Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - ATMI INC | Financial_Report.xls |

| EX-32 - EX-32 - ATMI INC | d301173dex32.htm |

| EX-21 - EX-21 - ATMI INC | d301173dex21.htm |

| EX-23 - EX-23 - ATMI INC | d301173dex23.htm |

| EX-31.1 - EX-31.1 - ATMI INC | d301173dex311.htm |

| EX-31.2 - EX-31.2 - ATMI INC | d301173dex312.htm |

| EX-10.52 - EX-10.52 - ATMI INC | d301173dex1052.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 1-16239

ATMI, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 06-1481060 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 7 Commerce Drive, Danbury, CT |

06810 | |

| (Address of principal executive offices) | (Zip Code) | |

203-794-1100

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, par value $0.01 per share | The NASDAQ Stock Market LLC (NASDAQ Global Select Market) |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer |

¨ |

Accelerated filer |

þ | |||

| Non-accelerated filer |

¨ |

Smaller reporting company |

¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the common stock held by non-affiliates of the registrant at June 30, 2011, was approximately $638,332,000 based on the closing sale price of such stock on the NASDAQ Global Select Market on that date.

The number of shares outstanding of the registrant’s common stock as of January 31, 2012 was 31,728,205.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of our proxy statement for the annual meeting of stockholders to be held on May 23, 2012 (are incorporated by reference in Part III of this form 10-K).

Table of Contents

ATMI, INC.

Annual Report on Form 10-K

For the Fiscal Year Ended December 31, 2011

| Page | ||||||

| Part I | ||||||

| Item 1. | 1 | |||||

| Item 1A. | 10 | |||||

| Item 1B. | 14 | |||||

| Item 2. | 14 | |||||

| Item 3. | 15 | |||||

| Item 4. | 15 | |||||

| Part II | ||||||

| Item 5. | 16 | |||||

| Item 6. | 18 | |||||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

20 | ||||

| Item 7A. | 32 | |||||

| Item 8. | 33 | |||||

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

33 | ||||

| Item 9A. | 33 | |||||

| Item 9B. | 33 | |||||

| Part III | ||||||

| Item 10. | 34 | |||||

| Item 11. | 34 | |||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

34 | ||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence |

34 | ||||

| Item 14. | 34 | |||||

| Part IV | ||||||

| Item 15. | 35 | |||||

| Signatures | 41 | |||||

| Index to Consolidated Financial Statements and Financial Statement Schedule | F-1 | |||||

Table of Contents

References in this annual report to “the Company,” “ATMI,” “we,” “us” and “our” refer to ATMI, Inc. and our wholly-owned subsidiaries on a consolidated basis.

Cautionary Statements Under the Private Securities Litigation Reform Act of 1995

Forward-Looking Statements

Disclosures included in this Form 10-K contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements may be identified by words such as “anticipate,” “plan,” “believe,” “seek,” “estimate,” “expect,” “could,” and words of similar meanings and include, without limitation, statements about the expected future business and financial performance of ATMI such as financial projections, expectations for demand and sales of new and existing products, customer and supplier relationships, research and development programs, market and technology opportunities, international trends, business strategies, business opportunities, objectives of management for future operations, microelectronics industry (including wafer start) growth, life sciences industry growth and trends in the markets in which the Company participates. Forward-looking statements are based on management’s current expectations and assumptions, which are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. Investors and others should consider the cautionary statements and risk factors discussed in Item 1A below. Actual outcomes and results may differ materially from these expectations and assumptions because of changes in political, economic, business, competitive, market, regulatory, and other factors. ATMI undertakes no obligation to update publicly or review any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by law.

Our Business

We believe we are among the leading suppliers of high performance materials, materials packaging and materials delivery systems used worldwide in the manufacture of microelectronics devices. Our products consist of “front-end” semiconductor performance materials, sub-atmospheric pressure gas delivery systems for safe handling and delivery of toxic and hazardous gases to semiconductor process equipment, and high-purity materials packaging and dispensing systems that allow for the reliable introduction of low volatility liquids and solids to microelectronics and biopharmaceutical processes. ATMI targets semiconductor and flat-panel display manufacturers, whose products form the foundation of microelectronics technology rapidly proliferating through the consumer products, information technology, automotive, and communications industries. The market for microelectronics devices is continually changing, which drives demand for new products and technologies that have improved performance at lower cost. ATMI’s customers include many of the leading semiconductor manufacturers in the world who target leading-edge technologies. ATMI also addresses an increasing number of critical materials handling needs for the life sciences markets. Our proprietary containment, mixing, and bioreactor technologies are sold to the biotechnology, laboratory and cell therapy markets, which we believe offer significant growth potential. ATMI’s objective is to meet the demands of our microelectronics and life sciences customers with solutions that maximize the efficiency and safety of their manufacturing processes, reduce capital or operating costs, and minimize the time to develop new products and integrate them into their processes.

ATMI’s core competencies include:

| • | knowledge of the science and economics of process applications for customer needs in markets served; |

| • | the ability to use a combinatorial science-based research approach and high-productivity development (“HPD”) capabilities to significantly shorten our new product development life cycle and develop next generation materials necessary as the semiconductor industry moves toward advanced technology generations, such as 14 nanometers; |

| • | the materials science of packaging, delivery, and deposition of ultra-pure semiconductor materials; |

| • | the ability to rapidly develop innovative technology and intellectual property that strengthens our competitive position; |

| • | knowledge of high-purity materials handling, containment, dispensing, mixing and bioreactor systems to address life sciences customers’ needs for drug research, development and commercialization. |

1

Table of Contents

Our customers’ manufacturing processes are increasingly complex, resulting in rapidly changing requirements for materials and materials handling solutions. ATMI has historically capitalized on the growth of the microelectronics and life sciences industries in general through:

| • | a strategy of leveraging the combination of our performance materials and materials handling competence to provide greater process efficiency value to our customers; |

| • | an extensive research and development program that has produced a stream of proprietary and patented products for these markets; |

| • | a key customer focus, which has included providing applications development in order to offer materials solutions for future generation technologies and the ability to perform electrical test measurements in our development efforts to ensure our solutions meet our customers’ needs; and |

| • | strategic alliances and collaboration efforts that have allowed us to add complementary technologies to our product portfolio more rapidly than through internal development alone. |

The majority of ATMI’s semiconductor business generally tracks semiconductor wafer starts. Additional financial information about the Company and related geographic information can be found in Item 7: “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Form 10-K.

We believe we have achieved a leadership position in high-performance semiconductor materials, materials packaging, and materials delivery systems for the microelectronics market by focusing on providing solutions to our customers that allow them to make faster, more advanced, or less expensive devices while improving their manufacturing asset productivity and production yields. We also focus on partnering with customers to bring new technologies into high-volume production as quickly and efficiently as possible. ATMI plans to continue to focus on leveraging our core technologies to create new high-growth product lines, including growing our leadership position in advanced interconnect applications, which today is focused on copper. We believe we also have achieved a leadership position in the small but fast growing market for one-time use mixing and bioreactor applications in the life sciences market.

In the first half of 2009, driven by the challenging repercussions of global credit and financial market disruptions which caused an economic downturn, our customers cautiously managed their inventories. In the second half of 2009, macroeconomic indicators began to recover driven by customers who had reduced their inventory levels earlier in the year and government sponsored demand generation programs. However, unemployment levels remained at historically high levels in the U.S., Europe and certain other parts of the world, which caused continued economic uncertainty. In 2010, we have seen periods of increasing momentum and then contraction as our customers respond to the global macroeconomic cycles. Through the first half of 2011 our quarterly sequential revenue continued to improve, but in the second half of 2011, global economic conditions began to soften as customers managed inventories in the face of continued uncertainty.

ATMI’s operations comprise one operating business segment.

ATMI’s Strategy

ATMI’s strategic intent is to be the source of process efficiency solutions to technology-driven customers by providing innovative materials and related delivery systems and technologies to:

| • | Focus development and application engineering initiatives with the leading manufacturers to provide next generation performance materials and process solutions; |

| • | Target high-growth, high-margin specialty markets that use ATMI’s core materials and packaging technologies and require products that are consumed in the production process; |

| • | Add value through performance materials packaging, dispensing, and process technologies designed to meet the demands of users for greater levels of purity, productivity, safety, environmental responsiveness, and speed; |

| • | Significantly shorten new product development time lines and the development of next generation materials through the use of a combinatorial science-based research approach and HPD capabilities; |

2

Table of Contents

| • | Leverage ATMI’s technology leadership by investing extensively to develop proprietary and patented materials and process solutions, which the Company uses to quickly commercialize new offerings for customers; and |

| • | Form strategic alliances, including joint development programs and collaborative marketing efforts, to accelerate the introduction of ATMI’s products into existing and new markets. |

In summary, ATMI’s strategy does not encompass a “traditional” materials supplier-to-customer relationship. In those relationships, suppliers tend to provide materials to customers based solely on the cost, quantity, and quality of the materials being supplied. Instead, ATMI works to develop partnerships with its customers based on our ability to improve the process efficiency of customers’ development, scale-up, manufacturing and supply chain processes, thereby reducing customers’ total cost of ownership. ATMI seeks to provide value to its customers through the use of its technical capabilities, and applications knowledge in a manner that changes its commercial relationship with those customers to a value-sharing relationship.

Microelectronics Products and Processes

ATMI believes it is among the most innovative suppliers of high-purity materials and related delivery systems and technologies. Products serving the integrated circuit (“IC”) fabrication market represent the largest portion of ATMI’s business and development activities. The principal drivers for this market are cost, yield, speed, utilization of capital, and risk reduction. The success of an electronic component or device is driven by the increased functionality it can deliver at a lower cost. Yield and capital utilization are significant drivers for the IC industry due to the implications on throughput and financial return, and the challenge is compounded by the requirement to manufacture devices for increasingly complex advanced technology generations. In an industry where the capital infrastructure is significant and product life cycles are short, the ability to bring the next generation technology rapidly to market can make a significant difference in our customers’ success. ATMI’s ability to shorten deployment of production-ready solutions is critical to our success.

High Productivity Development. ATMI uses utilizes combinatorial-science based methods for materials discovery, unit process development and device integration in support of our customers’ needs to develop new materials in response to the challenges of decreasing node sizes. Our experience in materials development and packaging combined with these capabilities bring the unique ability to provide massively parallel experimentation for materials screening, process window characterization, device integration and performance optimization.

Collaborative Arrangements. In 2011, ATMI entered into a collaborative development agreement (“CDA”) with an advanced memory integrated circuit manufacturer for the purpose of developing molecules, including chemical precursors, and material systems for next generation semiconductor products. ATMI will use its HPD platform to collaboratively work with this customer on specific statements of work designed to develop next-generation materials and is currently working with other customers negotiating similar types of arrangements.

Ion Implantation. The primary issues for IC manufacturers are production throughput, cost, and safety because of the hazardous properties of the implant gases used. ATMI’s patented SDS® solutions use a standard gas cylinder containing an adsorbent material. The cylinder is filled with gas under conditions such that the gas is adsorbed onto the adsorbent material at sub-atmospheric pressure. Sub-atmospheric storage of hazardous gases minimizes potential leaks of gas during transportation and use, thus providing significant safety and environmental improvements over traditional high-pressure cylinders. In addition, SDS products allow more process gas to be stored in the cylinder, providing significantly higher rates of productivity than traditional methods of gas delivery used in ion implantation manufacturing processes. These advantages have led the majority of significant chip manufacturers to adopt this technology as the industry standard for dopant gas delivery. Materials packaged in SDS systems include primarily arsine, phosphine, and boron trifluoride. The third generation of SDS products, called SDS3, maintains all the inherent safety features of previous generation SDS products, but dramatically increases the gas storage capacity by using a new adsorbent. The two to three times capacity improvement over the previous SDS products allows ion implanter users to reduce tool down time, resulting in significant cost savings for our customers.

Copper Integration. ATMI believes it is a market leader in copper electroplating materials and processes in semiconductor development and manufacturing with our Viaform® product, which includes inorganic and proprietary organic molecules that provide the wiring for copper interconnects allowing manufacturers to eliminate processing steps. ATMI also focuses on the total copper integration scheme with post-chemical mechanical planarization (“CMP”) cleaning solutions developed using our HPD capability, which uses knowledge-rich, combinatorial science experiments to deliver the best possible solution. One such outcome is PlanarClean®, a new post-CMP cleaning solution which is part of our Surface Preparation product line.

Deposition. Several processes for depositing thin films such as chemical vapor deposition (“CVD”) and atomic layer deposition (“ALD”) processes are enabled by advanced liquid, gaseous and solid precursors. ATMI’s UltraPur-™ brand of materials provides solutions for pre-metal dielectric, dielectric and barrier applications. ATMI is well-positioned for the incorporation of ALD processes

3

Table of Contents

by the semiconductor industry with its ProE-Vap® ampoule. This proprietary container allows for reliable delivery of low volatility solid precursors required for processes that demand ALD, like high-k gates. ATMI has successfully adopted the carbon adsorption technology used in SDS and introduced products for semiconductor deposition processes marketed under the SAGE® brand. These applications include: low-k plasma-enhanced deposition, or “PE-CVD”, processes using low-k materials, pre-metal dielectric high-density plasma, or “HDP-CVD”, and films using phosphine gases and thermal deposition processes using germane gases.

Surface Preparation. ATMI’s ST and AP photoresist strip cleaning materials are proprietary chemistries used for applications such as semiconductor post-etch residue removal, wafer etching, organics removal, negative resist removal, edge bead removal, and corrosion prevention.

Materials Packaging. ATMI’s NOWPak® liner technologies and container assemblies form the basis for its high-purity liquid materials packaging and dispensing system product portfolio for applications in IC fabrication and flat-panel display. This product line includes the: Bag-in-a-Bottle™ and Bag-in-a-Can ™ container systems which have their own companion dispense connection systems. Each package features a pre-cleaned collapsible inner liner, or “bag”, inside a rugged, high-density polyethylene overpack. The standard liner films are made of polytetrafluoroethylene and other polymers, which allow chemicals to be delivered to the manufacturing process without compromising their inherent purity. The empty inner liner is easily removed for waste consolidation, and the outer shell is recyclable or returnable for insertion of a new replacement liner. The dispensing system promotes full use of the chemical, chemical isolation from environmental contamination, and improved safety during dispense by sealing and isolating the chemical from the environment to further protect the chemical and the operator.

Life Sciences Products

ATMI is addressing an increasing number of critical materials handling needs for the life sciences markets. Other markets for our proprietary high-purity materials handling and dispensing systems include the biotechnology, laboratory and cell therapy markets, which we believe offer significant growth potential. The biotechnology industry has been using disposable components like filters, connectors, and disposable storage bags for several years; however, biotechnology customers have a growing need to combine these disposable components and integrate them into disposable systems. ATMI has responded to this trend by launching a complete offering of scalable disposable containment, dispensing, mixing and bioreactor systems.

ATMI’s Integrity™ line of proprietary disposable mixing technology is the market leading technology for disposable mixing applications within the life sciences market. The solutions delivered to our customers consist of a hardware system that is compatible with a one-time use mixing “bag” container; the technology delivers unique particle-free mixing and is scalable to an industrial scale. A typical biotech manufacturing process has over 20 different mixing steps starting from a cell culture process through the final-fill drug solutions. ATMI mixing technology is typically used for preparing buffers and media solutions for feeding the cell culture and chromatography applications, but also other process steps like virus inactivation and final-fill solutions.

In November 2010, we acquired the Belgian biotechnology firm Artelis S.A., an innovator in the area of highly-efficient bioprocesses and technologies for cell therapy research and manufacturing scale-up. The acquisition complements ATMI’s leadership in ultra-pure single-use films, bioreactors, and mixing systems for characterizing, developing, and manufacturing biopharmaceuticals and extends our global capabilities to a broad range of biopharmaceutical process expertise.

Raw Materials

We use a broad range of specialty and commodity chemicals and polymers in the development of our products, including parts and sub-assemblies that are obtained from outside suppliers. We seek, where possible, to have several sources of supply for all of these materials. Although we may, in some instances, rely on a single or a limited number of suppliers, or upon suppliers in a single country, for certain of these materials, we have not experienced any sustained interruption in production or the supply of these materials and do not anticipate any significant difficulties in obtaining the materials necessary to manufacture our products.

4

Table of Contents

Working Capital

In the ordinary course of our business, we maintain an adequate level of working capital at all times to support business needs. In accordance with microelectronics, flat panel display and life sciences industry practices, we do not need to carry significant amounts of finished goods inventory to meet the delivery requirements of our customers. We generally do not provide customers with rights of return (with the exception of standard warranty provisions, which historically have not been material) and we generally do not provide customers extended payment terms beyond 90 days.

Customers, Sales, and Marketing

ATMI sells and distributes its products worldwide primarily through a direct global sales and service organization. For a breakdown of revenue by geography, see Note 16 in the Notes to the Consolidated Financial Statements (Part II, Item 8 of this Form 10-K). Also, for detail regarding revenue by product type, see Note 15 in the Notes to the Consolidated Financial Statements (Part II, Item 8 of this Form 10-K). ATMI markets and sells its materials products to end-use customers, chemical suppliers, and original equipment manufacturers (“OEMs”) through its direct sales force in North America, Europe, Taiwan, South Korea, Japan, China, and Singapore, with limited use of regional manufacturing representatives in certain parts of Asia and Europe. NOWPak containers are generally sold to chemical suppliers, who sell their high-purity chemicals in NOWPak containers at the request of end-users. ATMI’s life sciences products are sold directly and through a global distribution agreement to life sciences and certain semiconductor companies, predominately in Europe and to an increasing extent in the United States. Consistent with 2010, through October of 2011, ATMI sold its SDS products for ion implant applications directly to certain end-users and through an exclusive distribution agreement with Matheson Tri-Gas, Inc. (“Matheson”). During the years ended December 31, 2011, 2010 and 2009, respectively, ATMI recognized $65.8 million, $79.9 million, and $37.9 million of revenues from Matheson, which represented 16.9 percent, 21.8 percent, and 14.9 percent of our revenues for these periods. On October 31, 2011, ATMI entered into an agreement with Matheson which terminated their exclusive license, manufacturing and distribution rights for SDS ® in exchange for a $95 million cash payment by ATMI, and payments for the repurchase by ATMI of certain inventory in the Matheson distribution channel. During the years ended December 31, 2011, 2010 and 2009, respectively, ATMI recognized revenues from a Taiwanese foundry of $48.7 million, $46.8 million, and $36.2 million, which represented 12.5 percent, 12.7 percent, and 14.2 percent of our revenues for these periods. During the years ended December 31, 2011, 2010 and 2009, respectively, ATMI recognized revenues from a leading Korean integrated circuit manufacturer of $47.6 million, $31.3 million, and $16.3 million, which represented 12.2 percent, 8.5 percent, and 6.4 percent of our revenues for these periods. There are no material seasonal effects on our business. The global nature of our business and the significance of our foreign operations expose us to certain risks in the countries in which we operate, including political and economic stability, the adequacy of country infrastructure and labor resources, currency fluctuations and controls, compliance with foreign laws and intellectual property protection. Investors and others should consider the cautionary statements and risk factors discussed in Item 1A below.

5

Table of Contents

Manufacturing

This table summarizes the locations, products manufactured and size of ATMI’s various manufacturing facilities as of December 31, 2011.

| Location |

Products |

Square Footage | ||||

| Anseong, South Korea |

• CVD materials (Microelectronics) |

13,000 | ||||

| Anseong, South Korea |

• high-purity materials packaging systems (Microelectronics) |

10,000 | ||||

| Brussels, Belgium |

• high efficiency bioreactor solutions (Life sciences) |

22,000 | ||||

| Burnet, TX |

• liquid materials and delivery systems (Microelectronics) |

77,000 | ||||

| Bloomington, MN |

• high-purity materials packaging systems (Microelectronics / Life sciences) |

68,000 | ||||

| Danbury, CT |

• gas delivery systems and liquid materials (Microelectronics) |

73,000 | ||||

| Hoegaarden, Belgium |

• high-purity materials packaging and mixing systems (Life sciences) |

74,000 | ||||

Until October 31, 2011, we used an exclusive contract manufacturer, Matheson, for the manufacture and distribution of approximately 75 percent of our SDS products. Under the terms of this manufacturing agreement, ATMI retained the right to manufacture 25 percent of all SDS Products, which were manufactured in our Danbury, CT facility. We terminated this agreement on October 31, 2011, but under the terms of the termination agreement, Matheson will continue to manufacture approximately 75 percent of the SDS products for a period of up to two years. We use contract manufacturers for certain of our other materials and delivery equipment products, both in the U.S. and in Asia. For further information regarding the termination of Matheson’s license, manufacturing and distribution rights, please see Item 7: “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Form 10-K.

6

Table of Contents

Competition

ATMI’s primary competitors in the semiconductor materials product lines include Air Products and Chemicals (Electronics Division), DuPont Electronic Technologies, Dow Chemical Company (including Rohm and Haas), BASF and Air Liquide as well as several smaller companies that specialize in niche markets.

ATMI’s SDS products (using adsorbent-based delivery technology) face competition from Praxair, Inc., and others, who have a mechanical-based product approach to delivering gas at sub-atmospheric pressure which currently comprise a small portion of the market. Several companies compete with high-pressure gas cylinders and solid sources. There are numerous domestic and foreign companies that offer products that compete with ATMI’s materials, materials packaging and materials delivery systems.

ATMI believes that its ability to compete in the markets for containers and dispensing systems is dependent largely upon its patented NOWPak technology and its proven ability to enhance and improve its products and technologies. Our NOWPak product line primarily competes with glass bottle manufacturers.

ATMI’s primary competitors in the life sciences product line include Sartorius Stedim Biotech S.A., Thermo Scientific HyClone, Inc., Merck Millipore, and Xcellerex.

ATMI competes in established markets based on our ability to innovate and on product performance, process efficiency, safety and price. In new and emerging markets we compete based on our ability to develop innovative products that fulfill new and changing customer needs in an efficient, cost-effective manner. Increased competition has, and may continue to, affect the prices we are able to charge for our products. In addition, our competitors could own or could obtain intellectual property rights which could restrict our ability to market our existing products and/or to innovate and develop new products.

Research and Development

The Company’s R&D expenses consist of personnel and other direct and indirect costs for internally funded project development, including the use of outside service providers. ATMI also participates in joint development efforts with several key semiconductor manufacturers, advanced technology developers, and semiconductor equipment manufacturers. Total expenses for R&D for the years ended December 31, 2011, 2010 and 2009 were $53.7 million, $48.6 million, and $37.2 million, respectively. Total research and development expenditures represented 13.8 percent, 13.2 percent, and 14.6 percent of revenues in 2011, 2010 and 2009, respectively.

ATMI has made significant investments to create global HPD capabilities that incorporate high-productivity combinatorial science-based research tools to shorten the new product development life cycle and more rapidly create new materials needed by our customers for their advanced technology roadmaps. While conventional R&D methods allow for one process experiment to be conducted on a single wafer, HPD capabilities enable engineers to evaluate up to 192 different test chemistries on a wafer at once. This technique allows independent control of formulation, stir rate and exposure time at each independent site on a test surface, yielding a rich source of data regarding materials choices in a fraction of the time and at lower cost than conventional research methods. Beyond the improvements in speed and data quality during the evaluation period, results are also subjected to both automated and human experience-driven understanding of semiconductor manufacturing process flows. The union of these forces produces much faster learning cycles, and makes it possible to rapidly narrow substantial volumes of data to a most promising subset of chemical formulations. The process is iterative, concurrently assessing large numbers of precisely selected, newly designed test variations.

Since production of the earliest integrated circuits (“ICs”), a readily identifiable group of the same dielectrics, dopants and metals were applied with only limited refinements or modifications. The introduction of copper has changed that dynamic; now, virtually every new technology generation requires no fewer than a dozen new materials. Looking into the future, the industry evolution to 14 nanometer will encompass approximately 45 new materials in a process involving nearly 1,200 steps, dramatically increasing the need to have a capability which enables more rapid feedback for the determination of materials that would be appropriate for individual processes. There is a significant and growing need among our customers to have access to HPD capabilities to enable them to keep pace with these market changes. The fundamental obstacle to overcome in trying to develop optimal chemistries in this environment is that conducting experiments in the conventional serial fashion will not produce answers rapidly enough to meet technology node insertion deadlines or competitive needs. Our HPD capabilities allow us to pursue more new product opportunities, in a shorter time, and using fewer resources compared to previous methods. By performing a higher rate of experiments and identifying promising routes for integrating these materials in actual production flows, and in certain instances, learning about device characteristics, including electrical performance, much earlier in the process than traditional approaches should differentiate ATMI’s materials development capabilities from our competition. We have demonstrated reductions in cycle time of up to 70 percent in the development of certain customer solutions. We are currently using our HPD capabilities to solve customers’ materials challenges in applications such as post-CMP cleaning, high-dose implant strip, copper post-etch residue removal, advanced precursors, high-k/metal

gate cleaning and others — all areas that pose substantial development hurdles for our customers in the race to transition to the next technology node.

7

Table of Contents

Strategic Alliances

ATMI forms strategic alliances, including joint development programs and collaborative marketing efforts, to develop new products and to accelerate the introduction of its products. These programs have led to significant technological advances, including the development of proprietary advanced materials and semiconductor manufacturing processes. In October 2011, ATMI terminated its exclusive license, manufacture, and distribution agreement with Matheson, whereby ATMI had granted licensing rights for the manufacturing and worldwide distribution of certain SDS products to Matheson. Following a transition period of up to two years, ATMI will manufacture SDS products for worldwide distribution. ATMI has a strategic alliance with Enthone, Inc. (“Enthone”), a subsidiary of Cookson Electronics, pursuant to which ATMI purchased the exclusive worldwide marketing and distribution rights to Enthone’s copper ECD products, including its ViaForm products, through 2013, subject to automatic renewal upon satisfaction of certain conditions. Under the terms of the agreement, Enthone continues to manufacture the ViaForm products for ATMI. ATMI holds a minority equity interest in Intermolecular Inc. (“Intermolecular”), has purchased HPD tools from Intermolecular, and has dedicated development resources with multiple key customers using this technology platform. ATMI has a minority equity interest in Anji Microelectronics Co., Ltd., with operations in Shanghai, China, as well as marketing agreements and licensing agreements around advanced semiconductor materials. ATMI has a minority equity investment in Lake LED Materials, Co., LTD (“Lake LED”), a South Korean company. We have also formed a strategic alliance with Lake LED focused on providing metal organic precursors to the light emitting diode (“LED”) market for customers outside of Asia. ATMI holds a minority interest in Disposable-Lab, S.A.S., a French start-up whose mission is to design and manufacture disposable lab equipment for the biopharmaceutical industry. We also hold a minority interest in ATMI Austar Lifesciences, Ltd., an early stage enterprise whose purpose is to manufacture high density polyethylene and Tyvek bags and other pharmaceutical components for the life sciences industry. We have an equity interest in Green Lyon Group, Inc., a United States company that is developing technology for the recycling of printed circuit boards. These programs enhance ATMI’s core technology base and promote the introduction of targeted products.

Backlog

Substantial portions of our business are conducted with open-ended supply contracts and / or consignment agreements that do not specify quantities. Also, the SDS gas delivery source product carries no backlog. Therefore, the Company does not believe that backlog as of any particular date is indicative of future results.

Patents and Proprietary Rights

ATMI has made, and continues to make, a significant investment in securing intellectual property protection for its technology and products. ATMI seeks to protect its technology by, among other things, filing patent applications where appropriate. The Company also relies upon trade secrets, know-how, continuing technological innovation, and licensing opportunities to help develop and maintain its competitive position.

As of December 31, 2011, ATMI owns or controls approximately 374 United States patents and has approximately 192 current United States patent applications pending. Foreign counterparts of certain of these applications have been filed, or may be filed at an appropriate time. ATMI decides on a case-by-case basis whether, and in which countries, it will file counterparts of a United States patent application. ATMI’s United States patents expire between approximately 2012 and 2029. ATMI also holds approximately 29 United States registered trademarks.

ATMI requires all employees, outside scientific collaborators, sponsored researchers, and other advisors and consultants who are provided confidential information to execute confidentiality agreements upon the commencement of employment or consulting relationships with the Company. These agreements generally provide that all confidential information developed or made known to the entity or individual during the course of the entity’s or individual’s relationship with ATMI is to be kept confidential and not disclosed to third parties except in specific circumstances. All of ATMI’s employees have entered into agreements providing for the assignment of rights to inventions made by them while employed by the Company.

Environmental Considerations

Regulation. ATMI uses hazardous materials and generates regulated waste streams as part of its manufacturing, processing and R&D activities. As a result, the Company is subject to a variety of governmental regulations related to the storage, use, transportation, and disposal of these materials. ATMI’s failure to comply with present or future laws could result in fines or other liabilities being imposed on the Company, suspension of production or a cessation of operations. Investors and others should consider the cautionary statements and risk factors discussed in Item 1A below.

8

Table of Contents

Sustainability. ATMI considers the environmental sustainability of our products through our development process with the objective of ensuring we provide our customers with solutions that meet their needs and, to the extent possible, minimize environmental impact.

Employees and Employee Relations

As of December 31, 2011, ATMI employed 814 individuals, including 329 in sales, marketing, and administration, 324 in operations, and 161 in research and development. Approximately 9 percent of the Company’s employees are covered by collective bargaining agreements, which expire in June 2013. All of the employees covered by these agreements are based in Belgium. ATMI has never experienced any work stoppages and considers its relations with its employees to be good.

Company Information

ATMI was incorporated under the laws of Delaware in 1997, and its predecessor company was incorporated under the laws of Delaware in 1987. ATMI’s headquarters is located at 7 Commerce Drive, Danbury, Connecticut 06810, and the telephone number is (203) 794-1100.

ATMI’s website can be found on the Internet at www.atmi.com. The website contains information about the Company and its operations. We make available free of charge through our website our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, and amendments to these reports, as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the Securities and Exchange Commission (SEC). These reports may be accessed on our website by following the link under Investor and then clicking on Financial information.

Any of our reports filed or furnished with the SEC can also be obtained in print by any stockholder who requests them from our Investor Relations Department:

Investor Relations

ATMI, Inc.

7 Commerce Drive

Danbury, CT 06810

9

Table of Contents

Cautionary Statements Regarding Future Results of Operations

You should read the following cautionary statements in conjunction with the factors discussed elsewhere in this and other of our filings with the Securities and Exchange Commission (SEC) and in materials incorporated by reference in these filings. These cautionary statements are intended to highlight material factors that may affect our financial condition and results of operations. Like other companies, we are susceptible to macroeconomic downturns in the United States or abroad that may affect the general economic climate and our performance and the performance of our customers. Similarly, the price of our common stock is subject to volatility because of fluctuations in general market conditions, differences in our results of operations from estimates and projections generated by the investment community, and other factors beyond our control.

Our profit margins may be adversely affected by a number of factors.

Our profit margins may be adversely affected in the future by a number of factors, including price reductions, decreases in our shipment volume, reductions in, or obsolescence of, our inventory and shifts in our product mix. Many of our expenses, particularly those relating to capital equipment and manufacturing overhead, are fixed in the short term. Accordingly, reduced demand for our products and services can cause our fixed production costs to be allocated across reduced production volumes, which can adversely affect our gross margin and profitability, and reduced demand could adversely affect our performance. Our ability to reduce expenses is further constrained because we must continue to invest in research and development to maintain our competitive position and to maintain service and support for our existing global customer base.

Cyclicality in the markets we sell to may adversely affect our performance.

The semiconductor market has historically been cyclical and subject to significant and often rapid increases or decreases in demand. These changes, along with cyclical changes in the flat-panel display market, could adversely affect our results of operations and could have an adverse effect on the market price of our common stock. Our results of operations have been adversely affected, and may be further affected in the future, if demand for semiconductors, or devices that use semiconductors, or flat panels decreases or grows at a significantly slower pace than has historically occurred. Subsequent upturns in the markets which we serve have historically been characterized by sudden increased product demand and production capacity constraints. We may have difficulty reacting quickly enough to a sudden upturn in demand for our products and may incur significant expediting and manufacturing costs to meet a rapid increase in customer demand.

The recent global economic crisis and continuing uncertainty in the financial markets could materially and adversely affect our business and results of operations.

In the second half of 2009, we began to see indications of industry recovery from the global credit and financial market disruptions that began in late 2008 and continued into 2009, which caused customers to reduce their inventory levels in the face of the economic downturn and government sponsored demand generation programs. As the recovery gained momentum, our quarterly sequential revenues improved into the first half of 2011; however, as we saw with the decline in wafer starts in the second half of 2011, and the global economic uncertainty, particularly in the European Economic Community, until the general global economy demonstrates marked improvement in the form of consistent growth, uncertainties will continue to affect businesses such as ours in a number of ways, making it difficult to accurately forecast and plan our future business activities. In addition, financial difficulties experienced by our suppliers, distributors or customers could result in product delays, increased accounts receivable defaults and inventory challenges. Similarly, the price of our common stock is subject to volatility due to fluctuations in general market conditions, differences in our results of operations from estimates and projections generated by the investment community, and other factors beyond our control.

On an ongoing basis, our business may be affected by economic down-turns which could impact the volatility and liquidity of financial and credit markets, the general global economy, and factors such as inflationary or deflationary pressures yielding other market or economic challenges. There can be no assurance that there will not be deterioration in credit and financial markets affecting consumer confidence in economic conditions.

Our business could be adversely affected if we cannot protect our proprietary technology or if we infringe on the proprietary technology of others.

Our proprietary technology supports our ability to compete effectively with other companies. Although we have been awarded, have filed applications for or have been licensed under numerous patents in the United States and other countries, these patents may not

fully protect our technology or competitive position. Further, our competitors may apply for and obtain patents that will restrict our ability to make and sell our products.

10

Table of Contents

Our competitors may intentionally infringe our patents. Third parties may also assert infringement claims against us in the future. Litigation may be necessary to enforce patents issued to us, to protect our trade secrets or know-how, to defend ourselves against claimed infringement of the rights of others or to determine the scope and validity of the proprietary rights of others. The defense and prosecution of patent suits are both costly and time consuming, even if the outcome is favorable to us. Outside the United States, in particular, such proceedings can be extremely expensive and their outcome very unpredictable. An adverse outcome in the defense of a patent suit could cause us to lose proprietary rights, subject us to significant liabilities to third parties or require us to license rights from third parties or to cease selling our products. Any of these events could have a material adverse effect on our business, operating results and financial condition. We also rely on unpatented proprietary technology that others may independently develop or otherwise obtain access to. Our inability to maintain the proprietary nature of our technologies could negatively affect our revenues and earnings.

The loss of or significant curtailment of purchases by any of our largest customers could adversely affect our results of operations.

While we generate revenue from hundreds of customers worldwide, in 2011, approximately 75 percent of our revenues were generated by 20 customers. The loss of or significant curtailment of purchases by one or more of our top customers, including curtailments due to a change in the design or manufacturing sourcing policies or practices of these customers or the timing of customer inventory adjustments may adversely affect our results of operations. Our customers and their customers aggressive management of inventory has already adversely affected our results of operations in the past and may continue to adversely affect future results of operations.

Customer driven pricing pressure may adversely affect our average selling prices.

We face aggressive cost-containment pressures from our customers. There can be no assurances that we will be able to maintain current prices in the face of continuing pricing pressures. Over time, the average price for our products may decline as the markets for these products become more competitive. Any material reduction in product prices could negatively affect both revenues and profits.

Our revenues and earnings could be negatively affected if we cannot anticipate market trends, enhance our existing products and processes, develop and commercialize new products and processes, and identify and consummate strategic acquisitions.

We believe that our future success will depend, in part, upon our ability to anticipate rapidly changing technologies and market trends, to enhance our existing products and processes, to develop and commercialize new products and processes, and to expand through selected acquisitions of technologies or businesses or other strategic alliances. The microelectronics industry markets we serve undergo frequent technological changes, which in turn create demand for new and improved products and process technologies. We may not be able to improve our existing products and process technologies or to develop and market new products and technologies that will be cost-effective or introduced in a timely manner or accepted in the marketplace. We may not be able to leverage our knowledge to make full use of combinatorial science and HPD capabilities as an effective market offering for our customers. Our failure to develop or introduce enhanced and new products and processes in a timely manner may negatively affect our revenues and earnings, and result in a potential impairment of assets. Management considers, on a continuing basis, potential acquisitions of technologies and businesses and other strategic alliances, some of which may be material to us. However, we cannot be assured that we will identify or succeed in consummating transactions with suitable acquisition candidates or alliance partners in the future.

We may have difficulty obtaining the resources or products we need for manufacturing or assembling our products or operating other aspects of our business, which could adversely affect our ability to meet demand for our products and may increase our costs.

We have hundreds of suppliers providing various materials that we use in the production of our products and other aspects of our business, and we seek, where possible, to have several sources of supply for all of these materials. However, we may rely on a single or a limited number of suppliers, or upon suppliers in a single country, for certain of these materials. The inability of such suppliers to deliver adequate supplies of reasonable quality production materials or other supplies could disrupt our production process. In addition, production could be disrupted by the unavailability of the resources used in production such as electricity, chemicals, and gases. The unavailability or reduced availability of the materials or resources we use in our business may require us to reduce production of products or may require us to incur additional costs in order to obtain an adequate supply of these materials or resources. Our life sciences business is also subject to governmental approval for products that are part of the manufacture of pharmaceuticals. The occurrence of any of these events could adversely affect our business and results of operations.

11

Table of Contents

We face intense competition from a variety of sources, including larger companies.

The markets for our products are intensely competitive. A number of domestic and international companies engage in commercial activities in the markets we serve. Many of these companies have substantially greater financial, research and development, manufacturing and marketing resources than we do. In addition, as these industries evolve, other competitors may emerge. To remain competitive, we must continue to invest in and focus upon research and development and product and process innovation. We may not be successful if we cannot compete on: price, technical capabilities, quality, or customer service.

Our global manufacturing and sales activities subject us to risks associated with legal, political, economic or other changes.

We have facilities in eight countries worldwide and, in 2011, approximately 80 percent of our revenues came from sales to companies outside the United States. The global nature of our business and the significance of our foreign operations expose us to certain risks in the countries in which we operate, including political and economic instability, the adequacy of country infrastructure and labor resources, currency fluctuations and controls, compliance with foreign laws and intellectual property protection, changes in export controls, health conditions, and possible disruptions in transportation networks, which could result in an adverse effect on our business operations in such countries and our results of operations.

Our results of operations could be adversely affected by fluctuations in exchanges rates.

Given our current operations and large customer base outside the United States, we employ the use of forward currency exchange contracts to attempt to minimize the potentially adverse earnings effect from exchange rate fluctuations on our net balance sheet exposures. Nevertheless, in periods when the U.S. dollar significantly fluctuates in relation to the non-U.S. currencies in which we transact business, such as the Euro, Japanese Yen, the South Korean Won, and the New Taiwan Dollar, fluctuations can have an adverse effect on our revenues and results of operations.

Our results of operations could be adversely affected by climate change and natural events in the locations in which we, our customers or our suppliers operate.

We have manufacturing and other operations in locations subject to natural events such as severe weather and earthquakes that could disrupt operations. In addition, our suppliers and customers also have operations in such locations. A natural disaster that results in a prolonged disruption to our operations, or our customers’ or suppliers’ operations, may adversely affect our results of operations and financial condition. Also, climate change poses both regulatory and physical risks that could harm our results of operations or affect the way we conduct our businesses.

Incorrect forecasts of customer demand could adversely affect our results of operations.

Our ability to match inventory and production mix with the product mix needed to fill current orders and orders to be delivered may affect our ability to meet our forecasts. In addition, when responding to customers’ requests for shorter shipment lead times, we manufacture product based on forecasts of customers’ demands. These forecasts are based on multiple assumptions. If we inaccurately forecast customer demand, we may incur expedited shipping costs to deliver products to meet customer demand or hold excess or obsolete inventory that would reduce our profit margins and could adversely affect our results of operations.

We may have difficulty managing our growth and attracting and retaining highly skilled scientific, technical, managerial and marketing personnel, which could adversely affect our revenues and increase our operating expenses.

We have historically experienced periods of growth and intend to grow our business in the future. The management of our growth requires qualified personnel, systems and other resources. Our future success will depend in part on our ability to attract and retain highly skilled scientific, technical, managerial and marketing personnel. Competition for such personnel in the industries that we serve is intense, and our competitors are often larger and more established than we are. We may not be successful in attracting and retaining qualified personnel. In addition, our expansion may also significantly strain operational, management, financial, sales and marketing and other resources. To manage growth effectively, we must continue to enhance and integrate our information technology infrastructure, systems and controls and successfully expand, train and manage our employee base. We may not be able to manage this expansion effectively, including by providing satisfactory levels of customer service and technical support. Inability to manage our growth and to attract and retain skilled personnel could have a material adverse effect on our business, operating results and financial condition.

12

Table of Contents

We engage in business combinations and asset acquisitions, and may encounter difficulties integrating acquired businesses with our current operations; therefore, we may not realize the anticipated benefits of the acquisitions.

We seek to grow, in part, through strategic business combinations and asset acquisitions. In the past several years, we have made certain acquisitions intended to complement and expand our business, and may continue to do so in the future. The success of these transactions will depend on our ability to integrate assets and personnel acquired in these transactions, apply our internal controls to these acquired businesses, and cooperate with our strategic partners. We may encounter difficulties in integrating acquisitions with our operations, applying our internal controls processes to these acquisitions, and in managing strategic investments. We may also have difficulty in integrating and managing new IT environments. Furthermore, we may not realize the degree or timing of benefits we anticipate when we first enter into a transaction. Any of the foregoing could adversely affect our business and results of operations.

In 2011, we terminated the license, manufacturing, and distribution agreements for our proprietary SDS® and VAC® products (“SDS Direct transaction”). To achieve the anticipated benefits of this transaction requires a transition period with the former license, manufacturing, and distribution partner. It will also require a certain amount of capital spending associated with expanding our manufacturing facilities and obtaining new business licenses and permits in certain countries. We may have difficulty transitioning responsibilities away from the former partner of our SDS® and VAC® products causing the transition to be more expensive than anticipated, or potentially causing business interruptions. We may also encounter issues in obtaining the necessary licenses and permits in certain countries making it difficult to achieve the full revenue and cash flow benefits of this transaction in a timely manner.

We face the risk of product liability claims.

The manufacture and sale of our products, which include thin film, other toxic materials and packages for life sciences applications, involve the risk of product liability claims. In addition, a failure of one of our products at a customer site could interrupt the business operations of the customer. Our existing insurance coverage limits may not be adequate to protect us from all liabilities that we might incur in connection with the manufacture and sale of our products if a successful product liability claim or series of product liability claims were brought against us.

We may be subject to information technology system failures, network disruptions and breaches in data security.

Information technology system failures, network disruptions and breaches of data security from cyber-attacks could disrupt our operations causing customer communication and order management issues, unintentional disclosure of customer, employee and proprietary information, and disruption in transaction processing which could affect our reputation and reporting of financial results. While management has taken steps to address these concerns by implementing sophisticated network security, hiring competent personnel and establishing prudent internal control measures, there can be no assurance that a system failure or data security breach will not have a material adverse effect on our financial condition and operating results.

Our business is potentially subject to substantial liabilities for failure to comply with environmental regulations.

We use, generate and discharge toxic or otherwise hazardous chemicals and waste in our manufacturing, processing and research and development activities. As a result, we are subject to a variety of governmental regulations related to the storage, use and disposal of these materials. Our failure to comply with present or future laws could result in fines or other liabilities being imposed on us, suspension of production or a cessation of operations.

In addition, under federal and state statutes and regulations, a government agency may seek to recover its response costs and/or require future remedial measures from both operators and owners of property where releases of hazardous substances may have occurred (including releases by prior occupants) or are ongoing, and for which only partial indemnification may be available in some cases.

Our activities may also result in our being subject to additional regulation. Such regulations could require us to acquire significant additional equipment or to incur other substantial expenses to comply with environmental laws. Our failure to control the use of hazardous substances could subject us to substantial financial liabilities.

Our financial results or financial condition could be adversely affected by changes in accounting standards and subjective assumptions, estimates and judgments by management related to complex accounting matters.

Generally accepted accounting principles and related accounting pronouncements, implementation guidelines and interpretations with regard to a wide range of matters that are relevant to our business, such as revenue recognition, business combinations, asset impairment, inventories, fair value measurements, self-insurance, tax matters and litigation, are highly complex and involve many

subjective assumptions, estimates and judgments. Changes in these rules or their interpretation or changes in underlying assumptions, estimates or judgments could significantly change our reported or expected financial performance or financial condition.

13

Table of Contents

Our results of operations could be adversely affected by changes in taxation.

Because we are a multi-national company, we have a business presence in many countries and, as a result, are subject to taxation and audit by a number of taxing authorities. Tax rates vary among the jurisdictions in which we operate. Our results of operations could be affected by market opportunities or decisions we make that cause us to increase or decrease operations in one or more countries, or by changes in applicable tax rates or audits by the taxing authorities in countries in which we operate. In addition, we are subject to laws and regulations in various locations that govern the determination of which is the appropriate jurisdiction to decide when and how much profit has been earned and is subject to taxation in that jurisdiction. Changes in these laws and regulations could affect the locations where we are deemed to earn income, which could in turn affect our results of operations. We have deferred tax assets on our balance sheet. Changes in applicable tax laws and regulations could affect our ability to realize those deferred tax assets, which could also affect our results of operations. Each quarter we forecast our tax liability based on our forecast of our performance for the year. If that performance forecast changes, our forecasted tax liability may change.

Compliance with changing corporate governance regulations and public disclosures may result in additional risks and exposures.

Changing laws, regulations and standards relating to corporate governance and public disclosure, and new regulations from the SEC, have created uncertainty for public companies such as ours. One such example is the current ambiguity regarding the breadth and pace of adoption of IFRS whether by convergence or SEC mandate. These laws, regulations, and standards are subject to varying interpretations in many cases and as a result, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies. This could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices and our commitment to maintaining high standards with regard thereto. As a result, our efforts to comply with evolving laws, regulations, and standards have resulted in, and are likely to continue to result in, increased selling, general, and administrative expenses and significant management time and attention. In particular, our efforts to comply with Section 404 of the Sarbanes-Oxley Act of 2002 and the related regulations regarding our required assessment and, our independent registered public accounting firm’s audit, for fiscal 2011 have necessitated, and we expect such efforts to continue to necessitate, the commitment of significant financial and managerial resources. We are also monitoring the evolving establishment of SEC rules in compliance with the Dodd-Frank Wall Street Reform and Consumer Protection Act to determine the potential future effect on our disclosures and shareholders rights.

Item 1B. Unresolved Staff Comments

None.

This table summarizes the location and size of ATMI’s significant real properties as of December 31, 2011:

| Location |

Square Footage | Lease / Own | ||

| Anseong, South Korea |

13,000 | Own | ||

| Anseong, South Korea |

10,000 | Lease | ||

| Bloomington, MN |

68,000 | Lease | ||

| Burnet, TX |

77,000 | Own | ||

| Brussels, Belgium |

22,000 | Lease | ||

| Chutung Town, Taiwan |

18,000 | Lease | ||

| Danbury, CT (1) |

31,000 | Lease | ||

| Danbury, CT |

73,000 | Lease | ||

| Hoegaarden, Belgium |

74,000 | Own | ||

| Hsin-chu, Taiwan |

30,000 | Lease | ||

| Round Rock, TX |

15,000 | Lease | ||

| Shanghai, China |

7,000 | Lease | ||

| Suwon-si, South Korea |

7,000 | Lease | ||

| Tempe, AZ |

11,000 | Lease | ||

| Tokyo, Japan |

6,000 | Lease |

14

Table of Contents

| (1) | ATMI’s headquarters. |

ATMI also leases other sales offices throughout the world, each one of which occupies 5,000 or fewer square feet.

Our fixed assets as of December 31, 2011 include the manufacturing facilities and non-manufacturing facilities such as sales and administrative offices, including leasehold improvements made to those facilities under non-cancelable leases, set forth in the table above and a substantial quantity of machinery and equipment. The facilities, leasehold improvements, machinery and equipment in use as of December 31, 2011 are in good operating condition, are well-maintained and substantially all are in regular use.

We believe that the fixed assets capitalized and facilities in operation at December 31, 2011 for the production of our products are suitable and adequate for the business conducted therein in the current business environment and have sufficient production capacity for their present intended purposes. While we are currently assessing the required amount of capital spending necessary for the expected incremental demand for our SDS products, because of the transition services contracted from the former manufacturer as a result of the SDS Direct transaction, we do not foresee any production capacity issues. Utilization of our facilities varies based on demand for our products. We continuously review our anticipated requirements for facilities and, based on that review, may from time to time adjust our facility plans.

ATMI is, from time to time, involved in legal actions, governmental audits, and proceedings relating to various matters incidental to its business including contract disputes, intellectual property disputes, product liability claims, employment matters, export and trade matters, and environmental claims. While the outcome of such matters cannot be predicted with certainty, in the opinion of management, after reviewing such matters and consulting with ATMI’s counsel and considering any applicable insurance or indemnifications, any liability which may ultimately be incurred is not expected to materially affect ATMI’s consolidated financial position, cash flows or results of operations.

Item 4. (Removed and Reserved)

15

Table of Contents

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

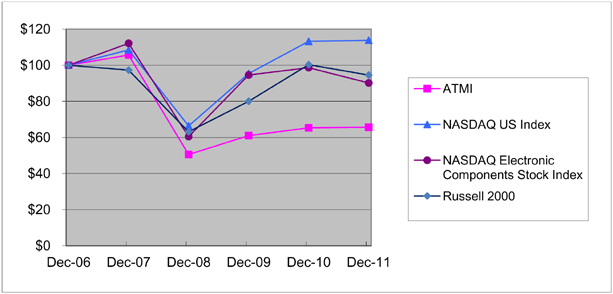

The following graph compares the cumulative total stockholder return on ATMI’s common stock with the return on the Total Return Index for the NASDAQ Global Select Market (NASDAQ US Index) and the NASDAQ Electronic Components Stock Index. The measurement assumes a $100 investment as of December 31, 2006 with all dividends, if any, reinvested. The data presented are on an annual basis for the five years ended December 31, 2011. The performance shown is not necessarily indicative of future performance.

Relative Stock Performance

| NASDAQ | ||||||||||||||||

| Electronic | ||||||||||||||||

| NASDAQ | Components | Russell | ||||||||||||||

| Date |

US Index | Stock Index | ATMI | 2000 | ||||||||||||

| 12/29/06 |

100.00 | 100.00 | 100.00 | 100.00 | ||||||||||||

| 12/31/07 |

108.47 | 112.12 | 105.63 | 97.27 | ||||||||||||

| 12/31/08 |

66.35 | 60.44 | 50.54 | 63.10 | ||||||||||||

| 12/31/09 |

95.38 | 94.57 | 60.99 | 80.02 | ||||||||||||

| 12/31/10 |

113.19 | 98.61 | 65.31 | 100.27 | ||||||||||||

| 12/31/11 |

113.81 | 90.17 | 65.61 | 94.51 | ||||||||||||

The cumulative total stockholder return graph and related data provided in Part II Item 5 of this Form 10-K is not “soliciting material,” is not deemed filed with the SEC and is not to be incorporated by reference in any filing by us under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

16

Table of Contents

The common stock of ATMI has traded on the NASDAQ Global Select Market under the symbol ATMI since October 13, 1997, and the common stock of our predecessor company traded under that symbol from 1993 until October 12, 1997. This table sets forth, for the periods indicated, the high and low sales price for the common stock as reported on the NASDAQ Global Select Market:

| High | Low | |||||||

| Fiscal year ended December 31, 2011 |

||||||||

| 1st Quarter |

$ | 21.28 | $ | 17.01 | ||||

| 2nd Quarter |

20.65 | 17.25 | ||||||

| 3rd Quarter |

21.32 | 15.32 | ||||||

| 4th Quarter |

21.48 | 15.15 | ||||||

| Fiscal year ended December 31, 2010 |

||||||||

| 1st Quarter |

$ | 19.65 | $ | 15.13 | ||||

| 2nd Quarter |

22.05 | 14.21 | ||||||

| 3rd Quarter |

16.07 | 12.13 | ||||||

| 4th Quarter |

20.99 | 14.47 | ||||||

As of January 31, 2012, there were approximately 153 holders of record of our common stock.

We have never paid cash dividends on our common stock and have no current plans to do so. There are no contractual restrictions in place that currently materially limit, or are likely in the future to materially limit, us from paying dividends on our common stock, but applicable state law may limit the payment of dividends. Our present policy is to retain earnings, if any, to provide funds for the operation and expansion of our business.

The Transfer Agent and Registrar for ATMI is Continental Stock Transfer & Trust Company.

Purchases of Equity Securities – This table lists all repurchases (both open market and private transactions) during the three months ended December 31, 2011 of any of our securities registered under Section 12 of the Exchange Act, by or on behalf of us, or any affiliated purchaser.

| Total Number of Shares Repurchased (2) |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Programs (3) |

Maximum Dollar Value of Shares that May Yet Be Purchased Under the Programs |

|||||||||||||

| Period (1) |

||||||||||||||||

| October 2011 |

1,063 | $ | 15.28 | — | $ | 48,182,523 | ||||||||||

| November 2011 |

659 | $ | 20.16 | — | $ | 48,182,523 | ||||||||||

| December 2011 |

663 | $ | 19.17 | — | $ | 48,182,523 | ||||||||||

|

|

|

|

|

|||||||||||||

| Total |

2,385 | $ | 17.71 | — | $ | 48,182,523 | ||||||||||

|

|

|

|

|

|||||||||||||

| (1) | There were no other repurchases of our equity securities by or on behalf of us or any affiliated purchaser during the fiscal quarter ended December 31, 2011. |

| (2) | Share repurchases are shown on a trade-date basis. Represents shares repurchased to satisfy employee minimum tax withholding obligations on vesting of restricted stock. |

| (3) | In August 2010, the Company’s Board of Directors approved a share repurchase program for up to $50.0 million of ATMI common stock. Under the terms of the share repurchase program, repurchases are made from time to time in open market transactions at prevailing market prices or in privately negotiated transactions. Management determines the timing and amount of purchases under the programs based upon market conditions or other factors. The program, which has no expiration date, does not require the Company to purchase any specific number or amount of shares and may be suspended or reinstated at any time at the Company’s discretion and without notice. |

17

Table of Contents

Item 6. Selected Financial Data

These selected consolidated statements of operations for the years ended December 31, 2011, 2010, 2009, 2008 and 2007 and the consolidated balance sheet data as of such dates are derived from ATMI’s audited consolidated financial statements. The data below should be read in conjunction with the consolidated financial statements and notes thereto and other financial information included elsewhere in this Form 10-K (in thousands, except per share data).

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| Consolidated Statements of Operations: |

||||||||||||||||||||

| Revenues |

$ | 390,087 | (1) | $ | 367,256 | $ | 254,704 | $ | 339,063 | $ | 364,088 | |||||||||

| Cost of revenues |

205,957 | (2) | 191,248 | 152,520 | (9) | 172,551 | (16) | 182,480 | (20) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

184,130 | 176,008 | 102,184 | 166,512 | (17) | 181,608 | ||||||||||||||

| Operating expenses: |

||||||||||||||||||||

| Research and development |

53,708 | 48,645 | 37,162 | (10) | 37,809 | 29,879 | ||||||||||||||

| Selling, general, and administrative |

83,546 | (3) | 85,425 | 76,359 | (11) | 88,781 | 99,227 | (21) | ||||||||||||

| Contract termination |

84,590 | (4) | — | — | — | — | ||||||||||||||

|

|

|

|

|

|

|

|