Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PEABODY ENERGY CORP | btu8k20120207.htm |

Exhibit 99.1

Credit Suisse Energy Summit 2012

Michael C. Crews

Executive Vice President and Chief Financial Officer

February 7-8, 2012

Peabody Energy

Energizing The World One BTU At A Time

Statement on Forward-Looking Information

Some of the following information contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended, and is intended to come within the safe-harbor protection provided by those sections.

Some of the following information contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended, and is intended to come within the safe-harbor protection provided by those sections. Our forward-looking statements are based on numerous assumptions that the company believes are reasonable, but they are open to a wide range of uncertainties and business risks that may cause actual results to differ materially from expectations as of Jan. 24, 2012. These factors are difficult to accurately predict and may be beyond the company's control. The company does not undertake to update its forward-looking statements. Factors that could affect the company's results include, but are not limited to: demand for coal in the United States and the seaborne thermal and metallurgical coal markets; price volatility and demand, particularly in higher-margin products and in our trading and brokerage businesses; impact of weather on demand, production and transportation; reductions and/or deferrals of purchases by major customers and ability to renew sales contracts; credit and performance risks associated with customers, suppliers, co-shippers, trading, banks and other financial counterparties; geologic, equipment, permitting and operational risks related to mining; transportation availability, performance and costs; availability, timing of delivery and costs of key supplies, capital equipment or commodities such as diesel fuel, steel, explosives and tires; successful integration and management of the newly acquired Macarthur Coal operations; successful implementation of business strategies, including our Btu Conversion and generation development initiatives; negotiation of labor contracts, employee relations and workforce availability; changes in postretirement benefit and pension obligations and funding requirements; replacement and development of coal reserves; access to capital and credit markets and availability and costs of credit, margin capacity, surety bonds, letters of credit, and insurance; effects of changes in interest rates and currency exchange rates (primarily the Australian dollar); effects of acquisitions or divestitures; economic strength and political stability of countries in which we have operations or serve customers; legislation, regulations and court decisions or other government actions, including new environmental and mine safety requirements; changes in income tax regulations or other regulatory taxes; litigation, including claims not yet asserted; and other risks detailed in the company's reports filed with the Securities and Exchange Commission (SEC). The use of “Peabody,” “the company,” and “our” relate to Peabody, its subsidiaries and majority-owned affiliates.

EBITDA (also called Adjusted EBITDA) is defined as income from continuing operations before deducting net interest expense, income taxes, asset retirement obligation expense and depreciation, depletion and amortization. EBITDA, which is not calculated identically by all companies, is not a substitute for operating income, net income or cash flow as determined in accordance with United States generally accepted accounting principles. Management uses EBITDA as a key measure of operating performance and also believes it is a useful indicator of the company's ability to meet debt service and capital expenditure requirements.

Adjusted Income from Continuing Operations and Adjusted EPS are defined as income from continuing operations and diluted earnings per share excluding the impact of the remeasurement of foreign income tax accounts. Management has included these measures because, in management's opinion, excluding such impact is a better indicator of the company's ongoing effective tax rate and diluted earnings per share, and is therefore more useful in comparing the company's results with prior and future periods.

2

Peabody Energy (NYSE: BTU) Well Positioned for Near and Long Term

Record safety and financial results in 2011

Expected growth of 8 - 11 million tons of Australian met and thermal volumes in 2012

Reshaped portfolio targets highest growth regions

Well positioned in U.S.; Fully contracted 2012 volumes and a leader in low-cost growth regions

3

Peabody's Global Transformation Leads to Record Financial Results

Increasing Revenues, EBITDA and Operating Cash Flow

+80% Revenues $ in Millions 2007 $4,422 2008 2009 2010 2011 $7,974

+122% EBITDA $ in Millions 2007 $958 2008 2009 2010 2011 $2,129

+258% Operating Cash Flow $ in Millions 2007 $463 2008 2009 2010 2011 $1,657

Financials include Macarthur acquisition and exclude discontinued operations. Operating cash flows are from continuing operations.

4

Global Markets Continue to Grow

5

Near-Term Global Coal Markets Marked by Opportunities and Challenges

Opportunities

World tops 1 billion tonnes of seaborne coal imports

China and India continue to import at record levels

Asia markets provide support for seaborne coal

Global gas and oil prices remain strong

Global steel demand projected to increase 5% in 2012

Japan and Germany continue to shift away from nuclear power

Challenges

U.S. challenged by:

Natural gas oversupply

Sluggish economy

Recent stockpile building

European economies flat overall

Steel projections based on World Steel Association outlook.

6

PRB and Illinois Basin Expected to Grow as Appalachia Declines

PRB, Illinois Basin Expected to Grow By 15-20% Over Next 5 Years

Additional near-term coal-to-gas switching projected

CAPP most impacted; challenged by costs, permitting, geology

U.S. basins expected to see significant demand shift

Lower-cost PRB and ILB regions growing from new plants, increasing exports and backfill to Eastern plants

Ultra-low sulfur PRB demand likely to increase from new regulations

Estimates based on Peabody analysis and industry reports.

7

Seaborne Markets Continue to Import Record Volumes: China

World's Largest Coal Consumer Increasing Demand and Imports

China Net Coal Imports

Tonnes in Millions

2009 2010 2011 2012P 2016P Met Thermal

China's 2011 coal-fueled generation up 14%

Net coal imports rise 14% to record 168 million tonnes

GDP projected to grow 8.2% in 2012, 8.8% in 2013

100 GW of coal-fueled generation coming on line over next two years

> $1 trillion investments expected in rail and power sector in next five years

Source: GDP growth based on International Monetary Fund projections; Forecasted imports and new coal generation based on Peabody estimates and other industry sources.

8

Seaborne Markets Continue to Import Record Volumes: India

India's Needs Growing Significantly, Bolstering Asia Demand

India's 2011 coal-fueled generation rises 9%

Thermal imports rise 35% to 85 million tonnes

GDP projected to grow 7.0% in 2012, 7.3% in 2013

Nearly 40 GW of coal-fueled generation expected to come on line in next two years alone

$1 trillion in infrastructure spending in five-year plan

India Coal Imports

Tonnes in Millions

2009 2010 2011 2012P 2016P Met Thermal

Source: GDP growth based on International Monetary Fund projections; Forecasted imports and new coal generation based on Peabody estimates and other industry sources.

9

Major Build Out of Global Coal Generation Continues

New Coal-Fueled Generating Capacity 2011-2016

Gigawatts

Rest of World

India

China

Coal-fueled generation expected to grow 370+ GW by 2016

Additional 1.2+ billion tonnes of coal demand anticipated

Vast majority of growth in China and India, driving higher seaborne demand

Many new Chinese plants built along coast

India domestic production struggling to meet demand

Source: Platts Worldwide Power Plant Database and Peabody analysis.

10

Steel Production Growth Expected to Drive Ongoing Met Coal Increases

40% Steel Increase by 2020 = ~400 Million Tonnes Added Met Coal

Global Steel Production

Steel Production (million tonnes)

2010 2015P 2020P

Seaborne met volumes expected to rise as much as

10 - 15% in 2012; could reach 300 million tonnes

Met coal prices continue to rebase at higher levels

Tighter supply for high quality coking coals and low vol PCI

China, India and Brazil to drive demand through increased urbanization and economic growth

Global steel production source: Raw Materials Group, 2011 Global Commodity Forum for UN Committee on Trade and Development

11

Australia to Supply Half the Growth in Seaborne Market Demand in 2012

Global Seaborne Supply Growth 2011 - 2016 (Projected)

Tonnes in Millions

Other U.S. Colombia Mongolia Indonesia Australia

0 50 100 150 200

Why Australia?

Top global coal exporting nation

Predominant met coal supplier

Delivers high-quality thermal and metallurgical products

Better proximity to growing Asian demand centers

Favorable mine-to-port and port-to-customer economics

Mining strongly supported

How Australia?

Major port expansions continue in Queensland and

New South Wales

Projects to improve utilization of existing ports continue

Rail improvements expected to keep pace with port and mine expansions

450 - 500 MTPA throughput expected by 2015

Projected supply based on Peabody estimates; Mongolia exports by land.

12

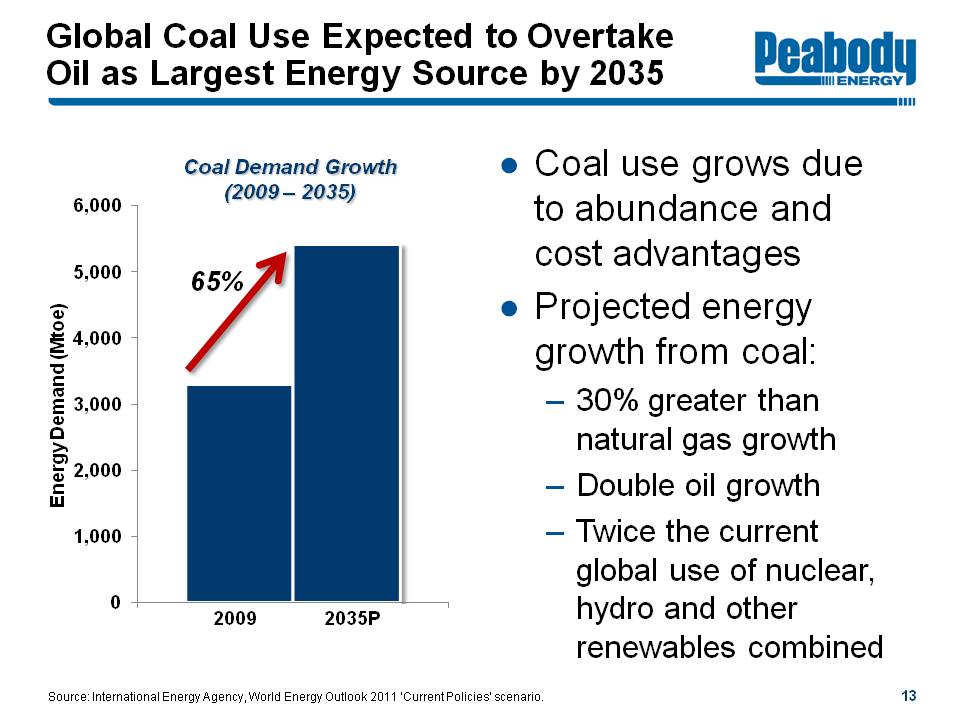

Global Coal Use Expected to Overtake Oil as Largest Energy Source by 2035

Coal Demand Growth (2009 - 2035)

Energy Demand (Mtoe)

65% 2009 2035P

Coal use grows due to abundance and cost advantages

Projected energy growth from coal:

30% greater than natural gas growth

Double oil growth

Twice the current global use of nuclear, hydro and other renewables combined

Source: International Energy Agency, World Energy Outlook 2011 'Current Policies' scenario.

13

World's Fastest-Growing Economies Fueled by Coal

Asia Represents 90% of 4.5 Billion Tonne Expected Demand Growth

+315 +50 +1,080 +2,220 +100 +710

Coal Demand Growth 2009 - 2035 (Tonnes in Millions)

U.S. growth presented in short tons.

Source: World Energy Outlook 2011, International Energy Agency; Annual Energy Outlook 2011, Energy Information Administration; Peabody analysis.

14

Peabody's Global Platform Drives Results

Peabody Continues Global Expansion to Serve High-Growth Regions

World's Only Global Pure-Play Coal Investment

International Offices

Brisbane New Delhi Newcastle Beijing London Urumqi Ulaanbaatar Singapore Essen Jakarta Balikpapan

London Essen New Delhi Urumqi Ulaanbaatar Beijing Singapore Jakarta Balikpapan NCIG St. Louis DTA

Mining Operations

Position S. PRB #1 Midwest #1 Southwest #1 Colorado #1 Australia #5

Sales S. PRB 148 Midwest 30 Southwest 18 Colorado 7 Australia 25

Reserves S. PRB 2.7 Midwest 3.7 Southwest 1.1 Colorado 0.2 Australia 1.2

Mining Sales represent 2011 reported sales volumes in millions of tons. Position based on 2011 sales tons. Reserves based on 2010 10-K filing in billions of tons, and do not reflect recently-acquired Macarthur reserves.

16

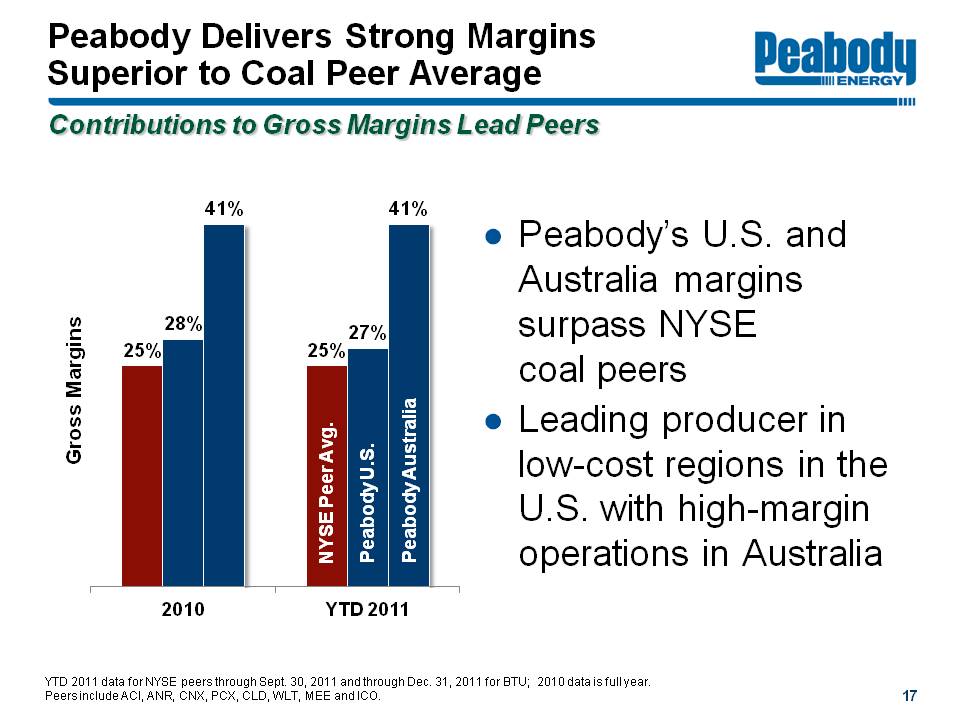

Peabody Delivers Strong Margins Superior to Coal Peer Average

Contributions to Gross Margins Lead Peers

Gross Margins

2010 25% 28% 41% YTD 2011 NYSE Peer Avg. 25% Peabody U.S. 27% Peabody Australia 41%

Peabody's U.S. and Australia margins surpass NYSE coal peers

Leading producer in low-cost regions in the U.S. with high-margin operations in Australia

YTD 2011 data for NYSE peers through Sept. 30, 2011 and through Dec. 31, 2011 for BTU; 2010 data is full year. Peers include ACI, ANR, CNX, PCX, CLD, WLT, MEE and ICO.

17

Multiple Catalysts Driving Value Creation in 2012

Increasing metallurgical coal output

2012 sales target: 14-15 million tons

Rising Australian thermal coal exports

2012 sales target: 12-13 million tons

Delivering on multiple expansion projects

Significant pipeline for future opportunities

Fully committed U.S. position

Strong cash flows and balance sheet

18

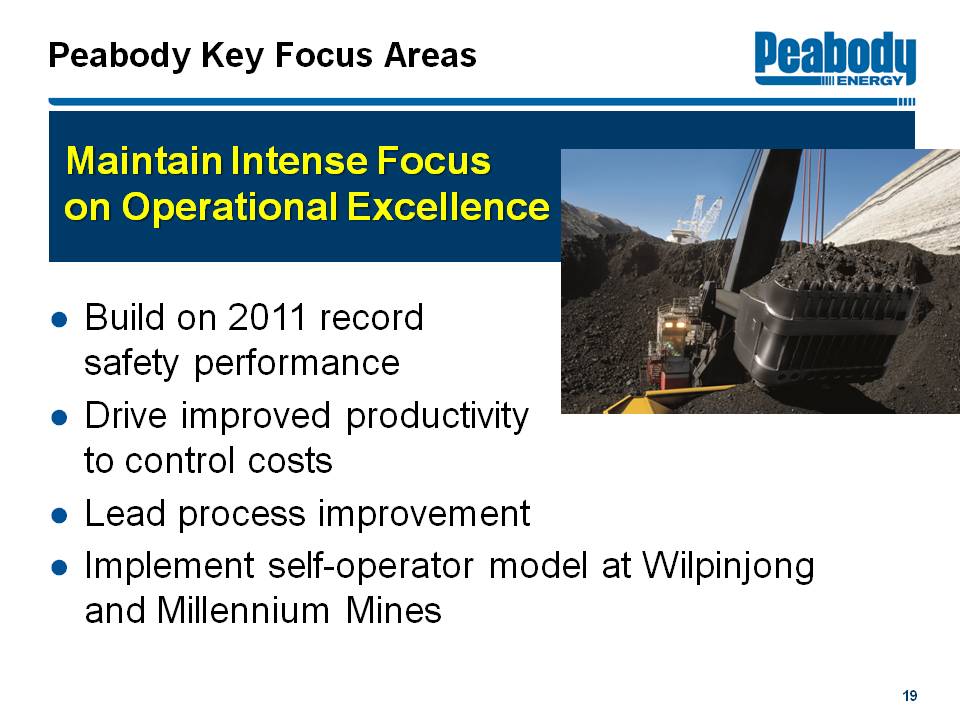

Peabody Key Focus Areas

Maintain Intense Focus on Operational Excellence

Build on 2011 record safety performance

Drive improved productivity to control costs

Lead process improvement

Implement self-operator model at Wilpinjong and Millennium Mines

19

Peabody Key Focus Areas

Integrate Macarthur Acquisition into Australian Platform

Upgrade operations to Peabody standards

Rebuild larger operating footprint at Coppabella

Increase major equipment utilization

Begin to realize synergies in marketing, blending, logistics, operating, and financial areas

$60 to $80 million per year targeted beginning in 2013

Ramp up Middlemount Mine and target first coal from Codrilla in late 2013

20

Peabody Key Focus Areas

Advance Organic Growth Projects

Ramp up from expansions at Wilpinjong, Millennium and Wambo Open-Cut

Target first coal from Burton extension by year-end 2012

Advance projects in U.S. to meet demand for coal in fastest-growing regions

Australia Platform Expanding Through Organic Growth, Macarthur Acquisition

Queensland

Port Abbot Point Dalrymple Bay Gladstone Brisbane

BTU Met Burton N. Goonyella Eaglefield Millennium

MCC Mine Coppabella Moorvale Middlemount

MCC Project Olive Downs Codrilla Vermont East/Wilunga

New South Wales

Port PWCS NCIG Port Kembla

BTU Thermal Wilpinjong Wambo Underground Wambo Open Cut

BTU Met Metropolitan

Expected Australia Volumes

Tons in Millions

2005 Seaborne Thermal 2.5 Met 5.8 Total 8.3

2011 Domestic Thermal 5.9 Seaborne Thermal 10.1 Met 9.3 Total 25.3

2012P Domestic Thermal 7-8 Seaborne Thermal 12-13 Met 14-15 Total 33-36

2015P Domestic Thermal ~8 Seaborne Thermal 15-17 Met 22-25 Total 45-50

22

Australia Organic Pipeline To Deliver Growth in 2012 and Beyond

2011 2012 2013 2014 2015

Wilpinjong 2 - 3 MTPY Thermal

Millennium 1 - 2 MTPY SHCC/PCI Capex of ~ $275M

Wambo Open-Cut 2 - 3 MTPY Thermal/PCI

Middlemount ~2 MTPY SHCC/PCI

Burton ~1MTPY HCC

Metropolitan 1 MTPY HCC Capex of ~ $70M for expansion and $200M for modernization

N. Goonyella LTCC 1 - 2 MTPY HQHCC

Codrilla ~2 - 3 MTPY PCI

Developmental Opportunities MDL 162 Goonyella Corridor Burton North Olive Downs Moorevale West Moorevale Underground Willunga

Projections based on tonnage attributable to Peabody. Capital projections listed for selected operations based on full project estimates.

23

Peabody Key Focus Areas

Pursue Continued Deleveraging

Target selective capital investments

Ongoing review of growth capital to focus on high-return projects

Sustaining capital remains low at $1.25 to $1.75 per ton

Continue to evaluate asset portfolio

Sale process announced for Wilkie Creek

Emphasize cash generation and margin enhancement

Debt-to-Capital Ratio %

2006* 57

2007 52

2008 47

2009 42

2010 37

2011 55

* Debt to capital percentage following the Excel transaction

24

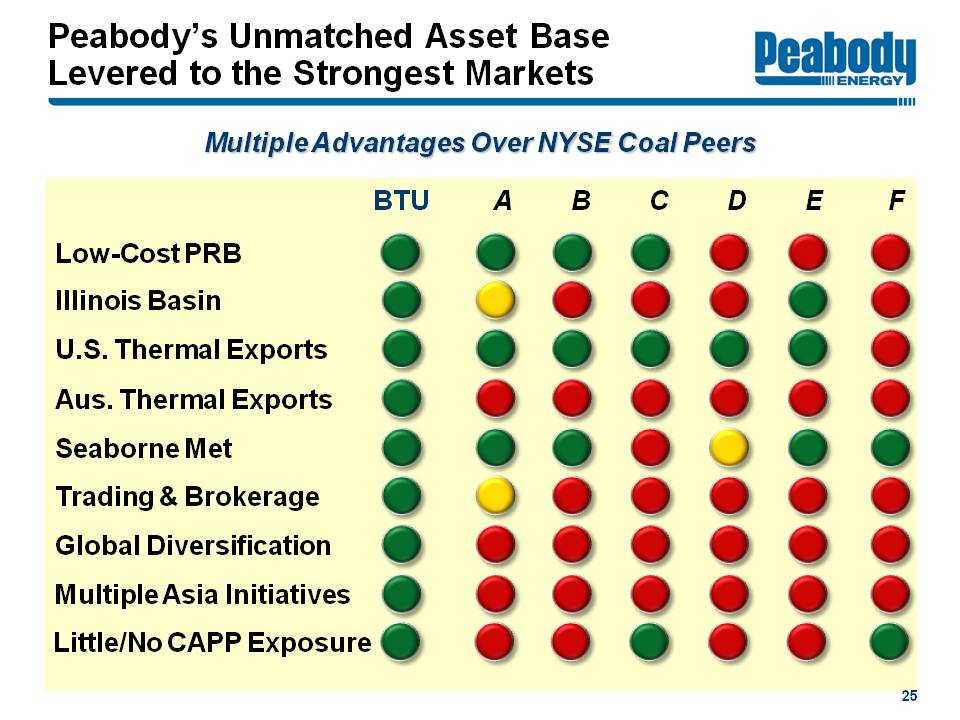

Peabody's Unmatched Asset Base Levered to the Strongest Markets

Multiple Advantages Over NYSE Coal Peers

BTU A B C D E F

Low-Cost PRB

Illinois Basin

U.S. Thermal Exports

Aus. Thermal Exports

Seaborne Met

Trading & Brokerage

Global Diversification

Multiple Asia Initiatives

Little/No CAPP Exposure

25

Credit Suisse Energy Summit 2012

Michael C. Crews

Executive Vice President and Chief Financial Officer

February 7-8, 2012

Peabody Energy

Energizing The World One BTU At A Time