Attached files

| file | filename |

|---|---|

| 8-K - GARTNER INC | c68628_8k.htm |

Brian Shipman

GVP Investor Relations

Gartner

Forward Looking Statements

Statements contained in this presentation regarding the growth and prospects of the business, the Company’s projected 2011 financial results, long-term objectives and all other statements in this presentation other than recitation of historical facts are forward looking statements (as defined in the Private Securities Litigation Reform Act of 1995). Such forward looking statements involve known and unknown risks, uncertainties and other factors; consequently, actual results may differ materially from those expressed or implied thereby.

Factors that could cause actual results to differ materially include, but are not limited to, the ability to maintain and expand Gartner’s products and services; the ability to expand or retain Gartner’s customer base; the ability to grow or sustain revenue from individual customers; the ability to attract and retain a professional staff of research analysts and consultants upon whom Gartner is dependent; the ability to achieve and effectively manage growth, including the ability to integrate acquisitions and consummate acquisitions in the future; the ability to pay Gartner’s debt obligations; the ability to achieve continued customer renewals and achieve new contract value, backlog and deferred revenue growth in light of competitive pressures; the ability to carry out Gartner’s strategic initiatives and manage associated costs; the ability to successfully compete with existing competitors and potential new competitors; the ability to enforce our intellectual property rights; additional risks associated with international operations including foreign currency fluctuations; the impact of restructuring and other charges on Gartner’s businesses and operations; general economic conditions; risks associated with the credit worthiness and budget cuts of governments and agencies; and other risks listed from time to time in Gartner’s reports filed with the Securities and Exchange Commission, including Gartner’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q.

The Company’s SEC filings can be found on Gartner’s website at investor.gartner.com and on the SEC’s website at www.sec.gov. Forward looking statements included herein speak only as of February 16, 2011 and the Company disclaims any obligation to revise or update such statements to reflect events or circumstances after this date or to reflect the occurrence of unanticipated events or circumstances.

Agenda

Business Overview Gene Hall

Research Peter Sondergaard

Events Alwyn Dawkins

Consulting Per Anders Waern

Break

Sales David Godfrey

Financial Overview Chris Lafond

Summary / Q&A Gene Hall and Chris Lafond

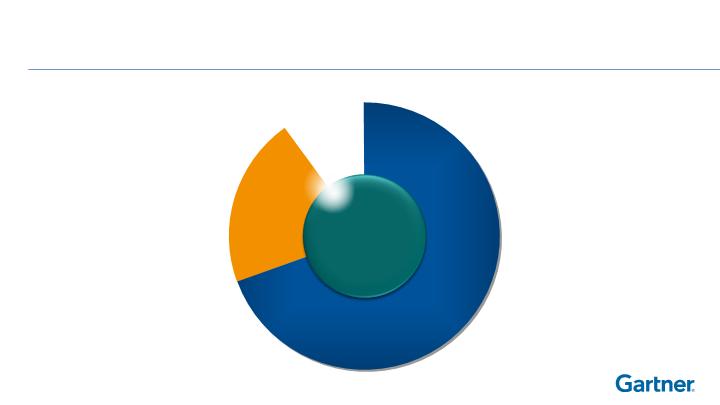

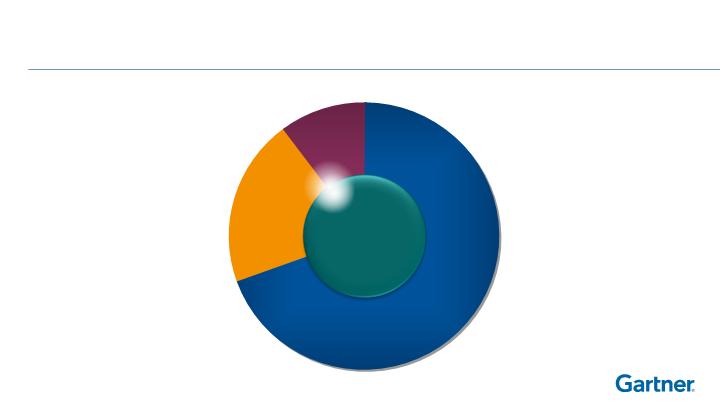

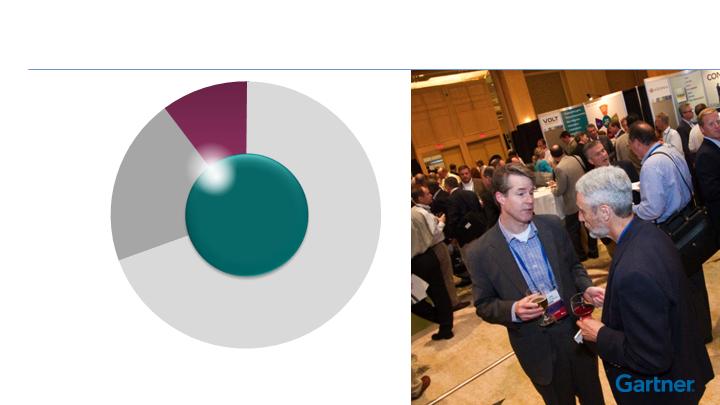

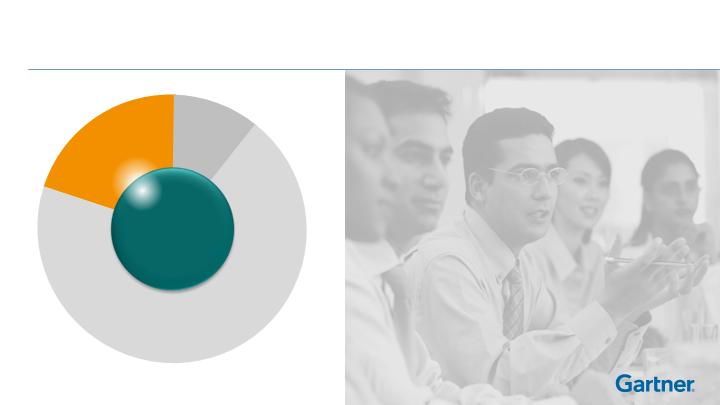

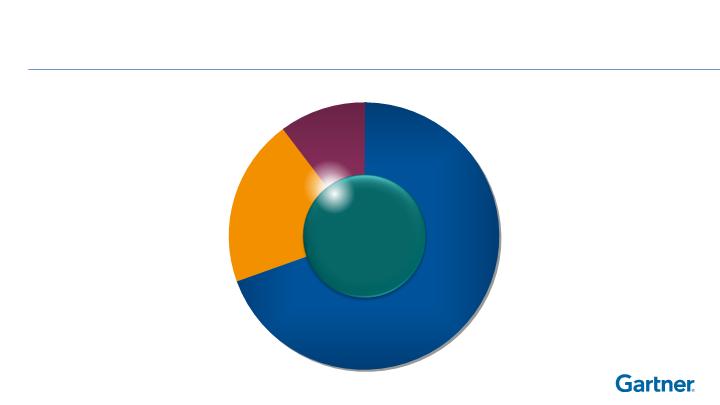

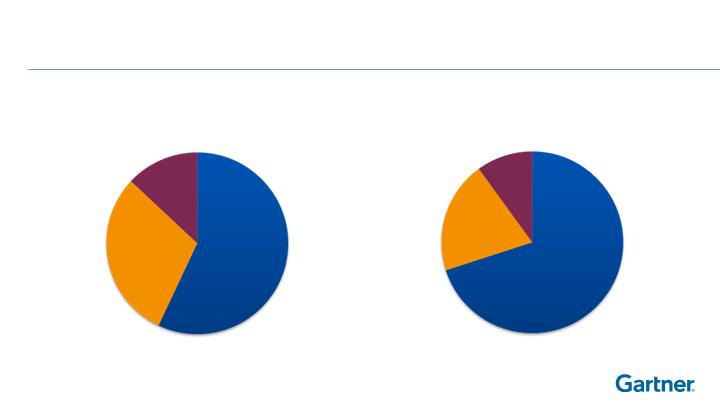

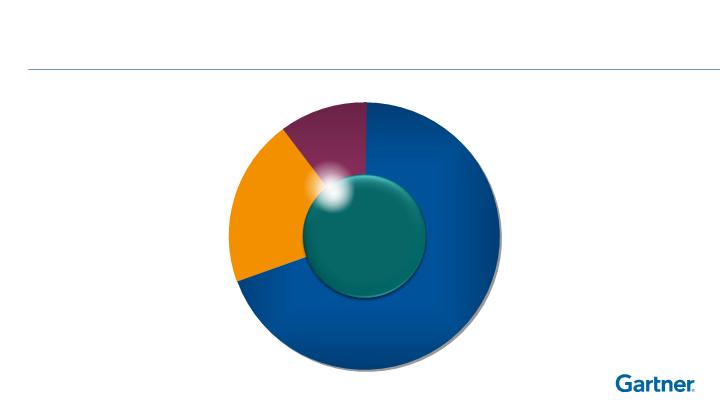

Extraordinary Research Insight Through

Three Business Segments

Extraordinary

Research

Insight

Note: Percentages based on midpoint of 2012 revenue guidance.

Gartner

Research

Business

70%

Extraordinary

Research

Insight

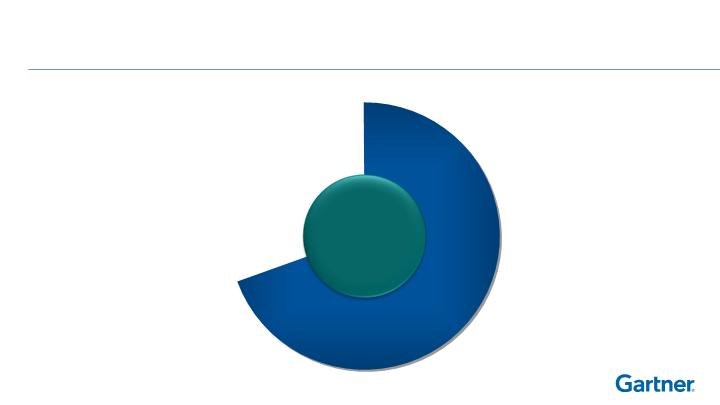

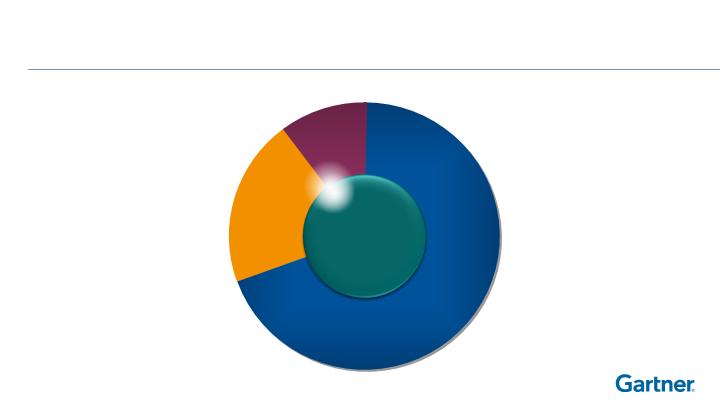

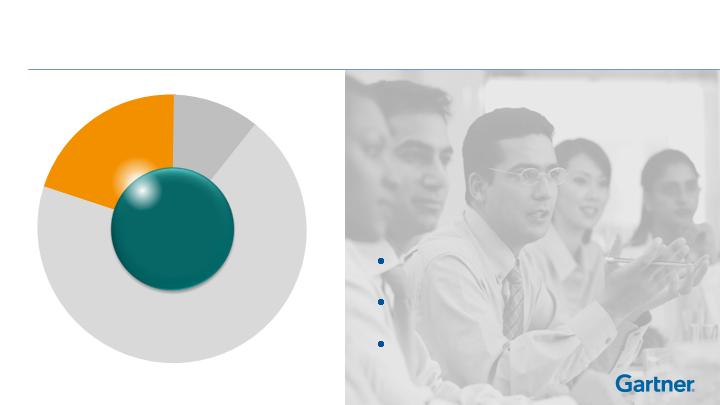

Extraordinary Research Insight Through

Three Business Segments

Note: Percentages based on midpoint of 2012 revenue guidance.

Gartner

Consulting

Business

20%

Gartner

Research

Business

70%

Extraordinary

Research

Insight

Extraordinary Research Insight Through

Three Business Segments

Note: Percentages based on midpoint of 2012 revenue guidance.

Gartner

Consulting

Business

20%

Gartner

Research

Business

70%

Gartner Events

Business

10%

Extraordinary

Research

Insight

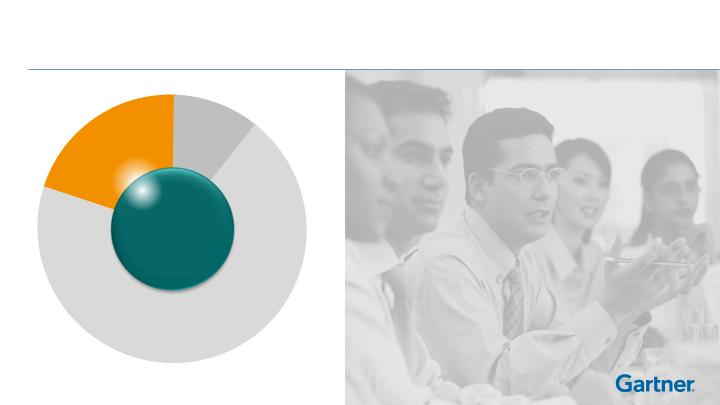

Extraordinary Research Insight Through

Three Business Segments

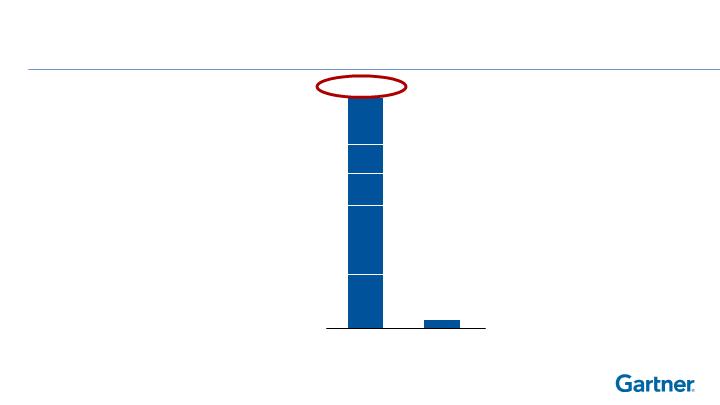

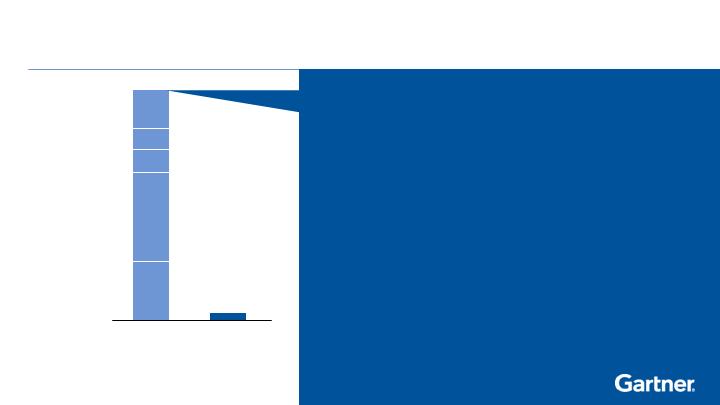

A Vast, Untapped Market Opportunity

Source: Gartner internal estimates.

$1.1 Billion**

* technology, professional services, telecommunications and investors

** 2011 ending contract value

$47 Billion

2012

12

18

5

4

8

Other*

Front-line IT

Professionals

Supply Chain

CIOs

IT Functional

Leaders

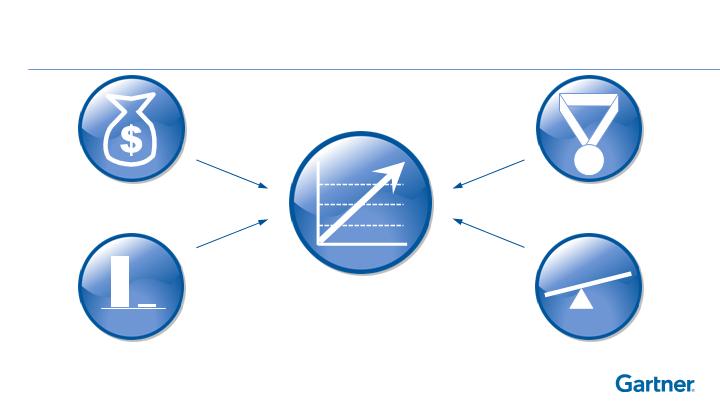

Winning Growth Strategy

Extraordinary

Research

Insight

Strong Sales

Capability

High-Value

Differentiated

Offerings

Performance-Driven Leadership Team

Continuous Improvement and Innovation

World-Class

Service

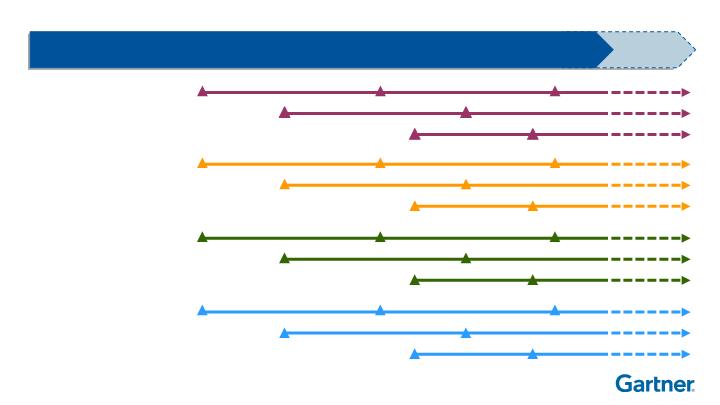

Extraordinary Research Insight

2005

Today

Focus on

Critical Topics

V2

V3

V4

V5

V6

V7

Expanded

Coverage Areas

Enterprise Architecture

Supply Chain

Tech Professionals

Analyst Time

Optimization

V1

V2

V3

2005

Today

Extraordinary

Research Insight

Strong Sales

Capability

High-Value,

Differentiated

Offerings

World Class

Service

Winning Growth Strategy

Extraordinary

Research

Insight

Strong Sales

Capability

High-Value

Differentiated

Offerings

Performance-Driven Leadership Team

Continuous Improvement and Innovation

World-Class

Service

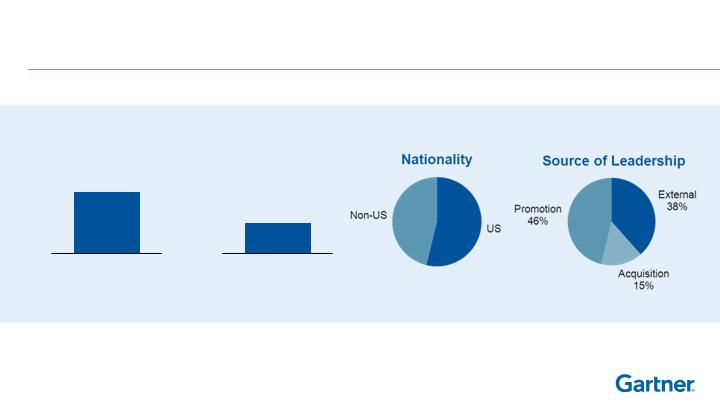

Performance Driven Leadership Team

Tenure

World-Class Talent

Global

6 years

Avg Tenure in Role

12 years

Avg Tenure at Gartner

Winning Growth Strategy

Extraordinary

Research

Insight

Strong Sales

Capability

High-Value

Differentiated

Offerings

Performance-Driven Leadership Team

Continuous Improvement and Innovation

World-Class

Service

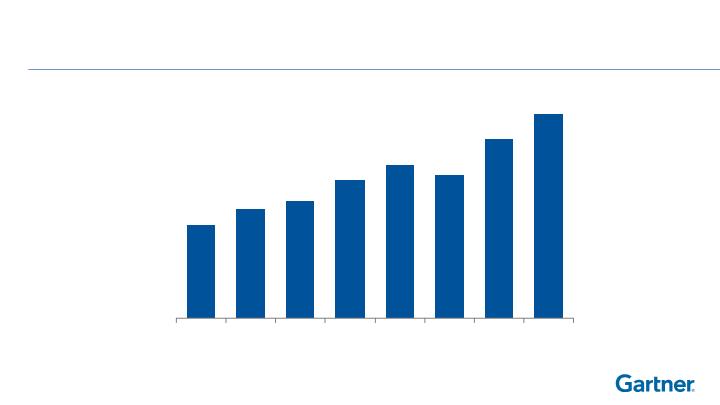

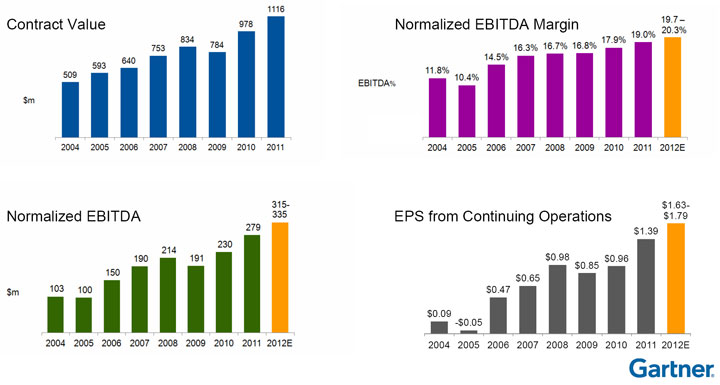

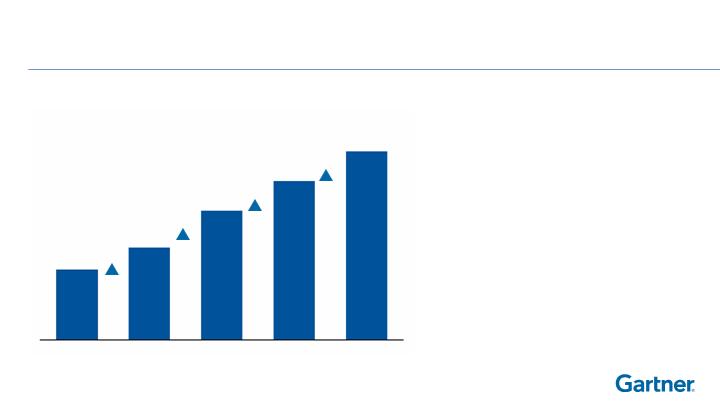

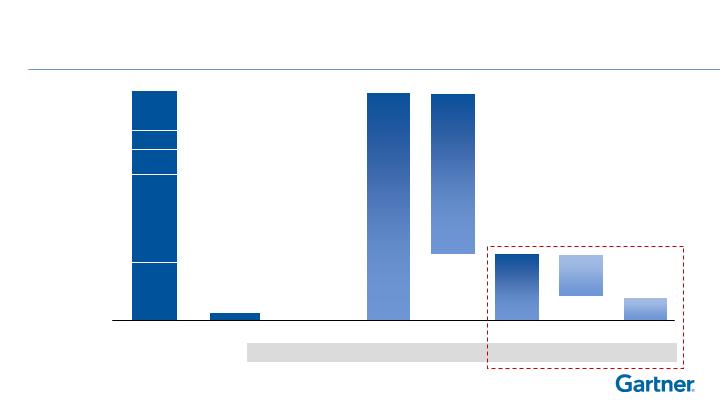

Contract Value

509

593

640

753

834

784

978

1116

2004

2005

2006

2007

2008

2009

2010

2011

$m

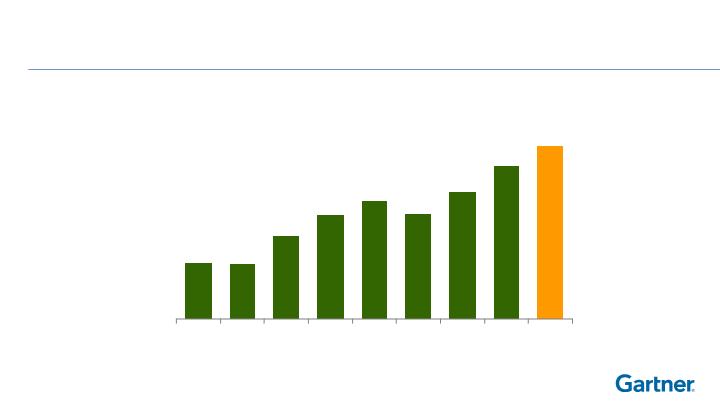

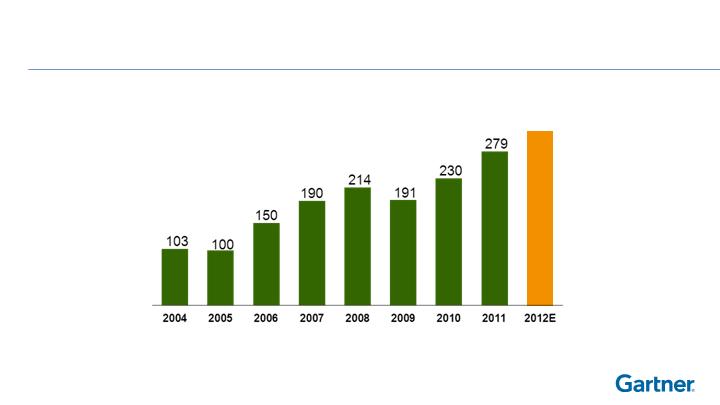

Normalized EBITDA

Restated to exclude results of Vision Events. See attached Glossary for a discussion of normalized EBITDA.

$m

103

100

150

190

214

191

230

279

315-

335

2004

2005

2006

2007

2008

2009

2010

2011

2012E

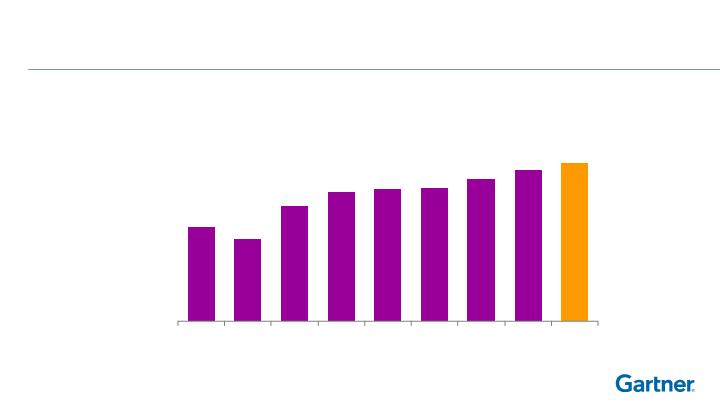

Normalized EBITDA Margin

Restated to exclude results of Vision Events. See attached Glossary for a discussion of normalized EBITDA.

19.7 –

20.3%

11.8%

10.4%

14.5%

16.3%

16.7%

16.8%

17.9%

19.0%

2004

2005

2006

2007

2008

2009

2010

2011

2012E

EBITDA

%

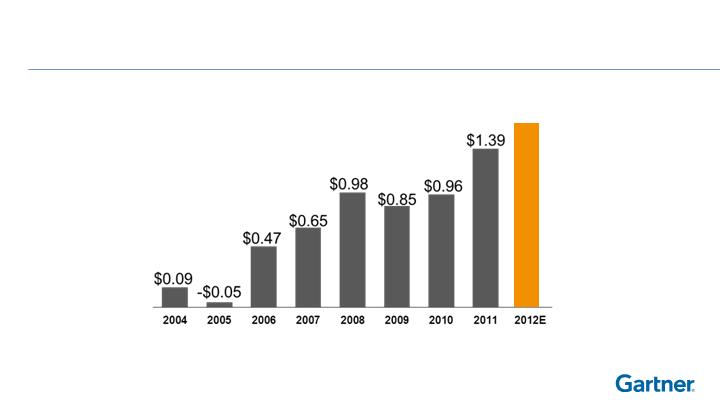

EPS from Continuing Operations

$0.09

-$0.05

$0.47

$0.65

$0.98

$0.85

$0.96

$1.39

$

1.63-

$1.79

2004

2005

2006

2007

2008

2009

2010

2011

2012E

5,100 CIOs

The World’s Most Important Gathering of CIOs and Senior IT Executives

2012 Sales Kickoff

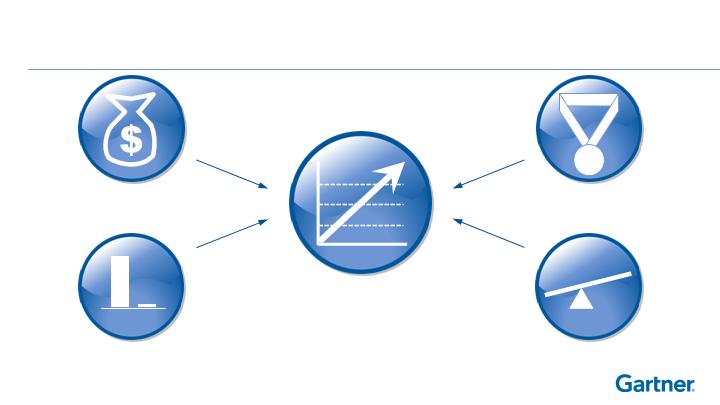

Why Invest in Gartner?

Long-term,

Double-Digit

Revenue, EPS &

CF Growth

Winning Strategy

Exceptional Business Model

Vast Market Opportunity

Strong Value Proposition

Senior Vice President

Research

Peter Sondergaard

Gartner Research

Winning Strategy

Strong Value Proposition

Vast Market Opportunity

The Next Age of Computing

INFORMATION

MOBILE

SOCIAL

CLOUD

NEXUS OF FORCES

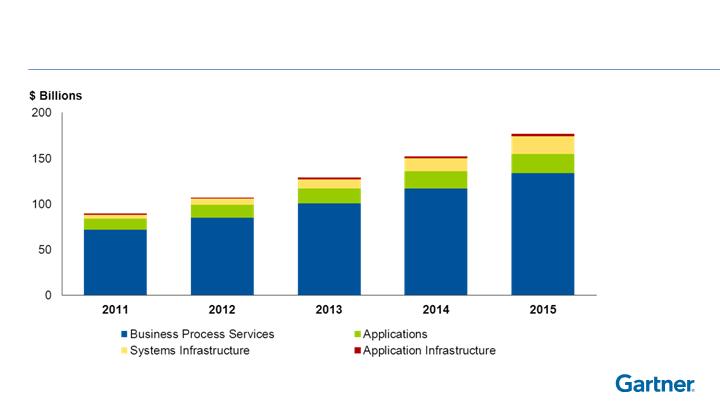

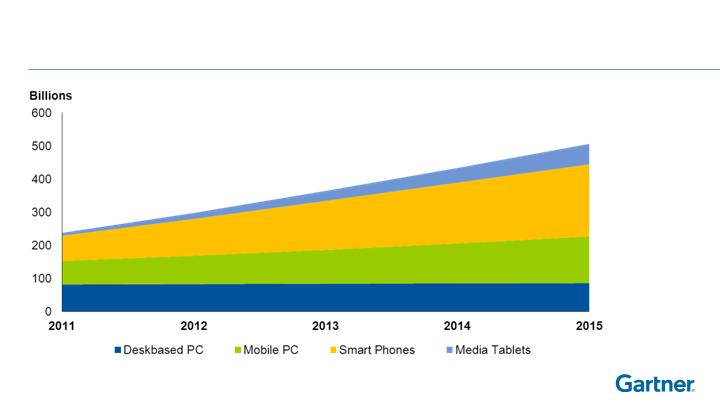

Public Cloud Growth

Source: Gartner Estimates (2Q11 Update)

The Next Age of Computing

INFORMATION

MOBILE

SOCIAL

CLOUD

NEXUS OF FORCES

What’s Installed

Source: Gartner Estimates (2Q11 Update)

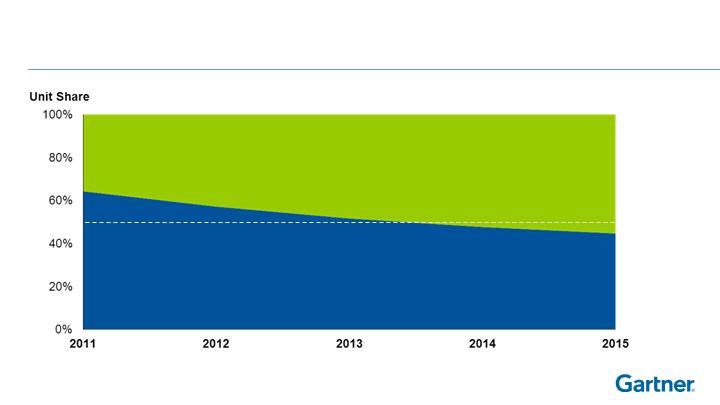

The Big Shift

Source: Gartner Estimates (2Q11 Update)

Mobile OS

PC OS

The Next Age of Computing

INFORMATION

MOBILE

SOCIAL

CLOUD

NEXUS OF FORCES

2012 Client Key Initiatives

Source: Gartner.com Data, January 2012

1 Cloud Computing

2 Mobile Enterprise Strategy

3 Enterprise Architecture

4 IT Strategic Planning

5 IT Governance

6 ITIL and Process Improvement

7 Data Center Modernization

8 IT Cost Optimization

9 Business Intelligence

10 Application Development

Rank Key Initiative

Rank Key Initiative

2006 Client Key Initiatives

Source: Gartner.com Data, January 2007

4 Application Development

5 ERP & Supply

Chain

Management

6 Mobile & Wireless

7 Customer Relationship

Management

8 Application Integration

and

Middleware

9 Outsourcing

10 Emerging Technologies

1 IT Strategic Planning

2 Security & Privacy

3 Business Intelligence

Rank Key Initiative

Rank Key Initiative

Gartner Research

Note: Percentages based on midpoint of 2012 revenue guidance.

Gartner

Research

Business

Gartner

Consulting

Business

Gartner Events

Business

20%

70%

Extraordinary

Research

Insight

10%

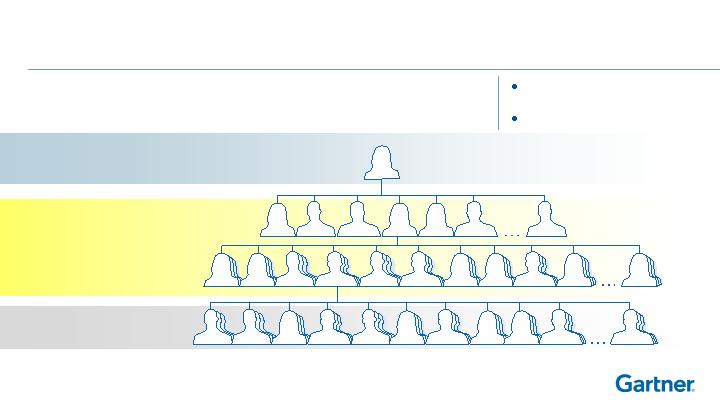

Gartner Research Model

The Research Process

People

Process

Proprietary Data

Packaging

Gartner Research Model

The People — Analysts

Subject Matter Experts

Over 810 analysts in 26 countries

Over 135 based in APAC,

over 190

based in Europe

Minimum 12 years of experience at

time of hire

60% have 20+ years of industry

experience

135

190

485

People

Process

Proprietary Data

Packaging

Gartner Research Model

The Research Process

Decision Makers

in 12,400 organizations

Academic

Institutions

Technology &

Service Providers

12,000 briefings

Investors

People

Process

Proprietary Data

Packaging

Gartner Research Model

The Research Process

People

Process

Proprietary Data

Packaging

Transparency

Objectivity

Collaboration

Quality

2 Mobile Enterprise Strategy

3 Enterprise Architecture

4 IT Strategic Planning

5 IT Governance

Rank Key Initiative

1 Cloud Computing

Gartner Research Model

The Research Process

People

Process

Proprietary Data

Packaging

Gartner Research Model

Proprietary Data and Analytics

42

Proprietary Data and Analytics

Over 2,300

contract

reviews

and almost

8,500 strategy

reviews

A terabyte of

continually

updated market

data

5,500 IT Cost

and Price

benchmarks

290,000

recorded

interactions

5.5 million

document page

views

4.5 million

end-user

searches per

year

People

Process

Proprietary Data

Packaging

8,600 documents annually including:

Magic Quadrants

Hype Cycles

Vendor Ratings

Written Actionable Advice

Gartner Research Model

Packaging and Presentation

People

Process

Proprietary Data

Packaging

Scalable structure and process to

handle 290,000 interactions

Phone access to analysts

Face-to-face interactions

Interactions

Gartner Research Model

Packaging and Presentation

People

Process

Proprietary Data

Packaging

Gartner Research

Highly differentiated insight

delivered primarily through

digital media subscriptions

Gartner Research Business

Gartner

Research

Business

Note: Percentages based on midpoint of 2012 revenue guidance.

70%

People

Process

Proprietary Data

Packaging

Gartner for IT Executives

Equips CIOs with the role-specific tools and

knowledge they need to deliver exceptional

business results for their organizations

Gartner Research

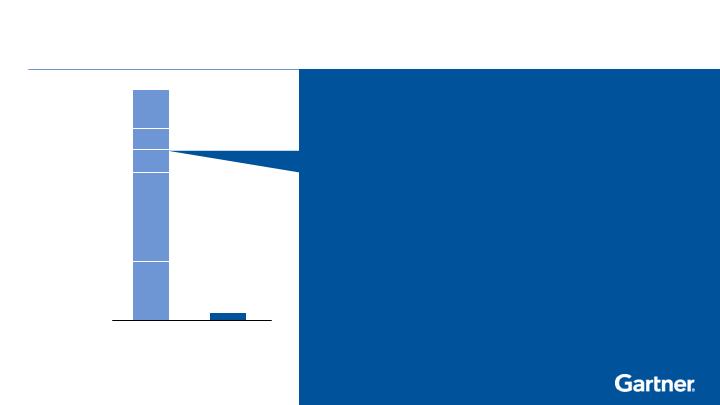

Vast Untapped Market Opportunity

$1.1 Billion**

Source: Gartner internal estimates

* technology, professional services, telecommunications

and investors

** 2011 ending contract value

$47 Billion

2012

Other*

Front-line IT

Professionals

Supply Chain

CIOs

IT Functional

Leaders

12

18

5

4

8

Gartner Research

Vast Untapped Market Opportunity

$1.1 Billion**

Source: Gartner internal estimates

* technology, professional services, telecommunications

and investors

** 2011 ending contract value

$47 Billion

2012

Other*

Front-line IT

Professionals

Supply Chain

CIOs

IT Functional

Leaders

12

18

5

4

8

Gartner for IT Leaders

Provides IT leaders with just-in-time, role-

specific insight and advice from Gartner

analysts to drive success on critical initiatives

and IT purchases

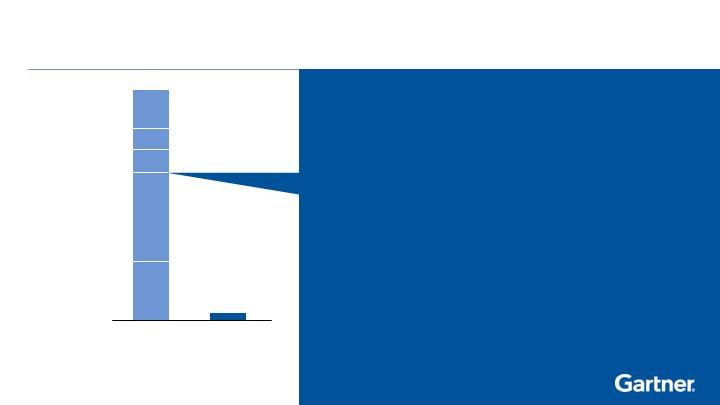

Gartner Research

Vast Untapped Market Opportunity

$1.1 Billion**

Source: Gartner internal estimates

* technology, professional services, telecommunications

and investors

** 2011 ending contract value

$47 Billion

2012

Other*

Front-line IT

Professionals

Supply Chain

CIOs

IT Functional

Leaders

12

18

5

4

8

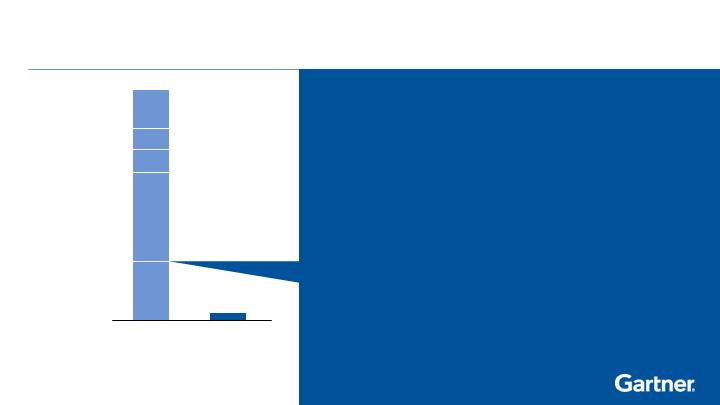

Gartner for Technical Professionals

Provides IT technical professionals with in-depth

advice to drive technology architecture decisions

and implementation strategy

Gartner for Supply Leaders

Provides Supply Chain leaders within different

industries advice and tools to optimize and drive

success on critical initiatives around their specific

value chain

Gartner Research

Vast Untapped Market Opportunity

$1.1 Billion**

Source: Gartner internal estimates

* technology, professional services, telecommunications

and investors

** 2011 ending contract value

$47 Billion

2012

Other*

Front-line IT

Professionals

Supply Chain

CIOs

IT Functional

Leaders

12

18

5

4

8

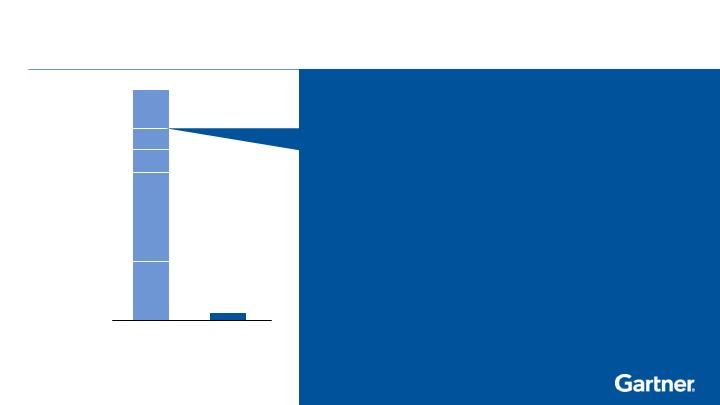

Gartner Research

Vast Untapped Market Opportunity

$1.1 Billion**

Source: Gartner internal estimates

* technology, professional services, telecommunications

and investors

** 2011 ending contract value

$47 Billion

2012

Other*

Front-line IT

Professionals

Supply Chain

CIOs

IT Functional

Leaders

12

18

5

4

8

Gartner for Business Leaders

Provides business leaders in Technology and

Service providers with the tools and insight to

ensure they succeed in the marketplace

Continuous Product Innovation

Content

Technology Platform

Usability/interface

Strong Value Proposition

Right direction,

right away

Immediate

shortlists on key

initiatives

Contract reviews

Best-practice

budget benchmark

Cost avoidance

Global perspective

Best practice by

vertical industry

Strategic guidance

Making the right

decision

Personal

development

Increased credibility

Save Time

Save Money

Gain

Resources

Gain

Confidence

Gartner Research

Winning Strategy

Vast Market Opportunity

Strong Value Proposition

Senior Vice President

Gartner Events

Alwyn Dawkins

Gartner Events

Winning Strategy

Vast Market Opportunity

Strong Value Proposition

Gartner Events

Gartner

Events

Business

Differentiated live

events leveraging

research content

Gartner Events

Business

Note: Percentages based on midpoint of 2012 revenue guidance.

Extraordinary

Research

Insight

10%

Make every conference we produce the MUST

ATTEND

event for the communities we serve

Our mission:

Gartner Events

Business

Gartner Events

60 Events

6 Continents

42,800 Attendees

1,500 Exhibitors

World’s Leading IT Conference Producer

Extraordinary

Research

Insight

10%

10%

People

Process

Proprietary

Data

Gartner Events

Gartner Events

Business

Current

Relevant

Actionable

Note: Percentages based on midpoint of 2012 revenue guidance.

Attendee Value Proposition

Face-to-face Analyst interaction

Industry leaders

Unparalleled peer networking

Access to leading solution

providers

Actionable advice

Exhibitor Value Proposition

Face to face interaction

with high level attendees

Cost effective means to

generate leads

2011 Gartner Event Portfolio

60 strategic conferences

15% increase in global attendance

5,100 CIOs (up 18% YoY) and over 18,000 Attendees (up 16% YoY)

The World’s Most Important Gathering of CIOs and Senior IT Executives

Symposium strategy driving

increased CIO attendance

5,100 plus CIOs

18% YOY increase

2007

2010

2008

2009

2011

+32%

+40%

+23%

+18%

1,900

2,500

3,500

4,300

5,100

Global Symposium CIO Attendance

2012 Gartner Event Portfolio

63 strategic conferences

Gartner Events

Winning Strategy

Vast Market Opportunity

Strong Value Proposition

Senior Vice President

Gartner Consulting

Per Anders Waern

Gartner Consulting

Longer-term differentiated

engagements leveraging

Gartner research

Gartner

Consulting

Business

Note: Percentages based on midpoint of 2012 revenue guidance.

20%

Extraordinary

Research

Insight

Gartner Consulting

Winning Strategy

Vast Market Opportunity

Strong Value Proposition

Gartner Consulting

Note: Percentages based on midpoint of 2012 revenue guidance.

Core Consulting

Benchmarking Services

Contract Optimization

20%

Extraordinary

Research

Insight

Gartner Consulting

Note: Percentages based on midpoint of 2012 revenue guidance.

Independent and Objective

Powered by Gartner

Research

Proprietary Benchmark

Enabled

20%

Extraordinary

Research

Insight

Experienced Senior Practitioners

481 billable Consultants

$424K average annual

revenue per head

Powerful value proposition

for attracting top talent

Managing Partner

Trust-based relationships

Repeatable services

Gartner Consulting

Note: Percentages based on midpoint of 2012 revenue guidance.

Longer-term differentiated

engagements leveraging

Gartner research

50% cost savings

Mobility roadmap

Cloud strategy

20%

Extraordinary

Research

Insight

Contract Optimization

>$1.4B

in documented client savings

Gartner Consulting Contract Optimization

Gartner Consulting

Note: Percentages based on midpoint of 2012 revenue guidance.

Longer-term differentiated

engagements leveraging

Gartner research

20%

Extraordinary

Research

Insight

Gartner Consulting – Continuous Productivity

Improvements

Gross Contribution Margin

37%

34%

2011

2004

Note: 2004 Gross Contribution Margin re-stated to reflect the impact of equity compensation expense – impact is 1 pt.

Gartner Consulting

Winning Strategy

Strong Value Proposition

Vast Market Opportunity

Senior Vice President

Worldwide Sales

David Godfrey

Gartner

Note: Percentages based on midpoint of 2012 revenue guidance.

Gartner

Research

Business

Gartner

Consulting

Business

Gartner Events

Business

20%

70%

10%

Extraordinary

Research

Insight

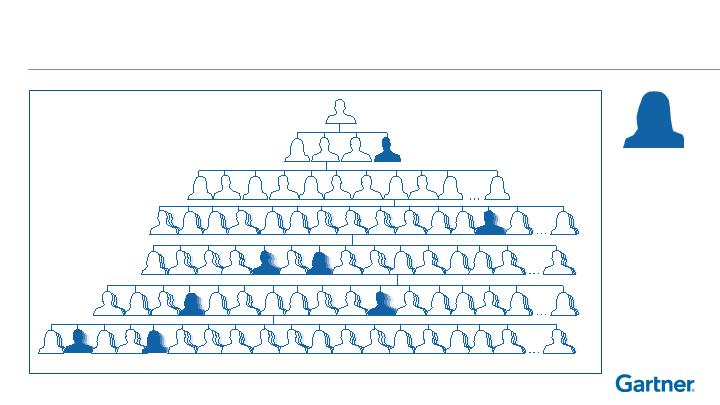

Gartner Sales

Gartner Sales

1,268 quota-bearing

sales associates

186% growth since

2004

48% outside of United

States

Profile of a

Gartner Account

Executive

Highly motivated

Great sales DNA

Passionate

Goal oriented

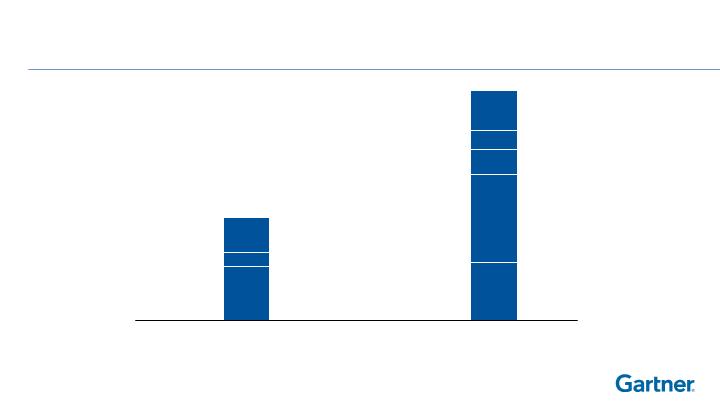

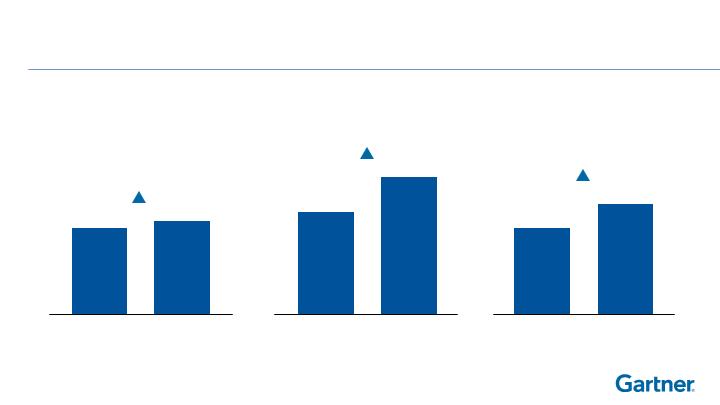

Market Opportunity

2008

80,000

2012

108,000

Enterprise Opportunity

Market Opportunity

2008

19,000

2012

34,000

Covered Enterprises

Market Opportunity

2008

6,800

2012

8,100

Client Enterprises

18

5

8

$47 Billion

2012

Other*

Front-line IT

Professionals

Supply Chain

CIOs

IT Functional

Leaders

Total Market Opportunity

* technology, professional services, telecommunications and investors

Source: Gartner internal estimates

Other*

CIOs

IT Functional

Leaders

2008

$21 Billion

7

11

3

12

4

74,000

Total

108,000

Uncovered

Covered

34,000

# of Enterprises

12

18

5

4

8

$47 Billion

2012

Other*

Front-line IT

Professionals

Supply Chain

CIOs

IT Functional

Leaders

Prospects

Clients

25,900

8,100

Percent of Total

100%

69%

31%

24%

7%

$1.1 Billion**

Vast Market Opportunity For Research

* technology, professional services, telecommunications and investors

** 2011 ending contract value

Source: Gartner internal estimates

Research sold as subscriptions to individuals

IT Functional Leaders

IT Professionals

CIO

Role-based

Recurring revenue

Case Study: Growing the Account

Case Study: Growing the Account

Gartner Sales

Winning Strategy

Vast Market Opportunity

Strong Value Proposition

Sales Strategy to Capture Market Opportunity

Coverage

Capacity

Sales

Effectiveness

Sales Strategy to Capture Market Opportunity

Coverage

Capacity

Sales

Effectivenes

s

Sales Strategy to Capture Market Opportunity

Capacity

Sales

Effectivenes

s

Coverage

Sales Strategy to Capture Market Opportunity

Capacity

Coverage

Sales Effectiveness

Sales Strategy to Capture Market Opportunity

15 - 20% increased annual sales headcount

objective

Architected recruitment and training plan

Capacity

Sales Strategy to Capture Market Opportunity

15 - 20% increased annual sales headcount

objective

Architected recruitment and training plan

Capacity

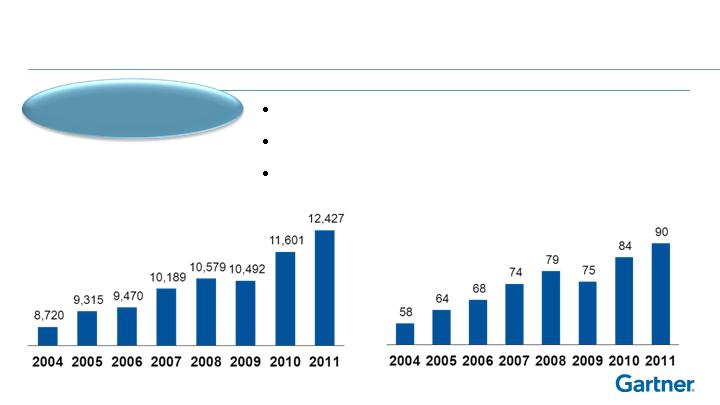

Direct Quota Bearing Headcount

Gartner Sales: A great place to work

Gartner culture

Collaboration

Leading tools and

Best Practices

Access to the C-Level

Innovative products

Sales Strategy to Capture Market Opportunity

Focused channel approach

Matched to global opportunity

Emphasizing client intimacy

Coverage

Research Client Organizations

Average Contract Value

per Organization

$K

Sales Strategy to Capture Market Opportunity

Great Talent

World Class Training

Proprietary Tools and Best Practices

Sales

Effectiveness

Gartner Sales

Winning Strategy

Strong Value Proposition

Vast Market Opportunity

Gartner Chief Financial Officer

Chris Lafond

Consistent, Winning Growth Strategy

Extraordinary

Research

Insight

Strong Sales

Capability

High-Value

Differentiated

Offerings

Performance-Driven Leadership Team

Continuous Improvement and Innovation

World-Class

Service

Consistent, Winning Growth Strategy:

The Financial Plan We Set in 2005

Grow the Research business

Optimize the Events portfolio

Improve the profitability of the Consulting business

Leverage our G&A infrastructure

Drive shareholder value

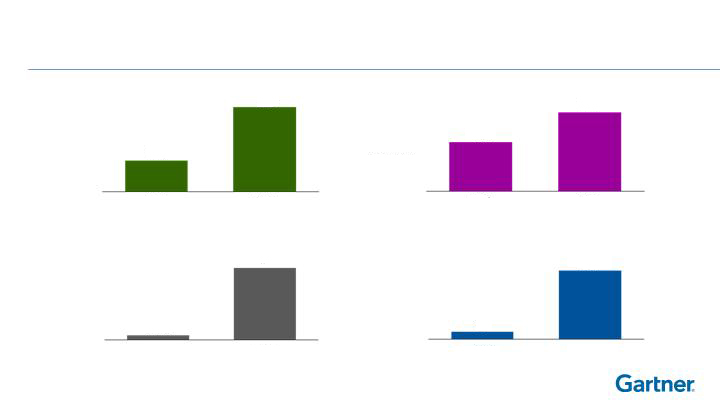

Grow the Research Business

Contract Value

>100%

1,116

509

$M

2004

2011

Consistent Growth Strategy:

Grow the Research Business

(a)

Based on midpoint of 2012 revenue guidance.

Events 13%

2004

Consulting

30%

Research 57%

Events 10%

2012 Estimate (a)

Consulting

20%

Research

70%

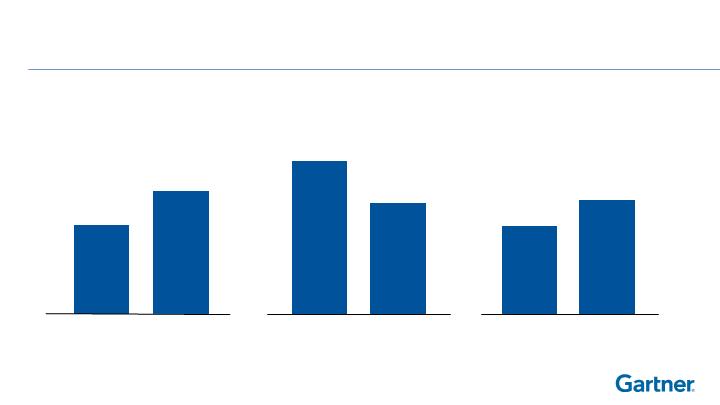

Optimize the Events Portfolio

# Events

+7%

2004

60

2011

56

Attendees

30,999

42,808

+38%

2004

2011

1,321

+16%

1,532

2004

2011

Exhibitors

Revenue ($M)

2004

$259

2011

$308

Headcount

2004

493

2011

481

Gross Contribution

Margin (%)

2004

34%

2011

37%

Improve Consulting Profitability

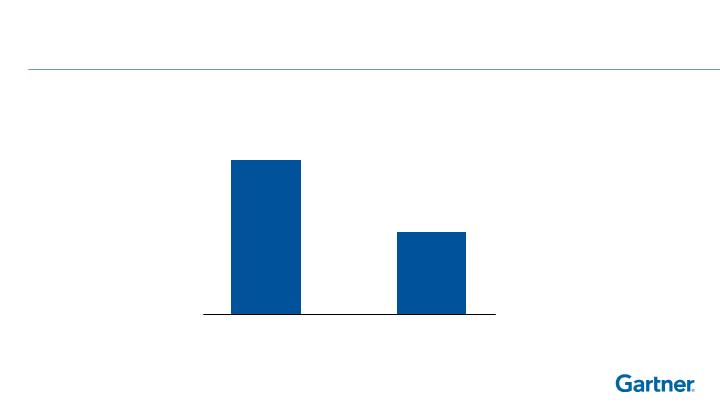

Leverage our G & A Infrastructure

2004

18% of

revenue

2011

15% of

revenue

Drive Shareholder Value

44 Million shares

repurchased

$963.5M returned

to shareholders

Shares Outstanding ($000’s)

2004

126,326

2011

98,846

-21%

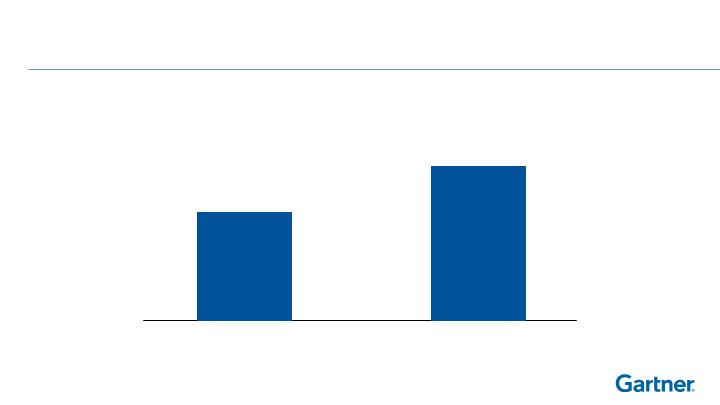

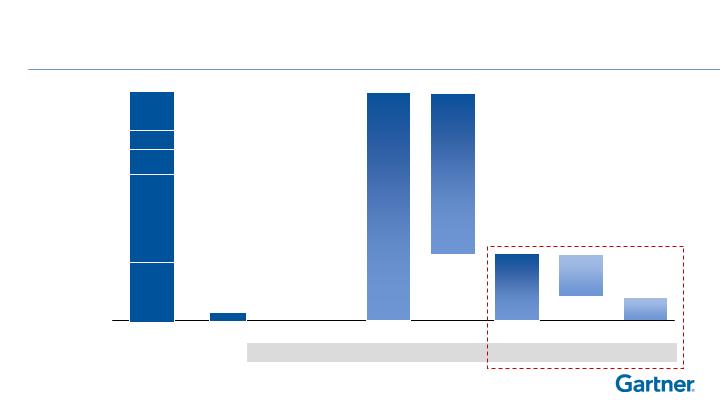

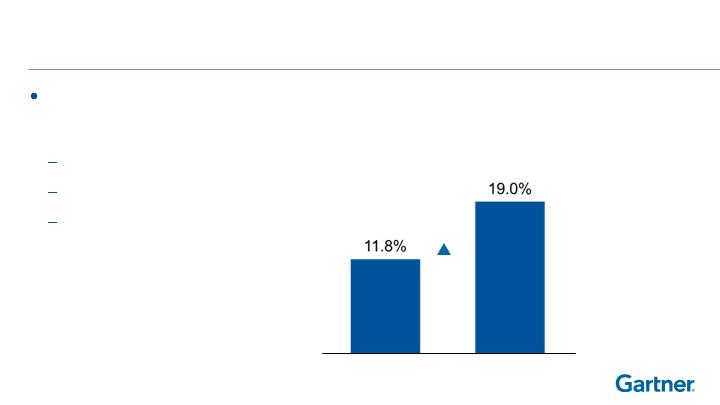

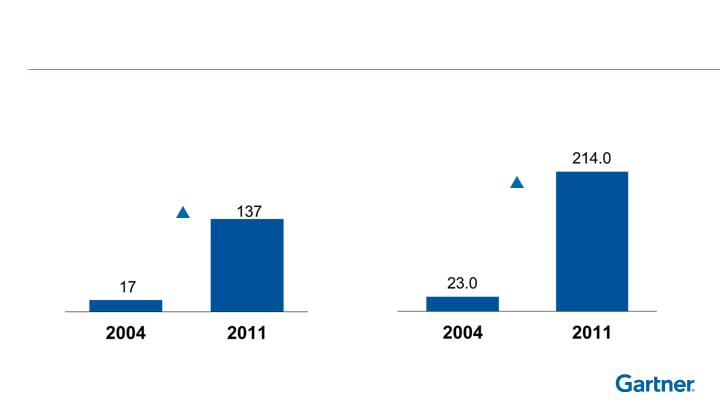

Consistent, Winning Growth Strategy:

CF & Earnings Track Record

Normalized EBITDA (a)

$ in millions

103

279

EBITDA%

2004

2011

11.8

19.0

2004

2011

Normalized EBITDA Margin (a)

EPS from Continuing Operations

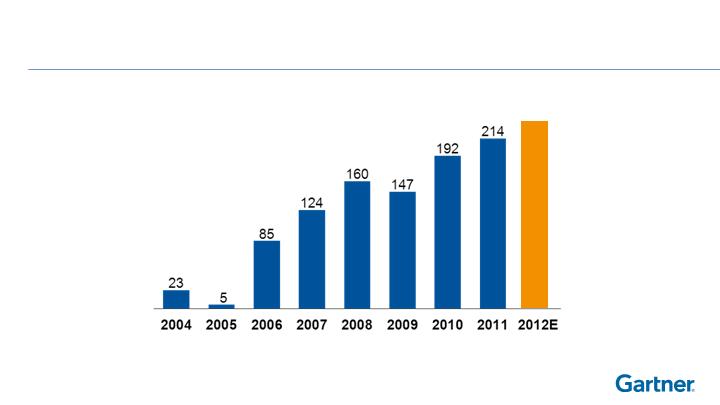

Free Cash Flow (a)

2004

$0.09

$1.39

2011

23

2004

214

2011

$ in millions

(a)

See the attached Glossary for the definition of Free Cash Flow, and cautionary statement regarding this non-GAAP

financial measure.

Why Invest in Gartner?

Long-term,

Double-Digit

Revenue, EPS &

CF Growth

Winning Strategy

Exceptional Business Model

Vast Market Opportunity

Strong Value Proposition

Value Proposition: We Deliver Our Extraordinary

Research Insight Through Three Business Segments

Note: Percentages based on midpoint of 2012 revenue guidance.

Gartner

Research

Business

Gartner

Consulting

Business

Gartner Events

Business

20%

70%

10%

Extraordinary

Research

Insight

Vast Market Opportunity For Research

Prospects

Clients

25,900

8,100

Percent of Total

100%

69%

31%

24%

7%

74,000

Total

108,000

Uncovered

Covered

34,000

# of Enterprises

$1.1 Billion**

* technology, professional services, telecommunications and investors

** 2011 ending contract value

Source: Gartner internal estimates

$47 Billion

2012

Other*

Front-line IT

Professionals

Supply Chain

CIOs

IT Functional

Leaders

8

4

5

18

12

Attractive and Predictable Business Model

Subscription-based business model

High renewal/retention rates–80% plus–attractive

level of recurring revenue

Negative working capital

High incremental margins

Strong balance sheet

High level of conversion from earnings into FCF

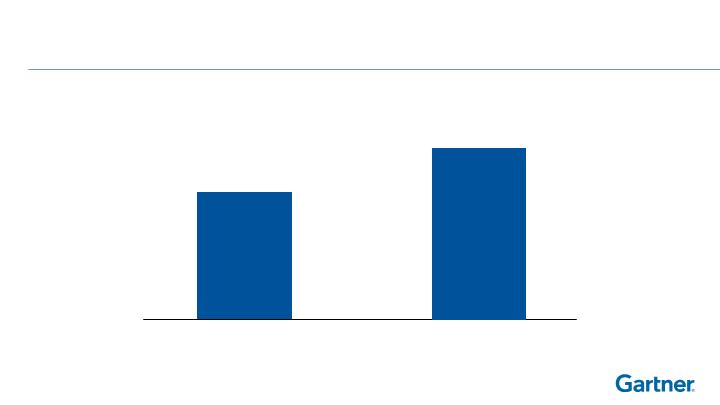

Attractive Business Model: Margin Expansion

High incremental gross contribution margin

long-term targets

Research—70%

Events—50%

Consulting—40%

Normalized EBITDA Margin

+720

BPS

2004

2011

Attractive Business Model: Strong Cash Flow

Leverage Conversion

(a)

See the attached Glossary for the definition of Free Cash Flow, and cautionary statement regarding this non-GAAP financial

measure.

Net Income

$ in millions

+706%

+830%

Free Cash Flow (a)

$ in millions

Long-Term Financial Objectives

Normalized EBITDA

margin improvement

50 – 150 bps per year

Total Revenue Growth

11 – 16%

Annual

Research

15 – 20%

Consulting

3 – 8%

Events

5 – 10%

Consistent Growth Strategy

(a)

Restated to exclude results of Vision Events.

(b)

See the attached Glossary for the definition of Normalized EBITDA, and cautionary statement regarding this non-GAAP financial measure

(c)

2012 Normalized EBITDA margin based upon mid-point of 2012 guidance

(d)

See Forward Looking Statement disclaimer on page 1 for factors that may affect our ability to achieve these results.

(e)

See the attached Glossary for the definition of Free Cash Flow, and cautionary statement regarding this non-GAAP financial measure

Total Revenue (a, d)

$ in millions

1,600-

1,650

Consistent Growth Strategy

(a)

Restated to exclude results of Vision Events.

(b)

See the attached Glossary for the definition of Normalized EBITDA, and cautionary statement regarding this non-GAAP financial measure

(c)

2012 Normalized EBITDA margin based upon mid-point of 2012 guidance

(d)

See Forward Looking Statement disclaimer on page 1 for factors that may affect our ability to achieve these results.

(e)

See the attached Glossary for the definition of Free Cash Flow, and cautionary statement regarding this non-GAAP financial measure

Normalized EBITDA (a, b, c, d)

315-

335

Consistent Growth Strategy

(a)

Restated to exclude results of Vision Events.

(b)

See the attached Glossary for the definition of Normalized EBITDA, and cautionary statement regarding this non-GAAP financial measure

(c)

2012 Normalized EBITDA margin based upon mid-point of 2012 guidance

(d)

See Forward Looking Statement disclaimer on page 1 for factors that may affect our ability to achieve these results.

(e)

See the attached Glossary for the definition of Free Cash Flow, and cautionary statement regarding this non-GAAP financial measure

EPS from Continuing Operations (d)

$1.63-

$1.79

Consistent Growth Strategy

(a)

Restated to exclude results of Vision Events.

(b)

See the attached Glossary for the definition of Normalized EBITDA, and cautionary statement regarding this non-GAAP financial measure

(c)

2012 Normalized EBITDA margin based upon mid-point of 2012 guidance

(d)

See Forward Looking Statement disclaimer on page 1 for factors that may affect our ability to achieve these results.

(e)

See the attached Glossary for the definition of Free Cash Flow, and cautionary statement regarding this non-GAAP financial measure

Free Cash Flow (a, d, e)

$ in millions

239-

257

Why Invest in Gartner?

Long-term,

Double-Digit

Revenue, EPS &

CF Growth

Winning Strategy

Exceptional Business Model

Vast Market Opportunity

8

Strong Value Proposition

Appendix

Projected 2012

Full Year Revenue and

EBITDA Outlook

($ in millions except per share data)

Research

$ 1,130

-

1,150

12%

-

14%

Consulting

310

-

330

1%

-

7%

Events

160

-

170

8%

-

14%

Total Revenue

$1,600

-

1,650

9%

-

12%

2012 Projection (1)

Reported

% change (1)

Normalized EBITDA (2)

$315

-

335

13%

-

20%

(1)

See Forward Looking Statement disclaimer on page 1 for factors that may affect our ability to

achieve these results.

(2)

See the attached Glossary for a discussion of Normalized EBITDA

Projected 2012

Earnings and Cash Flow

Outlook

($ in millions except per share data)

2012 Projection (3)

Reported

% change (1)

Diluted Income per share

$1.63

-

1.79

17%

-

29%

Operating Cash Flow (1)

$285

- 305

12%

-

19%

Capital Expenditures (1)

(46)

- (48)

Free Cash Flow (2)

239

- 257

12%

-

20%

(1)

Capital expenditures includes $16.0 million of estimated payments we will make for the renovation of our Stamford headquarters facility, which are contractually reimbursable

from the landlord. The accounting

impact of these renovation payments increases both cash flow from operations and capital expenditures (investing activities) by the same

amount and as a result has no net impact on Free Cash Flow.

(2)

See the attached Glossary for a discussion of Free Cash Flow.

(3)

See Forward Looking Statement disclaimer on page 1 for factors that may affect our ability to achieve these results.

Projected 2012 Quarterly Phasing – Revenue

Research revenue driven by retention rates and timing of new

business

Balanced renewals with 26% expected in Q1

Fourth quarter historically the largest for new business

Events revenue recognized when conferences delivered

Symposium Series in Q4 drives phasing

12 events in Q1, 23 events in Q2, 13 events in Q3, and

15 events in Q4

Consulting revenue is seasonal

Q2 and Q4 slightly higher volume quarters

Q1 expected to be 23% of full year revenue

Note: See Forward Looking Statement disclaimer on page 1 for factors that may affect our

ability to achieve these results.

Projected 2012 Quarterly Phasing – Revenue

Research

Consulting

Events

Q1

Q2

Q3

Q4

24%

26%

25%

25%

22%

26%

24%

28%

11%

25%

11%

53%

Above based on midpoint of revenue guidance

Note: See Forward Looking Statement disclaimer on page 1 for factors that may affect our

ability to achieve these results.

Approximate estimated revenue phasing in 2012:

Projected 2012 Quarterly Phasing – Expense

Quarterly fluctuations in cost of services driven primarily by the

conference schedule in our Events business

Higher Research and Sales expenses in Q4 related to Symposia

and year-end sales support activities

G&A is less seasonal

Note: See Forward Looking Statement disclaimer on page 1 for factors that may affect our

ability to achieve these results.

Projected 2012 Sales, G&A and Other Expenses

Depreciation and amortization of $29 - 30 million

Interest expense of $10 – 11 million

Other income/expense of $2 – 3 million (primarily transaction FX

gains/losses)

Tax rate projected to be between 32 and 33%

Note: See Forward Looking Statement disclaimer on page 1 for factors

that may affect our ability to achieve these results.

Projected 2012 Quarterly Phasing – Earnings

Approximate income per share:

Q1

Q2

Q3

Q4

19%

36%

25%

20%

Above based on the midpoint of guidance

Based upon business conditions the Company may accelerate or

postpone expenses throughout the year which could shift earnings

between quarters

Note: See Forward Looking Statement disclaimer on page 1 for factors

that may affect our ability to achieve these results.

Why Invest in Gartner?

139

139

Long-term,

Double-Digit

Revenue, EPS &

CF Growth

Winning Strategy

Exceptional Business Model

Vast Market Opportunity

8

Strong Value Proposition

Glossary

140

Non-GAAP Financial Measures

Investors are cautioned that Normalized EBITDA and Free Cash Flow are not financial measures under generally accepted accounting principles. In addition, they should

not be construed as alternatives to any

other measures of performance determined in accordance with generally accepted accounting principles. These non-GAAP

financial measures are provided to enhance the user’s overall understanding of the Company’s current financial performance and the Company’s

prospects for the future.

Normalized EBITDA

Represents operating income excluding depreciation, accretion on obligations related to excess facilities, amortization, stock-based compensation expense, Acquisition

Adjustments and Other charges. We believe

Normalized EBITDA is an important measure of our recurring operations as it excludes items that may not be indicative of

our core operating results.

Reconciliation of Normalized EBITDA to GAAP

($ in millions)

2004

2005

2006

2007

2008

2009

2010

2011

Net income (loss)

$17

($2)

$58

$74

$104

$83

$96

$137

Interest expense, net

1

11

17

22

19

16

16

10

Other (income) expense, net

7

9

1

(3)

1

3

—

2

Discontinued operations (1)

(5)

(4)

(4)

(3)

(7)

—

—

—

Tax provision

16

7

26

40

48

33

38

65

Operating income (1)

$36

$20

$98

$129

$164

$134

$149

214

Normalizing adjustments:

Depreciation, accretion and amortization

31

36

34

28

28

28

36

32

META integration charges

—

15

1

—

—

—

—

—

Other charges

36

29

—

9

—

—

—

—

SFAS No. 123(R) stock compensation expense

—

—

17

24

21

26

33

33

Pre-acquisition deferred revenue fair value adjustments

—

4

—

Acquisition and Integration Charges (2)

3

8

—

Normalized EBITDA (1)

$103

$100

$150

$190

$213

$191

$230

$279

Glossary

141

Non-GAAP Financial Measures

Free Cash Flow: Represents cash provided by operating activities excluding cash charges related to the acquisitions of AMR Research and Burton

Group, which primarily consist of certain nonrecurring costs such

as severance and other exit costs (“Cash Acquisition and Integration Charges”), less

additions to property, equipment and leasehold improvements (“Capital Expenditures”). We believe

that Free Cash Flow is an important measure of

the recurring cash generated by the Company’s core operations that is available to be used to repurchase stock, repay debt obligations and invest in

future growth through new business development activities

or acquisitions.

Reconciliation of Free Cash Flow to GAAP

($ in millions)

2004

2005

2006

2007

2008

2009

2010

2011

Cash provided by operating activities

$48

$27

$106

$148

$184

$162

$205

$256

Cash Acquisition and Integration Charges

—

—

—

—

—

—

8

—

Capital Expenditures

(25)

(22)

(21)

(24)

(24)

(15)

(21)

(42)

Free Cash Flow

$23

$5

$85

124

$160

$147

$192

$214