Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SUPERIOR ENERGY SERVICES INC | d296383d8k.htm |

| EX-99.2 - PRESS RELEASE - SUPERIOR ENERGY SERVICES INC | d296383dex992.htm |

Superior Energy Services

Credit Suisse Energy Summit

February 8, 2012

Exhibit 99.1 |

Company Overview

Company Overview |

Rationale for Superior

•

Diversified family of products

–

Serving the drilling, completion, production and decommissioning

needs of the oil and gas

industry in the U.S. with a growing presence in select international

markets •

Globally focused and not market share constrained

•

Opportunity to expand platform to new geographic markets

•

Well-positioned company

–

Competitive advantages: Quality, innovation and integrated solutions

–

Healthy balance sheet

–

High margins and returns on capital relative to peers

3 |

4 |

Participate in $90 billion of Global Market segments

5

Sources: Spears & Associates, Inc. Oilfield Market Report: 1999-2012,

Intervention & Coiled Tubing Association (1)

Excludes accommodations

(2)

#1 U.S. market share based on unit count

SPN

Rank

Drilling Products and Services (1)

Onshore Completion and Workover Services

Well Servicing

Pressure Pumping

Production Services

Coiled Tubing Services (2)

Wireline Logging

Production Testing

Subsea and Technical Solutions

Completion Tools and Products

6

th

5

th

5

th

4

th

4

th

11

th

3

rd |

Among U.S. Coiled Tubing Leaders

6

Estimated U.S. Coiled Tubing Unit Count

Source: Intervention & Coiled Tubing Association

23

34

39

49

51

73

84

Archer

RES

HAL

KEG

BHI

SLB

SPN

Includes ~66 highly-capable units (2”+) |

Pro Forma Superior Revenue by Product for TTM Ended September 30, 2011

7

Balanced Contribution from Diversified Product Mix

North America Land Revenue

Total Company Revenue

(1) Includes Snubbing, Pressure Control and Well Servicing

|

Strategic Overview

Strategic Overview |

Strategy Execution: U.S. Land Markets

•

Leveraged to wellbore

geometry and oil prices

–

Horizontal drilling has stressed

the supply chain

•

Multi-basin, multi-product

line approach

–

Deploy assets to basins with

greatest demand and service

intensity

•

Focused on undersupplied

products and services

–

Downhole drilling tools

–

Completion and production

services

9

Horizontal/Directional

Vertical

Service Intensity

(2)

(1) Source: Spears & Associates, Drilling & Production Outlook

Report, December 2011 (2) Service Intensity assumes: 1.0x intensity for

vertical wells, 1.6x intensity for directional wells and 7.0x intensity for horizontal wells

U.S. Active Rigs by Commodity

(1)

U.S. Active Rigs by Type

(1) |

•

Markets slowly recovering

from 2008 financial crisis

•

Geomarket approach

–

Maximize opportunities through

centralized diversified product

offering

•

Offer higher technology and

innovative solutions

–

Sand control completion tools

–

Subsea well containment

•

Expand into growing and

mature markets with similar

U.S. margin profile

10

Strategy Execution: International

International Revenue Since 2003 ($ MM)

(1) Annualized actual 2011 international revenue of $385 million through

9/30/2011. |

International Expansion: South America

11 |

International Expansion: UK, Middle East and Africa

12 |

International Expansion: Asia Pacific

13 |

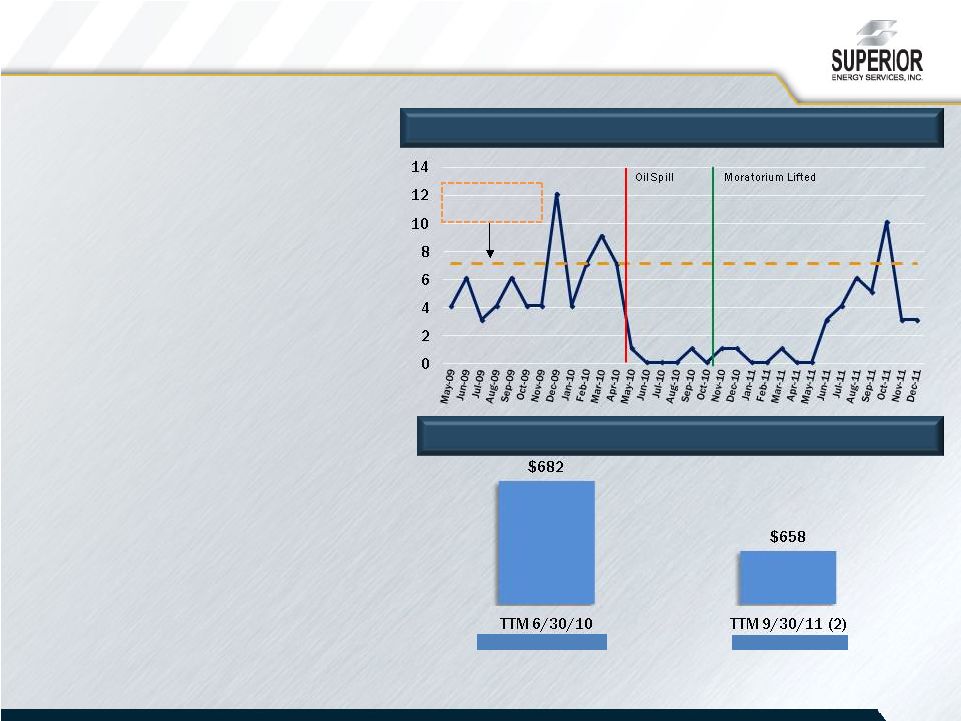

Strategy Execution: Gulf of Mexico

•

Upside to rig count

recovery in deep water

•

Maintain high share of

deep water rig count

•

Incremental exposure

through completion tools

and services

•

Primary shallow water

focus remains on well

maintenance and end-of-

life services

14

Monthly

Deep

Water

Permits

to

Drill

New

Wells

(1)

SPN Gulf of Mexico Revenue ($ in millions)

Pre-Macondo

Post-Macondo

(1)

A new well is defined as an operator drilling an original wellbore hole in the

seafloor to a geological target. Excludes permits for bypass, sidetracks, completions, interventions and end-of-life services

(2)

Content difference from TTM 6/30/10. Includes revenue from the completion

tools and products product line acquired in August of 2010.

3-year pre-spill

average:

7/mo

. |

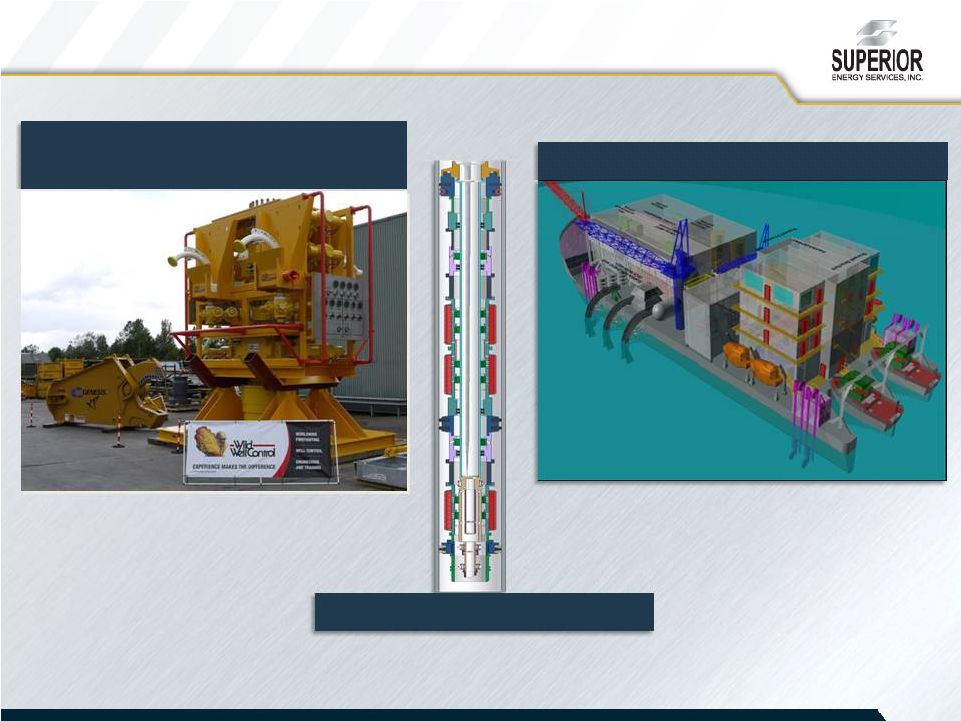

Strategy Execution: Innovation and Technical Solutions

15

Multi-zone Single Trip System

Global Subsea Containment

Capping Stack

Arctic Subsea Containment System |

Flexible Capital Expenditures Program

Estimated Lead Time for Key Capital Items (Years)

16 |

Investment Highlights

•

Diversified product line with multi-basin, multi-product offering

approach •

Small share of large, fragmented global markets provides growth potential

•

Geographic growth strategy in place

•

Positioned to benefit from continued recovery in deepwater Gulf of Mexico

•

Strong balance sheet to execute growth strategy

–

History of disciplined investments that yield high returns on capital

17 |

Forward-Looking Statements

18

This presentation contains forward-looking statements, including, in

particular, statements about Superior Energy’s plans, strategies

and prospects. These statements are based on the Company’s

current assumptions, expectations and projections about future events,

which are subject to a wide range of business risks. Although the Company

believes that the assumptions reflected in these forward-looking

statements are reasonable, the Company can give no assurance that these

assumptions will prove to be correct or that financial or market

forecasts, savings or other benefits anticipated in the

forward-looking statements will be achieved. Forward-looking

statements are not guarantees of future performance and actual results

may differ materially from those projected. The information contained in

this presentation is only current as of February 7, 2012, and the

Company undertakes no obligation to update this presentation.

|