Attached files

Exhibit 99.4

Reserve And Economic Evaluation Of

Proved Reserves

Of Certain Quicksilver Resources, Inc.

Oil And Gas Interests

As Of 31 December 2010

Executive Summary

Prepared For

Quicksilver Resources, Inc.

Fort Worth, Texas

Prepared By

Schlumberger Data & Consulting Services

Pittsburgh, Pennsylvania

December 2011

| Data & Consulting Services Division of Schlumberger Technology Corporation |

| |

Two Robinson Plaza, Suite 200

Pittsburgh, PA 15205

Tel: 412-787-5403

Fax: 412-787-2906

8 December 2011

Quicksilver Resources, Inc.

801 Cherry Street

Suite 3700, Unit 19

Fort Worth, Texas 76102

Dear Gentlemen:

At the request of Quicksilver Resources, Inc. (QRI), through their letter of engagement, Data & Consulting Services (DCS) Division of Schlumberger Technology Corporation has evaluated the proved reserves of certain QRI oil and gas interests located in the United States (U.S.) as of 31 December 2010. The evaluated properties are located in Colorado, Montana, Texas, and Wyoming. This report was completed as of the date of this letter and has been prepared using constant prices and costs and conforms to our understanding of the U.S. Securities and Exchange Commission (SEC) guidelines and applicable financial accounting rules. All prices, costs, and cash flow estimates are expressed in U.S. dollars (US$). It is our understanding that the properties evaluated by DCS comprise one hundred percent (100%) of QRI’s proved reserves located in the U.S. and comprise approximately 90.8% of QRI’s total proved reserves. The proved reserves included in this report represent the portion of QRI’s proved reserves located in the U.S. that are not included in the MLP assets and account for approximately 83.7% of QRI’s proved reserves located in the U.S. We believe that the assumptions, data, methods, and procedures used in preparing this report are appropriate for the purpose of this report. The Lead Evaluator for this evaluation was Charles M. Boyer II, PG, CPG, and his qualifications, independence, objectivity, and confidentiality meet the requirements set forth in the Standards Pertaining to the Estimating and Auditing of Oil and Gas Reserves Information promulgated by the Society of Petroleum Engineers.

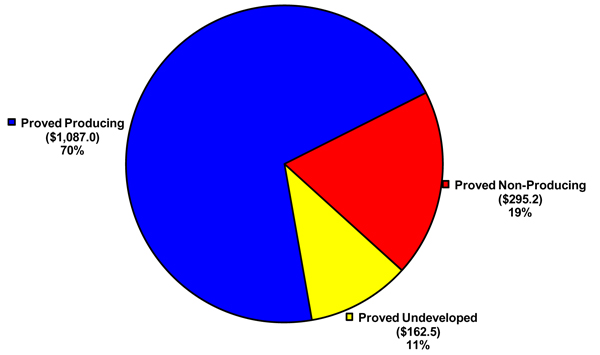

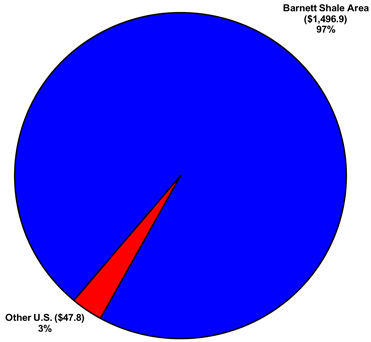

The results of the Proved reserve evaluation are summarized in Table 1. Fig. 1 illustrates the distribution by Proved reserve category for the present value at a 10% discount rate (PV10). The net volumes and PV10 values by Proved reserve category for each U.S. geographic area are given in Tables 2A, 2B, 2C, and 2D. Fig. 2 shows the distribution of the Proved PV10 by U.S. geographic area.

Table 1

Estimated Net Reserves And Income

Certain U.S. Proved Oil And Gas Interests

Unescalated Prices And Costs

Quicksilver Resources, Inc.

As Of 31 December 2010

| Proved Producing Reserves |

Proved Nonproducing Reserves |

Proved Undeveloped Reserves |

Total Proved Reserves |

|||||||||||||

| Remaining Net Reserves |

||||||||||||||||

| Oil – Mbbls |

2,165.2 | 524.0 | 452.5 | 3,141.7 | ||||||||||||

| Gas – MMscf |

711,355.9 | 408,663.9 | 584,231.1 | 1,704,251.0 | ||||||||||||

| NGL – Mbbls |

33,844.7 | 5,689.5 | 40,927.6 | 80,461.8 | ||||||||||||

| Income Data (M$) |

||||||||||||||||

| Future Net Revenue |

4,208,462.0 | 1,820,876.1 | 3,870,076.0 | 9,899,414.0 | ||||||||||||

| Deductions |

||||||||||||||||

| Operating Expense |

1,649,734.1 | 790,476.9 | 1,481,350.6 | 3,921,562.0 | ||||||||||||

| Production Taxes |

292,940.4 | 126,338.2 | 259,960.2 | 679,238.8 | ||||||||||||

| Investment |

2,354.6 | 159,948.7 | 908,105.7 | 1,070,409.0 | ||||||||||||

| Abandonment |

25,136.1 | 4,209.8 | 11,116.6 | 40,462.5 | ||||||||||||

| Future Net Cashflow |

2,238,296.3 | 739,902.4 | 1209,543.1 | 4,187,742.3 | ||||||||||||

| Discounted PV @ 10% (M$) |

1,086,981.5 | 295,200.8 | 162,496.7 | 1,544,678.8 | ||||||||||||

Note: Proved producing reserves include Inactive and Salt Water Disposal well costs.

| Data & Consulting Services |

| |

| Division of Schlumberger Technology Corporation |

8 December 2011

Page 2

| Fig. 1 - | Present value distribution by U.S. Proved reserve category - calculated using | |

| a 10% discount rate (MM$), unescalated prices and costs. |

| Fig.2 - | Proved present value distribution by U.S. geographic area – calculated | |

| using a 10% discount rate (MM$), unescalated prices and costs. |

| Data & Consulting Services |

| |

| Division of Schlumberger Technology Corporation |

8 December 2011

Page 3

Table 2A

Summary Of Total Proved Reserves Volumes And Present Value

By U.S. Geographic Area, Unescalated Prices And Costs

As Of 31 December 2010

| Geographic Area |

Oil (Mbbl) |

Gas (MMscf) |

NGL (Mbbl) |

Unrisked PV @10% (M$) |

||||||||||||

| Barnett Shale Area |

612.7 | 1,702,981.4 | 80,309.6 | 1,496,926.4 | ||||||||||||

| Other US |

2,529.0 | 1,269.5 | 152.2 | 47,753.0 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

3,141.7 | 1,704,251.0 | 80,461.8 | 1,544,678.8 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Note: Proved reserves include Inactive and Salt Water Disposal well costs.

Table 2B

Summary Of Total Proved Producing Reserves Volumes And Present Value

By U.S. Geographic Area, Unescalated Prices And Costs

As Of 31 December 2010

| Geographic Area |

Oil (Mbbl) |

Gas (MMscf) |

NGL (Mbbl) |

Unrisked PV @10% (M$) |

||||||||||||

| Barnett Shale Area |

91.4 | 710,610.9 | 33,699.5 | 1,044,804.4 | ||||||||||||

| Other US |

2,073.8 | 744.9 | 145.2 | 42,177.2 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

2,165.2 | 711,355.9 | 33,844.7 | 1,086,981.5 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Note: Proved producing reserves include Inactive and Salt Water Disposal well costs.

Table 2C

Summary Of Total Proved Non-Producing Reserves Volumes And Present Value

By U.S. Geographic Area, Unescalated Prices And Costs

As Of 31 December 2010

| Geographic Area |

Oil (Mbbl) |

Gas (MMscf) |

NGL (Mbbl) |

Unrisked PV @10% (M$) |

||||||||||||

| Barnett Shale Area |

68.8 | 408,139.3 | 5,682.5 | 289,625.0 | ||||||||||||

| Other US |

455.2 | 524.6 | 7.0 | 5,575.8 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

524.0 | 408,663.9 | 5,689.5 | 295,200.8 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Data & Consulting Services |

| |

| Division of Schlumberger Technology Corporation |

8 December 2011

Page 4

Table 2D

Summary Of Total Proved Undeveloped Reserves Volumes And Present Value

By U.S. Geographic Area, Unescalated Prices And Costs

As Of 31 December 2010

| Geographic Area |

Oil (Mbbl) |

Gas (MMscf) |

NGL (Mbbl) |

Unrisked PV @10% (M$) |

||||||||||||

| Barnett Shale Area |

452.5 | 584,231.1 | 40,927.6 | 162,496.7 | ||||||||||||

| Other US |

0.0 | 0.0 | 0.0 | 0.0 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

452.5 | 584,231.1 | 40,927.6 | 162,496.7 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The values in the tables above may not add up arithmetically or exactly match the attached cash flows due to rounding procedures in the computer software program used to prepare the economic projections. Cash flows summarized by reserve category and state are included in the attachments of this report. Well count summaries are not accurate in several of the attached cash flows. Many proved non-producing wells are counted in the current proved producing well counts.

RESERVES ESTIMATES

Standard geological and engineering methods generally accepted by the petroleum industry were used in the estimation of QRI’s reserves. Deterministic methods were used for all reserves included in this report. The appropriate combination of conventional decline curve analysis (DCA), production data analysis, volumetrics, and type curves were used to estimate the remaining reserves in the various producing areas. Volumetric calculations were based on data and maps provided by QRI. Comparisons were made to similar properties for which more complete data were available for areas of new development.

Reserve estimates are strictly technical judgments. The accuracy of any reserve estimate is a function of the quality and quantity of data available and of the engineering and geological interpretations. The reserve estimates presented in this report are believed reasonable; however, they are estimates only and should be accepted with the understanding that reservoir performance subsequent to the date of the estimate may justify their revision. A portion of these reserves are for undeveloped locations and producing or non-producing wells that lack sufficient production history to utilize conventional performance-based reserve estimates. In these cases, the reserves are based on volumetric estimates and recovery efficiencies along with analogies to similar producing areas. These reserve estimates are subject to a greater degree of uncertainty than those based on substantial production and pressure data. As additional production and pressure data becomes available, these estimates may be revised up or down. Actual future prices may vary significantly from the prices used in this evaluation; therefore, future hydrocarbon volumes recovered and the income received from these volumes may vary significantly from those estimated in this report. The present worth is shown to indicate the effect of time on the value of money and should not be construed as being the fair market value of the properties.

RESERVE CATEGORIES

Reserves were assigned to the proved developed producing (PDP), proved developed non-producing (PDNP), and proved undeveloped (PUD) reserve categories. Oil and gas reserves by definition fall into one of the following categories: proved, probable, and possible. The proved category is further divided into: developed and undeveloped. The developed reserve category is even further divided into the appropriate reserve status subcategories: producing and non-producing. Non-producing reserves include shut-in and behind-pipe reserves. The reserves evaluated in this report conform to the U.S. Securities and Exchange Commission Regulation S-X, Rule 210.4-10 (a). These reserve definitions are presented in the Reserve Definitions section of this report.

| Data & Consulting Services |

| |

| Division of Schlumberger Technology Corporation |

8 December 2011

Page 5

In our opinion the above-described estimates of QRI’s reserves and supporting data are, in the aggregate, reasonable. It is also our opinion that the above-described estimates of QRI’s proved reserves conform to the definitions of proved oil and gas reserves promulgated by the SEC.

QRI has an active exploration and development program to develop their interests in certain tracts not classified as proved at this time. Future drilling may result in the reclassification of additional volumes to the proved reserve category. However, changes in the regulatory requirements for oil and gas operations may impact future development plans and the ability of the company to recover the estimated proved undeveloped reserves. The reserves and income attributable to the various reserve categories included in this report have not been adjusted to reflect the varying degrees of risk associated with them.

ECONOMIC TERMS

Net revenue (sales) is defined as the total proceeds from the sale of oil, condensate, natural gas liquids (NGL), and gas adjusted for commodity price basis differential and gathering/ transportation expense. Future net income (cashflow) is future net revenue less net lease operating expenses, state severance or production taxes, operating/development capital expenses and net salvage. Future net income (cashflow) for nonoperated wells includes those general and administrative (G&A) deductions charged by the operator for a particular well or project on a monthly basis; operated well G&A deductions include only those expenses estimated as necessary to continue production activities. Future plugging, abandonment, and salvage costs are included at the economic life of each well or unit. No provisions for State or Federal income taxes have been made in this evaluation. The present worth (discounted cashflow) at various discount rates is calculated on a monthly basis.

PRICING AND ECONOMIC PARAMETERS

All product prices, costs, and economic parameters used in this report were supplied by QRI and reviewed by DCS. Data from QRI were accepted as presented. All prices used in preparation of this report were based on the twelve month unweighted arithmetic average of the first day of the month price for the period January through December 2010. The resulting Henry Hub gas price used was $4.380/MMBtu and the resulting West Texas Intermediate oil price used was $79.43/Bbl. The prices were adjusted for local differentials, gravity and Btu where applicable. As required by SEC guidelines, all pricing was held constant for the life of the projects (no escalation). QRI’s estimates for capital costs for all non-producing and undeveloped wells are included in the evaluation. QRI has indicated to us that they have the ability and intent to implement their capital expenditure program as scheduled.

Future plugging and abandonment, net of salvage costs, were added at the economic life of each well or project. The costs are based on estimated plugging costs by area. The addition of plugging costs to the properties reduces both the total proved undiscounted cash flow and the present worth value discounted at 10% by $40,306.3M and $6,978.6M respectively. The cash flow summaries by reserve category excluding the plugging and salvage are included in the No Abandonment section of this report.

OWNERSHIP

The leasehold interests were supplied by QRI and were accepted as presented. No attempt was made by the undersigned to verify the title or ownership of the interests evaluated.

GENERAL

All data used in this study were obtained from QRI, public industry information sources, or the non-confidential files of DCS. A field inspection of the properties was not made in connection with the preparation of this report.

| Data & Consulting Services |

| |

| Division of Schlumberger Technology Corporation |

8 December 2011

Page 6

The potential environmental liabilities attendant to ownership and/or operation of the properties have not been addressed in this report. Abandonment and clean-up costs and possible salvage value of the equipment were considered in this report.

In the conduct of our evaluation, we have not independently verified the accuracy and completeness of information and data furnished by QRI with respect to ownership interests, historical gas production, costs of operation and development, product prices, payout balances, and agreements relating to current and future operations and sales of production. If in the course of our examination something came to our attention which brought into question the validity or sufficiency of any of the information or data provided by QRI, we did not rely on such information or data until we had satisfactorily resolved our questions relating thereto or independently verified such information or data.

In evaluating the information at our disposal related to this report, we have excluded from our consideration all matters which require a legal or accounting interpretation, or any interpretation other than those of an engineering or geological nature. In assessing the conclusions expressed in this report pertaining to all aspects of oil and gas evaluations, especially pertaining to reserve evaluations, there are uncertainties inherent in the interpretation of engineering data, and such conclusions represent only informed professional judgments.

We are independent with respect to QRI as provided in the SEC regulations. Neither the employment of nor the compensation received by DCS was contingent upon the values estimated for the properties included in this report.

Data and worksheets used in the preparation of this evaluation will be maintained in our files in Pittsburgh and will be available for inspection by anyone having proper authorization by QRI.

We appreciate the opportunity to perform this evaluation and are available should you need further assistance in this matter.

| Sincerely yours, | ||||

|

| |||

| Denise L. Delozier | Charles M. Boyer II, PG, CPG | |||

| Technical Director of Reserves | NE Basin Consulting Services Manager | |||

| North America | ||||

|

||||

| Walter K. Sawyer, PE | ||||

| Principal Consultant | ||||

Reserves Definitions

SECURITIES AND EXCHANGE COMMISION

REGULATION S-X, RULE 210.4-10 (a)

RESERVES DEFINITIONS

(2) Analogous reservoir. Analogous reservoirs, as used in resources assessments, have similar rock and fluid properties, reservoir conditions (depth, temperature, and pressure) and drive mechanisms, but are typically at a more advanced stage of development than the reservoir of interest and thus may provide concepts to assist in the interpretation of more limited data and estimation of recovery. When used to support proved reserves, an “analogous reservoir” refers to a reservoir that shares the following characteristics with the reservoir of interest:

(i) Same geological formation (but not necessarily in pressure communication with the reservoir of interest);

(ii) Same environment of deposition;

(iii) Similar geological structure; and

(iv) Same drive mechanism.

Instruction to paragraph (a)(2): Reservoir properties must, in the aggregate, be no more favorable in the analog than in the reservoir of interest.

(5) Deterministic estimate. The method of estimating reserves or resources is called deterministic when a single value for each parameter (from the geoscience, engineering, or economic data) in the reserves calculation is used in the reserves estimation procedure.

(6) Developed oil and gas reserves. Developed oil and gas reserves are reserves of any category that can be expected to be recovered:

(i) Through existing wells with existing equipment and operating methods or in which the cost of the required equipment is relatively minor compared to the cost of a new well; and

(ii) Through installed extraction equipment and infrastructure operational at the time of the reserves estimate if the extraction is by means not involving a well.

(10) Economically producible. The term economically producible, as it relates to a resource, means a resource which generates revenue that exceeds, or is reasonably expected to exceed, the costs of the operation. The value of the products that generate revenue shall be determined at the terminal point of oil and gas producing activities as defined in paragraph (a)(16) of this section.

| (16) | Oil and gas producing activities. |

(i) Oil and gas producing activities include:

(A) The search for crude oil, including condensate and natural gas liquids, or natural gas (“oil and gas”) in their natural states and original locations;

(B) The acquisition of property rights or properties for the purpose of further exploration or for the purpose of removing the oil or gas from such properties;

(C) The construction, drilling, and production activities necessary to retrieve oil and gas from their natural reservoirs, including the acquisition, construction, installation, and maintenance of field gathering and storage systems, such as:

(1) Lifting the oil and gas to the surface; and

(2) Gathering, treating, and field processing (as in the case of processing gas to extract liquid hydrocarbons); and

(D) Extraction of saleable hydrocarbons, in the solid, liquid, or gaseous state, from oil sands, shale, coalbeds, or other nonrenewable natural resources which are intended to be upgraded into synthetic oil or gas, and activities undertaken with a view to such extraction.

Instruction 1 to paragraph (a)(16)(i): The oil and gas production function shall be regarded as ending at a “terminal point”, which is the outlet valve on the lease or field storage tank. If unusual physical or operational circumstances exist, it may be appropriate to regard the terminal point for the production function as:

a. The first point at which oil, gas, or gas liquids, natural or synthetic, are delivered to a main pipeline, a common carrier, a refinery, or a marine terminal; and

b. In the case of natural resources that are intended to be upgraded into synthetic oil or gas, if those natural resources are delivered to a purchaser prior to upgrading, the first point at which the natural resources are delivered to a main pipeline, a common carrier, a refinery, a marine terminal, or a facility which upgrades such natural resources into synthetic oil or gas.

Instruction 2 to paragraph (a)(16)(i): For purposes of this paragraph (a)(16), the term saleable hydrocarbons means hydrocarbons that are saleable in the state in which the hydrocarbons are delivered.

(ii) Oil and gas producing activities do not include:

(A) Transporting, refining, or marketing oil and gas;

(B) Processing of produced oil, gas or natural resources that can be upgraded into synthetic oil or gas by a registrant that does not have the legal right to produce or a revenue interest in such production;

(C) Activities relating to the production of natural resources other than oil, gas, or natural resources from which synthetic oil and gas can be extracted; or

(D) Production of geothermal steam.

(17) Possible reserves. Possible reserves are those additional reserves that are less certain to be recovered than probable reserves.

(i) When deterministic methods are used, the total quantities ultimately recovered from a project have a low probability of exceeding proved plus probable plus possible reserves. When probabilistic methods are used, there should be at least a 10% probability that the total quantities ultimately recovered will equal or exceed the proved plus probable plus possible reserves estimates.

(ii) Possible reserves may be assigned to areas of a reservoir adjacent to probable reserves where data control and interpretations of available data are progressively less certain. Frequently, this will be in areas where geoscience and engineering data are unable to define clearly the area and vertical limits of commercial production from the reservoir by a defined project.

(iii) Possible reserves also include incremental quantities associated with a greater percentage recovery of the hydrocarbons in place than the recovery quantities assumed for probable reserves.

(iv) The proved plus probable and proved plus probable plus possible reserves estimates must be based on reasonable alternative technical and commercial interpretations within the reservoir or subject project that are clearly documented, including comparisons to results in successful similar projects.

(v) Possible reserves may be assigned where geoscience and engineering data identify directly adjacent portions of a reservoir within the same accumulation that may be separated from proved areas by faults with displacement less than formation thickness or other geological discontinuities and that have not been penetrated by a wellbore, and the registrant believes that such adjacent portions are in communication with the known (proved) reservoir. Possible reserves may be assigned to areas that are structurally higher or lower than the proved area if these areas are in communication with the proved reservoir.

(vi) Pursuant to paragraph (a)(22)(iii) of this section, where direct observation has defined a highest known oil (HKO) elevation and the potential exists for an associated gas cap, proved oil reserves should be assigned in the structurally higher portions of the reservoir above the HKO only if the higher contact can be established with reasonable certainty through reliable technology. Portions of the reservoir that do not meet this reasonable certainty criterion may be assigned as probable and possible oil or gas based on reservoir fluid properties and pressure gradient interpretations.

(18) Probable reserves. Probable reserves are those additional reserves that are less certain to be recovered than proved reserves but which, together with proved reserves, are as likely as not to be recovered.

(i) When deterministic methods are used, it is as likely as not that actual remaining quantities recovered will exceed the sum of estimated proved plus probable reserves. When probabilistic methods are used, there should be at least a 50% probability that the actual quantities recovered will equal or exceed the proved plus probable reserves estimates.

(ii) Probable reserves may be assigned to areas of a reservoir adjacent to proved reserves where data control or interpretations of available data are less certain, even if the interpreted reservoir continuity of structure or productivity does not meet the reasonable certainty criterion. Probable reserves may be assigned to areas that are structurally higher than the proved area if these areas are in communication with the proved reservoir.

(iii) Probable reserves estimates also include potential incremental quantities associated with a greater percentage recovery of the hydrocarbons in place than assumed for proved reserves.

(iv) See also guidelines in paragraphs (a)(17)(iv) and (a)(17)(vi) of this section.

(19) Probabilistic estimate. The method of estimation of reserves or resources is called probabilistic when the full range of values that could reasonably occur for each unknown parameter (from the geoscience and engineering data) is used to generate a full range of possible outcomes and their associated probabilities of occurrence.

| (21) | Proved area. The part of a property to which proved reserves have been specifically attributed. |

(22) Proved oil and gas reserves. Proved oil and gas reserves are those quantities of oil and gas, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible—from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations—prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. The project to extract the hydrocarbons must have commenced or the operator must be reasonably certain that it will commence the project within a reasonable time.

(i) The area of the reservoir considered as proved includes:

(A) The area identified by drilling and limited by fluid contacts, if any, and

(B) Adjacent undrilled portions of the reservoir that can, with reasonable certainty, be judged to be continuous with it and to contain economically producible oil or gas on the basis of available geoscience and engineering data.

(ii) In the absence of data on fluid contacts, proved quantities in a reservoir are limited by the lowest known hydrocarbons (LKH) as seen in a well penetration unless geoscience, engineering, or performance data and reliable technology establishes a lower contact with reasonable certainty.

(iii) Where direct observation from well penetrations has defined a highest known oil (HKO) elevation and the potential exists for an associated gas cap, proved oil reserves may be assigned in the structurally higher portions of the reservoir only if geoscience, engineering, or performance data and reliable technology establish the higher contact with reasonable certainty.

(iv) Reserves which can be produced economically through application of improved recovery techniques (including, but not limited to, fluid injection) are included in the proved classification when:

(A) Successful testing by a pilot project in an area of the reservoir with properties no more favorable than in the reservoir as a whole, the operation of an installed program in the reservoir or an analogous reservoir, or other evidence using reliable technology establishes the reasonable certainty of the engineering analysis on which the project or program was based; and

(B) The project has been approved for development by all necessary parties and entities, including governmental entities.

(v) Existing economic conditions include prices and costs at which economic producibility from a reservoir is to be determined. The price shall be the average price during the 12-month period prior to the ending date of the period covered by the report, determined as an unweighted arithmetic average of the first-day-of-the-month price for each month within such period, unless prices are defined by contractual arrangements, excluding escalations based upon future conditions.

| (23) | Proved properties. Properties with proved reserves. |

(24) Reasonable certainty. If deterministic methods are used, reasonable certainty means a high degree of confidence that the quantities will be recovered. If probabilistic methods are used, there should be at least a 90% probability that the quantities actually recovered will equal or exceed the estimate. A high degree of confidence exists if the quantity is much more likely to be achieved than not, and, as changes due to increased availability of geoscience (geological, geophysical, and geochemical), engineering, and economic data are made to estimated ultimate recovery (EUR) with time, reasonably certain EUR is much more likely to increase or remain constant than to decrease.

(25) Reliable technology. Reliable technology is a grouping of one or more technologies (including computational methods) that has been field tested and has been demonstrated to provide reasonably certain results with consistency and repeatability in the formation being evaluated or in an analogous formation.

(26) Reserves. Reserves are estimated remaining quantities of oil and gas and related substances anticipated to be economically producible, as of a given date, by application of development projects to known accumulations. In addition, there must exist, or there must be a reasonable expectation that there will exist, the legal right to produce or a revenue interest in the production, installed means of delivering oil and gas or related substances to market, and all permits and financing required to implement the project.

Note to paragraph (a)(26): Reserves should not be assigned to adjacent reservoirs isolated by major, potentially sealing, faults until those reservoirs are penetrated and evaluated as economically producible. Reserves should not be assigned to areas that are clearly separated from a known accumulation by a non-productive reservoir (i.e., absence of reservoir, structurally low reservoir, or negative test results). Such areas may contain prospective resources (i.e., potentially recoverable resources from undiscovered accumulations).

(27) Reservoir. A porous and permeable underground formation containing a natural accumulation of producible oil and/or gas that is confined by impermeable rock or water barriers and is individual and separate from other reservoirs.

(28) Resources. Resources are quantities of oil and gas estimated to exist in naturally occurring accumulations. A portion of the resources may be estimated to be recoverable, and another portion may be considered to be unrecoverable. Resources include both discovered and undiscovered accumulations.

(31) Undeveloped oil and gas reserves. Undeveloped oil and gas reserves are reserves of any category that are expected to be recovered from new wells on undrilled acreage, or from existing wells where a relatively major expenditure is required for recompletion.

(i) Reserves on undrilled acreage shall be limited to those directly offsetting development spacing areas that are reasonably certain of production when drilled, unless evidence using reliable technology exists that establishes reasonable certainty of economic producibility at greater distances.

(ii) Undrilled locations can be classified as having undeveloped reserves only if a development plan has been adopted indicating that they are scheduled to be drilled within five years, unless the specific circumstances, justify a longer time.

(iii) Under no circumstances shall estimates for undeveloped reserves be attributable to any acreage for which an application of fluid injection or other improved recovery technique is contemplated, unless such techniques have been proved effective by actual projects in the same reservoir or an analogous reservoir, as defined in paragraph (a)(2) of this section, or by other evidence using reliable technology establishing reasonable certainty.

(32) Unproved properties. Properties with no proved reserves.