Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ATC Ventures Group, Inc. | cyclecountry8k01232012.htm |

| EX-3.1 - EXHIBIT 3.1 - ATC Ventures Group, Inc. | ex31.htm |

| EX-99.2 - EXHIBIT 99.2 - ATC Ventures Group, Inc. | ex992.htm |

Exhibit 99.1

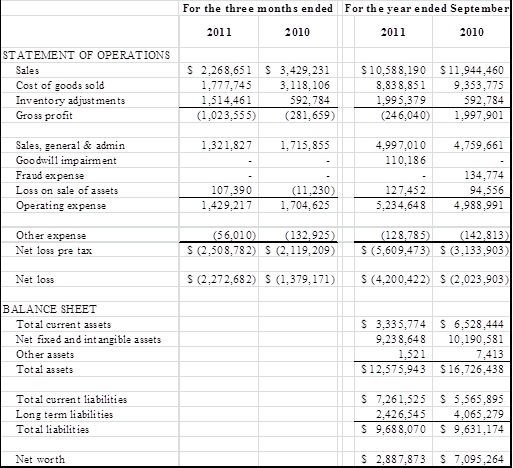

Cycle Country Announces Preliminary, Unaudited Fiscal 2011 Fourth Quarter and Full Year Results, Restatement of Prior Financial Results

|

·

|

Fourth quarter 2011 net loss of ($2,272,682), compared to net loss in the fourth quarter of fiscal year 2010 of ($1,379,171).

|

|

·

|

Fourth quarter 2011 net sales of $2,268,651 compared to net sales in the fourth quarter of fiscal year 2010 of $3,429,231.

|

|

·

|

Full-year net loss for the fiscal year 2011 of ($4,200,422), compared to full-year net loss in fiscal year 2010 of ($2,023,903).

|

|

·

|

Full-year net sales for the fiscal year 2011 of $10,588,190, compared to full-year net sales in fiscal year 2010 of $11,944,460.

|

|

·

|

Non-recurring charges for fiscal year 2011 exceeded $3,000,000.

|

Spencer, Iowa, January 17, 2011—(BUSINESS WIRE)—Cycle Country Accessories Corp. (AMEX:ATC), announced its preliminary, unaudited financial results today for the quarter and year ended September 30, 2011.

For the full year, the Company announced a net loss of ($4,200,422) compared to a net loss in the prior fiscal year of ($2,023,903). Included in this year’s losses are non-recurring expenses of $2,554,245, made up significantly of non-cash charges to impair inventory and fixed assets as a result of the Company’s divestiture of its ATV Accessories and Perf-Form Oil Filter Product Lines.

As previously discussed in the Company's SEC filings, the Company has undergone a substantial restructuring of its business since January 1, 2011. The Company sold two of its reportable business segments, and mitigated its losses in one other by selling its plastic injection molding operations which were inefficient to operate. The Company now outsources the production of that business line. However, the company will continue to operate its metal manufacturing plant for all of its OEM and other contract metal fabrication clients.

The Company incurred a substantial impairment charge against inventory, fixed assets, and other intangible assets for the full year and for the fourth quarter, resulting primarily from the sale of the company's ATV Accessories Product Line to Kolpin Outdoors Inc. (“Kolpin”). This transaction was announced September 1, 2011, and closed on December 30, 2011. Because the Company will no longer control the production of that Product Line beyond March 31, 2012, the termination date of the current Master Supply Agreement between the Company and Kolpin, the Company felt it necessary to take a substantial charge against the inventories on hand that would be deemed to be excess or obsolete once the Kolpin transaction closes and the Company no longer controls the manufacturing of the Product Line. A portion of this charge of approximately$2,000,000 for inventory impairment and approximately $500,000 for fixed asset and other intangible asset impairment could potentially be recaptured in subsequent periods if the Company is able to successfully negotiate a continuation of the Master Supply Agreement with Kolpin.

The Company has also sold its Perf-Form segment that manufactured and marketed oil filters. Further, it discontinued manufacturing of its PlazCo segment and has outsourced the manufacturing of that segment’s wheel covers and other products for the aftermarket and OEM golf industry. In doing so, the Company incurred charges of approximately $250,000 in inventory, goodwill and other intangible asset impairment for the full year of fiscal 2011 for these segments, in addition to the charges noted above for the ATV Accessories segment.

The Company also announced that it has discovered an error in the way it accounted for certain equity compensation grants, which will require it to amend its previously-filed Annual Report on Form 10-K for the fiscal year ended September 30, 2010, and its Quarterly Reports on Form 10-Q for the first, second and third quarters of fiscal 2011. The error, which related to a non-cash compensation expense, caused the Company to understate the number of shares that were to have been issued and outstanding, having the effect of inaccurately reporting the basic and fully-diluted earnings per share for those periods.

Amending these previously-filed SEC reports will cause a delay in filing the Company’s Annual Report on Form 10-K for the year ended September 30, 2011. The Company expects to file its 2011 Form 10-K by February 14, 2012.

Preliminary, Unaudited Results for the Quarter and Year ended September 30, 2011.

For more information, contact: Robert Davis, CEO at 952-215-3100.