Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MOLINA HEALTHCARE, INC. | d287700d8k.htm |

| EX-99.1 - PRESS RELEASE - MOLINA HEALTHCARE, INC. | d287700dex991.htm |

Investor Day

2012A January 26, 2012

New York, New York

Exhibit 99.2 |

©

2012 Molina Healthcare, Inc.

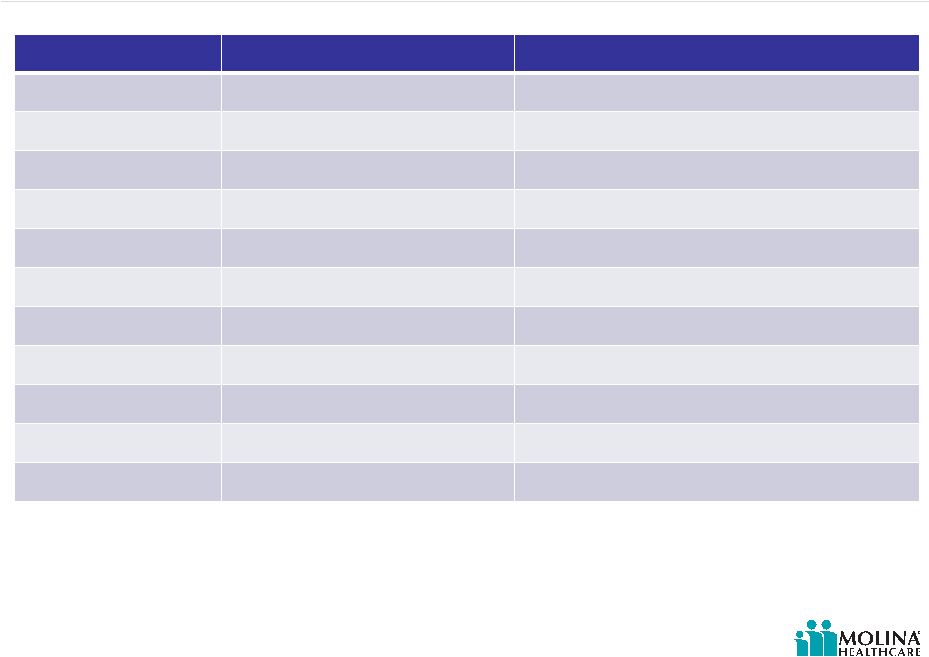

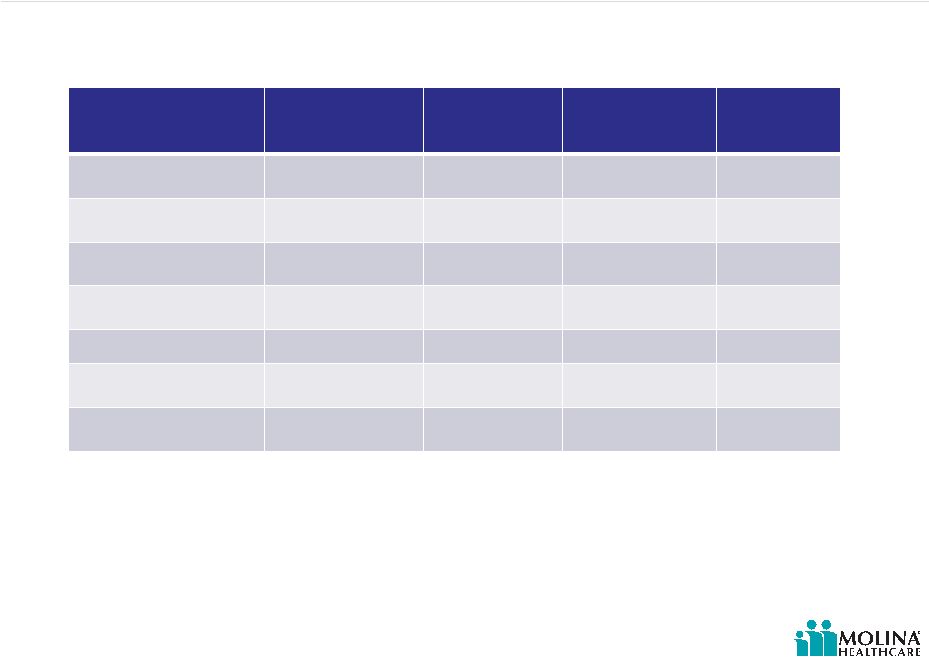

Agenda

Time

Topic

Speaker

12:30pm-12:35pm

Opening Remarks

Juan José

Orellana, VP Investor Relations

12:35pm-1:10pm

Business Overview

J. Mario Molina, MD, Chief Executive Officer

1:10pm-1:30pm

Q&A

1:30pm-1:40pm

Break

1:40pm-2:15pm

Operations Update

Terry Bayer, Chief Operating Officer

2:15pm-2:40pm

Capital Adequacy

Joseph White, Chief Accounting Officer

2:40pm-3:00pm

Q&A

3:00pm-3:15pm

Break

3:15pm-3:50pm

Outlook 2012

John Molina, Chief Financial Officer

3:50pm-4:30pm

Q&A

4:30pm

End of Program

2 |

©

2012 Molina Healthcare, Inc.

Cautionary Statement

3

regarding the Company’s expected results for fiscal year 2012. All of our

forward-looking statements are based on our current expectations and assumptions. Actual results could differ

materially due to the unexpected failure of our assumptions or due to adverse developments

related to numerous risk factors, including but not limited to the following: uncertainty regarding the effect of our Washington health plan’s being named an

“apparently successful bidder” by the Health Care Authority of Washington in that state’s

recent managed care procurement;

significant budget pressures on state governments which cause them to lower rates unexpectedly

or to rescind expected rates increases, or their failure to maintain existing benefit

packages or membership eligibility thresholds or criteria; uncertainties regarding the impact of the Patient Protection and Affordable Care Act,

including its possible repeal, judicial overturning of the individual insurance mandate or

Medicaid expansion, the effect of various implementing regulations, and uncertainties

regarding the impact of other federal or state health care and insurance reform

measures;

management of our medical costs, including costs associated with unexpectedly severe or

widespread illnesses such as influenza, and rates of utilization that are consistent

with our expectations;

the success of our efforts to retain existing government contracts and to obtain new

government contracts in connection with state requests for proposals (RFPs) in both

existing and new states, and our ability to grow our revenues consistent with our

expectations; the accurate estimation of incurred but not reported medical costs across our health plans;

risks associated with the continued growth in new Medicaid and Medicare enrollees, and in dual

eligible members; retroactive adjustments to premium revenue or accounting estimates which require adjustment

based upon subsequent developments; the continuation and renewal of the government contracts of both our health plans and Molina

Medicaid Solutions and the terms under which such contracts are renewed; the timing of receipt and recognition of revenue and the amortization of expense under the

state contracts of Molina Medicaid Solutions in Maine and Idaho; government audits and reviews;

changes with respect to our provider contracts and the loss of providers;

the establishment, interpretation, and implementation of a federal or state medical cost

expenditure floor as a percentage of the premiums we receive, administrative cost and

profit ceilings, and profit sharing arrangements; the interpretation and implementation of at-risk premium rules regarding the achievement

of certain quality measures; the successful integration of our acquisitions;

approval by state regulators of dividends and distributions by our health plan subsidiaries;

changes in funding under our contracts as a result of regulatory changes, programmatic

adjustments, or other reforms; high dollar claims related to catastrophic illness;

the favorable resolution of litigation, arbitration, or administrative proceedings, and the

costs associated therewith; restrictions and covenants in our credit facility;

the availability of financing to fund and capitalize our acquisitions and start-up

activities and to meet our liquidity needs and the costs and fees associated therewith; a state’s failure to renew its federal Medicaid waiver;

an inadvertent unauthorized disclosure of protected health information by us or our business

associates; changes generally affecting the managed care or Medicaid management information systems

industries; increases in government surcharges, taxes, and assessments;

changes in general economic conditions, including unemployment rates;

and numerous other risk factors, including those identified within this slide presentation

and/or our accompanying oral remarks, and those discussed in our periodic reports and filings

with the Securities and Exchange Commission. These reports can be accessed under the investor

relations tab of our Company website or on the SEC’s website at www.sec.gov. Given

these risks and uncertainties, we can give no assurances that our forward-looking

statements will prove to be accurate, or that any other results or events projected or contemplated by

our forward-looking statements will in fact occur, and we caution investors not to place

undue reliance on these statements. All forward-looking statements in this release represent our

judgment as of January 26, 2012, and we disclaim any obligation to update any

forward-looking statements to conform the statement to actual results or changes in our expectations.

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995:

This slide presentation and our accompanying oral remarks contain “forward-looking

statements” |

Business

Overview J. Mario Molina, MD

President & Chief Executive Officer

January 26, 2012

New York, New York |

©

2012 Molina Healthcare, Inc.

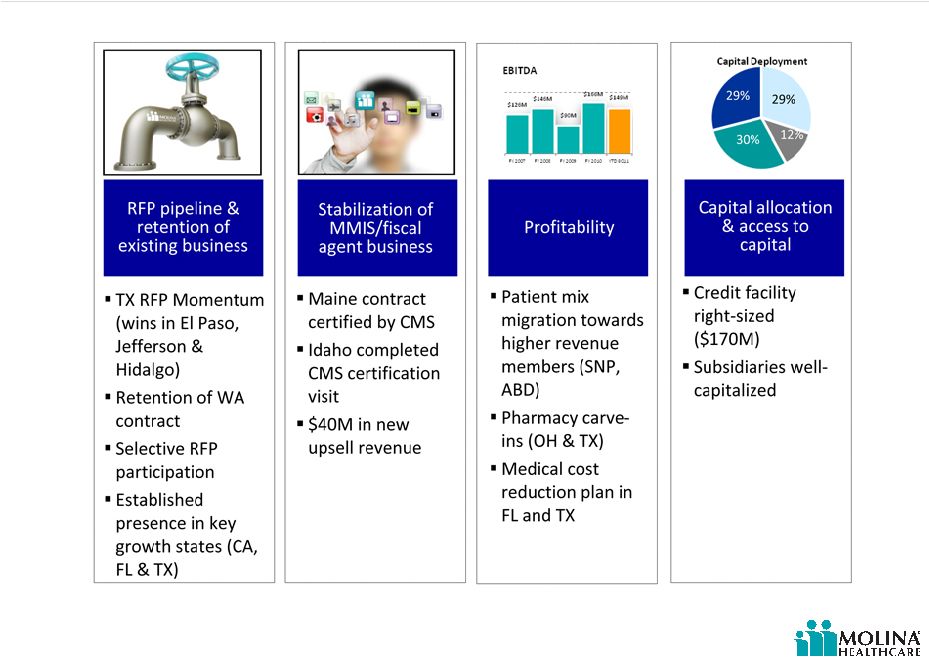

Goal setting and results

Executed on our plans for 2011

Health plan business remains stable

Medicare SNP business continues to grow

Improved profitability despite rate environment

First CMS certification achieved for fiscal agent

contract

Positioned for strong growth in 2012

New markets in Texas effective 3/12

Dual eligible care coordination integration

5

Solid progress on long-term value creation |

©

2012 Molina Healthcare, Inc.

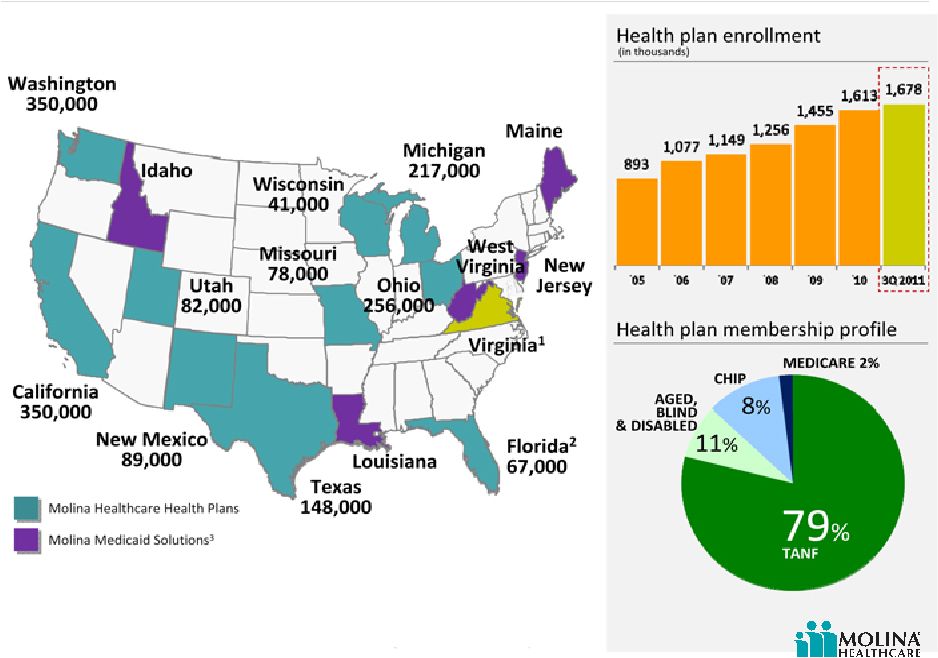

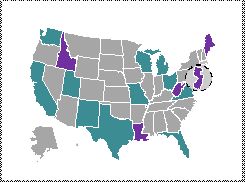

Business snapshot

Markets and members served –

3Q 2011

1.

Virginia clinics provide Direct Delivery.

2.

Florida has a managed care program as well as a Pharmacy Rebate Program.

3.

Fee based fiscal agent business.

6 |

©

2012 Molina Healthcare, Inc.

7

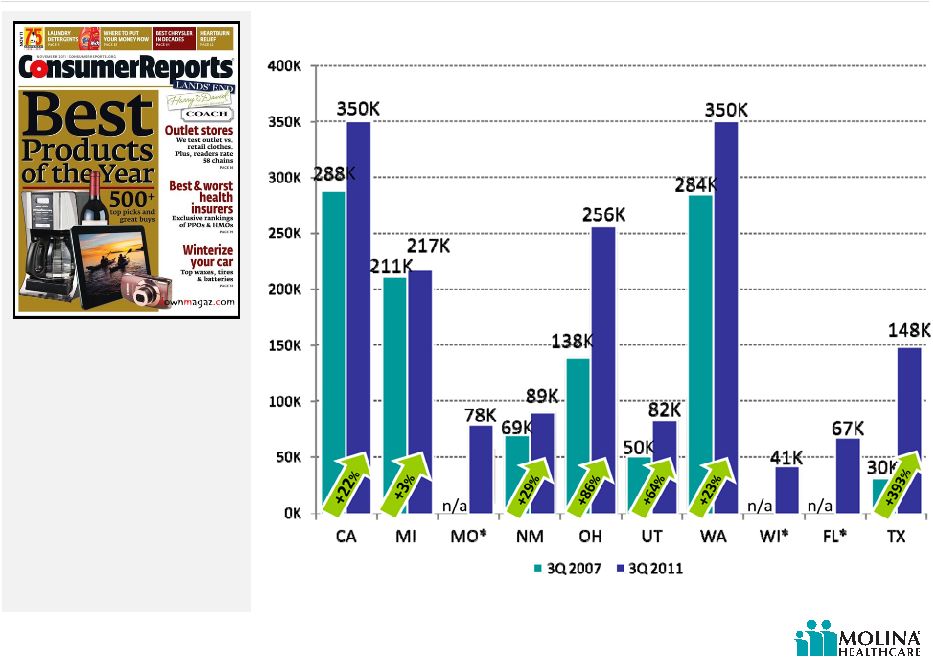

Delivering enrollment growth by market

As our enrollment grows,

Molina remains committed to

delivering quality health care.

Except for Wisconsin, all of

our eligible health plans have

earned NCQA accreditation.

Enrollment

(3Q 2007 –

3Q 2011)

Molina health plans ranked in Consumer Reports Magazine,

November 2011.

*Molina did not have a presence in these markets in 2007. |

©

2012 Molina Healthcare, Inc.

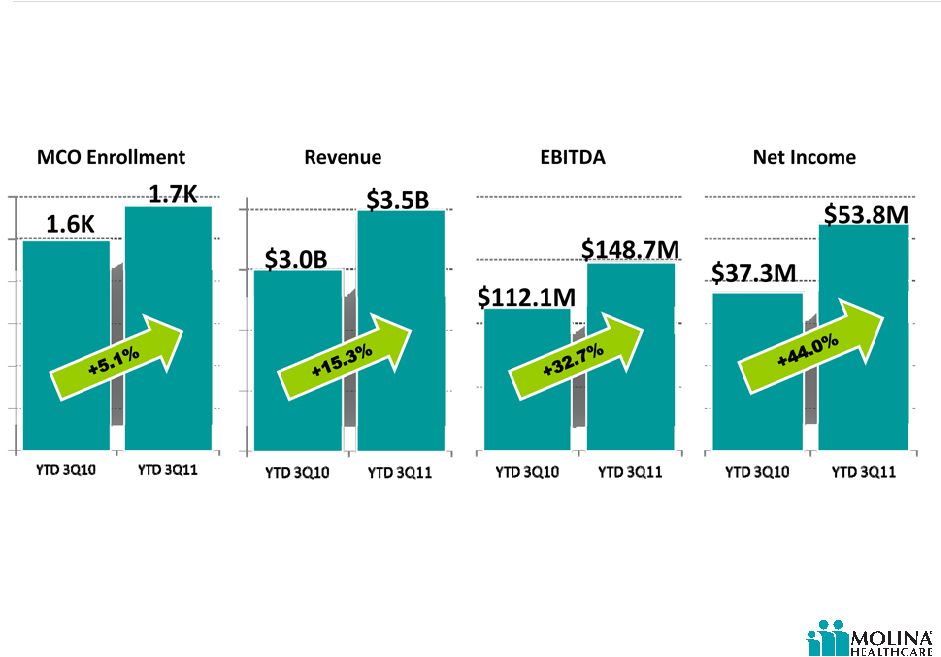

Executing on our plan

8

YTD 3Q 2010 vs. YTD 3Q 2011 |

©

2012 Molina Healthcare, Inc.

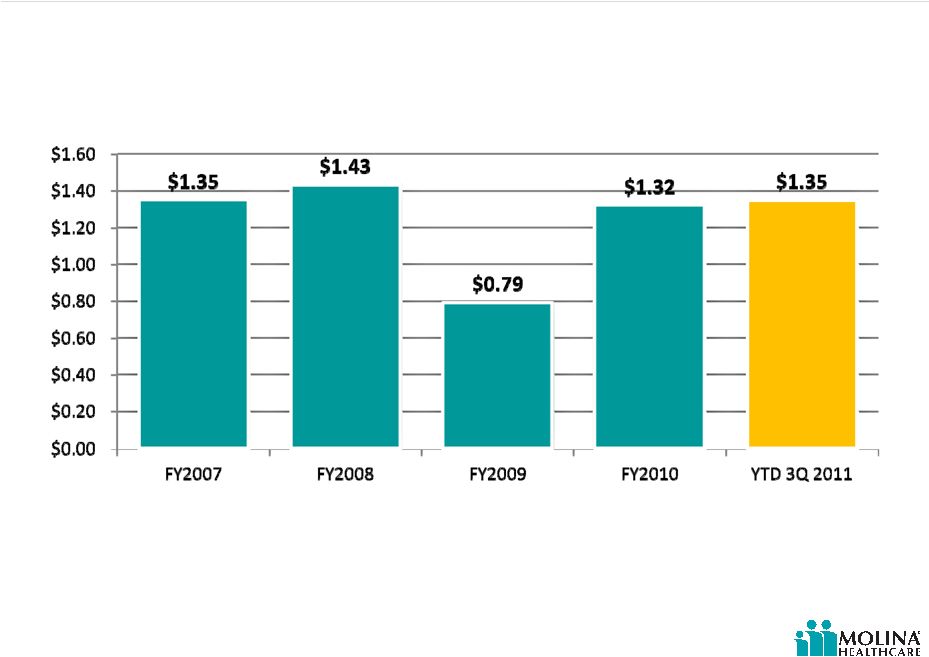

Molina earnings per share

9

Split adjusted |

©

2012 Molina Healthcare, Inc.

Positioned for growth

Building on momentum from new business wins and

retention of existing contracts

Leveraging established SNP (duals) growth platform

Investing in Company-owned direct delivery footprint

Continue developing and up-selling our fiscal agent

offering

Investing in corporate infrastructure (Molina Center)

10 |

©

2012 Molina Healthcare, Inc.

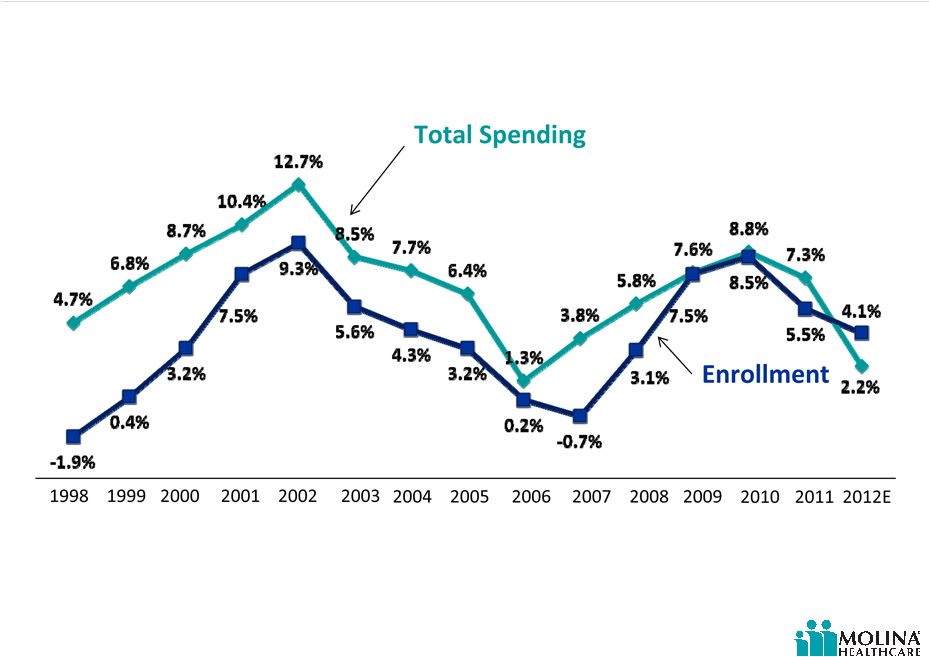

U.S. Medicaid Spending and Enrollment

Percent Changes, FY 1998 –

FY 2012E

Source:

Medicaid

Enrollment

June

2010

Data

Snapshot,

KCMU,

February

2011.

Spending

Data

from

KCMU

Analysis

of

CMS

Form

64

Data

for

Historic

Medicaid

Growth

Rates.

FY

2011

and

FY

2012

data

based

on

KCMU

survey

of

Medicaid

officials

in

50

states

and

DC

conducted

by

Health

Management

Associates,

September

2011.

Note:

Enrollment

percentage

changes

from

June

to

June

of

each

year.

Spending

growth

percentages

in

state

fiscal

year.

U.S. Medicaid spending and enrollment

11 |

©

2012 Molina Healthcare, Inc.

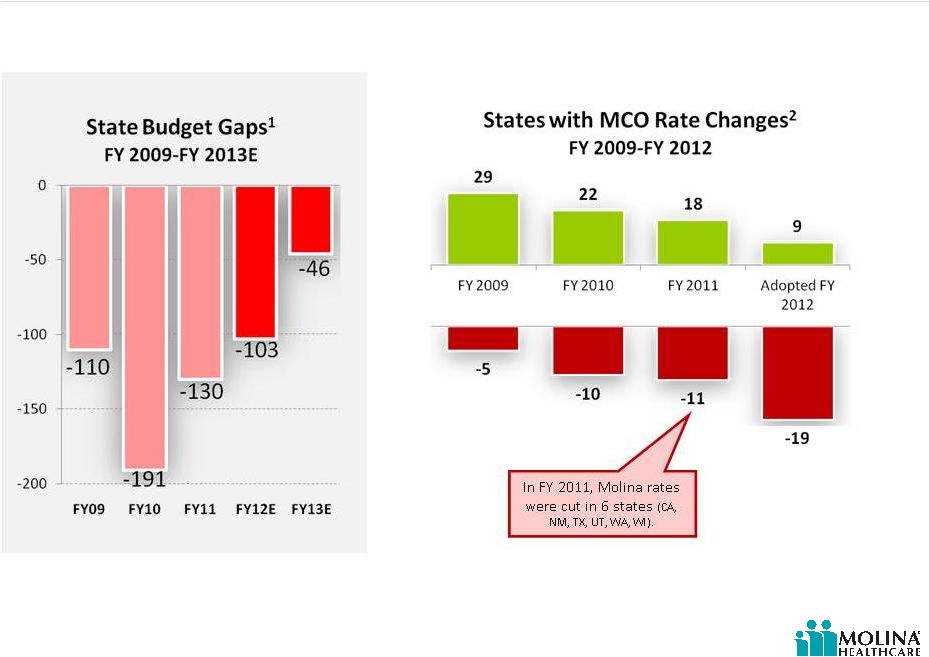

Key challenges for 2012

12

Sources:

1.

“States

Continue

to

Feel

Recession’s

Impact.”

Center

on

Budget

and

Policy

Priorities,

June

17,

2011.

2.

KMCU

survey

of

Medicaid

officials

in

50

states

and

DC

conducted

by

Health

Management

Associates,

September

2009,

September

2010,

and

September

2011.

Although some states project improved cash flows over the next few years as the economy

recovers, states’

fiscal conditions remain very weak. |

©

2012 Molina Healthcare, Inc.

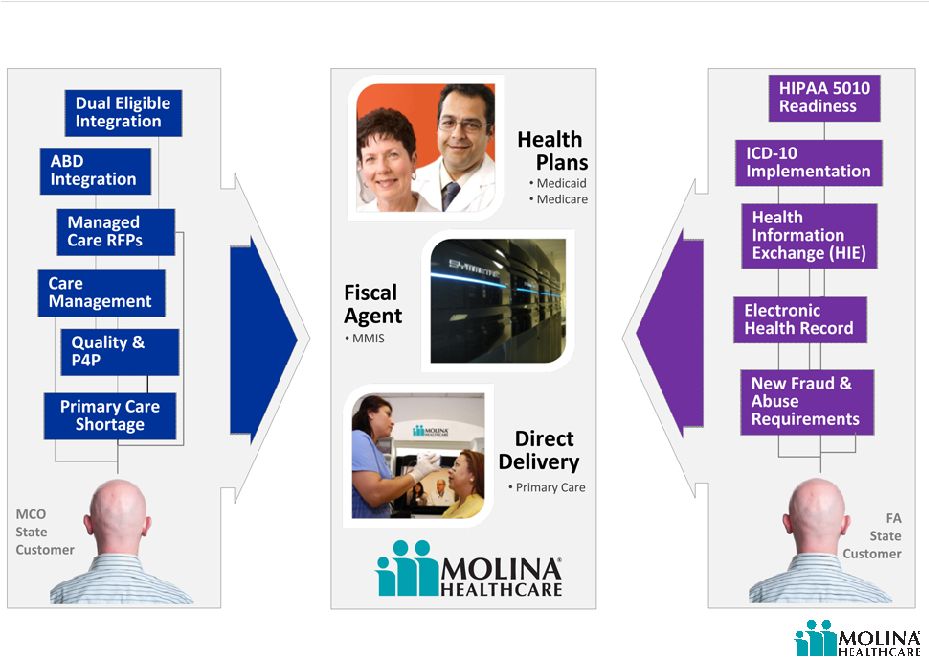

Short term growth opportunities

13

Economic, healthcare, and technology trends will translate into revenue opportunities in the

short run. |

©

2012 Molina Healthcare, Inc.

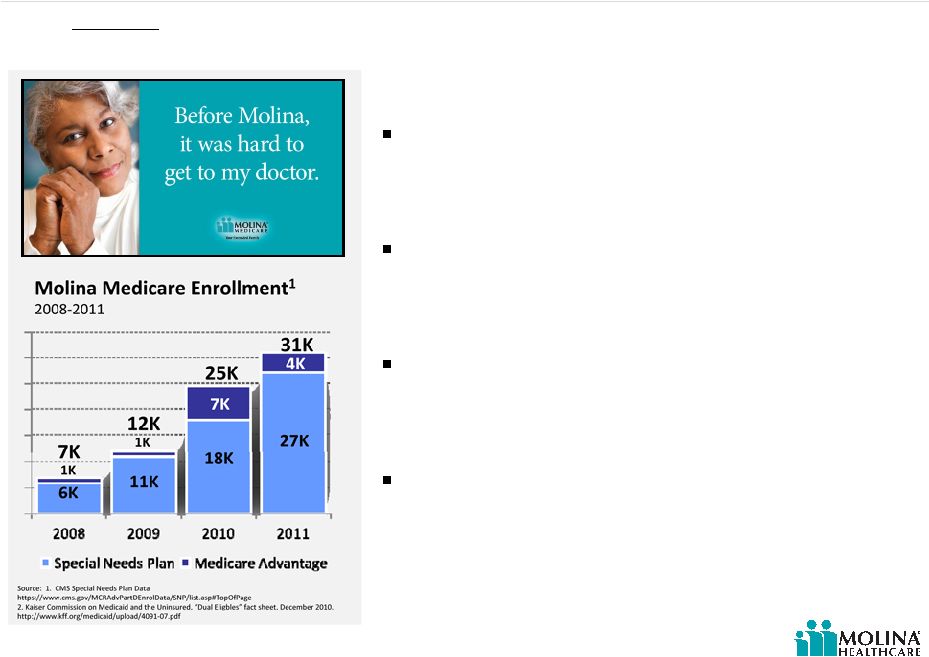

Unprecedented new focus on dual eligibles

Recognition that dual eligibles are the most

costly group of beneficiaries for both

Medicaid and Medicare

Dual eligibles account for approximately 15%

of Medicaid enrollees but contribute to 39%

of all Medicaid spending²

Medicaid/Medicare spending averages $20K

per dual per year, 5X greater than other

Medicare beneficiaries

Dual eligible population will highly benefit

from managed care

Nearly 9 million

Medicaid beneficiaries are dual eligibles: low-income seniors and younger

persons with disabilities who are enrolled in both the Medicare and Medicaid programs.

14 |

©

2012 Molina Healthcare, Inc.

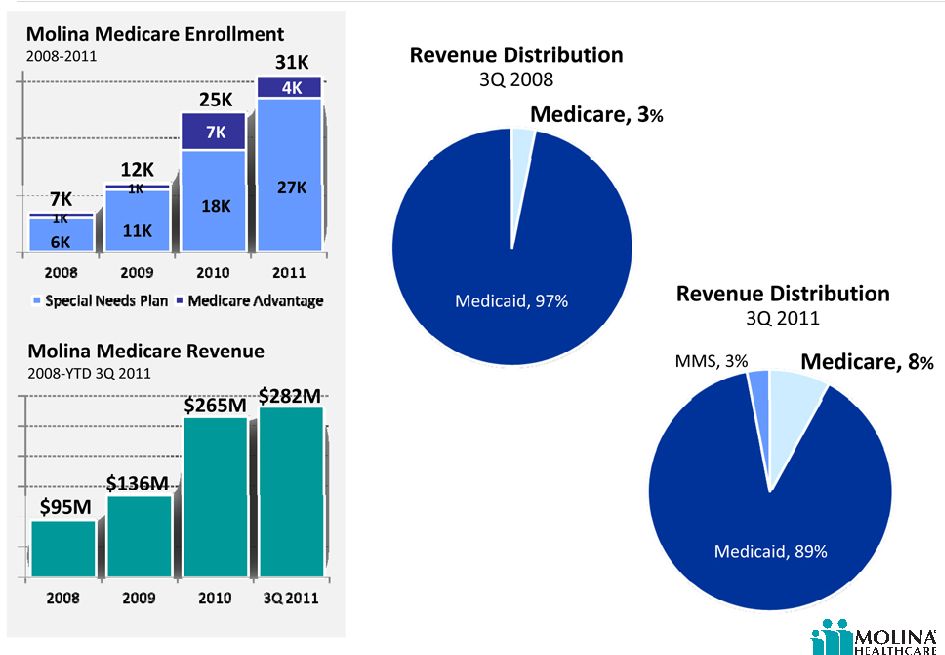

Our Medicare business is growing

15

Source: Company Data and CMS Special Needs Plan Data

https://www.cms.gov/MCRAdvPartDEnrolData/SNP/list.asp#TopOfPage |

©

2012 Molina Healthcare, Inc.

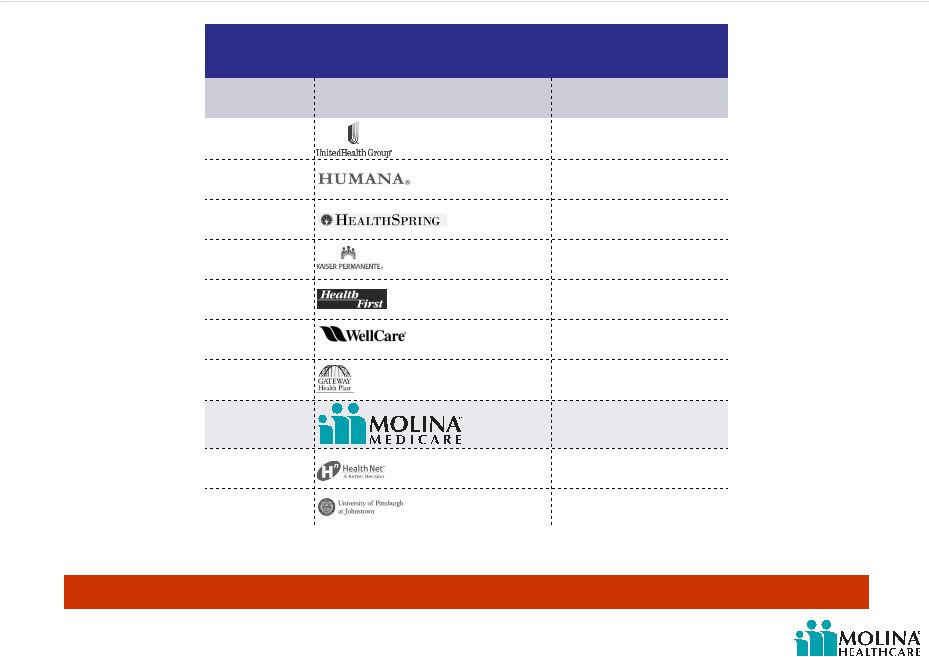

Molina’s dual eligible enrollment

16

Source: CMS Health Plan Management System as of 12/2011. Information sourced

quarterly. Top 10 SNP Dual Eligible Plans Nationwide*

Rank

Plan

Membership

1

203k

2

75k

3

75k

4

68k

5

53k

6

42k

7

28k

8

27k

9

18k

10

16k

Molina has well established SNPs serving the financially vulnerable

1.

United includes PacifiCare, Evercare, APIPA and Secure Horizons products

2.

Humana includes Arcadian, Care Plus, Arta, and MD Care.

1

2 |

©

2012 Molina Healthcare, Inc.

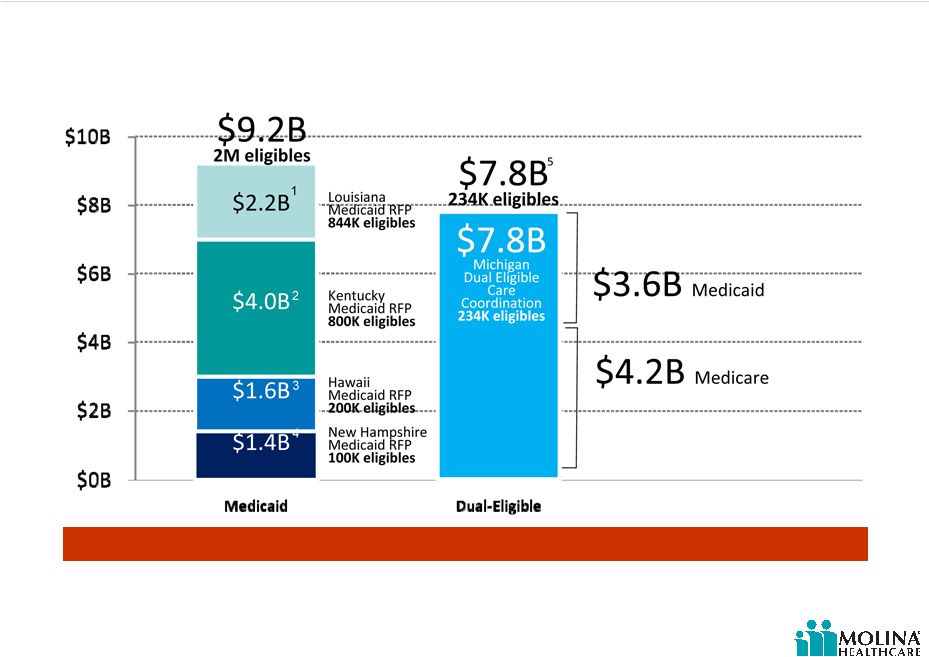

Opportunities in perspective

17

1.

The

Advocate,

“Contract

Winners

want

to

protect

data.”

August

2,

2011

2.

Insider

Louisville,

Multiple

mega

firms

pursue

Kentucky’s

$4

billion

Medicaid

contract

.”

June

23,

2011

3.

Pacific

Business

News,

$1.65B

in

Medicaid

contracts

will

expire

in

June.”

May

6,

2011.

(http://www.bizjournals.com/pacific/print-edition/2011/05/06/165-billion-in-medicaid-contracts.html)

4.

Union

Leader,

“State

reviewing

proposals

for

massive

Medicaid

contract.”

January

2,

2012.

(http://www.unionleader.com/article/20120102/NEWS06/701029974)

5.

CMS

document,

“Michigan’s

Response

to

CMS

Solicitation

State

Demonstrations

to

Integrate

Care

for

Dual

Eligible

Individuals

”

Michigan is among the 15 states selected to

receive up to $1 million to support the design

of programs

to integrate care for the dual eligible.

Select Expansion Opportunities

Molina already serves nearly 7,000 SNP beneficiaries in Michigan |

©

2012 Molina Healthcare, Inc.

Supporting integrated care for duals

18

Medicare and Medicaid are each governed by their own policies and procedures, Dual

eligibles are forced to navigate a system with two sets of providers, benefits, and even

enrollment cards. This fragmentation can result in unnecessary,

duplicative, or missed

services. |

©

2012 Molina Healthcare, Inc.

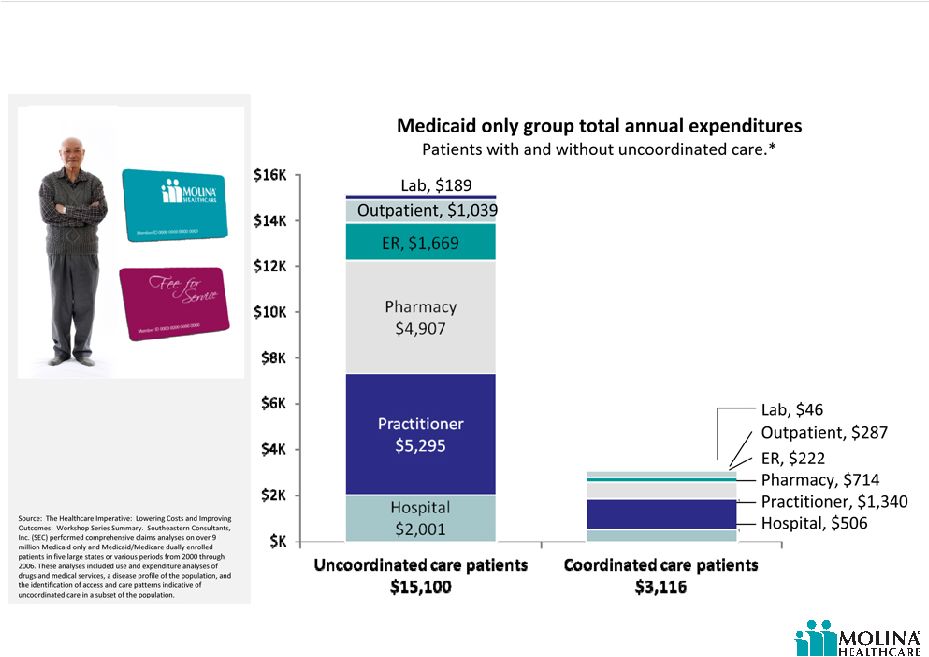

Cost of uncoordinated care

19

Medicaid patients with extremely uncoordinated care account for a disproportionate share

of costs.

These patterns are even more significant among dual patients who experience a

greater prevalence of chronic diseases and co-morbid conditions.

|

©

2012 Molina Healthcare, Inc.

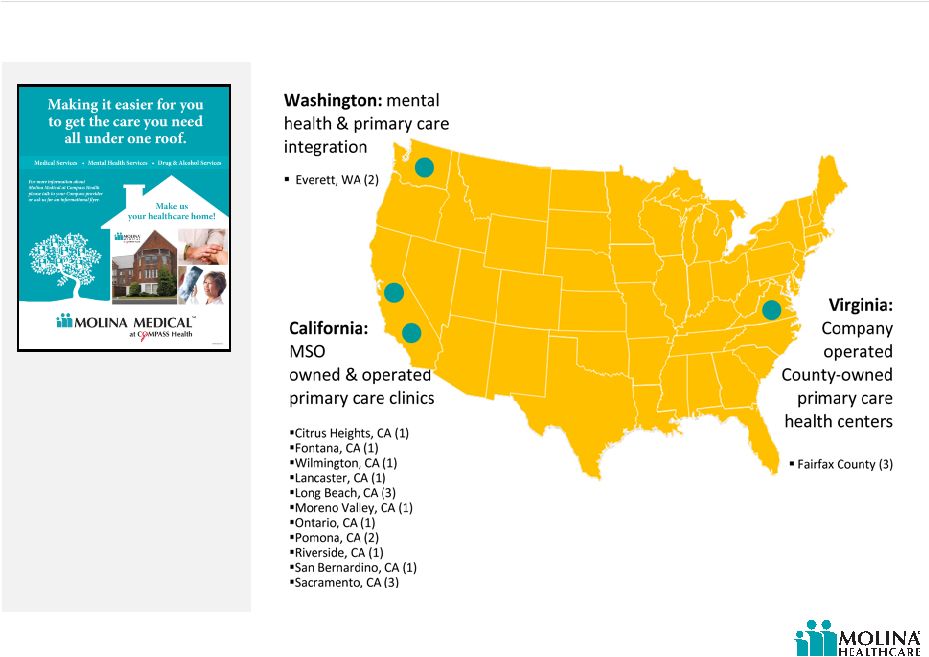

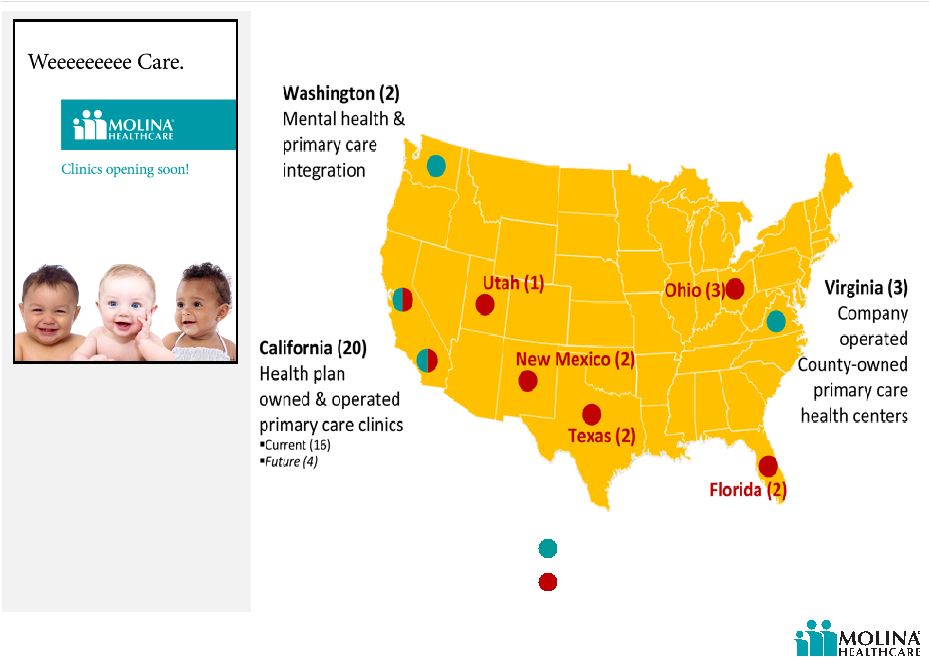

Our approach to direct delivery is flexible and can accommodate changes in local market

requirements and needs. We currently operate 21 clinics and plan

to continue expanding.

Direct Delivery

20 |

©

2012 Molina Healthcare, Inc.

Why build clinics at all?

21

Augment network in areas of provider scarcity

Supplement provider capacity issues

Greater emphasis on quality and outcomes

States continue to cut rates

Nurtures patient loyalty to the health plan

Brand awareness & community engagement |

©

2012 Molina Healthcare, Inc.

Why not build more clinics?

22

Need to augment the network not replace the network

Can be perceived as competing directly with network

providers

Identifying right locations can be a challenge

Hiring doctors to serve Medicaid patients is not easy

Get it right from the beginning |

©

2012 Molina Healthcare, Inc.

Direct Delivery: expanding our footprint

23

Current Molina clinics

Future Molina clinics

15 new clinics planned for 2012 |

©

2012 Molina Healthcare, Inc.

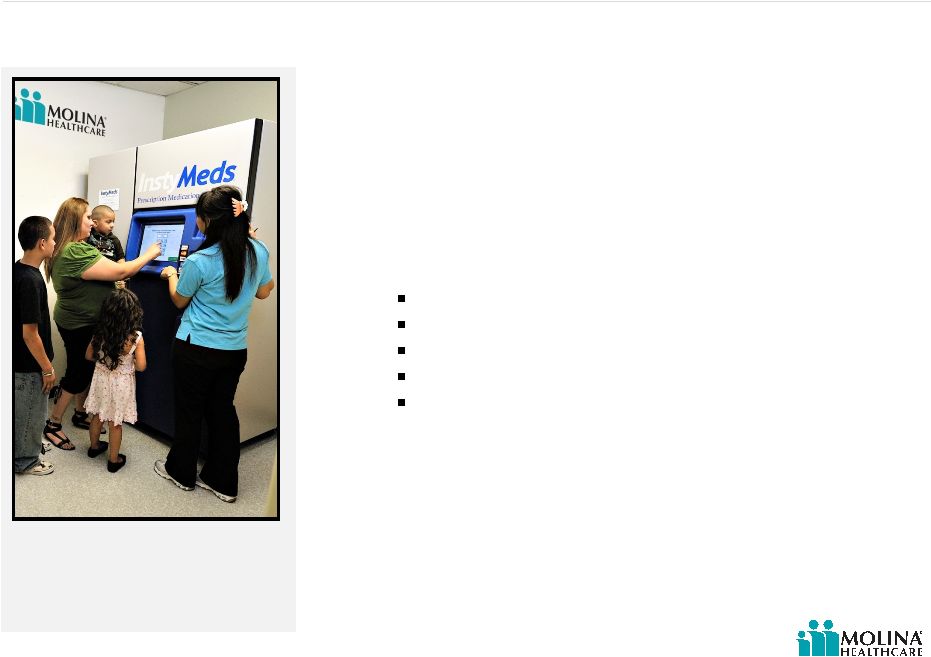

24

Direct Delivery –

Rx solutions

A 2007 U.S. survey reported that nearly 31% of those polled had not filled a prescription they

were given by their physician.¹

1. Source: Enhancing Prescription Medicine Adherence: A National

Action Plan, National Council on Patient Information and Education

August 2007

Molina now offers patients on-site medication

dispensing to increase the likelihood that patients

will fill their prescription and undergo the

physician’s medical treatment plan.

Value added benefit for Molina members

Acute care scripts only

Wait time: 10 -15 min

Direct member customer service line

Over 50,000 scripts already dispensed |

©

2012 Molina Healthcare, Inc.

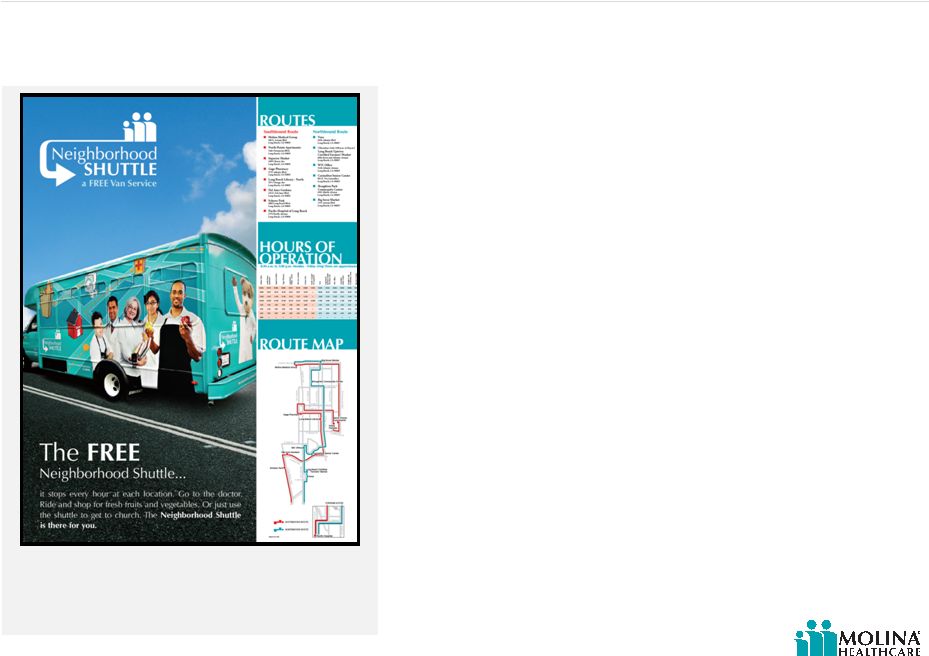

Direct Delivery –

transportation solution

25

Transportation solution

Free shuttle service offers a ride between

various key community access points,

including our clinics. (Long Beach, Inland

Empire.)

Transportation to and from a physician’s office remains a key problem for Medicaid

beneficiaries. The use of public transportation often results in missed appointments or

late arrivals. |

©

2012 Molina Healthcare, Inc.

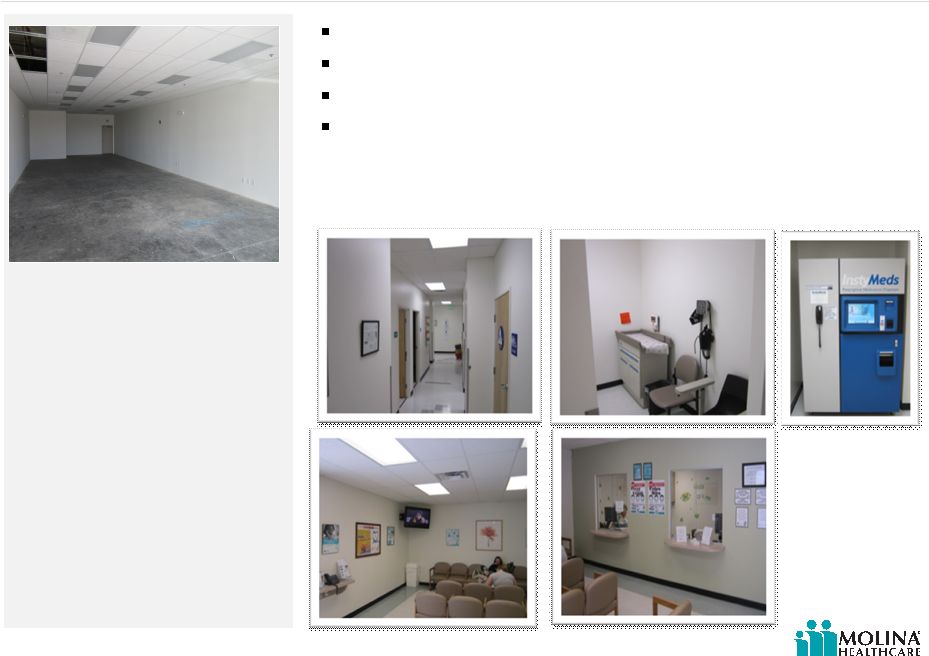

Direct Delivery –

our facilities

26

Typically leased facilities about 4,000 sq/ft

4-5 employees

1-2 Primary Care Physicians per office

Contracted: Lab, X-Ray, and Specialty services

pre build-out

after build-out |

©

2012 Molina Healthcare, Inc.

27

Preparation for anticipated growth

Rent vs. own decision (MOH already occupied 40%

of complex)

Advantageous real estate market conditions

Molina acquires office complex in Long Beach, California.

Purchase price of $81 million

Two connected 14-story

towers

461,263 square feet

Class A building |

©

2012 Molina Healthcare, Inc.

Summary of investor areas of interest

28 |

©

2012 Molina Healthcare, Inc.

29

Q&A |

Operations

Update Terry Bayer

Chief Operating Officer

January 26, 2012

New York, New York |

©

2012 Molina Healthcare, Inc.

Operations update

Highlights from our health plans

Florida

Texas

Ohio

Washington

Dual eligible opportunity

Michigan duals

California budget

Carve-in trends

MMS certification

31 |

©

2012 Molina Healthcare, Inc.

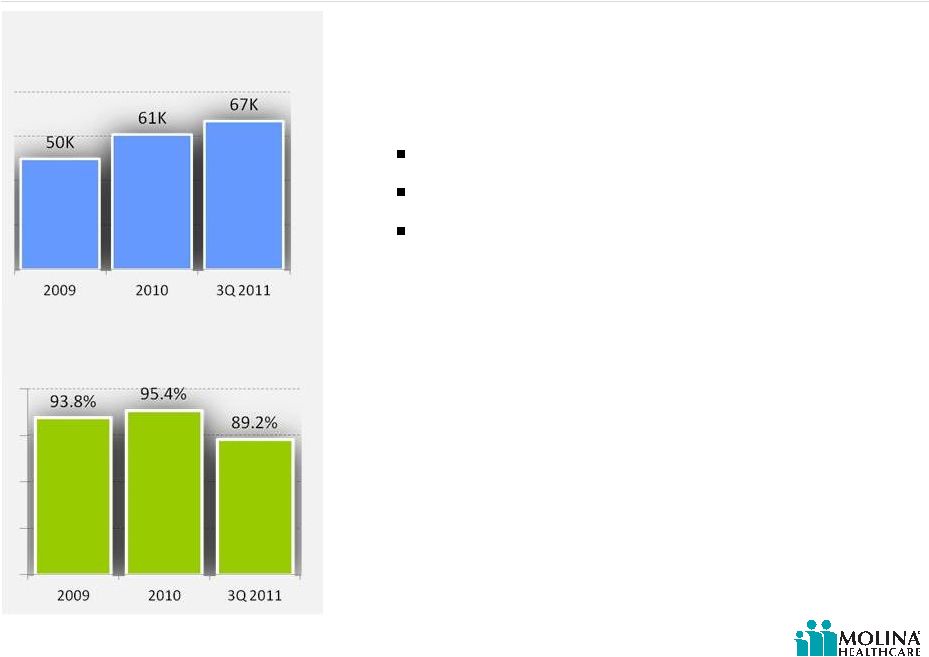

Florida

Improved financial performance due to:

Reduced unit costs

Utilization improvement

Premium rate increase effective 9/1/11

32

Molina Healthcare of Florida

Historical and YTD Enrollment

2009-3Q2011

Molina Healthcare of Florida

Historical and YTD MCR

2009-3Q2011 |

©

2012 Molina Healthcare, Inc.

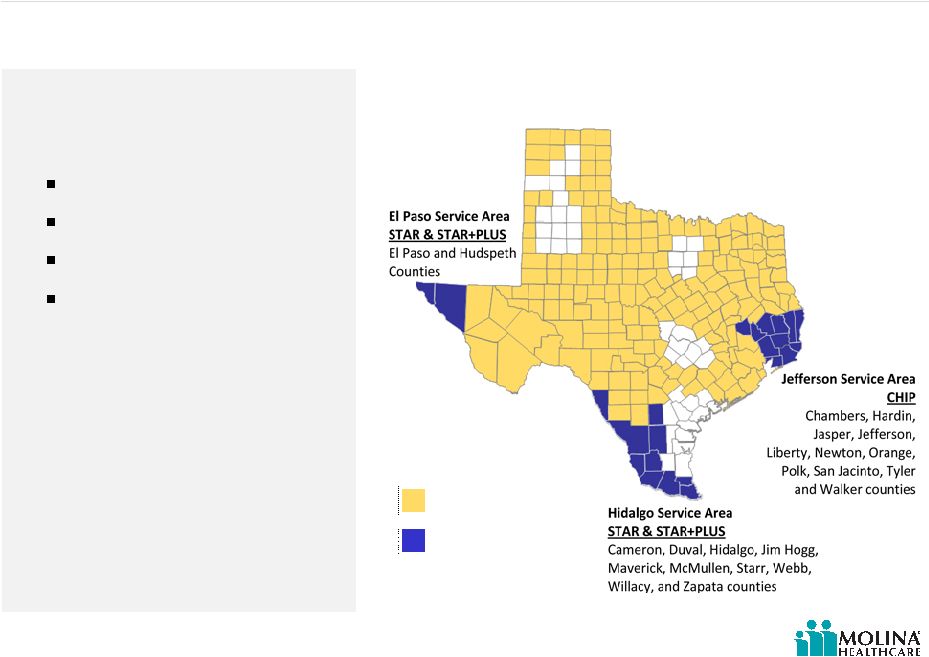

Texas overview

Existing Molina

footprint

33

Molina new SDAs effective

3/1/2012

In addition to Molina’s already expansive footprint in Texas, effective March 1, 2012,

Molina

will have three new service delivery areas (SDAs).

Source: Texas Health and Human Services Commission

Molina New SDAs

(effective 3/1/2012)

Profitability Improvement

Plan:

Rate Increases

Care Coordination

Utilization Management

Unit Costs-recontracting |

©

2012 Molina Healthcare, Inc.

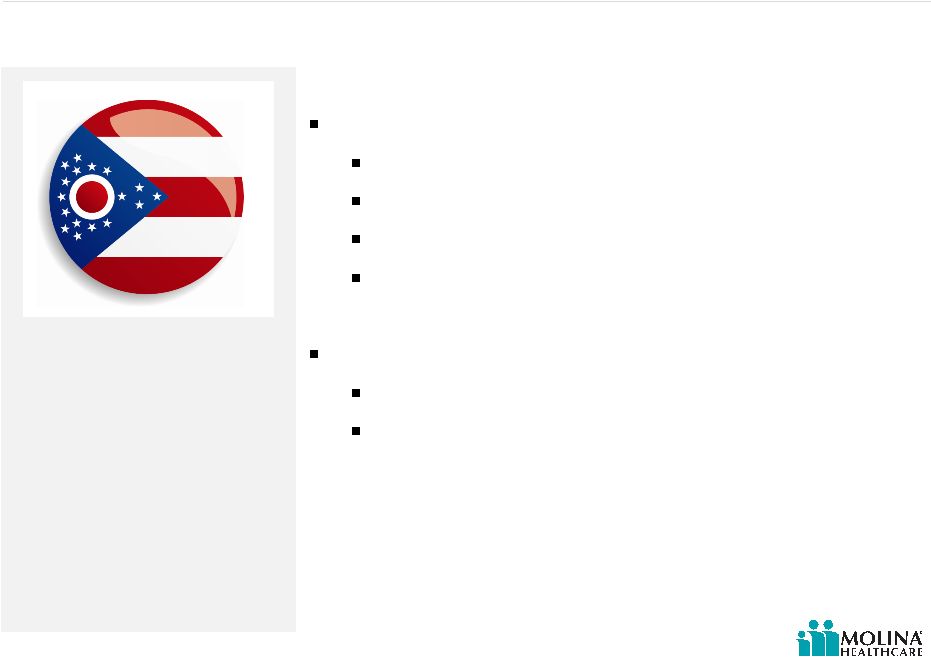

Ohio

34

Improved financial performance due to:

Premium rate increase (effective 1/1/11)

Utilization management

Care coordination

Reducing unit costs by improving contracts

RFA issued January 11, 2011:

Re-procurement statewide

Addition of disabled children |

©

2012 Molina Healthcare, Inc.

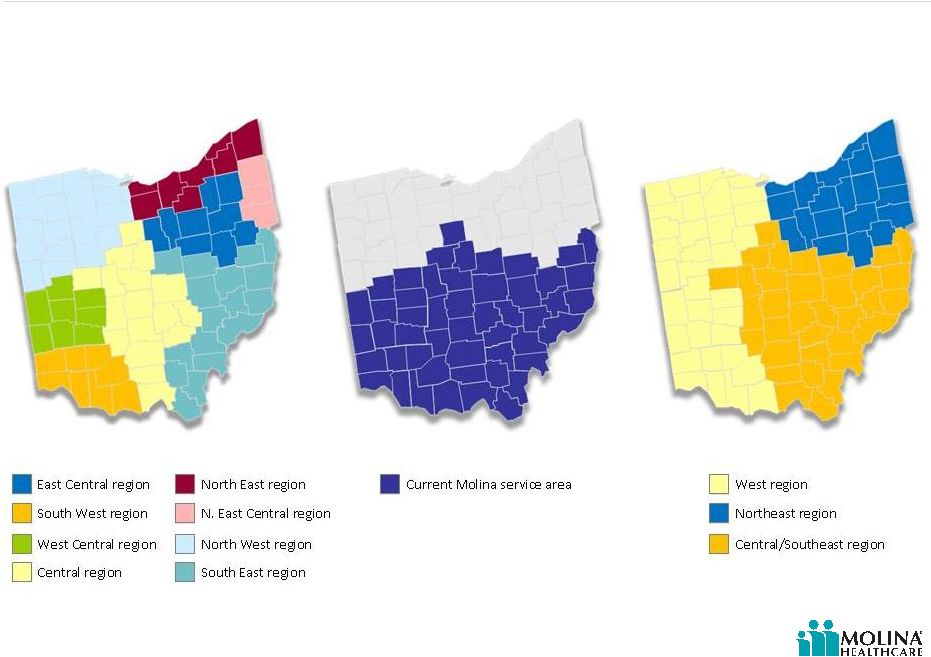

Ohio RFA

$5.1 billion rebid

Implementation expected January 1, 2013

1.5M covered families and children (CFC) lives, 125K ABD lives, and 37K

children with disabilities

Mandates ABDs, including children, into managed care

Beneficiaries currently enrolled in the covered families and children (CFC)

program will continue to be mandatorily enrolled

Divides state into three regions each with four managed care plans

Three

regions

each

with

a

unique

health

plan,

therefore

allowing

three

distinct MCOs to operate statewide.

Bids are due March 19, 2012

Not a rate bid (compliance, HEDIS, experience 60% of bid)

35

On January 11

th

, the Ohio Department of Job and Family Services issued a Request for

applications under which it will rebid the current managed care population and expand

managed care to the aged, blind, or disabled (ABD) population. |

©

2012 Molina Healthcare, Inc.

Post-2012 RFA

Ohio Managed Care Regions

(3 regions)

Pre-2012 RFA

Ohio Managed Care Regions

(8 regions)

Ohio RFA

Source: Ohio Department of Job and Family Services

(http://jfs.ohio.gov/rfp/JFSR1213078019/JFSR1213078019.stm)

36

Pre-2012 RFA

Current Molina Service Area

(4 regions) |

©

2012 Molina Healthcare, Inc.

Washington

37

RFP results announced January 17, 2012

Qualified as one of five “apparently successful”

bidders

New population:

100,000 SSI members included in Healthy

Options program effective 7/1/12.

MCO’s exiting program 7/1/12 (123,000

members)

Columbia United Providers (CUP)

Group Health

Regence

Kaiser |

©

2012 Molina Healthcare, Inc.

Michigan duals

38

State began enrolling dual eligibles in Medicaid

(12/11)

Dual eligibles in SNP automatically enrolled with opt-

out

Michigan Department of Community Health (MDCH)

developing Dual Eligible Integrated Care Plan

CMS submission target (4/1)

Implementation target (1/2013) |

©

2012 Molina Healthcare, Inc.

California Budget

Proposed changes to Medi-Cal (Medicaid)

Phased-in transfer of duals to managed care starting in January 2013. Medi-Cal

benefits transition in first year; Medicare benefits over three years. (approx.

$670M projected savings in SFY 2013)

Statewide expansion of Medi-Cal managed care starting in June 2012;

fee-for-service transition to managed care in 2014-15.

Annual open enrollment and lock-in period for Medi-Cal managed care.

Extension of gross premiums tax on Medi-Cal managed care plans and hospital fee on

hospitals. 3.61% proposed rate increase in Medi-Cal rates.

Proposed changes to Healthy Families (CHIP)

Aggregate 25.7% managed care plan rate cut effective Oct. 1, 2012. Because of varying

contract rates, the effective rate change for health plans may be significantly

different. Transfer of all Healthy Families members (approx. 875,000) to Medi-Cal

over a 9 month period beginning in Oct. 2012.

Elimination of the Managed Risk Medical Insurance Board (MRMIB) by July 2013.

Final budget terms may vary materially.

39

On January 5

th

, Governor Brown released initial California budget proposal. |

©

2012 Molina Healthcare, Inc.

Carve-in trends

Ohio Rx: 10/11

Texas Rx: 3/12

Texas inpatient: 3/12

40 |

©

2012 Molina Healthcare, Inc.

Maine MMIS certification

Certification allows state to receive maximum federal

funding for Maine Integrated Health Management

Solution (MIHMS) by meeting federal standards for claims

management system.

State of Maine can claim 75% federal reimbursement for

ongoing operations retroactive to September 1, 2010.

MIHMS was designed and implemented by Molina

Healthcare’s wholly owned subsidiary, Molina Medicaid

Solutions.

41

Centers for Medicare and Medicaid Services (CMS) awarded Molina Medicaid Solutions full

federal certification in Maine in December 2011.

Since September 1, 2010, the Maine

Integrated Health Management

Solution (MIHMS) system has been

processing approximately 1 million

claims per month and paying nearly

3,000 providers each week. |

©

2012 Molina Healthcare, Inc.

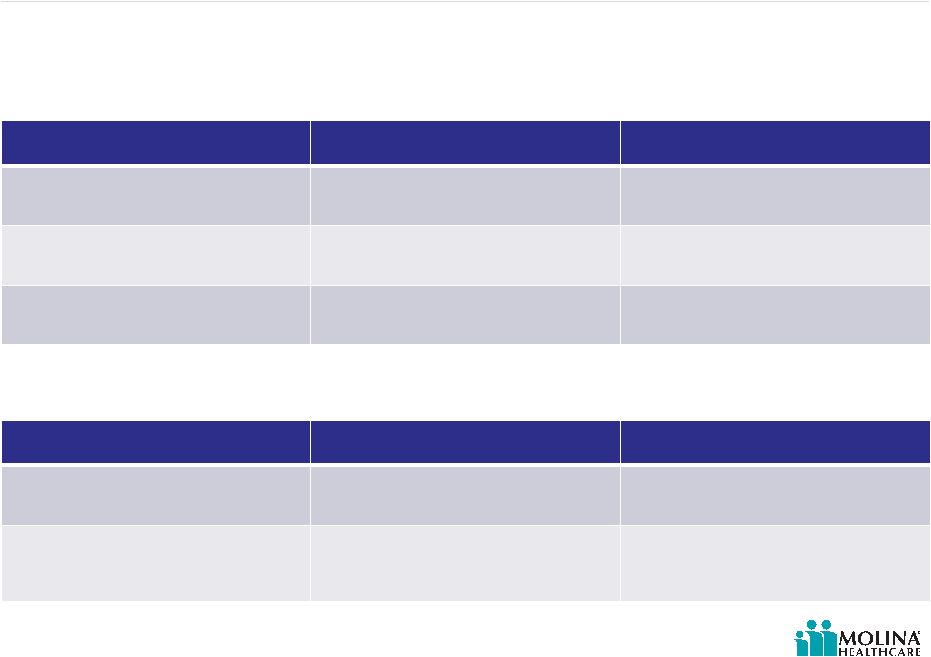

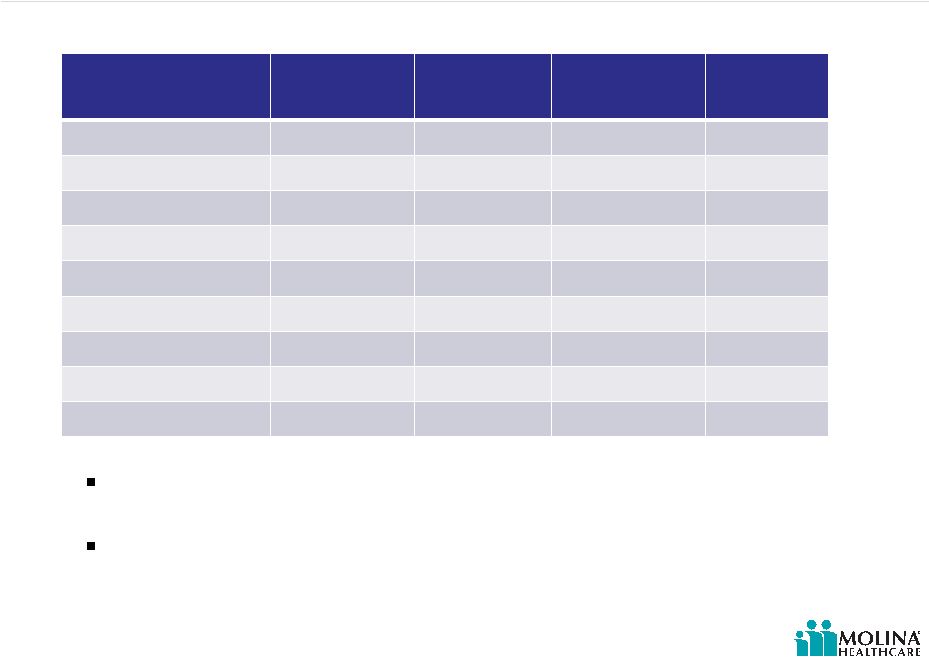

Molina Medicaid Solutions upsells

Item

Narrative

When Sold (Qtr/Yr)

Provider Incentive Payments

Incentive payments made to the

medical community

3Q 2011

Provider Enrollment Application

Enhancement of provider portal

application

3Q 2011

5010

HIPAA standards for installation

of 5010

3Q 2011

42

Item

Narrative

When Sold (Qtr/Yr)

InterQual

Application of InterQual criteria

to state operated facilities

1Q 2011

5010/ ICD-10

10th Revision of the International

Code of Diagnoses Compliance

Project

1Q 2011/3Q 2011

West Virginia

Louisiana

Our fiscal agent business has pursued various new revenue opportunities (upgrades, add-

ons, new services and products), producing $40M in additional sales in 2011.*

*This revenue will be recognized through 2014.

Please refer to the Company’s cautionary statements. |

©

2012 Molina Healthcare, Inc.

43

Q&A |

©

2012 Molina Healthcare, Inc.

Capital Adequacy

Joseph White

Chief Accounting Officer

January 26, 2012

New York, New York |

©

2012 Molina Healthcare, Inc.

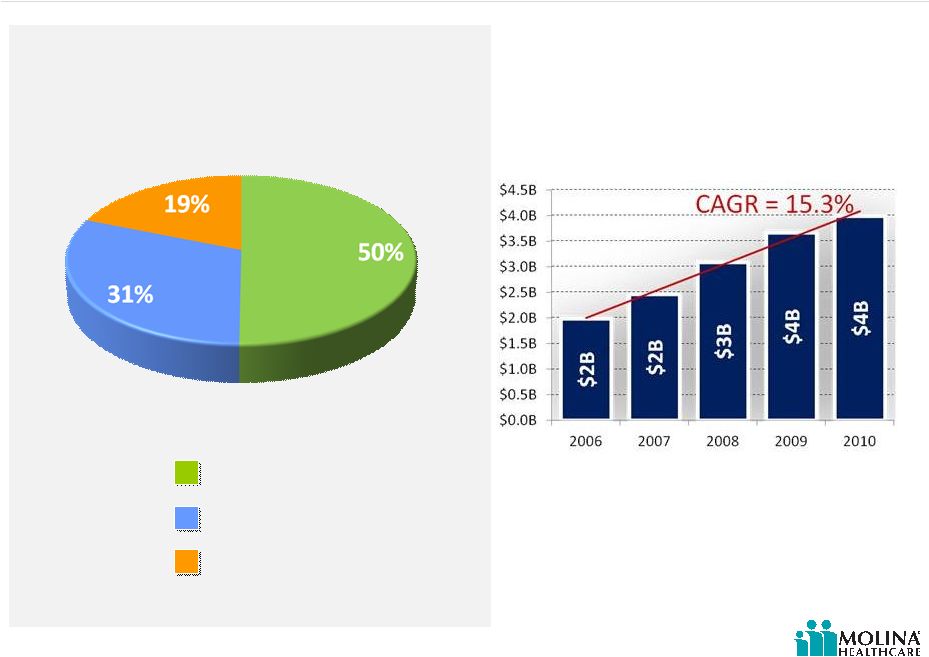

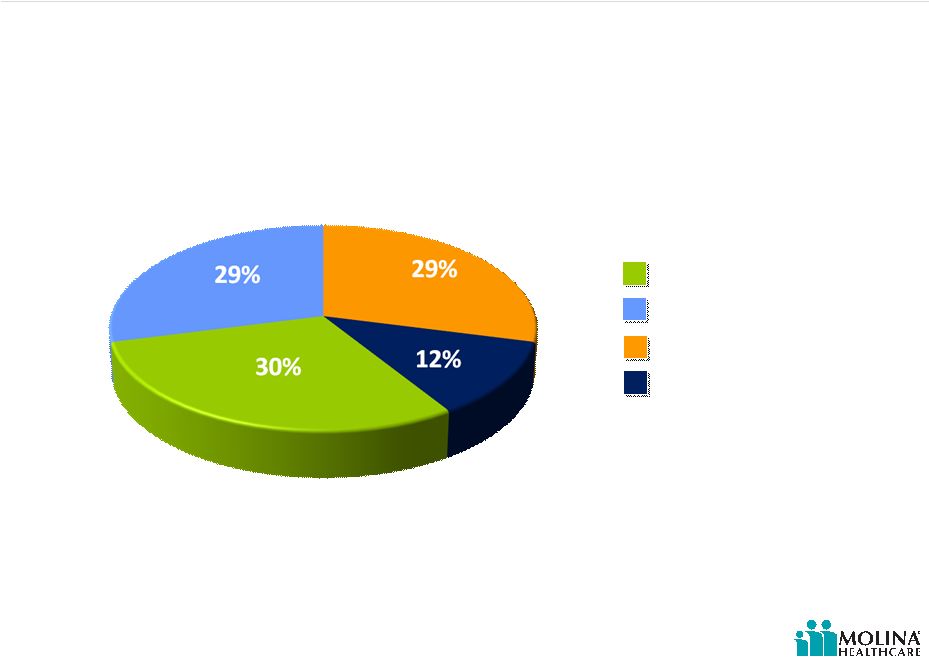

Molina earnings have funded past growth

45

Sources of Capital

2006 through 3Q2011

Common Equity

Convertible Debt

Net Income

Total Revenue

2006-2010

Source(s): SEC Filings

Please refer to the Company’s cautionary statements. |

©

2012 Molina Healthcare, Inc.

Molina has invested to grow its business

46

Capital Deployment

2006 through 3Q2011

Cash Paid for Acquisitions

Contributions to Subsidiaries

Capital Expenditures

Share Repurchases

Source(s): SEC Filings and Company Data

Please refer to the Company’s cautionary statements. |

©

2012 Molina Healthcare, Inc.

47

1997

Entered Michigan

by

acquiring Minority

Interest

1999

Acquired

controlling interest

in Michigan

Plan

2004

Entered New

Mexico by

acquiring

Health

Care Horizons the

parent company of

Cimarron Health

Plan

2004

Acquired the rights

to serve Wellness

Plan

members in

Michigan

2000

Entered

Washington

by

acquiring

Qualmed

Washington

Health Plan

2004

Acquired

members in

Washington

from Premera

Blue Cross

2005

Entered San

Diego County,

CA by acquiring

Sharp &

Universal Plan

members

2006

Acquired HCLB the

parent company

of CAPE

Health

Plan in Michigan

2007

Entered

Missouri by

acquiring

Mercy

CarePlus

2008

Entered Florida

by acquiring

Florida

NetPASS

2010

Acquired

the Health

Information

Management business

from Unisys, now

Molina Medicaid

Solutions

2010

Acquired Abri

Health Plan in

Wisconsin

2011

Acquired the

Arco Towers

in Long Beach,

CA

Capital deployment: acquisitions

Our deployment of capital has included strategic acquisitions that enable the company to

increase its market penetration in existing markets, or enter new markets and new

programs. (risk and fee based)

Please refer to the Company’s cautionary statements. |

©

2012 Molina Healthcare, Inc.

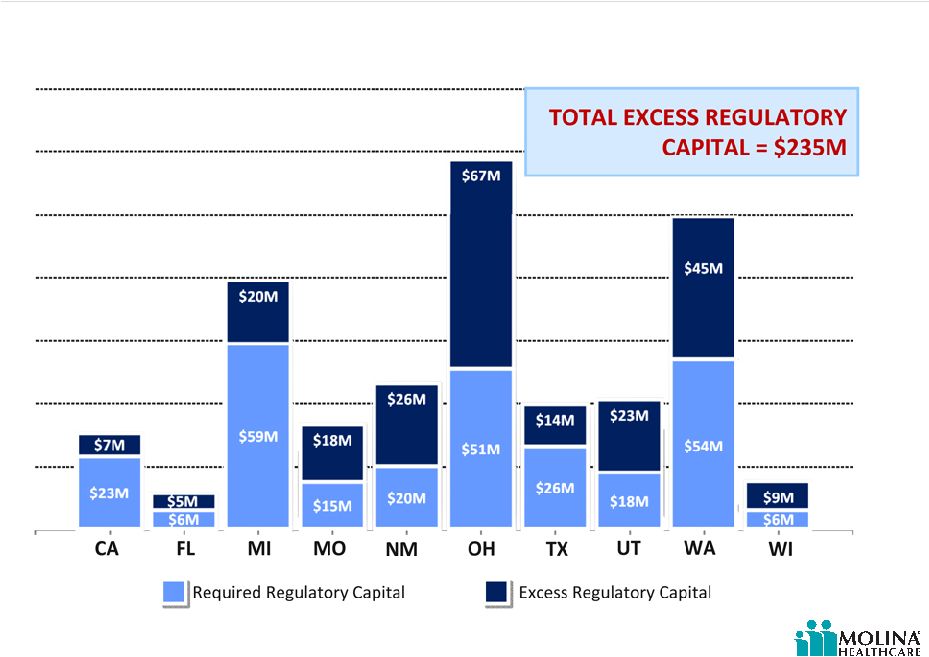

Molina health plans are well capitalized

48

*E denotes estimate.

Source(s): Company Estimates

Regulatory Capital

2011E*

Please refer to the Company’s cautionary statements. |

©

2012 Molina Healthcare, Inc.

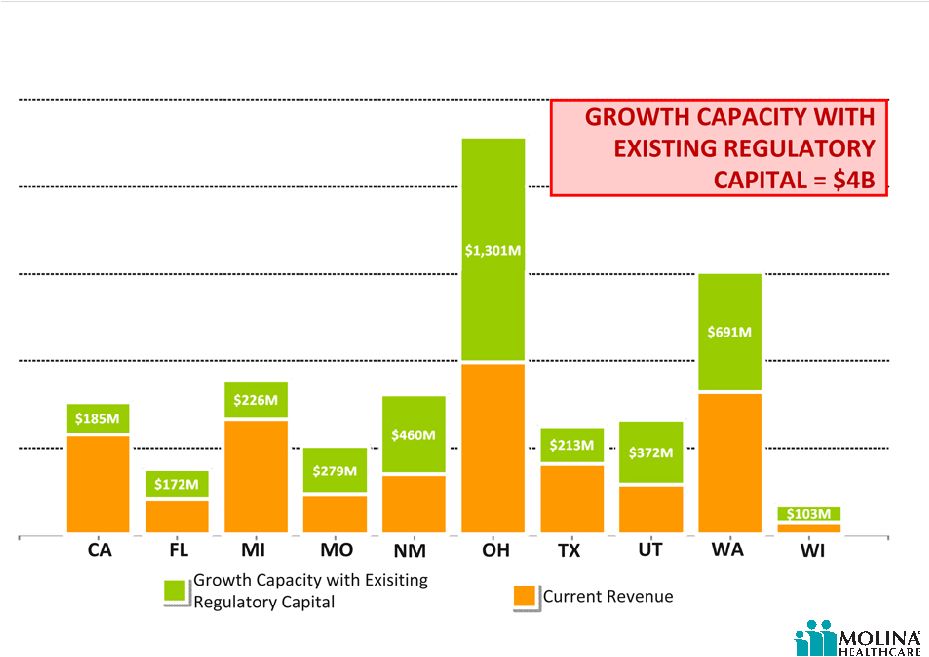

Molina health plans have capital to support growth

49

Health Plan Growth Potential without New Capital

2011E*

*E denots estimate.

Source(s): Company Estimates

Please refer to the Company’s cautionary statements. |

©

2012 Molina Healthcare, Inc.

Start-up operations need capital

Regulatory capital

Systems development and configuration

Start up costs/initial operating losses

Direct Delivery set up

Molina Medicaid Solutions development costs

50

Please refer to the Company’s cautionary statements. |

©

2012 Molina Healthcare, Inc.

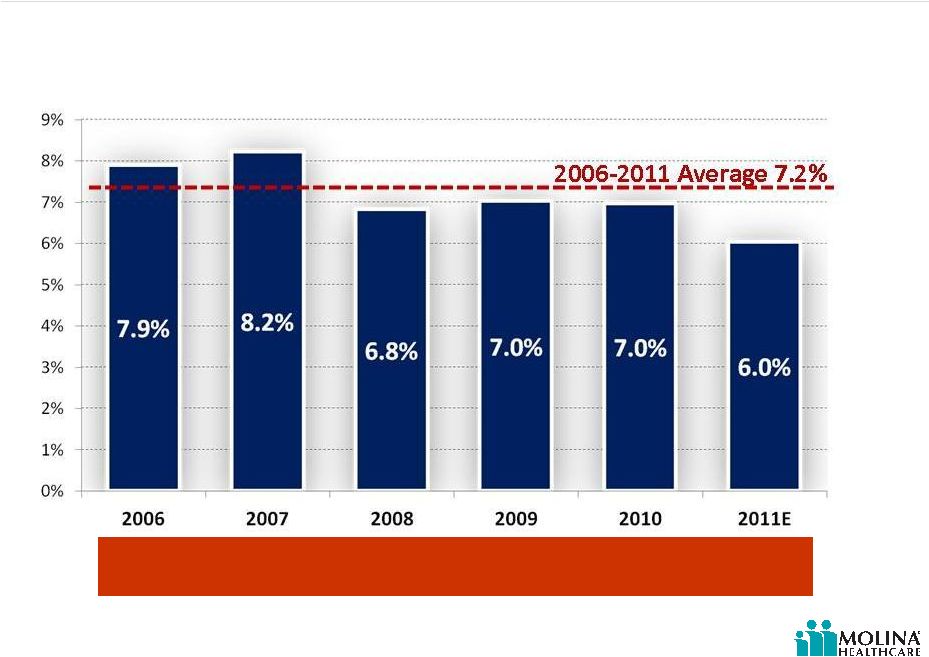

Required regulatory capital as % of revenue

51

Required Equity as % of Premium Revenue

2006-2011E*

On average our health plans need regulatory capital of approximately

7% of premium revenue.

*E denotes estimate.

Source(s): Company Data

Please refer to the Company’s cautionary statements. |

©

2012 Molina Healthcare, Inc.

Startup costs and initial operating losses

52

Molina Healthcare of Ohio

Operating Income or (Loss)

2005-3Q 2011 YTD

Source(s): NAIC Statutory Filings

“It takes time and

money to build a

profitable health plan.”

Joseph White

May 29, 2008

Molina Healthcare

Investor Day, NY

Please refer to the Company’s cautionary statements. |

©

2012 Molina Healthcare, Inc.

Other costs to start a health plan

53

Systems Development and Configuration

Approximately $2M for HMO system development and configuration

Direct Delivery set-up

On average build out cost for a typical clinic is $750K

Please refer to the Company’s cautionary statements. |

©

2012 Molina Healthcare, Inc.

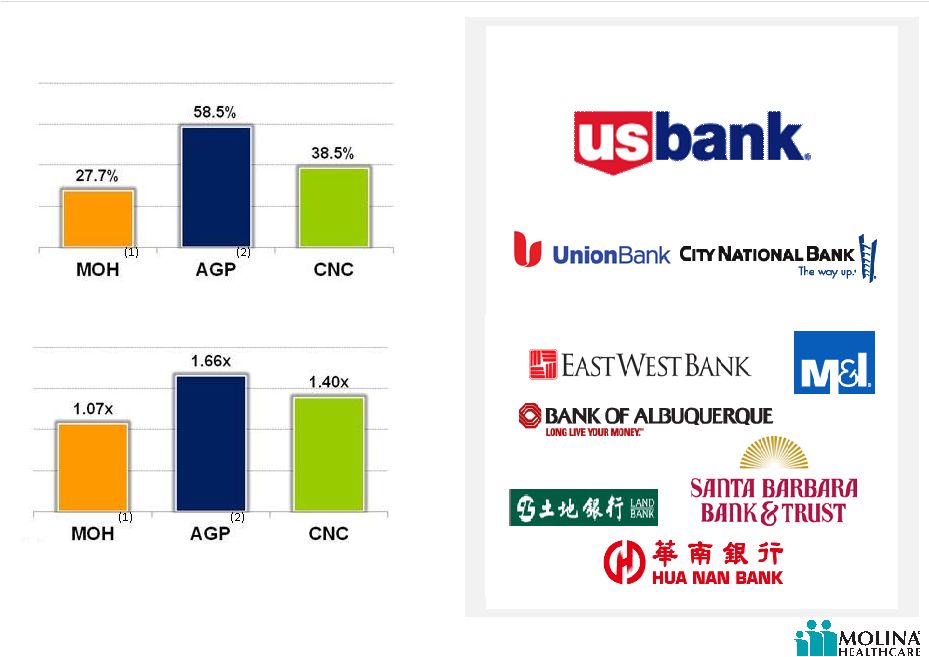

Pure Play LT Debt to Equity Ratio

Last Twelve Months as of Sept. 30, 2011

(1),(2)

Note:

(1)

MOH

Long

Term

Debt

includes

$48.6M

term

loan

issued

December

7,

2011

to

finance

the

Molina

Center

acquisition.

(2)

AGP

Long

Term

Debt

includes

$400M

Senior

Notes

issued

November

16,

2011

and

$75M

Senior

Notes

issued

January

18,

2012.

Molina $170M Credit Agreement

Pure Play Long Term Debt / EBITDA

Last Twelve Months as of Sept. 30, 2011

(1),(2)

Source(s): SEC Filings

54

Access to additional capital

Please refer to the Company’s cautionary statements. |

©

2012 Molina Healthcare, Inc.

Q&A

55 |

Financial

Outlook 2012 John Molina

Chief Financial Officer

January 26, 2012

New York, New York |

©

2012 Molina Healthcare, Inc.

Cautionary Statement

57

regarding the Company’s expected results for fiscal year 2012. All of our

forward-looking statements are based on our current expectations and assumptions. Actual results could differ

materially due to the unexpected failure of our assumptions or due to adverse developments

related to numerous risk factors, including but not limited to the following: uncertainty regarding the effect of our Washington health plan’s being named an

“apparently successful bidder” by the Health Care Authority of Washington in that state’s

recent managed care procurement;

significant budget pressures on state governments which cause them to lower rates unexpectedly

or to rescind expected rates increases, or their failure to maintain existing benefit

packages or membership eligibility thresholds or criteria; uncertainties regarding the impact of the Patient Protection and Affordable Care Act,

including its possible repeal, judicial overturning of the individual insurance mandate or

Medicaid expansion, the effect of various implementing regulations, and uncertainties

regarding the impact of other federal or state health care and insurance reform

measures;

management of our medical costs, including costs associated with unexpectedly severe or

widespread illnesses such as influenza, and rates of utilization that are consistent

with our expectations;

the success of our efforts to retain existing government contracts and to obtain new

government contracts in connection with state requests for proposals (RFPs) in both

existing and new states, and our ability to grow our revenues consistent with our

expectations; the accurate estimation of incurred but not reported medical costs across our health plans;

risks associated with the continued growth in new Medicaid and Medicare enrollees, and in dual

eligible members; retroactive adjustments to premium revenue or accounting estimates which require adjustment

based upon subsequent developments; the continuation and renewal of the government contracts of both our health plans and Molina

Medicaid Solutions and the terms under which such contracts are renewed; the timing of receipt and recognition of revenue and the amortization of expense under the

state contracts of Molina Medicaid Solutions in Maine and Idaho; government audits and reviews;

changes with respect to our provider contracts and the loss of providers;

the establishment, interpretation, and implementation of a federal or state medical cost

expenditure floor as a percentage of the premiums we receive, administrative cost and

profit ceilings, and profit sharing arrangements; the interpretation and implementation of at-risk premium rules regarding the achievement

of certain quality measures; the successful integration of our acquisitions;

approval by state regulators of dividends and distributions by our health plan subsidiaries;

changes in funding under our contracts as a result of regulatory changes, programmatic

adjustments, or other reforms; high dollar claims related to catastrophic illness;

the favorable resolution of litigation, arbitration, or administrative proceedings, and the

costs associated therewith; restrictions and covenants in our credit facility;

the availability of financing to fund and capitalize our acquisitions and start-up

activities and to meet our liquidity needs and the costs and fees associated therewith; a state’s failure to renew its federal Medicaid waiver;

an inadvertent unauthorized disclosure of protected health information by us or our business

associates; changes generally affecting the managed care or Medicaid management information systems

industries; increases in government surcharges, taxes, and assessments;

changes in general economic conditions, including unemployment rates;

and numerous other risk factors, including those identified within this slide presentation

and/or our accompanying oral remarks, and those discussed in our periodic reports and filings

with the Securities and Exchange Commission. These reports can be accessed under the investor

relations tab of our Company website or on the SEC’s website at www.sec.gov. Given

these risks and uncertainties, we can give no assurances that our forward-looking

statements will prove to be accurate, or that any other results or events projected or contemplated by

our forward-looking statements will in fact occur, and we caution investors not to place

undue reliance on these statements. All forward-looking statements in this release represent our

judgment as of January 26, 2012, and we disclaim any obligation to update any

forward-looking statements to conform the statement to actual results or changes in our expectations.

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995:

This slide presentation and our accompanying oral remarks contain “forward-looking

statements” |

©

2012 Molina Healthcare, Inc.

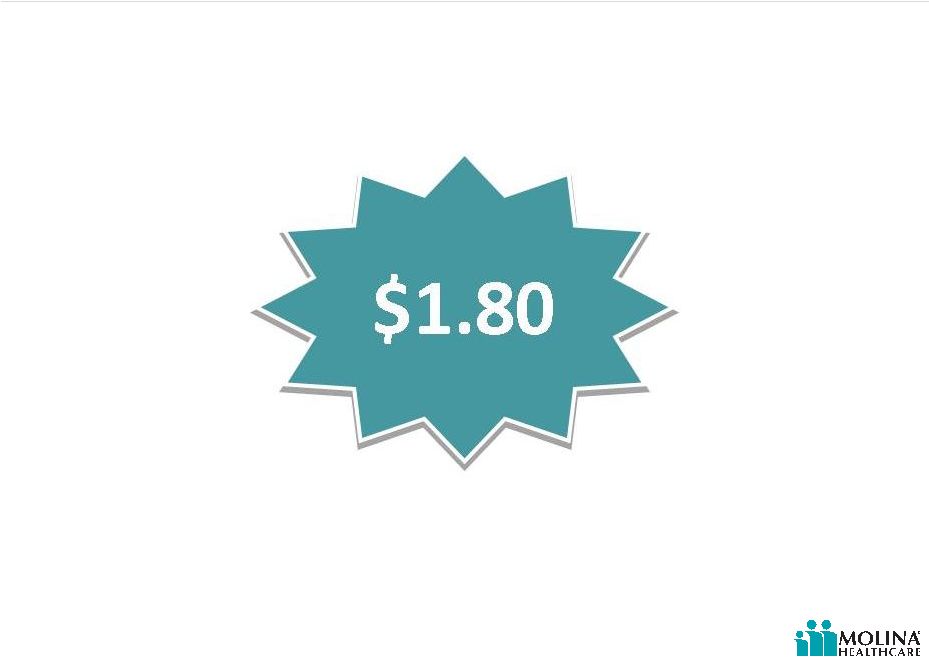

2012 EPS outlook

58

Please refer to the Company’s cautionary statements. |

©

2012 Molina Healthcare, Inc.

59

2012 EPS outlook

$1.80

Guidance Issued January 26, 2012

Re-procurements in WA & MO

Benefit carve-ins in TX and OH

TX inpatient and pharmacy

Ohio full year of pharmacy

Change in mix: CA SPDs, TX STAR+PLUS & WA ABDs

TX expansion commencing March 2012

Continuing rate pressure

Infrastructure build for 2012 and beyond

Molina Center

ICD-10

Healthcare reform

Additional clinics

Please refer to the Company’s cautionary statements. |

©

2012 Molina Healthcare, Inc.

60

Note:

“G”

denote

guidance.

Amounts

are

estimates

and

subject

to

change.

Actual

results

may

differ

materially.

See

cautionary

statement.

2012G*

Premium Revenue

Service Revenue

Investment Income

Total Revenue

Medical Care Costs

Medical Care Ratio

Service Costs

Service Revenue Ratio

G&A Expense

G&A Ratio

Premium Tax Expense

Depreciation

Amortization

Interest Expense

Income Before Tax

Net Income

Diluted EPS

Weighted Average Diluted Shares Outstanding

EBITDA

Effective Tax Rate

$5.9B

$185M

$6M

$6.1B

$5.1B

86%

$158M

85%

$476M

7.8%

$169M

$35M

$17M

$17M

$137M

$85M

$1.80

47.3M

$220M

38%

2012 guidance

Please refer to the Company’s cautionary statements. |

©

2012 Molina Healthcare, Inc.

61

MMS

Total

2012 MOH segment guidance

Health Plans

Premium Revenue

Service Revenue

Investment Income

Total Revenue

Medical Care Costs

Medical Care Ratio

Service Costs

Service Revenue Ratio

G&A Expense

G&A Ratio

Premium Tax Expense

Depreciation

Amortization

Interest Expense

Income Before Tax

Net Income

Diluted EPS

Weighted Average Diluted Shares Outstanding

EBITDA

Effective Tax Rate

$5.9B

--

$6M

$5.9B

$5.1B

86%

--

--

$471M

--

$169M

$35M

$12M

$17M

$120M

$74M

--

--

$184M

--

--

$185M

--

$185M

--

--

$158M

85%

$5M

--

--

--

$5M

--

$17M

$11M

--

--

$36M

--

$5.9B

$185M

$6M

$6.1B

$5.1B

86%

$158M

85%

$476M

7.8%

$169M

$35M

$17M

$17M

$137M

$85M

$1.80

47.3M

$220M

38%

Note:

“G”

denote

guidance.

Amounts

are

estimates

and

subject

to

change.

Actual

results

may

differ

materially.

See

cautionary

statement.

Please refer to the Company’s cautionary statements. |

©

2012 Molina Healthcare, Inc.

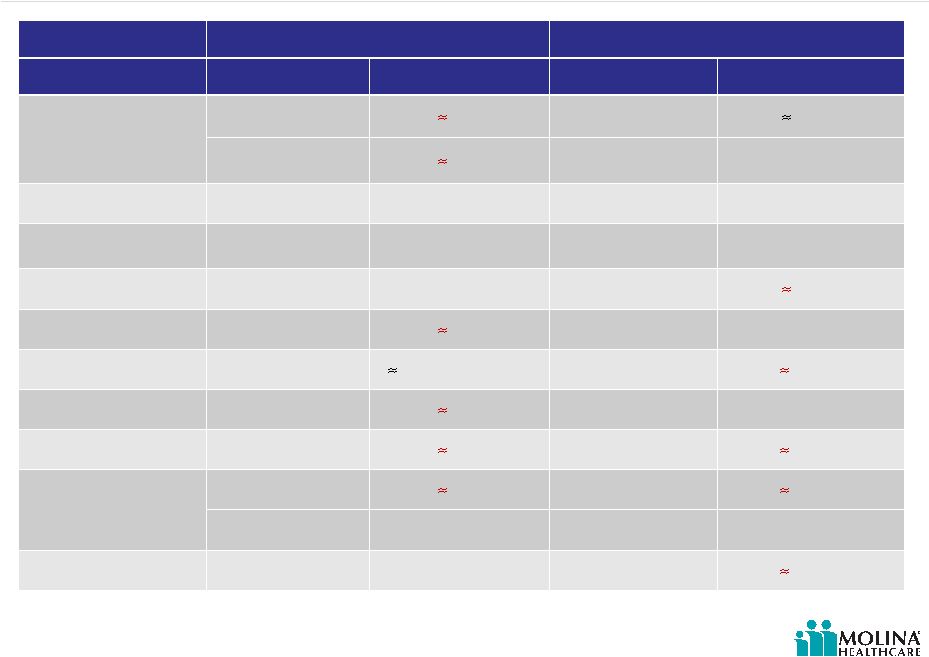

Rate change update

62

2011 CARRYOVER

2012

Health Plan

Effective Date

Revenue Change

Effective Date

Revenue Change

California

7/1/2011

(

3.5%)

1/1/2012

0.5%

(1)

10/1/2011

(

0.5%)

10/1/2012

no change

(2)

Florida

9/1/2011

˜7.5% 9/1/2012

no change

(2)

Michigan

10/1/2011

˜1.0% 10/1/2012

no change

(2)

Missouri

7/1/2011

˜5.0% 7/1/2012

(

0.5%)

(2)

New Mexico

7/1/2011

(

2.5%)

7/1/2012

no change

(2)

Ohio

10/1/2011

27.0% (Rx carve in)

1/1/2012

(

2.0%)

(1)

Texas

9/1/2011

(

2.0%)

3/1/2012

n/a

(3)

Utah

7/1/2011

(

2.0%)

7/1/2012

(

1.5%)

(2)

Washington

10/1/2011

(

0.5%)

1/1/2012

(

0.2%)

(1)

n/a

n/a

7/1/2012

n/a

(3)

Wisconsin

1/1/2011

(11.0%)

1/1/2012

(

7.5%)

(2)

Note:

(1)

Denotes known rate changes

(2)

Denotes estimated rate changes excluding new business

(3)

Rate changes not meaningful due to benefit carve ins and/or geographic population

expansion Please refer to the Company’s cautionary statements.

|

©

2012 Molina Healthcare, Inc.

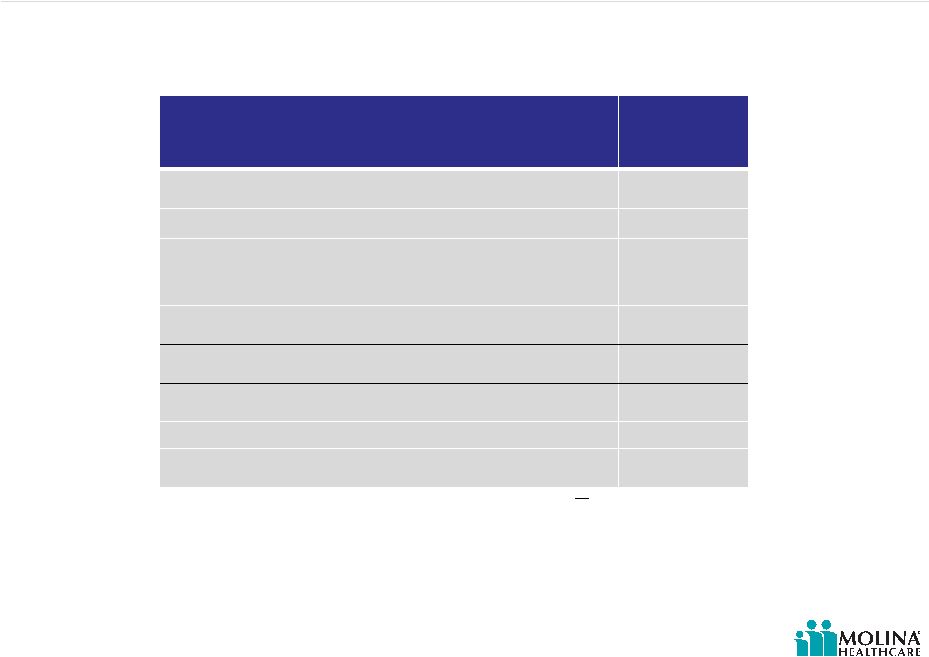

Texas expansion

63

2012

Guidance

Effective Date

3/12

MOH Expected Membership Prior to

Expansion¹

155K

MOH Expected Additional Membership

170K

Total Expected MOH Membership²

325K

MOH Expected Market Penetration² 10%

MOH Expected Incremental Revenue

$900M

1.

Denotes estimated membership at 2/29/12.

2.

Denotes

estimated

membership

at

12/31/12

.

Note:

Denotes

guidance.

Amounts

are

estimates

and

subject

to

change.

Actual

results

may

differ

materially.

See

cautionary

statements.

Please refer to the Company’s cautionary statements. |

©

2012 Molina Healthcare, Inc.

Texas March 2012 –

estimated impact of re-procurement

64

Line of Business

Dec 2011

Members

Dec 2011

Rates

Mar 2012

Members

Mar 2012

Rates

TOTAL STAR

18,000

$220

123,000

$235

TOTAL CHIP

73,000

$85

80,000

$130

TOTAL STAR PLUS

64,000

$440

100,000

$780

TOTAL

155,000

$250

303,000

$390

*Guidance assumes MCR of 90% FY 2012

Please refer to the Company’s cautionary statements. |

©

2012 Molina Healthcare, Inc.

65

Line of Business

June 2012

Members

June 2012

Rates

July 2012

Members

July 2012

Rates

TANF

327,000

$160

288,000

$150

ABD

5,000

$850

12,000

$865

CHIP

11,000

$100

9,000

$95

State Funded -

BHP

8,000

$225

6,000

$240

TOTAL

351,000

$170

315,000

$180

Premium revenue excluding Medicare, is expected to drop

approximately 10% year-over-year

Guidance assumes MCR of 86% FY 2012

Washington July 2012 –

estimated impact of re-procurement

Please refer to the Company’s cautionary statements. |

©

2012 Molina Healthcare, Inc.

What could affect our 2012 number?

66

Potential headwinds:

Premium rate decreases greater than projected

Texas cost and utilization issues

Greater loss of enrollment than projected in WA

Higher than projected ABD utilization in WA

MO RFP outcome

Revenue and cost pressures in Idaho and Maine

Please refer to the Company’s cautionary statements. |

©

2012 Molina Healthcare, Inc.

What could affect our 2012 number?

Potential tailwinds:

Rate increases in markets where we are expecting

none

Cost and utilization improvement Texas

Higher than projected enrollment in CA (ABD), TX and

WA

67

Please refer to the Company’s cautionary statements. |

©

2012 Molina Healthcare, Inc.

Where is 2013 guidance?

68

Moving parts for 2013

2012 Supreme Court Decision on individual mandate

and Medicaid expansion

2012 Presidential election

Ohio RFP (goes into effect 1/2013)

Dual eligible enrollment

1

CA opportunity: 1.1M

MI opportunity: 234K

WA opportunity: 142K

Florida expansion

Georgia RFP

Sources: 1. http://www.kff.org/medicaid/upload/8215.pdf

Please refer to the Company’s cautionary statements. |

©

2012 Molina Healthcare, Inc.

Investment highlights

Attractive sector growth prospects driven by

government policies and economic conditions

Proven flexible health care services portfolio (risk-

based, fee-based and direct delivery)

Diversified geographic exposure with significant

presence in high growth regions

Focus on government-sponsored health care

programs

Seasoned management team with strong track

record of delivering earnings growth

Over 30 years of experience

69

Please refer to the Company’s cautionary statements. |

©

2012 Molina Healthcare, Inc.

Q&A

70 |