Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BANCORPSOUTH INC | d287588d8k.htm |

BancorpSouth, Inc.

Financial Information

As of December 31, 2011

Exhibit 99.2 |

Forward Looking Information

2

Certain statements contained in this presentation and the accompanying slides may not be based on

historical facts and are “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These

forward-looking statements may be identified by reference to a future period or by the use of

forward-looking terminology, such as “anticipate,” “believe,”

“estimate,” “expect,” “foresee,” “may,” “might,”

“will,” “intend,” “could,” “would” or “plan,” or future or conditional verb tenses, and variations or negatives of

such terms. These forward-looking statements include, without limitation, statements about the use

of proceeds from the offering, pro forma capital ratios, regulatory stress tests, results of

operations and financial condition. We caution you not to place undue reliance on the forward-looking statements contained

in this presentation, in that actual results could differ materially from those indicated in such

forward-looking statements as a result of a variety of factors. These factors include, but

are not limited to, conditions in the financial markets and economic conditions generally, including conditions in the financial

markets and economic conditions generally, the adequacy of the Company’s provision and allowance

for credit losses to cover actual credit losses, the credit risk associated with real estate

construction, acquisition and development loans, the impact of legal or administrative proceedings, the availability of capital

on favorable terms if and when needed, liquidity risk, the Company’s ability to improve its

internal controls adequately, governmental regulation, including the Dodd Frank Act, and

supervision of the Company’s operations, the impact of regulations on service charges on the Company’s core deposit accounts, the

susceptibility of the Company’s business to local economic conditions, the soundness of other

financial institutions, changes in interest rates, the impact of monetary policies and economic

factors on the Company’s ability to attract deposits or make loans, volatility in capital and credit markets, reputational risk,

the impact of hurricanes or other adverse weather events, any requirement that the Company write down

goodwill or other intangible assets, diversification in the types of financial services the

Company offers, competition with other financial services companies, risks in connection with completed or potential

acquisitions, the Company’s growth strategy, interruptions or breaches in security of the

Company’s information systems, the failure of certain third party vendors to perform,

limitations on the Company’s ability to declare and pay dividends, dilution caused by the Company’s issuance of any additional shares of

its common stock to raise capital or acquire other banks, bank holding companies, financial holding

companies and insurance agencies, other factors generally understood to affect the financial

results of financial services companies and other factors detailed from time to time in the Company’s press

releases and filings with the Securities and Exchange Commission. Forward-looking statements speak

only as of the date they were made, and, except as required by law, we do not undertake any

obligation to update or revise forward-looking statements to reflect events or circumstances after the date of this

presentation. Certain tabular presentations may not reconcile because of rounding. Unless otherwise

noted, any quotes in this presentation can be attributed to company management. |

This presentation contains financial information determined by methods other than

those prescribed by accounting principles generally accepted in the United

States ("GAAP'). Management uses these "non-GAAP" financial measures in its analysis of the Company's capital and

performance. Management believes that the ratio of tangible common equity to

tangible assets is important to investors who are interested in evaluating

the adequacy of the Company’s capital levels. You should not view these

disclosures as a substitute for results determined in accordance with GAAP, and they are not necessarily

comparable to non-GAAP measures used by other companies. The limitations

associated with these measures are the risks that persons might disagree as

to the appropriateness of items comprising these measures and that different companies might calculate these measures

differently. Information provided in the Appendix of this presentation reconciles

these non-GAAP measures with comparable measures calculated in

accordance with GAAP. Non-GAAP Financial Disclaimer

3 |

Financial Highlights

At and for the three months ended December 31, 2011

Net income of $13.3 million, or $0.16 per diluted share

Improvement in many credit quality indicators including the provision

for credit losses, total NPLs and NPAs, nonaccrual loan formation, and

near-term past dues

Net interest margin remained stable at 3.69%

Mortgage production increased to $390 million, although a negative

MSR market valuation adjustment reduced mortgage revenue by $1

million

Capital levels improved:

12/31/11

9/30/11

12/31/10

Equity/Assets

9.72%

9.60%

8.98%

TIER I Leverage Capital

8.85%

8.66%

8.07%

Total Capital

13.03% 12.62%

11.87%

4 |

Provision for credit losses declined $5.9 million, or 23.3%, from the

previous quarter

NPLs decreased $40.5 million, or 11.1%, from the previous quarter and

NPAs declined $29.4 million, or 5.6%

Nonaccrual loan formation declined from $60.8 million for the third quarter

of 2011 to $39.5 million for the fourth quarter of 2011

51% of non-accrual loans were paying as agreed

Loans 30-89 days past due, still accruing, declined from $54.1 million as

of

9/30/11 to $37.5 million as of 12/31/11

Credit Quality Highlights

At and for the three months ended December 31, 2011

5 |

September 2011 and December 2010 noninterest revenue includes net securities

gains/losses of $2.0 million and ($0.5) million, respectively. Net

securities gains/losses were not significant for the fourth quarter of

2011 6

Recent Operating Results

NM

–

Not

meaningful

Dollars in millions, except per share data

12/31/11

9/30/11

12/31/10

Net interest revenue

$107.5

$108.1

$110.2

(2.5)

%

Provision for credit losses

19.3

25.1

43.3

(55.5)

Noninterest revenue

65.3

62.1

74.0

(11.7)

Noninterest expense

135.9

130.7

123.5

10.0

Income before income taxes

17.7

14.3

17.4

1.8

Income tax provision

4.4

2.4

1.6

NM

Net income

$13.3

$11.9

$15.8

(15.8)

Net income per share: diluted

$0.16

$0.14

$0.19

(15.8)

Three Months Ended

Q4'11 vs.

Q4'10 |

Noninterest Revenue

Dollars in thousands

7

12/31/11

9/30/11

12/31/10

Mortgage origination and servicing

9,919

$

10,233

$

9,231

$

MSR valuation adjustment

(991)

(11,676)

8,895

Credit card, debit card and merchant fees

7,783

12,981

9,951

Service charges

17,412

17,334

16,854

Trust income

3,348

2,854

3,072

Security gains (losses), net

18

2,047

(470)

Insurance commissions

19,416

22,012

18,013

Other

8,430

6,270

8,428

Total noninterest revenue

65,335

$

62,055

$

73,974

$

Three Months Ended |

Change

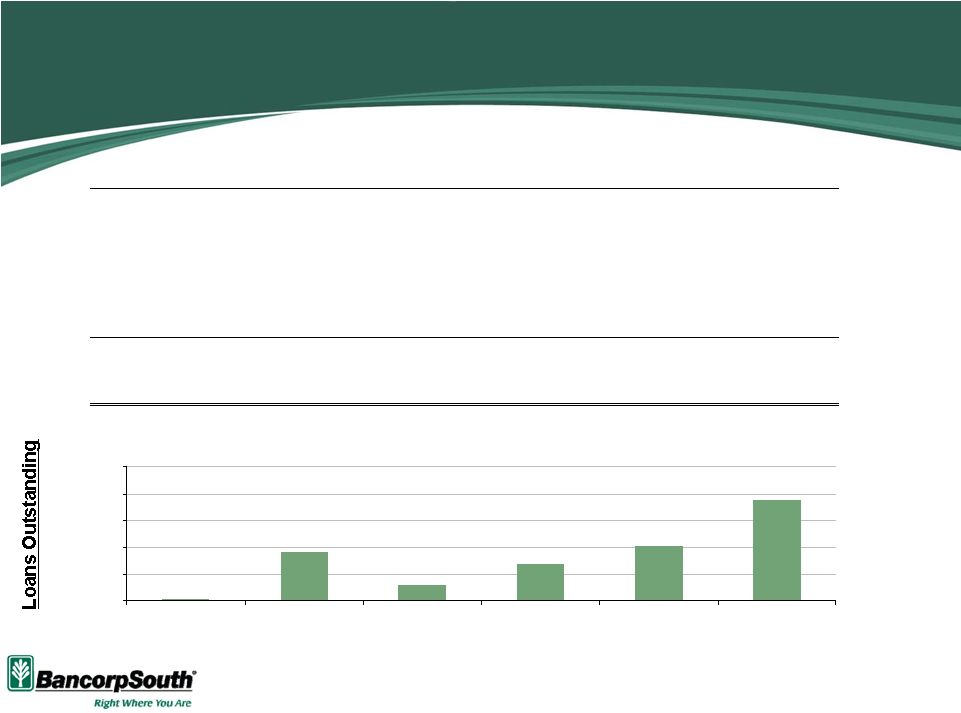

in Loan Portfolio 8

% Change

As of

Linked

YOY

12/31/11

9/30/11

12/31/10

12/31/11 vs. 9/30/11

12/31/11 vs. 12/31/10

Commercial and industrial

1,474

$

1,503

$

1,491

$

(2.0%)

(1.2%)

Real estate:

Consumer mortgages

1,945

1,966

1,952

(1.1%)

(0.3%)

Home equity

514

523

543

(1.7%)

(5.3%)

Agricultural

239

250

252

(4.1%)

(5.1%)

Commercial and industrial-owner occupied

1,302

1,330

1,331

(2.1%)

(2.2%)

Construction, acquisition and development

908

977

1,175

(7.0%)

(22.7%)

Commercial

1,754

1,772

1,817

(1.0%)

(3.5%)

Credit Cards

106

103

106

3.0%

(0.1%)

Other

627

632

665

(0.8%)

(5.7%)

Total

8,870

$

9,056

$

9,333

$

(2.0%)

(5.0%)

Dollars in millions

Loan balances shown net of unearned income |

NPLs

Dollars in millions

Net loans and leases as of December 31, 2011

9

NPLs as a Percent

Outstanding

NPLs

of Outstanding

Commercial and industrial

$1,473.7

$13.6

0.9%

Real estate:

Consumer mortgages

1,945.2

52.6

2.7%

Home equity

514.4

2.0

0.4%

Agricultural

239.5

4.3

1.8%

Commercial and industrial-owner occupied

1,301.6

42.0

3.2%

Construction, acquisition and development

908.4

135.2

14.9%

Commercial

1,754.0

61.8

3.5%

Credit cards

106.3

3.4

3.2%

All other

627.3

7.4

1.2%

Total loans

$8,870.3

$322.3

3.6% |

Outstanding NPLs

NPLs as a Percent of

Outstanding

Multi-Family Construction

$2.1

$1.1

1-4 Family Construction

169.8

15.0

Recreation and All Other Loans

67.2

1.3

Commercial Construction

130.1

5.2

Commercial Acquisition and Development

197.0

24.4

Residential Acquisition and Development

342.0

88.2

Real Estate Construction, Acquisition

and Development

$908.4

$135.2

12.4

25.8

14.9%

49.9%

8.8

1.9

4.0

Real Estate Construction, Acquisition and Development

$0

$100

$200

$300

$400

$500

Multi-Family

Construction

1-4 Family

Construction

Recreation & All

Other Loans

Commercial

Construction

Commercial A & D

Residential A & D

10

Dollars in millions

As of December 31, 2011 |

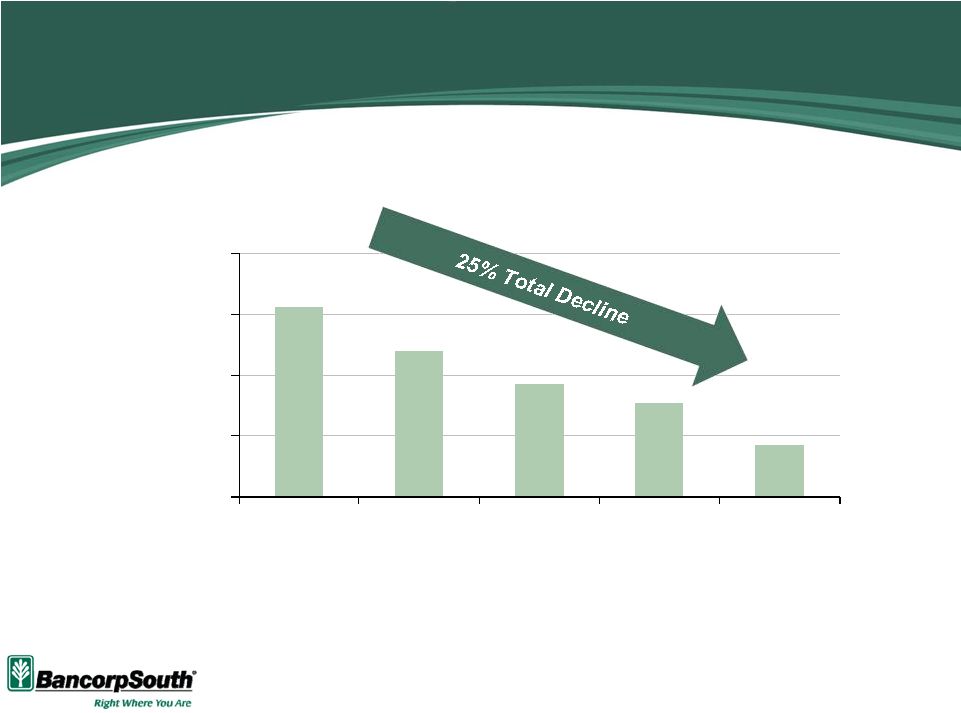

$456

$420

$393

$377

$342

$300

$350

$400

$450

$500

12/31/10

3/31/11

6/30/11

9/30/11

12/31/11

Residential Acquisition and Development

11

Dollars in millions |

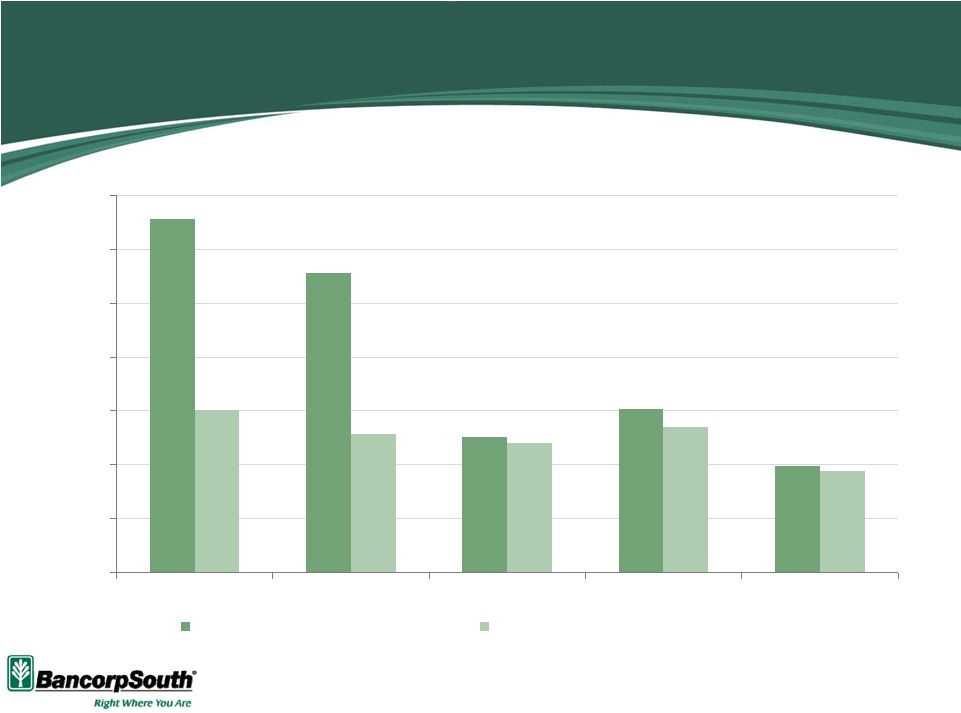

Newly

Identified Non-Accrual Loans Dollars in millions

Based on period end balances

12

$131M

$111M

$50M

$61M

$39M

$60M

$52M

$48M

$54M

$38M

$0

$20

$40

$60

$80

$100

$120

$140

12/31/10

3/31/11

6/30/11

9/30/11

12/31/11

Newly Identified Non-Accrual Loans

Loans 30-89 Days Past Due, Still Accruing |

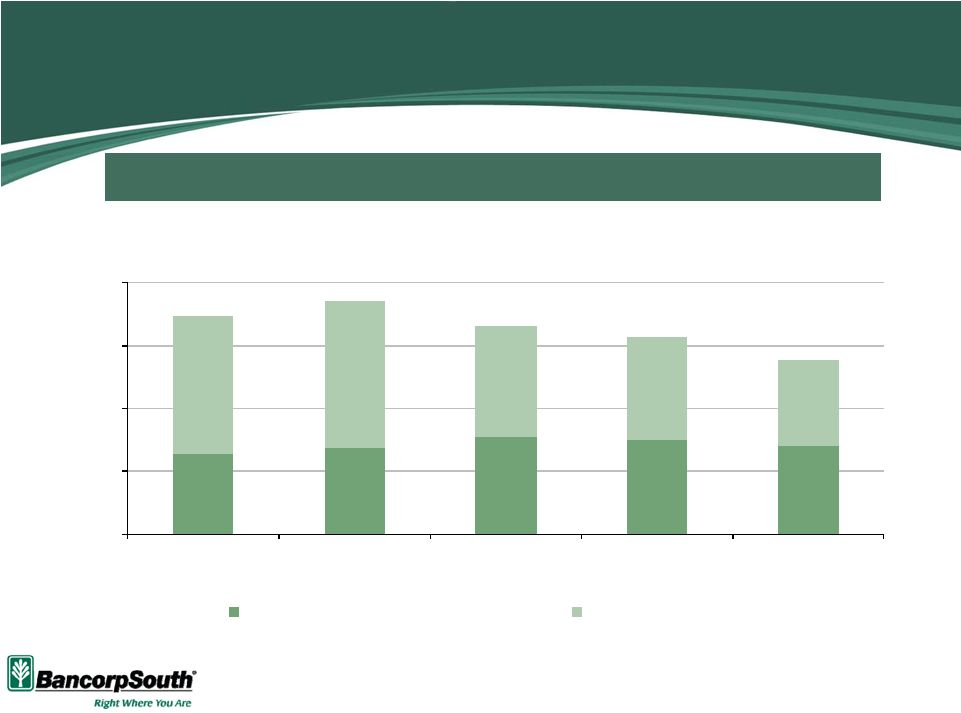

$0

$100

$200

$300

$400

12/31/10

3/31/11

6/30/11

9/30/11

12/31/11

Non-Accrual Lns Paying as Agreed

All Other Non-Accrual Lns

Non-Accrual Loans

36%

37%

47%

48%

51%

51% of non-accrual loans were paying as agreed as of December 31, 2011

13

Dollars in millions

“Paying as Agreed” includes loans < 30 days past due with payments occurring at least

quarterly |

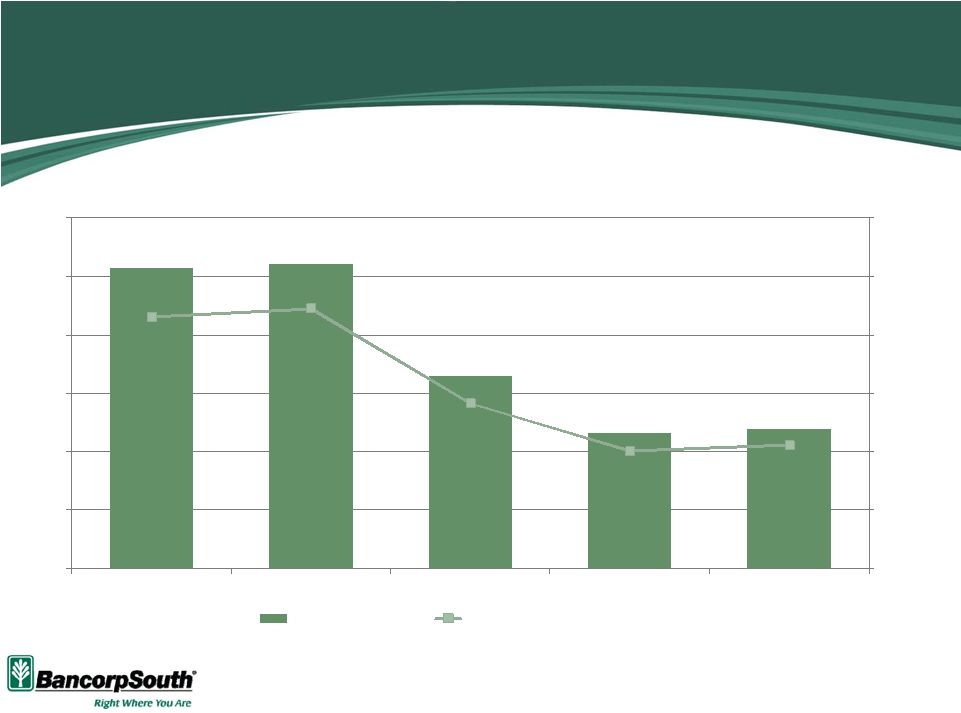

Dollars in millions

Net Charge-offs are Stabilizing

% Avg. Loans

14

$51

$52

$33

$23

$24

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

$0

$10

$20

$30

$40

$50

$60

12/31/10

3/31/11

6/30/11

9/30/11

12/31/11

Net Charge-Offs

Net Charge-offs / Average loans |

Loan

Impairment Analysis As of December 31, 2011

Dollars in millions

15

85% of non-accrual loans are impaired and are carried at 68% of UPB

Total

Unpaid principal balance ("UPB") of impaired loans

$287.1

Cumulative charge-offs on impaired loans

(52.2)

Allowance for impaired loans

(39.7)

Net book value of impaired loans

$195.2

Net book value / UPB

68% |

Other

Real Estate Owned 16

Total

Unpaid principal balance at time of foreclosure

$319.1

Cumulative charge-offs and writedowns of OREO

(145.3)

Current book value of OREO

$173.8

Current book value / UPB

54%

Write-downs of OREO were $8.7 million for the fourth quarter of 2011

compared with $4.4 million for the third quarter of 2011

Sales

of

OREO

totaled

$16.7

million

during

the

fourth

quarter

of

2011

and

resulted in no material net gain/loss

OREO

is

carried

at

54%

of

the

aggregate

unpaid

principal

balance

at

the

time of foreclosure

Dollars in millions

As of December 31, 2011 |

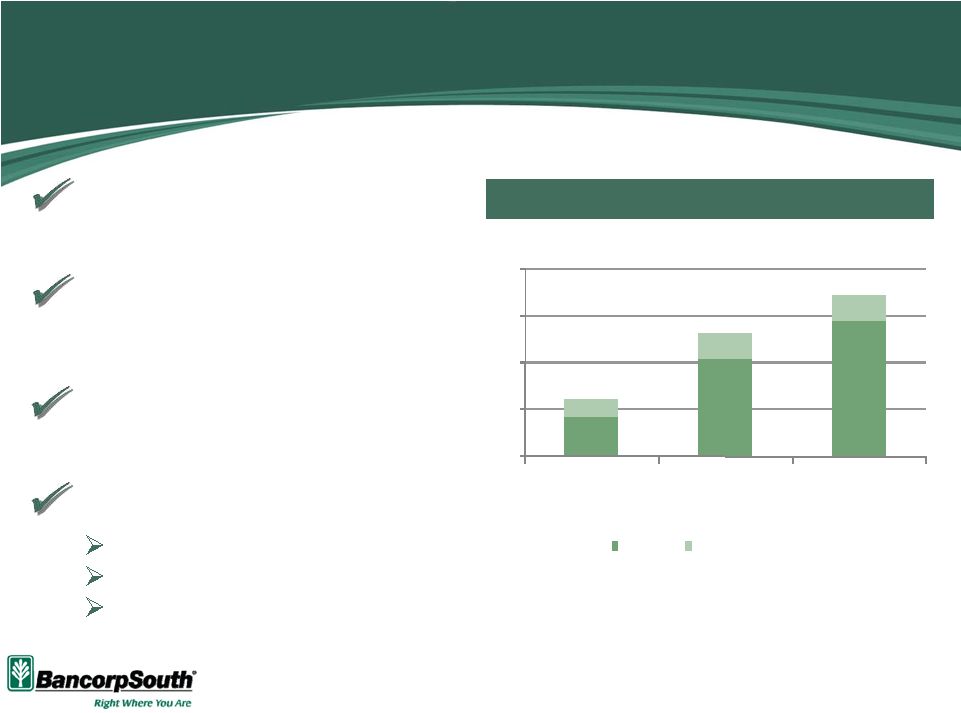

Common Stock Offering

Pro forma capital ratios assume $109 million of net proceeds.

Announced $100 million common

stock offering on January 17, 2012

Improves capitalization at the

Holding Company and maintains

flexibility at the Bank

Increases Holding Company

liquidity

Enhances strategic flexibility

Positioned for recovery

Ability to invest

Opportunistic M&A

Holding Company Capital Ratios

17

7.67%

10.15%

11.77%

8.46%

11.28%

12.90%

6.00%

8.00%

10.00%

12.00%

14.00%

TCE / TA

Tier 1 Common

Ratio

Tier 1 Ratio

12/31/11

12/31/11 Pro Forma |

Reasons for the Offering

A strong capital position is consistent with the Company’s operating

philosophy.

The common equity raise will enhance our capital ratios, particularly

tangible common equity to tangible assets and Tier I risk-based capital, and

will bring our capital ratios more in-line with peers

In the post-financial crisis environment, all banks will be expected to

operate with higher capital levels.

As a large insured depository institution, the Company’s bank subsidiary

will be subjected to a regulatory “stress test”

on capital. Since the final

parameters of this upcoming test are unknown, capital ratios in line with

peers is a prudent position.

18 |

Appendix |

20

Non-GAAP Financial Reconciliation

Tangible Common Equity / Tangible Assets (TCE/TA)

As of

As of

As of

12/31/2011

9/30/2011

12/31/2010

(Dollars In Thousands)

Common Equity --> A

$1,262,912

$1,266,753

$1,222,244

Assets --> B

12,995,851

13,198,518

13,615,010

Intangibles --> C

287,910

288,723

289,720

Tangible Common Equity --> D=A-C

975,002

978,030

932,524

Tangible Assets --> E=B-C

12,707,941

12,909,795

13,325,290

TCE/TA --> D/E

7.67%

7.58%

7.00% |