Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NEVADA POWER CO | d304959d8k.htm |

| EX-99.1 - PRESS RELEASE DATED FEBRUARY 21, 2012 - NEVADA POWER CO | d304959dex991.htm |

Exhibit 99.2

Fourth Quarter 2011 Earnings Call Supplemental Slides

February 21, 2012

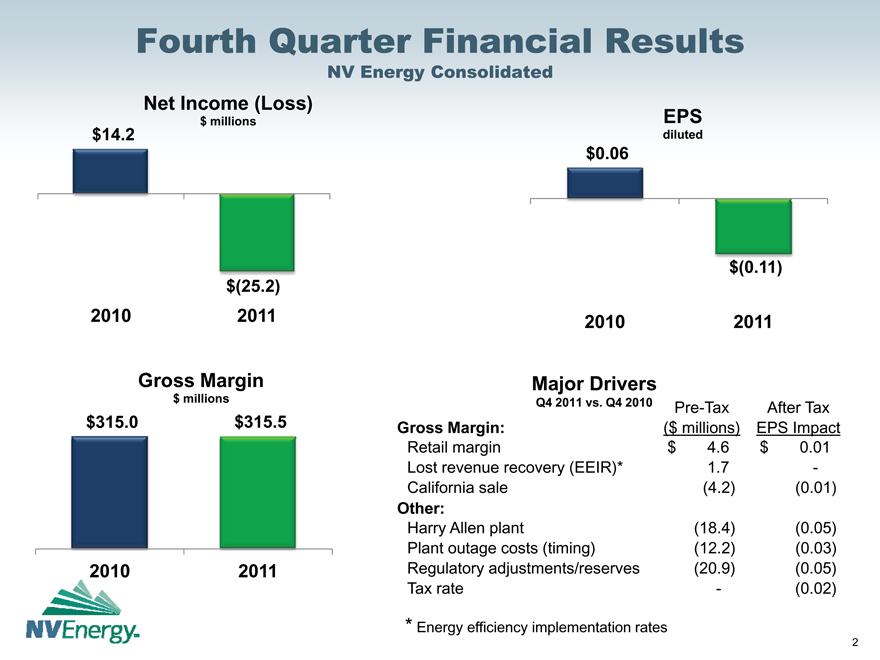

Fourth Quarter Financial Results

NV Energy Consolidated

Net Income (Loss)

$14.2 $ millions

$(25.2) 2010 2011

EPS

diluted

$0.06

$(0.11) 2010 2011

Gross Margin

$ millions

$315.0 $315.5

Major Drivers

Q4 2011 vs. Q4 2010 Pre-Tax After Tax

Gross Margin: ($ millions) EPS Impact

Retail margin $ 4.6 $ 0.01

Lost revenue recovery (EEIR)* 1.7 —

California sale (4.2) (0.01)

Other:

Harry Allen plant (18.4) (0.05)

Plant outage costs (timing) (12.2) (0.03)

Regulatory adjustments/reserves (20.9) (0.05)

Tax rate — (0.02)

* Energy efficiency implementation rates

2

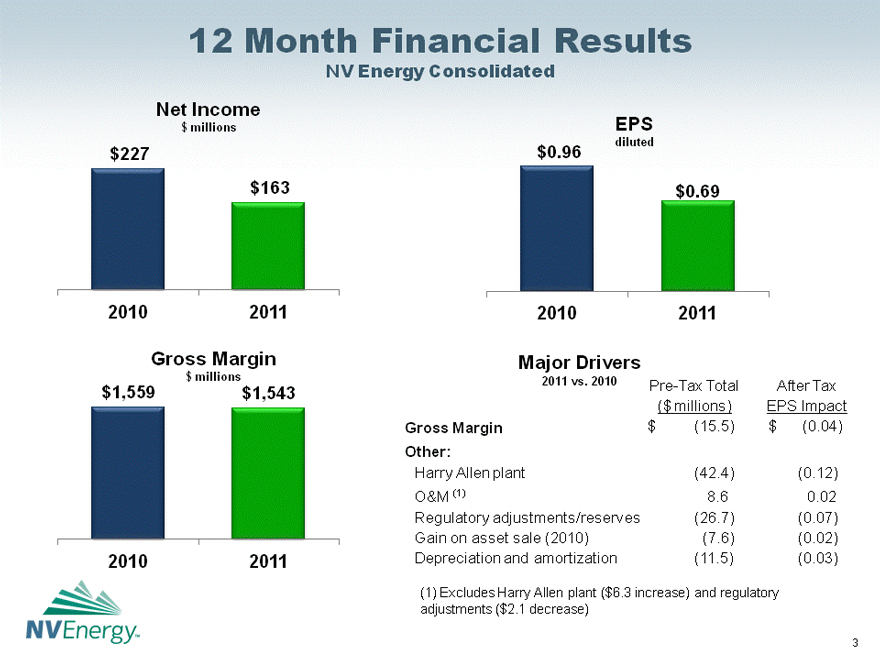

12 Month Financial Results

NV Energy Consolidated

Net Income

$ millions EPS diluted

$227 $0.96 $163 $0.69

2010 2011 2010 2011

Gross Margin

$ millions

$1,559 $1,543

2010 2011

Major Drivers

2011 vs. 2010 Pre-Tax Total After Tax

($ millions) EPS Impact

Gross Margin $ (15.5) $ (0.04)

Other:

Harry Allen plant (42.4) (0.12)

O&M (1) 8.6 0.02

Regulatory adjustments/reserves (26.7) (0.07)

Gain on asset sale (2010) (7.6) (0.02)

Depreciation and amortization (11.5) (0.03)

(1) Excludes Harry Allen plant ($6.3 increase) and regulatory

adjustments ($2.1 decrease)

3

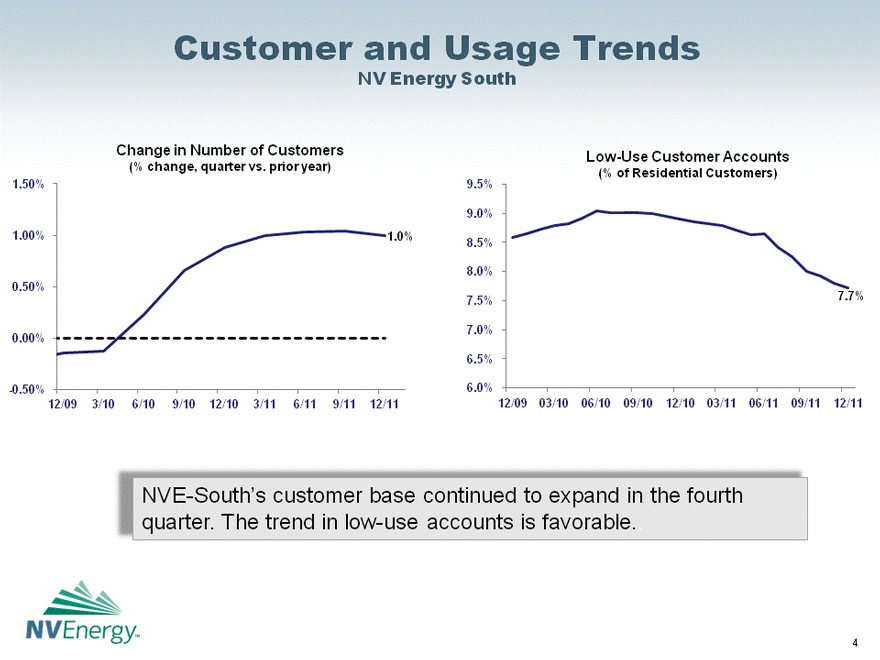

Customer and Usage Trends

NV Energy South

Change in Number of Customers (% change, quarter vs. prior year)

Low-Use Customer Accounts (% of Residential Customers)

1.50%

1.00% 1.0%

0.50%

0.00%

-0.50%

12/09 3/10 6/10 9/10 12/10 3/11 6/11 9/11 12/11

9.5%

9.0%

8.5%

8.0%

7.5% 7.7%

7.0%

6.5%

6.0%

12/09 03/10 06/10 09/10 12/10 03/11 06/11 09/11 12/11

NVE-South’s customer base continued to expand in the fourth quarter. The trend in low-use accounts is favorable.

4

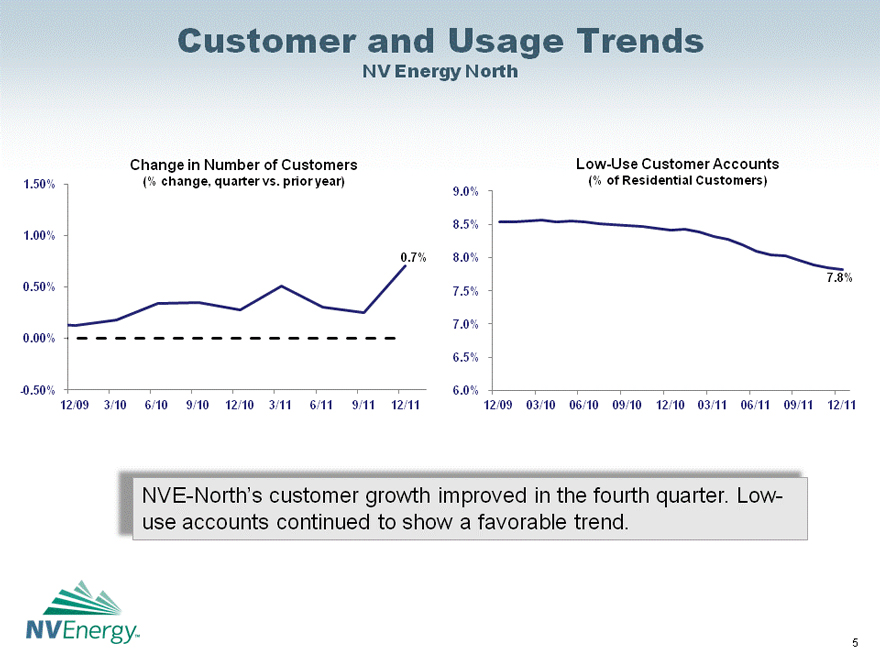

Customer and Usage Trends

NV Energy North

Change in Number of Customers

1.50% (% change, quarter vs. prior year)

1.00%

0.7%

0.50%

0.00%

-0.50%

12/09 3/10 6/10 9/10 12/10 3/11 6/11 9/11 12/11

Low-Use Customer Accounts

9.0% (% of Residential Customers)

8.5%

8.0%

7.8%

7.5%

7.0%

6.5%

6.0%

12/09 03/10 06/10 09/10 12/10 03/11 06/11 09/11 12/11

NVE-North’s customer growth improved in the fourth quarter. Low-use accounts continued to show a favorable trend.

5

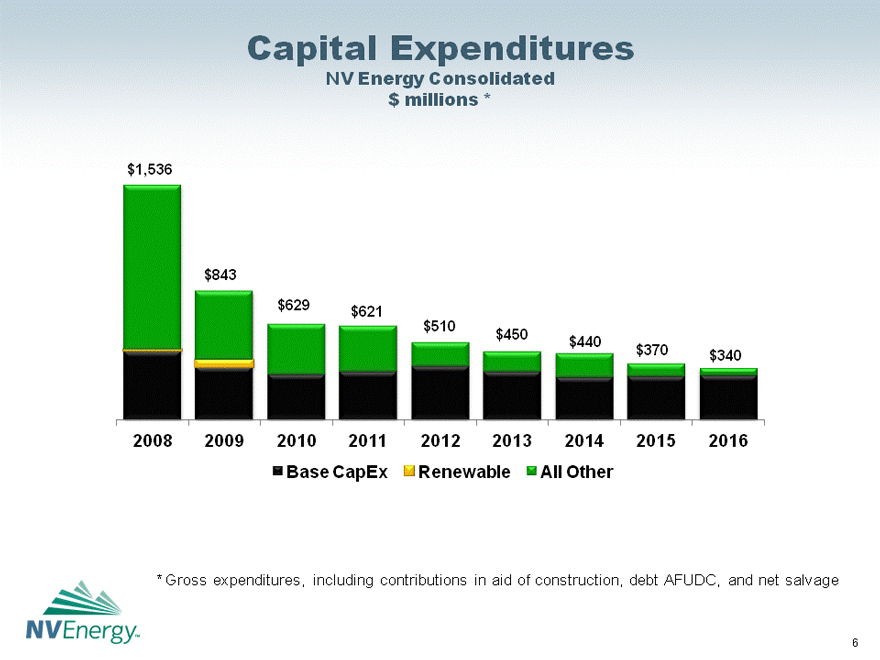

Capital Expenditures

NV Energy Consolidated $ millions *

$1,536

$843 $629 $621 $510 $450 $440 $370 $340

2008 2009 2010 2011 2012 2013 2014 2015 2016 Base CapEx Renewable All Other

* Gross expenditures, including contributions in aid of construction, debt AFUDC, and net salvage

6