Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Farm Lands of Africa, Inc. | Financial_Report.xls |

| EX-4.3 - Farm Lands of Africa, Inc. | ex4-3.htm |

| EX-31.1 - Farm Lands of Africa, Inc. | ex31-1.htm |

| EX-32.1 - Farm Lands of Africa, Inc. | ex32-1.htm |

| EX-21.1 - Farm Lands of Africa, Inc. | ex21-1.htm |

| EX-31.2 - Farm Lands of Africa, Inc. | ex31-2.htm |

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the Fiscal Year Ended September 30, 2011

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ________________ to __________________

Commission File Number 000-53274

Farm Lands of Guinea, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

83-0510954

|

|

|

(State or other jurisdiction of

|

(IRS Employer

|

|

|

incorporation or organization)

|

Identification No.)

|

401 Atlantic Suites, Europort, Gibraltar

(Address of principal executive offices)

Issuer’s telephone number, including area code: +353 696 8961

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.001 Par Value.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was Required to submit and post such files). þ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. (as defined in Rule 12b-2 of the Exchange Act). Check one:

|

Large accelerated filer

|

¨

|

Non-accelerated filer

|

¨

|

|

|

Accelerated Filer

|

¨

|

Smaller reporting company

|

þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

As of March 31, 2011, the last day of the Registrant’s most recently completed second fiscal quarter, the aggregate market value of the shares of the Registrant’s common stock held by non-affiliates (based upon the closing stock price of $5.10 as reported on the Over-the-Counter Bulletin Board) was approximately $28,242,403. Shares of the Registrant’s common stock held by each executive officer and director and by each person who owns 10 percent or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates of the Registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of January 12, 2012, there were outstanding 9,208,335 shares of the registrant’s common stock, $.001 par value.

Documents incorporated by reference: None.

Farm Lands of Guinea, Inc.

Form 10-K

Table of Contents

|

Page

|

||||

|

PART I

|

||||

|

Item 1.

|

Description of Business

|

3

|

||

|

Item 1A.

|

Risk Factors

|

12

|

||

|

Item 2.

|

Description of Property

|

16

|

||

|

Item 3.

|

Legal Proceedings

|

17

|

||

|

PART II

|

||||

|

Item 5.

|

Market for Common Equity and Related Stockholder Matters

|

17

|

||

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

18

|

||

|

Item 8.

|

Financial Statements and Supplementary Data

|

22

|

||

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

22

|

||

|

Item 9A

|

Controls and Procedures

|

22

|

||

|

Item 9B.

|

Other Information

|

23 | ||

|

PART III

|

||||

|

Item 10.

|

Directors and Executive Officers

|

23

|

||

|

Item 11.

|

Executive Compensation

|

25

|

||

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

26

|

||

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

28

|

||

|

Item 14.

|

Principal Accountant Fees and Services

|

29

|

||

|

PART IV

|

||||

|

Item 15.

|

Exhibits

|

30

|

||

|

Signatures

|

31

|

|||

|

Financial Statements

|

F-1

|

|||

2

PREDICTIVE STATEMENTS AND ASSOCIATED RISK

Certain statements in this Report, and the documents incorporated by reference herein, constitute predictive statements. Such predictive statements involve known and unknown risks, uncertainties and other factors which may cause deviations in actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied. Such factors include, but are not limited to: market and customer acceptance and demand for our products; our ability to market our products; the impact of competitive products and pricing; the ability to develop and launch new products on a timely basis; the regulatory environment, including government regulation in the Republic of Guinea; our ability to obtain the requisite regulatory approvals to commercialize our products; fluctuations in operating results, including spending for research and development and sales and marketing activities; and other risks detailed from time-to-time in our filings with the U.S. Securities and Exchange Commission (the “SEC”).

The words "believe, expect, anticipate, intend and plan" and similar expressions identify predictive statements. These statements are subject to risks and uncertainties that cannot be known or quantified and, consequently, actual results may differ materially from those expressed or implied by such predictive statements. Readers are cautioned not to place undue reliance on these predictive statements, which speak only as of the date they are made.

Unless otherwise noted, all currency figures in this filing are in U.S. dollars.

PART I

ITEM 1. BUSINESS

Overview

Farm Lands of Guinea, Inc. (the “Company”) was organized in Nevada on October 11, 2007. The Company, through Land & Resources of Guinea SA, its indirect majority-owned subsidiary in the Republic of Guinea (“Guinea”), intends to engage in rehabilitation and farming of land in Guinea.

Corporate History

The Company was incorporated under the name Kryptic Entertainment Inc. on October 11, 2007 in the State of Nevada. Effective April 1, 2011, the Company changed its name to Farm Lands of Guinea, Inc. Because of a planned expansion of its operations in Africa, the Company intends to change its name to Farm Lands of Africa, Inc.

On February 28, 2011, we consummated a share exchange with stockholders (the “FLG Stockholders”) of Farm Lands of Guinea Ltd., a British Virgin Islands company (“FLG”) whereby FLG Stockholders transferred 100% of the outstanding ordinary shares of FLG held by them, in exchange for an aggregate of 7,801,000 newly issued shares of our Common Stock representing approximately 86.7% of our then issued and outstanding Common Stock.

On February 28, 2011, we entered into and consummated transactions pursuant to a subscription agreement with certain investors whereby the investors agreed to and did purchase for an aggregate of $1.0 million an aggregate of 50,000 Units with each Unit comprised of four (4) shares of Common Stock, a Series A Warrant to purchase one (1) share of Common Stock at an exercise price of $7.50 per share and a Series B Warrant to purchase one (1) share of Common Stock at an exercise price of $10.00 per share.

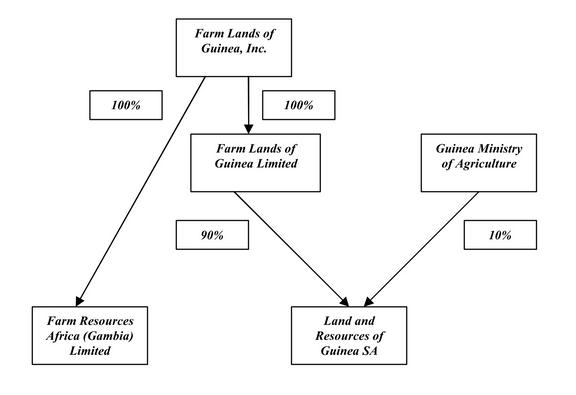

The share exchange and the private placement resulted in (i) a change in control of the Company with the shareholders of FLG owning approximately 86.7% of issued and outstanding shares of common stock of the Company, (ii) FLG becoming a wholly-owned subsidiary of the Company, (iii) Land & Resources becoming an indirect 90% owned subsidiary of the Company, and (iv) appointment of certain nominees of FLG as directors and officers of the Company and resignation of Shan Qiang as sole director, Chief Executive Officer, Chief Financial Officer, Secretary and Treasurer of the Company.

3

FLG was incorporated in the British Virgin Islands as a Business Company on August 9, 2010. FLG through its 90%-owned subsidiary, Land & Resources, a limited liability company organized under the laws of Guinea on September 14, 2010, intends to engage in rehabilitation and farming of land in Guinea. The Ministry of Agriculture of Guinea holds the 10% ownership stake in Land & Resources.

On August 4, 2011, Farm Resources Africa (Gambia) Limited (“FRAG”) was formed as a Gambia corporation. FRAG is a 100% owned subsidiary of the Company. FRAG will engage in rehabilitation and farming of land in Gambia. As of the date of this report, it has not commenced its operations yet.

Our current corporate structure is set forth in the following diagram:

Recent Developments

On August 17, 2011, the Company consummated transactions pursuant to a subscription agreement with AIM Investments plc, a public limited company organized under the U.K. laws (“AIMI”), pursuant to which AIMI purchased for an aggregate price of $1.0 million an aggregate of 50,000 units with each unit comprised of four (4) shares of our common stock, a Series A Warrant to purchase one (1) share of common stock at an exercise price of $7.50 per share and a Series B Warrant to purchase one (1) share of common stock at an exercise price of $10.00 per share.

On August 17, 2011, we consummated transactions pursuant to a letter agreement with AIMI, pursuant to which we purchased 24,500,000 ordinary shares, par value GBX0.1 per share, of AIMI at a per share purchase price of GBX1.25 for a total price of $500,000. In connection with the purchase of the Shares, AIMI agreed to issue to the Company for no additional consideration warrants to purchase 24,500,000 ordinary shares of AIMI at an exercise price of GBX1.5 per share.

Our Business

Overview

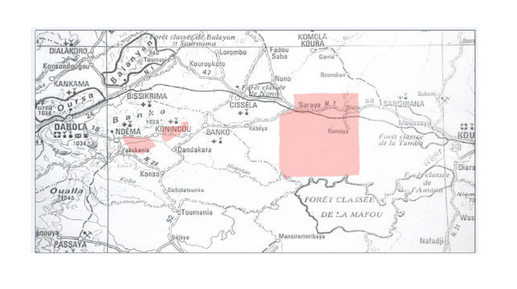

FLG through its 90%-owned subsidiary, Land & Resources, a limited liability company organized under the laws of Guinea, intends to engage in rehabilitation and farming of land in Guinea. Land & Resources currently plans to develop 8,815 hectares in the villages of N’Dema and Konindou to grow maize and soybeans in rotation as a pilot project for the development of 98,400 hectares lying to the south and east of Saraya.

4

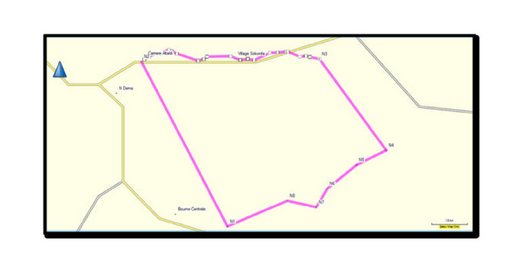

Land & Resources is a development stage agricultural company in Guinea. It intends to engage in acquiring and consolidating farm land and operations in Guinea and rehabilitating them back into production using modern agricultural techniques and practices. Pursuant to the Contract for a Program of Agricultural Development in Guinea dated September 16, 2010 (the “Contract for Development”), the Ministry of Agriculture of Guinea (“MAG”) has agreed to grant to Land & Resources 99-year leases over two parcels of land in the villages of N’Dema and Konindou of 5,340 and 3,475 hectares respectively to be developed as agricultural land. The leases are in a form agreed upon by both parties to the Contract for Development. The rent payments under each proposed lease are nominal.

The land lots to be leased require development before any agricultural production can start. This will involve removal of existing forestation in the form of bush and leveling the land to be suitable for a large scale agricultural use. Land & Resources is currently focused on developing the first stage of its pilot project in the village of N’Dema in Guinea on a 300 hectares land lot to grow maize and soybeans in rotation. This initial stage is planned to start following the execution of the lease with the Ministry of Agriculture of Guinea and be completed by the end of 2012. The entire pilot project (the “Pilot Project”) involves development for agricultural use of both parcels of land in N’Dema and Konindou and is planned to go into active phase following the completion of the first stage of the project on 300 hectares in N’Dema. Farm Lands of Guinea intends to raise additional capital to complete this development.

On September 16, 2010, Land & Resources and MAG entered into an Option Agreement (the “Option Agreement”) pursuant to which Land & Resources was granted an option to assume a lease of approximately 98,400 hectares located in the village of Saraya in Guinea (the “Option Land”) on the same terms as the Pilot Project. Under the Option Agreement, as a consideration for the grant of the option, within a year after the execution of the leases for the Pilot Project Land & Resources shall conduct a full survey of suitability and viability of the Option Land for long term commercial soybean, maize and rice farming taking into account factors including land fertility, climate, availability of local labor, local land ownership interests, likely market demand, economics and other relevant factors.

On October 25, 2010, Land & Resources signed a Protocol d’Accord with MAG (the "Protocol D'Accord") under which the Company undertook obligations to survey and map additional underutilized land in Guinea estimated to be up to 1.5 million hectares of combined area and prepare it for disposal under 99-year leases. In consideration thereof the Ministry of Agriculture has agreed to grant Land and Resources exclusive marketing rights with a commission of 15% being payable on closed sales.

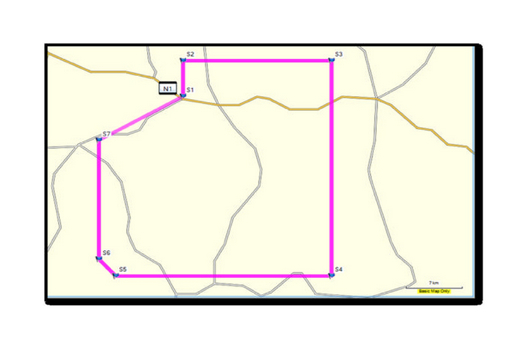

Set forth below is the map showing all three locations in the villages of N’Dema, Konindou and Saraya to be developed by Land & Resources pursuant to the proposed leases, the Contract for Development and the Option Agreement.

5

N’Dema, Dabola

The parcel of land lays 19 kilometers south by east of Dabola which is 430 kilometers east of Conakry, the capital of the Republic of Guinea. It is linked to the N1 by a B road which while unpaved is in excellent condition. This road, to which the property has a frontage of about 10 kilometers, forms its northern boundary. The N1 is the principal east/west arterial highway connecting Conakry to Kankan, the Republic’s third city. West of Dabola, the N1 is in reasonable condition; to the east it is not. In colonial times, the railway ran through Dabola. It no longer functions but a protocol d’accord has been signed with Chinese interests to re-instate it. Work is scheduled to start after confirmation of the recent Presidential election by the Supreme Court of the Republic of Guinea.

The property is at the head of a valley which is drained by the River Niantan. It is sheltered to the north by a range of hills some 3 kilometers away which rise to 1000 m. It is also sheltered to the east and south by hills, again about 3 kilometers distant. The property is presently unfenced but the extent of the estate has been agreed with the Ministry of Agriculture of the Republic of Guinea as having the following co-ordinates and bearings on the western and eastern extremities of the property: north western boundary point N10.40.895 W10.57.354, bearing 148 degrees 8 kilometers to south western boundary point N10.37.141 W10.55.199; the northern boundary follows the

6

N’Dema/Konindou road (allowing a 10 metre verge) approximately due west to the north eastern boundary point N10.40.952. The distance recorded between the two points by GPS was 8.83 kilometers. The south eastern boundary point was fixed by taking a bearing 139 degrees from the original estate plan and producing the line 5 kilometers, again using data from the plan to fix the south eastern boundary point at N10.38.64 W10.50.069. The area of the N’Dema estate by GPS is 5,340 hectares. The southern boundary of the estate is irregular and follows physical features. The site is generally level with some undulation. It is covered with relatively open scrub and forest, the trees of which rise to about 15 metres. The above plan forms part of the lease.

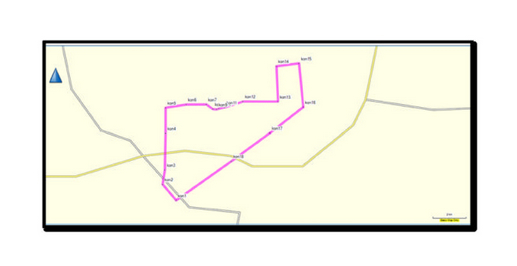

Konindou

Konindou is a large traditional village lying 14 kilometres east of N’Dema.

The land comprises 3,475 hectares and is of similar quality to the parcel in N’Dema, although lighter and sandier. It is also predominantly flat, rising steeply at the eastern boundary. The rainfall pattern affecting this property is similar to Dabola some 33 kilometres to the west.

The land at Konindou starts about 1.5 kilometers east of the eastern boundary of the N’Dema parcel. It is comprised of predominantly virgin land suitable for cropping with small areas being used for subsistence farming by the local people. It will require less clearance than the N’Dema land, but might require a heavier application of fertilizer to regenerate it. The quality of the land is variable but much of it is excellent agricultural use. Some 3,475 hectares approximately have been identified. The parcel is irregularly shaped running first north from N10.40.115 W10.50.288 5.57 kilometers to N10.43.090 W10.50,704, then east 8.05 kilometers to N10.43.286 W10.46.290, then north again 2.09 kilometers to N10.44.423 W10.46.353, then east 1.6 kilometers to N10.44.516 W10.45.466, then south 2.63 kilometers to N10.43.110 W10.45.302, then south west 10.65 kilometers to the starting point. Evidence from a number of wells inspected suggests that the water table lies between 3 and 8 metres below the surface. Konindou is large enough to be capable of providing up to one hundred skilled workers to carry out the manual part of the land clearance.

7

Saraya

The Option Land lies to the south of the N1 approximately 100 kilometers east of Dabola between the villages of Saraya and Diata. It comprises approximately 98,400 hectares and has a frontage to the N1 of approximately 20 kilometers. It extends 40 kilometers to the south of the N1. It is between 200 and 500 meters above sea level. It is watered and drained by the River Banie. The average annual rainfall is about 1,400 millimeters. The land is verdant and fertile and largely covered in low scrub and bush. Small scale agriculture is practiced. Groundnuts and maize are grown. The route of the railway that is planned to be rebuilt by the government with participation of Chinese investors passes through the land.

Industry Overview

The Republic of Guinea is a former French colony. It is a West African country on the North Atlantic Ocean, bordering Senegal, Mali, Ivory Coast, Liberia, Sierra Leone and Bissau. It is part of the emerging African reformation chain and now presents the optimum timing opportunity for investment in agriculture. Conakry with a population of approximately 1.5 million people is the largest city and the seat of the national government. The

8

Country has a population of approximately eight million. The official language is French and the principal religion is Islam. The government was essentially a military dictatorship until the end of 2010 when following free elections Alpha Condé was elected the president of Guinea. Guinea has abundant natural resources, including significant gold and diamond deposits and also more than one third of the world’s known bauxite reserves. Even during problematic periods, the country has always had a strong mining sector. By contrast, although agriculture accounts for 24% of its GDP and employs 84% of the active population, the sector has stagnated since independence and less than 3% of Guinea’s arable land is currently being cultivated.

The Guinean government adopted policies in the 1990s to return commercial activity to the private sector, promote investment, reduce the role of the state in the economy and improve the administrative and judicial framework. The Government revised the private investment code in 1998 to stimulate economic activity in the spirit of free enterprise. The code does not discriminate between foreigners and nationals and allows for repatriation of profits. It is undeniable that there are numerous problems facing the Guinea economy, but this has not detracted a wide range of foreign investors, notably large international aluminum producers, Australian, British, Canadian and Swiss mining consortia prospecting for gold, diamonds and other metals and more recently the China International Fund announced its intention to invest $7 billion in infrastructure projects. Multinational corporations currently operating in Guinea include BHP Billiton, Rio Tinto, RUSAL, Royal Dutch Shell, and Dana Petroleum, among others. Guinea is a fertile country. Its mineral resources have pushed the development of agriculture into second place. Its present subsistence model cannot adequately feed its increasingly urban population. Its plentiful rain fall and virgin soil offer opportunities to create an export business in a world with a growing demand for food.

Since independence in 1958, much of the arable land in the Republic of Guinea has been neglected. The once vibrant agricultural sector has largely disappeared. The Ministry of Agriculture has therefore been examining ways to regenerate vast areas of scrubland and make it suitable for modern methods of agriculture. Recognizing that Guinea’s climate is suitable for the production of a number of crops including Soya, the Ministry of Agriculture has been seeking partners to assist it in developing this aspect of Guinea’s resources.

Corn-like Maize is a staple food in Guinea. According to data collected by the Ministry of Agriculture of Guinea, there is currently a national shortfall of 500,000 tons of this product which to date has been filled with importation from international markets. Local production is carried out by farmers and does not involve use of fertilizer, mechanized tools and machinery. As a result, the yields of the crop are poor and well below the needs of the local market.

Bean crop Soya is not in significant production in Guinea. There is currently a substantial consumption shortfall in home produced cooking oil for which manufactured Soya or soybeans is particularly well suited. The shortfall is compensated for by importing Soya derived oil from international markets. The three major regions where Soya is grown profitably are the United States of America, Brazil, and Argentina. Each of them suffers local disadvantages. Farmers in the United States face first world costs. The Brazilians have to cope with vast distances and poor roads. In Argentina the government retains 35% of the gross yield at no charge. By contrast, the government of the Republic of Guinea actively promotes rather than penalizes production.

Production

Overview

The Company proposes to develop the leased land to grow in rotation, maize and soybeans. Given the rainfall, the temperature profile and the nature of the soil, it is anticipated that the land when developed will produce about 4 tons of soybeans per hectare. The rotation will be one year of maize followed by two years of Soya.

Development

The land is covered by sparse forestation which needs to be removed. The work required to remove bush is not complicated and the local labour force is accustomed to it. Modern hand tools and machinery including a Seppi Maxiforst Mulcher and a Seppi Multisoil stump crusher powered by two Fendt 930 tractors will be used. Given the current weakness of the dollar, consideration will be given to sourcing alternative machines in the United States of America. The workers and the machine operators, experienced in bush clearance, will be assembled into teams. The next step of the process is producing a level surface into which to direct drill and over which subsequently to run a modern combine harvester. There exist opportunities to defray some of the cost of clearance from the proceeds of charcoal production and the sale of timber.

9

Turning bush into arable land will naturally change the landscape, but by leaving wildlife corridors between each paddock, generous margins around water courses, and by instigating from the outset a strict spraying policy, the impact on wildlife should be restricted. A greater food supply should benefit such local wildlife as currently exists. The provision of wildlife corridors, the protection of watercourses and the loss from escarpments will reduce the viable area by approximately 25%. An initial estimate of the net farmable land of the two trial parcels is 6.700 hectares. A budget for land clearance has been set at $500 per arable hectare. The land will be cleared with machines and local teams during the dry season, which starts in November with manual work continuing even during the summer rainy months. The process of developing the land will not stop upon it being cleared. It can take up to a further four years while the land is drilled and counter-drilled until the paddocks become fully level and yield their optimum crop levels.

Crops

Groundnuts are currently the crop of choice of the indigenous farmers but by breaking up the topsoil the land is immediately subject to the vagaries of the weather and subsequent erosion. Land which grows groundnuts will grow soybeans. The only reservation concerning the efficacy of Soya as a crop is that as a bean it is quite delicate and the weight of rainfall may be detrimental. There are, however, sturdy varieties such as those used in Brazil which successfully endure tropical rain. The evidence of traditional husbandry is that the land will grow maize and it is the intention that it will be the first crop grown on the land first cleared. The reasons are threefold: (1) the platform of the harvester is set higher than for Soya which reduces the possibility of damage from obstructions in recently cleared land (2) the post-harvest detritus leaves heavier mulch than Soya and (3) there is a strong national market for the crop.

The second crop planted will be Soya. Soybeans are one of the “biotech food” crops that have been genetically modified. In 1995, Monsanto introduced “Roundup Ready” soybeans that were genetically modified (“GM”) to be resistant to the herbicide known as glysophate and marketed as “Roundup,” which dramatically reduces the cost and difficulties of production. The great bulk of soybean grown in South America is genetically modified and in the US this figure is now up to 93%. A small premium market exists principally in Europe for the non-genetically modified strains. At present, the EU still bans the import of GM soy into either the animal or human food chain, unless meeting extensive certification standards. No convincing evidence, however, exists that the inclusion of genetically modified strains into the human or animal food chain has any detrimental effect. The discomfort at its use appears to be largely a rich nation phenomenon. Soybeans provide affordable protein for people who live on a subsistence level and there is an ever-increasing market for this valuable source of food. China in 2010 increased its soybean imports for the third consecutive year, from 37.44 million tons in 2008, to an estimated 53.96 million tons this year.

Whichever variety, the plant is amazing in its vigour and versatility. It has been used in the East since time immemorial and was considered sacred for its use in crop rotation as a method of fixing nitrogen into the soil prior to ploughing and planting other food crops. It is high in protein producing twice as much per hectare as other grain or vegetable crops, and can be used for making a multitude of end products including flour, milk substitute, animal feed, processed foods and the oil extracted estimated at 19% is used primarily as vegetable oils but also in many industrial applications including the creation of biodiesel.

The cropping of land in rotation of soybeans and maize increases fertility, because the detritus of the harvest acts as both a cover from the sun and when decomposed, fertilises the soil. It is essential that all livestock is excluded from the land while it lies fallow as the rotting process is paramount. Although small scale and unimportant, there was evidence in Konindou of the damage done to the soil by the prolonged cultivation of peanuts that are harvested by turning the soil in a process similar to harvesting potatoes. The harvest coincides with the beginning of the dry season which means that the soil completely dries out. The cultivation of Soya/maize leaves the soil protected from the sun by a mass of vegetation, which in turn rots and puts back nutrients into the soil.

Raw Materials

Initially, the Company plans to purchase fertilizer from the local merchants in Conakry. If larger amounts are needed during the subsequent years, it will access international markets for importation. The amount of fertilizer required for the first stage of the Pilot Project is estimated to be approximately 30 to 45 tons which can be purchased locally. Seeds and pesticides will be sourced from regional and international producers at current market prices.

10

Crop Storage

The Company plans to adopt for storage a technology called the “chorizo” which proved to be a success in Argentina. Essentially, it is a 100-meter plastic “sausage” into which the grain is fed, the air is vacuumed out with a simple device that fits on the back of a tractor powered by the power take-off, and the unit is sealed. As long as the air does not get in, the crop is secure for up to 18 months. This eliminates the need to build silos. Nor is there any need to sell the crop at the time of glut.

Sales and Marketing

The genesis of the project was an invitation from the Guinea Minister of Agriculture to bring modern agriculture to Guinea. His motivation was the country’s current 500,000-ton maize shortfall that arose from the production failure of traditional indigenous agriculture, the chief power source of which is oxen. Maize currently retails in Guinea at about $360 per ton depending on season and location. This leaves a significant margin for transport and bagging. With maize we will be producing a crop in short supply. As a consequence, we do not plan at this stage to engage in special sales or marketing programs. Our initial production of soybeans will be relatively small. The intention is to keep all the seed for the following year’s planting.

Employees

We currently have no employees. We plan to add up to at least 40 employees at the start of the active development of our properties.

Seasonality

Guinea is equatorial. Crops may be grown throughout the year if irrigated during the dry season (November-March). We do not intend to irrigate having taken into account the cost and will rely on rainfall which averages 1400 millimeters per annum which is more than sufficient for single cropping.

Competition

Our main competitors are local importers/traders and local producers. We intend to offer high quality products from local sources at a competitive price, which we believe will provide a competitive advantage over the imported products and has the potential to encourage the importers to switch from their overseas suppliers to our products. Local producers are unlikely to be able to compete with us in terms of technology and efficiencies of scale, and the diversification of the market should ease the levels of competition. While local producers are not able to compete with us in terms of technology and efficiencies of scale, it is recognized that some of these local growers will continue to conduct small scale processing for their own consumption.

Our other competitors are agencies such as non-governmental organizations. However, one of our marketing strategies will be to form alliances with such organizations, for example by selling them our products to meet their needs in Guinea or elsewhere in the region at competitive prices.

Research and Development

We will carry out no original research and development. Save that we will experiment with different varieties of genetically modified seed products which are generally available.

11

Intellectual Property

The Company does not own any intellectual property.

Regulation

The Company will comply with standards laid down by the government of the Republic of Guinea where they apply to agricultural production.

ITEM 1A. RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

We have a limited operating history and are a development stage company.

FLG and Land & Resources were formed in 2010. To date, our operations have consisted primarily of formulating our plan to bring into production farm land in Guinea, executing the Contract for a Program of Agricultural Development in Guinea regarding 99-year leases over two parcels of land totaling 8,815 hectares to be developed as agricultural land, the Option Agreement regarding a 10 year option to take up a third lease on a further 98,400 hectares on the same terms, and the Protocol D’Accord regarding preparation for sale and sale of up to 1.5 million hectares of land in Guinea on behalf of the Guinea government. Accordingly, we have a limited operating history upon which an evaluation of our business and prospects can be based. An investment in our securities is subject to all of the risks involved in a newly established business venture. Potential investors should be aware of the problems, delays, expenses, and difficulties experienced by companies in the early developmental stage, which generally include unanticipated problems and additional costs relating to the commencement of operation and implementation of a business plan. Many of these factors may be beyond our control, including, but not limited to, unanticipated difficulties in negotiating land leases, clearing land and hiring local labor. In addition, our future performance also will be subject to other factors beyond our control, including general economic conditions. See “Description of Business”

We may be unable to enter into land leases under our contract for a program of agricultural development in Guinea and our option agreement.

Pursuant to the Contract for a Program of Agricultural Development in Guinea and Option Agreement, we can obtain 99-year leases on approximately 103,879 hectares of land. However, these agreements require that we enter into certain leases with the Guinea Ministry of Agriculture. There can be no assurance that we will be able to enter into the leases on the terms and within the timeframe as per the agreements.

We may be unable to satisfy the Guinea Ministry of Agriculture requirements during our probationary period.

Our Option from the Ministry of Agriculture in Guinea requires that we conduct a survey of long term commercial production on the land that is subject to the option during a probationary period of between six months and one year. We may be unable to complete the survey in the time allotted, or, the survey may not meet with government approval as there are no defined standards for the survey in the Option. The failure to complete the survey or its rejection as suitable may lead to a loss of the Option which would adversely affect our planned business.

We may not be able to effectively control and manage our growth, and a failure to do so could adversely affect our operations and financial condition.

12

Even if we are able to secure the funds necessary to implement our business plan, we will face management, resource and other challenges in expanding farming activities, clearing land and managing farming activities. Failure to effectively deal with increased demands on our resources could interrupt or adversely affect our operations and prospects:

|

·

|

unanticipated costs;

|

|

·

|

the diversion of management’s attention from other business concerns;

|

|

·

|

maintaining adequate control of our expenses and accounting systems;

|

|

·

|

anticipating and adapting to changing conditions in our industry, whether from changes in government regulations, technological developments or other economic, competitive or market dynamics.

|

Foreign operations are subject to various political, economic and other risks and uncertainties.

All of our operations will be conducted in Guinea, and as a result, the operations are vulnerable to various levels of political, economic and other risks and uncertainties associated with operating in a foreign jurisdiction. Such risks and uncertainties include, but are not limited to: high rates of inflation; currency exchange rates; labor unrest; renegotiation or nullification of existing concessions, licenses, permits and contracts; changes in taxation policies; restrictions on foreign exchange; changing political conditions; and currency controls.

Although there are currently favorable laws encouraging foreign investment, any changes in investment policies or changes in political attitude in Guinea may adversely affect our operations and prospects. Operations may also be affected by government regulations relating to, but not limited to, restrictions on production, price controls, import and export controls, currency remittance, income taxes, foreign investment, environmental legislation and land use.

Political instability may adversely affect the business of the Resulting Issuer.

Our operations in Guinea may be subject to the effects of political changes, civil conflict and war, changes in governmental policy, the uncertainty of the Guinea legal system, lack of law enforcement and labor unrest. Guinea is an impoverished country with physical and institutional infrastructure which is in a debilitated condition. There is a history of unrest and on June 16, 2010, the U.S. Department of State advised U.S. citizens in a travel warning that the political situation in Guinea remains unpredictable and the potential for violence persists.

In the event that there are changes in the current government, we may also encounter difficulties maintaining consistent relationships with the Guinea Ministry of Agriculture. Therefore, we may be exposed to political pressures in the form of expected consultation and ministerial influence over certain of our operations. Furthermore, in the event of a change in government, the current trend towards privatization may revert back to state-owned operations and consequential rescinding of agreements.

A lack of infrastructure in Guinea may adversely affect our business.

Certain areas of Guinea and across Africa lack basic infrastructure, including transport and communications. As a consequence, we will need to invest in building and maintaining our own network of roads and satellite-based communications systems, which may require significant financing and obtaining any necessary governmental approvals, neither of which can be assured. The inability to build such roads and establish appropriate communications systems may have an adverse effect on our operations and prevent us from achieving our stated business objectives.

High inflation rates are unlikely to subside in the near future.

Guinea has historically experienced relatively high rates of inflation, which are unlikely to subside in the near future. As a result, our costs may be materially affected, which may adversely affect the business and results of operations.

13

There is a limited availability of debt financing in Guinea.

The financial sector within Guinea is relatively weak, with the primary lending facilities being offered by international banks. As a result, there is limited availability of debt financing in Guinea, which may materially affect our financial condition. In order to meet future funding requirements, we may be required to undertake additional equity financing, which would be dilutive to shareholders. There is no assurance that additional financing will be available on terms acceptable to us or at all. If we are unable to obtain additional financing as needed, we may be required to reduce the scope of our operations or anticipated expansion, and pursue only those development plans that can be funded through cash flows generated from our existing operations.

Fluctuations in currency exchange rates may adversely affect our financial condition.

Our operating expenses may be incurred in U.S. dollars, Guinean francs and Euros. From time to time, we may borrow funds and incur capital expenditures that are denominated in foreign currency. In addition, any revenue generated from operations may be in U.S. dollars. Accordingly, foreign currency fluctuations may adversely affect our financial position and results of operations.

We could be adversely affected by the occurrence of natural disasters in Guinea.

Natural disasters could impede operations, damage infrastructure necessary to our operations or adversely affect our ability to clear and utilize farmland in Guinea. The occurrence of natural disasters in Guinea could adversely affect our business, the results of our operations, prospects and financial condition.

Competition from other businesses may adversely affect our business.

We will face competition from other international businesses with political connections. Some of these competitors have greater financial resources than us and, accordingly, may be in a better position to compete for future business opportunities. There can be no assurance that we will be able to compete effectively with these companies.

If we lose any of our key personnel, the operations and business may suffer.

We will be heavily dependent upon our management team in relation to their expertise in the agricultural industry and the relationships cultivated by them. The departure or otherwise loss of service, of any of our senior management may materially and adversely affect our business, financial condition and results of operations.

We rely heavily on local labor in Guinea.

Our heavy reliance on local labor may provide trade unions with strong bargaining positions. Also, adverse changes in labor legislation may have a material adverse effect on our business, results of operations and financial condition. Any prolonged labor disruption could also have an adverse effect on our ability to achieve our objectives.

We will rely on the importation of machinery and other key items.

We will rely on the importation of machinery and other key items which are required for production, without the ability to substitute such imported items, if required, with locally-produced goods. As a result, in the event that the machinery or other key items cannot be imported into Guinea, there may be a detrimental impact on our business and operations.

If we are unable to protect our business relationships, the operations and business may suffer.

We will rely heavily on good relationships with regulatory or other governmental departments in Guinea. There can be no assurance that any existing relationships will continue to be maintained or new ones will be successfully formed and we may be adversely affected by changes to such relationships or difficulties in forming new ones.

14

Our operations may be subject to environmental risks and hazards.

Our operations may be subject to certain environmental risks and hazards. For example, with respect to the arable farmland operations, there may be a risk of chemical spills which are harmful to the workforce and the environment. In addition, there may be a risk of injury or damage from the mishandling of hazardous inputs, such as ammonium nitrate fertilizer. There is no assurance that future changes in environmental regulation, if any, will not adversely affect our operations.

We may not be able to meets expectations for the yields of our land.

The success of our business depends on the productivity of our farmland and ability to realize yields at estimated levels. The yields depend on a number of factors, many of which may be beyond our control, including weather, climate and soil conditions, as well as damage by disease, pests and other natural disasters. Our ability to maintain yields will depend on these factors, and in particular the weather, climate and soil conditions for additional farmland that we may obtain in the future. If we cannot achieve yields at expected levels, our business, financial condition and results of operations may be materially and adversely affected.

Any outbreak of severe communicable diseases may materially affect our operations and business.

An outbreak of a communicable disease such as influenza A, severe acute respiratory syndrome or avian flu, may potentially result in a quarantine of infected employees and related persons, and if uncontrolled, may affect our operations and business. In addition, HIV/AIDS, malaria and other diseases are a major healthcare challenge in Guinea. There can be no assurance that we will not lose workforce hours or incur increased medical costs, which may have an adverse effect on our operations and business.

Risks Relating to our Industry

Agricultural production by its nature contains elements of risks and uncertainties.

Agricultural production by its nature contains elements of significant risks and uncertainties which may adversely affect our business and operations, including but not limited to the following: (i) any future climate change with a potential shift in weather patterns leading to droughts and associated crop losses; (ii) potential insect, fungal and weed infestations resulting in crop failure and reduced yields; and (iii) wild and domestic animal conflicts and crop-raiding. Adverse weather conditions represent a significant operating risk to us, affecting the quality and quantity of production and the levels of farm inputs.

We may also encounter difficulties with the importation of agro-inputs and securing a supply of spares and maintenance items.

In the event of a delay in the delivery from suppliers of agricultural inputs like fertilizers and seeds, and machinery, we may be unable to achieve production targets.

A shift in commodity trends and demands will result in an associated change in prices.

The price for products being produced by us will depend on available markets at acceptable prices and distribution costs. Any substantial decline in the price of the products being produced by us, or any increase in agricultural production costs, processing, transportation or distribution costs may have an adverse effect on our business.

Soya, Rice and Maize are vulnerable to fluctuations in the world market.

Fluctuations in the world market for Soya, rice and maize is driven either by consumer demand or changes in biofuel directives from foreign central governments. Any decline in consumer demand or negative change in biofuel directives may have a material adverse effect on our business.

RISKS RELATING TO THE PURCHASE OF COMMON STOCK

Common stock of the Company is quoted on the OTC Bulletin Board which may have an unfavorable impact on its stock price and liquidity.

15

Common stock of the Company is quoted on the Over-the-Counter Bulletin Board (the “OTCBB”). The OTCBB is a significantly more limited market than the New York Stock Exchange or NASDAQ. The quotation of our shares on the OTCBB may result in a less liquid market available for existing and potential stockholders to trade shares of our common stock, could depress the trading price of our common stock, could cause high volatility and price fluctuations, and could have a long-term adverse impact on our ability to raise capital in the future.

There is currently a limited trading market for our common stock and we cannot ensure that an active market will ever develop or be sustained.

There is currently a limited trading market on the OTCBB for our common stock, and there is no assurance that an active market will develop or be sustained.

RISKS RELATING TO OUR COMPANY

We do not intend to pay cash dividends.

The payment of dividends, if any, would be contingent upon our revenues and earnings, if any, capital requirements, and general financial condition. The payment of any dividends is within the discretion of our Board of Directors. We presently intend to retain any earnings to provide funds for the operation and expansion of our business. Accordingly, we do not anticipate the declaration of any dividends in the foreseeable future.

Conflicts of interest may affect certain directors and officers.

As of the date hereof, certain of our senior officers and directors own or control a substantial percentage of the outstanding Common Stock. Certain conflicts may arise between such individuals' interests as members of the management team and their interests as shareholders. Such conflicts could arise, for example, with respect to the payment of salaries and bonuses and similar matters. Our directors and officers are subject to fiduciary obligations to act in our best interests.

ITEM 2. DESCRIPTION OF PROPERTY

Pursuant to the Contract for a Program of Agricultural Development in Guinea dated September 16, 2010 (the “Contract for Development”), the Ministry of Agriculture of Guinea (“MAG”) has agreed to grant to Land & Resources 99-year leases over two parcels of land in the villages of N’Dema and Konindou of 5,340 and 3,475 hectares respectively to be developed as agricultural land. The leases are in a form agreed upon by both parties to the Contract for Development. The rent payments under each proposed lease are nominal.

On September 16, 2010, Land & Resources and MAG entered into an Option Agreement (the “Option Agreement”) pursuant to which Land & Resources was granted an option to assume a lease of approximately 98,400 hectares located in the village of Saraya in Guinea (the “Option Land”) on the same terms as the Pilot Project. Under the Option Agreement, as a consideration for the grant of the option, within a year after the execution of the leases for the Pilot Project Land & Resources shall conduct a full survey of suitability and viability of the Option Land for long term commercial soybean, maize and rice farming taking into account factors including land fertility, climate, availability of local labor, local land ownership interests, likely market demand, economics and other relevant factors.

On October 25, 2010, Land & Resources signed a Protocol d’Accord with MAG (the "Protocol D'Accord") under which the Company undertook obligations to survey and map additional underutilized land in Guinea estimated to be up to 1.5 million hectares of combined area and prepare it for disposal under 99-year leases. In consideration thereof the Ministry of Agriculture has agreed to grant Land and Resources exclusive marketing rights with a commission of 15% being payable on closed sales.

The Company believes that the foregoing properties are adequate for its present needs.

16

ITEM 3. LEGAL PROCEEDINGS

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. We are currently not aware of any such legal proceedings or claims that we believe will have a material adverse affect on our business, financial condition or operating results.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market for Our Common Stock

There is a limited market for our common stock. Our common stock is listed on the OTC Bulletin Board under the symbol “FLGI.” The following table sets forth the high and low inter-dealer prices, without mark-up, mark-down or commission, involving our Common Stock during each calendar quarter, and may not represent actual transactions. There were no reported quotations for our common stock during the fiscal year 2010, and the first quarter of the fiscal year 2011.

|

High

|

Low

|

|||||||

|

Fiscal Year 2011

|

||||||||

|

Fourth quarter

|

$

|

5.10

|

$

|

5.10

|

||||

|

Third quarter

|

$

|

5.45

|

$

|

4.50

|

||||

|

Second quarter

|

$

|

5.49

|

$

|

5.49

|

||||

At January 12, 2012, there were 9,208,335 shares of our Common Stock outstanding. Our shares of Common Stock are held by approximately 31 stockholders of record. The number of record holders was determined from the records of our transfer agent and does not include beneficial owners of Common Stock whose shares are held in the names of various security brokers, dealers, and registered clearing agencies.

Dividends

We have not paid dividends on our common stock and do not anticipate paying such dividends in the foreseeable future.

Sale of Unregistered Securities

On August 11, 2011, the Company issued 8,335 shares of common stock to a consultant. The foregoing issuance of the shares was effectuated pursuant to the exemption from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), provided by Section 4(2) of the Securities Act and/or Regulation S promulgated thereunder.

Securities authorized for issuance under equity compensation plans

As of the date of this Annual Report, we do not have any securities authorized for issuance under any equity compensation plans and we do not have any equity compensation plans.

17

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

SPECIAL NOTE OF CAUTION REGARDING FORWARD-LOOKING STATEMENTS

CERTAIN STATEMENTS IN THIS REPORT, INCLUDING STATEMENTS IN THE FOLLOWING DISCUSSION, ARE WHAT ARE KNOWN AS "FORWARD-LOOKING STATEMENTS", WHICH ARE BASICALLY STATEMENTS ABOUT THE FUTURE. FOR THAT REASON, THESE STATEMENTS INVOLVE RISK AND UNCERTAINTY SINCE NO ONE CAN ACCURATELY PREDICT THE FUTURE. WORDS SUCH AS "PLANS", "INTENDS", "WILL", "HOPES", "SEEKS", "ANTICIPATES", "EXPECTS "AND THE LIKE OFTEN IDENTIFY SUCH FORWARD-LOOKING STATEMENTS, BUT ARE NOT THE ONLY INDICATION THAT A STATEMENT IS A FORWARD-LOOKING STATEMENT. SUCH FORWARD-LOOKING STATEMENTS INCLUDE STATEMENTS CONCERNING OUR PLANS AND OBJECTIVES WITH RESPECT TO THE PRESENT AND FUTURE OPERATIONS OF THE COMPANY, AND STATEMENTS WHICH EXPRESS OR IMPLY THAT SUCH PRESENT AND FUTURE OPERATIONS WILL OR MAY PRODUCE REVENUES, INCOME OR PROFITS. NUMEROUS FACTORS AND FUTURE EVENTS COULD CAUSE THE COMPANY TO CHANGE SUCH PLANS AND OBJECTIVES OR FAIL TO SUCCESSFULLY IMPLEMENT SUCH PLANS OR ACHIEVE SUCH OBJECTIVES, OR CAUSE SUCH PRESENT AND FUTURE OPERATIONS TO FAIL TO PRODUCE REVENUES, INCOME OR PROFITS. THEREFORE, THE READER IS ADVISED THAT THE FOLLOWING DISCUSSION SHOULD BE CONSIDERED IN LIGHT OF THE DISCUSSION OF RISKS AND OTHER FACTORS CONTAINED IN THIS REPORT ON FORM 10-K AND IN THE COMPANY'S OTHER FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION. NO STATEMENTS CONTAINED IN THE FOLLOWING DISCUSSION SHOULD BE CONSTRUED AS A GUARANTEE OR ASSURANCE OF FUTURE PERFORMANCE OR FUTURE RESULTS.

Unless the context otherwise requires, The "Company", "we," "us," and "our," refer to (i) Farm Lands of Guinea, Inc.; (ii) Farm Lands of Guinea Ltd. (“FLG”), (iii) Land & Resources of Guinea SA (“Land & Resources”), and (iv) Farm Resources Africa (Gambia) Limited (“FRAG”).

Overview

The Company was incorporated under the name Kryptic Entertainment Inc. on October 11, 2007 in the State of Nevada. Effective April 1, 2011, the Company changed its name to Farm Lands of Guinea, Inc.

On February 28, 2011, we consummated a share exchange with stockholders of FLG (the “FLG Stockholders”) whereby FLG Stockholders transferred 100% of the outstanding ordinary shares of FLG held by them, in exchange for an aggregate of 7,801,000 newly issued shares of our Common Stock representing approximately 86.7% of our then issued and outstanding Common Stock.

On February 28, 2011, we entered into and consummated transactions pursuant to a Subscription Agreement (the “Subscription Agreement”) with certain investors whereby the investors agreed to and did purchase for an aggregate of $1.0 million an aggregate of 50,000 Units with each Unit comprised of four (4) shares of Common Stock, a Series A Warrant to purchase one (1) share of Common Stock at an exercise price of $7.50 per share and a Series B Warrant (together with Series A Warrant, the “Warrants”) to purchase one (1) share of Common Stock at an exercise price of $10.00 per share.

The share exchange and the private placement resulted in (i) a change in control of the Company with the shareholders of FLG owning approximately 86.7% of issued and outstanding shares of common stock of the Company, (ii) FLG becoming a wholly-owned subsidiary of the Company, (iii) Land & Resources becoming an indirect 90% owned subsidiary of the Company, and (iv) appointment of certain nominees of FLG as directors and officers of the Company and resignation of Shan Qiang as sole director, Chief Executive Officer, Chief Financial Officer, Secretary and Treasurer of the Company.

18

FLG was incorporated in the British Virgin Islands as a Business Company on August 9, 2010. FLG through its 90%-owned subsidiary, Land & Resources, a limited liability company organized under the laws of the Republic of Guinea on September 14, 2010 (“Guinea”), intends to engage in rehabilitation and farming of land in Guinea. The Ministry of Agriculture of Guinea holds the 10% ownership stake in Land & Resources.

On August 4, 2011, Farm Resources Africa (Gambia) Limited (“FRAG”) was formed as a Gambia corporation. FRAG is a 100% owned subsidiary of the Company. FRAG will engage in rehabilitation and farming of land in Gambia. As of the date of this report, it has not commenced its operations yet.

Land & Resources is a development stage agricultural company in Guinea. It intends to engage in acquiring and consolidating farm land and operations in Guinea and rehabilitating them back into production using modern agricultural techniques and practices. Land & Resources currently plans to develop 8,815 hectares in the villages of N’Dema and Konindou to grow maize and soybeans in rotation as a pilot program for the development of 98,400 hectares lying to the south and east of Saraya. The rotation will be one year of maize followed by two years of soya.

The total assets of the Company as reported on a GAAP basis for the fiscal year 2011 and since inception in 2010 do not include certain lease rights. We believe that such lease rights provide useful information to assess the business of the Company, because it provides investors with a view of the Company’s operations from management’s perspective. Inclusion of the lease rights in the Company’s total assets is a non-GAAP measure and should not be considered a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP.

Should the Company value the lease rights under IFRS, the reconciliation would be as follows;

|

Project development costs under GAAP

|

$

|

90,708

|

||

|

Valuation of lease rights under IFRS

|

$

|

59,000,000

|

||

|

Potential revaluation arising

|

$

|

58,909,292

|

The Republic of Guinea is a former French colony. It is a West African country on the North Atlantic Ocean, bordering Senegal, Mali, Ivory Coast, Liberia, Sierra Leone and Bissau. It is part of the emerging African reformation chain and now presents the optimum timing opportunity for investment in agriculture.

Since independence in 1958, much of the arable land in the Republic of Guinea has been neglected. The once vibrant agricultural sector has largely disappeared. The Ministry of Agriculture has therefore been examining ways to regenerate vast areas of scrubland and make it suitable for modern methods of agriculture. Recognizing that Guinea’s climate is suitable for the production of a number of crops including Soya, the Ministry of Agriculture has been seeking partners to assist it in developing this aspect of Guinea’s resources.

Corn-like Maize is a staple food in Guinea. According to data collected by the Ministry of Agriculture of Guinea, there is currently a national shortfall of 500,000 tons of this product which to date has been filled with importation from international markets. Local production is carried out by farmers and does not involve use of fertilizer, mechanized tools and machinery. As a result, the yields of the crop are poor and well below the needs of the local market.

Bean crop Soya is not in significant production in Guinea. There is currently a substantial consumption shortfall in home produced cooking oil for which manufactured Soya or soybeans is particularly well suited. The shortfall is compensated for by importing Soya derived oil from international markets. The three major regions where Soya is grown profitably are the United States of America, Brazil, and Argentina. Each of them suffers local disadvantages. Farmers in the United States face first world costs. The Brazilians have to cope with vast distances and poor roads. In Argentina, the government retains 35% of the gross yield at no charge. By contrast, the government of the Republic of Guinea actively promotes rather than penalizes production.

In addition to its core business plan to engage in farming business in Guinea, on October 25, 2010, Land & Resources signed a Protocol d’Accord with the Ministry of Agriculture of Guinea under which it undertook obligations to survey and map additional underutilized land in Guinea estimated to be up to 1.5 million hectares of combined area and prepare it for disposal under 99-year leases. In consideration thereof, the Ministry of Agriculture has agreed to grant Land and Resources exclusive marketing rights with a commission of 15% being payable on closed sales.

19

During the year ended September 30, 2011, the Company completed the exploration and mapping of Saraya property comprising 98,400 hectares of Option Land.

Results of Operations

We did not have any revenues during the year ended September 30, 2011 or since inception in August of 2010.

We incurred operating expenses of $981,644 and $20,365 for the year ended September 30, 2011 and since inception in 2010, respectively. Our operating expenses primarily consisted of Administrative Expenses.

The Company realized a net loss from continuing operations of $990,711 and $18,329 for the year ended September 30, 2011 and since inception in 2010, respectively.

Liquidity and Capital Resources

The Company does not currently have sufficient resources to cover on-going expenses and expansion. As of September 30, 2011, the Company had cash of $273,999 and current liabilities of $308,540. We plan on raising additional funds from investors to implement our business model. In the event we are unsuccessful, this will have a negative impact on our operations. Our owners have previously provided funding for working capital needs and our expectation is that they will continue to do so.

If the Company cannot find sources of additional financing to fund its working capital needs, the Company will be unable to obtain sufficient capital resources to operate our business. We cannot assure you that we will be able to access any financing in sufficient amounts or at all when needed. Our inability to obtain sufficient working capital funding will have an immediate material adverse effect upon our financial condition and our business.

Our operations used $988,681 in cash since inception in August 2010. We have historically financed our operations primarily through private placements of common stock.

Critical Accounting Policies

Development stage entity

The Company is considered a development stage entity, as defined in FASB ASC 915, because since August 2010 it has not commenced operations that have resulted in significant revenue and the Company’s efforts have been devoted primarily to activities related to raising capital.

Going concern

As shown in the accompanying financial statements, the Company had limited cash, an accumulated deficit, and a net loss through September 30, 2011, which raise substantial doubt about the Company’s ability to continue as a going concern. The financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amount and classification of liabilities that might be necessary in the event the Company cannot continue in existence. Management intends to seek new capital from owners and related parties to provide needed funds.

Effective August 9, 2010, the Company adopted ASC Topic No. 815-40 which defines determining whether an instrument (or embedded feature) is solely indexed to an entity’s own stock. On February 28, 2011, the Company sold units to investors which consisted of four (4) shares of the Company’s common stock, one (1) Series A warrant and one (1) Series B warrant.

20

Within the unit subscription agreement, subscribers of the units are given anti-dilution protection for a period of twenty-four (24) months. In the event the Company subsequently issues common stock, stock warrants, stock options or convertible debt with a stock price, exercise price or conversion price lower than 130% of $5.00, the subscriber will be compensated with additional shares of the Company’s common stock so that the average per share purchase price of the purchased securities owned by the subscriber on the date of the lower price issuance plus such additional shares issued to the subscriber is equal to the lower price per share. As a result, the Company has determined that the anti-dilution feature is not considered to be solely indexed to the Company’s own stock and is therefore not afforded equity treatment. In accordance with ASC 815, the Company has bifurcated the anti-dilution feature of the units and recorded a derivative liability.

The fair value of the derivative liability was calculated using a Lattice Model that values the compound embedded derivatives based on future projections of the various potential outcomes. The assumptions that were analysed and incorporated into the model included the conversion feature with the full ratchet and weighted average anti-dilution reset, expectations of future stock price performance and expectations of future issuances. Probabilities were assigned to various scenarios in which the reset provisions would go into effect and weighted accordingly.

The total fair value of the anti-dilutive feature issued on February 28, 2011, amounting to $129,422 has been recognized as a derivative liability on the date of issuance with all future changes in the fair value of this anti-dilutive feature being recognized in earnings in the Company’s statement of operations under the caption “Other income (expense) – Gain (loss) on derivative liability” until such time as the anti-dilution provision expires. The total cash proceeds of $1,000,000 were first applied to the derivative with the remaining $653,804 being allocated to the 200,000 common shares, $111,434 being allocated to the Series A warrants and $105,340 being allocated to the Series B Warrants. The common stock and warrants were valued as described in the following note.

On August 15, 2011, the Company sold further units to investors in the same format as the issue of February 28, 2011. Accordingly, the derivative liability was adjusted and the total fair value of the anti-dilutive feature issued on August 15, 2011, amounting to $137,520, has been recognized as a derivative liability on the date of issuance. The total cash proceeds of $1,000,000 were first applied to the derivative with the remaining $633,396 being allocated to the 200,000 common shares, $117,420 being allocated to the Series A warrants and $111,664 being allocated to the Series B Warrants. The common stock and warrants were valued as described in Note 8.

ASC 815 requires Company management to assess the fair market value of certain derivatives at each reporting period and recognize any change in the fair market value as an other income or expense item. The Company’s only asset or liability measured at fair value on a recurring basis is its derivative liability associated with the above units. At September 30, 2011, the Company revalued the warrants and determined that, during the year ended September 30, 2011, the Company’s derivative liability increased by $8,096 to $275,038. The Company recognized a corresponding loss on derivative liability in conjunction with this revaluation.

Issuance of Common Stock & Warrants

On February 28, 2011, the Company entered into and consummated transactions pursuant to a Subscription Agreement with certain investors whereby the investors agreed to and did purchase for an aggregate of $1 million an aggregate of 50,000 units with each unit comprised of four (4) shares of common stock, Series A Warrant to purchase one (1) share of common stock at an exercise price of $7.50 per share and Series B Warrant to purchase one (1) share of common stock at an exercise price of $10.00 per share.

The warrants were valued using the Black Scholes model using the following assumptions: stock price at valuation, $3.40; strike price, $7.50-$10.00; risk free rate 2.13%; 3 year term; and volatility of 140%. The Company attributed $111,434 related to the Series A warrants and $105,340 related to the Series B warrants of the total $1,000,000 of cash proceeds associated with the transaction to the warrants based on the relative fair value of the warrants. After applying the fair market values of the derivative liability and each set of warrants, the remaining $653,804 was attributed to the 200,000 shares of common stock.

On August 11, 2011, the Company issued 8,335 shares of common stock to a consultant.

21

On August 17, 2011, the Company entered into and consummated transactions pursuant to a Subscription Agreement with certain investors whereby the investors agreed to and did purchase for an aggregate of $1.0 million an aggregate of 50,000 units with each unit comprised of four (4) shares of common stock, Series A Warrant to purchase one (1) share of common stock at an exercise price of $7.50 per share and Series B Warrant to purchase one (1) share of common stock at an exercise price of $10.00 per share.

The warrants were valued using the Black Scholes model using the following assumptions: stock price at valuation, $5.49; strike price, $7.50-$10.00; risk free rate 0.99%; 3 year term; and volatility of 140%. The Company attributed $117,420 related to the Series A warrants and $111,664 related to the Series B warrants of the total $1,000,000 of cash proceeds associated with the transaction to the warrants based on the relative fair value of the warrants. After applying the fair market values of the derivative liability and each set of warrants, the remaining $633,396 was attributed to the 200,000 shares of common stock.

Off-Balance Sheet Arrangements

The Company does not have any off-balance sheet arrangements.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The Company's consolidated audited financial statements for the fiscal years ended September 30, 2011 and 2010, together with the report of the independent certified public accounting firm thereon and the notes thereto, are presented beginning at page F-1.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None.

ITEM 9A. CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

The Securities and Exchange Commission defines the term “disclosure controls and procedures” to mean controls and other procedures of an issuer that are designed to ensure that information required to be disclosed in the reports that it files or submits under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported, within the time periods specified in the Securities and Exchange Commission’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under the Securities Exchange Act of 1934 is accumulated and communicated to the issuer’s management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure. The Company maintains such a system of controls and procedures in an effort to ensure that all information which it is required to disclose in the reports it files under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified under the SEC's rules and forms and that information required to be disclosed is accumulated and communicated to principal executive and principal financial officers to allow timely decisions regarding disclosure.

As of the end of the period covered by this report, we carried out an evaluation, under the supervision and with the participation of our chief executive officer and chief financial officer, of the effectiveness of the design and operation of our disclosure controls and procedures. Based on this evaluation, our chief executive officer and chief financial officer concluded that our disclosure controls and procedures were effective as of the end of the period covered by this report.

22

Management’s Annual Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting as defined in Rules 13a-15(f) and 15d-15(f) under the Securities Exchange Act. Our internal control over financial reporting is designed to provide reasonable assurance regarding the (i) effectiveness and efficiency of operations, (ii) reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles, and (iii) compliance with applicable laws and regulations.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies and procedures may deteriorate.

Management assessed the effectiveness of our internal control over financial reporting as of September 30, 2011. In making this assessment, we used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal Control - Integrated Framework. Based on our assessment, we determined that, as of September 30, 2011, our internal control over financial reporting was effective based on those criteria.

Changes in Internal Controls over Financial Reporting

No change in our system of internal control over financial reporting occurred during the fourth quarter of the fiscal year ended September 30, 2011 that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

ITEM 9B. OTHER INFORMATION

Effective December 31, 2011, Sir Redmond Watt resigned from his position as a Director of the Company. Sir Redmond Watt’s resignation was not the result of any disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

The following are the officers and directors of the Company as of the date of this report. Our officers and directors are residents of the U.K. and Guinea. As a result, it may be difficult for investors to effect service of process within the United States upon them or to enforce judgments obtained in the United States courts against them in the U.K. or Guinea.

|

Name

|

Age

|

Position

|

||

|