Attached files

2011

Full-Year and Fourth-Quarter Results

February 9, 2012

Exhibit 99.3

***********************************************************************************************

|

***********************************************************************************************

2

Introduction

Unless otherwise stated, we will be talking about results for the full-

year or fourth-quarter 2011 and comparing them with the same period

in 2010

References to PMI volumes refer to PMI shipment data, unless

otherwise stated

Industry volume and market shares are the latest data available from

a number of sources

Organic volume refers to volume excluding acquisitions

Net revenues exclude excise taxes

OCI stands for Operating Companies Income, which is defined as

operating income before general corporate expenses and the

amortization of intangibles. OCI growth rates are on an adjusted

basis, which excludes asset impairment, exit and other costs

Data tables showing adjustments to net revenues and OCI for

currency, acquisitions, asset impairment, exit and other costs, free

cash flow calculations, adjustments to EPS, and reconciliations to

U.S. GAAP measures are at the end of today’s webcast slides and

are posted on our web site |

***********************************************************************************************

3

Forward-Looking and Cautionary Statements

This presentation and related discussion contain statements that, to the

extent they do not relate strictly to historical or current facts, constitute

“forward-looking statements”

within the meaning of the Private Securities

Litigation Reform Act of 1995. Such forward-looking statements are

based on current plans, estimates and expectations, and are not

guarantees of future performance. They are based on management’s

expectations that involve a number of business risks and uncertainties,

any of which could cause actual results to differ materially from those

expressed in or implied by the forward-looking statements. PMI

undertakes no obligation to publicly update or revise any forward-looking

statements, except in the normal course of its public disclosure

obligations. The risks and uncertainties relating to the forward-looking

statements in this presentation include those described under Item 1A.

“Risk Factors”

in PMI’s Form 10-Q for the quarter ended September 30,

2011, filed with the Securities and Exchange Commission.

|

4

Outstanding 2011 Results

Organic cigarette volume growth of 0.5%, thanks notably

to Indonesia and Japan

Fourth consecutive year of global share growth driven by

our superior brand portfolio

Solid volume performance, strong pricing, and significant

productivity savings led to record profitability

Strong cash flow driving generous returns to shareholders

Source: PMI Financials

***********************************************************************************************

|

Outstanding 2011 Results

(a)

Excluding currency and acquisitions

(b)

Excluding currency

Source: PMI Financials

5

***********************************************************************************************

|

6

Reversal of Currency Favorability in 2012

Recent unfavorable currency movements:

Weaker Euro, due to debt issues in Europe

Depreciation of certain emerging market currencies

At prevailing exchange rates, forecast currency headwind

of approximately 10 cents per share in 2012

This would amount to a reversal of about half the 2011

favorability of 19 cents per share

Source: PMI Forecasts

***********************************************************************************************

|

7

2012 EPS Guidance

Excellent business momentum

We will fully compensate the EPS hurdle of 10 cents

related to the exceptional circumstances in Japan in 2011

Reported diluted EPS guidance for 2012, at prevailing

exchange rates, is $5.25 to $5.35 versus $4.85 in 2011

This corresponds to a growth rate of approximately 10%

to 12% on a currency-neutral basis, compared to adjusted

diluted EPS of $4.88 in 2011

Expect to again meet our mid to long-term currency-

neutral annual growth targets in 2012

Source: PMI Forecasts

***********************************************************************************************

|

8

Growing Free Cash Flow

(a)

at Double-Digit Rate

(a)

Free cash flow equals net cash provided by operating activities less capital

expenditures Source: PMI Financials

($ billion)

***********************************************************************************************

|

9

Accelerated Share Repurchases

$12 billion three-year share repurchase program initiated

in May 2010

$3.6 billion available under this program at the end of

2011

Current program expected to be completed well ahead of

schedule

Plan to spend $6 billion on share repurchases in 2012

Source: PMI Financials and PMI Forecasts

***********************************************************************************************

|

10

2011 Key Drivers and 2012 Business Outlook

Manageable excise tax environment

Stable industry volume trends

Superior brand portfolio

Market share growth

Favorable pricing environment

Limited input cost increases and strong productivity gains

***********************************************************************************************

|

***********************************************************************************************

11

Manageable Excise Tax Environment

Most governments appear to have understood that large

disruptive excise tax increases usually do not generate

targeted increases in revenues, nor are sustainable

No excessive excise tax increases implemented or

announced so far in 2011

Reasonable approach in terms of incidence and structure

Several countries in Europe are most likely to increase

VAT this year, but believe this should be manageable

Source: PMI Forecasts |

***********************************************************************************************

12

Outlook for Industry Volume Trends

Cigarette industry volume trends anticipated to be similar

to those prevalent in 2011

Potential for growth in non-OECD markets where adult

smoking population expanding and economy vibrant

(Asia, Middle East)

Moderate decline expected in OECD markets and Eastern

Europe

Southern Europe remains a concern, due to high and

rising unemployment

Expect PMI organic cigarette volume to be relatively flat in

2012

Source: PMI Forecasts |

***********************************************************************************************

13

PMI Market Share Growth Momentum

(a)

(a)

Excluding USA and China. Historical data adjusted for pro-forma inclusion

of 2010 business combination with FTC in the Philippines and the

2011 acquisition in Jordan

(b)

Also excluding duty-free

(c)

Organisation for Economic Co-operation and Development (OECD) member countries

are listed on their website (www.oecd.org) Source: PMI estimates

(%)

Non-OECD Markets

(b)

(%)

Total

(%)

Top 30 OCI Markets

(%)

OECD Markets

(b)(c) |

***********************************************************************************************

14

Top Ten PMI Brands Grew in 2011

% Volume Growth vs. Prior Year

Q4, 2011

FY 2011

Marlboro

2.3%

0.9%

L&M

(1.9)

1.7

Fortune

6.4

8.2

(a)

Bond Street

1.5

2.0

Parliament

18.7

12.1

Philip Morris

2.4

1.4

Chesterfield

1.4

0.6

Sampoerna A

12.0

11.8

Lark

25.8

17.5

Dji Sam Soe

10.1

10.3

(a) March through December (business combination with FTC)

Source: PMI Financials |

***********************************************************************************************

Market Shares

2009

2010

2011

Asia

(a)

5.8%

6.1%

6.4%

EEMA

6.4

6.5

6.8

EU

18.4

18.1

17.9

LA&C

13.8

14.1

13.8

(c)

Total

(a)(b)

9.0

9.1

9.2

15

Marlboro

Gaining

Market

Share

(a) Excluding China

(b)

Also excluding the USA

(c)

Marlboro

share

up

in

all

major

markets

in

the

Latin

America

&

Canada

Region.

However,

the

regional

share

decreased

due

to

a

steep

excise

tax-

driven decline in industry volume in Mexico where the brand had a 52.3% market

share in 2011 Source: PMI estimates |

***********************************************************************************************

16

Tremendous Performance of Parliament

Luxury positioning

Above premium price

Volume in 2011 grew by

12.1% to 39 billion units

PMI Market Shares

(%)

Note: Kaz. is Kazakhstan

Source:

PMI

Financials,

PMI

estimates,

Hankook

Research

and

A.C.

Nielsen |

***********************************************************************************************

17

Increased Volume of L&M

Leading international low-

price brand

Volume in 2011 grew by

1.7% to 90 billion units

Innovative line extensions

(%)

PMI Market Shares

Source: PMI Financials and PMI estimates |

***********************************************************************************************

18

Favorable OCI Volume/Mix Variance in 2011

Source: PMI Financials |

***********************************************************************************************

Pricing Variance of $1.9 Billion in 2011

($ million)

Source: PMI Financials

2008-10 average:

$1,623 mio.

19 |

************************************************************************************************

***********************************************************************************************

Adjusted OCI Margins

Full-Year

2010

2011

(a)

Variance

(a)

Asia

38.7%

44.7%

6.0pp

EEMA

42.5

42.9

0.4

EU

49.2

49.4

0.2

LA&C

31.2

31.4

0.2

Total

42.3

44.2

1.9

20

Improved Margins

(a)

Excluding currency and acquisitions

Source: PMI Financials |

***********************************************************************************************

21

$300 Million Productivity Target in 2012

Forecast moderate increases in tobacco leaf prices and direct

material costs, broadly in line with inflation

Increased but manageable costs, mainly in Europe, relating to

the imposition of “RCIP”

paper

$300 million productivity pre-tax target in 2012, mainly derived

from manufacturing and supply chain initiatives

Source: PMI Forecasts |

***********************************************************************************************

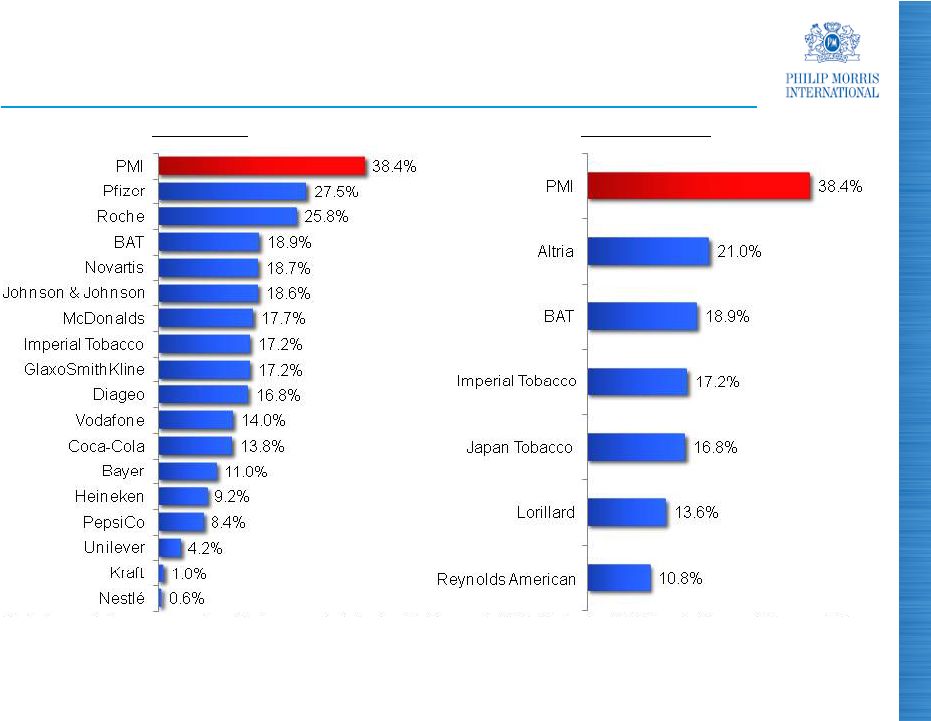

Peer Group

Tobacco Sector

Free Cash Flow as a % of Net Revenues –

(YTD September, 2011)

22

Note: Free cash flow as a percentage of net revenues is defined as total January 1,

2011 – September 30, 2011 period free cash flow over total

January 1, 2011 –

September 30, 2011 period net revenues. Free cash flow is defined as net cash

provided by operating activities less capital expenditures. Nearest

comparable period is used where the January 1, 2011 – September 30,

2011 comparison is not available. PMI’s free cash flow and net revenues

for the period were $9,000 million and $23,426 million, respectively Source:

Company filings, compiled by Centerview |

***********************************************************************************************

Significant Returns to Shareholders Through

Dividends and Share Repurchases

Note: Dividends for 2008 and 2011 are annualized rates. 2008 annualized rate is

based on a quarterly dividend of $0.46 per common share, declared June 18,

2008. The annualized rate for 2011 is based on a quarterly dividend of $0.77 per common share, declared September 14, 2011. The

outstanding PMI shares at the time of the spin were 2,109 million

Source: PMI Financials

23 |

***********************************************************************************************

PMI Outperformed All 30 Stocks in the Dow Jones

Industrial Average in 2011

24

Source: FactSet, compiled by Centerview |

***********************************************************************************************

25

Questions & Answers

2011 Full-Year and Fourth-Quarter

Results |

***********************************************************************************************

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Adjustments for the Impact of Currency and Acquisitions

For the Quarters Ended December 31,

($ in millions)

(Unaudited)

Reported Net

Revenues

Less

Excise

Taxes

Reported Net

Revenues

excluding

Excise Taxes

Less

Currency

Reported Net

Revenues

excluding

Excise Taxes &

Currency

Less

Acquisi-

tions

Reported Net

Revenues

excluding

Excise Taxes,

Currency &

Acquisitions

Reported

Net

Revenues

Less

Excise

Taxes

Reported Net

Revenues

excluding

Excise Taxes

Reported

Reported

excluding

Currency

Reported

excluding

Currency &

Acquisitions

7,118

$

4,910

$

2,208

$

38

$

2,170

$

-

$

2,170

$

European Union

6,997

$

4,804

$

2,193

$

0.7%

(1.0)%

(1.0)%

4,257

2,285

1,972

(66)

2,038

12

2,026

EEMA

4,263

2,385

1,878

5.0%

8.5%

7.9%

5,013

2,366

2,647

92

2,555

2

2,553

Asia

4,141

2,035

2,106

25.7%

21.3%

21.2%

2,488

1,644

844

(23)

867

-

867

Latin America & Canada

2,406

1,546

860

(1.9)%

0.8%

0.8%

18,876

$

11,205

$

7,671

$

41

$

7,630

$

14

$

7,616

$

PMI Total

17,807

$

10,770

$

7,037

$

9.0%

8.4%

8.2%

Reported

Operating

Companies

Income

Less

Currency

Reported

Operating

Companies

Income

excluding

Currency

Less

Acquisi-

tions

Reported

Operating

Companies

Income

excluding

Currency &

Acquisitions

Reported

Operating

Companies

Income

Reported

Reported

excluding

Currency

Reported

excluding

Currency &

Acquisitions

1,012

$

41

$

971

$

-

$

971

$

European Union

1,031

$

(1.8)%

(5.8)%

(5.8)%

747

(64)

811

-

811

EEMA

740

0.9%

9.6%

9.6%

1,036

49

987

2

985

Asia

790

31.1%

24.9%

24.7%

214

(12)

226

-

226

Latin America & Canada

254

(15.7)%

(11.0)%

(11.0)%

3,009

$

14

$

2,995

$

2

$

2,993

$

PMI Total

2,815

$

6.9%

6.4%

6.3%

2011

2010

% Change in Reported Operating

Companies Income

2011

2010

% Change in Reported Net Revenues

excluding Excise Taxes

26 |

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Operating Companies Income to Adjusted Operating

Companies Income & Reconciliation of Adjusted Operating Companies Income

Margin, excluding Currency and Acquisitions For the Quarters Ended December

31, ($ in millions)

(Unaudited)

(a) For the calculation of net revenues excluding excise taxes, currency and

acquisitions, refer to previous slide Reported

Operating

Companies

Income

Less

Asset

Impairment &

Exit Costs

Adjusted

Operating

Companies

Income

Less

Currency

Adjusted

Operating

Companies

Income

excluding

Currency

Less

Acquisi-

tions

Adjusted

Operating

Companies

Income

excluding

Currency &

Acquisitions

Reported

Operating

Companies

Income

Less

Asset Impairment &

Exit Costs

Adjusted

Operating

Companies

Income

Adjusted

Adjusted

excluding

Currency

Adjusted

excluding

Currency &

Acquisitions

1,012

$

(22)

$

1,034

$

41

$

993

$

-

$

993

$

European Union

1,031

$

(7)

$

1,038

$

(0.4)%

(4.3)%

(4.3)%

747

(7)

754

(64)

818

-

818

EEMA

740

-

740

1.9%

10.5%

10.5%

1,036

(8)

1,044

49

995

2

993

Asia

790

(20)

810

28.9%

22.8%

22.6%

214

(12)

226

(12)

238

-

238

Latin America & Canada

254

-

254

(11.0)%

(6.3)%

(6.3)%

3,009

$

(49)

$

3,058

$

14

$

3,044

$

2

$

3,042

$

PMI Total

2,815

$

(27)

$

2,842

$

7.6%

7.1%

7.0%

% Points Change

Adjusted

Operating

Companies

Income

excluding

Currency

Net Revenues

excluding

Excise Taxes &

Currency

(a)

Adjusted

Operating

Companies

Income

Margin

excluding

Currency

Adjusted

Operating

Companies

Income

excluding

Currency &

Acquisitions

Net Revenues

excluding

Excise Taxes,

Currency &

Acquisitions

(a)

Adjusted

Operating

Companies

Income

Margin

excluding

Currency &

Acquisitions

Adjusted

Operating

Companies

Income

Net Revenues

excluding Excise

Taxes

(a)

Adjusted

Operating

Companies

Income

Margin

Adjusted

Operating

Companies

Income

Margin

excluding

Currency

Adjusted

Operating

Companies

Income Margin

excluding

Currency &

Acquisitions

993

$

2,170

$

45.8%

993

$

2,170

$

45.8%

European Union

1,038

$

2,193

$

47.3%

(1.5)

(1.5)

818

2,038

40.1%

818

2,026

40.4%

EEMA

740

1,878

39.4%

0.7

1.0

995

2,555

38.9%

993

2,553

38.9%

Asia

810

2,106

38.5%

0.4

0.4

238

867

27.5%

238

867

27.5%

Latin America & Canada

254

860

29.5%

(2.0)

(2.0)

3,044

$

7,630

$

39.9%

3,042

$

7,616

$

39.9%

PMI Total

2,842

$

7,037

$

40.4%

(0.5)

(0.5)

2010

2011

2010

2011

% Change in Adjusted Operating

Companies Income

27

***********************************************************************************************

|

***********************************************************************************************

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS and Adjusted

Diluted EPS, excluding Currency For the Quarters Ended December 31,

(Unaudited)

2011

2010

% Change

Reported Diluted EPS

1.08

$

0.96

$

12.5%

Adjustments:

Asset impairment and exit costs

0.02

0.01

Tax items

-

-

Adjusted Diluted EPS

1.10

$

0.97

$

13.4%

Less:

Currency impact

-

Adjusted Diluted EPS, excluding Currency

1.10

$

0.97

$

13.4%

28 |

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Adjustments for the Impact of Currency and Acquisitions

For the Years Ended December 31,

($ in millions)

(Unaudited)

(a) Includes the business combination in the Philippines ($105)

(b) Includes the business combination in the Philippines ($23)

Reported Net

Revenues

Less

Excise

Taxes

Reported Net

Revenues

excluding

Excise Taxes

Less

Currency

Reported Net

Revenues

excluding

Excise Taxes &

Currency

Less

Acquisi-

tions

Reported Net

Revenues

excluding

Excise Taxes,

Currency &

Acquisitions

Reported

Net

Revenues

Less

Excise

Taxes

Reported Net

Revenues

excluding

Excise Taxes

Reported

Reported

excluding

Currency

Reported

excluding

Currency &

Acquisitions

29,768

$

20,556

$

9,212

$

440

$

8,772

$

-

$

8,772

$

European Union

28,050

$

19,239

$

8,811

$

4.6%

(0.4)%

(0.4)%

17,452

9,571

7,881

49

7,832

25

7,807

EEMA

15,928

8,519

7,409

6.4%

5.7%

5.4%

19,590

8,885

10,705

690

10,015

112

(a)

9,903

Asia

15,235

7,300

7,935

34.9%

26.2%

24.8%

9,536

6,237

3,299

70

3,229

-

3,229

Latin America & Canada

8,500

5,447

3,053

8.1%

5.8%

5.8%

76,346

$

45,249

$

31,097

$

1,249

$

29,848

$

137

$

29,711

$

PMI Total

67,713

$

40,505

$

27,208

$

14.3%

9.7%

9.2%

Reported

Operating

Companies

Income

Less

Currency

Reported

Operating

Companies

Income

excluding

Currency

Less

Acquisi-

tions

Reported

Operating

Companies

Income

excluding

Currency &

Acquisitions

Reported

Operating

Companies

Income

Reported

Reported

excluding

Currency

Reported

excluding

Currency &

Acquisitions

4,560

$

277

$

4,283

$

(1)

$

4,284

$

European Union

4,311

$

5.8%

(0.6)%

(0.6)%

3,229

(97)

3,326

(13)

3,339

EEMA

3,152

2.4%

5.5%

5.9%

4,836

400

4,436

28

(b)

4,408

Asia

3,049

58.6%

45.5%

44.6%

988

(2)

990

-

990

Latin America & Canada

953

3.7%

3.9%

3.9%

13,613

$

578

$

13,035

$

14

$

13,021

$

PMI Total

11,465

$

18.7%

13.7%

13.6%

2011

2010

% Change in Reported Operating

Companies Income

2011

2010

% Change in Reported Net Revenues

excluding Excise Taxes

29

***********************************************************************************************

|

***********************************************************************************************

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Operating Companies Income to Adjusted Operating

Companies Income & Reconciliation of Adjusted Operating Companies Income

Margin, excluding Currency and Acquisitions For the Years Ended December

31, ($ in millions)

(Unaudited)

(a) Includes the business combination in the Philippines ($23)

(b) For the calculation of net revenues excluding excise taxes, currency and

acquisitions, refer to previous slide Reported

Operating

Companies

Income

Less

Asset

Impairment &

Exit Costs

Adjusted

Operating

Companies

Income

Less

Currency

Adjusted

Operating

Companies

Income

excluding

Currency

Less

Acquisi-

tions

Adjusted

Operating

Companies

Income

excluding

Currency &

Acquisitions

Reported

Operating

Companies

Income

Less

Asset Impairment &

Exit Costs

Adjusted

Operating

Companies

Income

Adjusted

Adjusted

excluding

Currency

Adjusted

excluding

Currency &

Acquisitions

4,560

$

(45)

$

4,605

$

277

$

4,328

$

(1)

$

4,329

$

European Union

4,311

$

(27)

$

4,338

$

6.2%

(0.2)%

(0.2)%

3,229

(25)

3,254

(97)

3,351

(1)

3,352

EEMA

3,152

-

3,152

3.2%

6.3%

6.3%

4,836

(15)

4,851

400

4,451

28

(a)

4,423

Asia

3,049

(20)

3,069

58.1%

45.0%

44.1%

988

(24)

1,012

(2)

1,014

-

1,014

Latin America & Canada

953

-

953

6.2%

6.4%

6.4%

13,613

$

(109)

$

13,722

$

578

$

13,144

$

26

$

13,118

$

PMI Total

11,465

$

(47)

$

11,512

$

19.2%

14.2%

14.0%

% Points Change

Adjusted

Operating

Companies

Income

excluding

Currency

Net Revenues

excluding

Excise Taxes &

Currency

(b)

Adjusted

Operating

Companies

Income

Margin

excluding

Currency

Adjusted

Operating

Companies

Income

excluding

Currency &

Acquisitions

Net Revenues

excluding

Excise Taxes,

Currency &

Acquisitions

(b)

Adjusted

Operating

Companies

Income

Margin

excluding

Currency &

Acquisitions

Adjusted

Operating

Companies

Income

Net Revenues

excluding Excise

Taxes

(b)

Adjusted

Operating

Companies

Income

Margin

Adjusted

Operating

Companies

Income

Margin

excluding

Currency

Adjusted

Operating

Companies

Income Margin

excluding

Currency &

Acquisitions

4,328

$

8,772

$

49.3%

4,329

$

8,772

$

49.4%

European Union

4,338

$

8,811

$

49.2%

0.1

0.2

3,351

7,832

42.8%

3,352

7,807

42.9%

EEMA

3,152

7,409

42.5%

0.3

0.4

4,451

10,015

44.4%

4,423

9,903

44.7%

Asia

3,069

7,935

38.7%

5.7

6.0

1,014

3,229

31.4%

1,014

3,229

31.4%

Latin America & Canada

953

3,053

31.2%

0.2

0.2

13,144

$

29,848

$

44.0%

13,118

$

29,711

$

44.2%

PMI Total

11,512

$

27,208

$

42.3%

1.7

1.9

2010

2011

2010

2011

% Change in Adjusted Operating

Companies Income

30 |

***********************************************************************************************

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS and Adjusted

Diluted EPS, excluding Currency For the Years Ended December 31,

(Unaudited)

2011

2010

% Change

Reported Diluted EPS

4.85

$

3.92

$

23.7%

Adjustments:

Asset impairment and exit costs

0.05

0.02

Tax items

(0.02)

(0.07)

Adjusted Diluted EPS

4.88

$

3.87

$

26.1%

Less:

Currency impact

0.19

Adjusted Diluted EPS, excluding Currency

4.69

$

3.87

$

21.2%

31 |

***********************************************************************************************

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Operating Cash Flow to Free Cash Flow

($ in millions)

(Unaudited)

(a) Operating Cash Flow

32

For the Years Ended

December 31,

2008

2009

2010

2011

Net cash provided by operating activities

(a)

7,935

$

7,884

$

9,437

$

10,529

$

Less:

Capital expenditures

1,099

715

713

897

Free cash flow

6,836

$

7,169

$

8,724

$

9,632

$ |

***********************************************************************************************

33

Reconciliation of Operating Cash Flow to Free Cash Flow and

Free Cash Flow as a Percent of Net Revenues excluding Excise Taxes

($ in millions)

(Unaudited)

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

(a) Operating Cash Flow |

34

2011 Full-Year and Fourth-Quarter

Results

February 9, 2012

***********************************************************************************************

|