Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Federal Home Loan Bank of New York | d299535d8k.htm |

| EX-99.1 - FHLBNY PRESS RELEASE DATED FEBRUARY 13, 2012 - Federal Home Loan Bank of New York | d299535dex991.htm |

Exhibit 99.2

FHLBNY Member Update

February 14, 2012

© FEDERAL 2011 FEDERAL HOME LOAN HOMEBANK LOAN OF BANK NEW OF YORK NEW YORK • 101 PARK AVENUE • NEW YORK, NY 10178 • WWW.FHLBNY.COM

Agenda

• Financial Highlights

• Advances Opportunities for Members

FEDERAL HOME LOAN BANK OF NEW YORK

FHLBNY: Mission and Strategic Vision

Our Mission

To advance housing opportunity and local community development by maximizing the capacity of community-based member-lenders to serve their markets.

Our Strategic Vision

“A balanced provider of liquidity to members in all operating environments”

» Balanced: FHLBNY provides members with competitively priced products while considering the risks of providing those products and the financial return requirements of the co-operative

» Provider of liquidity: FHLBNY will maintain a focus on advances but also continue to evaluate other ways of providing liquidity to members

» Members: FHLBNY will serve all eligible banks, thrifts, credit unions, and insurance companies, both large and small

» All operating environments: FHLBNY aims to be a source of liquidity for members in all economic conditions

FEDERAL HOME LOAN BANK OF NEW YORK 3

FINANCIAL HIGHLIGHTS

FEDERAL HOME LOAN BANK OF NEW YORK

FHLBNY Financial Results: Key Messages

• “Advances Bank”

• 2011 results were solid

• Strong performance record for customers and shareholders

• Balance sheet is conservatively positioned

FEDERAL HOME LOAN BANK OF NEW YORK

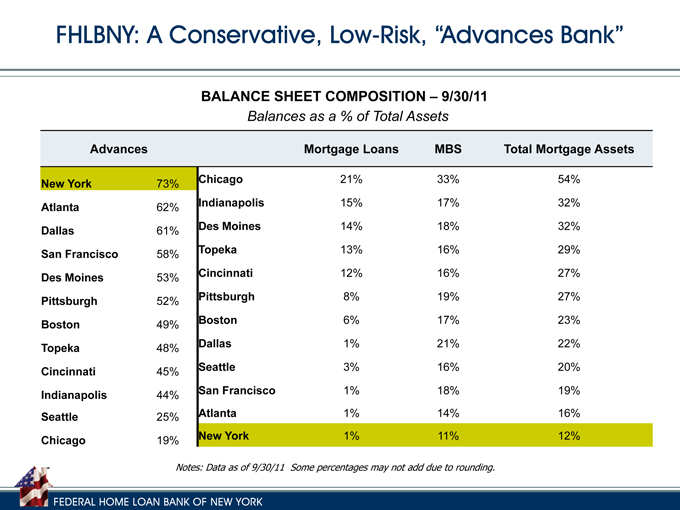

FHLBNY: A Conservative, Low-Risk, “Advances Bank”

BALANCE SHEET COMPOSITION – 9/30/11

Balances as a % of Total Assets

Advances Mortgage Loans MBS Total Mortgage Assets

New York 73% Chicago 21% 33% 54%

Atlanta 62% Indianapolis 15% 17% 32%

Dallas 61% Des Moines 14% 18% 32%

San Francisco 58% Topeka 13% 16% 29%

Des Moines 53% Cincinnati 12% 16% 27%

Pittsburgh 52% Pittsburgh 8% 19% 27%

Boston 49% Boston 6% 17% 23%

Topeka 48% Dallas 1% 21% 22%

Cincinnati 45% Seattle 3% 16% 20%

Indianapolis 44% San Francisco 1% 18% 19%

Seattle 25% Atlanta 1% 14% 16%

Chicago 19% New York 1% 11% 12%

Notes: Data as of 9/30/11 Some percentages may not add due to rounding.

FEDERAL HOME LOAN BANK OF NEW YORK

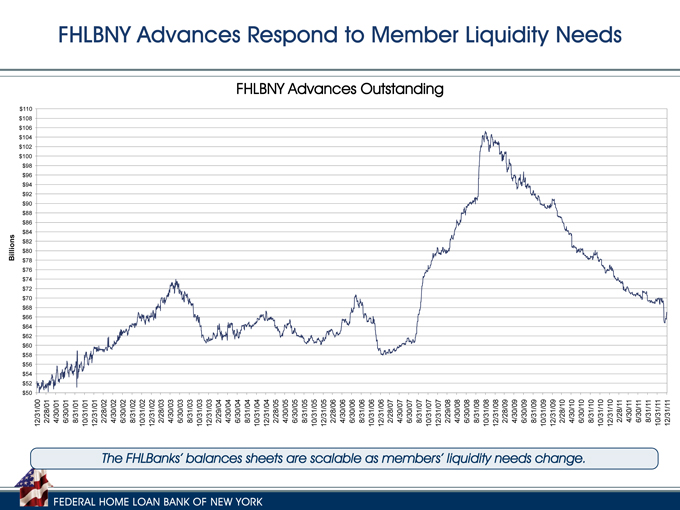

FHLBNY Advances Respond to Member Liquidity Needs

FHLBNY Advances Outstanding

The FHLBanks’ balances sheets are scalable as members’ liquidity needs change.

FEDERAL HOME LOAN BANK OF NEW YORK

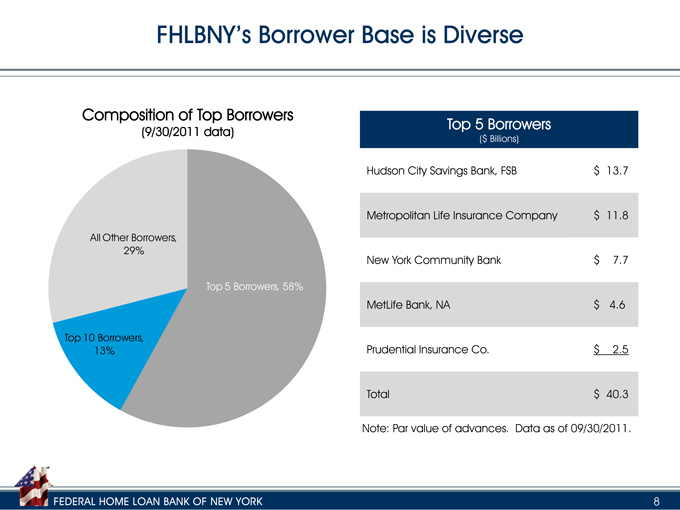

FHLBNY’s Borrower Base is Diverse

Composition of Top Borrowers

(9/30/2011 data)

All Other Borrowers, 29%

Top 10 Borrowers, 13%

Top 5 Borrowers, 58%

Top 5 Borrowers

($ Billions)

Hudson City Savings Bank, FSB $ 13.7 Metropolitan Life Insurance Company $ 11.8 New York Community Bank $ 7.7 MetLife Bank, NA $ 4.6 Prudential Insurance Co. $ 2.5 Total $ 40.3 Note: Par value of advances. Data as of 09/30/2011.

FEDERAL HOME LOAN BANK OF NEW YORK

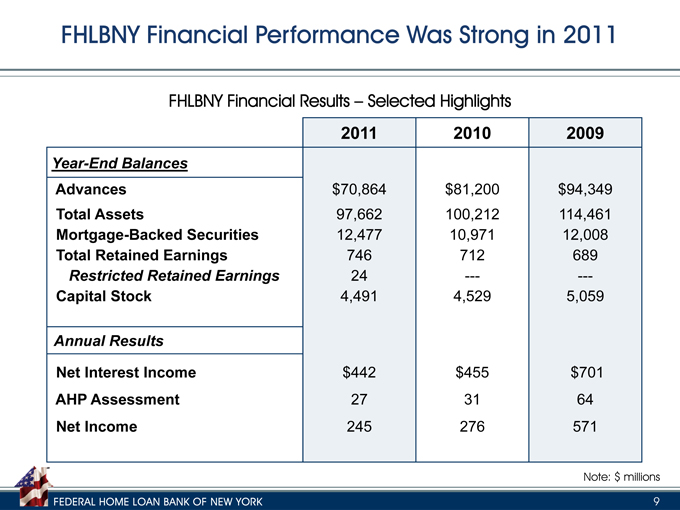

FHLBNY Financial Performance Was Strong in 2011

FHLBNY Financial Results – Selected Highlights

2011 2010 2009

Year-End Balances

Advances $70,864 $81,200 $94,349 Total Assets 97,662 100,212 114,461

Mortgage-Backed Securities 12,477 10,971 12,008 Total Retained Earnings 746 712 689

Restricted Retained Earnings 24 -— -—

Capital Stock 4,491 4,529 5,059

Annual Results

Net Interest Income $442 $455 $701 AHP Assessment 27 31 64

Net Income 245 276 571

Note: $ millions

FEDERAL HOME LOAN BANK OF NEW YORK 9

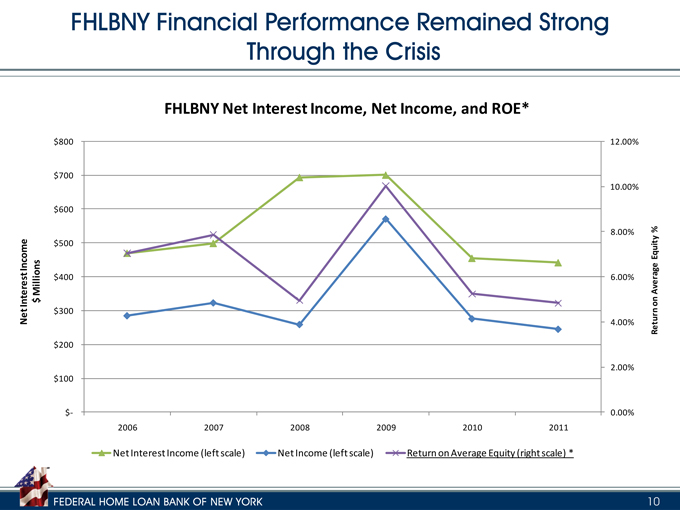

FHLBNY Financial Performance Remained Strong Through the Crisis

FHLBNY Net Interest Income, Net Income, and ROE*

NetInterestIncome Millions$

Net Interest Income (left scale) Net Income (left scale) Return on Average Equity (right scale) *

Return on Average Equity %

FEDERAL HOME LOAN BANK OF NEW YORK 10

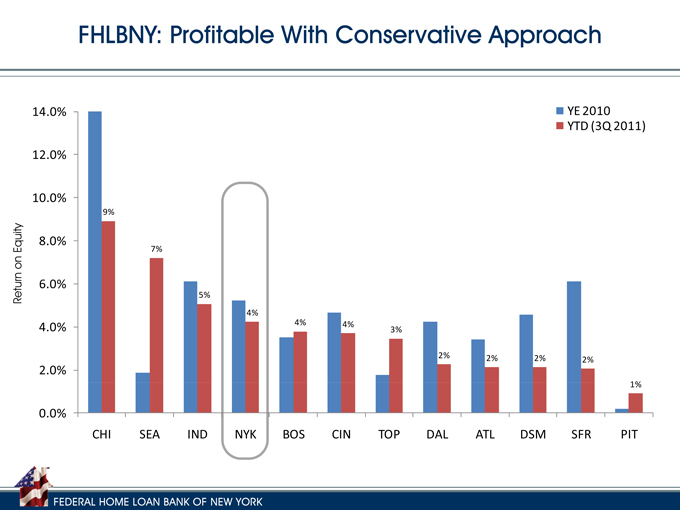

FHLBNY: Profitable With Conservative Approach

Return on Equity

YE 2010 YTD (3Q 2011)

FEDERAL HOME LOAN BANK OF NEW YORK

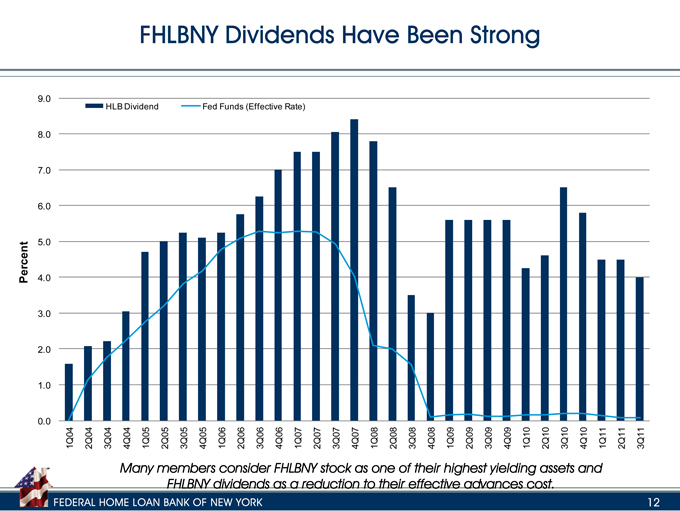

FHLBNY Dividends Have Been Strong

Percent

HLB Dividend

Fed Funds (Effective Rate)

Many members consider FHLBNY stock as one of their highest yielding assets and FHLBNY dividends as a reduction to their effective advances cost.

FEDERAL HOME LOAN BANK OF NEW YORK 12

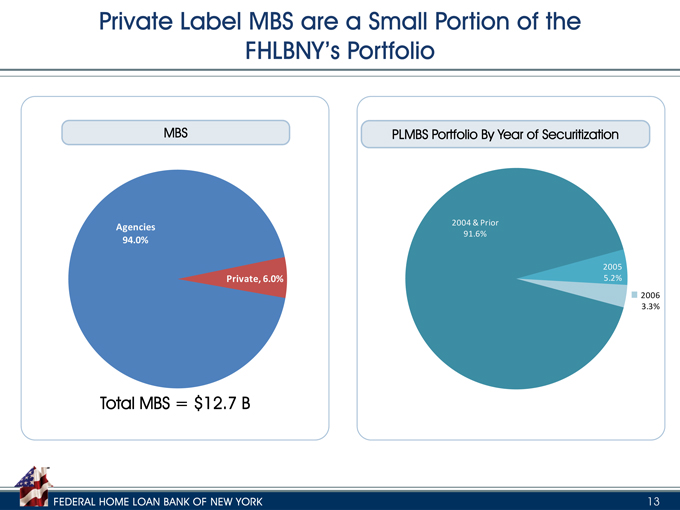

Private Label MBS are a Small Portion of the FHLBNY’s Portfolio

MBS

Agencies 94.0%

Agencies 94.0%

Private, 6.0%

Total MBS = $12.7 B

PLMBS Portfolio By Year of Securitization

2004 & Prior 91.6%

2005 5.2%

2006 3.3%

FEDERAL HOME LOAN BANK OF NEW YORK 13

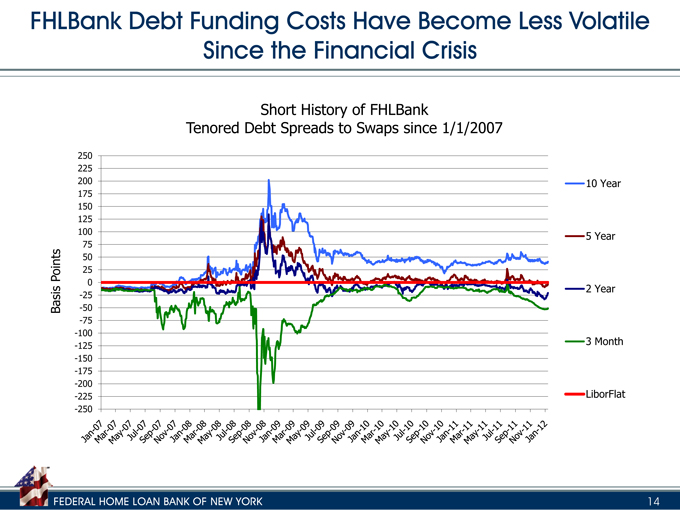

FHLBank Debt Funding Costs Have Become Less Volatile Since the Financial Crisis

Short History of FHLBank

Tenored Debt Spreads to Swaps since 1/1/2007

Basis Points

FEDERAL HOME LOAN BANK OF NEW YORK 14

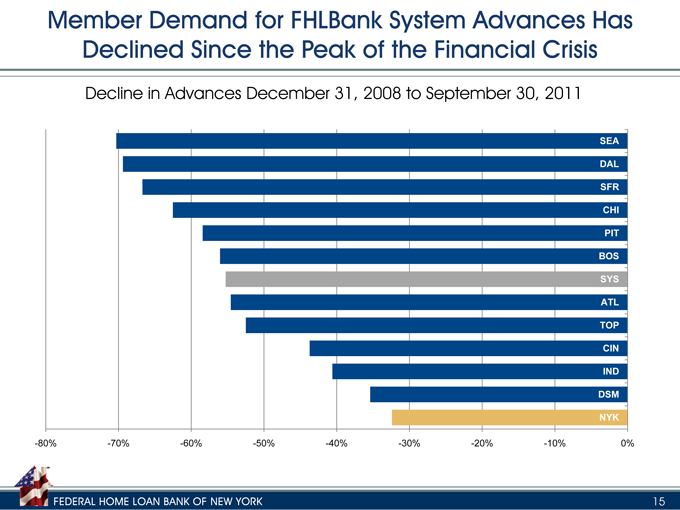

Member Demand for FHLBank System Advances Has Declined Since the Peak of the Financial Crisis

Decline in Advances December 31, 2008 to September 30, 2011

FEDERAL HOME LOAN BANK OF NEW YORK 15

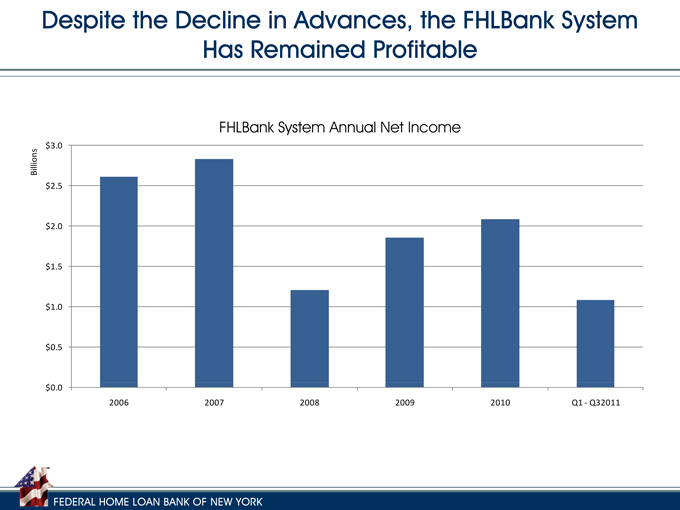

Despite the Decline in Advances, the FHLBank System Has Remained Profitable

FHLBank System Annual Net Income

Billions

FEDERAL HOME LOAN BANK OF NEW YORK

ADVANCES OPPORTUNITIES FOR MEMBERS

FEDERAL HOME LOAN BANK OF NEW YORK

FHLBNY Advance Business

Use of FHLBNY Advances

» Liquidity management

» Asset/liability management

– Transactional micro hedges

– Balance sheet macro hedges

» Minimizing liability costs

» Wholesale leveraging

» Funding retail loan growth

Credit Products

» Overnight to 30 years

» Fixed or Floating Rate

» Amortizing or Bullet Structure

» Forward Starting Advances up to 1 year

» Special features such as embedded options

FEDERAL HOME LOAN BANK OF NEW YORK 18

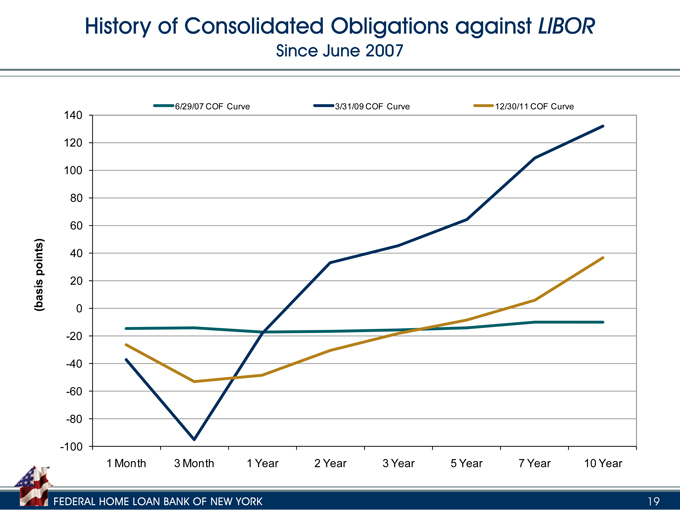

History of Consolidated Obligations against LIBOR

Since June 2007

6/29/07 COF Curve

3/31/09 COF Curve

12/30/11 COF Curve

(basis points)

FEDERAL HOME LOAN BANK OF NEW YORK 19

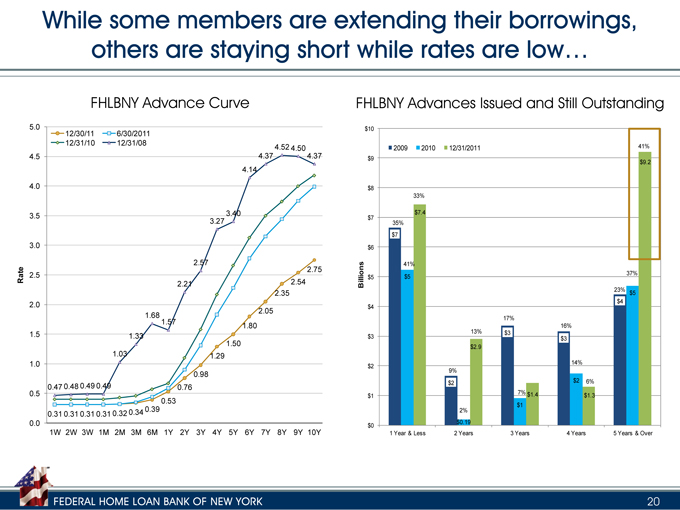

While some members are extending their borrowings, others are staying short while rates are low…

FHLBNY Advance Curve

FHLBNY Advances Issued and Still Outstanding

FEDERAL HOME LOAN BANK OF NEW YORK

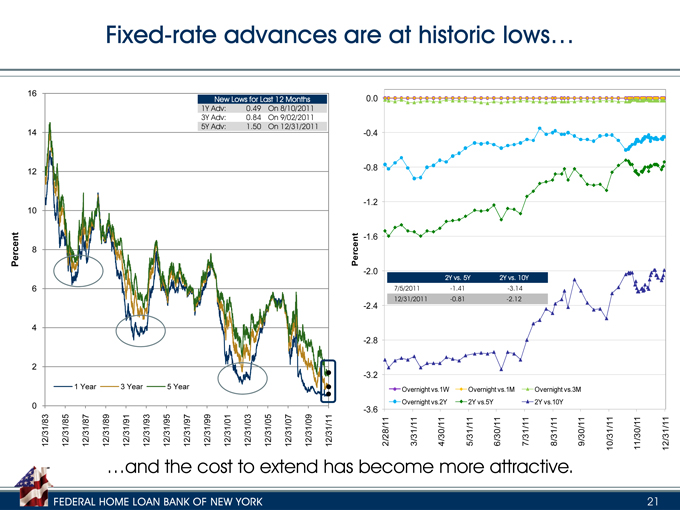

Fixed-rate advances are at historic lows…

New Lows for Last 12 Months

1Y Adv: 0.49 On 8/10/2011

3Y Adv: 0.84 On 9/02/2011

5Y Adv: 1.50 On 12/31/2011

2Y vs. 5Y 2Y vs. 10Y 7/5/2011 -1.41 -3.14 12/31/2011 -0.81 -2.12

…and the cost to extend has become more attractive.

FEDERAL HOME LOAN BANK OF NEW YORK 21

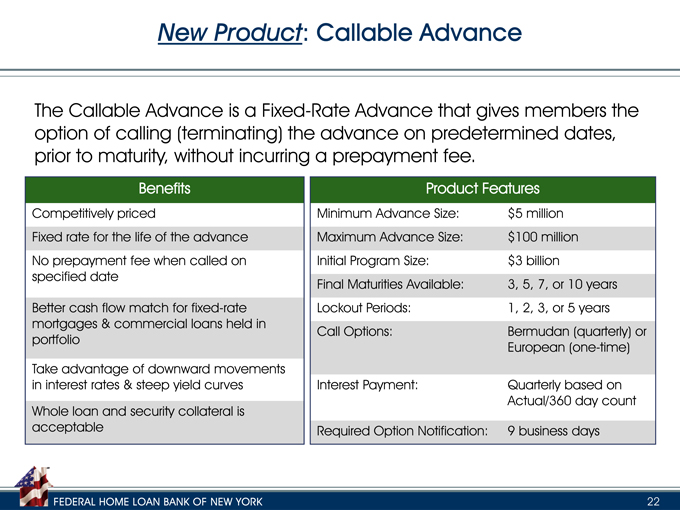

New Product: Callable Advance

The Callable Advance is a Fixed-Rate Advance that gives members the option of calling (terminating) the advance on predetermined dates, prior to maturity, without incurring a prepayment fee.

Benefits Product Features

Competitively priced Minimum Advance Size: $5 million Fixed rate for the life of the advance Maximum Advance Size: $100 million No prepayment fee when called on Initial Program Size: $3 billion specified date Final Maturities Available: 3, 5, 7, or 10 years Better cash flow match for fixed-rate Lockout Periods: 1, 2, 3, or 5 years mortgages & commercial loans held in Call Options: Bermudan (quarterly) or portfolio European (one-time) Take advantage of downward movements in interest rates & steep yield curves Interest Payment: Quarterly based on Actual/360 day count Whole loan and security collateral is acceptable Required Option Notification: 9 business days

FEDERAL HOME LOAN BANK OF NEW YORK 22

Other Products to Consider in a Rising Rate Environment

Amortizing Advance

» Match the amortization characteristics of your fixed-rate mortgage portfolio.

» Enhance match funding of long-term assets Principal-Deferred Advance (PDA)

» A “combination” advance product that begins as a Fixed-Rate Advance, allowing members to choose a specific amount of time they would like to defer the principal payment, then becomes an Amortizing Advance, where the member makes principal and interest payments on the loan.

Strip Advance

» Manage interest rate risk by setting your own quarterly principal payoff schedule to closely match cash flows between your funding and mortgage assets.

» Achieve funding flexibility by creating your own payoff schedule

Adjustable-Rate Credit (ARC) Advance

» Match the interest rate characteristics of your adjustable-rate loan portfolio.

» Limit exposure to rising rates by using an embedded rate cap

FEDERAL HOME LOAN BANK OF NEW YORK 23

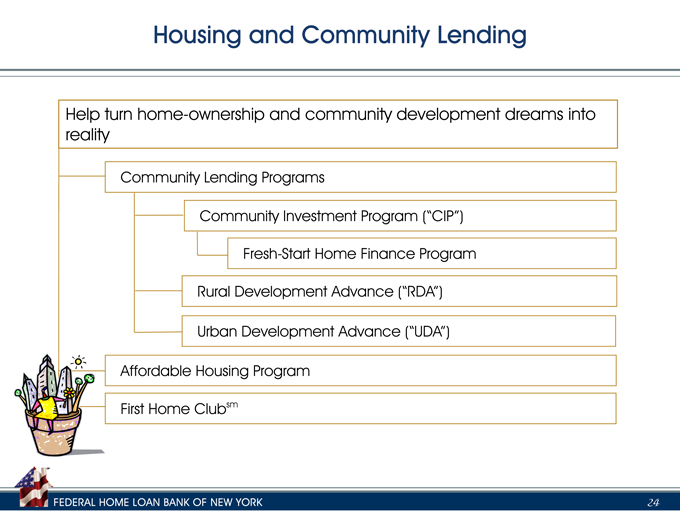

Housing and Community Lending

Help turn home-ownership and community development dreams into reality

Community Lending Programs

Community Investment Program (“CIP”) Fresh-Start Home Finance Program Rural Development Advance (“RDA”) Urban Development Advance (“UDA”)

Affordable Housing Program

First Home Clubsm

FEDERAL HOME LOAN BANK OF NEW YORK 24

Advancing Housing and Community Growth

Kevin Neylan Adam Goldstein

Senior Vice President Senior Vice President

Strategy & Finance Head of Sales & Business Development 212-441-6818 212-441-6703 Kevin.neylan@fhlbny.com goldstein@fhlbny.com

The information provided by the Federal Home Loan Bank of New York (FHLBNY) in this communications is set forth for informational purposes only. The information should not be construed as an opinion, recommendation or solicitation regarding the use of any financial strategy and/or the purchase or sale of any financial instrument. All customers are advised to conduct their own independent due diligence before making any financial decisions. Please note that the past performance of any FHLBNY service or product should not be viewed as a guarantee of future results. Also, the information presented here and/or the services or products provided by the FHLBNY may change at any time without notice.

101 OF PARK NEW AVENUE YORK • NEW YORK, NY 10178 • WWW.FHLBNY.COM