Attached files

| file | filename |

|---|---|

| 8-K - FORTUNE BRANDS HOME & SECURITY, INC. 8-K - Fortune Brands Home & Security, Inc. | a50152773.htm |

| EX-99.1 - EXHIBTI 99.1 - Fortune Brands Home & Security, Inc. | a50152773ex99_1.htm |

EXHIBIT 99.2

1Fortune Brands Home & Security, Inc. Defined Benefit Plan Accounting Change February 1, 2012 CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS This document contains certain “forward-looking statements” regarding the rate of return on plan assets and other matters. Statements preceded by, followed by or that otherwise include the words “believes,” “expects,” “anticipates,” “intends,” “projects,” “estimates,” “plans,” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may” and “could” are generally forward-looking in nature and not historical facts. Where, in any forward-looking statement, we express an expectation or belief as to future results or events, such expectation or belief is based on the current plans and expectations of our management. Although we believe that these statements are based on reasonable assumptions, they are subject to numerous factors, risks and uncertainties that could cause actual outcomes and results to be materially different from those indicated in such statements. These factors include those listed under “Risk Factors” in the “Risk Factors” section contained in the Information Statement filed as an exhibit to our registration statement on Form 10, as amended, filed with the Securities and Exchange Commission. The forward-looking statements included in this release are made as of the date hereof, and except as required by law, we undertake no obligation to update, amend or clarify any forward-looking statements to reflect events, new information or circumstances occurring after the date hereof.

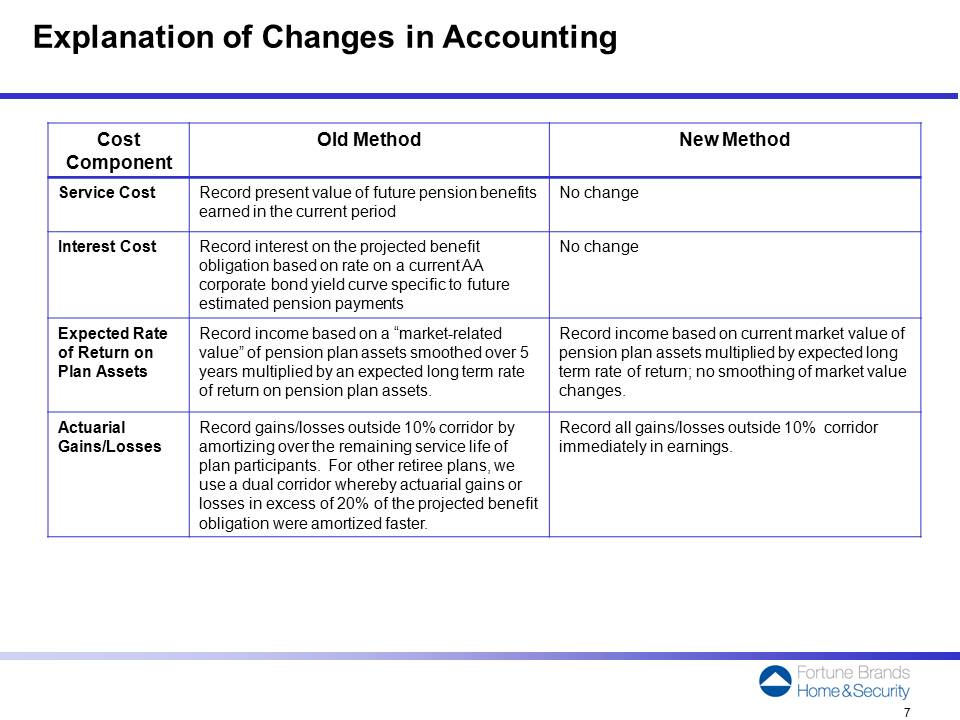

2Defined Benefit Plan Accounting ChangeThe Company’s U.S. subsidiaries maintain a number of defined benefit pension and other post retirement benefit plans (collectively, “the Plans”). This document summarizes key aspects of the Company’s change in accounting for the Plans. Additional disclosures and information will be included in the Company’s annual report on Form 10-K that will be filed with the SEC. Terms in bold are defined in a glossary at the end of this document. On December 31, 2011, the Company changed its method of accounting for the Plans. The changes in accounting method are summarized below. Old accounting method: Actuarial gains/losses in excess of 10 percent of the greater of the market-related value of plan assets or the Plans’ projected benefit obligation (defined as the “corridor”) were generally recognized in earnings over the remaining service life of plan participants. New accounting method: Actuarial gains/losses in excess of 10 percent of the greater of the fair value of plan assets or the Plans’ projected benefit obligation are recognized in earnings immediately upon remeasurement (which is at least annually in the fourth quarter of each year). Refer to Appendix for more detailed explanation. The Company believes its new accounting method is preferable because it eliminates any delay in recognition within earnings of actuarial gains and losses that are outside the corridor. The Company’s independent auditors concur with the preferability of the new accounting method. The accounting change is applied by retroactively restating the Company’s financial statements for all prior periods by applying the new accounting method. As a result, previously reported GAAP net income and EPS change.

3 Defined Benefit Plan Accounting Change (Continued) This accounting change has no impact on: Cash flow Pension and postretirement liabilities Pension funding requirements Financial covenant compliance in the Company’s lending arrangements Under the new method, the Company will refer to actuarial gains/losses in excess of 10 percent of the greater of the fair value of plan assets or the Plans’ projected benefit obligation as “AGL Adjustments.” Future AGL Adjustments may occur at least annually in the fourth quarter and the extent of any AGL Adjustments will be influenced principally by changes in the required discount rate and variances between the expected rate of return on plan assets and actual returns on plan assets. Segment reporting considerations Impacts of the pension accounting change are entirely reflected in Corporate as other segments only record the service cost component of expense. The amount of service cost is not impacted by the accounting change. In addition to the change in accounting for the Plans, beginning in 2012 the Company changed its estimated expected rate of return on plan assets to reflect changes in the long-term investment strategy of the pension Plans. The Company expects that over the long-term its pension Plans may invest a greater portion of their assets in fixed income securities whose maturities more closely match the timing of expected future benefit payments. As a result, effective December 31, 2011 the Company reduced its expected rate of return on plan assets to approximately 7.8% from 8.5% in 2011.

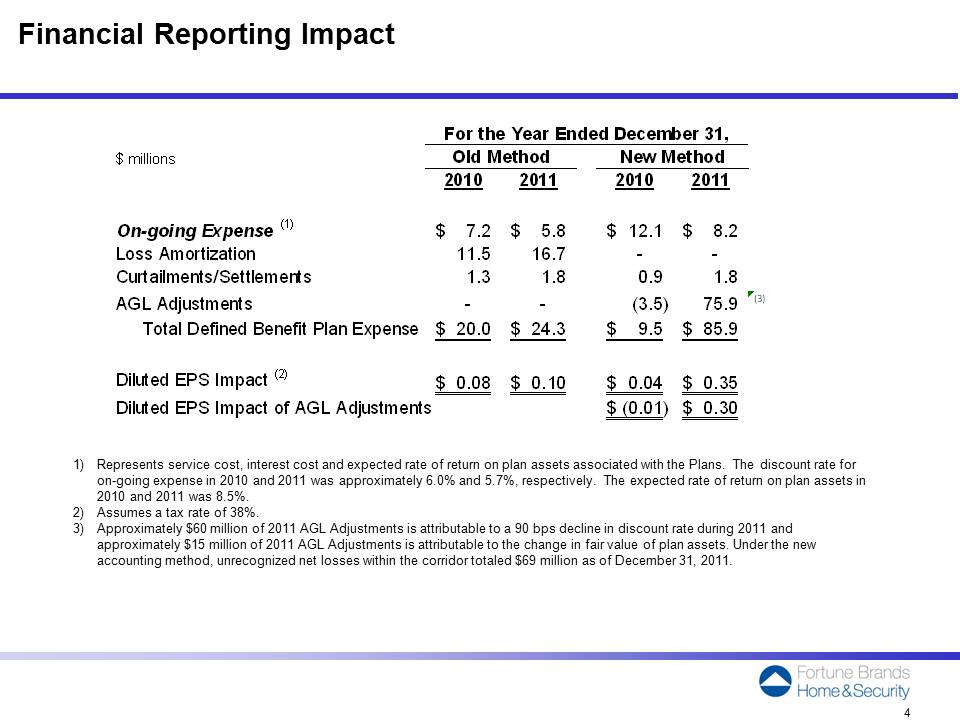

4 Financial Reporting Impact 1)Represents service cost, interest cost and expected rate of return on plan assets associated with the Plans. The discount rate for on-going expense in 2010 and 2011 was approximately 6.0% and 5.7%, respectively. The expected rate of return on plan assets in 2010 and 2011 was 8.5%. 2)Assumes a tax rate of 38%. 3)Approximately $60 million of 2011 AGL Adjustments is attributable to a 90 bps decline in discount rate during 2011 and approximately $15 million of 2011 AGL Adjustments is attributable to the change in fair value of plan assets. Under the new accounting method, unrecognized net losses within the corridor totaled $69 million as of December 31, 2011.

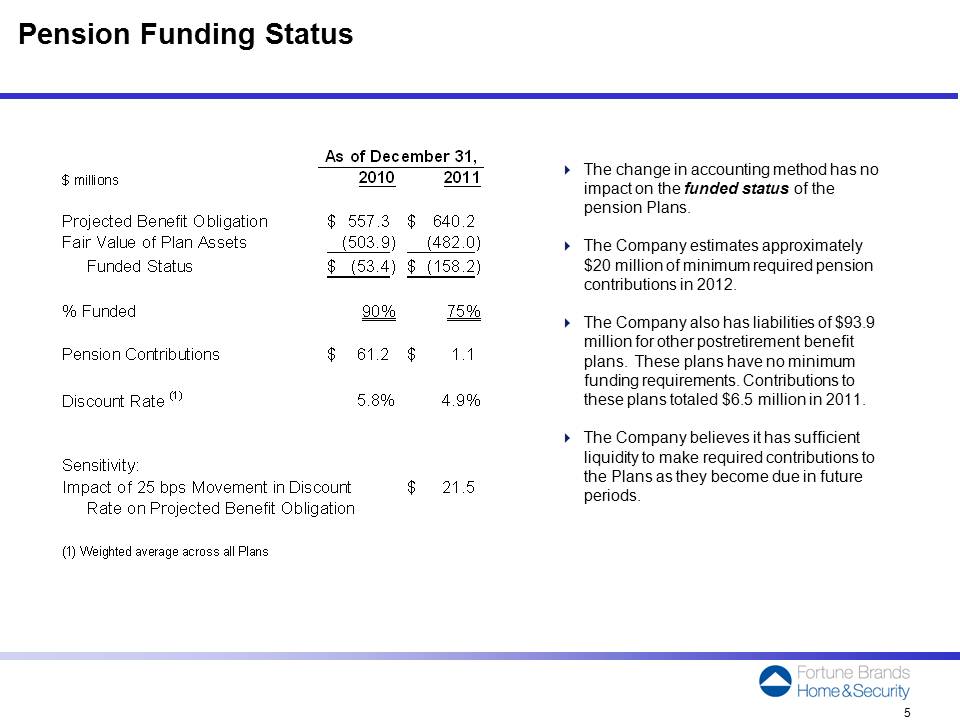

5 Pension Funding Status The change in accounting method has no impact on the funded status of the pension Plans. The Company estimates approximately $20 million of minimum required pension contributions in 2012. The Company also has liabilities of $93.9 million for other postretirement benefit plans. These plans have no minimum funding requirements. Contributions to these plans totaled $6.5 million in 2011. The Company believes it has sufficient liquidity to make required contributions to the Plans as they become due in future periods.

6Appendix

7 Explanation of Changes in Accounting Cost Component Old Method New Method Service Cost Record present value of future pension benefits earned in the current period No change Interest Cost Record interest on the projected benefit obligation based on rate on a current AA corporate bond yield curve specific to future estimated pension payments No change Expected Rate of Return on Plan Assets Record income based on a “market-related value” of pension plan assets smoothed over 5 years multiplied by an expected long term rate of return on pension plan assets Record income based on current market value of pension plan assets multiplied by expected long term rate of return; no smoothing of market value changes. Actuarial Gains/LossesRecord gains/losses outside 10% corridor by amortizing over the remaining service life of plan participants. For other retiree plans, we use a dual corridor whereby actuarial gains or losses in excess of 20% of the projected benefit obligation were amortized faster Record all gains/losses outside 10% corridor immediately in earnings.

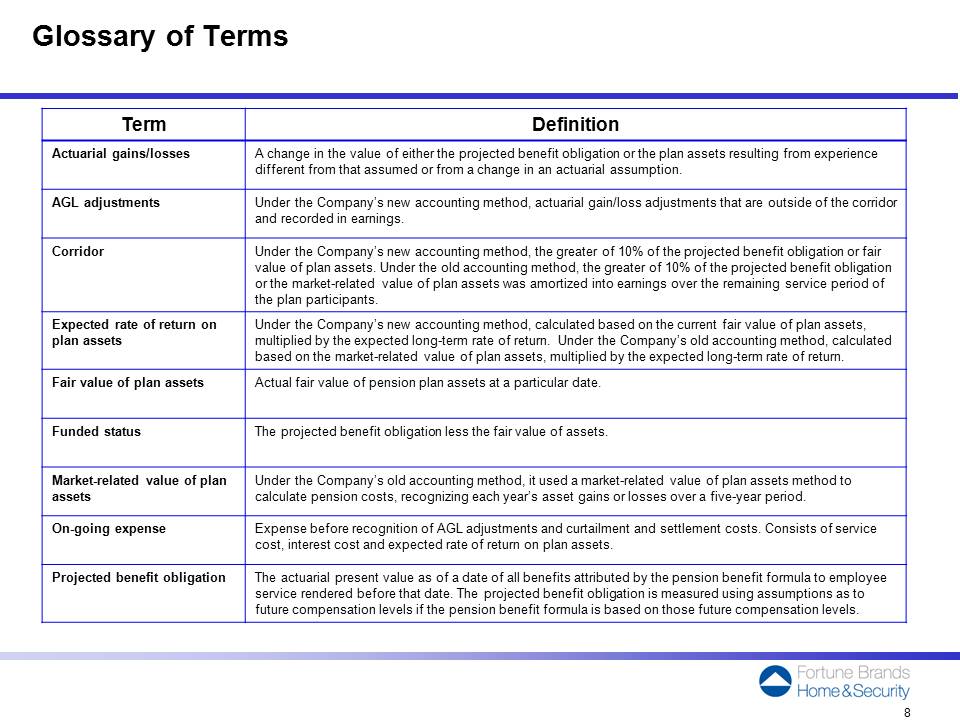

8 Glossary of Terms Term Definition Actuarial gains/losses A change in the value of either the projected benefit obligation or the plan assets resulting from experience different from that assumed or from a change in an actuarial assumption. AGL adjustments Under the Company’s new accounting method, actuarial gain/loss adjustments that are outside of the corridor and recorded in earningsCorridor Under the Company’s new accounting method, the greater of 10% of the projected benefit obligation or fair value of plan assets. Under the old accounting method, the greater of 10% of the projected benefit obligation or the market-related value of plan assets was amortized into earnings over the remaining service period of the plan participants. Expected rate of return on plan assets Under the Company’s new accounting method, calculated based on the current fair value of plan assets, multiplied by the expected long-term rate of return. Under the Company’s old accounting method, calculated based on the market-related value of plan assets, multiplied by the expected long-term rate of return.Fair value of plan assets Actual fair value of pension plan assets at a particular date.Funded status The projected benefit obligation less the fair value of assets. Market-related value of plan assets Under the Company’s old accounting method, it used a market-related value of plan assets method to calculate pension costs, recognizing each year’s asset gains or losses over a five-year period. On-going expense Expense before recognition of AGL adjustments and curtailment and settlement costs. Consists of service cost, interest cost and expected rate of return on plan assets. Projected benefit obligation The actuarial present value as of a date of all benefits attributed by the pension benefit formula to employee service rendered before that date. The projected benefit obligation is measured using assumptions as to future compensation levels if the pension benefit formula is based on those future compensation levels.