Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - JONES LANG LASALLE INC | d292607d8k.htm |

| EX-99.1 - EX-99.1 - JONES LANG LASALLE INC | d292607dex991.htm |

Supplemental Information

Fourth Quarter

Earnings Call

2011

Exhibit 99.2 |

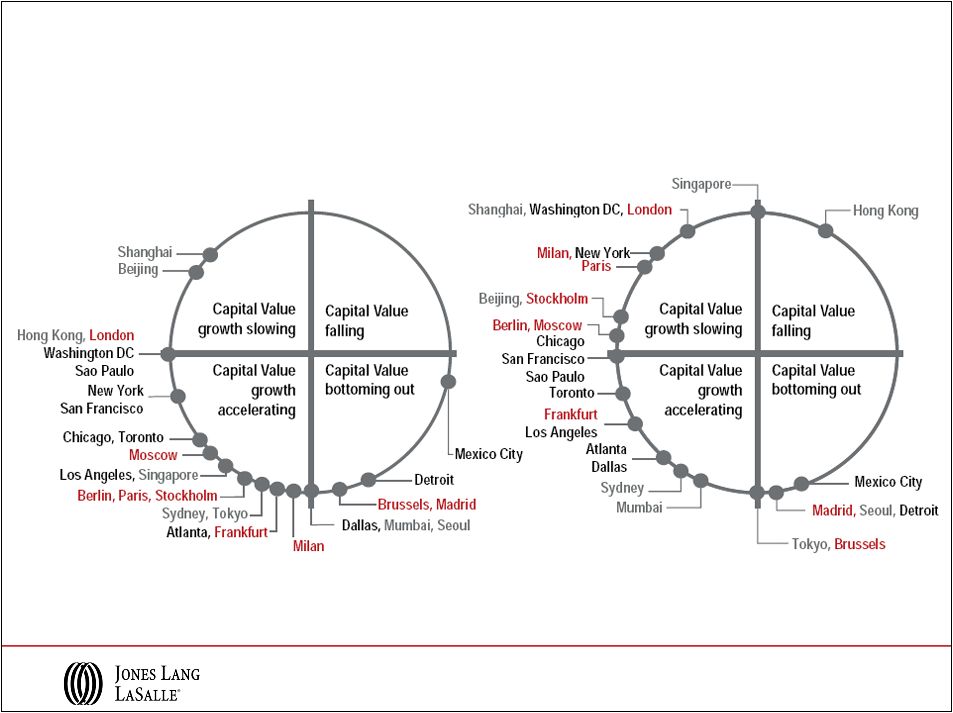

Market & Financial Overview |

3

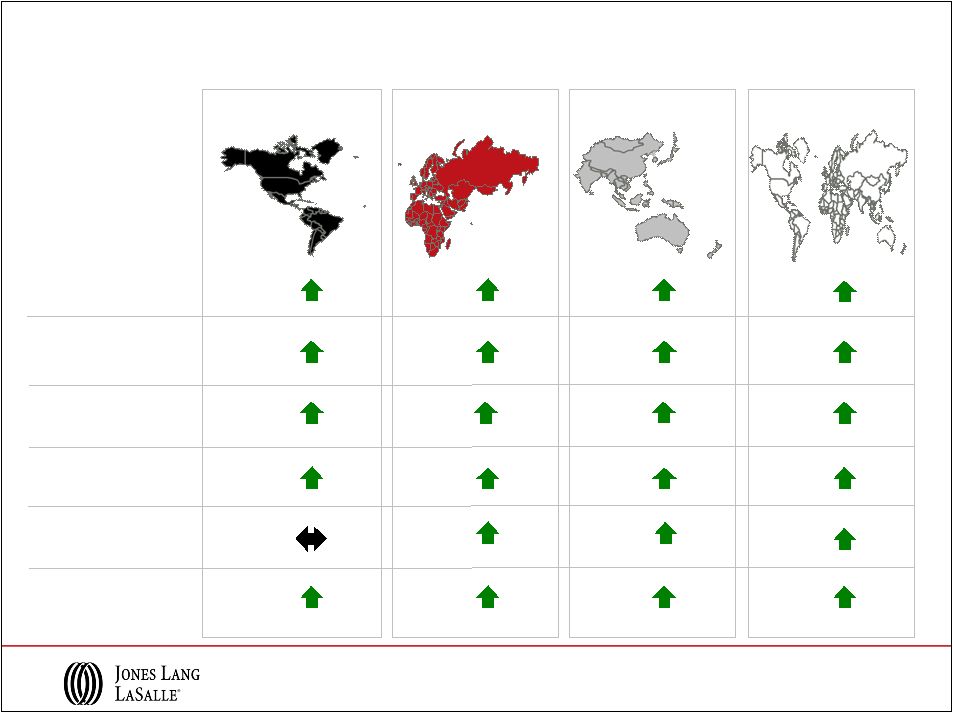

Americas

EMEA

Asia

Pacific

Capital

Values

As

of

Q4

2011

The

Jones

Lang

LaSalle

Property

Clocks

SM

Q4

2011

Q4

2010 |

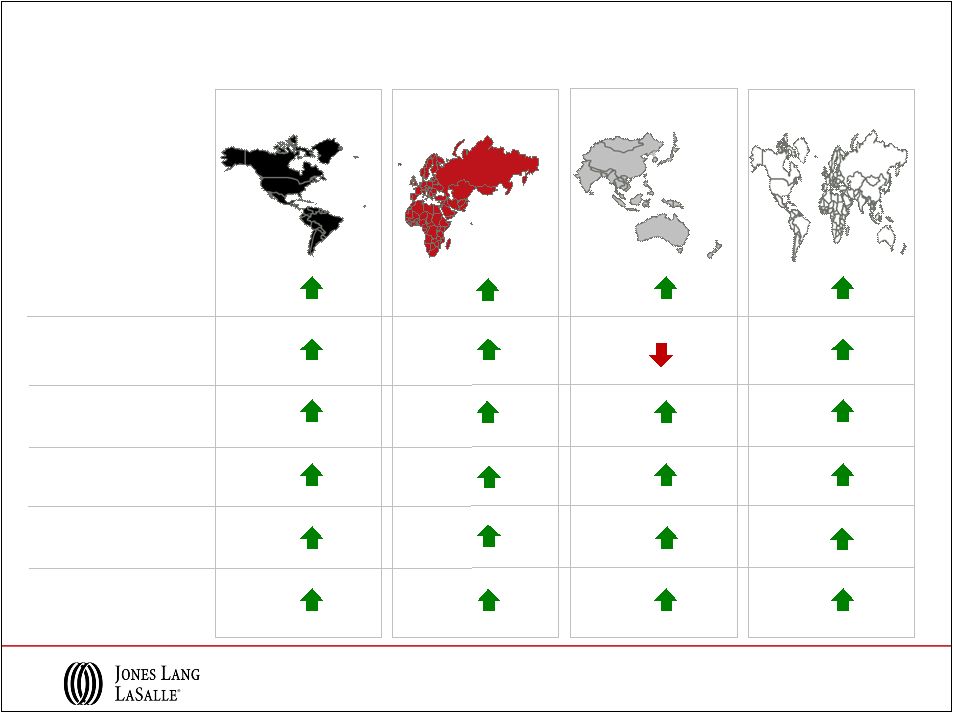

4

Leasing

Market

Fundamentals

Q4

2010

As

of

Q4

2011

The

Jones

Lang

LaSalle

Property

Clocks

SM

Americas

EMEA

Asia

Pacific

Q4

2011 |

Q4 Selected Business Wins and Expansions

5

Americas

EMEA

Asia Pacific

–

AMC

Theaters

–

4M

sf

–

1800

9

th

Avenue,

Seattle

–

$77M

–

70

Pine

Street,

New

York

–

$205M

–

55

West

Monroe,

Chicago

–

$136M

–

Paramount

Hotel,

New

York

–

$255M

–

DIRECTV,

Los

Angeles

–

630K

sf

–

AMA,

Chicago

–

275K

sf

–

Guggenheim

Partners,

New

York

–

185K

sf

–

UBS

–

27

countries

–

UK

Logistics

–

£312M

–

PEP

Shopping

Centre,

Munich

–

€400M+

–

Industrial

portfolio,

Czech

Republic

–

€135M

–

W

Hotel,

London

–

$295M

–

Tesco

International,

Slovakia

–

460K

sf

–

St.

David’s

Mall,

Cardiff

–

1.4M

sf

–

Fonterra

Group,

China

–

4.4M

sf

–

Commerce

Point,

Singapore

–

$161M

–

RREEF

Investment,

Dalian

–

960K

sf

–

Cairns

Central

Shopping

Centre,

Australia

–

AUD

261M

–

MAPS,

Seoul

–

700K

sf

–

Baker

&

McKenzie,

Thailand

–

65K

sf

–

Merck,

Sharp

&

Dohme,

Beijing

–

545K

sf

–

Mercedes-Benz,

Bangalore

–

200K

sf

Global

–

GlaxoSmithKline

–

80M

sf |

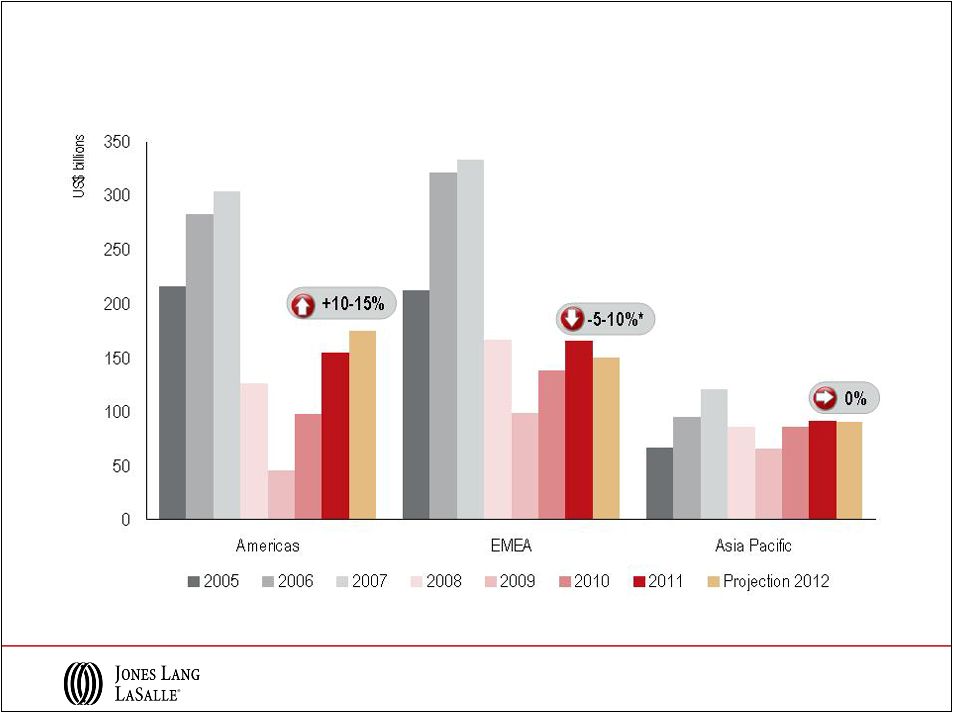

Direct

Commercial

Real

Estate

Investment,

2005

-

2012

*

EMEA:

Presented

In

US$

terms.

Volumes

unchanged

in

Euro

terms.

Source:

Jones

Lang

LaSalle,

January

2012

6 |

+

10-20% Capital Values

Rental Values

+ 5-10%

+ 0-5%

-

0-5%

-

5-10%

Moscow, Shanghai, Mumbai

Sydney, Tokyo

Sao Paulo, New York*

London*, Frankfurt, Paris, Stockholm

Boston, Chicago, Los Angeles, Washington DC

+ 20%

Toronto, Tokyo, Moscow

San Francisco, New York*

Sydney, Mumbai

Boston, Chicago, Los Angeles

Washington DC, Sao Paulo, Stockholm

Shanghai, London*, Frankfurt

Provisional.

*New

York

–

Midtown,

London

–

West

End.

Nominal

rates

in

local

currency.

Source:

Jones

Lang

LaSalle,

January

2012

-

10-20%

Dubai

Brussels, Madrid, Mexico City

Brussels, Madrid, Paris

Mexico City

Dubai

Toronto, San Francisco

Hong Kong, Singapore

Hong Kong, Singapore

Beijing

Beijing

7

2012 Market Outlook

Projected Change in Prime Office Values |

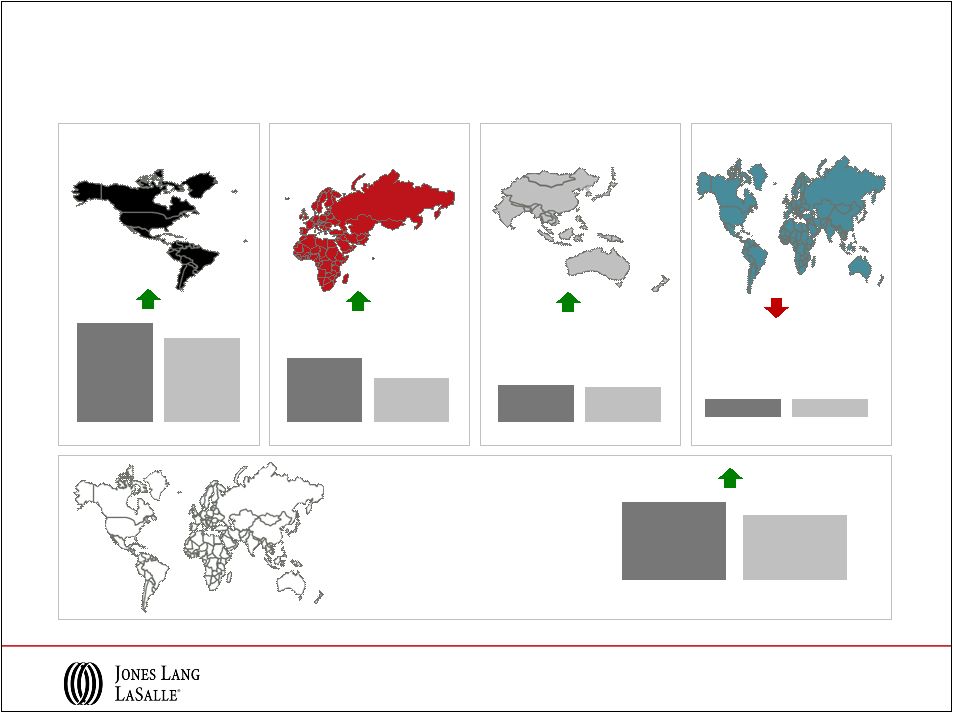

Financial Information |

FY 2011 Consolidated Revenue Mix

2011 Revenue = $3.6 billion

Service Line

Geography

9 |

10

FY

2011

Revenue

Performance

Note:

Equity

earnings

(losses)

of

$6.4M

and

($11.4M)

in

2011

and

2010,

respectively,

are

included

in

segment

results,

however,

are

excluded

from

Consolidated

totals.

Americas

EMEA

Asia Pacific

LIM

Consolidated

$3,584.5

$2,925.6

2011

2010

($

in

millions;

%

change

in

USD )

21%

$1,525.3

$1,261.5

2011

2010

$816.5

$678.5

2011

2010

$275.4

$245.4

2011

2010

$973.7

$728.8

2011

2010

34%

20%

12%

23% |

Asia

Pacific 11

FY 2011 Real Estate Services Revenue

($ in millions; % change in USD )

Americas

EMEA

Leasing

Capital Markets &

Hotels

Property & Facility

Management

Project &

Development Services

Advisory, Consulting

& Other

Total RES

Operating Revenue

$760.2

$136.1

$335.6

$178.5

$112.2

$1,522.6

19%

62%

25%

12%

2%

21%

$236.1

$229.1

$152.8

$182.5

$173.5

$974.0

17%

62%

7%

59%

36%

34%

$192.3

$94.8

$364.6

$80.8

$83.8

$816.3

22%

16%

20%

27%

17%

20%

$1,188.6

$460.0

$853.0

$441.8

$369.5

$3,312.9

19%

50%

19%

31%

20%

24%

Total RES

Revenue

Note:

Segment

and

Consolidated

Real

Estate

Services

(“RES”)

operating

revenue

exclude

Equity

earnings

(losses). |

$235.9

$223.2

2011

2010

$66.2

$66.8

2011

2010

$340.3

$237.4

2011

2010

12

Q4

2011

Revenue

Performance

Note:

Equity

earnings

(losses)

of

$3.7M

and

($0.4M)

in

2011

and

2010,

respectively,

are

included

in

segment

results,

however,

are

excluded

from

Consolidated

totals.

Americas

EMEA

Asia Pacific

$509.5

$428.5

2011

2010

Consolidated

$1,148.2

$956.3

2011

2010

($

in

millions,

%

change

in

USD)

LIM

19%

43%

6%

1%

20% |

Asia

Pacific 13

Q4 2011 Real Estate Services Revenue

Americas

EMEA

Leasing

Capital Markets &

Hotels

Property & Facility

Management

Project &

Development Services

Advisory, Consulting

& Other

Total RES

Operating Revenue

$258.4

$48.2

$115.2

$54.4

$33.3

$509.5

13%

37%

34%

13%

8%

19%

$81.0

$103.1

$42.4

$51.6

$62.2

$340.3

17%

98%

4%

60%

44%

43%

$69.1

$22.0

$98.9

$20.9

$25.0

$235.9

12%

(25%)

11%

11%

4%

6%

$408.5

$173.3

$256.5

$126.9

$120.5

$1,085.7

14%

49%

19%

28%

22%

Total RES

Revenue

23%

Note:

Segment

and

Consolidated

Real

Estate

Services

(“RES”)

operating

revenue

exclude

Equity

earnings

(losses).

($ in millions; % change in USD ) |

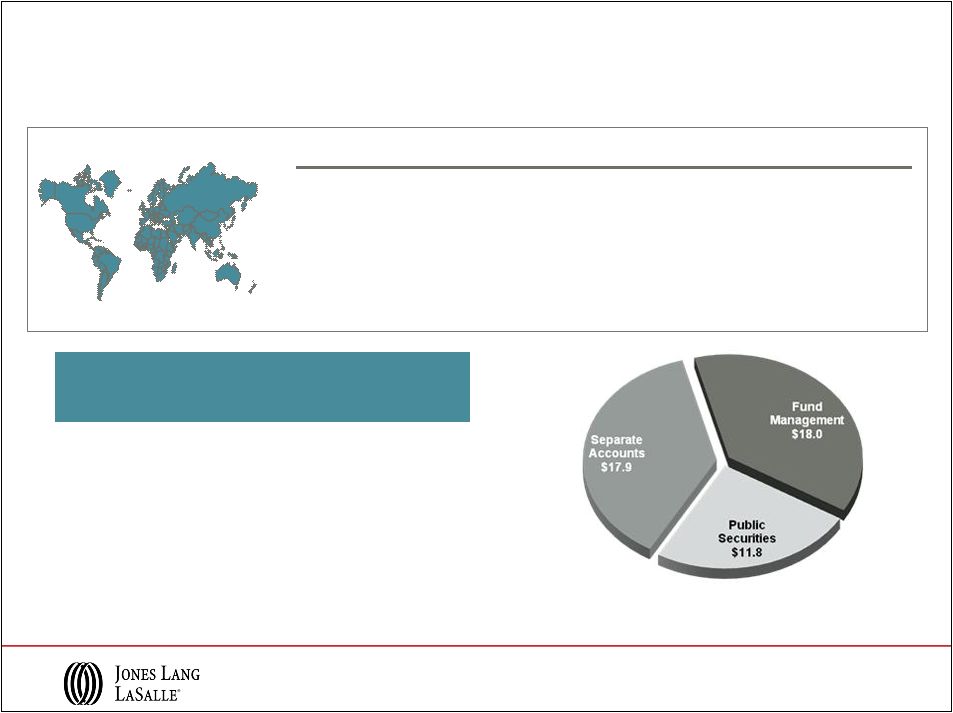

A

premier

global

investment

manager

LaSalle

Investment

Management

Note: AUM data reported on a one-quarter lag

2011 Highlights

AUM by Fund type

($ in billions)

•

Investment

performance

at

or

above

benchmarks

for

all

business

segments

•

Nearly

$5

billion

of

net

capital

raised

in

2011,

consistent

with

2010

•

High-margin

advisory

fees

contribute

to

operating

income

margin

of

21%

•

Trinity

Funds

Management

acquisition

added

$700

M

of

AUM

and

established

LaSalle

as

a

domestic

player

in

capital-rich

Australia

Product

Assets Under

Management

($ in billions)

Average

Performance

Private Equity

U.K.

$11.9

Above benchmark

Continental Europe

$4.3

Return: >1x equity

North America

$10.7

Above benchmark

Asia Pacific

$9.0

Return: >1x equity

Public Securities

$11.8

Above benchmark

Total Q4 2011 AUM

$47.7 B

14 |

Solid Cash Flows and Balance Sheet Position

•

Steady

quarterly

improvement

in

Cash

from

Operations

-

Cash

from

earnings,

excluding

Restructuring

and

acquisition

charges,

increased

$30

million

versus

Q4

2010

-

Working

capital

impacted

by

higher

receivables

resulting

from

strong

year

end

transaction

revenue

•

Fourth

quarter

acquisition

activity

includes

Pacific

Real

Estate

Partners,

Procon

and

DST

-

Smaller

transactions

in

strategically

important

markets

•

Investment

grade

balance

sheet;

Baa2

/

BBB-

(Stable)

-

Low

debt

cost:

2011

net

interest

expense

of

$36

million

vs.

$46

million

in

2010

-

Total

net

debt

reduced

$184

million

in

Q4

2011

to

end

year

at

$643

million

2011 Highlights

($ in millions)

2011

2010

Q1

Q2

Q3

Q4

Q4

Cash from Earnings

$42

$81

$68

$120

$124

Working Capital

(239)

(20)

27

133

152

Cash (used in) from Operations

($197)

$61

$95

$253

$276

Primary Uses

Capital Expenses

(17)

(19)

(20)

(36)

(25)

Acquisitions & Deferred Payment Obligations

(25)

(210)

(162)

(19)

(17)

Co-Investment

(2)

2

(47)

2

6

Dividends

-

(7)

-

(7)

(5)

Net Cash Outflows

($44)

($234)

($229)

($60)

($41)

Net Share Activity & Other Financing

(4)

(2)

(8)

(2)

4

Net Bank Debt Borrowings

($245)

($175)

($142)

$191

$239

15 |

Appendix |

17

FY 2011 Adjusted EBITDA* Performance

Americas

EMEA

Asia Pacific

LIM

$201.2

$183.9

2011

2010

Consolidated

$394.9

$336.7

2011

2010

*

Refer

to

slide

20

for

Reconciliation

of

GAAP

Net

Income

to

adjusted

EBITDA

for

the

twelve

months

ended

December

31,

2011,

and

2010,

for

details

relative

to

these

adjusted

EBITDA

calculations.

Segment

EBITDA

is

calculated

by

adding

the

segment’s

Depreciation

and

amortization

to

its

reported

Operating

income,

which

excludes

Restructuring

and

acquisition

charges.

Consolidated

adjusted

EBITDA

is

the

sum

of

the

EBITDA

of

the

four

segments

less

net

income

attributable

to

non-controlling

interest

and,

dividends

on

unvested

common

stock.

($ in millions)

$38.3

$57.3

2011

2010

$78.4

$62.4

2011

2010

$59.7

$53.0

2011

2010 |

18

Q4 2011 Adjusted EBITDA* Performance

Americas

EMEA

Asia Pacific

LIM

$94.1

$78.7

2011

2010

Consolidated

$179.0

$143.1

2011

2010

*

Refer

to

slide

20

for

Reconciliation

of

GAAP

Net

Income

to

adjusted

EBITDA

for

the

three

months

ended

December

31,

2011,

and

2010,

for

details

relative

to

these

adjusted

EBITDA

calculations.

Segment

EBITDA

is

calculated

by

adding

the

segment’s

Depreciation

and

amortization

to

its

reported

Operating

income,

which

excludes

Restructuring

and

acquisition

charges.

Consolidated

adjusted

EBITDA

is

the

sum

of

the

EBITDA

of

the

four

segments

less

net

income

attributable

to

non-controlling

interests

and

dividends

on

unvested

common

stock.

($ in millions)

$43.0

$25.6

2011

2010

$28.2

$28.7

2011

2010

$13.9

$10.4

2011

2010 |

19

($ in millions)

Reconciliation of GAAP Net Income to Adjusted Net Income

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2011

2010

2011

2010

GAAP Net income attributable to common

shareholders

$ 84.8

$ 84.4

$ 164.0

$ 153.5

Shares (in 000s)

44,402

44,235

44,367

44,084

GAAP earnings per share

$ 1.91

$ 1.91

$ 3.70

$ 3.48

GAAP Net income attributable to common

shareholders

$ 84.8

$ 84.4

$ 164.0

$ 153.5

Restructuring and acquisition charges, net

25.2

0.7

41.9

4.9

Intangible amortization, net

3.6

-

8.6

-

Non-cash co-investment charges, net

-

0.7

-

7.9

Adjusted net income

$ 113.6

$ 85.8

$ 214.5

$ 166.3

Shares (in 000s)

44,402

44,235

44,367

44,084

Adjusted earnings per share

$ 2.56

$ 1.94

$ 4.83

$ 3.77 |

20

($ in millions)

Reconciliation of GAAP Net Income to Adjusted EBITDA

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2011

2010

2011

2010

GAAP Net income attributable to

common shareholders

$84.8

$84.4

$164.0

$153.5

Interest expense, net of interest income

8.4

10.1

35.6

45.8

Provision for income taxes

29.5

28.2

56.4

49.0

Depreciation and amortization

22.3

18.6

82.8

71.6

EBITDA

$ 145.0

$ 141.3

$ 338.8

$ 319.9

Restructuring and acquisition charges

34.0

0.9

56.1

6.4

Non-cash co-investment charges

-

0.9

-

10.4

Adjusted EBITDA

$ 179.0

$ 143.1

$ 394.9

$ 336.7

|