Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AGILYSYS INC | d300482d8k.htm |

February 2012

1

Exhibit 99.1

Company Overview |

2

Forward-looking statements & non-GAAP financial

information

Forward-Looking Language This

Quarterly Report contains certain management expectations, which may constitute forward-looking information within the meaning of

Section 27A of the Securities Act of 1933, Section 21E of the Securities and Exchange Act of 1934, and

the Private Securities Reform Act of 1995. Forward-looking information speaks only as to

the date of this Quarterly Report and may be identified by use of words such as “may,”

“will,” “believes,” “anticipates,” “plans,”

“expects,” “estimates,” “projects,” “targets,” “forecasts,” “continues,” “seeks,” or the negative of those

terms or similar expressions. Many important factors could cause actual results to be materially

different from those in forward-looking information, including, without limitation,

competitive factors, disruption of supplies, changes in market conditions, pending or future claims or

litigation, or technology advances. No assurances can be provided as to the outcome of cost

reductions, expected benefits and outcomes from our recent ERP implementation, business

strategies, future financial results, unanticipated downturns to our relationships with

customers and macroeconomic demand for IT products and services, unanticipated difficulties

integrating acquisitions, new laws and government regulations, interest rate changes,

consequences related to the concentrated ownership of our outstanding shares by MAK Capital,

unanticipated deterioration in economic and financial conditions in the United States and around the world or the consequences

associated with the sale of the Company’s TSG business, and uncertainties regarding restructuring

actions and the relocation of the Company’s corporate headquarters. The Company does not

undertake to update or revise any forward-looking information, even if events make it clear

that any projected results, actions, or impact, express or implied, will not be realized.

Other potential risks and uncertainties that may cause actual results to be materially different from

those in forward-looking information are described in “Risk Factors,” which is

included in Part I, Item 1A of the Company’s Annual Report for the fiscal year ended March 31, 2011.

Use of Non-GAAP Financial Information To

supplement the unaudited condensed consolidated financial statements presented in accordance with U.S. GAAP in this presentation,

certain non-GAAP financial measures as defined by the SEC rules are used.

Management believes that such information can enhance investors' understanding of the Company's

ongoing operations. The non-GAAP measures included in this presentation have been

reconciled to the comparable GAAP measures within an accompanying table, shown on the last page

of this presentation. |

Quick

Facts Summary

•

Leading developer and marketer of proprietary enterprise software, services and

solutions to the hospitality and retail industries

•

Two

reportable

businesses:

Hospitality

Solutions

Group

(“HSG”)

develops

and

markets

proprietary

software

for

hospitality

markets

and

Retail

Solutions

Group

(“RSG”)

is a system integrator of store front technology for retailers

Formed:

1963

Ticker symbol:

AGYS (NASDAQ)

Market capitalization:

~$175 million

Capital structure as of 12/31/11:

Debt-free

Fiscal

2011

sales

1

:

$201 million

Markets served as % of revenue:

94% North America

6% Asia and Europe

Employees:

800

Corporate HQ:

Solon, Ohio (relocating to Alpharetta, GA)

(1) March

31

st

fiscal

year:

excludes

TSG

which

was

divested

7/31/11

3

Agilysys: overview |

FY

12 Initiatives •

Sold non-core asset

•

Restructured the business

•

New management team

•

Relocated corporate headquarters

•

Returned capital to shareholders

Expected Impact

•

Business performance improvement

•

Pursue highest quality revenue

•

Improve ROIC

•

Streamlined operations, software and

services management team

•

Reduced corporate costs, reposition

corporate closer to revenue generating

activities

•

Eliminating $14-$16m of expense,

realizing $16-$18m of restructuring

expense, primarily realized in FY12

•

Repurchased 1.6m shares,

approximately 7%

•

Permitting investors who choose to leave

the stock to exit

4

Focused Business Strategy |

5

5

Business Emphasis

Investor Returns

•

Serve large end markets that use

technology as a value differentiator

•

Improve guest experience in hospitality

and retail through best-in-class products

and services

•

Maintain solution leadership through

market-focused product development

•

Deploy shareholder capital in pursuit of

highest value added activities

•

Exceed market rate growth with highest

quality revenue available

•

Peer-leading performance metrics

•

Price leadership

•

Most efficient provider

•

Capital allocation

•

Apply capital to highest margin

opportunities

•

R&D spend based on line of sight to return

on investment

•

Value creating M&A opportunities

Aligning business focus and investor returns

Deliver profitable growth, generating strong investment returns for shareholders |

•

Hospitality customers can rely

on HSG to deliver:

•

Enterprise applications

•

Hardware enabling our complete

array of enterprise applications

•

Recurring services such as

software maintenance and

hosting or SaaS offerings

•

Implementation and training

services as well as help desk

support

6

Help Desk

Enterprise

Applications

Complementary

Offerings

Hardware

Hosting

(SaaS)

Training

Agilysys

Hospitality

Solutions

Agilysys Hospitality Solutions

Implementation

Software

Maintenance |

Document

Management Central Reservation

Mobility

•

G360 capabilities

•

Buy/build capabilities

•

POS (IG Roam)

•

PMS (iPad enabled)

•

RSG (mPOS)

Property Management

Inventory & Procurement

Point of Sale

•

New product 1QFY13

•

SOA architecture

•

Lighter installation

services

7

Market Leading Products

Best in class point solutions for the markets we service |

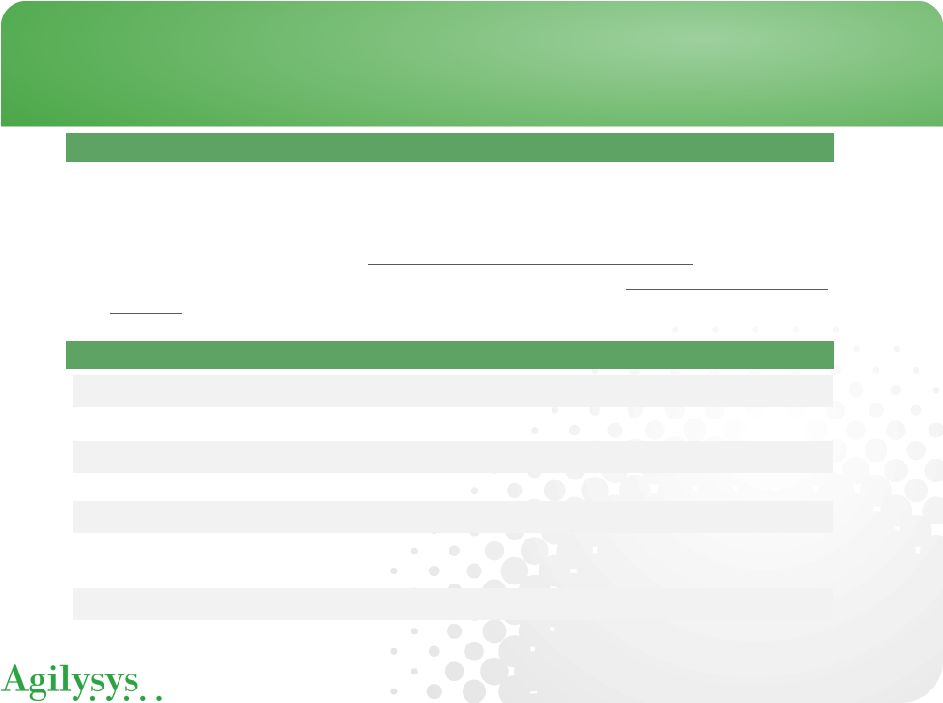

8

Notes:

1.

Based on Nine Months Ended 12/31/11

2.

Includes Commercial and Tribal Gaming

HSG Markets Served

1 |

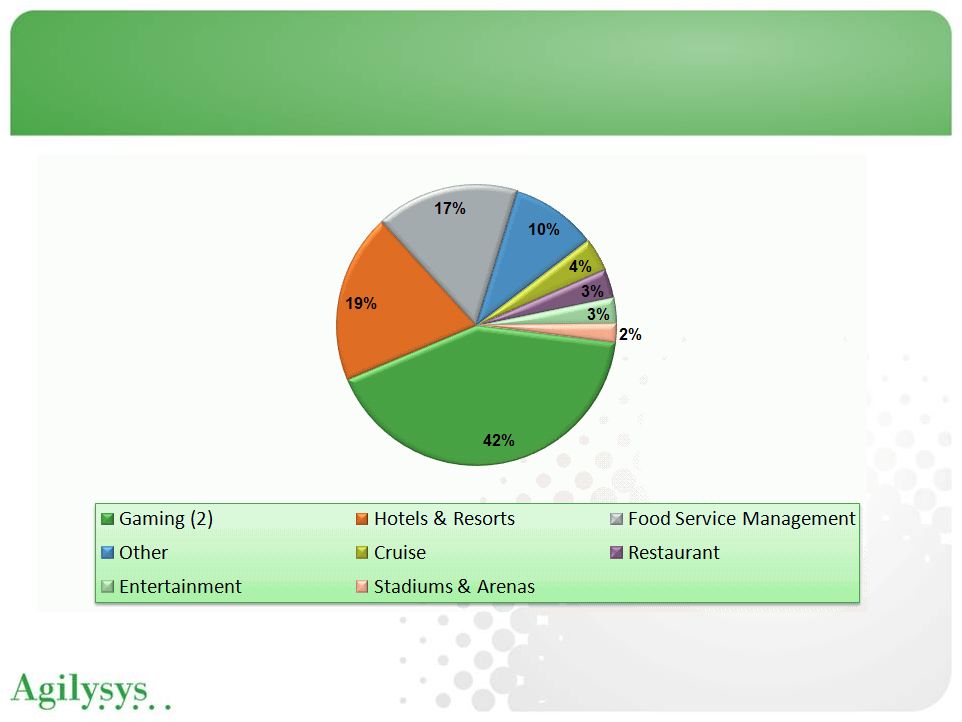

9

(1) TTM, Quarter ending 12/31/11

HSG Revenue Profile

Balanced revenue mix driven by proprietary software |

•

Agilysys Retail Solutions provides:

•

Integration of end-to-end in-store technology solutions

•

Unparalleled expertise in POS and Mobility solutions

•

Personnel with an average of 18 years experience in the retail market

•

Agilysys Retail Solutions is:

•

Solution partner for IBM Retail Store Solutions receiving the IBM RSS

Excellence Award for 16 consecutive years (since the award’s inception)

•

Large Motorola Enterprise Mobility Solutions Partner and also one of

Motorola’s largest Enterprise Mobility Wireless (WLAN) Partners

•

Verifone Premier Partner

10

Agilysys Retail Solutions |

•

Lifecycle management of

store-centric business

systems

•

Higher ROI and lower TCO

•

Servicing the needs of

smart consumers

•

Point-of-Sale

•

Customer Self-Service

•

Mobile Point-of-Service

•

Mobile Store Managers

•

Mobile Store Associates

11

Agilysys Retail Solutions

Agilysys

Retail

Services

Consulting

Software

Development

Project

Management

Integration

Implementation

Equipment

Disposal

Maintenance

24x7 Help

Desk |

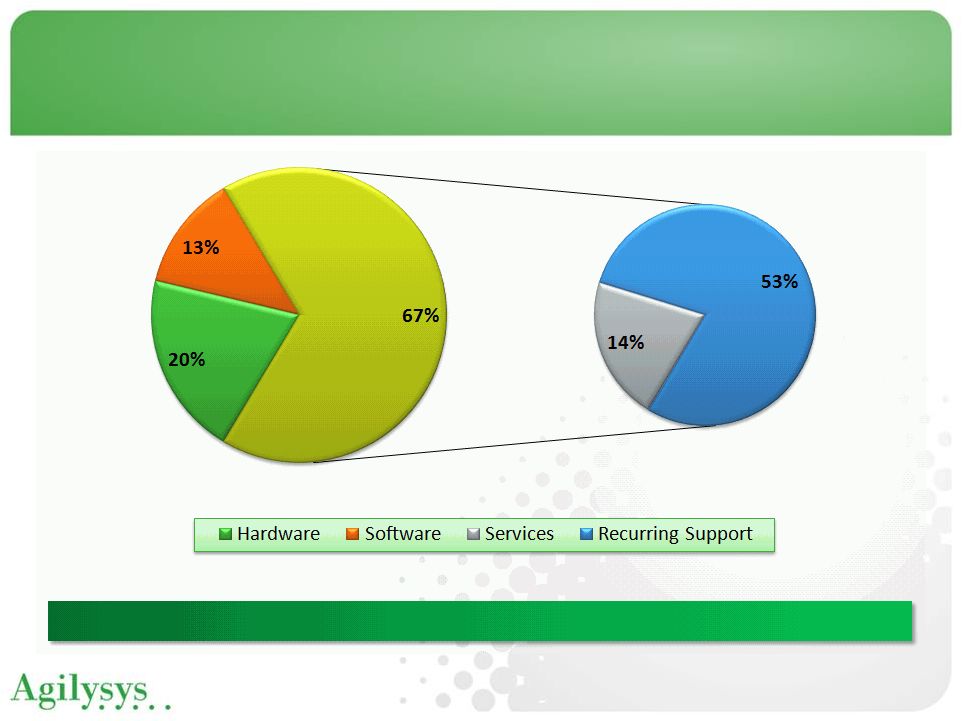

12

Note:

1.

Based on Nine Months Ended 12/31/11

RSG Markets Served

1 |

13

(1) TTM, Quarter ending 12/31/11

RSG Revenue Profile

Comprehensive proprietary services differentiates RSG from other system integrators |

Market Opportunities

•

Large installed base with untapped capacity to

deliver multiple point solutions

•

Increase participation in new market segments

through focused investment

•

Deliver on market demand from their

investment in guest facing business systems

•

Enhanced guest experiences leading to

increased revenue opportunities

•

Intelligent reporting for improves decision making

•

Reduce operating expenses

•

Mobility-enabled solutions

•

No clear end-to-end hospitality solution

Key Initiatives

Software

•

•

•

•

•

Services

•

•

•

•

14

Market Opportunities and Key Initiatives

Pursue highest margin revenue opportunities in markets we service

Strengthen best in class portfolio

Increase investment in mobility enabled

solutions

Enterprise solutions through integrated

software assets

Customer and market driven technology

delivery (Above/On Premise, SaaS, Mobility)

Guest centric business intelligence & reporting

Develop/acquire higher margin solution

offerings

Extend mobility initiatives

Pursue higher margin service engagements

Expand specialty retail and franchise business |

•

Invest in existing products and new products to increase software sales

•

Continue product development refresh to latest technologies

•

Mobility enabled solutions

•

Enterprise solutions through integrated software assets

•

Customer and market driven technology deliver (SaaS, Mobility)

•

Pursue highest margin revenue opportunities in markets we service

•

Increase penetration of new market opportunities in food service

management, cruise, specialty retail, franchised retailers and chain hotels

•

Partner for international expansion —

currently we derive less than 10% of

revenue from international customers

•

Pursue M&A opportunities in pursuit of technology and markets

•

Align current and future R&D spend with line of sight return on

investment 15

Earnings Growth Focus |

16

Appendix |

17

17

•

Prior period adjustments associated with fiscal

years prior to 2012, negatively impacted

current fiscal year results by reducing revenue

by $1.0 million and gross profit by $1.1 million

•

Adjusted revenue grew approximately 1.4%

year over year

•

Gross margins improved to approximately

38.1%

•

Adjusted EBITDA, excluding charges and one-

time items was a loss of $2.7 million compared

to a loss of $8.8 million in the previous year

•

Restructuring charges of $8.0 million primarily

relate to costs associated with relocating

headquarters to Atlanta and other cost-saving

initiatives

•

Other income in prior year includes gain on

company-owned life insurance policy

•

Income tax benefit in current year reflects

realized tax benefit from sale of TSG

•

Net loss per share narrowed to $0.26,

compared with $0.46 in the prior year

FY12 fiscal-to-date (FTD) review: consolidated

results

Statement of Operations ($Mil., except per-share)

FTD Year-over-Year Commentary

2011

2010

%

Net sales

$156.9

$155.7

0.7%

Cost of goods sold

$97.8

$99.9

(2.0%)

Gross profit

$59.0

$55.9

5.7%

37.6%

35.9%

SG&A (excl. depr. & amort.)

$63.6

$65.4

(2.8%)

Depreciation & amortization

$8.6

$6.5

32.3%

Asset impairment charge

$0.0

$0.1

(100.0%)

Restructuring charges

$8.0

$0.4

1859.1%

Operating loss

($21.2)

($16.5)

Other expense/(income), net

$0.3

($2.3)

Interest expense, net

$0.9

$0.8

Loss before income taxes

($22.4)

($15.0)

Income tax (benefit)/expense

($6.2)

$0.5

Loss from cont. ops.

($16.2)

($15.5)

Income from disc. ops., net of taxes

$10.4

$5.0

Net income/(loss)

($5.8)

($10.5)

Basic and diluted loss per share:

Net (loss) from continuing operations

($0.72)

($0.68)

Net income from discontinued operations

$0.46

$0.22

Net (loss) income

($0.26)

($0.46)

Adjusted EBITDA

($2.7)

($8.8)

(1.7%)

(5.6%)

Nine Months Ended

Dec 31 |

18

18

Dec 31,

March 31,

(In thousands, except share data)

2011

2011

ASSETS

(Unaudited)

Current assets:

Cash and cash equivalents

$ 44,061

$ 70,559

Short-term investments - available for sale

39,994

-

Accounts receivable, net

30,055

31,926

Inventories, net

11,694

10,921

Deferred income taxes – current

17

-

Prepaid expenses

3,356

2,829

Income taxes receivable

1,460

1,403

Other current assets

8,524

6,344

Assets of discontinued operations – current

-

105,810

Total current assets

139,161

229,792

Goodwill

15,084

15,211

Intangible assets, net

21,611

22,535

Other non-current assets

3,781

11,709

Assets of discontinued operations – non-current

-

8,296

Property and equipment, net

19,136

24,855

Total assets

$ 198,773

$ 312,398

LIABILITIES AND SHAREHOLDERS’ EQUITY

Current liabilities:

Accounts payable

$ 20,603

$ 17,852

Deferred revenue

13,318

23,995

Accrued and other current liabilities

20,888

14,594

Income taxes payable

626

265

Deferred income taxes – current

-

77

Capital lease obligations – current

819

999

Liabilities of discontinued operations – current

-

89,005

Total current liabilities

56,254

146,787

Deferred income taxes – non-current

4,043

3,894

Capital lease obligations – non-current

499

907

Other non-current liabilities

6,133

11,972

Liabilities of discontinued operations – non-current

-

734

Shareholders’ equity:

Common shares, without par value, at $0.30 stated

value; authorized 80,000,000 shares; 31,606,831

issued; and 21,972,661 and 23,022,398 shares

outstanding at December 31, 2011 and March 31,

2011, respectively

9,482

9,482

Treasury shares (9,634,170 shares at December 31,

2011 and 8,584,433 at March 31, 2011)

(2,892)

(2,575)

Capital in excess of stated value

(15,378)

(5,421)

Retained earnings

140,854

146,659

Accumulated other comprehensive loss

(222)

(41)

Total shareholders’ equity

131,844

148,104

Total liabilities and shareholders’ equity

$ 198,773

$ 312,398

Balance Sheet as of 12/31/11 |

19

19

2011

2010

2011

2010

Net loss from continuing operations

(5,774)

$

(2,290)

$

(16,208)

$

(15,498)

$

Plus:

Interest expense, net (a)

56

164

315

426

Income tax (benefit) expense

(1,353)

(2,947)

(6,209)

505

Depreciation and amortization

expense 3,764

2,463

10,003

7,669

Other expenses (income), net

22

(321)

293

(2,281)

Adjusted EBITDA (b)

(3,285)

$

(2,931)

$

(11,806)

$

(9,179)

$

Restructuring charges

3,238

3

7,954

406

Impact from revision to prior period financial

statements -

(140)

1,127

(79)

Asset impairment expense

-

-

-

59

Adjusted EBITDA excluding charges and

one-time items (47)

$

(3,068)

$

(2,725)

$

(8,793)

$

(a) Interest expense excludes amortization of deferred financing fees

totaling $0 and $131 for the three

months ended December 31, 2011 and 2010, respectively, and $568 and $393 for the nine months ended

December 31, 2011 and 2010,

respectively. (b) Non-GAAP financial measure

(In thousands)

Three Months Ended

December 31,

Nine Months Ended

December 31,

Reconciliation of loss from continuing operations to

adjusted EBITDA excluding charges |