative to three-month Libor. This measure is driven in large part by fluctuating gains and losses on derivatives and hedging activities and continuing OTTI charges. Our goal is to reduce the variability in this measure over time.

6