Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - Trellis Earth Products Inc | ex231.htm |

| EX-10.14 - EXHIBIT 10.14 - Trellis Earth Products Inc | ex1014.htm |

Registration No. 333- 176970

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

Trellis Earth Products, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

2821

|

20-8066386

|

||

|

(State or jurisdiction of

|

(Primary Standard Industrial

|

(I.R.S. Employer

|

||

|

incorporation or organization)

|

Classification Code Number)

|

Identification No.)

|

9125 S.W. Ridder Road, Suite D

Wilsonville, OR 97070

(503) 582-1300

(Address and telephone number of principal executive offices)

William Collins

Chairman, President and Chief Executive Officer

Trellis Earth Products, Inc.

9125 S.W. Ridder Road, Suite D

Wilsonville, OR 97070

(503) 582-1300

(Name, address and telephone number of agent for service)

|

With copies to:

Gregory Sichenzia, Esq.

Marcelle Balcombe, Esq.

Sichenzia Ross Friedman Ference LLP

61 Broadway, 32 nd Floor

New York, NY 10006

(212) 930-9700

|

||

APPROXIMATE DATE OF PROPOSED SALE TO PUBLIC: As soon as practicable after the effective date of this registration statement.

If any securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

Indicate by check mark whether the registrant is a large accelerated filed, an accelerated filer, a non-accelerated filed, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o

|

Smaller reporting company x

|

|

(Do not check if a smaller reporting company)

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class

of Securities to be Registered

|

Proposed Maximum Aggregate

Offering Price (1)

|

Amount of

Registration Fee (2)

|

||||||

|

Common Stock, $0.0001 par value per share (2)

|

$ | $ | ||||||

|

Common Stock Purchase Warrant

|

___

|

(3 | ) | |||||

|

Shares of Common Stock underlying Common Stock Purchase Warrant (2)

|

$ | $ | ||||||

|

Placement Agent’s Common Stock Purchase Warrant

|

___

|

(3 | ) | |||||

|

Shares of Common Stock underlying Placement Agent’s Common Stock Purchase Warrant (2)

|

$ | $ | ||||||

|

Total Registration Fee

|

$ | 8,000,000 | $ | 916.80 | (4) | |||

|

(1)

|

Estimated solely for the purpose of calculating the amount of registration fee pursuant to Rule 457(o) under the Securities Act.

|

|

(2)

|

Pursuant to Rule 416, the securities being registered hereunder include such indeterminate number of additional shares of common stock as may be issued after the date hereof as a result of stock splits, stock dividends or similar transactions

|

|

(3)

|

No registration fee required pursuant to Rule 457(g) under the Securities Act.

|

|

(4)

|

$3,378.51 was previously paid.

|

_________________

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS

|

SUBJECT TO COMPLETION

|

JANUARY 18, 2012

|

|

Up to $8,000,000 of Common Stock and

Warrants to purchase up to _____ shares of Common Stock

|

We are offering up to __ shares of our common stock and warrants to purchase up to ______ shares of common stock at an exercise price of $____ per share. Each purchaser will receive a warrant to purchase one share of common stock for each share of common stock purchased in this offering. We are not required to sell any specific number or dollar amount of shares of common stock or warrants, but will use our best efforts to sell all of the shares of common stock and warrants being offered. This offering expires on the earlier of (i) the date upon which all of the shares of common stock and warrants being offered have been sold, or (ii) _________.

As of the date of this prospectus, there is no trading market in our common stock or warrants, and there is no assurance that a trading market will develop. A market maker has submitted an application for our common stock to be approved for quotation on the Over-The-Counter Bulletin Board upon the effectiveness of this prospectus. There is no assurance the application will be approved.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 5 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities .

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

Per share

|

Total

|

||||||

|

Public offering price

|

$

|

$

|

||||||

|

Placement Agent’s fees (1)

|

$

|

$

|

||||||

|

Proceeds, before expenses, to us

|

$

|

$

|

||||||

|

(1)

|

Tripoint Global Equities, LLC has agreed to act as our placement agent in connection with this offering. In addition, we may engage one or more sub placement agents or selected dealers. The placement agent is not purchasing the securities offered by us, and is not required to sell any specific number or dollar amount of securities offered by us, but will assist us in this offering on a reasonable “best efforts” basis. See “Plan of Distribution” for a description of compensation payable to the placement agent.

|

This offering will terminate on __________, unless the offering is fully subscribed before that date or we decide to terminate the offering prior to that date. In either event, the offering may be closed without further notice to you. All costs associated with the registration will be borne by us.

Brokers or dealers effecting transactions in these securities should confirm that the securities are registered under the applicable state law or that an exemption from registration is available.

The date of this prospectus is ___, 2012.

iv

Table of Contents

|

Page

|

|

|

Prospectus Summary

|

1

|

|

Risk Factors

|

5

|

|

Special Note Regarding Forward-Looking Statements

|

12

|

|

Use of Proceeds

|

13

|

|

Dividend Policy

|

14

|

|

Capitalization

|

14

|

|

Dilution

|

15

|

|

Management’s Discussion and Analysis Of Financial Condition and Results of Operations

|

16

|

|

Business

|

23

|

|

Management

|

34

|

|

Executive Compensation

|

37

|

|

Certain Relationships and Related Transactions

|

39

|

|

Principal Stockholders

|

40

|

|

Description of Capital Stock

|

41

|

|

Shares Eligible for Future Sale

|

43

|

|

Plan of Distribution

|

44

|

|

Experts

|

45

|

|

Legal Matters

|

45

|

|

Commission Position on Indemnification for Securities Act Liabilities

|

45

|

|

Where You Can Find More Information

|

45

|

|

Index to Financial Statements

|

F-1

|

You may only rely on the information contained in this prospectus or that we have referred you to. We have not authorized anyone to provide you with different information. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the common stock offered by this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any common stock in any circumstances in which such offer or solicitation is unlawful. Neither the delivery of this prospectus nor any sale made in connection with this prospectus shall, under any circumstances, create any implication that there has been no change in our affairs since the date of this prospectus or that the information contained by reference to this prospectus is correct as of any time after its date.

Notice to California investors: Each purchaser of our shares and common stock hereunder in California must meet one of the following suitability standards:

|

·

|

any bank as defined in section 3(a)(2) of the Securities Act, or any savings and loan association or other institution as defined in section 3(a)(5)(A) of the Securities Act whether acting in its individual or fiduciary capacity; any broker or dealer registered pursuant to section 15 of the Securities Exchange Act of 1934; any insurance company as defined in section 2(a)(13) of the Securities Act; any investment company registered under the Investment Company Act of 1940 or a business development company as defined in section 2(a)(48) of that Act; any Small Business Investment Company licensed by the U.S. Small Business Administration under section 301(c) or (d) of the Small Business Investment Act of 1958; any plan established and maintained by a state, its political subdivisions, or any agency or instrumentality of a state or its political subdivisions, for the benefit of its employees, if such plan has total assets in excess of $5,000,000; any employee benefit plan within the meaning of the Employee Retirement Income Security Act of 1974 if the investment decision is made by a plan fiduciary, as defined in section 3(21) of such act, which is either a bank, savings and loan association, insurance company, or registered investment adviser, or if the employee benefit plan has total assets in excess of $5,000,000 or, if a self-directed plan, with investment decisions made solely by persons that are accredited investors;

|

|

·

|

any private business development company as defined in section 202(a)(22) of the Investment Advisers Act of 1940;

|

|

·

|

any organization described in section 501(c)(3) of the Internal Revenue Code, corporation, Massachusetts or similar business trust, or partnership, not formed for the specific purpose of acquiring the securities offered, with total assets in excess of $5,000,000;

|

|

·

|

any director, executive officer, or general partner of the issuer of the securities being offered or sold, or any director, executive officer, or general partner of a general partner of that issuer

|

|

·

|

any natural person whose individual net worth, or joint net worth with that person's spouse, at the time of his purchase exceeds $225,000 (exclusive of home, home furnishings and automobile);

|

|

·

|

any natural person who had an individual income in excess of $200,000 in each of the two most recent years or joint income with that person's spouse in excess of $300,000 in each of those years and has a reasonable expectation of reaching the same income level in the current year;

|

|

·

|

any trust, with total assets in excess of $5,000,000, not formed for the specific purpose of acquiring the securities offered, whose purchase is directed by a sophisticated person as described in Rule 506(b)(2)(ii) and

|

|

·

|

any entity in which all of the equity owners are accredited investors.

|

vi

|

PROSPECTUS SUMMARY

The following summary highlights selected information contained in this prospectus. This summary does not contain all the information you should consider before investing in our common stock. Before making an investment decision, you should read this entire prospectus carefully, including the “Risk Factors” section.

About Us

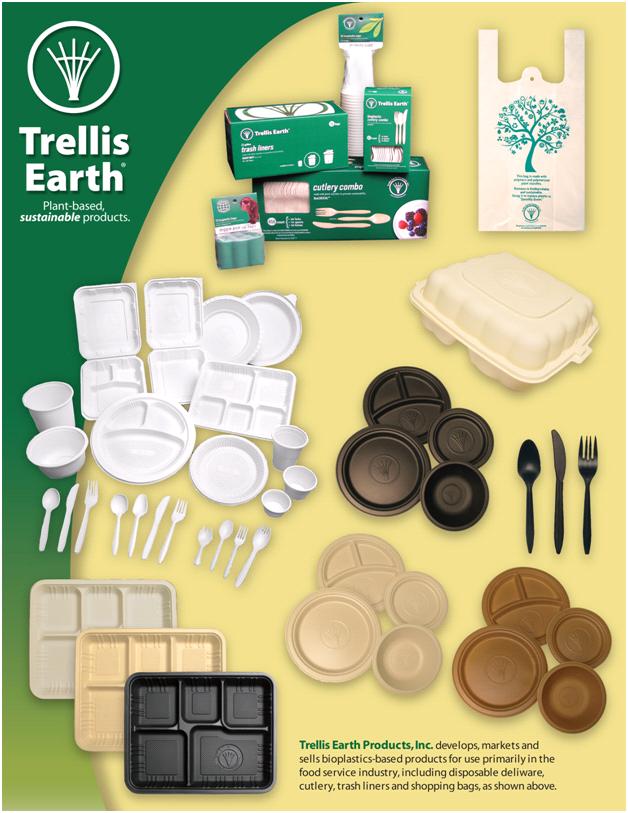

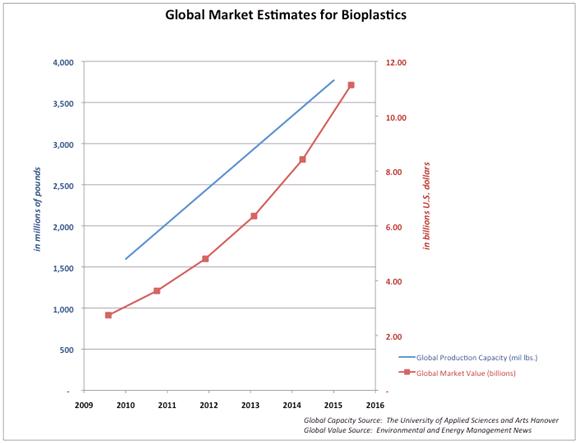

Trellis Earth Products, Inc. develops, markets and sells bioplastics-based products for use primarily in the food service industry, including disposable deliware, cutlery, trash liners and shopping bags. Bioplastics are compounds or blends of materials that incorporate or are derived from renewable biomass sources (such as corn starch, soybeans , wheat chaff, rice hulls and sugar cane) as a substitute for conventional plastics which are commonly comprised entirely of petroleum derivatives. Using advanced technology that we have developed, we believe our bioplastics-based products can be sold on a cost neutral basis with similar conventional plastic products. Annual global bioplastics production in 2010, according to the University of Applied Sciences and Arts in Hanover, Germany, as quoted on the European Bioplastics website, was 1.6 billion pounds, with a market value of $2.7 billion, as reported by Environmental and Energy Management News, an independent organization.

Our bioplastics-based products are presently manufactured to our specifications by a factory in China. Since January 2010, this factory has produced for us at least 200,000 pounds of bioplastics-based products per month. In the first quarter of 2011, we began transitioning manufacturing operations to our current headquarters in Wilsonville, Oregon (about 15 miles south of Portland) and expect to commence production there in mid- 2012. In 2013, subject to obtaining additional funding of approximately $8,000,000, we plan to equip a second plant in Illinois. Together, these facilities are expected to have an estimated annual production capacity of 40 million pounds of bioplastics-based products.

Many well-established trends favor bioplastics production in the United States. Global demand for petroleum products remains strong as emerging economies, such as China, grow and compete with the United States for finite supplies. At the same time, traditional plastic bags, food containers and food contact service items require significant amounts of energy and raw materials to produce, such as natural gas and crude oil in the form of various plastic feedstocks, with their recent prices reaching record high levels. Meanwhile, renewable biomass in forms such as starch -- the primary raw material component of many bioplastics -- has remained comparatively less expensive and in abundant supply. As a result, bioplastics producers, with highly automated facilities, can experience high operating margins if they can leverage these materials’ cost advantages in the manufacture of finished goods that compete directly with pure petroleum-based plastics.

In addition to consumer preference for "green" products like bioplastics, state and city government policies are increasingly supportive of bioplastic alternatives to reduce the volume of waste in landfills, and accomplish other ecological objectives, by requiring that some food contact service items be certified as compostable, which almost always excludes pure petroleum-based plastics. Bioplastics address the economic, social and environmental issues associated with the prolonged and broad use of disposable petroleum-based plastic products.

Our growth strategy is to capitalize on these favorable trends by:

· expanding our manufacturing capacity by equipping and facilitizing a highly automated Oregon-based manufacturingfacility in 2012;

· increasing the number of products we sell through our distribution channel partners across North America;

· growing our customer base and recurring business with major national brands;

· developing new wholesale product lines for core food service clients;

· expanding into conventional non-food product packaging; and

· making opportunistic acquisitions that serve our vertical markets within the bioplastics industry.

|

1

|

Our objective is to become one of the largest U.S. suppliers of bioplastics-based products by leveraging our domestic manufacturing capacity, distribution reach and proprietary process technologies. Because there is a significant gap between prospective demand and potential supply, we believe that United States and global markets can absorb all of our production, and that of our competitors, for the foreseeable future.

We are currently marketing and distributing our bioplastics products through a combination of distribution arrangements, select resellers, brokers, agents, direct sales and vertical market suppliers. As of January 17, 2012, more than 500 customers are using our bioplastics-based products. We sell through distributors, such as Bunzl Distribution USA, Inc., which in turn sell directly to their customers and to other distributors such as Sysco Corporation, which has authorized our products for national distribution.

Additional distributors carrying our products include Food Services of America (FSA), West Coast Paper Company and Walter E. Nelson Co. Grocery stores and resellers that purchase our products include Costco Wholesale Corporation, Smart & Final Inc., The Kroger Co., The Trader Joe’s Company, Wegmans Food Markets, Inc., Smart Foodservice, Cash & Carry and Restaurant Depot LLC. Hospitality companies that use our products include Marriott International Inc., Canyon Ranch, Shilo Inns and more recently Westin Hotels. Additionally, health food stores, farm stores, food co-ops, farmer’s markets and Internet-based resellers purchase our products online. To date, we have primarily sold our products on the West Coast. In 2011, we have expanded our sales reach to the Midwest and to the East Coast.

We are also exploring new vertical market sales opportunities in customized biodegradable product packaging for certain current and potential new customers that have indicated their willingness to incorporate our bioplastic packaging into their consumer goods products. We successfully developed a test package for one maker of nationally-branded merchandise, and have had ongoing discussions with other potential customers about having us produce their product packaging. In addition, we have created sample test food containers for use by a national quick-service restaurant chain. Once our U.S. manufacturing platform is fully operational. we believe that we can compete in this market on the basis of price, while maintaining strong operating margins,

Our current bioplastics product line consists of:

|

|

|

·

|

Deliware - We design and sell plates, clamshells, cups, trays and other similar types of food containers. The deliware items typically comprise a bioplastics blend made of approximately 70% plasticized corn starch compounded with various base polymers and ingredients that make our food containers resistant to heat and water, sanitary, capable of a long shelf life and partially biodegradable. The bioplastic used to create these products can be processed by modern, automated-forming equipment, which is integral to the low cost characteristics of the products.

|

|

We have invented a new blend of bioresin that combines the best features of our starch-based, pure biomass and fiber-based products into a new type of bioplastic resin. This innovative blend creates a new type of deliware that performs like plastic (is waterproof and food-contact safe, for instance ) and has the manufacturing economies of scale of plastic, yet is entirely petroleum-free and compostable. It can also be significantly lower priced than petroleum-based plastics. We believe this material will make possible our consumer-value proposition captured by the slogan “Go Green for Free.” Sm

|

|

|

·

|

Cutlery - Our cutlery is made with the same blends as our deliware, but is injection molded instead of thermoformed. The cutlery bioplastic blends range from 55% biomass to 99+% biomass, depending on specific characteristics sought by customers. For example, 99% biomass cutlery is compostable using commercial composting processes available in various locations (such as in Seattle and San Francisco). Cutlery that is 55% biomass is more heat resistant and partially biodegradable, yet is lower priced than fully compostable cutlery. We sell more than 30 part numbers (SKUs) of cutlery covering a range of premium, lightweight, bagged, colored and specialty cutlery items.

|

|

·

|

Film Products - We sell a wide range of shopping bags, produce bags, trash liners and similar bioplastic “film” items, all of which are made with a blend that is part plant starch, part polymer and part bonding compounds needed to incorporate biomass into their matrix.

|

|

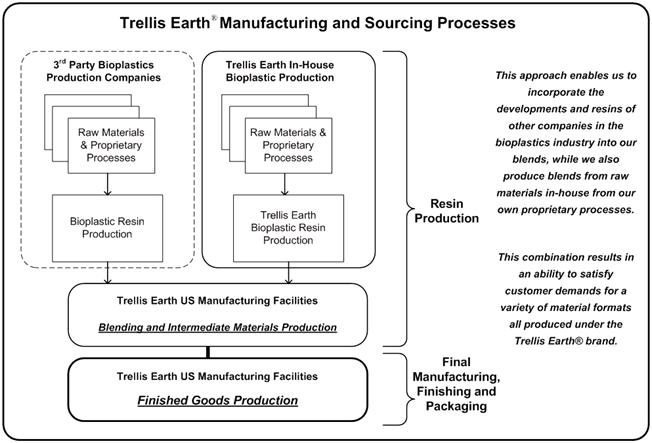

We believe that recent market conditions make bioplastics increasingly commercially competitive with entrenched petroleum-based plastic products. We have recently developed two new methods for production of formulations featuring our proprietary bioplastics resin technology, focusing on what customer features are most desirable, the chemistry to construct those features in new materials and our ability to design manufacturing equipment and processes that are highly automated and cost-efficient throughout the production cycle.

Although bioplastics are commonly a hybrid blend of conventional polymers and biomass, along with the agents necessary to cross link them and give them various qualities, our newest material removes all petrochemicals from the blending and composition of the bioplastics resin. We have submitted a provisional patent application in the United States for this improved method of bioplastics production. We believe that by introducing proprietary process technologies and formulations, we can increase operating margins and potential profitability.

We were incorporated in December 2006 as an Oregon corporation and reincorporated in August 2011 as a Nevada corporation. Our principal executive offices are located at 9125 S.W. Ridder Road, Suite D, Wilsonville, Oregon 97070, and our telephone number is (503) 582-1300. Our website address is www.trellisearth.com. Our website and the information contained on our website are not incorporated into this prospectus.

|

|

2

|

The Offering

|

||

|

Securities offered by us

|

Up to [●] shares of common stock and warrants to purchase up to [●] shares of common stock. The warrants will be exercisable at a price of $___ per share and have a ___ year term.

|

|

|

Offering price

|

$___ per share and warrant.

|

|

|

Common Stock to be outstanding after this offering assuming the sale of all shares covered by this prospectus and assuming no exercise of the warrants for the shares covered by this prospectus

|

[●] shares.

|

|

|

Common Stock to be outstanding after this offering assuming the sale of all shares covered by this prospectus and assuming the exercise of all warrants for the shares covered by this prospectus

|

[●] shares.

|

|

|

Use of proceeds

|

We plan to use the net proceeds of this offering to finance capital expenditures for our planned Oregon manufacturing facility, purchase raw materials, repay outstanding indebtedness, expand marketing and brand development and for other general corporate purposes. For a more complete description of our intended use of the net proceeds from this offering, see “Use of Proceeds.”

|

|

|

Risk factors

|

The securities offered by this prospectus are speculative and involve a high degree of risk and investors purchasing our securities should not purchase the securities unless they can afford the loss of their entire investment. See “Risk Factors” beginning on page 5 of this prospectus.

|

|

|

General Information About this Prospectus

Unless otherwise noted, throughout this prospectus the number of shares of common stock to be outstanding after this offering is based on 5,543,870 shares of common stock outstanding as of January 17, 2012 , and excludes 1,005,000 shares of common stock issuable upon exercise of outstanding stock options with an exercise price of $2.00 per share as of January 17, 2012 .

Unless otherwise indicated, all information in this prospectus gives effect to the 1-for-2 reverse stock split of our outstanding shares of common stock, which became effective on September 16, 2011.

|

||

3

|

Summary Financial Data

The following tables set forth summary financial data. The financial data as of and for the nine months ended September 30, 2011 and 2010 have been derived from our unaudited financial statements, included in this prospectus. The statements of operations data for the years ended December 31, 2010 and December 31, 2009 have been derived from our audited financial statements included in this prospectus. The unaudited financial statements include all adjustments, consisting of normal recurring accruals, which we consider necessary for a fair presentation of the financial position and the results of operations for these periods. You should read this summary financial data in conjunction with the section “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes, included in this prospectus. Our historical results are not necessarily indicative of the results to be expected for any future period.

|

|||||||||||||

| Nine Months ended September 30, |

Years ended December 31,

|

||||||||||||

|

2011

|

2010

|

2010

|

2009

|

||||||||||

|

Statement of Operations Data:

|

|||||||||||||

|

Revenues

|

$

|

2,151,837

|

$

|

1,987,085

|

$

|

2,686,255

|

$

|

2,178,534

|

|||||

|

Cost of Revenues

|

1,517,792

|

1,345,832

|

1,946,782

|

1,569,600

|

|||||||||

|

Gross Profit

|

634,045

|

641,253

|

739,473

|

608,934

|

|||||||||

|

Operating Expenses:

|

|||||||||||||

|

Selling, general and administrative expenses

|

1,753,310

|

623,572

|

879,676

|

889,895

|

|||||||||

|

Research and development expenses

|

45,600

|

31,000

|

42,300

|

38,500

|

|||||||||

|

Employee severance expense

|

-

|

-

|

160,000

|

-

|

|||||||||

|

Depreciation expense

|

9,422

|

6,528

|

10,899

|

8,126

|

|||||||||

|

Loss from Operations

|

(1,174,287

|

)

|

(72,454

|

) |

(353,402

|

)

|

(327,587

|

)

|

|||||

|

Other Income (Expense):

|

|||||||||||||

|

Loss on disposition of fixed assets

|

-

|

-

|

(1,583)

|

-

|

|||||||||

|

Interest expense

|

(77,314)

|

(52,607

|

) |

(104,487)

|

(116,494)

|

||||||||

|

Net Loss

|

$

|

(1,251,601)

|

$

|

(72,454

|

) | $ |

(459,472)

|

$ |

(444,081

|

)

|

|||

|

Net loss per share – basic and diluted

|

$ |

(0.30)

|

$ |

(0.02

|

) | $ |

(0.12)

|

$ |

(0.12

|

)

|

|||

|

Weighted average common shares outstanding- basic and diluted

|

4,227,783

|

4,773,812

|

3,782,213,

|

3,656,056

|

|||||||||

|

September 30, 2011

|

|||||||||||||

|

Balance Sheet Data:

|

|

||||||||||||

|

Cash and cash equivalents

|

$

|

88,825

|

|||||||||||

|

Total assets

|

$ |

858,308

|

|||||||||||

|

Total current liabilities

|

$ |

1,189,754

|

|||||||||||

|

Long-term notes payable

|

100,000

|

||||||||||||

|

Total liabilities

|

$ |

1,289,754

|

|||||||||||

|

Total stockholders’ (deficit)

|

$ |

(329,542

|

) | ||||||||||

4

RISK FACTORS

You should carefully consider the risks described below as well as other information provided to you in this document, including information in the section “Special Note Regarding Forward-Looking Statements.” If any of the following risks actually occur, our business, financial condition or results of operations could be materially and adversely affected, the value of our common stock could decline and you may lose all or part of your investment.

Risks Related to Our Company and Business

We have a limited operating history upon which an evaluation of our prospects can be made, and we received a going concern qualification in our 2010 audit; there can be no assurance we will succeed.

We have been in the bioplastics business since December 2006. We have had limited operations to date upon which to evaluate our business prospects. As a result, an investor does not have access to the same type of information in assessing his or her proposed investment as would be available to purchasers in a company with a longer history of prior operations. We face all the risks inherent in a new business, including the expenses, difficulties, complications and delays frequently encountered in connection with conducting operations, including capital requirements and management’s potential underestimate of initial and ongoing costs (including with respect to our new planned facilities in Oregon and Illinois). We also face the risk that we may not be able to effectively implement our business plan. If we are not effective in addressing these risks, we may not operate profitably and we may not have adequate working capital to meet our obligations as they become due. The report of our independent registered public accounting firm with respect to our audited financial statements in this prospectus includes a “going concern” paragraph indicating that our accumulated deficit as of December 31, 2010, limited liquidity and failure to complete our efforts to establish a recurring source of revenues sufficient to cover operating costs for the next 12-month period, raises substantial doubt about our ability to continue as a going concern.

We have a history of net losses and we may not be able to achieve profitability in the future, which may have a detrimental effect on the long-term capital appreciation of our common stock.

We recorded revenues of $2,686,255 and $2,178,534 for the years ended December 31, 2010 and 2009, respectively, and a net loss of $459,472 and $444,081 for the years ended December 31, 2010 and 2009, respectively. We recorded revenues of $2,151,837 and $1,987,085 for the nine months ended September 30, 2011 and 2010, respectively, and a net loss of $1,251,601 and $72,454 for the nine months ended September 30, 2011 and 2010, respectively. From our date of inception (December 5, 2006) through September 30, 2011, we have an accumulated deficit of $3,375,605. Our losses to date have been due to expenses related to start-up costs incurred as we grew our business, and the costs of developing our sales and marketing organization. A component of the losses can be attributed to stock compensation charges and one-time expenses relating to legal settlement of employee severance pay 2011. There can be no assurance that we will generate significant revenues or be profitable in the future. If we are not profitable and cannot obtain sufficient capital, we may have to curtail or even cease our operations.

There can be no assurance that bioplastics will achieve market acceptance and grow; thus, the future of our business and the bioplastics industry is uncertain.

The market for biodegradable and sustainable materials may be disrupted by the introduction of new products and services, and is subject to changing consumer preferences and industry trends, which may adversely affect our ability to plan for the future development and marketing of our products. Though rising and volatile oil prices, environmental concerns, regulatory initiatives, and increasing consumer demand for products that have a smaller ecological impact are long ‐ term drivers for the adoption of bioplastics, and are creating consumer demand for the types of products we sell, there is no assurance such trends will continue or, even if they do, that general market acceptance for bioplastics will continue to grow.

We rely on a single distributor for a majority of our revenues, and if we lose this distributor for any reason, we would lose a significant amount of our revenue and need to divert our efforts and resources to this area.

Since mid-2007, we have been highly dependent on sales of our bioplastics products through Bunzl to its customers and other distributors. We sell products to Bunzl pursuant to purchase orders; we do not have a long-term written contract or any oral contract with Bunzl. Approximately 59%, 64% and 71% of our revenues for the nine months ended September 30, 2011 and the years ended December 31, 2010 and 2009, respectively, resulted from sales through Bunzl and its affiliates. Therefore, at present, a significant portion of our business depends largely on the success of Bunzl in the disposable plastic food service items market. Our business could be adversely affected if Bunzl’s share of this market declined or if its customer base in that market eroded. A decision by Bunzl to discontinue ordering products from us could have a material and adverse impact on our business, and result in a significant loss of revenue to us.

5

We have been historically dependent upon a single manufacturer for substantially all of the products we sell, and could be adversely impacted through the loss of customers if this relationship were to end without reasonable notice.

We are currently dependent upon a single manufacturer for substantially all of the products we sell. This manufacturer, Zhejiang Wafa Ecosystem Science & Technology Co. Ltd., is located in the People’s Republic of China. Each shipment of the products to us could be delayed, waylaid, rerouted, stolen, lost or damaged, the occurrence of each of which could adversely affect our performance and profitability. We may also face increased pressure for the supply of finished products that are produced by the manufacturer, as a result of increased demand and competitors seeking to displace us. Further, we have no written or oral agreement with the manufacturer by which we may ensure that our products will be manufactured and shipped to us on a timely basis, the failure for which we would have no legal remedy.

We may face additional barriers and costs as a result of importing our products from China, which could increase our prices and make our products less desirable.

China and the United States may create additional barriers to business between our principal manufacturer and us, including new tariffs, restrictions, controls or embargos that could negatively impact our business. For example, new or increased tariffs would result in higher prices (and thus lower sales volumes) and/or lower operating margins on our products, and thus negatively impact our operating results.

We may be unable to protect our proprietary and technology rights, which may cause an erosion of our competitive strengths.

Our success will depend in part on our ability to protect our proprietary rights and technologies. We intend to rely on a combination of patents, trademark laws, trade secret laws of general applicability, employee confidentiality and invention assignment agreements and other contractual provisions to protect our proprietary rights. However, these measures afford only limited protection. For example, we currently do not own any patents, and we have two patent applications pending with the U.S. Patent and Trademark Office, for technologies that have yet to be tested and produced on a large scale (see “Business”).If these applications are not approved, or if we otherwise fail to adequately protect our proprietary rights, our competitive prospects will be adversely affected. Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy aspects of our products or obtain and use trade secrets or other information that we regard as proprietary. There can be no assurance that our technology will remain proprietary.

Litigation or other legal proceedings or third-party claims of intellectual property infringement could require us to spend significant time and money, could prevent us from selling our products and could adversely impact the price of our common stock.

Our commercial success depends in part on our non-infringement of the patents or proprietary rights of third parties and the ability to protect our own intellectual property. Third parties may assert that we are employing their proprietary technology without authorization even if we are not. As we enter new markets, if any, competitors may assert that our products infringe their intellectual property rights as part of a business strategy to impede our successful entry into those markets. Third parties may have obtained and may in the future obtain patents and claim that manufacture, use and/or sale of our technologies, methods or products infringes these patents. We could incur substantial costs and divert the attention of our management and technical personnel in defending ourselves against these claims even if we are eventually successful in such defense. Furthermore, parties making claims against us may be able to obtain injunctive or other relief, which effectively could block our ability to further develop, commercialize, manufacture, use and sell methods and products, and could result in the award of substantial damages against us. In the event of a successful claim of infringement against us, we may be required to pay damages and obtain one or more licenses from third parties, or we may be prohibited from making, using or selling certain methods and/or products. We may not be able to obtain such a license at a reasonable cost, or at all. In that event, we could encounter delays in product introductions while we attempt to develop alternative methods or products. Defense of any lawsuit or failure to obtain any of these licenses on favorable terms could prevent us from commercializing products, and the prohibition of sale of any of our products could materially affect our ability to grow and to maintain profitability.

Our revenues and operating results could decline due to macroeconomic and other factors outside of our control, such as changes in consumer confidence.

Changes in international, national, regional and local economic conditions may result in reduced purchases of the products we sell by consumers and reduction in the prices we are able to charge for the products we sell. These economic conditions involve, among other things, conditions of supply and demand in local markets and changes in consumer confidence and income, employment levels and government regulations. If these changes in economic conditions have an adverse effect on consumer demand for and the pricing of our products, our operating results will suffer.

6

Because we are smaller and have fewer financial resources than many of our competitors, we may not be able to successfully compete in the intensely competitive bioplastics industry.

The bioplastics industry is new but intensely competitive and highly fragmented. We compete with numerous companies, many of which are larger and more established and have significantly greater financial, technical, marketing and other resources than we do. These competitors may be able to respond more quickly to new or changing opportunities and customer requirements and may be able to undertake more extensive promotional activities, offer more attractive terms to customers, and adopt more aggressive pricing policies. We cannot assure you that we will be able to compete effectively or successfully with current or future competitors or that the competitive pressures we face will not harm our business. We also expect to encounter intense competition from other entities seeking to pursue new business opportunities or business combinations. Many of these entities are well-established and have extensive experience in connection with identifying new prospective business opportunities or in effecting business combinations. Many of these competitors possess greater financial, technical, human and other resources than we do and there can be no assurance that we will have the ability to compete successfully for new opportunities or business combinations. Based upon limited financial and personnel resources, we may lack sufficient resources as compared to those of many of potential competitors.

There are risks associated with conducting business operations with China, including increased costs resulting from possible labor shortages and the ability to effectively monitor product quality.

Our primary supplier, from whom we have secured distribution rights for certain bioplastic products, is located in China. As a result, we are subject to the risk of possible increased costs resulting from possible labor shortages in China. In addition, since we do not assemble or otherwise manufacture these products, we are subject to risks associated with the quality-control infrastructure at this manufacturer. Since we are not in control of the actual manufacture or production of these products, we cannot guarantee the quality of their production.

Our success will be influenced by the price of petroleum, the primary ingredient in conventional petroleum-based plastics, relative to the cost of bioplastic raw materials such as cornstarch.

Our success will be influenced by the cost of our eco-friendly alternative products relative to the cost of petroleum-based plastics. The cost of petroleum-based plastic is in part based on the price of petroleum. The prices of our products will depend in part on the cost of certain raw materials such as cornstarch. For example, in past years, the prices of petroleum and corn have diverged. If the price of corn or were to dramatically increase or if the price of petroleum decreases, any of our products based on cornstarch may be less competitive relative to petroleum-based plastics. A material decrease in the cost of conventional petroleum-based plastics may require a reduction in the prices of our products for them to remain attractive in the marketplace. In such instance, if corn prices or the cost of other bioplastic inputs remain stable or increase, we may be required to price our products at a level that causes us to operate at a loss. Recently, the prices of both corn and petroleum have fluctuated. However, based on the nature and scope of such increases, we believe that the fluctuation is a normal part of the price cycle. At this time, we have yet to discern what impact, if any, the recent fluctuations in corn and petroleum prices will have on our business.

Fluctuations in the Chinese RMB to U.S. dollar exchange rate may adversely affect our reported operating results.

We have a significant relationship with a supplier in China, and thus will be affected by the strength of the U.S. dollar relative to the value of the Chinese RMB. A decline in the value of the dollar relative to the Chinese RMB could negatively affect our actual operating costs in U.S. dollars and our reported results of operations, since we may have to pay more for the same products. We do not currently engage in any currency hedging transactions intended to reduce the effect of fluctuations in foreign currency exchange rates on our results of operations. We cannot guarantee that we will enter into any such currency hedging transactions in the future or, if we do, that these transactions will successfully protect us against currency fluctuations.

Changes in government regulations encouraging the use of biodegradable alternatives to plastic products and changes in regulations pertaining to marketing of biodegradable products may have an adverse effect on our business.

One of the key markets for our products is as compostable and biodegradable substitutes for non-biodegradable petroleum-based plastics. This market is driven in part by laws, regulations and policies designed to encourage or mandate the increased use of biodegradable and sustainable alternatives to petroleum-based plastics. Numerous countries, states and localities have enacted such laws and regulations, including bans and taxes on the use of single-use plastic and non-biodegradable plastic bags, due to ecological and waste management concerns. For example, the cities of San Francisco, Manhattan Beach, Malibu and Palo Alto in California, all have imposed bans on single-use non-biodegradable plastic bags. Similar laws have been proposed or enacted in parts of Europe, China, Taiwan and India. The phasing out or elimination of these or similar laws and regulations may adversely affect the demand for our products.

7

The State of California has enacted legislation limiting the use of the terms “compostable,” “biodegradable” and similar terms in connection with certain plastic products. Similar legislation has been adopted or is being proposed in other jurisdictions. While these restrictions also impact our competitors, these laws and regulations may limit our ability to promote or market our products based on their biodegradability characteristics. This could adversely affect the demand for our products which, in turn, could have a material adverse effect on our business, financial condition and results of operations.

We may not be successful in identifying market needs for new technologies and developing new products to meet those needs.

The success of our business model depends on our ability to correctly identify market opportunities for biologically produced plastics. We intend to identify new market needs, but we may not always have success in doing so because the markets for new materials and other products are not well-developed.

The materials and manufacturing technologies we research and develop are new and are steadily changing and advancing. The products that are derived from these technologies may not be applicable or compatible with the demands in existing markets. Our existing products and technologies may become uncompetitive or obsolete if our competitors adapt more quickly than we do to new technologies and changes in customers' requirements. Furthermore, we may not be able to identify new opportunities as they arise for our products since future applications of any given product may not be readily determinable, and we cannot reasonably estimate the size of any markets that may develop. If we are not able to successfully develop new products, we may be unable to increase our product revenues.

Our success depends on our executive officers and other key personnel; the loss of any of them could disrupt our business operations and jeopardize our competitive position.

Our future success will depend in substantial part on the active participation and technical expertise of our senior management, namely William Collins, our Chairman, President and Chief Executive Officer, and Michael Senzaki, our Chief Operating Officer and Chief Financial Officer. The loss of the services of Messrs. Collins or Senzaki, or one or more of our other key personnel, could jeopardize our ability to maintain a competitive position in the bioplastics industry. Effective upon completion of this offering, we will be party to an employment agreement with Mr. Collins. We do not currently have any employment agreements in place with our other executive officers and key personnel, and we do not carry key-man life or other insurance for our benefit on the lives of any of our executive officers and key personnel. Our future success will also depend on the continued ability to attract, retain and motivate highly qualified technical sales and marketing customer support personnel. We cannot guarantee that we will be able to retain our key personnel or that we will be able to attract and retain qualified personnel in the future.

If we fail to maintain effective internal controls over financial reporting, the price of our common stock may be negatively affected.

Because we have not yet evaluated the effectiveness of our internal control over financial reporting, it may have weaknesses and conditions that could require correction or remediation, the disclosure of which may have a negative impact on the price of our common stock. We are required to establish and maintain appropriate internal controls over financial reporting. Failure to establish those controls, or any failure of those controls once established, could adversely impact our public disclosures regarding our business, financial condition or results of operations. In addition, management’s assessment of internal controls over financial reporting may identify weaknesses and conditions that need to be addressed in our internal controls over financial reporting or other matters that may raise concerns for investors. Any actual or perceived weaknesses and conditions that need to be addressed in our internal control over financial reporting, disclosure of management’s assessment of our internal controls over financial reporting or disclosure of our public accounting firm’s attestation to or report on management’s assessment of our internal controls over financial reporting may have a negative impact on the price of our common stock.

If we fail to comply in a timely manner with Section 404 of the Sarbanes Oxley Act of 2002, our business could be harmed and our stock price could decline.

Rules adopted by the SEC pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 require annual assessment of our internal controls over financial reporting. The standards that must be met for management to assess the internal controls over financial reporting as effective are evolving and complex, and require significant documentation, testing and possible remediation to meet the detailed standards. We expect to incur significant expenses and to devote resources to Section 404 compliance on an ongoing basis. It is difficult for us to predict how long it will take or costly it will be to complete the assessment of the effectiveness of our internal control over financial reporting for each year and to remediate any deficiencies in our internal control over financial reporting. As a result, we may not be able to complete the assessment and remediation process on a timely basis. In the event that our chief executive officer or chief financial officer determine that our internal control over financial reporting is not effective as defined under Section 404, we cannot predict how regulators will react or how the market price of our shares will be affected; as such, we believe that there is a risk that investor confidence and share value may be negatively impacted.

8

Risks Relating to Our Common Stock and this Offering

There is no trading market for our common stock and as a result you may not be able to sell our common stock.

There is no market for our common stock and there may never be a market for our common stock. We do not anticipate that a market for our common stock will develop, if at all, until after the registration statement of which this prospectus is a part has been declared effective by the SEC. In the absence of an active trading market, you may have difficulty buying and selling or obtaining market quotations; the market visibility for our stock may be limited, and the lack of visibility for our common stock may have a depressive effect on the market price for our common stock.

There is no trading market for the warrants to purchase common stock in this offering.

There is no established public trading market for the warrants being offered in this offering, and we do not expect a market to develop. In addition, we do not intend to list the warrants on a national securities exchange or arrange to have the warrants quoted on the OTC Bulletin Board following this offering. Without an active market, the liquidity of the warrants will be limited.

You will experience immediate and substantial dilution as a result of this offering and may experience additional dilution in the future.

You will incur immediate and substantial dilution as a result of this offering. After giving effect to the sale by us of up to [●] shares and warrants offered in this offering at a public offering price of $[●] per share and warrant, and after deducting the placement agent’s fees and estimated offering expenses payable by us, investors in this offering can expect an immediate dilution of $[●] per share, or [●] %, at the public offering price. In addition, in the past, we issued options and warrants to acquire shares of common stock and will issued warrants in this offering. To the extent these options or warrants are ultimately exercised, you will sustain future dilution.

9

Additional stock offerings in the future may dilute your percentage ownership of our company.

Given our plans and expectations that we may need additional capital and personnel, we may need to issue additional shares of common stock or securities convertible or exercisable for shares of common stock, including convertible preferred stock, convertible notes, stock options or warrants. The issuance of additional securities in the future will dilute the percentage ownership of then current stockholders.

There is no minimum amount required to be raised in the offering, and if we cannot raise sufficient funds from this offering, we may need to curtail or cease operations.

There is not a minimum amount of securities that need to be sold in this offering for us to access the funds. Therefore, the proceeds of this offering will be immediately available for use by us and we do not have to wait until a minimum number of shares have been sold to keep the proceeds from any sales. We cannot assure you that subscriptions for the entire offering will be obtained. We have the right to terminate this offering at any time, regardless of the number of securities we have sold since there is no minimum subscription requirement. Our ability to meet our financial obligations, cash needs, and to achieve our objectives, could be adversely affected if the entire offering is not fully subscribed for and as a result we could be forced to curtail or cease our operations.

The rights of holders of common stock may be impaired by the possible future issuance of preferred stock.

Our board of directors has the right, without stockholder approval, to issue preferred stock with voting, dividend, conversion, liquidation and other rights which could adversely affect the voting power and equity interest of the holders of common stock, which could be issued with the right to more than one vote per share, and could be utilized as a method of discouraging, delaying or preventing a change of control. The possible negative impact on takeover attempts could adversely affect the price of our common stock. Although we have no present intention to issue any shares of preferred stock or to create any series of preferred stock, we may issue these shares in the future.

William Collins will continue to own a substantial amount of our common stock after this offering, which could delay or prevent a change in corporate control or result in the entrenchment of our management and board of directors.

Upon completion of this offering, assuming the sale of all the securities offered hereby, William Collins, our Chairman, President and Chief Executive Officer, will beneficially own approximately [●]% of the outstanding shares of our common stock. As a result of his continuing ownership interest, Mr. Collins will have the ability to exert substantial control over the outcome of certain matters requiring a stockholder vote, including the election of directors and offers to acquire our company. In addition, Mr. Collins will have the ability to exert substantial control over the management and affairs of our company. Accordingly, this concentration of ownership may harm the market price of our common stock by:

|

•

|

delaying, deferring or preventing a change in control;

|

|

•

|

entrenching our management or our board of directors;

|

|

•

|

impeding a merger, consolidation, takeover or other business combination; or

|

|

•

|

discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of the company.

|

We have not paid dividends in the past and do not expect to pay dividends in the future. Any return on your investment will likely be limited to the value of our common stock.

We have never paid cash dividends on our common stock and do not anticipate paying cash dividends in the foreseeable future. The payment of dividends on our common stock will depend on earnings, financial condition and other business and economic factors affecting us at such time as our board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because a return on your investment will only occur if our stock price appreciates.

We have broad discretion in the use of the net proceeds of this offering and may not use them effectively.

Management will retain broad discretion over the use of the net proceeds of this offering. Stockholders may not agree with such uses, and our use of the proceeds may not yield a significant return or any return at all for our stockholders. We plan to use the net proceeds from this offering for capital expenditures relating to our new planned facility in Oregon, working capital and general corporate purposes. Because of the number and variability of factors that will determine our use of the proceeds from this offering, their ultimate use may vary substantially from their currently intended use. The failure by our management to apply these funds effectively could have a material and adverse effect on our business. For a further description of our intended use of the net proceeds of the offering, see “Use of Proceeds.”

10

Because we are seeking a limited offering qualification in California, sales of our shares and warrants will be limited in California.

We are seeking a limited offering qualification of our units in California. If the offering is approved in California on the basis of such limited offering qualification, in the absence of any other exemptions, offers and sales of our units can only be made to proposed California purchasers based on their meeting certain suitability standards. California investors must meet at least one of the following criteria:

|

·

|

|

·

|

|

·

|

|

·

|

any natural person whose individual net worth, or joint net worth with that person's spouse, at the time of his purchase exceeds $1,000,000 (exclusive of home, home furnishings and automobile);

|

|

·

|

|

·

|

|

·

|

any entity in which all of the equity owners are accredited investors.

|

If the offering is approved in California on the basis of a limited offering qualification, we will not have to demonstrate compliance with some of the merit regulations of the California Department of Corporations as found in Title 10, California Code of Regulations, Rule 260.140 et seq. In addition, the exemptions for secondary trading in California available under California Corporations Code Section 25104(h) will be withheld, although there may be other exemptions to cover private sales in California of a bona fide owner for his own account without advertising and without being effected by or through a broker dealer in a public offering.

Because our common stock will be subject to the SEC’s penny stock rules, broker-dealers may experience difficulty in completing customer transactions and trading activity in our securities may be adversely affected.

Our common stock will be subject to the “penny stock” rules adopted under Section 15(g) of the Exchange Act. The penny stock rules generally apply to companies whose common stock is not listed on The Nasdaq Stock Market or other national securities exchange and trades at less than $1.00 per share, other than companies that have had average revenue of at least $6,000,000 for the last three years or that have tangible net worth of at least $5,000,000 ($2,000,000 if the company has been operating for three or more years). So long as our common stock remains subject to the “penny stock” rules promulgated under the Securities Exchange Act of 1934, broker-dealers may find it difficult to effectuate customer transactions and trading activity in our securities may be adversely affected.

In accordance with these rules, broker-dealers participating in transactions in low-priced securities must first deliver a risk disclosure document that describes the risks associated with such stocks, the broker-dealer's duties in selling the stock, the customer's rights and remedies and certain market and other information. Furthermore, the broker-dealer must make a suitability determination approving the customer for low-priced stock transactions based on the customer's financial situation, investment experience and objectives. Broker-dealers must also disclose these restrictions in writing to the customer, obtain specific written consent from the customer, and provide monthly account statements to the customer. The effect of these restrictions will probably decrease the willingness of broker-dealers to make a market in our common stock, decrease liquidity of our common stock and increase transaction costs for sales and purchases of our common stock as compared to other securities. Our management is aware of the abuses that have occurred historically in the penny stock market.

As a result, so long as our common stock remains subject to the penny stock rules, the market price of our securities may be depressed, and you may find it more difficult to sell our securities.

11

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements contained in this prospectus that are not historical facts are "forward-looking statements" which can be identified by the use of terminology such as “estimates,” “projects,” “plans,” “believes,” “expects,” “anticipates,” “intends,” or the negative or other variations, or by discussions of strategy that involve risks and uncertainties. We urge you to be cautious of the forward-looking statements, that such statements, which are contained in this prospectus, reflect our current beliefs with respect to future events and involve known and unknown risks, uncertainties and other factors affecting our operations, market growth, and products. No assurance can be given regarding the achievement of future results, as actual results may differ materially as a result of the risks we face, and actual events may differ from the assumptions underlying the statements that have been made regarding anticipated events. Factors that may cause actual results, our performance or achievements, or industry results, to differ materially from those contemplated by such forward-looking statements include without limitation:

|

·

|

Uncertainties regarding the growth or sustainability of the market for biodegradable materials;

|

|

·

|

Changes in consumer preferences with regard to plastic products;

|

|

·

|

The risk that we may not be able to achieve or maintain a technological advantage over any of our competitors in the industry;

|

|

·

|

Risks relating to the protection of our intellectual property and proprietary technology; and

|

|

·

|

The risks associated with limited management, employees and financial resources.

|

12

USE OF PROCEEDS

We estimate that the aggregate net proceeds to us assuming the sale of all the securities in this offering will be approximately $6,780,000, after deducting placement agent fees and approximately $300,000 of estimated offering expenses that will be payable by us from the proceeds of this offering. However, this is a best efforts offering, with no minimum, and there can be no assurance that the offering will result in significant proceeds, or enough proceeds to continue to operate our business operations.

We intend to use the net proceeds from this offering as follows:

|

Use of Proceeds

|

Approximate Dollar Amount

|

Approximate Percentage of Net Proceeds

|

||||||

|

Purchasing Machinery for Production Facilities (1)

|

$

|

5,000,000

|

73.8

|

%

|

||||

|

Purchasing Components for Tooling (2)

|

250,000

|

3.7

|

%

|

|||||

|

Equipping Facilities for Operations (3)

|

250,000

|

3.7

|

%

|

|||||

|

Repaying Debt (4)

|

654,775

|

9.7

|

%

|

|||||

|

Expanding Marketing and Brand Development (5)

|

175,000

|

2.6

|

%

|

|||||

|

Purchasing Raw Materials (6)

|

175,000

|

2.6

|

%

|

|||||

|

General Corporate Purposes (7)

|

275,225

|

4.1

|

%

|

|||||

|

Total

|

$

|

6,780,000

|

100.0

|

%

|

||||

______________________

(1) We plan to use approximately $5,000,000 in net proceeds to purchase extrusion, thermoforming and injection- molding equipment, and associated materials handling, packaging and operating equipment needed in our planned manufacturing facility in Oregon.

(2) We plan to use approximately $250,000 in net proceeds to purchase tooling components such as our initial product molds for our injection-molding lines (such as forks, knives and spoons) and thermoforming lines (such as clamshells, bowls, cups and plates) in our planned manufacturing facility in Oregon.

(3) We plan to use approximately $250,000 in net proceeds to prepare our planned manufacturing facility in Oregon for adequate power distribution, chilled water, compressed air and similar utility services.

(4) We plan to use $654,775 in net proceeds to retire the inventory financing note due Zhejiang Wafa Ecosystem Science & Technology Co. Ltd. (known as Zwest) in the amount of $450,000, and a related-party note payable to William Collins, our Chairman, President and Chief Executive Officer, in the amount of $204,775 (including $145,679 in principal and $59,096 in accrued interest). Zwest’s note accrues interest at the rate of 18% per year and is payable on September 30, 2012. Mr. Collins’s note accrues interest at the rate of 12% per year and is payable on demand. We used the proceeds from both of these notes to finance our purchase of inventory.

( 5) We plan to use approximately $175,000 in net proceeds to increase our visibility and brand awareness in the marketplace. Specific uses of such net proceeds will include design patent and trademark registration costs, trade show collateral and attendance expenses, advertising and related marketing activities.

(6) In order to initiate manufacturing, we will be required to take delivery by railcar of the raw materials in an amount roughly equivalent to our holding capacity, or approximately 154 metric tons of supplies at an approximate cost of $175,000.

|

(7) We plan to use the remaining $275,225 in net proceeds for working capital and general corporate purposes, including interest and overhead.

|

13

As of the date of this prospectus, we cannot predict with certainty the amounts that we will actually spend on the uses set forth above. The amounts and timing of our actual expenditures will depend upon numerous factors, including the progress of our research, product development, and commercialization efforts, and our operating costs and expenditures. Accordingly, our management will have significant flexibility in applying the net proceeds of this offering.

We believe that the net proceeds of this offering, together with operating revenues and the remaining proceeds from our prior private placement, will be sufficient to meet our projected requirements for working capital and capital expenditures through at least the next 12 months. Pending use of the proceeds from this offering as described above or otherwise, we intend to invest the net proceeds in short-term interest-bearing, investment grade securities.

We have never declared or paid cash dividends on our capital stock. Following the completion of this offering, we intend to retain our future earnings, if any, to finance the further development and expansion of our business and do not expect to pay cash dividends on our common stock in the foreseeable future. Payment of future cash dividends, if any, will be at the discretion of our board of directors after taking into account various factors, including our financial condition, operating results, current and anticipated cash needs, outstanding indebtedness and plans for expansion and restrictions imposed by lenders, if any.

CAPITALIZATION

The following table sets forth our short-term debt and capitalization as of September 30, 2011, (a) on an actual basis and (b) on a pro forma, as adjusted basis, to reflect: (i) the estimated net proceeds of $6,780,000 from the sale of all of the securities offered hereby and (ii) the repayment of short-term debt and long-term debt in the amounts of $204,775 and $450,000, respectively.

You should read this table together with our financial statements and the related notes included in this prospectus.

|

As of September 30, 2011

|

||||||||||||||

|

Actual

|

Pro forma adjustment

|

Pro forma, as adjusted

|

||||||||||||

|

Current liabilities:

|

||||||||||||||

|

Note payable and accrued interest - related party

|

$ | 204,775 | $ | (204,775 | ) | (2 | ) | $ | - | |||||

|

Long-term debt:

|

||||||||||||||

|

Notes payable

|

$ | 550,000 | $ | (450,000 | ) | (2 | ) | $ | 100,000 | |||||

|

Stockholders’ (deficit) equity:

|

||||||||||||||

|

Preferred stock, $0.001 par value, 20,000,000 shares authorized, 0 shares issued and outstanding

|

- | - | - | |||||||||||

|

Common stock, $0.001 par value, 100,000,000 shares authorized, 6,493,345 shares issued, actual, 5,493,345 shares issued and outstanding, actual; _______ shares issued, pro forma, as adjusted, ________- shares issued and outstanding, pro forma, as adjusted

|

6,493 | (1 | ) | |||||||||||

|

Additional paid-in capital

|

2,183,283 | (1 | ) | |||||||||||

|

Treasury stock

|

(100,000 | ) | - | (100,000 | ) | |||||||||

|

Accumulated deficit

|

(3,375,605 | ) | - | (3,337,605 | ) | |||||||||

|

Total shareholders’ (deficit) equity

|

(329,542 | ) | 6,780,000 | 6,450,458 | ||||||||||

|

Total capitalization

|

$ | 220,458 | $ | 6,330,000 | $ | 6,550,458 | ||||||||

|

Footnotes for the pro forma adjustments:

|

||||||||||||||

|

(1) Assumes that all of the shares of common stock and warrants to purchase [●] shares of common stock are sold in this offering at an offering price of $ per share and warrant and that the net proceeds thereof are approximately $6,780,000 after deducting placement agent’s fees and our estimated offering expenses.

|

||

|

(2) Represents repayment of short-term debt and long-term debt in the amounts of $204,775 and $450,000, respectively.

|

||

14

DILUTION

If you invest in shares of our common stock, your interest will be diluted to the extent of the difference between the public offering price per share and warrant and our net tangible book value per share after this offering. Dilution results from the fact that the public offering price per share is substantially in excess of the book value per share attributable to the existing shareholders for our presently outstanding shares.

Our net tangible book value as of September 30, 2011 was approximately ($329,542) or ($0.06) per share as of that date. Net tangible book value represents the amount of our total assets (all tangible), less the amount of our total liabilities. Dilution is determined by subtracting net tangible book value per share, after giving effect to the estimated net proceeds of $6,780,000 which we will receive from the sale of shares of our common stock and warrants in this offering at an offering price of $ per share, after deducting placement agent’s fee and other estimated offering expenses payable by us.

Without taking into account any other changes in net tangible book value after September 30, 2011, other than giving effect to the sale of the common stock offered in this offering at an offering price of $_______ per share less placement agent’s fees and other estimated offering expenses payable by us, our pro forma net tangible book value as of September 30, 2011 would have been $6,450,458, or $ per share. This represents an immediate increase in net tangible book value of $ per share to the existing shareholders and an immediate dilution in net tangible book value of $ per share to investors purchasing shares in this offering. The following table illustrates such dilution

|

Public offering price per share

|

$

|

|||||||

|

Historical net tangible book value per share as of September 30, 2011

|

$

|

(0.06)

|

||||||

|

Increase in net tangible book value per share attributable to purchasing shares offered hereby

|

|

|||||||

|

Pro forma net tangible book value per share after this offering

|

||||||||

|

Amount of dilution in net tangible book value per share to new investors in this offering

|

$

|

The following table summarizes, on a pro forma basis as of September 30, 2011, the differences between existing shareholders and new investors with respect to the number of shares purchased from us, the total consideration paid and the average price per share paid, without deducting the placement agent’s fees and other estimated expenses payable by us in connection with this offering.

|

Shares Purchased

|

Total Consideration

|

||||||||||||||||

|

Number

|

Percent

|

Amount

|

Percent

|

Average Price Per Share

|

|||||||||||||

|

Existing shareholders

|

5,493,345

|

%

|

$

|

%

|

$

|

||||||||||||

|

New investors

|

%

|

$

|

8,000,000

|

%

|

$

|

||||||||||||

|

Total

|

100.0

|

%

|

$

|