Attached files

| file | filename |

|---|---|

| 8-K - BLUEGREEN VACATIONS CORP | i00038_bxg-8k.htm |

|

|

|

|

|

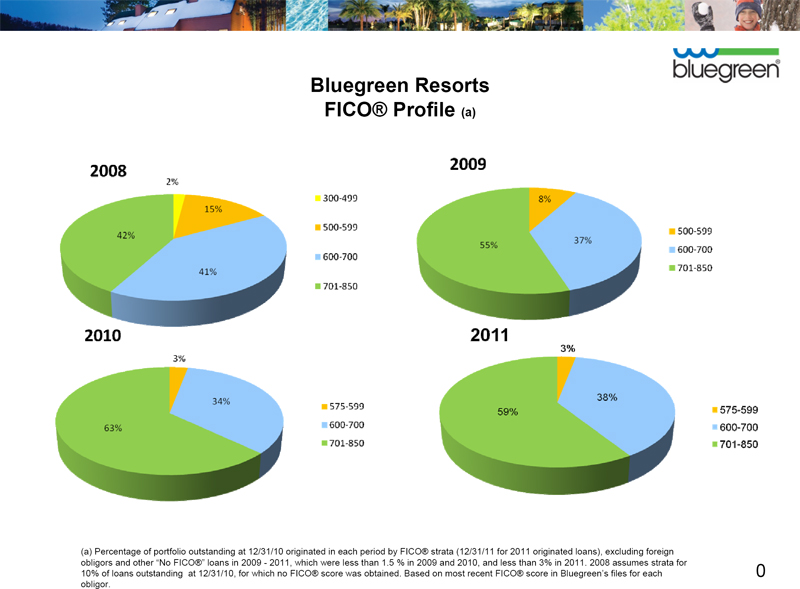

Bluegreen Resorts FICO® Profile (a) (a) Percentage of portfolio outstanding at 12/31/10 originated in each period by FICO® strata (12/31/11 for 2011 originated loans), excluding foreign obligors and other “No FICO®” loans in 2009 — 2011, which were less than 1.5 % in 2009 and 2010, and less than 3% in 2011. 2008 assumes strata for 10% of loans outstanding at 12/31/10, for which no FICO® score was obtained. Based on most recent FICO® score in Bluegreen’s files for each obligor. 0 |

|

|

|

|

|

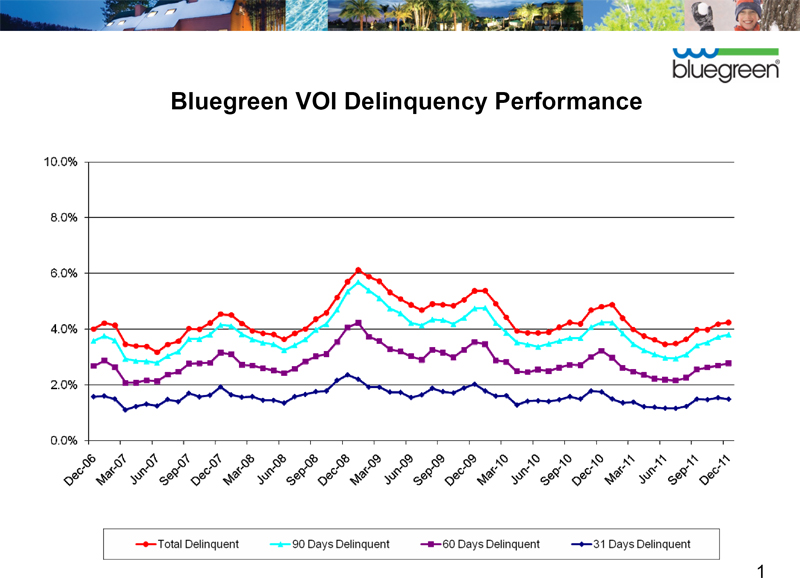

Bluegreen VOI Delinquency Performance 1 |

|

|

|

|

|

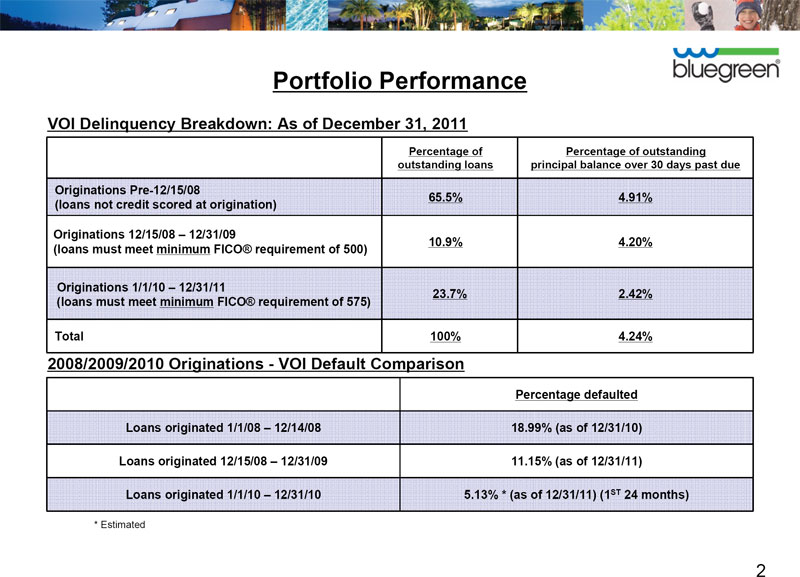

Portfolio Performance VOI Delinquency Breakdown: As of December 31, 2011 Percentage of Percentage of outstanding outstanding loans principal balance over 30 days past due Originations Pre-12/15/08 65.5% 4.91% (loans not credit scored at origination) Originations 12/15/08 – 12/31/09 10.9% 4.20% (loans must meet minimum FICO® requirement of 500) Originations 1/1/10 – 12/31/11 23.7% 2.42% (loans must meet minimum FICO® requirement of 575) Total 100% 4.24% 2008/2009/2010 Originations - VOI Default Comparison Percentage defaulted Loans originated 1/1/08 - 12/14/08 18.99% (as of 12/31/10) Loans originated 12/15/08 - 12/31/09 11.15% (as of 12/31/11) Loans originated 1/1/10 - 12/31/10 5.13% * (as of 12/31/11) (1ST 24 months) * Estimated 2 |

|

|

|

|

|

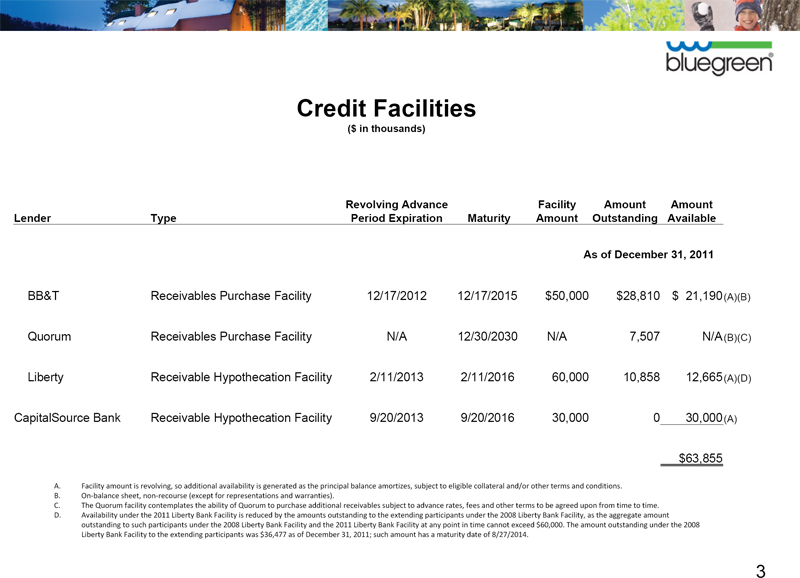

Credit Facilities ($ in thousands) Revolving Advance Facility Amount Amount Lender Type Period Expiration Maturity Amount Outstanding Available As of December 31, 2011 BB&T Receivables Purchase Facility 12/17/2012 12/17/2015 $50,000 $28,810 $ 21,190 (A)(B) Quorum Receivables Purchase Facility N/A 12/30/2030 N/A 7,507 N/A(B)(C) Liberty Receivable Hypothecation Facility 2/11/2013 2/11/2016 60,000 10,858 12,665(A)(D) CapitalSource Bank Receivable Hypothecation Facility 9/20/2013 9/20/2016 30,000 0 30,000(A) $63,855 A. Facility amount is revolving, so additional availability is generated as the principal balance amortizes, subject to eligible collateral and/or other terms and conditions. B. On-balance sheet, non-recourse (except for representations and warranties). C. The Quorum facility contemplates the ability of Quorum to purchase additional receivables subject to advance rates, fees and other terms to be agreed upon from time to time. D. Availability under the 2011 Liberty Bank Facility is reduced by the amounts outstanding to the extending participants under the 2008 Liberty Bank Facility, as the aggregate amount outstanding to such participants under the 2008 Liberty Bank Facility and the 2011 Liberty Bank Facility at any point in time cannot exceed $60,000. The amount outstanding under the 2008 Liberty Bank Facility to the extending participants was $36,477 as of December 31, 2011; such amount has a maturity date of 8/27/2014. 3 |