Attached files

| file | filename |

|---|---|

| EX-4.1 - GlyEco, Inc. | ex4-1.htm |

| EX-4.2 - GlyEco, Inc. | ex4-2.htm |

| EX-4.3 - GlyEco, Inc. | ex4-3.htm |

| EX-99.1 - GlyEco, Inc. | ex99-1.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K /A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 21, 2011

GLYECO, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

000-30396

|

|

45-4030261

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

4802 East Ray Road, Suite 23-196 Phoenix, Arizona

|

|

|

|

85044

|

|

(Address of principal executive offices)

|

|

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (866) 960-1539

ENVIRONMENTAL CREDITS, LTD.

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

EXPLANATORY NOTE

GlyEco, Inc., a Nevada corporation (the “Company”) is filing this Form 8-K/A Amendment No. 1 in response to a comment letter, dated December 23, 2011, received by the Company from the Securities and Exchange Commission (the “Commission”) in connection with the Company’s Form 8-K filed with the Commission on November 28, 2011.

Part of this Amendment No. 1 to Form 8-K/A is being submitted to reclassify certain items on the consolidated statements of operations and the consolidated statements of cash flows for Global Recycling Technologies, Ltd. (“Global Recycling”) for the year ended December 31, 2009.

Additional disclosures are being provided in the accompanying financial statements regarding the $22,739 charge to earnings as a loss from discontinued operations in accordance with ASC Topic 205-20-50. The $22,739 is being reclassified as a result of WEBA’s (a wholly-owned subsidiary of Global Recycling) operating income and expenses (net) for the year ended December 31, 2009.

As a result of WEBA’s assets being sold on December 31, 2009, a loss on the disposal of assets of $2,000,000 is being reclassified from a fair value adjustment to the loss on the disposal of assets.

None of reclassifications or disclosures resulted in any changes to the previously reported net loss for the years ended December 31, 2010 and 2009 of $925,196 and $2,863,571, respectively.

2

|

Global Recycling Technologies, Ltd.

|

||||||||||||

|

Restated Consolidated Statements of Operations

|

||||||||||||

|

For the year ended December 31, 2009

|

||||||||||||

|

As filed

|

Restatements

(1)

|

Restated

|

||||||||||

|

Net Sales

|

$ | 1,647,159 | $ | (1,521,293 | ) | $ | 125,866 | |||||

|

Cost of goods sold

|

1,406,787 | (1,093,295 | ) | 313,492 | ||||||||

|

Gross profit (loss)

|

240,371 | (427,999 | ) | (187,628 | ) | |||||||

|

Operating expenses

|

||||||||||||

|

Executive consulting compensation

|

699,480 | (343,815 | ) | 355,665 | ||||||||

|

Professional fees

|

119,997 | (455 | ) | 119,542 | ||||||||

|

General and administrative

|

181,044 | (106,467 | ) | 74,577 | ||||||||

|

Impairment charge

|

2,000,000 | (2,000,000 | ) | - | ||||||||

|

Total operating expenses

|

3,000,521 | (2,450,737 | ) | 549,784 | ||||||||

|

Loss from operations

|

(2,760,150 | ) | 2,021,829 | (737,411 | ) | |||||||

|

Other income and expenses

|

||||||||||||

|

Interest income

|

2,725 | - | 2,725 | |||||||||

|

Interest expense

|

(106,147 | ) | - | (106,147 | ) | |||||||

|

Loss from discontinued operations

|

- | (21,829 | ) | (21,829 | ) | |||||||

|

Loss from disposal of assets

|

- | (2,000,000 | ) | (2,000,000 | ) | |||||||

|

Total other income and expenses

|

(103,421 | ) | (2,021,829 | ) | (2,125,250 | ) | ||||||

|

Loss before provision for income taxes

|

(2,863,571 | ) | - | (2,863,571 | ) | |||||||

|

Provision for income taxes

|

- | - | - | |||||||||

|

Net loss

|

$ | (2,863,571 | ) | $ | - | $ | (2,863,571 | ) | ||||

|

Primary and fully diluted loss per share

|

$ | (0.41 | ) | $ | - | $ | (0.41 | ) | ||||

(1) - to reflect the disposal of the WEBA assets and related discontinued operations effective as of December 31, 2009

3

|

Global Recycling Technologies, Ltd.

|

||||||||||||

|

Restated Consolidated Statements of Cash Flows

|

||||||||||||

|

For the year ended December 31, 2009

|

||||||||||||

|

As filed

|

Restatements

(1) |

Restated

|

||||||||||

|

Net cash flow from operating activities

|

||||||||||||

|

Net loss

|

$ | (2,863,571 | ) | $ | - | $ | (2,863,571 | ) | ||||

|

Adjustments to reconcile net loss to net cash used by

|

||||||||||||

|

used in operating activities

|

||||||||||||

|

Bad debt expense

|

(714 | ) | - | (714 | ) | |||||||

|

Loss from discontinued operations

|

- | 21,829 | 21,829 | |||||||||

|

Loss from disposal of assets

|

- | 2,000,000 | 2,000,000 | |||||||||

|

Loss on impairment of long lived assets

|

2,000,000 | (2,000,000 | ) | - | ||||||||

|

(Increase) decrease in accounts receivable

|

30,081 | - | 30,081 | |||||||||

|

Increase (decrease) in accounts payable

|

(26,811 | ) | - | (26,811 | ) | |||||||

|

Increase (decrease) in related party payable

|

128,154 | (21,829 | ) | 106,325 | ||||||||

|

Increase (decrease) in accrued interest

|

105,673 | - | 105,673 | |||||||||

|

Net cash used by operating activities

|

(627,188 | ) | - | (627,188 | ) | |||||||

|

Cash flows from investing activities

|

||||||||||||

|

Net payments on disposal of assets

|

- | - | - | |||||||||

|

Net cash used in financing activities

|

- | - | - | |||||||||

|

Cash flows from financing activities

|

||||||||||||

|

Proceeds from the sale of common stock

|

12,387 | - | 12,387 | |||||||||

|

Net cash provided by operating activities

|

12,387 | - | 12,387 | |||||||||

|

Net decrease in cash

|

(614,801 | ) | - | (614,801 | ) | |||||||

|

Cash at the beginning of the year

|

700,975 | - | 700,975 | |||||||||

|

Cash at end of year

|

$ | 86,174 | $ | - | $ | 86,174 | ||||||

(1) - to reflect the disposal of the WEBA assets and related discontinued operations effective as of December 31, 2009

4

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K contains forward-looking statements that involve risks and uncertainties, principally in the sections entitled “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” All statements other than statements of historical fact contained in this Current Report on Form 8-K, including statements regarding future events, our future financial performance, business strategy and plans and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” or “will” or the negative of these terms or other comparable terminology. Although we do not make forward-looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or elsewhere in this Current Report on Form 8-K. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time and it is not possible for us to predict all risk factors, nor can we address the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause our actual results to differ materially from those contained in any forward-looking statements.

We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations, and financial needs. These forward-looking statements are subject to certain risks and uncertainties that could cause our actual results to differ materially from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this Current Report on Form 8-K, and in particular, the risks discussed below and under the heading “Risk Factors” and those discussed in other documents we file with the Securities and Exchange Commission that are incorporated into this Current Report on Form 8-K by reference. The following discussion should be read in conjunction with our consolidated financial statements and notes thereto included in this Report. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this Current Report on Form 8-K may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not place undue reliance on any forward-looking statement, each of which applies only as of the date of this Current Report on Form 8-K. Before you invest in our common stock, you should be aware that the occurrence of the events described in the section entitled “Risk Factors” and elsewhere in this Current Report on Form 8-K could negatively affect our business, operating results, financial condition and stock price. Except as required by law, we undertake no obligation to update or revise publicly any of the forward-looking statements after the date of this Current Report on Form 8-K to conform our statements to actual results or changed expectations.

5

ITEM 1.01. ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

General

GlyEco, Inc. (hereinafter, “GlyEco,” the “Company,” or the “Registrant”), formerly known as Environmental Credits, Ltd. (“Environmental Credits” or “EVCL”), was originally incorporated in the State of Delaware on April 21, 1997 under the name Wagg Corp. In January 1998, Wagg Corp. changed its name to Alternative Entertainment, Inc. In December 1998, Alternative Entertainment, Inc. changed its name to BoysToys.com, Inc. On December 29, 1998, BoyToys.com changed its name to Environmental Credits, Ltd.

As disclosed by Environmental Credits in a Preliminary and Definitive Information Statement on Schedule 14C filed with the United States Securities and Exchange Commission (the “SEC” or “Commission”) on October 21, 2011 and November 1, 2011, respectively, on October 20, 2011, Ralph M. Amato, the Company’s Chief Executive Officer, President and Chairman and the holder of 70,000,000 shares of common stock (approximately 95.85% of the issued and outstanding common stock), approved by written consent in lieu of a meeting of stockholders (the “Written Consent”) to the following corporate actions (the “Corporate Actions”):

|

1.

|

To change the name of the Company from Environmental Credits, Ltd. to GlyEco, Inc.;

|

|

2.

|

To increase the number of authorized “blank check” preferred stock, par value $0.01 per share, from 10,000,000 to 40,000,000 shares;

|

|

3.

|

To decrease the par value of the Company’s common stock and preferred stock from $0.01 per share to $0.0001 per share; and

|

|

4.

|

To change the state of incorporation of the Company from the State of Delaware to the State of Nevada.

|

The Corporate Actions were effectuated by merging Environmental Credits into its wholly-owned subsidiary, GlyEco, Inc. (the “Reincorporation”).

GlyEco, Inc. was formed in the state of Nevada on October 21, 2011 for the sole purpose of the Reincorporation. GlyEco’s capital structure was 300,000,000 shares of common stock, par value $0.0001, and 40,000,000 shares of “blank check” preferred stock, par value $0.0001 per share. Environmental Credit’s capital structure was 300,000,000 share of common stock, par value $0.01 per share, and 10,000,000 shares of “blank check” preferred stock, par value $0.01 per share. The number of authorized common stock was the same for Environmental Credits and GlyEco, Inc. On October 21, 2011, GlyEco issued 1,000 shares of common stock to Environmental Credits in consideration for $10 and became a wholly-owned subsidiary of Environmental Credits.

6

The Written Consent constituted the consent of a majority of the total number of shares of outstanding common stock and was sufficient under the Delaware General Corporation Law and the Company’s Bylaws to approve the Corporate Actions. Accordingly, the Corporate Actions were not submitted to the Company’s other stockholders for a vote. The Corporate Actions were effectuated on November 21, 2011 by Environmental Credits and GlyEco executing an Agreement and Plan of Merger and filing the agreement and a Certificate of Merger with the Secretary of State of Delaware and the agreement and Articles of Merger with the Secretary of State of Nevada. The Agreement and Plan of Merger, Certificate of Merger and Articles of Merger are filed as exhibits to this Form 8-K and are incorporated by reference herein.

Upon the consummation of the Reincorporation, GlyEco, Inc. was the surviving corporation and the Articles of Incorporation and Bylaws of GlyEco, Inc. replaced the Certificate of Incorporation and Bylaws of Environmental Credits. Stockholders of Environmental Credits automatically became stockholders of GlyEco and the number of shares of common stock held by each stockholder did not change. There were no outstanding shares of preferred stock of Environmental Credits outstanding at the time of the Reincorporation. The Series A preferred stock which had been designated by Environmental Credits in 2006 but none of which were outstanding as of the time of the Reincorporation was terminated.

Environmental Credits’ common stock was quoted on the OTC Bulletin Board under the ticker symbol EVCL. On November 21, 2011, the Company changed the ticker symbol from EVCL

Reverse Triangular Merger -- Agreement and Plan of Merger

On November 21 2011, GlyEco, Inc. consummated a reverse triangular merger (the “Merger” or “Transaction”) intended to constitute a tax-free reorganization within the meaning of Section 368 of the United States Internal Revenue Code of 1986, as amended, pursuant to an Agreement and Plan of Merger (the “Merger Agreement”) with GRT Acquisition, Inc., a Nevada corporation and wholly-owned subsidiary of the Company, and Global Recycling Technologies, Ltd., a Delaware corporation and privately-held operating subsidiary (“Global Recycling”).

GRT Acquisition, Inc. (referred to in the Merger Agreement and this Form 8-K as “Merger Sub”) was incorporated in the state of Nevada on November 7, 2011 for the sole purpose of the consummating the Merger. Pursuant to the Merger Agreement, Merger Sub merged with and into Global Recycling, with Global Recycling being the surviving corporation and which resulted in Global Recycling becoming a wholly-owned subsidiary of the Company. The stockholders of Global Recycling exchanged an aggregate of 11,591,958 shares of common stock of Global Recycling, representing 100% of the issued and outstanding shares of common stock of Global Recycling on the date the Merger was consummated (the “Closing Date”), for aggregate of 11,591,958 shares of common stock of GlyEco which represented approximately 53.60% of issued and outstanding shares of common stock of GlyEco upon the consummation of the Merger. Also, pursuant to the Merger Agreement, the Company cancelled an aggregate of 63,000,000 shares of common stock held by Ralph M. Amato, the Chief Executive Officer, President and Chairman of the Company prior to the Merger. Upon the consummation of the Merger, GlyEco had an aggregate of 21,626,241 shares of common stock issued and outstanding.

Ralph M. Amato was the sole officer and director of the Company prior to the Merger. Upon the consummation of the Merger, Mr. Amato resigned as a director and executive officer of the Company and John Lorenz, the Chief Executive Officer, President and Chairman of Global Recycling, replaced Mr. Amato as the Chief Executive Officer, President and Chairman of Board of Directors of GlyEco, Inc. The Merger Agreement provides that James Flach, Michael Jaap, and William Miller will also be directors of the Company upon the consummation of the Merger. The Merger Agreement also provides that Kevin Conner will be the Chief Financial Officer and Richard Geib will be the Chief Technical Officer of GlyEco, both of whom shall take office upon the consummation of the Merger.

7

The Merger Agreement contained customary representation, warranties and covenants. The Merger Agreement is filed as exhibit to this Form 8-K and is incorporated by reference herein.

The Company was a shell company (as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended) immediately before the Merger. Upon the consummation of the Merger, the Company ceased being a shell company and the business and operations of Global Recycling became the primary business of the Company. The Company initially will conduct its business operations through Global Recycling. The Company anticipates that it will merger Global Recycling into the Company promptly upon consummation of the Merger. See Item 2.01 below for a description of Global Recycling’s business.

Upon the consummation of the Merger, there was an aggregate of 21,626,241 shares of common stock of GlyEco, Inc. issued and outstanding, consisting of (i) 11,591,958 shares of our common stock held by the pre-merger stockholders of Global Recycling, (ii) 3,034,283 shares of our common stock held by the pre-Merger non-affiliated stockholders of EVCL, and (iii) 7,000,000 shares of our common stock beneficially held by Ralph M. Amato.

ITEM 2.01. COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS.

See “Item 1.01. Entry into a Material Definitive Agreement” of this Form 8-K in connection with the reverse triangular merger by and among the Company, Merger Sub and Global Recycling Technologies, Ltd. (“Global Recycling”) pursuant to which Merger Sub merged with and into Global Recycling, resulting in Global Recycling becoming a wholly-owned subsidiary of the Company. The disclosure contained in Item 1.01 of this Form 8-K is incorporated by reference herein.

The Company was a shell company (as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended) immediately before the Merger. Upon the consummation of the Merger, the Company ceased being a shell company and the business and operations of Global Recycling became the primary business of the Company. The Company will conduct its business operations through Global Recycling.

Unless otherwise indicated in this Item 2.01, terms such as “we,” “us,” “our” and similar terms refer to Global Recycling.

8

Description of Business of Global Recycling Technologies, Ltd.

Company Overview

We are a green chemistry company formed to roll-out our proprietary and patent pending glycol recycling technology. Branded GlyEco Technology™, our unique technology transforms hazardous materials into profitable green products. Glycol, a petroleum-based product, is used as a raw material in five industries: automotive antifreeze; polyester manufacturing; aircraft de-icing; HVAC transfer fluid; and medical device sterilization. During use in these industries, the glycol becomes contaminated with impurities. Our GlyEco TechnologyTM can recycle waste glycol from all five industries to the ASTM E1177 Type I standard, a purity level equivalent to refinery-grade glycol (i.e. virgin grade) (“Type I”). Competitors generally recycle waste glycols from only one or two of the five industries and most competitors can recycle waste glycol at best to an ASTM E1177 Type II standard (“Type II”), a standard allowing more impurities than Type I—which is unacceptable to many customers and industries. Additionally, ultra pure GlyEco Certified®, our recycled glycol material, can be produced at a cost advantage ranging between 20-50% lower than commonly used recycling methods.

Company History

We were originally formed as an Arizona corporation named EnviroSolutions, Inc., in May 2006. In December 2006, we changed our name to Global Recycling Technologies, Ltd. In July 2007, we changed our domicile from Arizona to Delaware.

Our initial business strategy was to acquire, operate and upgrade six glycol recycling facilities and companies in North America with our GlyEco TechnologyTM. We formed various wholly-owned subsidiaries that entered into definitive asset purchase agreements to purchase these six facilities and companies. In July 2007, we, through our wholly-owned subsidiary, purchased substantially all of the assets of WEBA Technology Corporation, a Texas corporation (“WEBA”) in consideration for an aggregate of 2,000,000 shares (800,000 post forward split, see stock splits described in last paragraph of this section Company History) of our common stock. WEBA develops specialty chemical products, including antifreeze additive packages and heat transfer fluid additive packages, and the assets purchased consisted of product formulas, customer lists, and equipment.

In late 2007, however, the world’s financial markets became volatile. The ensuing instability led to what we believe became a severe hindrance in our ability to obtain funding on acceptable terms to achieve our acquisition strategy and the business of recycling glycol. In late 2008, we temporarily abandoned our acquisition strategy and drastically reduced costs. We changed our strategic focus to become fully operational and to produce virgin grade glycol in commercial volumes out of one facility before seeking further significant funding from the financial markets (see Our Current Business Strategy below).

In June 2010, we sold all of the assets of WEBA back to its original owners in exchange for the return of 1,500,000 shares (600,000 shares, post forward split) of our Common Stock.

9

On August 29, 2011, we re-filed our application for a provisional patent to protect our GlyEco Technology™ processes—a technology that we believe will provide our Company and our customers and clients with a proven, efficient, cost effective, and tested process of recycling glycol in a way that meets and/or exceeds current industry standards.

On September 7, 2010, we effectuated a 5-for-1 reverse stock split of our common stock. On April 8, 2011, we effectuated a 1-for-2 forward stock split of our common stock.

Our Current Business Strategy

In July 2009, we entered into an agreement (“West Virginia Agreement”) with DTC Services, Inc. (“DTC”) to recycle glycol at its facility in West Virginia (“West Virginia Facility”). Currently, we process approximately 40,000 to 80,000 gallons of Type II glycol per month through the West Virginia Facility owner, and to date, we have recycled approximately 1.4 million gallons of waste glycol. The West Virginia Agreement provides that the West Virginia Facility owner will process glycol sourced by us to agreed upon specifications, delivery terms, scheduling, and pricing. The West Virginia Agreement automatically extends for successive one year periods, unless it is terminated by either party upon at least 60 days’ notice given prior to the end of that one-year term. On July 28, 2010, the West Virginia Agreement was amended to extend the term until September 30, 2010. In the fourth quarter of 2010, C&C Environmental Services (“C&C”) acquired the West Virginia Facility from DTC. We continue to source waste glycol for processing by C&C at the West Virginia Facility without a formal written agreement under the same terms as the original West Virginia Agreement. If this arrangement was terminated by C&C or any future owner of the West Virginia Facility, we believe other facilities would be available to us to process waste glycol. Depending on negotiations, availability, and other variables. We cannot make any assurances that we would not experience a delay from stopping operations at the West Virginia Facility and starting operations at a new facility, and this could limit or eliminate our ability to process glycol at our current processing rate.

During our time processing glycol, we have received waste glycol from a variety of sources—including MEGlobal (a joint venture established in 2004 between Dow Chemical and Petrochemical Industries Company of Kuwait), MEGlobal Canada, DAK Americas, and Performance Fibers. The price of waste glycol depends on the quality of its chemical composition. At times, we pay a de minimus amount per gallon. We do not have any contracts with suppliers and each order is placed on a case-by-case basis. The West Virginia Facility is located next to a railroad line, and the vast majority of feedstock is delivered by rail car, although some feedstock is delivered by truck.

Our immediate business strategy is to continue operations at the West Virginia Facility while constructing or retrofitting a Type I facility capable of implementing our GlyEco TechnologyTM. We are considering several sites for the Type I facility, including the West Virginia Facility and a facility in New Jersey (the “New Jersey Facility”), among others. We believe construction of a Greenfield site will cost approximately $4,000,000. The cost for a retrofit to an existing facility depends on the real property and equipment already in place. Depending on the site selected for the Type I facility, we expect to be completed and operational on or before the third quarter of 2012. Upon completion of construction or the retrofit, we anticipate to quickly ramp up our volumes and project to produce 6.5 million gallons in Year 1 of operations and 14 million gallons in Year 5 of operations.

Current Acquisition and International Strategy

In addition to the Type I facility, we are in the process of acquiring and creating strategic alliances with companies controlling waste glycol. In the United States, we have non-binding letters of intent with five companies to acquire their glycol recycling businesses, and we are in discussions with five other companies to acquire their glycol recycling businesses. One of the companies party to a non-binding letter of intent is the owner of the New Jersey Facility. Internationally, we are in varying stages of development with waste collectors and polyester companies. We have a non-binding letter of intent with a large European waste collector to recycle all of its waste glycol. Additionally, we are in discussions with two large polyester manufacturing companies in China and Mexico to recycle their waste glycol. We have made additional inroads with sources of waste glycol in the Eurozone, Brazil, Argentina, India, Vietnam, Thailand, and the Philippines. Final definitive terms have not been established as of yet on any of the aforementioned letters of intent and there can be no assurances that any will be reached or that any transaction will be consummated.

10

Background on Glycol1

Glycols are man-made liquid chemicals derived from crude oil and natural gas—a non-renewable and limited natural resource. Glycols are used as a base chemical component in five primary industries. First, glycol is used as a raw material in the manufacturing of polyester fiber for fabrics and plastics, including water bottles. Second, glycol is used as the main active component in antifreeze for vehicle engines. Third, glycol is used as the heat transfer fluid in HVAC units used to heat and cool buildings. Fourth, glycol is used to de-ice aircrafts to ensure safe takeoff. Fifth, the gaseous component of glycol is used to sterilize equipment in the medical industry.

The world consumes over 5 billion gallons of ethylene glycol2 per year and analysts expect that global demand will continue growing around 7% per year. This upward trend is mainly due to the double-digit growth in China and India and growth in the polyester industry. China alone consumes approximately 2.1 billion gallons of ethylene glycol per year. The United States consumes over 700 million gallons of ethylene glycol per year. The Eurozone and emerging countries in South America are also major consumers of ethylene glycol.

During use in any of the five industries, glycols become contaminated with dirt, metals and oils which increase their toxicity and can contaminate soils and natural water. Glycols break down in water over a few days to a couple weeks. Because of this rapid biodegradability, the U.S. Environmental Protection Agency (“EPA”) allows disposal by “release to surface waters." However, when glycols break down in water they deplete oxygen levels, which kill fish and other aquatic life. The immediate effect of exposure to ethylene glycol can mean death for humans, animals, birds, fish & plants. Glycol ranks #23 on the National Pollutant Inventory Substance Profile hazardous waste list.

Despite the negative effects waste glycol can have on people and the environment, the vast majority is disposed of rather than recycled. For example, the EPA estimates only 12% of waste antifreeze is recycled. In the United States alone, over 696 million gallons of polluted glycol is disposed of per year, with an estimated 630 million gallons improperly disposed. Much of such polluted glycol ends up in surface waters. Statistics for industries besides antifreeze are not specifically reported, but the vast majority of waste glycol is disposed of without documentation—usually in a way that damages our environment.

|

Available U.S. Waste Glycol by Market Segment Source

gallons per year

|

|||

|

Available Material

|

Currently Recycled

|

Currently Disposed

|

|

|

Automotive Antifreeze (Concentrate EG)

|

202,000,000

|

24,500,000

|

177,500,000

|

|

Polyester Purge Stream

|

193,300,000

|

12,500,000

|

180,800,000

|

|

Aircraft Deicing Fluid

|

35,000,000

|

14,000,000

|

21,000,000

|

|

Heat Transfer Fluids

|

234,000,000

|

10,000,000

|

224,000,000

|

|

Sterilization Processing

|

32,130,000

|

4,860,000

|

27,270,000

|

|

TOTAL

|

696,430,000

|

65,860,000

|

630,570,000

|

|

1Antifreeze is usually diluted 50% water and 50% ethylene glycol resulting in approximately 404,000,000 gallons of material available each year

|

|||

As global demand for virgin glycol continues to rise, the effects of pollution through disposal become magnified. We believe that most, if not all, of this material can and should be recycled.

1 We have accumulated the information in this section from the following sources: U.S. Environmental Protection Agency; U.S. Office of the Federal Environment Executive (OFEE); U.S. Department of Energy Administration; Iowa Waste Reduction Center (IWRC); National Resource Defense Council; Agency for Toxic Substances and Disease Registry (ATSDR); ICIS Chemical Business; Fiber Economics Bureau; and The Air Conditioning and Refrigeration Institute.

2 Ethylene glycol, a type of glycol, is the main type of glycol that we recycle. The terms “ethylene glycol” and glycol may at times be used interchangeably in this document.

11

Glycol Regulations and Recycling

With some initial recognition of the environmental issues created by waste glycol, companies began recycling waste glycol in the 1980s. The technology to recycle glycols was developed in the 1980s, but material technological advances and market acceptance did not occur until the 1990s. At that time, recyclers rarely processed any other type of glycol than waste automotive antifreeze. To this day, recyclers still generally focus on automotive antifreeze, as waste glycol from the other industries have unique impurities and are challenging to process.

Currently, the glycol recycling industry is very fragmented with approximately 25-30 recyclers spread across the United States. While there are a few recyclers that collect waste glycol from a multi-state area, no recycling company currently operates more than one processing facility. Each company operates in its own region and most companies are either still owned by the original entrepreneur that founded the company or glycol recycling is only a small part of a larger chemical operation. These companies often use unsophisticated technologies with limited capacity and poor quality control processes. Consequently, most operations (1) produce substandard products, (2) cannot be trusted to produce consistent batches of recycled product, and (3) do not have the capacity to provide product to major buyers. The majority of recycled glycol from these operations is sold into secondary markets as generic automotive antifreeze because the quality does not meet the standards of many buyers and certain industries as a whole.

Due to the developing glycol recycling industry, the American Society for Testing and Materials (“ASTM”) began creating standards for the composition of glycol. One such standard, ASTM E1177, provides specifications on the purity level of ethylene glycol. ASTM has subdivided its ASTM E1177 ethylene glycol specification into two levels, Type I and Type II. Type I specifications are met by virgin ethylene glycol. Virgin ethylene glycol is produced in petrochemical plants using the ethane/ethylene extracted from natural gas or cracked from crude oil in refineries. Ethylene is oxidized in these petrochemical plants to ethylene oxide, which is then hydrated to form ethylene glycol. Recycled glycol can also meet the Type I standard, but no competing recyclers meet this standard. Meeting the Type I standard is important, as it determines what customers are willing to buy the recycled product. Customers in the polyester manufacturing industries generally require a Type I product, as do Original Equipment Manufacturers (“OEMs”) like General Motors.

Type II was established to define a product with more impurities than those in a Type I product. Glycols that are Type II can only be used in a limited number of applications (i.e. automotive antifreeze) and only certain customers are willing to purchase Type II glycol (e.g. Jiffy Lube). Only a few ethylene glycol recycling companies currently meet Type II requirements, and none meet Type I requirements on a commercial scale.

The regulation of waste glycol varies from country to country. Some countries have strong regulations, meaning they specifically identify waste glycol as a hazardous waste that requires particular handling (i.e. transportation, collection, processing, packaging, resale, and disposal). Other countries have weak regulations, meaning they do not specifically identify waste glycol as a hazardous waste that requires particular handling, allowing producers of waste glycol to dispose of the waste in ways that harm the environment. Europe and Canada have strong regulations. The United States has moderate regulations that vary significantly from state to state. Some states in the United States categorize waste glycol as a hazardous waste if it has a certain amount of chemicals and metals present in the waste, but handlers of the waste glycol often are not required to test the composition of the waste if it is being sent to a recycling facility. Some states regulate the quality of recycled glycol that is resold in the market. Some states have little to no regulation on any type of handling of waste glycol. Aside from the United States, Canada, and Europe, the remainder of the world generally has weak regulations. Despite strong regulations in certain parts of the world, we believe the United States is the only market with an established glycol recycling industry. Strong regulations are favorable for glycol recyclers because it causes waste producers to track the waste—resulting in more waste glycol supply for recyclers and potentially lower raw material prices.

12

Our Opportunity in the Glycol Recycling Industry

We believe that here is an opportunity to penetrate the glycol recycling market due to several reasons. First, as shown by the table above (Available U.S. Waste Glycol by Market Segment Source), we believe that there is a significant amount of glycol that is not being recycled that can be sourced and recycled. By providing the source of waste glycol with a safe, reliable, and EPA compliant outlet to dispose of its waste, the source could potentially limit its products liability potential. Second, existing recyclers can only handle waste glycol from a couple industries, thus increasing the volume of waste glycol for a company with the proper technology. Third, we believe that sources of waste glycol would be more likely to send the waste to a company that can produce a Type I recycled product, as it limits their liability. Fourth, we believe that the industry is primed for a multi-location company that can provide consistent product to national and international buyers.

Overall, there is a high demand for recycled products. We believe that the stage is set for rapid growth of the glycol recycling industry. Recycling used glycol can be far less expensive than making virgin product that is derived from high priced crude oil and natural gas. ASTM has written specifications for recycled ethylene glycol, giving potential buyers the criteria and testing procedures that they need to evaluate recycled glycol. In addition, the United States government and many private industries have given a high priority to recycling used products and to buying recycled products where they are available and meet specifications.

Our Technology

In 1999, our founders started developing innovative new methods for recycling glycols. We saw a need in the market to improve the quality of recycled glycol and to clean more types of waste glycol in a cost efficient manner. Each type of industrial waste glycol contains a different set of impurities which traditional waste antifreeze processing just doesn't clean effectively. And, many of the contaminants left behind using these processes - such as esters, organic acids and high dissolved solids - leave the recycled material risky to use in vehicles or machinery.

We spent ten years on research and development, independent market validation, and financial analysis to determine the most advantageous business position for expanding what we believe to be groundbreaking technologies. The result is our breakthrough patent pending processing system, GlyEco TechnologyTM. Our inventive technology removes challenging pollutants, including esters, organic acids, high dissolved solids and high undissolved solids. Our technology also has the added benefit of clearing oil/hydrocarbons, additives and dyes which are typically found in used engine coolants. Our quality assurance and control program, which includes independent lab testing seeks to ensure consistently high quality, ASTM standard compliant recycled material.

We have done extensive in-house testing of our technology, which indicates that our recycled glycol meets the standard of Type I, virgin ethylene glycol. We have processed approximately 350,000 gallons that were tested by an independent lab and met the Type I standard. The next step will be to construct or retrofit a Type I facility to produce in larger quantities.

13

Our Product Specifications

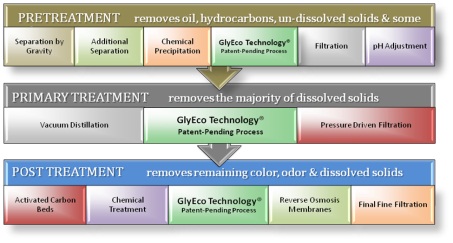

Our GlyEco Technology™ incorporates the following three recycling methods:

|

·

|

Pre-Treatment – As waste glycol arrives, a sample is tested to determine the types and levels of impurities to be removed. Pre-treatment is custom scaled to each batch of material and consists of a unique chemically assisted demulsification plus precoat rotary drum vacuum filtration. Testing and pretreatment maximize efficiency and save overall processing costs. Pre-treatment results in significantly cleaner material fed into the primary treatment process, which, in turn, improves the final output. Waste glycol from heat transfer fluids, polyester industry purge streams, aircraft deicing fluids, and medical sterilization processes generally contains varying types of impurities. These impurities, especially sulfates and esters, are notoriously difficult to remove and most glycol recyclers are currently unable to process these materials. The primary purpose of our pre-treatment technology is to remove contaminants from each of these feedstock streams. Our GlyEco Technology™ pre-treatment process includes a method to precipitate out sulfates and an evolutionary ester destruction technology.

|

|

·

|

Primary Treatment – We believe that the GlyEco Technology™ is the only recycling system to utilize a combination of vacuum distillation and nano filtration in the primary treatment process. Vacuum distillation is known for being the most efficient method to produce high quality concentrated recycled glycol and nano filtration is considered the most effective method for producing 50/50 diluted glycol for automotive antifreeze. The combination of these processes provides lowered costs and the most effective route to superior recycled material.1

|

|

·

|

Post Treatment – Our proprietary post-treatment systems remove any remaining impurities in an innovative and proprietary combination of electrodialysis with ion exchange resins, removing the last traces of chlorides, sulfates, esters, glycolates, and formats. ASTM has established maximum allowable concentrations of chlorides and sulfates for automotive antifreeze grade recycled materials. Standards for maximum allowable levels of esters, glycolates, and formates are in development. We believe our GlyEco Technology™ will remove contaminants to meet future standards. Finally, the materials that we recycle pass through our Global Recycling Quality Assurance Program, which includes in-house and independent lab purity testing. After successfully completing this testing, the recycled materials will be considered GlyEco Certified® recycled glycol and will be staged for delivery to our customers.

|

1This information is based upon the general knowledge and belief accumulated over time by , certain of our principals with over forty combined years experience in the glycol recycling and related industries. We have not commissioned a formal study or relied upon a particular study

14

We believe that GlyEco Technology™ will be the catalyst for expansive growth in an emerging industry due to a wide range of benefits and several first-to-market advantages, including the following:

|

·

|

Expanded Waste Sources – Effectively and profitably recycles all five types of polluted glycols, which opens up an additional four industries as target customers and potential revenue sources;

|

|

·

|

Equivalent to Virgin or Type I Glycol – recycled glycols are considered equivalent to virgin (refinery grade) produced material as pursuant to ASTM standards;

|

|

·

|

Reduced Production Costs – Proprietary tri-phase processing system reduces production costs by approximately 20.0% to 50.0% over existing glycol recycling methods; and

|

|

·

|

Recurring Revenue Model – Polluted glycols can be recycled, used, and reprocessed indefinitely, creating dependable revenue cycles from a base of repeat customers.

|

Because most polluted glycol is disposed of in our surface waters - which can have devastating results for aquatic life, we believe that our GlyEco solution will give our customers a way to reduce waste while caring for the environment.

On August 29, 2011, we re-filed our application for a provisional patent to protect our GlyEco Technology™ processes with the United States Patent and Trademark Office (the “Patent”).

Market Conditions3

15

Glycol is a commodity, and prices vary based upon supply and demand. One variable that influences the price of ethylene glycol is the price of crude oil and natural gas. Because there are few producers of ethylene glycol that control the majority of the market (e.g. MEGlobal, SABIC, and Formosa Group), those producers set the market with their sales to major polyester companies (e.g. Indorama, Sinopec, DAK Americas, and M&G Group) and antifreeze blenders (E.g. Old World, Prestone, and Peak). Large producers also can affect the price by fluctuating plant capacity and supply.

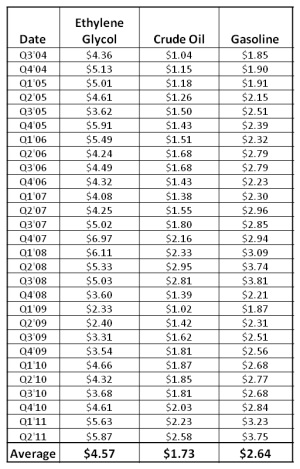

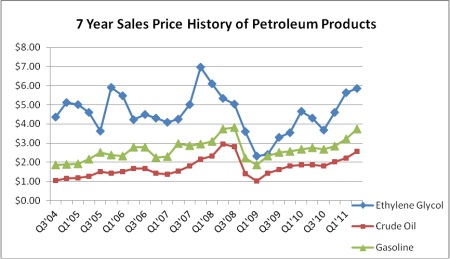

Over the last seven years, the average sales price for virgin ethylene glycol shipped by truck or rail was $4.57/gallon. As shown by the chart below, the price of crude oil has some correlation with the price of ethylene glycol.

Over the last seven years, the average sales price for virgin ethylene glycol shipped by truck or rail was $4.57/gallon. As shown by the chart below, the price of crude oil generally has a positive correlation with the price of ethylene glycol. Generally, glycol costs between 100% and 150% more than crude oil and between 40% and 70% more than gasoline. However, as the chart shows, glycol prices do not strictly correlate with crude oil prices. As mentioned both above and below, there are other variables in the supply chain that can affect glycol prices.

Source: ICIS

16

Between July 2011 and October 2011, the price of ethylene glycol shipped via truck or rail has ranged between $5.80-$6.50/gallon. While elevated oil prices have played a part, there are four main reasons for the high ethylene glycol prices: (1) high demand for plastic bottles during the summer and for antifreeze blending in preparation for the winter; (2) low supply caused by plant shutdowns and political unrest in the Middle East; (3) the high cost of cotton causing an increase in demand for polyester; and (4) the growth in Asia. Ethylene glycol prices have tapered off a bit in October and November of 2011, as many antifreeze blenders have already bought most of the ethylene glycol needed.

While GlyEco Certified® glycol can be sold for virgin prices, the cost to recycle waste glycol is not generally affected by these market fluctuations. The economic advantage to recycling waste glycol is rooted in more efficient processing costs. We anticipate that our GlyEco TechnologyTM will allow waste material to be recycled for much less than the costs incurred producing virgin refinery-grade glycol.

Our Competitive Positioning – Accessing Waste Glycol

We believe that we are positioned to take advantage of the major growth potential currently facing the glycol recycling industry. We believe that our GlyEco Technology™ process and our Quality Assurance Program will allow us to secure greater amounts of waste from national aggregators of glycol waste as we anticipate that we will provide a reliable and cost effective disposal option. We project that volume from our first full year of operations will initially start out at approximately 6.5 million net gallons. We expect this volume to increase to over 14.5 million net gallons per year by Year 5. We have had contract discussions with medical sterilization companies and polyester manufacturing companies and believe we can source at least 4 to 5 million gallons per year of these waste by-product streams, although we currently do not have any executed contracts. We also have begun sourcing discussions with the numerous heat transfer fluid collectors throughout the United States that we project could supply us with another 5 to 10 million gallons annually.

We anticipate that the total cost per gallon of finished ethylene glycol or antifreeze will be less than the variable costs of virgin ethylene glycol producers in North America and approximately 20.0% to 50.0% below the cost of other recyclers. We believe that we will be in a very good competitive position.

17

Initial Target Market – United States

We anticipate initially targeting the North America antifreeze market as buyers of our GlyEco Certified® material. We anticipate that a key component to our growth strategy will be our ability to provide uniform quality recycled products in national distribution. Several national consumers of ethylene glycol have expressed a continuing interest in utilizing a recycled product, but have been unable to obtain acceptable and consistent quality material from region to region. In the automotive antifreeze market segment alone, we believe that significant growth opportunity exists by expanding into four target markets:

|

·

|

Vehicle Manufactures – Several vehicle manufacturers, including General Motors, Chrysler, Cummins, Caterpillar, and John Deere have expressed an interest in using recycled automotive antifreeze. To date, they have been unable to obtain a recycled product that they can purchase in multiple regions which meets applicable quality specifications.

|

|

·

|

Vehicle Service Centers – Multiple site service centers see value in offering recycled automotive antifreeze to their customers. We anticipate targeting Firestone, Goodyear, Midas, Monro, and Jiffy Lube oil-change facilities as potential clients in this category. We believe that some of these businesses could also serve as waste glycol providers.

|

|

·

|

Branded Bottled Automotive Antifreeze Formulators – Consumer oriented bottled automotive antifreeze companies, such as Prestone, Valvoline, and PEAK see market potential for a recycled glycol product. We believe that many consumers will choose recycled material when available and shown to be of equivalent quality. We anticipate implementing a co-branded strategy to assure consumers they are choosing ultra-pure GlyEco Certified® recycled glycols.

|

|

·

|

Federal, State, and Local Government Agencies – Mandated to use ASTM specification grade recycled automotive antifreeze where available, most of these agencies are unable to obtain sufficient supplies of recycled product. By having a recycled automotive antifreeze which meets specification immediately, we seek to access this market segment and revenue stream.

|

Geographic Market Expansion

In the future, we expect to expand our business and our recycling services into Mexico, Brazil, Argentina, Canada, China, India, the United Kingdom, and the Eurozone. We believe that Canada, the United Kingdom, and the European Union are markets to establish our recycling services in, as they have strong regulations regarding the disposal of waste glycol—which may not only provide access to substantial waste glycol but also provide additional price advantages in our business model. Additionally, Asia, and China specifically, consume substantial amounts of glycol in the polyester industry and candidates to implement our GlyEco TechnologyTM. We currently have a non-binding letter of intent with a European waste glycol collector to recycle all of its glycol and are in discussions with polyester manufacturers in Mexico and China to recycle their glycol.

18

Competitive Analysis in the Type I Market

While there is a possibility of competitors (both from existing Type II glycol recyclers as described on page 9 and from new entrants into the glycol recycling industry) producing Type I glycol at commercial volumes, there are several barriers to entry. Potential competitors entering the Type I market would first need to develop technology which produces comparable quality recycled material without violating any of our intellectual property. Industry experts are not aware of any such systems currently in development. This solved, potential competitors would need to purchase or build sufficient facilities to service the North American territory. Finally, potential competitors would need to establish or build relationships with target customers to obtain waste glycol material in large volumes. While these challenges are not insurmountable, we believe they would take significant time to overcome.

Governmental and Environmental Regulation

Although ethylene glycol can be considered a hazardous material, there are no federal rules or regulations governing its characterization, transportation, packaging, processing, or disposal (i.e. handling). Any regulations that address such activity occur at either the state and/or county level and vary from region to region. Some states have little to no regulation on handling waste glycol. In those states that regulate the handling of waste glycol, waste glycol is not automatically characterized as hazardous but can be considered hazardous if the waste material is tested and has a certain level of chemicals and metals. However, the majority of states do not require that the handlers of waste glycol test the waste, provided that the destination of that waste material is a recycling facility. This is a major exception and allows the glycol recycling industry to function without significant barriers. Generally, the transportation of waste glycol is only regulated as hazardous waste if shipped in a one package that weighs 5,000 pounds or more. If the waste glycol exceeds this weight threshold, the shipper must meet all communications, labeling, and, packaging standards, There generally are no direct costs or permits to ship such waste, other than the time and resources necessary to meet the communication standards. Some states require that processors/recyclers maintain certain licenses or permits. The cost of permits and licenses to process waste glycol can vary from less than one hundred dollars to a few thousand dollars. Recyclers are often left with hazardous metals or chemicals as a byproduct of their process, for which they pay a nominal fee to register with the state/county as a hazardous waste producer, and pay for the waste to be incinerated or disposed of in some other environmentally friendly way. In addition to taking the necessary precautions and maintaining the required permits/licenses, glycol recyclers generally take out environmental liability insurance policies to mitigate risk regarding the handling of waste glycol.

In connection with our operations at the West Virginia Facility, the operator of that facility is required to obtain all necessary permits for the handling of the waste glycol. Also, all the transportation of the waste glycol to the West Virginia Facility is contracted with third-party transporters, who are required to obtain any necessary permits for its transportation. As a result, we are not required to obtain any permits or authorizations in connection with our current operations. For the planned Type I facility, it has not yet been determined who will be responsible for obtaining such permits in connection with those operations. However, we will do everything in our power to make sure that all permits, licenses, and insurance policies are in place to mitigate our risk from actions by employees and third parties.

Glycerine

Many antifreeze producers are evaluating base fluids other than ethylene glycol (or propylene glycol). The primary candidate is glycerine. Glycerine is becoming more available since it is a by-product of bio-diesel fuel production, which is growing rapidly in the United States. Glycerine has properties similar to those of ethylene glycol when it is diluted with water, as in antifreeze. Glycerine is being evaluated in blends of 10.0% to 20.0% with ethylene glycol and as a total replacement for ethylene glycol. Before glycerine could become a major base fluid for antifreeze, current test work must be completed and new specifications would have to be developed by ASTM, OEMs, trade organizations, and the United States Government. We believe that this will probably consume a few years at best and that major changes would have to be made in the industry. For example, pure glycerine starts to solidify at 62.6°F. 96.0% glycerine (the minimum concentration of ethylene glycol used in antifreeze concentrate currently) begins to solidify at 46.4°F, versus about 0°F for ethylene glycol based antifreeze concentrate. To obtain the same freeze protection (-34°F) as 50/50 service strength ethylene glycol-based antifreeze, 60.0% glycerin would be required. Because glycerine from bio-diesel plants must be refined prior to use in antifreeze, since it must be used at higher ratios with water to obtain the same freeze protection as ethylene glycol-based antifreeze, and since glycerine would have to be shipped in a more dilute form than ethylene glycol-based antifreeze concentrate to avoid freezing at common winter temperatures, the actual cost advantages of glycerine over ethylene glycol is still being determined. In any event, we believe that the Type I facility could be modified to recycle glycerine-based antifreeze. We will continue to monitor the evaluation of glycerine as a base fluid for antifreeze. Although we do not view glycerine as a significant threat to the achievement of our financial projections, we could make changes to the Type I facility as necessary.

19

Employees

As of the date of this Form 8-K, we have twelve consultants and no employees. We consider our relations with our consultants to be good. All of our consultants provide their services pursuant to consulting agreements, which may be terminated upon 30 days prior written notice.

We maintain our principal office at 4802 East Ray Road, Suite 23-196, Phoenix, Arizona 85044. Our telephone number at that office is (866) 960-1539. Beginning January 2012, we intend to lease office space at a cost of approximately $1,800 per month and terminate our existing affiliation. We maintain a website at www.glyeco.com (formerly www.grtus.com) and the information contained on that website is not incorporated by reference herein.

LEGAL PROCEEDINGS

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. We are currently not aware of any such legal proceedings or claims that we believe will have, individually or in the aggregate, a material adverse effect on our business, financial condition or operating results.

EXECUTIVE COMPENSATION

The following table sets forth all plan and non-plan compensation for the last two completed fiscal years paid to all individuals who served as the Company’s principal executive officer or acting in similar capacity during the last completed fiscal year (“PEO”), regardless of compensation level, and other individuals as required by Item 402(m)(2) of Regulation S-K. We refer to all of these individuals collectively as our “named executive officers.”

20

Summary Compensation Table

|

Name & Principal Position

|

Year

|

Salary ($)

|

Bonus ($)

|

Stock Awards ($)

|

Option Awards ($)

|

Non-Equity Incentive Plan Compensation ($)

|

Change in Pension Value and Non-Qualified Deferred Compensation Earnings ($)

|

All Other Compensation ($)

|

Total ($)

|

||||||||||||||

|

Ralph M. Amato, Former CEO (PEO) (1)

|

2010

|

$

|

0

|

0

|

0

|

0

|

0

|

0

|

$

|

0

|

$

|

0

|

|||||||||||

|

2009

|

$

|

0

|

0

|

0

|

0

|

0

|

0

|

$

|

0

|

$

|

0

|

||||||||||||

|

John Lorenz, President and CEO (PEO) (2)

|

2010

|

$

|

0

|

0

|

8,892

|

(3) |

0

|

0

|

0

|

$

|

148,500

|

(4) |

$

|

157,392

|

|||||||||

|

2009

|

$

|

0

|

0

|

0

|

0

|

0

|

-

|

$

|

124,500

|

(4) |

$

|

124,500

|

|||||||||||

|

(1)

|

Mr. Amato resigned as Chief Executive Officer of the Company upon the consummation of the Merger on November 21, 2011.

|

|

(2)

|

Mr. Lorenz was appointed as the President and Chief Executive Officer of the Company upon the consummation of the Merger.

|

|

(3)

|

The estimated value of warrants issued to Barcid Investment Group, a corporation solely owned by Mr. Lorenz, based on the Black-Scholes method. See the disclosure below under “Option/SAR Grants in Fiscal Year Ended December 31, 2010.”

|

|

(4)

|

Consisted of consulting service fees paid to Mr. Lorenz by Global Recycling. Mr. Lorenz provided management consulting services to Global Recycling through Barcid Investment Group (Barcid), a corporation solely owned by Mr. Lorenz. Neither Barcid nor Mr. Lorenz has a formal written consulting agreement with the Company or Global Recycling. Mr. Lorenz, by and through Barcid, is paid on a monthly basis and earned $148,500 and $124,500 for consulting services rendered to Global Recycling in 2010 and 2009, respectively. Mr. Lorenz, through Barcid, was paid $79,240 and $100,305 for consulting services in 2010 and 2009, respectively, and was owed $208,800 at December 31, 2010, and $117,000 at December 31, 2009.

|

Option/SAR Grants in Fiscal Year Ended December 31, 2010

No options were granted to the named executive officer during fiscal 2010. Mr. Lorenz, through Barcid Investment Group, a corporation solely owned by Mr. Lorenz, was issued 360,000 warrants at an exercise price of $0.00025 on June 17, 2010. These warrants had an expiration date of August 1, 2010. The estimated value of these warrants, determined by the Black-Scholes method, was $8,892.

No options or warrants were granted to the named executive officer during fiscal 2009.

Outstanding Equity Awards at Fiscal Year-End Table

The following table sets forth information for the named executive officer regarding the number of shares subject to both exercisable and unexercisable stock options, as well as the exercise prices and expiration dates thereof, as of December 31, 2010.

21

|

Name

|

Number of Securities underlying Unexercised Options (#) Exercisable

|

Number of Securities underlying Unexercised Options (#) Unexercisable

|

Option Exercise Price ($/Sh)

|

Option Expiration Date

|

|||||||||

|

John Lorenz

|

119,172 | - | $ | 1.00 |

6/27/2021

|

||||||||

| 316,250 | 258,750 | $ | 0.50 |

10/25/2021

|

|||||||||

| 318,356 | $ | 1.00 |

6/27/2021

|

||||||||||

Stock Option Plans

Upon the consummation of the Merger, Global Recycling’s Third Amended and Restated 2007 Stock Incentive Plan (the “Stock Plan”) was assumed by GlyEco, Inc.

The following is a summary of certain of the more significant provisions of our Stock Plan. The statements contained in this summary concerning the provisions of our Stock Plan are merely summaries and do not purport to be complete. They are subject to and qualified in their entirety by the actual terms of our Stock Plan.

Shares Reserved Under Our Stock Plan

We have reserved 6,742,606 shares of our common stock issuable upon exercise of options granted under our Stock Plan to employees, directors, proposed employees and directors, advisors, independent contractors (and their employees and agents), and other persons who provide valuable services to our Company (collectively, “Eligible Persons”). As of the date of this Form 8-K, we have issued 3,717,606 options to purchase the shares of our common stock originally reserved under our Stock Plan. All previously granted options issued pursuant to our Stock Plan will be subject to the requirements set forth in our Stock Plan and are Non-Qualified Stock Options.

The aggregate number of shares that may be granted to any one Eligible Person in any year will not exceed 50.0% of the total number of shares that may be issued under our Stock Plan. At the discretion of the Plan Administrator (defined below), the number and type of shares of our common stock available for award under our Stock Plan (including the number and type of shares and the exercise price covered by any outstanding award) may be adjusted for any increase or decrease in the number of issued shares of our common stock resulting from any stock split, reverse stock split, split-up, combination or exchange of shares, consolidation, spin-off, reorganization, or recapitalization of shares.

22

Administration

Our Stock Plan is currently being administered by our Board of Directors. Our Board of Directors may delegate its authority and duties under the Stock Plan to a committee. Our Board of Directors and/or any committee that has been delegated the authority to administer our Stock Plan is referred to as the “Plan Administrator.” Subject to certain restrictions, the Plan Administrator generally has full discretion and power to (i) determine all matters relating to awards issued under our Stock Plan, including the persons to be granted awards, the time of grant, the type of awards, the number of shares of our common stock subject to an award, vesting conditions, and any and all other terms, conditions, restrictions, and limitations of an award, (ii) interpret, amend, and rescind any rules and regulations relating to our Stock Plan, (iii) determine the terms of any award agreement made pursuant to our Stock Plan, and (iv) make all other determinations that may be necessary or advisable for the administration of our Stock Plan. All decisions made by the Plan Administrator relating to our Stock Plan will be final, conclusive, and binding on all persons.

Eligibility

The Plan Administrator may grant any award permitted under our Stock Plan to any Eligible Person. With respect to awards that are options, directors who are not employees of our Company, proposed non-employee directors, proposed employees, and independent contractors will be eligible to receive only Non-Qualified Stock Options (“NQSOs”). An award may be granted to a proposed employee or director prior to the date he, she, or it performs services for our Company, so long as the award will not vest prior to the date on which the proposed employee or director first performs such services.

Awards Under Our Stock Plan

Under our Stock Plan, Eligible Persons may be granted: (a) stock options (“Options”), which may be designated as NQSOs or Incentive Stock Options (“ISOs”); (b) stock appreciation rights (“SARs”); (c) restricted stock awards (“Restricted Stock”); (d) performance share awards (“Performance Awards”); or (e) other forms of stock-based incentive awards (collectively, the “Awards”). An Eligible Person who has been granted an Option is referred to in this summary as an “Optionee” and an Eligible Person who has been granted any other type of Award is referred to in this summary as a “Participant.”

No Award granted under our Stock Plan can be inconsistent with the terms and purposes of our Stock Plan. Additionally, the applicable exercise price for which shares of our common stock may be purchased upon exercise of an Award will not be less than (i) 100.0% of the Fair Market Value (as defined in our Stock Plan) of shares of our common stock on the date that the Award is granted, or (ii) 110.0% of the Fair Market Value if the Award is granted to an Eligible Person who, directly or indirectly, holds more than 10.0% of the total voting power of our Company.

The Plan Administrator may grant to Optionees NQSOs or ISOs that are evidenced by stock option agreements. A NQSO is a right to purchase a specific number of shares of our common stock during such time as the Plan Administrator may determine. A NQSO that is exercisable at the time an Optionee ceases providing services to our Company will remain exercisable for such period of time as determined by the Plan Administrator. Generally, Options that are intended to be ISOs will be treated as NQSOs to the extent that the Fair Market Value of the common stock issuable upon exercise of such ISO, plus all other ISOs held by such Optionee that become exercisable for the first time during any calendar year, exceeds $100,000.

23

An ISO is an Option that meets the requirements of Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”). To qualify as an ISO under the Code, the Option generally must (among other things) (x) be granted only to employees, (y) have an exercise price equal to or greater than the Fair Market Value on the date of grant, and (z) terminate if not exercised within 10 years from the date of grant (or five years if granted to an Optionee who, at the time the ISO is granted, directly or indirectly, holds more than 10.0% of the total voting power of our Company). Except in certain limited instances (including termination for cause, death, or disability), if any Optionee ceases to provide services to our Company, the Optionee’s rights to exercise vested ISOs will expire within three months following the date of termination.

A SAR is a right granted to a Participant to receive, upon surrender of the right, payment in an amount equal to (i) the excess of the Fair Market Value of one share of common stock on the date the right is exercised, over (ii) the Fair Market Value of one share of common stock on the date the right is granted.

Restricted Stock is common stock that is issued to a Participant at a price determined by the Plan Administrator. Restricted stock awards may be subject to (i) forfeiture upon termination of employment or service during an applicable restriction period, (ii) restrictions on transferability, (iii) limitations on the right to vote such shares, (iv) limitations on the right to receive dividends with respect to such shares, (v) attainment of certain performance goals, and (vi) such other conditions, limitations, and restrictions as determined by the Plan Administrator.

A Performance Award grants the Participant the right to receive payment upon achievement of certain performance goals established by the Plan Administrator. Such payments will be valued as determined by the Plan Administrator and will be payable to or exercisable by the Participant for cash, shares of our common stock, other awards, or other property determined by the Plan Administrator.

Other Awards may be issued under our Stock Plan, which include, without limitation, (i) shares of our common stock awarded purely as a bonus and not subject to any restrictions or conditions, (ii) convertible or exchangeable debt or equity securities, (iii) other rights convertible or exchangeable into shares of our common stock, and (iv) awards valued by reference to the value of shares of our common stock or the value of securities or the performance of specified subsidiaries of our Company.

Exercise Price

The price for which shares of our common stock may be purchased upon exercise of a particular Award will be determined by the Plan Administrator at the time of grant. However, the applicable exercise price for which shares of our common stock may be purchased upon exercise of an Award will not be less than (i) 100.0% of the Fair Market Value (as defined in our Stock Plan) of shares of our common stock on the date that the Award is granted, or (ii) 110.0% of the Fair Market Value if the Award is granted to an Eligible Person who, directly or indirectly, holds more than 10.0% of the total voting power of our Company.

24

No Deferral Features

No Award granted under our Stock Plan will contain a deferral feature. Awards cannot be modified or otherwise extended. No Award will contain a provision providing a reduction in the applicable exercise price, an addition of a deferral feature, or any extension of the term of the award.

Payment / Exercise of Award

An Award may be exercised using as the form of payment (a) cash or cash equivalent, (b) stock-for-stock payment, (c) cashless exercises, (d) the granting of replacement awards, (e) any combination of the above, or (f) such other means as the Plan Administrator may approve. No shares of our common stock will be delivered in connection with the exercise of any Award until payment in full of the exercise price is received by our Company.

Change of Control

The Stock Option provides that if a Change of Control (as defined in our Stock Plan) occurs, then the surviving, continuing, successor, or purchasing entity (the “Acquiring Company”), will either assume our rights and obligations under outstanding Awards or substitute for outstanding Awards substantially equivalent awards for the Acquiring Company’s capital stock. If the Acquiring Company elects not to assume or substitute for such outstanding Awards in connection with a Change of Control, our Board of Directors may determine that all or any unexercisable and/or unvested portions of outstanding Awards will be immediately vested and exercisable in full upon consummation of the Change of Control. Unless otherwise determined by our Board of Directors, Awards that are neither (i) assumed or substituted for by the Acquiring Company in connection with the Change of Control, nor (ii) exercised upon consummation of the Change of Control, will terminate and cease to be outstanding effective as of the date of the Change of Control. Upon the consummation of the Merger, the Company assumed the obligations of Global Recycling under the Plan.

Amendment

Our Board of Directors may, without action on the part of our stockholders, amend, change, make additions to, or suspend or terminate our Stock Plan as it may deem necessary or appropriate and in the best interests of our Company; provided, however, that our Board of Directors may not, without the consent of the Participants, take any action that disqualifies any previously granted Option for treatment as an ISO or which adversely affects or impairs the rights of the holder of any outstanding Award. Additionally, our Board of Directors will need to obtain the consent of our stockholders in order to (a) amend our Stock Plan to increase the aggregate number of shares of our common stock subject to the plan, or (b) amend our Stock Plan if stockholder approval is required either (i) to comply with Section 422 of the Code with respect to ISOs, or (ii) for purposes of Section 162(m) of the Code.

Term

Our Stock Plan will remain in full force and effect through May 30, 2017, unless terminated earlier by our Board of Directors. After our Stock Plan is terminated, no future Awards may be granted under the Stock Plan, but Awards previously granted will remain outstanding in accordance with their applicable terms and conditions.

Director Compensation

Ralph M. Amato served as the Chairman and sole director of the Board of Directors of the Company prior to the Merger. Upon the consummation of the Merger, Mr. Amato resigned from the Board of Directors, and John Lorenz was appointed as the Chairman of the Board of Directors of the Company. Mr. Amato’s and Mr. Lorenz’s compensation for service as a director to the Company and Global Recycling, respectively, is fully reflected in the Summary Compensation Table above pursuant to Item 402 of Regulation S-K.

25

DESCRIPTION OF OUR SECURITIES

Common Stock