Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BERKSHIRE HILLS BANCORP INC | v302066_8-k.htm |

BERKSHIRE HILLS BANCORP - BHLB www.jointheexcitement.com America’s Most Exciting Bank sm Sterne Agee Financial Institutions Investor Conference February 12 – 14, 2012

BERKSHIRE HILLS BANCORP - BHLB www.jointheexcitement.com America’s Most Exciting Bank sm P.O. Box 1308, Pittsfield, MA 01202 – Executive Offices – 66 West Street, Pittsfield, MA 01201 David H. Gonci Investor Relations Officer Phone: (413) 281 - 1973 Email: dgonci@berkshirebank.com Michael P. Daly President and CEO Phone: (413) 236 - 3194 Email: mdaly@berkshirebank.com 1 Kevin P. Riley Executive Vice President, CFO Phone: (413) 236 - 3195 Email: kriley@berkshirebank.com

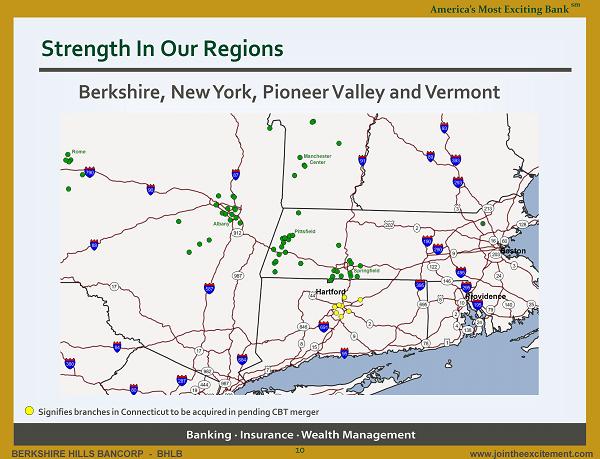

BERKSHIRE HILLS BANCORP - BHLB www.jointheexcitement.com America’s Most Exciting Bank sm Berkshire Hills Bancorp Regional bank with $4 billion in assets Approaching 60 full service branches in three states: Massachusetts , New York and Vermont (also Connecticut acquisition with 8 additional branches pending) Retail and commercial banking, insurance, and wealth management services 2 Presence in high value, strong markets – I - 90 and I - 91 Experienced/energetic management team Market cap recently over $500 million Strong revenue and earnings growth Quality balance sheet CTBC Pending

BERKSHIRE HILLS BANCORP - BHLB www.jointheexcitement.com America’s Most Exciting Bank sm 4th Quarter Results 57% increase in core earnings per share year over year 11% annualized increase in core earnings per share compared to linked quarter 7% annualized growth in commercial loans 8% annualized growth in deposits 3.61% net interest margin 0.66% non - performing assets / total assets 59% core efficiency ratio Note: See discussion on non - GAAP financial measures at end of presentation. 3

BERKSHIRE HILLS BANCORP - BHLB www.jointheexcitement.com America’s Most Exciting Bank sm Revenue Growth 20%+ Total Annual Growth 4 BERKSHIRE HILLS BANCORP - BHLB www.jointheexcitement.com America’s Most Exciting Bank sm Revenue Growth 20%+ Total Annual Growth 4 0 5 10 15 20 25 30 35 40 45 10Q1 10Q2 10Q3 10Q4 11Q1 11Q2 11Q3 11Q4 $40 Quarterly Revenue ($ million) Quarter Note: Revenue in 11Q3 includes $2 million non - core gain on Legacy stock

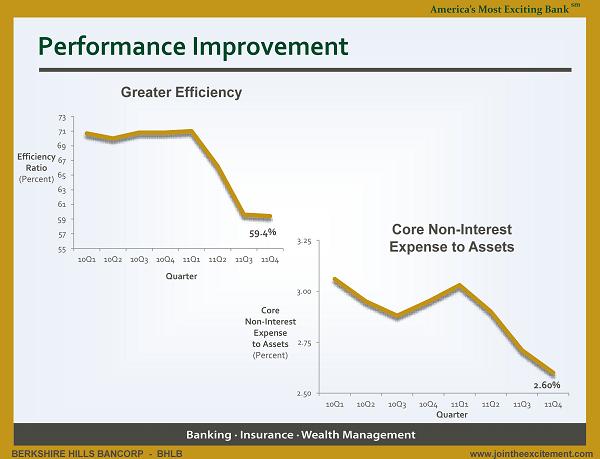

BERKSHIRE HILLS BANCORP - BHLB www.jointheexcitement.com America’s Most Exciting Bank sm Performance Improvement Core Non - Interest Expense to Assets Greater Efficiency Quarter Core Non - Interest Expense to Assets (Percent) Quarter Efficiency Ratio (Percent) 59.4% 55 57 59 61 63 65 67 69 71 73 10Q1 10Q2 10Q3 10Q4 11Q1 11Q2 11Q3 11Q4 2.60% 2.50 2.75 3.00 3.25 10Q1 10Q2 10Q3 10Q4 11Q1 11Q2 11Q3 11Q4

BERKSHIRE HILLS BANCORP - BHLB www.jointheexcitement.com America’s Most Exciting Bank sm Core EPS Growth 20%+ Total Annual Growth Positive Operating Leverage 6 0 5 10 15 20 25 30 35 40 45 10Q1 10Q2 10Q3 10Q4 11Q1 11Q2 11Q3 11Q4 44 ¢ Core EPS (cents) Quarter

BERKSHIRE HILLS BANCORP - BHLB www.jointheexcitement.com America’s Most Exciting Bank sm Balance Sheet Strength Favorable Asset Quality Net Loan Charge - Offs Net Charge - Offs/ Average Loans (Percent) Quarter NPAs/ Assets (Basis Points) Quarter 7 66 bp 40 50 60 70 80 90 100 10Q1 10Q2 10Q3 10Q4 11Q1 11Q2 11Q3 11Q4 0.27% 0.2 0.25 0.3 0.35 0.4 0.45 0.5 10Q1 10Q2 10Q3 10Q4 11Q1 11Q2 11Q3 11Q4

BERKSHIRE HILLS BANCORP - BHLB www.jointheexcitement.com America’s Most Exciting Bank sm Performance Improvement Core Return on Assets Core Return on Equity Quarte r Core ROE (Percent) Quarte r Core ROA (Basis Points) 8 6.7% 3 3.5 4 4.5 5 5.5 6 6.5 7 10Q1 10Q2 10Q3 10Q4 11Q1 11Q2 11Q3 11Q4 93 bp 30 40 50 60 70 80 90 100 10Q1 10Q2 10Q3 10Q4 11Q1 11Q2 11Q3 11Q4

BERKSHIRE HILLS BANCORP - BHLB www.jointheexcitement.com America’s Most Exciting Bank sm Capital Strength Total Risk Based Capital Tangible Equity / Assets Tangible Equity/Assets (Percent) Quarte r Risk Based Capital (Percent) 9 11.3% 9.00 9.50 10.00 10.50 11.00 11.50 12.00 12.50 13.00 10Q1 10Q2 10Q3 10Q4 11Q1 11Q2 11Q3 11Q4 8.8% 6.0 7.0 8.0 9.0 10Q1 10Q2 10Q3 10Q4 11Q1 11Q2 11Q3 11Q4 Quarte r

BERKSHIRE HILLS BANCORP - BHLB www.jointheexcitement.com America’s Most Exciting Bank sm Rome Pittsfield Albany Manchester Center Springfield Hartford Boston Providence Strength In Our Regions Berkshire, New York, Pioneer Valley and Vermont Signifies branches in Connecticut to be acquired in pending CBT merger 10

BERKSHIRE HILLS BANCORP - BHLB www.jointheexcitement.com America’s Most Exciting Bank sm Berkshire Hill Bancorp – Recent M & A Deals Bank Assets ($MM) Date Announced Date Closed Announced Deal Value ($MM) Price/ TBV Core Deposit Premium Rome Bancorp, Rome, NY 330 Oct 2010 Apr 2011 74 120% 6% Legac y Bancorp, Pittsfield, MA 970 Dec 2010 Jul 2011 108 110% 1% Connecticut Bank and Trust Co, Hartford, CT 280 Oct 2011 Target: Apr 2012 30 140% 4% 11 BHLB Stock Performance Relative to Peers Merger Announcement First Day As of 12/28/11 Trading Days to Recovery Rome Bancorp - 4.30% 9.40% 4 Legacy Bancorp - 2.20% 8.20% 6 Connecticut Bank and Trust - 4.80% 0.20% 44

BERKSHIRE HILLS BANCORP - BHLB www.jointheexcitement.com America’s Most Exciting Bank sm What To Expect Going Forward Strong organic loan and deposit growth Results from continued improvement in operating leverage Hiring of top talent employees Seamless integration of acquisitions Strong growth in core earnings per share 12

BERKSHIRE HILLS BANCORP - BHLB www.jointheexcitement.com America’s Most Exciting Bank sm Earnings Guidance – Q1 2012 Core EPS $0.45 ◦ 50% increase year - over - year ◦ 9% annualized increase quarter - over - quarter Net Interest Margin 3.65% Core r evenue growth 16% annualized quarter - over - quarter Organic loan growth in high single digits Organic deposit growth in mid single digits Asset quality favorable and improving 13

BERKSHIRE HILLS BANCORP - BHLB www.jointheexcitement.com America’s Most Exciting Bank sm Why Invest In Us Experienced executive management team Proven track record for results Solid strategies for growth Focused on shareholder return 100% buy ratings from the equity analysts who cover us 14

BERKSHIRE HILLS BANCORP - BHLB www.jointheexcitement.com America’s Most Exciting Bank sm FORWARD LOOKING STATEMENTS. This presentation contains certain forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include statements regarding anticipated future results. Forward - looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They o ften include words like "believe," "expect," "anticipate," "estimate," and "intend" or future or conditional verbs such as "will," "w ould," "should," "could" or "may." Certain factors could cause actual results to differ materially from expected results. Such fa cto rs include increased competitive pressures, changes in the interest rate environment, changes in general economic conditions, legislative and regulatory changes that adversely affect the business in which Berkshire is engaged, changes in the securitie s markets and other risks and uncertainties disclosed from time to time in documents that Berkshire files with the Securities a nd Exchange Commission. Additionally, Berkshire has entered into an agreement to acquire CBT - The Connecticut Bank and Trust Company. Factors that could cause actual results to differ materially from expected results include the delays in completing the merger or termination of the agreement, difficulties in achieving cost savings from the merger or in achieving such cost savings within the expected time frame, and difficulties in integrating Berkshire and CBT. ADDITIONAL INFORMATION FOR SHAREHOLDERS. The proposed acquisition of CBT will be submitted to CBT stockholders for their consideration. Berkshire will file with the SEC a Registration Statement on Form S - 4 that will include a Proxy Stateme nt of CBT and a Prospectus of Berkshire, as well as other relevant documents concerning the proposed transaction. Stockholders of CBT are urged to read the Registration Statement and the Proxy Statement/Prospectus when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. You will be able to obtain a free copy of the Registration Statement, Proxy Statement/Prospectus, as well as other filings containing information about Berkshire and CBT at the SEC's Internet site ( www.sec.gov ) and at CBT’s Internet site ( www.thecbt.com ). Berkshire and CBT and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of CBT in connection with the proposed merger. Information about the directors and executive officers of Berkshire is set forth in the proxy statement, dated March 24, 2011, for Berkshire’s 2011 annual meeting of stockholders, as filed with the SEC on Schedule 14A. Information about the directors and executive officers of CBT is set for th in the proxy statement, dated April 18, 2011, for CBT’s 2011 annual meeting of stockholders, which is available at CBT’s Inte rne t site. Additional information regarding the interests of such participants and other persons who may be deemed participants in the transaction may be obtained by reading the Proxy Statement/Prospectus when it becomes available NON - GAAP FINANCIAL MEASURES. This presentation references non - GAAP financial measures incorporating tangible equity and related measures, and core earnings excluding merger costs. These measures are commonly used by investors in evaluating business combinations and financial condition. GAAP earnings are lower than core earnings in 2011 and 2010 due to non - recurring merger related expenses. Reconciliations are in earnings releases at w ww.berkshirebank.com. 15

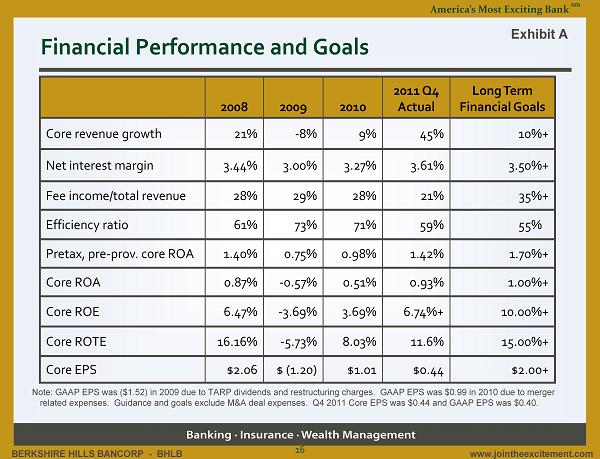

BERKSHIRE HILLS BANCORP - BHLB www.jointheexcitement.com America’s Most Exciting Bank sm Note: GAAP EPS was ($1.52) in 2009 due to TARP dividends and restructuring charges. GAAP EPS was $0.99 in 2010 due to merger related expenses. Guidance and goals exclude M&A deal expenses. Q4 2011 Core EPS was $ 0.44 and GAAP EPS was $ 0.40. Financial Performance and Goals 2008 2009 2010 2011 Q4 Actual Long Term Financial Goals Core revenue growth 21% - 8% 9% 45% 10%+ Net interest margin 3.44% 3.00% 3.27% 3.61% 3.50%+ Fee income/total revenue 28% 29% 28% 21% 35%+ Efficiency ratio 61% 73% 71% 59% 55% Pretax, pre - prov. core ROA 1.40% 0.75% 0.98% 1.42% 1.70%+ Core ROA 0.87% - 0.57% 0.51% 0.93% 1.00%+ Core ROE 6.47% - 3.69% 3.69% 6.74%+ 10.00%+ Core ROTE 16.16% - 5.73% 8.03% 11.6% 15.00%+ Core EPS $2.06 $ (1.20) $1.01 $0.44 $2.00+ Exhibit A 16

BERKSHIRE HILLS BANCORP - BHLB www.jointheexcitement.com America’s Most Exciting Bank sm Balanced Portfolios Note: Balances are as of December 31, 2011 and exclude discontinued operations. Deposits $3.1 Billion Loans $3.0 Billion Exhibit B Checking 14% NOW 9% Money Market 34% Savings 11% Time Under $100M 16% Time $100M+ 16% 17 Commercial & Industrial 14 % Residential Mortgage 34 % Commercial Real Estate 39 % Consumer 13 %

BERKSHIRE HILLS BANCORP - BHLB www.jointheexcitement.com America’s Most Exciting Bank sm Notes 18

If you have any questions, please contact: David Gonci Investor Relations Officer (413) 281 - 1973 dgonci@berkshirebank.com Committed to the RIGHT core values: Respect Integrity Guts Having Fun Teamwork