Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SunCoke Energy, Inc. | d292921d8k.htm |

| EX-99.1 - PRESS RELEASE DATED FEBRUARY 2, 2012 - SunCoke Energy, Inc. | d292921dex991.htm |

Q4 2011

Earnings Conference Call February 2, 2012

Exhibit 99.2 |

Safe Harbor

Statement This slide presentation should be reviewed in conjunction with SunCoke’s

Fourth Quarter 2011 earnings release and conference call held on February 2, 2012 at

4:30 p.m. ET. Some of the information included in this presentation contains

“forward-looking statements” (as defined in Section 27A of the Securities

Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as

amended). Such forward-looking statements are based on management’s beliefs

and assumptions and on information currently available. Forward-looking statements include the information

concerning SunCoke’s possible or assumed future results of operations, business

strategies, financing plans, competitive position, potential growth opportunities,

potential operating performance improvements, effects resulting from our separation from Sunoco, the effects of

competition and the effects of future legislation or regulations. Forward-looking

statements include all statements that are not historical facts and may be identified

by the use of forward-looking terminology such as the words “believe,”

“expect,”

“plan,”

“intend,”

“anticipate,”

“estimate,”

“predict,”

“potential,”

“continue,”

“may,”

“will,”

“should”

or the negative of these terms or similar expressions. Forward-looking

statements involve risks, uncertainties and assumptions. Actual results may differ materially

from those expressed in these forward-looking statements. You should not put undue

reliance on any forward-looking statements. In accordance with the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995, SunCoke has included in its filings with

the Securities and Exchange Commission cautionary language identifying important factors (but

not necessarily all the important factors) that could cause actual results to differ

materially from those expressed in any forward-looking statement made by SunCoke. For more

information concerning these factors, see SunCoke's Securities and Exchange Commission

filings. All forward-looking statements included in

this presentation are expressly qualified in their entirety by such cautionary statements.

SunCoke undertakes no obligation to update publicly any forward-looking statement

(or its associated cautionary language) whether as a result of new information or future events or

otherwise.

This presentation includes certain non-GAAP financial measures intended to supplement, not

substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial

measures to GAAP financial measures are provided in the Appendix at the end of the presentation.

Investors are urged to consider carefully the comparable GAAP measures and the reconciliations

to those measures provided in the Appendix, or on our website at www.suncoke.com.

Fourth Quarter 2011 Earnings Conference Call

1 |

Overview

Fourth Quarter 2011 Earnings Conference Call

•

Q4 2011 and Full Year 2011 missed expectations due to unfavorable

impact of $12.2 million (net of income attributable to noncontrolling

interests) in accounting adjustments at Indiana Harbor

•

Q4 2011 Net Income attributable to shareholders of $8.0 million and

EPS of $0.12 per share

•

Full Year Net Income attributable to shareholders of $60.6 million

and EPS of $0.87 per share

•

Q4 2011 Adjusted EBITDA of $31.4 million and Full Year 2011

Adjusted EBITDA of $140.5 million

•

Executed successful startup of Middletown in late October

•

Continued strong domestic coke plant performance

•

Full Year 2011 Coal Mining Adjusted EBITDA increased $28M over 2010

•

Solid year end liquidity position with cash balance of $128 million and

undrawn revolver

•

Separation from Sunoco, Inc. completed on January 17, 2012

•

Elected three new independent directors to the Board

2 |

Indiana Harbor

Accounting Adjustments Fourth Quarter 2011 Earnings Conference Call

3

•

Combined adjustments reduced annual incentive accrual by $1.1 million in

Corporate Segment; consolidated impact of $11.1 million in Q4 2011 and Full

Year 2011

Contract Billing Resolution

•

In late January 2012,

customer questioned 2011

invoicing

•

Accepted customer

interpretation; will adjust

2011 and go-forward billing

accordingly

•

$7.0 million unfavorable

impact to 2011 pre-tax

earnings ($6.0 million net of

noncontrolling interests)

•

Taking measures to mitigate

impact in 2012 and 2013

Inventory Adjustment

•

Adjustment for coal and coke

inventory accounting

•

Understated cost of goods

sold/overstated inventory in

second half 2011

•

$7.3 million unfavorable

impact to 2011 pre-tax

earnings ($6.2 million net of

noncontrolling interests), of

which $3.6 million attributable

to Q3 2011

•

Instituting corrective actions |

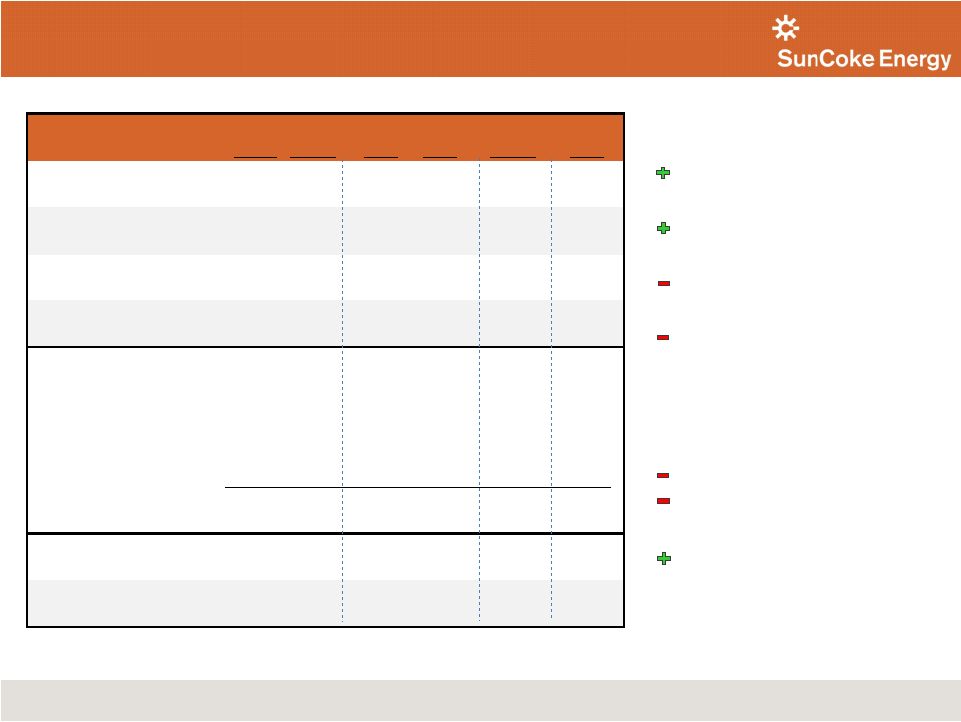

Q4 2011 &

Full Year 2011 Financial Results (1) Coke Adjusted EBITDA includes Adjusted

EBITDA from Jewell Coke, Other Domestic Coke, and International segments. (2)

Coal Adjusted EBITDA includes Adjusted EBITDA from Coal Mining segment. (3)

For a

definition

of

Adjusted

EBITDA

and

reconciliation

of

Adjusted

EBITDA

to

net

income

and

operating

income,

please

see

the

appendix.

Fourth Quarter 2011 Earnings Conference Call

•

Q4 2011 Adjusted EBITDA

decreased YoY:

Q4 2010 impact of

Legal/Settlement costs

Coal Mining

profitability

Indiana Harbor

adjustments

Black Lung charge and

corporate costs

•

Full Year 2011 Adjusted

EBITDA decreased YoY:

ArcelorMittal Settlement

Standalone corporate

and relocation costs

Coal Mining profitability

4

($ in millions)

Q4 '10

2011

2010

Q4 '11 vs.

Q4 '10

2011 vs.

2010

Revenue

$424.1

$317.2

$1,538.9

$1,326.5

$106.9

$212.4

Operating Income

$11.7

$15.8

$67.5

$174.2

($4.1)

($106.7)

Net Income Attributable to

Shareholders

$8.0

$18.5

$60.6

$139.2

($10.5)

($78.6)

Earnings Per Share

$0.12

$0.26

$0.87

$1.99

($0.14)

($1.12)

Coke Adjusted EBITDA

(1)

$42.9

$46.6

$160.7

$245.0

($3.7)

($84.3)

Coal Adjusted EBITDA

(2)

$1.7

($7.8)

$24.0

($3.6)

$9.5

$27.6

Corporate/Other

($13.2)

($4.1)

($44.2)

($14.1)

($9.1)

($30.1)

Adjusted EBITDA

(3)

$31.4

$34.7

$140.5

$227.3

($3.3)

($86.8)

Domestic Coke Sales Volumes

1,003

912

3,770

3,638

91

132

Coal Sales Volumes

363

321

1,454

1,277

42

177

Q4 '11 |

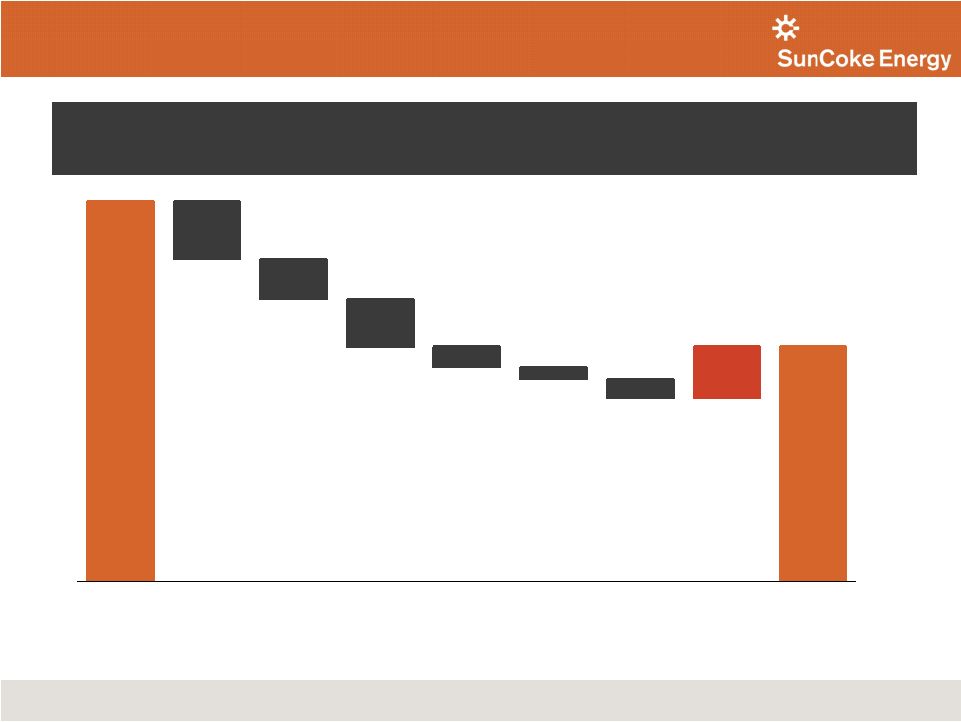

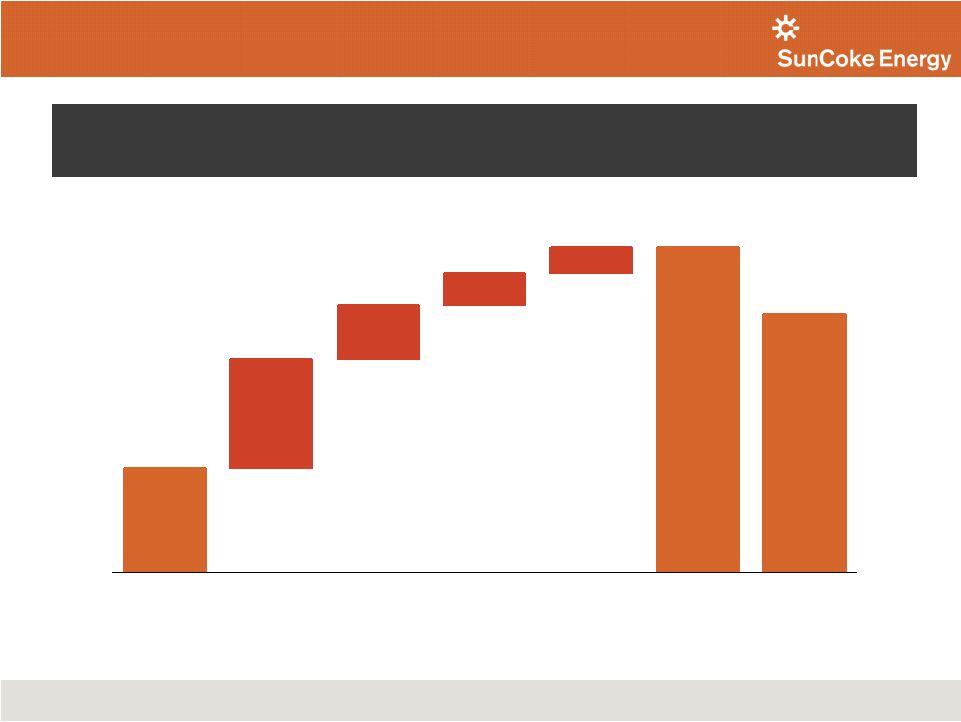

Q4 2010 to Q4

2011 Adjusted EBITDA

(1)

Bridge

Adjusted EBITDA decrease reflects Indiana Harbor adjustments, higher corporate

costs and Black Lung Liability charge, offset by improved performance in Coal Mining and

the absence of ArcelorMittal legal/settlement costs

($ in millions)

Fourth Quarter 2011 Earnings Conference Call

5

$34.7

$31.4

$10.2

$12.9

($12.2)

($6.5)

($6.0)

($1.7)

Q4 2010

Adjusted

EBITDA

Indiana Harbor

Adjustments

Corporate/Other

(Relocation/

Standalone) (2)

Black Lung

Liability Charge

Coke Segments

(Jewel Coke

Other Domestic Coke/

International)(3)

Net ArcelorMittal

Settlement Impact

Coal Mining (2) (3)

Q4 2011

Adjusted

EBITDA

(1) For a definition of Adjusted EBITDA and reconciliation of Adjusted EBITDA to net

income and operating income, please see the appendix. (2) Excludes Black Lung

Liability charge (3) Jewell Coke includes approximately $0.2 million in

favorable coal transfer impact, Coal Mining includes offsetting $0.2 million unfavorable coal transfer impact. |

$44.8

$31.4

$3.8

$8.5

($12.2)

($6.0)

($3.8)

($2.9)

($0.8)

Q3 2011 to Q4 2011

Adjusted EBITDA

(1)

Bridge

Adjusted EBITDA decrease reflects Indiana Harbor adjustments, Black Lung Liability charge,

and higher Coal Mining costs, offset by lower corporate expenses

and preferred dividend accrual in International segment

($ in millions)

6

Fourth Quarter 2011 Earnings Conference Call

Q3 2011

Adjusted

EBITDA

Indiana Harbor

Adjustments

Black Lung

Liability Charge

Coal Mining (2)(4)

Jewell Coke (2)

Other Domestic

Coke (3)

Corporate and

Other(4)

International

(Preferred

Dividend Accrual)

Q4 2011

Adjusted

EBITDA

(1)

For a definition of Adjusted EBITDA and reconciliation of Adjusted EBITDA to net income and operating

income, please see the appendix. (2)

Jewell Coke includes approximately $0.4 million in unfavorable coal transfer impact, Coal Mining

includes offsetting $0.4 million favorable coal transfer impact. (3)

Other Domestic Coke includes Middletown decreasing results by approximately $0.4 million.

(4)

Excludes Black Lung Liability charge and Corporate and Other includes Middletown losses.

|

$227.3

$140.5

$31.0

($34.7)

($23.9)

($28.5)

($12.2)

($7.3)

($11.2)

Full Year 2010 to 2011

Adjusted EBITDA

(1)

Bridge

Adjusted EBITDA decrease reflects impact of ArcelorMittal settlement and higher corporate

costs,

offset by improved Coal Mining results

($ in millions)

Fourth Quarter 2011 Earnings Conference Call

7

2010

Adjusted

EBITDA

Net ArcelorMittal

Settlement Impact

Corporate/Other

(Relocation/

Standalone Costs)

(2)(4)

Jewell Coke (3)

(ex-settlement)

Indiana Harbor

Adjustments

Other Domestic

Coke

(ex-settlement)(4)

Other

(Black Lung/

Middletown/

International)

Coal Mining (2)(3)

2011

Adjusted

EBITDA

(1) For a definition of Adjusted EBITDA and reconciliation of Adjusted EBITDA to net

income and operating income, please see the appendix. (2)

Excludes Black Lung Liability charge

(3)

Jewell Coke includes approximately $16.0 million in unfavorable coal transfer impact,

Coal Mining includes offsetting $16.0 million favorable coal transfer impact.

(4)

Excludes Middletown losses |

Domestic Coke

Financial Summary (Jewell Coke & Other Domestic Coke)

Domestic Coke Production

Domestic Coke Pro Forma Adjusted EBITDA

(1)

, Pro Forma for

ArcelorMittal Settlement and Coal Transfer Price

(Tons in thousands)

($ in millions, except per ton amounts)

Other

Domestic

Coke:

736

Other

Domestic

Coke:

745

Other

Domestic

Coke:

786

915

922

965

(1) For a definition of Pro Forma Adjusted EBITDA and Pro Forma Adjusted EBITDA/Ton

and a reconciliation of Pro Forma Adjusted EBITDA to operating income, please

see the appendix. (2) Other Domestic Coke results for Q4 ‘11 excludes

Middletown loss of approximately $0.4 million. (3) Includes Indiana Harbor

contract billing resolution of $6.0 million and inventory adjustment of $6.2 million,

of which $3.1 million is attributable to Q3 ’11.

Fourth Quarter 2011 Earnings Conference Call

Other

Domestic

Coke:

687

861

$48

$36

$19

•

Q4 ‘11 increase over Q4 ‘10 reflects Middletown startup

and improvement at Indiana Harbor

•

Q4 ‘11 performance impacted by Indiana Harbor

accounting adjustments

1,014

Other

Domestic

Coke:

838

$42

$32

8

(2)

(3)

$11

$11

$11

$14

$11

$31

$8

$25

$34

$21

$46/ton

$22/ton

$39/ton

$50/ton

$34/ton

$ 0

$ 20

$ 40

$ 60

$ 80

$ 100

$ 120

$ 140

($5)

$5

$15

$25

$35

$45

$55

$65

$75

Q4 '10

Q1 '11

Q2 '11

Q3 '11

Q4 '11

Jewell Coke Segment

Other Domestic Coke Segment

Pro Forma Adjusted EBITDA/ton |

Coal Mining

Financial Summary Coal Sales, Production and Purchases

Cost/Ton

(Tons in thousands)

Coal

Mining

Coal

Cash

Cost

(1)

($ per ton)

(1)

Mining and preparation costs, excluding depreciation, depletion and amortization,

divided by coal production volume. Q4 ‘11 excludes $300K reduction in fair value of HKCC

contingent consideration liability, $1.8M of OPEB expense allocation and $3.4M Black

Lung Liability charge.

Fourth Quarter 2011 Earnings Conference Call

•

Q4 2011 Coal operations delivered

highest production levels of year on

increases at Jewell and HKCC

•

Coal Cash Costs continued to

increase QoQ despite higher

production

•

Additional staffing in Q4 2011

at Jewell

•

Contract mining incentives

•

Jewell Q4 2011 also impacted

by royalty true-up and

employee retention costs

•

Full Year Jewell Coal Cash Costs

remained high at $138/ton

66

323

308

256

269

337

272

HKCC production

49

HKCC third-party sales

26

84

48

68

53

76

310

273

9

(1)

321

386

334 340

371

363

259

335

340

349

57

51

24

22

20

Q4 '10

Q1 '11

Q2 '11

Q4 '11

Coal sales

Coal production

Coal purchases

$123

$116

$126

$132

$138

$123

$123

$137

$138

$152

Q4 '10

Q1 '11

Q2 '11

Q3 '11

Q4 '11

Jewell

Coal

Cash

Cost

Q3 '11 |

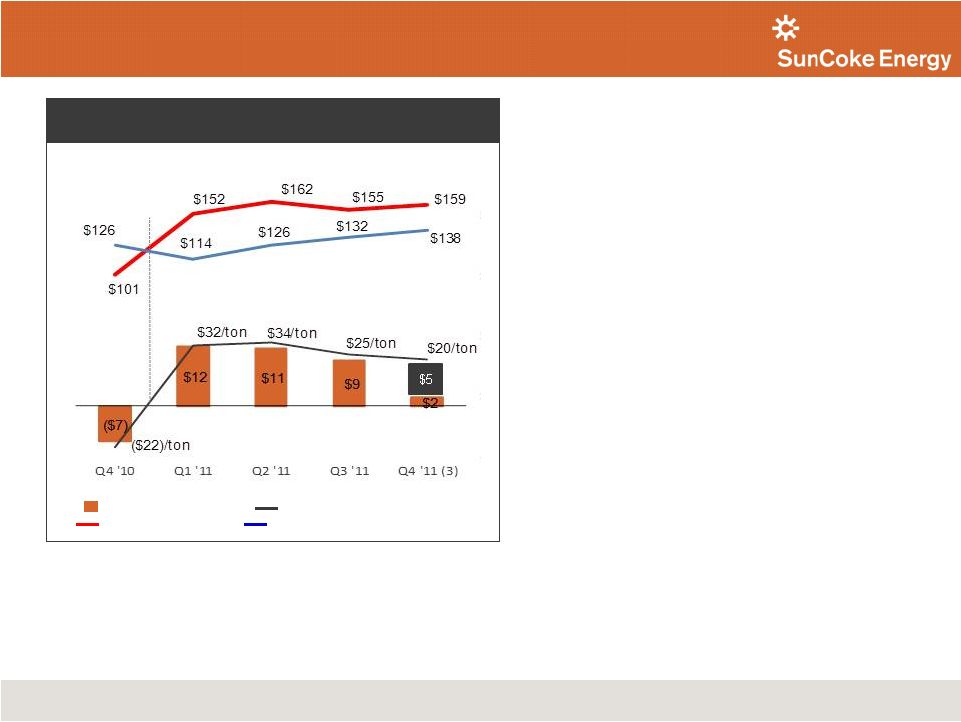

Coal Mining

Financial Summary Coal Mining Pro Forma Adjusted EBITDA

(1)

and Avg. Sales

Price/Ton

(2)

Pro Forma for Coal Transfer Price Impact

($ in millions, except per ton amounts)

Pro Forma Adjusted EBITDA

Pro Forma Adjusted EBITDA / ton

Fourth Quarter 2011 Earnings Conference Call

•

Q4 2011 Pro Forma Adjusted EBITDA

declined QoQ due to higher Coal Cash

Costs offset partially by higher average

sales pricing

•

Q4 2011 Pro Forma Adjusted EBITDA

improved by $9 million YoY on higher

coal prices and HKCC acquisition

•

$5.2 million of costs from Black

Lung Liability charge and OPEB

expense allocation

•

2012 Mid-Vol. coal volumes 88%

committed at

approximately

$177 per ton

•

Expect Full Year 2012 Coal Cash Costs

to be approximately $125-$130 per ton

combined (Jewell/HKCC/Revelation)

and $135 per ton for Jewell

Pro Forma Sales Price (2)

Coal Cash Cost per Ton

(3) Q4 ‘11 Pro Forma Adjusted EBITDA inclusive of Black Lung Liability

charge of $3.4 million and OPEB expense allocation of $1.8 million.

10

(1)

For a definition of Pro Forma Adjusted EBITDA and a reconciliation of ProForma Adjusted

EBITDA to operating income, please see the appendix.

(2)

Average Sales Price is the weighted average sales price for all coal sales volumes, includes

sales to affiliates and sales to Jewell Coke established via a transfer pricing agreement. The

transfer price per ton to Jewell Coke was $103.86, $133.57, $156.12, $163.53, and

$162.05 for Q4 ‘10, Q1 ‘11, Q2 ’11, Q3 ‘11, and Q4 ‘11

respectively. Pro Forma Sales Price is the Average Sales Price adjusted to set the

internal transfer price on Jewell Coke coal purchase volumes equal to the Jewell Coke

coal component contract price. The per ton coal cost component included in the Jewell

Coke contract was approximately $100, $165, $165, $165 and $165 for Q4 ‘10,

Q1 ‘11, Q2 ’11, Q3 ’11 and Q4 ‘11, respectively. |

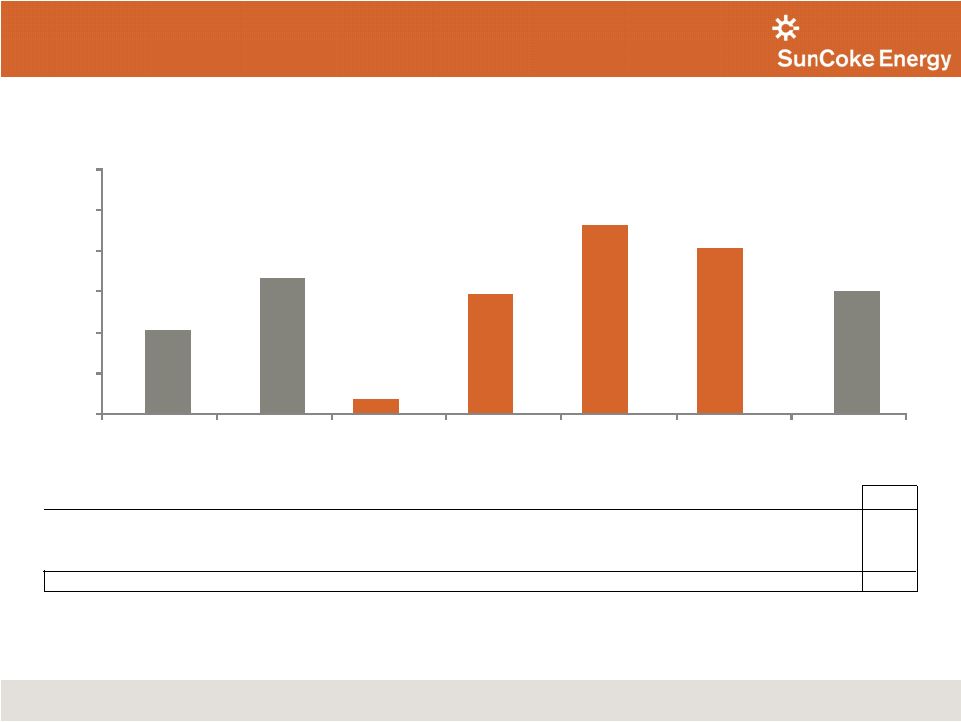

Fourth Quarter 2011 Earnings Conference Call

Pretax Return on Invested Capital

11

1)

For

a

definition

of

Pretax

ROIC,

please

see

the

definitions

page

in

the

appendix.

2)

Pretax

ROIC

is

calculated

as

Pro

Forma

Adjusted

Pretax

Operating

Income

divided

by

average

invested

capital

(stockholders’

equity

plus

total

debt

net

of

cash

and cash equivalents); for a reconciliation of Adjusted Pretax Operating Income to Pro Forma

Adjusted EBITDA, please see appendix. 3)

IncludesIndiana Harbor contract billing resolution of $6.0 million and inventory adjustment of

$6.2 million, of which $3.1 million is attributable to Q3 ’11. 16%

Pretax ROIC, ex-Middletown

(1)(2)

2009

2010

Q1 2011

Q2 2011

Q3 2011

Q4 2011

2011

Total Domestic Coke (Includes Jewell Coke and Other Domestic Coke)

10%

17%

2%

15%

24%

21%

15%

International Coke

59%

35%

9%

8%

19%

114%

35%

Coal Mining

140%

32%

46%

28%

20%

-4%

22%

Total SunCoke (Including Corp./Other)

19%

17%

4%

11%

16%

14%

11%

2%

15%

24%

21%

10%

17%

15%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

2009

2010

Q1 2011

Q2 2011

Q3 2011

Q4 2011

2011

Pretax ROIC

(1)(2)

:

Domestic Coke, ex-

Middletown

(3)

(3)

14% |

$14.1

$44.2

$14.9

$7.2

$4.4

$3.6

2010

Standalone Costs

Relocation

Costs

Business Development/

Black Lung/

Legal/Other

Middletown

2011

2012E

Full Year 2011 Corporate (Adjusted EBITDA)

Fourth Quarter 2011 Earnings Conference Call

2011 corporate costs primarily reflect costs associated with becoming a standalone company

and

relocation

costs;

2012

corporate

costs

expected

to

be

between

$30

-

$35

million

($ in millions)

$30 -

$35

12 |

Liquidity

Update Fourth Quarter 2011 Earnings Conference Call

•

Began decrease of 2011 working

capital build in Q4 2011

•

Targeting lower coal

inventories and sale of

cover coke

•

Borrowed incremental $30 million

from existing term loan facility,

due in 2018

•

Provides additional flexibility

to finance ongoing and

expansion projects

•

Expect 2012 free cash flow of

$50+ million, weighted to the

second half of 2012

•

Intend to build liquidity in near

term to support potential future

growth projects

(1) Free Cash Flow represents cash from operations less cash from investing less

payments to minority interest. For a definition of Free

Cash Flow and a reconciliation of Free Cash Flow, please see the appendix. (2)

For a definition of Adjusted

EBITDA

and

reconciliation

of

Adjusted

EBITDA

to

net

income

and

operating

income,

please

see

the

appendix.

13

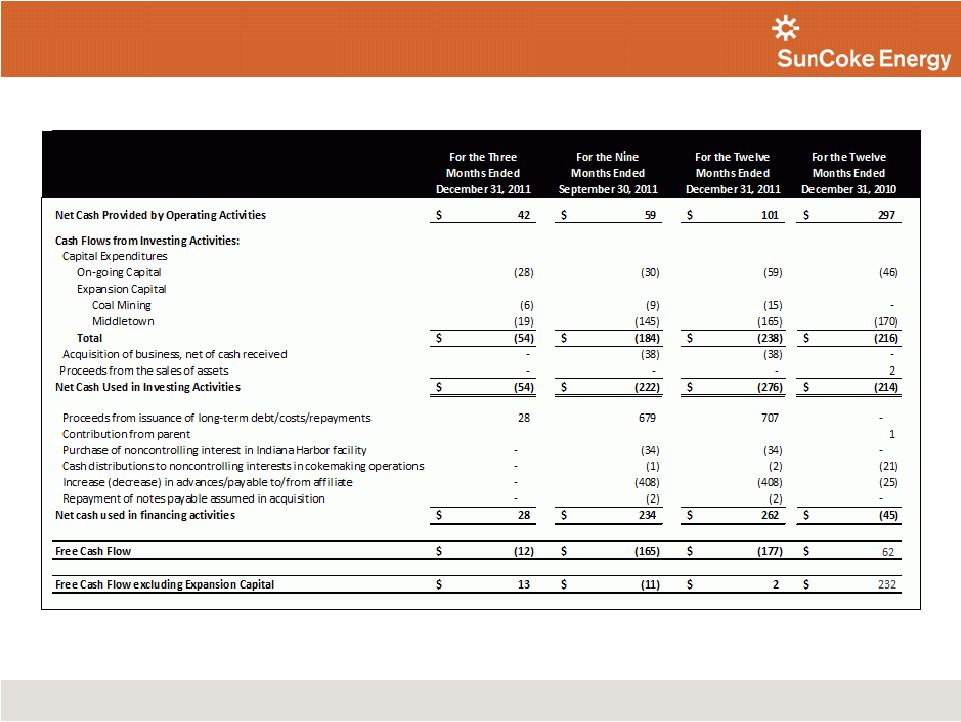

Summary Cash Flow

($ in millions, except where indicated)

Net Income

$8

$59

$146

Loss on firm purchase commitment

(0)

18

-

Depreciation, depletion, and amortization

16

58

48

Deferred income tax expense

9

24

15

Payments (in excess of) less than expense for retirement plans

6

6

(6)

Changes in working capital pertaining to operating activities

4

(61)

91

Other

0

(3)

2

Net cash provided by operations

$42

$101

$297

Capital Expenditures

Ongoing

($28)

($59)

($46)

Expansion

(25)

(179)

(170)

Proceeds from sale of assets

-

-

2

Acquisition of business, net of cash received

(0)

(38)

-

Net cash used in investing activities

($54)

($276)

($214)

Proceeds from issuance of long-term debt/costs/repayments

$28

$707

$0

Contribution from parent

-

-

$1

Purchase of noncontrolling interest in Indiana Harbor facility

-

(34)

-

Distributions to noncontrolling interests in cokemaking operations

(0)

(2)

(21)

Increase (decrease) in advances/payable to/from affiliate

-

(408)

(25)

Repayment of notes payable assumed in acquisition

-

(2)

-

Net cash provided by (used in) financing activities

$28

$262

($45)

Net increase in cash

$16

$87

$36

Cash balance at beginning of period

$111

$40

$3

Cash balance at end of period

$128

$128

$40

Free Cash Flow

(1)

($12)

($177)

$62

Liquidity and leverage ratios as of December 31, 2011

Undrawn revolver

$150

Total liquidity

$278

Total Debt

$726

Total Debt / Adj. EBITDA

(2)

4.8x

Net Debt

$598

Net Debt / Adj. EBITDA

(2)

3.9x

For the

Three

Months

Ended

December

31, 2011

For the

Twelve

Months

Ended

December

31, 2011

For the

Twelve

Months

Ended

December

31, 2010 |

Tax

Overview Fourth Quarter 2011 Earnings Conference Call

14

•

SunCoke entered tax sharing

agreement with Sunoco

(SUN) as part of separation

•

Provides SUN with right to

use SunCoke NOLs while

consolidated for periods

prior to January 17, 2012

(distribution date)

•

Provides SUN with right to

elect Middletown bonus

depreciation rate

•

Limits ability of SunCoke to

restructure business and

repurchase shares within 2

years of Distribution

•

SunCoke indemnifies SUN

against tax-related liabilities

related to separation

•

Additional Q4 2011 reduction of deferred

tax assets and equity of ~ $100M

•

SunCoke retains future NOLs/tax credits

•

Tax credits primary driver of lower

effective rate (20-24% for 2012);

migrating toward higher statutory rate as

credit eligibility exhausted

•

SunCoke 2011 NOL from Middletown

bonus depreciation likely used by SUN

•

Expect cash tax rate of 10% to 15% in

2012

•

Limited ability to restructure coal mining

business

•

Potential for limited coke business

restructuring

•

Limited ability for share repurchases

Tax Sharing Agreement

Balance

Sheet/

Effective Tax

Rate Impacts

Cash Tax Rate

Impacts

Restructuring

Restrictions

within

2

Years

of

Distribution |

2012

Priorities Fourth Quarter 2011 Earnings Conference Call

•

Execute the ramp up of Middletown; expect to reach full production

levels in Q2 2012

•

Achieve targeted coke production volumes of 4.0 to 4.2 million tons

•

Continue permitting work for potential new U.S. plant in anticipation of a

market recovery

•

Implement India entry strategy by completing due diligence and

negotiating definitive agreements

•

Drive improved productivity at existing mines; mining a

projected

1.8 million tons and positioning segment for future expansion

15 |

2012 Outlook

Summary Metric

Expected 2012 Outlook

Adjusted EBITDA

(1)

$250 million –

$280 million

Capital Expenditures

& Investments

Approximately $150 million

Free Cash Flow

(2)

$50 million +

Cash Tax Rate

10% –

15%

Effective Tax Rate

20% –

24%

Corporate Costs

$30 million -

$35 million

Coke Production

4.0 -

4.2 million tons

Coal Production

Approximately 1.8 million tons

EPS (at 22% tax rate)

$1.30 -

$1.65

(1) For a definition of Adjusted EBITDA, please see the appendix

(2) For a definition of Free Cash Flow, please see the appendix

Fourth Quarter 2011 Earnings Conference Call

16 |

Strategy for

Shareholder Value Creation Fourth Quarter 2011 Earnings Conference Call

17

Operational Excellence

•

Rigorous execution in

existing operations

•

Maintain focus on

safety and environment

•

Deliver returns through

strong, consistent coke

earnings and optimize

coal operations

Grow The Coke Business

•

Domestic

•

Secure permits for

next potential facility

•

Capitalize on aging

domestic capacity,

demand growth and

import displacement

•

International

•

Execute India entry

and pursue follow-on

growth

•

Continue evaluating

China for potential

entry

Potential Structuring

Alternatives

•

Coke MLP

•

Domestic assets well

suited and expected to

qualify

•

Will evaluate in 2012

•

Coal

•

Aggressively manage

the business

•

Optimize value in near

term and enhance

strategic flexibility |

Questions

Fourth Quarter 2011 Earnings Conference Call

18 |

Appendix

Fourth Quarter 2011 Earnings Conference Call

19 |

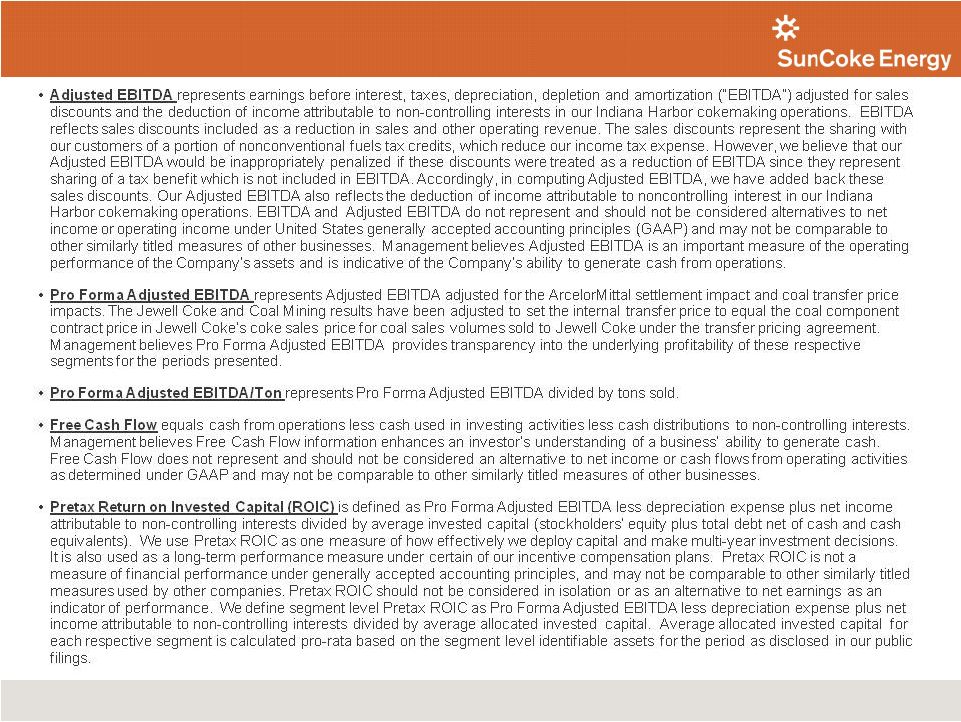

Definitions

Fourth Quarter 2011 Earnings Conference Call

20 |

21

2012E

Low

2012E

High

Net Income

$98

$122

Depreciation, Depletion and Amortization

74

72

Total financing costs, net

48

46

Income tax expense

25

37

EBITDA

$245

$277

Sales discounts

11

10

Noncontrolling interests

(6)

(7)

Adjusted EBITDA

$250

$280

Estimated EBITDA Reconciliation, $MM

2012E Net Income to Adjusted EBITDA Reconciliation

Fourth Quarter 2011 Earnings Conference Call |

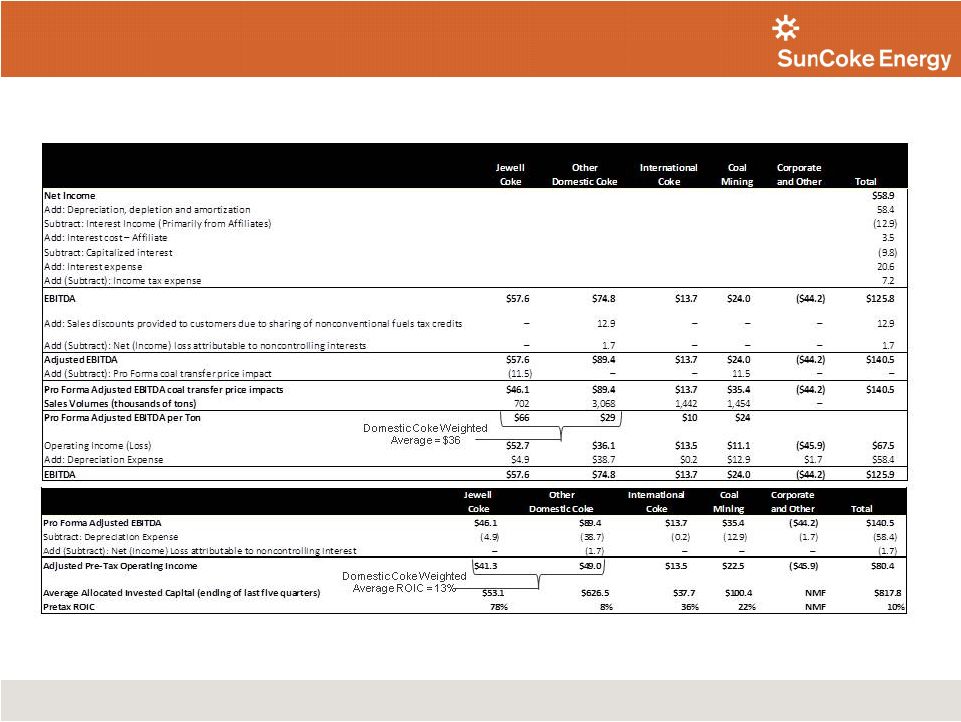

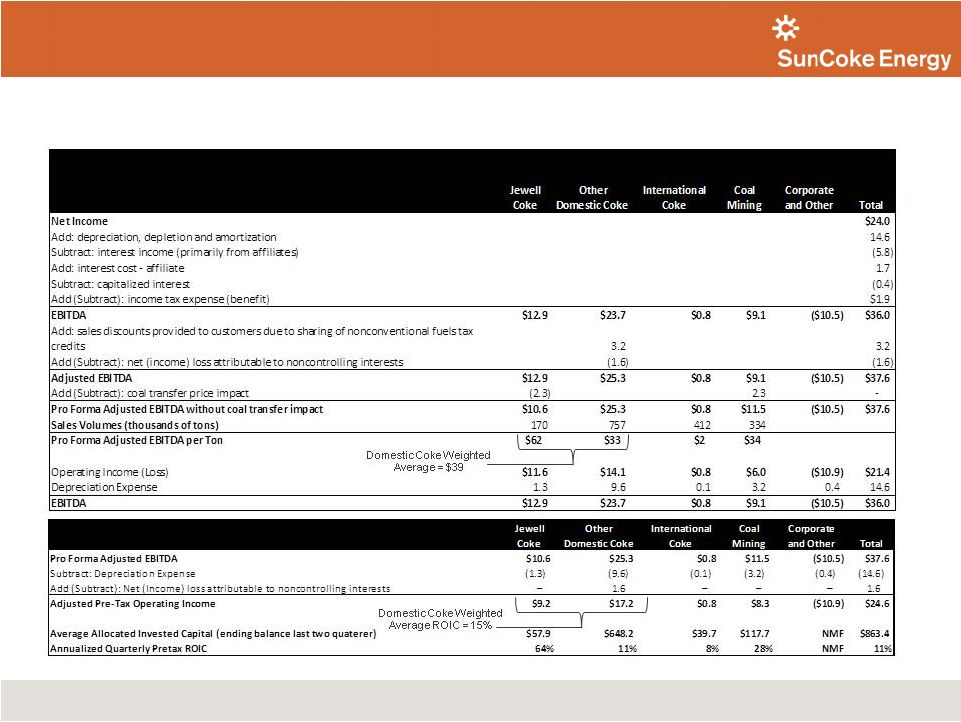

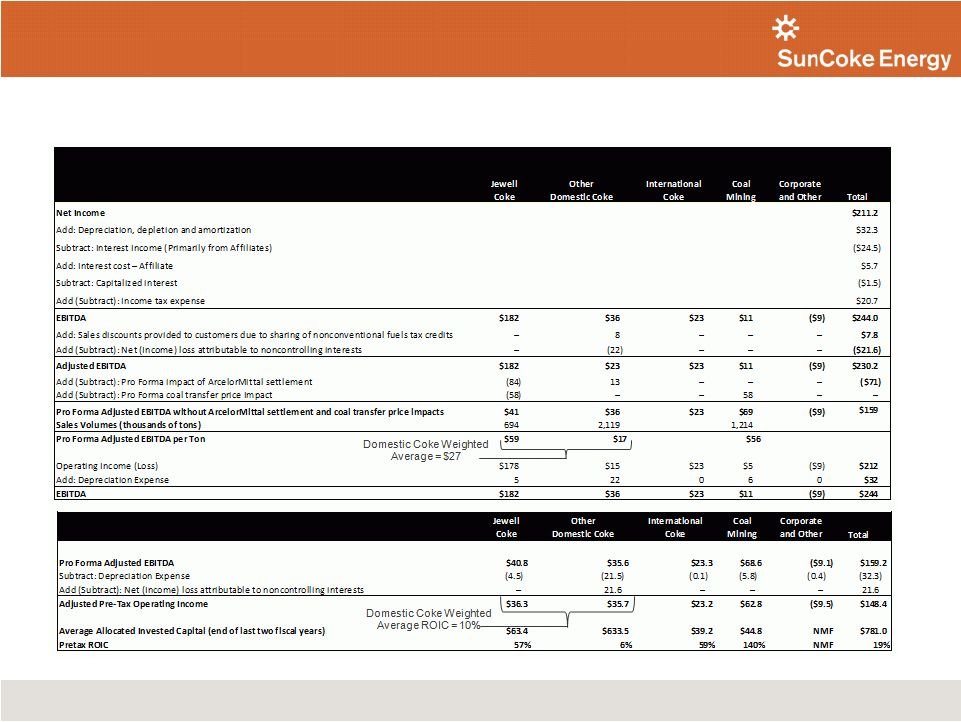

22

EBITDA and Pretax ROIC Reconciliation, $MM

Fourth Quarter 2011 Earnings Conference Call

For The Year Ended 2011 |

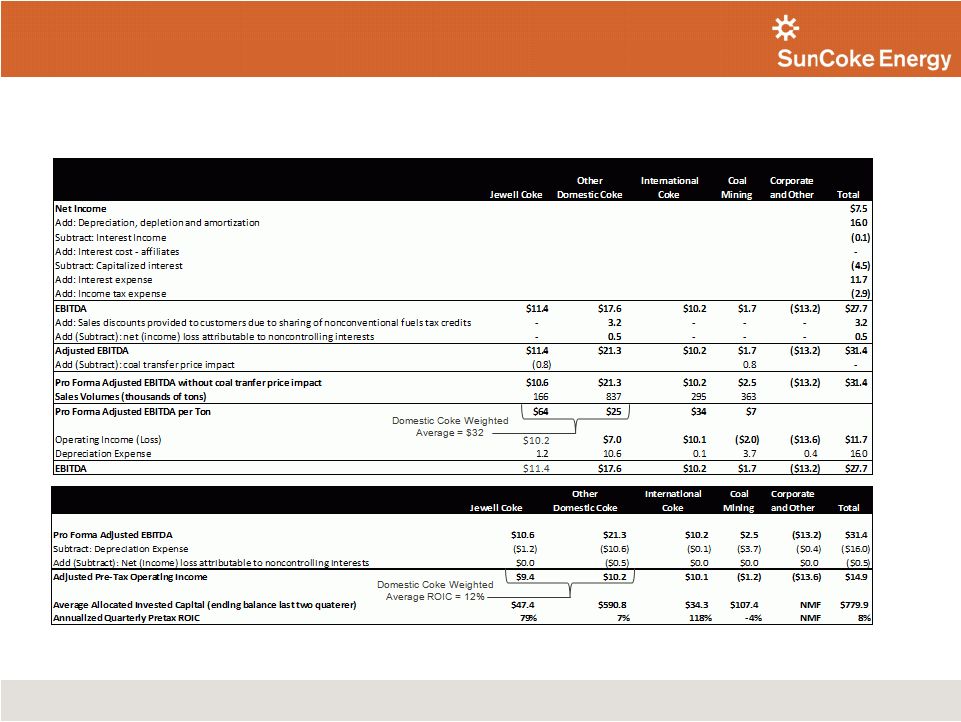

23

EBITDA and Pretax ROIC Reconciliation, $MM

Fourth Quarter 2011 Earnings Conference Call

For The Three Months Ended December 31, 2011 |

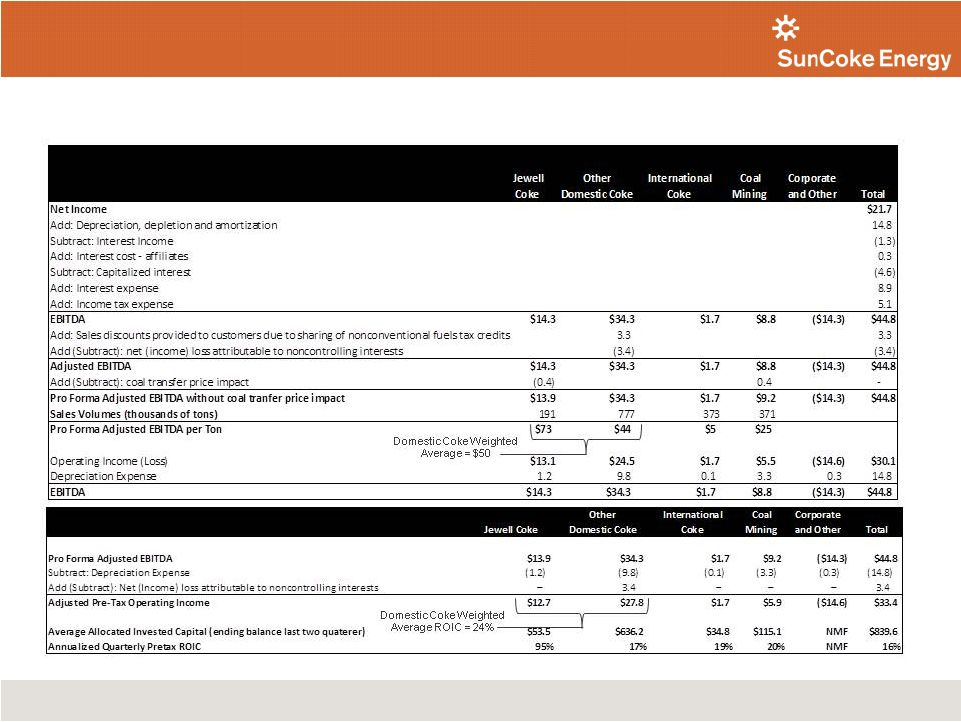

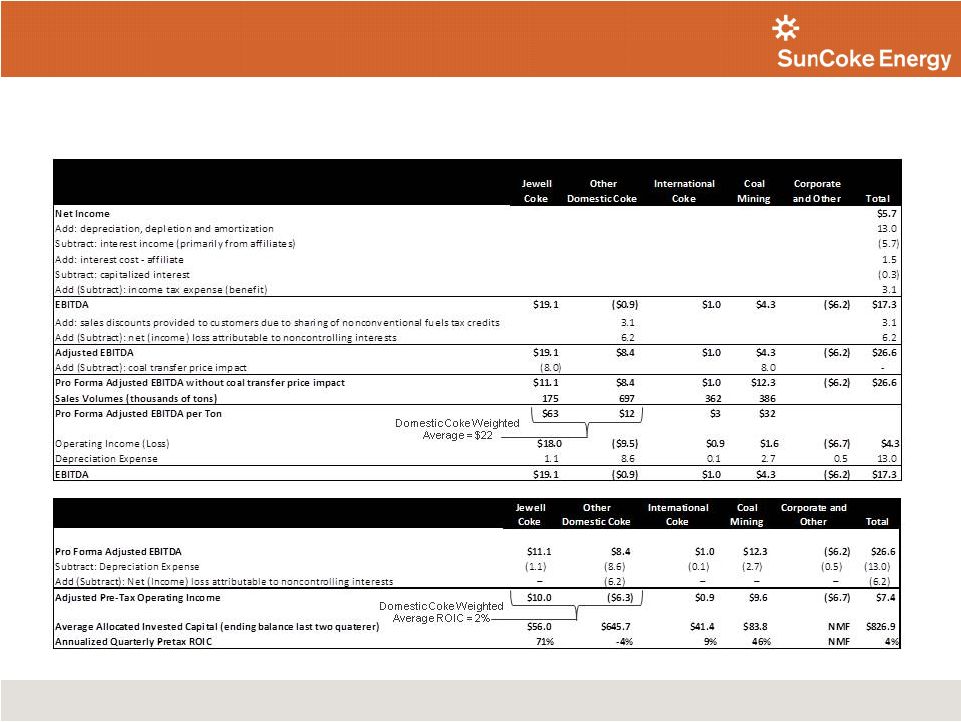

EBITDA and

Pretax ROIC Reconciliation, $MM For The Three Months Ended September 30,

2011 Fourth Quarter 2011 Earnings Conference Call

24 |

EBITDA and

Pretax ROIC Reconciliation, $MM For The Three Months Ended June 30, 2011

Fourth Quarter 2011 Earnings Conference Call

25 |

EBITDA and

Pretax ROIC Reconciliation, $MM For The Three Months Ended March 31, 2011

Fourth Quarter 2011 Earnings Conference Call

26 |

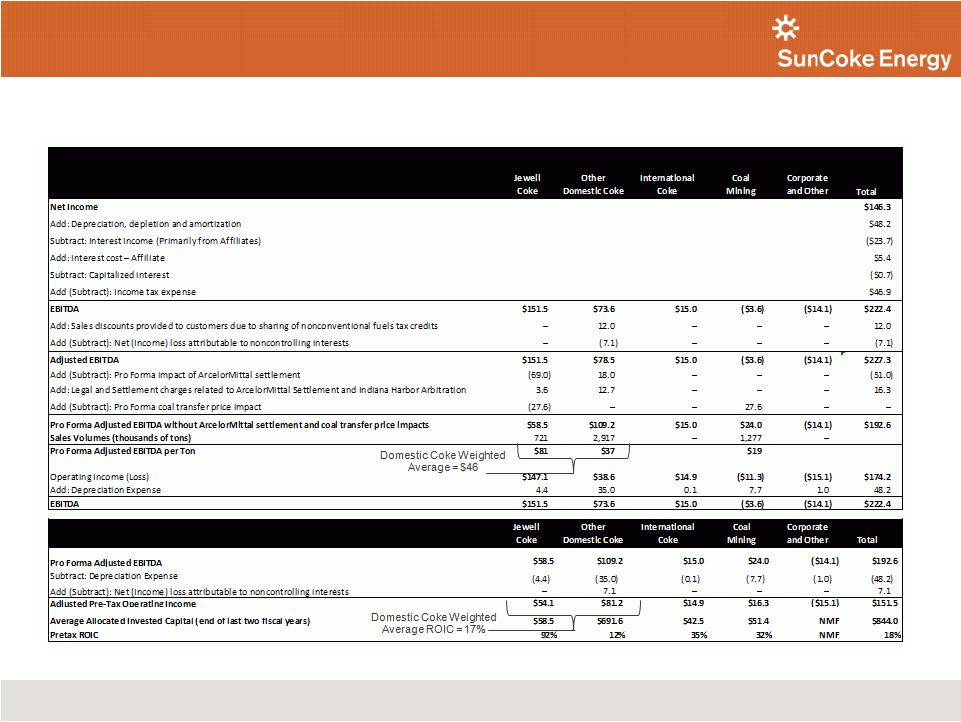

EBITDA and

Pretax ROIC Reconciliation, $MM For The Year Ended 2010

Fourth Quarter 2011 Earnings Conference Call

27 |

EBITDA and

Pretax ROIC Reconciliation, $MM For The Three Months Ended December 31,

2010 Fourth Quarter 2011 Earnings Conference Call

28 |

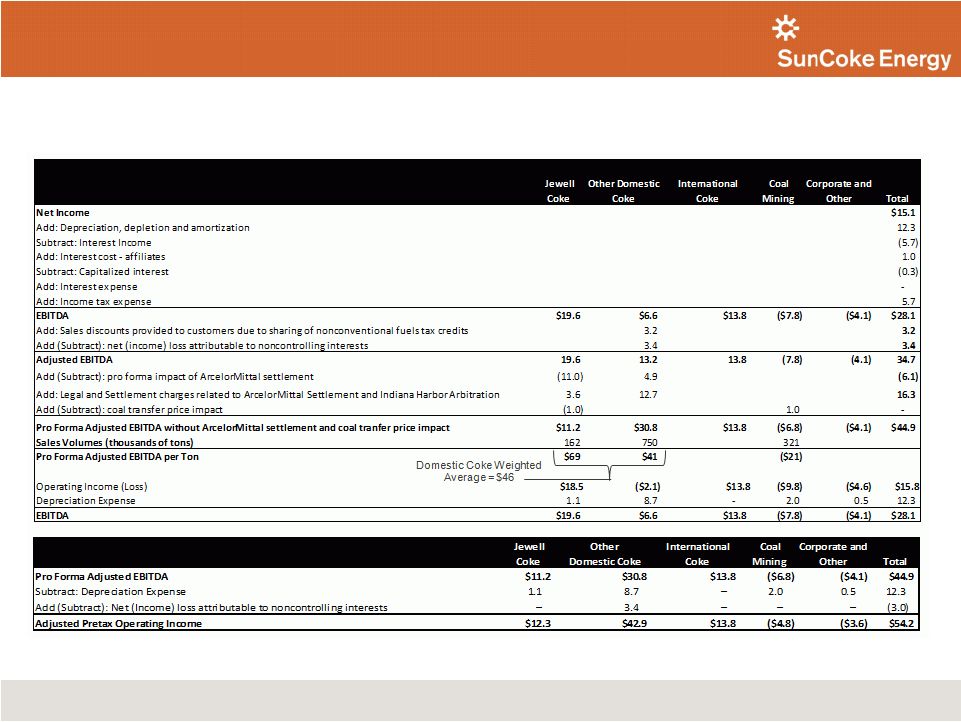

EBITDA and

Pretax ROIC Reconciliation, $MM For The Year Ended 2009

Fourth Quarter 2011 Earnings Conference Call

29 |

Free Cash Flow

Reconciliation, $MM Fourth Quarter 2011 Earnings Conference Call

30 |

Fourth Quarter 2011 Earnings Conference Call

Pretax Return on Invested Capital Reconciliation, $MM

For the period ended

Consolidated Sun Coke Energy

2011

Q4 2011

Q3 2011

Q2 2011

Q1 2011

2010

2009

2008

Adjusted Pretax Operating Income

(1)

$80.4

$14.9

$33.4

$24.6

$7.4

$151.5

$148.4

$111.7

Invested Capital

Q4 2011

Q3 2011

Q2 2011

Q1 2011

2010

2009

2008

Long-term Debt (including current portion)

$726.4

$697.8

$794.7

$715.7

$655.3

$145.3

$109.6

Total equity

559.9

604.5

457.3

433.4

429.3

815.6

636.9

Less: Cash and cash equivalents

(127.5)

(110.9)

(30.5)

(11.0)

(40.1)

(2.7)

(23.0)

Less: Middletown Identifiable Assets

(402.8)

(387.6)

(346.1)

(286.7)

(242.2)

(72.5)

(47.1)

Invested Capital

$756.0

$803.8

$875.4

$851.5

$802.4

$885.6

$676.4

Average Invested Capital

$817.8

$779.9

$839.6

$863.4

$826.9

$844.0

$781.0

Q4 2011

Q3 2011

Q2 2011

Q1 2011

2010

2009

2008

Annualized Quarterly Pretax ROIC

7.6%

15.9%

11.4%

3.6%

Last Twelve Months' Pretax ROIC

9.8%

18.0%

19.0%

For the period ended

Long-term Debt (Prior to Separation / IPO)

Q2 2011

Q1 2011

2010

2009

2008

Interest receivable from affiliate

(3.6)

(1.8)

0.0

0.0

0.0

Notes receivable from affiliate

(289.0)

(289.0)

(289.0)

(289.0)

(289.0)

Advances from affiliate

1,087.3

1,006.5

944.3

434.3

398.6

Total Debt

794.7

715.7

655.3

145.3

109.6

(1) See Adjusted EBITDA and Pretax ROIC Reconciliation for respective

periods 31 |

Fourth Quarter 2011 Earnings Conference Call

Pretax Return on Invested Capital Reconciliation, $MM

32

Period ended

Jewell

Coke

Other

Domestic

Coke

International

Coke

Coal

Mining

Corporate

and Other

Total

Identifiable Assets for

Allocating Invested Capital

Q4 2011

$81.6

$991.8

$62.8

$182.1

$220.8

$1,539.0

Q3 2011

77.7

990.6

52.7

178.3

192.3

1,491.6

Q2 2011

85.1

954.4

53.6

173.5

67.2

1,333.9

Q1 2011

82.6

922.6

61.2

167.2

48.9

1,282.6

2010

80.9

962.6

59.7

76.7

7.3

1,187.3

2009

82.7

972.1

59.2

67.6

3.7

1,185.2

2008

93.1

772.6

49.0

56.0

6.1

976.8

Invested Capital Allocation Percentage

Q4 2011

6.2%

75.2%

4.8%

13.8%

NMF

100.0%

Q3 2011

6.0%

76.2%

4.1%

13.7%

NMF

100.0%

Q2 2011

6.7%

75.4%

4.2%

13.7%

NMF

100.0%

Q1 2011

6.7%

74.8%

5.0%

13.6%

NMF

100.0%

2010

6.9%

81.6%

5.1%

6.5%

NMF

100.0%

2009

7.0%

82.3%

5.0%

5.7%

NMF

100.0%

2008

9.6%

79.6%

5.0%

5.8%

NMF

100.0%

Allocated Invested Capital

Q4 2011

$46.8

$568.8

$36.0

$104.4

-

$756.0

Q3 2011

48.1

612.9

32.6

110.3

-

803.8

Q2 2011

58.8

659.6

37.0

119.9

-

875.4

Q1 2011

57.0

636.8

42.3

115.4

-

851.5

2010

55.0

654.6

40.6

52.1

-

802.4

2009

62.0

728.7

44.4

50.6

-

885.6

2008

64.9

538.3

34.1

39.0

-

676.4

Note: Excludes Middletown in all periods shown; at the end of Q4 2011, identifiable assets

included in Other Domestic Coke attributable to Middletown were $402.8m (prior

to Q4 2011, Middletown was included in the Corporate and Other segment); see

historical segment detail in public filings for additional detail

|

Media releases and SEC filings are available

on our website at www.suncoke.com

Contact Investor Relations for more information: 630-824-1907

Fourth Quarter 2011 Earnings Conference Call

33 |