Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - LANTRONIX INC | lantronix_8k-020112.htm |

Exhibit 99.1

Investor Presentation Lantronix (NASDAQ: LTRX ) Kurt Busch , President & CEO Jeremy Whitaker , CFO Merriman Investor Summit February 1, 2012

| 1 |

Page 2 | Investor Presentation Feb 1, 2012 © 2012 Lantroni x . Safe Harbor This presentation contains forward - looking statements, including statements concerning financial results, anticipated market growth, market size, market vision, product features and availability timing, competitive assessments, the Company’s expectations concerning its operating results for fiscal year 2012, future revenues, margins and operating expenses. These forward - looking statements are based on current management expectations and are subject to risks and uncertainties that could cause actual reported results and outcomes to differ materially from those expressed in the forward - looking statements, including but not limited to: quarterly fluctuations in operating results; changing market conditions; government and industry standards; market acceptance of the Company’s products by its customers; pricing trends; actions by competitors; future revenues and margins; changes in the cost or availability of critical components; unusual or unexpected expenses; cash usage; and other factors that may affect financial performance. For a more detailed discussion of these and other risks and uncertainties, see the Company's recent SEC filings, including its Form 10 - Q filed for the fiscal quarter ended September 30, 2011 and Form 10 - K filed for the fiscal year ended June 30, 2011 . You are cautioned not to place undue reliance on these forward - looking statements, which speak only as of the date hereof, and the company undertakes no obligation to update these forward - looking statements to reflect subsequent events or circumstances. Lantronix®, Inc. believes that the presentation of non - GAAP financial information provides important supplemental information to management and investors regarding financial and business trends relating to the Company's financial condition and results of operations. The non - GAAP financial measures disclosed by the Company should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in accordance with GAAP and reconciliations to those financial statements should be carefully evaluated. The non - GAAP financial measures used by the Company may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies.

| 2 |

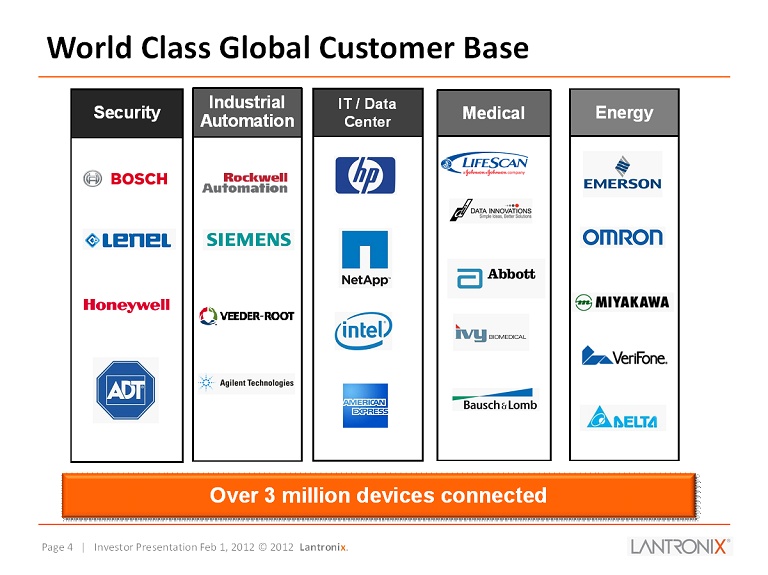

Page 3 | Investor Presentation Feb 1, 2012 © 2012 Lantroni x . About Lantronix (NASDAQ: LTRX ) Global leader in the design, manufacture and sale of secure connectivity solutions for machine - to - machine (M2M) local or internet communication • 3 million+ Lantronix devices currently deployed (in - market) • Customer base of 10,000+ global companies across key verticals: security, industrial automation , IT/data center, medical, and energy Worldwide reach, vast partner base • FY 11 Revenue: 52%, 31% and 17% for the Americas, EMEA, and Asia Pacific, respectively • Global partner base of distributors, OEM manufacturers, and VARs covering 50+ countries worldwide • 100+ employees worldwide: HQ in Irvine, CA; sales offices in Netherlands, Tokyo and Hong Kong Energized m anagement t eam • New team and growth strategy; over 150 years of experience in the technology sector among the top senior executives, with deep expertise in technology and communications equipment solutions Proven t echnology f oundation and robust p roduct p ipeline • 19 patents granted, 21 new applications in process Smart, Secure M2M Connectivity Solutions

| 3 |

Page 4 | Investor Presentation Feb 1, 2012 © 2012 Lantroni x . World Class Global Customer Base Security Industrial Automation IT / Data Center Medical Energy Over 3 million devices connected

| 4 |

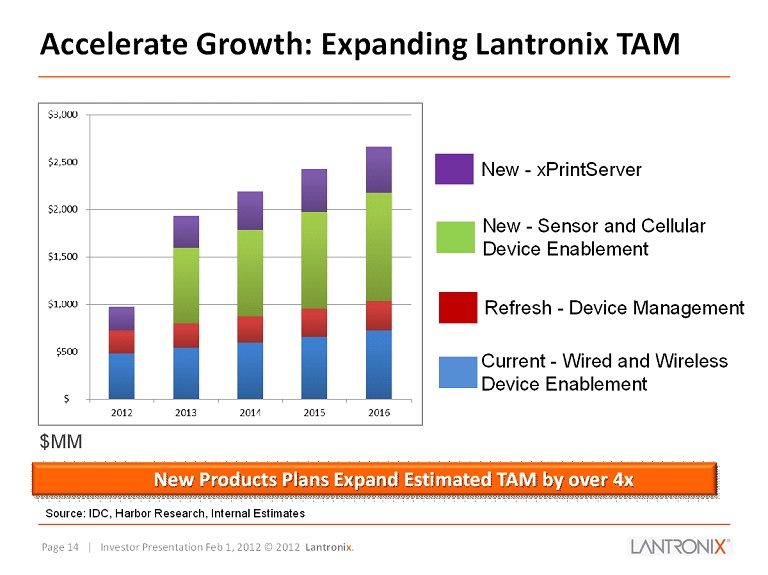

Page 5 | Investor Presentation Feb 1, 2012 © 2012 Lantroni x . • Strong new, energized management team with M2M and communications expertise • 20 years of company experience allows us to aggressively expand into new markets • Focused on execution – Financial – Product development and market growth • New products expected to expand estimated TAM by over 4x • The first new product under new management, xPrintServer ™, has received several industry accolades Lantronix: Investment Highlights

| 5 |

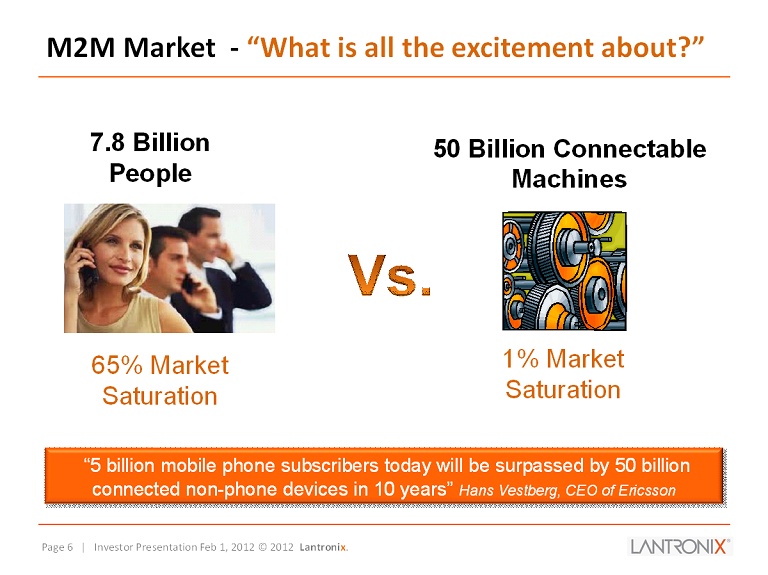

Page 6 | Investor Presentation Feb 1, 2012 © 2012 Lantroni x . 7.8 Billion People 65% Market Saturation 50 Billion Connectable Machines 1% Market Saturation M2M Market - “What is all the excitement about?” “5 billion mobile phone subscribers today will be surpassed by 50 billion connected non - phone devices in 10 years ” Hans Vestberg , CEO of Ericsson

| 6 |

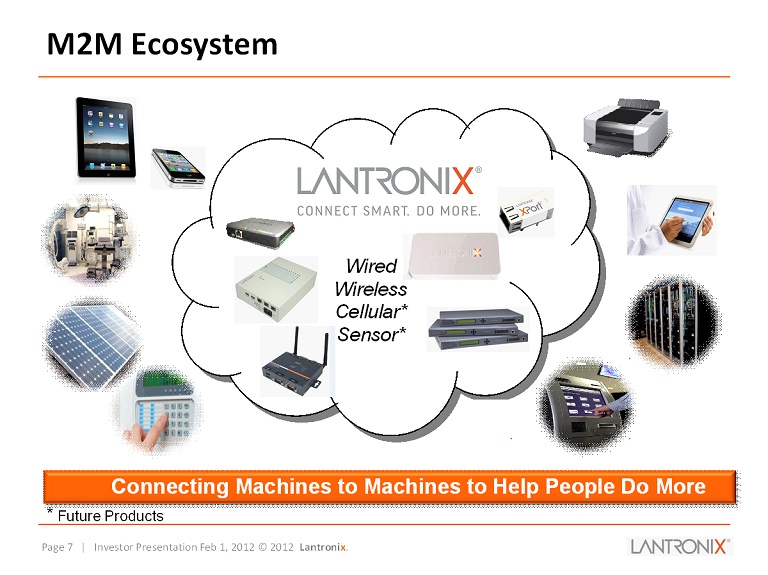

Page 7 | Investor Presentation Feb 1, 2012 © 2012 Lantroni x . Wired Wireless Cellular* Sensor* M2M Ecosystem . . . Connecting Machines to Machines to Help People Do More * Future Products

| 7 |

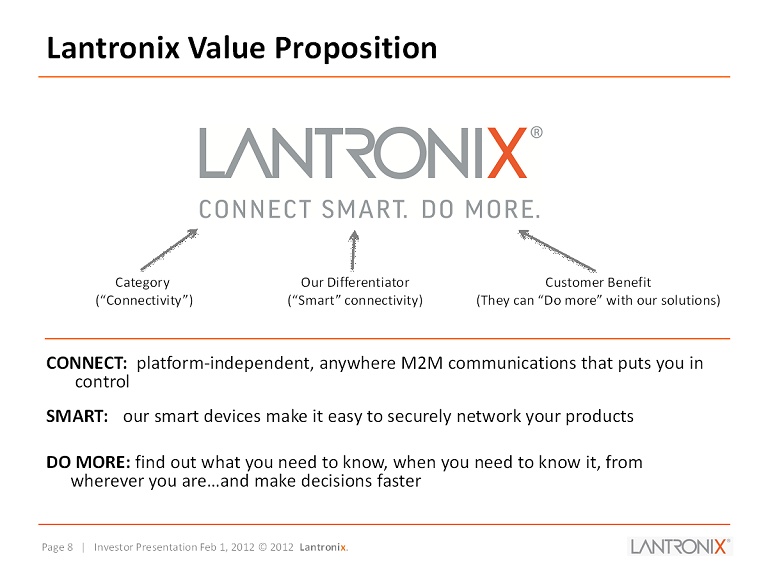

Page 8 | Investor Presentation Feb 1, 2012 © 2012 Lantroni x . Lantronix Value Proposition CONNECT: platform - independent, anywhere M2M communications that puts you in control SMART: our smart devices make it easy to securely network your products DO MORE: find out what you need to know, when you need to know it, from wherever you are…and make decisions faster Category (“Connectivity ”) Our Differentiator (“ Smart” connectivity ) Customer Benefit (They can “Do more ” with our solutions)

| 8 |

Page 9 | Investor Presentation Feb 1, 2012 © 2012 Lantroni x . Growth Strategy Capitalize on trends in the M2M connectivity market by leveraging our existing platforms to expand addressable markets and gain share in current segments • Expand TAM by introducing innovative new products and organizing resources to release on average one new product per quarter • Enable different price points, applications, network connectivity, form factors, and revive and refresh product lines Bring to Market O ne New Product E ach Quarter

| 9 |

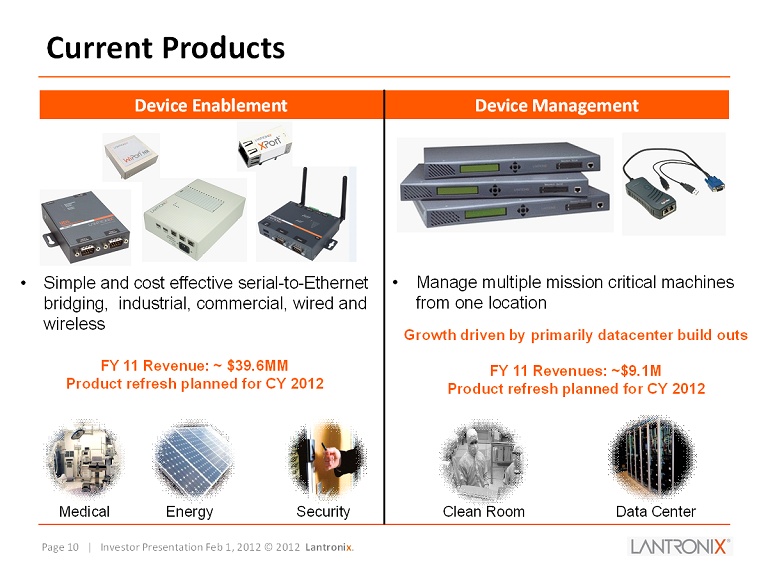

Page 10 | Investor Presentation Feb 1, 2012 © 2012 Lantroni x . Device Enablement Device Management Current Products • Simple and cost effective serial - to - Ethernet bridging, industrial, commercial, wired and wireless FY 11 Revenue: ~ $39.6MM Product refresh planned for CY 2012 • Manage multiple mission critical machines from one location Growth driven by primarily datacenter build outs FY 11 Revenues: ~$9.1M Product refresh planned for CY 2012 Clean Room Data Center Medical Energy Security

| 10 |

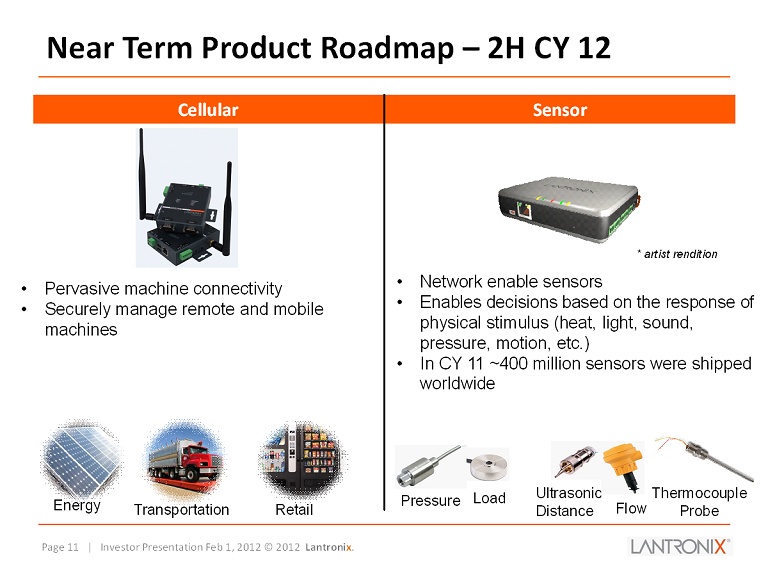

Page 11 | Investor Presentation Feb 1, 2012 © 2012 Lantroni x . Near Term Product Roadmap – 2H CY 12 Cellular Sensor • Pervasive machine connectivity • Securely manage remote and mobile machines • Network enable sensors • Enables decisions based on the response of physical stimulus (heat, light, sound, pressure, motion, etc .) • In CY 11 ~400 million sensors were shipped worldwide Ultrasonic Distance Load Flow Thermocouple Probe Pressure Energy Transportation Retail * artist rendition

| 11 |

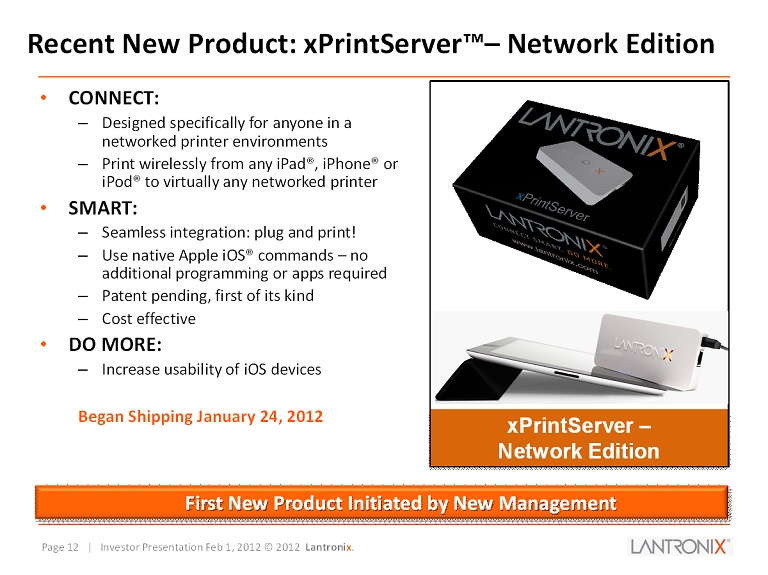

Page 12 | Investor Presentation Feb 1, 2012 © 2012 Lantroni x . Recent New Product: xPrintServer ™ – Network Edition First New Product Initiated by New Management xPrintServer – Network Edition • CONNECT: – Designed specifically for anyone in a networked printer environments – Print wirelessly from any iPad ®, iPhone® or iPod® to virtually any networked printer • SMART: – Seamless integration: plug and print! – Use native Apple iOS ® commands – no additional programming or apps required – Patent pending, first of its kind – Cost effective • DO MORE: – Increase usability of iOS devices Began Shipping January 24, 2012

| 12 |

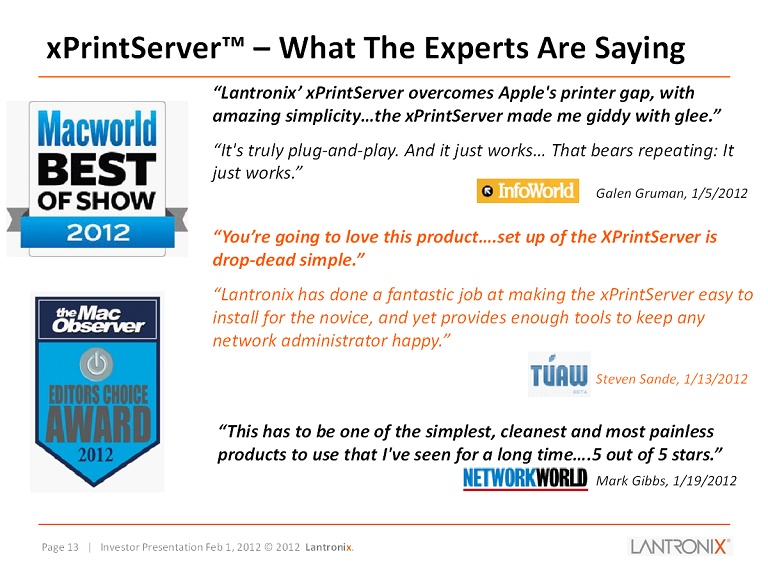

Page 13 | Investor Presentation Feb 1, 2012 © 2012 Lantroni x . xPrintServer ™ – What The Experts Are Saying “Lantronix’ xPrintServer overcomes Apple's printer gap, with amazing simplicity…the xPrintServer made me giddy with glee.” “ It's truly plug - and - play. And it just works… That bears repeating: It just works .” Galen Gruman , 1/5/2012 “ You’re going to love this product….set up of the XPrintServer is drop - dead simple.” “ Lantronix has done a fantastic job at making the xPrintServer easy to install for the novice, and yet provides enough tools to keep any network administrator happy .” Steven Sande , 1/13/2012 “ This has to be one of the simplest, cleanest and most painless products to use that I've seen for a long time….5 out of 5 stars.” Mark Gibbs, 1/19/2012

| 13 |

Page 14 | Investor Presentation Feb 1, 2012 © 2012 Lantroni x . Accelerate Growth: Expanding Lantronix TAM New Products Plans Expand Estimated TAM by over 4x New - xPrintServer New - Sensor and Cellular Device Enablement Refresh - Device Management Current - Wired and Wireless Device Enablement Source: IDC, Harbor Research, Internal Estimates $MM

| 14 |

Page 15 | Investor Presentation Feb 1, 2012 © 2012 Lantroni x . Turnaround Progress: First 150 Days… • New CEO and CFO appointed; • Recruited and retained experienced management team with strong background in M2M and communications technologies; • Developed strategy to expand market share as well as available market segments; • Reorganized and re - energized resources to increase product development and go - to - market with an average of one new product a quarter; • Launched into production two (2) new products; and • Implemented plan to improve financial metrics and discipline.

| 15 |

Page 16 | Investor Presentation Feb 1, 2012 © 2012 Lantroni x . Leadership Team Jeremy Whitaker , Chief Financial Officer * • Former Lantronix Vice President of Finance, returned to join turnaround • Broad perspective with both outside auditor (Ernst & Young) and internal finance and accounting experience Tom Morton , Vice President of Human Resources * • 30+ years human resource experience • Expert in the issues facing technology companies Mak Manesh , Vice President of Product Management * • 20+ years of direct M2M experience • Strong history with analog and digital device servers Robert Robinson , Vice President of Worldwide Sales * • 20+ years of direct and channel sales experience • Excellent background in wireless M2M applications and devices Kurt Busch , President & CEO * • 20+ years technology industry experience in marketing, sales, and general management roles • Former SVP and GM of MindSpeed’s High Performance Analog Business Unit Daryl Miller , Vice President of Engineering • 30+ years experience in engineering, embedded systems, software, and networking • Former experience at Tektronix and NCD * New leadership

| 16 |

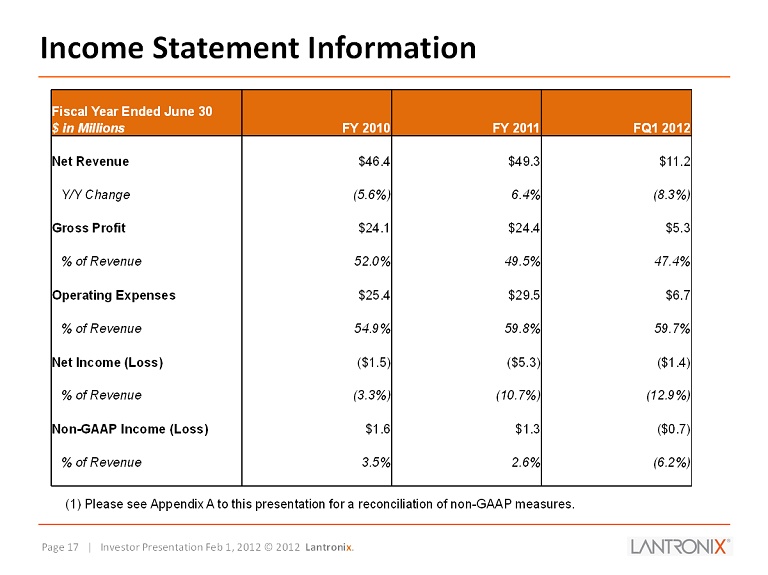

Page 17 | Investor Presentation Feb 1, 2012 © 2012 Lantroni x . Income Statement Information Fiscal Year Ended June 30 $ in Millions FY 2010 FY 2011 FQ1 2012 Net Revenue $46.4 $49.3 $11.2 Y/Y Change (5.6%) 6.4% (8.3%) Gross Profit $24.1 $24.4 $5.3 % of Revenue 52.0% 49.5% 47.4% Operating Expenses $25.4 $29.5 $6.7 % of Revenue 54.9% 59.8% 59.7% Net Income (Loss) ($1.5) ($5.3) ($1.4) % of Revenue (3.3%) (10.7%) (12.9%) Non - GAAP Income (Loss) $1.6 $1.3 ($0.7) % of Revenue 3.5% 2.6% (6.2%) (1) Please see Appendix A to this presentation for a reconciliation of non - GAAP measures.

| 17 |

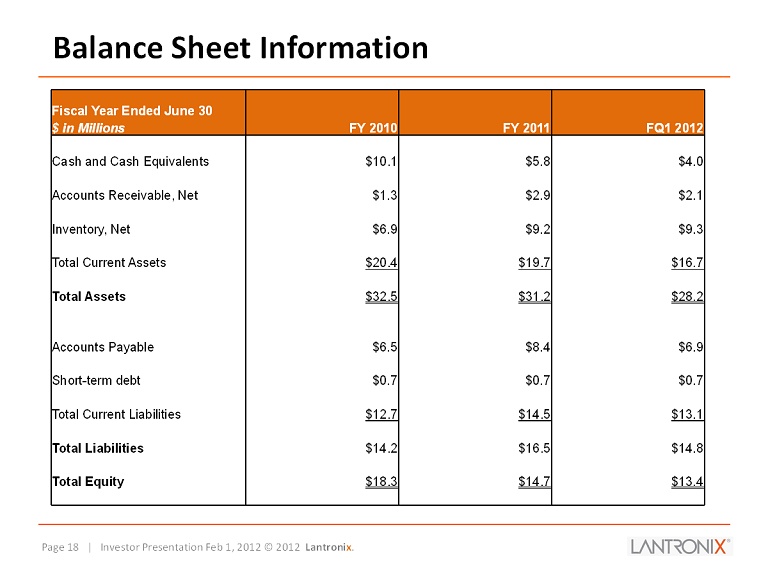

Page 18 | Investor Presentation Feb 1, 2012 © 2012 Lantroni x . Balance Sheet Information Fiscal Year Ended June 30 $ in Millions FY 2010 FY 2011 FQ1 2012 Cash and Cash Equivalents $10.1 $5.8 $4.0 Accounts Receivable, Net $1.3 $2.9 $2.1 Inventory, Net $6.9 $9.2 $9.3 Total Current Assets $20.4 $19.7 $16.7 Total Assets $32.5 $31.2 $28.2 Accounts Payable $6.5 $8.4 $6.9 Short - term debt $0.7 $0.7 $0.7 Total Current Liabilities $12.7 $14.5 $13.1 Total Liabilities $14.2 $16.5 $14.8 Total Equity $18.3 $14.7 $13.4

| 18 |

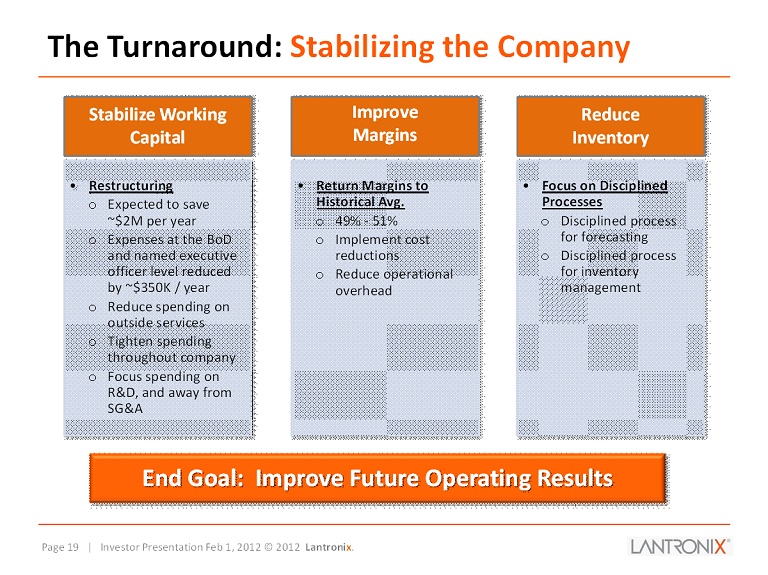

Page 19 | Investor Presentation Feb 1, 2012 © 2012 Lantroni x . The Turnaround: Stabilizing the Company Stabilize Working Capital • Restructuring o Expected to save ~$2M per year o Expenses at the BoD and named executive officer level reduced by ~$350K / year o Reduce spending on outside services o Tighten spending throughout company o Focus spending on R&D, and away from SG&A Improve Margins Reduce Inventory • Return Margins to Historical Avg. o 49% - 51% o Implement cost reductions o Reduce operational overhead • Focus on Disciplined Processes o Disciplined process for forecasting o Disciplined process for inventory management End Goal: Improve Future Operating Results

| 19 |

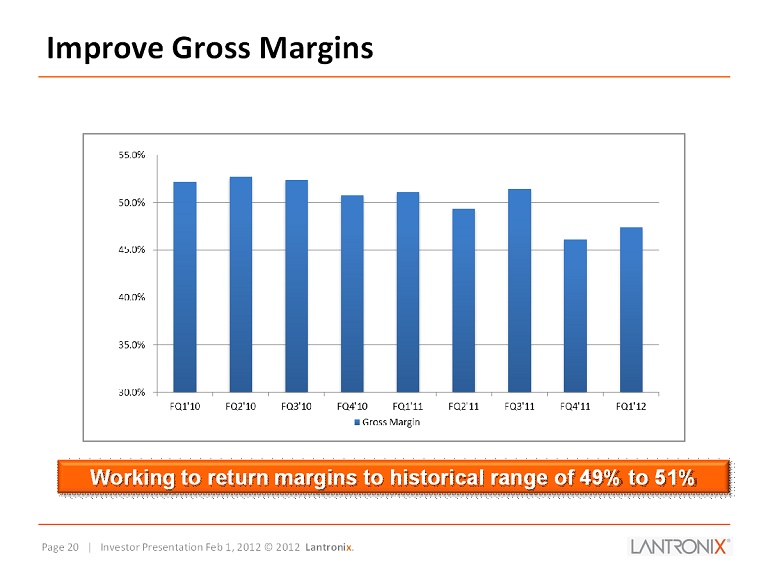

Page 20 | Investor Presentation Feb 1, 2012 © 2012 Lantroni x . Improve Gross Margins Working to return margins to historical range of 49% to 51%

| 20 |

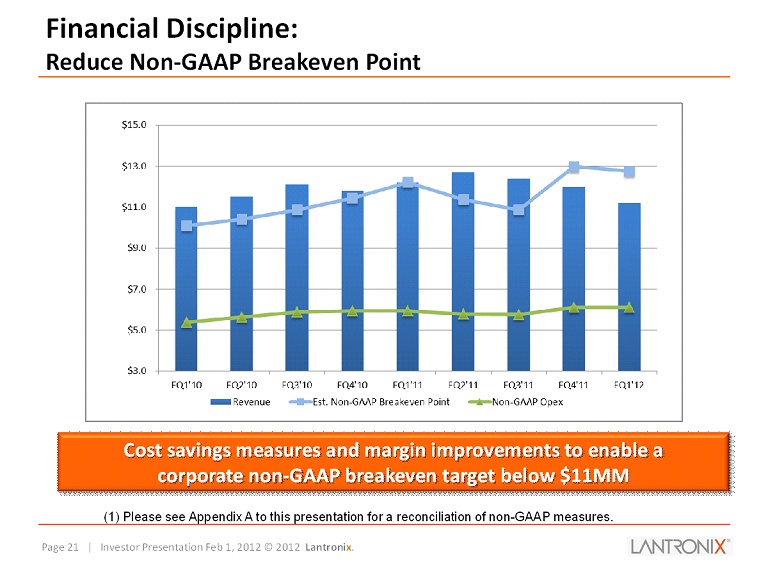

Page 21 | Investor Presentation Feb 1, 2012 © 2012 Lantroni x . Financial Discipline: Reduce Non - GAAP Breakeven Point Cost savings measures and margin improvements to enable a corporate non - GAAP breakeven target below $11MM (1) Please see Appendix A to this presentation for a reconciliation of non - GAAP measures.

| 21 |

Page 22 | Investor Presentation Feb 1, 2012 © 2012 Lantroni x . • Strong new, energized management team with M2M and communications expertise • Over 20 years of company connectivity experience allows us to aggressively expand into new markets • Focused on execution – Financial – Product development and market growth • New products expected to expand estimated TAM by over 4x • First new product under new management, xPrintServer ™, has begun shipping in under 5 months from initial concept Lantronix: Summary

| 22 |

Page 23 | Investor Presentation Feb 1, 2012 © 2012 Lantroni x . THANK YOU • For more information, email us at investors@lantronix.com • Please join us for our next quarterly conference call on Thursday, February 9 @ 5PM EST.

| 23 |

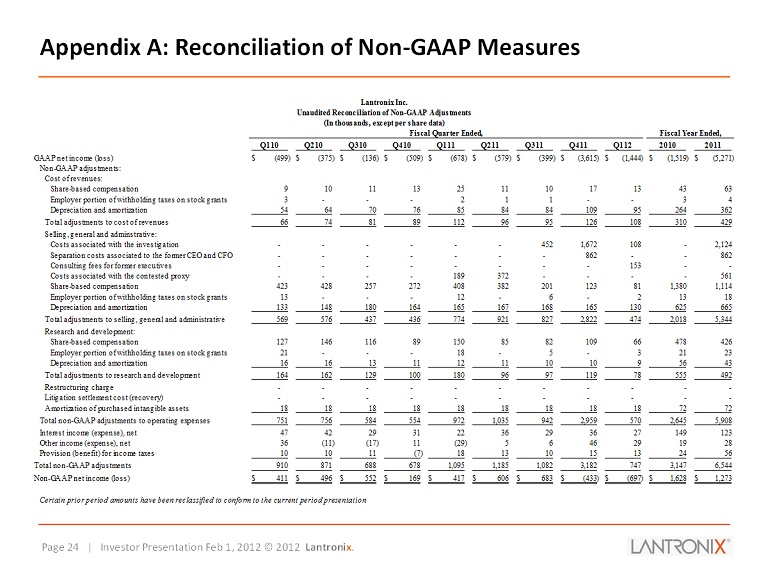

Page 24 | Investor Presentation Feb 1, 2012 © 2012 Lantroni x . Appendix A: Reconciliation of Non - GAAP Measures Q110 Q210 Q310 Q410 Q111 Q211 Q311 Q411 Q112 2010 2011 GAAP net income (loss) (499)$ (375)$ (136)$ (509)$ (678)$ (579)$ (399)$ (3,615)$ (1,444)$ (1,519)$ (5,271)$ Non-GAAP adjustments: Cost of revenues: Share-based compensation 9 10 11 13 25 11 10 17 13 43 63 Employer portion of withholding taxes on stock grants 3 - - - 2 1 1 - - 3 4 Depreciation and amortization 54 64 70 76 85 84 84 109 95 264 362 Total adjustments to cost of revenues 66 74 81 89 112 96 95 126 108 310 429 Selling, general and adminstrative: Costs associated with the investigation - - - - - - 452 1,672 108 - 2,124 Separation costs associated to the former CEO and CFO - - - - - - - 862 - - 862 Consulting fees for former executives - - - - - - - - 153 - - Costs associated with the contested proxy - - - - 189 372 - - - - 561 Share-based compensation 423 428 257 272 408 382 201 123 81 1,380 1,114 Employer portion of withholding taxes on stock grants 13 - - - 12 - 6 - 2 13 18 Depreciation and amortization 133 148 180 164 165 167 168 165 130 625 665 Total adjustments to selling, general and administrative 569 576 437 436 774 921 827 2,822 474 2,018 5,344 Research and development: Share-based compensation 127 146 116 89 150 85 82 109 66 478 426 Employer portion of withholding taxes on stock grants 21 - - - 18 - 5 - 3 21 23 Depreciation and amortization 16 16 13 11 12 11 10 10 9 56 43 Total adjustments to research and development 164 162 129 100 180 96 97 119 78 555 492 Restructuring charge - - - - - - - - - - - Litigation settlement cost (recovery) - - - - - - - - - - - Amortization of purchased intangible assets 18 18 18 18 18 18 18 18 18 72 72 Total non-GAAP adjustments to operating expenses 751 756 584 554 972 1,035 942 2,959 570 2,645 5,908 Interest income (expense), net 47 42 29 31 22 36 29 36 27 149 123 Other income (expense), net 36 (11) (17) 11 (29) 5 6 46 29 19 28 Provision (benefit) for income taxes 10 10 11 (7) 18 13 10 15 13 24 56 Total non-GAAP adjustments 910 871 688 678 1,095 1,185 1,082 3,182 747 3,147 6,544 Non-GAAP net income (loss) 411$ 496$ 552$ 169$ 417$ 606$ 683$ (433)$ (697)$ 1,628$ 1,273$ Certain prior period amounts have been reclassified to conform to the current period presentation Lantronix Inc. Unaudited Reconciliation of Non-GAAP Adjustments (In thousands, except per share data) Fiscal Quarter Ended, Fiscal Year Ended,

| 24 |