Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AgEagle Aerial Systems Inc. | v300343_8k.htm |

January 2012 A Domestic Onshore Oil Company

Forward - Looking Statements SUMMARY : The material presented is a presentation of general background information about EnerJex Resources, Inc . (“JEX”) as of the date of this document . This information is in summary form and does not purport to be complete . This document (and/or attachments to this document) is not intended to be relied upon as advice to potential investors . FORWARD - LOOKING STATEMENTS : This document (including the financial projections and any subsequent questions and answers) contains statements that are forward - looking within the meaning of Section 27 A of the Securities Act of 1933 and Section 21 E of the Securities Exchange Act of 1934 . Such forward - looking statements are only predictions and are not guarantees of future performance . Investors are cautioned that any such forward - looking statements are and will be, as the case may be, subject to many risks, uncertainties, certain assumptions and factors relating to the operations and business environment of JEX that may cause the actual results of the companies to be materially different from any future results expressed or implied in such forward - looking statements . RESERVE AND RESOURCE DISCLOSURE : Securities and Exchange Commission (“SEC”) rules prohibit a publicly - reporting oil and gas company from including oil and gas resource estimates in its filings with the SEC, except proved, probable and possible reserves that meet the SEC’s definition of such terms . Estimates of proved, probable and possible reserves included herein are not based on SEC definitions and guidelines . Unless otherwise indicated, estimates of non - proved reserves and other hydrocarbons included herein may also not meet specific definitions of reserves or resource categories within the meaning of the SPE/SPEE/WPC Petroleum Resource Management System . NO REPRESENTATIONS : This document (and/or attachments to this document) is as of the date indicated, is not complete nor have the performance projections been audited, and does not contain certain material information about JEX, including important disclosures and risk factors associated with an investment in JEX and is subject to revision at any time and JEX is not obligated to inform you of any changes made . Although JEX believes that the expectations and assumptions reflected in this document and the forward - looking statements are reasonable based on information currently available to JEX, and their respective principals, employees, agents and authorized representatives, none of JEX, or their respective principals, employees, agents or authorized representatives makes any warranty or representation, whether express or implied, or assumes any legal liability for the accuracy, completeness or usefulness of any information disclosed . JEX nor any of its respective principals, employees, agents or authorized representatives accepts any responsibility or liability whatsoever caused by any action taken in reliance upon this document and/or its attachments . 2

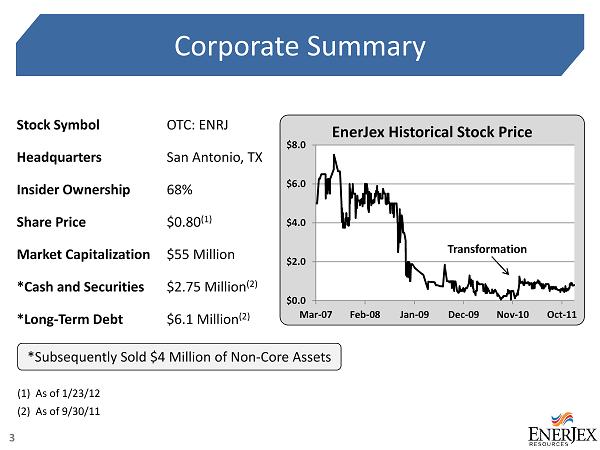

Corporate Summary 3 $0.0 $2.0 $4.0 $6.0 $8.0 Mar-07 Feb-08 Jan-09 Dec-09 Nov-10 Oct-11 EnerJex Historical Stock Price Stock Symbol OTC: ENRJ Headquarters San Antonio, TX Insider Ownership 68% Share Price $0.80 (1) Market Capitalization $55 Million *Cash and Securities $2.75 Million (2) *Long - Term Debt $6.1 Million (2) (1) As of 1/23/12 (2) As of 9/30/11 Transformation *Subsequently Sold $4 Million of Non - Core Assets

Company Overview EnerJex is a domestic onshore oil company with producing assets located in Eastern Kansas and South Texas. Oil represents 100% of production and reserves. 500+ low - risk shallow oil drilling opportunities on existing properties. Historical drilling success rate > 95%. Stable production in KS compliments high impact resource plays in TX. 4

2011 Company Transformation Completely reconstituted board of directors and management. Completed $25 million of acquisitions through issuance of stock. Converted $2.7 million debenture into common stock at $0.80 per share. Raised $8.5 million through the issuance of common equity and opportunistically repurchased 3.75 million shares of stock. Closed new $50 million senior credit facility. Closed general partnership with $5 million of scheduled funding. Sold $5.5 million of non - core assets. Began aggressive drilling program and dramatically increased production. 5

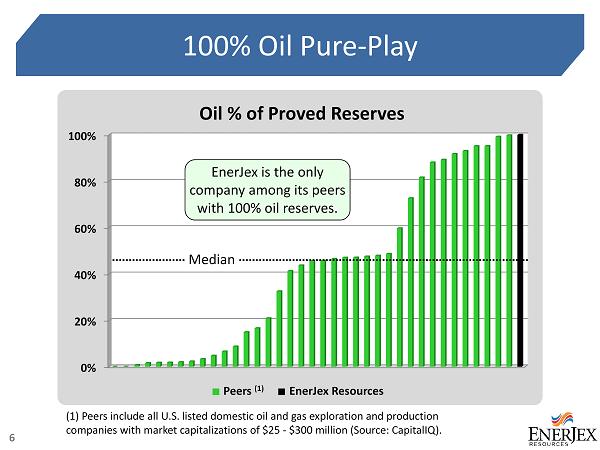

100% Oil Pure - Play 6 0% 20% 40% 60% 80% 100% Oil % of Proved Reserves Peers (1) EnerJex Resources (1) Peers include all U.S. listed domestic oil and gas exploration and production companies with market capitalizations of $25 - $300 million (Source: CapitalIQ). EnerJex is the only company among its peers with 100% oil reserves. Median

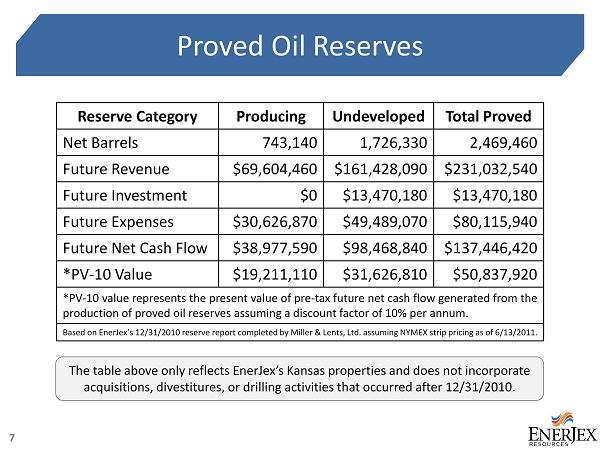

Proved Oil Reserves 7 Reserve Category Producing Undeveloped Total Proved Net Barrels 743,140 1,726,330 2,469,460 Future Revenue $69,604,460 $161,428,090 $231,032,540 Future Investment $0 $13,470,180 $13,470,180 Future Expenses $30,626,870 $49,489,070 $80,115,940 Future Net Cash Flow $38,977,590 $98,468,840 $137,446,420 *PV - 10 Value $19,211,110 $31,626,810 $50,837,920 *PV - 10 value represents the present value of pre - tax future net cash flow generated from the production of proved oil reserves assuming a discount factor of 10 % per annum . Based on EnerJex’s 12 / 31 / 2010 reserve report completed by Miller & Lents, Ltd . assuming NYMEX strip pricing as of 6 / 13 / 2011 . The table above only reflects EnerJex’s Kansas properties and does not incorporate acquisitions, divestitures, or drilling activities that occurred after 12/31/2010.

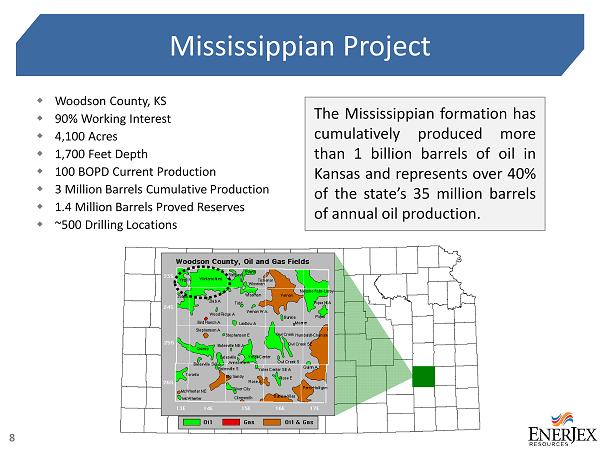

Mississippian Project 8 The Mississippian formation has cumulatively produced more than 1 billion barrels of oil in Kansas and represents over 40 % of the state’s 35 million barrels of annual oil production . Woodson County, KS 90% Working Interest 4,100 Acres 1,700 Feet Depth 100 BOPD Current Production 3 Million Barrels Cumulative Production 1.4 Million Barrels Proved Reserves ~500 Drilling Locations

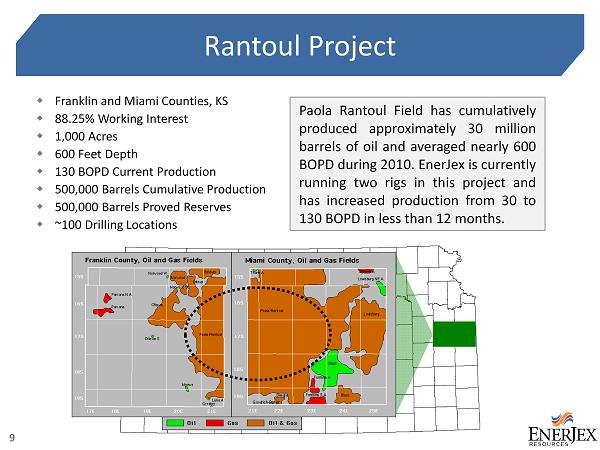

Rantoul Project 9 Franklin and Miami Counties, KS 88.25% Working Interest 1,000 Acres 6 00 Feet Depth 130 BOPD Current Production 500,000 Barrels Cumulative Production 500,000 Barrels Proved Reserves ~100 Drilling Locations Paola Rantoul Field has cumulatively produced approximately 30 million barrels of oil and averaged nearly 600 BOPD during 2010 . EnerJex is currently running two rigs in this project and has increased production from 30 to 130 BOPD in less than 12 months .

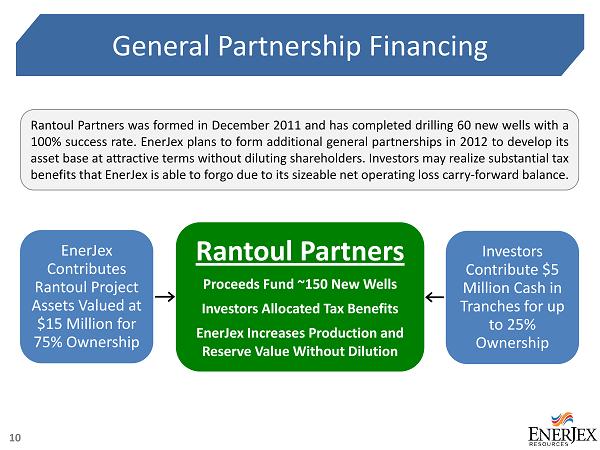

General Partnership Financing Rantoul Partners Proceeds Fund ~150 New Wells Investors Allocated Tax Benefits EnerJex Increases Production and Reserve Value Without Dilution Investors Contribute $5 Million Cash in Tranches for up to 25% Ownership EnerJex Contributes Rantoul Project Assets Valued at $15 Million for 75% Ownership 10 Rantoul Partners was formed in December 2011 and has completed drilling 60 new wells with a 100 % success rate . EnerJex plans to form additional general partnerships in 2012 to develop its asset base at attractive terms without diluting shareholders . Investors may realize substantial tax benefits that EnerJex is able to forgo due to its sizeable net operating loss carry - forward balance .

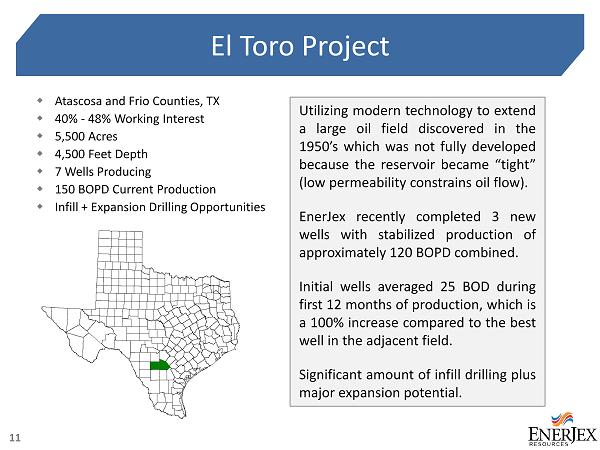

El Toro Project 11 Atascosa and Frio Counties, TX 40% - 48% Working Interest 5,500 Acres 4,500 Feet Depth 7 Wells Producing 150 BOPD Current Production Infill + Expansion Drilling Opportunities Utilizing modern technology to extend a large oil field discovered in the 1950 ’s which was not fully developed because the reservoir became “tight” (low permeability constrains oil flow) . EnerJex recently completed 3 new wells with stabilized production of approximately 120 BOPD combined . Initial wells averaged 25 BOD during first 12 months of production, which is a 100 % increase compared to the best well in the adjacent field . Significant amount of infill drilling plus major expansion potential .

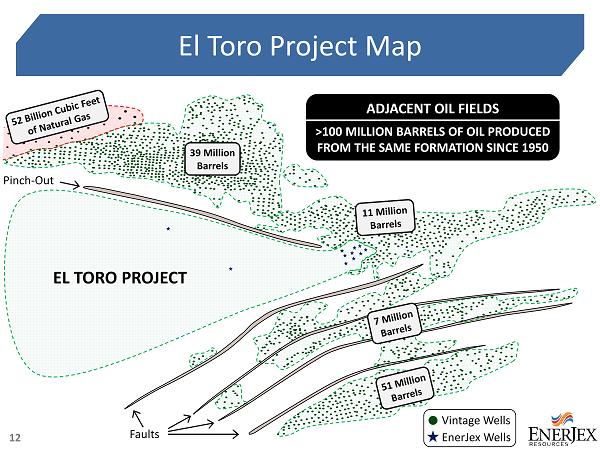

El Toro Project Map 12 39 Million Barrels EL TORO PROJECT Vintage Wells EnerJex Wells Faults ADJACENT OIL FIELDS >100 MILLION BARRELS OF OIL PRODUCED FROM THE SAME FORMATION SINCE 1950 Pinch - Out

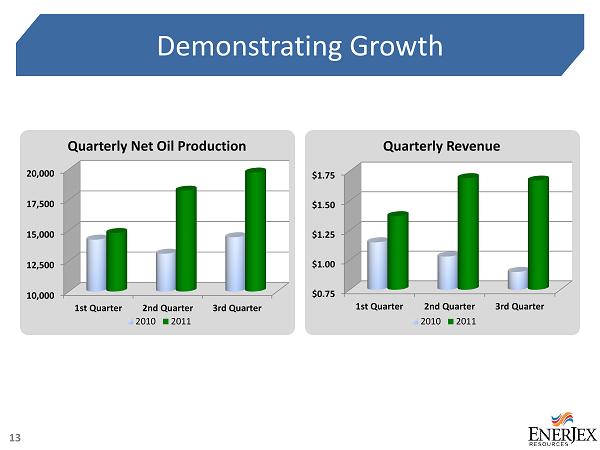

Demonstrating Growth 13 10,000 12,500 15,000 17,500 20,000 1st Quarter 2nd Quarter 3rd Quarter Quarterly Net Oil Production 2010 2011 $0.75 $1.00 $1.25 $1.50 $1.75 1st Quarter 2nd Quarter 3rd Quarter Quarterly Revenue 2010 2011

Corporate Objectives Increase Kansas production to 1,000 barrels of oil per day (BOPD) through development of current drilling inventory. Continue exploring and developing Texas assets. Implement proactive investor relations campaign to increase company exposure and improve stock trading volume. List stock on NYSE AMEX or NASDAQ. 14 MANAGEMENT IS 100% FOCUSED ON CREATING PER - SHARE VALUE FOR STOCKHOLDERS

Contact Information 15 Yancy #1 - El Toro Project Atascosa County, TX Website: www.enerjexresources.com Headquarters: 4040 Broadway Street Suite 305 San Antonio, TX 78209 Kansas Office: 27 Corporate Woods Suite 350 10975 Grandview Drive Overland Park, KS 66210 Phone: (913) 754 - 7755 CEO: Robert Watson, Jr. (210) 451 - 5545 Investor Relations: Brad Holmes (713) 654 - 4009