Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OCCIDENTAL PETROLEUM CORP /DE/ | form8k-20120125.htm |

| EX-99.1 - EXHIBIT 99.1 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_1-20120125.htm |

| EX-99.5 - EXHIBIT 99.5 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_5-20120125.htm |

| EX-99.2 - EXHIBIT 99.2 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_2-20120125.htm |

| EX-99.3 - EXHIBIT 99.3 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_3-20120125.htm |

EXHIBIT 99.4

Occidental Petroleum Corporation

Fourth Quarter 2011 Earnings Conference Call

January 25, 2012

Fourth Quarter 2011 Earnings Conference Call

January 25, 2012

1

2

• Net Income - $1.6 Billion in 4Q11 vs. $1.2 Billion in 4Q10

– EPS $2.01 (diluted) vs. $1.49 in 4Q10.

• Consolidated pre-tax income from continuing

operations - $2.6 Billion in 4Q11 vs. $2.9 Billion in 3Q11

operations - $2.6 Billion in 4Q11 vs. $2.9 Billion in 3Q11

• 3Q11 EPS $2.18 (diluted after tax)

– Major items resulting in the difference between 3Q11

and 4Q11 income included:

and 4Q11 income included:

» higher oil volumes and prices, +$0.07 per share;

» lower 4Q chemical and midstream income, -$0.08 per share;

» higher equity-based compensation costs, -$0.05 per share;

» higher exploration expense, -$0.02 per share, and;

» higher 4Q operating costs, -$0.08 per share.

• 4Q11 EPS $2.02 (diluted after tax)

Fourth Quarter 2011 Earnings - Highlights

Fourth Quarter 2011 Earnings - Highlights

2

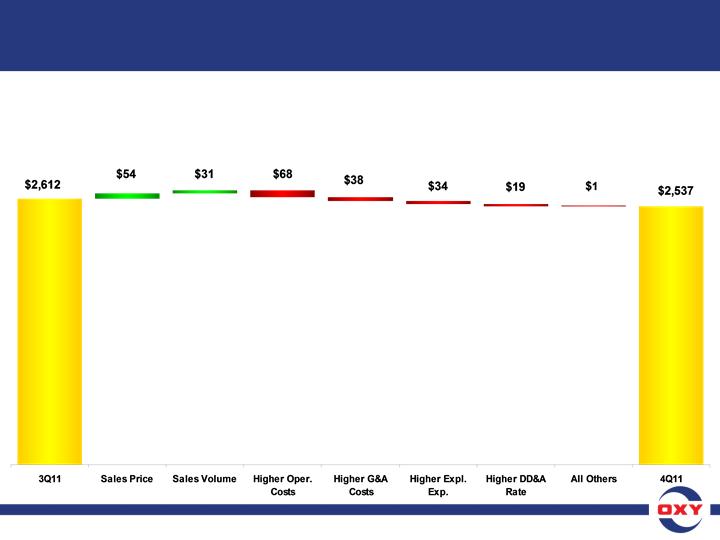

Fourth Quarter 2011 Earnings - Oil & Gas

Segment Variance Analysis - 4Q11 vs. 3Q11

Segment Variance Analysis - 4Q11 vs. 3Q11

($ in millions)

• Core Results for 4Q11 of $2.537 B vs. $2.612 B in 3Q11

– Higher oil volumes and prices, were offset by higher operating costs, higher

equity- based compensation costs, and higher exploration expense.

equity- based compensation costs, and higher exploration expense.

3

4

Fourth Quarter 2011 Earnings - Oil & Gas Segment

4Q11 3Q11

Reported Segment Earnings ($mm) $2,537 $2,612

WTI Oil Price ($/bbl) $94.06 $89.76

Brent Oil Price ($/bbl) $109.07 $112.22

NYMEX Gas Price ($/mcf) $3.68 $4.28

Oxy’s Realized Prices

Worldwide Oil ($/bbl) $99.62 $97.24

+ 2½% quarter-to-quarter

Worldwide NGLs ($/bbl) $55.25 $56.06

- 1½% quarter-to-quarter

US Natural Gas ($/mcf) $3.59 $4.23

- 15% quarter-to-quarter

4

5

4Q11 3Q11

Oil and Gas Production Volumes (mboe/d) 748 739

• Domestically, production was 449 mboe/d, representing the

highest ever domestic production volumes for the company,

compared to our guidance of 442 to 444 mboe/d.

highest ever domestic production volumes for the company,

compared to our guidance of 442 to 444 mboe/d.

• Our production rose by 13 mboe/d compared to 3Q11, with the

Permian and California contributing the bulk of the sequential

increase in our overall domestic production volumes.

Permian and California contributing the bulk of the sequential

increase in our overall domestic production volumes.

• Our better-than-expected 4Q11 domestic production reflected

the effect of the ramp up in capital spending as well as higher

levels of workover and well maintenance activity.

the effect of the ramp up in capital spending as well as higher

levels of workover and well maintenance activity.

• In addition, 4Q11 was relatively free of significant operational

disruptions, which also contributed to the better than expected

results.

disruptions, which also contributed to the better than expected

results.

Fourth Quarter 2011 Earnings - Oil & Gas Production

5

6

• Latin America volumes were 31 mboe/d.

– Colombia volumes increased slightly from 3Q11 while both periods

included pipeline interruptions caused by insurgent activity.

included pipeline interruptions caused by insurgent activity.

• In the Middle East region:

– We recorded 1 mboe/d production in Libya.

– In Iraq, we produced 9 mboe/d, an increase of 5 mboe/d from 3Q11 volumes.

The higher volume is the result of higher spending levels.

The higher volume is the result of higher spending levels.

– Yemen production was 23 mboe/d, a decrease of 5 mboe/d from 3Q11.

The decrease reflected the timing of cost recovery and the expiration of the

Masila Field contract in mid-December.

The decrease reflected the timing of cost recovery and the expiration of the

Masila Field contract in mid-December.

– In Oman, 4Q11 production was 76 mboe/d, a decrease of 3 mboe/d from 3Q11

volumes. The decrease was attributable to down time from operational issues.

volumes. The decrease was attributable to down time from operational issues.

– In Qatar, 4Q11 production was 76 mboe/d, an increase of 3 mboe/d over 3Q11.

– In Dolphin and Bahrain combined, production decreased 6 mboe/d from 3Q11.

Dolphin volumes declined 9 mboe/d because, during the quarter, it reached

annual maximum volumes allowed under its contract.

Dolphin volumes declined 9 mboe/d because, during the quarter, it reached

annual maximum volumes allowed under its contract.

• 4Q11 sales volumes were 749 mboe/d, compared to our guidance of

740 mboe/d. The improvement resulted from higher US production.

740 mboe/d. The improvement resulted from higher US production.

Fourth Quarter 2011 Earnings - Oil & Gas Production

Fourth Quarter 2011 Earnings - Oil & Gas Production

6

7

• Realized oil prices for the quarter represented 106% of

the average WTI and 91% of the average Brent price.

the average WTI and 91% of the average Brent price.

• Realized NGL prices were 59% of WTI and realized

domestic gas prices were 98% of NYMEX.

domestic gas prices were 98% of NYMEX.

• Price changes at current global prices affect our quarterly

earnings before income taxes by $38 mm for a $1.00 p/b

change in oil prices and $8 mm for a $1.00 p/b change in

NGL prices.

earnings before income taxes by $38 mm for a $1.00 p/b

change in oil prices and $8 mm for a $1.00 p/b change in

NGL prices.

• A swing of $0.50 per mm BTUs in domestic gas prices

affects quarterly pre-tax earnings by about $31 million.

affects quarterly pre-tax earnings by about $31 million.

Fourth Quarter 2011 Earnings - Oil & Gas

Segment - Realized Prices

Segment - Realized Prices

Fourth Quarter 2011 Earnings - Oil & Gas

Segment - Realized Prices

Segment - Realized Prices

7

8

• 4Q11 operating costs were about $130 mm higher

than 3Q11 as a result of higher workover and well

maintenance activity driven by our program to increase

production at these higher levels of oil prices.

than 3Q11 as a result of higher workover and well

maintenance activity driven by our program to increase

production at these higher levels of oil prices.

• Oil and gas cash production costs were $12.84 a boe

for the twelve months of 2011, compared with last year's

twelve-month costs of $10.19 a barrel.

for the twelve months of 2011, compared with last year's

twelve-month costs of $10.19 a barrel.

– The cost increase reflects higher workover and maintenance

activity mentioned earlier.

activity mentioned earlier.

• Taxes other than on income, which are directly related to

product prices, were $2.21 per boe for the twelve months

of 2011, compared to $1.83 per boe for all of 2010.

product prices, were $2.21 per boe for the twelve months

of 2011, compared to $1.83 per boe for all of 2010.

• 4Q11 exploration expense, which included the

impairment of several small leases, was $73 mm.

impairment of several small leases, was $73 mm.

Fourth Quarter 2011 Earnings - Oil & Gas

Segment - Production Costs and Taxes

Segment - Production Costs and Taxes

Fourth Quarter 2011 Earnings - Oil & Gas

Segment - Production Costs and Taxes

Segment - Production Costs and Taxes

8

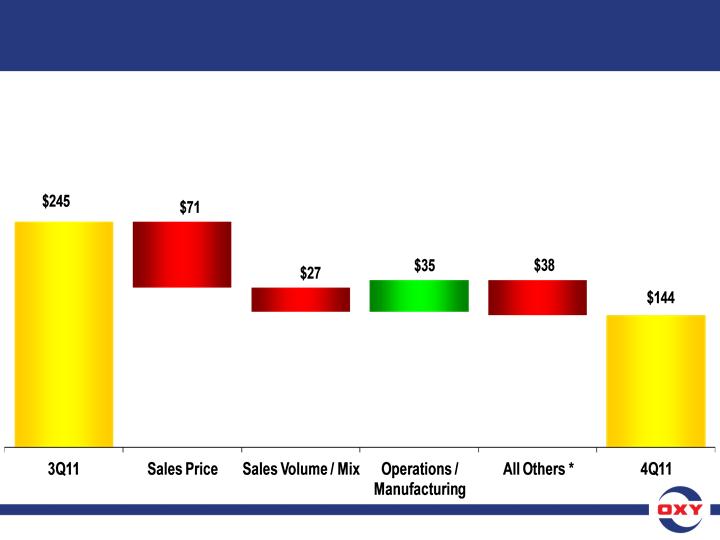

Fourth Quarter 2011 Earnings - Chemical

Segment Variance Analysis - 4Q11 vs. 3Q11

Segment Variance Analysis - 4Q11 vs. 3Q11

($ in millions)

*Power sold to the grid during Texas power shortage in 3Q11.

• Core Results for 4Q11 were $144 mm vs. $245 mm in 3Q11.

– The sequential drop in income was the result of seasonal factors.

9

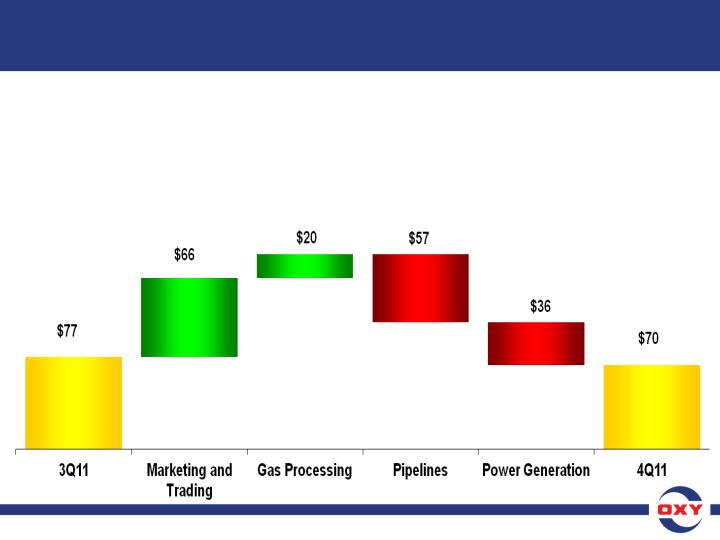

Fourth Quarter 2011 Earnings - Midstream

Segment Variance Analysis - 4Q11 vs. 3Q11

Segment Variance Analysis - 4Q11 vs. 3Q11

($ in millions)

• Core Results for 4Q11 were $70 mm vs. $77 mm in 3Q11.

10

11

• The significantly higher year-end Oxy stock price,

compared to the distressed levels at the end of 3Q11,

affected the quarterly valuation of equity-based

compensation plans reducing 4Q11 pre-tax income

of the company, compared to 3Q11, by $80 mm.

compared to the distressed levels at the end of 3Q11,

affected the quarterly valuation of equity-based

compensation plans reducing 4Q11 pre-tax income

of the company, compared to 3Q11, by $80 mm.

• The worldwide effective tax rate was 37% for 4Q11.

• Our 4Q11 US and foreign tax rates are included in

the “Investor Relations Supplemental Schedules.”

the “Investor Relations Supplemental Schedules.”

Fourth Quarter 2011 Earnings - Taxes and Other

11

12

Fourth Quarter 2011 Earnings -

Full Year 2011 Results

Full Year 2011 Results

Fourth Quarter 2011 Earnings -

Full Year 2011 Results

Full Year 2011 Results

FY2011 FY2010

• Core Income ($mm) $6,828 $4,664

• Core EPS (diluted) $8.39 $5.72

• Net Income ($mm) $6,771 $4,530

• EPS (diluted) $8.32 $5.56

• Cash flow from operations for the twelve months

of 2011 was $12.3 billion.

of 2011 was $12.3 billion.

12

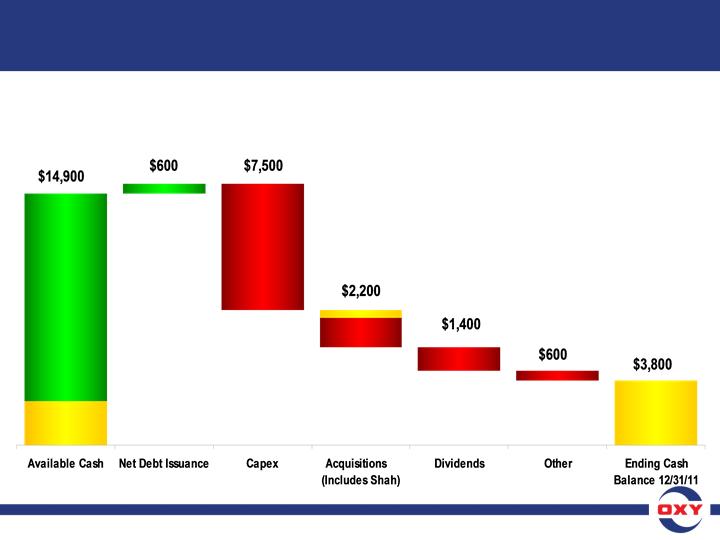

Fourth Quarter 2011 Earnings -

Full Year 2011 Cash Flow

Full Year 2011 Cash Flow

Cash Flow

From

Operations

$12,300

From

Operations

$12,300

Beginning

Cash $2,600

12/31/10

Cash $2,600

12/31/10

– Free cash flow from continuing operations after capex and dividends,

but before acquisition and debt activity, was about $3.4 billion.

but before acquisition and debt activity, was about $3.4 billion.

Shah - $500

($ in millions)

Note: See attached GAAP reconciliation.

13

14

One year cash flow 12/31/11

Total debt,

net of cash

at 12/31/10 $2.5 B

Total debt,

net of cash

at 12/31/11 $2.1 B

Net cash generated $0.4 B

Cash returned

to shareholders

• Dividends $1.4 B

• Share buybacks $275 mm

Fourth Quarter 2011 Earnings -

One and Two Year Simplified Cash Flow

One and Two Year Simplified Cash Flow

Two year cash flow 12/31/11

Total debt,

net of cash

at 12/31/09 $1.6 B

Total debt,

net of cash

at 12/31/11 $2.1 B

Net cash used $0.5 B

Cash outlays

• Capital $11.5 B

• Acquisitions $6.9 B

Cash returned to shareholders

• Dividends &

• share buybacks $2.9 B

14

15

Fourth Quarter 2011 Earnings -

2011 Capital Expenditures

2011 Capital Expenditures

Fourth Quarter 2011 Earnings -

2011 Capital Expenditures

2011 Capital Expenditures

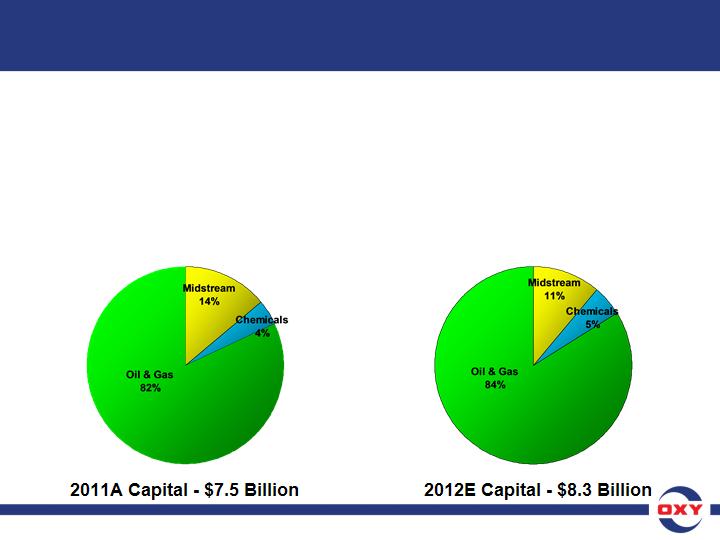

• Capital expenditures for 2011 were approximately $7.5

billion, of which about $2.6 billion was incurred in 4Q11.

billion, of which about $2.6 billion was incurred in 4Q11.

• Higher 4Q11 capital partially reflected the gradual

ramp-up of our program during 2011.

ramp-up of our program during 2011.

– The increases were mostly at Williston domestically,

and Iraq, Oman and Qatar internationally.

and Iraq, Oman and Qatar internationally.

– 4Q11 capital also included spending for several midstream

projects, such as the Elk Hills gas processing plant, which will

drop significantly during 1H12 as these projects are completed.

projects, such as the Elk Hills gas processing plant, which will

drop significantly during 1H12 as these projects are completed.

• Total 2011 capital expenditures by segment were 82%

in oil and gas, 14% in midstream and the remainder

in chemicals.

in oil and gas, 14% in midstream and the remainder

in chemicals.

15

16

Fourth Quarter 2011 Earnings -

Net Acquisition Expenditures

Net Acquisition Expenditures

Fourth Quarter 2011 Earnings -

Net Acquisition Expenditures

Net Acquisition Expenditures

• Our net acquisition expenditures in the twelve months

were $2.2 billion, which are net of proceeds from the

sale of our Argentina operations.

were $2.2 billion, which are net of proceeds from the

sale of our Argentina operations.

• The acquisitions included the South Texas purchase,

properties in California, the Permian and Williston, and a

payment in connection with the signing of the Al Hosn

Gas project in Abu Dhabi, which is the gas development

of the Shah field.

properties in California, the Permian and Williston, and a

payment in connection with the signing of the Al Hosn

Gas project in Abu Dhabi, which is the gas development

of the Shah field.

– This payment was for Oxy’s share of development expenditures

incurred by the project prior to the date the final agreement was

signed.

incurred by the project prior to the date the final agreement was

signed.

16

17

Fourth Quarter 2011 Earnings -

Shares Outstanding, Debt and ROE & ROCE

Shares Outstanding, Debt and ROE & ROCE

Shares Outstanding (mm) 2011 12/31/11

Weighted Average Basic 812.1

Weighted Average Diluted 812.9

Basic Shares Outstanding 810.5

Diluted Shares Outstanding 811.3

12/31/11 12/31/10

Debt/Capital 13% 14%

• Our return on equity for 2011 was 19.3% and the

return on capital employed was 17.2%.

return on capital employed was 17.2%.

17

18

Fourth Quarter 2011 Earnings -

DD&A, Oil and Gas Operating Costs

DD&A, Oil and Gas Operating Costs

Fourth Quarter 2011 Earnings -

DD&A, Oil and Gas Operating Costs

DD&A, Oil and Gas Operating Costs

• Oil and Gas DD&A expense was $11.48 per BOE for 2011.

• We expect the Oil and Gas segment DD&A rate to be

about $14 per barrel in 2012.

about $14 per barrel in 2012.

• The total Chemical and Midstream DD&A expense

is expected to be about $650 million for 2012.

is expected to be about $650 million for 2012.

• We expect operating costs per barrel to be about

$13.75 in 2012.

$13.75 in 2012.

– The 2012 expected costs reflect higher levels of workovers

and well maintenance activity.

and well maintenance activity.

– However, significant and substantial product price changes,

and changes in activity levels and inflation resulting from

product prices, may affect this cost estimate during the

course of the year.

and changes in activity levels and inflation resulting from

product prices, may affect this cost estimate during the

course of the year.

18

19

Oxy’s Three Main Performance Criteria -

Production Growth, Strong Returns & Dividend Growth

Production Growth, Strong Returns & Dividend Growth

• We finished a strong year in terms of the three main

performance criteria outlined last quarter.

performance criteria outlined last quarter.

• Our domestic oil and gas production grew by about 12%

for 2011 to 428 mboe/d.

for 2011 to 428 mboe/d.

– 4Q11 domestic production of 449 mboe/d was the highest U.S. total

production volume in Oxy’s history, reflecting the highest ever

quarterly volume for liquids of 310 mb/d and the second highest

quarterly volume for gas.

production volume in Oxy’s history, reflecting the highest ever

quarterly volume for liquids of 310 mb/d and the second highest

quarterly volume for gas.

– Total company production increased about 4% for the year.

• Our chemical business delivered exceptional results

for the year, achieving one of their highest earnings

levels ever.

for the year, achieving one of their highest earnings

levels ever.

• Our return on equity was 19% for the year and return on

capital was 17%.

capital was 17%.

19

20

Oxy’s Three Main Performance Criteria -

Production Growth, Strong Returns & Dividend Growth

Production Growth, Strong Returns & Dividend Growth

• We increased our annual dividends by $0.32 or by 21%,

to $1.84 per share.

to $1.84 per share.

• We expect to announce a further dividend increase after

the meeting of our Board of Directors in the second week

of February.

the meeting of our Board of Directors in the second week

of February.

20

21

• We have ample legitimate opportunities in our domestic

oil and gas business where we could deploy capital.

oil and gas business where we could deploy capital.

• We have tried to manage the program to a level that is

realistic at current price levels, and as a result, have

deferred some projects that otherwise would have

met our hurdle rates.

realistic at current price levels, and as a result, have

deferred some projects that otherwise would have

met our hurdle rates.

• We continue to have substantial inventory of high return

projects going forward to fulfill our growth objectives.

projects going forward to fulfill our growth objectives.

2012 Capital Program

2012 Capital Program

21

• We are increasing our capital program approximately 10% in 2012

to $8.3 billion from the $7.5 billion we spent in 2011.

to $8.3 billion from the $7.5 billion we spent in 2011.

• About $500 million of this increase will be in the US, mainly in the

Permian basin, and the rest in international projects including the

Al Hosn sour gas project and Iraq.

Permian basin, and the rest in international projects including the

Al Hosn sour gas project and Iraq.

• We will review our capital program around mid-year and adjust as

conditions dictate.

conditions dictate.

Capital Program - 2012E vs. 2011 Actual

Capital Program - 2012E vs. 2011 Actual

22

2012 Capital Program -

2012 Capital Program -

Domestic Oil & Gas and Related Midstream Projects

Domestic Oil & Gas and Related Midstream Projects

• We currently expect the rig count to

remain constant in 1H12 at 31, the same

as what we were running at YE-2011;

remain constant in 1H12 at 31, the same

as what we were running at YE-2011;

• We are seeing improvement with

respect to permitting issues in the state;

respect to permitting issues in the state;

• We have received approved field rules

and new permits for both injection wells

and drilling locations;

and new permits for both injection wells

and drilling locations;

• The regulatory agency is responsive

and committed to working through the

backlog of permits;

and committed to working through the

backlog of permits;

• We expect to maintain our capital

program at current levels for about

1H12, which will enable us to continue

to grow our production volumes;

program at current levels for about

1H12, which will enable us to continue

to grow our production volumes;

• We will reassess our capital program

when the number of permits in hand

allows it.

when the number of permits in hand

allows it.

• In domestic oil gas and related

midstream projects, development

capital will be about 55% of our

total program.

midstream projects, development

capital will be about 55% of our

total program.

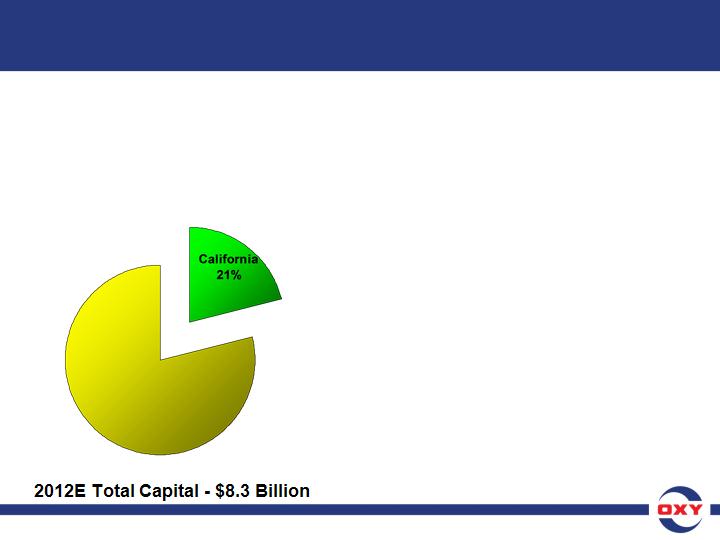

• In CA, we expect to spend about

21% of our total capital program.

21% of our total capital program.

23

2012E Total Capital - $8.3 Billion

2012 Capital Program -

2012 Capital Program -

Domestic Oil & Gas and Related Midstream Projects

Domestic Oil & Gas and Related Midstream Projects

• Our rig count at year-end 2011

was 23;

was 23;

• We expect our rig count to ramp up

during the year to around 27 rigs by

year end;

during the year to around 27 rigs by

year end;

• Our CO2 flood capital should remain

comparable to the 2011 levels;

comparable to the 2011 levels;

• In our non-CO2 operations we are

seeing additional opportunities for

good return projects;

seeing additional opportunities for

good return projects;

• As a result, we have stepped up

their development program and 2012

capital will be about 75% higher than

the 2011 levels.

their development program and 2012

capital will be about 75% higher than

the 2011 levels.

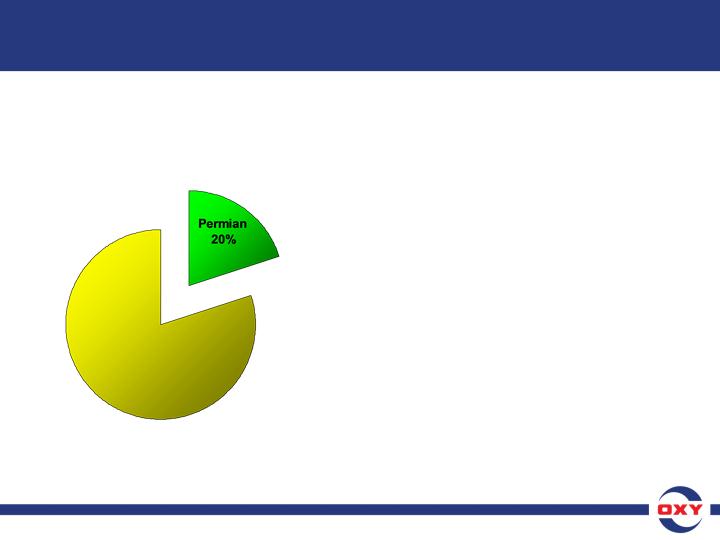

• In the Permian operations, we

expect to spend about 20% of

our total capital.

expect to spend about 20% of

our total capital.

24

2012E Total Capital - $8.3 Billion

2012 Capital Program -

2012 Capital Program -

Domestic Oil & Gas and Related Midstream Projects

Domestic Oil & Gas and Related Midstream Projects

• In the Midcontinent and other

operations, we expect to spend

around 14% of our total capital

program.

operations, we expect to spend

around 14% of our total capital

program.

25

2012 Capital Program -

2012 Capital Program -

• Total international development

capital will be about 30% of the

total company capital program.

capital will be about 30% of the

total company capital program.

• Exploration capital should increase

about 10% over the 2011 spending

levels and represent 6% of the total

capital program.

about 10% over the 2011 spending

levels and represent 6% of the total

capital program.

26

27

• As we look ahead to 2012, we expect oil and gas

production to be as follows:

production to be as follows:

– In 1H12, we expect our domestic production to grow 3 to 4 mboe/d

each month from the current quarterly average of 449 mboe/d,

which would correspond to a 6 to 8 mboe/d increase per quarter.

each month from the current quarterly average of 449 mboe/d,

which would correspond to a 6 to 8 mboe/d increase per quarter.

– 4Q11 was relatively free of significant operational disruptions

resulting in better than expected domestic production. A more

typical experience with respect to such issues could moderate the

growth somewhat in 1Q12.

resulting in better than expected domestic production. A more

typical experience with respect to such issues could moderate the

growth somewhat in 1Q12.

– If the production growth rate continued at a comparable pace in

2H12, our year-over-year average domestic production growth

would be between 8 and 10% in 2012.

2H12, our year-over-year average domestic production growth

would be between 8 and 10% in 2012.

• Internationally,

– Colombia production should be about flat for the year compared

to 2011. In 1Q12, volumes should be about 3 mboe/d higher

than 4Q11, although insurgent activity has picked up recently.

to 2011. In 1Q12, volumes should be about 3 mboe/d higher

than 4Q11, although insurgent activity has picked up recently.

Fourth Quarter 2011 Earnings -

Oil and Gas - 2012 Production Outlook

Oil and Gas - 2012 Production Outlook

27

28

• The Middle East region production is expected to be as

follows for 1H12:

follows for 1H12:

– Production has resumed in our operations in Libya, and at this point, we

expect about 5 mboe/d production, with further growth to come later in

the year. At this point we reasonably expect

that total year Libya production will be about half the level that existed

prior to the cessation of operations.

expect about 5 mboe/d production, with further growth to come later in

the year. At this point we reasonably expect

that total year Libya production will be about half the level that existed

prior to the cessation of operations.

– In Iraq, as I discussed previously, production levels depend on capital

spending levels. We are still unable to reliably predict the timing of

spending levels, but we expect production to be similar to the past

quarter.

spending levels. We are still unable to reliably predict the timing of

spending levels, but we expect production to be similar to the past

quarter.

– In Yemen, as we previously disclosed, our Masila block contract expired

in December 2011. Our share of the production from Masila was about 11

mboe/d for the full year. Our remaining operations in Yemen typically

have higher volumes early in the year due to the timing of cost recovery

each year, which will partially offset the loss of Masila barrels in 1H12.

As a result, we expect our total Yemen production to drop slightly from

4Q11 levels in 1H12.

in December 2011. Our share of the production from Masila was about 11

mboe/d for the full year. Our remaining operations in Yemen typically

have higher volumes early in the year due to the timing of cost recovery

each year, which will partially offset the loss of Masila barrels in 1H12.

As a result, we expect our total Yemen production to drop slightly from

4Q11 levels in 1H12.

– In the remainder of the Middle East, we expect production to be

comparable to 4Q11 volumes.

comparable to 4Q11 volumes.

Fourth Quarter 2011 Earnings -

Oil and Gas - 2012 Production Outlook

Oil and Gas - 2012 Production Outlook

28

29

• At current prices, we expect total 1Q12 sales volumes to

be comparable to 4Q11 volumes, depending on the

scheduling of liftings.

be comparable to 4Q11 volumes, depending on the

scheduling of liftings.

• A $5.00 change in global oil prices would impact our PSC

daily volumes by about 3 mboe/d.

daily volumes by about 3 mboe/d.

• We expect exploration expense to be about $100 mm for

seismic and drilling for our exploration programs in

1Q12.

seismic and drilling for our exploration programs in

1Q12.

Fourth Quarter 2011 Earnings -

1Q12 Outlook - Oil and Gas

1Q12 Outlook - Oil and Gas

29

30

• The chemical segment 1Q12 earnings are expected to

be about $165 mm with seasonal demand improvement

expected in the second and third quarters.

be about $165 mm with seasonal demand improvement

expected in the second and third quarters.

– We expect that lower natural gas prices and the continuing

improvement in the global economy will have a positive impact

on our chemical business margins, which is expected to be

offset partially by higher ethylene prices.

improvement in the global economy will have a positive impact

on our chemical business margins, which is expected to be

offset partially by higher ethylene prices.

• We expect our combined worldwide tax rate in 1Q12 to

increase to about 40%.

increase to about 40%.

– The increase from 2011 reflects a higher proportional mix of

international income with higher tax rates, in particular from

Libya.

international income with higher tax rates, in particular from

Libya.

Fourth Quarter 2011 Earnings -

1Q12 Outlook - Chemicals & Taxes

1Q12 Outlook - Chemicals & Taxes

30

31

Fourth Quarter 2011 Earnings - Summary

Fourth Quarter 2011 Earnings - Summary

• To summarize: We closed out 2011 on a solid note, with

record high domestic oil and gas production in 4Q11,

which was also ahead of our guidance.

record high domestic oil and gas production in 4Q11,

which was also ahead of our guidance.

• We continued to generate strong financial returns well

above our cost of capital.

above our cost of capital.

• We enter this year raising our capital program by about

10% vs. last year in order to prudently pursue our

substantial inventory of high return growth projects.

10% vs. last year in order to prudently pursue our

substantial inventory of high return growth projects.

• The business continues to grow and generate free cash

flow after capital, which should allow us to consistently

grow the dividend at an attractive rate, further boosting

the total return to our shareholders.

flow after capital, which should allow us to consistently

grow the dividend at an attractive rate, further boosting

the total return to our shareholders.

31

32

32

|

Occidental Petroleum Corporation

|

||

|

Free Cash Flow

|

||

|

Reconciliation to Generally Accepted Accounting Principles (GAAP)

|

||

|

($ Millions)

|

||

|

Twelve Months

|

||

|

2011

|

||

|

Consolidated Statement of Cash Flows

|

||

|

Cash flow from operating activities

|

12,281

|

|

|

Cash flow from investing activities

|

(9,903

|

)

|

|

Cash flow from financing activities

|

(1,175

|

)

|

|

Change in cash

|

1,203

|

|

|

Free Cash Flow

|

||

|

Cash flow from operating activities - continuing operations

|

12,306

|

|

|

Capital spending

|

(7,518

|

)

|

|

Free cash flow before dividends

|

4,788

|

|

|

Dividends

|

(1,436

|

)

|

|

Free cash flow after dividends

|

3,352

|

|

|

Occidental Petroleum Corporation

|

|||||

|

Return on Capital Employed (ROCE)

|

|||||

|

Reconciliation to Generally Accepted Accounting Principles (GAAP)

|

|||||

|

2010

|

2011

|

||||

|

RETURN ON CAPITAL EMPLOYED (%)

|

13.2

|

17.2

|

|||

|

GAAP measure - net income attributable

|

4,530

|

6,771

|

|||

|

to common stock

|

|||||

|

Interest expense

|

93

|

284

|

|||

|

Tax effect of interest expense

|

(33

|

)

|

(99

|

)

|

|

|

Earnings before tax-effected interest expense

|

4,590

|

6,956

|

|||

|

GAAP stockholders' equity

|

32,484

|

37,620

|

|||

|

Debt

|

5,111

|

5,871

|

|||

|

Total capital employed

|

37,595

|

43,491

|

|||

|

ROCE

|

13.2

|

17.2

|

|||