Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Johnson Controls International plc | a12-3631_2ex99d1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 31, 2012

TYCO INTERNATIONAL LTD.

(Exact Name of Registrant as Specified in its Charter)

|

Switzerland |

|

98-0390500 |

|

(Jurisdiction of Incorporation) |

|

(IRS Employer Identification Number) |

001-13836

(Commission File Number)

Freier Platz 10

CH-8200 Schaffhausen, Switzerland

(Address of Principal Executive Offices, including Zip Code)

41-52-633-02-44

(Registrant’s Telephone Number, including Area Code)

Check the appropriate box below if the form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

o |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

|

|

|

o |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

|

|

|

o |

|

Pre-commencement communications pursuant to Rule 14d-2 (b) under the Exchange Act (17 CFR 240.14d-2 (b)) |

|

|

|

|

|

o |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

The information disclosed in Item 7.01 of this Current Report on Form 8-K is furnished and incorporated by reference in this Item 2.02. The financial information referred to therein is furnished as Exhibit 99.1 to this report and incorporated by reference in this Item 2.02.

ITEM 7.01 REGULATION FD DISCLOSURE

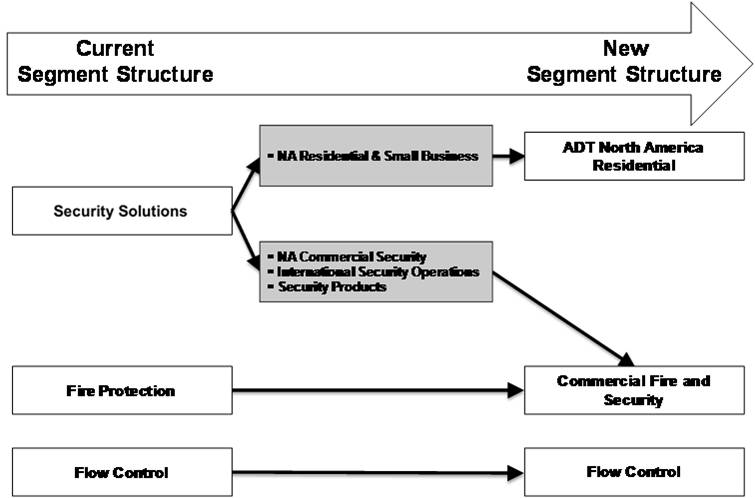

Effective in its second fiscal quarter of 2012, Tyco International Ltd. (the “Company”) reorganized its reporting segments to more closely align with its reporting and management structure, which has been realigned in anticipation of the spin-offs of the Company’s ADT North American residential security business and its flow control business (the “spin-offs”). Under the new reporting structure, the former Tyco Security Solutions segment will be split between the new ADT North America Residential segment and the new Commercial Fire and Security segment. The new ADT North America Residential segment will consist of the residential security business in the United States and Canada that was formerly part of the Tyco Security Solutions segment. The new Commercial Fire and Security segment will consist of (i) the former Tyco Fire Protection segment, (ii) the North American commercial security business that was formerly part of the Tyco Security Solutions segment, along with all of the security businesses outside of the United States and Canada, and (iii) the security products business that was formerly part of the Tyco Security Solutions segment. The Company’s Flow Control segment will continue as it is presently constituted. The diagram below illustrates the changes to the Company’s reporting structure:

Because the operating results of our new reporting segments for each quarter of 2011 will not be reported until we file our Form 10-Q for each of the comparable quarters of 2012, management desires to furnish more timely information to investors to improve the understanding of the Company’s operating performance for the new reporting segments. As a result, the Company is furnishing this Current Report on Form 8-K to supplement financial disclosures included in the Company’s previously filed reports and to recast previously disclosed information under the new reporting structure. The recasting of the previously issued financial information does not represent a restatement of previously issued financial statements and does not affect the consolidated Company’s reported net income, earnings per share, operating income or total assets or liabilities for any of the previously reported periods. The recast financial data presented herein should be read in conjunction with previously filed reports. Further, the recast financial data do not constitute stand-alone historical financial statements for the entities that will be distributed in the spin-offs and do not reflect any adjustments that are likely to be reflected therein. The combined historical financial statements for the entities to be distributed in the spin-offs will be contained in the Form 10 registration statements to be filed in connection with the spin-offs.

The unaudited financial information included in the attached schedules that is furnished with this report and incorporated herein is limited to revenue and operating income by segment for each quarter in fiscal 2011, the first quarter of fiscal 2012, and the fiscal year ended September 30, 2011, along with the reconciliation of non-GAAP financial measures to GAAP financial measures for operating income (loss) before special items by segment and organic revenue.

Non-GAAP Measure

“Organic revenue” and “operating income before special items” are non-GAAP measures and should not be considered replacements for GAAP results. Organic revenue is a useful measure used by the Company to measure the underlying results and trends in the business. The difference between reported net revenue (the most comparable GAAP measure) and organic revenue (the non-GAAP measure) consists of the impact from foreign currency, acquisitions and divestitures, and other changes that do not reflect the underlying results

and trends (for example, revenue reclassifications). Effective the first quarter of fiscal 2011, the Company’s organic growth / decline calculations incorporate an estimate of prior year reported revenue associated with acquired entities that have been fully integrated within the first year (such as Broadview Security), and exclude prior year revenues associated with entities that do not meet the criteria for discontinued operations which have been divested within the past year. The rate of organic growth or decline is calculated based on the adjusted number to better reflect the rate of growth or decline of the combined business, in the case of acquisitions, or the remaining business, in the case of dispositions. The rate of organic growth or decline for acquired businesses that are not fully integrated within the first year will continue to be based on unadjusted historical revenue. Organic revenue and the rate of organic growth or decline as presented herein may not be comparable to similarly titled measures reported by other companies. Organic revenue is a useful measure of the company’s performance because it excludes items that: i) are not completely under management’s control, such as the impact of foreign currency exchange; or ii) do not reflect the underlying results of the company’s businesses, such as acquisitions and divestitures. It may be used as a component of the company’s compensation programs. The limitation of this measure is that it excludes items that have an impact on the company’s revenue. This limitation is best addressed by using organic revenue in combination with the GAAP numbers.

Operating income before special excludes certain items from GAAP operating income. Special items include charges and gains related to divestitures, acquisitions, restructurings, impairments, separation, legacy legal and tax charges and other income or charges that may mask the underlying operating results and/or business trends of the Company or business segment, as applicable. The Company utilizes operating income before special items to assess overall operating performance and segment level core operating performance, as well as to provide insight to management in evaluating overall and segment operating plan execution and underlying market conditions. The measure may be used as a component in the Company’s incentive compensation plans. Operating income before special items is a useful measures for investors because it permits more meaningful comparisons of the Company’s underlying operating results and business trends between periods. The difference between operating income before special items and operating income (the most comparable GAAP measure) consists of the impact of charges and gains related to divestitures, acquisitions, restructurings, impairments, legacy legal and tax charges and other income or charges that may mask the underlying operating results and/or business trends. The limitation of this measure is that it excludes the impact (which may be material) of items that increase or decrease the Company’s reported operating income. This limitation is best addressed by using the non-GAAP measures in combination with the most comparable GAAP measures in order to better understand the amounts, character and impact of any increase or decrease on reported results.

Forward-Looking Statement

This Current Report on Form 8-K includes a forward-looking statement relating to the Company’s intention to spin-off its North American residential security and flow control businesses that is based on management’s current beliefs, assumptions, and available information. Forward-looking statements involve risks, uncertainties, and assumptions. Actual results may differ materially from those expressed in forward-looking statements and the Company undertakes no obligation to update such statements, except as required by law. The Company discloses risks involved with the spin-offs in the “Risk Factors” section of its Annual Report on Form 10-K for the fiscal year ended September 30, 2011 filed with the Securities and Exchange Commission, including the risks that the spin-offs may not be consummated on time and the benefits of such transactions may not accrue to the Company as expected.

|

Exhibit |

|

Description |

|

99.1 |

|

Supplementary Financial Information. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

TYCO INTERNATIONAL LTD. | |

|

|

(Registrant) | |

|

|

| |

|

|

By: |

/s/ Carol Anthony Davidson |

|

|

|

Carol Anthony Davidson |

|

|

|

Senior Vice-President, Controller and Chief |

|

|

|

Accounting Officer |

|

|

| |

|

Date: January 31, 2012 |

| |