Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EXELON GENERATION CO LLC | d287105d8k.htm |

| EX-99.1 - PRESS RELEASE AND EARNINGS RELEASE ATTACHMENTS - EXELON GENERATION CO LLC | d287105dex991.htm |

Earnings Conference Call

4

th

Quarter 2011

January 25, 2012

Exhibit 99.2 |

Cautionary Statements Regarding

Forward-Looking Information

2

Except for the historical information contained herein, certain of the matters discussed in this

communication constitute “forward- looking statements” within the meaning of the

Securities Act of 1933 and the Securities Exchange Act of 1934, both as amended by the Private

Securities Litigation Reform Act of 1995. Words such as “may,” “will,” “anticipate,” “estimate,” “expect,” “project,” “intend,”

“plan,” “believe,” “target,” “forecast,” and words and terms

of similar substance used in connection with any discussion of future plans, actions, or events

identify forward-looking statements. These forward-looking statements include, but are not limited to, statements

regarding benefits of the proposed merger of Exelon Corporation (Exelon) and Constellation Energy

Group, Inc. (Constellation), integration plans and expected synergies, the expected timing of

completion of the transaction, anticipated future financial and operating performance and

results, including estimates for growth. These statements are based on the current expectations of

management of Exelon and Constellation, as applicable. There are a number of risks and uncertainties

that could cause actual results to differ materially from the forward-looking statements

included in this communication regarding the proposed merger. For example, (1) the companies

may be unable to obtain regulatory approvals required for the merger, or required regulatory approvals may delay

the merger or result in the imposition of conditions that could have a material adverse effect on the

combined company or cause the companies to abandon the merger; (2) conditions to the closing of

the merger may not be satisfied; (3) an unsolicited offer of another company to acquire assets

or capital stock of Exelon or Constellation could interfere with the merger; (4) problems may arise in

successfully integrating the businesses of the companies, which may result in the combined company not

operating as effectively and efficiently as expected; (5) the combined company may be unable to

achieve cost-cutting synergies or it may take longer than expected to achieve those

synergies; (6) the merger may involve unexpected costs, unexpected liabilities or unexpected delays, or the

effects of purchase accounting may be different from the companies’ expectations; (7) the credit

ratings of the combined company or its subsidiaries may be different from what the companies

expect; (8) the businesses of the companies may suffer as a result of uncertainty surrounding

the merger; (9) the companies may not realize the values expected to be obtained for properties expected or

required to be divested; (10) the industry may be subject to future regulatory or legislative actions

that could adversely affect the companies; and (11) the companies may be adversely affected by

other economic, business, and/or competitive factors. Other unknown or unpredictable factors

could also have material adverse effects on future results, performance or achievements of Exelon,

Constellation or the combined company. |

Cautionary Statements Regarding

Forward-Looking Information (Continued)

3

Discussions of some of these other important factors and assumptions are contained in Exelon’s

and Constellation’s respective filings with the Securities and Exchange Commission (SEC),

and available at the SEC’s website at www.sec.gov, including: (1) Exelon’s 2010

Annual Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Management’s Discussion and Analysis of

Financial Condition and Results of Operations and (c) ITEM 8. Financial Statements and Supplementary

Data: Note 18; (2) Exelon’s Quarterly Report on Form 10-Q for the quarterly

period ended September 30, 2011 in (a) Part II, Other Information, ITEM 1A. Risk Factors, (b)

Part 1, Financial Information, ITEM 2. Management’s Discussion and Analysis of Financial Condition and Results of

Operations and (c) Part I, Financial Information, ITEM 1. Financial Statements: Note 13; (3)

Constellation’s 2010 Annual Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM

7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

and (c) ITEM 8. Financial Statements and Supplementary Data: Note 12; and (4) Constellation’s Quarterly Report on

Form 10-Q for the quarterly period ended September 30, 2011 in (a) Part II, Other Information,

ITEM 1A. Risk Factors and ITEM 5. Other Information, (b) Part I, Financial Information, ITEM 2.

Management’s Discussion and Analysis of Financial Condition and Results of Operations and

(c) Part I, Financial Information, ITEM 1. Financial Statements: Notes to Consolidated Financial

Statements, Commitments and Contingencies. These risks, as well as other risks associated with the

proposed merger, are more fully discussed in the definitive joint proxy statement/prospectus

included in the Registration Statement on Form S-4 that Exelon filed with the SEC and that

the SEC declared effective on October 11, 2011 in connection with the proposed merger. In light of these

risks, uncertainties, assumptions and factors, the forward-looking events discussed in this

communication may not occur. Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of this communication. Neither

Exelon nor Constellation undertake any obligation to publicly release any revision to its forward-looking

statements to reflect events or circumstances after the date of this communication.

In connection with the proposed merger between Exelon and Constellation, Exelon filed with the SEC a

Registration Statement on Form S-4 that included the definitive joint proxy

statement/prospectus. The Registration Statement was declared effective by the SEC on October

11, 2011. Exelon and Constellation mailed the definitive joint proxy statement/prospectus to their respective security

holders on or about October 12, 2011. WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE DEFINITIVE

JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, BECAUSE

THEY CONTAIN IMPORTANT INFORMATION about Exelon, Constellation and the proposed merger.

Investors and security holders may obtain copies of all documents filed with the SEC free of

charge at the SEC's website, www.sec.gov. In addition, a copy of the definitive joint proxy

statement/prospectus may be obtained free of charge from Exelon Corporation, Investor Relations, 10 South

Dearborn Street, P.O. Box 805398, Chicago, Illinois 60680-5398, or from Constellation Energy

Group, Inc., Investor Relations, 100 Constellation Way, Suite 600C, Baltimore, MD 21202. Additional

Information

and

Where

to

Find

it |

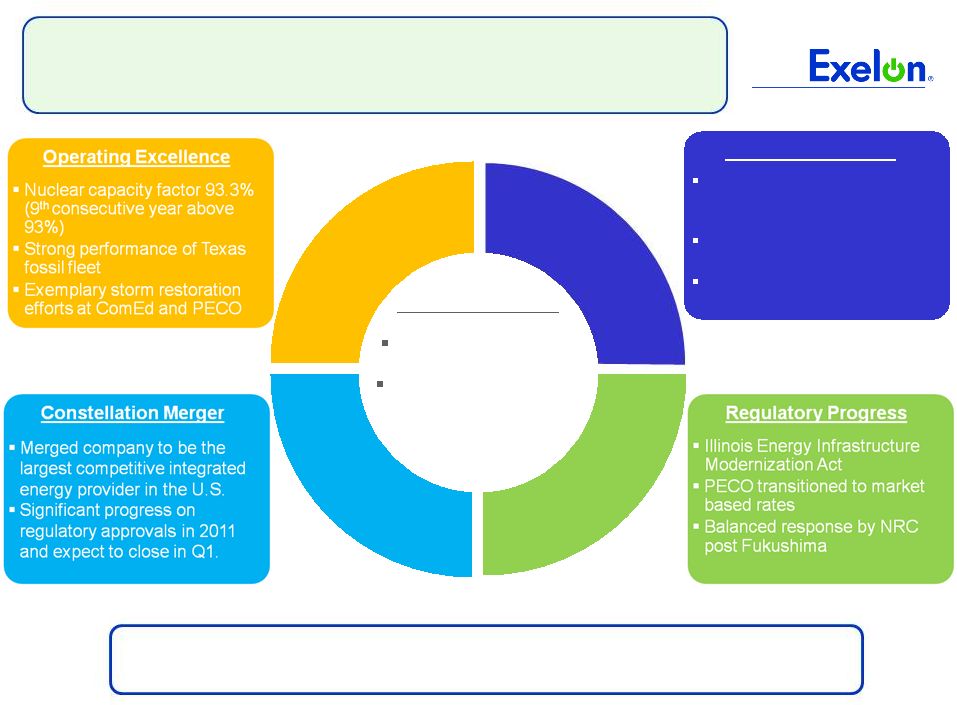

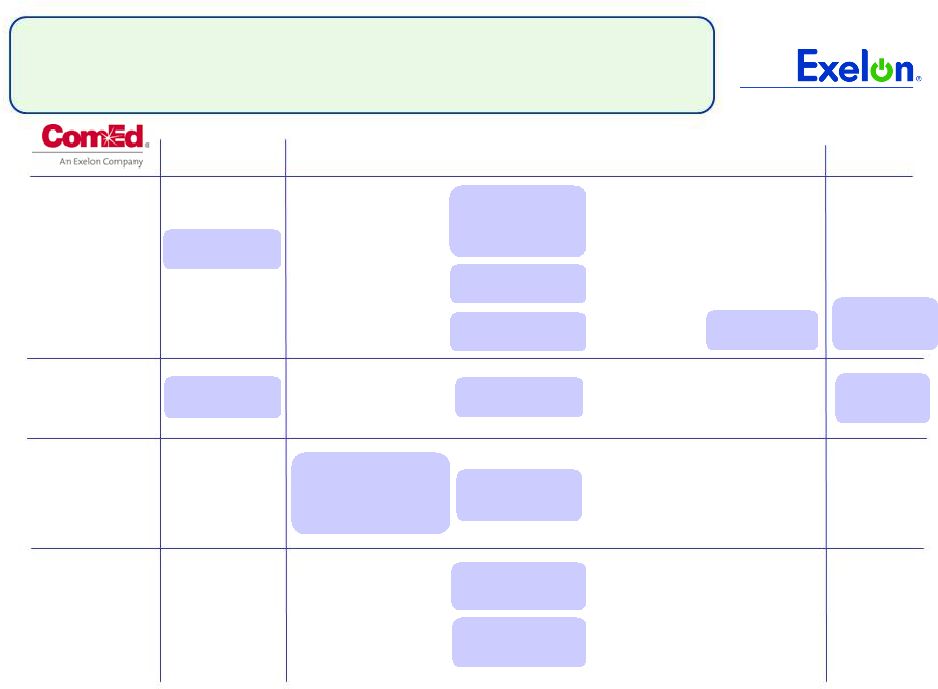

2011:

Year In Review 4

Financial Success

Q4 operating EPS of

$0.82 per share

2011 operating EPS of

$4.16 per share and

above original

expectations

Strategic

Execution

Acquired Wolf Hollow CCGT

in Texas and AVSR 1 Solar

PV facility in California

Nuclear uprate program

added 138.6 MW in 2011

Exelon Wind added 90 MW

in 2011

2011 was a year of exemplary financial and operating performance, constructive

regulatory environment and solid execution on strategic initiatives

|

EPA:

Clean Air Standards 5

Final rules substantially similar to proposed

rules; no significant changes to standards for

existing units

Rule provides sufficient flexibility for

compliance

•

Compliance timeline is three years

•

Some units will be granted a 1 year

extension on a case by case basis

PJM coal plant retirement estimate

unchanged by final rule

•

Expect rule to lead to the retirement

of 15 GW of coal

capacity Rule to be implemented in early 2015

D.C. Court of Appeals granted a stay on the

Cross State Air Pollution Rule (CSAPR)

Court’s recent order demonstrates

commitment to resolve this case on an

expedited basis

CSAPR is not a major driver of coal plant

retirements, as demonstrated by EPA

modeling

Minimal impact to Exelon’s 2012 gross

margin as generation position in PJM is well

hedged

Air Toxics Rule

Cross State Air Pollution Rule

•

Final

briefs

due

by

March

16

th

2012

•

Oral

arguments

on

April

13

th

2012

Air Toxics Rule is still expected to be the more impactful rule to drive coal plant

retirements, and we continue to believe the CSAPR is valid |

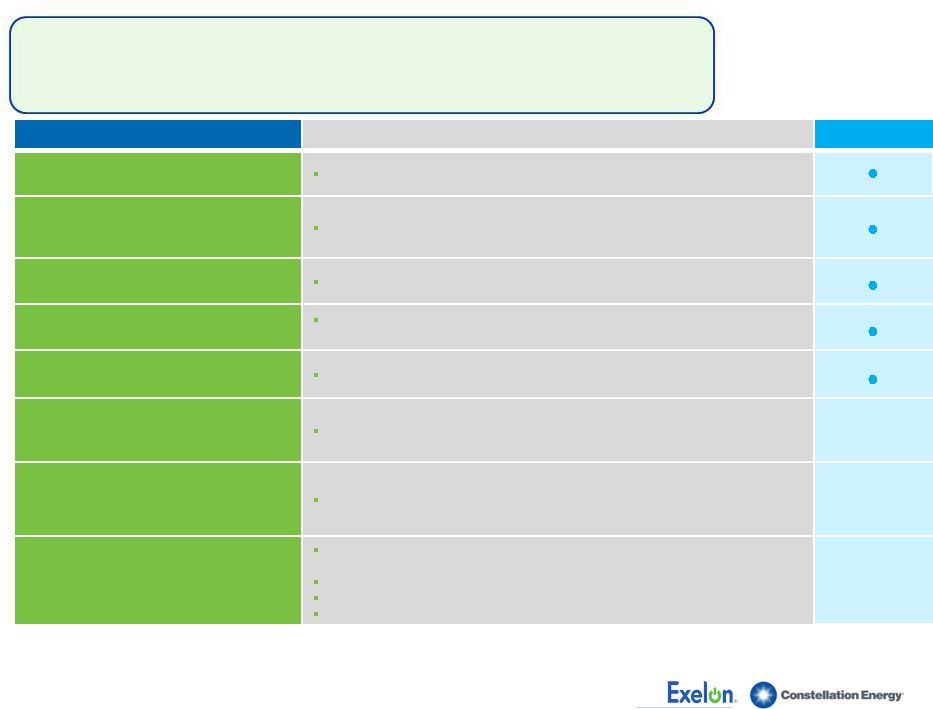

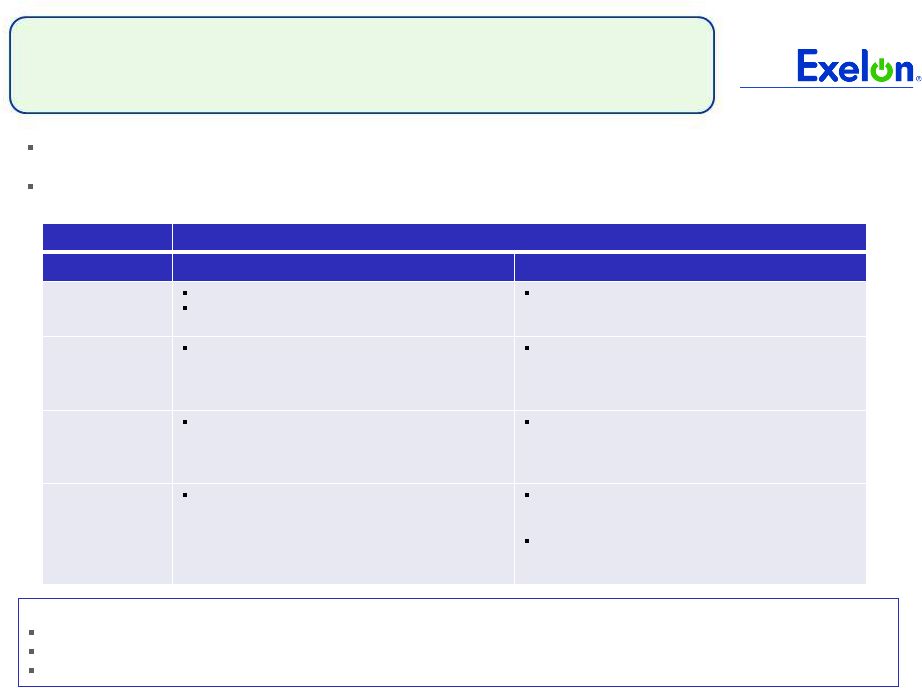

Merger

Approvals Process on Schedule (as of 1/20/2012)

6

Note: The Department of Public Utilities in Massachusetts concluded on September

26, 2011 that it does not have jurisdiction over the merger. Stakeholder

Status of Key Milestones

Approved

Texas PUC

(Case No. 39413)

Approval received on August 3, 2011

Securities and Exchange Commission

(SEC)

(File No. 333-175162)

Joint proxy statement declared effective on October 11, 2011

Shareholder Approval

Shareholders overwhelmingly approved the merger on November 17, 2011

New York PSC

(Case No. 11–E–0245)

Declaratory ruling on December 15, 2011 confirming that Commission review is

not required

Department of Justice (DOJ)

U.S. DOJ clearance received on December 21, 2011

Nuclear Regulatory Commission

(Docket Nos. 50-317, 50-318, 50-220,

50-410, 50-244, 72-8, 72-67)

Filed for indirect transfer of Constellation Energy licenses on May 12, 2011

Federal Energy Regulatory Commission

(FERC)

(Docket No. EC 11-83)

Settlement agreement filed with PJM Market Monitor on October 11, 2011

Maryland PSC

(Case No. 9271)

Settlement agreement reached with key stakeholders in Maryland on

December 15, 2011

Hearings scheduled for January 25 –

27, 2012

Briefs due February 6, 2012

Order expected on February 17, 2012 |

7

Key Financial Messages

Q4 2011 operating earnings of $0.82 per share

Full year 2011 operating earnings of $4.16 per share

Strong cash flow from operations

Credit metrics above target range across all operating

companies

Disciplined execution of ratable hedge program continues to

create value

Note: Refer to Earnings Release Attachments for additional details and to the

Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS. |

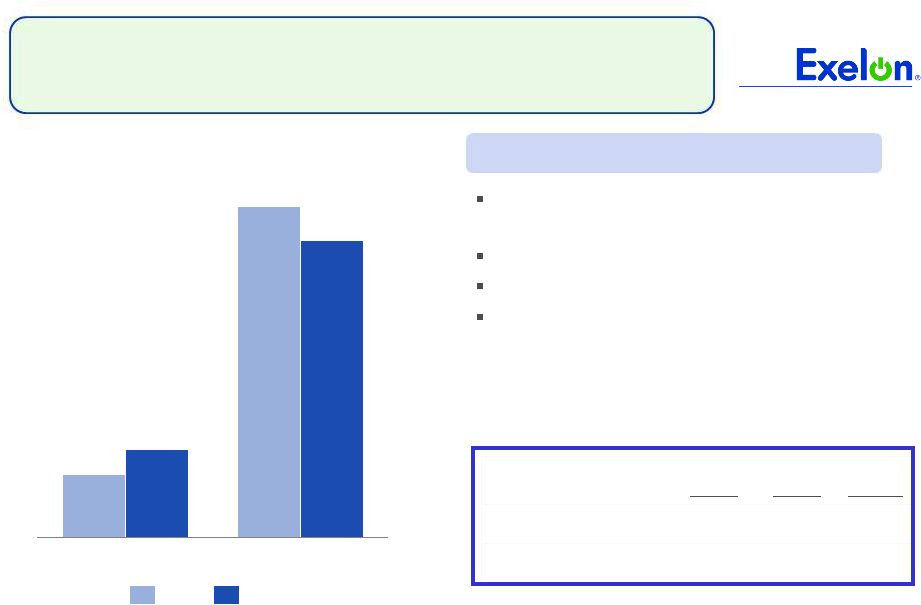

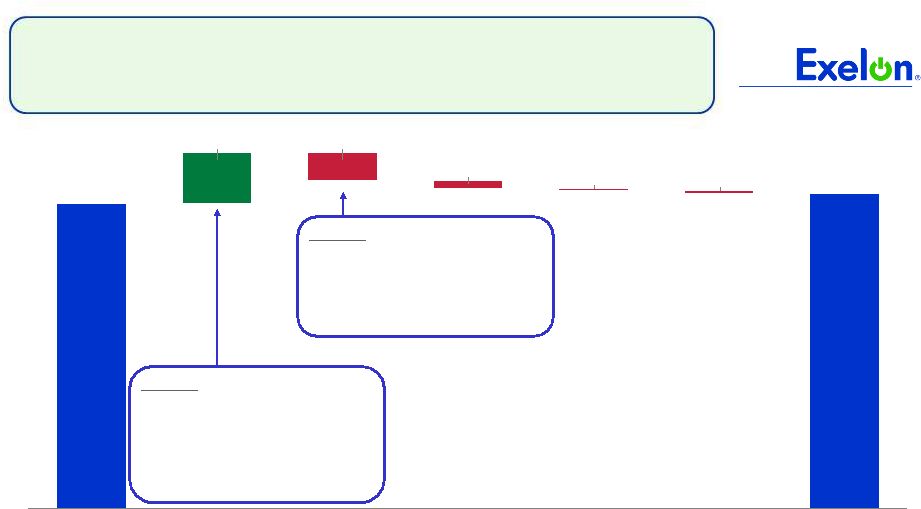

8

Exelon Generation

Operating EPS Contribution

$2.91

$0.81

$3.01

$0.54

Full Year

4Q

2011

2010

Outage Days

(3)

4Q10

4Q11

Refueling

97

103

Non-refueling

18

11

Favorable market/portfolio conditions:

$0.06

(2)

Unfavorable capacity pricing: $(0.13)

Higher O&M costs, including refueling costs

at Salem: $(0.08)

Increased planned nuclear refueling costs:

$(0.02)

Higher nuclear fuel costs: $(0.02)

Higher depreciation expense: $(0.02)

Nuclear volume: $(0.01)

Key Drivers –

4Q11 vs. 4Q10

(1)

(1) Refer to the Earnings Release Attachments for additional details and to the Appendix for a

reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS.

(2) Favorable market/portfolio conditions includes: $0.03 higher realized prices in the

Mid-Atlantic net of lower realized prices in the Midwest, $0.02 Wind and $0.01 Hydro

volume. (3) Outage days exclude Salem. |

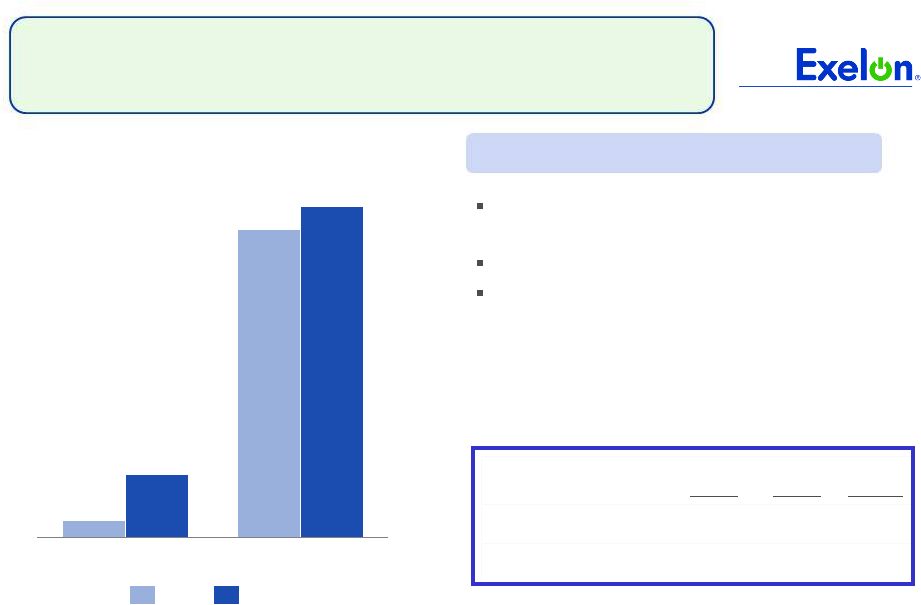

9

ComEd Operating EPS Contribution

$0.68

$0.13

$0.61

$0.18

Full Year

4Q

2011

2010

4Q10

Actual

4Q11

Actual

Normal

Heating Degree-Days

2,292

1,832

2,278

Cooling Degree-Days

15

14

7

Energy Infrastructure Modernization Act,

net

(2)

: $0.06

Electric distribution rates: $0.03

Higher O&M costs: $(0.04)

Weather: $(0.01)

Key Drivers –

4Q11 vs. 4Q10

(1)

(1)

Refer to the Earnings Release Attachments for additional details and to the Appendix for a

reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS.

(2)

O&M impacts include credit for the allowed recovery of certain 2011 storm costs, partially offset

by a one-time contribution. |

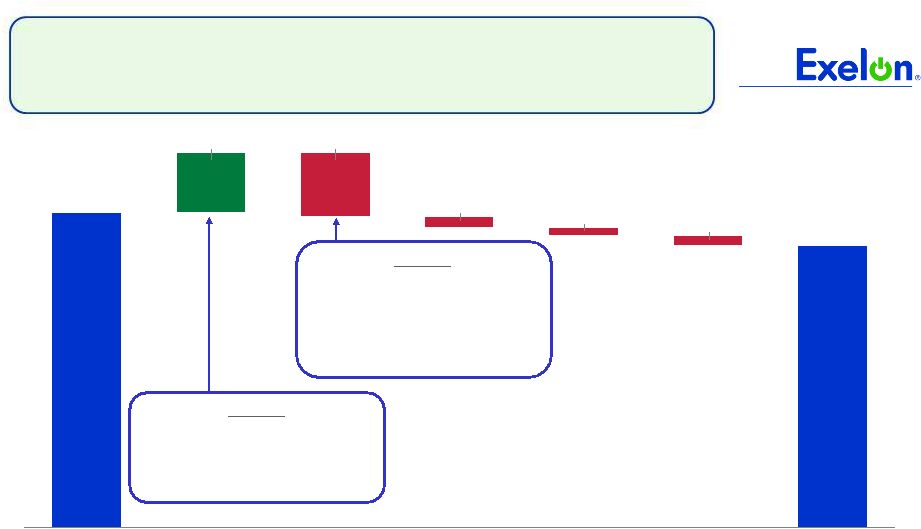

10

PECO Operating EPS Contribution

(1) Refer to the Earnings Release Attachments for additional details and to the

Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS.

Note: CTC = Competitive Transition Charge

$0.54

$0.03

$0.58

$0.11

Full Year

4Q

2010

2011

4Q10

Actual

4Q11

Actual

Normal

Heating Degree-Days

1,686

1,302

1,634

Cooling Degree-Days

19

14

21

2010 CTC amortization expense, net of

collections: $0.07

Electric and gas distribution rates: $0.04

Weather: $(0.04)

Key Drivers –

4Q11 vs. 4Q10

(1) |

11

2011 Actual Sources and Uses of Cash

(1)

Excludes counterparty collateral activity.

(2)

Cash Flow from Operations primarily includes net cash flows provided by operating

activities, replacement of credit facilities and net cash flows used in investing activities other than capital

expenditures.

(3)

2011 dividend of $2.10/share. Dividends are subject to declaration by the Board of

Directors. (4)

Includes $350 million in Nuclear Uprates and $250 million for Exelon Wind

spend. (5)

Represents new business, smart grid/smart meter investment and transmission growth

projects. (6)

Excludes PECO’s $225 million Accounts Receivable (A/R) Agreement with Bank of

Tokyo. PECO’s A/R Agreement was extended in accordance with its terms through August 31, 2012.

(7)

“Other”

includes proceeds from options and expected changes in short-term debt.

(8) Includes cash flow activity from Holding Company,

eliminations, and other corporate entities. ($ millions)

Exelon

(8)

Beginning Cash Balance

(1)

$800

Cash Flow from Operations

(2)

800

800

3,475

4,975

CapEx (excluding Nuclear Fuel, Nuclear Uprates, Exelon

Wind and Utility Growth CapEx)

(750)

(350)

(825)

(1,975)

Nuclear Fuel

n/a

n/a

(1,075)

(1,075)

Dividend

(3)

(1,400)

Nuclear Uprates and Exelon Wind

(4)

n/a

n/a

(600)

(600)

Wolf Hollow Acquisition

n/a

n/a

(300)

(300)

Antelope Valley Solar Ranch One Acquisition

n/a

n/a

(75)

(75)

Utility Growth CapEx

(5)

(275)

(125)

n/a

(400)

Net Financing (excluding Dividend):

Debt Issuances

(6)

1,200

--

--

1,200

Debt Retirements

(550)

(250)

--

(800)

Other

(7)

--

(50)

25

200

Ending Cash Balance

(1)

$550 |

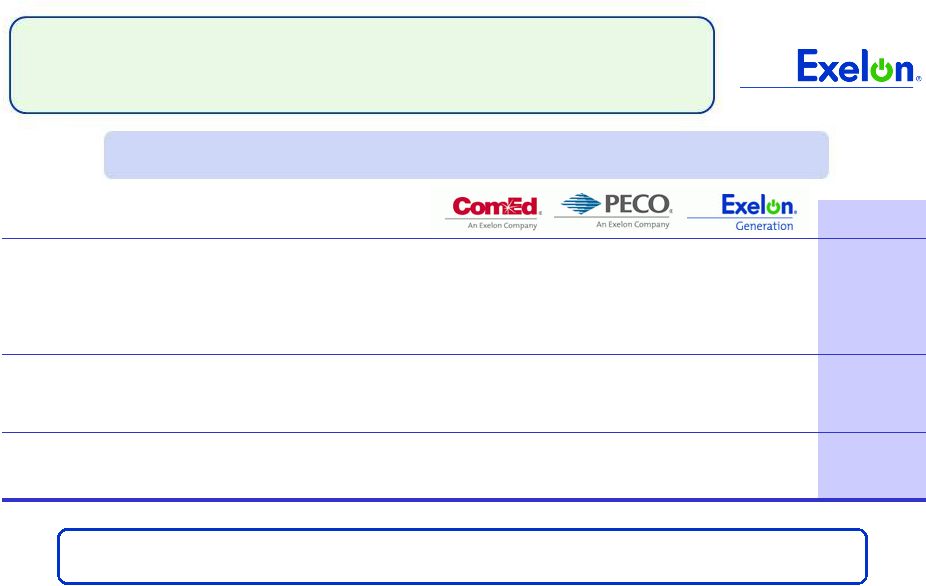

Post-Merger Legal Entity Structure

BGE

•

BGE will exist as a separate subsidiary under Exelon with its current

ring-fenced structure

•

BGE

will

continue

as

a

separate

SEC

registrant

and

will

continue

to

issue

debt

Constellation Energy Group, Inc. (CEG) will be merged into Exelon Corporation

•

CEG subsidiaries, excluding BGE, will then be transferred to Exelon Generation and

become direct wholly-owned subsidiaries of Exelon Generation

•

Exelon Corporation will assume the obligations of CEG’s publicly-held

debt, guarantees and other contracts

Benefits of merging CEG into Exelon

•

Placement at HoldCo provides bondholders with diversity of cash flows from

regulated and unregulated businesses

•

Optimizes funding costs by utilizing the Exelon Generation credit as the primary

financing vehicle for the unregulated business post-merger

•

Simplifies accounting and reporting through elimination of separate CEG SEC

registrant •

No impacts on BGE ring-fencing commitments to Maryland PSC

12 |

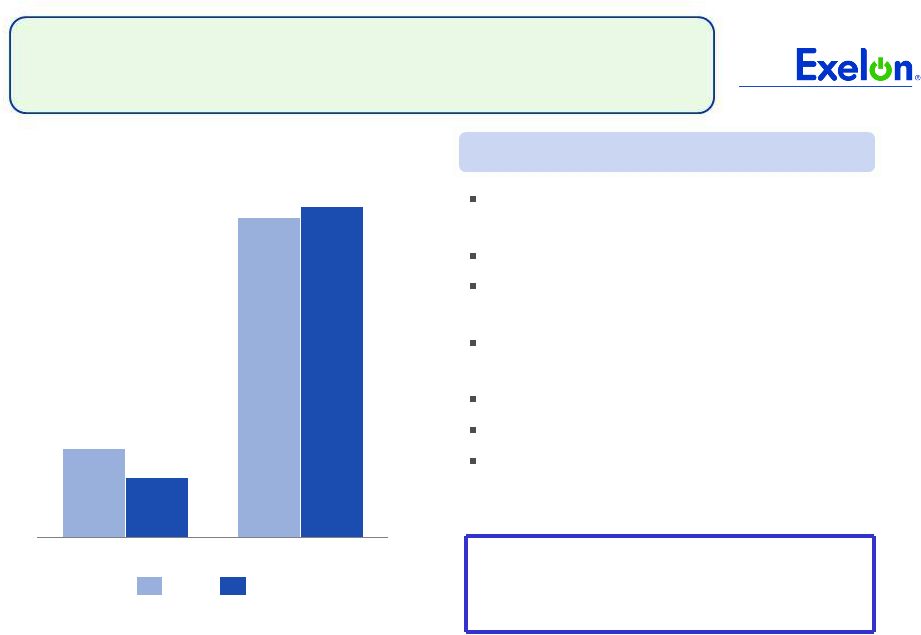

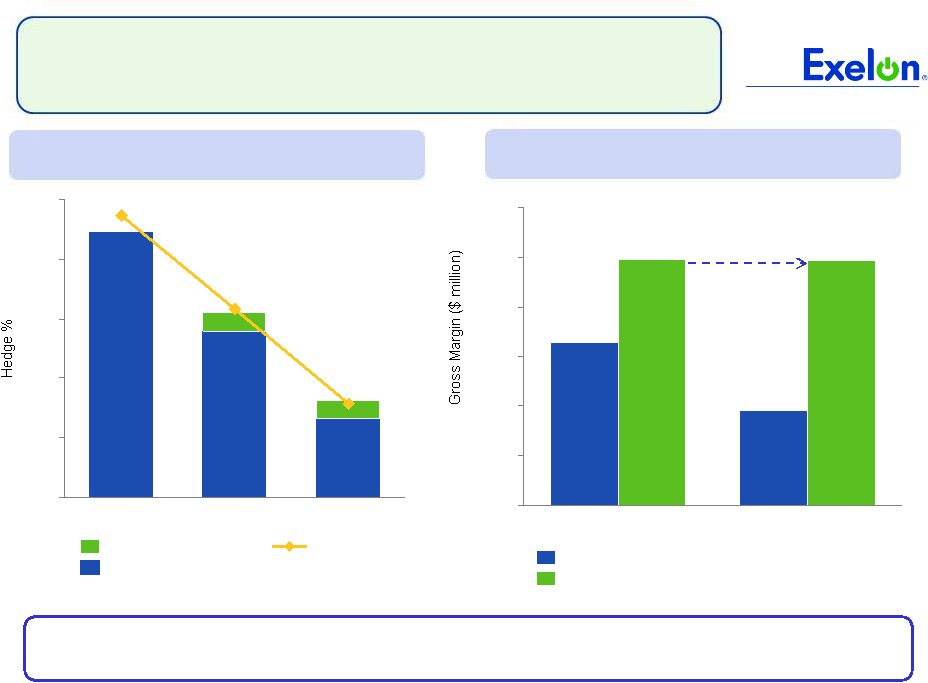

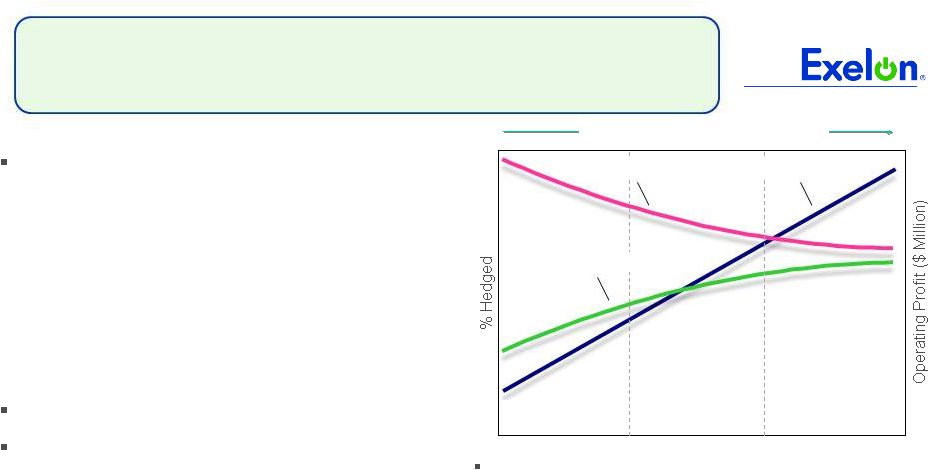

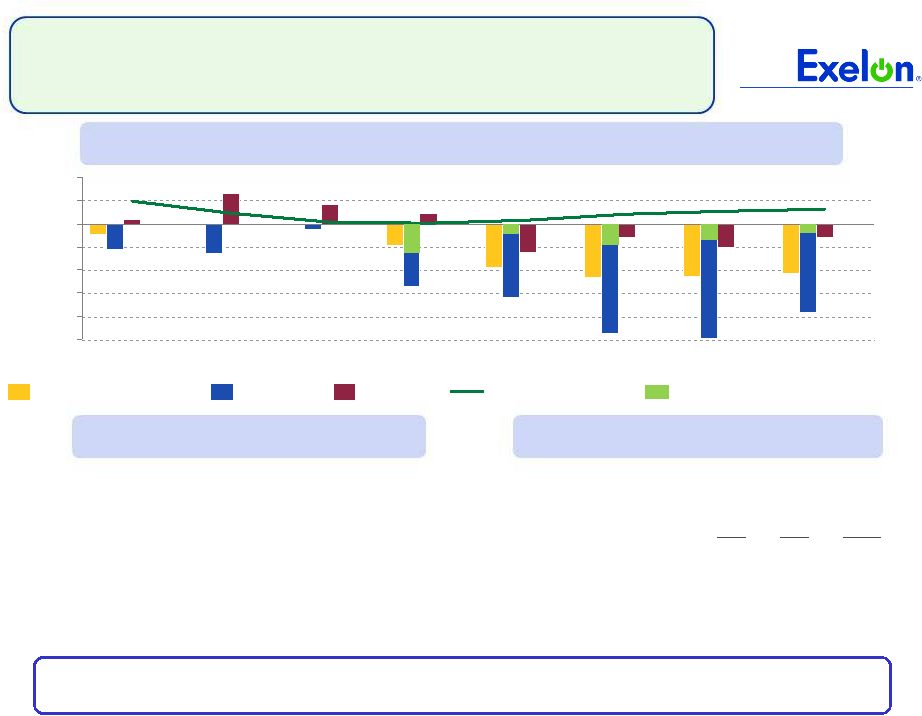

Exelon Generation Hedging Program

Percentage of Expected Generation Hedged

Being close to fully hedged in 2012 has protected us from the recent decline in power

prices 0%

20%

40%

60%

80%

100%

2014

2013

2012

Ratable

% Hedged without Options

Option %

2012 Gross Margin Comparison

(1)

4,450

5,150

3,500

4,000

4,500

5,000

5,500

6,000

6,500

5,965

09/30/2011

5,975

12/31/2011

2012 Hedged Gross Margin ($ millions)

2012 Open Gross Margin

13

(1) Gross Margin estimates are rounded. Open Gross Margin assumes no hedges.

|

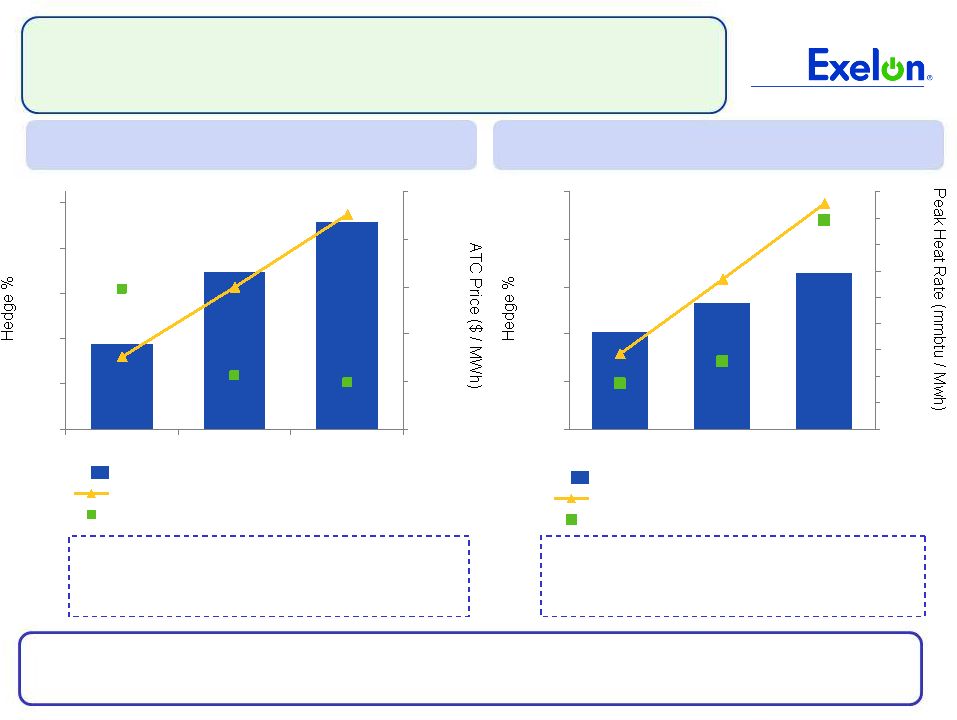

Exelon Generation Hedging Program

As a consequence of being ahead of a ratable pace in

2009 and 2010 in the PJM portfolio we were able to

capture higher market prices and be selective in 2011 by

holding off on sales when prices were low.

2012 Midwest & Mid-Atlantic Hedging

Over the Past Three Years

2012 South & West Hedging

Over the Past Three Years

We have consciously kept more open length in the

South and West region to benefit from increased heat

rates and volatility in the ERCOT market and are well

positioned to capture upside in the spot market.

$54.73

0%

20%

40%

60%

80%

100%

$40.00

$45.00

$50.00

$55.00

$60.00

$65.00

2011

2010

2009

West Hub 2012 ATC Avg Yearly Price

Ratable

2012 Year End Hedge %

9.98

0%

20%

40%

60%

80%

100%

8.40

8.60

8.80

9.00

9.20

9.40

9.60

9.80

10.00

10.20

2011

2010

2009

ERCOT North 2012 On Peak Yearly Avg Heat Rate

Ratable

2012 Year End Hedge %

14

$45.68

$44.91

8.75

8.91

While our three-year ratable hedging program ensures stable cash flows, we continue to use our

market views to create incremental value via timing, product and regional allocations of

sales |

15

John Rowe’s Key Accomplishments

•

Unicom/PECO merger

Creating Exelon

•

Running nuclear plants at world-class levels

Turning Around Nuclear

•

Vision for a cleaner, more competitive future

Selling ComEd’s

Fossil Fleet

•

Letting competitive markets work

Separating Generation

•

Keeping the lights on

Improving ComEd’s

Service

•

Smooth transition to competitive market, starting with the

2007 settlement

Promoting Competition in Illinois

•

Environmental strategy committed to clean generation

Launching Exelon 2020

•

Maintaining a solid regulatory relationship

Making Pennsylvania Proud

•

PECO’s rate settlement and ComEd’s

infrastructure

legislation

Regulatory Outcomes

•

Cost management, risk management

Maintaining Financial Discipline |

Exelon Generation Hedging Disclosures

(as of December 31, 2011)

16 |

17

Important Information

The following slides are intended to provide additional information regarding the hedging

program at Exelon Generation and to serve as an aid for the purposes of modeling Exelon

Generation’s gross margin (operating revenues less purchased power and fuel expense). The

information on the following slides is not intended to represent earnings guidance or a forecast

of future events. In fact, many of the factors that ultimately will determine Exelon

Generation’s actual gross margin are based upon highly variable market factors outside of

our control. The information on the following slides is as of December 31, 2011. We

update this information on a quarterly basis. Certain

information on the following slides is based upon an internal simulation model that incorporates

assumptions regarding future market conditions, including power and commodity prices, heat rates,

and demand conditions, in addition to operating performance and dispatch characteristics of our

generating fleet. Our simulation model and the assumptions therein are subject to

change. For example, actual market conditions and the dispatch profile of our generation

fleet in future periods will likely differ – and may differ significantly – from the

assumptions underlying the simulation results included in the slides. In addition, the

forward- looking information included in the following slides will likely change over time due

to continued refinement of our simulation model and changes in our views on future market

conditions. |

18

Portfolio Management Objective

Align Hedging Activities with Financial Commitments

Power Team utilizes several product types

and channels to market

•

Wholesale and retail sales

•

Block products

•

Load-following products

and load auctions

•

Put/call options

Exelon’s hedging program is designed to

protect the long-term value of our

generating fleet and maintain an

investment-grade balance sheet

•

Hedge enough commodity risk to meet future cash

requirements if prices drop

•

Consider: financing policy (credit rating objectives,

capital structure, liquidity); spending (capital and

O&M); shareholder value return policy

Consider market, credit, operating risk

Approach to managing volatility

•

Increase hedging as delivery approaches

•

Have enough supply to meet peak load

•

Purchase fossil fuels as power is sold

•

Choose hedging products based on generation

portfolio

–

sell what we own

•

Heat rate options

•

Fuel products

•

Capacity

•

Renewable credits

% Hedged

High End of Profit

Low End of Profit

Open Generation

with LT Contracts

Portfolio

Optimization

Portfolio

Management

Portfolio Management Over Time |

19

Percentage of Expected

Generation Hedged

•

How many equivalent MW have been

hedged at forward market prices; all hedge

products used are converted to an

equivalent average MW volume

•

Takes ALL

hedges into account whether

they are power sales or financial products

Equivalent MWs Sold

Expected Generation

=

Our normal practice is to hedge commodity risk on a ratable basis

over the three years leading to the spot market

•

Carry operating length into spot market to manage forced outage and

load-following risks

•

By

using

the

appropriate

product

mix,

expected

generation

hedged

approaches

the

mid-90s percentile as the delivery period approaches

•

Participation in larger procurement events, such as utility auctions, and some

flexibility in the timing of hedging may mean the hedge program is not

strictly ratable from quarter to quarter

Exelon Generation Hedging Program |

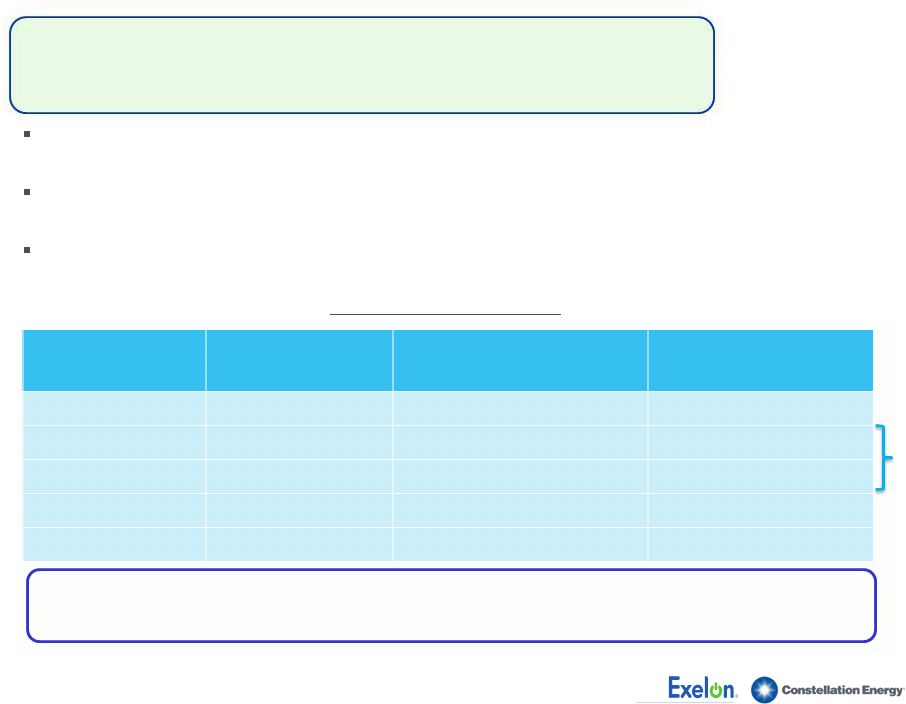

20

2012

2013

2014

Estimated Open Gross Margin ($ millions)

(1)(2)

$4,450

$4,950

$5,400

Reference Prices

(1)

Henry Hub Natural Gas ($/MMBtu)

NI-Hub ATC Energy Price ($/MWh)

PJM-W ATC Energy Price ($/MWh)

ERCOT

North

ATC

Spark

Spread

($/MWh)

(3)

$3.24

$29.77

$38.86

$7.29

$3.94

$31.44

$41.26

$6.37

$4.34

$33.15

$43.97

$5.22

Exelon Generation Open Gross Margin and

Reference Prices

(1)

Based on December 31, 2011 market conditions. (2)

Gross margin is defined as operating revenues less fuel expense and purchased power expense, excluding

the impact of decommissioning and other incidental revenues. Open gross

margin is estimated based upon an internal model that is developed by dispatching our expected generation to current market power and fossil

fuel prices. Open gross margin assumes there is no hedging in place other than

fixed assumptions for capacity cleared in the RPM auctions and uranium costs for nuclear power

plants. Open gross margin contains assumptions for other gross margin line items such as various ISO bill and ancillary revenues and costs and PPA

capacity revenues and payments.The estimation of open gross margin incorporates management discretion

and modeling assumptions that are subject to change.

(3)

ERCOT North ATC spark spread using Houston Ship Channel Gas, 7,200 heat rate, $2.50 variable

O&M. |

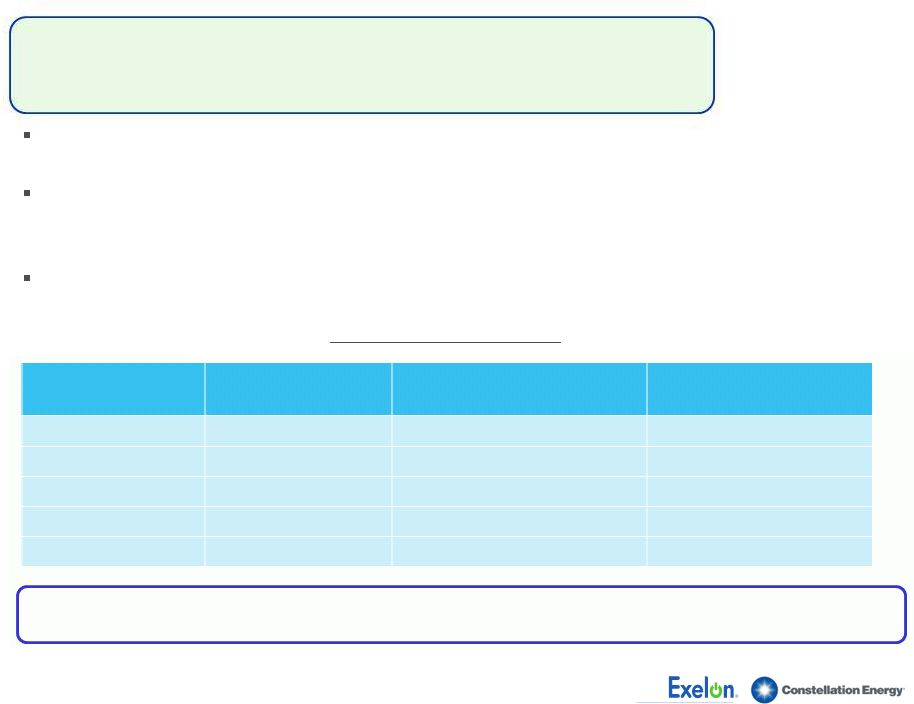

21

2012

2013

2014

Expected Generation

(GWh)

(1)

173,100

167,600

166,100

Midwest

99,200

95,800

95,400

Mid-Atlantic

56,800

56,100

55,700

South & West

17,100

15,700

15,000

Percentage

of

Expected

Generation

Hedged

(2)

88-91%

61-64%

32-35%

Midwest

89-92

62-65

30-33

Mid-Atlantic

94-97

66-69

33-36

South & West

65-68

43-46

34-37

Effective Realized Energy Price

($/MWh)

(3)

Midwest

$40.50

$40.00

$37.50

Mid-Atlantic

$50.50

$50.50

$51.00

South & West

$2.00

$3.00

$2.00

Generation Profile

(1)

Expected generation represents the amount of energy estimated to be generated or purchased through

owned or contracted for capacity. Expected generation is based upon a simulated dispatch model

that makes assumptions regarding future market conditions, which are calibrated to market quotes for power, fuel, load following products, and options.

Expected generation assumes 10 refueling outages in 2012 and 2013 and 11 refueling outages in 2014 at

Exelon-operated nuclear plants and Salem. Expected generation assumes capacity

factors of 93.5%, 93.3% and 93.4% in 2012, 2013 and 2014 at Exelon-operated nuclear plants. These estimates of expected generation in 2012, 2013 and 2014 do not

represent guidance or a forecast of future results as Exelon has not completed its planning or

optimization processes for those years. (2)

Percent of expected generation hedged is the amount of equivalent sales divided by the expected

generation. Includes all hedging products, such as wholesale and retail sales of power,

options, and swaps. Uses expected value on options. Reflects decision to permanently retire Cromby Station and Eddystone Units 1&2 as of May 31, 2011.

(3)

Effective realized energy price is representative of an all-in hedged price, on a per MWh basis,

at which expected generation has been hedged. It is developed by considering the energy

revenues and costs associated with our hedges and by considering the fossil fuel that has been purchased to lock in margin. It excludes uranium costs and RPM capacity

revenue, but includes the mark-to-market value of capacity contracted at prices other than RPM

clearing prices including our load obligations. It can be compared with the reference prices

used to calculate open gross margin in order to determine the mark-to-market value of Exelon Generation's energy hedges. |

22

Gross Margin Sensitivities with Existing Hedges ($ millions)

(1)

Henry Hub Natural Gas

+ $1/MMBtu

-

$1/MMBtu

NI-Hub ATC Energy Price

+$5/MWH

-$5/MWH

PJM-W ATC Energy Price

+$5/MWH

-$5/MWH

Nuclear Capacity Factor

+1% / -1%

2012

$20

$(5)

$40

$(30)

$15

$(15)

+/-

$35

2013

$260

$(230)

$185

$(180)

$115

$(110)

+/-

$40

2014

$600

$(560)

$335

$(330)

$205

$(205)

+/-

$40

Exelon Generation Gross Margin Sensitivities

(with Existing Hedges)

(1)

Based on December 31, 2011 market conditions and hedged position. Gas price sensitivities are based on

an assumed gas-power relationship derived from an internal model that is updated

periodically. Power prices sensitivities are derived by adjusting the power price assumption while keeping all other prices inputs constant. Due to

correlation of the various assumptions, the hedged gross margin impact calculated by aggregating

individual sensitivities may not be equal to the hedged gross margin impact calculated when

correlations between the various assumptions are also considered. |

23

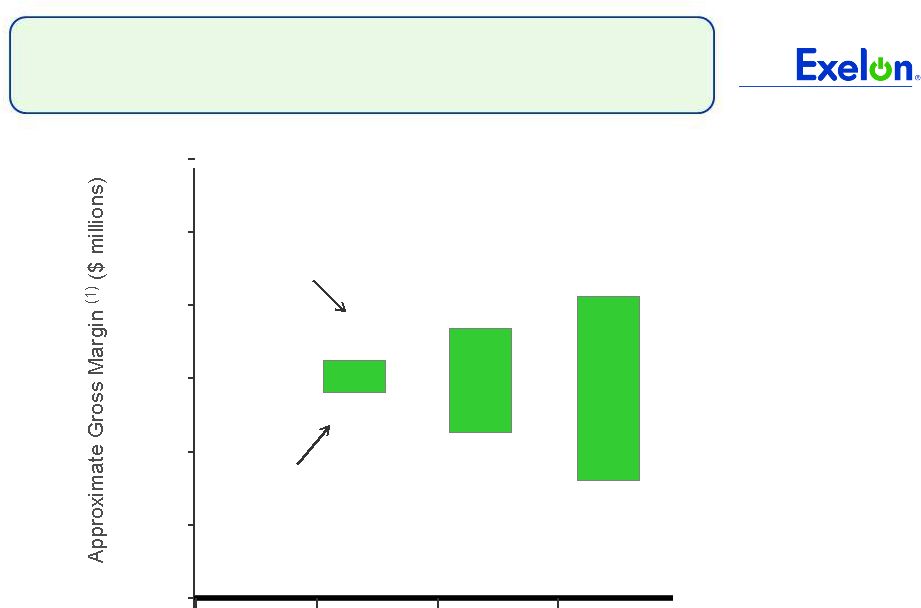

95% case

5% case

$5,300

$6,100

$5,800

$6,400

Exelon Generation Gross Margin Upside / Risk

(with Existing Hedges)

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

2012

2013

2014

$7,000

$4,600

(1)

Represents an approximate range of expected gross margin, taking into account hedges in place, between

the 5th and 95th percent confidence levels assuming all unhedged supply is sold into the spot

market. Approximate gross margin ranges are based upon an internal simulation model and are subject to change based upon market

inputs, future transactions and potential modeling changes. These ranges of approximate gross margin

in 2012 , 2013 and 2014 do not represent earnings guidance or a forecast of future results as

Exelon has not completed its planning or optimization processes for those years. The price distributions that generate this range are calibrated to

market quotes for power, fuel, load following products, and options as of December 31, 2011.

|

24

Midwest

Mid-Atlantic

South & West

Step 1

Start

with

fleetwide

open

gross

margin

$4.45 billion

Step 2

Determine the mark-to-market value

of energy

hedges

99,200GWh * 90% *

($40.50/MWh-$29.77MWh)

= $0.96 billion

56,800GWh * 94% *

($50.50/MWh-$38.86MWh)

= $0.62 billion

17,100GWh * 66% *

($2.00/MWh-$7.29MWh)

= $(0.06) billion

Step 3

Estimate

hedged

gross

margin

by

adding open gross margin to mark-to-

market value of energy hedges

Open gross

margin: $4.45 billion

MTM

value

of

energy

hedges:

$0.96billion

+

$0.62billion

+

$(0.06)

billion

Estimated hedged gross margin:

$5.97 billion

Illustrative Example

of Modeling Exelon Generation 2012 Gross Margin

(with Existing Hedges) |

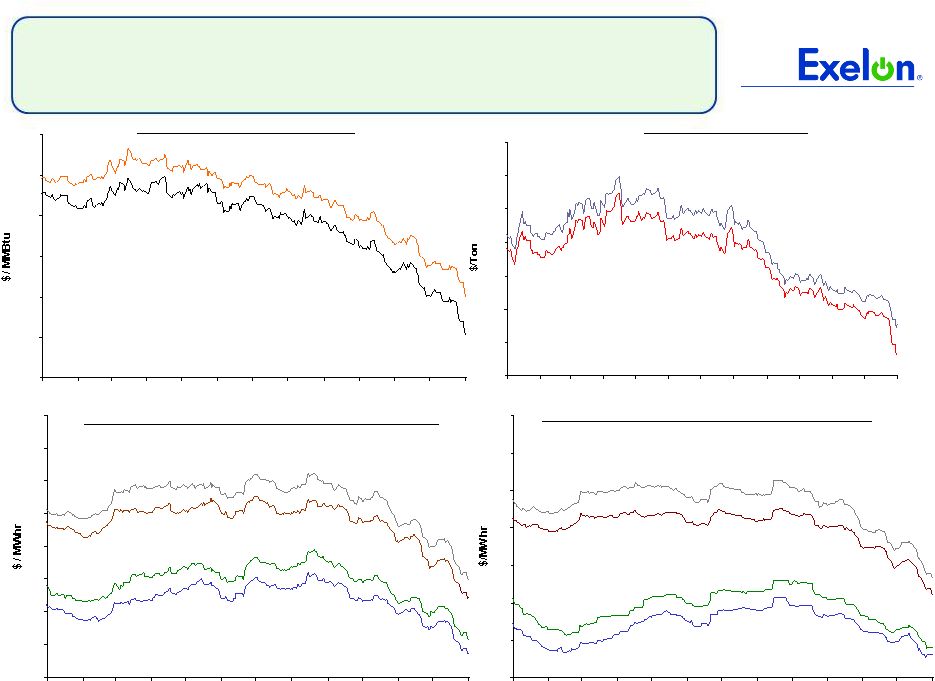

20

25

30

35

40

45

50

55

1/11

2/11

3/11

4/11

5/11

6/11

7/11

8/11

9/11

10/11

11/11

12/11

1/12

30

35

40

45

50

55

60

65

70

1/11

2/11

3/11

4/11

5/11

6/11

7/11

8/11

9/11

10/11

11/11

12/11

1/12

3.0

3.5

4.0

4.5

5.0

5.5

6.0

1/11

2/11

3/11

4/11

5/11

6/11

7/11

8/11

9/11

10/11

11/11

12/11

1/12

65

70

75

80

85

90

95

100

1/11

2/11

3/11

4/11

5/11

6/11

7/11

8/11

9/11

10/11

11/11

12/11

1/12

Market Price Snapshot

Forward NYMEX Natural Gas

PJM-West and Ni-Hub On-Peak Forward Prices

PJM-West and Ni-Hub Wrap Forward Prices

2014

$4.01

2013 $3.53

Forward NYMEX Coal

2014

$72.69

2013

$68.44

2013 Ni-Hub $33.58

2014 Ni-Hub

$35.73

2014 PJM-West $44.85

2013 PJM-West

$42.15

2013 Ni-Hub

$23.04

2014 Ni-Hub

$24.05

2014 PJM-West

$33.28

2013 PJM-West

$31.07

25

Rolling

12

months,

as

of

January

18

th

2012.

Source:

OTC

quotes

and

electronic

trading

system.

Quotes

are

daily. |

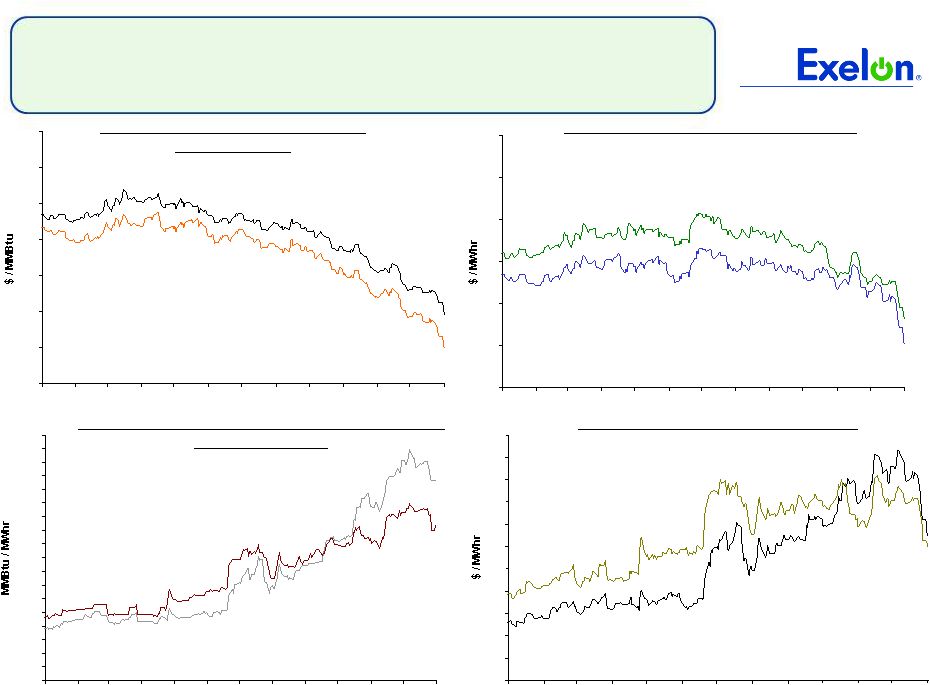

6

7

8

9

10

11

12

13

14

15

16

17

1/11

2/11

3/11

4/11

5/11

6/11

7/11

8/11

9/11

10/11

11/11

12/11

1/12

8.6

8.8

9.0

9.2

9.4

9.6

9.8

10.0

10.2

10.4

10.6

10.8

11.0

11.2

11.4

11.6

11.8

12.0

12.2

1/11

2/11

3/11

4/11

5/11

6/11

7/11

8/11

9/11

10/11

11/11

12/11

1/12

35

40

45

50

55

60

65

1/11

2/11

3/11

4/11

5/11

6/11

7/11

8/11

9/11

10/11

11/11

12/11

1/12

3.0

3.5

4.0

4.5

5.0

5.5

6.0

6.5

1/11

2/11

3/11

4/11

5/11

6/11

7/11

8/11

9/11

10/11

11/11

12/11

1/12

Market Price Snapshot

2014

10.88

2013

11.52

2013

$40.11

2014

$43.10

2013

$3.48

2014

$3.96

Houston Ship Channel Natural Gas

Forward Prices

ERCOT North On-Peak Forward Prices

ERCOT North On-Peak v. Houston Ship Channel

Implied Heat Rate

2013

$12.47

2014

$12.00

ERCOT North On Peak Spark Spread

Assumes a 7.2 Heat Rate, $1.50 O&M, and $.15 adder

26

Rolling

12

months,

as

of

January

18

th

2012.

Source:

OTC

quotes

and

electronic

trading

system.

Quotes

are

daily. |

27

Appendix |

2011 results were achieved in a very

challenging market environment due to

effectiveness of asset allocations and

hedging strategy

•

Decreased equity investments and

increased investment in fixed income

securities and alternative investments

•

The liability hedge has offset more than

50% of the pension liability increase

caused by lower interest rates

Pension plans are 83% funded as of

December 31, 2011

Pension Funds Performance

Exelon’s pension investment strategy has effectively dampened the volatility

of plan assets and plan funded status

28

S&P 500

Exelon Pension Assets

2.1%

9.8%

2011 Actual Returns |

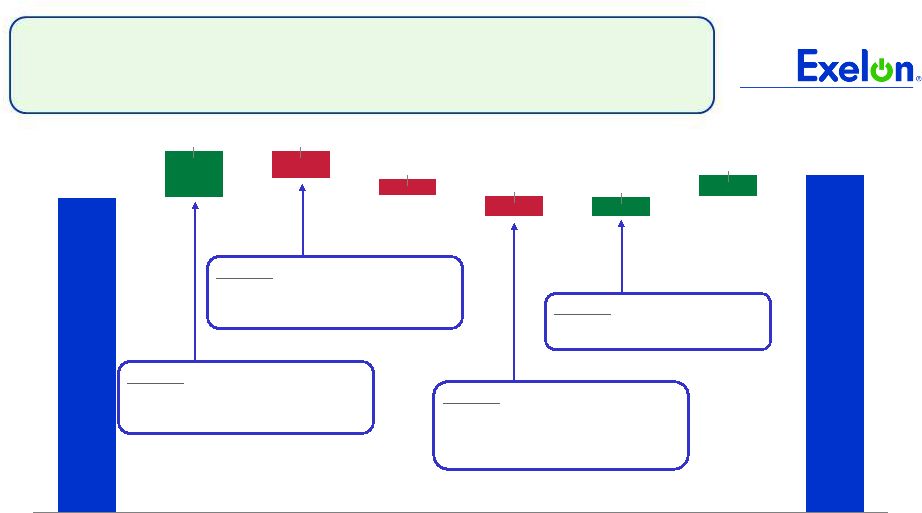

29

Exelon Generation 2011 EPS Contribution

$ / Share

$ 3.01

$ (0.03)

$ (0.01)

$ (0.08)

$ (0.26)

$ 0.49

$ 2.91

Other

RNF

2010A

O&M

2011A

Key Items:

Expiration of PECO PPA

$0.62

Market/portfolio conditions

(1)

$0.25

Unfavorable capacity pricing

($0.23)

Nuclear Fuel

($0.08)

Transmission

Upgrades

(2)

($0.06)

Key Items:

Inflation

($0.08)

Nuclear Outages

($0.05)

Exelon Wind

($0.04)

Higher refueling costs at Salem

($0.02)

Depreciation &

Amortization

Interest

Expense

(1)

Includes $0.15 of favorable market and portfolio conditions in the South and $0.07 related to Exelon

Wind.

(2)

Reflects intercompany expense at Generation for upgrades in transmission assets owned by ComEd, which

are reflected as assets at Exelon. |

30

ComEd 2011 EPS Contribution

$ / Share

30

$ 0.61

$ (0.02)

$ (0.02)

$ (0.02)

$ (0.14)

$ 0.13

$ 0.68

2011A

Other

O&M

RNF

2010A

Key Items:

Distribution Revenue

(1)

$0.08

Formula Rate Legislation

(2)

$0.03

Transmission Revenue

$0.02

Weather

($0.02)

Key Items:

2010 Bad Debt Recovery

(3)

($0.06)

Inflation

($0.03)

One-time contribution

(4)

($0.01)

Storm costs

(5)

($0.01)

2010 Distribution Rate Case Order

$0.02

(1)

Increased distribution revenue pursuant to the 2011 electric distribution rate case

order, effective June 1, 2011. (2)

Increased distribution revenues as a result of the annual true-up in the

performance based formula rate tariff pursuant to the Energy Infrastructure

Modernization Act (EIMA).

(3)

Reflects a 2010 credit for the recovery of 2008 and 2009 bad debt expense pursuant

to the ICC's February 2010 approval of a bad debt rider, partially offset by

a contribution mandated by Illinois legislation. (4)

Represents a one-time contribution to a new Science and Technology Innovation

Trust accrued pursuant to EIMA. (5)

Includes a $0.04 credit for the allowed recovery of certain 2011

storm costs, net of amortization expense.

Depreciation &

Amortization

Interest

Expense |

31

PECO 2011 EPS Contribution

$ / Share

$ 0.58

$ 0.04

$ 0.03

$ (0.04)

$ (0.03)

$ (0.05)

$ 0.08

$ 0.54

2011A

Other

Taxes

CTC, net

O&M

RNF

2010A

Key Items:

Electric & Gas Distribution Rate

(1)

$0.15

Weather

($0.05)

Key Items:

Storm costs

($0.01)

Inflation

($0.02)

(1)

Reflects increased distribution revenue pursuant to the 2010 Pennsylvania electric

and natural gas distribution rate case settlements effective January 1,

2011.

(2)

Includes associated gross receipts taxes.

Key Items:

Revenue net of amortization

(2)

($0.06)

Interest on PECO transition

$0.02

bonds

Key Items:

T&D

tax repairs deductions $0.05

Depreciation &

Amortization |

ComEd

Load Trends -3%

-2%

-1%

0%

1%

2%

3%

3Q11

2Q11

1Q11

4Q12

3Q12

2Q12

1Q12

4Q11

Residential

Gross Metro Product

All Customer Classes

Large C&I

Note: C&I = Commercial & Industrial

Chicago

U.S.

Unemployment rate

(1)

10.5%

8.5%

2011 annualized growth in

gross

domestic/metro

product

(2)

1.7%

1.8%

(1)

Source: U.S. Dept. of Labor (December 2011) and Illinois

Department of Security (November 2011)

(2)

Source: Global Insight (November 2011)

(3)

Not adjusted for leap year

4Q11

2011 2012E

(3)

Average Customer Growth

0.3%

0.4%

0.4%

Average Use-Per-Customer

0.9%

(1.7)%

(1.0)%

Total Residential

1.2%

(1.3)% (0.6)%

Small C&I

(1.2)%

(0.8)%

0.0%

Large C&I

1.8%

0.6%

(0.2)%

All Customer Classes

0.4%

(0.5)%

(0.2)%

32

Weather-Normalized Load Year-over-Year

Key Economic Indicators

Weather-Normalized Load |

PECO

Load Trends Note: C&I = Commercial & Industrial

-12.5%

-10.0%

-7.5%

-5.0%

-2.5%

0.0%

2.5%

5.0%

4Q12

3Q12

2Q12

1Q12

4Q11

3Q11

2Q11

1Q11

Gross Metro Product

Residential

Large C&I

All Customer Classes

Philadelphia

U.S.

Unemployment rate

(1)

7.9%

8.5%

2011 annualized growth in

gross domestic/metro product

(2)

0.9%

1.8% (1)

Source:

U.S.

Dept.

of

Labor

data

(December

2011)

–

US

U.S.

Dept.

of

Labor

prelim.

data

(November

2011)

–

Philadelphia

(2)

Source: Global Insight (November 2011)

(3)

Not adjusted for leap year

4Q11

2011 2012E

(3)

Average Customer Growth

0.3%

0.3%

0.4%

Average Use-Per-Customer

0.9%

1.3%

(2.5)%

Total Residential

1.1%

1.7% (2.2)%

Small C&I

0.3%

(0.7)%

(1.7)%

Large C&I

(6.8)%

(3.3)% (10.5)%

All Customer Classes

(2.2)%

(0.9)%

(5.4)%

Large C&I (excluding refinery impact)

Oil refinery closing estimated impact to reduce Large C&I and total load in 2012

by 9.1% and 3.7%, respectively

33

Weather-Normalized Load Year-over-Year

Key Economic Indicators

Weather-Normalized Load |

Maryland Settlement Summary

34

Settlement agreement with State of Maryland, City of Baltimore and other

key parties increases value of merger package to more than $1 billion

Package

includes

285

–

300

MW

of

new

generation

in

Maryland

•

120 MW of natural gas generation

•

125

MW

of

Tier

1

renewable

generation,

of

which

at

least

62.5

MW

will

be

wind

generation

•

30 MW of solar energy

•

10 -

25 MW of generation capacity from poultry litter

Significant benefits to the state and customers

•

$100 credit to each residential customer

•

Construction of LEED office building in Baltimore

•

$50M funding for low income weatherization measures

•

$32M funding for offshore wind research and development in Maryland

Commitments to preserve BGE as a leading Maryland company

•

Maintain capital and O&M spend and no dividend contributions to parent through

2014 •

Maintain investment in smart meters, reliability and other key initiatives

|

35

Exelon Dividend

Exelon’s Board of Directors approved a contingent stub dividend for Exelon

shareholders of $0.00583/share

per

day

for

Q2

2012

in

anticipation

of

the

merger

close

($0.525/share

for

the

quarter)

Stub dividend declaration ensures that Exelon shareholders continue to receive all

dividends at the current $2.10 per share annualized rate

Pre-

and post-close stub dividends must be declared separately to account for

Constellation shareholders becoming Exelon shareholders at merger

close Assuming

a

February

29,

2012

close

for

illustrative

purposes

only:

(1)

Assuming a 2/29/2012 merger close; for Exelon shareholders, Q2 2012 dividend will

be based on a per diem rate of $0.00583 ($0.525 divided by 90 days).

(2)

Future dividend, following the stub dividend, is subject to approval by the Board

of Directors. $0.525

Record Date

Payment Date

Dividend Type

Per Share Amount

2/15/2011

3/9/2011

Regular Dividend

$0.525

2/28/2012

3/28/2012

Pre-

close

Stub

Dividend

(1)

$0.076

5/15/2012

6/8/2012

Post-

close

Stub

Dividend

(1)

$0.449

8/15/2012

9/10/2012

Regular

Dividend

(2)

$0.525

11/15/2012

12/10/2012

Regular

Dividend

(2)

$0.525

Current Exelon shareholders will continue to receive a total dividend of

$0.525 per quarter |

36

Constellation Energy’s Board of Directors approved a contingent stub dividend

for Constellation shareholders of $0.00264/share per day for Q1 2012 in

anticipation of merger close Stub dividend declaration ensures that

Constellation shareholders continue to receive their existing quarterly

dividend rate prior to the merger, and benefit from the Exelon annualized dividend rate

($2.10 per share) beginning on the day the merger closes

Pre-

and post-close stub dividends must be declared separately to account for

Constellation shareholders becoming Exelon shareholders at merger

close Assuming

a

February

29,

2012

close

for

illustrative

purposes

only

:

(1)

Assuming a 2/29/2012 merger close, Q1 2012 dividend will be based on a per diem

rate of $0.00264 ($0.24 divided by 91 days). Post-close

Exelon

Q2

2012

stub

dividend

will

be

based

on

a

per

diem

rate

of

$0.00583.

(2)

Assuming a 2/29/2012 merger close, Constellation shareholders will start receiving

the full quarterly Exelon dividend of $0.525

per

share

in

Q3

2012.

Future

dividend,

following

the

stub

dividend,

is

subject

to

approval

by

the

Board

of

Directors.

Constellation Dividend

Record Date

Payment Date

Dividend Type

Per Share Amount

12/12/2011

1/3/2012

Regular CEG Dividend

$0.24

2/28/2012

3/28/2012

Pre-

close

CEG

Stub

Dividend

(1)

$0.206

5/15/2012

6/8/2012

Post-

close EXC Stub Dividend

(1)

$0.449

8/15/2012

9/10/2012

Regular EXC Dividend

(2)

$0.525

11/15/2012

12/10/2012

Regular Dividend

(2)

$0.525

Constellation shareholders will receive the Exelon dividend rate upon merger

close |

37

ComEd –

Regulatory Schedule for 2012

Q1

Q2

Q3

Q4

Initial filing with

ICC (11/8/11)

Proposed order

(around 5/1);

Final order

(by 5/31)

Procurements

for

ATC

supply

and

RECs

for

6/1/13-

12/31/17

(by

end

of

February)

Q4 2011

Distribution

Formula Rate

(Docket # 11-0721)

Performance

Metrics

(Docket # 11-0772)

Illinois Power

Agency

Procurement

Transmission

Rate Update

Annual update

filing with FERC

(5/15)

Rates effective

(June 2012 thru

May 2013)

Rates effective

June thru Dec.

Filing with ICC

(12/8/11)

Final order

(by 4/6)

Second filing with

ICC (by 5/1)

Rates

effective Jan.

thru Dec.

Regular annual

procurement

event (Spring)

Note: ICC = Illinois Commerce Commission; FERC = Federal Energy Regulatory

Commission; ATC = around-the-clock; REC = renewable energy credit

Final order

(by 12/27)

Annual

updates (by

6/1)

2013 |

38

PECO –

Default Service Plan Filing (DSP II)

(1) FR = Full Requirements; (2) FPFR = Fixed-Price Full

Requirements Proposed Procurement Mix

Class

DSP I (1/1/11

–

5/31/13)

DSP II (6/1/13

–

5/31/15)

Large C&I

Current load

retained: 4%

100% spot-priced FR

(1)

products

2011 opt-in FPFR

(2)

product

100% of supply procured directly from the PJM spot

market

Medium

Commercial

Current load

retained: 22%

85% 1-year FPFR products, 15% spot-priced FR

products

100% 6-month FPFR products

Small

Commercial

Current load

retained: 48%

70% 1-year FPFR products, 20% 2-year FPFR

products, 10% spot-priced FR products

100% 1-year FPFR products

Residential

Current load

retained: 75%

45% 2-year FPFR products; 30% 1-year FPFR

products; targeted 20% block products of 1-yr, 2-yr,

5-yr and seasonal terms; targeted 5% spot market

purchases

As block products expire, block and spot is replaced

by FPFR products with terms ending 5/31/15 (end of

DSP II period)

Remainder of portfolio is a mix of 2-yr and 1-yr FPFR

products, with delivery periods overlapping on a semi-

annual basis

Filing Schedule:

On 1/13/12, PECO filed a new Default Service Plan with the PAPUC, which outlines

how PECO will purchase electricity for customers not purchasing from a

competitive generation supplier from 6/1/13 through 5/31/15 PAPUC will assign

an Administrative Law Judge to set a procedural schedule with a Final Order requested no later

than mid-October 2012

Note: PAPUC = Pennsylvania Public Utility Commission

Incorporates Retail Market Enhancements suggested by PAPUC Order

issued 12/15/11:

Offers a 1-year opt-in auction program with price at least 5% less than

PECO’s expected Price to Compare as of 6/1/13 Establishes a residential

customer referral program to promote the lowest 1-year, fixed price available each month

Provides

customer

information

and

referral

programs

for

various

products;

“seamless”

moves

between

properties |

Sufficient Liquidity

($ millions)

Exelon

(3)

Aggregate

Bank

Commitments

(1)

$1,000

$600

$5,600

$7,700

Outstanding Facility Draws

--

--

--

--

Outstanding Letters of Credit

(1)

(1)

(884)

(894)

Available

Capacity

Under

Facilities

999

599

4,716

6,806

Outstanding Commercial Paper

--

--

--

(136)

Available Capacity Less Outstanding

Commercial Paper

$999

$599

$4,716

$6,670

Exelon bank facilities are largely untapped

39

(1) Excludes commitments from Exelon’s Community and Minority Bank Credit

Facility. (2) Available Capacity Under Facilities represents the unused bank

commitments under the borrower’s credit agreements net of outstanding letters of credit and

facility draws. The amount of commercial paper outstanding does not reduce the

available capacity under the credit agreements. (3) Includes Exelon

Corp’s $500M credit facility, letters of credit and commercial paper outstanding.

Available Capacity Under Bank Facilities as of January 17, 2012

(2) |

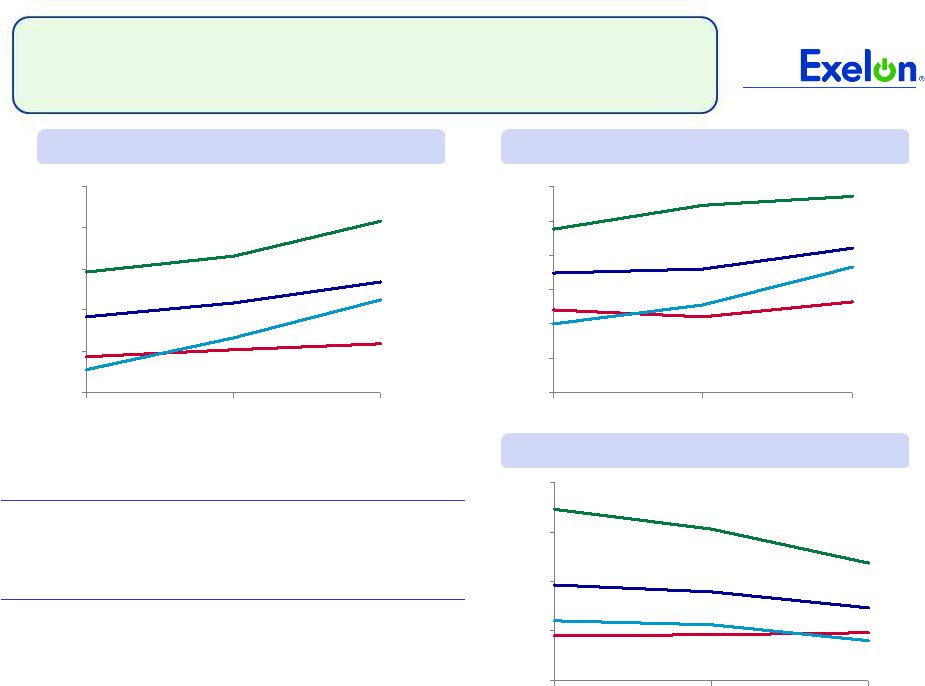

Key

Credit Metrics Moody’s Credit

Ratings

(2) (3)

S&P Credit

Ratings

(2) (3)

Fitch Credit

Ratings

(2) (3)

FFO / Debt

Target

Range

Exelon:

Baa1

BBB-

BBB+

ComEd:

Baa1

A-

BBB+

15-18%

PECO:

A1

A-

A

15-18%

Generation:

A3

BBB

BBB+

30-35%

(4)

10%

20%

30%

40%

50%

60%

Exelon

PECO

ComEd

2011A

2010A

2009A

0X

2X

4X

6X

8X

10X

12X

Exelon

PECO

ComEd

2011A

2010A

2009A

40%

50%

60%

70%

80%

Exelon

PECO

ComEd

2011A

2010A

2009A

FFO/Debt

(1)

Interest Coverage

(1)

Debt to Cap

(1)

40

(1)

See slide 41 for reconciliations to GAAP.

(2)

Current senior unsecured ratings for Exelon and Exelon Generation and senior

secured ratings for ComEd and PECO as of January 20, 2012.

(3)

Moody’s placed Exelon and Generation under review for a possible downgrade

after the proposed merger with Constellation Energy was announced. S&P

and Fitch affirmed ratings of Exelon and subsidiaries after the proposed

merger was announced. (4)

FFO/Debt Target Range reflects Generation FFO/Debt in addition to the debt

obligations of Exelon Corp. Range represents FFO/Debt to maintain current

ratings at current business risk. ExGen/

Corp

ExGen/

Corp

ExGen/

Corp |

Exelon Consolidated Metric Calculations and Ratios

Exelon 2010 YE Adjustments

FFO Calculation

2010 YE

Source - 2010 Form 10-K (.pdf version)

Net Cash Flows provided by Operating Activities

5,244

Pg 159 - Stmt. of Cash Flows

+/- Change in Working Capital

644

Pg 159 - Stmt. of Cash Flows

(1)

- PECO Transition Bond Principal Paydown

(392)

Pg 174 - Stmt. of Cash Flows

(2)

+ PPA Depreciation Adjustment

207

Pg 295 - Commitments and Contingencies

(3)

+/- Pension/OPEB Contribution Normalization

448

Pg 268-269 - Post-retirement Benefits

(4)

+ Operating Lease Depreciation Adjustment

35

Pg 299 - Commitments and Contingencies

(5)

+/- Decommissioning activity

(143)

Pg 159- Stmt. of Cash Flows

+/- Other Minor FFO Adjustments

(6)

(54)

= FFO (a)

5,989

Debt Calculation

Long-term Debt (incl. Current Maturities and A/R agreement)

12,828

Pg 161 - Balance Sheet

Short-term debt (incl. Notes Payable / Commercial Paper)

- Pg 161 - Balance Sheet

- PECO Transition Bond Principal Paydown

- N/A - no debt outstanding at year-end

+ PPA Imputed Debt

1,680

Pg 295 - Commitments and Contingencies

(7)

+ Pension/OPEB Imputed Debt

3,825

Pg 268 - Post-retirement benefits

(8)

+ Operating Lease Imputed Debt

428

Pg 299 - Commitments and Contingencies

(9)

+ Asset Retirement Obligation

- Pg 261-267 - Asset Retirement Obligations

(10)

+/- Other Minor Debt Equivalents

(11)

84

= Adjusted Debt (b)

18,845

Interest Calculation

Net Interest Expense

817

Pg 158 - Statement of Operations

- PECO Transition Bond Interest Expense

(22)

Pg 182 - Significant Accounting Policies

+ Interest on Present Value (PV) of Operating Leases

29

Pg 299 - Commitments and Contingencies

(12)

+ Interest on PV of Purchased Power Agreements (PPAs)

99

Pg 295 - Commitments and Contingencies

(13)

+/- Other Minor Interest Adjustments

(14)

37

= Adjusted Interest (c)

960

Equity Calculation

Total Equity

13,563

Pg 161 - Balance Sheet

+ Preferred Securities of Subsidaries

87

Pg 161 - Balance Sheet

+/- Other Minor Equity Equivalents

(15)

111

= Adjusted Equity (d)

13,761

(1)

Includes changes in A/R, Inventories, A/P and other accrued expenses, option

premiums, counterparty collateral and income taxes. Impact to FFO is

opposite of impact to cash flow (2)

Reflects retirement of variable interest entity + change in restricted cash

(3)

Reflects

net

capacity

payment

–

interest

on

PV

of

PPAs

(using

weighted

average

cost

of

debt)

(4)

Reflects

employer

contributions

–

(service

costs

+

interest

costs

+

expected

return

on

assets),

net

of

taxes at 35%

(5)

Reflects

operating

lease

payments

–

interest

on

PV

of

future

operating

lease

payments

(using

weighted average cost of debt)

(6)

Includes AFUDC / capitalized interest

(7)

Reflects PV of net capacity purchases (using weighted average cost of debt)

$ in millions

(8)

Reflects unfunded status, net of taxes at 35%

(9)

Reflects PV of minimum future operating lease payments (using weighted average cost

of debt) (10)

Nuclear decommissioning trust fund balance > asset retirement obligation.

No debt imputed (11)

Includes accrued interest less securities qualifying for hybrid treatment (50% debt

/ 50% equity) (12)

Reflects interest on PV of minimum future operating lease payments (using weighted

average cost of debt)

(13)

Reflects interest on PV of PPAs (using weighted average cost of debt)

(14)

Includes

AFUDC

/

capitalized

interest

and

interest

on

securities

qualifying

for

hybrid

treatment

(50% debt / 50% equity)

(15)

Includes interest on securities qualifying for hybrid treatment (50% debt / 50%

equity) 2010A Credit Metrics

41

FFO / Debt Coverage =

FFO (a)

Adjusted Debt (b)

FFO Interest Coverage =

FFO (a) + Adjusted Interest (c)

Adjusted Interest (c)

Adjusted Capitalization (e) =

Adjusted Debt (b) + Adjusted Equity (d)=

32,606

Rating Agency Debt Ratio =

Adjusted Debt (b)

Adjusted Capitalization (e)

32%

7.2x

58%

=

=

= |

42

4Q GAAP EPS Reconciliation

Three Months Ended December 31, 2011

ExGen

ComEd

PECO

Other

Exelon

2011 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share

$0.54

$0.18

$0.11

$(0.02)

$0.82

Mark-to-market adjustments from economic hedging activities

0.07

-

-

-

0.07

Unrealized gains related to nuclear decommissioning trust funds

0.07

-

-

-

0.07

Retirements of fossil generation units

(0.01)

-

-

-

(0.01)

Constellation acquisition costs

(0.01)

-

(0.00)

(0.02)

(0.03)

Non-cash remeasurement of deferred income taxes

0.01

-

-

(0.02)

(0.01)

4Q 2011 GAAP Earnings (Loss) Per Share

$0.67

$0.18

$0.11

$(0.05)

$0.91

Note:

All amounts shown are per Exelon share and represent contributions to Exelon's EPS.

Amounts may not add due to rounding. Three Months Ended December 31, 2010

ExGen

ComEd

PECO

Other

Exelon

2010 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share

$0.81

$0.13

$0.03

$(0.01)

$0.96

Mark-to-market adjustments from economic hedging activities

(0.17)

-

-

-

(0.17)

2007 Illinois electric rate settlement

(0.01)

-

-

-

(0.01)

Unrealized gains related to nuclear decommissioning trust funds

0.04

-

-

-

0.04

Retirements of fossil generation units

(0.03)

-

-

-

(0.03)

Exelon Wind acquisition costs

(0.01)

-

-

-

(0.01)

Asset retirement obligation

-

0.01

-

-

0.01

4Q 2010 GAAP Earnings (Loss) Per Share

$0.63

$0.14

$0.03

$(0.01)

$0.79 |

43

Full Year GAAP EPS Reconciliation

Twelve Months Ended December 31, 2011

ExGen

ComEd

PECO

Other

Exelon

2011 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share

$3.01

$0.61

$0.58

$(0.05)

$4.16

Mark-to-market adjustments from economic hedging activities

(0.27)

-

-

-

(0.27)

Unrealized losses related to nuclear decommissioning trust funds

(0.00)

-

-

-

(0.00)

Retirement of fossil generating units

(0.05)

-

-

-

(0.05)

Asset retirement obligation

(0.03)

-

0.00

-

(0.02)

Constellation acquisition costs

(0.01)

-

(0.00)

(0.06)

(0.07)

AVSR 1 acquisition costs

(0.01)

-

-

-

(0.01)

Non-cash charge resulting from Illinois tax rate change legislation

(0.03)

(0.01)

-

(0.00)

(0.04)

Wolf Hollow acquisition

0.03

-

-

-

0.03

Recovery of costs pursuant to distribution rate case order

-

0.03

-

-

0.03

Non-cash remeasurement of deferred income taxes

0.01

-

-

(0.02)

(0.01)

FY 2011 GAAP Earnings (Loss) Per Share

$2.66

$0.63

$0.58

$(0.12)

$3.75

Twelve Months Ended December 31, 2010

ExGen

ComEd

PECO

Other

Exelon

2010 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share

$2.91

$0.68

$0.54

$(0.07)

$4.06

Mark-to-market adjustments from economic hedging activities

0.08

-

-

-

0.08

2007 Illinois electric rate settlement

(0.02)

-

-

-

(0.02)

Unrealized gains related to nuclear decommissioning trust funds

0.08

-

-

-

0.08

Asset retirement obligation

-

0.01

-

-

0.01

Retirement of fossil generating units

(0.08)

-

-

-

(0.08)

Non-cash remeasurement of income tax uncertainties

0.10

(0.16)

(0.03)

(0.01)

(0.10)

Non-cash charge resulting from health care legislation

(0.04)

(0.02)

(0.02)

(0.02)

(0.10)

Emission allowances impairment

(0.05)

-

-

-

(0.05)

Exelon Wind acquisition costs

(0.01)

-

-

-

(0.01)

FY 2010 GAAP Earnings (Loss) Per Share

$2.97

$0.51

$0.49

$(0.10)

$3.87

Note:

All amounts shown are per Exelon share and represent contributions to Exelon's EPS.

Amounts may not add due to rounding. |