Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - KEY TRONIC CORP | d293921d8k.htm |

NASDAQ:

KTCC Trust. Commitment. Results.

Exhibit 99.1 |

Craig D.

Gates President and CEO

Trust. Commitment. Results. |

Leading

provider of Electronic Manufacturing Services (EMS)

with unique combination of

global capabilities and customer responsiveness

Trust. Commitment. Results. |

Safe Harbor

Statement This presentation may contain forward-looking statements within the meaning

of the federal securities laws and are subject to the safe harbor under those laws.

These forward-looking statements can be identified by the use of words such as

"expect", believe", "anticipate", "will", "may",

"should", "plan" and similar expressions. Forward-looking statements include

statements

made

as

to

future

revenue

and

earnings,

trends

in

the

EMS

industry,

existing

and

potential new customer relationships and competition. These forward-looking statements

involve risks and uncertainties that could cause actual results to differ materially from

those contemplated by the statements. These risks and uncertainties include, but

are not limited to the

challenge

of

effectively

managing

operations

in

an

uncertain

economic

environment

to

prepare

for

growth

in

coming

periods;

the

accuracy

of

customers'

forecasts;

success

of

customers' programs; timing of new programs; changes in pricing policies by the Company, its

competitors or customers; the dependence on a small number of large customers and the

other risks described under "Management's Discussion and Analysis of Financial

Condition and Results of Operations -

Risks and Uncertainties That Could Affect Future Results" in the

Company's most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q and

current reports on Form 8-K, filed with the SEC. Any forward-looking

statements in this presentation

are

based

on

the

Company's

current

expectations

and

the

Company

assumes

no

obligation to update these forward-looking statements.

Trust. Commitment. Results. |

Outsourcing

market expected to continue to grow Strong competitive position:

-

Unique combination of global capabilities and customer responsiveness

-

Increasing demand for EMS services in North America and Asia

-

Unique degree of vertical integration

Expanding customer portfolio across diverse industries

Strong revenue and earnings growth

Financial performance exceeds industry average

Strong balance sheet

Key Investment Highlights

Trust. Commitment. Results. |

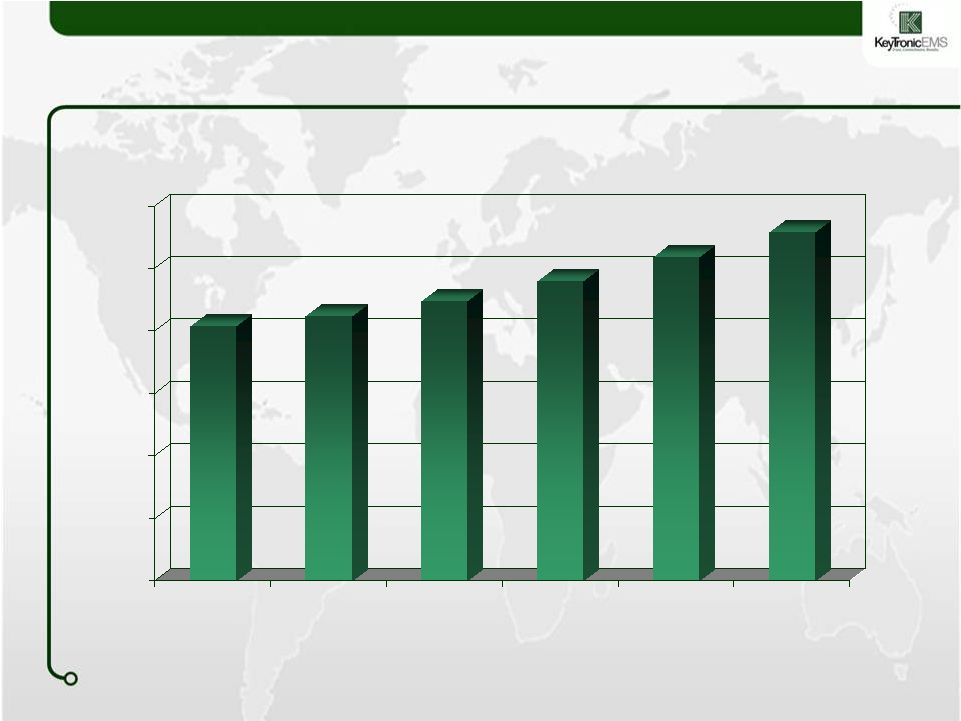

Electronic

Manufacturing Services Market $0

$50

$100

$150

$200

$250

$300

2011

2012

2013

2014

2015

2016

In Billions

Source: IDC, 2012

Trust. Commitment. Results. |

EMS Provider

Tiers Tier I: Over $2 billion in annual revenue

Tier II: $400 million to $2 billion in annual revenue

Tier III: $100 million to $400 million in annual revenue

Trust. Commitment. Results. |

Integrated

Global Operations: US Spokane, Washington

-

Corporate headquarters

-

Command and Control

-

Centralized program management,

production control, quality control,

material management

-

Tooling and prototyping

-

Low volume PCA and box build

El Paso, Texas

-

Product distribution

Trust. Commitment. Results. |

Integrated

Global Operations: Mexico Juarez, Mexico

-

Volume PCA, box build and

plastic molding

-

Repair operations

-

500,000 square feet

-

Contiguous campus of five

facilities

-

Long term presence since 1984

Trust. Commitment. Results. |

Integrated

Global Operations: China Shanghai, China

-

International material

sourcing organization

-

High-volume PCA and box

build

-

130,000 square feet

-

Presence since 1999

Trust. Commitment. Results. |

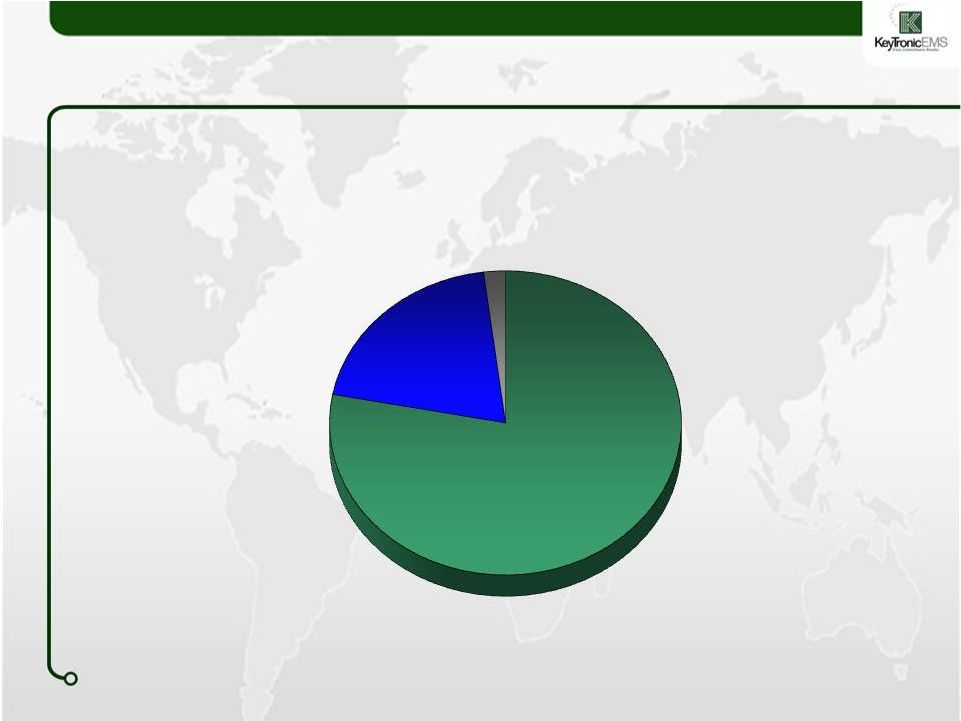

Worldwide

Production Mix Trust. Commitment. Results.

Shanghai China

20%

Spokane USA

2%

Juarez

Mexico

78% |

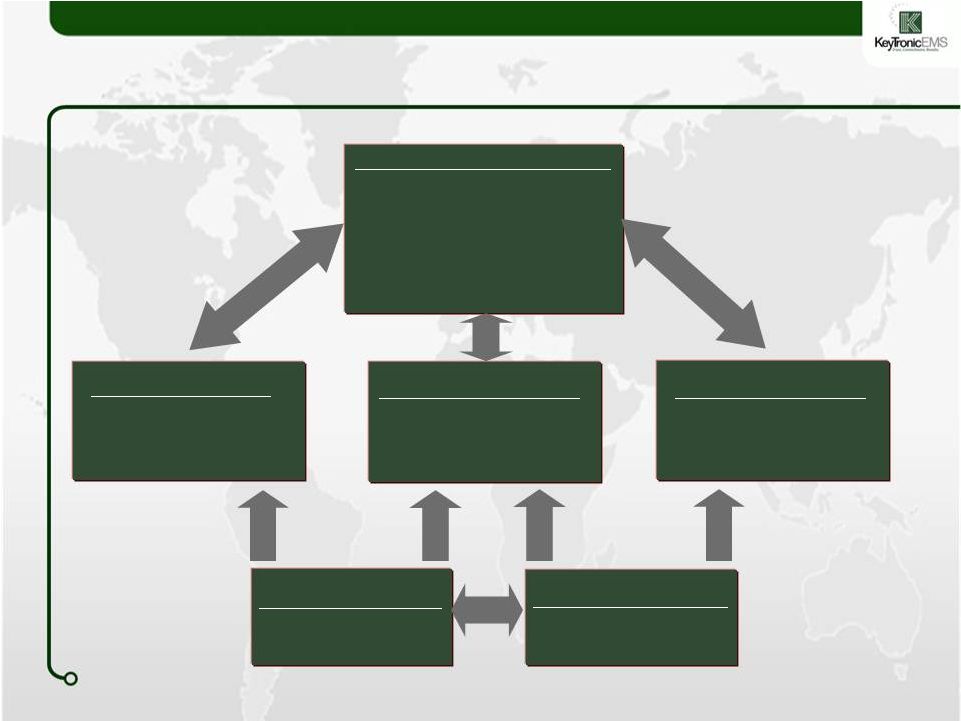

USA-based

Management

Operations

Materials

Production

Control

Quality

Control

Engineering

USA-Based Production

Prototyping

Low Volume

Mexico-based Production

Low to high volume

China-based Production

High volume

USA-Based Purchasing

Parts

China-Based Purchasing

Parts

Leveraging Global Capacities

Trust. Commitment. Results. |

Virtual Tier

I Capabilities International sourcing yields close to Tier I material pricing

Chinese and Mexican production yields Tier I conversion costs

One Stop Shopping:

-

Strong production and process design capabilities

-

Multiple production technologies and vertical Integration

-

Scalability as volume grows: Spokane

Juarez

China

Trust. Commitment. Results. |

Tier III

Responsiveness USA-based centralized operations management

Customer interface in English

Experienced program management for low/mid/high volume programs

Experienced management of offshore facilities

Trust. Commitment. Results. |

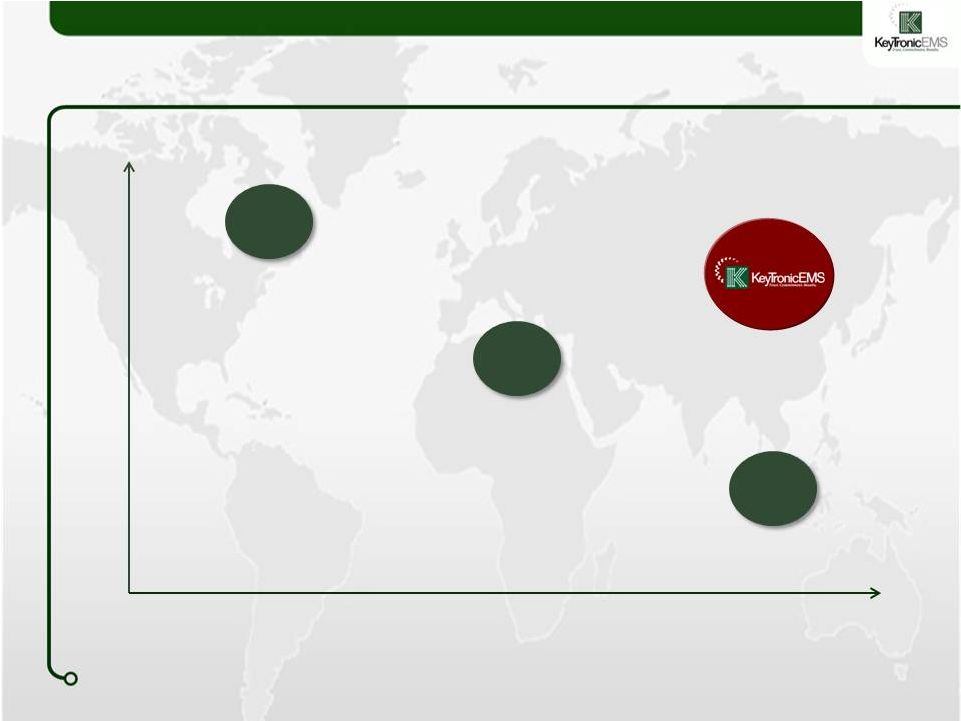

Tier I

COST

COST

Tier II

Tier III

RESPONSIVENESS

RESPONSIVENESS

Rapid

Rapid

Slow

Slow

Low

Low

High

High

Cost/Service Comparison For $5 to $80 Million Program

Trust. Commitment. Results. |

Target

Accounts Program with $5 million to $80 million in annual revenue

Involves at least two production technologies:

-

Plastic injection molding

-

Electrical assembly

-

Full box build

Complex product assembly at account maturity

Customer places high value on responsiveness

Customer seeking long-term relationship

Trust. Commitment. Results. |

Profitable

and Diverse Customer Programs Trust. Commitment.

Results. |

…From

Wide-Ranging Industries Consumer plastic products

Consumer electronics

Medical devices

Specialty printers

Gaming

Telecommunications

Automotive

Educational equipment

Electric transportation

Computer accessories

Industrial tools

Industrial controls

Networking equipment

Scientific instruments

Data storage

Financial Transaction

Military equipment

Irrigation equipment

Trust. Commitment. Results. |

Number of

Customers Generating Revenue Trust. Commitment.

Results. |

Number of

Programs Generating Revenue Trust. Commitment.

Results. |

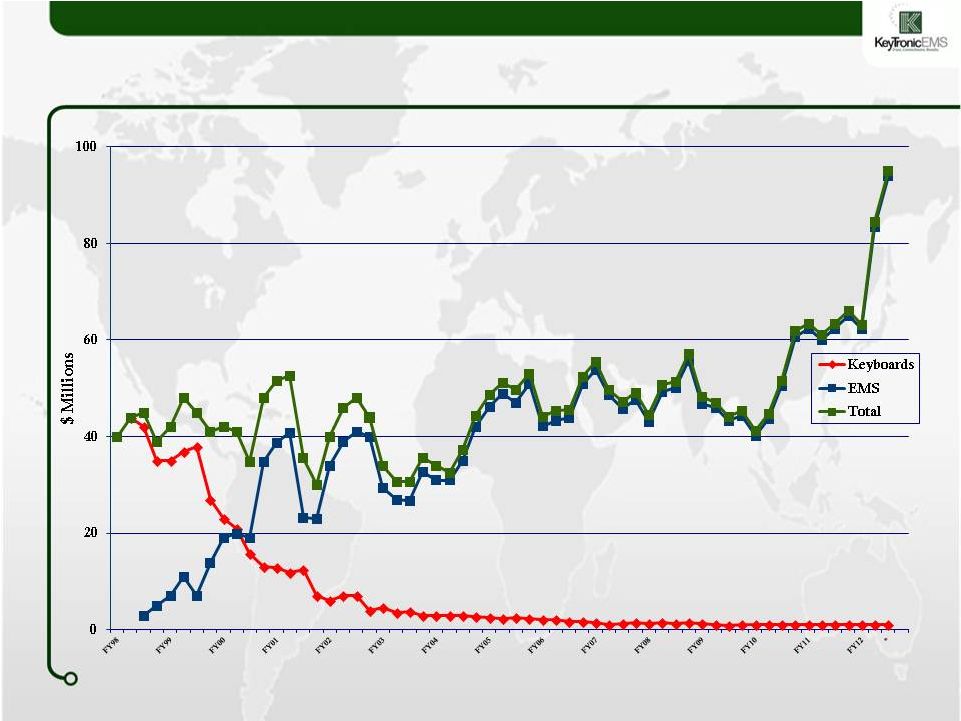

Historic

Transition to EMS * Projected Q3 Results

Trust. Commitment. Results. |

Growth

Strategy Continue to emphasize unique combination

of Tier I capabilities and Tier III responsiveness

Continue to invest in volume driven capacity

Continue to leverage materials and parts procurement

Continue to diversify customer portfolio across many industries

Expand into more high-value-added, multi-production technology programs

Trust. Commitment. Results. |

Financials

Ronald F. Klawitter

Chief Financial Officer and Treasurer

Trust. Commitment. Results. |

Core

Operating Objectives Grow faster than EMS industry

Maintain strong operating margins and profitability

Maintain strong balance sheet

ROIC that exceeds cost of capital

Trust. Commitment. Results. |

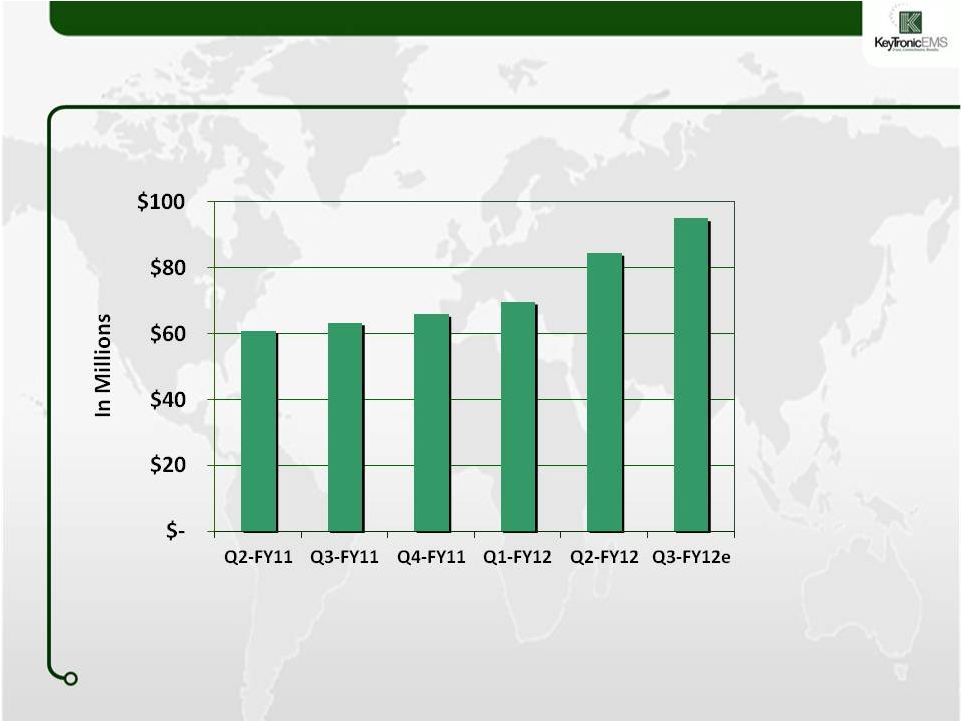

Quarterly

Revenue Trust. Commitment. Results.

|

Annual

Revenue * Based on annualized projection through Q3

Trust. Commitment. Results. |

Financial

Model 8.2%

4.8%

3.4%

Q2-FY12

8.9%

6.1%

2.8%

Q2-FY11

7.2%

4.9%

2.3%

Q1-FY12

Gross Margin

Operating Expenses

Operating Margin

9% -

10%

3% -

4%

5% -

7%

Target

Expecting gradual improvement with long term growth

Trust. Commitment. Results. |

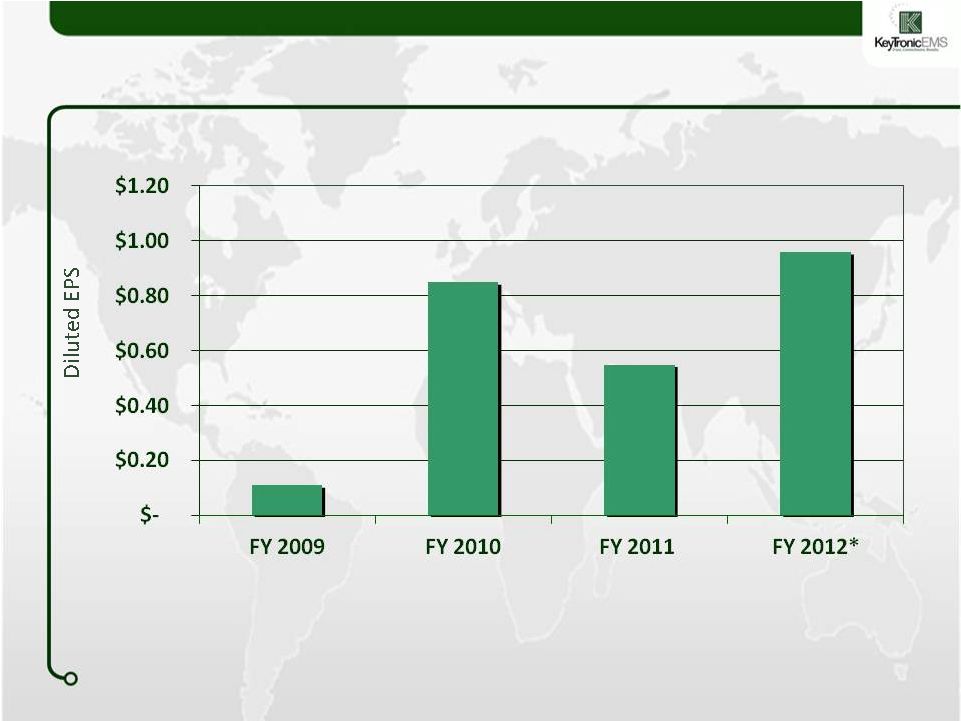

Annual

Earnings * Based on annualized projection through Q3

Trust. Commitment. Results. |

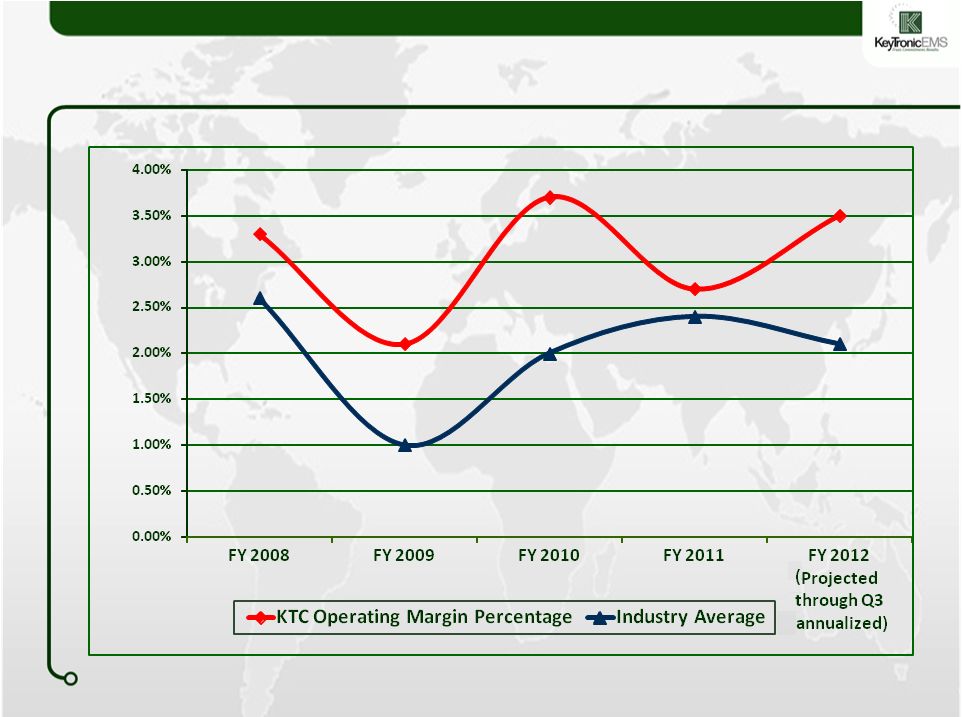

Operating

Margin Percentage Trust. Commitment. Results.

|

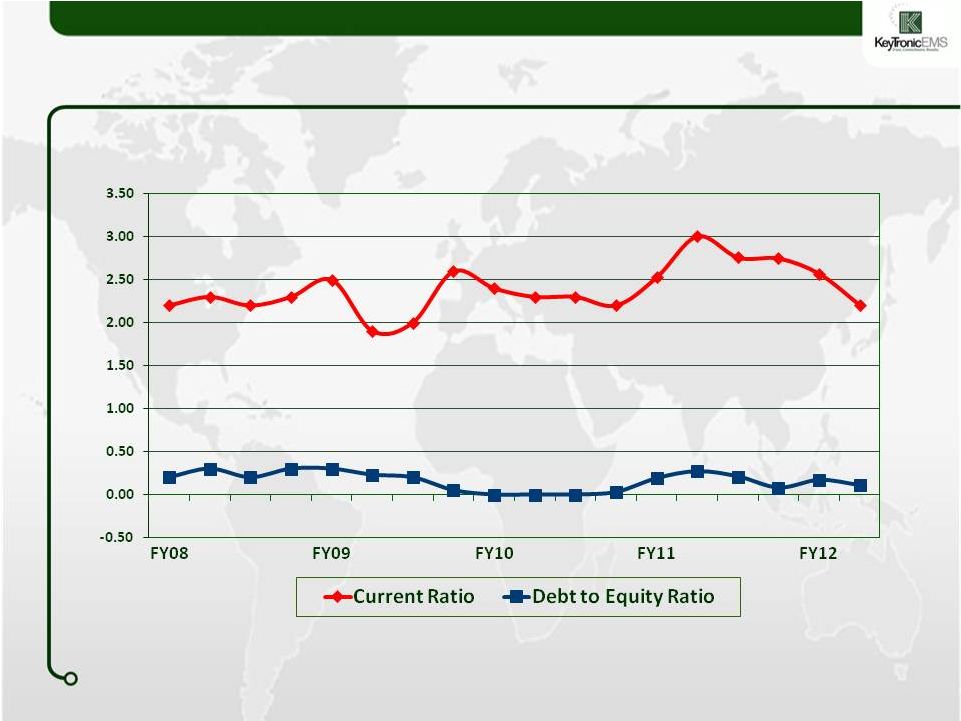

Key Balance

Sheet Ratios Trust. Commitment. Results.

|

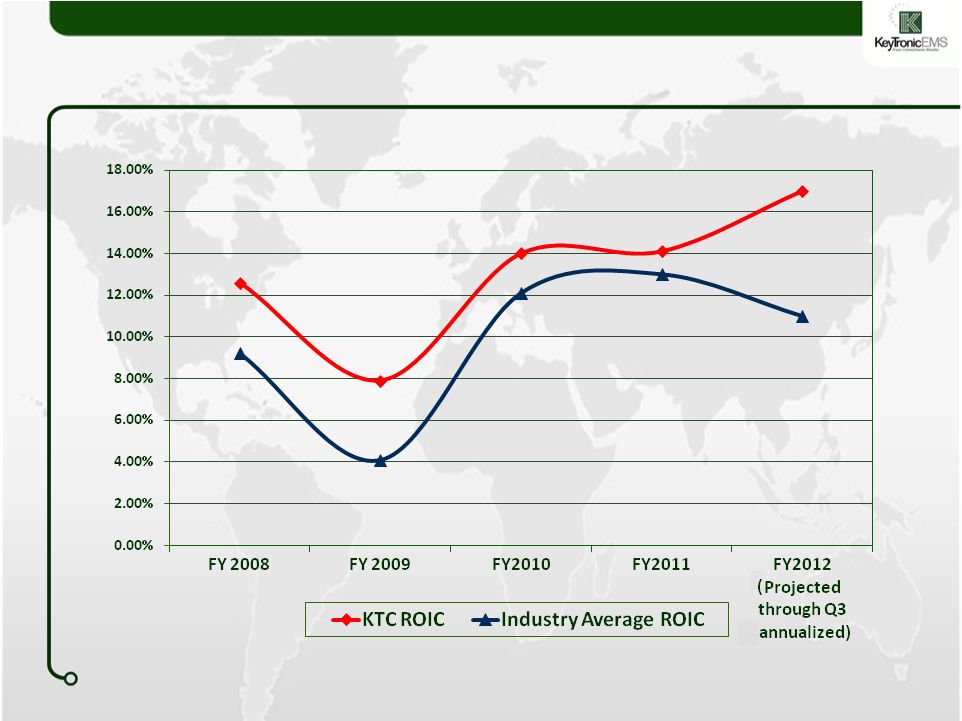

Return on

Invested Capital Trust. Commitment. Results.

|

Outsourcing

market expected to continue to grow Strong competitive position:

-

Unique combination of global capabilities and customer responsiveness

-

Increasing demand for EMS services in North America and Asia

-

Unique degree of vertical integration

Expanding customer portfolio across diverse industries

Strong revenue and earnings growth

Financial performance exceeds industry average

Strong balance sheet

Key Investment Highlights

Trust. Commitment. Results. |