Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - BROCADE COMMUNICATIONS SYSTEMS INC | d303958dex991.htm |

| 8-K - FORM 8-K - BROCADE COMMUNICATIONS SYSTEMS INC | d303958d8k.htm |

Q1 FY 2012 EARNINGS

February 21, 2012

1

Exhibit 99.2 |

| Prepared comments provided by Rob Eggers, Investor Relations

Thank you for your interest in Brocade’s Q1 Fiscal 2012 earnings

presentation, which includes prepared remarks, slides, and a press

release detailing fiscal first quarter 2012 financial results. The press release was issued shortly after 1:00 p.m. Pacific time

on February 21, 2012, via Marketwire. The press release, along with these

prepared comments and slides, has been furnished to the SEC on Form

8-K and will be made available on Brocade’s Investor Relations website at www.brcd.com. |

| Cautionary Statements and Disclosures

2

This presentation includes forward-looking statements regarding

Brocade’s financial results, plans guidance, strategy and business

outlook, TAX rate, OEM inventory, as well as EMEA economic outlook, worldwide SAN demand and growth

rate, IT spending, which are only predictions and involve risks and

uncertainties such that actual results may vary significantly. These and

other risks are set forth in more detail in our Form 10-K for the fiscal year ended October 29,

2011. These forward-looking statements reflect beliefs, assumptions,

outlook, estimates, and predictions as of today, and Brocade expressly

assumes no obligation to update any such forward-looking statements.

In addition, this presentation includes various third-party estimates

regarding the total available market and other measures,

which

do

not

necessarily

reflect

the

views

of

Brocade.

Further,

Brocade

does

not

guarantee

the

accuracy

or

reliability of any such information or forecast.

Certain financial information is presented on a non-GAAP basis. Management

believes that non-GAAP financial measures used in this presentation

allow management to gain a better understanding of Brocade’s comparative

operating

performance

both

from

period

to

period,

and

to

its

competitors’

operating

results.

Management

also

believes

these non-GAAP financial measures help indicate Brocade's baseline

performance before gains, losses or charges that are considered by

management to be outside ongoing operating results. Accordingly, management uses these non-GAAP

financial measures for planning and forecasting of future periods and in making

decisions regarding operations performance and the allocation of

resources. The most directly comparable GAAP information and a reconciliation

between the non-GAAP and GAAP figures are provided in the accompanying

press release, which has been furnished to the SEC on Form 8-K and

posted on Brocade’s website, and is included in the subsequent slide in this presentation.

Please see risk factors on Form 10-K filed with the SEC

|

Quarterly Net Income (Loss)

GAAP/Non-GAAP Reconciliation

(In $ Thousands)

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Net income (loss) on a GAAP basis

$ 26,918

$ 26,079

$ 1,937

$ (4,324)

$ 58,584

Gross margin adjustments:

Stock-based compensation

2,860

4,167

4,234

4,345

4,375

Amortization of acquired intangibles

14,466

14,466

14,466

14,090

14,090

Provision for (benefit from) certain pre-acquisition litigation

–

–

(14,334)

–

–

Legal fees associated with certain pre-acquisition litigation

77

216

92

59

(51)

Total gross margin adjustments

17,403

18,849

4,458

18,494

18,415

Operating expense adjustments:

Stock-based compensation

17,046

18,363

16,733

15,326

17,444

Amortization of acquired intangibles

16,190

15,023

15,023

14,476

14,993

Legal fees associated with indemnification obligations and other

related costs, net

124

–

–

–

–

Loss on sale of subsidiary

–

–

–

12,756

–

Total operating expense adjustments

33,360

33,386

31,756

42,558

32,437

Total operating income adjustments

50,763

52,235

36,214

61,052

50,851

Original issue discount and debt issuance costs of debt related to lenders

that did not participate in the refinancing

–

–

25,465

–

–

Income tax effect of adjustments

(17,208)

(17,037)

(17,657)

22,018

(16,623)

Non-GAAP net income

60,473

61,277

45,959

78,746

92,812

3 |

Q1

12 Q4 11

Q1 11

GAAP gross margin

61.5%

59.5%

58.8%

Non-GAAP gross margin

64.8%

62.9%

62.0%

GAAP product gross margin

63.2%

61.1%

61.1%

Non-GAAP product gross margin

66.6%

64.7%

64.6%

GAAP services gross margin

52.0%

51.1%

46.7%

Non-GAAP services gross margin

54.5%

53.4%

48.7%

GAAP operating margin

12.4%

9.9%

7.8%

Non-GAAP operating margin

21.5%

21.0%

17.1%

Additional Financial Information |

Agenda

Dan Fairfax

CFO

Mike Klayko

CEO

4

Prepared comments followed by live Q&A call |

| Today’s prepared comments include remarks by Mike Klayko, Brocade CEO,

regarding the company’s quarterly results, its strategy,

and a review of operations, as well as industry trends and market/technology

drivers related to its business; and by Dan Fairfax, Brocade CFO, who

will provide a financial review. A management discussion and live

question-and-answer conference call will be webcast beginning at 2:30 p.m. Pacific Time on

February

21

at

www.brcd.com

and

will

be

archived

on

the

Brocade

Investor

Relations

website. |

Fiscal 2012: Q1 Earnings

5

Mike Klayko, CEO |

| Prepared comments provided by Mike Klayko, CEO

|

Q1 Executive Summary

* For non-GAAP results, please see GAAP reconciliation

6

•

$561M record revenue, up 2% Qtr./Qtr.

and 3% Yr./Yr.

•

64.8% non-GAAP gross margin

•

21.5% non-GAAP operating margin

•

$0.12 GAAP EPS

•

$0.20 non-GAAP EPS, up 22%

Qtr./Qtr.

and 61% Yr./Yr.

•

$127M operating cash flow and $70M

debt reduction in Q1

•

Record Storage product revenue of $353M,

up 17% Qtr./Qtr. and 7% Yr./Yr.

•

Record

Service Provider business revenue

of $64M

•

Ethernet product revenue of $123M,

down 22% Qtr./Qtr. and 2% Yr./Yr.

•

Non-GAAP

product margin improved

to 66.6%

•

Global Services non-GAAP gross margin

improved to 54.5%

OVERALL RESULTS

PRODUCT

AND SERVICES RESULTS

Includes non-GAAP results* |

| Q1 was a revenue record-setting quarter for Brocade. We continue

to see strong momentum across many areas of our business, which resulted

in Q1 revenue of $561M, an all-time high for Brocade. We also significantly increased profits, coming

in at $0.12 of EPS on a GAAP basis and $0.20 of EPS on a non-GAAP basis. We

improved both gross margin and operating margin in the quarter, exceeding

our FY12 target model for both measures, and generated strong operating cash flow.

Our Storage business, including product and services, was a clear highlight for

Q1 with revenue coming in at $406M, a company record in what is

seasonally a strong quarter. The Service Provider business also established a record with revenue at

$64M in part due to customers investing in network infrastructure to address

emerging opportunities such as cloud services. A third highlight was the

continued adoption of our Ethernet fabric solutions. In Q1 we have now surpassed 400 customers for

our Brocade VDX switches and also saw a higher attach rate for the VCS software

used to create an Ethernet fabric. The strength in these areas of the

business helped offset some of the softness in other areas of our Ethernet business. Our

Federal business was down sequentially, which we had anticipated

given the typical purchasing patterns we see in Q1.

Enterprise revenue was lower in Q1 primarily due to the continued build-out

of our two-tiered distribution channel, some transactions getting

pushed out of the quarter, in part due to the anticipation of our new Campus products, and special

discounting for a few large transactions in the quarter.

|

Executing on FY12 Playbook

1.

Differentiate Through Innovation

2.

Grow Top Line Profitably

3.

Execute on 2011 Investments

4.

Increase Shareholder Value

5.

Be an Employer of Choice

7 |

| Much of the success we saw in Q1 is directly attributable to

our achievements in product innovation over the last few years. In fact,

innovation remains one of the strongest differentiators for Brocade in a

competitive networking field. Brocade remains committed to

out-innovating the rest of the networking industry through fundamental, game-changing products and solutions. We believe that

executing to this strategy will fuel Brocade’s growth for the next decade.

|

Innovation as a Differentiator Today

8

Product Awards

Milestones

Adapters:

Adapters:

Brocade 1860

Brocade 1860

16 Gbps SAN:

16 Gbps SAN:

Brocade 6510

Brocade 6510

Ethernet Fabrics:

Ethernet Fabrics:

Brocade VCS and VDX

Brocade VCS and VDX

Brocade 100 GbE

Brocade 100 GbE

modules

modules

115

115

line cards

line cards

shipped

shipped

to-date

to-date

Recognized leadership in key technology transitions

|

| Product Awards

Milestones

Three recent examples of our innovation success are in the areas

of Ethernet fabrics, next-generation SAN technologies,

and 100 Gigabit Ethernet. In Q1 we received notable industry recognition and

achieved significant milestones, specifically:

•

Our pioneering efforts in building the Ethernet fabric category and introducing

solutions well ahead of the market garnered some significant industry

recognition in Q1. The editors at TechTarget named the Brocade VCS software as

the “Gold”

product of the year in the Virtualization category. They also named the

Brocade VDX 6720 as its “Silver” product of the year award

winner in the Computing Hardware category. •

Brocade’s decision to transition the SAN industry to the next phase based

on 16 gigabit-per-second (Gbps) Fibre Channel was well-timed

as validated by the Dell’Oro Group in Q1 who noted that: “Total SAN switch sales enjoyed a

record quarter—propelled by both new technologies and higher priced

products”. In addition, we received awards for our new 16 Gbps

Brocade 6510 Switch and our Brocade 1860 Fabric Adapter. •

In Q1 Brocade crossed a milestone in 100 Gigabit Ethernet (GbE) by shipping

over two hundred 100 GbE ports since the launch of our 2-port module

last year. Research organizations such as CERN along with large Service

Providers and very large enterprises are now taking active steps to

increase their network size to terabit scale and beyond. The Brocade 100

GbE module is a cost-effective solution to accelerate this migration for CERN and other customers. |

9

MARCH 6, 2012

Join us for this virtual event.

THE EFFORTLESS NETWORK

™

EVENT

Brocade Campus LAN. Automated. Scalable. Affordable.

REGISTER ON BROCADE.COM |

REGISTER ON BROCADE.COM

Brocade is now turning our attention to the next phase of our innovation agenda

by tackling some of the most pressing challenges and

opportunities faced by enterprise and service provider customers. We will unveil

part of this agenda at “The Effortless

Network” event on March 6 where we will introduce game-changing

solutions and technologies that will modernize the campus LAN environment for

the next decade. We believe that the campus LAN incumbents have failed to

innovate in any meaningful way in recent years. The result is that

today’s campus LANs are not designed optimally to tackle the next wave

of IT challenges such as enterprise mobility, video, and

virtualization. This is an opportunity for Brocade to significantly

differentiate ourselves through fundamental innovation that will deliver a

new level of simplicity, automation and value. |

Innovation Agenda to be Unveiled

at Technology Day Summit

10

•

Ethernet Fabric Advancement

•

Software-defined networking

•

Networking “Big Data” |

| In early May, Brocade will host our annual Technology Day Summit,

where we will outline more innovations for both the Data Center and

Service Provider environments. This includes the next wave of our

Ethernet fabric capabilities as well as our solutions for

software-defined networking and Big Data opportunities. The message

is simple. The success we enjoyed in Q1 is a direct result of the investments we made in R&D over the last few

years in key technology segments. We are now ready with the next

phase of our innovation that will fuel future growth.

|

•

Record revenue quarter

•

$353M in product revenue

•

17% growth Qtr./Qtr.

•

Continued fast ramp of 16 Gbps

Fibre Channel products

•

27% of Brocade Director sales in Q1

•

Survey data reinforces Brocade’s

Fibre Channel strategy

•

Customers plan to increase SAN

purchases over next 3 years

Q1 Storage Business Highlights

Strength across all product segments

11 |

| Now I’ll turn to updates from our key business segments starting

with the Storage business, which exceeded our expectations for revenue

this quarter. This performance helps to demonstrate that there is strong

customer demand for this technology due to major IT imperatives such as

managing server virtualization and digital data growth. Q1 was highlighted

by record revenue of $406M, up 12% Qtr./Qtr., for the total Storage

business, which includes products and services. In terms of product

revenue, we were up 17% sequentially, generating nearly $353M. We also saw the continued fast

ramp of our next-generation 16 Gbps products in Q1. In fact, 16 Gbps

products accounted for 27% of our total Director sales in the quarter.

There is no doubt that the transition in the SAN industry to 16 Gbps is underway and is being validated by strong

customer demand.

Our Q1 performance reinforced the results from our customer survey that showed

customers expect to increase their purchases of SANs over the next three

years. That research validated the fact that Fibre Channel is preferred among end users for mission-

critical applications, because it is a familiar, tried-and-true

technology. |

•

Installed base of 400+

Brocade VDX customers

to-date

•

100+ new customers in Q1

•

Revenue up 33% Qtr./Qtr.

Q1 Ethernet Fabric Progress

12 |

| We are also making good progress in the Ethernet fabric business, a

market category that we helped pioneer with the introduction of our

VDX switches and VCS software. Sales of our VDX switches and VCS

software were up 33% sequentially and we now have an installed base

of more than 400 customers in high-performance, data-intensive

industries such as financial services, research networks, and media and

entertainment.

Our Ethernet fabric technology strategy is highly differentiated

as it is designed to allow our customers to scale over time, unlike the

all-or- nothing designs of some of our competitors. Therefore, we

expect many of our current customers to continue to build out their

Ethernet fabrics to keep pace with the growing demands on their data

center networks. |

•

Record Service Provider

business revenue

•

Brocade MLX and MLXe revenue

up 17% Yr./Yr.

•

Brocade ADX revenue up 13% Yr./Yr.

•

Total Ethernet business revenue

of $154M

•

Federal business down Qtr./Qtr.

as expected

•

Long-term trends align to strength

of the Brocade portfolio

Q1 Ethernet Business Update

13 |

| Total Ethernet revenue, including products and services, was $154M in

the quarter. The highlight of our Ethernet business was the Service

Provider segment, which generated more than $64M in revenue, another company

record. We are seeing demand in part from these customers as they upgrade

their network infrastructure to enable the delivery of new services and

capabilities such as cloud computing. This trend helped increase sales of

key products that are optimized for the Service Provider market including the Brocade MLX and MLXe

routers, which saw revenue growth of 17% Yr./Yr., and the Brocade ADX

application delivery switches, with 13% growth in revenue Yr./Yr. The

strength we saw in Service Provider helped offset some expected softness in other areas of the Ethernet business. For example, we

saw lower Federal Ethernet revenue in our seasonally slower Q1. We also saw a

decline in our Enterprise Ethernet revenue in the quarter. Some

transactions got pushed out of the quarter as we transition to “The

Effortless Network” portfolio. As we mentioned at Analyst Day, we

continue to focus our direct sales force towards large transactions for

Service Provider and Enterprise accounts while we move smaller accounts

to the channel. We saw this strategy working with the record Service Provider revenue in the quarter, but need to continue to

drive more growth through the channel. In addition, we had some special

discounting for a few large transactions in the quarter. On a

forward-looking basis, there are some key industry trends in the Ethernet market that align favorably to our strengths in this business.

For example, the Dell’Oro Group recently issued a report saying 10 Gigabit

Ethernet will be the top-selling Ethernet switch technology by 2016

and the forecast for 100 GbE revenue has that technology growing by triple-digit percentages for the next five years. I believe these

trends have positive implications for Brocade’s long-term Ethernet

business growth as more emphasis is placed on providing high-

performance, ultra-reliable solutions for demanding Enterprise, Data

Center, and Service Provider networks. |

•

All-time high revenue quarter

•

Record Storage quarter and continued

fast ramp of 16 Gbps products

•

Delivering on Playbook strategy of

“Innovation as a Differentiator”

•

Diversity of business portfolio and balance

across segments drove strong performance

Q1 Summary

Executing to our long-term strategy

14 |

| In summary, Q1 was a record quarter in many regards and built

on the momentum from last quarter. We exceeded both revenue and

profitability in Q1 versus our outlook. It is clear that we are executing well

on our Playbook strategy of using “innovation as a differentiator”

and it is reflected in Q1’s strong performance.

We are excited about the next phase of our innovation roadmap that will fuel

future growth and I look forward to sharing more information with you at

The Effortless Network and Technology Day Summit events. Thank you. |

Q1 FY 2012 Financials

Dan Fairfax, CFO

15 |

| Prepared comments provided by Dan Fairfax, CFO

|

Key Financial Metrics

* Non-GAAP, please see GAAP reconciliation

16

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Q1 12

Qtr./Qtr.

Q1 12

Yr./Yr.

Revenue

$546M

$548M

$503M

$550M

$561M

+2%

+3%

Storage product revenue

$331M

$329M

$275M

$303M

$353M

+17%

+7%

Ethernet product revenue

$126M

$129M

$139M

$158M

$123M

-22%

-2%

Global Services revenue

$89M

$91M

$89M

$89M

$84M

-6%

-5%

Non-GAAP gross margin*

62.0%

63.4%

61.8%

62.9%

64.8%

+1.9 pts

+2.8 pts

Non-GAAP operating margin*

17.1%

17.9%

14.0%

21.0%

21.5%

+0.5 pts

+4.4 pts

GAAP EPS—diluted

$0.05

$0.05

$0.00

-$0.01

$0.12

+$0.13

+$0.07

Non-GAAP EPS—diluted*

$0.12

$0.12

$0.09

$0.16

$0.20

+$0.04

+$0.08

Operating cash flow

$118M

$114M

$11M

$206M

$127M

-38%

+8%

Net debt

$503M

$394M

$374M

$382M

$241M

-37%

-52% |

| In Q1 12, Brocade generated record revenue of $561M, which was up 2%

Qtr./Qtr. and up 3% compared to Q1 11 results. Storage product revenue

grew 17% Qtr./Qtr. and 7% Yr./Yr. driven by good growth across all Storage product segments and continued ramp of our recently

introduced 16 Gbps products. Storage product revenue represented 63% of total

revenue in the first quarter, higher than the 61% reported in Q1 11 and

55% in Q4 11.

Q1 Ethernet product revenue was down 22% Qtr./Qtr. and slightly lower Yr./Yr.

The expected seasonally lower Federal revenue and lower Enterprise

revenue were offset in part by the strong growth in Service Provider revenue. Ethernet product revenue in Q1 represented 22% of

total revenue, down slightly from 23% in Q1 11 and down from 29% in Q4 when our

Ethernet revenue is seasonally stronger. Global Services revenue was $84M in Q1, down 6% Qtr./Qtr. and down 5% Yr./Yr.,

primarily driven by lower professional services revenue as a result of

the sale of our SBS consulting business at the end of Q4 11. The SBS business had previously contributed approximately $5M of

revenue per quarter. Our Global Services revenue represented approximately 15%

of total Q1 revenue, down slightly from Q1 11 and Q4 11.

Non-GAAP gross margin was 64.8% in Q1, better than the guidance we

provided; up 190 basis points from Q4 11 and up 280 basis points fro Q1

11. The higher-than-expected gross margin was driven by higher revenue and a favorable product mix due to the increase of Storage

revenue in the quarter. Non-GAAP operating margin was 21.5% in Q1, an

improvement of 50 basis points sequentially and above our outlook of 17%

to 19% that we provided for the quarter.

GAAP EPS on a diluted basis was $0.12 and non-GAAP EPS was $0.20 for the

quarter. In Q1 the effective GAAP tax benefit was (5.8)% and the

effective non-GAAP tax rate was 12.6%. The lower-than-expected

non-GAAP tax rate was driven by the resolution of both Federal and State tax

audits in the quarter which resulted in the favorable tax rate. Excluding the

benefit of the lower tax rate from the results of these audits, non-

GAAP EPS would have been $0.17 in Q1, higher than our guidance of $0.12 to

$0.14 for the quarter.

During Q1 we generated $127M in operating cash flow and paid down $70M on our

term loan, $62M more than the required principal payment. Net debt was

$241M exiting Q1 12, down from $382M at the end of fiscal 2011. Weighted average diluted shares outstanding were

469M in Q1, down 17M from Q4, and now reflect the full benefit of the

repurchase of 46.5M shares in Q4 11. |

Total Storage Business Revenue

17

$392.5

$389.4

$334.3

$361.3

$392.5

$389.4

$334.3

$361.3

Product and Global Services Split

Revenue Segment Split

$406.4

$406.4

Record Storage business revenue in Q1 2012

$330.9

$328.8

$275.4

$302.9

$352.9

$61.6

$60.6

$58.9

$58.4

$53.5

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

$144.3

$136.5

$115.4

$127.9

$144.6

$138.5

$143.9

$115.8

$127.6

$155.5

$48.1

$48.4

$44.2

$47.4

$52.9

$61.6

$60.6

$58.9

$58.4

$53.5

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Global

Services

Products

Global

Services

Server

Switch

Director |

| Turning your attention to our Storage business, including hardware

and Storage-based support and services, Q1 revenue was a record

$406.4M, up 12% sequentially and up 4% from Q1 11.

Demand for Storage products was higher than expected in our seasonally strong

Q1. This resulted in record Storage product revenue of $352.9M in the

quarter, up 17% sequentially and up 7% Yr./Yr. We experienced good

revenue growth across our Director, Switch, and Server product segments

in Q1, led by Switch segment growth of 22% Qtr./Qtr. Demand for our 16 Gbps portfolio of products continues to

track very well with approximately 27% of our Director revenue and

approximately 17% of Director and Switch revenue coming from our new 16

Gbps products. Our Server product group, including embedded switches and

server adapter products (HBAs and Mezzanine Cards), posted revenue of

$52.9M, up 12% from Q4 and up 10% Yr./Yr. Embedded switch revenue was up

10% Yr./Yr. while our server adapter product revenue was up 5%

Yr./Yr. |

Total Ethernet Business Revenue

$153.2

$158.9

$168.5

$189.2

Record Service Provider revenue offset by lower Enterprise revenue

$153.2

$158.9

$168.5

$189.2

Customer Segment Split

18

$154.3

$154.3

Product and Global Services Split

$126.1

$128.7

$138.9

$158.1

$123.4

$27.1

$30.2

$29.6

$31.1

$30.8

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Global

Services

Products

$93.5

$97.9

$90.6

$108.1

$69.2

$39.3

$42.5

$53.4

$47.2

$64.5

$20.4

$18.5

$24.5

$33.9

$20.5

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Federal

Service

Provider

Enterprise |

| Moving on to our Ethernet business, including hardware and

Ethernet-based support and services, Q1 revenue was $154.3M, up 1% Yr./Yr.

and down 18% from our seasonally strong Q4.

Looking at the individual product families, the Brocade MLX and MLXe router

revenue was up 17% Yr./Yr., the Brocade ADX Layer 4–7 product

revenue was up 13% Yr./Yr. while the Brocade FCX stackable switch revenue was down 16% Yr./Yr.

As we drill down into the Ethernet business details for Q1, we saw excellent

growth in the Service Provider segment achieving $64.5M in revenue, a

new record for the company. We continued to make progress in expanding our customer base as well increasing our share

in

some of the larger Service Providers customers. The Enterprise business was

lower year-over-year driven by softness in Americas specifically

and due to our continued build-out of our two-tiered distribution channel. Some deals were pushed out of the quarter and we

believe some customers may be postponing purchases in anticipation of our new

Campus LAN products coming out later this year. As expected, our Federal

Ethernet business was lower sequentially and generated $20.5M in revenue and was essentially flat compared

to

Q1 11.

From a geographic viewpoint, EMEA and Japan were both higher

year-over-year, with Americas, excluding Federal, relatively flat while APAC

was down year-over-year.

We continued to see good progress with Ethernet fabric-enabled Brocade VDX

product revenue, which grew 33% sequentially to more than

$7M in Q1. We now have over 400 VDX customers and also saw strong attach rates

of the VCS software enabling Ethernet fabrics in the quarter. We believe

we are in a leading competitive position and expect these products, as

well as additional product releases, to drive more meaningful growth for

us in the future. |

Revenue: Routes to Market,

10% Customers, Geographic Splits

Routes to Market

Geographic Split

19

47%

53%

43%

41%

48%

19%

11%

18%

21%

21%

34%

36%

39%

38%

31%

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Channel/Direct

Other OEM

10% Customers

41%

38%

39%

38%

39%

59%

62%

61%

62%

61%

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Domestic

International |

| In Q1, Brocade had three customers (EMC, HP, and IBM) that each

contributed revenue of at least 10% of the total company revenue. These

three customers contributed 48% of revenue in Q1, up from 41% in Q4 and up slightly from 47% in Q1 11 when we had the same

three 10% customers. Other OEMs represented 21% of revenue in Q1, no change from

Q4 11 and up from 19% in Q1 11. Channel and Direct were 31% of revenue in

Q1, a decrease from 38% in Q4 and 34% in Q1 11, driven by the shift of more Storage revenue which is

predominately shipped to OEM partners.

The mix of business based on ship-to location was 61% domestic and 39%

international in the quarter, reflecting a slight shift in mix to

international revenue from Q4. In Q1 11 the revenue mix was 59% domestic and

41% international. |

Revenue and Non-GAAP Gross Margin*

* Non-GAAP, please see GAAP reconciliation

Revenue Split by Product/Services

20

Non-GAAP Gross Margin*by Product/Services

$546

$548

$503

$550

$561

$457

$457

$414

$461

$477

$89

$91

$89

$89

$84

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Global

Services

Product

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

62.0%

64.6%

48.7%

63.4%

66.2%

49.0%

61.8%

62.9%

64.8%

64.5%

64.7%

66.6%

49.5%

53.4%

54.5%

Total

Product

Global Services |

| Q1 non-GAAP Company gross margin of 64.8% was above the range of

62.0% to 63.0% provided for the quarter. Gross margin improved 190 basis

points quarter-over-quarter driven by a more favorable product mix to Storage, improvements in Global Services gross margin

from the sale of SBS, and growth in overall revenue in the quarter. Gross margin

was higher by 280 basis points Yr./Yr. on improved product and services

margins, more favorable product mix and higher overall revenue. Q1

product non-GAAP gross margin was 66.6%, above our 63% to 66% target range, and up from 64.7% in Q4 11 and 64.6% in Q1 11

driven by overall product mix and improving margin for Storage products. Q1

Storage non-GAAP gross margin was in the mid-70’s, higher

compared to both Q1 11 and Q4 11 driven by revenue growth and a favorable

product mix to Directors and other higher price per port products. Q1

Ethernet non-GAAP gross margin was in the mid-40’s, lower than Q1 11 and Q4 11, driven by increased overhead costs on

lower revenue and increased competitive pricing pressure in certain large

deals. Global Services non-GAAP gross margin was 54.5% in Q1, an

improvement of 110 basis points compared to the 53.4% reported in Q4 11

and up significantly compared to the 48.7% reported in Q1 11 driven primarily

from the sale of SBS. Global Services gross margin in the

quarter was slightly above our target model of 51% to 54%.

|

Operating Performance vs. Target Model (FY 12)

*

Non-GAAP, please see GAAP reconciliation

Non-GAAP Gross Margin*

Non-GAAP Operating Expenses*

as a Percentage of Revenues

21

FY 12 target model: 44–46%

FY 12 target model: 61–63%

FY 12 target model: 16–18%

Outperformed target model in all areas

Non-GAAP Operating Margin*

62.0%

63.4%

61.8%

62.9%

64.8%

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

44.9%

45.4%

47.8%

41.8%

43.3%

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

17.1%

17.9%

14.0%

21.0%

21.5%

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12 |

| Non-GAAP gross margins were 64.8% for Q1, which was above our

target model range of 61% to 63% for FY12 and up

significantly compared to 62.0% reported in Q1 11 and 62.9% reported in Q4 11,

due to a favorable shift in product mix and increased volume.

On a non-GAAP basis, total operating expenses were 43.3% of revenues in Q1,

better than our target model of 44% to 46% for FY12 and better compared

to 44.9% reported in Q1 11. Operating expenses on a dollar basis increased from Q4 11 driven by

our annual employee cost of living increases, new FY12 variable compensation

plans, as well as a return of more normalized spending patterns in Q1.

As you may recall, last year we implemented various cost-cutting actions in response to the uncertain

macro-economic environment which resulted in lower operating expenses in Q3

and Q4. Total operating expenses were slightly lower on a

year-over-year basis. Q1 ending headcount of 4,542 was relatively flat from the prior quarter.

Non-GAAP operating margins were 21.5% in Q1, up 50 basis points Qtr./Qtr.

and up 440 basis points compared to Q1 11. The higher operating margins,

compared to our expected range of 17% to 19% for the quarter, were primarily driven by higher-than-

expected revenue and higher gross margins. |

Balance Sheet and Cash Flow Highlights

As of January 28, 2012

* Adjusted EBITDA is as defined in the term debt credit agreement

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Q1 12

Qtr./Qtr.

Q1 12

Yr./Yr.

Cash from operations

$118M

$114M

$11M

$206M

$127M

-38%

+8%

Capital expenditures

$23M

$27M

$26M

$20M

$18M

-10%

-22%

Free cash flow

$95M

$87M

($15M)

$186M

$109M

-41%

+15%

Debt payments

$40M

$59M

$12M

$50M

$70M

+40%

+75%

Cash, equivalents, and

short-term investments

$416M

$466M

$473M

$415M

$485M

+17%

+17%

Senior secured debt

$919M

$860M

$847M

$797M

$726M

-9%

-21%

Adjusted EBITDA*

$114M

$121M

$91M

$138M

$140M

+1%

+23%

Stock repurchase

$0

$0

$10M

$201M

$0

–

–

Senior secured leverage ratio

2.01x

1.86x

1.87x

1.72x

1.48x

-14%

-26%

Covenant

2.5x

2.5x

2.5x

2.5x

2.25x

–

–

Fixed charge coverage ratio

1.79x

2.26x

2.29x

2.63x

3.05x

+16%

+70%

Covenant

1.5x

1.5x

1.5x

1.5x

1.75x

–

–

22 |

| Cash generated from operations was $127M in Q1. We continued to see

good shipment linearity in the quarter which resulted in DSOs of 36 days.

Total capital expenditures in the quarter were $18M, slightly lower than $20M in our Q4 11.

Cash, equivalents, and short-term investments were $485M, up $70M from Q4 11

and up $69M from Q1 11. With the

$70M principal reduction of our term loan in Q1, our remaining term loan

principal is $120M exiting the quarter. We have $178M remaining of our

Board-authorized stock repurchase program, and with the steady and accelerated reduction of the

term loan, we plan to be more active with our share repurchases.

Adjusted EBITDA in the quarter was $140M, which was slightly higher than Q4 11

and up $26M Yr./Yr. The Senior Secured Leverage Ratio was 1.48x and the

Fixed Charge Coverage Ratio was 3.05x. Both ratios have improved

significantly over the past year and have significant headroom to the

covenant requirements of our term credit agreement. |

Strong Cash Flow: Reducing Debt

and Shares Outstanding

* Share repurchase in quarter

23

Term Loan Balance ($M)

Strong Operating Cash Flow ($M)

S&P Credit Rating Upgrade

Average Diluted Shares Outstanding (M)

$118

$114

$11

$206

$127

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

$311

$252

$240

$190

$120

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

491

502

510

486

469

Q1 11

Q2 11

Q3 11*

Q4 11*

Q1 12 |

| I am very pleased with the financial discipline and focus that we

have at Brocade. Our cash flow from operations continues to be very

strong, which has helped us to reduce our term loan by more than $190M over the past four quarters. Along with

that we have repurchased more than 48M shares over the past three

quarters. In Q1, Standard & Poor’s recognized the stability of

our business and the improvements we have made in our financial profile

and upgraded Brocade’s credit rating as well as our bond debt rating. |

Q2 2012 Planning Assumptions and Outlook

IT market conditions

•

Uncertainty around macro economic conditions

•

IT spending is growing

•

Certain customer segments growing slower

than others

Brocade business

•

Expect Storage TAM to be near high end of

annual growth rate of 2 to 5%

Other P&L items

•

Structure tax rate will be 27% to 29% for the

rest of FY12

•

Continue share repurchases

OEM inventories

•

Expected range of one to two weeks of supply

* Non-GAAP, please see GAAP reconciliation

Financial Outlook

Q2 2012

Revenue range

$530M–$545M

Non-GAAP gross margin*

62.0%–63.0%

Non-GAAP operating expenses*

46.0%–46.5%

Non-GAAP operating margin*

15.5%–17.0%

Other income/other expense

~($13M)

Non-GAAP tax rate*

27%–29%

Fully diluted shares outstanding

475M–480M

Non-GAAP EPS*

$0.11–$0.12

Operating cash flow

$90M–$100M

Capital expenditures

$20M–$23M

Free cash flow

$67M–$80M

24 |

| Looking forward to Q2 12, we contemplated the following in setting

our outlook: •

The current macro environment and economy continue to show uncertainty,

especially within the Eurozone countries. •

IT spending is growing but certain customer segments may see slower growth than

others. •

We continued to see good demand for our Storage products in Q1. We plan our

Storage business around expected long- term industry growth rates of

2 to 5% per year and expect the growth rate for FY12 to be towards the higher end of that

range.

•

We expect to see some small increases in operating expense dollars driven

primarily by higher engineering and prototype spending, launch costs for

new product offerings, and normal seasonal spending increases in our fiscal Q2.

•

Exiting Q1, OEM inventory was a little more than one week based on Storage

business revenue and we expect OEMs to hold between one week and two

weeks of inventory going forward. OEM inventory levels have and may change due to

seasonally stronger and weaker quarters of the year as well as product

transitions. •

From a tax rate perspective, we are planning at a structural rate of 27% to 29%

non-GAAP for the rest of the year. Discrete events, like what we

experienced in Q1, can impact our tax rate from time to time. However we do not provide guidance on

such events due to the inherent uncertainty of their timing.

•

And finally, we plan to continue our share repurchases.

That concludes Brocade’s prepared comments.

Thank you for your interest in Brocade. |

Prepared Comments and Live Conference Call

February 21, 2012, 2:30pm

Jason Nolet

VP of Data Center

and Enterprise

Networking

Dan Fairfax

CFO

John McHugh

CMO & VP of

Marketing

Ian Whiting

SVP of WW Sales

Mike Klayko

CEO

Dave Stevens

CTO & VP of

Corporate

Development

25 |

| Prepared comments provided by Rob Eggers, Investor Relations

That concludes Brocade’s prepared comments. At 2:30 p.m. Pacific Time on

February 21 Brocade will host a webcast conference call at

www.brcd.com.

Thank you for your interest in Brocade. |

Appendix and Reconciliations

26 |

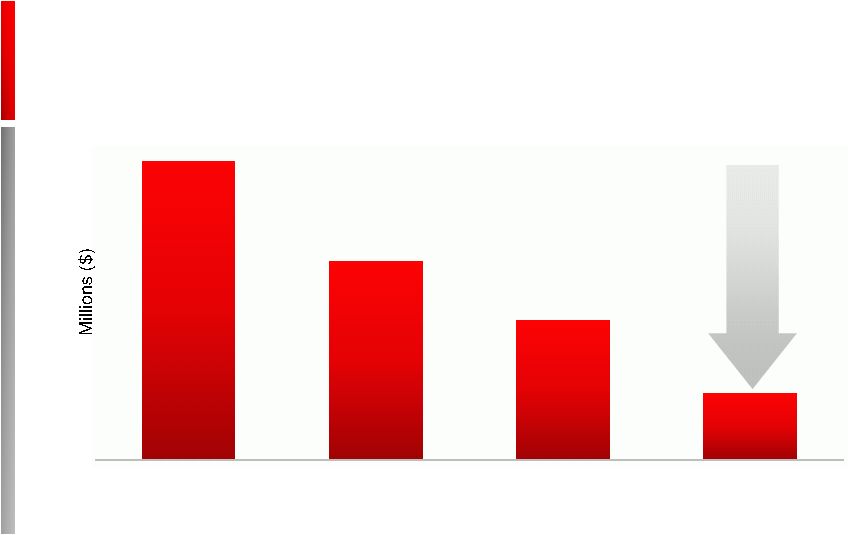

Net Debt: Defined as Total Debt Less Total Cash

Decreased by over $830M from Q1 09 to Q1 12

Nearly

80%

reduction in 3 years

27

$1,073

$713

$503

$241

Q1 09

Q1 10

Q1 11

Q1 12 |

Q1 Cash and Debt Metrics

*

Adjusted EBITDA is as defined in the term debt credit agreement

** Cash, equivalents and short-term investments

Adjusted EBITDA* Performance

(In Millions)

Reducing Debt Position

(In Millions)

Within Debt Covenant

Cash Balance**

(In Millions)

28

$114

$121

$91

$138

$140

$458

$463

$452

$464

$490

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Quarter

Trailing

12

Months

2.01

1.86

1.87

1.72

1.48

2.50

2.50

2.50

2.50

2.25

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Senior

Debt

Leverage

Ratio

Covenant

$919

$860

$847

$797

$726

$311

$252

$240

$190

$120

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Total Secured Debt

Term Debt

$416

$466

$473

$415

$485

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Ending Cash Balance |

Adjusted EBITDA and Sr. Secured Leverage Ratio

As defined in the term credit agreement

Consolidated Senior Secured Leverage Ratio

Q1 FY 11

Q2 FY 11

Q3 FY 11

Q4 FY 11

Q1 FY 12

$ Thousand

Actual

Actual

Actual

Actual

Actual

Consolidated Net Income (Loss)

$26,918

$26,079

$1,937

($4,324)

$58,584

plus

(i) Consolidated Interest Charges

$21,546

$20,745

$42,066

$13,483

$13,047

(ii) Provision for Federal, state, local and foreign income taxes payable

$0

$0

$0

$45,446

$0

(iii) Depreciation and amortization expense

$52,522

$51,712

$51,220

$50,898

$50,105

(iv) Fees, costs and expenses incurred on or prior to the Acquisition Closing

Date in connection with the Acquisition and the financing thereof

$0

$0

$0

$0

$0

(v) Any cash restructuring charges and integration costs in connection with the

Acquisition, in an aggregate amount not to exceed $75,000,000

$0

$0

$0

$0

$0

(vi) Non-cash restructuring charges incurred in connection with the

Transaction, all as approved by Arrangers

$848

$779

$687

$580

$483

(vii) Other non-recurring expenses reducing such Consolidated Net Income

which do not represent a cash item in such period or any future period

(in each case of or by the Borrower and its Subsidiaries for such

Measurement Period) $175

$1,735

$136

$13,035

$0

(viii) Any non-cash charges for stock compensation expense in compliance

with FAS 123R and amortization

of

the

fair

value

of

unvested

options

under

the

Acquired

Business’

employee

stock

option

plan assumed by the Borrower

$19,906

$22,530

$20,969

$19,670

$21,819

(ix)

Legal fees and expenses relating to the Borrower’s indemnification

obligations for the benefit of its former officers and directors in

connection with its historical stock option litigation $15

$0

$0

$0

$0

Minus

(i)

Federal, state, local and foreign income tax credits

$5,717

$612

$10,300

$0

$3,207

(ii)

All non-cash items increasing Consolidated Net Income (in each case of or

by the Borrower and its Subsidiaries for such Measurement Period)

$1,995

$1,992

$15,408

$1,024

$840

Consolidated EBITDA

$114,218

$120,976

$91,307

$137,764

$139,991

4 Quarter Trailing Consolidated EBITDA

$458,465

$463,371

$452,483

$464,266

$490,038

Consolidated Senior Secured Debt

$919,312

$859,983

$847,031

$796,782

$726,325

Consolidated Senior Secured Leverage Ratio (x)

2.01

1.86

1.87

1.72

1.48

29 |

Segment Revenue Detail

Product segment breakdown

30

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

SAN Product Breakdown

Directors

44%

41%

42%

42%

41%

Switches

42%

44%

42%

42%

44%

Server

15%

15%

16%

16%

15%

Ethernet Product Breakdown

Chassis

58%

57%

52%

50%

57%

Stackables

42%

43%

48%

50%

43% |

Thank You

www.brcd.com

31 |