Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CVB FINANCIAL CORP | d296646d8k.htm |

February 2012

February 2012

1

Exhibit 99.1 |

Certain matters set forth herein (including the exhibits hereto)

constitute forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995, including

forward-looking statements relating to the Company's current business plan

and expectations regarding future operating results. These

forward-looking statements are subject to risks and uncertainties that could

cause actual results, performance or achievements to differ materially from

those projected. These risks and uncertainties include, but are not limited

to, local, regional, national and international economic conditions and events

and the impact they may have on us and our customers; ability to

attract deposits and other sources of

liquidity; oversupply of inventory and continued deterioration in values of

California real estate, both residential and commercial; a prolonged slowdown

in construction activity; changes in the financial

performance and/or condition of our borrowers; changes in the level of

non-performing assets and charge- offs; the effect of changes in laws

and regulations (including laws and regulations concerning taxes, banking,

securities, executive compensation and insurance) with which we and our subsidiaries must

comply; changes in estimates of future reserve requirements based upon the periodic

review thereof under relevant regulatory and accounting requirements;

inflation, interest rate, securities market and monetary fluctuations;

political instability; acts of war or terrorism, or natural disasters, such as earthquakes, or the

effects of pandemic flu; the timely development and acceptance of new banking

products and services and perceived overall value of these products and

services by users; changes in consumer spending, borrowing

and savings habits; technological changes; the ability to increase market share and

control expenses; changes in the competitive environment among financial and

bank holding companies and other financial service providers; continued

volatility in the credit and equity markets and its effect on the general

economy; the effect of changes in accounting policies and practices, as may be

adopted by the regulatory agencies, as well as the Public Company Accounting

Oversight Board, the Financial Accounting Standards Board and other accounting

standard setters; changes in our organization, management, compensation and

benefit plans; the costs and effects of legal and regulatory developments including

the resolution of legal proceedings or regulatory or other governmental

inquiries and the results of regulatory examinations or reviews; our success

at managing the risks involved in the foregoing items and other factors set forth in the

Company's public reports including its Annual Report on Form 10-K for the year

ended December 31, 2010, and particularly the discussion of risk factors

within that document. The Company does not undertake, and specifically

disclaims any obligation to update any forward-looking statements to reflect occurrences or

unanticipated events or circumstances after the date of such statements except as

required by law. 2 |

3

Total Assets:

$6.5 Billion

Gross Loans:

$3.5 Billion

Total

Deposits

(Including

Repos):

Total Equity:

$715 Million

Source: Q4 2011 earnings release & company filings. *non-covered loans

Largest financial institution headquartered in the Inland Empire

region of

Southern California. Formed in 1974.

Serves 40 cities with 42 business financial centers and 5 commercial banking

centers throughout the Inland Empire, LA County, Orange County and the

Central Valley of California

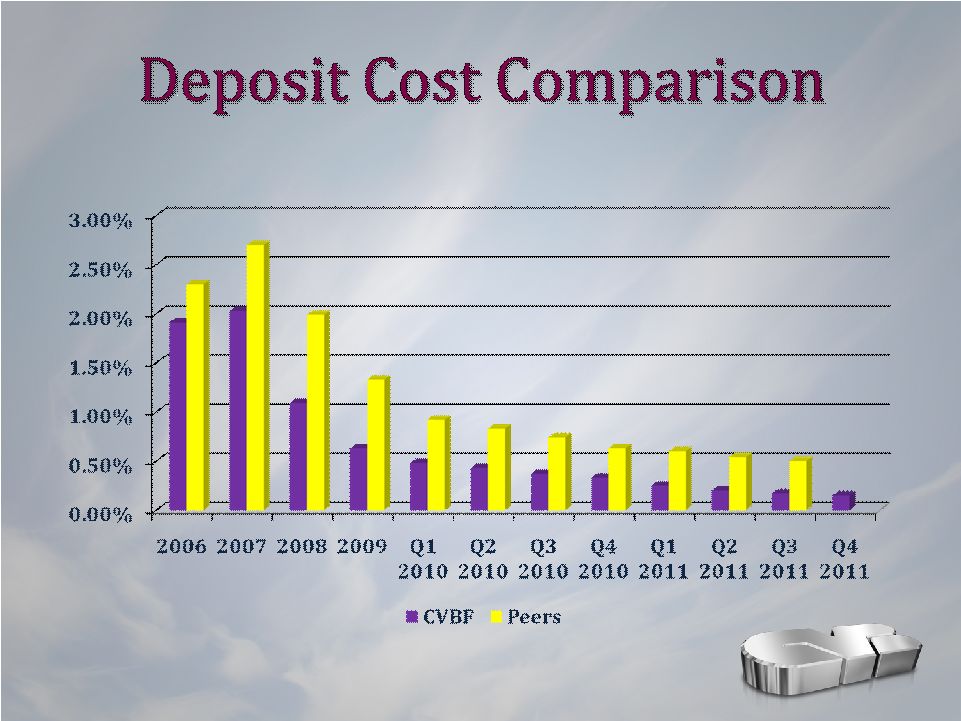

Average Cost of Deposits = 0.15%

Significant equity ownership board of directors: approximately 16%

$5.1

Billion |

4

Name

Position

Banking

Experience

CVBF

Service

Christopher D. Myers

President & CEO

27 Years

5 Years

Richard C. Thomas

Executive Vice President

Chief Financial Officer

2 Years

1 Year

James F. Dowd

Executive Vice President

Chief Credit Officer

35 Years

4 Years

David C. Harvey

Executive Vice President

Chief Operations Officer

22 Years

2 Years

David A. Brager

Executive Vice President

Sales Division

24 Years

9 Years

Chris A. Walters

Executive Vice President

CitizensTrust

25 Years

5 Years

Yamynn DeAngelis

Executive Vice President

Chief Risk Officer

32 Years

24 Years |

5

|

6

Rank

Name

Asset Size (12/31/11)

1

Wells Fargo

$1,313,867

2

Union Bank

$89,676

3

Bank of the West

$62,408

4

First Republic Bank

$27,792

5

OneWest Bank*

$27,391

6

City National Bank

$23,666

7

East West Bank

$21,969

8

SVB Financial

$19,969

9

Cathay Bank

$10,645

10

10

CVB Financial Corp

CVB Financial Corp

$6,483

$6,483

11

Pacific Capital Bank

$5,850

12

Pacific Western Bank

$5,528

13

Westamerica Bank

$5,042

14

Farmers & Merchants of Long Beach

$4,659

In millions

In millions

*One West Bank’s asset size is as of 9/30/11 |

•

139 Consecutive Quarters of Profitability

•

89 Consecutive Quarters of Cash Dividends

•

BauerFinancial Report

–

Five Star Rating (September 2011)

•

Fitch Rating

–

BBB (October 2011)

7 |

8

|

9

42 Business Financial Centers

42 Business Financial Centers

5 Commercial Banking Centers

5 Commercial Banking Centers |

(000’s)

# of Center

Locations

Total Deposits

(12/31/10)

Total Deposits

(12/31/11)

Los Angeles County

17

$1,793,171

$1,872,623

Inland Empire

(Riverside & San Bernardino Counties)

11

$1,529,042

$1,592,445

Central Valley

11

$838,198

$821,994

Orange County

8

$578,570

$598,426

Other

0

$322,035

$228,430

Total

47

$5,061,016

$5,113,918

10

*Includes Customer Repurchase Agreements; full-year average

Average Cost of Deposits (full year)

0.44%

0.21% |

11

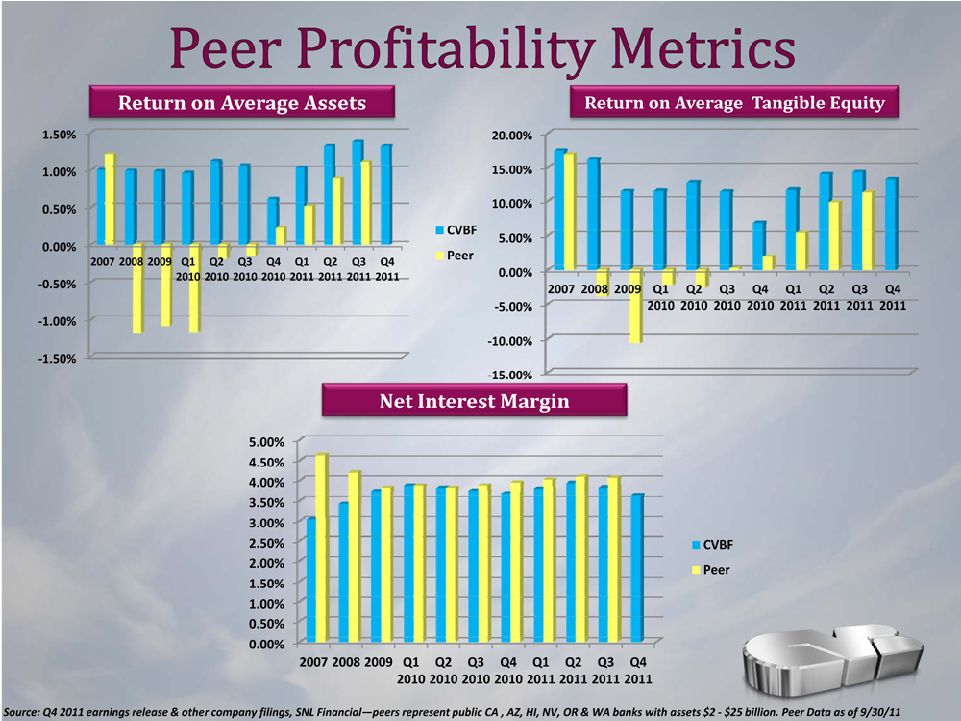

Source:

Q4

2011

earnings

release

&

other

company

filings,

SNL

Financial—peers

represent

public

CA

,

AZ,

HI,

NV,

OR

&

WA

banks

with

assets

$2

-

$25

billion.

Peer

Data

as

of

9/30/2011 |

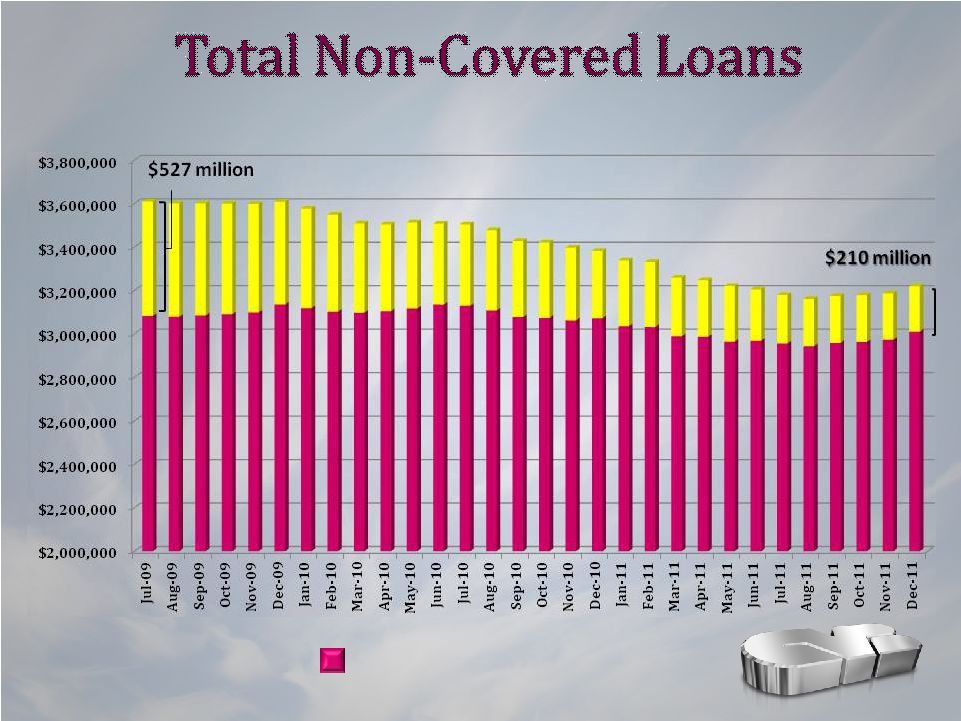

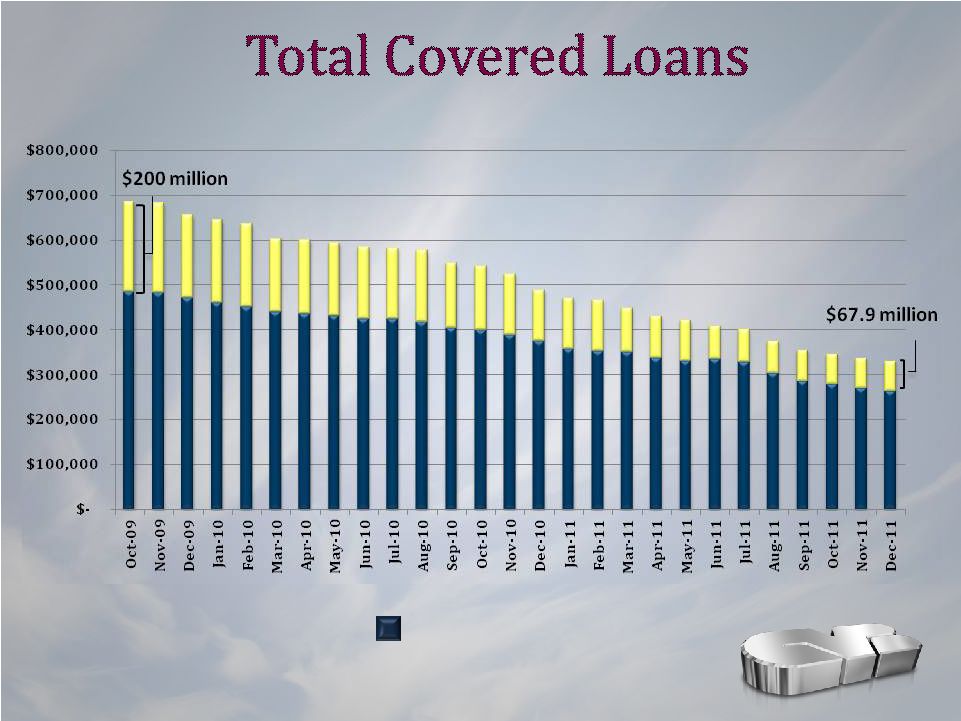

(000’s)

Non-Covered

Loans

Covered

Loans*

Total Loans*

%

Los Angeles County

$1,118,619

$15,632

$1,134,251

31.90%

Central Valley

$593,133

$252,072

$845,205

23.77%

Inland Empire

(Riverside & San Bernardino Counties)

$633,881

$2,753

$636,634

17.90%

Orange County

$471,508

$120

$471,628

13.26%

Other

$408,329

$59,835

$468,164

13.17%

Total

$3,225,470

$330,412

$3,555,882

100%

12

*Prior to MTM discount and loan loss reserve |

(000’s)

*Removed Mortgage Pools and Construction

Adjusted Non-Covered Loans* |

14

Source: Q4 2011 earnings release & company reports |

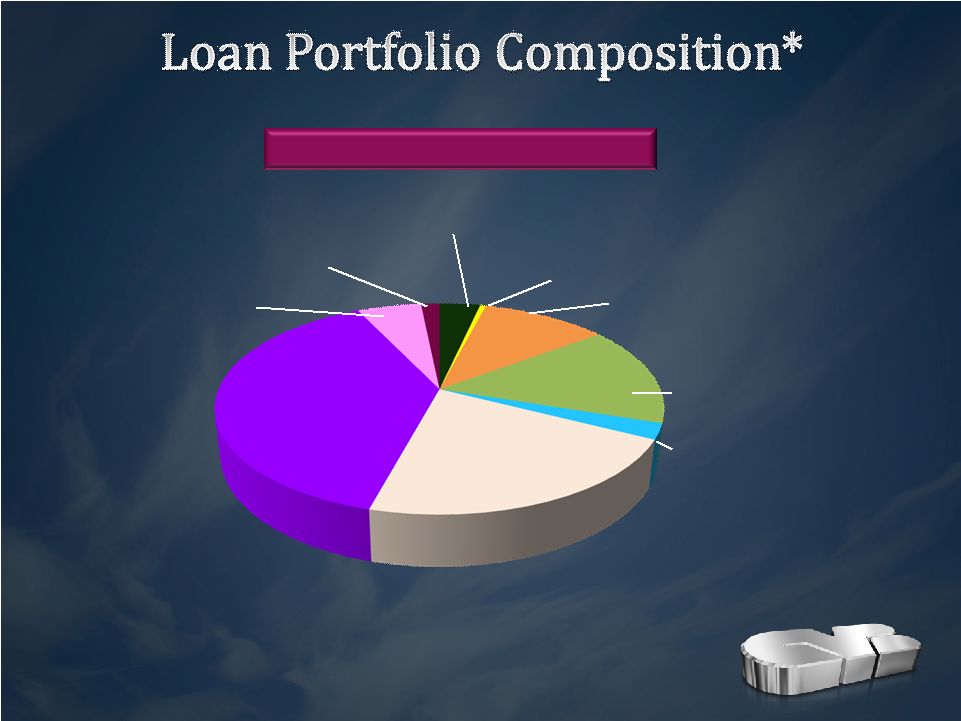

*Non-covered loans

Total Loans by Type

Commercial RE

Non-Owner Occupied

38.7%

Consumer

1.6%

SFR Mortgage

5.5%

Municipal Lease Finance Receivables 3.5%

Auto & Equipment 0.5%

Dairy, Livestock & Agribusiness

10.8%

Commercial & Industrial

15.3%

Construction RE 2.4%

Commercial RE

Owner Occupied 21.7% |

15

(000’s)

Net of Discount |

16

(000’s) |

17

|

18

(000’s) |

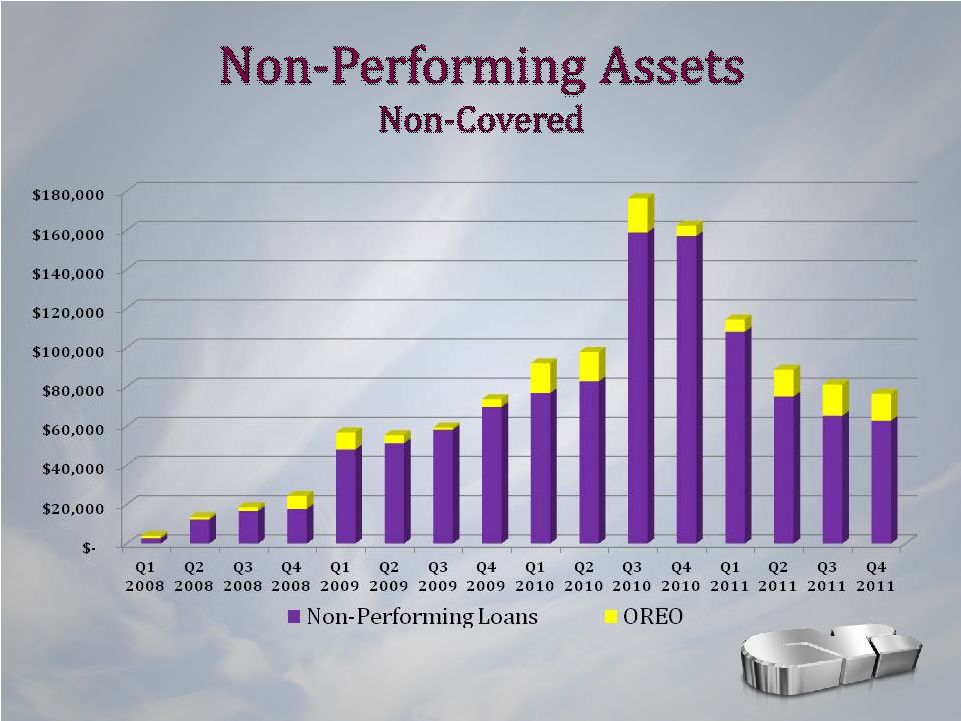

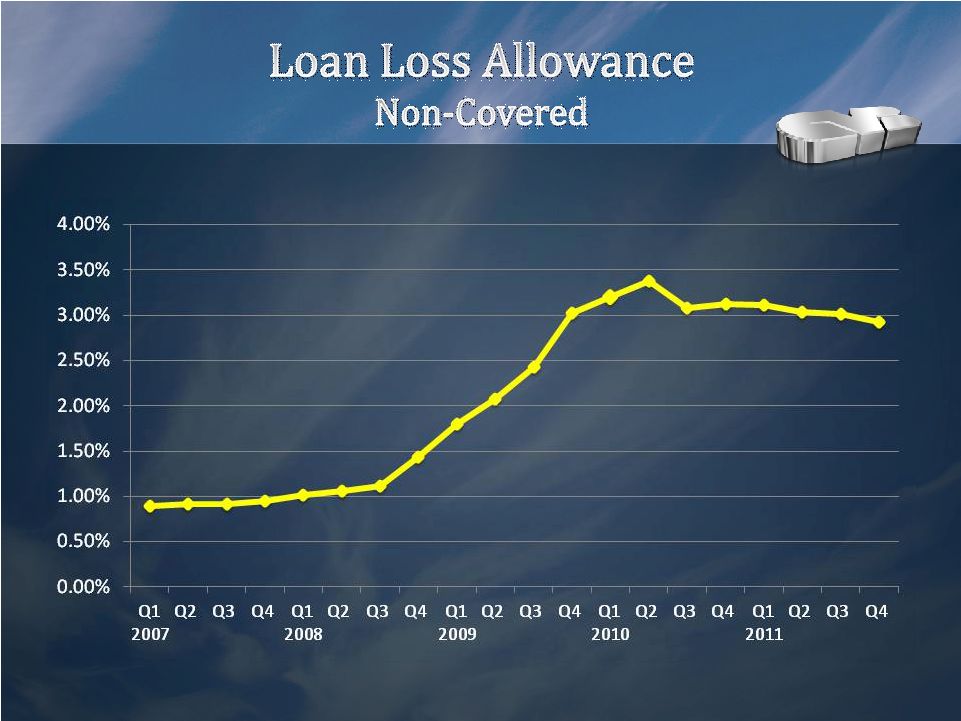

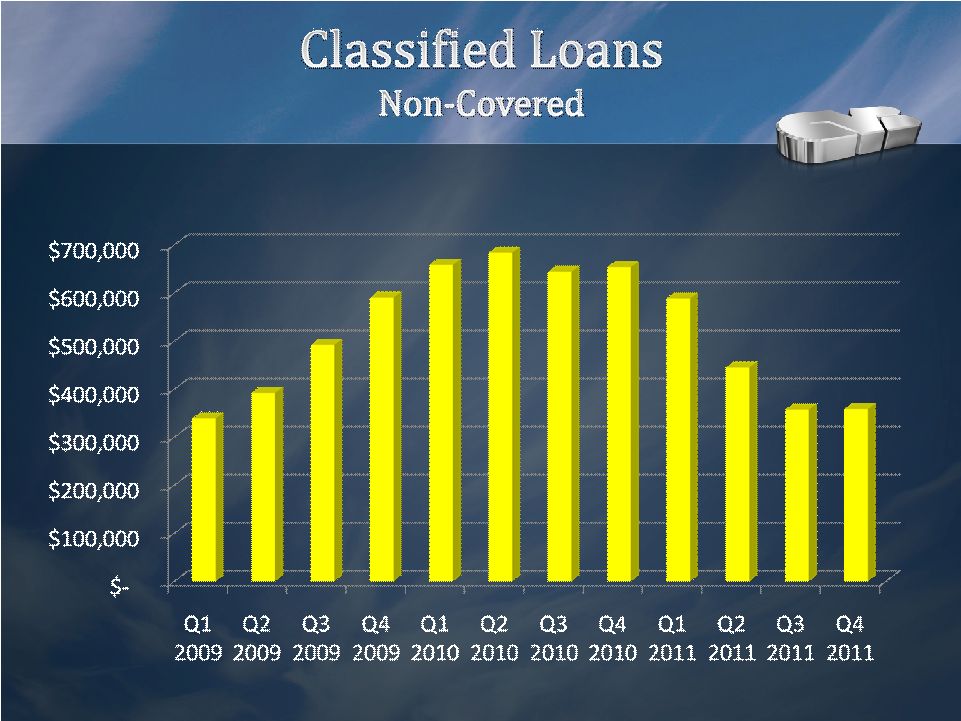

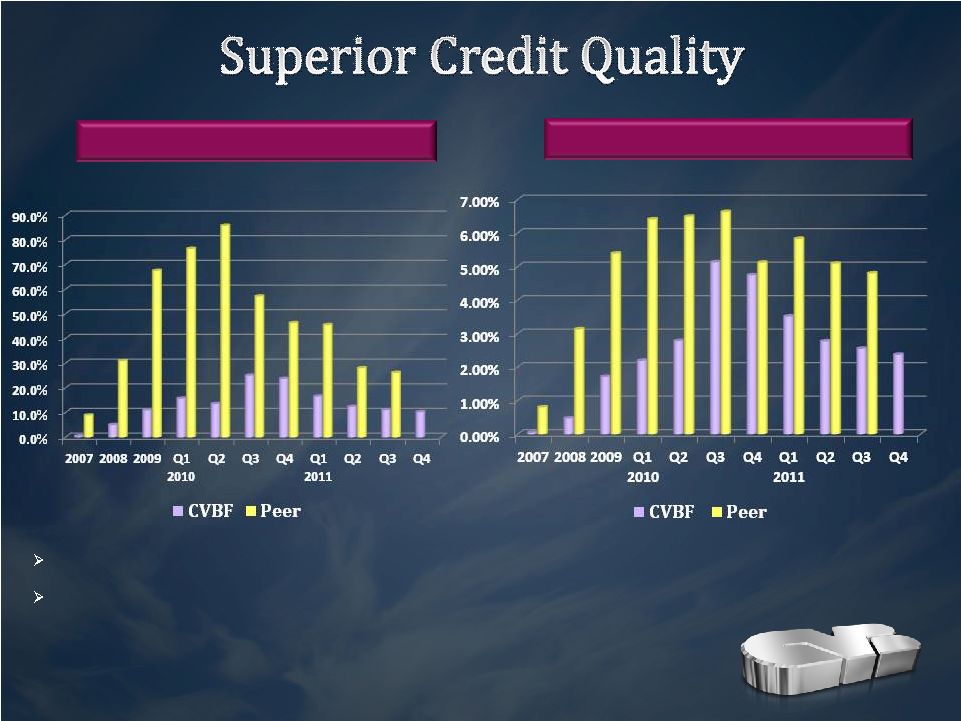

CVBF’s strong loan underwriting culture has limited its exposure to problem

credits Continued profitability has allowed CVB to build its capital base and

reserves for loan losses. Texas Ratio

NPA’s/Loans & OREO

Source: Q4 2011earnings release & other company filings, SNL Financial—peers represent

public CA , AZ, HI, NV, OR & WA banks with assets $2 -

$25 billion. Peer data as of 9/30/11

Non-Covered |

20

|

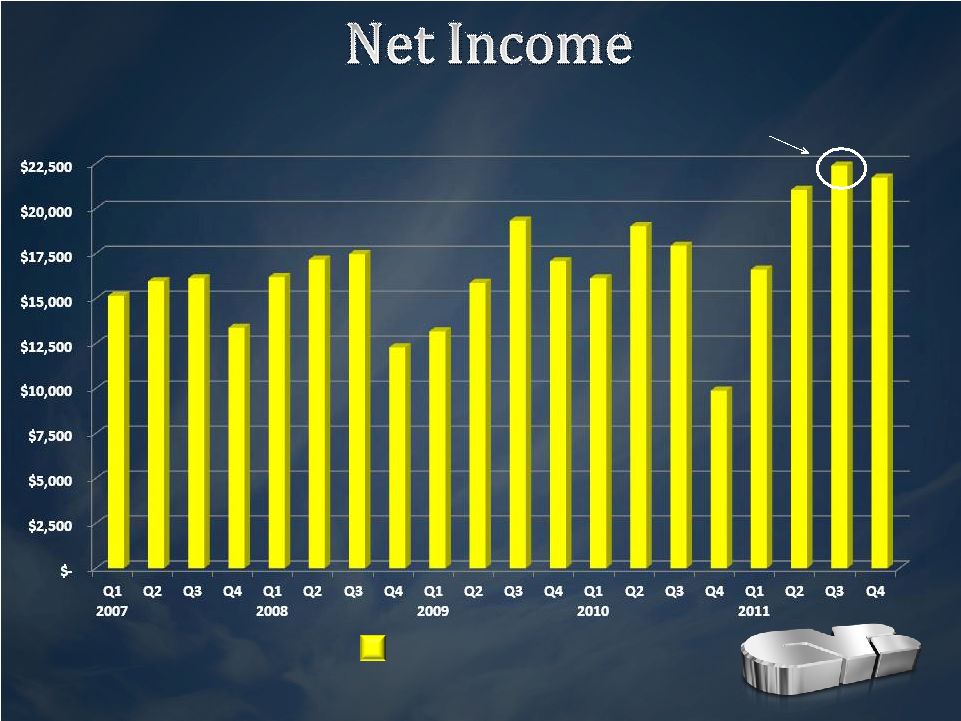

21

(000’s)

Net Income After Taxes

Highest in CVBF

History! |

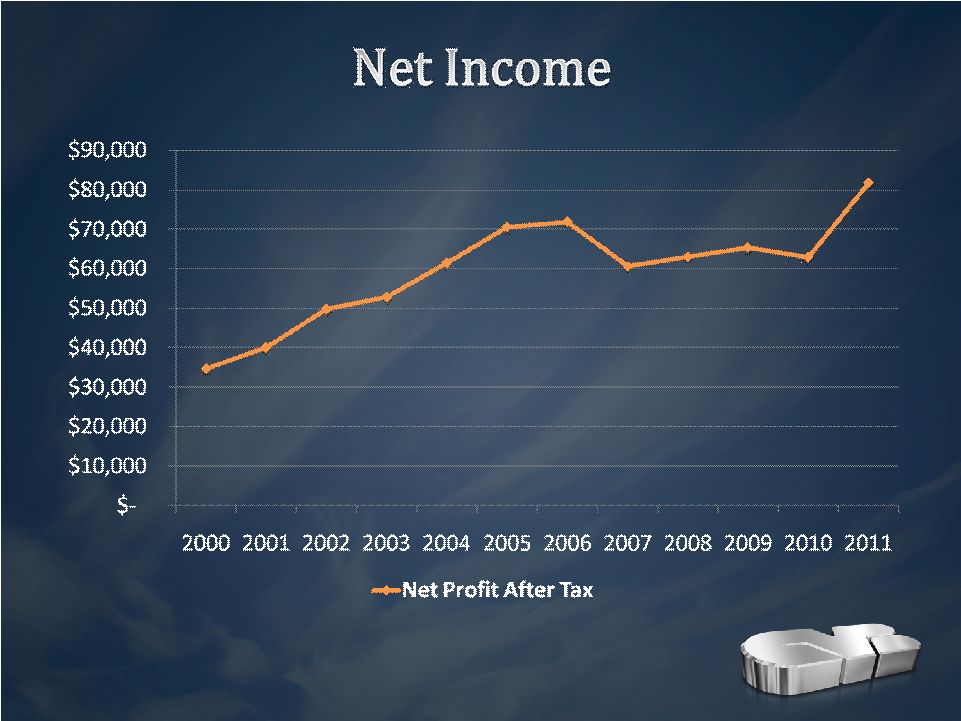

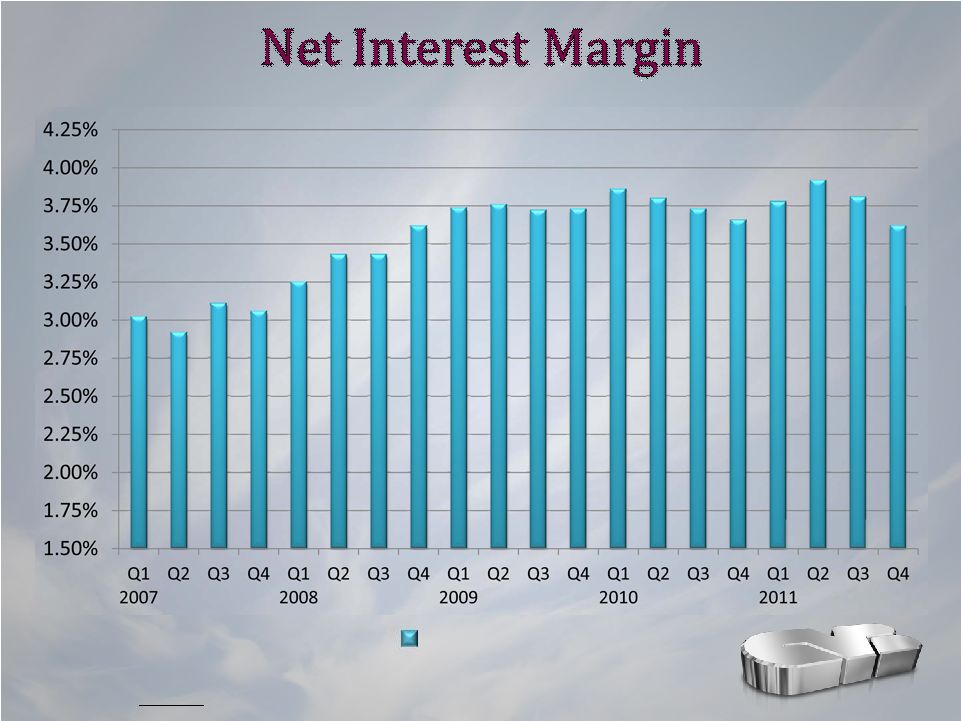

2007

2008

2009

2010

2011

2011

Net Interest Income

$161,142

$193,679

$222,264

$259,317

$234,681

Provision for Credit Losses

($4,000)

($26,600)

($80,500)

($61,200)

($7,068)

Other Operating

Income/Expenses (Net)

($74,079)

($81,331)

($52,515)

($111,378)

($106,809)

Income Taxes

($22,479)

($22,675)

($23,830)

($23,804)

($39,071)

Net Profit After Tax

$60,584

$63,073

$65,419

$62,935

$81,733

$81,733

22

(000’s) |

23

|

24

*Normalized excludes

accelerated accretion on covered loans

Normalized* |

|

26

|

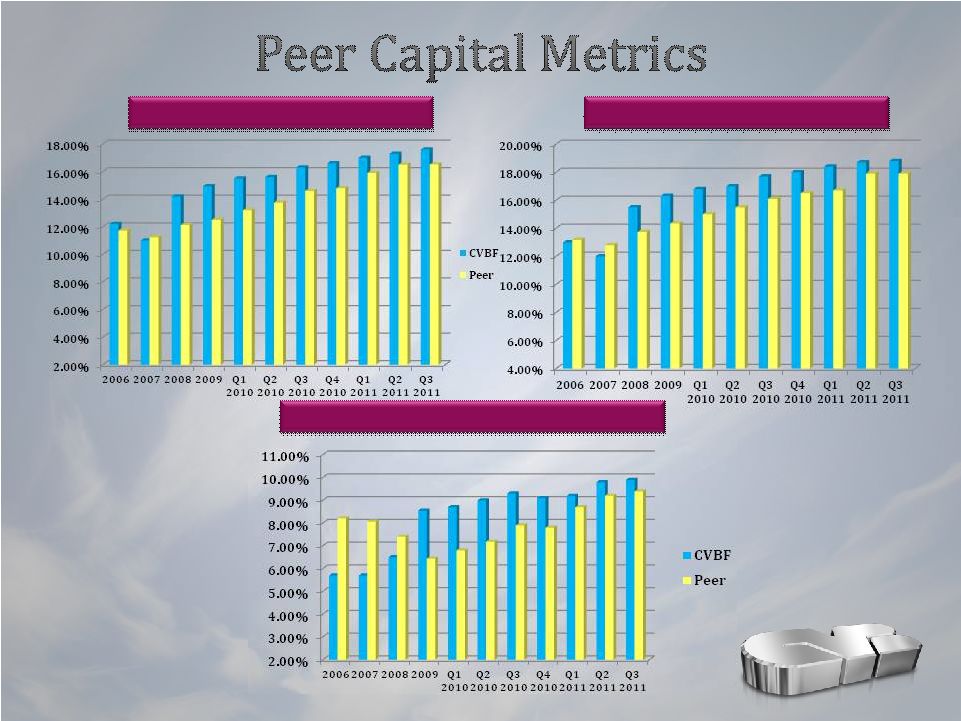

Regulatory

Minimum Ratio

Regulatory

Well-Capitalized

Ratio

September 30, 2011

Tier 1 Risk-based Capital Ratio

4.0%

6.0%

17.6%

Total Risk-based Capital Ratio

8.0%

10.0%

18.8%

Tier 1 Leverage Ratio

4.0%

5.0%

11.2%

Tangible Capital Ratio

4.0%

5.0%

9.9%

Core Tier 1 Capital Ratio

14.8%

27

*12/31/11 ratios should be at or above 9/30/11 numbers. Information will be

available in the 10K filing for 2011 |

28

Source:

Q3

2011

earnings

release

&

other

company

filings,

SNL

Financial—peers

represent

public

CA

,

AZ,

HI,

NV,

OR

&

WA

banks

with

assets

$2

-

$25

billion

Tier

1

Capital

Ratio

Total

Risk

–

Based

Capital

Ratio

Tangible

Common

Equity/Tangible

Assets |

29

|

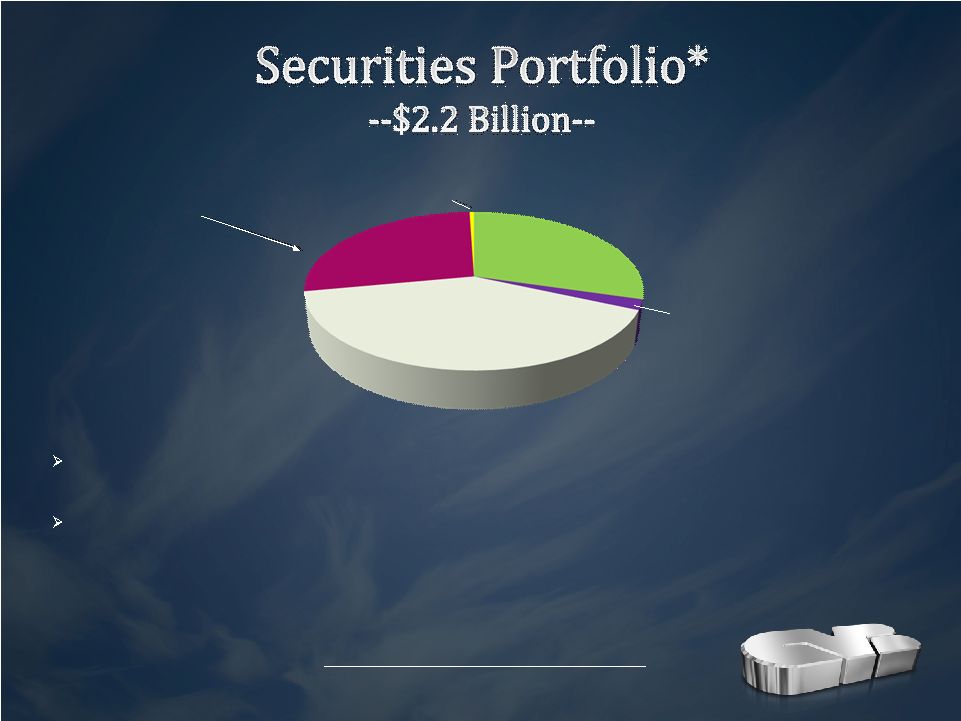

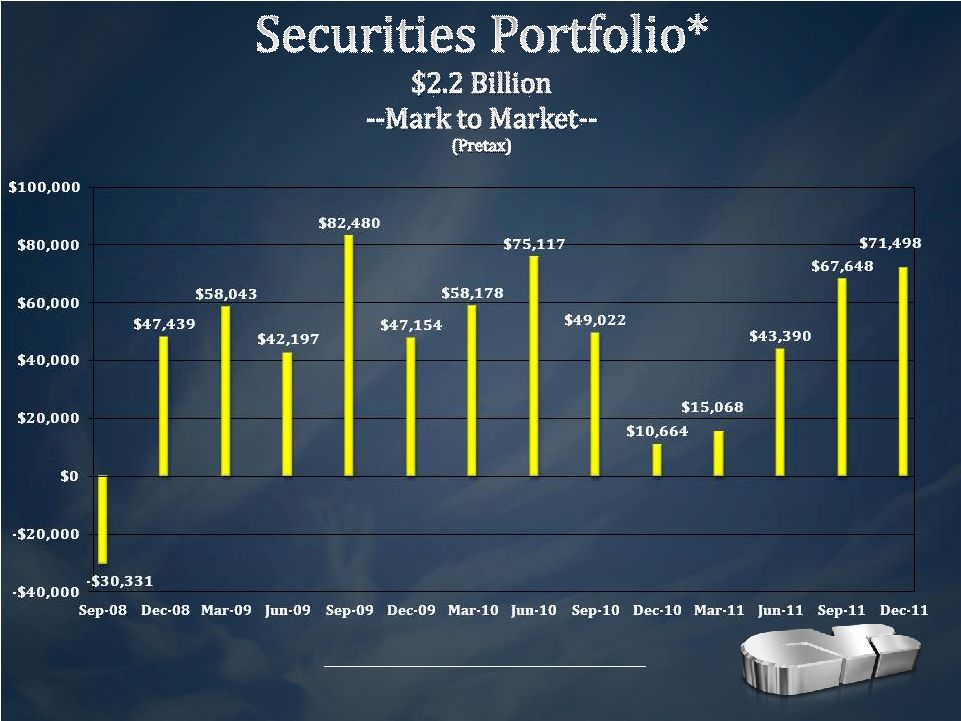

Source: Q4 2011

earnings release. As of 12/31/2011 securities held-to-maturity were valued at approximately $2.4 million | Yield on securities represents the fully taxable equivalent

*Securities Available For Sale

Securities

portfolio

totaled

$2.2

billion

at

12/31/2011.

The

portfolio

represents

34%

of

the

Bank’s

total

assets

Virtually

all

of

the

Bank’s

mortgage-backed

securities

were

issued

by

Freddie

Mac

or

Fannie

Mae

which

have

the

guarantee

of

the

U.S.

government.

99%

of

the

Bank’s

municipal

portfolio

contains

securities

which

have

an

underlying

rating

of

investment

grade.

California

municipals

represent

only

6

%

of

the

municipal

bond

portfolio

Government Agency &

GSEs

2.1%

MBS

40.3%

CMO

27.5%

Municipal Bonds

29.6%

Yield on securities

portfolio: 3.56%

Trust Preferred

0.5% |

(000’s)

*Securities Available For Sale |

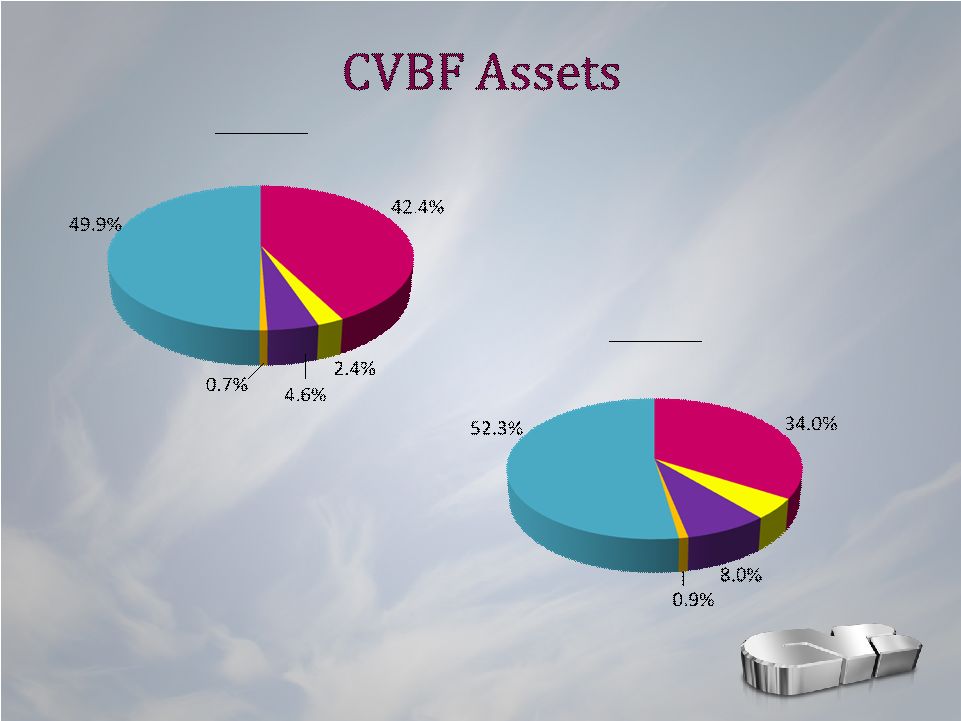

32

*Includes overnight funds held at the Federal Reserve, due from Correspondent

Banks, other short-term money market accounts or certificates of deposit

Loans

Securities

Fed Balance*

Other

Goodwill & Intangibles

12/31/11

$6.5 Billion

12/31/06

$6.1 Billion

Securities

Fed Balance*

Goodwill & Intangibles

Other

Loans

4.8% |

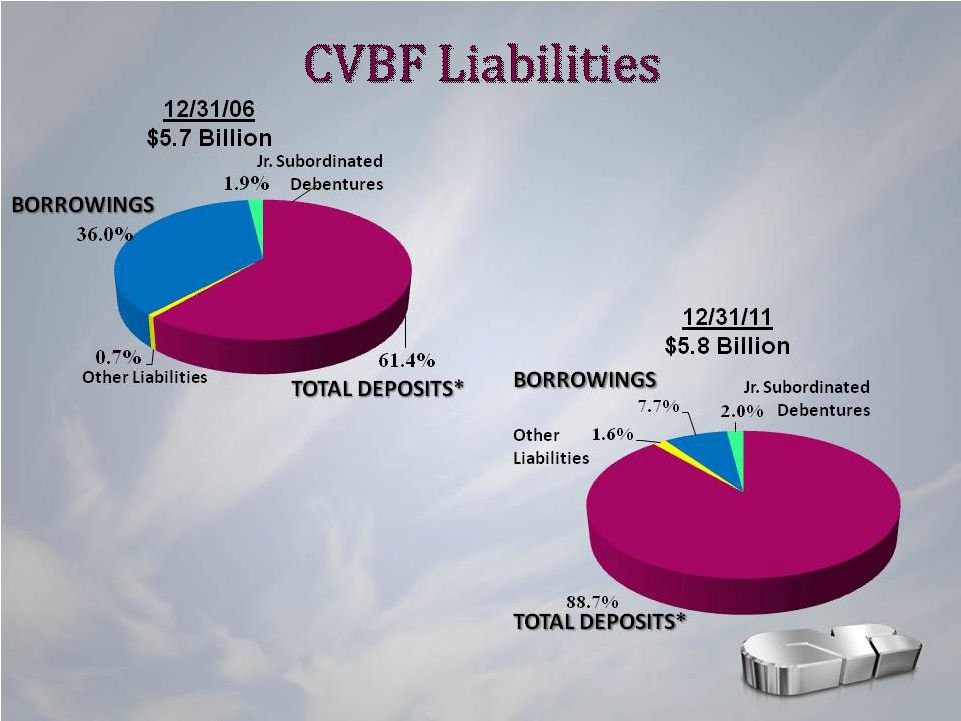

*Includes

Customer Repurchase Agreements |

34

|

35

•

The class action lawsuit against CVBF, which sought to draft onto

the SEC's investigation, was dismissed in its entirety by the federal

court in Los Angeles.

However, an amended and restated complaint

by the plaintiffs is possible.

•

In late December 2011, Citizens Business Bank prepaid $100

million in Federal Home Loan Bank (“FHLB”) debt and took a $3.3

million charge.

•

On January 7, 2012, we redeemed trust preferred securities totaling

$6.8 million. These securities were priced at 3-month LIBOR plus

3.25%.

Source: Q4 2011 earnings release & company filings.

Source: Q4 2011 earnings release & company filings. |

36

|

Citizens Business Bank will strive to

Citizens Business Bank will strive to

become the dominant financial

become the dominant financial

services company operating

services company operating

throughout the state of California,

throughout the state of California,

servicing the comprehensive financial

servicing the comprehensive financial

needs of successful small to medium

needs of successful small to medium

sized businesses and their owners.

sized businesses and their owners.

37 |

38

The best

The best

privately-held and/or family-owned

privately-held and/or family-owned

businesses throughout California

businesses throughout California

—

—

Annual revenues of $1-200 million

Annual revenues of $1-200 million

—

—

Top 25% in their respective industry

Top 25% in their respective industry

—

—

Full relationship

Full relationship

banking

banking

—

—

Build 20-year relationships

Build 20-year relationships |

39

Acquisitions

--Banks--

--Trust-- |

•

Conventional M&A

•

Target size: $300 million to $3 billion in assets

•

Financial & Strategic

•

In-market and/or adjacent geographic market

(California only)

40

--Banks--

--Trust/Investment--

•

Target size: AUM of $300 million to $1.5 billion

•

In California |

•

•

Quality Loan Growth

Quality Loan Growth

•

•

Non-Interest Bearing Deposit Growth

Non-Interest Bearing Deposit Growth

•

•

Non-Interest Income Growth

Non-Interest Income Growth

•

•

Expense Control

Expense Control

•

•

Grow Through Acquisition

Grow Through Acquisition

41 |

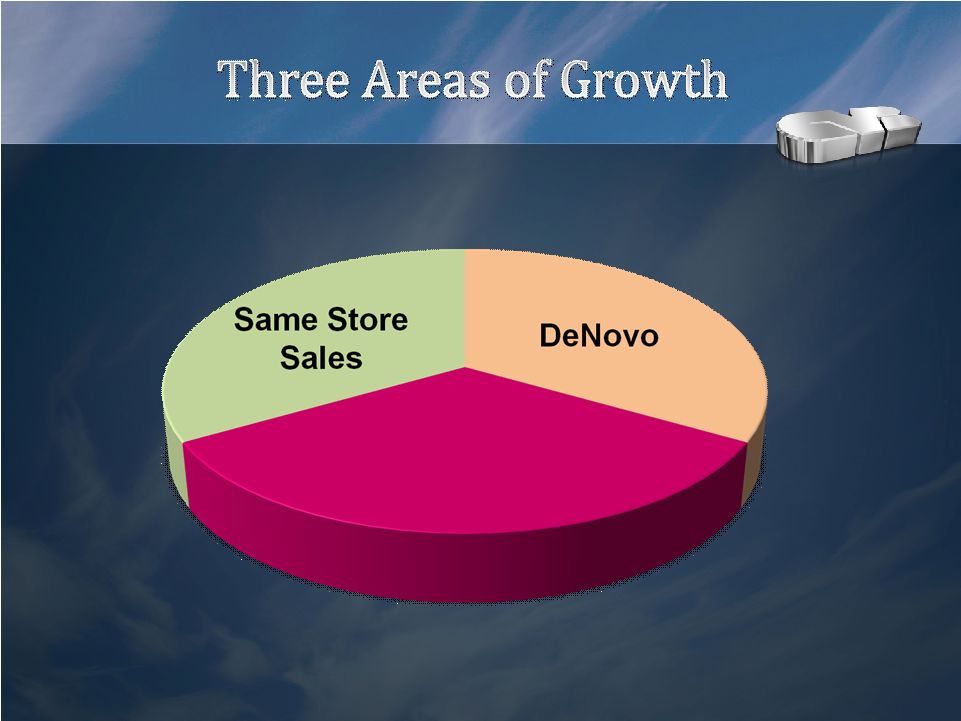

42

Our Strategic Focus

Our Strategic Focus

•

Strong Capital position

•

Strong, disciplined credit underwriting/credit culture

•

Drive

low-cost, sustainable deposits

•

Multiple forms of growth (don’t depend on one)

•

Same Store Sales

•

DeNovo

•

Acquisitions

•

Cross-sell: capture the whole wallet

•

Build new Fee Income opportunities

•

Long-term outlook |

Copy of Presentation: www.cbbank.com

Copy of Presentation: www.cbbank.com

43 |